Bank of America Securities Home Care Conference Supplemental Information December 09, 2025

Enhabit Home Health & Hospice 2 Disclaimer Forward looking statements This presentation contains historical information, as well as forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) that involve known and unknown risks and relate to, among other things, future events, projections, financial guidance, legislative or regulatory developments, strategy or growth opportunities, our future financial performance, our projected business results, or our projected capital expenditures. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, the reader can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “targets,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Any forward-looking statement speaks only as of the date of this presentation, and the Company undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties, many of which are beyond our control. Actual events or results may differ materially from the results anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by the Company include, but are not limited to, our ability to execute on our strategic plans; regulatory and other developments impacting the markets for our services; changes in reimbursement rates; general economic conditions; changes in the episodic versus non-episodic mix of our payers, the case mix of our patients, and payment methodologies; our ability to attract and retain key management personnel and healthcare professionals; potential disruptions or breaches of our or our vendors’, payers’, and other contract counterparties’ information systems; the outcome of litigation; quality performance and ratings; our ability to successfully complete and integrate de novo locations, acquisitions, investments, and joint ventures; our ability to successfully integrate technology in our operations; and our ability to control costs, particularly labor and employee benefit costs. Additional information regarding risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this presentation are described in reports filed with the SEC, including our annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, copies of which are available on the Company's website at http://investors.ehab.com. Note regarding presentation of non-GAAP financial measures This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Exchange Act, including Adjusted EBITDA, Adjusted earnings per share, and Adjusted free cash flow. For 2025, the Company has modified its methodology of calculating Adjusted free cash flow to exclude the impact of unusual or nonrecurring items on cash income taxes and changes in working capital. The change was made to conform to the Adjusted free cash flow measure with the current definition used by management and the Board of Directors to manage cash flow and evaluate performance. Prior periods presented herein have been recast to conform with the new methodology. The Company believes the non-GAAP financial measures are useful to investors because they facilitate evaluation of core business operating results over multiple periods unaffected by differences in unusual or nonrecurring items. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP are presented at the end of this presentation. Our Form 8-K, filed with the SEC on November 5, 2025, provides further explanation and disclosure regarding Enhabit’s use of non-GAAP financial measures and should be read in conjunction with this supplemental information. Additionally, our Form 10-Q for the three months ended September 30, 2025, provides further information regarding "unusual or nonrecurring items that are not typical of ongoing operations," a reconciliation item in our Adjusted EBITDA calculation.

