DRIVEN BY SCIENCE FOCUSED ON LIFE January 2026 .3

Forward-looking statements Certain statements included in this presentation (this “Presentation”) that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are sometimes accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding IBTROZI’s and safusidenib’s best-in-class therapeutic potential, our expectations for a MAA filing for IBTROZI in Europe and the timing thereof, and the receipt and timing of a regulatory and commercial milestone payment under our license and collaboration agreement with Eisai, IBTROZI’s commercial potential including its theoretical maximum ROS1+ NSCLC market opportunity based on IBTROZI’s median progression-free survival, our expectations that updated median duration of response results from taletrectinib TRUST-I and TRUST-II studies can support a supplemental NDA for IBTROZI, our plans for safusidenib G203 patient enrollment, our expectations that the G203 study may support approval of safusidenib for the maintenance treatment of high-grade IDH1-mutant glioma, our plans to share new data and updates from our clinical programs including for taletrectinib and safusidenib, the potential of the DDC platform, our expectations regarding regulatory and reimbursement developments, and strength of pro forma cash position providing a path to profitability without need to raise additional capital. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the management team of Nuvation Bio and are not predictions of actual performance. These forward-looking statements are subject to a number of risks and uncertainties that may cause actual results to differ from those anticipated by the forward-looking statements, including but not limited to the challenges associated with conducting drug discovery and commercialization and initiating or conducting clinical studies due to, among other things, difficulties or delays in the regulatory process, enrolling subjects or manufacturing or acquiring necessary products; the emergence or worsening of adverse events or other undesirable side effects; risks associated with preliminary and interim data, which may not be representative of more mature data; physician and patient behavior; and competitive developments. Risks and uncertainties facing Nuvation Bio are described more fully in its Form 10-Q filed with the SEC on November 3, 2025 under the heading “Risk Factors,” and other documents that Nuvation Bio has filed or will file with the SEC. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this Presentation. Nuvation Bio disclaims any obligation or undertaking to update, supplement or revise any forward-looking statements contained in this Presentation.

Nuvation Bio is focused on tackling the greatest challenges in cancer treatment IBTROZI® (taletrectinib) is a next generation, potentially best-in-class ROS1 inhibitor approved for advanced ROS1+ NSCLC in the U.S., Japan, and China Global, commercial-stage oncology company focused on innovating and developing first- or best-in-class medicines for diseases that represent particularly large unmet patient needs Safusidenib is a potentially best-in-class, brain penetrant, mIDH1 inhibitor being evaluated in a pivotal study for high-grade and high-risk IDH1-mutant glioma1 Robust pro forma cash balance of approximately $589 million2 is expected to provide path to profitability without need for additional funding 1. Includes patients grade 4 astrocytoma and patients with grade 2 or 3 astrocytoma with certain high-risk features. 2. Includes approximately $60 million received as an upfront payment from our recently announced partnership with Eisai; an additional $50 million under a term loan with Sagard Healthcare Partners is available to the Company until June 30, 2026; Pro forma cash balance is based on preliminary estimates. NUV-868 is a BD2-selective BET inhibitor that has completed Phase 1 and Phase 1b studies; Company is also evaluating preclinical candidates from its proprietary Drug-Drug Conjugate (DDC) platform

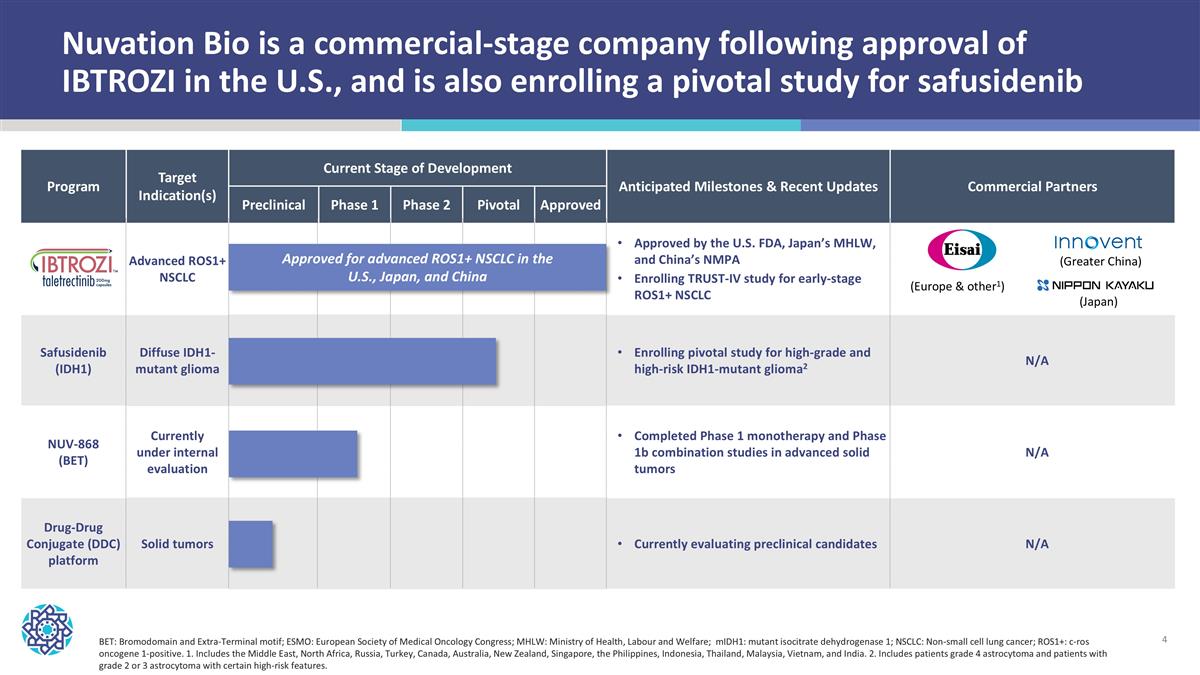

Nuvation Bio is a commercial-stage company following approval of IBTROZI in the U.S., and is also enrolling a pivotal study for safusidenib Program Target Indication(s) Current Stage of Development Anticipated Milestones & Recent Updates Commercial Partners Program Potential Indication(s) Preclinical Phase 1 Phase 2 Pivotal Approved Anticipated Milestones Advanced ROS1+ NSCLC Approved by the U.S. FDA, Japan’s MHLW, and China’s NMPA Enrolling TRUST-IV study for early-stage ROS1+ NSCLC Safusidenib (IDH1) Diffuse IDH1-mutant glioma Enrolling pivotal study for high-grade and high-risk IDH1-mutant glioma2 N/A NUV-868 (BET) Currently under internal evaluation Completed Phase 1 monotherapy and Phase 1b combination studies in advanced solid tumors N/A Drug-Drug Conjugate (DDC) platform Solid tumors Currently evaluating preclinical candidates N/A BET: Bromodomain and Extra-Terminal motif; ESMO: European Society of Medical Oncology Congress; MHLW: Ministry of Health, Labour and Welfare; mIDH1: mutant isocitrate dehydrogenase 1; NSCLC: Non-small cell lung cancer; ROS1+: c-ros oncogene 1-positive. 1. Includes the Middle East, North Africa, Russia, Turkey, Canada, Australia, New Zealand, Singapore, the Philippines, Indonesia, Thailand, Malaysia, Vietnam, and India. 2. Includes patients grade 4 astrocytoma and patients with grade 2 or 3 astrocytoma with certain high-risk features. Approved for advanced ROS1+ NSCLC in the U.S., Japan, and China (Europe & other1) (Japan) (Greater China)

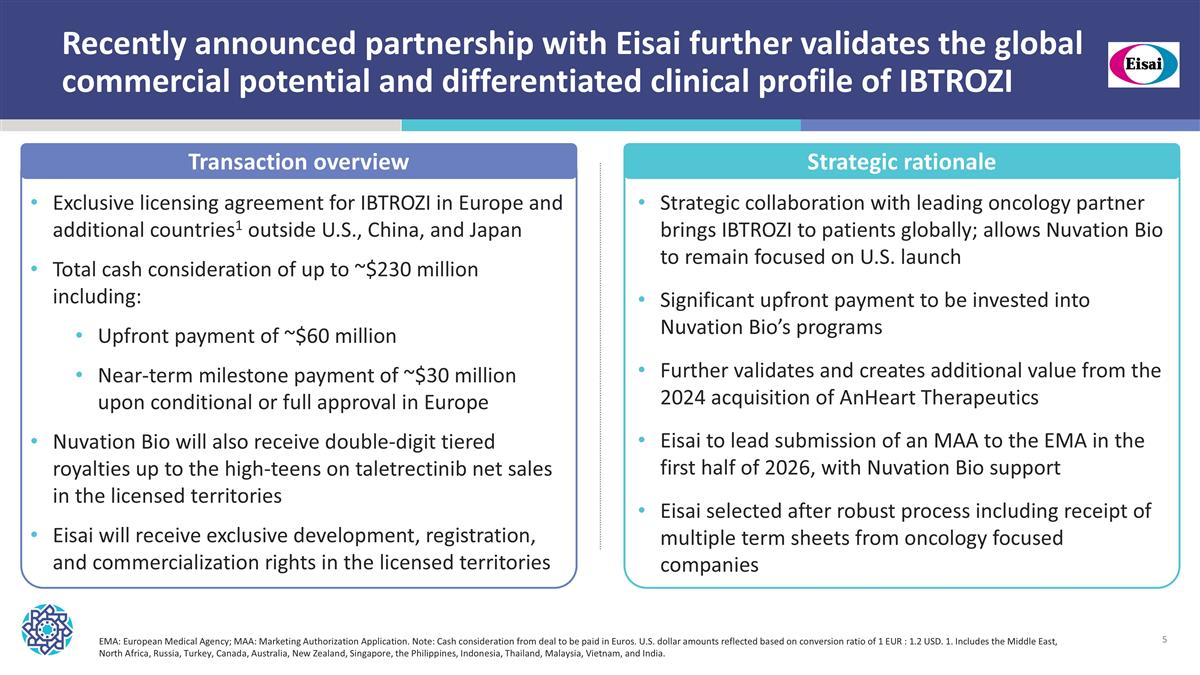

Recently announced partnership with Eisai further validates the global commercial potential and differentiated clinical profile of IBTROZI Exclusive licensing agreement for IBTROZI in Europe and additional countries1 outside U.S., China, and Japan Total cash consideration of up to ~$230 million including: Upfront payment of ~$60 million Near-term milestone payment of ~$30 million upon conditional or full approval in Europe Nuvation Bio will also receive double-digit tiered royalties up to the high-teens on taletrectinib net sales in the licensed territories Eisai will receive exclusive development, registration, and commercialization rights in the licensed territories Transaction overview Strategic rationale Strategic collaboration with leading oncology partner brings IBTROZI to patients globally; allows Nuvation Bio to remain focused on U.S. launch Significant upfront payment to be invested into Nuvation Bio’s programs Further validates and creates additional value from the 2024 acquisition of AnHeart Therapeutics Eisai to lead submission of an MAA to the EMA in the first half of 2026, with Nuvation Bio support Eisai selected after robust process including receipt of multiple term sheets from oncology focused companies EMA: European Medical Agency; MAA: Marketing Authorization Application. Note: Cash consideration from deal to be paid in Euros. U.S. dollar amounts reflected based on conversion ratio of 1 EUR : 1.2 USD. 1. Includes the Middle East, North Africa, Russia, Turkey, Canada, Australia, New Zealand, Singapore, the Philippines, Indonesia, Thailand, Malaysia, Vietnam, and India.

IBTROZI | ROS1i Advanced ROS1+ NSCLC Approved by U.S. FDA in June 2025

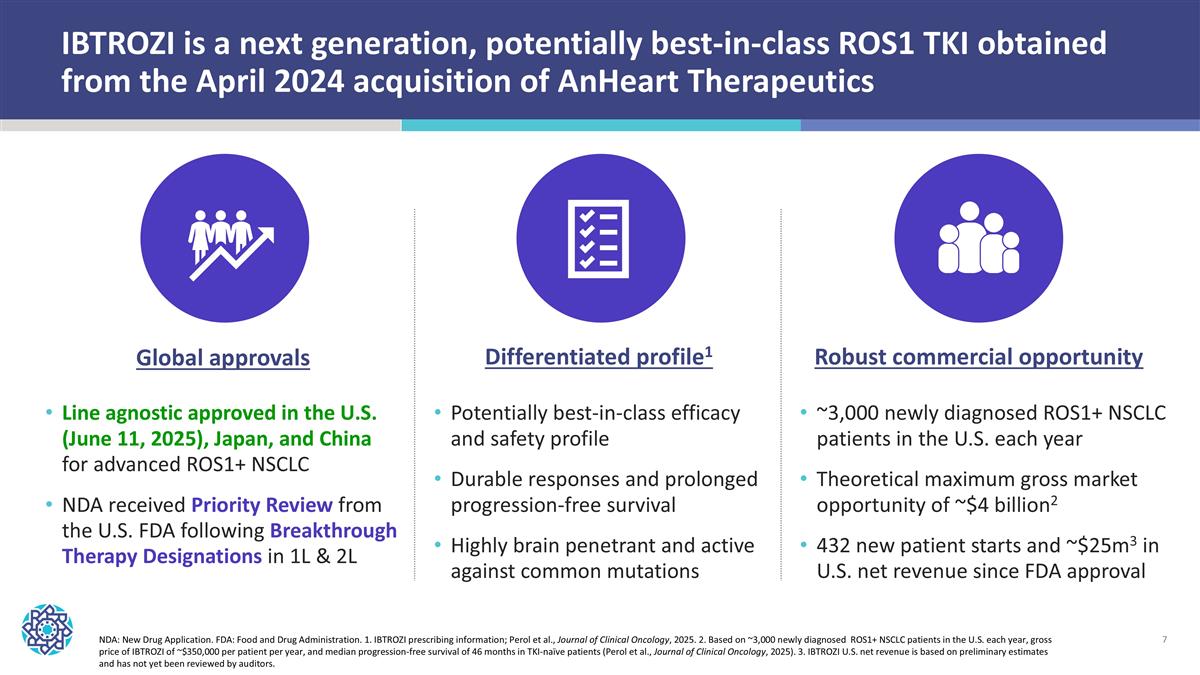

IBTROZI is a next generation, potentially best-in-class ROS1 TKI obtained from the April 2024 acquisition of AnHeart Therapeutics NDA: New Drug Application. FDA: Food and Drug Administration. 1. IBTROZI prescribing information; Perol et al., Journal of Clinical Oncology, 2025. 2. Based on ~3,000 newly diagnosed ROS1+ NSCLC patients in the U.S. each year, gross price of IBTROZI of ~$350,000 per patient per year, and median progression-free survival of 46 months in TKI-naïve patients (Perol et al., Journal of Clinical Oncology, 2025). 3. IBTROZI U.S. net revenue is based on preliminary estimates and has not yet been reviewed by auditors. Line agnostic approved in the U.S. (June 11, 2025), Japan, and China for advanced ROS1+ NSCLC NDA received Priority Review from the U.S. FDA following Breakthrough Therapy Designations in 1L & 2L ~3,000 newly diagnosed ROS1+ NSCLC patients in the U.S. each year Theoretical maximum gross market opportunity of ~$4 billion2 432 new patient starts and ~$25m3 in U.S. net revenue since FDA approval Global approvals Potentially best-in-class efficacy and safety profile Durable responses and prolonged progression-free survival Highly brain penetrant and active against common mutations Differentiated profile1 Robust commercial opportunity

