PROG Holdings, Inc. Announces Acquisition of Purchasing Power December 2, 2025 .2

PROG Internal Forward Looking Statements Statements in this presentation regarding PROG Holdings, Inc. (the “Company”) and its expected acquisition of Purchasing Power that are not historical facts are "forward-looking statements" that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “expected”, “continued”, “estimated”, “projected”, “anticipated” and similar forward-looking terminology. These risks and uncertainties include among others, the risks and uncertainties discussed under "Risk Factors" in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 19, 2025. Statements in this presentation that are "forward-looking" include, without limitation, statements regarding: (i) the expected revenue and Adjusted EBiTDA of Purchasing Power for 2026; (ii) the Company’s ability to drive sustained multi-year growth, including through the expansion of current and new offerings; (iii) earning-per-share accretion expected from the Company’s acquisition of Purchasing Power; (iv) the Company’s ability to rapidly deleverage its debt position following an acquisition of Purchasing Power and the estimated timing for returning to the Company’s targeted net leverage ratio range; (v) the Company’s capital allocation priorities, including its ability to continue to invest in its businesses, pursue accretive M&A opportunities and return capital to shareholders following an acquisition of Purchasing Power, or otherwise; and (vi) the timing of any closing of the Company’s acquisition of Purchasing Power, or the ability to close the transaction in any event, as well as other statements regarding the plans, intentions, expectations, objectives, goals and projections with respect to the proposed transaction, including future financial and operating results. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this presentation. 2

PROG Internal PROG Holdings’ Mission 3 Mission To create a better today and unlock the possibilities of tomorrow through financial empowerment

