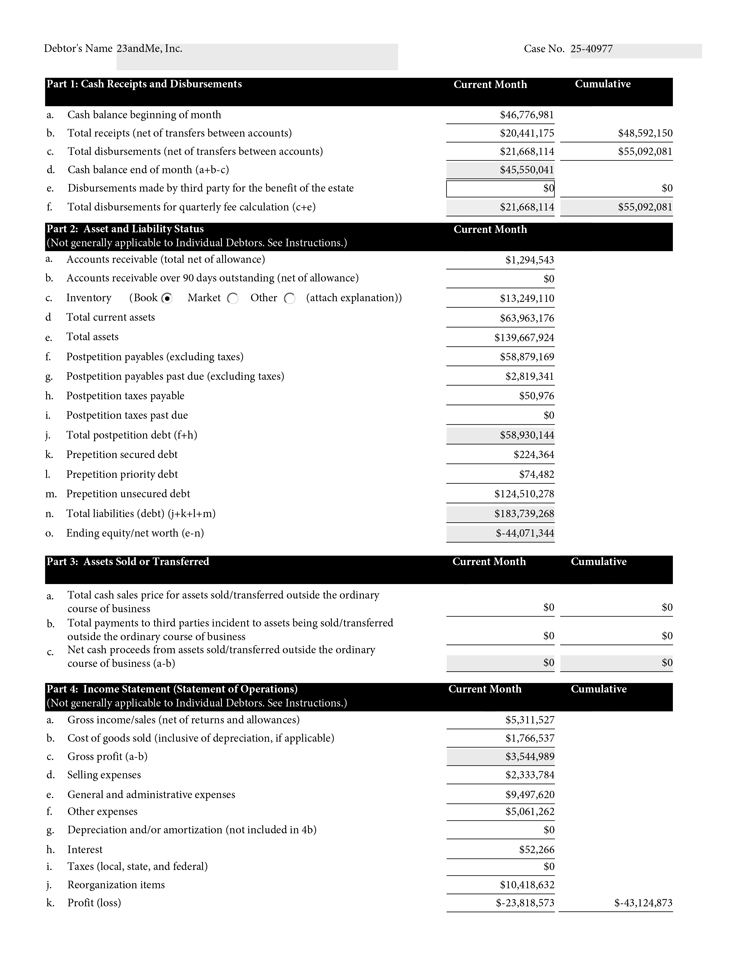

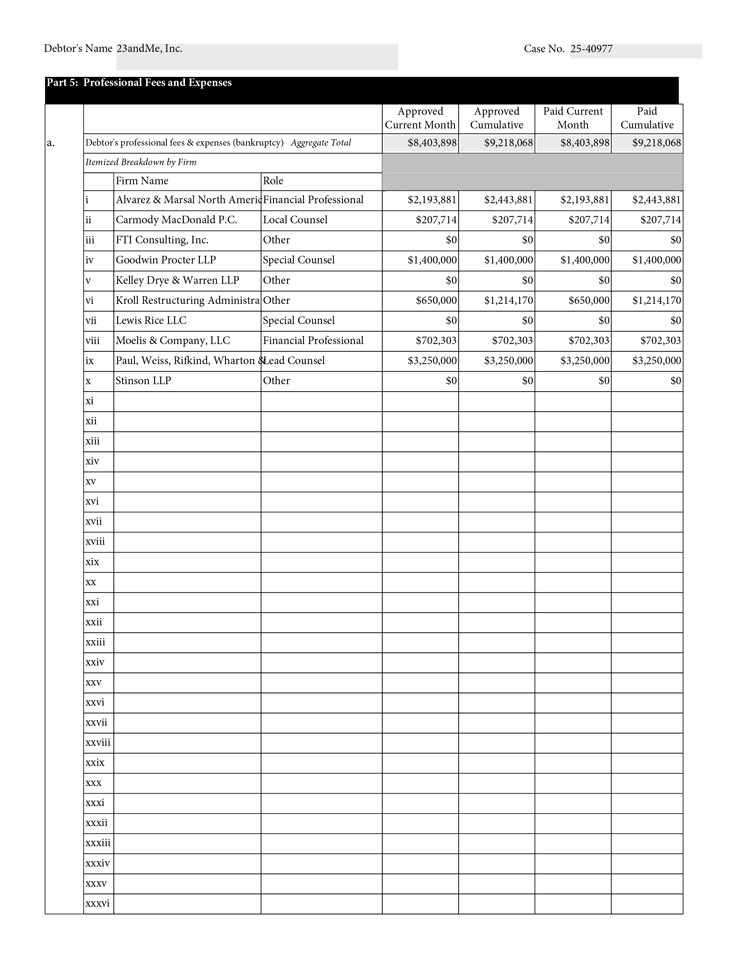

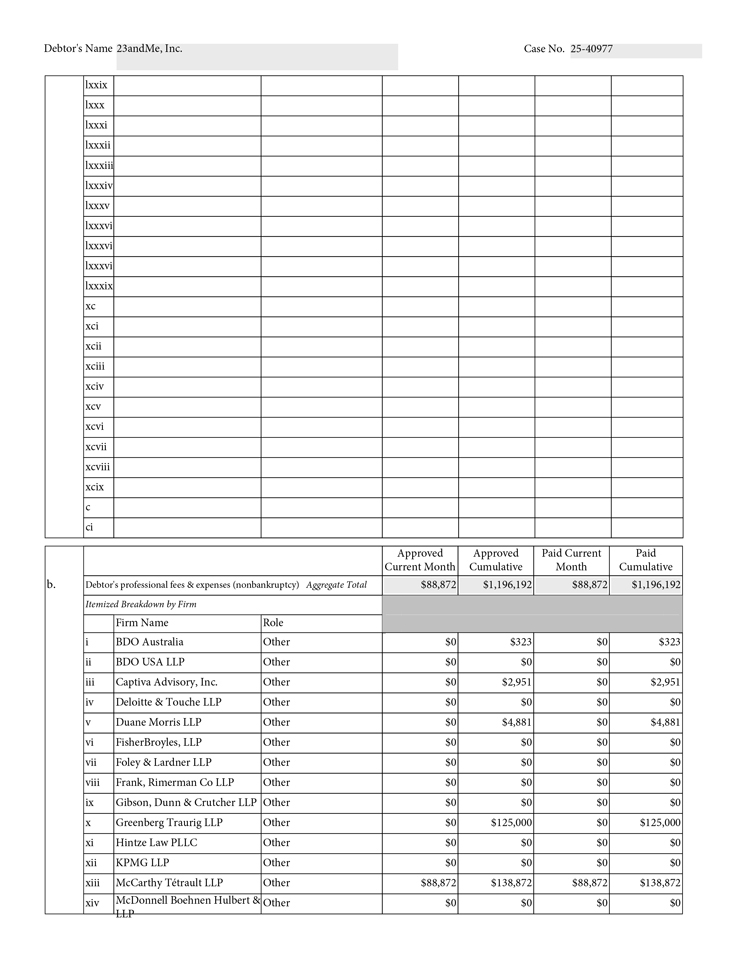

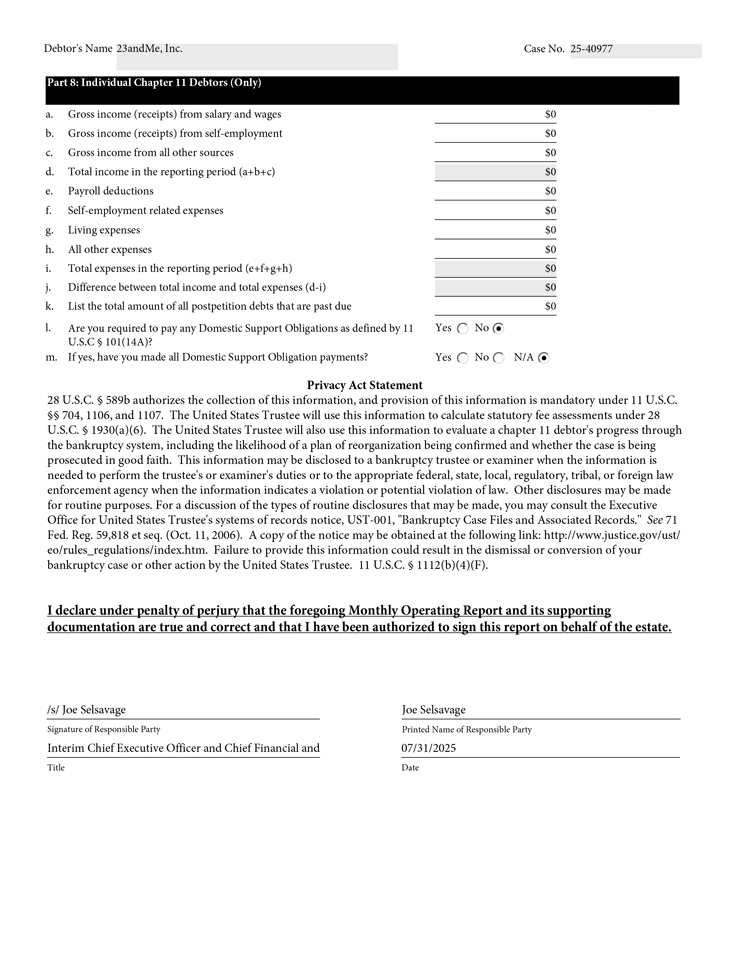

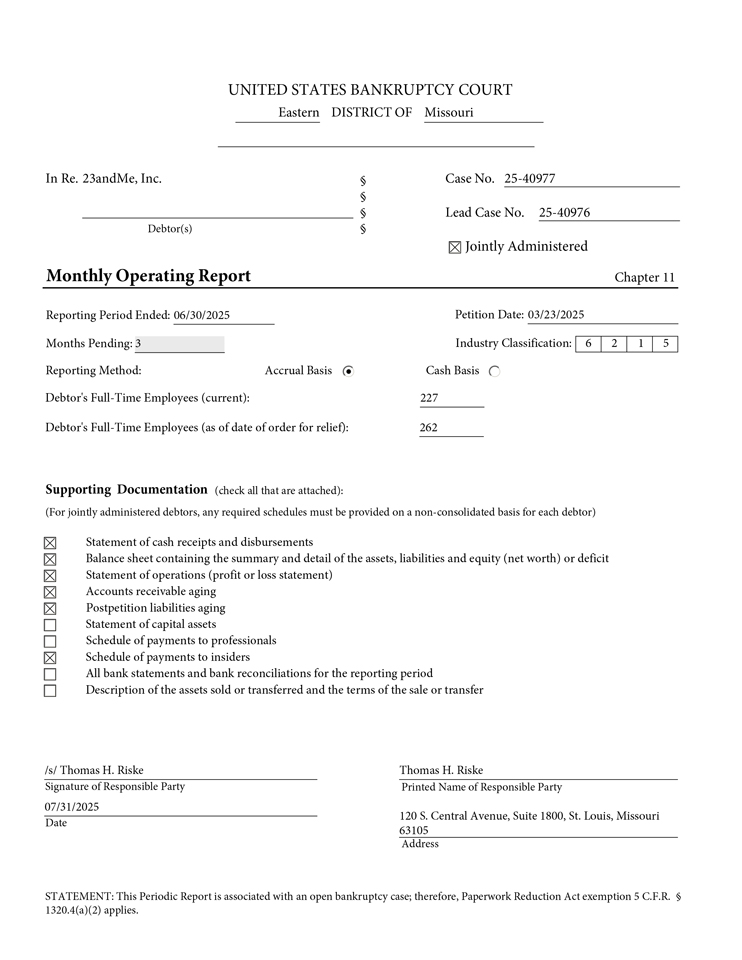

UNITED STATES BANKRUPTCY COURT Eastern DISTRICT OF Missouri In Re. 23andMe, Inc. § Case No. 25-40977 § § Lead Case No. 25-40976 Debtor(s) § Jointly Administered Monthly Operating Report Chapter 11 Reporting Period Ended: 06/30/2025 Petition Date: 03/23/2025 Months Pending: 3 Industry Classification: 6 2 1 5 Reporting Method: Accrual Basis Cash Basis Debtor’s Full-Time Employees (current): 227 Debtor’s Full-Time Employees (as of date of order for relief): 262 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer /s/ Thomas H. Riske Thomas H. Riske Signature of Responsible Party Printed Name of Responsible Party 07/31/2025 120 S. Central Avenue, Suite 1800, St. Louis, Missouri Date 63105 Address STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. §

| UST Form 11-MOR (12/23/2022) | 1 |