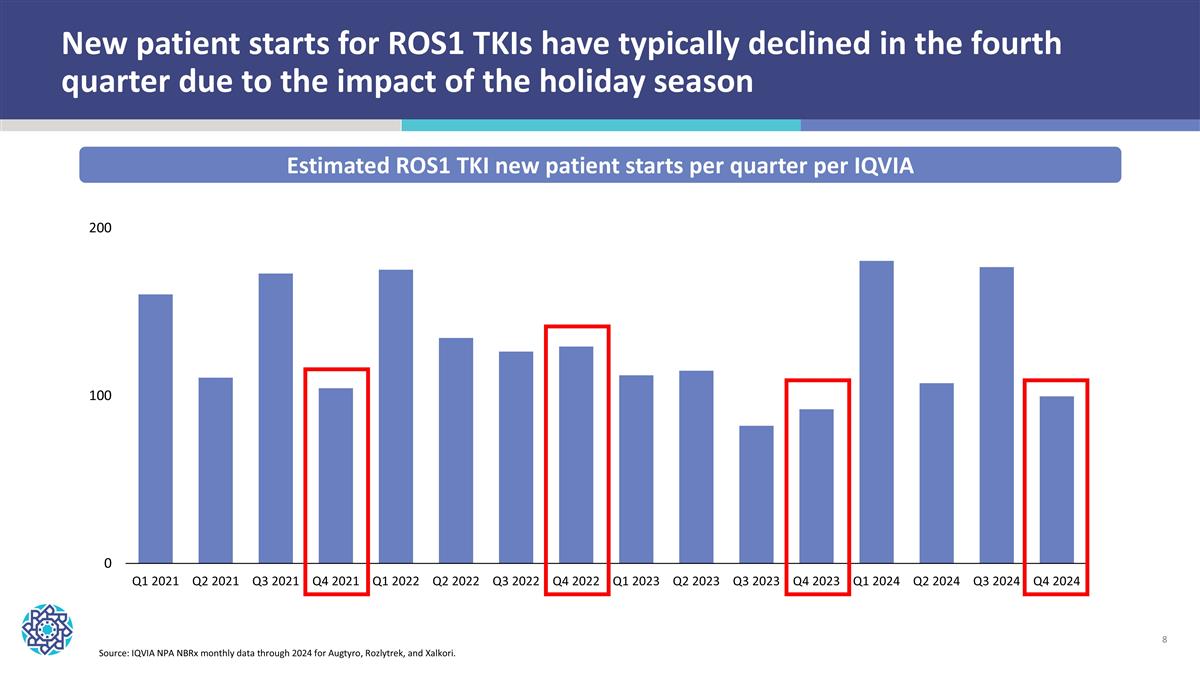

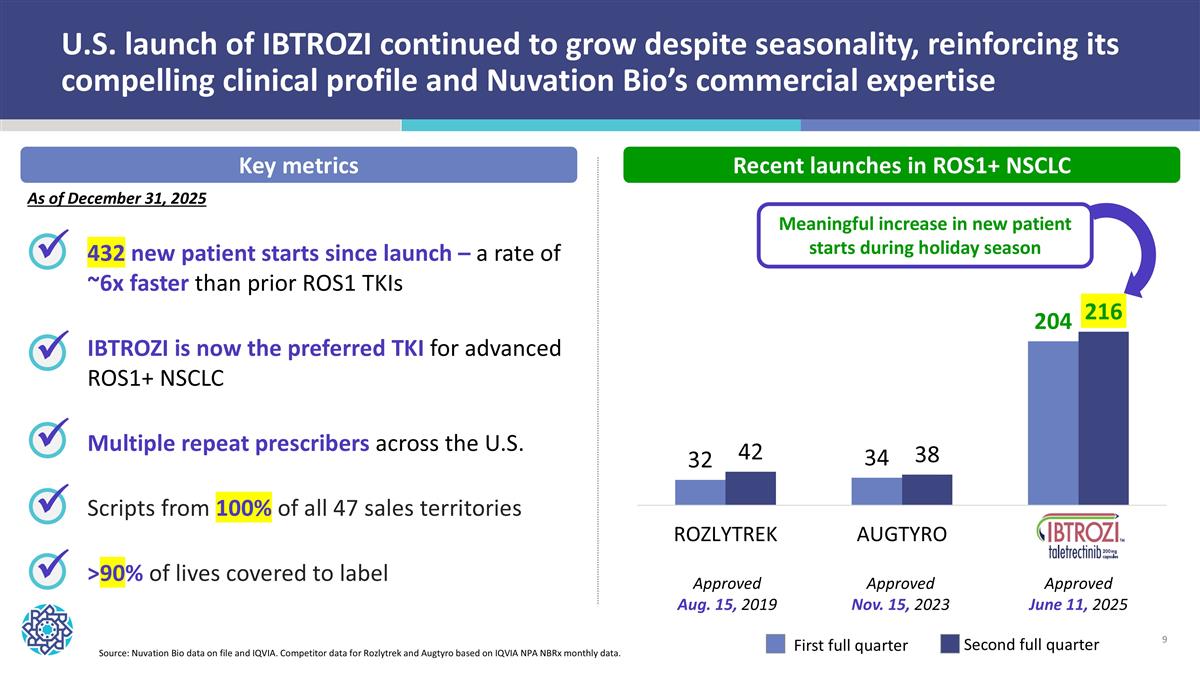

New patient starts for ROS1 TKIs have typically declined in the fourth quarter due to the impact of the holiday season Estimated ROS1 TKI new patient starts per quarter per IQVIA Source: IQVIA NPA NBRx monthly data through 2024 for Augtyro, Rozlytrek, and Xalkori.

U.S. launch of IBTROZI continued to grow despite seasonality, reinforcing its compelling clinical profile and Nuvation Bio’s commercial expertise 432 new patient starts since launch – a rate of ~6x faster than prior ROS1 TKIs IBTROZI is now the preferred TKI for advanced ROS1+ NSCLC Multiple repeat prescribers across the U.S. Scripts from 100% of all 47 sales territories >90% of lives covered to label ü ü ü ü Source: Nuvation Bio data on file and IQVIA. Competitor data for Rozlytrek and Augtyro based on IQVIA NPA NBRx monthly data. First full quarter Second full quarter Key metrics Recent launches in ROS1+ NSCLC Meaningful increase in new patient starts during holiday season ü As of December 31, 2025 Approved Aug. 15, 2019 Approved Nov. 15, 2023 Approved June 11, 2025

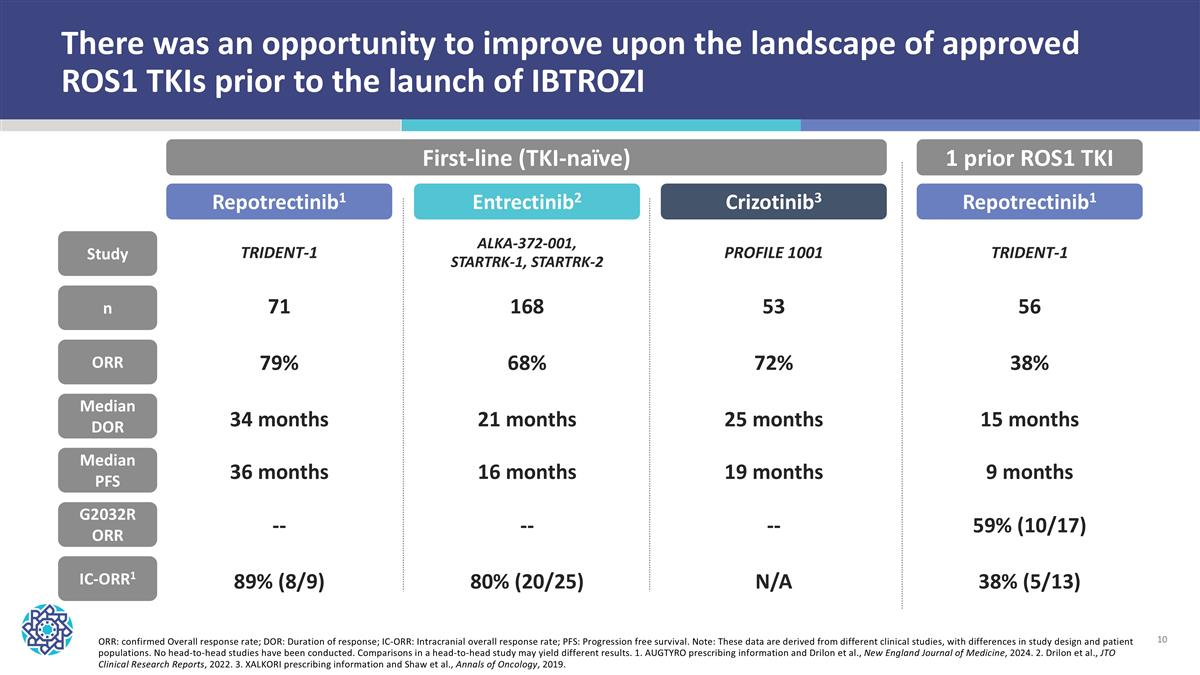

ORR: confirmed Overall response rate; DOR: Duration of response; IC-ORR: Intracranial overall response rate; PFS: Progression free survival. Note: These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been conducted. Comparisons in a head-to-head study may yield different results. 1. AUGTYRO prescribing information and Drilon et al., New England Journal of Medicine, 2024. 2. Drilon et al., JTO Clinical Research Reports, 2022. 3. XALKORI prescribing information and Shaw et al., Annals of Oncology, 2019. There was an opportunity to improve upon the landscape of approved ROS1 TKIs prior to the launch of IBTROZI n ORR Median DOR Median PFS IC-ORR1 Study First-line (TKI-naïve) 1 prior ROS1 TKI G2032R ORR Repotrectinib1 Entrectinib2 Crizotinib3 TRIDENT-1 ALKA-372-001, STARTRK-1, STARTRK-2 PROFILE 1001 71 79% 34 months 36 months 89% (8/9) 168 68% 21 months 16 months 80% (20/25) 53 72% 25 months 19 months N/A Repotrectinib1 TRIDENT-1 56 38% 15 months 9 months 38% (5/13) 59% (10/17) -- -- --

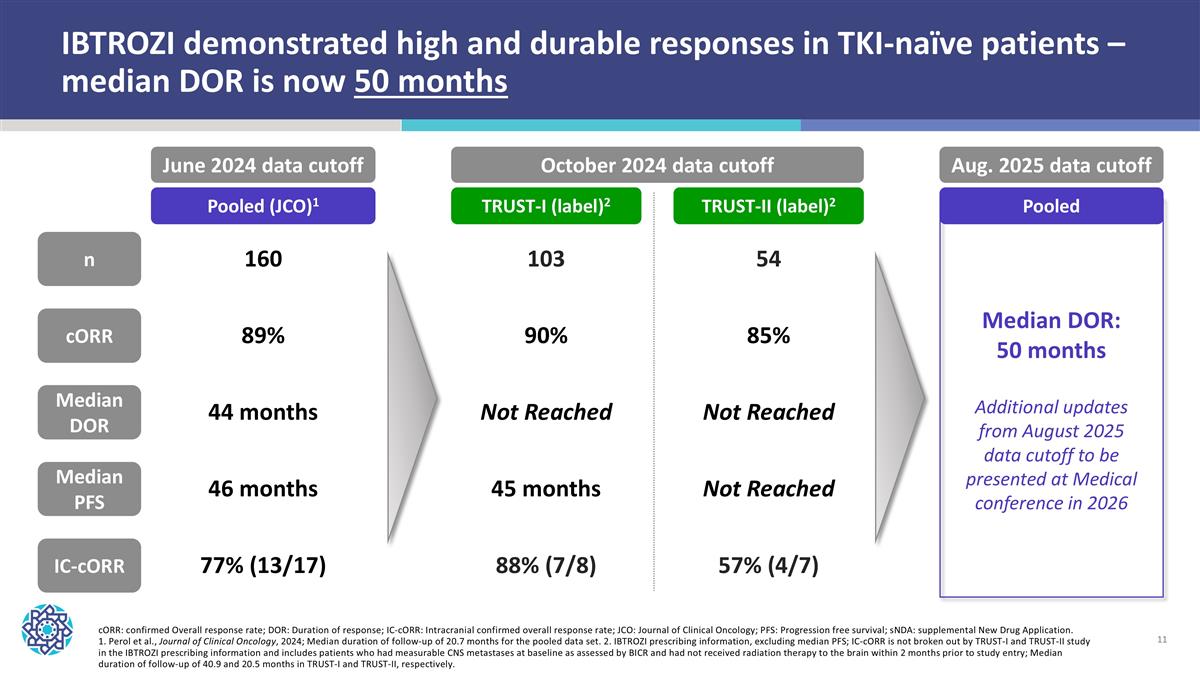

IBTROZI demonstrated high and durable responses in TKI-naïve patients – median DOR is now 50 months cORR: confirmed Overall response rate; DOR: Duration of response; IC-cORR: Intracranial confirmed overall response rate; JCO: Journal of Clinical Oncology; PFS: Progression free survival; sNDA: supplemental New Drug Application. 1. Perol et al., Journal of Clinical Oncology, 2024; Median duration of follow-up of 20.7 months for the pooled data set. 2. IBTROZI prescribing information, excluding median PFS; IC-cORR is not broken out by TRUST-I and TRUST-II study in the IBTROZI prescribing information and includes patients who had measurable CNS metastases at baseline as assessed by BICR and had not received radiation therapy to the brain within 2 months prior to study entry; Median duration of follow-up of 40.9 and 20.5 months in TRUST-I and TRUST-II, respectively. Pooled (JCO)1 TRUST-I (label)2 TRUST-II (label)2 n cORR Median DOR Median PFS IC-cORR 160 89% 44 months 46 months 77% (13/17) 103 90% Not Reached 45 months 88% (7/8) 54 85% Not Reached Not Reached 57% (4/7) June 2024 data cutoff October 2024 data cutoff Aug. 2025 data cutoff Pooled Median DOR: 50 months Additional updates from August 2025 data cutoff to be presented at Medical conference in 2026

