SCHEDULE 14A |

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

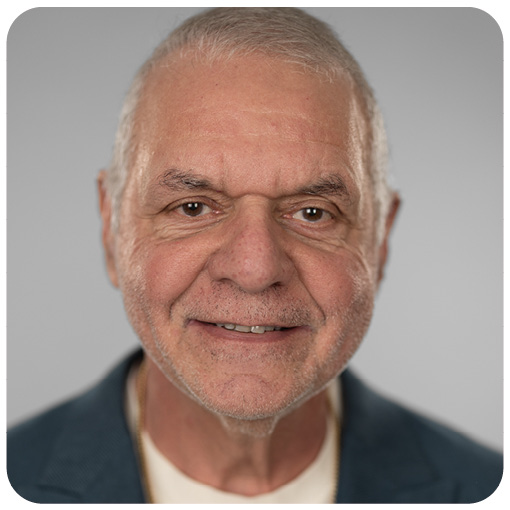

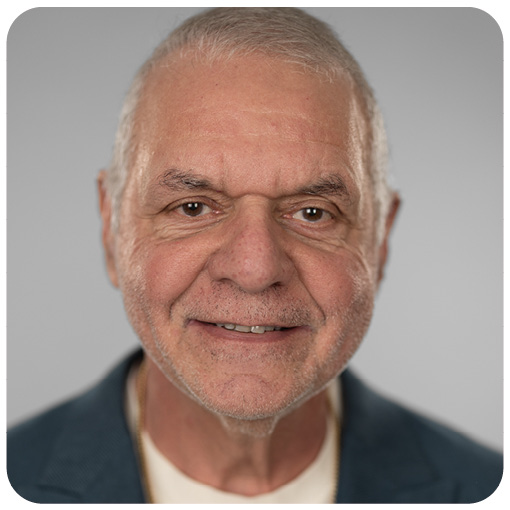

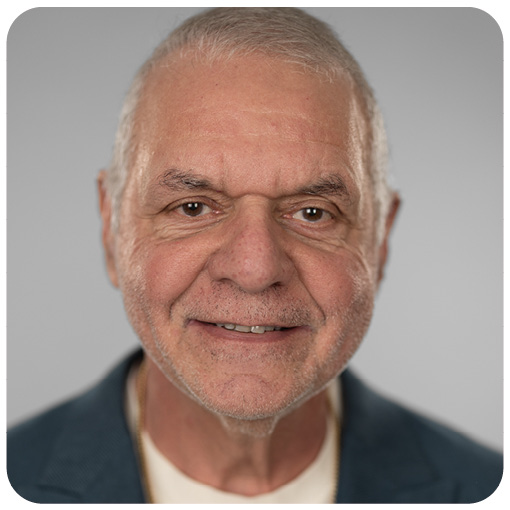

Dan Gilbert Founder and Chairman of the Board | |

Varun Krishna Chief Executive Officer and Member of the Board |

Proposal 1 | |

TO ELECT to our Board of Directors two Class II directors, named in the accompanying proxy statement, each to serve for a three-year term and until a successor has been duly elected and qualified, or until such director’s earlier resignation, retirement or other termination of service. | |

Board recommendation: FOR election of each director nominee | Proposal pages: 15 - 16 |

Proposal 2 | |

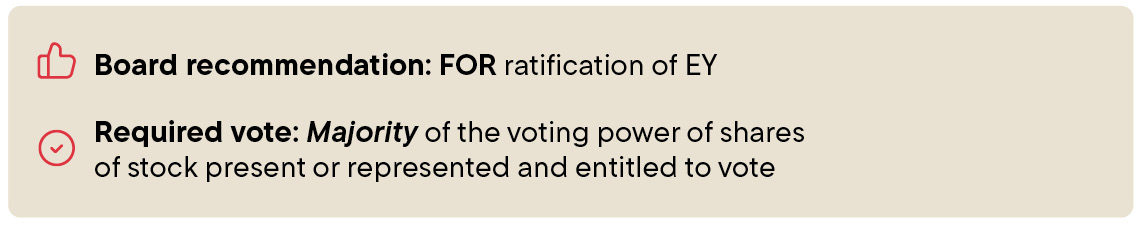

TO RATIFY the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2025. | |

Board recommendation: FOR ratification of EY | Proposal pages: 100-101 |

Online: Go to www.ProxyVote.com: you can use the internet 24 hours a day to transmit your voting instructions. | |

By phone: Call 1-800-690-6903: You can use any touch-tone telephone. | |

By mail: If you receive a printed copy of the proxy materials, complete, sign and return your proxy card or voting instruction card in the enclosed envelope in accordance with the instructions provided in the proxy statement. |

Tina V. John Corporate Secretary at Rocket Companies |

Proxy summary .................................................................................... | Option exercises and stock vested in 2024 .............................. | 71 | ||

Proposal no. 1 – Election of Class II directors ............................ | 15 | Potential payments upon termination of employment or Change in Control of the Company ....................................... | 72 | |

Director independence ................................................................. | 17 | Pay versus performance .............................................................. | 76 | |

Director backgrounds and qualifications ................................... | 18 | CEO pay ratio ................................................................................ | 84 | |

Director nominations and appointments .................................... | 26 | Certain relationships and related person transactions ............. | 85 | |

Corporate governance ........................................................................ | 27 | Security ownership of certain beneficial owners and management ........................................................................................ | ||

Board leadership ........................................................................... | 27 | 97 | ||

Board committees ......................................................................... | 28 | Proposal no. 2 — Ratification of appointment of independent registered public accounting firm for 2025 ........ | ||

Risk oversight by the Board ........................................................ | 32 | 100 | ||

Corporate policies and practices ................................................ | 36 | Audit Committee report ................................................................ | 102 | |

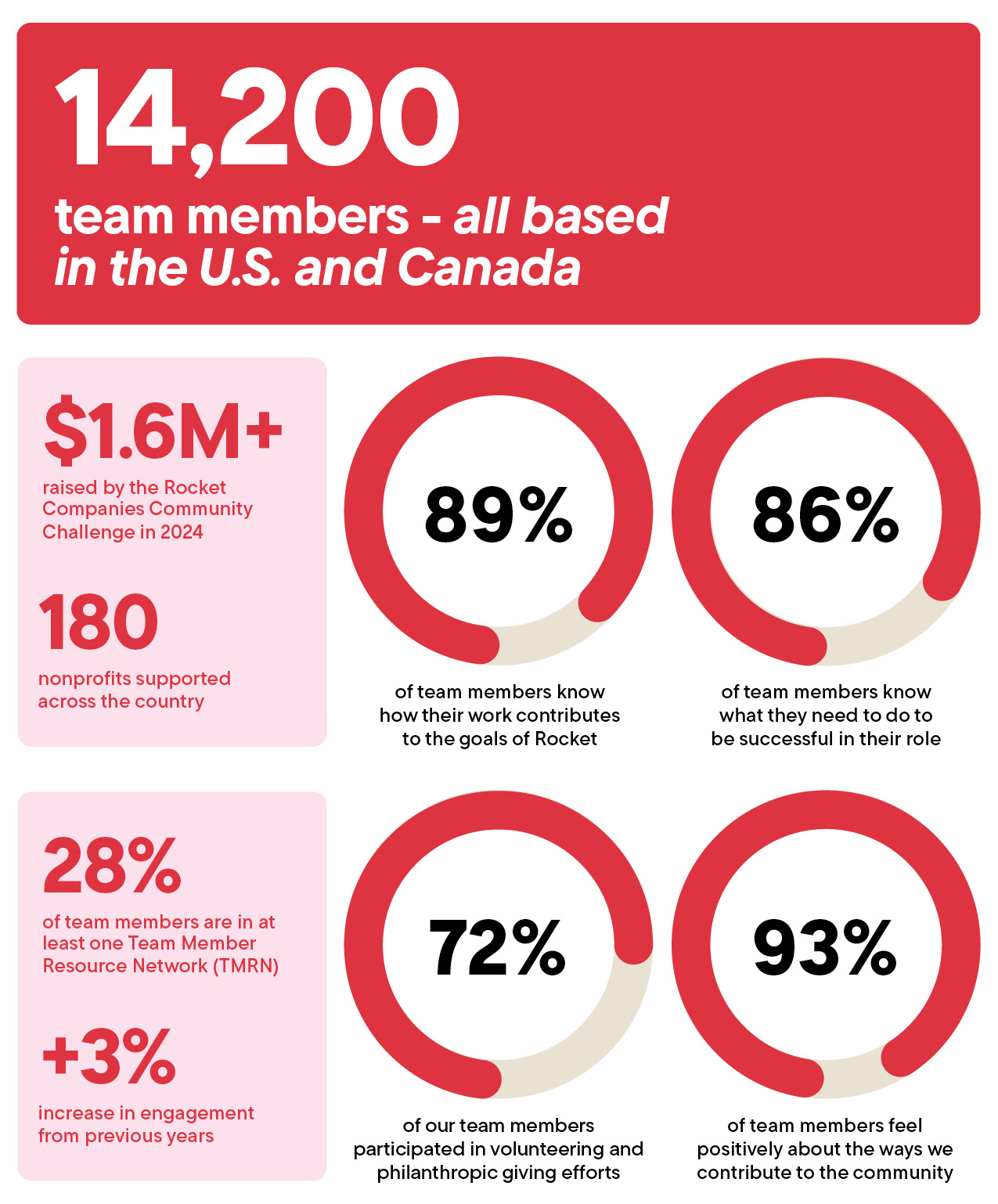

Human capital management ....................................................... | 39 | Audit Committee matters ............................................................. | 103 | |

Stockholder engagement ............................................................. | 41 | Questions and answers about the proxy materials and 2025 annual meeting .................................................................. | ||

Communications with our Board ................................................. | 42 | 104 | ||

Compensation of Non-Affiliated Directors .................................... | 43 | Other matters ........................................................................................ | 110 | |

Executive officers ................................................................................ | 45 | Securities authorized for issuance under equity compensation plans ...................................................................... | ||

Compensation discussion and analysis ....................................... | 49 | 110 | ||

Compensation Committee report .................................................... | 65 | Presentation of stockholder proposals and director nominations at 2026 annual meeting ........................................ | ||

Compensation Committee interlocks and insider participation .......................................................................................... | 110 | |||

65 | Delinquent Section 16(a) reports ................................................ | 111 | ||

Named executive officer compensation tables ........................... | 66 | Access to reports and other information .................................... | 111 | |

2024 summary compensation table ........................................... | 66 | Forward-looking statements ........................................................ | 111 | |

Grants of plan-based awards in 2024 ........................................ | 67 | |||

Narrative disclosure to summary compensation table and grants of plan-based awards table ............................................. | ||||

