DRIVEN BY SCIENCE FOCUSED ON LIFE November 2025

Forward-looking statements Certain statements included in this presentation (this “Presentation”) that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are sometimes accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding IBTROZI’s and safusidenib’s best-in-class therapeutic potential, IBTROZI’s commercial potential including its theoretical maximum ROS1+ NSCLC market opportunity based on IBTROZI’s mPFS, our expectations that updated median duration of response results from taletrectinib TRUST-I and TRUST-II studies can support a supplemental NDA for IBTROZI, our plans for safusidenib G203 study protocol amendment and patient enrollment, our expectations that such amended G203 study may support approval of safusidenib for the maintenance treatment of high-grade IDH1-mutant glioma, our plans to share new data and updates from our clinical programs including taletrectinib and NUV-1511, the potential of the DDC platform, our expectations regarding regulatory and reimbursement developments, and strength of pro forma cash position providing a path to profitability without need to raise additional capital. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the management team of Nuvation Bio and are not predictions of actual performance. These forward-looking statements are subject to a number of risks and uncertainties that may cause actual results to differ from those anticipated by the forward-looking statements, including but not limited to the challenges associated with conducting drug discovery and commercialization and initiating or conducting clinical studies due to, among other things, difficulties or delays in the regulatory process, enrolling subjects or manufacturing or acquiring necessary products; the emergence or worsening of adverse events or other undesirable side effects; risks associated with preliminary and interim data, which may not be representative of more mature data; physician and patient behavior; and competitive developments. Risks and uncertainties facing Nuvation Bio are described more fully in its Form 10-Q filed with the SEC on November 3, 2025 under the heading “Risk Factors,” and other documents that Nuvation Bio has filed or will file with the SEC. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this Presentation. Nuvation Bio disclaims any obligation or undertaking to update, supplement or revise any forward-looking statements contained in this Presentation. 2

Nuvation Bio is focused on tackling the greatest challenges in cancer treatment Global, commercial-stage oncology company focused on innovating and developing first- or best-in- class medicines for diseases that represent particularly large unmet patient needs TM IBTROZI (taletrectinib) is a next generation, potentially best-in-class ROS1 inhibitor approved in June 2025 for advanced ROS1+ NSCLC in the U.S., Japan, and China; 204 new patient starts in Q3 2025 1 Safusidenib is a potentially best-in-class, brain penetrant, mIDH1 inhibitor entering a pivotal study for high-grade IDH1-mutant glioma; potential to extend study into high-risk, low-grade patients NUV-1511, the Company’s first clinical-stage drug-drug conjugate (DDC), is being evaluated in a Phase 1/2 study; NUV-868 is a BD2-selective BET inhibitor that has completed Phase 1 and Phase 1b studies 2 Robust cash balance of $549 million as of 9/30/25 is expected to provide path to profitability without need for additional funding 3 1. Protocol amendment to upsize to a pivotal trial and include patients with grade 2 high-risk IDH1-mutant glioma are forthcoming. 2. An additional $50 million under a term loan with Sagard Healthcare Partners is available to the Company until June 30, 2026.

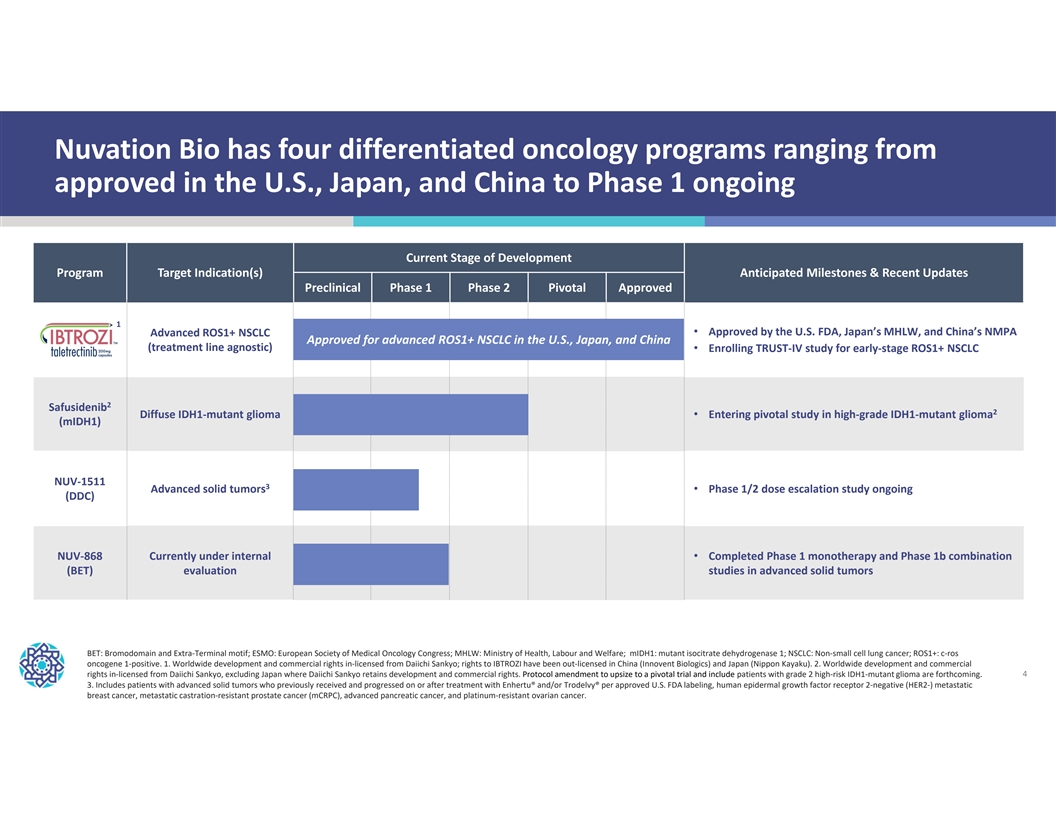

Nuvation Bio has four differentiated oncology programs ranging from approved in the U.S., Japan, and China to Phase 1 ongoing Current Stage of Development Program Target Indication(s) Anticipated Milestones & Recent Updates Preclinical Phase 1 Phase 2 Pivotal Approved 1 Advanced ROS1+ NSCLC • Approved by the U.S. FDA, Japan’s MHLW, and China’s NMPA Approved Approved f fo or advanced r advanced ROS1+ ROS1+ NSCL NSCLC in C in the U the U. .S., S., Japan, Japan, and and China China (treatment line agnostic) • Enrolling TRUST-IV study for early-stage ROS1+ NSCLC 2 Safusidenib 2 Diffuse IDH1-mutant glioma • Entering pivotal study in high-grade IDH1-mutant glioma (mIDH1) NUV-1511 3 Advanced solid tumors • Phase 1/2 dose escalation study ongoing (DDC) NUV-868 Currently under internal • Completed Phase 1 monotherapy and Phase 1b combination (BET) evaluation studies in advanced solid tumors BET: Bromodomain and Extra-Terminal motif; ESMO: European Society of Medical Oncology Congress; MHLW: Ministry of Health, Labour and Welfare; mIDH1: mutant isocitrate dehydrogenase 1; NSCLC: Non-small cell lung cancer; ROS1+: c-ros oncogene 1-positive. 1. Worldwide development and commercial rights in-licensed from Daiichi Sankyo; rights to IBTROZI have been out-licensed in China (Innovent Biologics) and Japan (Nippon Kayaku). 2. Worldwide development and commercial rights in-licensed from Daiichi Sankyo, excluding Japan where Daiichi Sankyo retains development and commercial rights. Protocol amendment to upsize to a pivotal trial and include patients with grade 2 high-risk IDH1-mutant glioma are forthcoming. 4 3. Includes patients with advanced solid tumors who previously received and progressed on or after treatment with Enhertu® and/or Trodelvy® per approved U.S. FDA labeling, human epidermal growth factor receptor 2-negative (HER2-) metastatic breast cancer, metastatic castration-resistant prostate cancer (mCRPC), advanced pancreatic cancer, and platinum-resistant ovarian cancer.

IBTROZI | ROS1i Approved by U.S. FDA Advanced ROS1+ NSCLC in June 2025 5

Approved by U.S. FDA on June 11, 2025 6

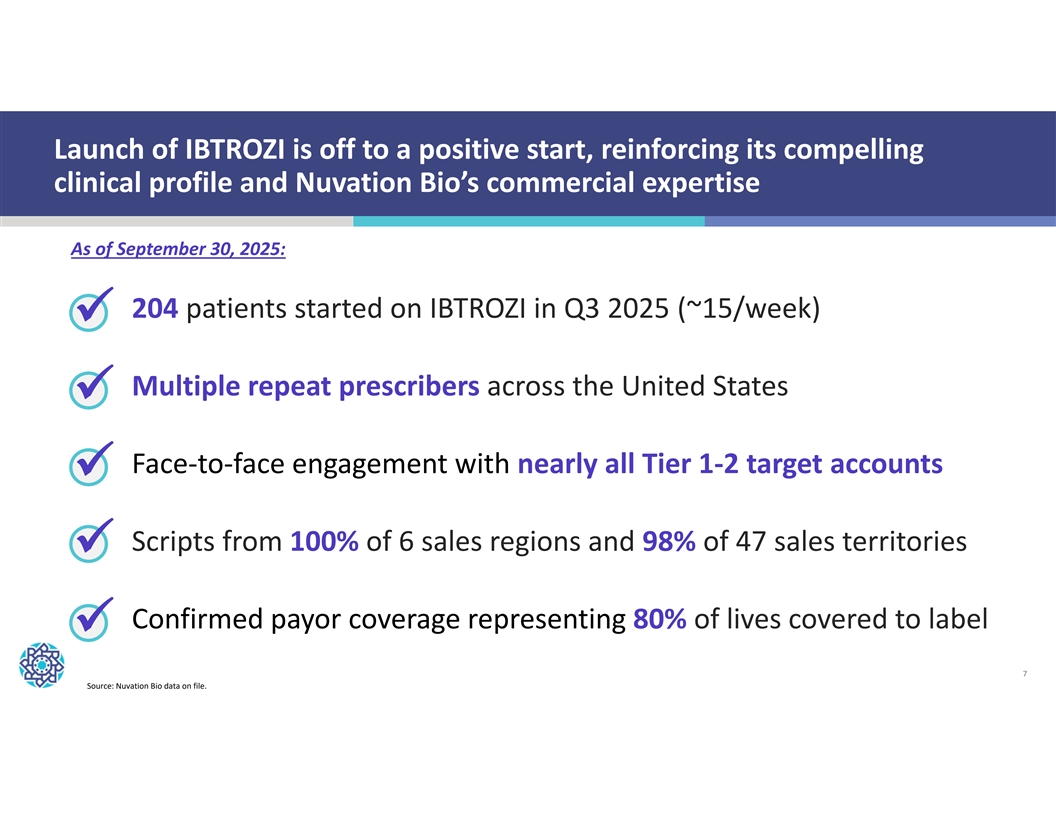

Launch of IBTROZI is off to a positive start, reinforcing its compelling clinical profile and Nuvation Bio’s commercial expertise As of September 30, 2025: 204 patients started on IBTROZI in Q3 2025 (~15/week) ü Multiple repeat prescribers across the United States ü Face-to-face engagement with nearly all Tier 1-2 target accounts ü Scripts from 100% of 6 sales regions and 98% of 47 sales territories ü Confirmed payor coverage representing 80% of lives covered to label ü 7 Source: Nuvation Bio data on file.

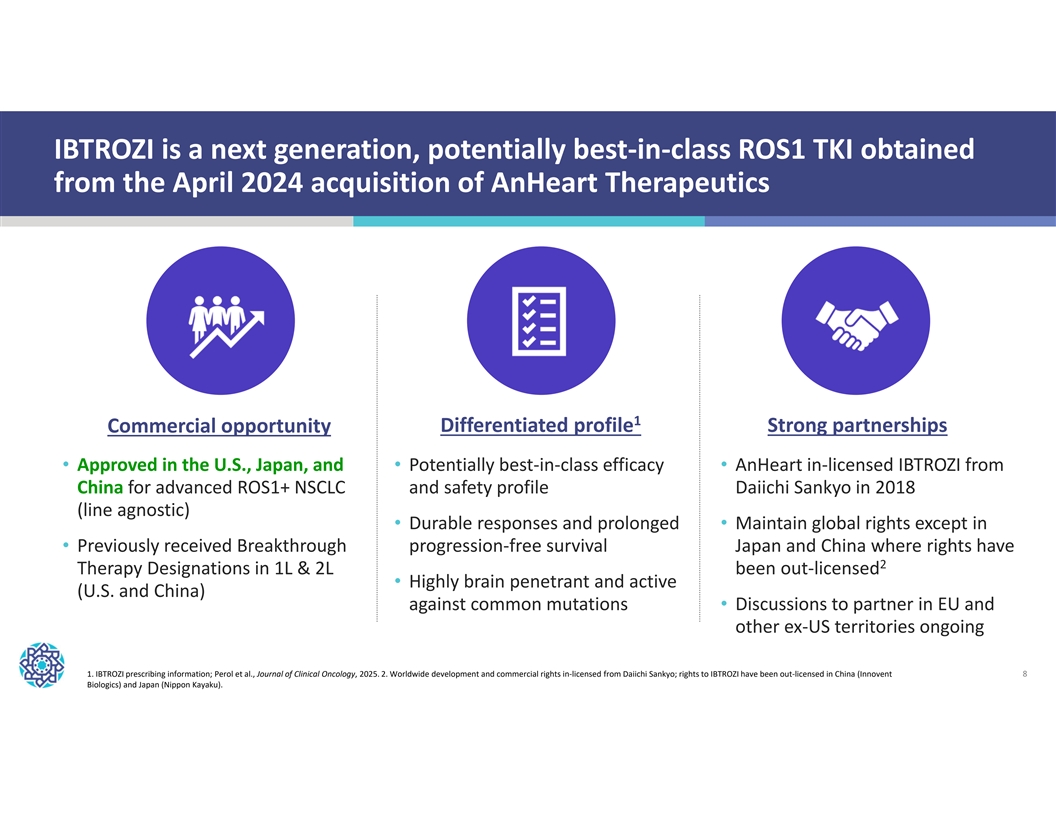

IBTROZI is a next generation, potentially best-in-class ROS1 TKI obtained from the April 2024 acquisition of AnHeart Therapeutics 1 Differentiated profile Strong partnerships Commercial opportunity • Approved in the U.S., Japan, and • Potentially best-in-class efficacy • AnHeart in-licensed IBTROZI from China for advanced ROS1+ NSCLC and safety profile Daiichi Sankyo in 2018 (line agnostic) • Durable responses and prolonged • Maintain global rights except in • Previously received Breakthrough progression-free survival Japan and China where rights have 2 Therapy Designations in 1L & 2L been out-licensed • Highly brain penetrant and active (U.S. and China) against common mutations • Discussions to partner in EU and other ex-US territories ongoing 1. IBTROZI prescribing information; Perol et al., Journal of Clinical Oncology, 2025. 2. Worldwide development and commercial rights in-licensed from Daiichi Sankyo; rights to IBTROZI have been out-licensed in China (Innovent 8 Biologics) and Japan (Nippon Kayaku).