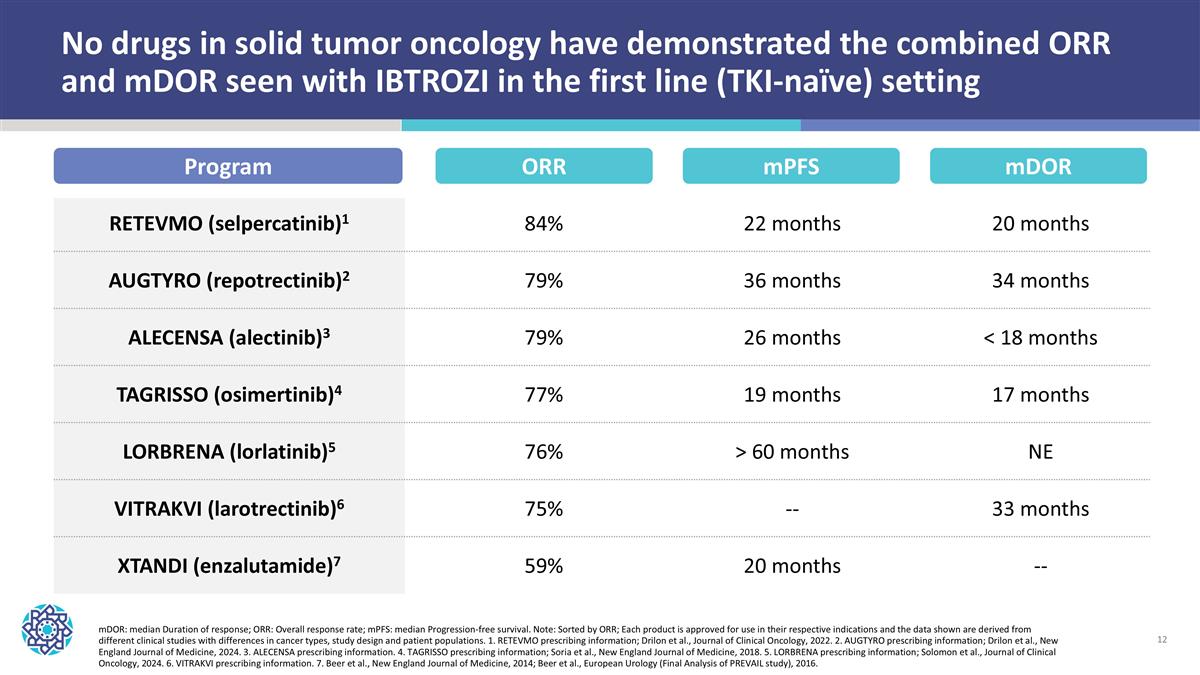

No drugs in solid tumor oncology have demonstrated the combined ORR and mDOR seen with IBTROZI in the first line (TKI-naïve) setting RETEVMO (selpercatinib)1 84% 22 months 20 months AUGTYRO (repotrectinib)2 79% 36 months 34 months ALECENSA (alectinib)3 79% 26 months < 18 months TAGRISSO (osimertinib)4 77% 19 months 17 months LORBRENA (lorlatinib)5 76% > 60 months NE VITRAKVI (larotrectinib)6 75% -- 33 months XTANDI (enzalutamide)7 59% 20 months -- Program ORR mDOR: median Duration of response; ORR: Overall response rate; mPFS: median Progression-free survival. Note: Sorted by ORR; Each product is approved for use in their respective indications and the data shown are derived from different clinical studies with differences in cancer types, study design and patient populations. 1. RETEVMO prescribing information; Drilon et al., Journal of Clinical Oncology, 2022. 2. AUGTYRO prescribing information; Drilon et al., New England Journal of Medicine, 2024. 3. ALECENSA prescribing information. 4. TAGRISSO prescribing information; Soria et al., New England Journal of Medicine, 2018. 5. LORBRENA prescribing information; Solomon et al., Journal of Clinical Oncology, 2024. 6. VITRAKVI prescribing information. 7. Beer et al., New England Journal of Medicine, 2014; Beer et al., European Urology (Final Analysis of PREVAIL study), 2016. mPFS mDOR

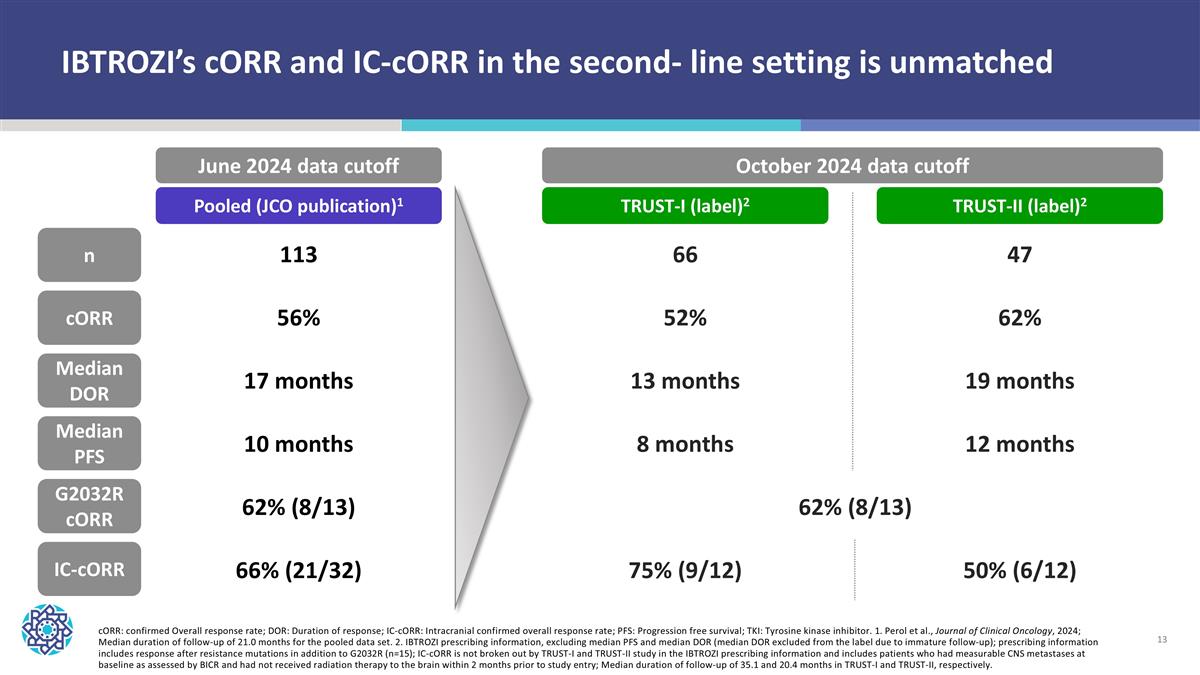

cORR: confirmed Overall response rate; DOR: Duration of response; IC-cORR: Intracranial confirmed overall response rate; PFS: Progression free survival; TKI: Tyrosine kinase inhibitor. 1. Perol et al., Journal of Clinical Oncology, 2024; Median duration of follow-up of 21.0 months for the pooled data set. 2. IBTROZI prescribing information, excluding median PFS and median DOR (median DOR excluded from the label due to immature follow-up); prescribing information includes response after resistance mutations in addition to G2032R (n=15); IC-cORR is not broken out by TRUST-I and TRUST-II study in the IBTROZI prescribing information and includes patients who had measurable CNS metastases at baseline as assessed by BICR and had not received radiation therapy to the brain within 2 months prior to study entry; Median duration of follow-up of 35.1 and 20.4 months in TRUST-I and TRUST-II, respectively. n cORR Median DOR Median PFS IC-cORR 113 56% 17 months 10 months 66% (21/32) 66 52% 13 months 8 months 75% (9/12) 47 62% 19 months 12 months 50% (6/12) G2032R cORR 62% (8/13) 62% (8/13) Pooled (JCO publication)1 TRUST-I (label)2 TRUST-II (label)2 June 2024 data cutoff October 2024 data cutoff IBTROZI’s cORR and IC-cORR in the second- line setting is unmatched

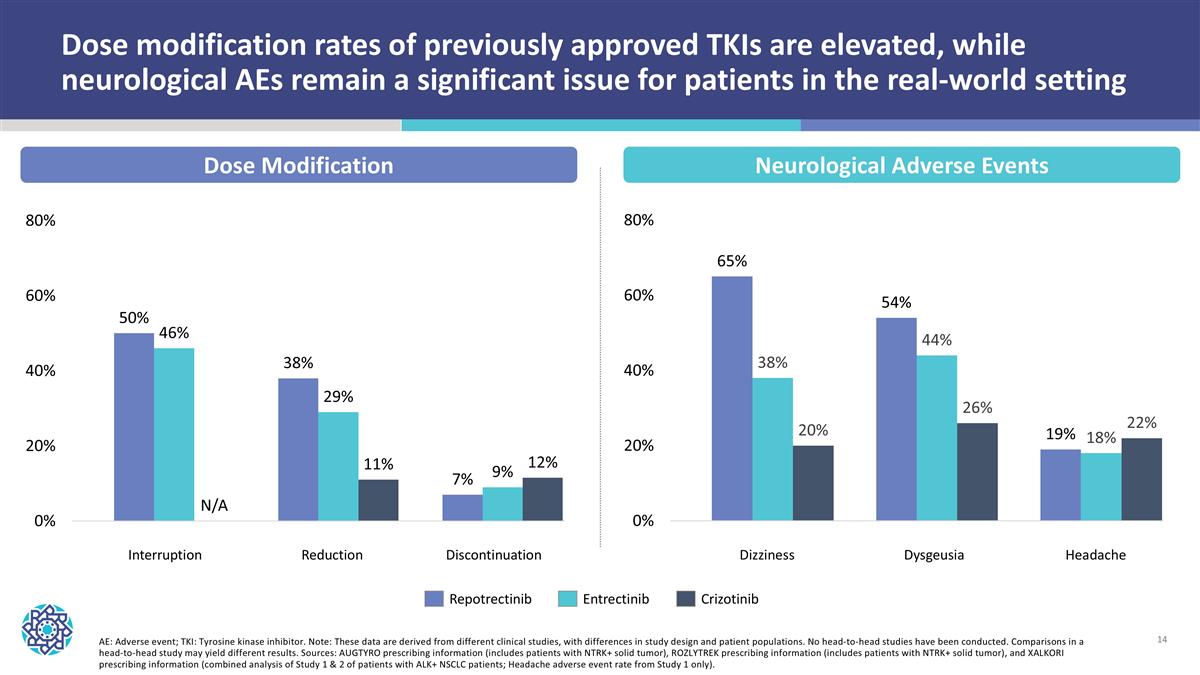

Dose modification rates of previously approved TKIs are elevated, while neurological AEs remain a significant issue for patients in the real-world setting Repotrectinib Entrectinib Crizotinib AE: Adverse event; TKI: Tyrosine kinase inhibitor. Note: These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been conducted. Comparisons in a head-to-head study may yield different results. Sources: AUGTYRO prescribing information (includes patients with NTRK+ solid tumor), ROZLYTREK prescribing information (includes patients with NTRK+ solid tumor), and XALKORI prescribing information (combined analysis of Study 1 & 2 of patients with ALK+ NSCLC patients; Headache adverse event rate from Study 1 only). Dose Modification Neurological Adverse Events Interruption Reduction Discontinuation Dizziness Dysgeusia Headache

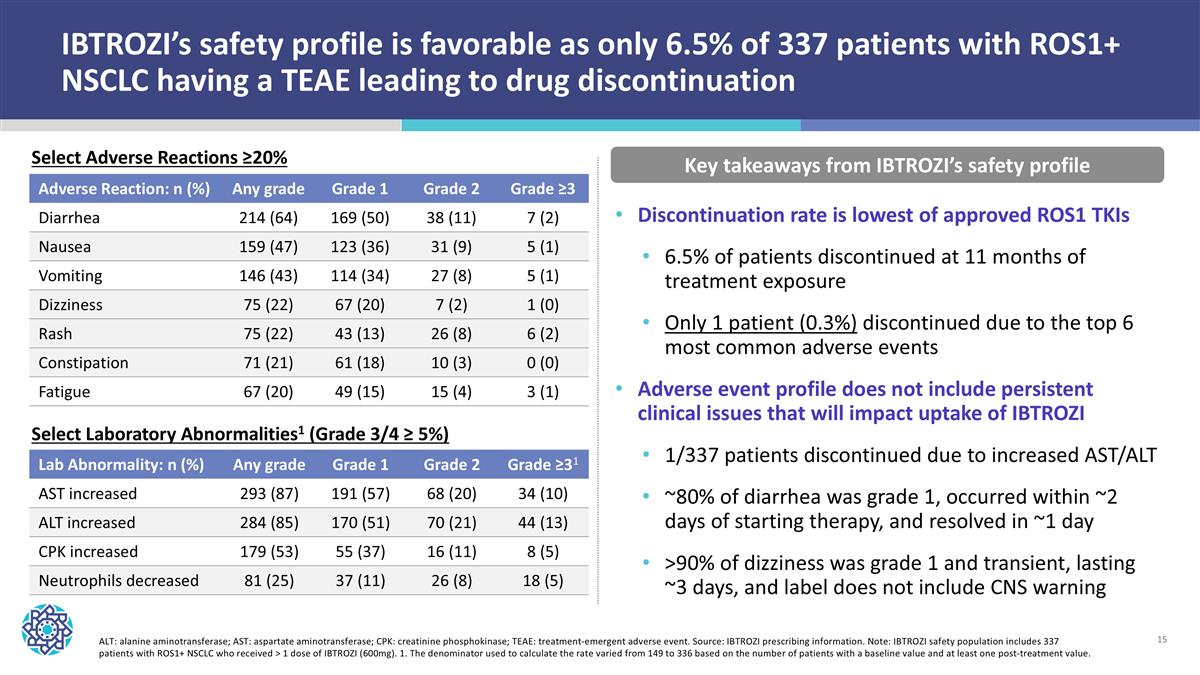

IBTROZI’s safety profile is favorable as only 6.5% of 337 patients with ROS1+ NSCLC having a TEAE leading to drug discontinuation Adverse Reaction: n (%) Any grade Grade 1 Grade 2 Grade ≥3 Diarrhea 214 (64) 169 (50) 38 (11) 7 (2) Nausea 159 (47) 123 (36) 31 (9) 5 (1) Vomiting 146 (43) 114 (34) 27 (8) 5 (1) Dizziness 75 (22) 67 (20) 7 (2) 1 (0) Rash 75 (22) 43 (13) 26 (8) 6 (2) Constipation 71 (21) 61 (18) 10 (3) 0 (0) Fatigue 67 (20) 49 (15) 15 (4) 3 (1) Key takeaways from IBTROZI’s safety profile ALT: alanine aminotransferase; AST: aspartate aminotransferase; CPK: creatinine phosphokinase; TEAE: treatment-emergent adverse event. Source: IBTROZI prescribing information. Note: IBTROZI safety population includes 337 patients with ROS1+ NSCLC who received > 1 dose of IBTROZI (600mg). 1. The denominator used to calculate the rate varied from 149 to 336 based on the number of patients with a baseline value and at least one post-treatment value. Discontinuation rate is lowest of approved ROS1 TKIs 6.5% of patients discontinued at 11 months of treatment exposure Only 1 patient (0.3%) discontinued due to the top 6 most common adverse events Adverse event profile does not include persistent clinical issues that will impact uptake of IBTROZI 1/337 patients discontinued due to increased AST/ALT ~80% of diarrhea was grade 1, occurred within ~2 days of starting therapy, and resolved in ~1 day >90% of dizziness was grade 1 and transient, lasting ~3 days, and label does not include CNS warning Lab Abnormality: n (%) Any grade Grade 1 Grade 2 Grade ≥31 AST increased 293 (87) 191 (57) 68 (20) 34 (10) ALT increased 284 (85) 170 (51) 70 (21) 44 (13) CPK increased 179 (53) 55 (37) 16 (11) 8 (5) Neutrophils decreased 81 (25) 37 (11) 26 (8) 18 (5) Select Adverse Reactions ≥20% Select Laboratory Abnormalities1 (Grade 3/4 ≥ 5%)

