Third Quarter Earnings Call Supplemental Information November 5, 2025

Enhabit Home Health & Hospice 2 Disclaimer Forward looking statements This presentation contains historical information, as well as forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) that involve known and unknown risks and relate to, among other things, future events, projections, financial guidance, legislative or regulatory developments, strategy or growth opportunities, our future financial performance, our projected business results, or our projected capital expenditures. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, the reader can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “targets,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Any forward-looking statement speaks only as of the date of this presentation, and the Company undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties, many of which are beyond our control. Actual events or results may differ materially from the results anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by the Company include, but are not limited to, our ability to execute on our strategic plans; regulatory and other developments impacting the markets for our services; changes in reimbursement rates; general economic conditions; changes in the episodic versus non-episodic mix of our payers, the case mix of our patients, and payment methodologies; our ability to attract and retain key management personnel and healthcare professionals; potential disruptions or breaches of our or our vendors’, payers’, and other contract counterparties’ information systems; the outcome of litigation; quality performance and ratings; our ability to successfully complete and integrate de novo locations, acquisitions, investments, and joint ventures; our ability to successfully integrate technology in our operations; and our ability to control costs, particularly labor and employee benefit costs. Additional information regarding risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this presentation are described in reports filed with the SEC, including our annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, copies of which are available on the Company's website at http://investors.ehab.com. Note regarding presentation of non-GAAP financial measures This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Exchange Act, including Adjusted EBITDA, Adjusted EBITDA margin, Segment Adjusted EBITDA, Segment Adjusted EBITDA margin, Adjusted earnings per share, and Adjusted free cash flow. For 2025, the Company has modified its methodology of calculating Adjusted free cash flow to exclude the impact of unusual or nonrecurring items on cash income taxes and changes in working capital. The change was made to conform to the Adjusted free cash flow measure with the current definition used by management and the Board of Directors to manage cash flow and evaluate performance. Prior periods presented herein have been recast to conform with the new methodology. The Company believes the non-GAAP financial measures are useful to investors because they facilitate evaluation of core business operating results over multiple periods unaffected by differences in unusual or nonrecurring items. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP are presented at the end of this presentation. Our Form 8-K, filed with the SEC as of the date of this presentation, provides further explanation and disclosure regarding Enhabit’s use of non-GAAP financial measures and should be read in conjunction with this supplemental information. Additionally, our Form 10-Q for the three months ended September 30, 2025, provides further information regarding "unusual or nonrecurring items that are not typical of ongoing operations," a reconciliation item in our Adjusted EBITDA calculation. Note regarding presentation of same-store comparisons The Company uses “same-store” comparisons to explain the changes in certain performance metrics and line items within its financial statements. Same-store comparisons are calculated based on home health and hospice locations open throughout both the full current period and the immediately prior period presented. These comparisons include the financial results of market consolidation transactions in existing markets, as it is difficult to determine, with precision, the incremental impact of these transactions on the Company’s results of operations.

Contents

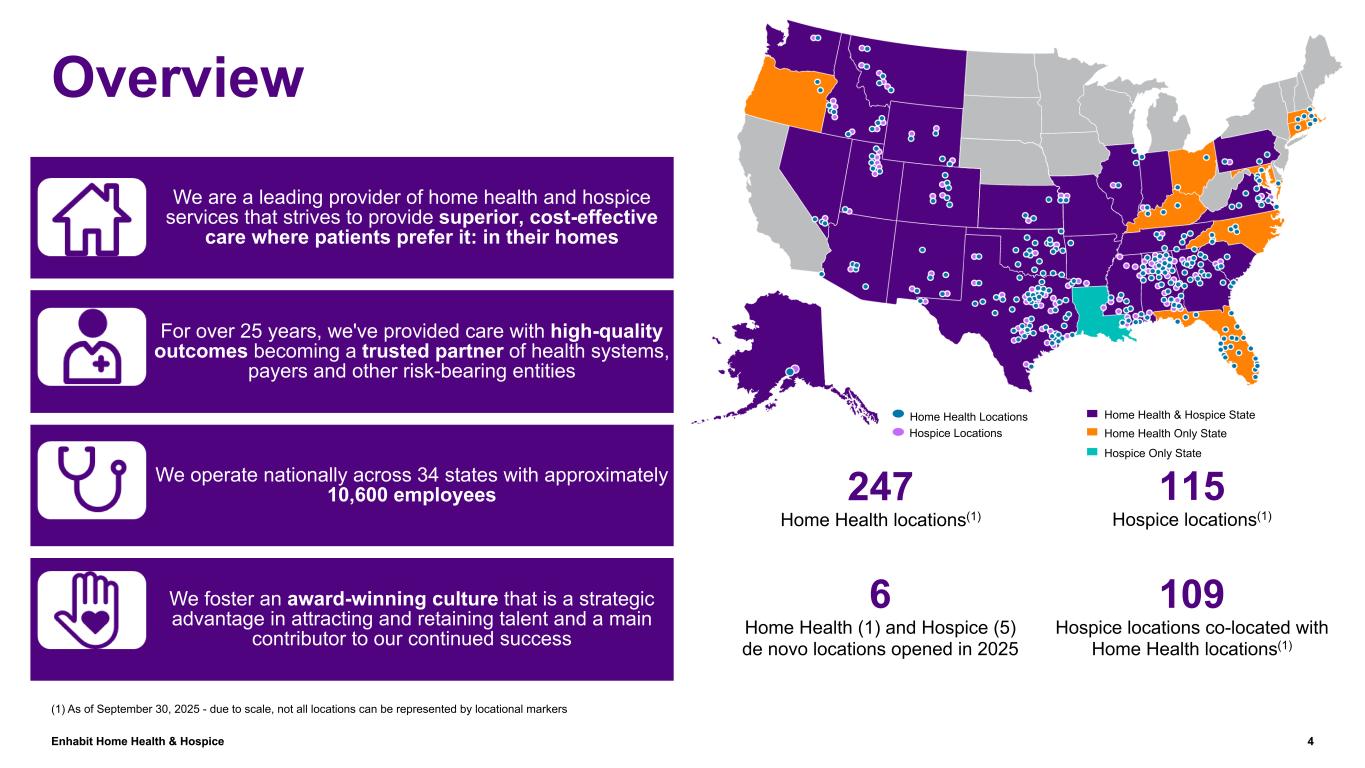

Enhabit Home Health & Hospice 4 Overview 109 Hospice locations co-located with Home Health locations(1) Home Health Locations Hospice Locations Home Health & Hospice State Home Health Only State (1) As of September 30, 2025 - due to scale, not all locations can be represented by locational markers 115 Hospice locations(1) 247 Home Health locations(1) We are a leading provider of home health and hospice services that strives to provide superior, cost-effective care where patients prefer it: in their homes For over 25 years, we've provided care with high-quality outcomes becoming a trusted partner of health systems, payers and other risk-bearing entities We operate nationally across 34 states with approximately 10,600 employees We foster an award-winning culture that is a strategic advantage in attracting and retaining talent and a main contributor to our continued success 6 Home Health (1) and Hospice (5) de novo locations opened in 2025 Hospice Only State

Enhabit Home Health & Hospice 5 2025 Priorities for Success • 3rd consecutive quarter of Adj. EBITDA growth vs. prior year. • Home health year over year quarterly admissions growth since Q1 2024, 2nd consecutive quarter of year over year ADC improvement. • Continued Hospice outperformance with record quarterly net service revenue and Adjusted EBITDA, 6th straight quarter of sequential ADC growth. • Consistent de-levering - 7th consecutive quarter of debt prepayments through Q4 2025, exited Q3 with 3.9x leverage ratio. • Home health census ◦ Payer mix • Hospice average daily census • Open de novo locations in strategic markets • Optimize de novo locations opened in 2023 and 2024 • Continue de- leveraging the balance sheet • G&A expense management • Home health and Hospice cost per patient day • Home health revenue per patient day • Value-based performance • Patient and family experience • Home health hospital readmission rates • Hospice visits in the last days of life • Engagement • Retention • Business development direct selling headcount • Leadership development Strategy Execution Q3 2025 Highlights Growth Financial Health Quality People Reconciliations to GAAP provided in Appendix B

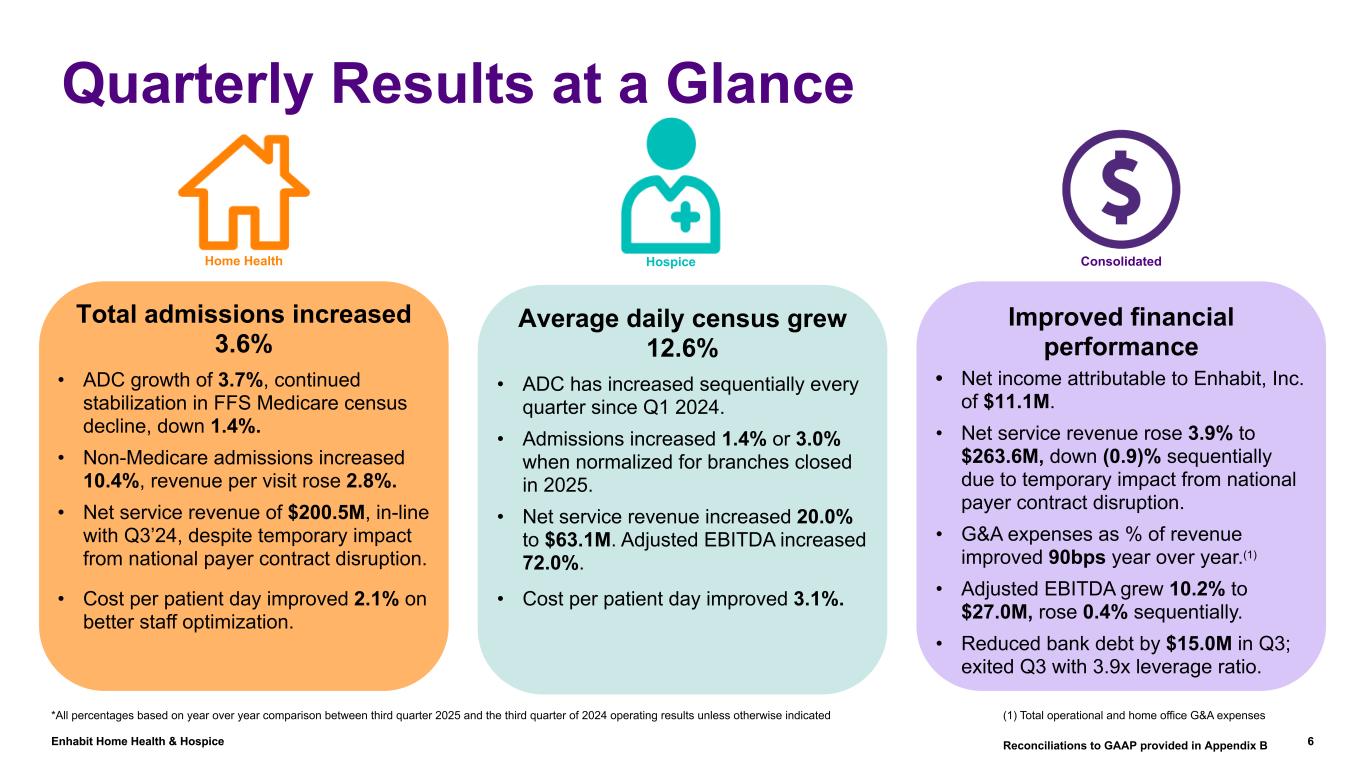

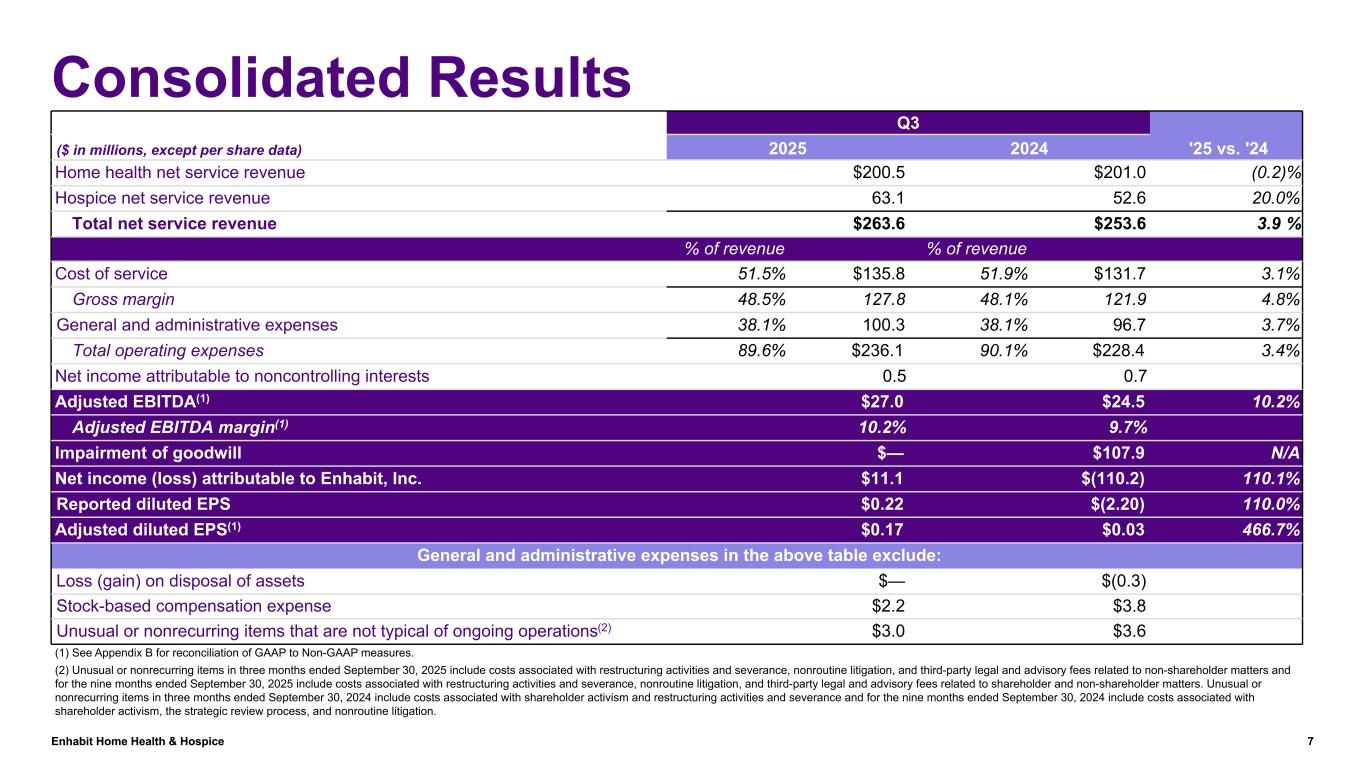

Enhabit Home Health & Hospice 6 Improved financial performance • Net income attributable to Enhabit, Inc. of $11.1M. • Net service revenue rose 3.9% to $263.6M, down (0.9)% sequentially due to temporary impact from national payer contract disruption. • G&A expenses as % of revenue improved 90bps year over year.(1) • Adjusted EBITDA grew 10.2% to $27.0M, rose 0.4% sequentially. • Reduced bank debt by $15.0M in Q3; exited Q3 with 3.9x leverage ratio. (1) Total operational and home office G&A expenses Reconciliations to GAAP provided in Appendix B Quarterly Results at a Glance Total admissions increased 3.6% • ADC growth of 3.7%, continued stabilization in FFS Medicare census decline, down 1.4%. • Non-Medicare admissions increased 10.4%, revenue per visit rose 2.8%. • Net service revenue of $200.5M, in-line with Q3’24, despite temporary impact from national payer contract disruption. • Cost per patient day improved 2.1% on better staff optimization. Average daily census grew 12.6% • ADC has increased sequentially every quarter since Q1 2024. • Admissions increased 1.4% or 3.0% when normalized for branches closed in 2025. • Net service revenue increased 20.0% to $63.1M. Adjusted EBITDA increased 72.0%. • Cost per patient day improved 3.1%. Home Health Hospice Consolidated *All percentages based on year over year comparison between third quarter 2025 and the third quarter of 2024 operating results unless otherwise indicated

Enhabit Home Health & Hospice 7 Consolidated Results Q3 '25 vs. '24($ in millions, except per share data) 2025 2024 Home health net service revenue $200.5 $201.0 (0.2) % Hospice net service revenue 63.1 52.6 20.0 % Total net service revenue $263.6 $253.6 3.9 % % of revenue % of revenue Cost of service 51.5 % $135.8 51.9 % $131.7 3.1 % Gross margin 48.5 % 127.8 48.1 % 121.9 4.8 % General and administrative expenses 38.1 % 100.3 38.1 % 96.7 3.7 % Total operating expenses 89.6 % $236.1 90.1 % $228.4 3.4 % Net income attributable to noncontrolling interests 0.5 0.7 Adjusted EBITDA(1) $27.0 $24.5 10.2 % Adjusted EBITDA margin(1) 10.2 % 9.7 % Impairment of goodwill $— $107.9 N/A Net income (loss) attributable to Enhabit, Inc. $11.1 $(110.2) 110.1 % Reported diluted EPS $0.22 $(2.20) 110.0 % Adjusted diluted EPS(1) $0.17 $0.03 466.7 % General and administrative expenses in the above table exclude: Loss (gain) on disposal of assets $— $(0.3) Stock-based compensation expense $2.2 $3.8 Unusual or nonrecurring items that are not typical of ongoing operations(2) $3.0 $3.6 (1) See Appendix B for reconciliation of GAAP to Non-GAAP measures. (2) Unusual or nonrecurring items in three months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to non-shareholder matters and for the nine months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to shareholder and non-shareholder matters. Unusual or nonrecurring items in three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance and for the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process, and nonroutine litigation.