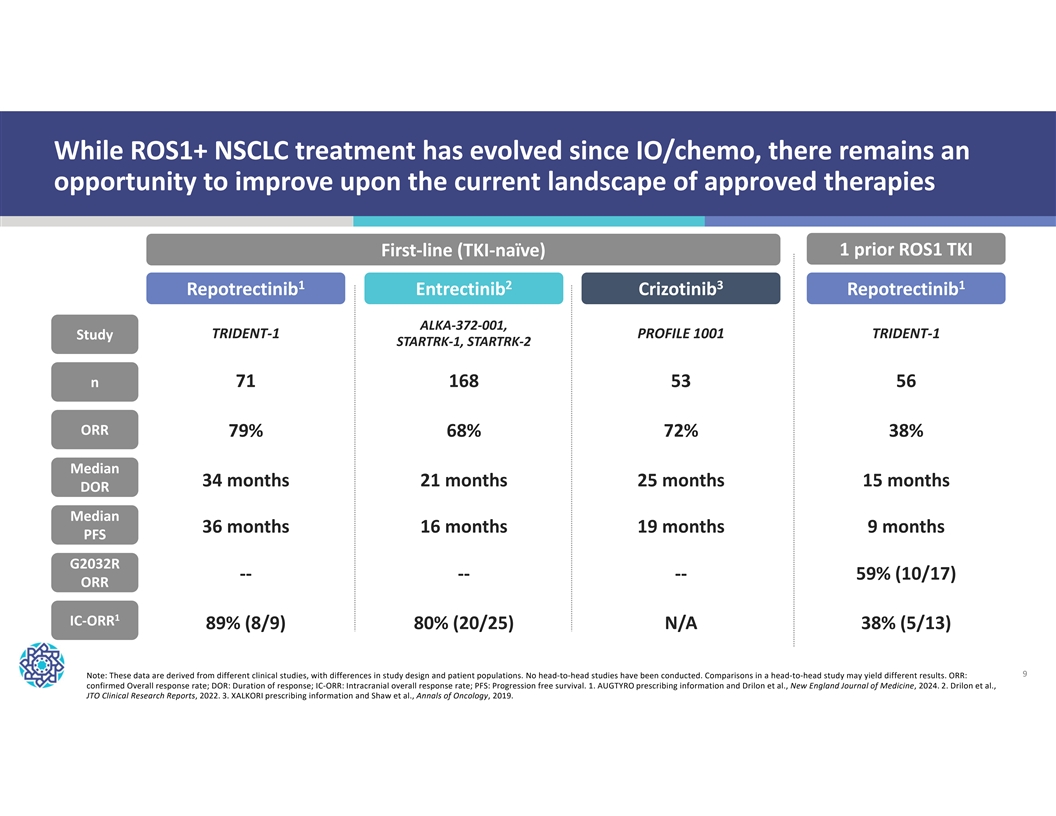

While ROS1+ NSCLC treatment has evolved since IO/chemo, there remains an opportunity to improve upon the current landscape of approved therapies First-line (TKI-naïve) 1 prior ROS1 TKI 1 2 3 1 Repotrectinib Entrectinib Crizotinib Repotrectinib ALKA-372-001, TRIDENT-1 PROFILE 1001 TRIDENT-1 Study STARTRK-1, STARTRK-2 71 168 53 56 n ORR 79% 68% 72% 38% Median 34 months 21 months 25 months 15 months DOR Median 36 months 16 months 19 months 9 months PFS G2032R -- -- -- 59% (10/17) ORR 1 IC-ORR 89% (8/9) 80% (20/25) N/A 38% (5/13) 9 Note: These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been conducted. Comparisons in a head-to-head study may yield different results. ORR: confirmed Overall response rate; DOR: Duration of response; IC-ORR: Intracranial overall response rate; PFS: Progression free survival. 1. AUGTYRO prescribing information and Drilon et al., New England Journal of Medicine, 2024. 2. Drilon et al., JTO Clinical Research Reports, 2022. 3. XALKORI prescribing information and Shaw et al., Annals of Oncology, 2019.

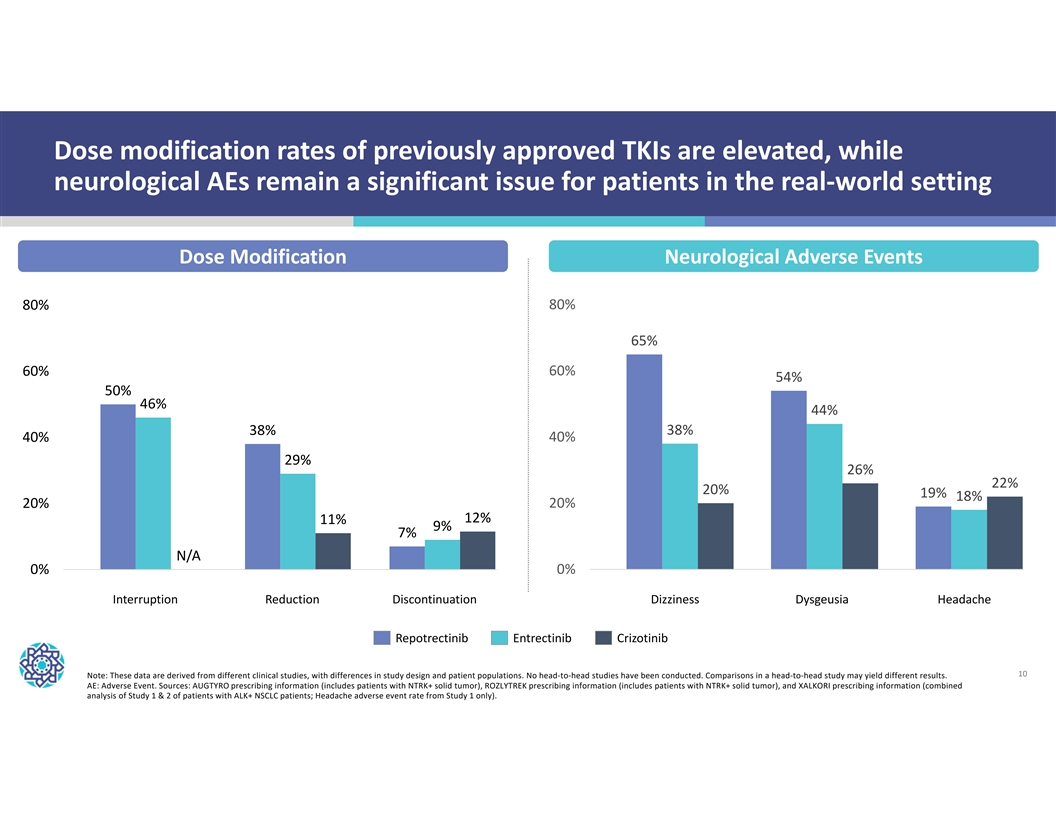

Dose modification rates of previously approved TKIs are elevated, while neurological AEs remain a significant issue for patients in the real-world setting Dose Modification Neurological Adverse Events 80% 80% 65% 60% 60% 54% 50% 46% 44% 38% 38% 40% 40% 29% 26% 22% 20% 19% 18% 20% 20% 12% 11% 9% 7% N/A 0% 0% Interruption Reduction Discontinuation Dizziness Dysgeusia Headache Interruption Reduction Discontinuation Dizziness Dysgeusia Headache Repotrectinib Entrectinib Crizotinib 10 Note: These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been conducted. Comparisons in a head-to-head study may yield different results. AE: Adverse Event. Sources: AUGTYRO prescribing information (includes patients with NTRK+ solid tumor), ROZLYTREK prescribing information (includes patients with NTRK+ solid tumor), and XALKORI prescribing information (combined analysis of Study 1 & 2 of patients with ALK+ NSCLC patients; Headache adverse event rate from Study 1 only).

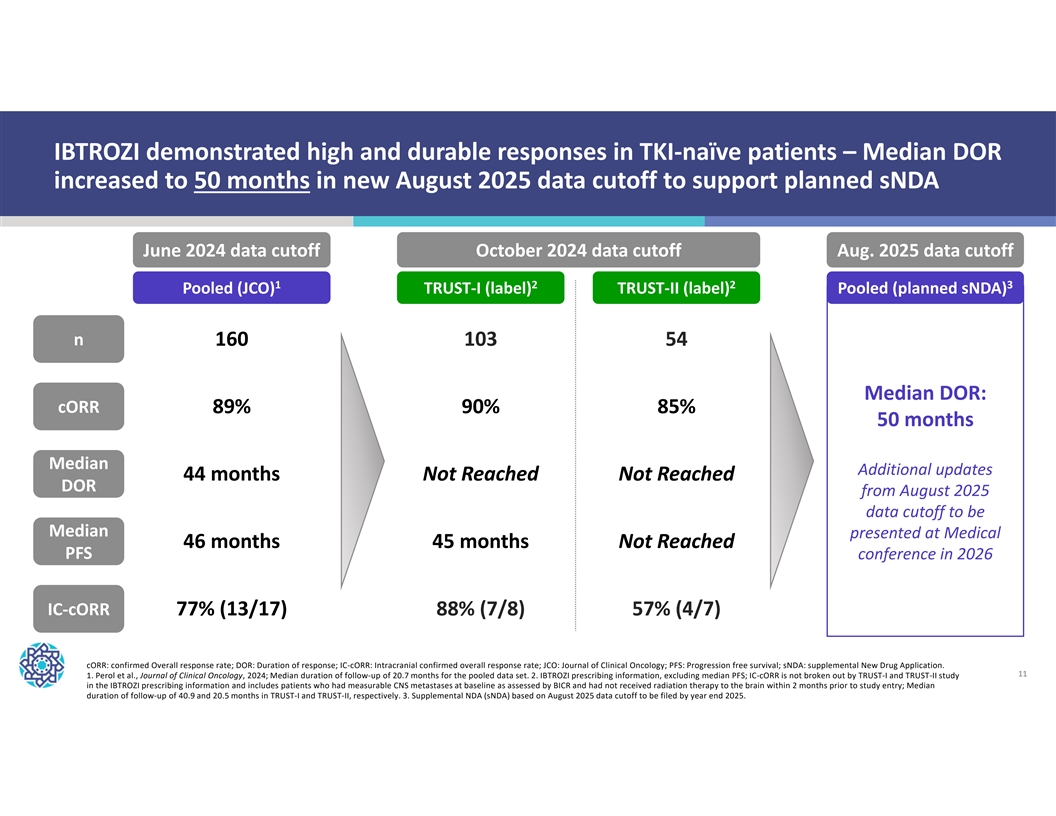

IBTROZI demonstrated high and durable responses in TKI-naïve patients – Median DOR increased to 50 months in new August 2025 data cutoff to support planned sNDA June 2024 data cutoff October 2024 data cutoff Aug. 2025 data cutoff 1 2 2 3 Pooled (JCO) TRUST-I (label) TRUST-II (label) Pooled (planned sNDA) n 160 103 54 Median DOR: cORR 89% 90% 85% 50 months Median Additional updates 44 months Not Reached Not Reached DOR from August 2025 data cutoff to be Median presented at Medical 46 months 45 months Not Reached PFS conference in 2026 IC-cORR 77% (13/17) 88% (7/8) 57% (4/7) cORR: confirmed Overall response rate; DOR: Duration of response; IC-cORR: Intracranial confirmed overall response rate; JCO: Journal of Clinical Oncology; PFS: Progression free survival; sNDA: supplemental New Drug Application. 11 1. Perol et al., Journal of Clinical Oncology, 2024; Median duration of follow-up of 20.7 months for the pooled data set. 2. IBTROZI prescribing information, excluding median PFS; IC-cORR is not broken out by TRUST-I and TRUST-II study in the IBTROZI prescribing information and includes patients who had measurable CNS metastases at baseline as assessed by BICR and had not received radiation therapy to the brain within 2 months prior to study entry; Median duration of follow-up of 40.9 and 20.5 months in TRUST-I and TRUST-II, respectively. 3. Supplemental NDA (sNDA) based on August 2025 data cutoff to be filed by year end 2025.

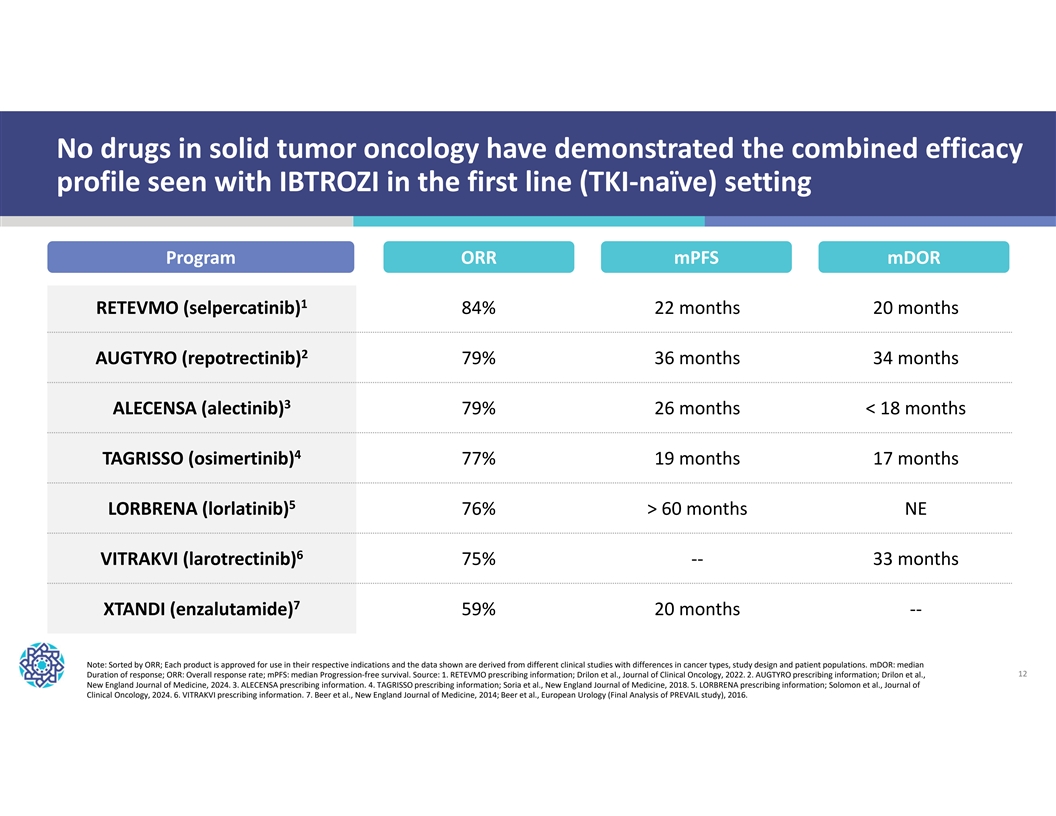

No drugs in solid tumor oncology have demonstrated the combined efficacy profile seen with IBTROZI in the first line (TKI-naïve) setting Program ORR mPFS mDOR 1 RETEVMO (selpercatinib) 84% 22 months 20 months 2 AUGTYRO (repotrectinib) 79% 36 months 34 months 3 ALECENSA (alectinib) 79% 26 months < 18 months 4 TAGRISSO (osimertinib) 77% 19 months 17 months 5 LORBRENA (lorlatinib) 76% > 60 months NE 6 VITRAKVI (larotrectinib) 75% -- 33 months 7 XTANDI (enzalutamide) 59% 20 months -- Note: Sorted by ORR; Each product is approved for use in their respective indications and the data shown are derived from different clinical studies with differences in cancer types, study design and patient populations. mDOR: median Duration of response; ORR: Overall response rate; mPFS: median Progression-free survival. Source: 1. RETEVMO prescribing information; Drilon et al., Journal of Clinical Oncology, 2022. 2. AUGTYRO prescribing information; Drilon et al., 12 New England Journal of Medicine, 2024. 3. ALECENSA prescribing information. 4. TAGRISSO prescribing information; Soria et al., New England Journal of Medicine, 2018. 5. LORBRENA prescribing information; Solomon et al., Journal of Clinical Oncology, 2024. 6. VITRAKVI prescribing information. 7. Beer et al., New England Journal of Medicine, 2014; Beer et al., European Urology (Final Analysis of PREVAIL study), 2016.