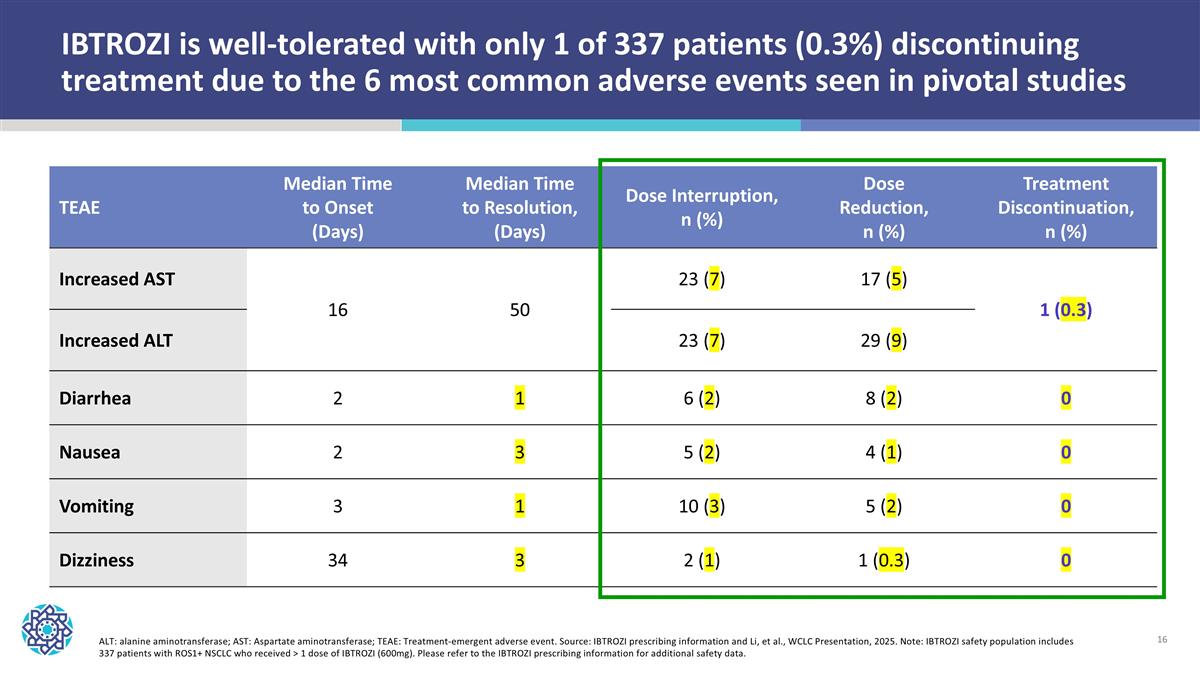

ALT: alanine aminotransferase; AST: Aspartate aminotransferase; TEAE: Treatment-emergent adverse event. Source: IBTROZI prescribing information and Li, et al., WCLC Presentation, 2025. Note: IBTROZI safety population includes 337 patients with ROS1+ NSCLC who received > 1 dose of IBTROZI (600mg). Please refer to the IBTROZI prescribing information for additional safety data. TEAE Median Time to Onset (Days) Median Time to Resolution, (Days) Dose Interruption, n (%) Dose Reduction, n (%) Treatment Discontinuation, n (%) Increased AST 16 50 23 (7) 17 (5) 1 (0.3) Increased ALT 23 (7) 29 (9) Diarrhea 2 1 6 (2) 8 (2) 0 Nausea 2 3 5 (2) 4 (1) 0 Vomiting 3 1 10 (3) 5 (2) 0 Dizziness 34 3 2 (1) 1 (0.3) 0 IBTROZI is well-tolerated with only 1 of 337 patients (0.3%) discontinuing treatment due to the 6 most common adverse events seen in pivotal studies

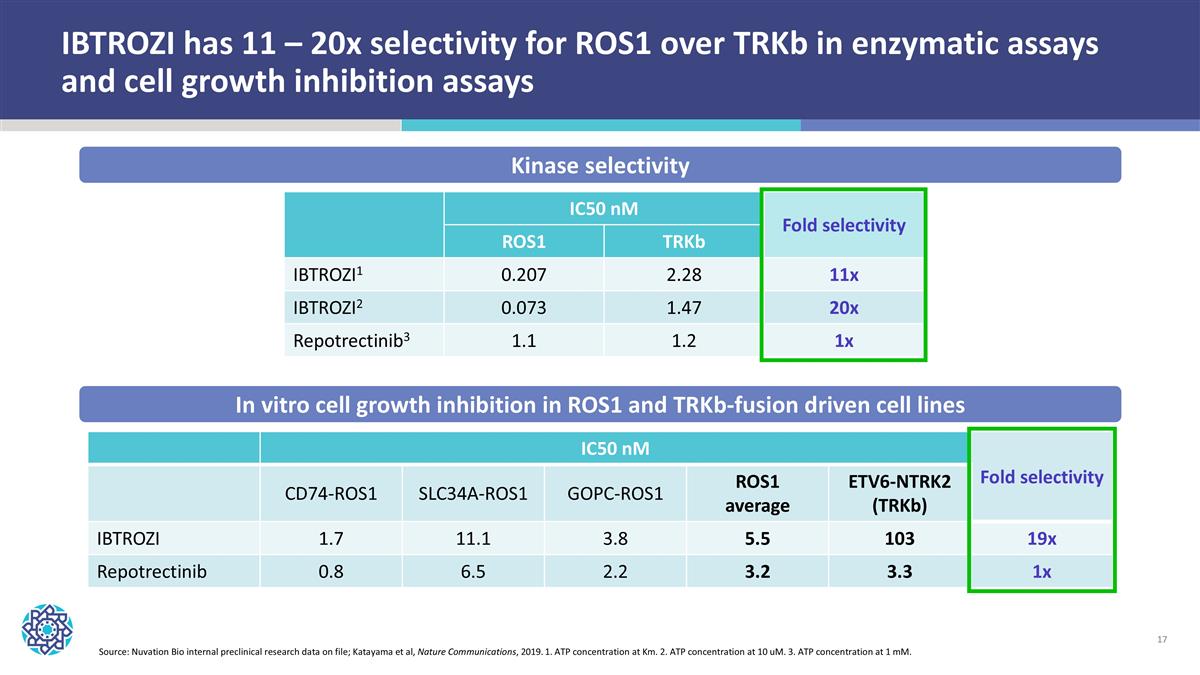

IBTROZI has 11 – 20x selectivity for ROS1 over TRKb in enzymatic assays and cell growth inhibition assays IC50 nM Fold selectivity CD74-ROS1 SLC34A-ROS1 GOPC-ROS1 ROS1 average ETV6-NTRK2 (TRKb) IBTROZI 1.7 11.1 3.8 5.5 103 19x Repotrectinib 0.8 6.5 2.2 3.2 3.3 1x IC50 nM Fold selectivity ROS1 TRKb IBTROZI1 0.207 2.28 11x IBTROZI2 0.073 1.47 20x Repotrectinib3 1.1 1.2 1x Kinase selectivity In vitro cell growth inhibition in ROS1 and TRKb-fusion driven cell lines Source: Nuvation Bio internal preclinical research data on file; Katayama et al, Nature Communications, 2019. 1. ATP concentration at Km. 2. ATP concentration at 10 uM. 3. ATP concentration at 1 mM.

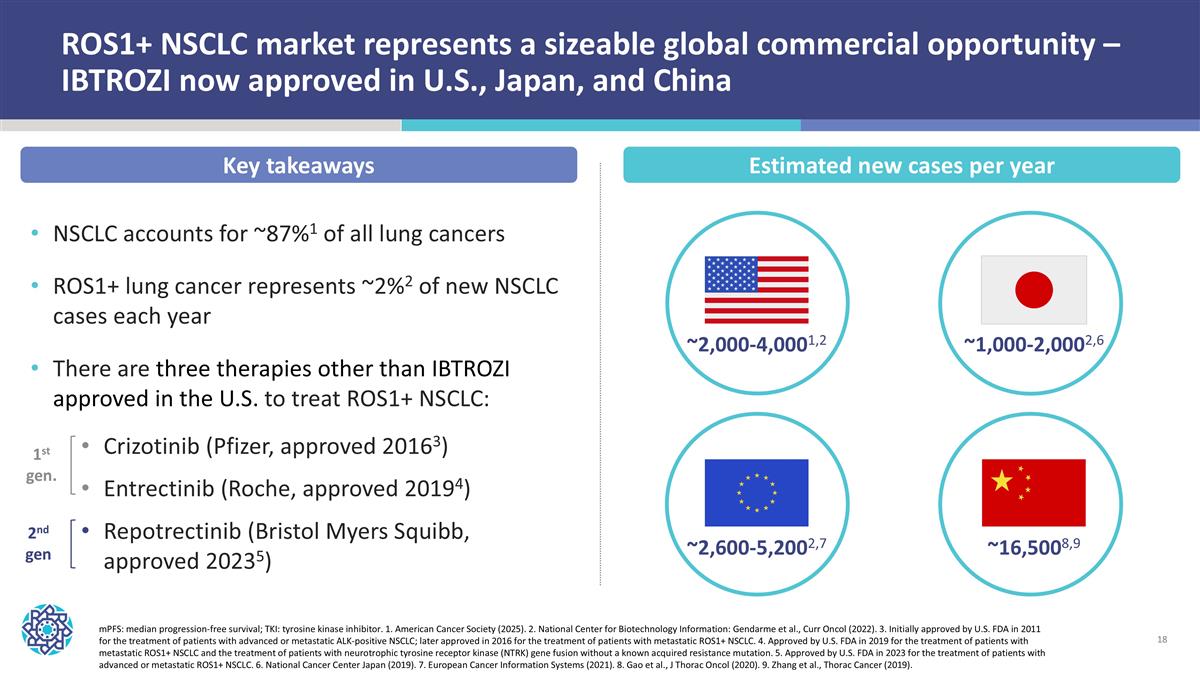

ROS1+ NSCLC market represents a sizeable global commercial opportunity – IBTROZI now approved in U.S., Japan, and China mPFS: median progression-free survival; TKI: tyrosine kinase inhibitor. 1. American Cancer Society (2025). 2. National Center for Biotechnology Information: Gendarme et al., Curr Oncol (2022). 3. Initially approved by U.S. FDA in 2011 for the treatment of patients with advanced or metastatic ALK-positive NSCLC; later approved in 2016 for the treatment of patients with metastatic ROS1+ NSCLC. 4. Approved by U.S. FDA in 2019 for the treatment of patients with metastatic ROS1+ NSCLC and the treatment of patients with neurotrophic tyrosine receptor kinase (NTRK) gene fusion without a known acquired resistance mutation. 5. Approved by U.S. FDA in 2023 for the treatment of patients with advanced or metastatic ROS1+ NSCLC. 6. National Cancer Center Japan (2019). 7. European Cancer Information Systems (2021). 8. Gao et al., J Thorac Oncol (2020). 9. Zhang et al., Thorac Cancer (2019). ~2,000-4,0001,2 ~2,600-5,2002,7 ~16,5008,9 ~1,000-2,0002,6 NSCLC accounts for ~87%1 of all lung cancers ROS1+ lung cancer represents ~2%2 of new NSCLC cases each year There are three therapies other than IBTROZI approved in the U.S. to treat ROS1+ NSCLC: Crizotinib (Pfizer, approved 20163) Entrectinib (Roche, approved 20194) Repotrectinib (Bristol Myers Squibb, approved 20235) 1st gen. 2nd gen Key takeaways Estimated new cases per year