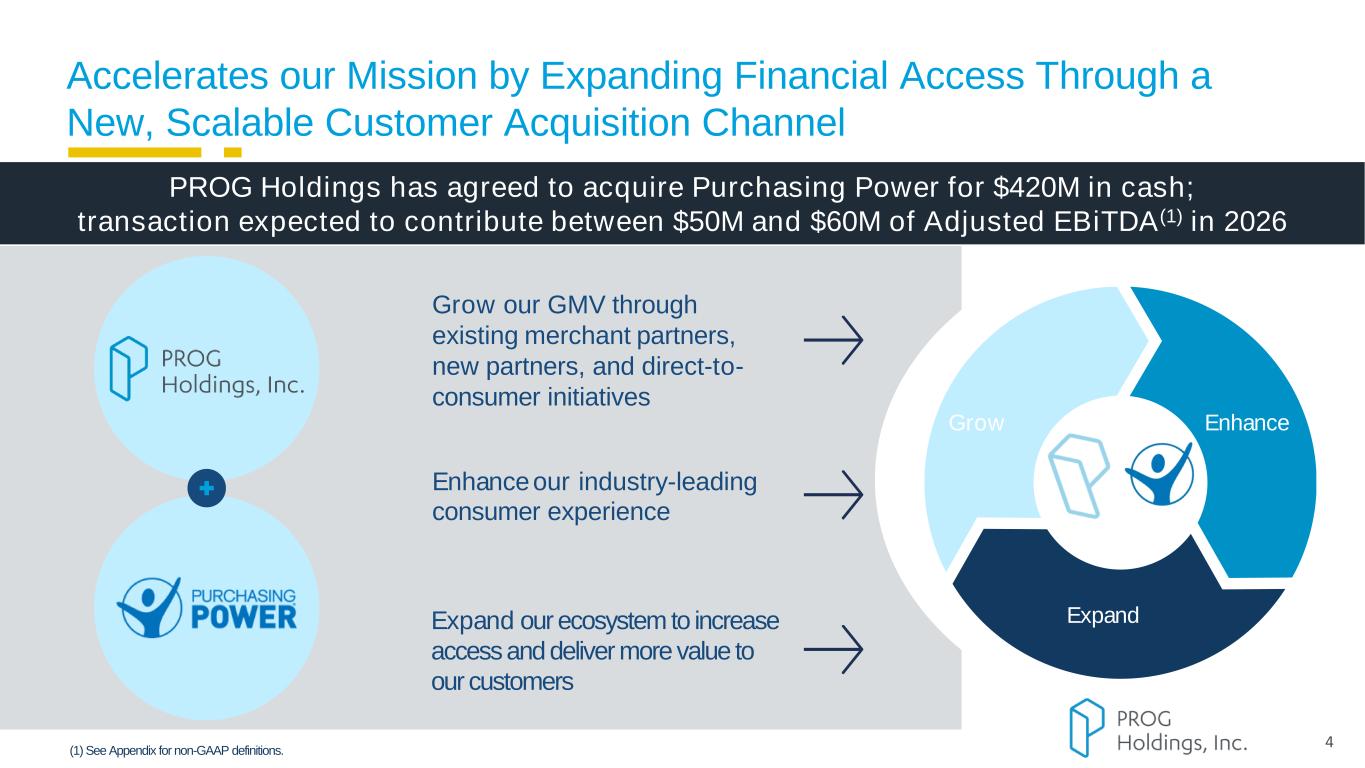

PROG Internal Accelerates our Mission by Expanding Financial Access Through a New, Scalable Customer Acquisition Channel 4 Grow Expand Enhance Grow our GMV through existing merchant partners, new partners, and direct-to- consumer initiatives Expand our ecosystem to increase access and deliver more value to our customers Enhance our industry-leading consumer experience PROG Holdings has agreed to acquire Purchasing Power for $420M in cash; transaction expected to contribute between $50M and $60M of Adjusted EBiTDA(1) in 2026 (1) See Appendix for non-GAAP definitions.

PROG Internal Purchasing Power at a Glance 5 Purchasing Power is an e-commerce based FinTech platform offering consumers a way to buy and pay for goods and services over time, directly from their paycheck $680M -$730M 2026E revenue ~90% of Purchasing Power’s outstanding balance has payment terms of 12 months or less 360+ Established employer clients from diversified industries ~98% Client revenue retention(1) 96% of employees find Purchasing Power valuable(2) 100+ Relationships with distribution partners Purchasing Power is an e-commerce based platform whereby customers purchase goods and services and pay for those items in installments via direct payroll deduction or payroll allotment ▪ Moated B2B2C model where Purchasing Power is offered as a voluntary benefit to employees (customers) of the employer (client) ▪ Go-to-market strategy powered by strong network of nationwide benefit brokers / partners and supplemented by growing direct sales force ▪ Provides access to over 7 million employees nationwide through its client relationships with over 360 established employers as well as public sector-related employers ▪ Sticky client relationships combined with consistent repeat buyer behavior provides predictability and visibility ▪ Increasing trend of employer offered voluntary benefits and focus on employee financial wellness to foster employee engagement and retention (1) For a given year, represents the % of revenue from clients who joined the platform prior to the current year. (2) Based on Purchasing Power surveys.

