| | |  |

Title of each class | | | Trading Symbol | | | Name of each exchange on which registered |

Common shares, par value $0.01 per share | | | [ ] | | | New York Stock Exchange (“NYSE”) |

Large Accelerated Filer ☐ | | | Accelerated Filer ☐ | | | Non-accelerated Filer ☒ |

| | | | | Emerging Growth Company ☐ |

† | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

☐ | | | U.S. GAAP |

☒ | | | International Financial Reporting Standards as issued by the International Accounting Standards Board |

☐ | | | Other |

| | | Page | ||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | |||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | |||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | |||||

• | our realization of the expected benefits of the Redomiciliation; |

• | our future operating and financial results and our future financial condition, including our ability to obtain financing in the future to fund capital expenditures, acquisitions and other general corporate activities; |

• | our business strategy and expected capital spending or operating expenses, including drydocking and insurance costs; |

• | global and regional economic and political conditions, including piracy, war including but not limited to, the war between Russia and Ukraine, and other conflicts including but not limited to, the conflict in Israel; |

• | the health and condition of world economies and currencies, including the value of the U.S. dollar relative to other currencies and the impact of the COVID-19 pandemic; |

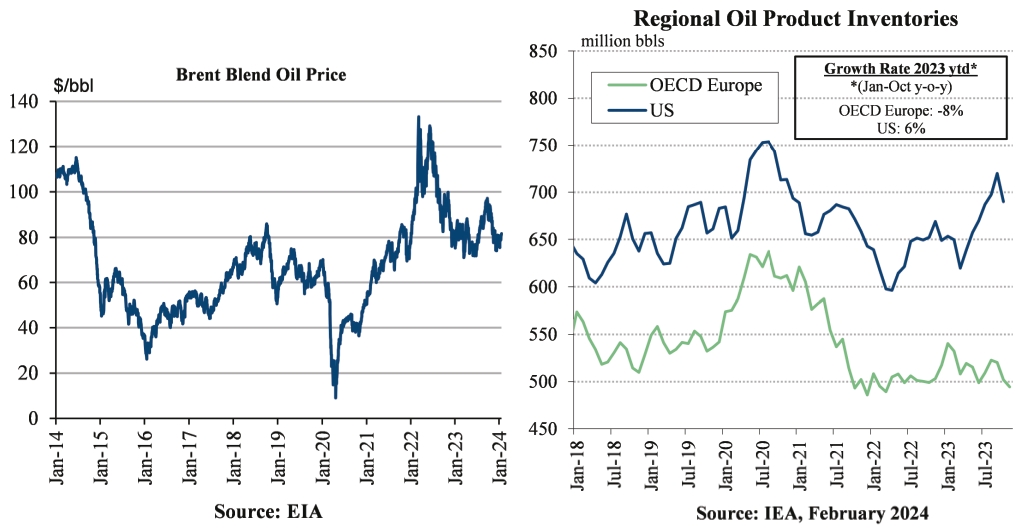

• | fluctuations in commodity prices, interest rates and foreign exchange rates; |

• | our expectations of the availability of vessels to purchase, the time it may take to construct new vessels and vessels’ useful lives as well as our plans to acquire vessels and any associated contracts thereof; |

• | expected trends in our industry, including those discussed under “Item 4. Information on the Company – B. Business Overview – Industry”; |