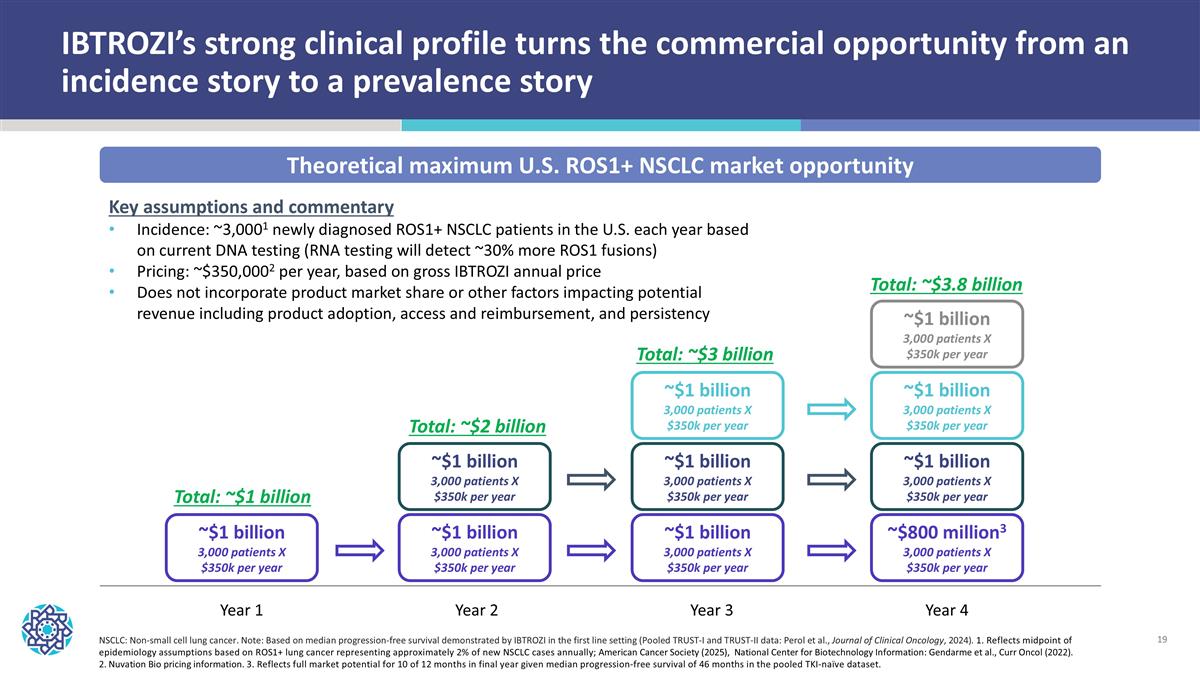

NSCLC: Non-small cell lung cancer. Note: Based on median progression-free survival demonstrated by IBTROZI in the first line setting (Pooled TRUST-I and TRUST-II data: Perol et al., Journal of Clinical Oncology, 2024). 1. Reflects midpoint of epidemiology assumptions based on ROS1+ lung cancer representing approximately 2% of new NSCLC cases annually; American Cancer Society (2025), National Center for Biotechnology Information: Gendarme et al., Curr Oncol (2022). 2. Nuvation Bio pricing information. 3. Reflects full market potential for 10 of 12 months in final year given median progression-free survival of 46 months in the pooled TKI-naïve dataset. Theoretical maximum U.S. ROS1+ NSCLC market opportunity Year 1 Year 2 Year 3 Year 4 ~$1 billion 3,000 patients X $350k per year ~$1 billion 3,000 patients X $350k per year ~$1 billion 3,000 patients X $350k per year ~$800 million3 3,000 patients X $350k per year ~$1 billion 3,000 patients X $350k per year ~$1 billion 3,000 patients X $350k per year ~$1 billion 3,000 patients X $350k per year ~$1 billion 3,000 patients X $350k per year ~$1 billion 3,000 patients X $350k per year ~$1 billion 3,000 patients X $350k per year Total: ~$1 billion Total: ~$2 billion Total: ~$3 billion Total: ~$3.8 billion Key assumptions and commentary Incidence: ~3,0001 newly diagnosed ROS1+ NSCLC patients in the U.S. each year based on current DNA testing (RNA testing will detect ~30% more ROS1 fusions) Pricing: ~$350,0002 per year, based on gross IBTROZI annual price Does not incorporate product market share or other factors impacting potential revenue including product adoption, access and reimbursement, and persistency IBTROZI’s strong clinical profile turns the commercial opportunity from an incidence story to a prevalence story

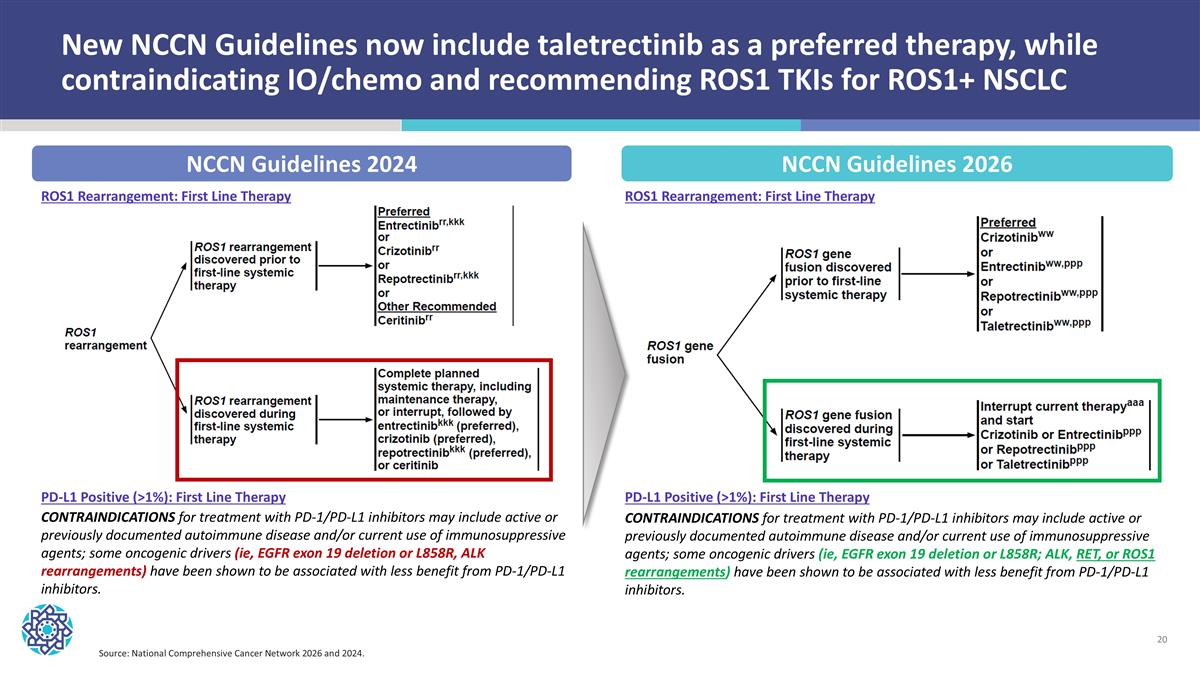

New NCCN Guidelines now include taletrectinib as a preferred therapy, while contraindicating IO/chemo and recommending ROS1 TKIs for ROS1+ NSCLC Source: National Comprehensive Cancer Network 2026 and 2024. NCCN Guidelines 2024 NCCN Guidelines 2026 ROS1 Rearrangement: First Line Therapy ROS1 Rearrangement: First Line Therapy PD-L1 Positive (>1%): First Line Therapy PD-L1 Positive (>1%): First Line Therapy CONTRAINDICATIONS for treatment with PD-1/PD-L1 inhibitors may include active or previously documented autoimmune disease and/or current use of immunosuppressive agents; some oncogenic drivers (ie, EGFR exon 19 deletion or L858R; ALK, RET, or ROS1 rearrangements) have been shown to be associated with less benefit from PD-1/PD-L1 inhibitors. CONTRAINDICATIONS for treatment with PD-1/PD-L1 inhibitors may include active or previously documented autoimmune disease and/or current use of immunosuppressive agents; some oncogenic drivers (ie, EGFR exon 19 deletion or L858R, ALK rearrangements) have been shown to be associated with less benefit from PD-1/PD-L1 inhibitors.

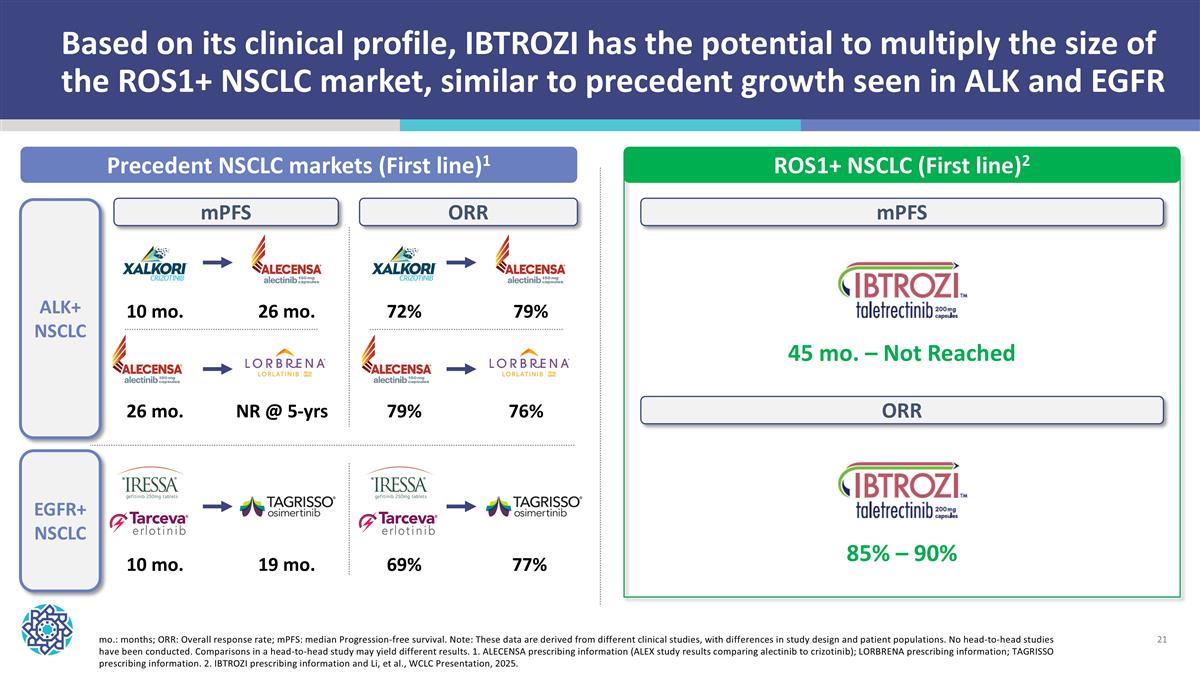

Based on its clinical profile, IBTROZI has the potential to multiply the size of the ROS1+ NSCLC market, similar to precedent growth seen in ALK and EGFR Precedent NSCLC markets (First line)1 ROS1+ NSCLC (First line)2 ALK+ NSCLC mo.: months; ORR: Overall response rate; mPFS: median Progression-free survival. Note: These data are derived from different clinical studies, with differences in study design and patient populations. No head-to-head studies have been conducted. Comparisons in a head-to-head study may yield different results. 1. ALECENSA prescribing information (ALEX study results comparing alectinib to crizotinib); LORBRENA prescribing information; TAGRISSO prescribing information. 2. IBTROZI prescribing information and Li, et al., WCLC Presentation, 2025. EGFR+ NSCLC mPFS ORR 45 mo. – Not Reached 10 mo. 26 mo. 26 mo. NR @ 5-yrs 10 mo. 19 mo. mPFS 72% 79% 79% 76% 69% 77% ORR 85% – 90%

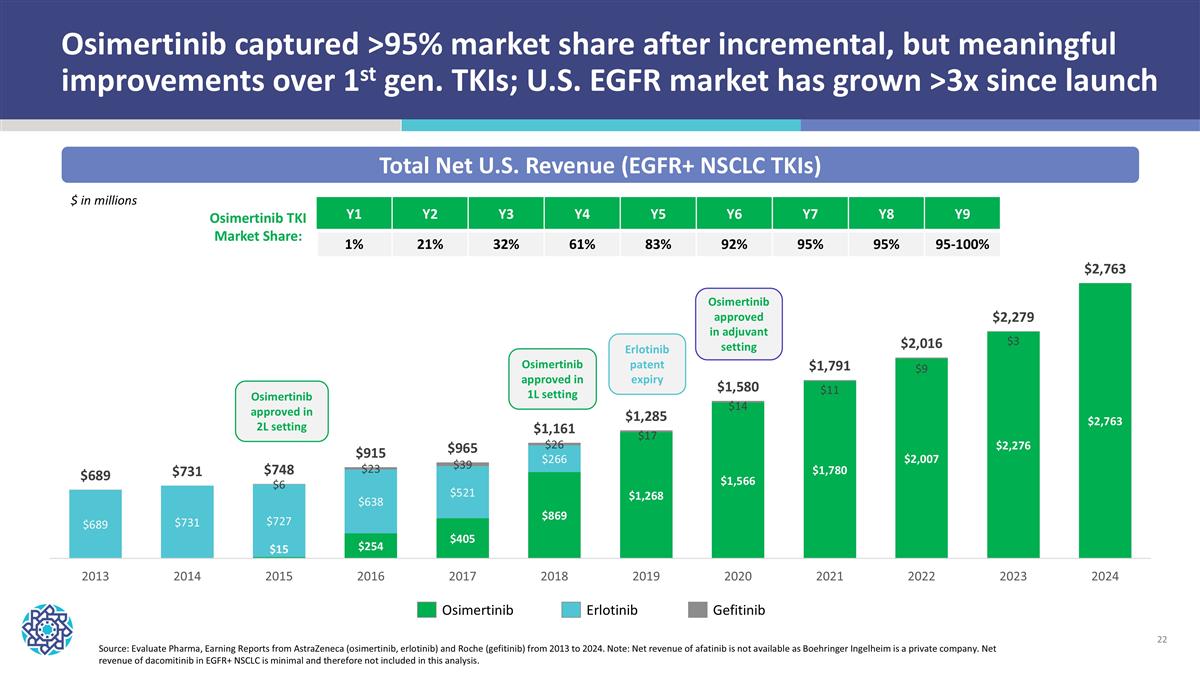

Osimertinib captured >95% market share after incremental, but meaningful improvements over 1st gen. TKIs; U.S. EGFR market has grown >3x since launch Source: Evaluate Pharma, Earning Reports from AstraZeneca (osimertinib, erlotinib) and Roche (gefitinib) from 2013 to 2024. Note: Net revenue of afatinib is not available as Boehringer Ingelheim is a private company. Net revenue of dacomitinib in EGFR+ NSCLC is minimal and therefore not included in this analysis. Total Net U.S. Revenue (EGFR+ NSCLC TKIs) Osimertinib Erlotinib Gefitinib Osimertinib approved in 1L setting Erlotinib patent expiry Osimertinib approved in 2L setting Osimertinib approved in adjuvant setting $ in millions Osimertinib TKI Market Share: Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 1% 21% 32% 61% 83% 92% 95% 95% 95-100%