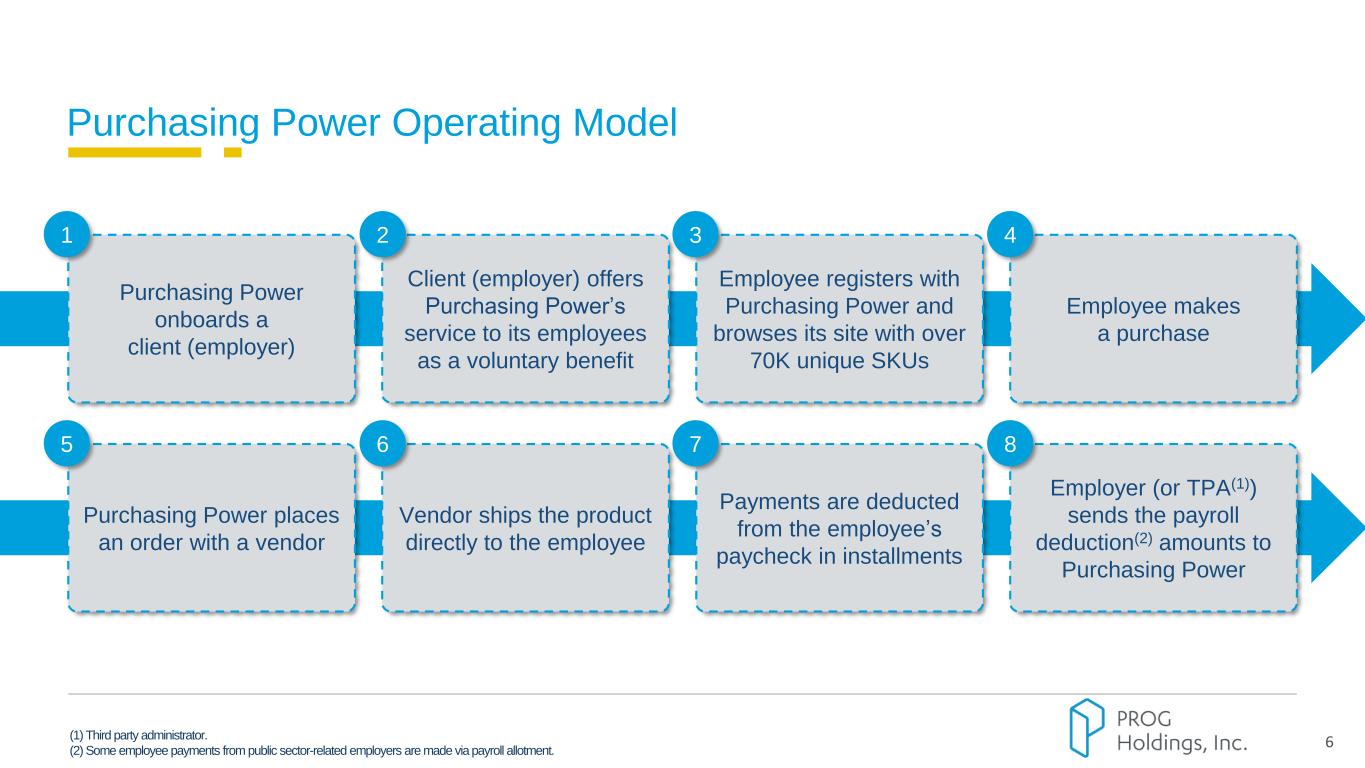

PROG Internal 6 Purchasing Power Operating Model Client (employer) offers Purchasing Power’s service to its employees as a voluntary benefit Employee registers with Purchasing Power and browses its site with over 70K unique SKUs Employee makes a purchase 2 3 4 Purchasing Power onboards a client (employer) 1 Vendor ships the product directly to the employee Payments are deducted from the employee’s paycheck in installments Employer (or TPA(1)) sends the payroll deduction(2) amounts to Purchasing Power 6 7 8 Purchasing Power places an order with a vendor 5 (1) Third party administrator. (2) Some employee payments from public sector-related employers are made via payroll allotment.