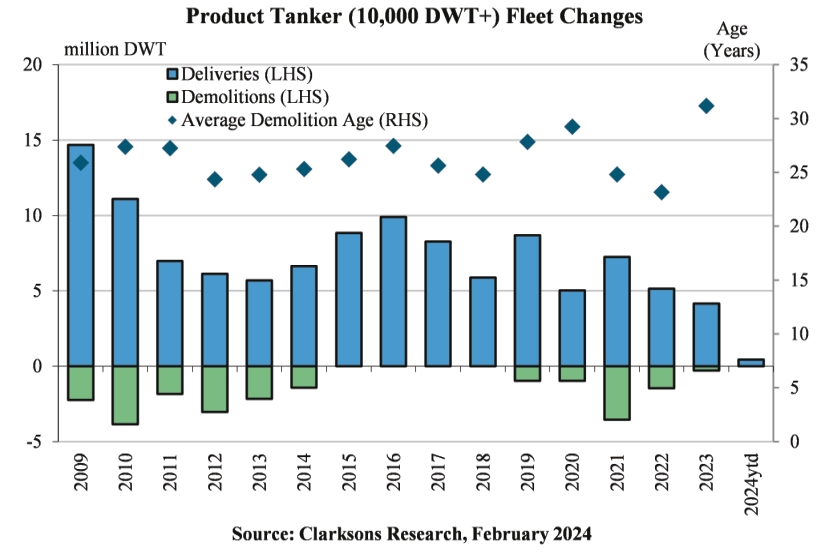

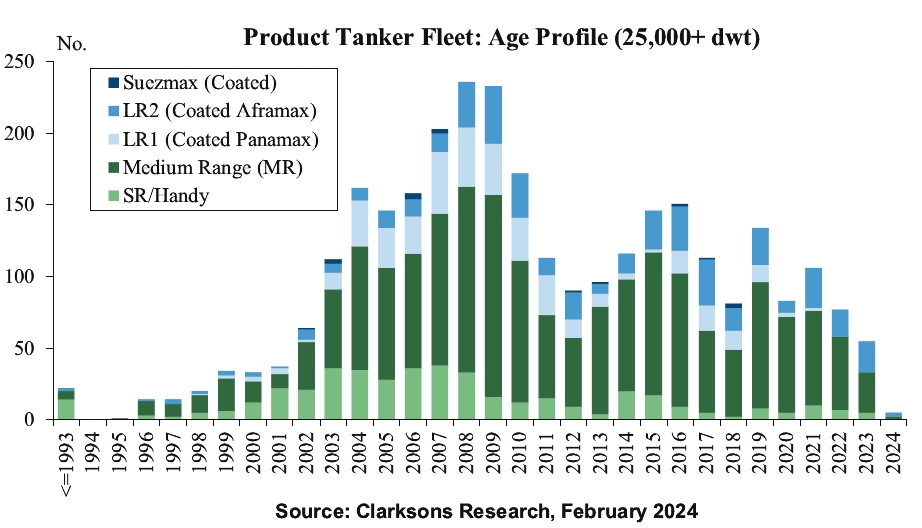

• | expected trends in the global fleet of chemical and product tanker vessels, including expected scrapping; |

• | expected trends in the supply and demand for products we transport; |

• | expected employment of the vessels in our Combined Fleet, including our ability to enter into time charters after our current charters expire and our ability to earn income in the spot market; |

• | expected market trends and expected impact of sanctions; |

• | statements about expected trends in the shipping market, including charter rates for chemical and product tankers and factors affecting supply and demand for chemical and product tankers; |

• | intention to reduce carbon emissions intensity; and |

• | the future price of our common shares. |

• | general economic, political, security, and business conditions, including the development of the ongoing war between Russia and Ukraine and conflict in Israel, sanctions, and other measures; |

• | general chemical and product tanker market conditions, including fluctuations in charter rates, vessel values and factors affecting supply and demand of crude oil and petroleum products or chemicals, including the impact of the COVID-19 pandemic and the ongoing efforts throughout the world to contain it; |

• | changes in expected trends in scrapping of vessels; |

• | changes in demand in the chemical and product tanker industry, including the market for LR2, LR1, MR and Handy chemical and product tankers; |

• | competition within our industry, including changes in the supply of chemical and product tankers; |

• | our ability to successfully employ the vessels in our Hafnia Fleet and the vessels under our commercial management; |

• | changes in our operating expenses, including fuel or cooling down prices and lay-up costs when vessels are not on charter, drydocking and insurance costs; |

• | our ability to comply with, and our liabilities under, governmental, tax, environmental and safety laws and regulations; |

• | changes in governmental regulation, tax and trade matters and actions taken by regulatory authorities; |

• | potential disruption of shipping routes and demand due to accidents, piracy or political events; |

• | vessel breakdowns and instances of loss of hire; |

• | vessel underperformance and related warranty claims; |

• | our expectations regarding the availability of vessel acquisitions and our ability to complete the acquisition of newbuild vessels; |

• | our ability to procure or have access to financing and refinancing; |

• | our continued borrowing availability under our credit facilities and compliance with the financial covenants therein; |

• | fluctuations in commodity prices, foreign currency exchange and interest rates; |

• | potential conflicts of interest involving our significant shareholders; |

• | our ability to pay dividends; |

• | technological developments; |

• | our limited operating history following the merger between Hafnia Tankers and BW Tankers in 2019 and following our acquisition of the CTI Fleet (as defined in “Item 4. Information on the Company – A. History and Development of the Company” below) in 2022; |

• | the impact of increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to environmental, social and governance initiatives, objectives and compliance; |

• | other factors that may affect our financial condition, liquidity and results of operations; and |

• | other risk factors discussed under “Item 3. Key Information – D. Risk Factors.” |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Directors and Senior Management |