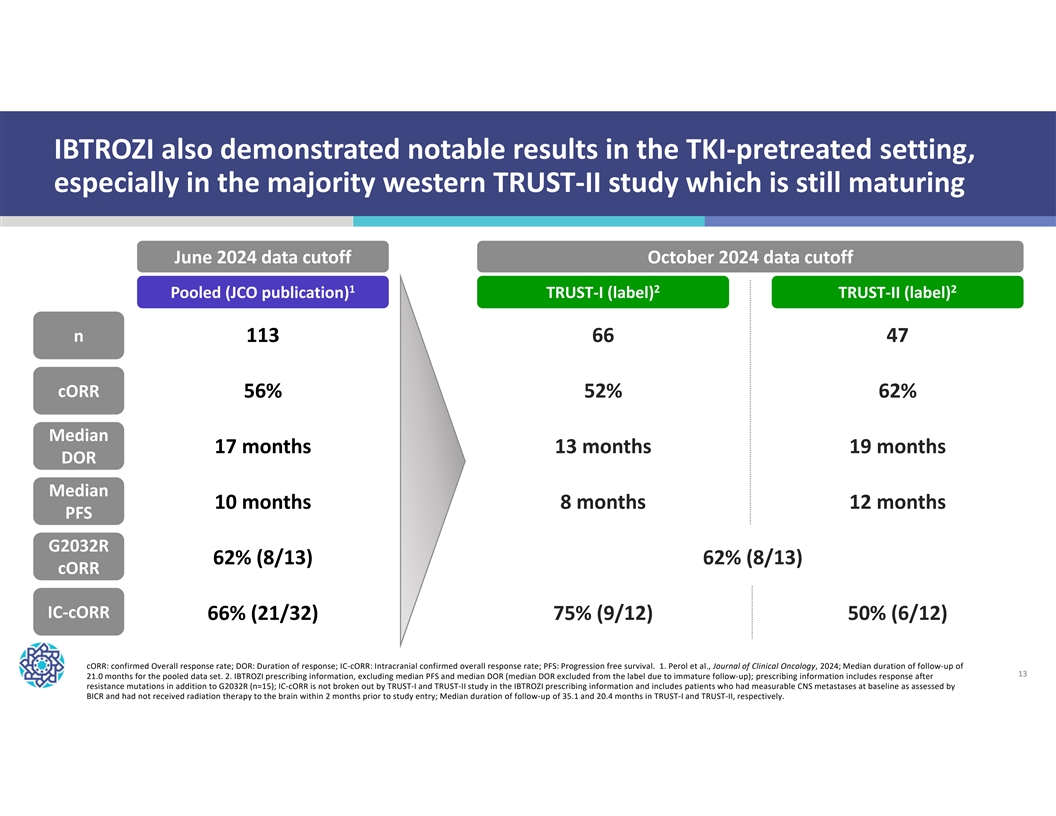

IBTROZI also demonstrated notable results in the TKI-pretreated setting, especially in the majority western TRUST-II study which is still maturing June 2024 data cutoff October 2024 data cutoff 1 2 2 Pooled (JCO publication) TRUST-I (label) TRUST-II (label) n 113 66 47 cORR 56% 52% 62% Median 17 months 13 months 19 months DOR Median 10 months 8 months 12 months PFS G2032R 62% (8/13) 62% (8/13) cORR IC-cORR 66% (21/32) 75% (9/12) 50% (6/12) cORR: confirmed Overall response rate; DOR: Duration of response; IC-cORR: Intracranial confirmed overall response rate; PFS: Progression free survival. 1. Perol et al., Journal of Clinical Oncology, 2024; Median duration of follow-up of 13 21.0 months for the pooled data set. 2. IBTROZI prescribing information, excluding median PFS and median DOR (median DOR excluded from the label due to immature follow-up); prescribing information includes response after resistance mutations in addition to G2032R (n=15); IC-cORR is not broken out by TRUST-I and TRUST-II study in the IBTROZI prescribing information and includes patients who had measurable CNS metastases at baseline as assessed by BICR and had not received radiation therapy to the brain within 2 months prior to study entry; Median duration of follow-up of 35.1 and 20.4 months in TRUST-I and TRUST-II, respectively.

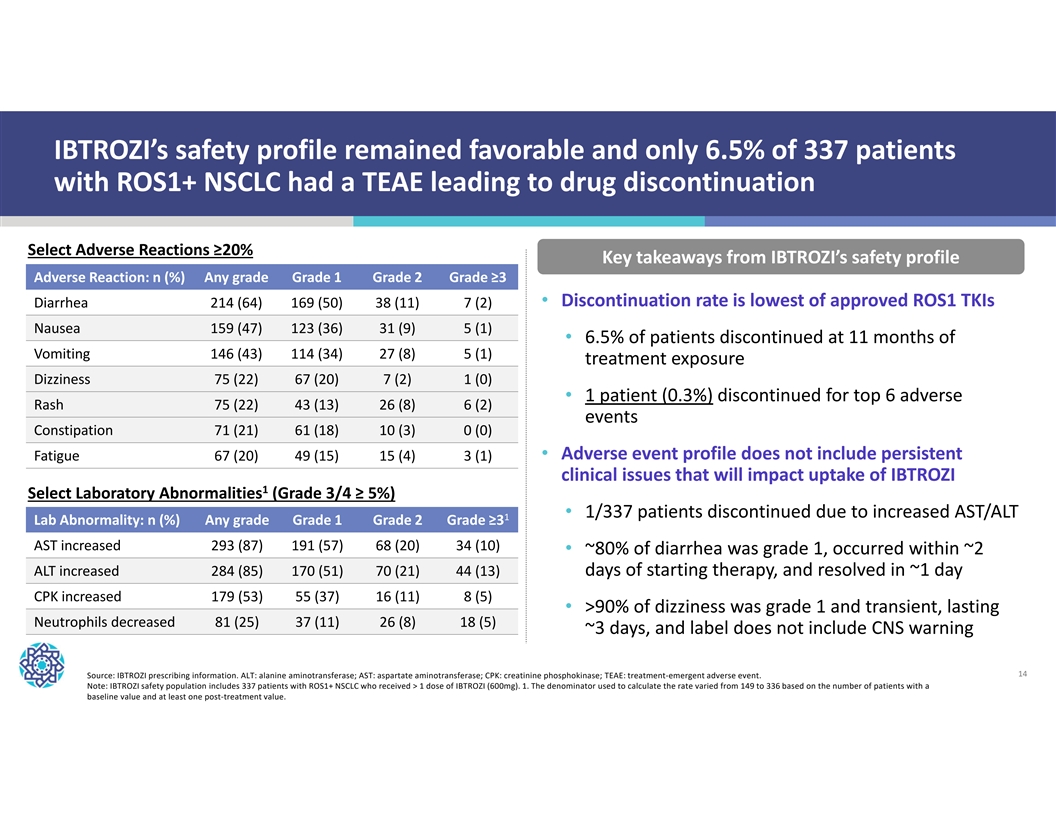

IBTROZI’s safety profile remained favorable and only 6.5% of 337 patients with ROS1+ NSCLC had a TEAE leading to drug discontinuation Select Adverse Reactions ≥20% Key takeaways from IBTROZI’s safety profile Adverse Reaction: n (%) Any grade Grade 1 Grade 2 Grade ≥3 • Discontinuation rate is lowest of approved ROS1 TKIs Diarrhea 214 (64) 169 (50) 38 (11) 7 (2) Nausea 159 (47) 123 (36) 31 (9) 5 (1) • 6.5% of patients discontinued at 11 months of Vomiting 146 (43) 114 (34) 27 (8) 5 (1) treatment exposure Dizziness 75 (22) 67 (20) 7 (2) 1 (0) • 1 patient (0.3%) discontinued for top 6 adverse Rash 75 (22) 43 (13) 26 (8) 6 (2) events Constipation 71 (21) 61 (18) 10 (3) 0 (0) • Adverse event profile does not include persistent Fatigue 67 (20) 49 (15) 15 (4) 3 (1) clinical issues that will impact uptake of IBTROZI 1 Select Laboratory Abnormalities (Grade 3/4 ≥ 5%) • 1/337 patients discontinued due to increased AST/ALT 1 Lab Abnormality: n (%) Any grade Grade 1 Grade 2 Grade ≥3 AST increased 293 (87) 191 (57) 68 (20) 34 (10) • ~80% of diarrhea was grade 1, occurred within ~2 ALT increased 284 (85) 170 (51) 70 (21) 44 (13) days of starting therapy, and resolved in ~1 day CPK increased 179 (53) 55 (37) 16 (11) 8 (5) • >90% of dizziness was grade 1 and transient, lasting Neutrophils decreased 81 (25) 37 (11) 26 (8) 18 (5) ~3 days, and label does not include CNS warning 14 Source: IBTROZI prescribing information. ALT: alanine aminotransferase; AST: aspartate aminotransferase; CPK: creatinine phosphokinase; TEAE: treatment-emergent adverse event. Note: IBTROZI safety population includes 337 patients with ROS1+ NSCLC who received > 1 dose of IBTROZI (600mg). 1. The denominator used to calculate the rate varied from 149 to 336 based on the number of patients with a baseline value and at least one post-treatment value.

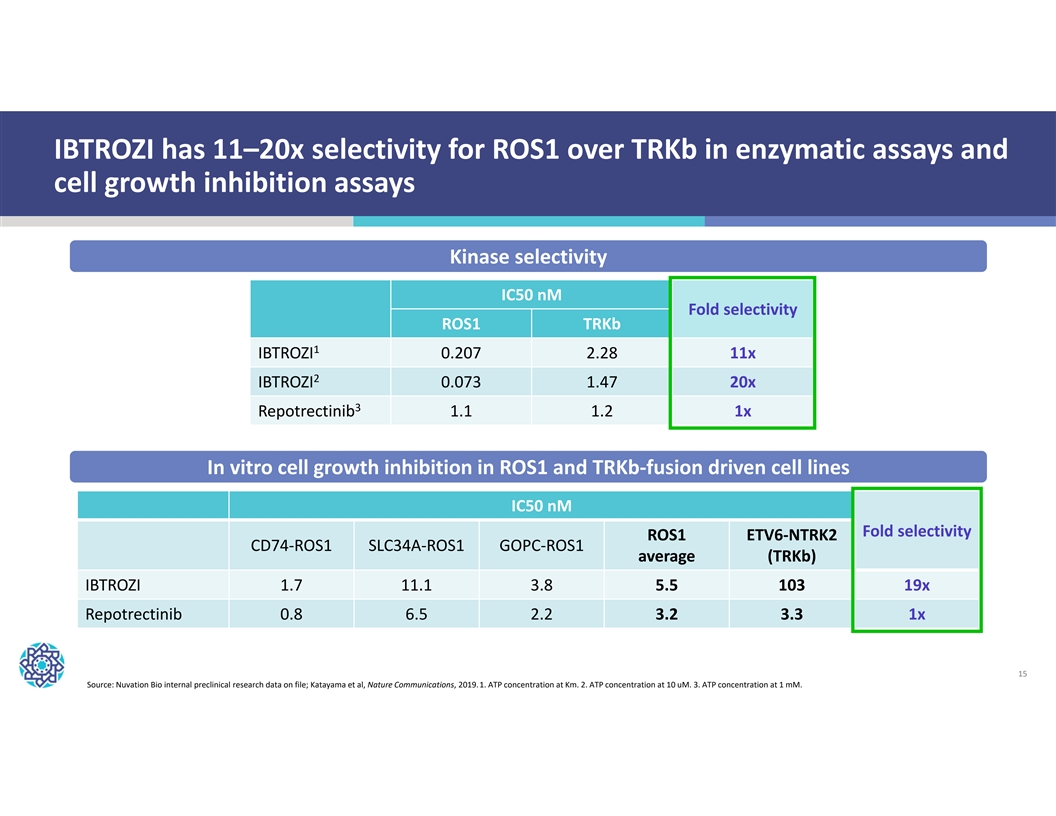

IBTROZI has 11–20x selectivity for ROS1 over TRKb in enzymatic assays and cell growth inhibition assays Kinase selectivity IC50 nM Fold selectivity ROS1 TRKb 1 IBTROZI 0.207 2.28 11x 2 IBTROZI 0.073 1.47 20x 3 Repotrectinib 1.1 1.2 1x In vitro cell growth inhibition in ROS1 and TRKb-fusion driven cell lines IC50 nM Fold selectivity ROS1 ETV6-NTRK2 CD74-ROS1 SLC34A-ROS1 GOPC-ROS1 average (TRKb) IBTROZI 1.7 11.1 3.8 5.5 103 19x Repotrectinib 0.8 6.5 2.2 3.2 3.3 1x 15 Source: Nuvation Bio internal preclinical research data on file; Katayama et al, Nature Communications, 2019. 1. ATP concentration at Km. 2. ATP concentration at 10 uM. 3. ATP concentration at 1 mM.