68 | ||||

Outstanding equity awards at December 31, 2024 ................. | 70 | |||

Topic | Page | Topic | Page | |

Audit Fees | 103 | Hedging and Pledging Policies | 37 | |

Auditor Ratification Proposal | 100 | Human Capital Management | 39 | |

Board Leadership Structure | 27 | Key Acquisitions | 4 | |

Clawback Policy | 63 | Peer Group | 53 | |

Director Qualifications | 9 | Proposals and Required Approvals | 107 | |

Director Independence | 17 | Risk Oversight of Board and Board Committees | 32 | |

Director Meeting Attendance | 27 | Stock Ownership Guidelines – Directors | 43 | |

Components of Compensation | 54 | Stock Ownership Guidelines – Named Executive Officers | 63 | |

Executive Succession Planning | 35 | Up-C Collapse | 92 |

Rocket key terms and abbreviations | ||||

Meeting date: Wednesday, June 11, 2025 | |

Time: 1:00 P.M., Eastern Daylight Time | |

Location (virtual only): www.VirtualShareholderMeeting.com/RKT2025 | |

Record date: Tuesday, May 20, 2025 |

Online: Go to www.ProxyVote.com: you can use the internet 24 hours a day to transmit your voting instructions. | |

By phone: Call 1-800-690-6903: You can use any touch-tone telephone. | |

By mail: If you receive a printed copy of the proxy materials, complete, sign and return your proxy card or voting instruction card in the enclosed envelope in accordance with the instructions provided in the proxy statement. |

Dan Gilbert, Chairman | |

Age: 63 | |

Director since: March 2020 | |

Independent: No | |

Committee(s): None | |

Primary occupation: Founder and Chairman of the Company | |

Current service on other public company boards: None | |

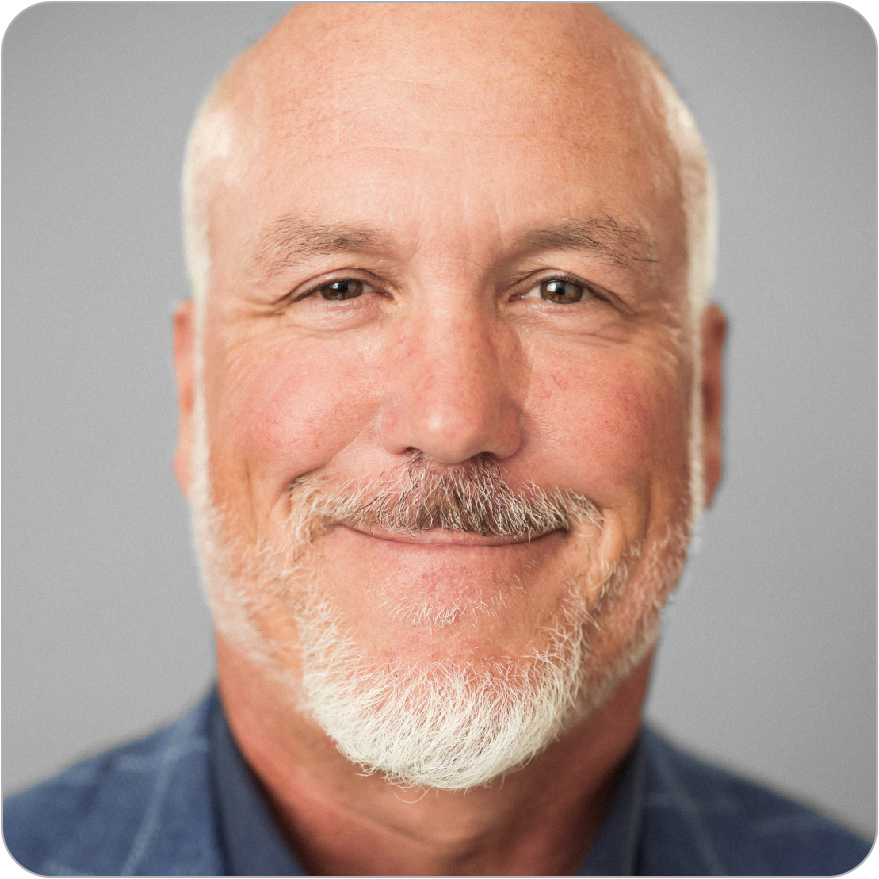

Alastair (Alex) Rampell | |

Age: 43 | |

Director since: February 2024 | |

Independent: Yes | |

Committee(s): None | |

Primary occupation: General Partner at Andreessen Horowitz | |

Current service on other public company boards: Wise Ltd. (LSE: WISE.L) | |

Annual meeting | Board and management | |

Proxy Statement. | Board of Directors. https://www.rocketcompanies.com/ our-team/board-of-directors/ | |

Annual Report. | Management. https://www.rocketcompanies.com/our- team/leadership/ | |

Voting Website. www.proxyvote.com | ||

Certain governance and compensation documents | Other | |

Code of Conduct and Ethics. | Investor Relations. ir.rocketcompanies.com | |

Corporate Governance Guidelines. | 2024 Rocket Community Fund Report. https:// www.rocketcommunityfund.org/impact-report-2024/ | |

Committee Charters. | ||

Insider Trading Policy. | ||

Clawback Policy. | ||

ir.rocketcompanies.com/governance/governance- documents |

CLASS II | CLASS III | CLASS I |

Terms Expiring in 2025 | Terms Expiring in 2026 | Terms Expiring in 2027 |

Dan Gilbert | Varun Krishna | Bill Emerson |

Alastair (Alex) Rampell | Matthew Rizik | Jennifer Gilbert |

Suzanne Shank | Jonathan Mariner |

Dan Gilbert, Chairman of our Board |

Age: 63 |

Director and Chairman since: March 2020 |

Chairman of Rocket Mortgage since: 1985 |

Alastair (Alex) Rampell, Director (Independent) |

Age: 43 |

Director since: February 2024 |

Public Company Boards: Current •Wise Ltd. (since 2021; LSE: WISE.L), a UK-based foreign exchange financial technology company |

Varun Krishna, Chief Executive Officer, Director |

Age: 43 |

Director since: December 2023 |

Matthew Rizik, Director |

Age: 70 |

Director since: March 2020 |

Committee memberships: Compensation (Chair), Nominating and Governance (Chair) |

Suzanne Shank, Director (Independent) |

Age: 63 |

Director since: August 2020 |

Committee memberships: Audit, Nominating and Governance |

Public Company Boards: Current •CMS Energy and Consumer’s Energy (since 2019; NYSE: CMS), an electric and natural gas utility provider + Audit (Member), Executive (Member), Finance (Chair) •White Mountains Insurance Group Ltd. (since 2021; NYSE: WTM), a Bermuda company engaged in the business of making acquisitions in the insurance, financial services and related sectors + Finance (Member), Compensation and Nominating and Governance (Member) Last five years •American Virtual Cloud Technologies (2017 to 2020; Nasdaq: AVCT), a blank check company, or a SPAC + Audit (Member), Nominating (Member) |

Bill Emerson, President, Director |

Age: 62 |

Director since: February 2023 |

Jennifer Gilbert, Director |

Age: 56 |

Director since: March 2020 |

Committee memberships: Nominating and Governance |

Jonathan Mariner, Director (Independent) |

Age: 70 |

Director since: March 2020 |

Committee memberships: Audit (Chair), Compensation |

Public Company Boards: Current •Five9, Inc. (since 2023; Nasdaq: FIVN), a provider of cloud contact centers + Audit (Member) •OneStream, Inc. (since 2024; Nasdaq: OS), an enterprise finance management platform + Audit (Member) Last five years •Tyson Foods, Inc (2019 to 2025; NYSE: TSN), a global food company •Enjoy Technology, Inc. (2021 to 2022; a public company through July 2022; Nasdaq: ENJY) an eCommerce company |

Jonathan Mariner, Chair | Suzanne Shank | Nancy Tellem |

2024 Meetings: 6 | ||

Matthew Rizik, Chair | Jonathan Mariner | Nancy Tellem |

2024 Meetings: 8 | ||

Matt Rizik, Chair | Suzanne Shank | Jennifer Gilbert |

2024 Meetings: 3 | ||

Retainer | 2024 ($) |

Cash | |

Annual – All Directors | 75,000 |

Annual – Committee Chair | 30,000 |

Annual – Committee Member (non-Chair) | 15,000 |

Fee Per Meeting | — |

RSU Award (grant value) | 215,000 |

Name | Fees earned or paid in cash ($)(1) | Stock awards ($)(2) | All other compensation ($) | Total ($) |

Dan Gilbert | — | — | — | — |

Jennifer Gilbert | — | — | — | — |

Jonathan Mariner | 120,000 | 214,986 | — | 334,986 |

Alex Rampell(3) | 68,613 | 296,042 | — | 364,655 |

Matthew Rizik(4) | — | — | — | — |

Suzanne Shank | 105,000 | 214,986 | — | 319,986 |

Nancy Tellem | 105,000 | 214,986 | — | 319,986 |

Varun Krishna, Chief Executive Officer, Director Age: 43 See “Proposal no. 1 - election of Class II directors – Director backgrounds and qualifications” for biographical and other information regarding Varun. | |

Bill Emerson, President, Director Age: 62 See “Proposal no. 1 - election of Class II directors – Director backgrounds and qualifications” for biographical and other information regarding Bill. | |

William Banfield, Chief Business Officer Age: 53 Bill Banfield is our Chief Business Officer. He has held this position since March 2024. In this role, Bill is responsible for overseeing critical business areas including capital markets, mortgage servicing and government affairs. Under Bill’s leadership, the company navigates the ever-evolving financial landscape, safeguarding the company’s interests while fostering growth. Bill’s team creates innovative mortgage offerings that help more Americans responsibly achieve homeownership, manages its interest rate risk, and partners with the government regarding the mortgage market and home accessibility. Bill also serves on the Mortgage Bankers Association Board of Directors and is a sought-after commentator on mortgage and personal finance topics. Bill joined Rocket Mortgage in 1999, holding many leadership roles in capital markets over the last 25 years, including most recently as Chief Risk Officer since January 2020, and Executive Vice President – Capital Markets from February 2017 to January 2020. Before Rocket, Bill served at MCA Mortgage and Lambrecht Mortgage Company. He earned his Bachelor’s degree in Finance from Western Michigan University. Favorite ISM: Innovation is rewarded, Execution is Worshipped. |

Brian Brown, Chief Financial Officer and Treasurer Age: 46 Brian Brown is our Chief Financial Officer and Treasurer. Brian has held these positions since November 2022. In these positions, Brian is responsible for the accounting, finance, treasury, tax, investor relations and procurement functions, while also overseeing the internal audit work. Brian previously served as our Chief Accounting Officer since our initial public offering in August 2020. In his role as Chief Accounting Officer, Brian led our accounting, finance, treasury and procurement functions. He also serves as the Treasurer of Rocket Mortgage, LLC. Brian previously held a number of roles at Rocket Mortgage, LLC from 2014 to 2020, including Senior Vice President of Accounting and Finance. Prior to joining Rocket Mortgage, LLC, Brian spent eight years as a senior manager at Ernst & Young serving financial services and mortgage banking clients. Brian earned his Bachelor’s degree in Accounting from Wayne State University. Favorite ISM: Numbers And Money Follow; They Do Not Lead. | |