Name | | | Position |

Mikael Øpstun Skov | | | Chief Executive Officer |

Petrus Wouter Van Echtelt | | | Chief Financial Officer |

Andreas Sohmen-Pao | | | Chair |

Erik Bartnes | | | Director |

Peter Graham Read | | | Director |

Donald John Ridgway | | | Director |

Su Yin Anand | | | Director |

Advisers |

Auditors |

OFFER STATISTICS AND EXPECTED TIMETABLE |

Offer Statistics |

Method And Expected Timetable |

KEY INFORMATION |

[Reserved] |

Capitalization and Indebtedness |

| | | As at December 31, 2023 | |

| | | (in thousands of $) | |

Cash: | | | |

Cash:(1) | | | • |

Cash equivalents: | | | • |

Total cash and cash equivalents: | | | • |

| | | ||

Capitalization: | | | |

Debts: | | | • |

Borrowings (current): | | | • |

Borrowings (non-current) | | | • |

Total debt: | | | • |

| | | ||

Equity: | | | |

Share capital: | | | • |

Share premium: | | | • |

Contributed surplus: | | | • |

Other reserves: | | | • |

Treasury shares: | | | • |

Retained earnings: | | | • |

Total shareholders’ equity: | | | • |

| | | ||

Total capitalization: | | | • |

(1) | This does not include cash retained in the commercial pools or restricted cash. |

Reasons for the Offer and Use of Proceeds |

Risk Factors |

• | Developments in the global economy and the shipping industry, including the chemical and product tanker market, resulting in a downturn in the hire and freight rates could adversely affect our business, financial condition, cash flows and results of operation. |

• | The tanker industry is cyclical and volatile, which may adversely affect our earnings and available cash flow. |

• | The occurrence of ‘peak oil’ may have a material adverse effect on our future performance, results of operations, cash flows and financial position. |

• | A shift in consumer demand from oil towards other energy sources or changes to trade patterns for refined oil products may have a material adverse effect on our business. |

• | We are dependent on spot-oriented pools and spot charters and any decrease in spot charter rates in the future may have a material adverse effect on our business. |

• | Changes in global trading patterns, particularly but not limited to the trading patterns for oil and oil products, may have a negative impact on our business. |

• | An over-supply of tanker capacity may lead to a reduction of charter rates, which may limit our ability to operate the vessels in our Combined Fleet profitably. |

• | Tanker rates are subject to seasonal variations in demand and cyclical fluctuations. |

• | An economic slowdown or changes in the economic and political environment in the Asia Pacific region could have a material adverse effect on our business, financial condition, and results of operations. |

• | The continuing effects of the COVID-19 pandemic and other outbreaks of epidemic and pandemic diseases and governmental responses thereto could materially and adversely affect our business, financial condition, and results of operations. |

• | Acts of piracy or other attacks on ocean-going vessels could adversely affect our business. |

• | An increase in frequency salvage operations, including immigrant salvage operations in the Mediterranean, could adversely affect our business. |

• | The smuggling of drugs or other contraband onto vessels in our Combined Fleet may lead to governmental claims against us. |

• | We may be exposed to fraudulent behaviour, which may have a material adverse effect on our future performance, results of operations, cash flows and financial position. |

• | If we, including the Pools, cannot meet our customers’ quality and compliance requirements, we may not be able to operate the vessels in our Combined Fleet profitably which could have an adverse effect on our future performance, results of operations, cash flows and financial position. |

• | Fluctuations in exchange rates and non-convertibility of currencies could result in financial losses to us. |

• | Increased requirements relating to the fuel used by vessels may require us to retrofit our Hafnia Vessels and/or JV Vessels and may cause us to incur significant costs. |

• | We are subject to complex laws and regulations, including environmental laws and regulations, that can increase our liability and adversely affect our business, results of operations, cash flows and financial condition and our available cash. |

• | Developments in safety and environmental requirements relating to the recycling of vessels may result in escalated and unexpected costs. |

• | Increased inspection procedures could increase costs and disrupt our business. |

• | Our global operations expose us to global risks, such as political instability, terrorist or other attacks, war, and international hostilities which may affect the tanker industry and adversely affect our business. |

• | If vessels in our Combined Fleet call on ports located in countries or territories that are subject to sanctions or embargoes imposed by the United States, the European Union, the United Kingdom, or other governments, it could result in monetary fines or other penalties imposed on us and may adversely affect our reputation and the market for our securities. |