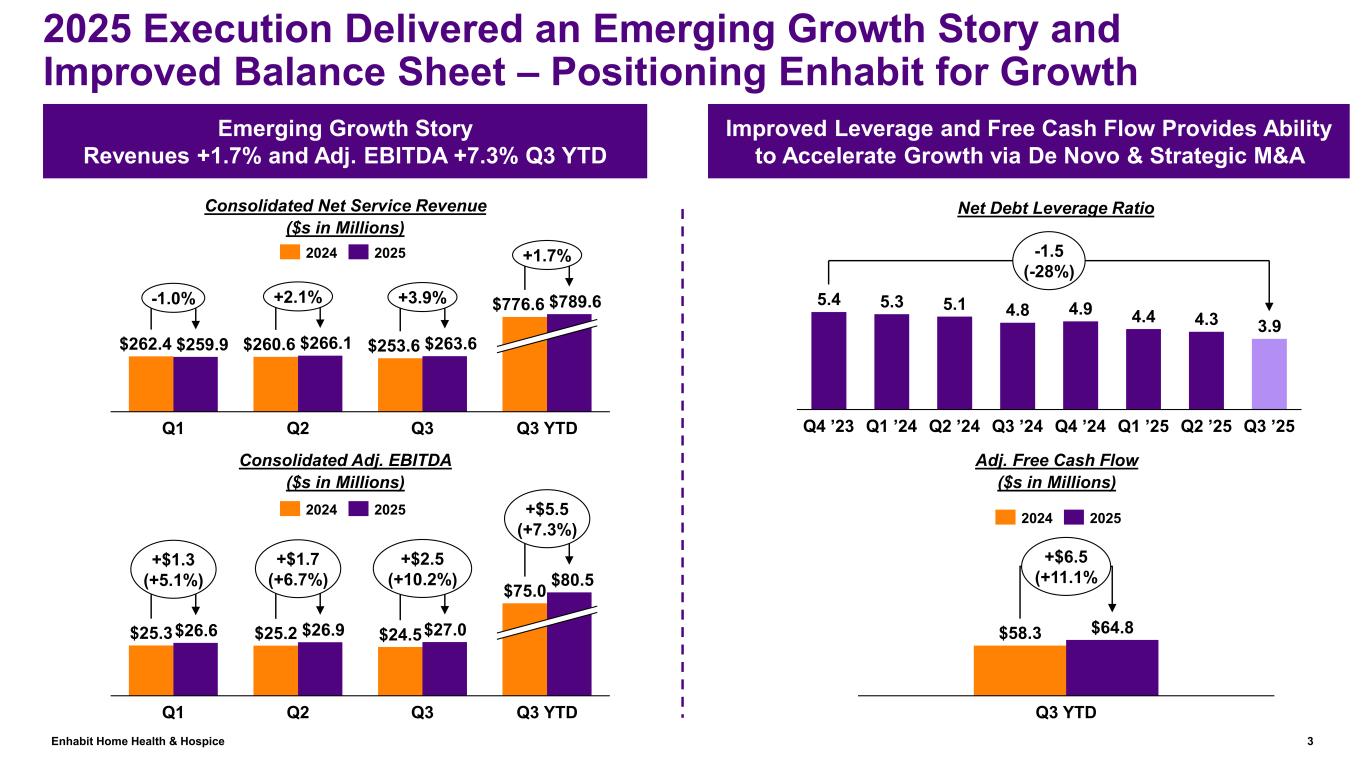

Enhabit Home Health & Hospice 3 2025 Execution Delivered an Emerging Growth Story and Improved Balance Sheet – Positioning Enhabit for Growth Emerging Growth Story Revenues +1.7% and Adj. EBITDA +7.3% Q3 YTD Improved Leverage and Free Cash Flow Provides Ability to Accelerate Growth via De Novo & Strategic M&A Q1 Q2 Q3 Q3 YTD $25.3$26.6 $25.2 $26.9 $24.5$27.0 $75.0 $80.5 +$1.3 (+5.1%) +$1.7 (+6.7%) +$2.5 (+10.2%) +$5.5 (+7.3%) 2024 2025 Q1 Q2 Q3 Q3 YTD $262.4 $259.9 $260.6 $266.1 $253.6 $263.6 $776.6 $789.6-1.0% +2.1% +3.9% +1.7% Consolidated Net Service Revenue ($s in Millions) Consolidated Adj. EBITDA ($s in Millions) 2024 2025 5.4 5.3 5.1 4.8 4.9 4.4 4.3 3.9 Q4 ’23 Q1 ’24 Q2 ’24 Q3 ’24 Q4 ’24 Q1 ’25 Q2 ’25 Q3 ’25 -1.5 (-28%) Net Debt Leverage Ratio Adj. Free Cash Flow ($s in Millions) Q3 YTD $58.3 $64.8 +$6.5 (+11.1% 2024 2025