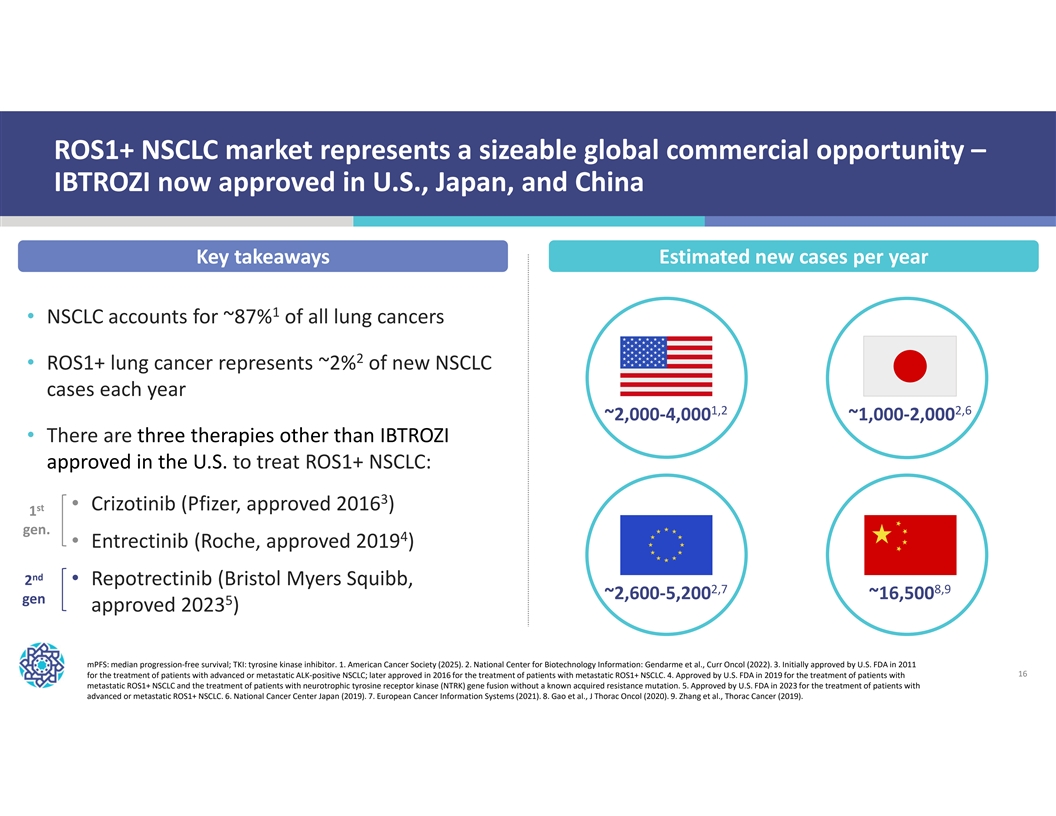

ROS1+ NSCLC market represents a sizeable global commercial opportunity – IBTROZI now approved in U.S., Japan, and China Key takeaways Estimated new cases per year 1 • NSCLC accounts for ~87% of all lung cancers 2 • ROS1+ lung cancer represents ~2% of new NSCLC cases each year 1,2 2,6 ~2,000-4,000 ~1,000-2,000 • There are three therapies other than IBTROZI approved in the U.S. to treat ROS1+ NSCLC: 3 • Crizotinib (Pfizer, approved 2016 ) st 1 gen. 4 • Entrectinib (Roche, approved 2019 ) nd 2 • Repotrectinib (Bristol Myers Squibb, 2,7 8,9 ~2,600-5,200 ~16,500 gen 5 approved 2023 ) mPFS: median progression-free survival; TKI: tyrosine kinase inhibitor. 1. American Cancer Society (2025). 2. National Center for Biotechnology Information: Gendarme et al., Curr Oncol (2022). 3. Initially approved by U.S. FDA in 2011 16 for the treatment of patients with advanced or metastatic ALK-positive NSCLC; later approved in 2016 for the treatment of patients with metastatic ROS1+ NSCLC. 4. Approved by U.S. FDA in 2019 for the treatment of patients with metastatic ROS1+ NSCLC and the treatment of patients with neurotrophic tyrosine receptor kinase (NTRK) gene fusion without a known acquired resistance mutation. 5. Approved by U.S. FDA in 2023 for the treatment of patients with advanced or metastatic ROS1+ NSCLC. 6. National Cancer Center Japan (2019). 7. European Cancer Information Systems (2021). 8. Gao et al., J Thorac Oncol (2020). 9. Zhang et al., Thorac Cancer (2019).

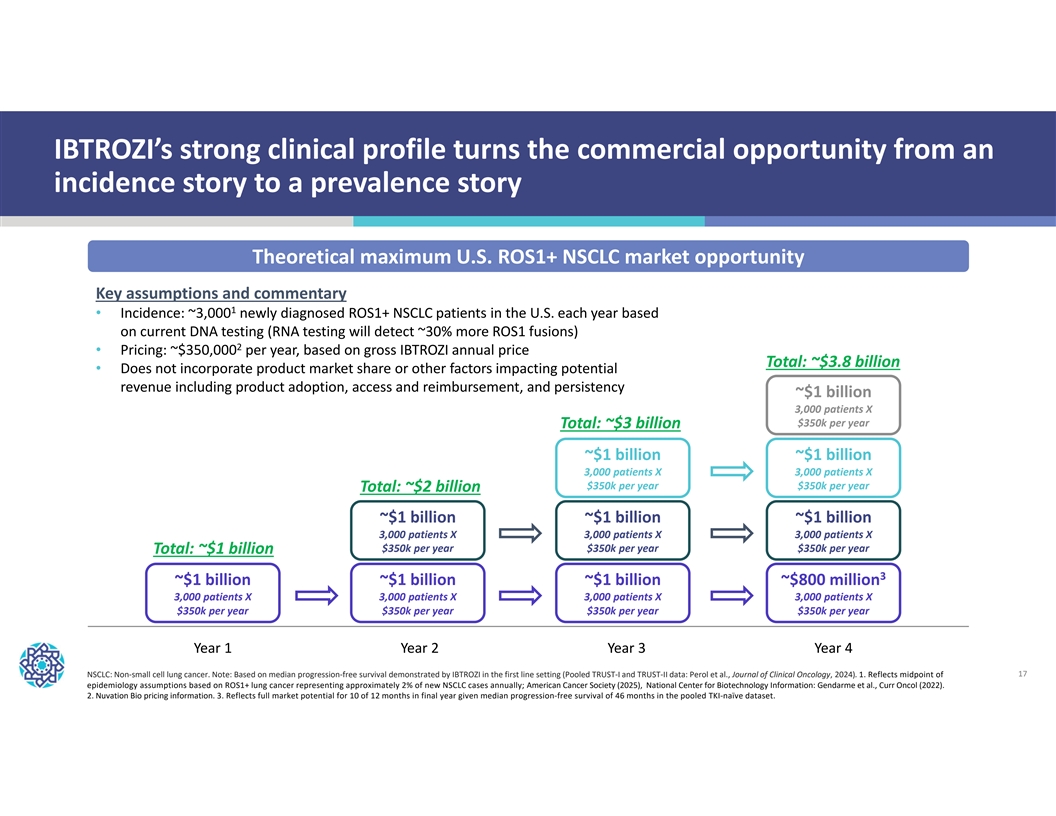

IBTROZI’s strong clinical profile turns the commercial opportunity from an incidence story to a prevalence story Theoretical maximum U.S. ROS1+ NSCLC market opportunity Key assumptions and commentary 1 • Incidence: ~3,000 newly diagnosed ROS1+ NSCLC patients in the U.S. each year based on current DNA testing (RNA testing will detect ~30% more ROS1 fusions) 2 • Pricing: ~$350,000 per year, based on gross IBTROZI annual price Total: ~$3.8 billion • Does not incorporate product market share or other factors impacting potential revenue including product adoption, access and reimbursement, and persistency ~$1 billion 3,000 patients X $350k per year Total: ~$3 billion ~$1 billion ~$1 billion 3,000 patients X 3,000 patients X $350k per year $350k per year Total: ~$2 billion ~$1 billion ~$1 billion ~$1 billion 3,000 patients X 3,000 patients X 3,000 patients X $350k per year $350k per year $350k per year Total: ~$1 billion 3 ~$1 billion ~$1 billion ~$1 billion ~$800 million 3,000 patients X 3,000 patients X 3,000 patients X 3,000 patients X $350k per year $350k per year $350k per year $350k per year Year 1Year 2Year 3Year 4 NSCLC: Non-small cell lung cancer. Note: Based on median progression-free survival demonstrated by IBTROZI in the first line setting (Pooled TRUST-I and TRUST-II data: Perol et al., Journal of Clinical Oncology, 2024). 1. Reflects midpoint of 17 epidemiology assumptions based on ROS1+ lung cancer representing approximately 2% of new NSCLC cases annually; American Cancer Society (2025), National Center for Biotechnology Information: Gendarme et al., Curr Oncol (2022). 2. Nuvation Bio pricing information. 3. Reflects full market potential for 10 of 12 months in final year given median progression-free survival of 46 months in the pooled TKI-naïve dataset.

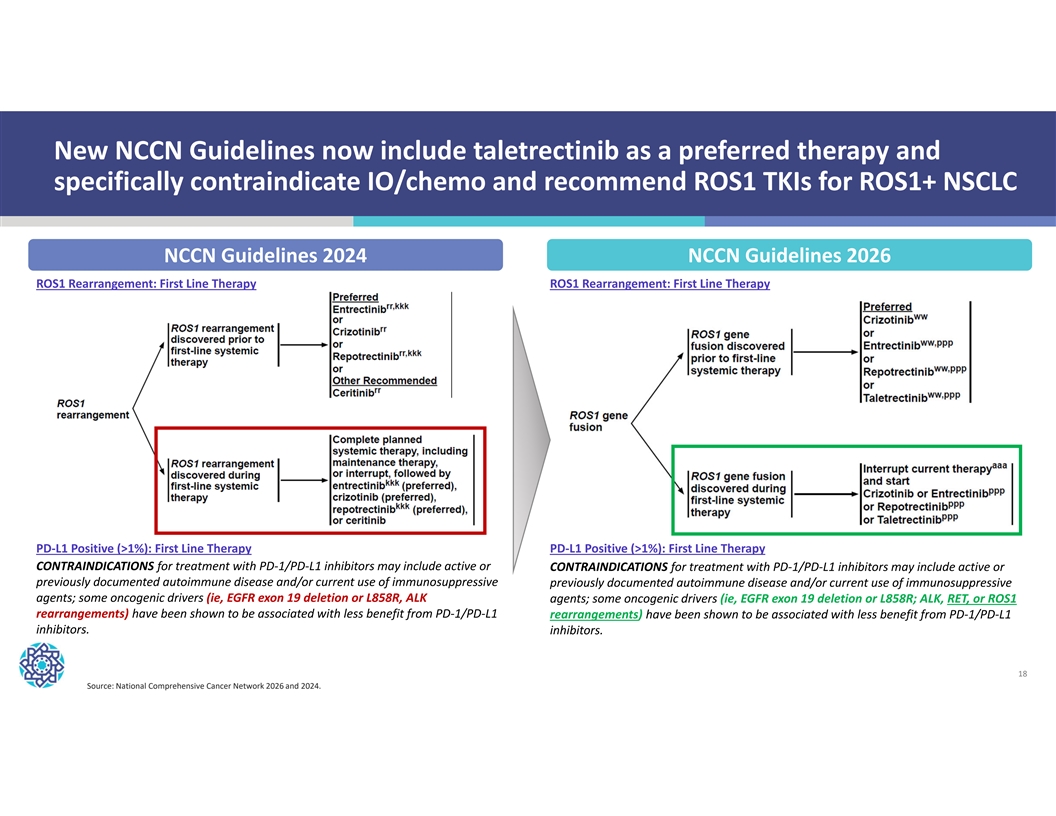

New NCCN Guidelines now include taletrectinib as a preferred therapy and specifically contraindicate IO/chemo and recommend ROS1 TKIs for ROS1+ NSCLC NCCN Guidelines 2024 NCCN Guidelines 2026 ROS1 Rearrangement: First Line Therapy ROS1 Rearrangement: First Line Therapy PD-L1 Positive (>1%): First Line Therapy PD-L1 Positive (>1%): First Line Therapy CONTRAINDICATIONS for treatment with PD-1/PD-L1 inhibitors may include active or CONTRAINDICATIONS for treatment with PD-1/PD-L1 inhibitors may include active or previously documented autoimmune disease and/or current use of immunosuppressive previously documented autoimmune disease and/or current use of immunosuppressive agents; some oncogenic drivers (ie, EGFR exon 19 deletion or L858R, ALK agents; some oncogenic drivers (ie, EGFR exon 19 deletion or L858R; ALK, RET, or ROS1 rearrangements) have been shown to be associated with less benefit from PD-1/PD-L1 rearrangements) have been shown to be associated with less benefit from PD-1/PD-L1 inhibitors. inhibitors. 18 Source: National Comprehensive Cancer Network 2026 and 2024.

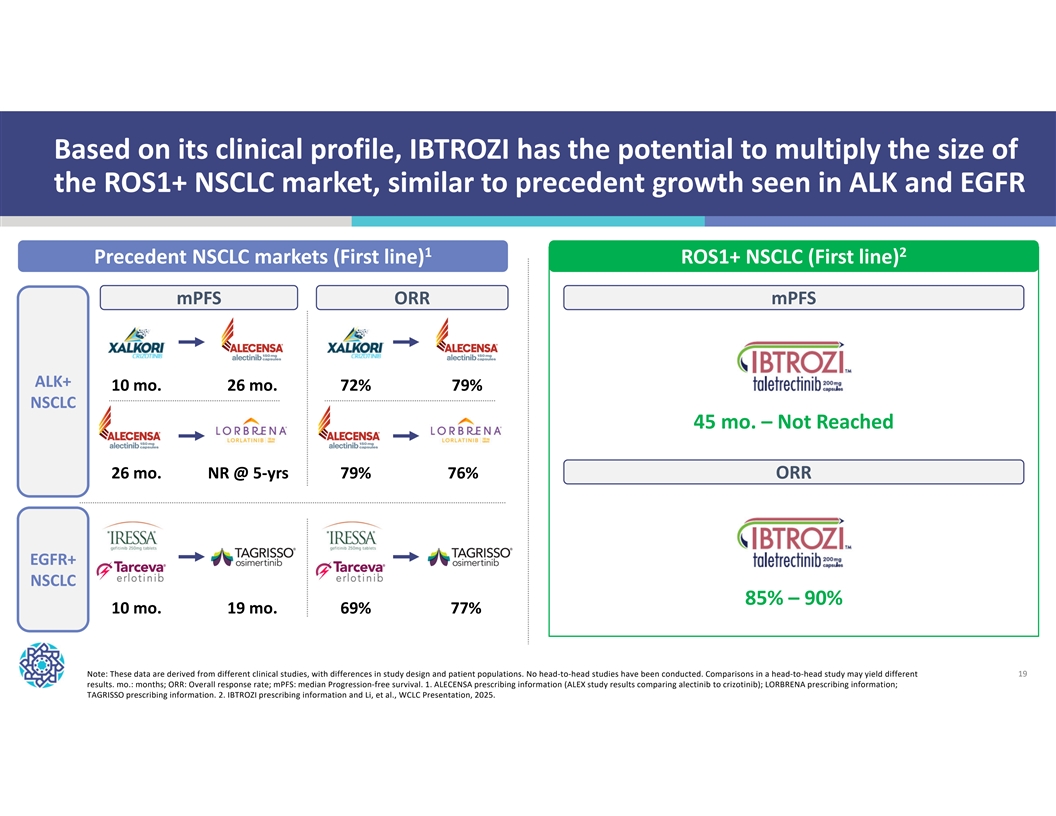

Based on its clinical profile, IBTROZI has the potential to multiply the size of the ROS1+ NSCLC market, similar to precedent growth seen in ALK and EGFR 1 2 Precedent NSCLC markets (First line) ROS1+ NSCLC (First line) mPFS ORR mPFS ALK+ 10 mo. 26 mo. 72% 79% NSCLC 45 mo. – Not Reached 26 mo. NR @ 5-yrs 79% 76% ORR EGFR+ NSCLC 85% – 90% 10 mo. 19 mo. 69% 77% Note: These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been conducted. Comparisons in a head-to-head study may yield different 19 results. mo.: months; ORR: Overall response rate; mPFS: median Progression-free survival. 1. ALECENSA prescribing information (ALEX study results comparing alectinib to crizotinib); LORBRENA prescribing information; TAGRISSO prescribing information. 2. IBTROZI prescribing information and Li, et al., WCLC Presentation, 2025.