• | Disruptions to shipping in the Red Sea could have a negative effect on our operations, business, cash flows, financial condition, and results of operation. |

• | We may be subject to litigation that, if not resolved in our favour and not sufficiently insured against, could have a material adverse effect on us. |

• | Maritime claimants could arrest or attach vessels in our Combined Fleet, which would have a negative effect on our cash flows. |

• | Governments could requisition vessels in our Combined Fleet during a period of war or emergency, which may negatively impact our business, financial condition, cash flows, results of operations, available cash and ability to pay dividends. |

• | Technological innovation could lower our vessel utilization, reduce our charter rates and/or reduce the value of our Hafnia Vessels and JV Vessels. |

• | Global climate change may increase the frequency and severity of weather events and the losses resulting therefrom, which could have a material adverse effect on the economies in the markets in which we operate or plan to operate in the future and therefore on our business. |

• | Increasing scrutiny and changing expectations from investors, lenders, regulators, and other market participants with respect to our Environmental, Social and Governance (“ESG”) policies may impose additional costs on us or expose us to additional risks. |

• | Potential labour disruptions could interfere with our operations and have an adverse effect on our business. |

• | Compliance with international safety regulations and other vessel requirements verified by classification societies may be costly and noncompliance with such regulations and requirements could adversely affect our business, financial condition, and results of operations. |

• | Operation and management of a chemical and product tanker fleet involves a high degree of risk. |

• | Potential delays and cost overruns of newbuilds or other failures by our counterparties under our newbuild contracts in meeting their obligations may result in increased costs, loss of revenue and liquidated damages or could otherwise adversely affect our business. |

• | International, regional, and local competition rules and regulations for the shipping industry may adversely affect our business, financial condition and results of operations. |

• | We may in the future experience difficulties in employing and retaining the personnel required to maintain and develop our business and a shortage of relevantly skilled personnel in the future may have material adverse consequences for our operations, business, and financial condition. |

• | We may have difficulty managing our planned growth, if any, properly. |

• | An increase in operating expenses and voyage expenses would decrease our earnings and available cash and could have a material adverse effect on our future performance, results of operations, cash flows, and financial position, and rising inflation may impact our operating expenses and voyage expenses as well as our access to financing and the market price of our common shares. |

• | Breakdowns in our information technology, including as a result of cyberattacks, disruptions, failures, or security breaches may negatively impact our business, including our ability to service customers, and may have a material adverse effect on our future performance, results of operations, cash flows and financial position. |

• | The market values of our Hafnia Vessels and JV Vessels may fluctuate substantially potentially leading to impairment charges, losses upon the sale of a vessel or have other material adverse effects for our business, financing agreements, or financial condition. |

• | From time to time, we make investments in companies and/or projects in the shipping industry and companies and/or projects not in the shipping industry. We cannot assure that we will make a return on these investments and the underlying projects may be delayed or may fail entirely. |

• | Increased levels of competition in the chemical and product tanker industry could adversely affect our business. |

• | We will be required to make substantial additional capital expenditures in order to maintain the quality and operating capacity of our Hafnia Vessels, to acquire new vessels to replace our existing vessels before or at the end of their useful lives and in the event that we should decide to expand the number of vessels in our Hafnia Fleet and if we do not set aside funds or are unable to borrow or raise funds in the future or if we are unable to correctly time our capital expenditures, it may adversely affect our revenue, business, results of operations, financial condition and available cash. |

• | We are subject to certain risks with respect to our counterparties on contracts, and failure of such counterparties to meet their obligations could cause us to suffer losses or negatively impact our results of operations, financial condition, and cash flows. |

• | Insurance may be difficult to obtain, and if obtained, may not be adequate to cover our losses that may result from our operations due to the inherent operational risks of the tanker industry. |

• | Because we obtain some of our insurance through protection and indemnity associations, which result in significant expenses to us, we may be required to make additional premium payments. |

• | Failure to comply with the U.S. Foreign Corrupt Practices Act, the United Kingdom Bribery Act 2010, the Bermuda Bribery Act 2016, the Singapore Prevention of Corruption Act 1960 or other applicable anti-bribery regulations, anti-corruption regulations, anti-money laundering regulations or any other laws affecting our operations could result in fines, criminal penalties, contract terminations and could have an adverse effect on our business, reputation, and financial condition. |

• | If we are unable to operate our financial and operations systems effectively, our performance may be affected. |

• | Our failure to comply with data privacy laws could damage our customer relationships and expose us to litigation. |

• | Due to our lack of diversification, adverse developments in the sector for maritime transportation of oil products and chemicals could adversely affect our business. |