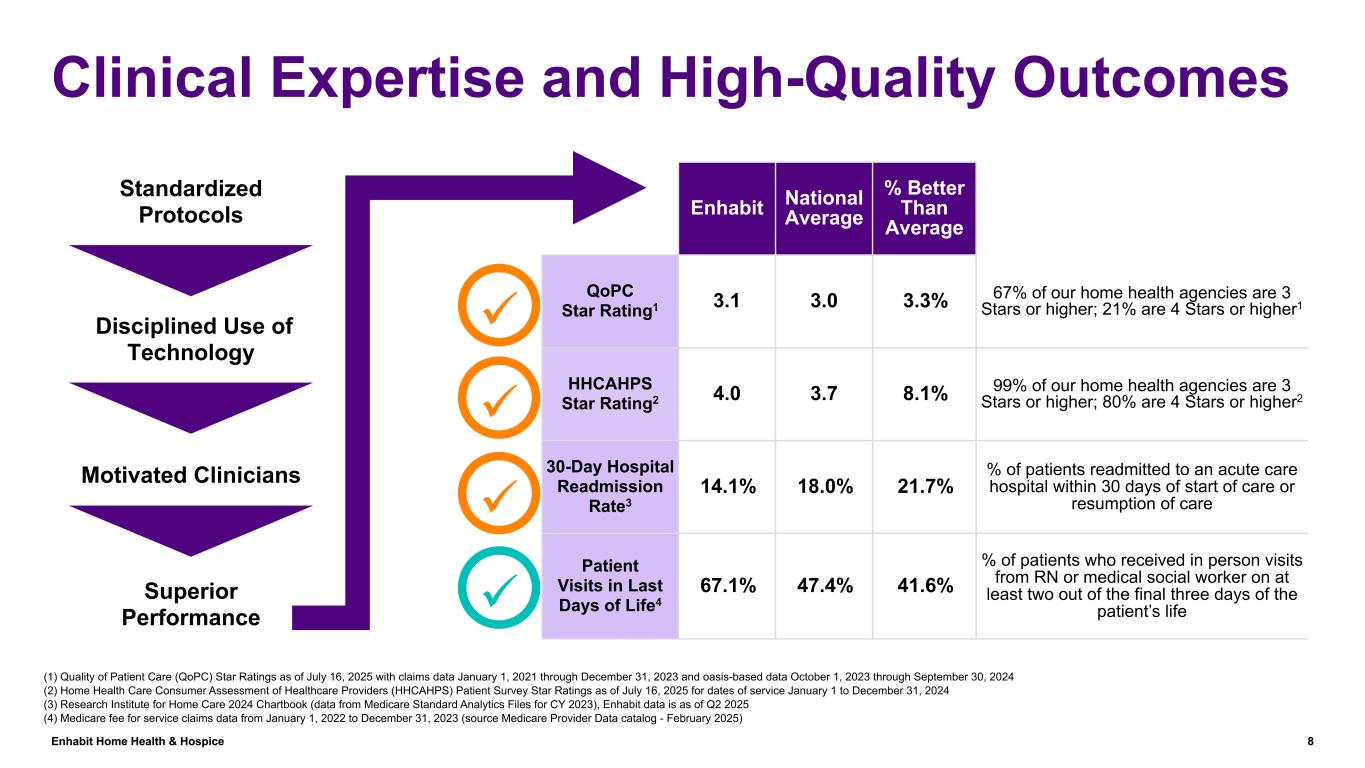

Enhabit Home Health & Hospice 8 Clinical Expertise and High-Quality Outcomes Enhabit National Average % Better Than Average QoPC Star Rating1 3.1 3.0 3.3% 67% of our home health agencies are 3 Stars or higher; 21% are 4 Stars or higher1 HHCAHPS Star Rating2 4.0 3.7 8.1% 99% of our home health agencies are 3 Stars or higher; 80% are 4 Stars or higher2 30-Day Hospital Readmission Rate3 14.1% 18.0% 21.7% % of patients readmitted to an acute care hospital within 30 days of start of care or resumption of care Patient Visits in Last Days of Life4 67.1% 47.4% 41.6% % of patients who received in person visits from RN or medical social worker on at least two out of the final three days of the patient’s life Standardized Protocols Motivated Clinicians Disciplined Use of Technology Superior Performance ü ü ü ü (1) Quality of Patient Care (QoPC) Star Ratings as of July 16, 2025 with claims data January 1, 2021 through December 31, 2023 and oasis-based data October 1, 2023 through September 30, 2024 (2) Home Health Care Consumer Assessment of Healthcare Providers (HHCAHPS) Patient Survey Star Ratings as of July 16, 2025 for dates of service January 1 to December 31, 2024 (3) Research Institute for Home Care 2024 Chartbook (data from Medicare Standard Analytics Files for CY 2023), Enhabit data is as of Q2 2025 (4) Medicare fee for service claims data from January 1, 2022 to December 31, 2023 (source Medicare Provider Data catalog - February 2025)

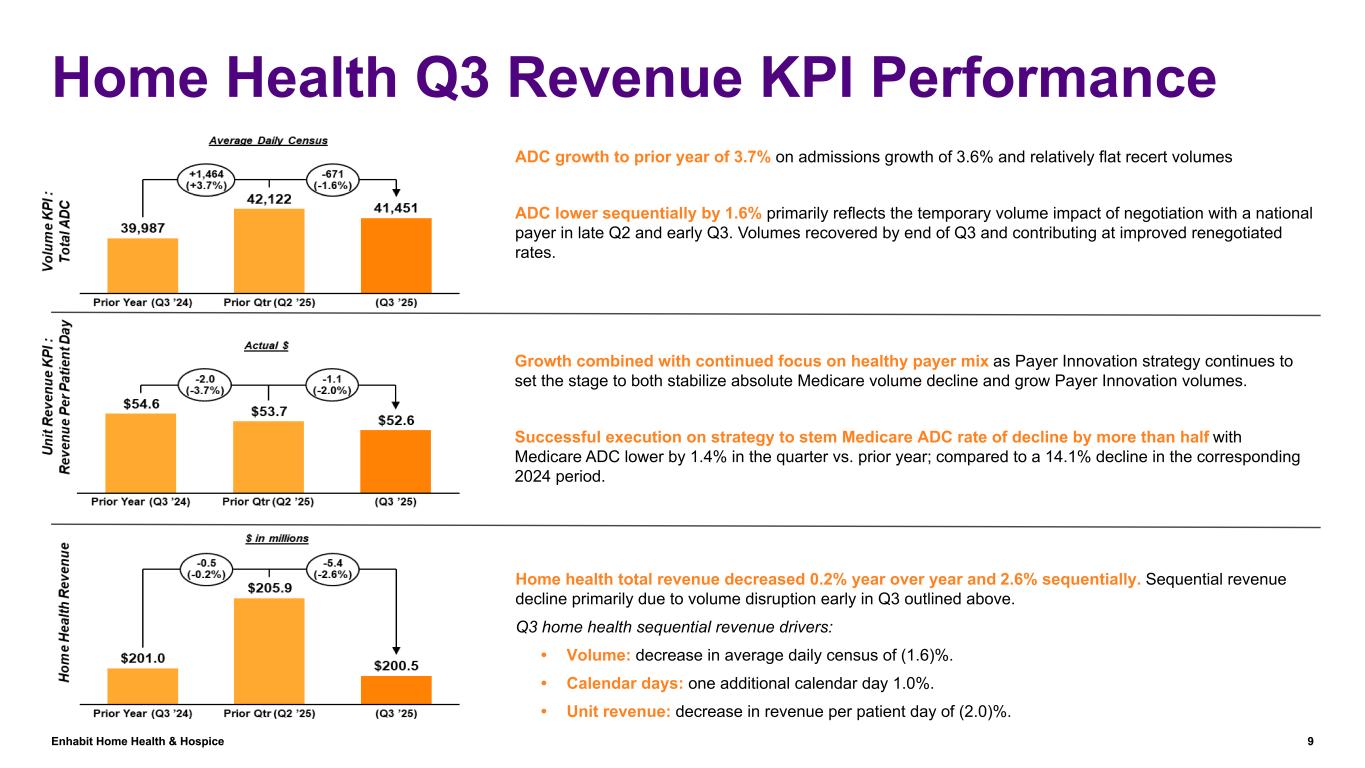

Enhabit Home Health & Hospice 9 Home Health Q3 Revenue KPI Performance Growth combined with continued focus on healthy payer mix as Payer Innovation strategy continues to set the stage to both stabilize absolute Medicare volume decline and grow Payer Innovation volumes. Successful execution on strategy to stem Medicare ADC rate of decline by more than half with Medicare ADC lower by 1.4% in the quarter vs. prior year; compared to a 14.1% decline in the corresponding 2024 period. Home health total revenue decreased 0.2% year over year and 2.6% sequentially. Sequential revenue decline primarily due to volume disruption early in Q3 outlined above. Q3 home health sequential revenue drivers: • Volume: decrease in average daily census of (1.6)%. • Calendar days: one additional calendar day 1.0%. • Unit revenue: decrease in revenue per patient day of (2.0)%. ADC growth to prior year of 3.7% on admissions growth of 3.6% and relatively flat recert volumes ADC lower sequentially by 1.6% primarily reflects the temporary volume impact of negotiation with a national payer in late Q2 and early Q3. Volumes recovered by end of Q3 and contributing at improved renegotiated rates.

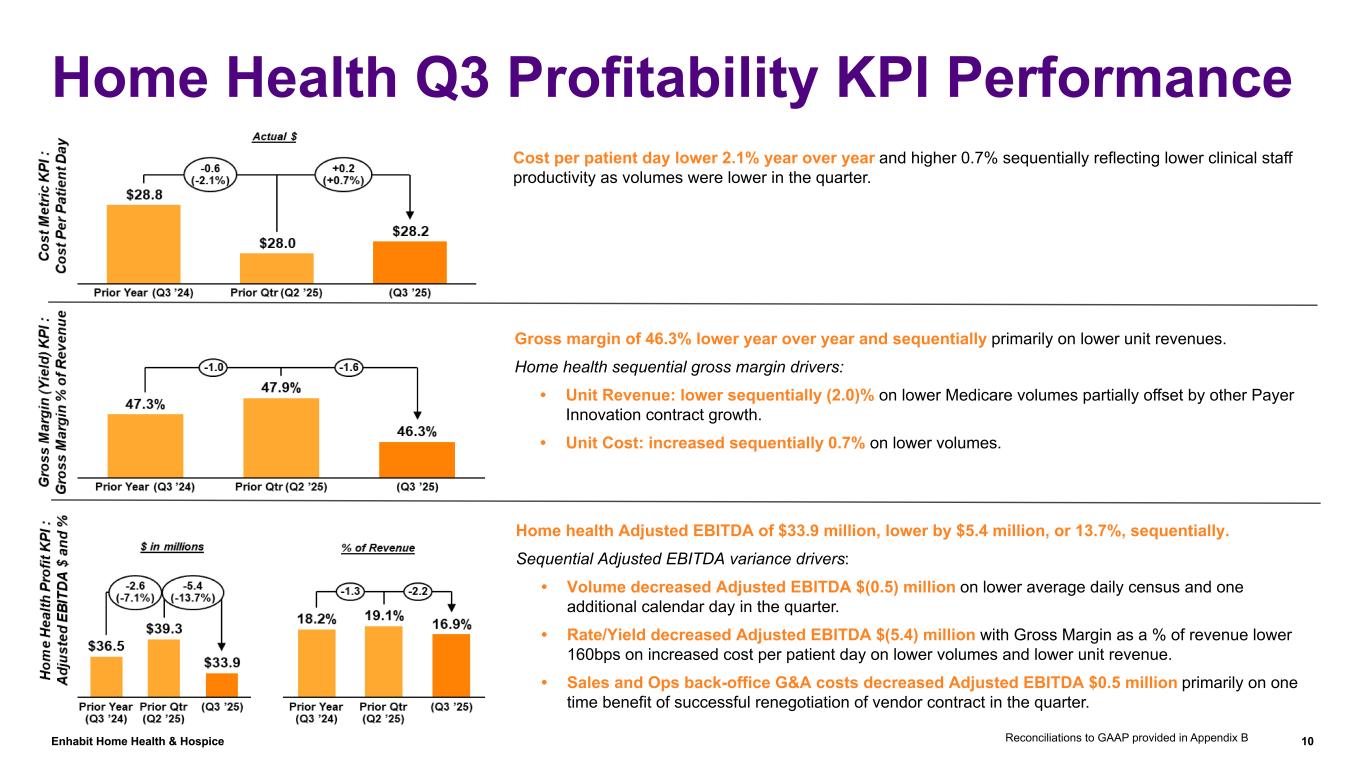

Enhabit Home Health & Hospice 10 Home Health Q3 Profitability KPI Performance Gross margin of 46.3% lower year over year and sequentially primarily on lower unit revenues. Home health sequential gross margin drivers: • Unit Revenue: lower sequentially (2.0)% on lower Medicare volumes partially offset by other Payer Innovation contract growth. • Unit Cost: increased sequentially 0.7% on lower volumes. Reconciliations to GAAP provided in Appendix B Home health Adjusted EBITDA of $33.9 million, lower by $5.4 million, or 13.7%, sequentially. Sequential Adjusted EBITDA variance drivers: • Volume decreased Adjusted EBITDA $(0.5) million on lower average daily census and one additional calendar day in the quarter. • Rate/Yield decreased Adjusted EBITDA $(5.4) million with Gross Margin as a % of revenue lower 160bps on increased cost per patient day on lower volumes and lower unit revenue. • Sales and Ops back-office G&A costs decreased Adjusted EBITDA $0.5 million primarily on one time benefit of successful renegotiation of vendor contract in the quarter. Cost per patient day lower 2.1% year over year and higher 0.7% sequentially reflecting lower clinical staff productivity as volumes were lower in the quarter.