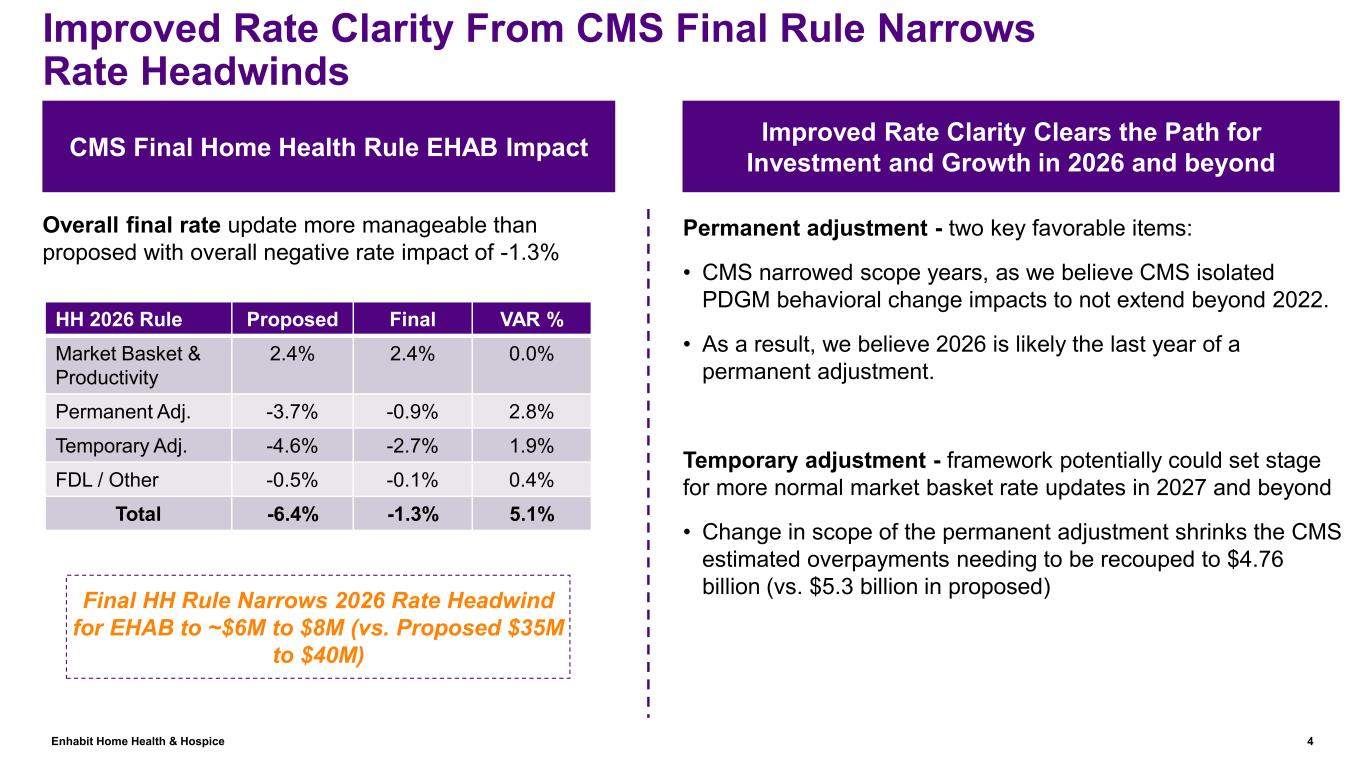

Enhabit Home Health & Hospice 4 Improved Rate Clarity From CMS Final Rule Narrows Rate Headwinds CMS Final Home Health Rule EHAB Impact Overall final rate update more manageable than proposed with overall negative rate impact of -1.3% Final HH Rule Narrows 2026 Rate Headwind for EHAB to ~$6M to $8M (vs. Proposed $35M to $40M) Permanent adjustment - two key favorable items: • CMS narrowed scope years, as we believe CMS isolated PDGM behavioral change impacts to not extend beyond 2022. • As a result, we believe 2026 is likely the last year of a permanent adjustment. Temporary adjustment - framework potentially could set stage for more normal market basket rate updates in 2027 and beyond • Change in scope of the permanent adjustment shrinks the CMS estimated overpayments needing to be recouped to $4.76 billion (vs. $5.3 billion in proposed) Improved Rate Clarity Clears the Path for Investment and Growth in 2026 and beyond HH 2026 Rule Proposed Final VAR % Market Basket & Productivity 2.4% 2.4% 0.0% Permanent Adj. -3.7% -0.9% 2.8% Temporary Adj. -4.6% -2.7% 1.9% FDL / Other -0.5% -0.1% 0.4% Total -6.4% -1.3% 5.1%