Heather Lovier, Chief Operating Officer Age: 51 Heather Lovier serves as the Chief Operating Officer at Rocket, a role she has held since June 2024. In this position, she oversees the entire homeownership experience, with a strong focus on delivering a world-class client journey and leveraging artificial intelligence to enhance every stage of the process. Heather leads strategy and operations for Rocket Mortgage’s Banking and Client Experience teams, ensuring seamless integration with sister companies Rocket Close, LLC and Rocket Homes Real Estate LLC. Prior to her current role, Heather served as Chief Client Experience Officer from November 2021 to March 2024. From 2015 to 2021, she held various Vice President positions, including leading the Client Experience team. Between 2010 and 2015, she led the Business Development team. Heather began her career at Rocket in 2003 as a loan analyst in Operations and later joined the Mousetrap team in 2005, where she focused on innovation and client solutions.Before joining Rocket, Heather spent eight years in the automotive industry, where she led a customer service team and developed her leadership expertise. Favorite ISM: Obsessed with Finding a Better Way |

Shawn Malhotra, Chief Technology Officer Age: 43 Shawn Malhotra is our Chief Technology Officer. He has held this position since May 2024. In this role, Shawn oversees the development and implementation of technology across the entire Rocket Companies’ ecosystem. Shawn is especially focused on increasing the rate of innovation and execution in the organization and amplifying Rocket’s AI initiatives driving the company toward its goal of AI-fueled homeownership. In addition, he has oversight of the company’s data science, product engineering, technology operations and information security. Prior to joining Rocket Companies, Shawn worked at Thomson Reuters Corporation, including as Head of Engineering from September 2020 to May 2024, Chief Technology Officer of the Corporate Technology business unit from August 2018 to September 2020, and Vice President, Toronto Technology Centre from February 2017 to August 2018. Previously, Shawn served as the Site Director, Software Engineering for Intel Corporation from August 2013 to February 2017. Prior to Intel, Shawn served as Manager, Software Engineering at Altera Corporation from 2005 to 2013. He began his career in technology at Qualcomm Incorporated as a software engineer in 2000. Shawn earned a Bachelor of Applied Science degree in Computer Engineering at the University of Waterloo, and a Master of Engineering degree at the University of Toronto and is credited with five issued U.S. patents and two published papers. Favorite ISM: You’ll see it when you believe it. | |

Jonathan Mildenhall, Chief Marketing Officer Age: 57 Jonathan Mildenhall, a British-American, is the first-ever Chief Marketing Officer for Rocket Companies, a position he has held since January 2024. He is responsible for creating a unified and compelling voice for all businesses under the Rocket Companies umbrella, with all marketing and communications teams for the Rocket brands reporting directly to him. Jonathan is also the Co-Founder and served as the Executive Chairman of TwentyFirstCenturyBrand since 2018, a consumer brand strategy and marketing consultancy firm, and serves on the board of Sonos, Inc. (Nasdaq: SONO) and Fanatics, Inc. He previously served on the board of Peloton Interactive (Nasdaq: PTON) from February 2022 to December 2023 and the board of Northern Star Investment Corp. IV (NYSE: NSTD), a special purpose acquisition company, from March 2021 to September 2023. Jonathan has more than 30 years of experience building and promoting large, brand-focused companies. Prior to co-founding TwentyFirstCenturyBrand, Jonathan served as the first Chief Marketing Officer of Airbnb from 2014 to 2018. Before Airbnb, Jonathan led Coca-Cola’s marketing initiatives as Senior Vice President of integrated marketing communication and design excellence from 2013 to 2014 and as Senior Vice President of global advertising strategy and content excellence from 2007 to 2013. Earlier in his career, Jonathan served in various management positions in marketing and advertising at The Mother Group, TBWA UK Group Limited, DLKW Lowe, and Bartle Bogle Hegarty, Inc. Jonathan holds a Higher National Diploma in Business and Finance from The Manchester Metropolitan University. He completed the Advanced Management Program at Harvard Business School, and holds an Honorary Doctorate in Business Administration from The Manchester Metropolitan University. Favorite ISM: It’s not about who is right; it’s about what is right. |

Name | Titles in 2024 | Title since | Rocket team member since |

Varun Krishna | Chief Executive Officer (“CEO”) | September 2023 | September 2023 |

Brian Brown | Chief Financial Officer (“CFO”) and Treasurer | November 2022 | June 2014 |

Shawn Malhotra | Chief Technology Officer (“CTO”) | May 2024 | May 2024 |

Jonathan Mildenhall | Chief Marketing Officer (“CMO”) | January 2024 | January 2024 |

Heather Lovier(1) | Chief Operating Officer (“COO”) | June 2024 | April 2003 |

Executive summary | Page 50 |

2024 executive compensation program and pay | Page 54 |

Annual base salary | Page 55 |

Annual cash incentive plan (AIP) | Page 55 |

Long-term equity awards | Page 57 |

2024 PSU plan | Page 58 |

Compensation Governance | Page 62 |

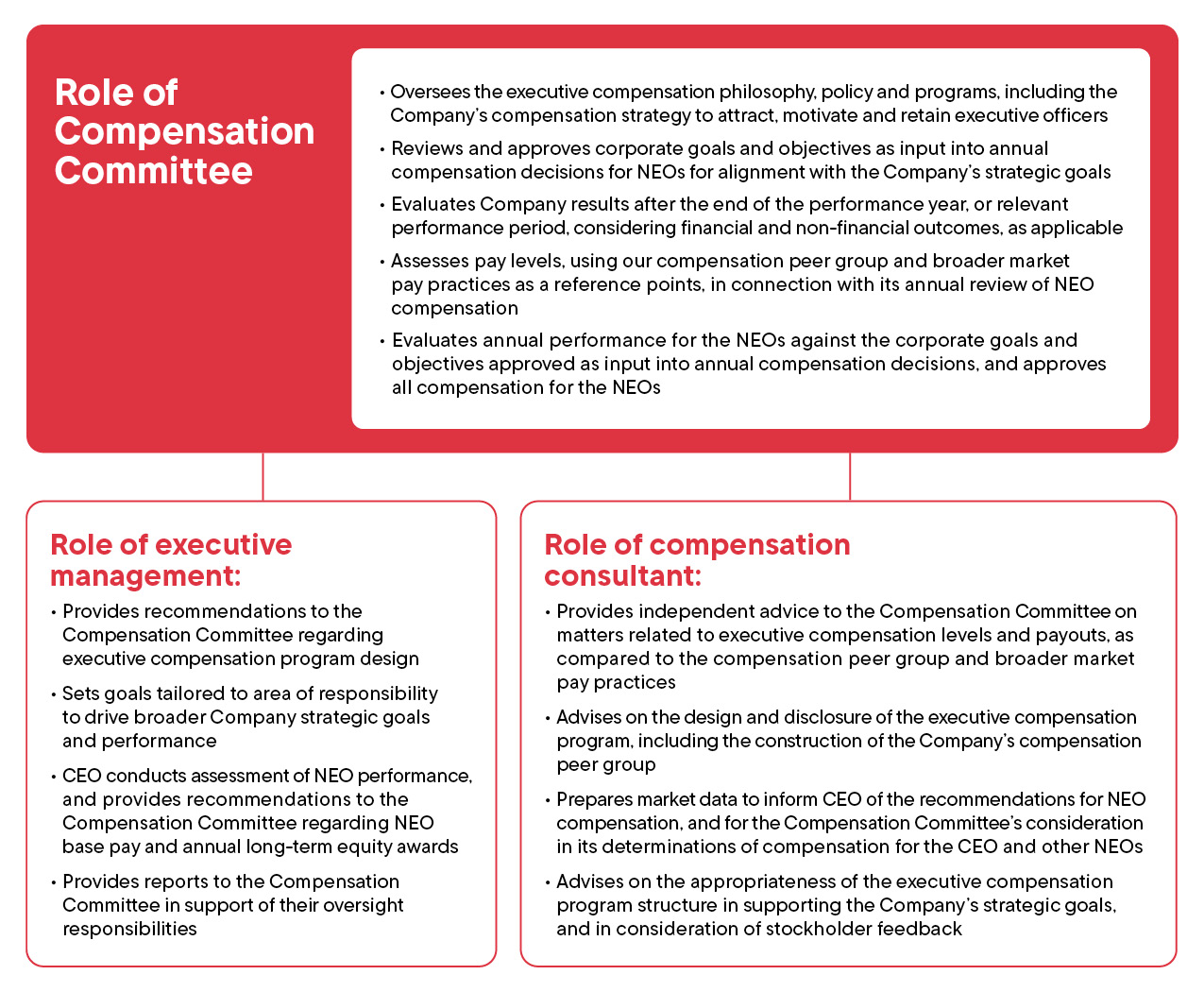

Defining roles for effective compensation oversight | Page 62 |

Independent compensation consultant | Page 62 |

Compensation policies and practices | Page 63 |

Stock ownership guidelines for executive officers | Page 63 |

Timing and pricing of equity awards | Page 63 |

Hedging and pledging | Page 63 |

Clawback policy | Page 63 |

Benefits and perquisites | Page 64 |

Other Compensation | Page 64 |

Tax considerations | Page 64 |

What we do | What we don’t do | |||

Provide incentive compensation that is variable, “at risk” and balances short- and long-term results | No guaranteed annual salary increases, bonuses or equity awards | |||

Align compensation with stockholder returns through long-term equity with multi-year vesting | No supplemental company-paid retirement benefits or nonqualified deferred compensation plans | |||

Use peer group, and broader market data, to establish competitive compensation | No repricing of stock options | |||

Engage independent compensation consultant to advise on executive and director compensation | No excise tax “gross-up” on change-of-control payments | |||

Maintain robust stock ownership guidelines for NEOs and non-employee directors | No dividends on unvested equity awards | |||

Conduct annual risk assessment of compensation policies, plans and practices | No discounted stock options | |||

Maintain Clawback Policy for financial restatements | ||||

Hold say-on-pay vote every three years | ||||

Maintain Insider Trading Policy that prohibits, or provides guidelines and limitations, with respect to transactions in our securities | ||||

Use market-aligned cash severance and right to acceleration of equity awards upon death, disability, change in control and, for certain executives, upon termination without cause | ||||