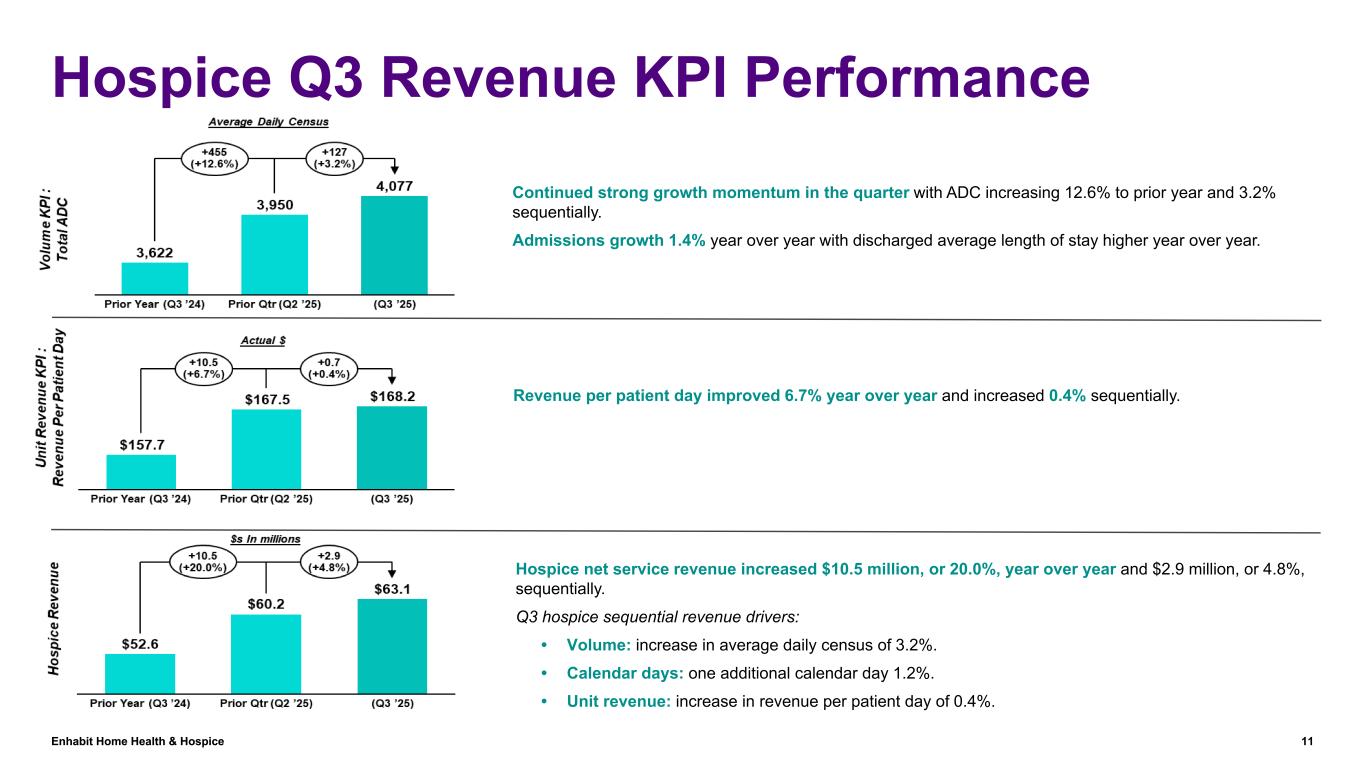

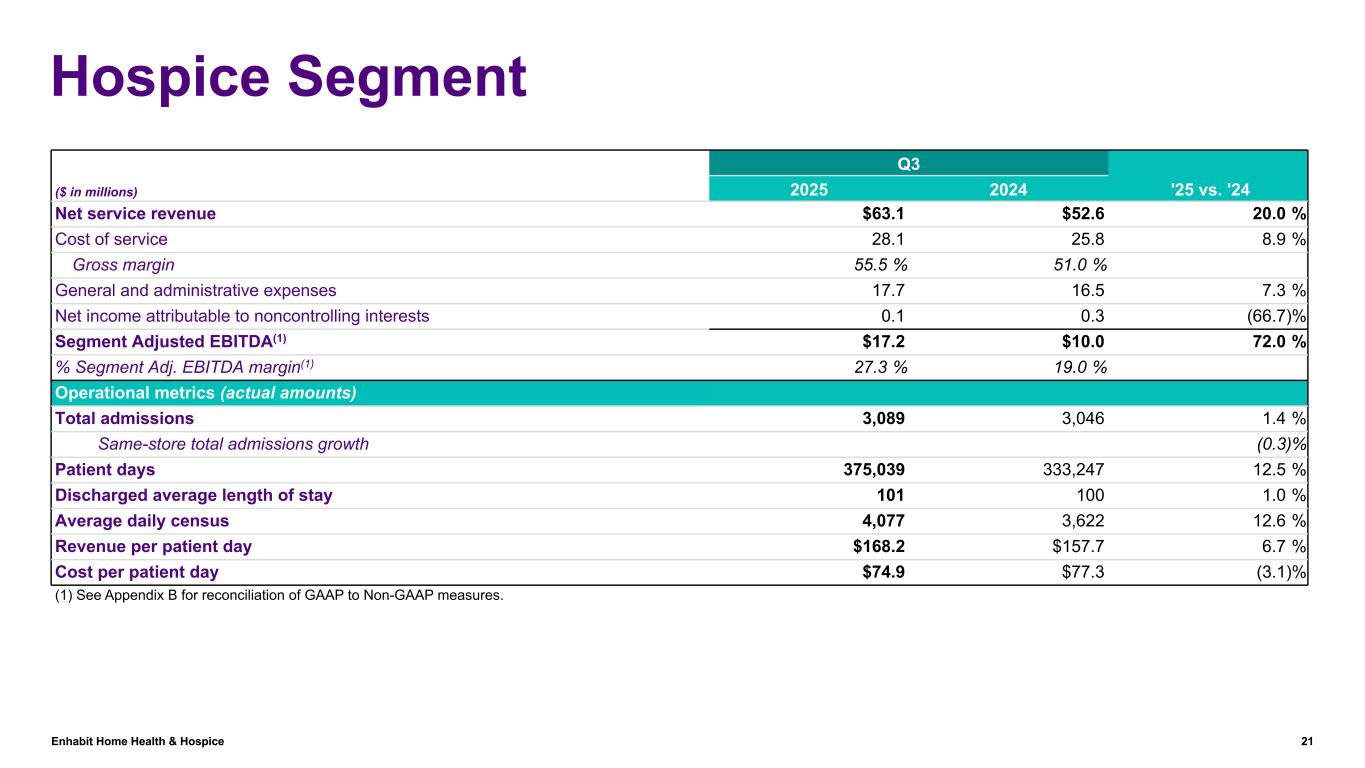

Enhabit Home Health & Hospice 11 Hospice Q3 Revenue KPI Performance Revenue per patient day improved 6.7% year over year and increased 0.4% sequentially. Continued strong growth momentum in the quarter with ADC increasing 12.6% to prior year and 3.2% sequentially. Admissions growth 1.4% year over year with discharged average length of stay higher year over year. Hospice net service revenue increased $10.5 million, or 20.0%, year over year and $2.9 million, or 4.8%, sequentially. Q3 hospice sequential revenue drivers: • Volume: increase in average daily census of 3.2%. • Calendar days: one additional calendar day 1.2%. • Unit revenue: increase in revenue per patient day of 0.4%.

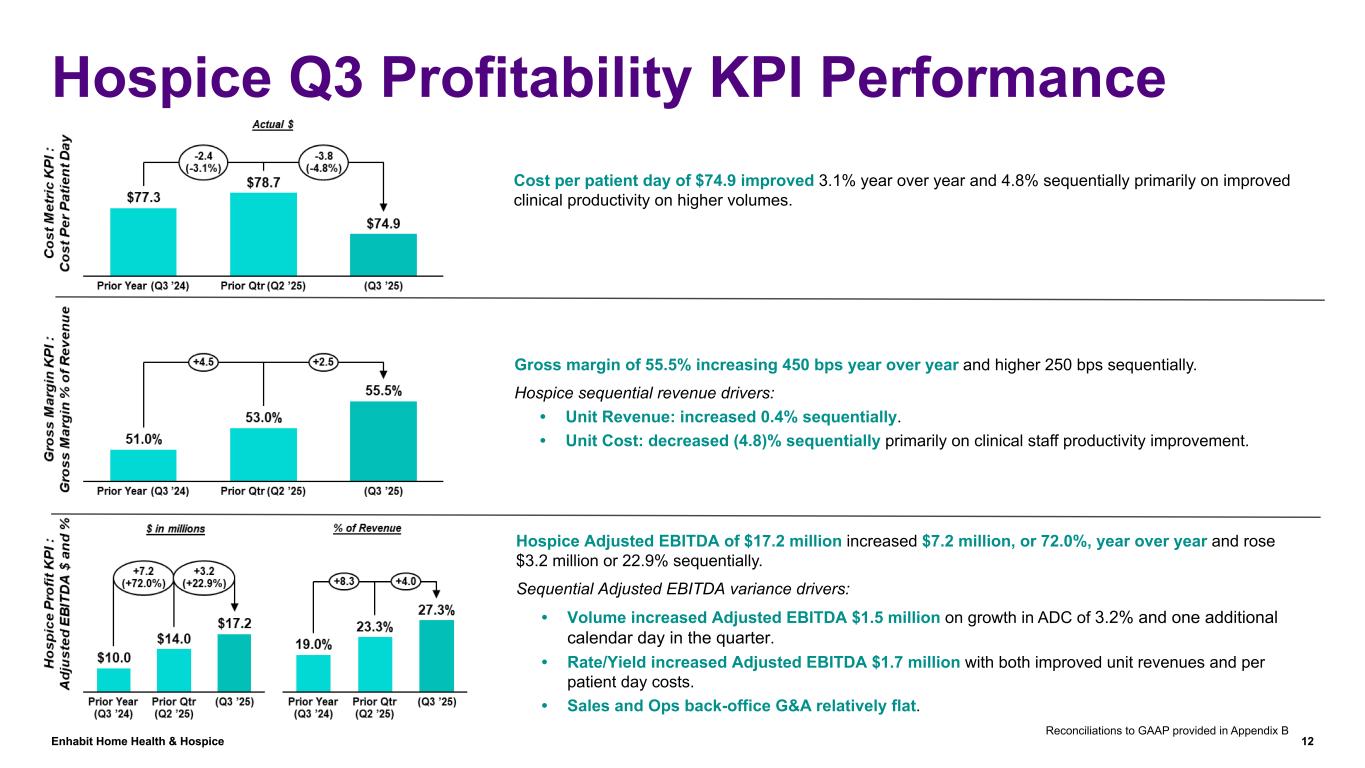

Enhabit Home Health & Hospice 12 Hospice Q3 Profitability KPI Performance Gross margin of 55.5% increasing 450 bps year over year and higher 250 bps sequentially. Hospice sequential revenue drivers: • Unit Revenue: increased 0.4% sequentially. • Unit Cost: decreased (4.8)% sequentially primarily on clinical staff productivity improvement. Hospice Adjusted EBITDA of $17.2 million increased $7.2 million, or 72.0%, year over year and rose $3.2 million or 22.9% sequentially. Sequential Adjusted EBITDA variance drivers: • Volume increased Adjusted EBITDA $1.5 million on growth in ADC of 3.2% and one additional calendar day in the quarter. • Rate/Yield increased Adjusted EBITDA $1.7 million with both improved unit revenues and per patient day costs. • Sales and Ops back-office G&A relatively flat. Cost per patient day of $74.9 improved 3.1% year over year and 4.8% sequentially primarily on improved clinical productivity on higher volumes. Reconciliations to GAAP provided in Appendix B

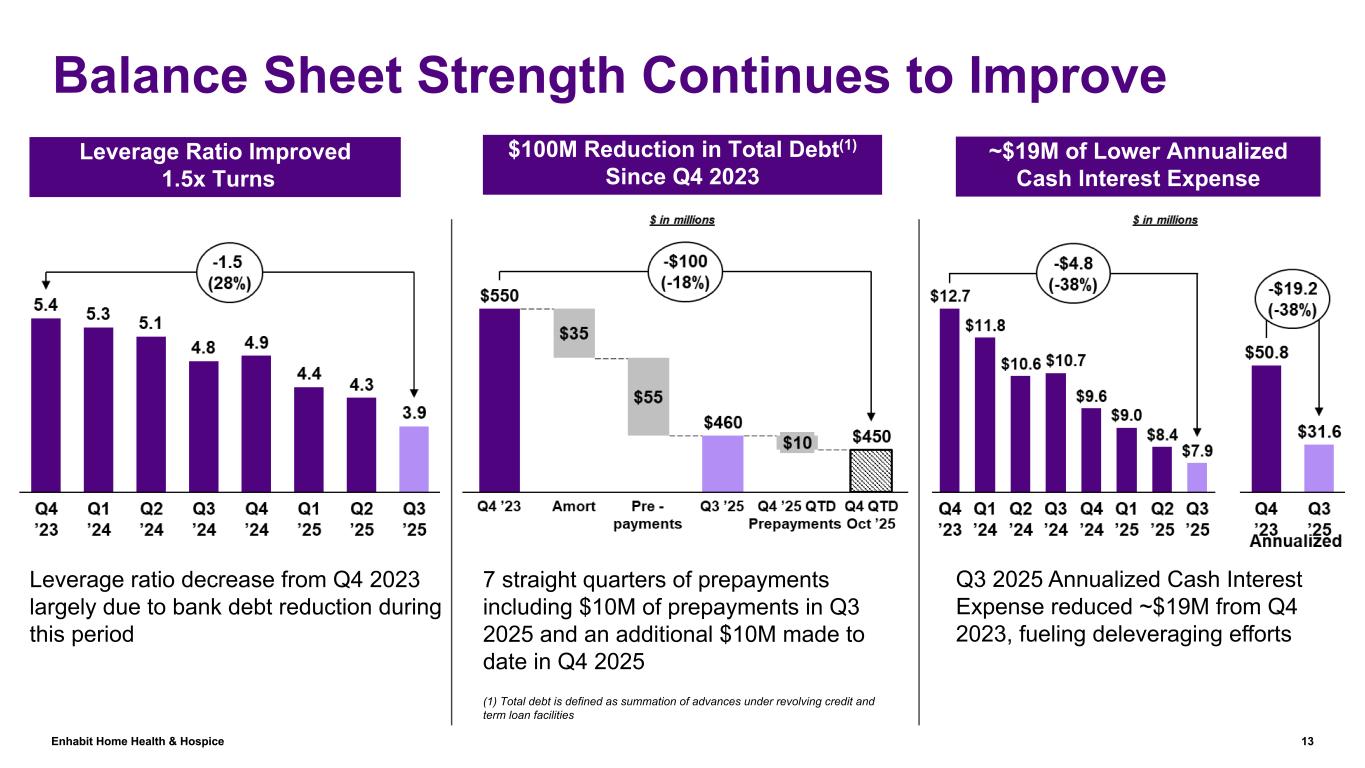

Enhabit Home Health & Hospice 13 Balance Sheet Strength Continues to Improve Leverage ratio decrease from Q4 2023 largely due to bank debt reduction during this period Leverage Ratio Improved 1.5x Turns $100M Reduction in Total Debt(1) Since Q4 2023 7 straight quarters of prepayments including $10M of prepayments in Q3 2025 and an additional $10M made to date in Q4 2025 (1) Total debt is defined as summation of advances under revolving credit and term loan facilities ~$19M of Lower Annualized Cash Interest Expense Q3 2025 Annualized Cash Interest Expense reduced ~$19M from Q4 2023, fueling deleveraging efforts

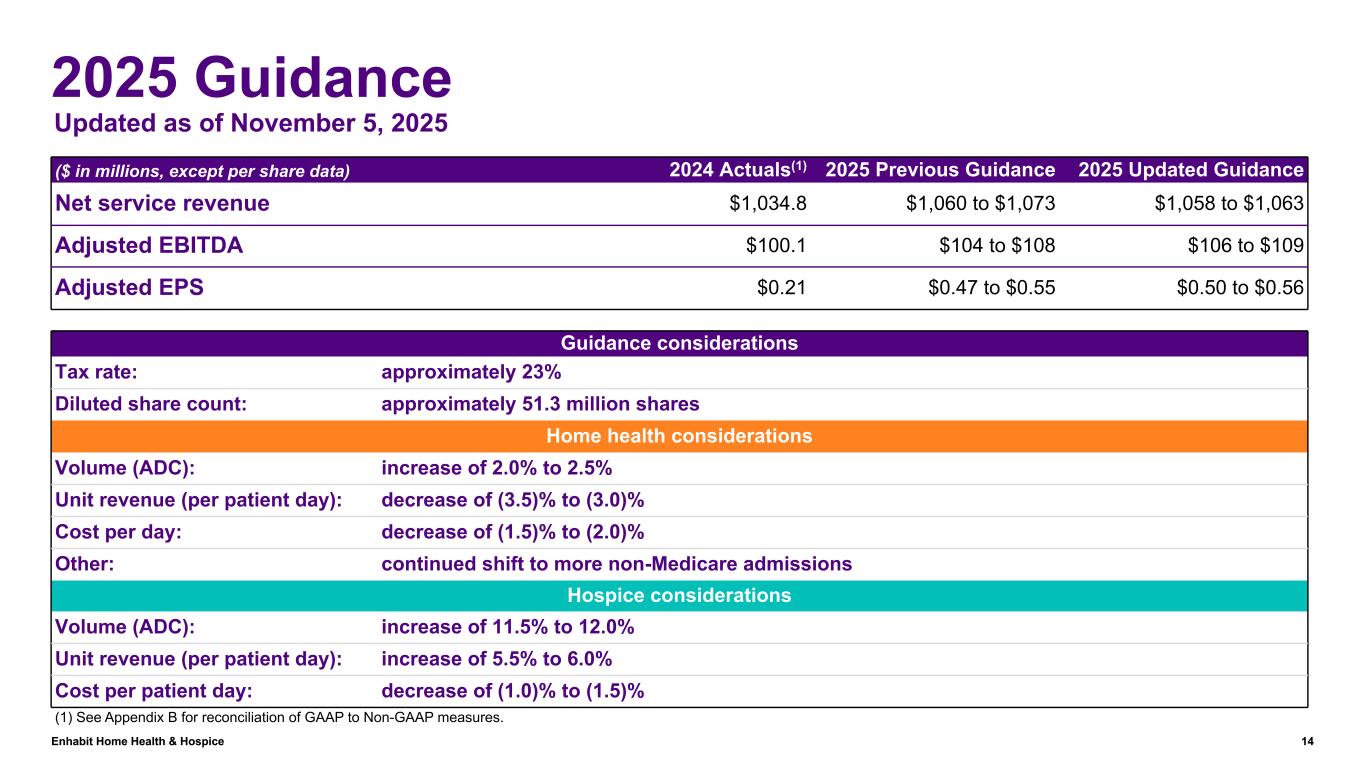

Enhabit Home Health & Hospice 14 2025 Guidance ($ in millions, except per share data) 2024 Actuals(1) 2025 Previous Guidance 2025 Updated Guidance Net service revenue $1,034.8 $1,060 to $1,073 $1,058 to $1,063 Adjusted EBITDA $100.1 $104 to $108 $106 to $109 Adjusted EPS $0.21 $0.47 to $0.55 $0.50 to $0.56 Guidance considerations Tax rate: approximately 23% Diluted share count: approximately 51.3 million shares Home health considerations Volume (ADC): increase of 2.0% to 2.5% Unit revenue (per patient day): decrease of (3.5)% to (3.0)% Cost per day: decrease of (1.5)% to (2.0)% Other: continued shift to more non-Medicare admissions Hospice considerations Volume (ADC): increase of 11.5% to 12.0% Unit revenue (per patient day): increase of 5.5% to 6.0% Cost per patient day: decrease of (1.0)% to (1.5)% (1) See Appendix B for reconciliation of GAAP to Non-GAAP measures. Updated as of November 5, 2025