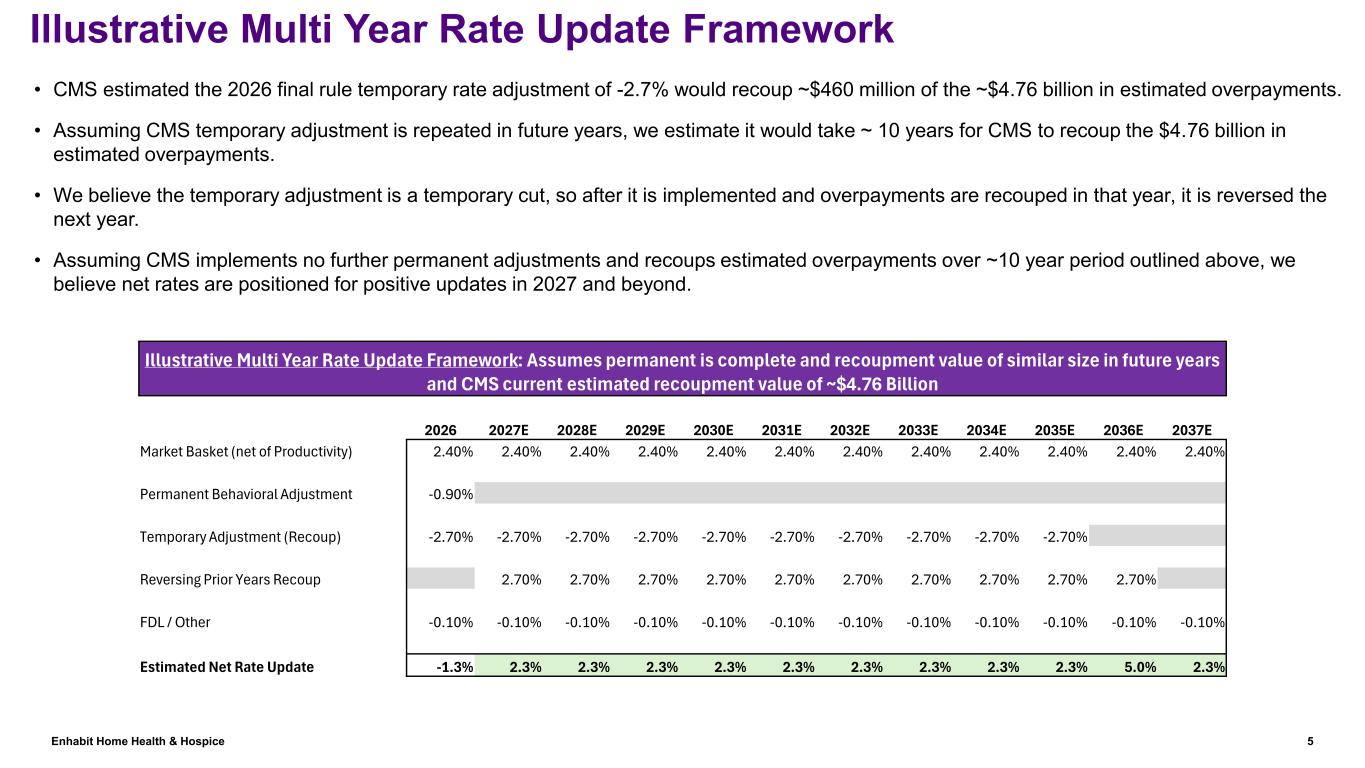

Enhabit Home Health & Hospice 5 Illustrative Multi Year Rate Update Framework • CMS estimated the 2026 final rule temporary rate adjustment of -2.7% would recoup ~$460 million of the ~$4.76 billion in estimated overpayments. • Assuming CMS temporary adjustment is repeated in future years, we estimate it would take ~ 10 years for CMS to recoup the $4.76 billion in estimated overpayments. • We believe the temporary adjustment is a temporary cut, so after it is implemented and overpayments are recouped in that year, it is reversed the next year. • Assuming CMS implements no further permanent adjustments and recoups estimated overpayments over ~10 year period outlined above, we believe net rates are positioned for positive updates in 2027 and beyond. Illustrative Multi Year Rate Update Framework: Assumes permanent is complete and recoupment value of similar size in future years and CMS current estimated recoupment value of ~$4.76 Billion 2026 2027E 2028E 2029E 2030E 2031E 2032E 2033E 2034E 2035E 2036E 2037E Market Basket (net of Productivity) 2.40% 2.40% 2.40% 2.40% 2.40% 2.40% 2.40% 2.40% 2.40% 2.40% 2.40% 2.40% Permanent Behavioral Adjustment -0.90% Temporary Adjustment (Recoup) -2.70% -2.70% -2.70% -2.70% -2.70% -2.70% -2.70% -2.70% -2.70% -2.70% Reversing Prior Years Recoup 2.70% 2.70% 2.70% 2.70% 2.70% 2.70% 2.70% 2.70% 2.70% 2.70% FDL / Other -0.10% -0.10% -0.10% -0.10% -0.10% -0.10% -0.10% -0.10% -0.10% -0.10% -0.10% -0.10% Estimated Net Rate Update -1.3% 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% 5.0% 2.3%