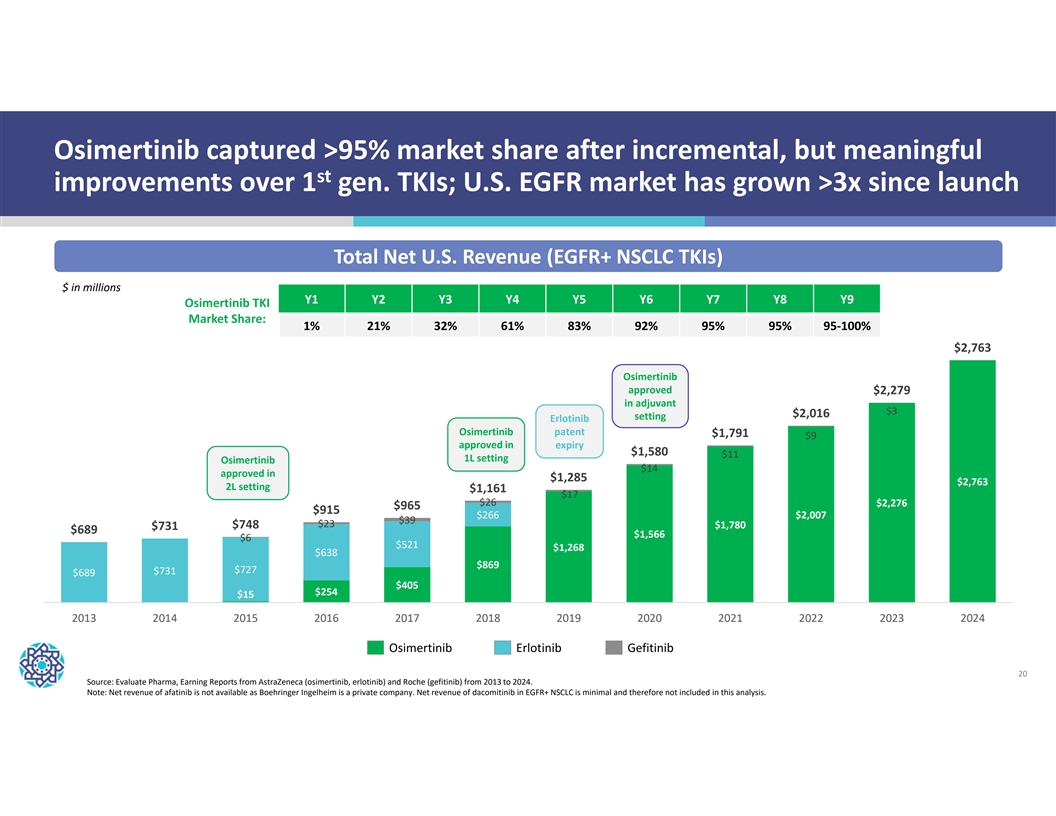

Osimertinib captured >95% market share after incremental, but meaningful st improvements over 1 gen. TKIs; U.S. EGFR market has grown >3x since launch Total Net U.S. Revenue (EGFR+ NSCLC TKIs) $ in millions Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Osimertinib TKI Market Share: 1% 21% 32% 61% 83% 92% 95% 95% 95-100% $2,763 Osimertinib approved $2,279 in adjuvant $3 $2,016 setting Erlotinib Osimertinib patent $1,791 $9 approved in expiry $1,580 $11 1L setting Osimertinib $14 approved in $1,285 $2,763 2L setting $1,161 $17 $26 $2,276 $965 $915 $266 $2,007 $39 $23 $1,780 $748 $731 $689 $1,566 $6 $521 $1,268 $638 $869 $727 $731 $689 $405 $254 $15 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Osimertinib Erlotinib Gefitinib 20 Source: Evaluate Pharma, Earning Reports from AstraZeneca (osimertinib, erlotinib) and Roche (gefitinib) from 2013 to 2024. Note: Net revenue of afatinib is not available as Boehringer Ingelheim is a private company. Net revenue of dacomitinib in EGFR+ NSCLC is minimal and therefore not included in this analysis.

Safusidenib | mIDH1i Entering pivotal study Diffuse in high-grade IDH1- IDH1-mutant glioma mutant glioma 21

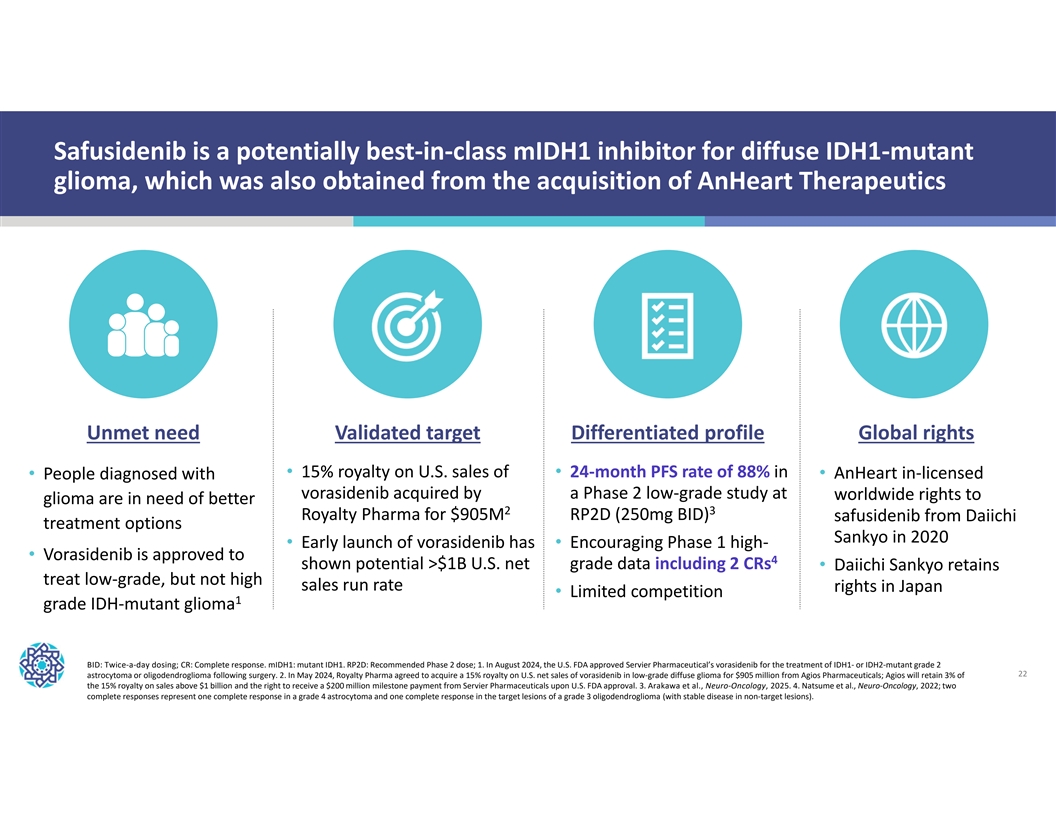

Safusidenib is a potentially best-in-class mIDH1 inhibitor for diffuse IDH1-mutant glioma, which was also obtained from the acquisition of AnHeart Therapeutics Unmet need Validated target Differentiated profile Global rights • 15% royalty on U.S. sales of • 24-month PFS rate of 88% in • AnHeart in-licensed • People diagnosed with vorasidenib acquired by a Phase 2 low-grade study at worldwide rights to glioma are in need of better 2 3 Royalty Pharma for $905M RP2D (250mg BID) safusidenib from Daiichi treatment options Sankyo in 2020 • Early launch of vorasidenib has • Encouraging Phase 1 high- • Vorasidenib is approved to 4 shown potential >$1B U.S. net grade data including 2 CRs • Daiichi Sankyo retains treat low-grade, but not high sales run rate rights in Japan • Limited competition 1 grade IDH-mutant glioma BID: Twice-a-day dosing; CR: Complete response. mIDH1: mutant IDH1. RP2D: Recommended Phase 2 dose; 1. In August 2024, the U.S. FDA approved Servier Pharmaceutical’s vorasidenib for the treatment of IDH1- or IDH2-mutant grade 2 22 astrocytoma or oligodendroglioma following surgery. 2. In May 2024, Royalty Pharma agreed to acquire a 15% royalty on U.S. net sales of vorasidenib in low-grade diffuse glioma for $905 million from Agios Pharmaceuticals; Agios will retain 3% of the 15% royalty on sales above $1 billion and the right to receive a $200 million milestone payment from Servier Pharmaceuticals upon U.S. FDA approval. 3. Arakawa et al., Neuro-Oncology, 2025. 4. Natsume et al., Neuro-Oncology, 2022; two complete responses represent one complete response in a grade 4 astrocytoma and one complete response in the target lesions of a grade 3 oligodendroglioma (with stable disease in non-target lesions).

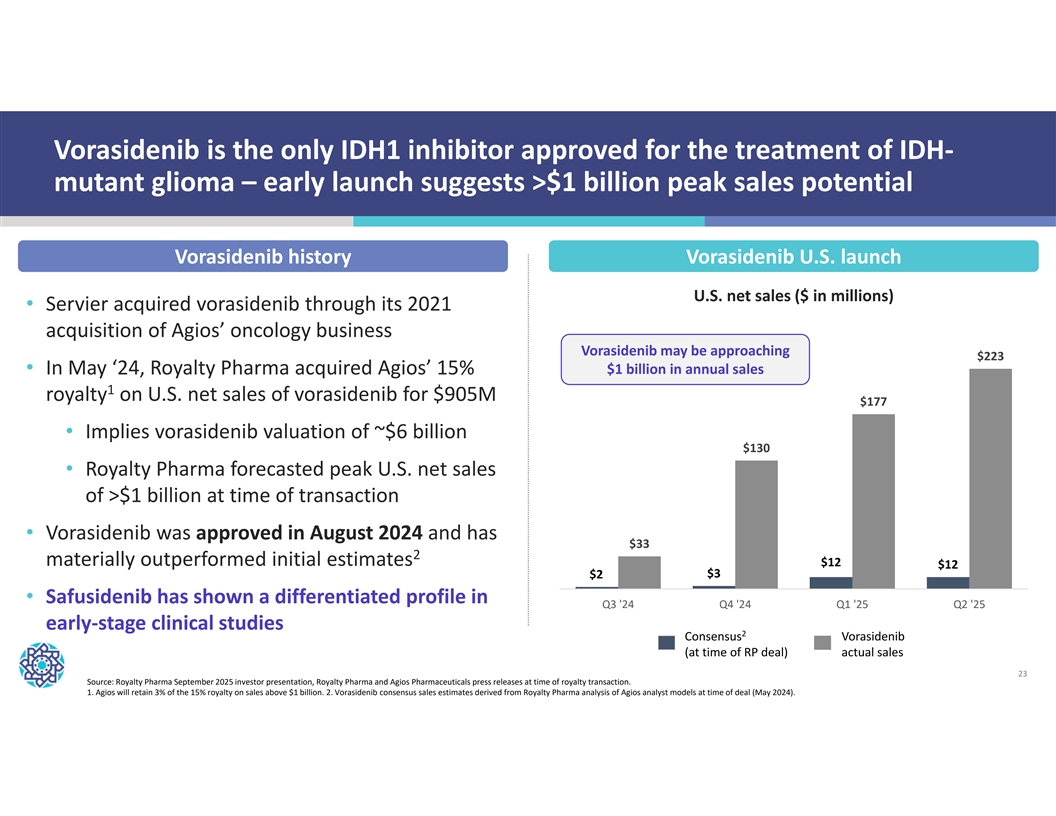

Vorasidenib is the only IDH1 inhibitor approved for the treatment of IDH- mutant glioma – early launch suggests >$1 billion peak sales potential Vorasidenib history Vorasidenib U.S. launch U.S. net sales ($ in millions) • Servier acquired vorasidenib through its 2021 acquisition of Agios’ oncology business Vorasidenib may be approaching $223 • In May ‘24, Royalty Pharma acquired Agios’ 15% $1 billion in annual sales 1 royalty on U.S. net sales of vorasidenib for $905M $177 • Implies vorasidenib valuation of ~$6 billion $130 • Royalty Pharma forecasted peak U.S. net sales of >$1 billion at time of transaction • Vorasidenib was approved in August 2024 and has $33 2 materially outperformed initial estimates $12 $12 $3 $2 • Safusidenib has shown a differentiated profile in Q3 '24 Q4 '24 Q1 '25 Q2 '25 early-stage clinical studies 2 Consensus Vorasidenib (at time of RP deal) actual sales 23 Source: Royalty Pharma September 2025 investor presentation, Royalty Pharma and Agios Pharmaceuticals press releases at time of royalty transaction. 1. Agios will retain 3% of the 15% royalty on sales above $1 billion. 2. Vorasidenib consensus sales estimates derived from Royalty Pharma analysis of Agios analyst models at time of deal (May 2024).

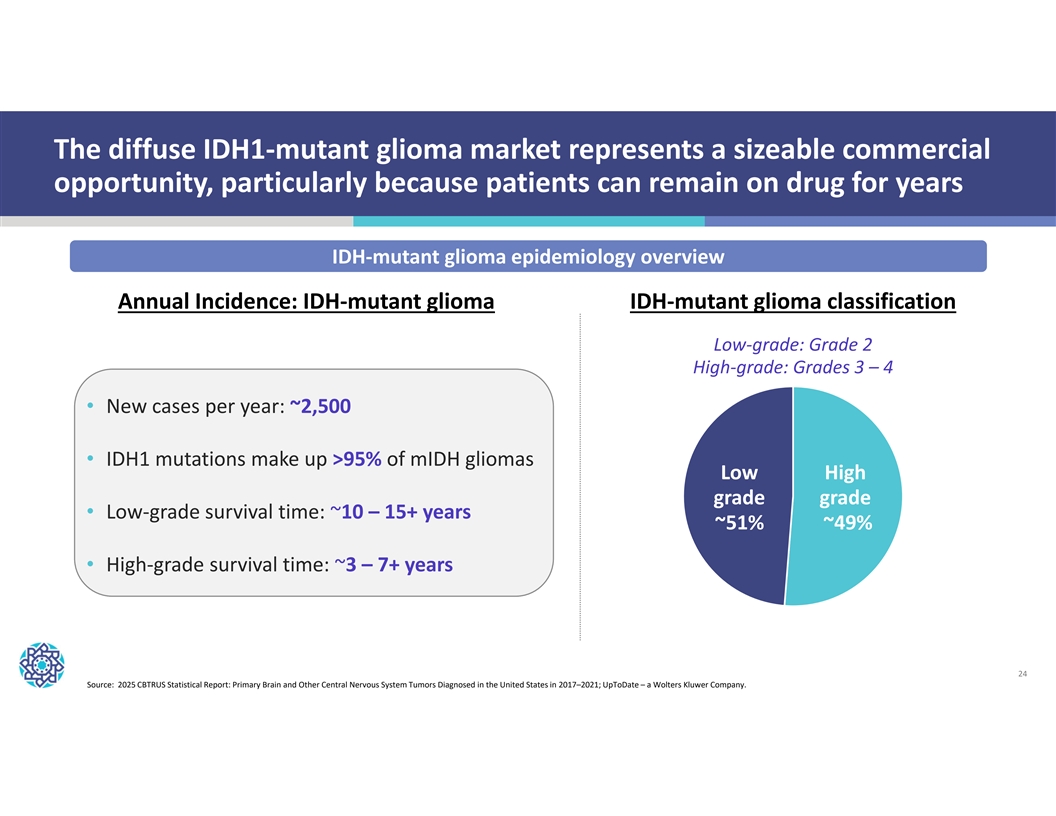

The diffuse IDH1-mutant glioma market represents a sizeable commercial opportunity, particularly because patients can remain on drug for years IDH-mutant glioma epidemiology overview Annual Incidence: IDH-mutant glioma IDH-mutant glioma classification Low-grade: Grade 2 High-grade: Grades 3 – 4 • New cases per year: ~2,500 • IDH1 mutations make up >95% of mIDH gliomas Low High grade grade • Low-grade survival time: ~10 – 15+ years ~51% ~49% • High-grade survival time: ~3 – 7+ years 24 Source: 2025 CBTRUS Statistical Report: Primary Brain and Other Central Nervous System Tumors Diagnosed in the United States in 2017–2021; UpToDate – a Wolters Kluwer Company.