Safusidenib | mIDH1i Diffuse IDH1-mutant glioma Enrolling pivotal study

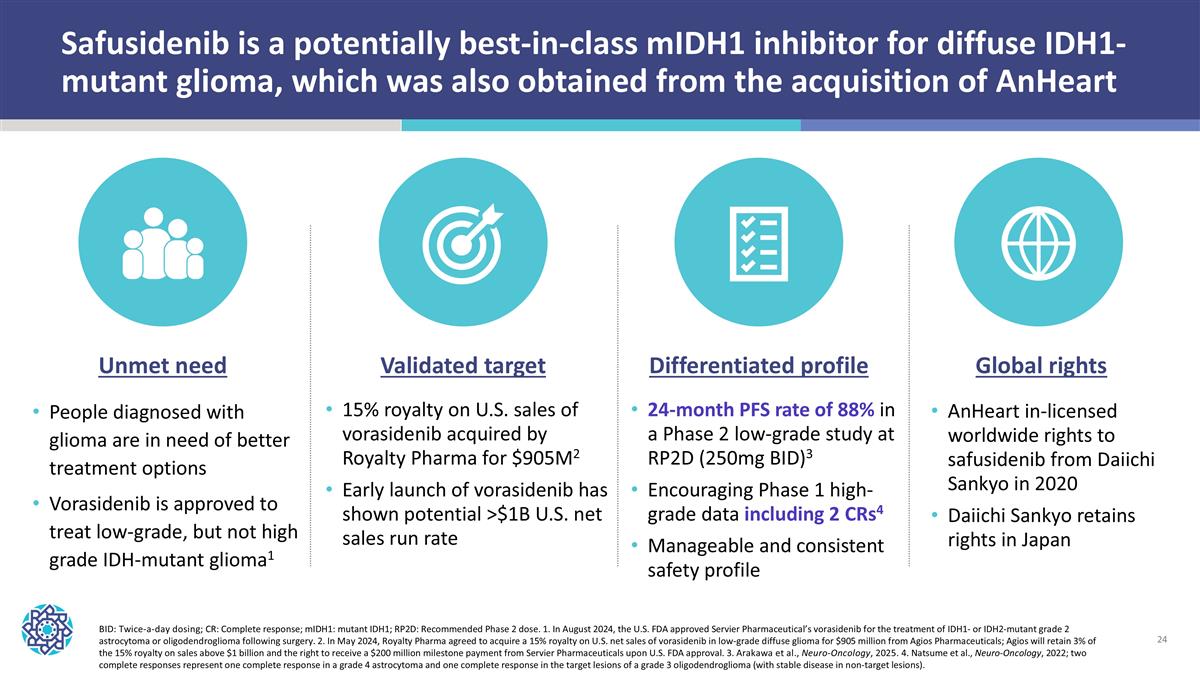

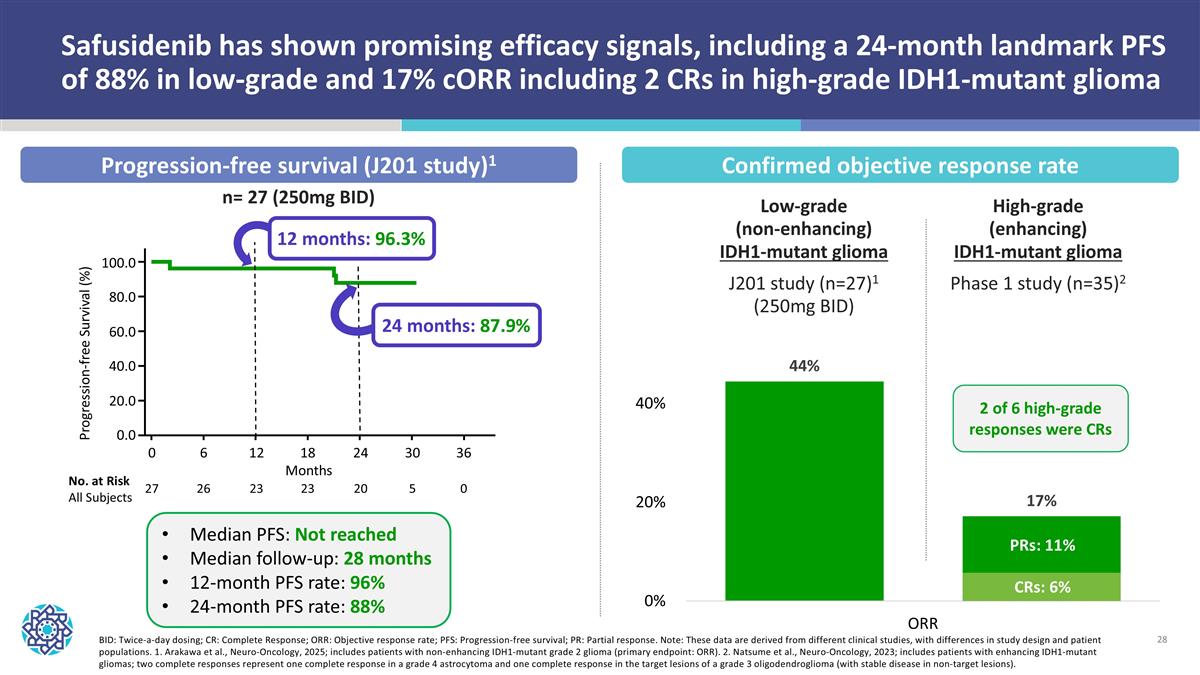

Safusidenib is a potentially best-in-class mIDH1 inhibitor for diffuse IDH1-mutant glioma, which was also obtained from the acquisition of AnHeart BID: Twice-a-day dosing; CR: Complete response; mIDH1: mutant IDH1; RP2D: Recommended Phase 2 dose. 1. In August 2024, the U.S. FDA approved Servier Pharmaceutical’s vorasidenib for the treatment of IDH1- or IDH2-mutant grade 2 astrocytoma or oligodendroglioma following surgery. 2. In May 2024, Royalty Pharma agreed to acquire a 15% royalty on U.S. net sales of vorasidenib in low-grade diffuse glioma for $905 million from Agios Pharmaceuticals; Agios will retain 3% of the 15% royalty on sales above $1 billion and the right to receive a $200 million milestone payment from Servier Pharmaceuticals upon U.S. FDA approval. 3. Arakawa et al., Neuro-Oncology, 2025. 4. Natsume et al., Neuro-Oncology, 2022; two complete responses represent one complete response in a grade 4 astrocytoma and one complete response in the target lesions of a grade 3 oligodendroglioma (with stable disease in non-target lesions). Global rights AnHeart in-licensed worldwide rights to safusidenib from Daiichi Sankyo in 2020 Daiichi Sankyo retains rights in Japan Validated target 15% royalty on U.S. sales of vorasidenib acquired by Royalty Pharma for $905M2 Early launch of vorasidenib has shown potential >$1B U.S. net sales run rate Unmet need People diagnosed with glioma are in need of better treatment options Vorasidenib is approved to treat low-grade, but not high grade IDH-mutant glioma1 Differentiated profile 24-month PFS rate of 88% in a Phase 2 low-grade study at RP2D (250mg BID)3 Encouraging Phase 1 high-grade data including 2 CRs4 Manageable and consistent safety profile

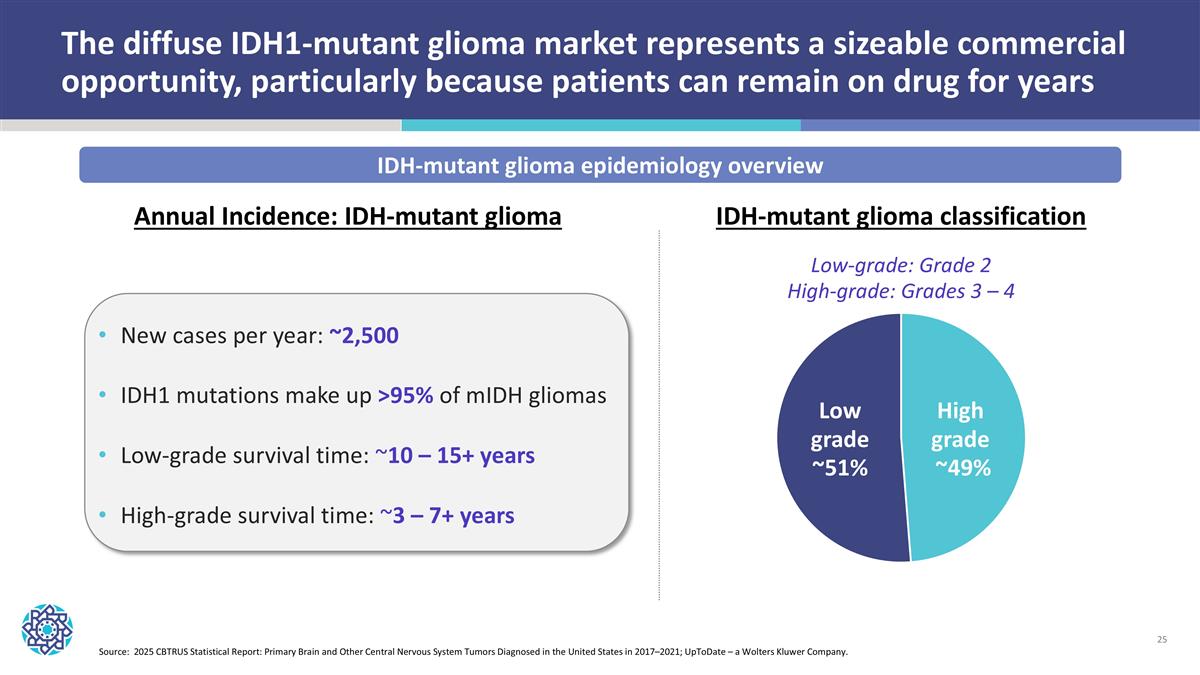

The diffuse IDH1-mutant glioma market represents a sizeable commercial opportunity, particularly because patients can remain on drug for years Source: 2025 CBTRUS Statistical Report: Primary Brain and Other Central Nervous System Tumors Diagnosed in the United States in 2017–2021; UpToDate – a Wolters Kluwer Company. IDH-mutant glioma epidemiology overview New cases per year: ~2,500 IDH1 mutations make up >95% of mIDH gliomas Low-grade survival time: ~10 – 15+ years High-grade survival time: ~3 – 7+ years Low grade ~51% High grade ~49% Annual Incidence: IDH-mutant glioma IDH-mutant glioma classification Low-grade: Grade 2 High-grade: Grades 3 – 4

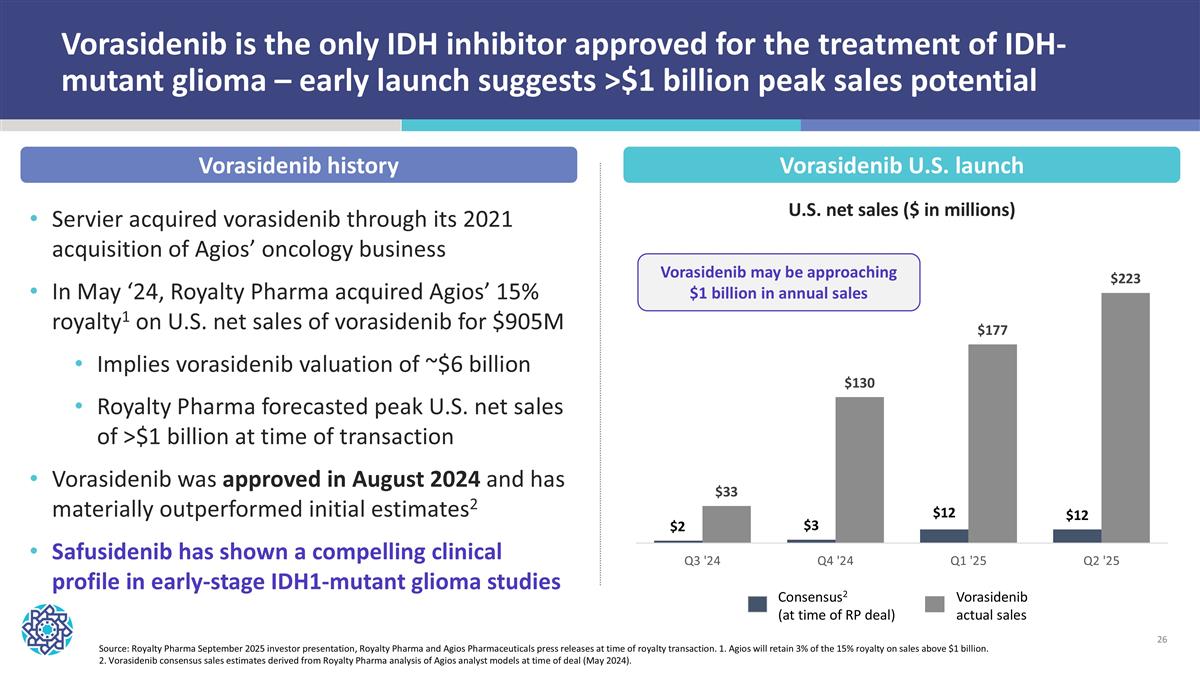

Vorasidenib is the only IDH inhibitor approved for the treatment of IDH-mutant glioma – early launch suggests >$1 billion peak sales potential Servier acquired vorasidenib through its 2021 acquisition of Agios’ oncology business In May ‘24, Royalty Pharma acquired Agios’ 15% royalty1 on U.S. net sales of vorasidenib for $905M Implies vorasidenib valuation of ~$6 billion Royalty Pharma forecasted peak U.S. net sales of >$1 billion at time of transaction Vorasidenib was approved in August 2024 and has materially outperformed initial estimates2 Safusidenib has shown a compelling clinical profile in early-stage IDH1-mutant glioma studies Source: Royalty Pharma September 2025 investor presentation, Royalty Pharma and Agios Pharmaceuticals press releases at time of royalty transaction. 1. Agios will retain 3% of the 15% royalty on sales above $1 billion. 2. Vorasidenib consensus sales estimates derived from Royalty Pharma analysis of Agios analyst models at time of deal (May 2024). Vorasidenib U.S. launch U.S. net sales ($ in millions) Vorasidenib history Vorasidenib may be approaching $1 billion in annual sales Consensus2 (at time of RP deal) Vorasidenib actual sales

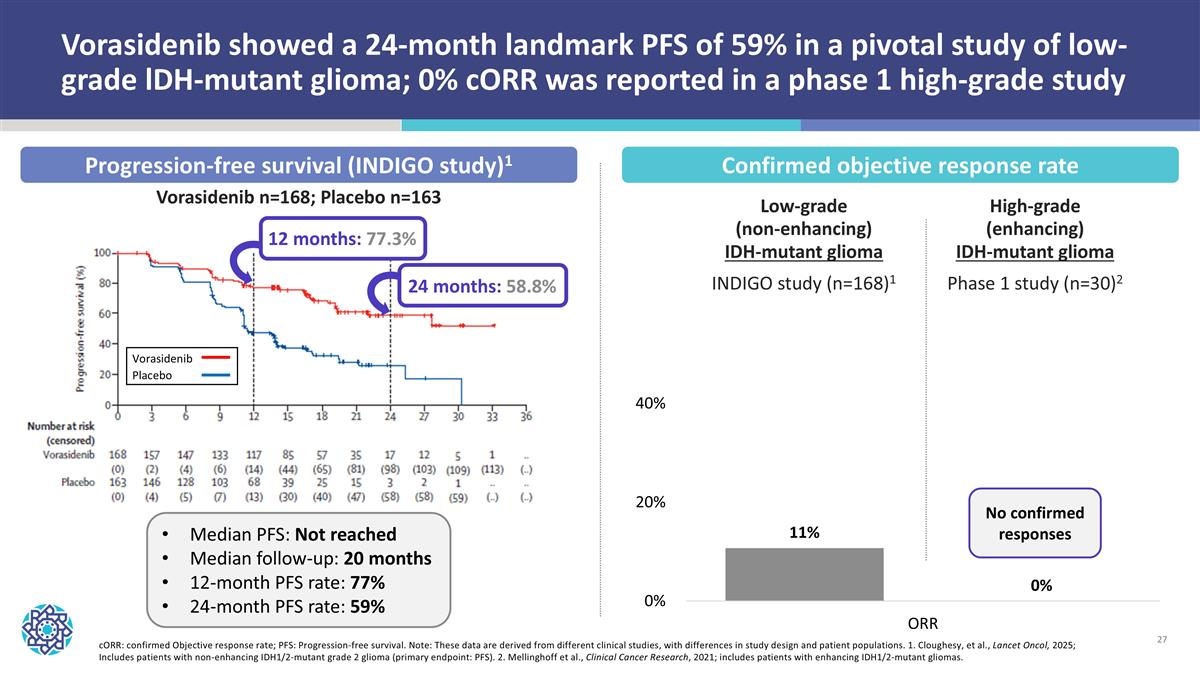

cORR: confirmed Objective response rate; PFS: Progression-free survival. Note: These data are derived from different clinical studies, with differences in study design and patient populations. 1. Cloughesy, et al., Lancet Oncol, 2025; Includes patients with non-enhancing IDH1/2-mutant grade 2 glioma (primary endpoint: PFS). 2. Mellinghoff et al., Clinical Cancer Research, 2021; includes patients with enhancing IDH1/2-mutant gliomas. Vorasidenib showed a 24-month landmark PFS of 59% in a pivotal study of low-grade lDH-mutant glioma; 0% cORR was reported in a phase 1 high-grade study Confirmed objective response rate Progression-free survival (INDIGO study)1 Median PFS: Not reached Median follow-up: 20 months 12-month PFS rate: 77% 24-month PFS rate: 59% Vorasidenib n=168; Placebo n=163 Vorasidenib Placebo 12 months: 77.3% 24 months: 58.8% Low-grade (non-enhancing) IDH-mutant glioma INDIGO study (n=168)1 High-grade (enhancing) IDH-mutant glioma Phase 1 study (n=30)2 No confirmed responses