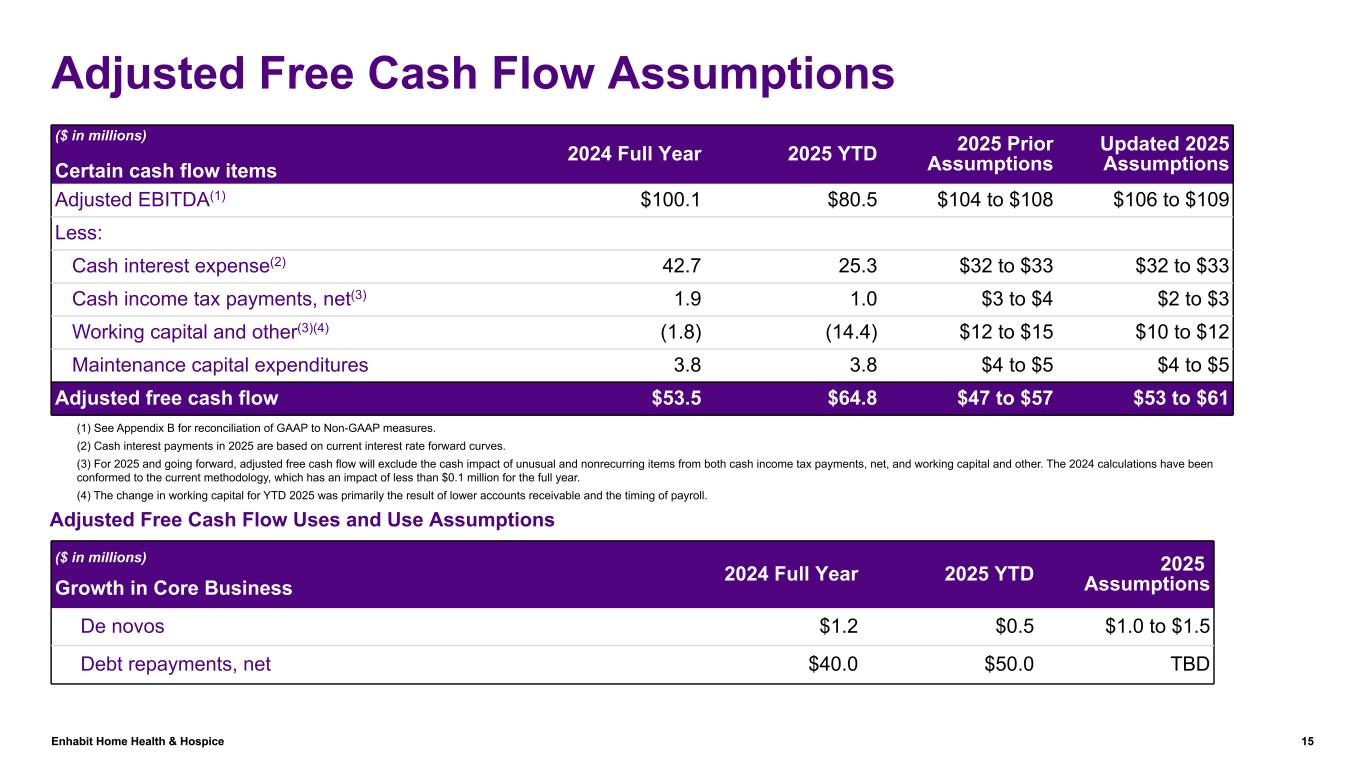

Enhabit Home Health & Hospice 15 Adjusted Free Cash Flow Assumptions ($ in millions) Certain cash flow items 2024 Full Year 2025 YTD 2025 Prior Assumptions Updated 2025 Assumptions Adjusted EBITDA(1) $100.1 $80.5 $104 to $108 $106 to $109 Less: Cash interest expense(2) 42.7 25.3 $32 to $33 $32 to $33 Cash income tax payments, net(3) 1.9 1.0 $3 to $4 $2 to $3 Working capital and other(3)(4) (1.8) (14.4) $12 to $15 $10 to $12 Maintenance capital expenditures 3.8 3.8 $4 to $5 $4 to $5 Adjusted free cash flow $53.5 $64.8 $47 to $57 $53 to $61 (1) See Appendix B for reconciliation of GAAP to Non-GAAP measures. (2) Cash interest payments in 2025 are based on current interest rate forward curves. (3) For 2025 and going forward, adjusted free cash flow will exclude the cash impact of unusual and nonrecurring items from both cash income tax payments, net, and working capital and other. The 2024 calculations have been conformed to the current methodology, which has an impact of less than $0.1 million for the full year. (4) The change in working capital for YTD 2025 was primarily the result of lower accounts receivable and the timing of payroll. ($ in millions) Growth in Core Business 2024 Full Year 2025 YTD 2025 Assumptions De novos $1.2 $0.5 $1.0 to $1.5 Debt repayments, net $40.0 $50.0 TBD Adjusted Free Cash Flow Uses and Use Assumptions

Enhabit Home Health & Hospice 16 Appendix A

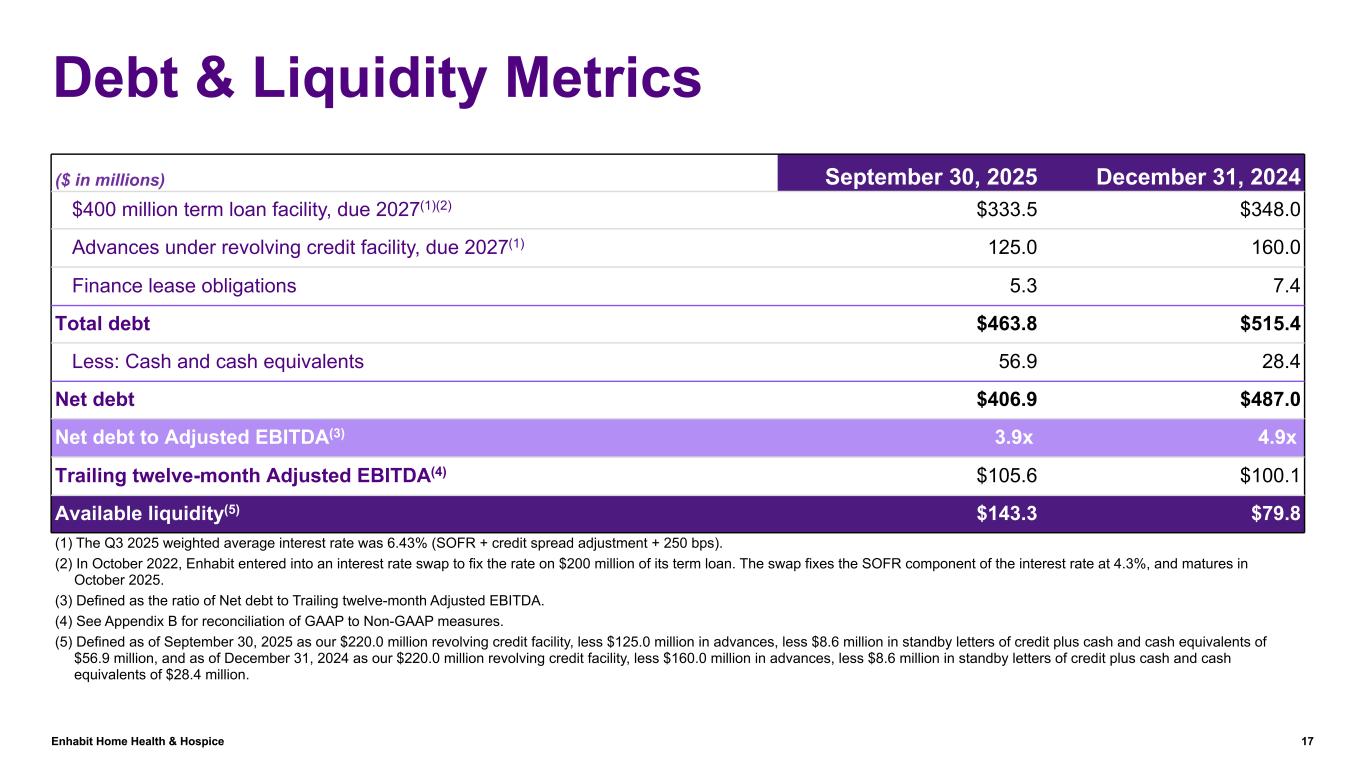

Enhabit Home Health & Hospice 17 Debt & Liquidity Metrics ($ in millions) September 30, 2025 December 31, 2024 $400 million term loan facility, due 2027(1)(2) $333.5 $348.0 Advances under revolving credit facility, due 2027(1) 125.0 160.0 Finance lease obligations 5.3 7.4 Total debt $463.8 $515.4 Less: Cash and cash equivalents 56.9 28.4 Net debt $406.9 $487.0 Net debt to Adjusted EBITDA(3) 3.9x 4.9x Trailing twelve-month Adjusted EBITDA(4) $105.6 $100.1 Available liquidity(5) $143.3 $79.8 (1) The Q3 2025 weighted average interest rate was 6.43% (SOFR + credit spread adjustment + 250 bps). (2) In October 2022, Enhabit entered into an interest rate swap to fix the rate on $200 million of its term loan. The swap fixes the SOFR component of the interest rate at 4.3%, and matures in October 2025. (3) Defined as the ratio of Net debt to Trailing twelve-month Adjusted EBITDA. (4) See Appendix B for reconciliation of GAAP to Non-GAAP measures. (5) Defined as of September 30, 2025 as our $220.0 million revolving credit facility, less $125.0 million in advances, less $8.6 million in standby letters of credit plus cash and cash equivalents of $56.9 million, and as of December 31, 2024 as our $220.0 million revolving credit facility, less $160.0 million in advances, less $8.6 million in standby letters of credit plus cash and cash equivalents of $28.4 million.

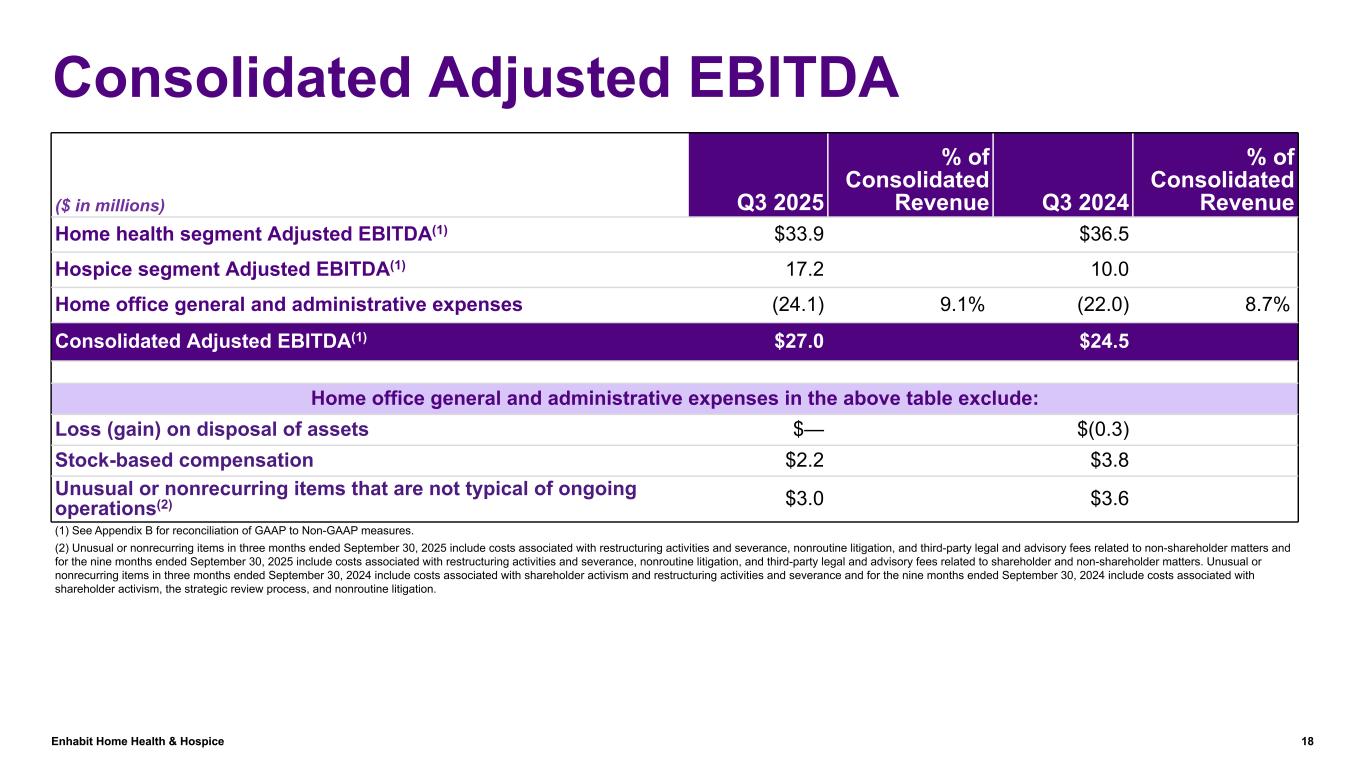

Enhabit Home Health & Hospice 18 Consolidated Adjusted EBITDA ($ in millions) Q3 2025 % of Consolidated Revenue Q3 2024 % of Consolidated Revenue Home health segment Adjusted EBITDA(1) $33.9 $36.5 Hospice segment Adjusted EBITDA(1) 17.2 10.0 Home office general and administrative expenses (24.1) 9.1% (22.0) 8.7% Consolidated Adjusted EBITDA(1) $27.0 $24.5 Home office general and administrative expenses in the above table exclude: Loss (gain) on disposal of assets $— $(0.3) Stock-based compensation $2.2 $3.8 Unusual or nonrecurring items that are not typical of ongoing operations(2) $3.0 $3.6 (1) See Appendix B for reconciliation of GAAP to Non-GAAP measures. (2) Unusual or nonrecurring items in three months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to non-shareholder matters and for the nine months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to shareholder and non-shareholder matters. Unusual or nonrecurring items in three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance and for the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process, and nonroutine litigation.