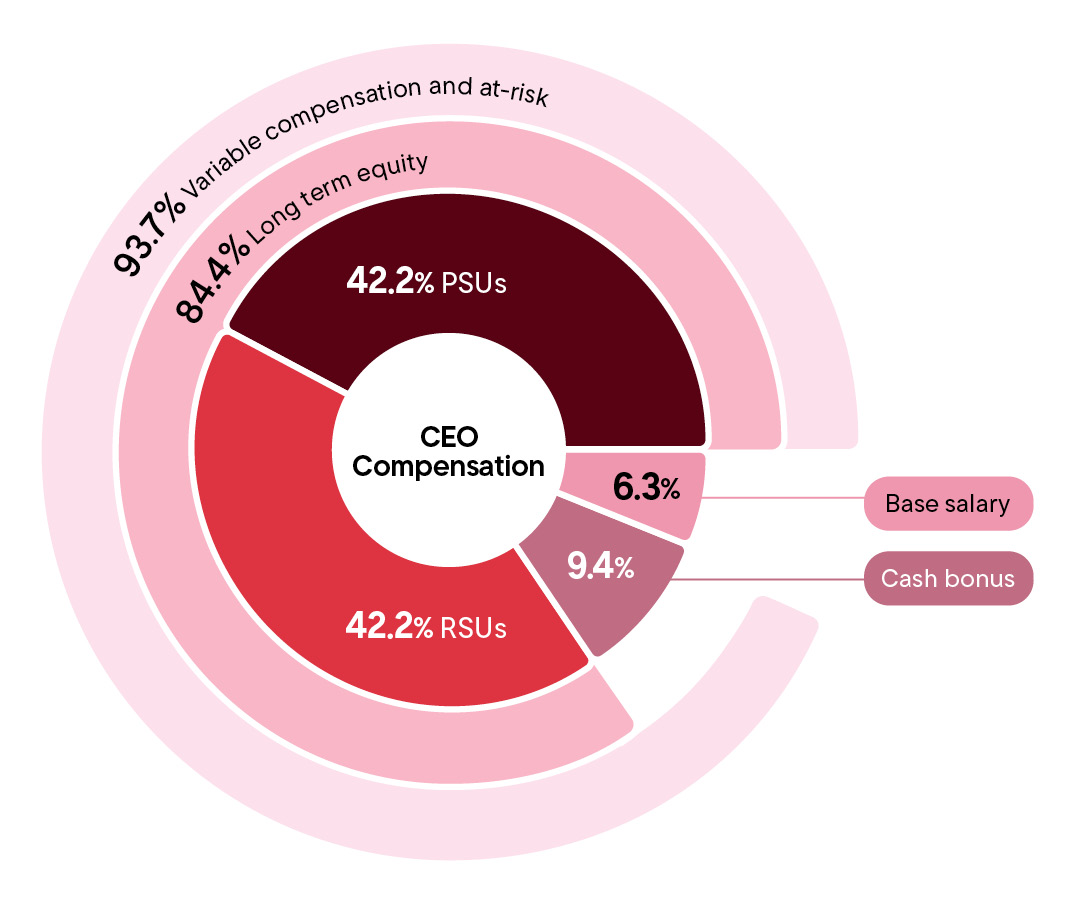

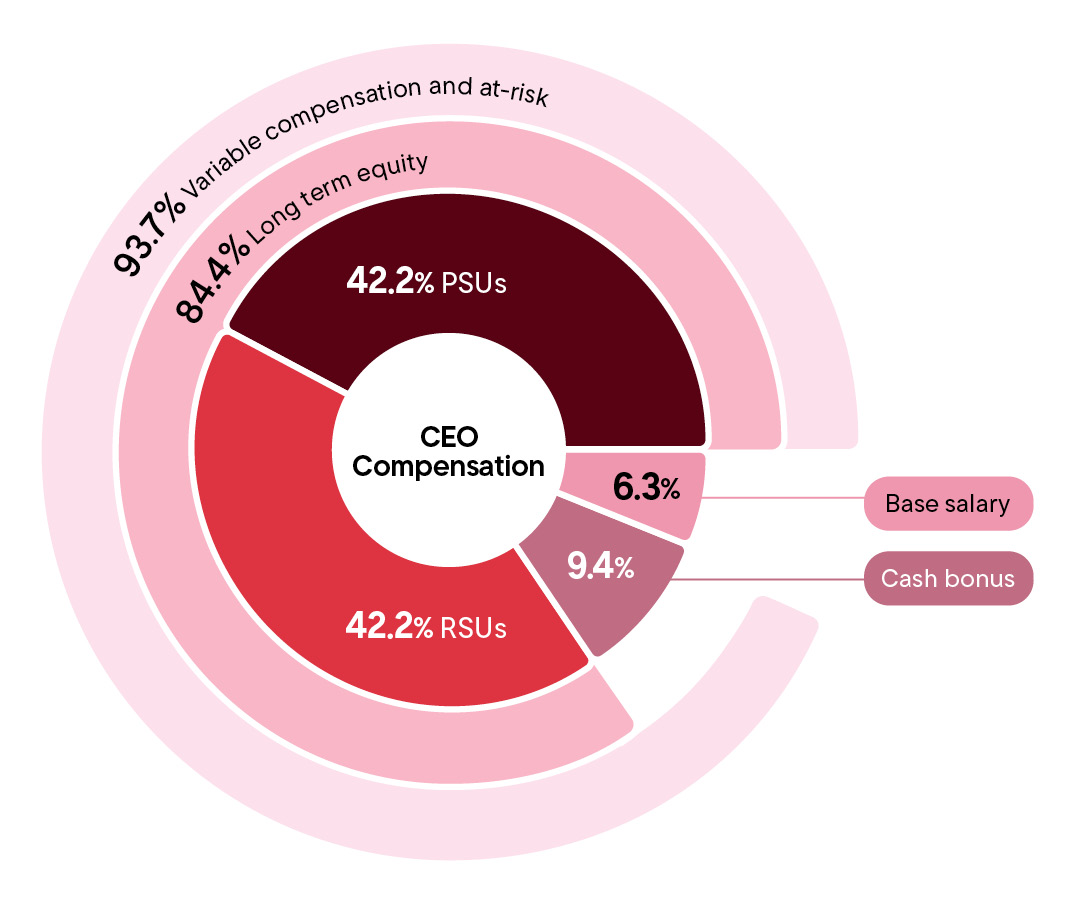

Pay-for- performance | Compensation reflects financial and non-financial performance metrics to drive achievement of our strategic goals and to create long-term value aligned with stockholder interest |

Use a balanced compensation structure | Compensation delivered in a mix of fixed and variable compensation, with an emphasis on variable compensation that appropriately balances short- and long-term goals and promotes long-term stockholder value creation |

Attract, motivate and retain | Compensation is competitive to our peers and the broader market in order attract, motivate and retain executives that possess the skills, talent and experience necessary to drive our long-term success |

Revenue 0.25x to 4x that of Rocket | Fintech companies | Consumer financial products | Significant brand presence |

Based on such considerations, we determined that the following companies were appropriate for 2024: | |||

• Adobe Inc. • Ally Financial Inc. • Airbnb, Inc. • Block, Inc. (f/k/a Square, Inc.) • Carvana Co. • Discover Financial Services | • eBay Inc. • Expedia Group, Inc. • Fidelity National Information Services, Inc. • Intercontinental Exchange, Inc. • Fiserv, Inc. | • Interactive Brokers Group, Inc. • Intuit Inc. • PayPal Holdings, Inc. • PennyMac Financial Services, Inc. • Servicenow, Inc. | • Sofi Technologies, Inc. • The Charles Schwab Corporation • The Western Union Company • Visa Inc. • Zillow Group, Inc. |

Type | Component | Vehicle | Objectives and key features |

Fixed | Base salary | Cash | •Provide fixed compensation for performing responsibilities of role to attract and retain talent •Reflect competitive market compensation |

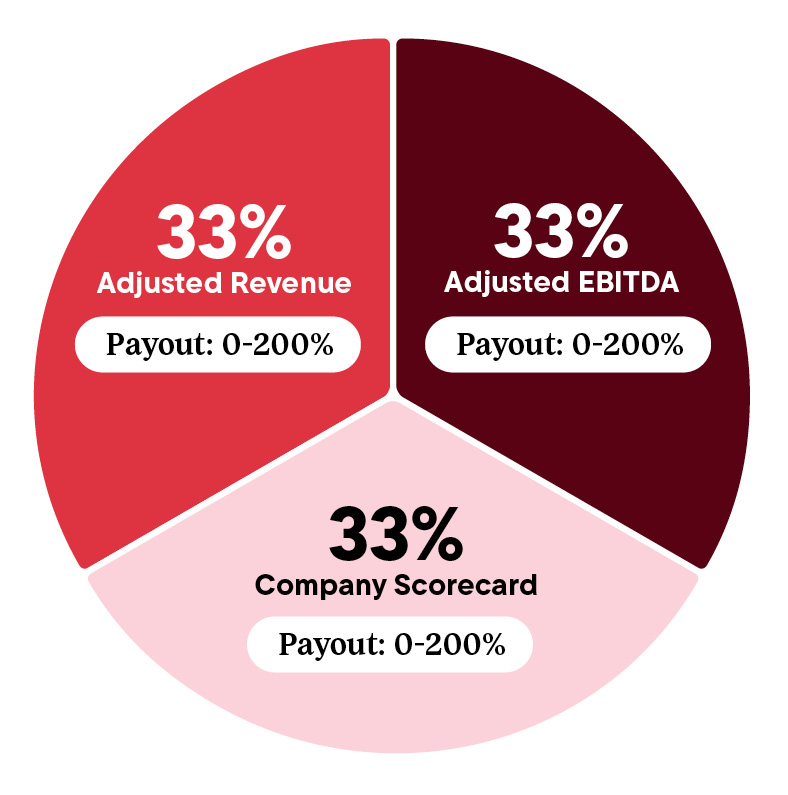

Variable (“at-risk”) | Annual cash bonus | Cash | •Reinforce key financial objective achievement, as well as maintain a focus on key strategic business goals •Reward for achievement of Company performance over 1-year period under the annual cash bonus incentive plan (“AIP”) •Determine payout with 2/3rd based on the achievement of financial metrics and 1/3rd based on subjective Company performance scorecard •Payouts can range from 0% to 200% of the weighted target bonus for each metric •Subject to recovery under the Clawback Policy, for 2/3rd of payout determined based on financial metrics |

Annual long-term equity awards | RSUs | •Reward for long-term stockholder value to create alignment with stockholder interest; promote long-term retention •Time vest semiannually in equal portions over three years and, if earned and vested, are settled in common stock | |

PSUs | •Reward achievement of key long-term performance measures and stock performance to create alignment with stockholder interest; promote long-term retention •Determine payout based on achievement against three metrics (relative total shareholder return, refinance market share growth, purchase market share growth) over a 3-year performance period, and, if earned and vested, are settled in common stock •Any payout is subject to a circuit breaker - cumulative adjusted EBITDA over the first two years must be greater than zero •Payouts can range from 0% to 200% of the weighted target performance amount for each metric •Subject to recovery under the Clawback Policy |

Name | 2023 annual base salary rates ($) | 2024 annual base salary rates ($) |

Varun Krishna | 1,250,000 | 1,250,000 |

Brian Brown | 500,000 | 700,000(1) |

Shawn Malhotra | — | 700,000(2) |

Jonathan Mildenhall | — | 670,000(2) |

Heather Lovier | N/A | 600,000(3) |

($ in billions) | |||||||

Financial metric | Weight (%) | Performance period | Threshold (50% payout) | Target (100% payout) | Maximum (200% payout) | 2024 actual performance | 2024 actual payout |