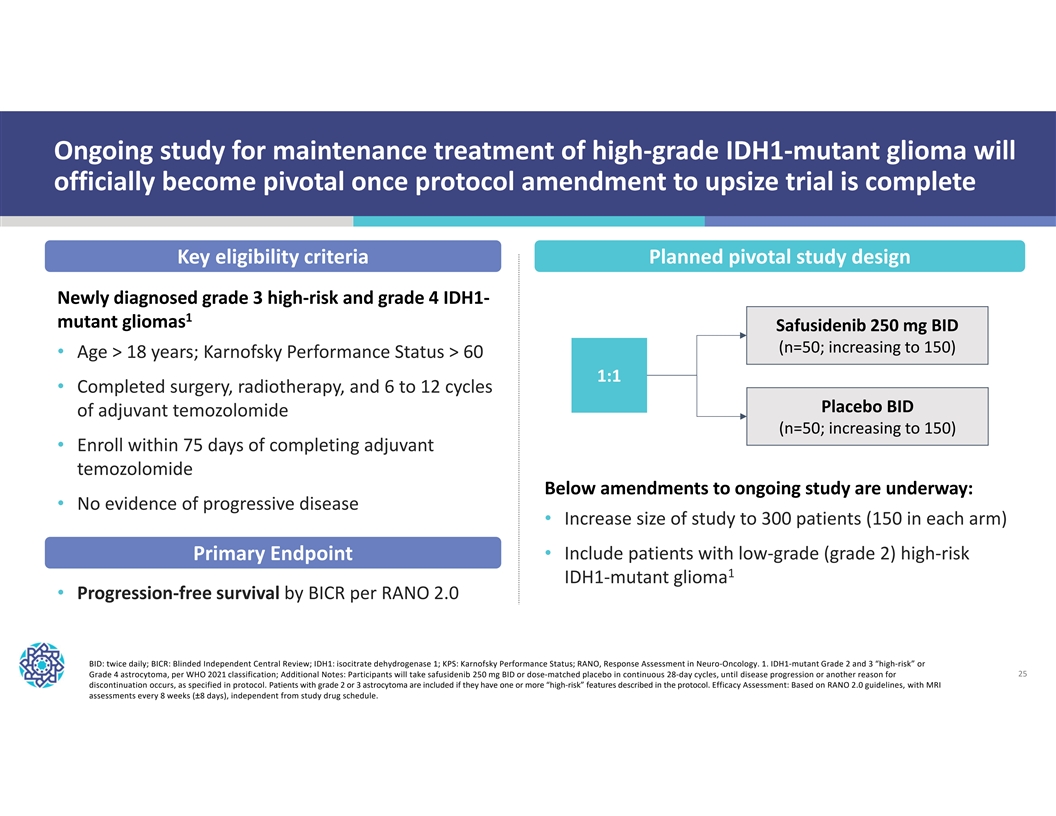

Ongoing study for maintenance treatment of high-grade IDH1-mutant glioma will officially become pivotal once protocol amendment to upsize trial is complete Key eligibility criteria Planned pivotal study design Newly diagnosed grade 3 high-risk and grade 4 IDH1- 1 mutant gliomas Safusidenib 250 mg BID (n=50; increasing to 150) • Age > 18 years; Karnofsky Performance Status > 60 1:1 • Completed surgery, radiotherapy, and 6 to 12 cycles Placebo BID of adjuvant temozolomide (n=50; increasing to 150) • Enroll within 75 days of completing adjuvant temozolomide Below amendments to ongoing study are underway: • No evidence of progressive disease • Increase size of study to 300 patients (150 in each arm) Primary Endpoint • Include patients with low-grade (grade 2) high-risk 1 IDH1-mutant glioma • Progression-free survival by BICR per RANO 2.0 BID: twice daily; BICR: Blinded Independent Central Review; IDH1: isocitrate dehydrogenase 1; KPS: Karnofsky Performance Status; RANO, Response Assessment in Neuro-Oncology. 1. IDH1-mutant Grade 2 and 3 “high-risk” or Grade 4 astrocytoma, per WHO 2021 classification; Additional Notes: Participants will take safusidenib 250 mg BID or dose-matched placebo in continuous 28-day cycles, until disease progression or another reason for 25 discontinuation occurs, as specified in protocol. Patients with grade 2 or 3 astrocytoma are included if they have one or more “high-risk” features described in the protocol. Efficacy Assessment: Based on RANO 2.0 guidelines, with MRI assessments every 8 weeks (±8 days), independent from study drug schedule.

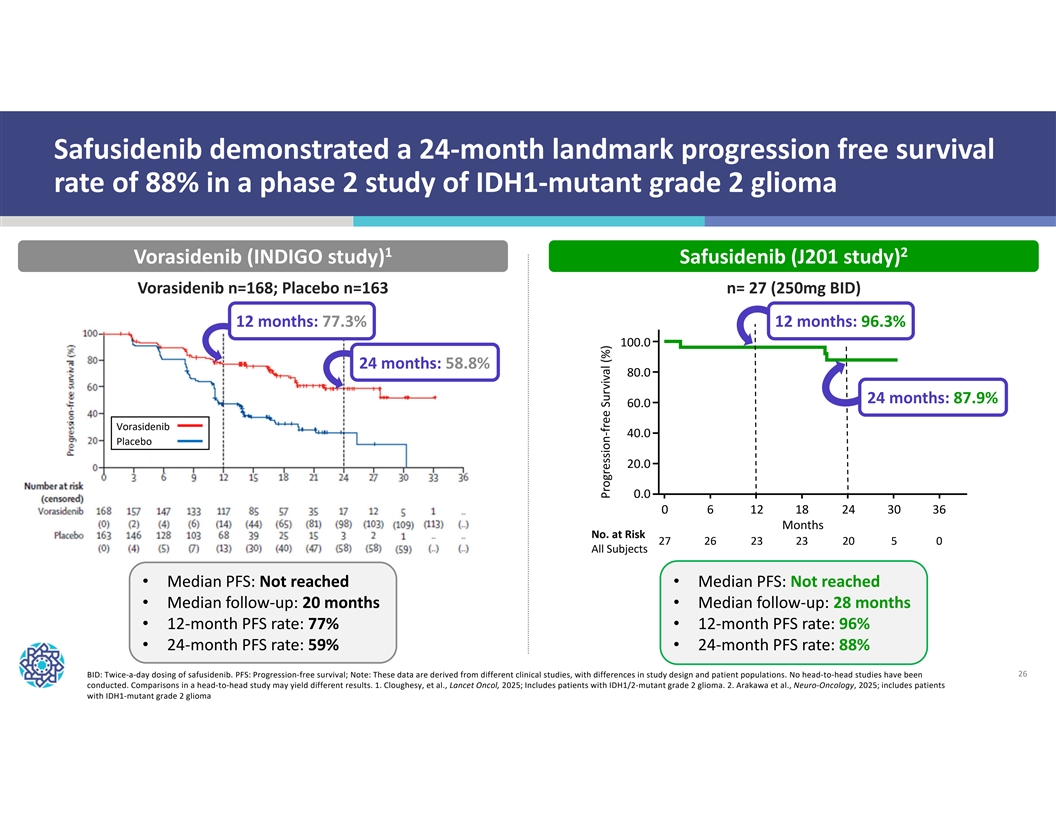

Safusidenib demonstrated a 24-month landmark progression free survival rate of 88% in a phase 2 study of IDH1-mutant grade 2 glioma 1 2 Vorasidenib (INDIGO study) Safusidenib (J201 study) Vorasidenib n=168; Placebo n=163 n= 27 (250mg BID) 12 months: 77.3% 12 months: 96.3% 100.0 24 months: 58.8% 80.0 24 months: 87.9% 60.0 Vorasidenib 40.0 Placebo 20.0 0.0 0 6 1218 24 3036 Months No. at Risk 27 26 23 23 20 5 0 All Subjects • Median PFS: Not reached • Median PFS: Not reached • Median follow-up: 20 months • Median follow-up: 28 months • 12-month PFS rate: 77% • 12-month PFS rate: 96% • 24-month PFS rate: 59% • 24-month PFS rate: 88% BID: Twice-a-day dosing of safusidenib. PFS: Progression-free survival; Note: These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been 26 conducted. Comparisons in a head-to-head study may yield different results. 1. Cloughesy, et al., Lancet Oncol, 2025; Includes patients with IDH1/2-mutant grade 2 glioma. 2. Arakawa et al., Neuro-Oncology, 2025; includes patients with IDH1-mutant grade 2 glioma Progression-free Survival (%)

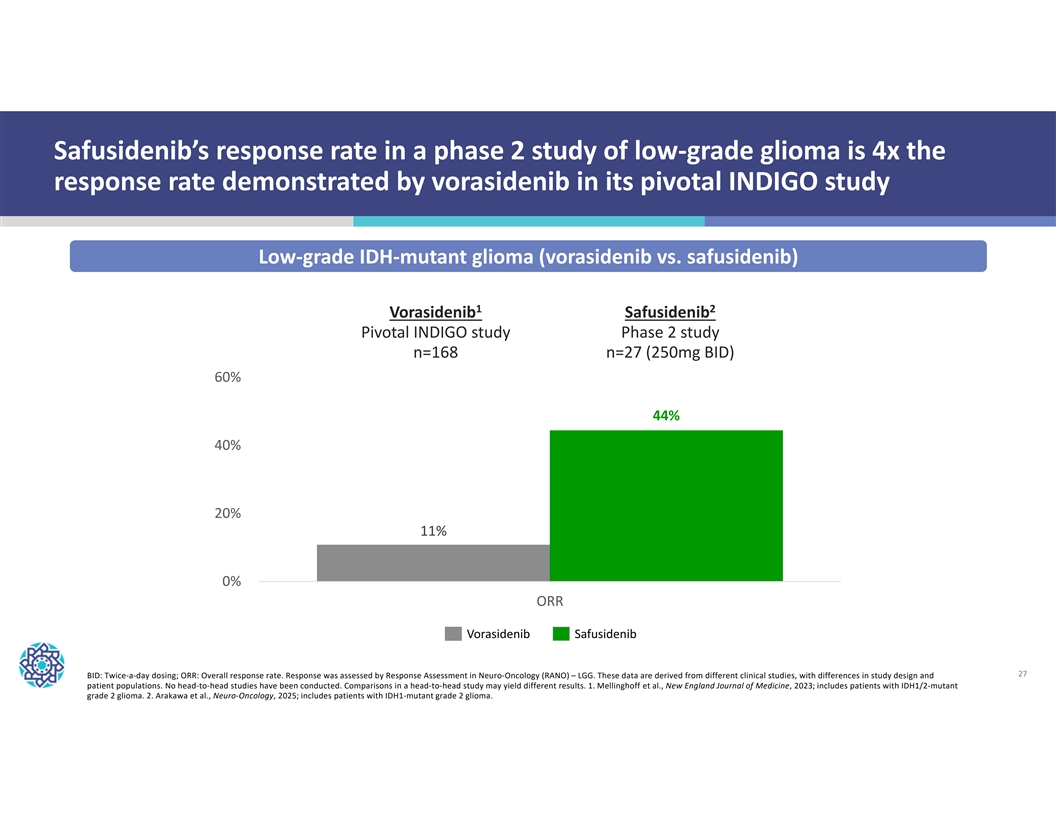

Safusidenib’s response rate in a phase 2 study of low-grade glioma is 4x the response rate demonstrated by vorasidenib in its pivotal INDIGO study Low-grade IDH-mutant glioma (vorasidenib vs. safusidenib) 1 2 Vorasidenib Safusidenib Pivotal INDIGO study Phase 2 study n=168 n=27 (250mg BID) 60% 44% 40% 20% 11% 0% ORR Vorasidenib Safusidenib 27 BID: Twice-a-day dosing; ORR: Overall response rate. Response was assessed by Response Assessment in Neuro-Oncology (RANO) – LGG. These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been conducted. Comparisons in a head-to-head study may yield different results. 1. Mellinghoff et al., New England Journal of Medicine, 2023; includes patients with IDH1/2-mutant grade 2 glioma. 2. Arakawa et al., Neuro-Oncology, 2025; includes patients with IDH1-mutant grade 2 glioma.