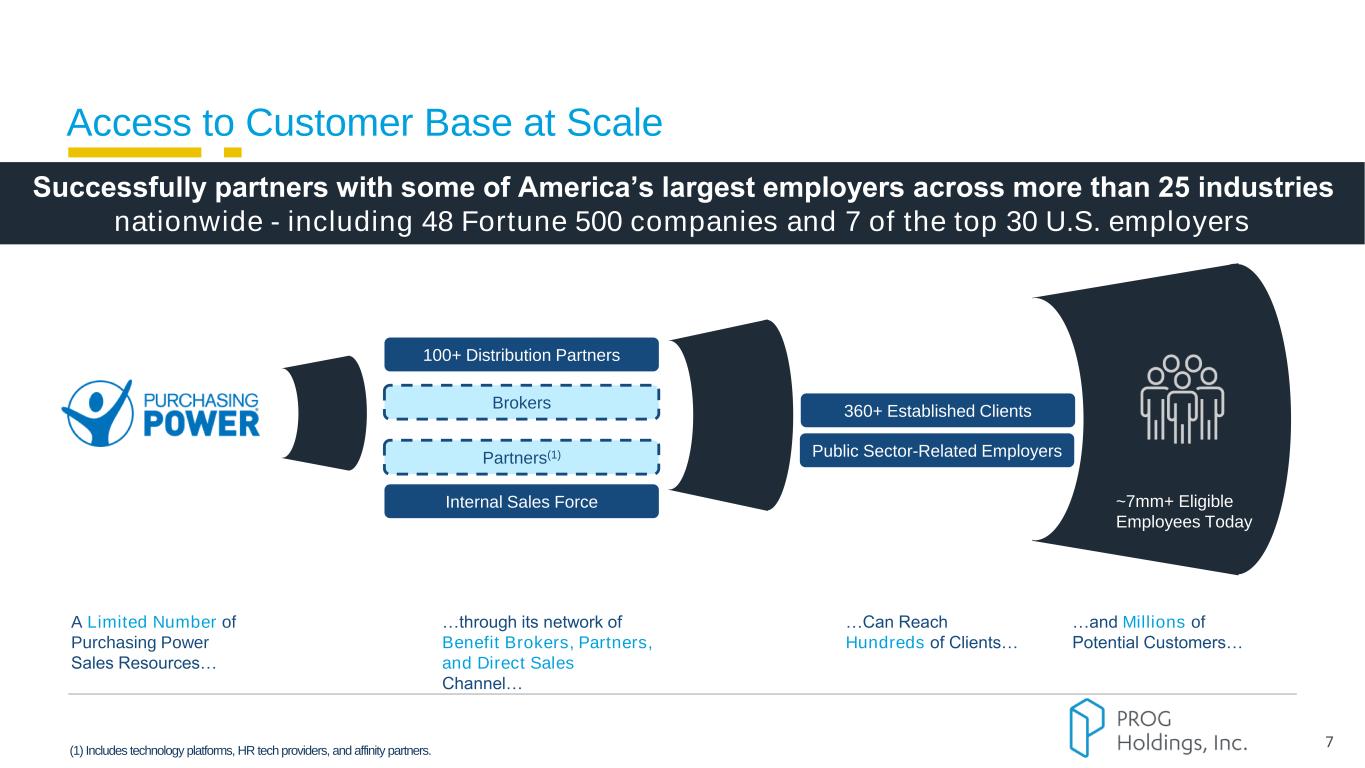

PROG Internal Access to Customer Base at Scale 7 100+ Distribution Partners Brokers Partners(1) Internal Sales Force 360+ Established Clients ~7mm+ Eligible Employees Today A Limited Number of Purchasing Power Sales Resources… …Can Reach Hundreds of Clients… …through its network of Benefit Brokers, Partners, and Direct Sales Channel… …and Millions of Potential Customers… (1) Includes technology platforms, HR tech providers, and affinity partners. Successfully partners with some of America’s largest employers across more than 25 industries nationwide - including 48 Fortune 500 companies and 7 of the top 30 U.S. employers Public Sector-Related Employers

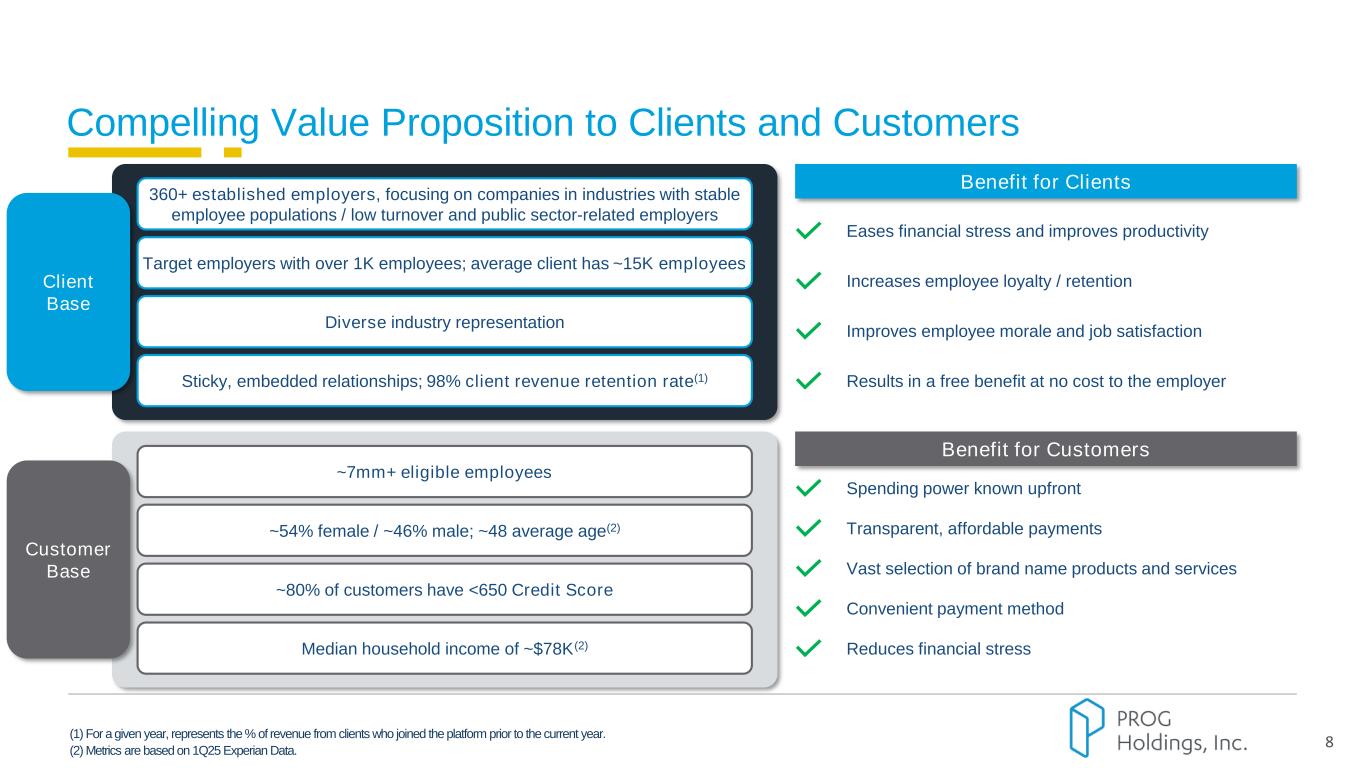

PROG Internal Compelling Value Proposition to Clients and Customers 8 ~7mm+ eligible employees ~54% female / ~46% male; ~48 average age(2) ~80% of customers have <650 Credit Score Median household income of ~$78K(2) 360+ established employers, focusing on companies in industries with stable employee populations / low turnover and public sector-related employers Target employers with over 1K employees; average client has ~15K employees Diverse industry representation Sticky, embedded relationships; 98% client revenue retention rate(1) (1) For a given year, represents the % of revenue from clients who joined the platform prior to the current year. (2) Metrics are based on 1Q25 Experian Data. Benefit for Clients Eases financial stress and improves productivity Increases employee loyalty / retention Improves employee morale and job satisfaction Results in a free benefit at no cost to the employer Benefit for Customers Spending power known upfront Transparent, affordable payments Vast selection of brand name products and services Reduces financial stress Convenient payment method Client Base Customer Base