• | We are to a certain extent dependent on the continuation of the Pools and termination or a withdrawal of a majority of the pool participants may adversely affect our business. |

• | We depend on our subsidiaries to distribute funds to us. |

• | We derive a significant portion of our revenue from our top five customers, and the loss or default of any such customers could result in a significant loss of revenue and adversely affect our business. |

• | We have a limited operating history following the completion of the CTI Transaction. |

• | Our major shareholder, currently BW Group Limited, may have interests that are different from our interests and the interests of our other shareholders. |

• | We are incorporated in Bermuda and the rights of our shareholders may differ from the rights and protections typically offered to shareholders of a U.S. corporation organised in Delaware. |

• | We have anti-takeover provisions in our Bye-laws that could discourage an acquisition of us by others, even if an acquisition would be beneficial to our shareholders and may prevent replacement or removal of the members of our Board of Directors. |

• | It may be difficult to serve process on or enforce a U.S. judgment against us, our officers, our directors and the experts named in this Registration Statement because we are a foreign corporation incorporated in Bermuda and, following the Redomiciliation, will be a foreign corporation incorporated in Singapore. |

• | The international nature of our operations may make the outcome of any bankruptcy proceedings difficult to predict. |

• | Our Bye-laws contain an exclusive jurisdiction provision applicable to certain types of actions and after the Redomiciliation, if approved by our shareholders, our Constitution will contain an exclusive jurisdiction provision applicable to certain types of actions. These exclusive jurisdiction provisions could limit the ability of our shareholders to obtain a favourable judicial forum for disputes against us or our directors or officers. |

• | Our Bye-laws restrict shareholders from bringing legal action against our officers and directors. |

• | Our future capital needs are uncertain and we may need to raise additional funds in the future. |

• | Servicing our current or future indebtedness limits funds available for other purposes and if we cannot service our debt, we may lose the vessels in our Hafnia Fleet. |

• | Our credit facilities and lease financing agreements contain restrictive and financial covenants which may limit our ability to conduct certain activities, and further, we may be unable to comply with such covenants, which could result in an event of default under the terms of such agreements. |

• | Change of control and mandatory repayment provisions contained in certain of our credit facilities may lead to a foreclosure of our Hafnia Fleet. |

• | We may be exposed to risk in relation to our use of financial market products. |

• | As a Bermuda exempted company incorporated under Bermuda law, our operations may be subject to economic substance requirements. |

• | A change in tax laws in any country in which we operate, including, but not limited to the imposition of freight taxes, or disagreements with tax authorities could adversely affect us. |

• | A change to the way in which our international shipping income is taxed in Singapore could have an adverse effect on our business and results of operations. |

• | We could be treated as or become a passive foreign investment company (“PFIC”) for U.S. federal income tax purposes, which could have adverse U.S. federal income tax consequences to U.S. shareholders. |

• | We may have to pay tax on U.S. sourced income, which would reduce our earnings. |

• | The Organization for Economic Cooperation and Development (“OECD”), Bermuda and other jurisdictions are considering or have passed measures that might change long-standing tax principles that could increase the Company’s taxes. |

• | We may become subject to taxation in Bermuda which would negatively affect our results. |

• | We and certain of our subsidiaries have entered into and may in the future enter into internal agreements which must be at market value or on terms no more favourable than would have been agreed if the transaction was not conducted on an intra-group basis. |

• | Certain of our subsidiaries are incorporated in offshore jurisdictions and our operations may be subject to economic substance requirements, which could impact our business. |

• | Our share price has fluctuated in the past, has been volatile and may be volatile in the future and as a result, investors in our common shares could incur substantial losses. |

• | Our common shares will be traded on more than one stock exchange and this may result in price variations between the markets. |

• | Any dividend payments on our shares would be denominated in U.S. dollars and any shareholder whose principal currency is not the U.S. dollars would be subject to risks of exchange rate fluctuations. |

• | You may be liable to pay taxes on dividends or distributions from us or on any income or gains otherwise resulting from your ownership of our shares including any gains as a result of an increase in value of the shares, if any. |

• | We do not know whether a market for our common shares will develop to provide you with adequate liquidity. If our share price fluctuates after this listing, you could lose a significant part of your investment. |

• | The requirements of being a public company in the United States, including compliance with the reporting requirements of the Exchange Act and the requirements of the Sarbanes-Oxley Act, may strain our resources, increase our costs, and absorb a significant amount of time of management, and we may be unable to comply with these requirements in a timely or cost-effective manner. |