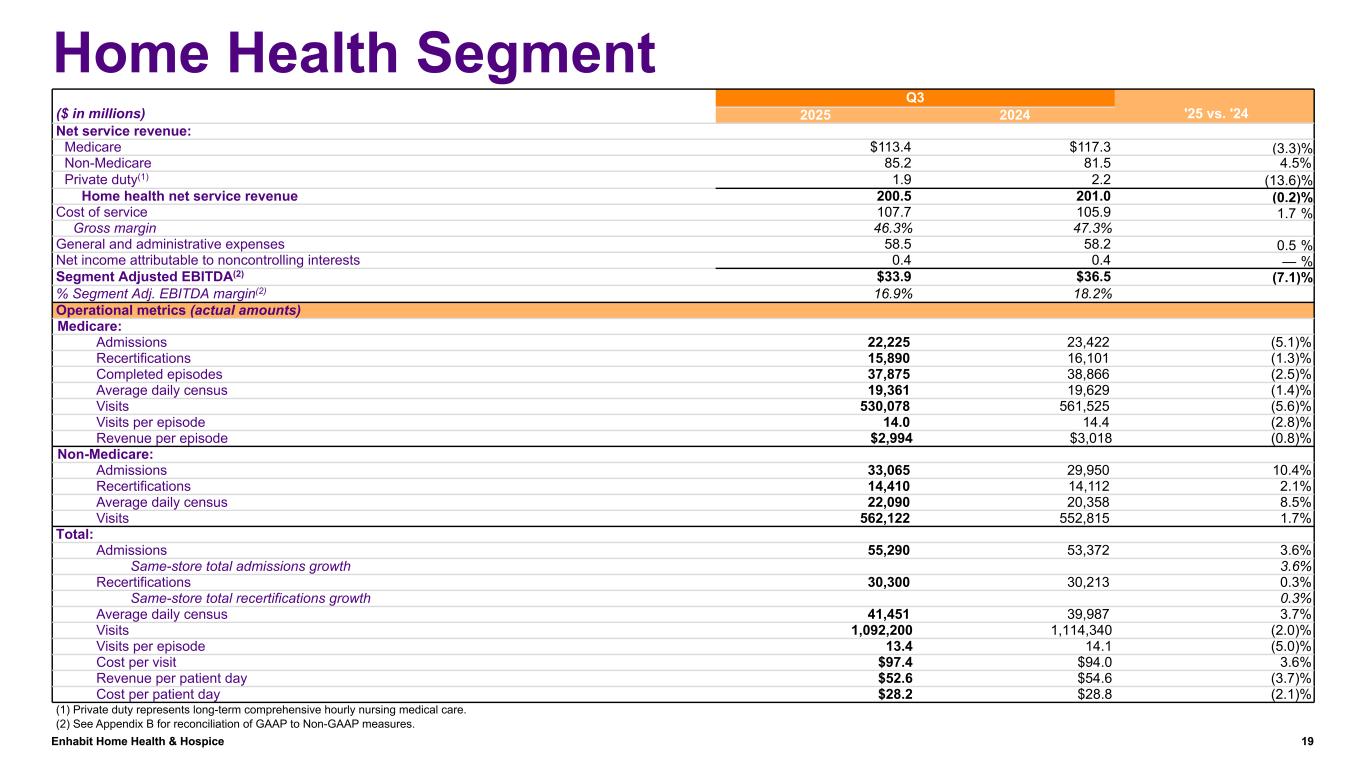

Enhabit Home Health & Hospice 19 Home Health Segment ($ in millions) Q3 '25 vs. '242025 2024 Net service revenue: Medicare $113.4 $117.3 (3.3) % Non-Medicare 85.2 81.5 4.5 % Private duty(1) 1.9 2.2 (13.6) % Home health net service revenue 200.5 201.0 (0.2) % Cost of service 107.7 105.9 1.7 % Gross margin 46.3 % 47.3 % General and administrative expenses 58.5 58.2 0.5 % Net income attributable to noncontrolling interests 0.4 0.4 — % Segment Adjusted EBITDA(2) $33.9 $36.5 (7.1) % % Segment Adj. EBITDA margin(2) 16.9 % 18.2 % Operational metrics (actual amounts) Medicare: Admissions 22,225 23,422 (5.1) % Recertifications 15,890 16,101 (1.3) % Completed episodes 37,875 38,866 (2.5) % Average daily census 19,361 19,629 (1.4) % Visits 530,078 561,525 (5.6) % Visits per episode 14.0 14.4 (2.8) % Revenue per episode $2,994 $3,018 (0.8) % Non-Medicare: Admissions 33,065 29,950 10.4 % Recertifications 14,410 14,112 2.1 % Average daily census 22,090 20,358 8.5 % Visits 562,122 552,815 1.7 % Total: Admissions 55,290 53,372 3.6 % Same-store total admissions growth 3.6 % Recertifications 30,300 30,213 0.3 % Same-store total recertifications growth 0.3 % Average daily census 41,451 39,987 3.7 % Visits 1,092,200 1,114,340 (2.0) % Visits per episode 13.4 14.1 (5.0) % Cost per visit $97.4 $94.0 3.6 % Revenue per patient day $52.6 $54.6 (3.7) % Cost per patient day $28.2 $28.8 (2.1) % (1) Private duty represents long-term comprehensive hourly nursing medical care. (2) See Appendix B for reconciliation of GAAP to Non-GAAP measures.

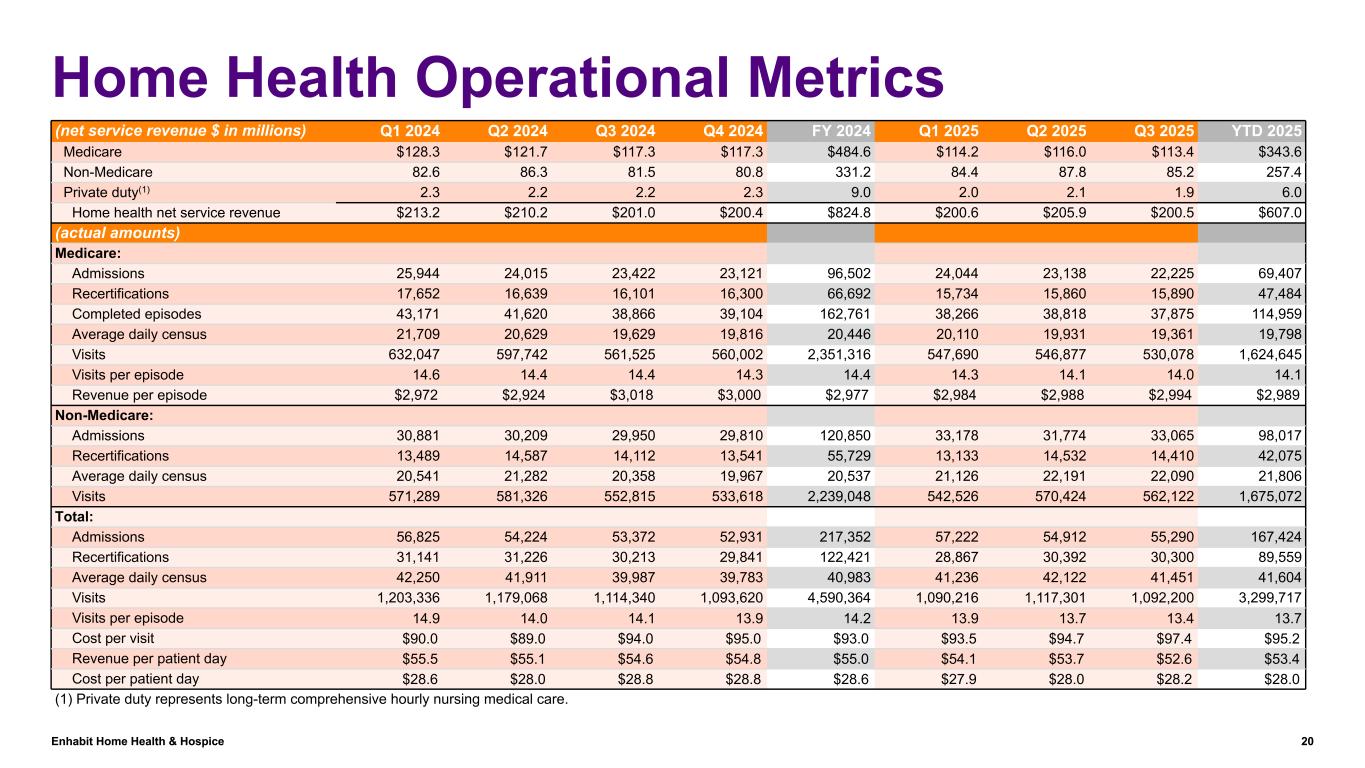

Enhabit Home Health & Hospice 20 Home Health Operational Metrics (net service revenue $ in millions) Q1 2024 Q2 2024 Q3 2024 Q4 2024 FY 2024 Q1 2025 Q2 2025 Q3 2025 YTD 2025 Medicare $128.3 $121.7 $117.3 $117.3 $484.6 $114.2 $116.0 $113.4 $343.6 Non-Medicare 82.6 86.3 81.5 80.8 331.2 84.4 87.8 85.2 257.4 Private duty(1) 2.3 2.2 2.2 2.3 9.0 2.0 2.1 1.9 6.0 Home health net service revenue $213.2 $210.2 $201.0 $200.4 $824.8 $200.6 $205.9 $200.5 $607.0 (actual amounts) Medicare: Admissions 25,944 24,015 23,422 23,121 96,502 24,044 23,138 22,225 69,407 Recertifications 17,652 16,639 16,101 16,300 66,692 15,734 15,860 15,890 47,484 Completed episodes 43,171 41,620 38,866 39,104 162,761 38,266 38,818 37,875 114,959 Average daily census 21,709 20,629 19,629 19,816 20,446 20,110 19,931 19,361 19,798 Visits 632,047 597,742 561,525 560,002 2,351,316 547,690 546,877 530,078 1,624,645 Visits per episode 14.6 14.4 14.4 14.3 14.4 14.3 14.1 14.0 14.1 Revenue per episode $2,972 $2,924 $3,018 $3,000 $2,977 $2,984 $2,988 $2,994 $2,989 Non-Medicare: Admissions 30,881 30,209 29,950 29,810 120,850 33,178 31,774 33,065 98,017 Recertifications 13,489 14,587 14,112 13,541 55,729 13,133 14,532 14,410 42,075 Average daily census 20,541 21,282 20,358 19,967 20,537 21,126 22,191 22,090 21,806 Visits 571,289 581,326 552,815 533,618 2,239,048 542,526 570,424 562,122 1,675,072 Total: Admissions 56,825 54,224 53,372 52,931 217,352 57,222 54,912 55,290 167,424 Recertifications 31,141 31,226 30,213 29,841 122,421 28,867 30,392 30,300 89,559 Average daily census 42,250 41,911 39,987 39,783 40,983 41,236 42,122 41,451 41,604 Visits 1,203,336 1,179,068 1,114,340 1,093,620 4,590,364 1,090,216 1,117,301 1,092,200 3,299,717 Visits per episode 14.9 14.0 14.1 13.9 14.2 13.9 13.7 13.4 13.7 Cost per visit $90.0 $89.0 $94.0 $95.0 $93.0 $93.5 $94.7 $97.4 $95.2 Revenue per patient day $55.5 $55.1 $54.6 $54.8 $55.0 $54.1 $53.7 $52.6 $53.4 Cost per patient day $28.6 $28.0 $28.8 $28.8 $28.6 $27.9 $28.0 $28.2 $28.0 (1) Private duty represents long-term comprehensive hourly nursing medical care.

Enhabit Home Health & Hospice 21 Hospice Segment ($ in millions) Q3 '25 vs. '242025 2024 Net service revenue $63.1 $52.6 20.0 % Cost of service 28.1 25.8 8.9 % Gross margin 55.5 % 51.0 % General and administrative expenses 17.7 16.5 7.3 % Net income attributable to noncontrolling interests 0.1 0.3 (66.7) % Segment Adjusted EBITDA(1) $17.2 $10.0 72.0 % % Segment Adj. EBITDA margin(1) 27.3 % 19.0 % Operational metrics (actual amounts) Total admissions 3,089 3,046 1.4 % Same-store total admissions growth (0.3) % Patient days 375,039 333,247 12.5 % Discharged average length of stay 101 100 1.0 % Average daily census 4,077 3,622 12.6 % Revenue per patient day $168.2 $157.7 6.7 % Cost per patient day $74.9 $77.3 (3.1) % (1) See Appendix B for reconciliation of GAAP to Non-GAAP measures.

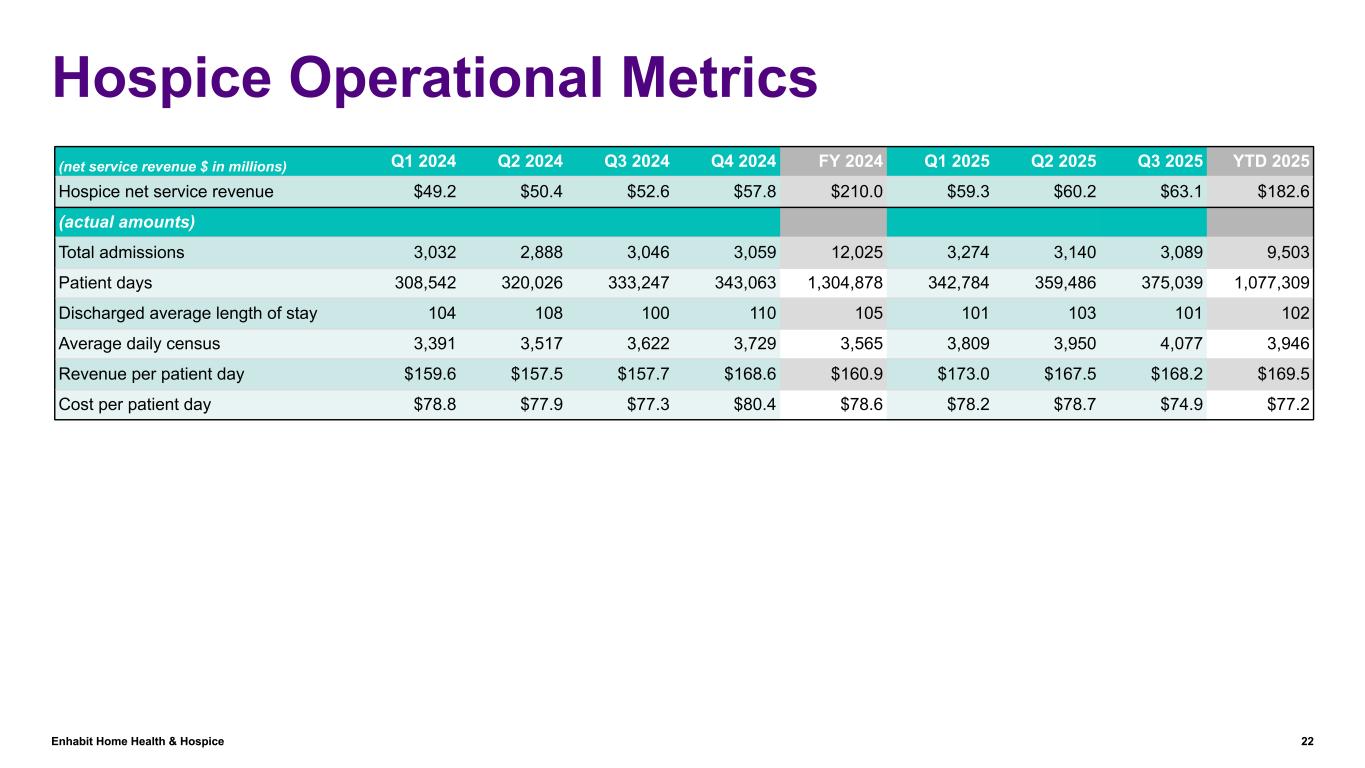

Enhabit Home Health & Hospice 22 Hospice Operational Metrics (net service revenue $ in millions) Q1 2024 Q2 2024 Q3 2024 Q4 2024 FY 2024 Q1 2025 Q2 2025 Q3 2025 YTD 2025 Hospice net service revenue $49.2 $50.4 $52.6 $57.8 $210.0 $59.3 $60.2 $63.1 $182.6 (actual amounts) Total admissions 3,032 2,888 3,046 3,059 12,025 3,274 3,140 3,089 9,503 Patient days 308,542 320,026 333,247 343,063 1,304,878 342,784 359,486 375,039 1,077,309 Discharged average length of stay 104 108 100 110 105 101 103 101 102 Average daily census 3,391 3,517 3,622 3,729 3,565 3,809 3,950 4,077 3,946 Revenue per patient day $159.6 $157.5 $157.7 $168.6 $160.9 $173.0 $167.5 $168.2 $169.5 Cost per patient day $78.8 $77.9 $77.3 $80.4 $78.6 $78.2 $78.7 $74.9 $77.2

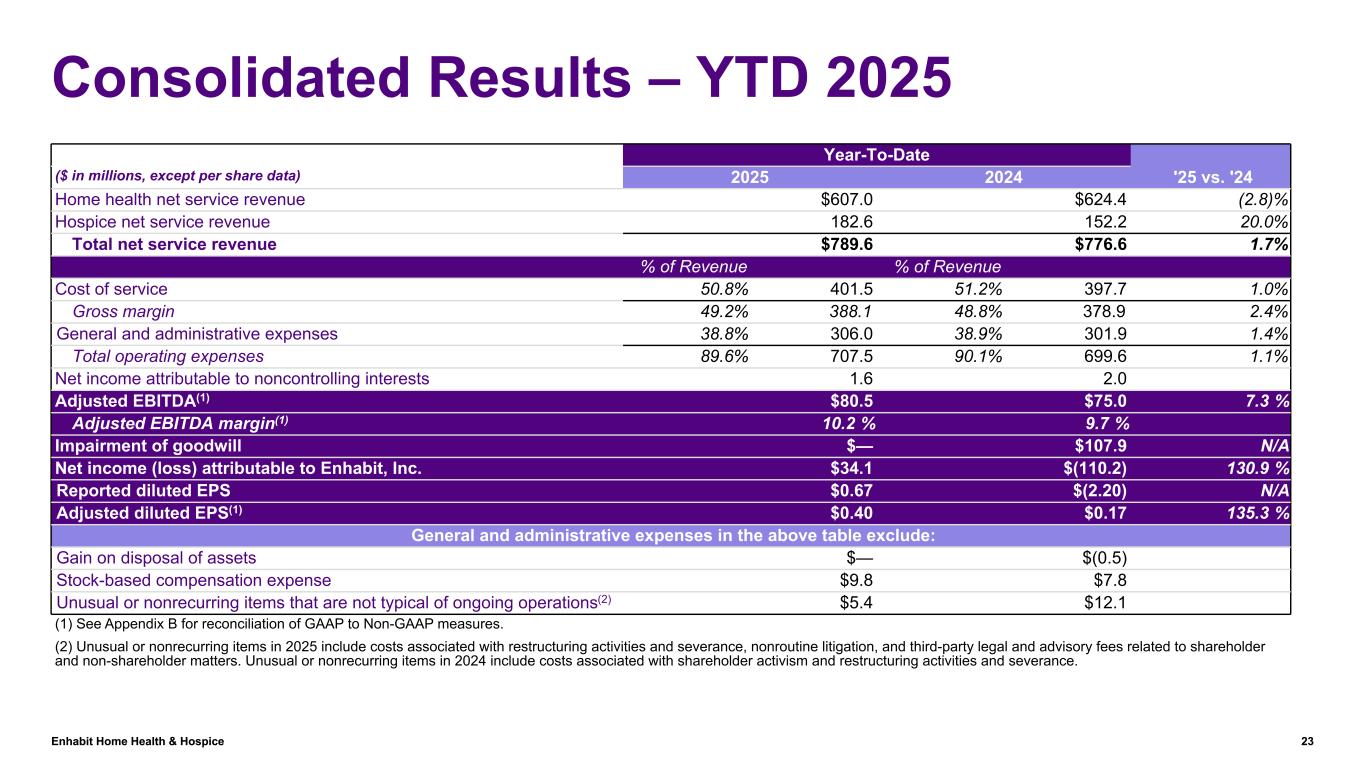

Enhabit Home Health & Hospice 23 Consolidated Results – YTD 2025 Year-To-Date '25 vs. '24($ in millions, except per share data) 2025 2024 Home health net service revenue $607.0 $624.4 (2.8) % Hospice net service revenue 182.6 152.2 20.0 % Total net service revenue $789.6 $776.6 1.7 % % of Revenue % of Revenue Cost of service 50.8 % 401.5 51.2 % 397.7 1.0 % Gross margin 49.2 % 388.1 48.8 % 378.9 2.4 % General and administrative expenses 38.8 % 306.0 38.9 % 301.9 1.4 % Total operating expenses 89.6 % 707.5 90.1 % 699.6 1.1 % Net income attributable to noncontrolling interests 1.6 2.0 Adjusted EBITDA(1) $80.5 $75.0 7.3 % Adjusted EBITDA margin(1) 10.2 % 9.7 % Impairment of goodwill $— $107.9 N/A Net income (loss) attributable to Enhabit, Inc. $34.1 $(110.2) 130.9 % Reported diluted EPS $0.67 $(2.20) N/A Adjusted diluted EPS(1) $0.40 $0.17 135.3 % General and administrative expenses in the above table exclude: Gain on disposal of assets $— $(0.5) Stock-based compensation expense $9.8 $7.8 Unusual or nonrecurring items that are not typical of ongoing operations(2) $5.4 $12.1 (1) See Appendix B for reconciliation of GAAP to Non-GAAP measures. (2) Unusual or nonrecurring items in 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to shareholder and non-shareholder matters. Unusual or nonrecurring items in 2024 include costs associated with shareholder activism and restructuring activities and severance.