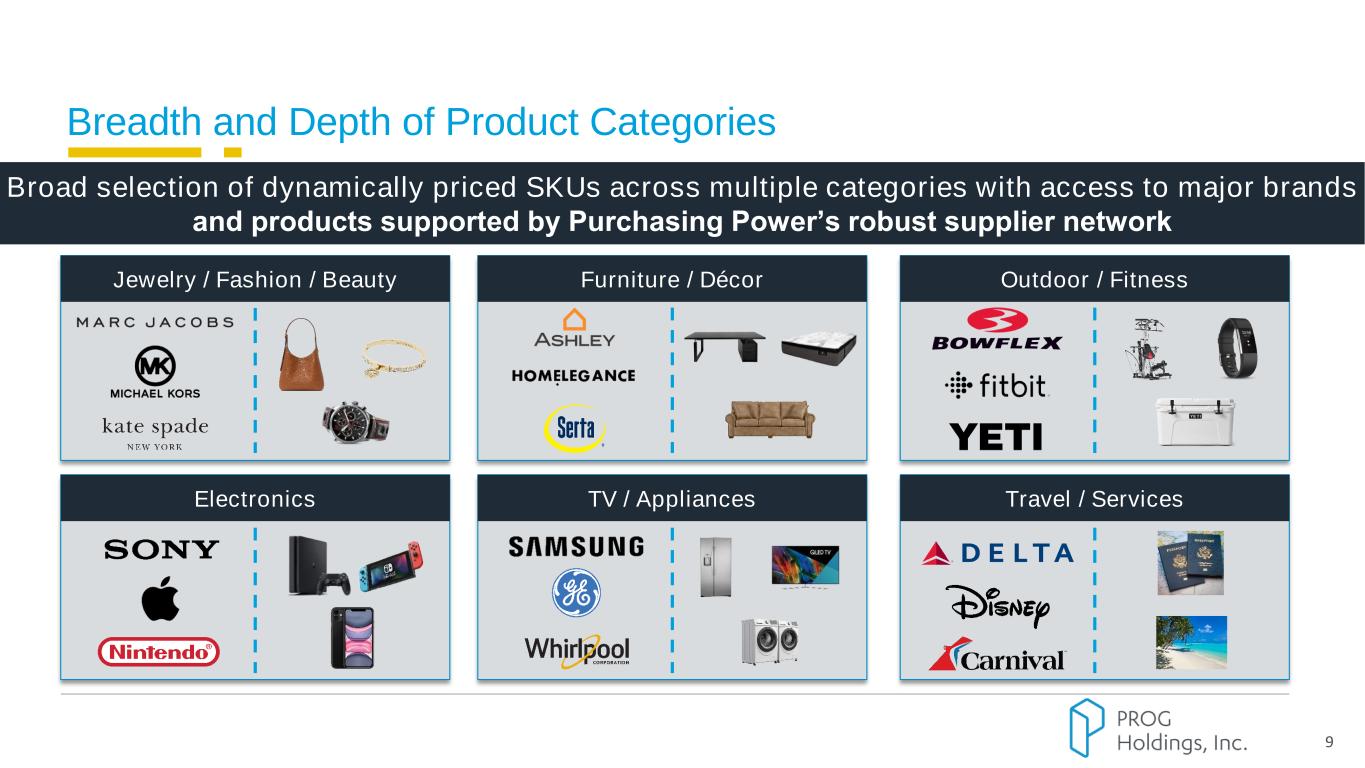

Breadth and Depth of Product Categories 9 Jewelry / Fashion / Beauty Outdoor / Fitness Electronics TV / Appliances Travel / Services Furniture / Décor Broad selection of dynamically priced SKUs across multiple categories with access to major brands and products supported by Purchasing Power’s robust supplier network