• | Future offerings of debt securities, which would rank senior to our common shares upon our bankruptcy or liquidation, and future offerings of equity securities that may be senior to our common shares for the purposes of dividend and liquidation distributions, may adversely affect the market price of our common shares. |

• | We cannot assure you that we will pay dividends on our common shares, and a number of factors, including but not limited to our earnings, commitments to service our debts, and the indebtedness covenants in our financing arrangements may limit our ability to pay dividends on our common shares. |

• | As a foreign private issuer, we are permitted to, and we will, adopt certain home country practices in relation to corporate governance that differ signicantly from NYSE corporate governance standards applicable to U.S. issuers. This may afford less protection to our shareholders. |

• | Future sales or issuances of our common shares in the public markets, or the perception that they might occur, could cause the price of our common shares to decline, could dilute your voting power and your ownership interest in us and/or could lead to a loss of all or part of your investment. |

• | The historical financial information in this Registration Statement may make it difficult to accurately predict our costs of operations in the future. |

• | We have identified material weaknesses in our internal control over financial reporting that could, if not remediated, result in material misstatements in our financial statements. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our common share. |

• | Currently, rights of our shareholders are governed by the laws of Bermuda and the Memorandum of Association and Bye-laws of Hafnia (Bermuda), while following our Redomiciliation, rights of our shareholders will be governed by the laws of Singapore and the Constitution of Hafnia (Singapore), and accordingly certain rights of our shareholders will change as a result of the Redomiciliation, which may adversely affect the position of our shareholders. |

• | After the Redomiciliation, we will be incorporated in Singapore and the rights of our shareholders may differ from the rights and protections typically offered to shareholders of a corporation organised in Delaware. |

• | The Redomiciliation may not be implemented or may not be implemented in a timely manner. |

• | The change in regulatory regime involves uncertainty as to the implications, and adapting to such new regime may lead to substantial costs and require substantial time spent by Hafnia’s management. |

• | Changes in facts, law, policy or practice may result in adverse tax consequences to Hafnia and its shareholders in relation to the Redomiciliation and Hafnia (Singapore) going forward. |

• | The Redomiciliation may result in adverse tax consequences to our shareholders. |

• | The Redomiciliation may have an adverse effect on trading, liquidity and the price of our common shares on the stock exchanges upon which our shares are listed and tradeable, as some shareholders may not wish to hold shares of a Singapore issuer, and this could negatively affect trading, liquidity and the price of our common shares. |

• | Under Singapore law, shareholder approval is required to allow us to issue new shares. Our Board of Directors may in the future be granted authorization to issue new shares without additional shareholder approval and our issuance of such shares may dilute the ownership interests of existing shareholders and negatively impact the price of our common shares. |

• | Singapore law and provisions in our Constitution following our Redomiciliation may have anti-takeover effects that could discourage an acquisition of us by others, even if an acquisition would be beneficial to our shareholders and may prevent replacement or removal of the members of our Board of Directors. |

• | supply of and demand for energy resources and oil and petroleum products; |

• | supply of and demand for chemical products; |

• | supply of and demand for alternative sources of energy; |

• | changes in the consumption of oil and petroleum products due to availability of new, alternative energy sources or changes in the price of oil and petroleum products relative to other energy sources or other factors making consumption of oil and petroleum products less attractive; |

• | changes in the consumption of chemicals; |

• | the number of shipyards and ability of shipyards to deliver vessels; |

• | the number of newbuild orders and deliveries, including slippage in deliveries; |

• | technological advances in tanker design and capacity; |

• | price of steel and vessel equipment; |

• | availability of financing for new vessels and shipping activity; |

• | available interest rate on financing; |

• | the number of vessel casualties; |

• | the degree of scrapping or recycling rate of older vessels, depending, among other things, on scrapping or recycling rates and international scrapping or recycling regulations; |

• | the number of conversions of tankers to other uses or conversions of other vessels to tankers; |

• | the number of product tankers trading crude or “dirty” oil products (such as fuel oil); |

• | the number of vessels that are out of service, namely those that are laid up, drydocked, awaiting repairs, used for floating storage, or otherwise not available for hire; |

• | the efficiency and age of the world tanker fleet; |

• | technical developments which affect the efficiency of vessels and time to vessel obsoletion; |

• | prevailing and expected future freight and charter rates; |

• | cost of bunkers and other sources of fuel for vessels and its impact on vessel speed; |