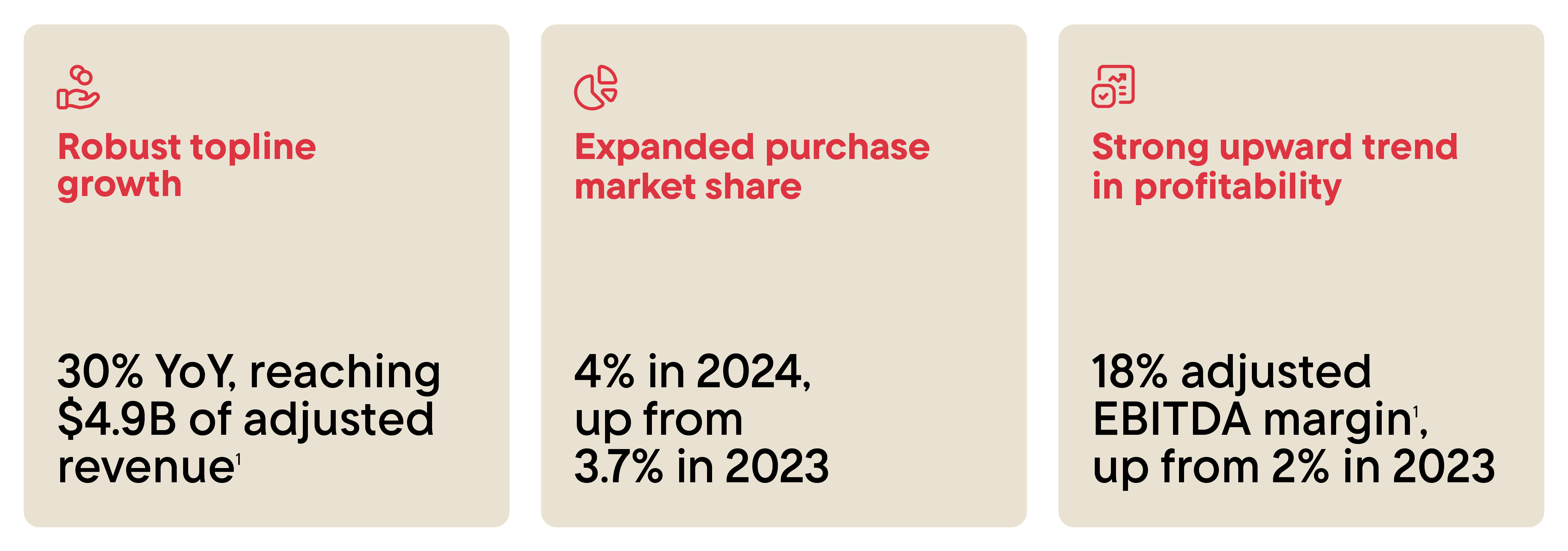

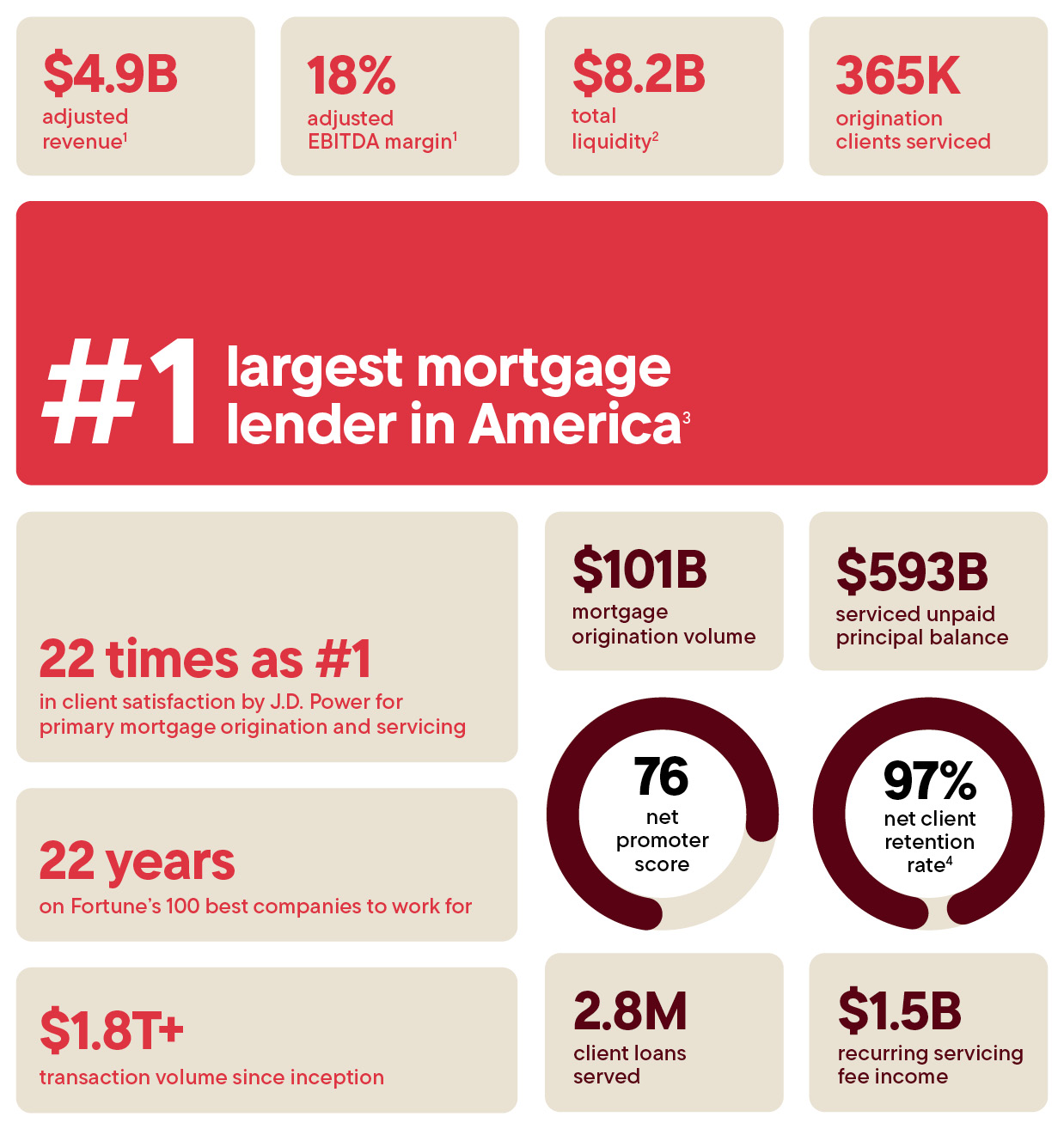

Adjusted Revenue(1) | 33% | Full year | $3.610 (80% of target) | $4.512 (100% of target) | $5.414 (120% of target) | $4.902 | 143% |

Adjusted EBITDA(2) | 33% | Full year | $0.321 (60% of target) | $0.534 (100% of target) | $0.748 (140% of target) | $0.862 | 200% |

Focus area descriptions | Results summary |

Execution A product and strategy focus based on the adoption of AI, launch of new products and technology infrastructure. | We concluded an important foundational year for Rocket’s next chapter, with successes across all of our three focus areas, with continuing and opportunities for improvement, including: •Rolled out a refreshed line of sight from a new mission statement, strategic bets and execution system •Set clear goals to grow profitable market share, and organized around refreshed priorities, with a focus on business model diversification •Shipped product 3x faster, AI saving us thousands of hours a year, yet AI is still in its infancy at Rocket •Completed foundation brand transformation work, but yet to realize impact •Maintained company engagement survey score of 82% through significant change; top 10% of companies with over 5,000 employees(1) •Significantly strengthened our executive bench with the top 45 leadership roles filled with high-performing leaders who reflect a broad range of backgrounds and experiences, and the opportunity to cascade this culture throughout the Company |

Client A consumer focus based on client satisfaction, client trust and market brand health. | |

Culture A culture focus based on organizational health, fostering innovation, engaging team members and consistently enhancing performance. | |

2024 payout: 73% | |

Financial metric | Weight (%) | 2024 actual payout (%) | Weighted payout (%) |

Adjusted Revenue | 33% | 143% | 48% |

Adjusted EBITDA | 33% | 200% | 67% |

Company Scorecard | 33% | 73% | 24% |

Total(1) | 100% | 139% |

Name | Base salary ($) | Target bonus (%) | Target bonus ($) | AIP payout (%) | Actual cash bonus ($) |

Varun Krishna | 1,250,000 | 150 | 1,875,000 | 139 | 2,606,250 |

Brian Brown | 700,000(1) | 100(1) | 700,000(1) | 139 | 973,000 |

Shawn Malhotra | 459,016(2) | 75(2) | 344,262(2) | 139 | 478,525 |

Jonathan Mildenhall | 657,186(2) | 75(2) | 492,890(2) | 139 | 685,116 |

Heather Lovier | 600,000(1) | 100(1) | 600,000(1) | 139 | 834,000 |

Name | Target total grant values ($) | Target RSUs | Target PSUs | ||

Grant value ($) | Shares (#) | Grant value ($) | Shares (#) | ||

Varun Krishna(1) | 16,875,000 | 8,437,500 | 780,252 | 8,437,500 | 780,252 |

Brian Brown(2) | 5,000,000 | 2,500,000 | 196,540 | 2,500,000 | 196,540 |

Shawn Malhotra(2) | 8,000,000 | 8,000,000 | 579,290 | — | — |

Jonathan Mildenhall(2) | 7,000,000 | 7,000,000 | 553,797 | — | — |

Heather Lovier(2) | 3,250,000 | 3,250,000 | 218,380 | — | — |

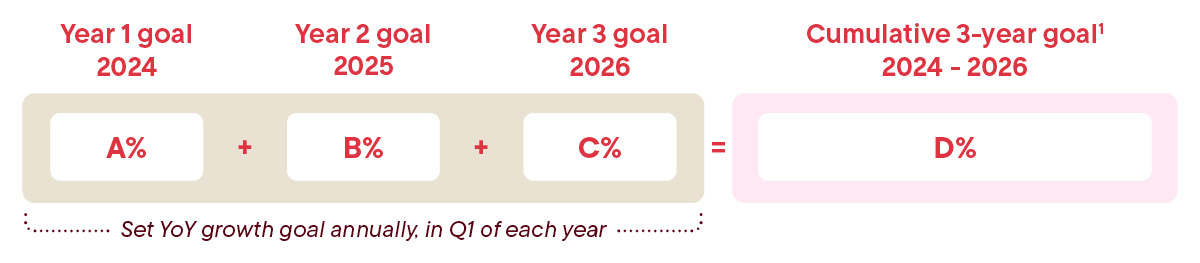

Metric | % of grant value of target PSUs | Description |

Relative Total Shareholder Return(1)(2) | 50% | Measures the Company’s total shareholder return (“TSR”) at the end of the performance period, where performance is determined by the ranking (as a percentile) of the Company’s TSR versus a custom peer group. See below for the TSR peer companies. |