BID: Twice-a-day dosing; CR: Complete Response; ORR: Objective response rate; PFS: Progression-free survival; PR: Partial response. Note: These data are derived from different clinical studies, with differences in study design and patient populations. 1. Arakawa et al., Neuro-Oncology, 2025; includes patients with non-enhancing IDH1-mutant grade 2 glioma (primary endpoint: ORR). 2. Natsume et al., Neuro-Oncology, 2023; includes patients with enhancing IDH1-mutant gliomas; two complete responses represent one complete response in a grade 4 astrocytoma and one complete response in the target lesions of a grade 3 oligodendroglioma (with stable disease in non-target lesions). Safusidenib has shown promising efficacy signals, including a 24-month landmark PFS of 88% in low-grade and 17% cORR including 2 CRs in high-grade IDH1-mutant glioma 6 12 18 24 30 36 Months 0 26 23 23 20 5 0 27 No. at Risk All Subjects 100.0 80.0 60.0 40.0 20.0 0.0 Progression-free Survival (%) 12 months: 96.3% 24 months: 87.9% Median PFS: Not reached Median follow-up: 28 months 12-month PFS rate: 96% 24-month PFS rate: 88% n= 27 (250mg BID) Confirmed objective response rate Progression-free survival (J201 study)1 Low-grade (non-enhancing) IDH1-mutant glioma J201 study (n=27)1 (250mg BID) High-grade (enhancing) IDH1-mutant glioma Phase 1 study (n=35)2 2 of 6 high-grade responses were CRs PRs: 11% CRs: 6%

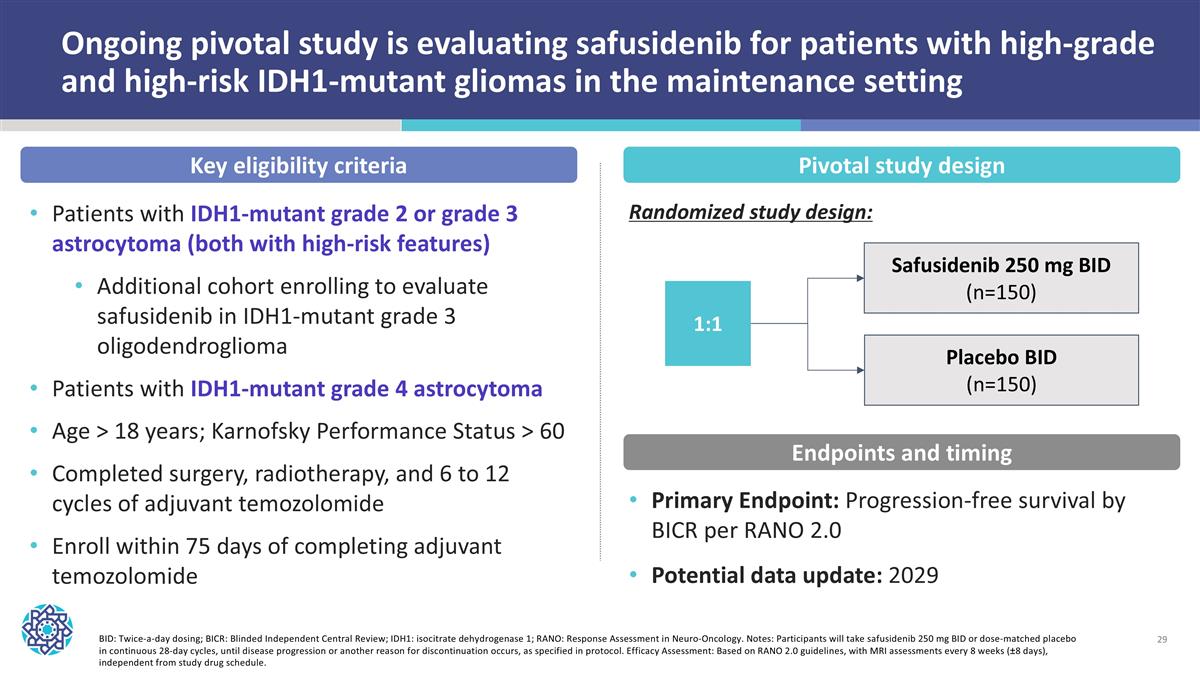

Ongoing pivotal study is evaluating safusidenib for patients with high-grade and high-risk IDH1-mutant gliomas in the maintenance setting BID: Twice-a-day dosing; BICR: Blinded Independent Central Review; IDH1: isocitrate dehydrogenase 1; RANO: Response Assessment in Neuro-Oncology. Notes: Participants will take safusidenib 250 mg BID or dose-matched placebo in continuous 28-day cycles, until disease progression or another reason for discontinuation occurs, as specified in protocol. Efficacy Assessment: Based on RANO 2.0 guidelines, with MRI assessments every 8 weeks (±8 days), independent from study drug schedule. 1:1 Placebo BID (n=150) Safusidenib 250 mg BID (n=150) Key eligibility criteria Pivotal study design Primary Endpoint: Progression-free survival by BICR per RANO 2.0 Potential data update: 2029 Endpoints and timing Patients with IDH1-mutant grade 2 or grade 3 astrocytoma (both with high-risk features) Additional cohort enrolling to evaluate safusidenib in IDH1-mutant grade 3 oligodendroglioma Patients with IDH1-mutant grade 4 astrocytoma Age > 18 years; Karnofsky Performance Status > 60 Completed surgery, radiotherapy, and 6 to 12 cycles of adjuvant temozolomide Enroll within 75 days of completing adjuvant temozolomide Randomized study design:

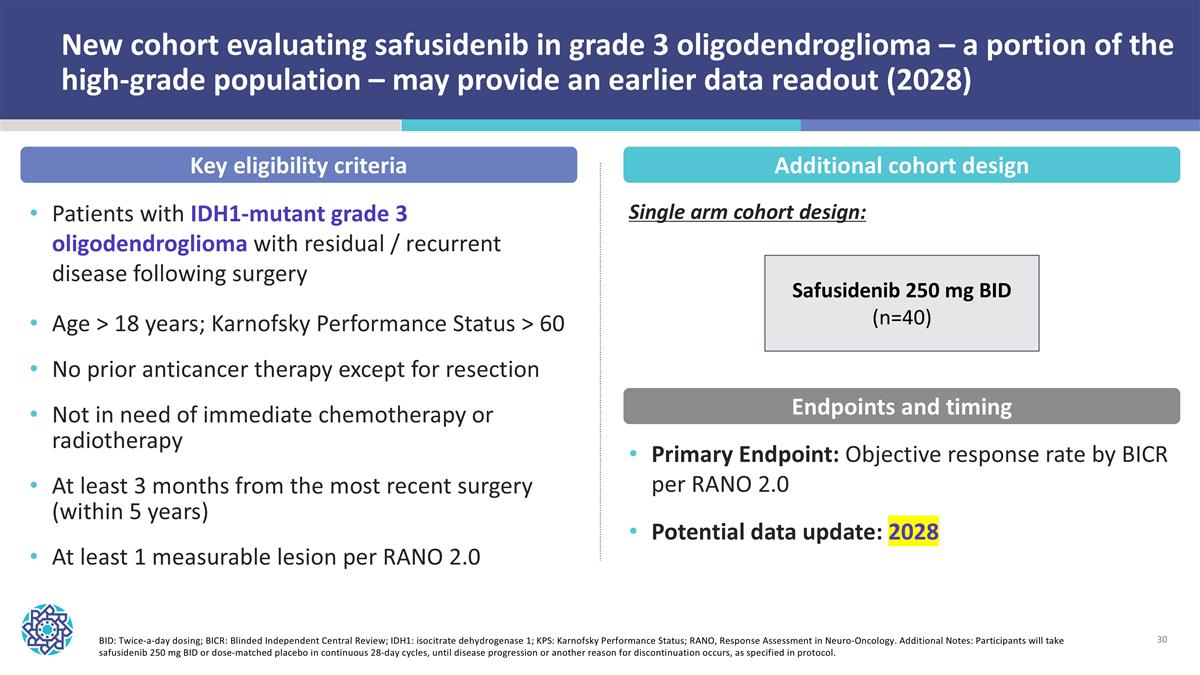

New cohort evaluating safusidenib in grade 3 oligodendroglioma – a portion of the high-grade population – may provide an earlier data readout (2028) BID: Twice-a-day dosing; BICR: Blinded Independent Central Review; IDH1: isocitrate dehydrogenase 1; KPS: Karnofsky Performance Status; RANO, Response Assessment in Neuro-Oncology. Additional Notes: Participants will take safusidenib 250 mg BID or dose-matched placebo in continuous 28-day cycles, until disease progression or another reason for discontinuation occurs, as specified in protocol. Key eligibility criteria Patients with IDH1-mutant grade 3 oligodendroglioma with residual / recurrent disease following surgery Age > 18 years; Karnofsky Performance Status > 60 No prior anticancer therapy except for resection Not in need of immediate chemotherapy or radiotherapy At least 3 months from the most recent surgery (within 5 years) At least 1 measurable lesion per RANO 2.0 Additional cohort design Primary Endpoint: Objective response rate by BICR per RANO 2.0 Potential data update: 2028 Endpoints and timing Safusidenib 250 mg BID (n=40) Single arm cohort design:

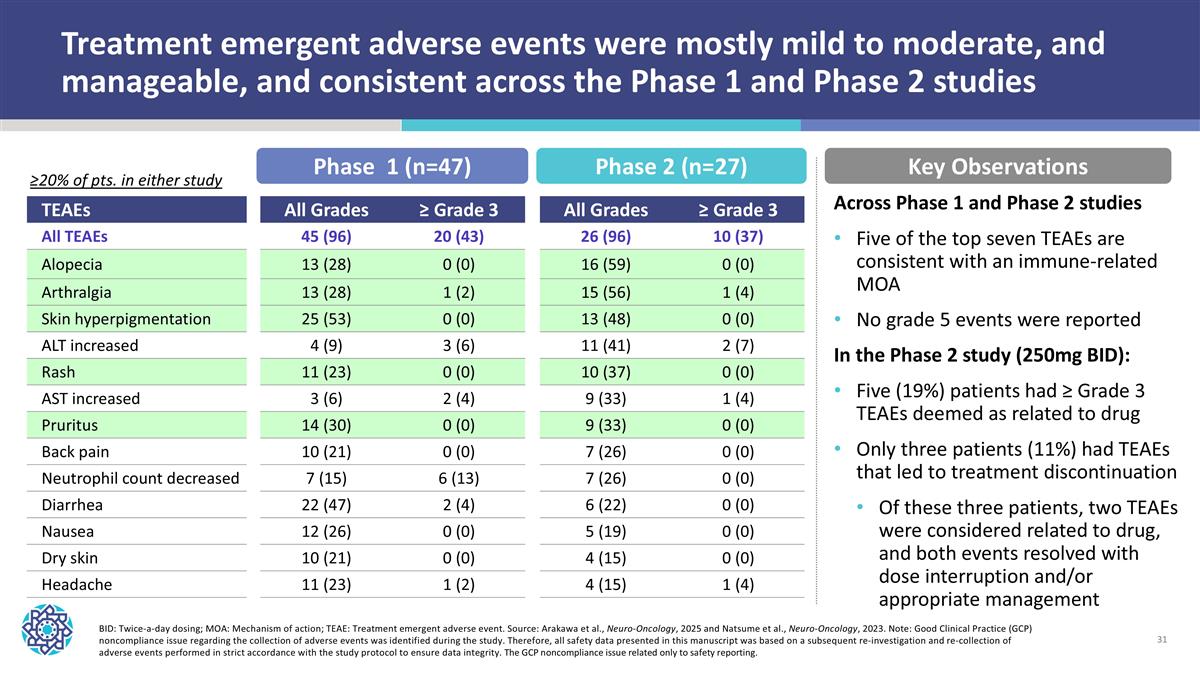

TEAEs All Grades ≥ Grade 3 All Grades ≥ Grade 3 All TEAEs 45 (96) 20 (43) 26 (96) 10 (37) Alopecia 13 (28) 0 (0) 16 (59) 0 (0) Arthralgia 13 (28) 1 (2) 15 (56) 1 (4) Skin hyperpigmentation 25 (53) 0 (0) 13 (48) 0 (0) ALT increased 4 (9) 3 (6) 11 (41) 2 (7) Rash 11 (23) 0 (0) 10 (37) 0 (0) AST increased 3 (6) 2 (4) 9 (33) 1 (4) Pruritus 14 (30) 0 (0) 9 (33) 0 (0) Back pain 10 (21) 0 (0) 7 (26) 0 (0) Neutrophil count decreased 7 (15) 6 (13) 7 (26) 0 (0) Diarrhea 22 (47) 2 (4) 6 (22) 0 (0) Nausea 12 (26) 0 (0) 5 (19) 0 (0) Dry skin 10 (21) 0 (0) 4 (15) 0 (0) Headache 11 (23) 1 (2) 4 (15) 1 (4) BID: Twice-a-day dosing; MOA: Mechanism of action; TEAE: Treatment emergent adverse event. Source: Arakawa et al., Neuro-Oncology, 2025 and Natsume et al., Neuro-Oncology, 2023. Note: Good Clinical Practice (GCP) noncompliance issue regarding the collection of adverse events was identified during the study. Therefore, all safety data presented in this manuscript was based on a subsequent re-investigation and re-collection of adverse events performed in strict accordance with the study protocol to ensure data integrity. The GCP noncompliance issue related only to safety reporting. Treatment emergent adverse events were mostly mild to moderate, and manageable, and consistent across the Phase 1 and Phase 2 studies Phase 1 (n=47) Phase 2 (n=27) ≥20% of pts. in either study Key Observations Across Phase 1 and Phase 2 studies Five of the top seven TEAEs are consistent with an immune-related MOA No grade 5 events were reported In the Phase 2 study (250mg BID): Five (19%) patients had ≥ Grade 3 TEAEs deemed as related to drug Only three patients (11%) had TEAEs that led to treatment discontinuation Of these three patients, two TEAEs were considered related to drug, and both events resolved with dose interruption and/or appropriate management