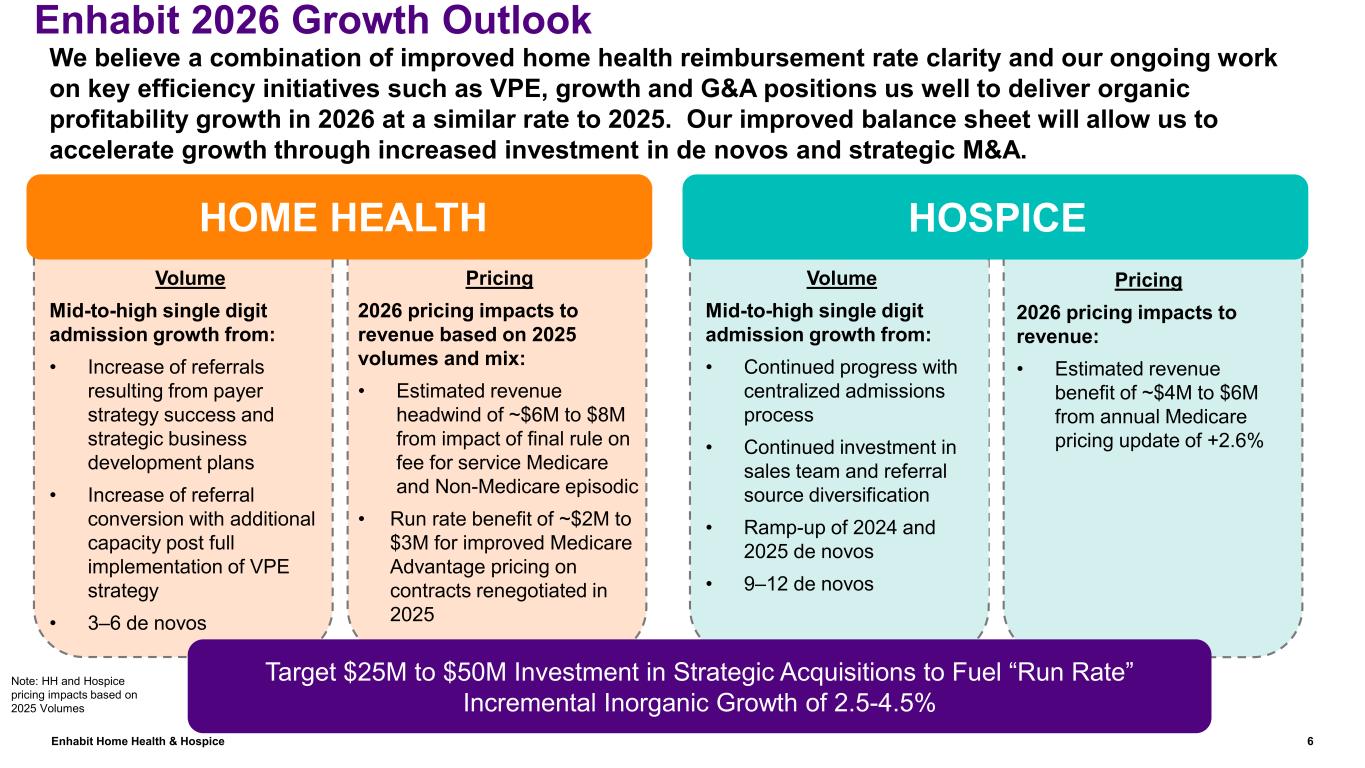

Enhabit Home Health & Hospice 6 Pricing 2026 pricing impacts to revenue based on 2025 volumes and mix: • Estimated revenue headwind of ~$6M to $8M from impact of final rule on fee for service Medicare and Non-Medicare episodic • Run rate benefit of ~$2M to $3M for improved Medicare Advantage pricing on contracts renegotiated in 2025 Enhabit 2026 Growth Outlook HOME HEALTH Volume Mid-to-high single digit admission growth from: • Increase of referrals resulting from payer strategy success and strategic business development plans • Increase of referral conversion with additional capacity post full implementation of VPE strategy • 3–6 de novos HOSPICE HOSPICE Volume Mid-to-high single digit admission growth from: • Continued progress with centralized admissions process • Continued investment in sales team and referral source diversification • Ramp-up of 2024 and 2025 de novos • 9–12 de novos Target $25M to $50M Investment in Strategic Acquisitions to Fuel “Run Rate” Incremental Inorganic Growth of 2.5-4.5% Pricing 2026 pricing impacts to revenue: • Estimated revenue benefit of ~$4M to $6M from annual Medicare pricing update of +2.6% Note: HH and Hospice pricing impacts based on 2025 Volumes We believe a combination of improved home health reimbursement rate clarity and our ongoing work on key efficiency initiatives such as VPE, growth and G&A positions us well to deliver organic profitability growth in 2026 at a similar rate to 2025. Our improved balance sheet will allow us to accelerate growth through increased investment in de novos and strategic M&A.