Refinance Mortgage Market Share Growth(2)(3) | 40% | Measures growth of the Company’s market share of U.S. residential single family (1-4 units) mortgages originated whose loan purpose is a refinance. See below for more details on year- over-year growth cumulative goal-setting. |

Purchase Mortgage Market Share Growth(2)(3) | 10% | Measures growth of the Company’s market share of U.S. residential single family (1-4 units) mortgages originated whose loan purpose is a purchase. See below for more details on year- over-year growth cumulative goal-setting. |

Target PSUs rTSR (50% weighting) | Target PSUs Refinance Mortgage Market (40% weighting) | Target PSUs Purchase Mortgage Market (10% weighting) | ||||

Name | Grant value ($) | Shares (#) | Grant value ($) | Shares (#) | Grant value ($) | Shares (#) |

Varun Krishna(1) | 4,218,750 | 390,126 | 3,375,000 | 312,100 | 843,750 | 78,026 |

Brian Brown | 1,250,000 | 98,270 | 1,000,000 | 78,616 | 250,000 | 19,654 |

Companies(1) | |||

Affirm Holdings Inc. | DR Horton, Inc. | Loan Depot | SoFi Technologies, Inc. |

Ally Financial Inc. | Ellington Financial, Inc. | Mr Cooper Group, Inc. | Stewart Information Services Corp. |

American Express Co. | Fidelity National Financial, Inc. | NMI Holdings, Inc. | Toll Brothers, Inc. |

Annaly Capital Management Inc. | First American Financial Corp. | PayPal Holdings, Inc. | Truist Financial Corp. |

Block, Inc. | Guild Holdings Co. | PennyMac Financial Services, Inc. | Upstart Holdings, Inc. |

Charles Schwab | Intercontinental Exchange, Inc. | PNC Financial Services Group, Inc. | U.S. Bancorp |

Compass, Inc. | KB Home | Radian Group, Inc. | UWM Holdings Corp. |

CoStar Group Inc. | Lennar Corp. | Rithm Capital (New Residential) Corp. | Zillow Group Inc. |

Executive officer | Minimum ownership level | What counts towards ownership level | What doesn’t count towards ownership level |

CEO | 6x base salary | • Stock or units owned outright (or vested) • Stock or units (or equivalents) held in the Team Member Stock Purchase Program • Stock or units owned outright (or vested) by immediate family members | • Stock options • Unvested RSUs • Unvested PSUs |

Other NEOs | 3x base salary |

Name and principal position | Year | Salary ($)(1) | Bonus ($)(2) | Stock awards ($)(3) | Non-equity incentive plan compensation ($)(4) | All other compensation ($)(5) | Total ($) |

Varun Krishna CEO | 2024 | 1,250,000 | — | 21,995,304 | 2,606,250 | 36,372 | 25,887,926 |

2023 | 404,110 | 2,606,164 | — | — | 435,640 | 3,445,914 | |

Brian Brown CFO And Treasurer | 2024 | 667,486 | — | 5,540,463 | 973,000 | 29,660 | 7,210,609 |

2023 | 500,000 | 250,000 | 2,250,003 | — | 18,036* | 3,018,039 | |

2022 | 325,000 | 466,500 | 3,044,233 | — | 5,998 | 3,841,731 | |

Shawn Malhotra CTO | 2024 | 459,016 | 2,000,000 | 7,999,995 | 478,525 | 131,148 | 11,068,684 |

Jonathan Mildenhall CMO | 2024 | 657,186 | 2,015,000 | 6,999,994 | 685,116 | 474,371 | 10,831,667 |

Heather Lovier COO | 2024 | 516,530 | — | 3,249,969 | 834,000 | 55,486 | 4,655,985 |

Name | Grant date | Board approval date | Estimated possible payouts under non-equity incentive plan awards(1) | Estimated future payouts under equity incentive plan awards(2) | All other stock awards: number of shares of stock or units (#) | Grant date fair value of stock awards ($)(3) | ||||

Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | |||||

Varun Krishna | 3/8/2024(2) | 3/8/2024 | — | — | — | 390,126 | 780,252 | 1,560,504 | — | 12,070,498 |

3/8/2024(4) | 3/8/2024 | — | — | — | — | — | — | 780,252 | 9,924,805 | |

— | — | 312,500 | 1,250,000 | 2,500,000 | — | — | — | — | — | |

Brian Brown | 3/8/2024(2) | 3/8/2024 | — | — | — | 98,270 | 196,540 | 393,080 | — | 3,040,474 |

3/8/2024(4) | 3/8/2024 | — | — | — | — | — | — | 196,540 | 2,499,989 | |

— | — | 116,667 | 466,667 | 933,333 | — | — | — | — | — | |

Shawn Malhotra | 5/6/2024(5) | 5/6/2024 | — | — | — | — | — | — | 579,290 | 7,999,995 |

— | — | 57,377 | 229,508 | 459,016 | — | — | — | — | — | |

Jonathan Mildenhall | 3/7/2024(6) | 3/7/2024 | — | — | — | — | — | — | 553,797 | 6,999,994 |

— | — | 82,148 | 328,593 | 657,186 | — | — | — | — | — | |

Heather Lovier | 3/7/2024(6) | 3/7/2024 | — | — | — | — | — | — | 158,227 | 1,999,989 |

8/26/2024(7) | 8/26/2024 | — | — | — | — | — | — | 60,153 | 1,249,979 | |

— | — | 100,000 | 400,000 | 800,000 | — | — | — | — | — | |

Name | Grant date | Option awards | Stock awards | ||||||

Number of securities underlying unexercised options exercisable (#) | Number of securities underlying unexercised options unexercisable (#) | Option exercise price ($) | Option expiration date | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested ($)(8) | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#)(9) | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($)(10) | ||

Varun Krishna | 3/8/2024(1) | — | — | — | — | 650,210 | 7,321,365 | 585,189 | 6,589,228 |

Brian Brown | 3/8/2024(1) | — | — | — | — | 163,784 | 1,844,208 | 147,405 | 1,659,780 |

3/3/2023(2) | — | — | — | — | 173,612 | 1,954,871 | — | — | |

3/7/2022(2) | — | — | — | — | 54,201 | 610,303 | — | — | |

8/5/2020(3) | 92,402 | — | 18.00 | 8/5/2030 | — | — | — | — | |

Shawn Malhotra | 5/6/2024(4) | — | — | — | — | 482,742 | 5,435,675 | — | — |

Jonathan Mildenhall | 3/7/2024(5) | — | — | — | — | 461,498 | 5,196,467 | — | — |

Heather Lovier | 8/26/2024(6) | — | — | — | — | 60,153 | 677,323 | — | — |

3/7/2024(5) | — | — | — | — | 131,856 | 1,484,699 | — | — | |

9/28/2023(7) | — | — | — | — | 121,508 | 1,368,180 | — | — | |

3/7/2022(2) | — | — | — | — | 12,195 | 137,316 | — | — | |

8/5/2020(3) | 123,203 | — | 18.00 | 8/5/2030 | — | — | — | — | |

Name | Number of shares acquired on vesting (#) | Value realized on vesting ($)(1) |

Varun Krishna | 130,042 | 2,511,111 |

Brian Brown | 173,761 | 2,489,529 |

Shawn Malhotra | 96,548 | 1,520,631 |

Jonathan Mildenhall | 92,299 | 1,782,294 |

Heather Lovier | 99,318 | 1,646,199 |

Name | Payments upon termination | Termination due to death or disability ($)(1) | Change in control and termination (for good reason or without cause) ($)(1) | Termination without cause or for good reason ($) |

Varun Krishna | Severance amount | — | — | 2,518,612(2) |

Equity incentives (vesting accelerated) | 10,249,910 | 16,107,002 | 5,857,092(4) | |

Total | 10,249,910 | 16,107,002 | 8,375,704 | |

Brian Brown | Severance amount | — | — | — |

Equity incentives (vesting accelerated) | 4,224,381 | 5,699,741 | — | |

Total | 4,224,381 | 5,699,741 | — | |

Shawn Malhotra | Severance amount | — | — | 712,408(3) |

Equity incentives (vesting accelerated) | 5,435,675 | 5,435,675 | 2,174,261(4) | |

Total | 5,435,675 | 5,435,675 | 2,886,669 | |

Jonathan Mildenhall | Severance amount | — | — | 682,408(3) |

Equity incentives (vesting accelerated) | 5,196,467 | 5,196,467 | 2,078,573(4) | |