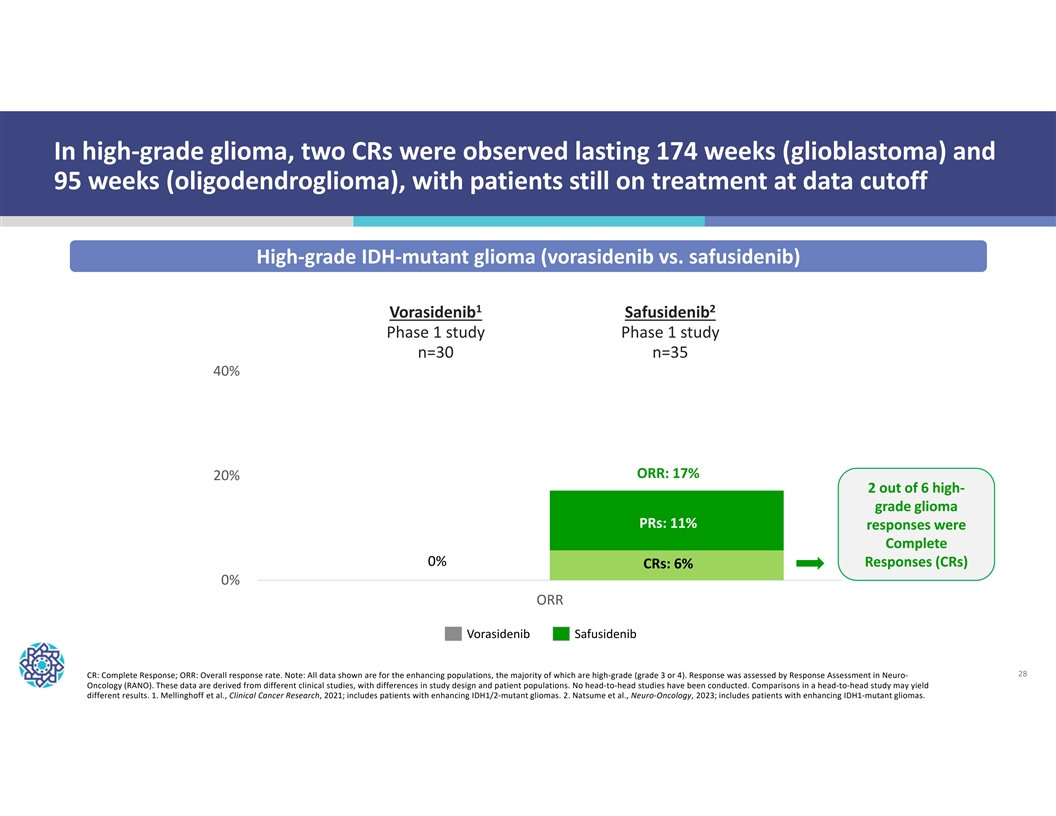

In high-grade glioma, two CRs were observed lasting 174 weeks (glioblastoma) and 95 weeks (oligodendroglioma), with patients still on treatment at data cutoff High-grade IDH-mutant glioma (vorasidenib vs. safusidenib) 1 2 Vorasidenib Safusidenib Phase 1 study Phase 1 study n=30 n=35 40% ORR: 17% 20% 2 out of 6 high- grade glioma PRs: 11% responses were Complete Pivotal study 0% Responses (CRs) CRs: 6% (INDIGO) 0% ORR Vorasidenib Safusidenib 28 CR: Complete Response; ORR: Overall response rate. Note: All data shown are for the enhancing populations, the majority of which are high-grade (grade 3 or 4). Response was assessed by Response Assessment in Neuro- Oncology (RANO). These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been conducted. Comparisons in a head-to-head study may yield different results. 1. Mellinghoff et al., Clinical Cancer Research, 2021; includes patients with enhancing IDH1/2-mutant gliomas. 2. Natsume et al., Neuro-Oncology, 2023; includes patients with enhancing IDH1-mutant gliomas.

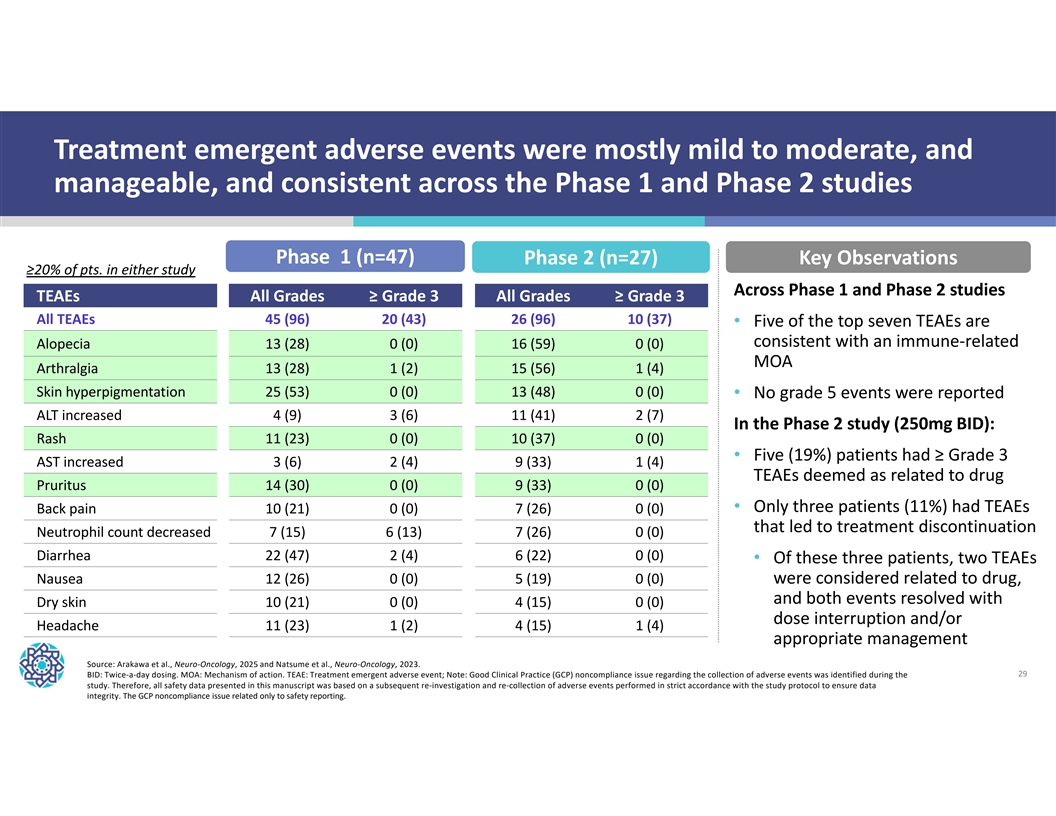

Treatment emergent adverse events were mostly mild to moderate, and manageable, and consistent across the Phase 1 and Phase 2 studies Phase 1 (n=47) Phase 2 (n=27) Key Observations ≥20% of pts. in either study Across Phase 1 and Phase 2 studies TEAEs All Grades≥ Grade 3 All Grades≥ Grade 3 All TEAEs 45 (96) 20 (43) 26 (96) 10 (37) • Five of the top seven TEAEs are consistent with an immune-related Alopecia 13 (28) 0 (0) 16 (59) 0 (0) MOA Arthralgia 13 (28) 1 (2) 15 (56) 1 (4) Skin hyperpigmentation 25 (53) 0 (0) 13 (48) 0 (0) • No grade 5 events were reported ALT increased 4 (9) 3 (6) 11 (41) 2 (7) In the Phase 2 study (250mg BID): Rash 11 (23) 0 (0) 10 (37) 0 (0) • Five (19%) patients had ≥ Grade 3 AST increased 3 (6) 2 (4) 9 (33) 1 (4) TEAEs deemed as related to drug Pruritus 14 (30) 0 (0) 9 (33) 0 (0) • Only three patients (11%) had TEAEs Back pain 10 (21) 0 (0) 7 (26) 0 (0) that led to treatment discontinuation Neutrophil count decreased 7 (15) 6 (13) 7 (26) 0 (0) Diarrhea 22 (47) 2 (4) 6 (22) 0 (0) • Of these three patients, two TEAEs Nausea 12 (26) 0 (0) 5 (19) 0 (0) were considered related to drug, and both events resolved with Dry skin 10 (21) 0 (0) 4 (15) 0 (0) dose interruption and/or Headache 11 (23) 1 (2) 4 (15) 1 (4) appropriate management Source: Arakawa et al., Neuro-Oncology, 2025 and Natsume et al., Neuro-Oncology, 2023. BID: Twice-a-day dosing. MOA: Mechanism of action. TEAE: Treatment emergent adverse event; Note: Good Clinical Practice (GCP) noncompliance issue regarding the collection of adverse events was identified during the 29 study. Therefore, all safety data presented in this manuscript was based on a subsequent re-investigation and re-collection of adverse events performed in strict accordance with the study protocol to ensure data integrity. The GCP noncompliance issue related only to safety reporting.

NUV-1511 | DDC Advanced solid Phase 1/2 study ongoing tumors 30

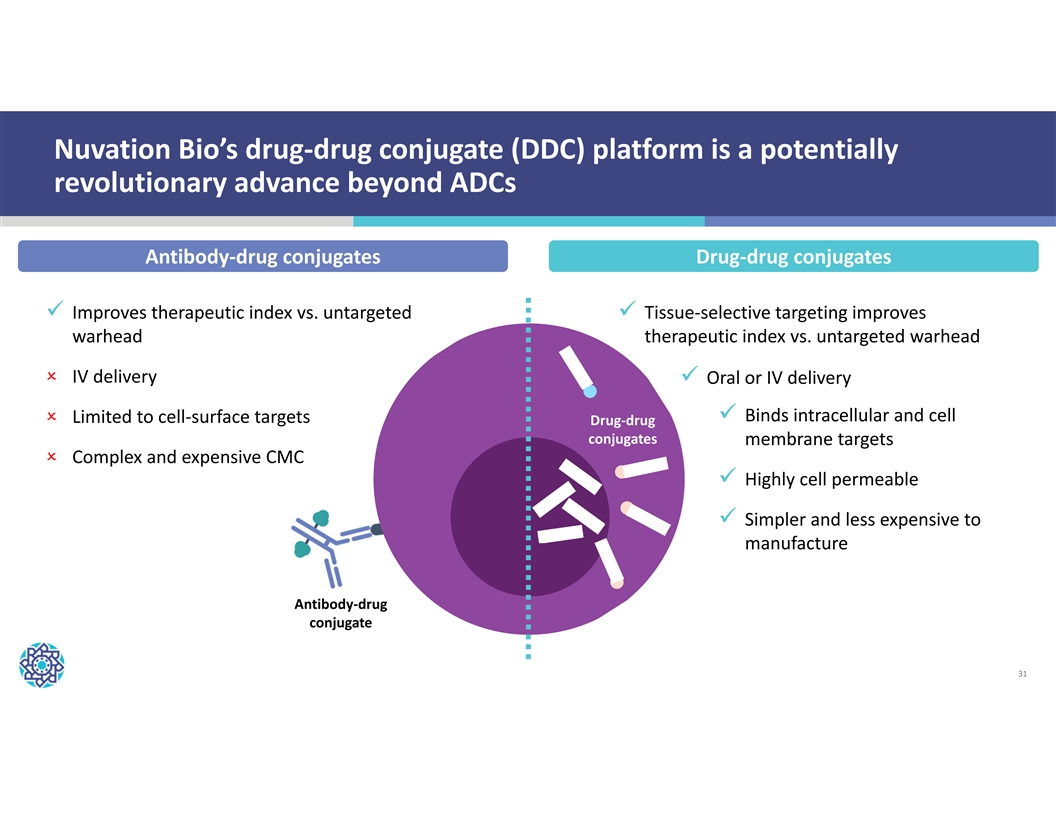

Nuvation Bio’s drug-drug conjugate (DDC) platform is a potentially revolutionary advance beyond ADCs Antibody-drug conjugates Drug-drug conjugates ü Improves therapeutic index vs. untargeted ü Tissue-selective targeting improves warhead therapeutic index vs. untargeted warhead O IV delivery ü Oral or IV delivery ü Binds intracellular and cell O Limited to cell-surface targets Drug-drug conjugates membrane targets O Complex and expensive CMC ü Highly cell permeable ü Simpler and less expensive to manufacture Antibody-drug conjugate 31

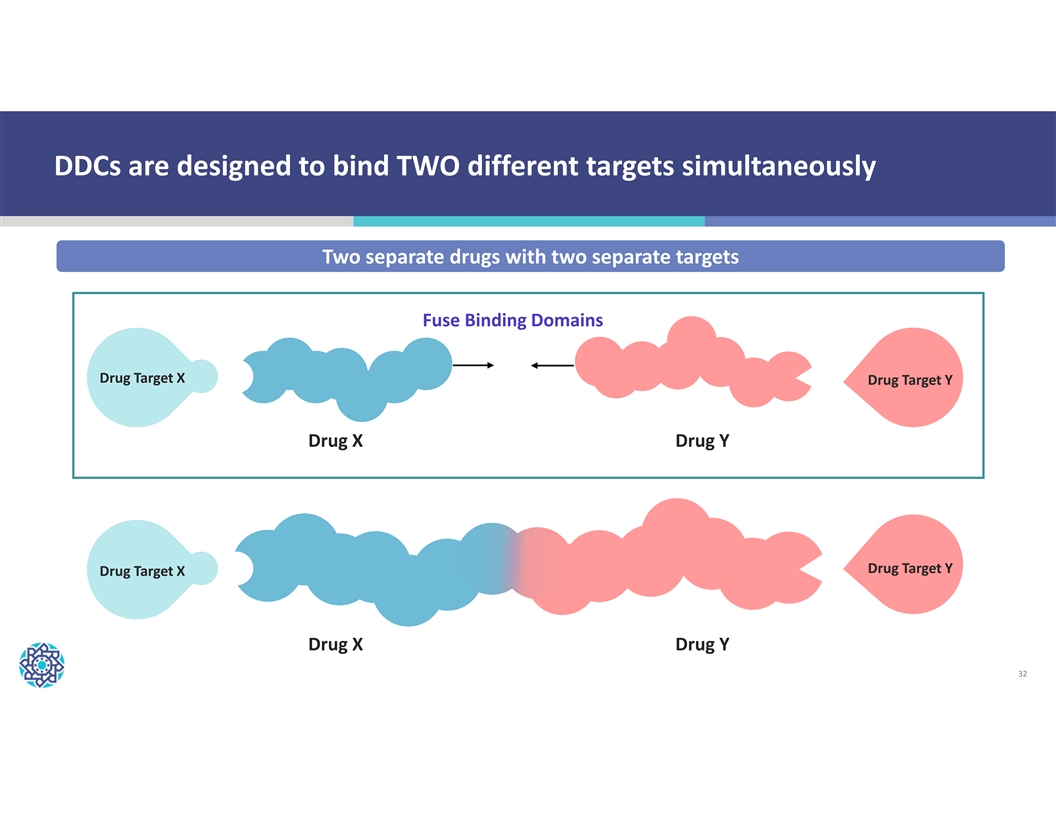

DDCs are designed to bind TWO different targets simultaneously Two separate drugs with two separate targets Fuse Binding Domains Drug Target X Drug Target Y Drug X Drug Y Drug Target Y Drug Target X Drug X Drug Y 32