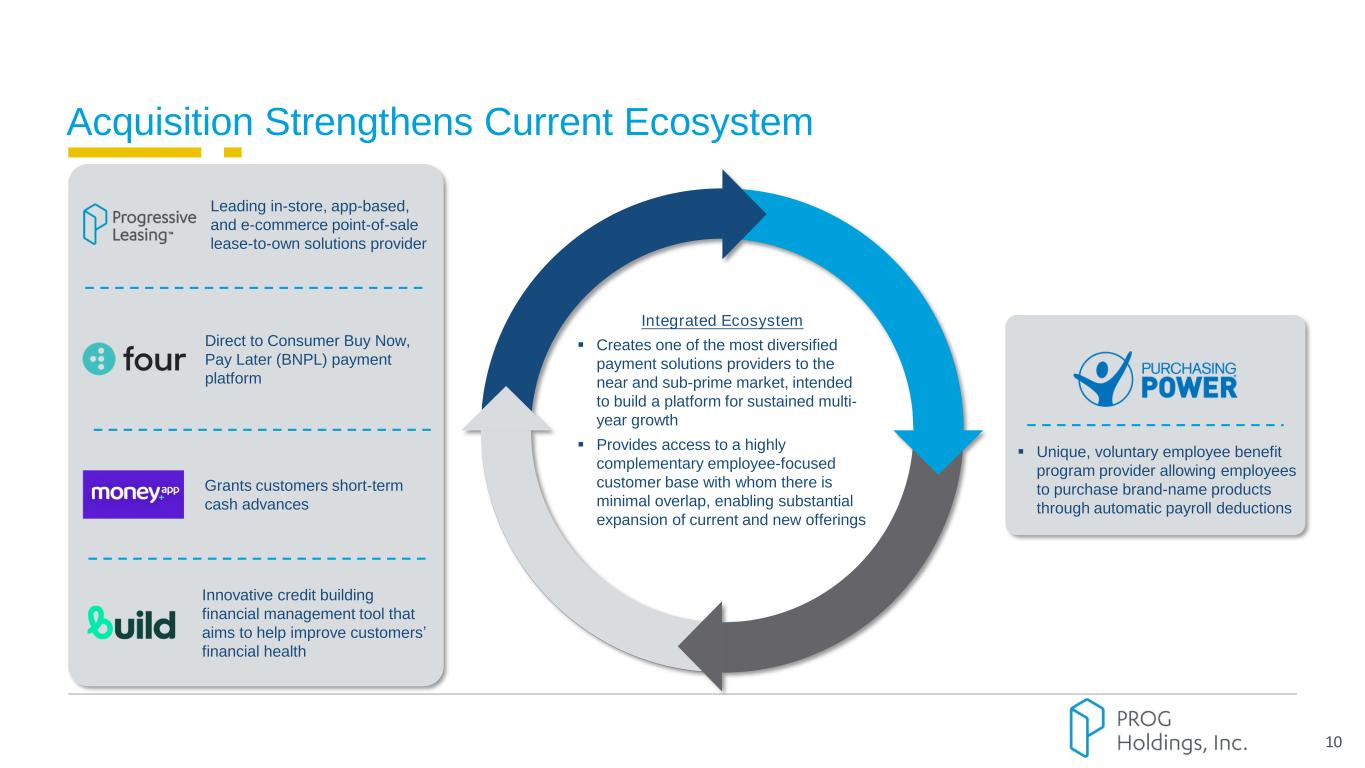

PROG Internal Acquisition Strengthens Current Ecosystem 10 Leading in-store, app-based, and e-commerce point-of-sale lease-to-own solutions provider Direct to Consumer Buy Now, Pay Later (BNPL) payment platform Innovative credit building financial management tool that aims to help improve customers’ financial health Integrated Ecosystem ▪ Creates one of the most diversified payment solutions providers to the near and sub-prime market, intended to build a platform for sustained multi- year growth ▪ Provides access to a highly complementary employee-focused customer base with whom there is minimal overlap, enabling substantial expansion of current and new offerings Grants customers short-term cash advances ▪ Unique, voluntary employee benefit program provider allowing employees to purchase brand-name products through automatic payroll deductions