Total | 5,196,467 | 5,196,467 | 2,760,981 | |

Heather Lovier | Severance amount | — | — | — |

Equity incentives (vesting accelerated) | 3,679,834 | 3,679,834 | — | |

Total | 3,679,834 | 3,679,834 | — |

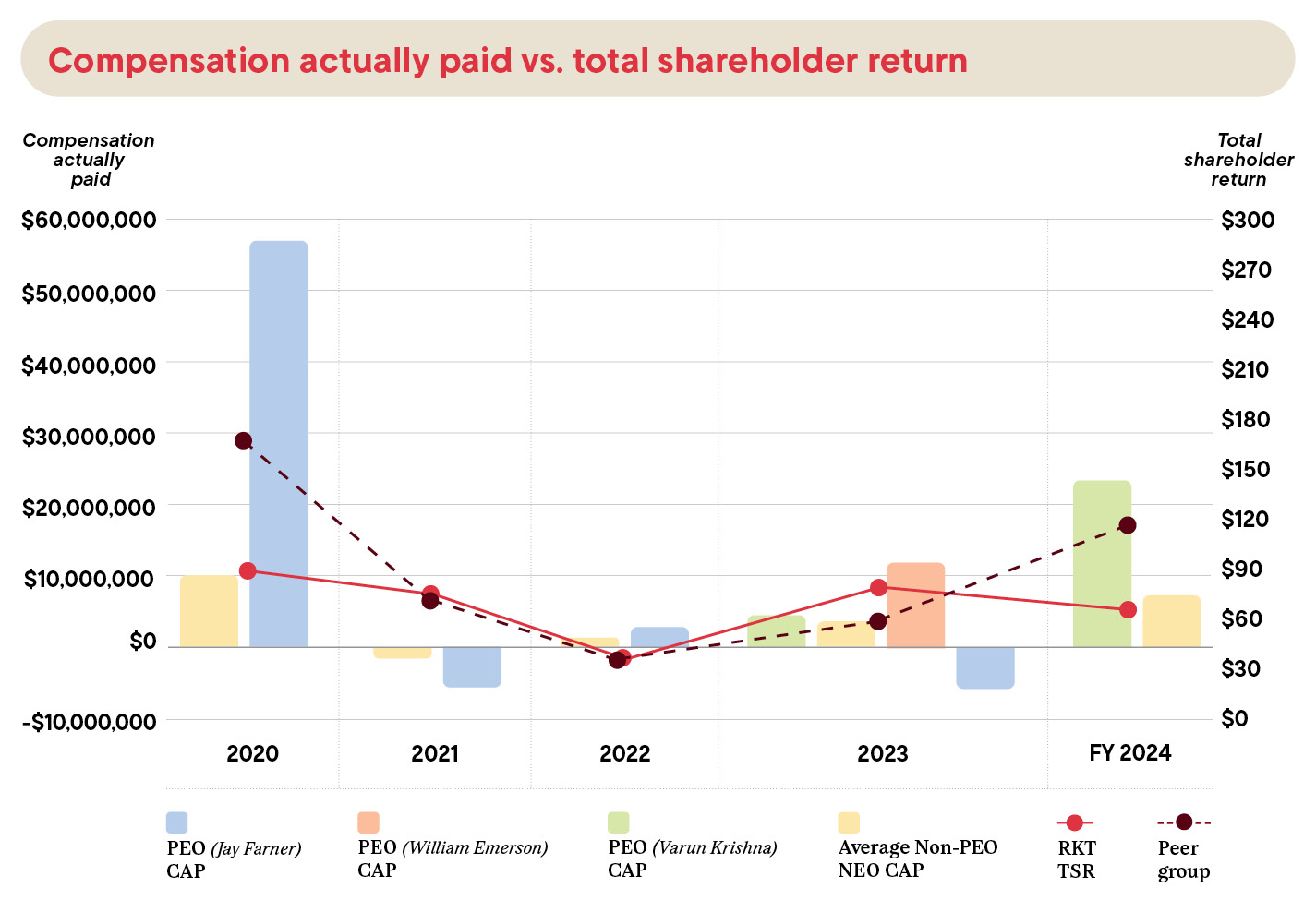

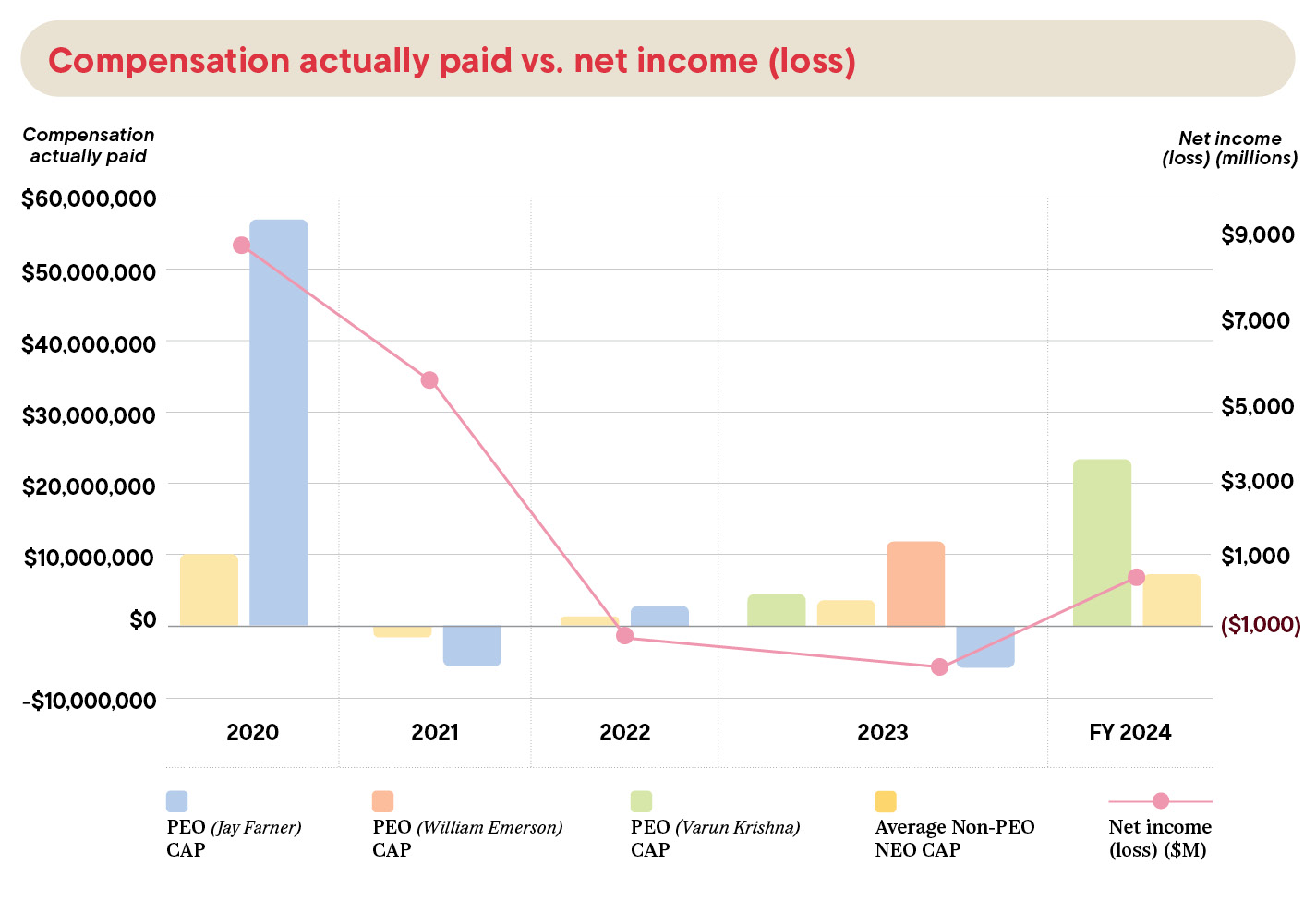

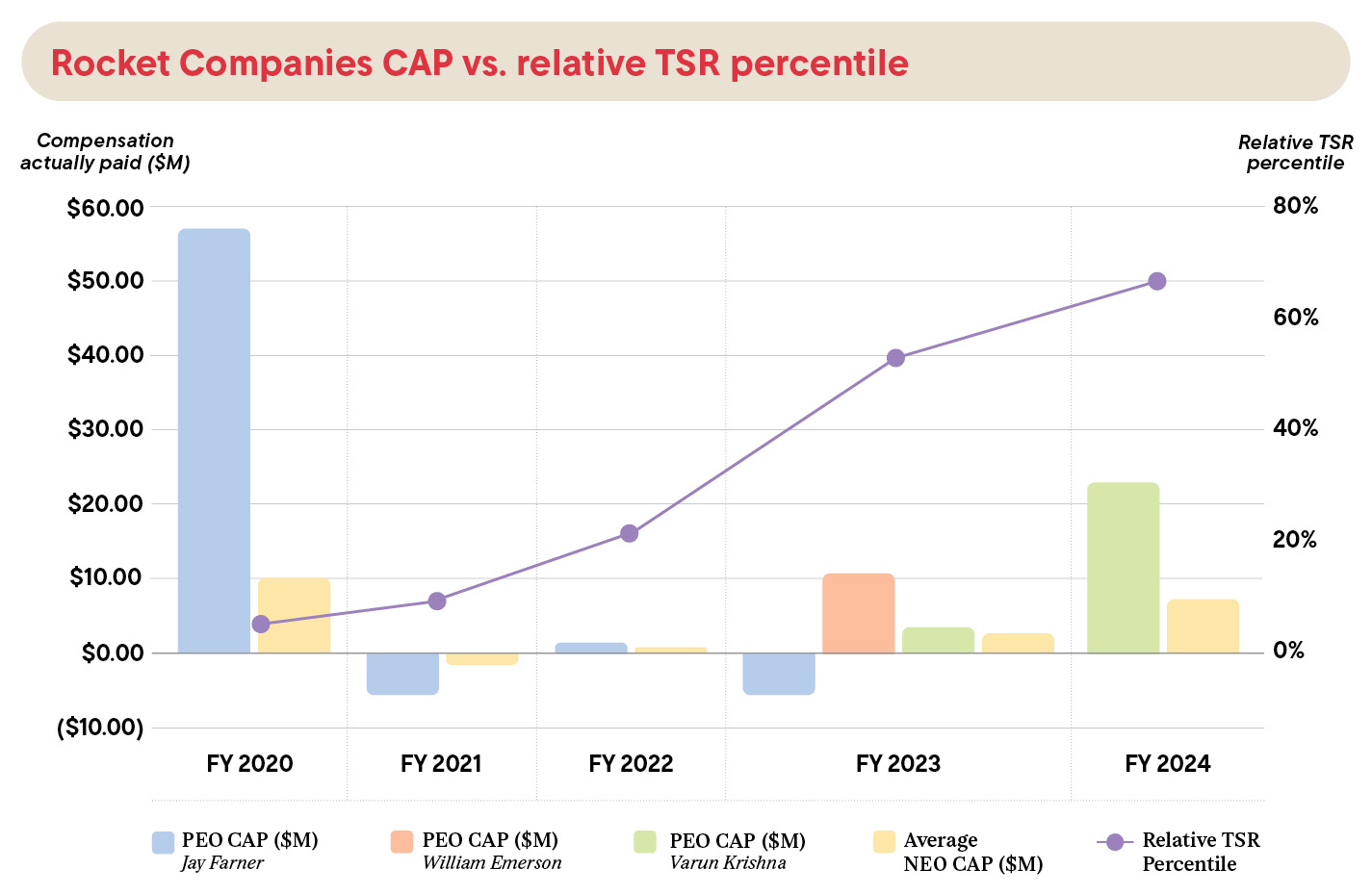

Year | Summary compensation table total for PEO (Jay) ($)(1) | Compensation actually paid to PEO (Jay) ($)(2) | Summary compensation table total for PEO (Bill) ($)(1) | Compensation actually paid to PEO (Bill) ($)(2) | Summary compensation table total for PEO Varun) ($)(1) | Compensation actually paid to PEO (Varun) ($)(2) |