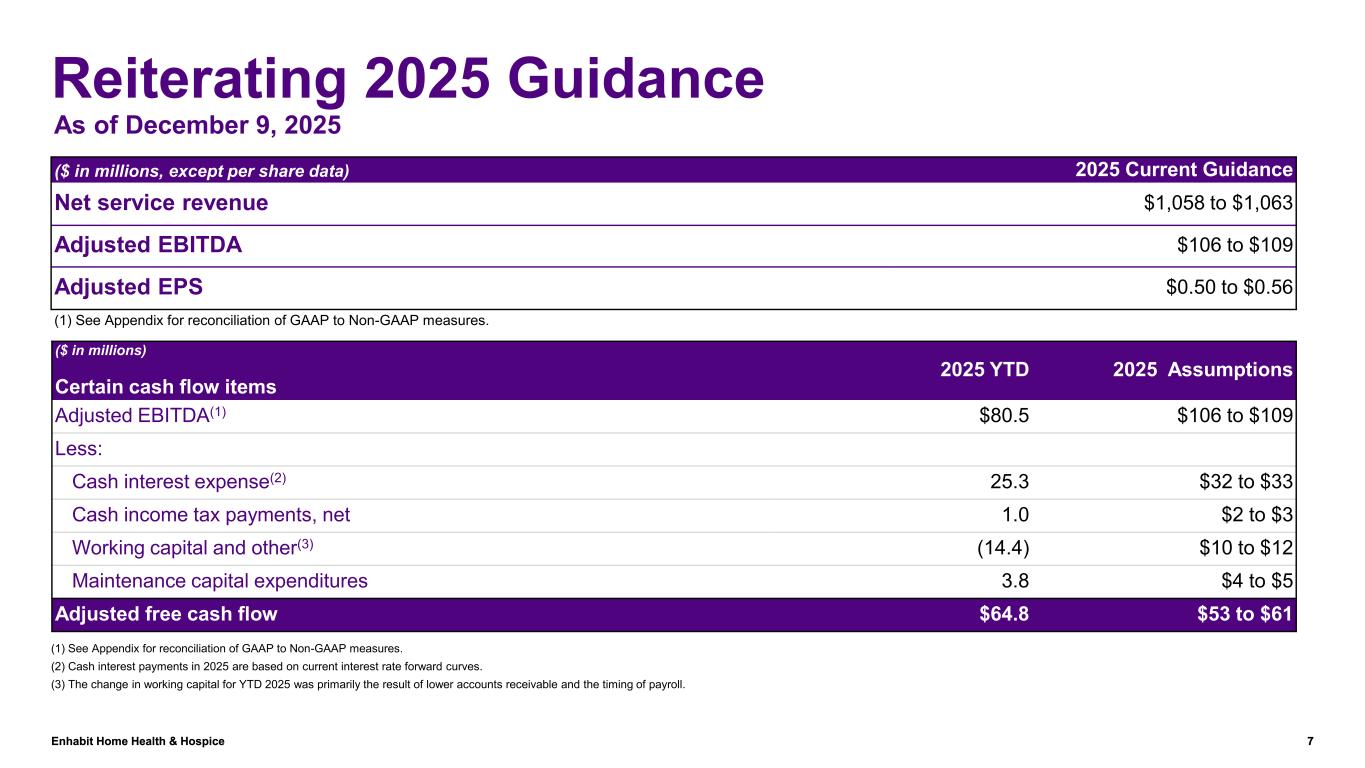

Enhabit Home Health & Hospice 7 Reiterating 2025 Guidance ($ in millions, except per share data) 2025 Current Guidance Net service revenue $1,058 to $1,063 Adjusted EBITDA $106 to $109 Adjusted EPS $0.50 to $0.56 (1) See Appendix for reconciliation of GAAP to Non-GAAP measures. As of December 9, 2025 ($ in millions) Certain cash flow items 2025 YTD 2025 Assumptions Adjusted EBITDA(1) $80.5 $106 to $109 Less: Cash interest expense(2) 25.3 $32 to $33 Cash income tax payments, net 1.0 $2 to $3 Working capital and other(3) (14.4) $10 to $12 Maintenance capital expenditures 3.8 $4 to $5 Adjusted free cash flow $64.8 $53 to $61 (1) See Appendix for reconciliation of GAAP to Non-GAAP measures. (2) Cash interest payments in 2025 are based on current interest rate forward curves. (3) The change in working capital for YTD 2025 was primarily the result of lower accounts receivable and the timing of payroll.