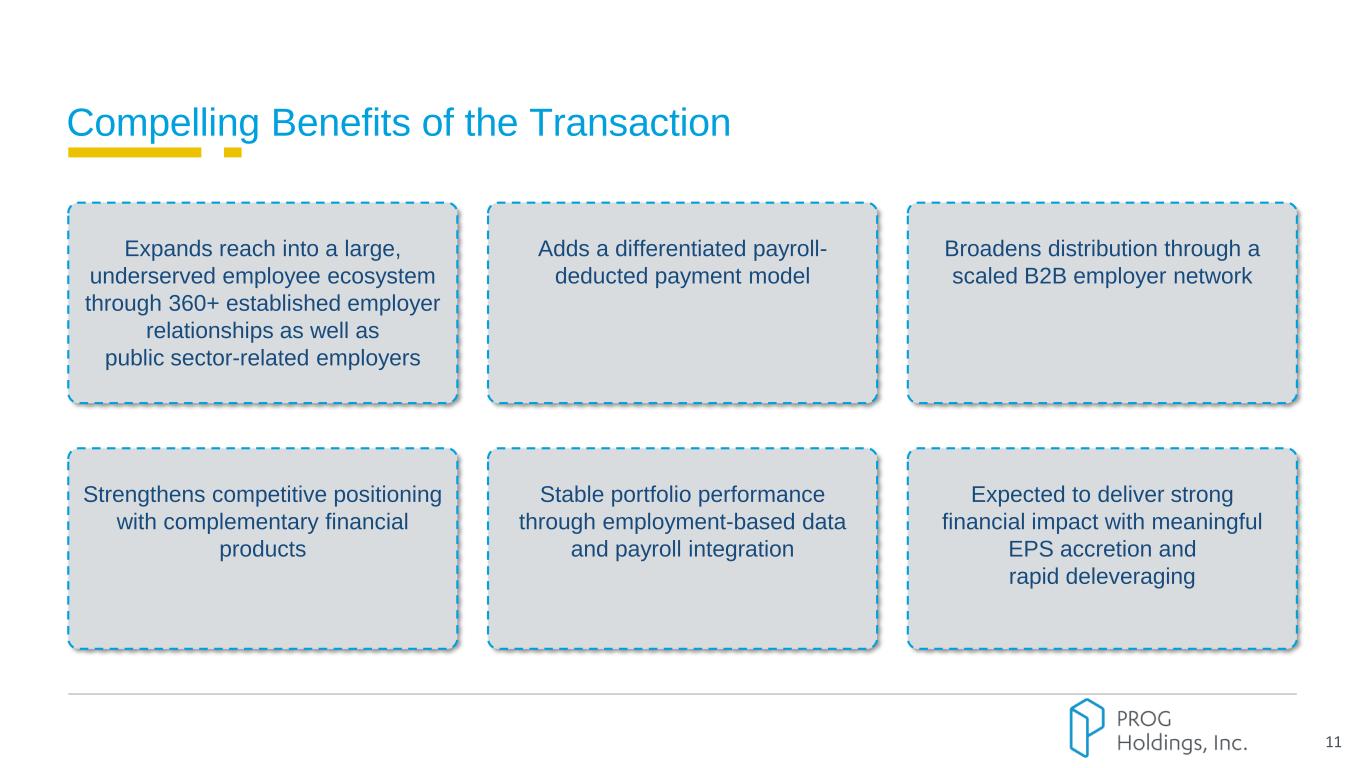

PROG Internal Compelling Benefits of the Transaction 11 Expands reach into a large, underserved employee ecosystem through 360+ established employer relationships as well as public sector-related employers Broadens distribution through a scaled B2B employer network Adds a differentiated payroll- deducted payment model Expected to deliver strong financial impact with meaningful EPS accretion and rapid deleveraging Stable portfolio performance through employment-based data and payroll integration Strengthens competitive positioning with complementary financial products

12 Capital Allocation Fuel Growth Return Excess Capital to Shareholders Explore Strategic M&A Opportunities ▪ Capital-efficient model that pairs self-funding with securitization ▪ Strategically reinvest in business and technologies ▪ Flexible funding capacity supporting strong GMV growth ▪ Explore adjacent products to further our financially empowering ecosystem strategy ▪ Entertain accretive acquisition opportunities ▪ Committed to returning excess capital to shareholders while managing toward our target net leverage(1) range of 1.5x – 2.0x(2) (1) See Appendix for non-GAAP definitions. (2) Excludes non-recourse funding debt.