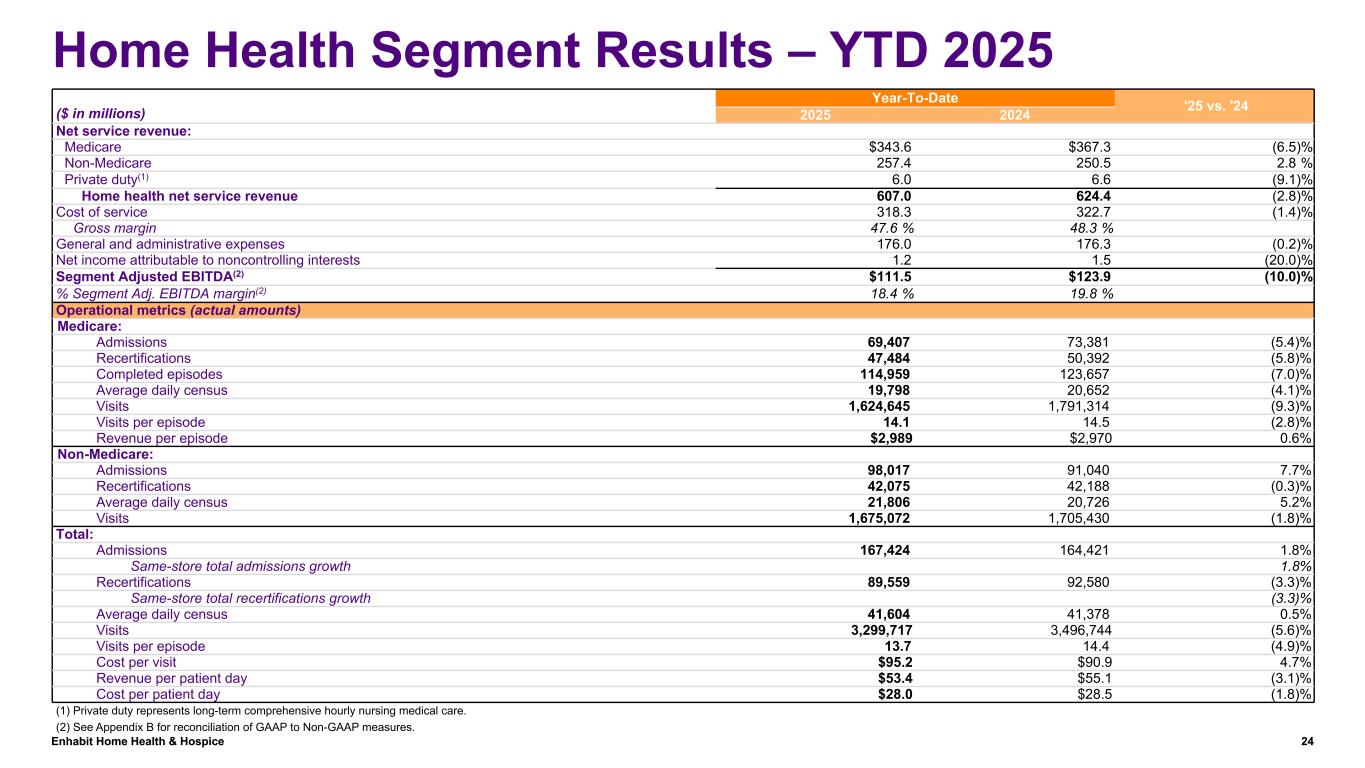

Enhabit Home Health & Hospice 24 Home Health Segment Results – YTD 2025 ($ in millions) Year-To-Date '25 vs. '242025 2024 Net service revenue: Medicare $343.6 $367.3 (6.5) % Non-Medicare 257.4 250.5 2.8 % Private duty(1) 6.0 6.6 (9.1) % Home health net service revenue 607.0 624.4 (2.8) % Cost of service 318.3 322.7 (1.4) % Gross margin 47.6 % 48.3 % General and administrative expenses 176.0 176.3 (0.2) % Net income attributable to noncontrolling interests 1.2 1.5 (20.0) % Segment Adjusted EBITDA(2) $111.5 $123.9 (10.0) % % Segment Adj. EBITDA margin(2) 18.4 % 19.8 % Operational metrics (actual amounts) Medicare: Admissions 69,407 73,381 (5.4) % Recertifications 47,484 50,392 (5.8) % Completed episodes 114,959 123,657 (7.0) % Average daily census 19,798 20,652 (4.1) % Visits 1,624,645 1,791,314 (9.3) % Visits per episode 14.1 14.5 (2.8) % Revenue per episode $2,989 $2,970 0.6 % Non-Medicare: Admissions 98,017 91,040 7.7 % Recertifications 42,075 42,188 (0.3) % Average daily census 21,806 20,726 5.2 % Visits 1,675,072 1,705,430 (1.8) % Total: Admissions 167,424 164,421 1.8 % Same-store total admissions growth 1.8 % Recertifications 89,559 92,580 (3.3) % Same-store total recertifications growth (3.3) % Average daily census 41,604 41,378 0.5 % Visits 3,299,717 3,496,744 (5.6) % Visits per episode 13.7 14.4 (4.9) % Cost per visit $95.2 $90.9 4.7 % Revenue per patient day $53.4 $55.1 (3.1) % Cost per patient day $28.0 $28.5 (1.8) % (1) Private duty represents long-term comprehensive hourly nursing medical care. (2) See Appendix B for reconciliation of GAAP to Non-GAAP measures.

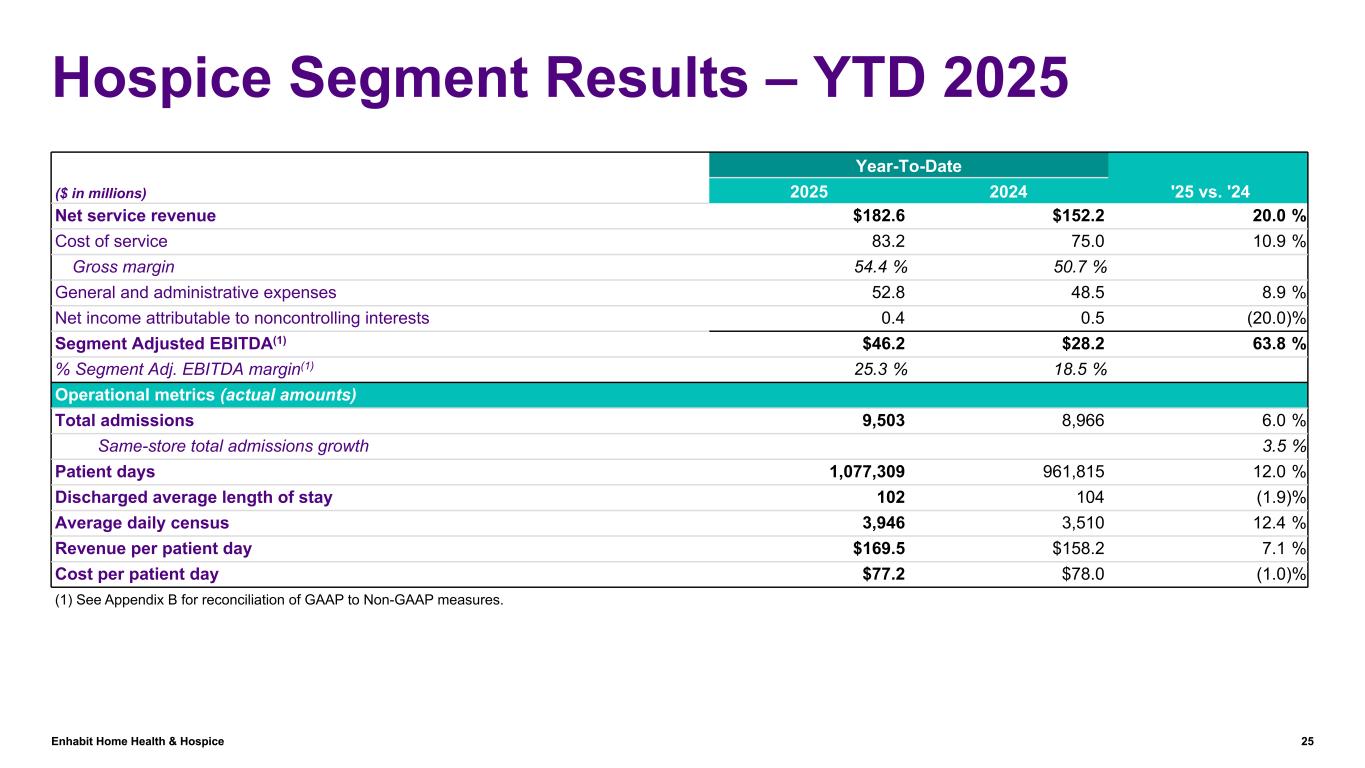

Enhabit Home Health & Hospice 25 Hospice Segment Results – YTD 2025 ($ in millions) Year-To-Date '25 vs. '242025 2024 Net service revenue $182.6 $152.2 20.0 % Cost of service 83.2 75.0 10.9 % Gross margin 54.4 % 50.7 % General and administrative expenses 52.8 48.5 8.9 % Net income attributable to noncontrolling interests 0.4 0.5 (20.0) % Segment Adjusted EBITDA(1) $46.2 $28.2 63.8 % % Segment Adj. EBITDA margin(1) 25.3 % 18.5 % Operational metrics (actual amounts) Total admissions 9,503 8,966 6.0 % Same-store total admissions growth 3.5 % Patient days 1,077,309 961,815 12.0 % Discharged average length of stay 102 104 (1.9) % Average daily census 3,946 3,510 12.4 % Revenue per patient day $169.5 $158.2 7.1 % Cost per patient day $77.2 $78.0 (1.0) % (1) See Appendix B for reconciliation of GAAP to Non-GAAP measures.

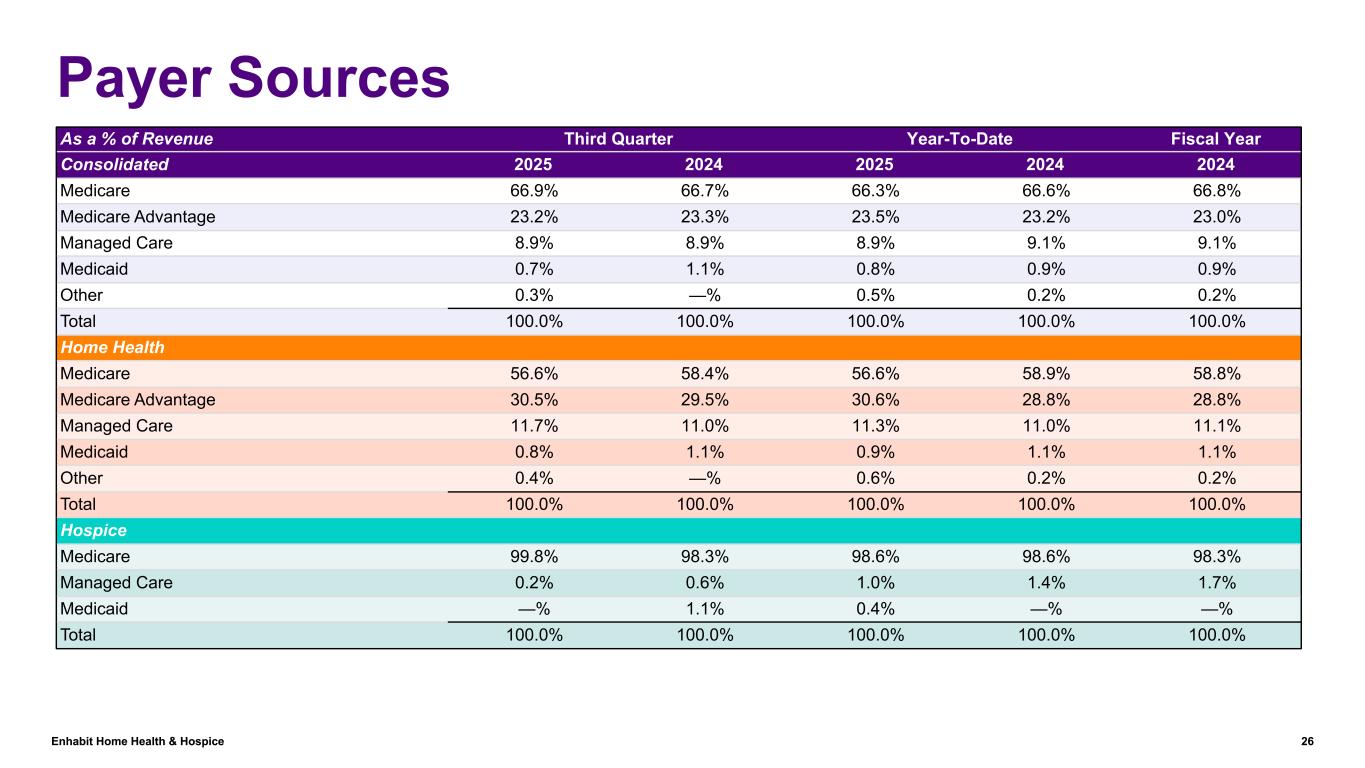

Enhabit Home Health & Hospice 26 Payer Sources As a % of Revenue Third Quarter Year-To-Date Fiscal Year Consolidated 2025 2024 2025 2024 2024 Medicare 66.9% 66.7% 66.3% 66.6% 66.8% Medicare Advantage 23.2% 23.3% 23.5% 23.2% 23.0% Managed Care 8.9% 8.9% 8.9% 9.1% 9.1% Medicaid 0.7% 1.1% 0.8% 0.9% 0.9% Other 0.3% —% 0.5% 0.2% 0.2% Total 100.0% 100.0% 100.0% 100.0% 100.0% Home Health Medicare 56.6% 58.4% 56.6% 58.9% 58.8% Medicare Advantage 30.5% 29.5% 30.6% 28.8% 28.8% Managed Care 11.7% 11.0% 11.3% 11.0% 11.1% Medicaid 0.8% 1.1% 0.9% 1.1% 1.1% Other 0.4% —% 0.6% 0.2% 0.2% Total 100.0% 100.0% 100.0% 100.0% 100.0% Hospice Medicare 99.8% 98.3% 98.6% 98.6% 98.3% Managed Care 0.2% 0.6% 1.0% 1.4% 1.7% Medicaid —% 1.1% 0.4% —% —% Total 100.0% 100.0% 100.0% 100.0% 100.0%