Appendix December 09, 2025

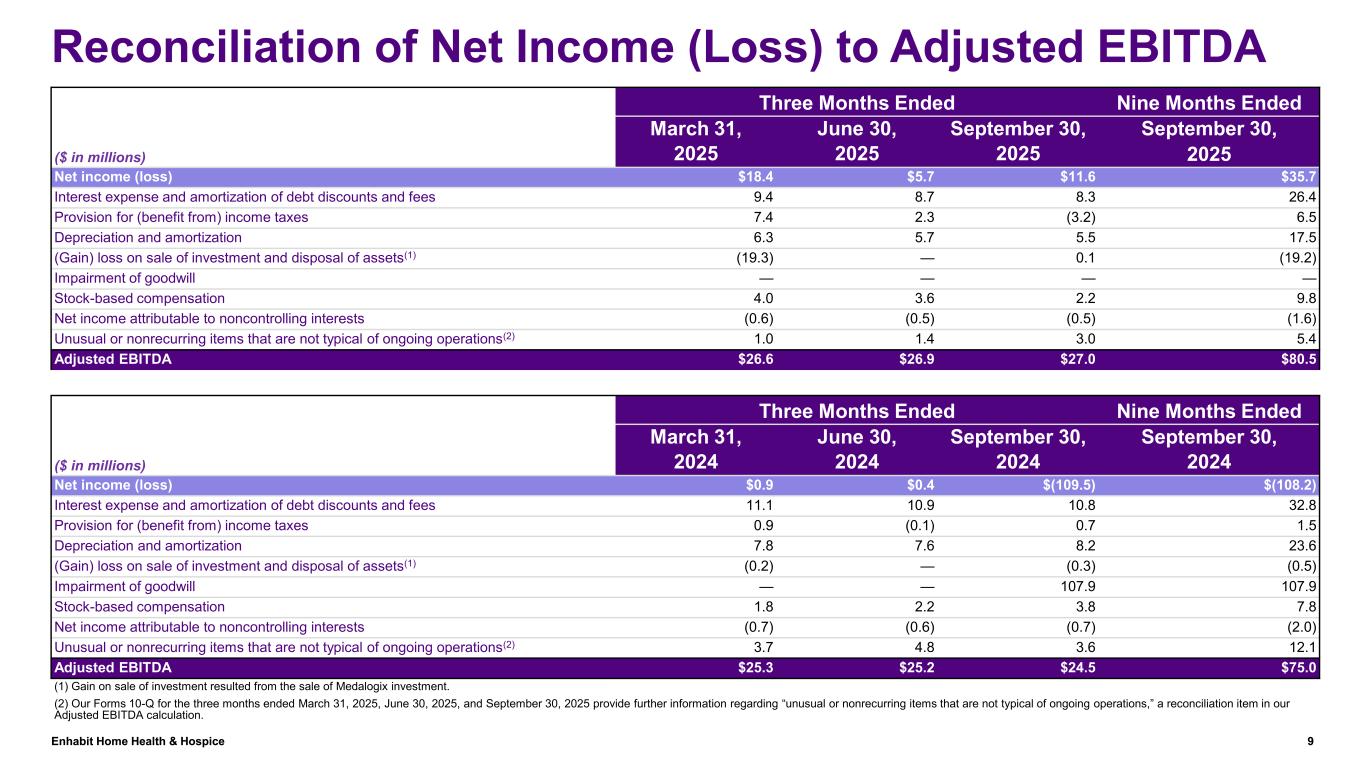

Enhabit Home Health & Hospice 9 Reconciliation of Net Income (Loss) to Adjusted EBITDA ($ in millions) Three Months Ended Nine Months Ended March 31, June 30, September 30, September 30, 2025 2025 2025 2025 Net income (loss) $18.4 $5.7 $11.6 $35.7 Interest expense and amortization of debt discounts and fees 9.4 8.7 8.3 26.4 Provision for (benefit from) income taxes 7.4 2.3 (3.2) 6.5 Depreciation and amortization 6.3 5.7 5.5 17.5 (Gain) loss on sale of investment and disposal of assets(1) (19.3) — 0.1 (19.2) Impairment of goodwill — — — — Stock-based compensation 4.0 3.6 2.2 9.8 Net income attributable to noncontrolling interests (0.6) (0.5) (0.5) (1.6) Unusual or nonrecurring items that are not typical of ongoing operations(2) 1.0 1.4 3.0 5.4 Adjusted EBITDA $26.6 $26.9 $27.0 $80.5 ($ in millions) Three Months Ended Nine Months Ended March 31, June 30, September 30, September 30, 2024 2024 2024 2024 Net income (loss) $0.9 $0.4 $(109.5) $(108.2) Interest expense and amortization of debt discounts and fees 11.1 10.9 10.8 32.8 Provision for (benefit from) income taxes 0.9 (0.1) 0.7 1.5 Depreciation and amortization 7.8 7.6 8.2 23.6 (Gain) loss on sale of investment and disposal of assets(1) (0.2) — (0.3) (0.5) Impairment of goodwill — — 107.9 107.9 Stock-based compensation 1.8 2.2 3.8 7.8 Net income attributable to noncontrolling interests (0.7) (0.6) (0.7) (2.0) Unusual or nonrecurring items that are not typical of ongoing operations(2) 3.7 4.8 3.6 12.1 Adjusted EBITDA $25.3 $25.2 $24.5 $75.0 (1) Gain on sale of investment resulted from the sale of Medalogix investment. (2) Our Forms 10-Q for the three months ended March 31, 2025, June 30, 2025, and September 30, 2025 provide further information regarding “unusual or nonrecurring items that are not typical of ongoing operations,” a reconciliation item in our Adjusted EBITDA calculation.