2024 | — | — | — | — | ||

2023 | ( | |||||

2022 | — | — | — | — | ||

2021 | ( | — | — | — | — | |

2020 | — | — | — | — | ||

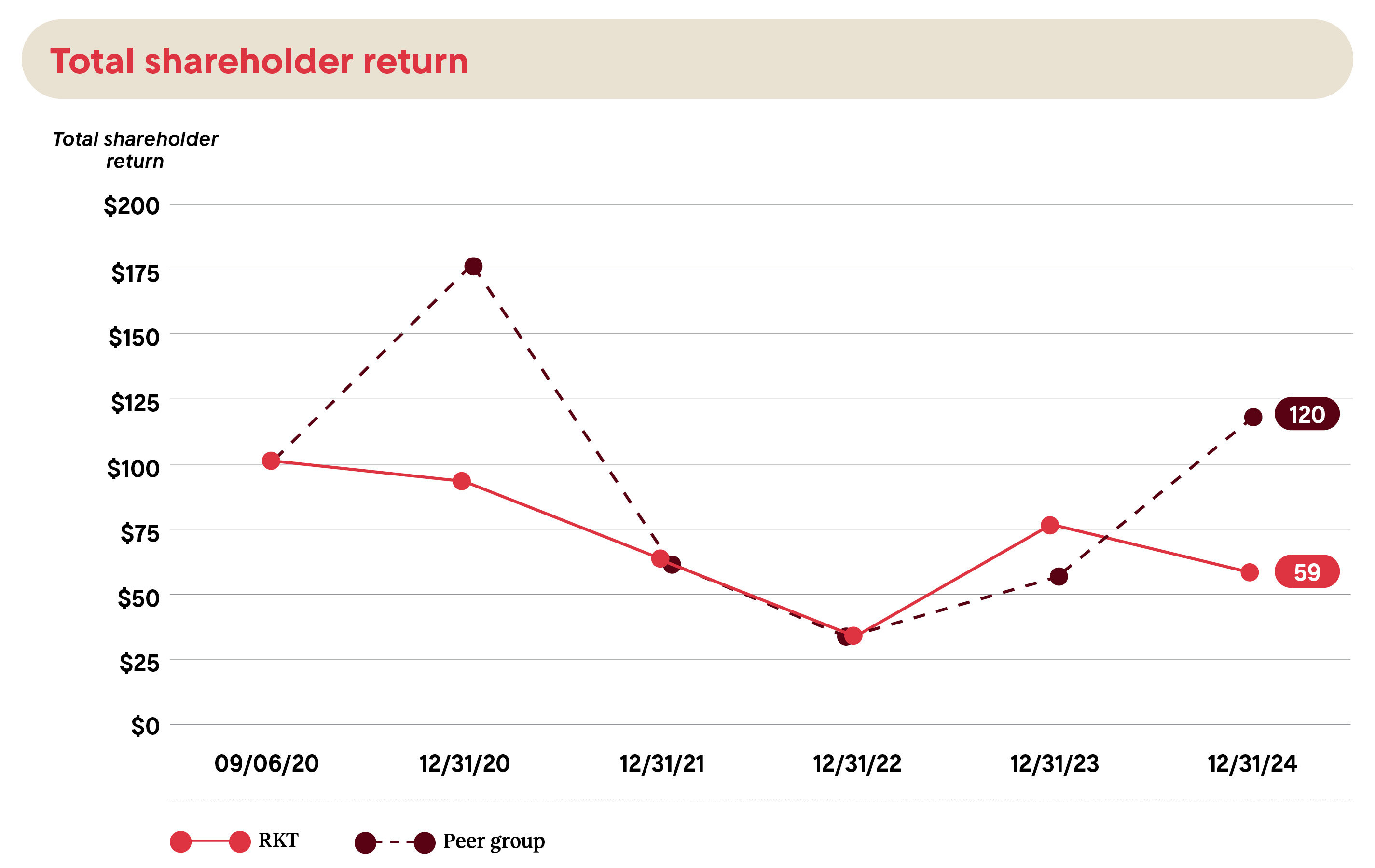

Year | Average summary compensation table to for non-PEO NEOs ($)(3) | Average compensation actually paid to non-PEO NEOs ($)(4) | Value of initial fixed $100 investment based on: | Net income (loss) (millions) ($)(7) | Relative TSR (percentile)(8) | |

Total shareholder return ($)(5) | Peer group total shareholder return ($)(6) | |||||

2024 | ||||||

2023 | ( | |||||

2022 | ||||||

2021 | ( | |||||

2020 | ||||||

Year | Reported summary compensation table total for PEO ($) | Reported value of equity awards ($)(a) | Equity award adjustments ($)(b) | Compensation actually paid to PEO ($) |

Varun Krishna | ||||

2024 | ( | |||

2023 | ||||

Jay Farner | ||||

2023 | ( | ( | ||

2022 | ( | |||

2021 | ( | ( | ||

2020 | ( | |||

Bill Emerson | ||||

2023 | ( | |||

Year | Year end fair value of equity awards granted in the year ($) | Year over year change in fair value of outstanding and unvested equity awards ($) | Fair value as of vesting date of equity awards granted and vested in the year ($) | Year over year change in fair value of equity awards granted in prior years that vested in the year ($) | Fair value at the end of the prior year of equity awards that failed to meet vesting conditions in the year ($) | Value of dividends or other earnings paid on stock or option swards not otherwise reflected in fair value or total compensation ($) | Total equity award adjustments ($) |

Varun Krishna | |||||||

2024 | |||||||

2023 | |||||||

Jay Farner | |||||||

2023 | ( | ( | |||||

2022 | ( | ( | |||||

2021 | ( | ( | ( | ||||

2020 | |||||||

Bill Emerson | |||||||

2023 | |||||||

Year | Average reported summary compensation table total for non-PEO named executive officers ($) | Average reported value of equity awards ($) | Average equity award adjustments ($)(a) | Average compensation actually paid to non-PEO named executive officers ($) |

2024 | ( | |||

2023 | ( | |||

2022 | ( |

2021 | ( | ( | ||

2020 | ( |

Year | Average year end fair value of equity awards granted in the year ($) | Year over year average change in fair value of outstanding and unvested equity awards ($) | Average fair value as of vesting date of equity awards granted and vested in the year ($) | Year over year average change in fair value of equity awards granted in prior years that vested in the year ($)(i) | Average fair value at the end of the prior year of equity awards that failed to meet vesting conditions in the year ($) | Average value of dividends or other earnings paid on stock or option awards not otherwise reflected in fair value or total compensation ($) | Total average equity award adjustments ($) |

2024 | ( | ( | |||||

2023 | ( | ||||||

2022 | ( | ( | |||||

2021 | ( | ( | ( | ||||

2020 |

Most important performance measures | |

Name and address of beneficial owner | Class A Common St owned directly or indirectly(1) | Class D Common Stock owned directly or indirectly(1) | Combined voting power(1)(3) | Class A Common Stock beneficially owned (on a fully exchanged and converted basis)(1)(2) | ||||

Number | Percentage | Number | Percentage | Percentage | Number | Percentage | ||

5% Equityholders | ||||||||

Rock Holdings Inc.(4) | — | — | 1,847,777,661 | 99.9% | 79.0% | 1,847,777,661 | 92.4% | |

VA Partners I, LLC(5) | 15,125,609 | 9.9% | — | — | 2.0% | 15,125,609 | 0.8% | |

Boston Partners(6) | 13,615,609 | 9.0% | — | — | 1.8% | 13,615,609 | 0.7% | |

The Vanguard Group(7) | 11,702,838 | 7.7% | — | — | 1.5% | 11,702,838 | 0.6% | |

JPMorgan Chase(8) | 10,761,186 | 7.1% | — | — | 1.4% | 10,761,186 | 0.5% | |

FMR LLC(9) | 8,427,850 | 5.6% | — | — | 1.1% | 8,427,850 | 0.4% | |

Directors and Named Executive Officers | ||||||||

Bill Emerson(10) | 444,283 | * | — | — | * | 444,283 | * | |

Dan Gilbert(4)(11) | — | — | 1,848,879,483 | 100% | 79.0% | 1,848,879,483 | 92.4% | |

Jennifer Gilbert | — | — | — | — | — | — | — | |

Jonathan Mariner(12) | 70,284 | * | — | — | * | 70,284 | * | |

Alex Rampell(13) | 22,623 | * | — | — | * | 22,623 | * | |

Matthew Rizik(14) | 770,441 | * | — | — | * | 770,441 | * | |

Suzanne Shank(15) | 87,542 | * | — | — | * | 87,542 | * | |

Nancy Tellem(16) | 122,542 | * | — | — | * | 122,542 | * | |

Varun Krishna | 143,566 | * | — | — | * | 143,566 | * | |

Brian Brown(17) | 473,693 | * | — | — | * | 473,693 | * | |

Shawn Malhotra | 140,602 | * | — | — | * | 140,602 | * | |

Jonathan Mildenhall | 91,684 | * | — | — | * | 91,684 | * | |

Heather Lovier(18) | 344,817 | * | — | — | * | 344,817 | * | |

All directors and executive officers as a group (14 persons)(19) | 3,071,123 | 2.0% | 1,848,879,483 | 100% | 80.8% | 1,851,950,606 | 92.6% | |

Type of Service | 2024 ($ in thousands) | 2023 ($ in thousands) |

Audit Fees(1) | 5,125 | 4,417 |

Audit-Related Fees(2) | 1,372 | 1,170 |

Tax Fees(3) | 157 | 180 |

All Other Fees | — | — |

Total | 6,654 | 5,767 |

Proposal 1 Election Of Class II Directors | |

How may I vote? | How does our Board recommend that I vote? |

FOR the election of all Class II director nominees named here WITHHOLD authority to vote for all such Class II director nominees FOR the election of all such Class II director nominees other than any nominees with respect to whom the authority to vote is specifically withheld by indicating in the space provided on the proxy | Our Board recommends that you vote FOR all Class II director nominees named herein |

Proposal 2 Ratification of appointment of Ernst & Young as independent registered public accounting firm for 2025 | |

How may I vote? | How does our Board recommend that I vote? |

FOR or AGAINST the ratification of the appointment of Ernst & Young as our independent registered public accounting firm for the year ending December 31, 2025 You may indicate that you wish to ABSTAIN from voting on the matter | Our Board recommends that you vote FOR the ratification of the appointment of Ernst & Young as our independent registered public accounting firm for the year ending December 31, 2025 |

Proposal | Required Vote | Treatment And Effect Of Vote | ||||

For | Withhold/ Against | Abstain | Broker Non- Votes | |||

1 | Election Of Class II Directors | Plurality of the votes cast | For the director nominee(s) | Against the director nominee(s) | — | Not a vote cast |

2 | Ratification Of Appointment Of The Independent Registered Public Accounting Firm | Majority of the voting power of shares of stock present or represented and entitled to vote | For the proposal | Against the proposal | Against the proposal | None (brokers have discretionary authority) |

Plan Category | Number of Securities to Be Issued upon Exercise of Outstanding Options, Warrants, and Rights (#)(a) | Weighted-Average Exercise Price of Outstanding Options, Warrants, and Rights ($)(b)(1) | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Securities Reflected in Column (a)(#) (c) |

Equity compensation plans approved by security holders: | |||

2020 Omnibus Incentive Plan | |||

– Stock options | 14,552,254 | 17.98 | — |

– RSUs(1) | 21,892,391 | — | — |

– PSUs(1) | 1,055,408 | — | — |

2020 Omnibus Incentive Plan Total | 37,500,053 | — | 111,747,297(2) |

Team Member Stock Purchase Plan (TMSPP) | — | — | 7,627,478 |

Total equity compensation plans approved by security holders | 37,500,053 | — | 119,374,775 |

Equity compensation plans not approved by security holders | — | — | — |

Total | 37,500,053 | 17.98 | 119,374,775 |