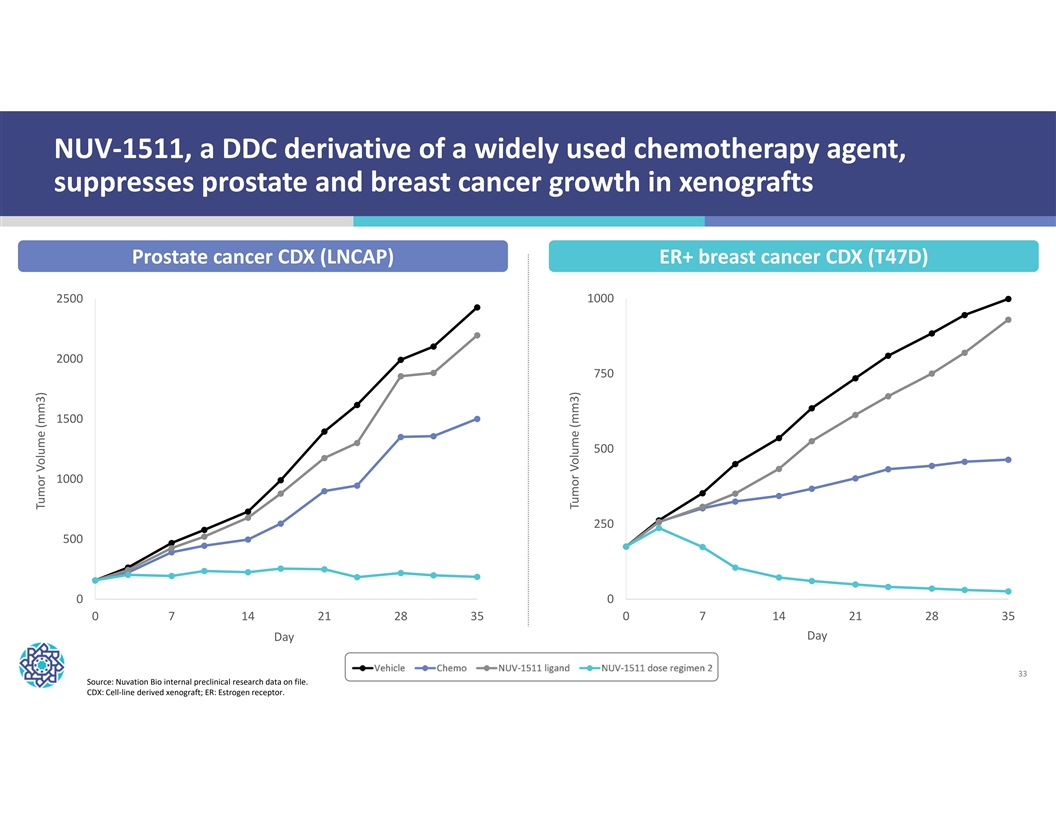

NUV-1511, a DDC derivative of a widely used chemotherapy agent, suppresses prostate and breast cancer growth in xenografts Prostate cancer CDX (LNCAP) ER+ breast cancer CDX (T47D) 2500 1000 2000 750 1500 500 1000 250 500 0 0 0 7 14 21 28 35 0 7 14 21 28 35 Day Day 33 Source: Nuvation Bio internal preclinical research data on file. CDX: Cell-line derived xenograft; ER: Estrogen receptor. Tumor Volume (mm3) Tumor Volume (mm3)

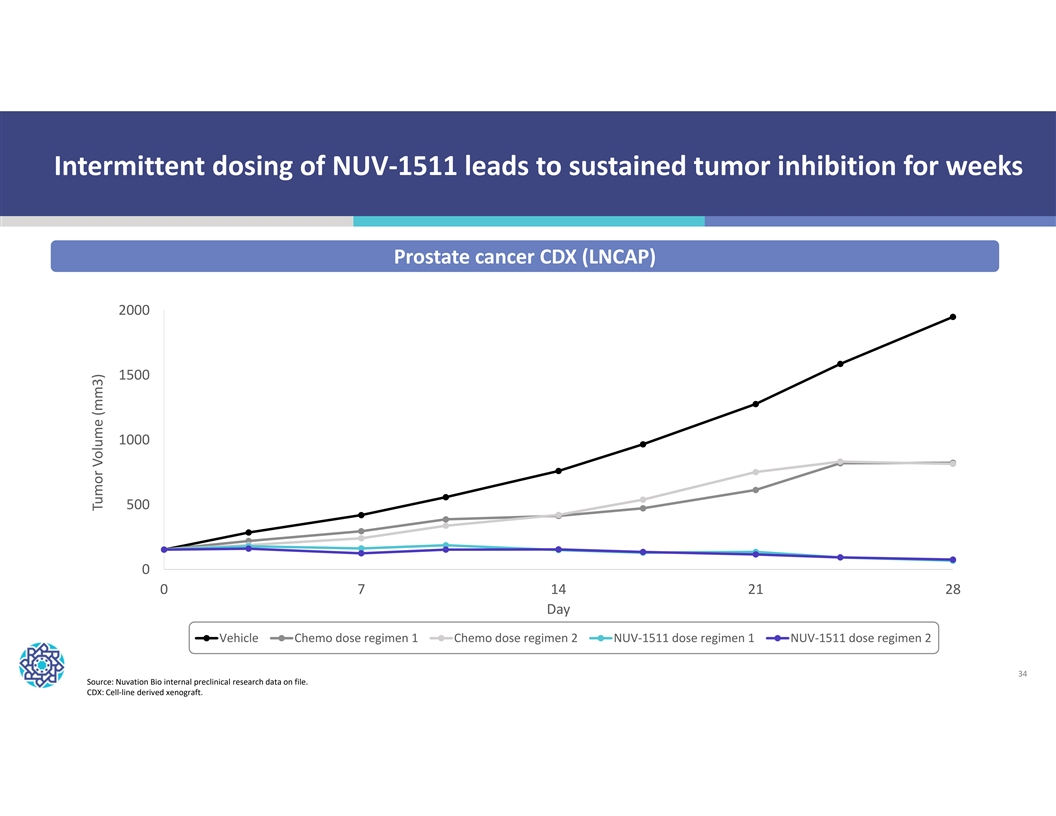

Intermittent dosing of NUV-1511 leads to sustained tumor inhibition for weeks Prostate cancer CDX (LNCAP) 2000 1500 1000 500 0 0 7 14 21 28 Day Vehicle Chemo dose regimen 1 Chemo dose regimen 2 NUV-1511 dose regimen 1 NUV-1511 dose regimen 2 34 Source: Nuvation Bio internal preclinical research data on file. CDX: Cell-line derived xenograft. Tumor Volume (mm3)

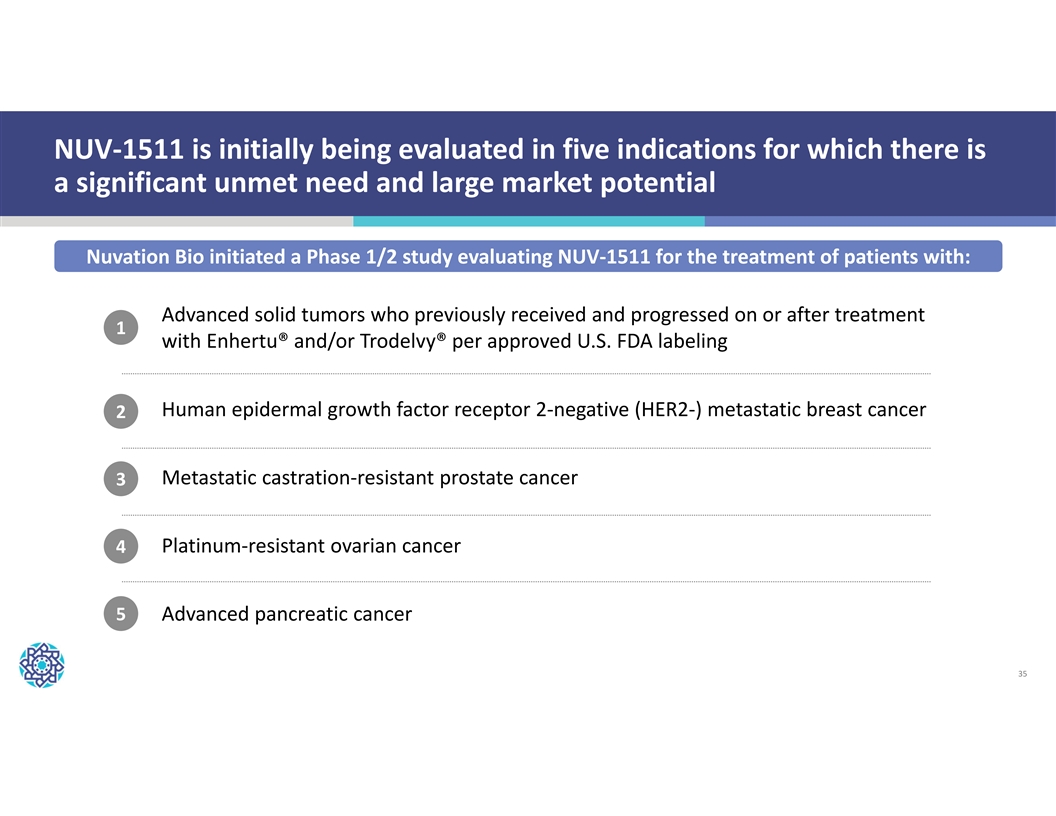

NUV-1511 is initially being evaluated in five indications for which there is a significant unmet need and large market potential Nuvation Bio initiated a Phase 1/2 study evaluating NUV-1511 for the treatment of patients with: Advanced solid tumors who previously received and progressed on or after treatment 1 with Enhertu® and/or Trodelvy® per approved U.S. FDA labeling Human epidermal growth factor receptor 2-negative (HER2-) metastatic breast cancer 2 Metastatic castration-resistant prostate cancer 3 4 Platinum-resistant ovarian cancer 5 Advanced pancreatic cancer 35

NUV-868 | BETi Advanced solid Completed Phase 1 and Phase 1b studies tumors Currently evaluating Future indications next steps for program 36

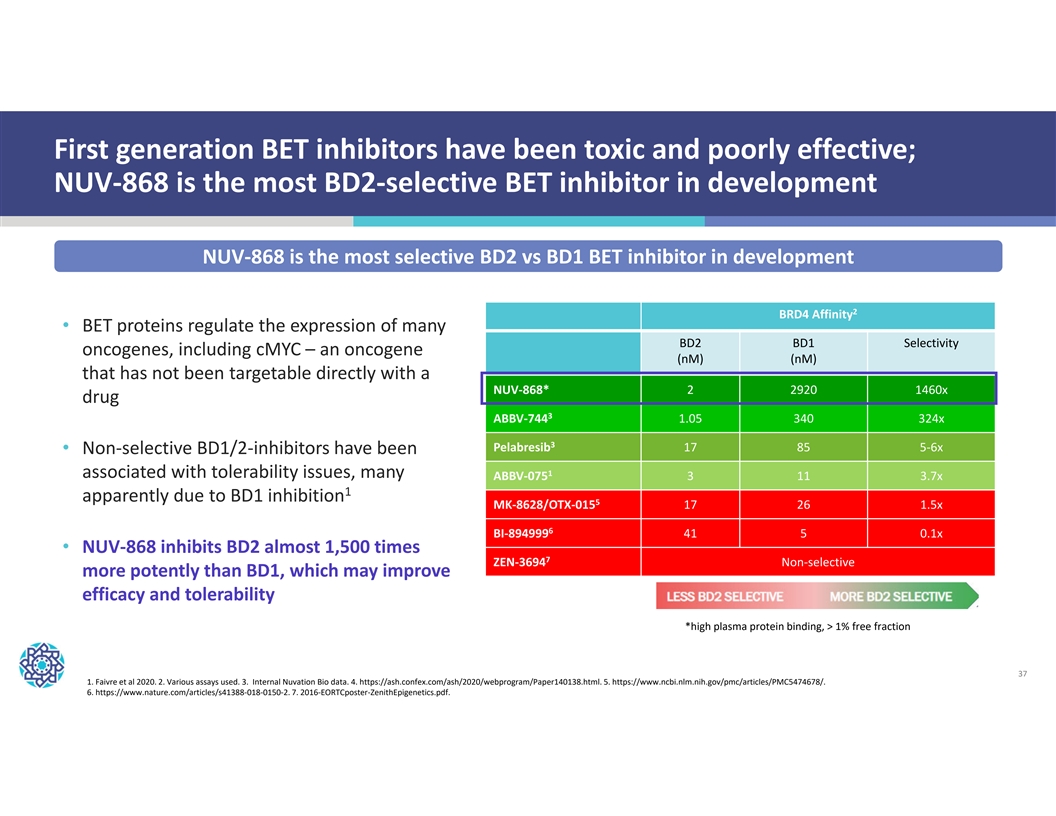

First generation BET inhibitors have been toxic and poorly effective; NUV-868 is the most BD2-selective BET inhibitor in development NUV-868 is the most selective BD2 vs BD1 BET inhibitor in development 2 BRD4 Affinity • BET proteins regulate the expression of many BD2 BD1 Selectivity oncogenes, including cMYC – an oncogene (nM) (nM) that has not been targetable directly with a NUV-868* 2 2920 1460x drug 3 ABBV-744 1.05 340 324x 3 Pelabresib 17 85 5-6x • Non-selective BD1/2-inhibitors have been 1 associated with tolerability issues, many ABBV-075 3 11 3.7x 1 apparently due to BD1 inhibition 5 MK-8628/OTX-015 17 26 1.5x 6 BI-894999 41 5 0.1x • NUV-868 inhibits BD2 almost 1,500 times 7 ZEN-3694 Non-selective more potently than BD1, which may improve efficacy and tolerability *high plasma protein binding, > 1% free fraction 37 1. Faivre et al 2020. 2. Various assays used. 3. Internal Nuvation Bio data. 4. https://ash.confex.com/ash/2020/webprogram/Paper140138.html. 5. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5474678/. 6. https://www.nature.com/articles/s41388-018-0150-2. 7. 2016-EORTCposter-ZenithEpigenetics.pdf.

Nuvation Bio is focused on tackling the greatest challenges in cancer treatment Experienced biotech leadership team IBTROZI approved in the U.S., Japan, and China for advanced ROS1+ NSCLC (line agnostic) • Founded by Dr. David Hung, the founder • Approved by the U.S. FDA on June 11, 2025 and CEO of Medivation, who successfully developed and commercialized XTANDI® • 204 new patient starts in Q3 2025 • Management team has broad expertise • Approved by Japan’s MHLW in September 2025 from development through • Approved by China’s NMPA in January 2025 commercialization Strong pro forma cash position provides Broad clinical-stage pipeline led by safusidenib path to potential profitability • Safusidenib | mIDH1 inhibitor: 2 Entering high-grade pivotal study supported by • $549 million as of September 30, 2025 Phase 2 and Phase 1 results • Cash balance includes $200 million from 1 • NUV-1511 | Drug-drug conjugate: Sagard financings , with an option for Update on Phase 1/2 study by year end additional $50 million under a term loan • NUV-868 | BD2-selective BET inhibitor: • No need to raise additional capital to fund Completed Phase 1 and Phase 1b studies IBTROZI launch or pipeline programs 38 1. Includes $150 million of royalty interest financing and $50 million under a term loan funded after U.S. FDA approval of IBTROZI. An additional $50 million under the term loan is available until June 30, 2026. 2. Protocol amendment to upsize to a pivotal trial and include patients with grade 2 high-risk IDH1-mutant glioma are forthcoming.

$250 million non-dilutive financing with Sagard validates IBTROZI’s commercial potential and provides Nuvation Bio with path to profitability $150 million royalty financing $100 million senior term loan • Tiered, declining mid-single-digit royalty on annual • $50M was funded upon U.S. FDA approval of IBTROZI U.S. net sales of IBTROZI: 1 • $50M available at Company’s option for 12 months • $0 – $600M: 5.5% • Interest-only to 5-year maturity at SOFR + 6.00% • $600M – $1B: 3.0% • Single financial covenant: $25M of minimum liquidity • Nuvation retains all annual U.S. net sales above $1B (0% royalty) and after 1.6x – 2.0x return cap is met Opportunistic transaction solidifies financial position without need to raise additional capital Royalty financing Pro forma cash Improves flexibility Extracts value from 2 funds U.S. launch funds clinical- for strategic capital ~$260M acquisition üüüü of IBTROZI stage pipeline deployment of AnHeart Source: Nuvation Bio press release and financing agreements. 39 1. $50 million in debt is available at the company’s option for 12 months following first commercial sale. 2. Based on closing price of $2.31 per Nuvation Bio share prior to announcement on March 25, 2024. Nuvation Bio acquired AnHeart Therapeutics for ~113 million shares of common stock.