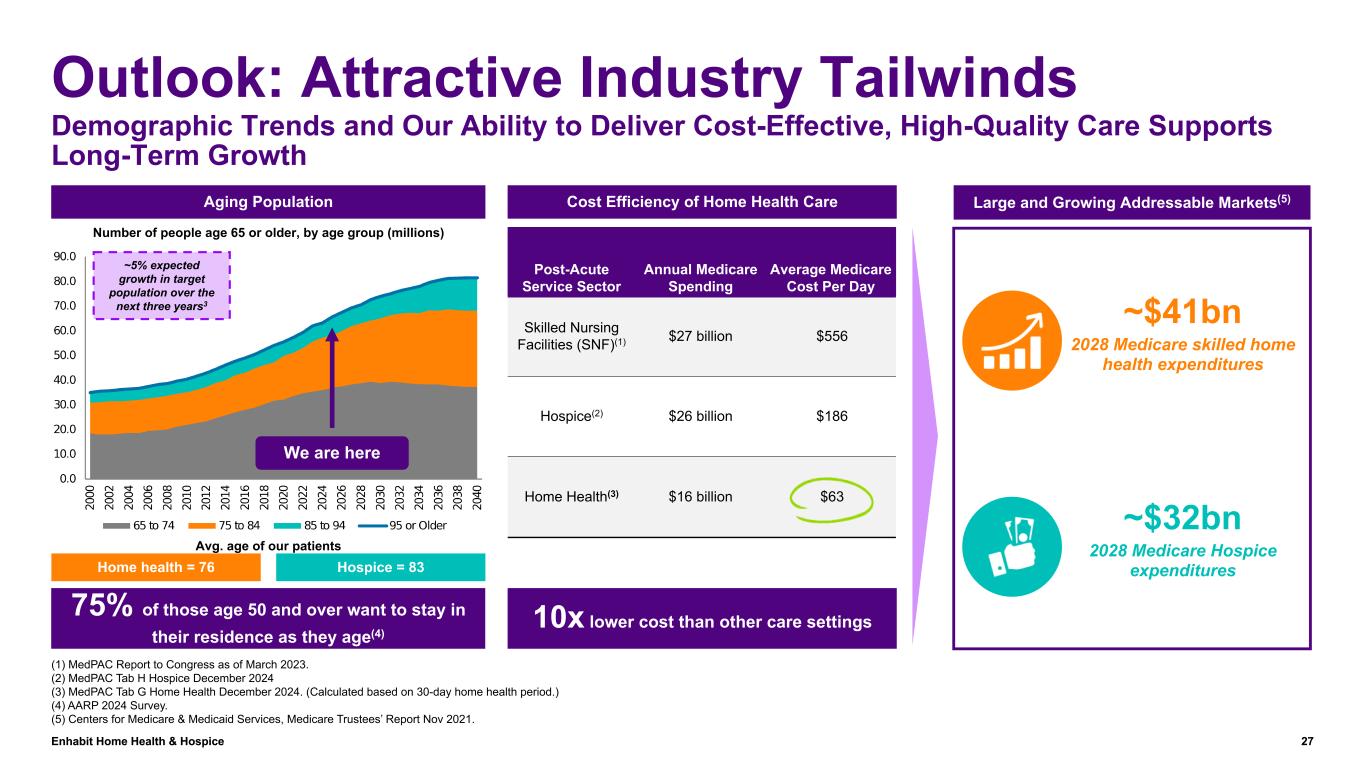

Enhabit Home Health & Hospice 27 (1) MedPAC Report to Congress as of March 2023. (2) MedPAC Tab H Hospice December 2024 (3) MedPAC Tab G Home Health December 2024. (Calculated based on 30-day home health period.) (4) AARP 2024 Survey. (5) Centers for Medicare & Medicaid Services, Medicare Trustees’ Report Nov 2021. Aging Population Cost Efficiency of Home Health Care Large and Growing Addressable Markets(5) Large and Growing Addressable Markets4 ~$41bn 2028 Medicare skilled home health expenditures ~$32bn 2028 Medicare Hospice expenditures 75% of those age 50 and over want to stay in their residence as they age(4) 10x lower cost than other care settings Post-Acute Service Sector Annual Medicare Spending Average Medicare Cost Per Day Skilled Nursing Facilities (SNF)(1) $27 billion $556 Hospice(2) $26 billion $186 Home Health(3) $16 billion $63 Home health = 76 Hospice = 83 Number of people age 65 or older, by age group (millions) ~5% expected growth in target population over the next three years3 We are here Avg. age of our patients Outlook: Attractive Industry Tailwinds Demographic Trends and Our Ability to Deliver Cost-Effective, High-Quality Care Supports Long-Term Growth

Enhabit Home Health & Hospice 28 Appendix B

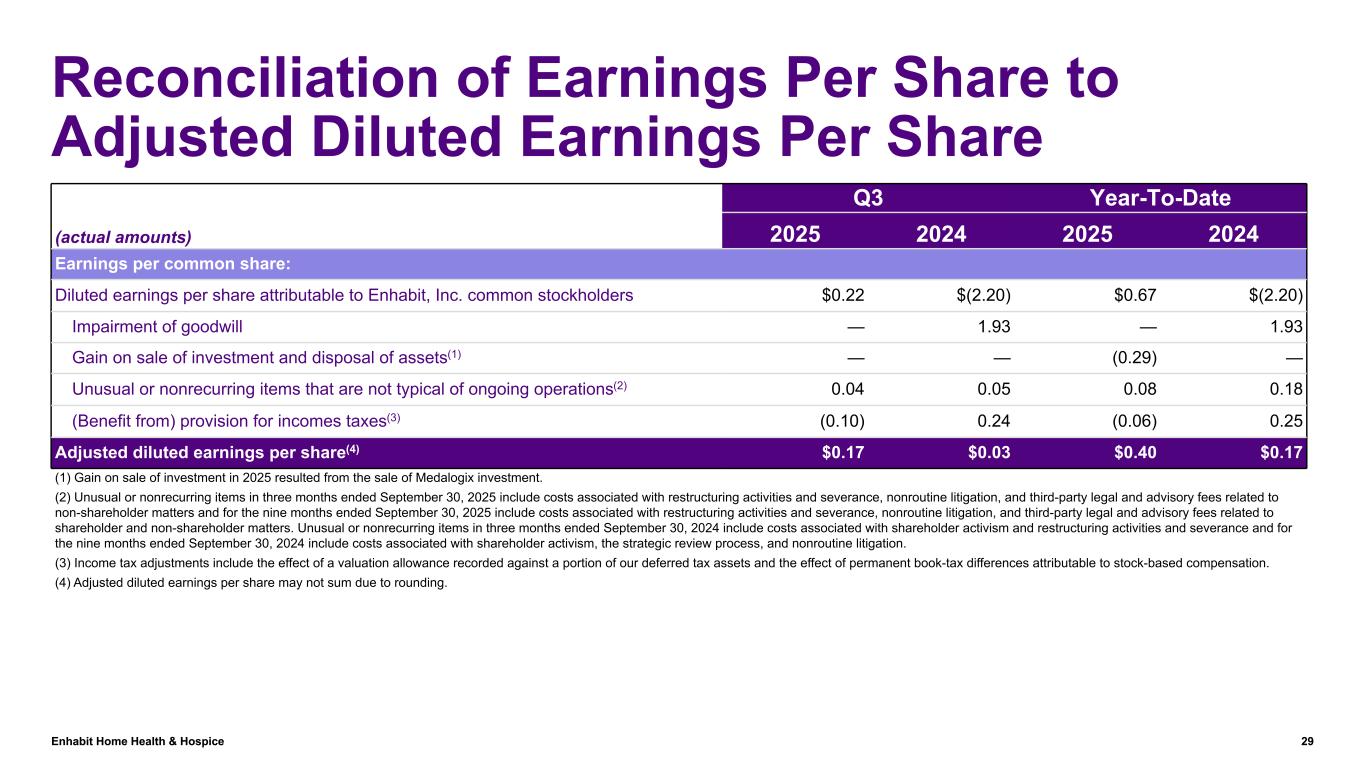

Enhabit Home Health & Hospice 29 Reconciliation of Earnings Per Share to Adjusted Diluted Earnings Per Share (actual amounts) Q3 Year-To-Date 2025 2024 2025 2024 Earnings per common share: Diluted earnings per share attributable to Enhabit, Inc. common stockholders $0.22 $(2.20) $0.67 $(2.20) Impairment of goodwill — 1.93 — 1.93 Gain on sale of investment and disposal of assets(1) — — (0.29) — Unusual or nonrecurring items that are not typical of ongoing operations(2) 0.04 0.05 0.08 0.18 (Benefit from) provision for incomes taxes(3) (0.10) 0.24 (0.06) 0.25 Adjusted diluted earnings per share(4) $0.17 $0.03 $0.40 $0.17 (1) Gain on sale of investment in 2025 resulted from the sale of Medalogix investment. (2) Unusual or nonrecurring items in three months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to non-shareholder matters and for the nine months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to shareholder and non-shareholder matters. Unusual or nonrecurring items in three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance and for the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process, and nonroutine litigation. (3) Income tax adjustments include the effect of a valuation allowance recorded against a portion of our deferred tax assets and the effect of permanent book-tax differences attributable to stock-based compensation. (4) Adjusted diluted earnings per share may not sum due to rounding.

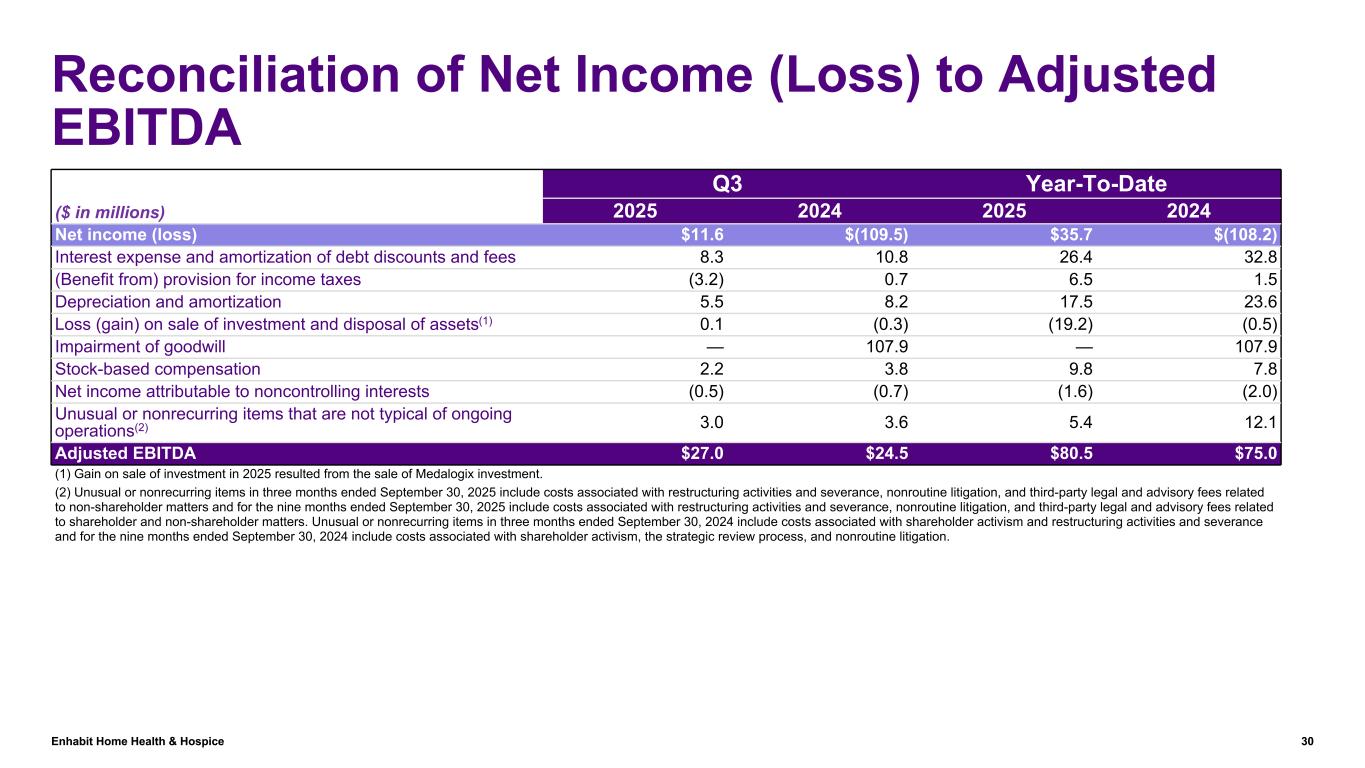

Enhabit Home Health & Hospice 30 Reconciliation of Net Income (Loss) to Adjusted EBITDA ($ in millions) Q3 Year-To-Date 2025 2024 2025 2024 Net income (loss) $11.6 $(109.5) $35.7 $(108.2) Interest expense and amortization of debt discounts and fees 8.3 10.8 26.4 32.8 (Benefit from) provision for income taxes (3.2) 0.7 6.5 1.5 Depreciation and amortization 5.5 8.2 17.5 23.6 Loss (gain) on sale of investment and disposal of assets(1) 0.1 (0.3) (19.2) (0.5) Impairment of goodwill — 107.9 — 107.9 Stock-based compensation 2.2 3.8 9.8 7.8 Net income attributable to noncontrolling interests (0.5) (0.7) (1.6) (2.0) Unusual or nonrecurring items that are not typical of ongoing operations(2) 3.0 3.6 5.4 12.1 Adjusted EBITDA $27.0 $24.5 $80.5 $75.0 (1) Gain on sale of investment in 2025 resulted from the sale of Medalogix investment. (2) Unusual or nonrecurring items in three months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to non-shareholder matters and for the nine months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to shareholder and non-shareholder matters. Unusual or nonrecurring items in three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance and for the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process, and nonroutine litigation.