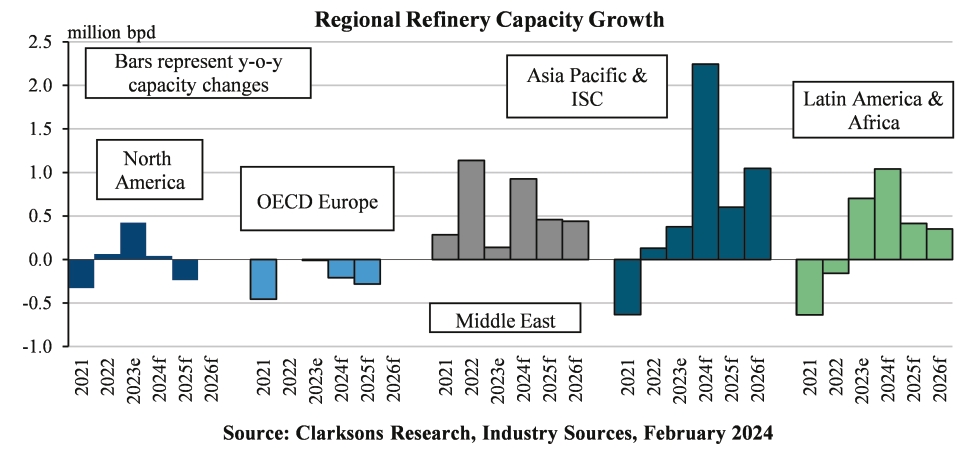

• | regional availability of refining capacity and inventories compared to geographies of oil production regions; |

• | increases in the production of oil in areas linked by pipelines to consuming areas, the extension of existing or the development of new pipeline systems in markets we may serve or the conversion of existing non-oil pipelines to oil pipelines in those markets; |

• | market expectations with respect to future supply of petroleum and petroleum products; |

• | regional availability of chemicals production and usage; |

• | developments in international trade, including refinery additions and closures; |

• | national policies regarding strategic oil inventories (including if strategic reserves are set at a lower level in the future as oil decreases in the energy mix); |

• | global and regional economic and political conditions, including economic slowdowns in certain countries and/or regions; |

• | currency exchange rates; |

• | the distance over which oil, oil products and chemical products are to be moved by sea; |

• | changes in seaborne and other transportation patterns; |

• | changes in governmental or maritime self-regulatory organizations’ rules and regulations or actions taken by regulatory authorities; |

• | environmental and other legal and regulatory developments; |

• | changes in government and industry environmental, maritime transportation, and other regulations, recommendations and practices that may affect the useful lives of tankers and impact environmental concerns and regulations; |

• | product imbalances and hence lack of or surplus supply in certain regions (affecting the level of trading activity); |

• | business disruptions, including supply chain issues, due to climate, weather, and natural or other disasters, or otherwise; |

• | global and regional political developments, including ‘trade wars’, armed conflicts, including the ongoing war between Russia and Ukraine, conflict between Israel and Hamas, and other international hostilities or terrorist activities; |

• | labour disruptions including strikes and lock-outs; |

• | port or canal congestion; |

• | speed of vessel operation; |

• | crew availability; |

• | developments in international trade, including those relating to the imposition of tariffs; and |

• | international sanctions, embargoes, price caps, import and export restrictions, nationalizations, and wars. |

• | low charter rates, particularly for vessels employed on short-term time charters or in the spot market; |

• | decreases in the market value of tanker vessels and limited second-hand market for the sale of vessels; |

• | reduction of global demand for oil and oil products; |

• | limited financing for vessels; |

• | loan covenant defaults; and |

• | declaration of bankruptcy by certain vessel operators, vessel owners, shipyards and charterers. |

• | restrictions, with certain exceptions, on business transactions with “interested shareholders” for a period of three years from the date a shareholder qualifies as an interested shareholder; |

• | restrictions on the time period in which directors may be nominated; |

• | an affirmative vote of 75% of our voting shares for certain “business combination” transactions, including certain mergers and amalgamations if such “business combination” or merger or amalgamation has not been approved by our Board of Directors; and |

• | an exclusive jurisdiction clause. |

• | our financial performance; |

• | our credit rating; |

• | the liquidity of the overall capital markets; |

• | Singapore, United States, Norwegian, and global economies; |

• | general economic conditions and other contingencies and uncertainties beyond our control; and |

• | the state of the chemical and product tanker market. |

• | our ability to obtain additional financing for working capital, capital expenditures, vessel acquisitions or other purposes may be impaired or such financing may be unavailable on favourable terms; |

• | our costs of borrowing could increase as we become more leveraged; |

• | we may need to use a substantial portion of our cash from operations to make principal and interest payments on our debt, reducing the funds that would otherwise be available for operations, general corporate activities, future business opportunities, and dividends to our shareholders; |