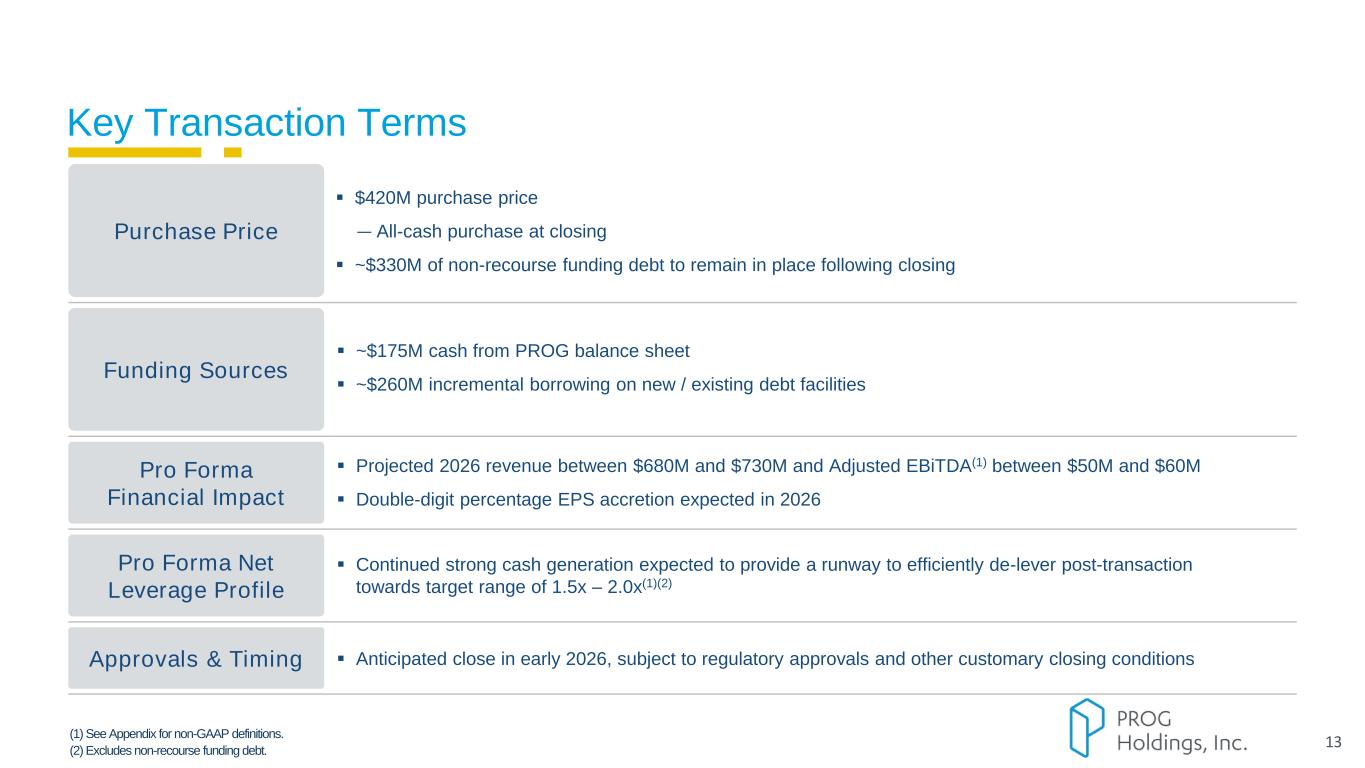

PROG Internal 13 Purchase Price ▪ $420M purchase price ― All-cash purchase at closing ▪ ~$330M of non-recourse funding debt to remain in place following closing Funding Sources ▪ ~$175M cash from PROG balance sheet ▪ ~$260M incremental borrowing on new / existing debt facilities Pro Forma Net Leverage Profile Approvals & Timing ▪ Anticipated close in early 2026, subject to regulatory approvals and other customary closing conditions ▪ Continued strong cash generation expected to provide a runway to efficiently de-lever post-transaction towards target range of 1.5x – 2.0x(1)(2) Key Transaction Terms Pro Forma Financial Impact ▪ Projected 2026 revenue between $680M and $730M and Adjusted EBiTDA(1) between $50M and $60M ▪ Double-digit percentage EPS accretion expected in 2026 (1) See Appendix for non-GAAP definitions. (2) Excludes non-recourse funding debt.

PROG Internal Appendix

PROG Internal Use of Non-GAAP Financial Measures This presentation contains financial measures that are not calculated in accordance with generally accepted accounting principles in the United States ("GAAP"), including (1) pro forma forecasted Adjusted EBiTDA for Purchasing Power for 2026, and (2) forecasted total net leverage ratio. Pro forma forecasted Adjusted EBiTDA for Purchasing Power for 2026 assumes the acquisition closes on January 2, 2026, and is calculated as Purchasing Power’s earnings before interest expense, net; depreciation on property and equipment; amortization of intangible assets; income taxes; restructuring charges; acquisition- related transaction fees; and stock-based compensation expense, less funded non-recourse debt net interest expense. Forecasted Total net leverage ratio is calculated as consolidated recourse debt less unrestricted cash, divided by consolidated Adjusted EBiTDA. Because of the inherent uncertainty related to these adjustments, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measures or reconciliation to any forecasted GAAP measure without unreasonable effort. Management believes Adjusted EBiTDA and total net leverage ratio provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry, as well as by our management, in assessing both operating performance and consolidated liquidity. However, non-GAAP financial measures should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings. Further, we caution investors that amounts presented in accordance with our definitions of Adjusted EBiTDA and total net leverage may not be comparable to similar measures disclosed by other companies because not all companies and analysts calculate these measures in the same manner. 15