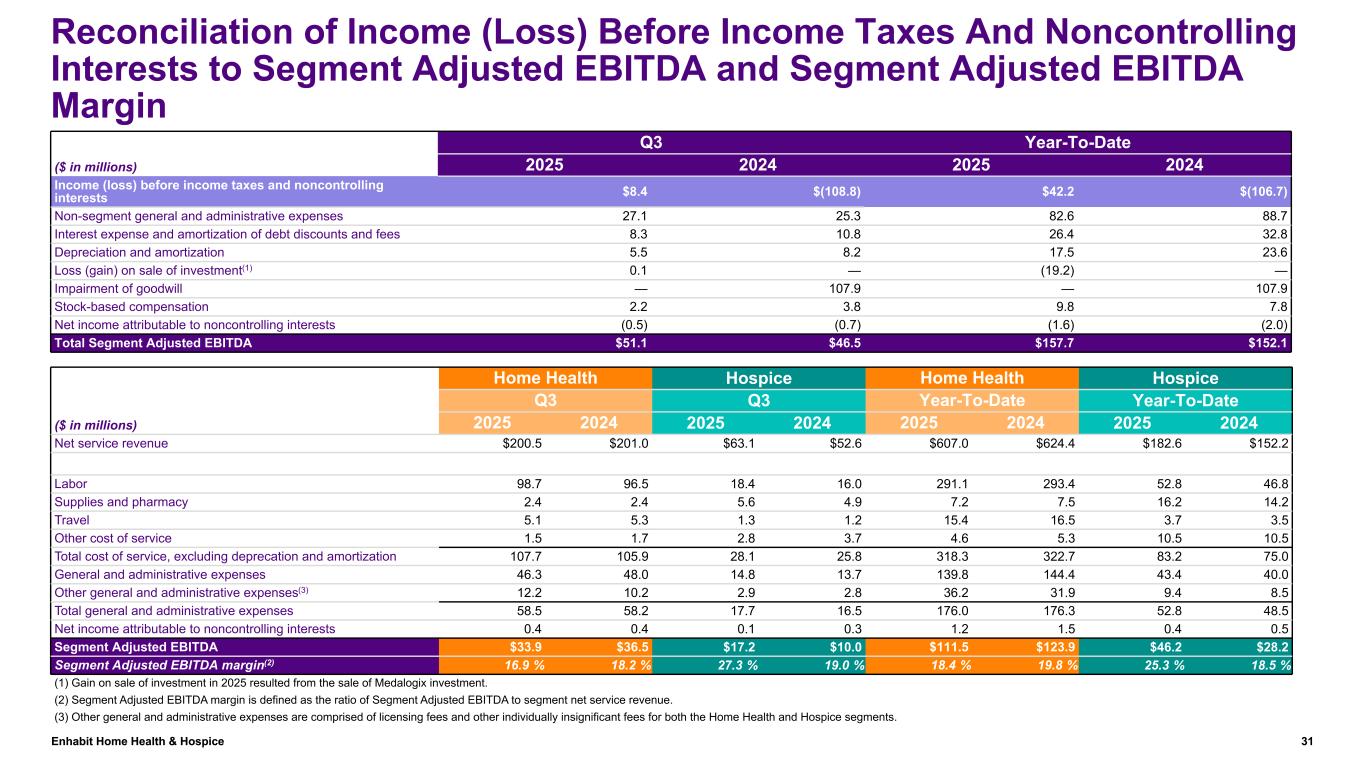

Enhabit Home Health & Hospice 31 Q3 Year-To-Date ($ in millions) 2025 2024 2025 2024 Income (loss) before income taxes and noncontrolling interests $8.4 $(108.8) $42.2 $(106.7) Non-segment general and administrative expenses 27.1 25.3 82.6 88.7 Interest expense and amortization of debt discounts and fees 8.3 10.8 26.4 32.8 Depreciation and amortization 5.5 8.2 17.5 23.6 Loss (gain) on sale of investment(1) 0.1 — (19.2) — Impairment of goodwill — 107.9 — 107.9 Stock-based compensation 2.2 3.8 9.8 7.8 Net income attributable to noncontrolling interests (0.5) (0.7) (1.6) (2.0) Total Segment Adjusted EBITDA $51.1 $46.5 $157.7 $152.1 Home Health Hospice Home Health Hospice Q3 Q3 Year-To-Date Year-To-Date ($ in millions) 2025 2024 2025 2024 2025 2024 2025 2024 Net service revenue $200.5 $201.0 $63.1 $52.6 $607.0 $624.4 $182.6 $152.2 Labor 98.7 96.5 18.4 16.0 291.1 293.4 52.8 46.8 Supplies and pharmacy 2.4 2.4 5.6 4.9 7.2 7.5 16.2 14.2 Travel 5.1 5.3 1.3 1.2 15.4 16.5 3.7 3.5 Other cost of service 1.5 1.7 2.8 3.7 4.6 5.3 10.5 10.5 Total cost of service, excluding deprecation and amortization 107.7 105.9 28.1 25.8 318.3 322.7 83.2 75.0 General and administrative expenses 46.3 48.0 14.8 13.7 139.8 144.4 43.4 40.0 Other general and administrative expenses(3) 12.2 10.2 2.9 2.8 36.2 31.9 9.4 8.5 Total general and administrative expenses 58.5 58.2 17.7 16.5 176.0 176.3 52.8 48.5 Net income attributable to noncontrolling interests 0.4 0.4 0.1 0.3 1.2 1.5 0.4 0.5 Segment Adjusted EBITDA $33.9 $36.5 $17.2 $10.0 $111.5 $123.9 $46.2 $28.2 Segment Adjusted EBITDA margin(2) 16.9 % 18.2 % 27.3 % 19.0 % 18.4 % 19.8 % 25.3 % 18.5 % (1) Gain on sale of investment in 2025 resulted from the sale of Medalogix investment. (2) Segment Adjusted EBITDA margin is defined as the ratio of Segment Adjusted EBITDA to segment net service revenue. (3) Other general and administrative expenses are comprised of licensing fees and other individually insignificant fees for both the Home Health and Hospice segments. Reconciliation of Income (Loss) Before Income Taxes And Noncontrolling Interests to Segment Adjusted EBITDA and Segment Adjusted EBITDA Margin

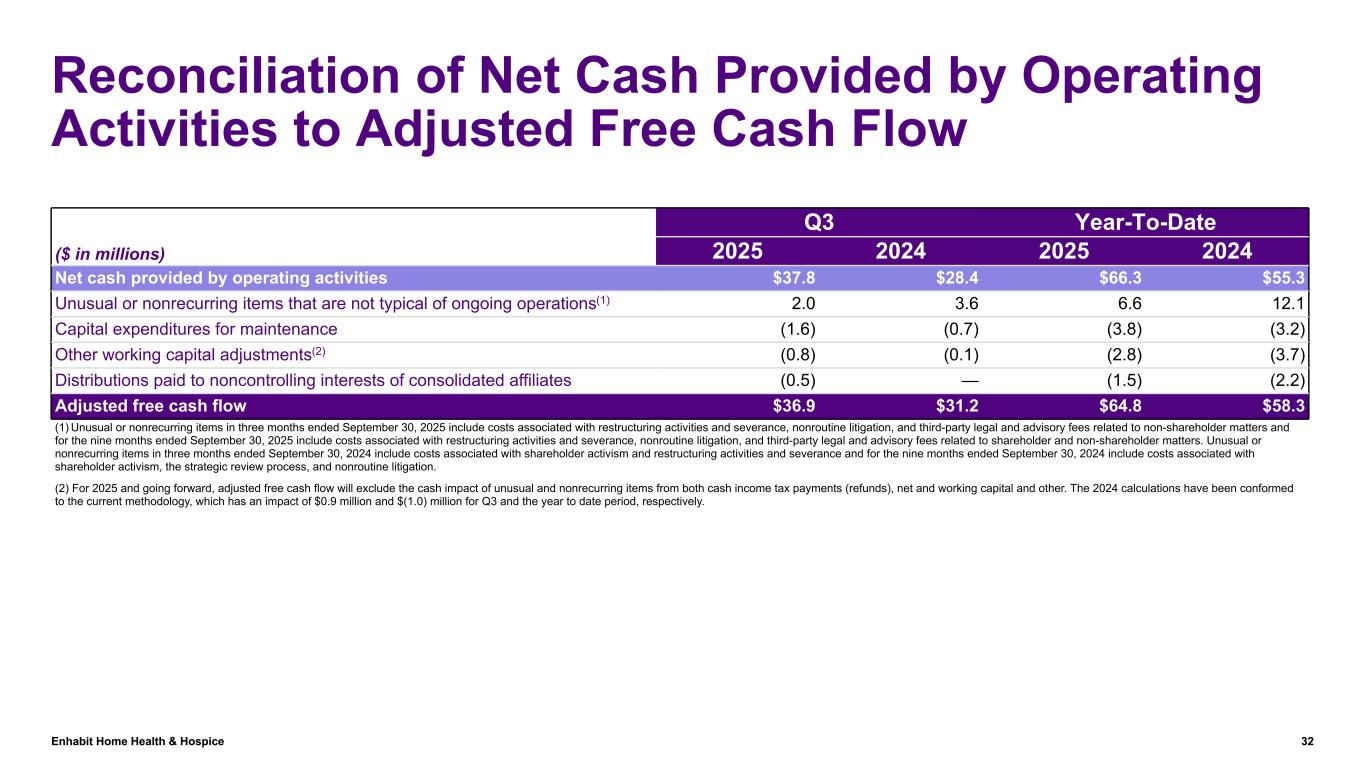

Enhabit Home Health & Hospice 32 Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow ($ in millions) Q3 Year-To-Date 2025 2024 2025 2024 Net cash provided by operating activities $37.8 $28.4 $66.3 $55.3 Unusual or nonrecurring items that are not typical of ongoing operations(1) 2.0 3.6 6.6 12.1 Capital expenditures for maintenance (1.6) (0.7) (3.8) (3.2) Other working capital adjustments(2) (0.8) (0.1) (2.8) (3.7) Distributions paid to noncontrolling interests of consolidated affiliates (0.5) — (1.5) (2.2) Adjusted free cash flow $36.9 $31.2 $64.8 $58.3 (1) Unusual or nonrecurring items in three months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to non-shareholder matters and for the nine months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to shareholder and non-shareholder matters. Unusual or nonrecurring items in three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance and for the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process, and nonroutine litigation. (2) For 2025 and going forward, adjusted free cash flow will exclude the cash impact of unusual and nonrecurring items from both cash income tax payments (refunds), net and working capital and other. The 2024 calculations have been conformed to the current methodology, which has an impact of $0.9 million and $(1.0) million for Q3 and the year to date period, respectively.

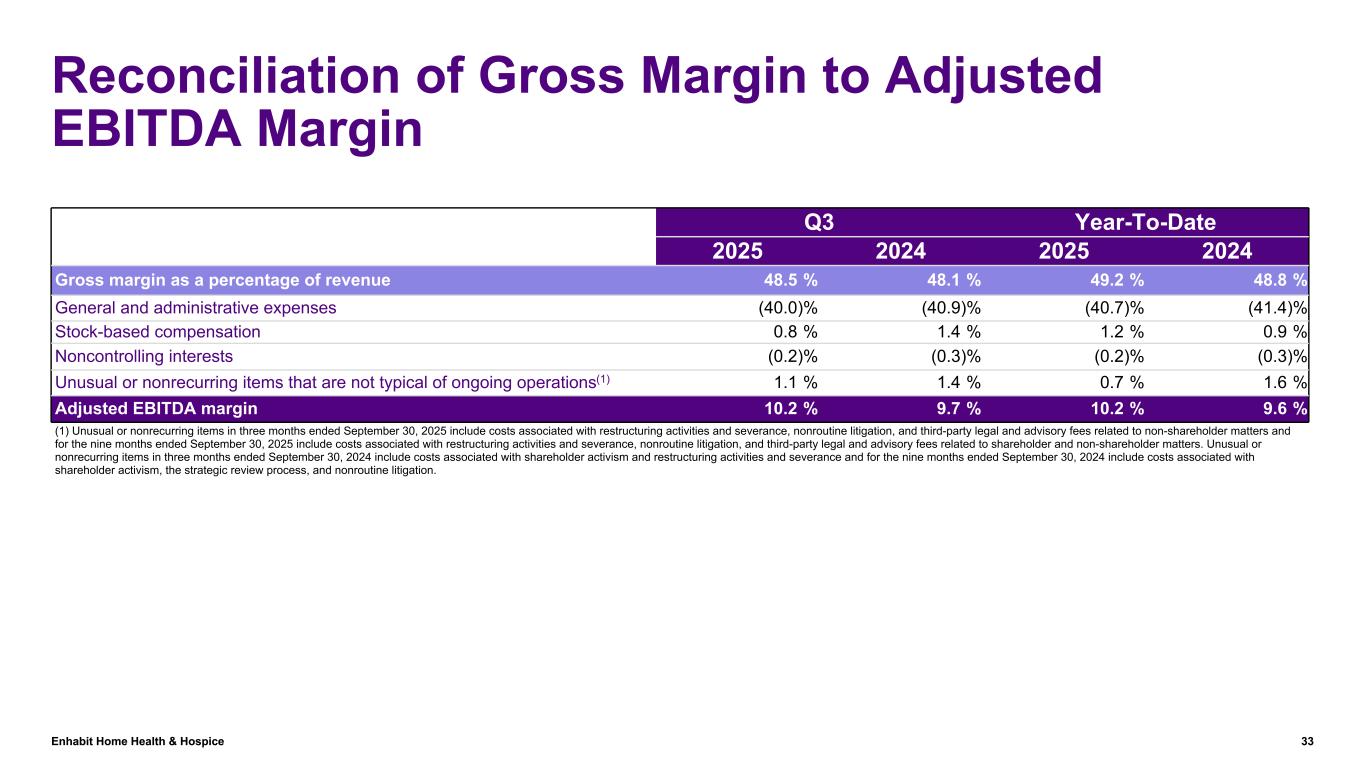

Enhabit Home Health & Hospice 33 Reconciliation of Gross Margin to Adjusted EBITDA Margin Q3 Year-To-Date 2025 2024 2025 2024 Gross margin as a percentage of revenue 48.5 % 48.1 % 49.2 % 48.8 % General and administrative expenses (40.0) % (40.9) % (40.7) % (41.4) % Stock-based compensation 0.8 % 1.4 % 1.2 % 0.9 % Noncontrolling interests (0.2) % (0.3) % (0.2) % (0.3) % Unusual or nonrecurring items that are not typical of ongoing operations(1) 1.1 % 1.4 % 0.7 % 1.6 % Adjusted EBITDA margin 10.2 % 9.7 % 10.2 % 9.6 % (1) Unusual or nonrecurring items in three months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to non-shareholder matters and for the nine months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to shareholder and non-shareholder matters. Unusual or nonrecurring items in three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance and for the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process, and nonroutine litigation.

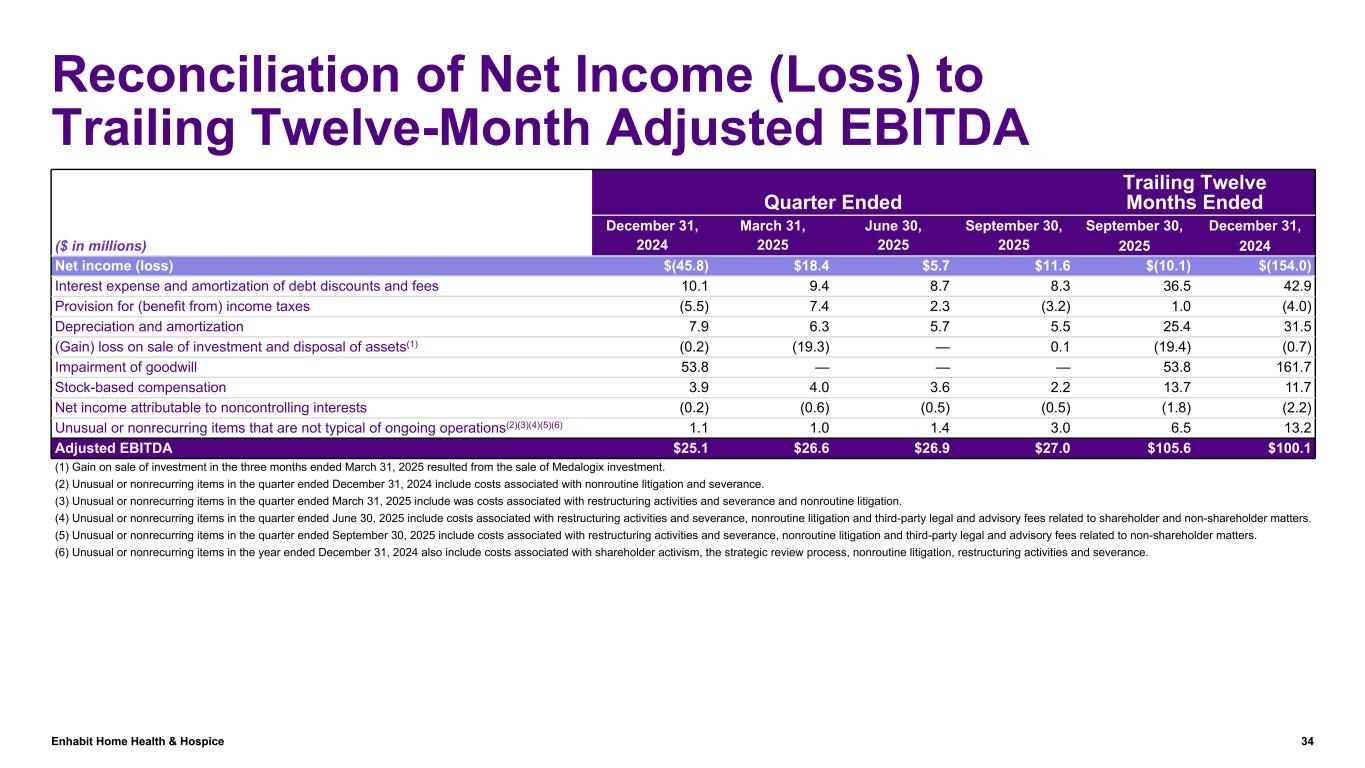

Enhabit Home Health & Hospice 34 Reconciliation of Net Income (Loss) to Trailing Twelve-Month Adjusted EBITDA ($ in millions) Quarter Ended Trailing Twelve Months Ended December 31, March 31, June 30, September 30, September 30, December 31, 2024 2025 2025 2025 2025 2024 Net income (loss) $(45.8) $18.4 $5.7 $11.6 $(10.1) $(154.0) Interest expense and amortization of debt discounts and fees 10.1 9.4 8.7 8.3 36.5 42.9 Provision for (benefit from) income taxes (5.5) 7.4 2.3 (3.2) 1.0 (4.0) Depreciation and amortization 7.9 6.3 5.7 5.5 25.4 31.5 (Gain) loss on sale of investment and disposal of assets(1) (0.2) (19.3) — 0.1 (19.4) (0.7) Impairment of goodwill 53.8 — — — 53.8 161.7 Stock-based compensation 3.9 4.0 3.6 2.2 13.7 11.7 Net income attributable to noncontrolling interests (0.2) (0.6) (0.5) (0.5) (1.8) (2.2) Unusual or nonrecurring items that are not typical of ongoing operations(2)(3)(4)(5)(6) 1.1 1.0 1.4 3.0 6.5 13.2 Adjusted EBITDA $25.1 $26.6 $26.9 $27.0 $105.6 $100.1 (1) Gain on sale of investment in the three months ended March 31, 2025 resulted from the sale of Medalogix investment. (2) Unusual or nonrecurring items in the quarter ended December 31, 2024 include costs associated with nonroutine litigation and severance. (3) Unusual or nonrecurring items in the quarter ended March 31, 2025 include was costs associated with restructuring activities and severance and nonroutine litigation. (4) Unusual or nonrecurring items in the quarter ended June 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation and third-party legal and advisory fees related to shareholder and non-shareholder matters. (5) Unusual or nonrecurring items in the quarter ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation and third-party legal and advisory fees related to non-shareholder matters. (6) Unusual or nonrecurring items in the year ended December 31, 2024 also include costs associated with shareholder activism, the strategic review process, nonroutine litigation, restructuring activities and severance.