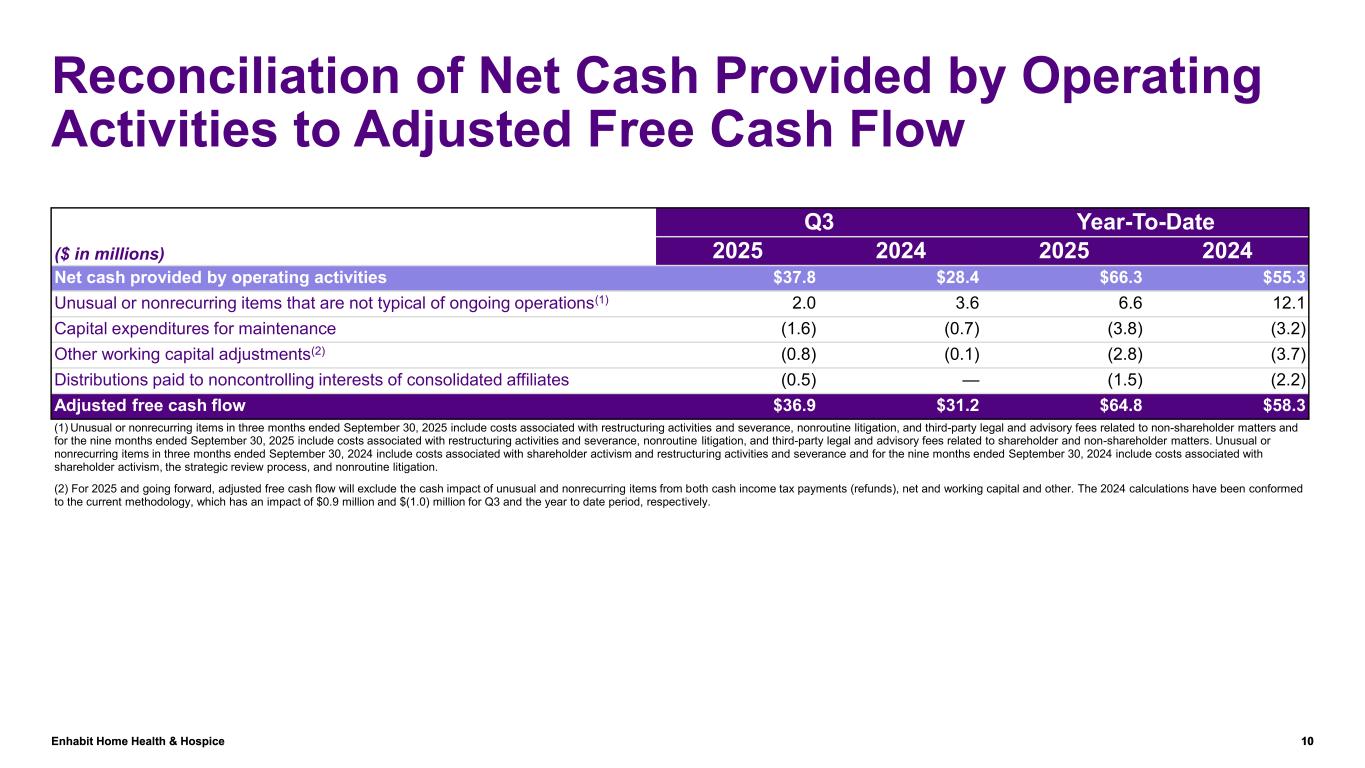

Enhabit Home Health & Hospice 10 Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow ($ in millions) Q3 Year-To-Date 2025 2024 2025 2024 Net cash provided by operating activities $37.8 $28.4 $66.3 $55.3 Unusual or nonrecurring items that are not typical of ongoing operations(1) 2.0 3.6 6.6 12.1 Capital expenditures for maintenance (1.6) (0.7) (3.8) (3.2) Other working capital adjustments(2) (0.8) (0.1) (2.8) (3.7) Distributions paid to noncontrolling interests of consolidated affiliates (0.5) — (1.5) (2.2) Adjusted free cash flow $36.9 $31.2 $64.8 $58.3 (1) Unusual or nonrecurring items in three months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to non-shareholder matters and for the nine months ended September 30, 2025 include costs associated with restructuring activities and severance, nonroutine litigation, and third-party legal and advisory fees related to shareholder and non-shareholder matters. Unusual or nonrecurring items in three months ended September 30, 2024 include costs associated with shareholder activism and restructuring activities and severance and for the nine months ended September 30, 2024 include costs associated with shareholder activism, the strategic review process, and nonroutine litigation. (2) For 2025 and going forward, adjusted free cash flow will exclude the cash impact of unusual and nonrecurring items from both cash income tax payments (refunds), net and working capital and other. The 2024 calculations have been conformed to the current methodology, which has an impact of $0.9 million and $(1.0) million for Q3 and the year to date period, respectively.