NUV-868 | BETi Advanced solid tumors Completed Phase 1 and Phase 1b studies Future indications Currently evaluating next steps for program

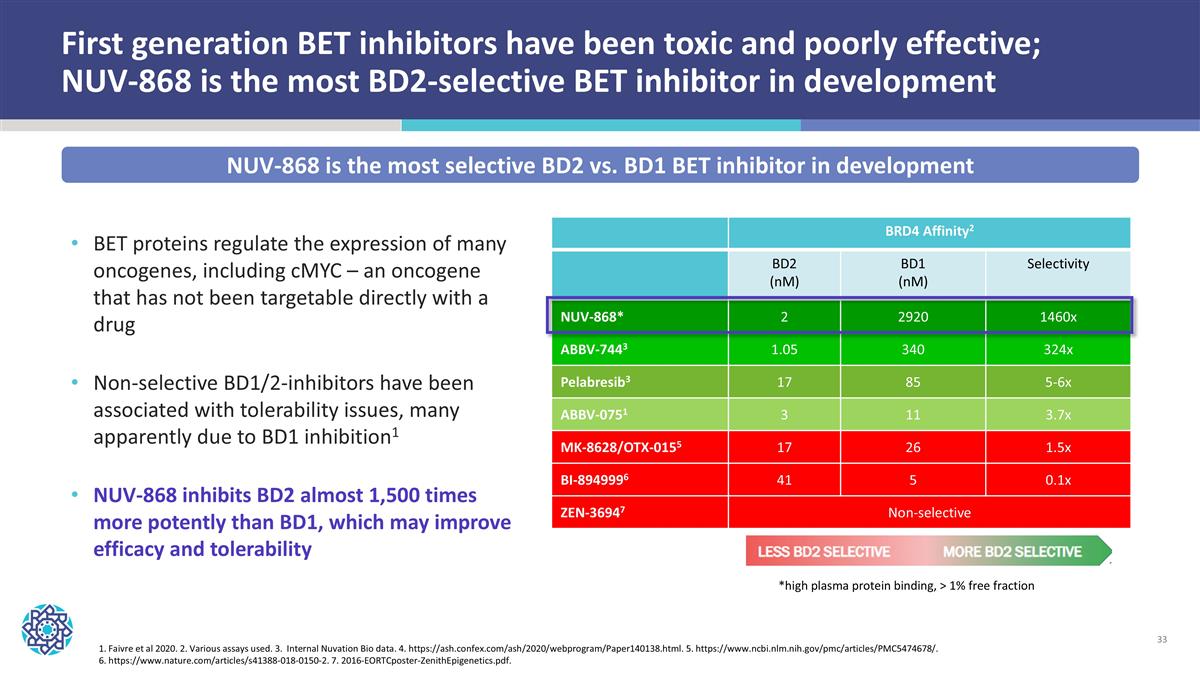

First generation BET inhibitors have been toxic and poorly effective; NUV-868 is the most BD2-selective BET inhibitor in development BET proteins regulate the expression of many oncogenes, including cMYC – an oncogene that has not been targetable directly with a drug Non-selective BD1/2-inhibitors have been associated with tolerability issues, many apparently due to BD1 inhibition1 NUV-868 inhibits BD2 almost 1,500 times more potently than BD1, which may improve efficacy and tolerability 1. Faivre et al 2020. 2. Various assays used. 3. Internal Nuvation Bio data. 4. https://ash.confex.com/ash/2020/webprogram/Paper140138.html. 5. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5474678/. 6. https://www.nature.com/articles/s41388-018-0150-2. 7. 2016-EORTCposter-ZenithEpigenetics.pdf. BRD4 Affinity2 BD2 (nM) BD1 (nM) Selectivity NUV-868* 2 2920 1460x ABBV-7443 1.05 340 324x Pelabresib3 17 85 5-6x ABBV-0751 3 11 3.7x MK-8628/OTX-0155 17 26 1.5x BI-8949996 41 5 0.1x ZEN-36947 Non-selective *high plasma protein binding, > 1% free fraction NUV-868 is the most selective BD2 vs. BD1 BET inhibitor in development

DDC Platform Advanced solid tumors Evaluating preclinical candidates

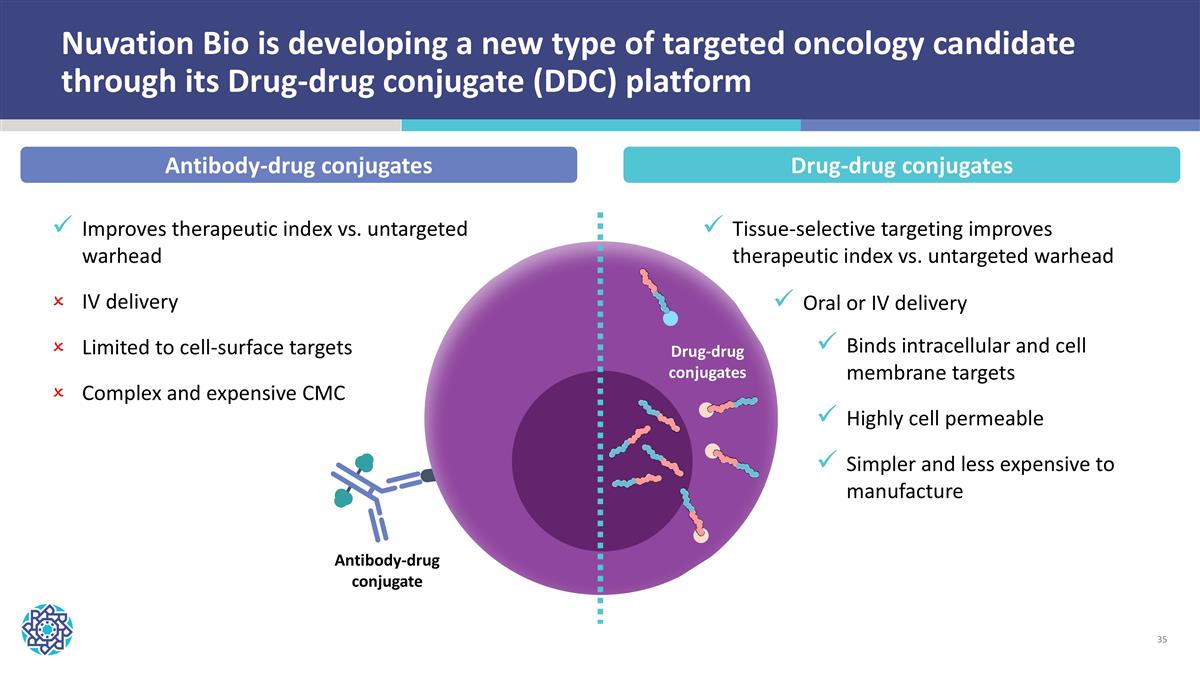

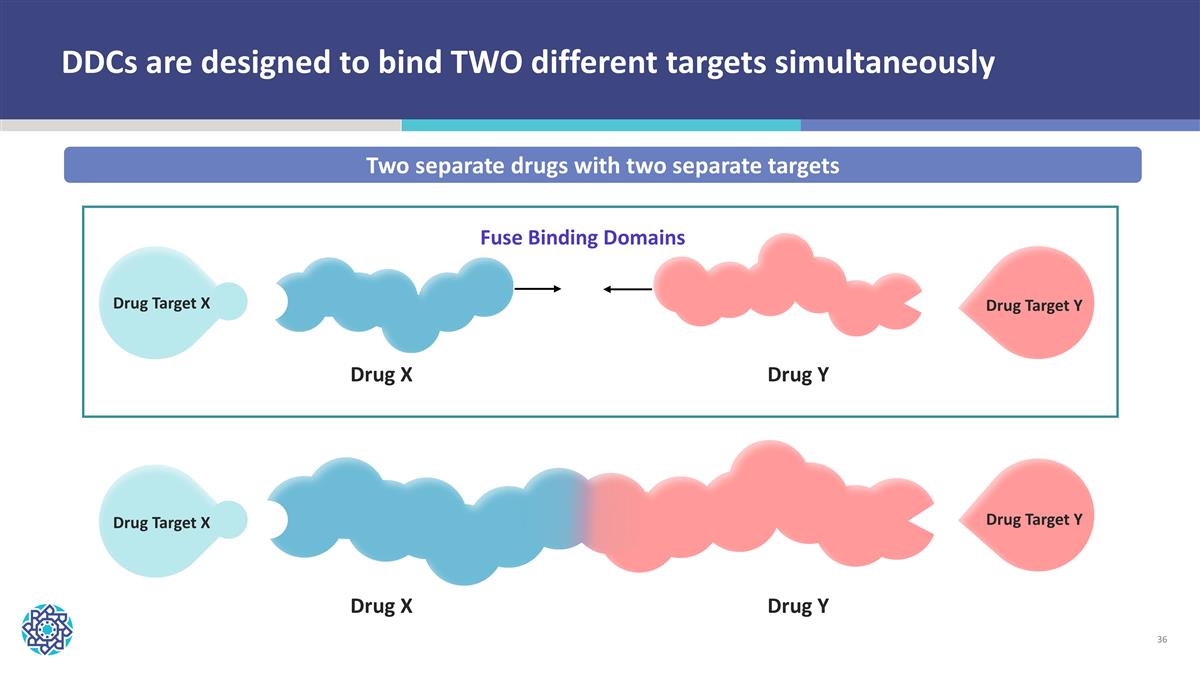

Oral or IV delivery Improves therapeutic index vs. untargeted warhead IV delivery Limited to cell-surface targets Complex and expensive CMC Antibody-drug conjugate Nuvation Bio is developing a new type of targeted oncology candidate through its Drug-drug conjugate (DDC) platform Drug-drug conjugates Tissue-selective targeting improves therapeutic index vs. untargeted warhead Binds intracellular and cell membrane targets Highly cell permeable Simpler and less expensive to manufacture Antibody-drug conjugates Drug-drug conjugates

DDCs are designed to bind TWO different targets simultaneously Two separate drugs with two separate targets Drug Target X Drug Target Y Drug X Drug Y Fuse Binding Domains Drug Target X Drug Target Y Drug X Drug Y

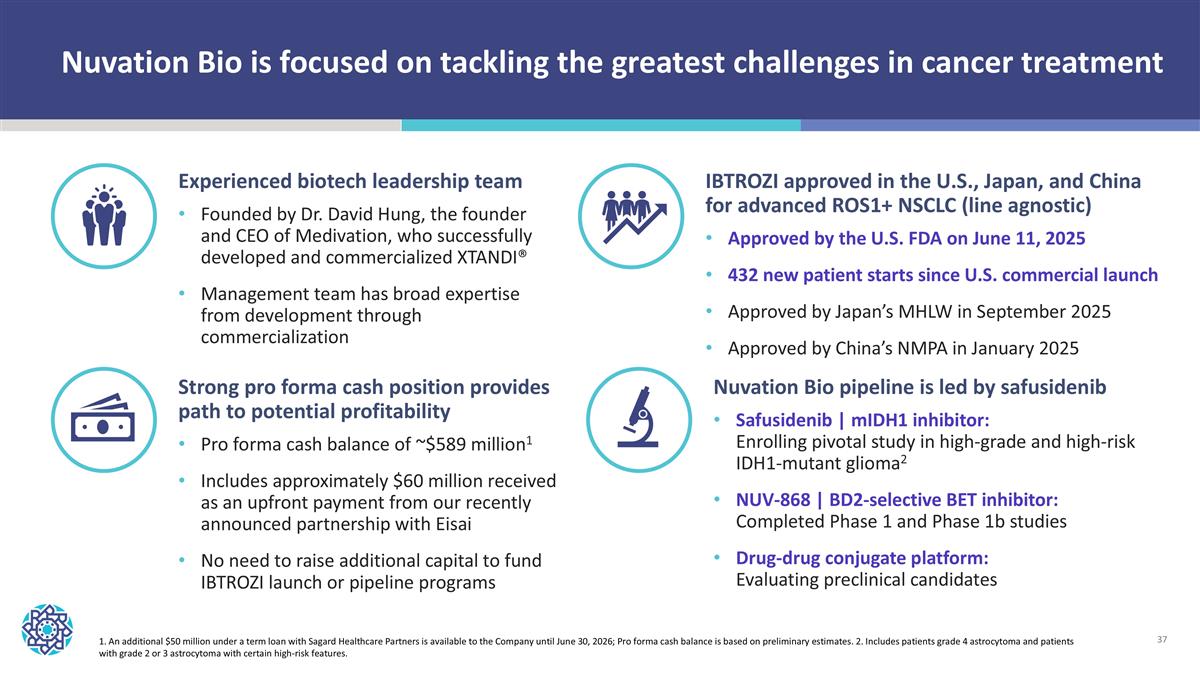

Nuvation Bio is focused on tackling the greatest challenges in cancer treatment Nuvation Bio pipeline is led by safusidenib Safusidenib | mIDH1 inhibitor: Enrolling pivotal study in high-grade and high-risk IDH1-mutant glioma2 NUV-868 | BD2-selective BET inhibitor: Completed Phase 1 and Phase 1b studies Drug-drug conjugate platform: Evaluating preclinical candidates Strong pro forma cash position provides path to potential profitability Pro forma cash balance of ~$589 million1 Includes approximately $60 million received as an upfront payment from our recently announced partnership with Eisai No need to raise additional capital to fund IBTROZI launch or pipeline programs Experienced biotech leadership team Founded by Dr. David Hung, the founder and CEO of Medivation, who successfully developed and commercialized XTANDI® Management team has broad expertise from development through commercialization IBTROZI approved in the U.S., Japan, and China for advanced ROS1+ NSCLC (line agnostic) Approved by the U.S. FDA on June 11, 2025 432 new patient starts since U.S. commercial launch Approved by Japan’s MHLW in September 2025 Approved by China’s NMPA in January 2025 1. An additional $50 million under a term loan with Sagard Healthcare Partners is available to the Company until June 30, 2026; Pro forma cash balance is based on preliminary estimates. 2. Includes patients grade 4 astrocytoma and patients with grade 2 or 3 astrocytoma with certain high-risk features.