• | future creditors may subject us to limitations on our business and future financing activities as well as certain financial and operational covenants and such restrictions may prevent us from taking actions that otherwise might be deemed to be in the best interests of us and our shareholders; |

• | our debt level could make us more vulnerable than our competitors with less debt to competitive pressures, a downturn in our business or the economy in general; and |

• | our debt level may limit our flexibility in responding to changing business and economic conditions in our business and the industry where we operate or detract from our ability to successfully withstand a downturn in our business or the economy in general. |

• | pay dividends and make capital expenditures if we do not repay amounts drawn under our credit facilities or if there is another default under our credit facilities; |

• | incur additional indebtedness, including the issuance of guarantees; |

• | create liens on our assets; |

• | change the flag, class or management of our Hafnia Vessels or JV Vessels (as applicable) or terminate or materially amend the management agreement relating to each vessel; |

• | sell our Hafnia Vessels or JV Vessels (as applicable); |

• | merge or consolidate with, or transfer all or substantially all our assets to, another person; |

• | increase or reduce capital; |

• | be subject to a change of control; or |

• | enter into a new line of business. |

• | our operating and financial performance; |

• | investor reactions to our business strategy; |

• | our continued compliance with the listing standards of the NYSE and Oslo Børs; |

• | regulatory or legal developments in the United States, European Union, and other countries, especially changes in laws or regulations applicable to our industry; |

• | quarterly variations in the rate of growth of our financial indicators, such as net income per share, net income, and revenues; |

• | actual or anticipated variations in our quarterly and annual financial results or those of companies that are perceived to be similar to us; |

• | the public reaction to our press releases, our other public announcements and our filings with the SEC; |

• | our success or failure to meet the expectation of analysts, investors, lenders, and other market participants; |

• | announcements concerning us or our competitors; |

• | market conditions in the shipping industry and particularly in the chemical and product tanker market; |

• | our ability or inability to raise additional capital and the terms on which we raise it; |

• | declines in the market prices of shares generally, |

• | the suspension of our dividend payments; |

• | mergers and strategic alliances in the shipping industry; |

• | sales of our common shares by us or our shareholders; |

• | general economic, industry and market conditions, including the prevailing economic and market conditions in the energy markets; |

• | strategic actions by our competitors; |

• | changes in revenue or earnings estimates, or changes in recommendations or withdrawals of research coverage, by equity research analysts; |

• | market and industry perception of our success, or lack thereof, in pursuing our growth strategies; |

• | introductions or announcements of new products offered by us or significant acquisitions, strategic partnerships, joint ventures or capital commitments by us or our competitors and the timing of such introductions or announcements; |

• | our ability to effectively manage our growth; |

• | the impact of pandemics on us and the national and global economies; |

• | speculation in the press or investment community; |

• | the failure of research analysts to cover our common shares; |

• | whether investors or securities analysts view our share structure unfavourably, particularly any significant voting control of our executive officers, directors, and their affiliates; |

• | our ability or inability to raise additional capital through the issuance of equity or debt or other arrangements and the relevant terms; |

• | additional shares of our common shares being sold into the market by us or our existing shareholders, or the anticipation of such sales; |

• | changes in accounting principles, policies, guidance, interpretations, or standards; |

• | additions or departures of key management personnel; |

• | actions by our shareholders; |

• | changes in operating performance and stock market valuations of companies in our industry, including our vendors and competitors; |

• | trading volume of our common shares; |

• | price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole and those resulting from natural disasters, severe weather events, terrorist attacks and responses to such events; |

• | lawsuits threatened or filed against us; |

• | economic, legal, and regulatory factors unrelated to our performance; |

• | privacy or cybersecurity breaches, data theft or other security incidents or failure to comply with applicable data privacy laws, rules, and regulations; |

• | our ability to obtain, maintain, protect, defend, and enforce our intellectual property; |

• | the realization of any risks described under this “Risk Factors” section; and |

• | other events or factors, including those resulting from such events, or the prospect of such events, including marine disasters, war, piracy, terrorism and other international conflicts, environmental accidents, public health issues including pandemics or epidemics, such as the ongoing COVID-19 pandemic, adverse weather and climate conditions or other events disrupting our operations or resulting in political or economic instability. |

• | the likelihood that an active trading market for our common shares will develop or be sustained; |

• | the liquidity of any such market; |

• | the ability of our shareholders to sell their common shares; or |

• | the price that our shareholders may obtain for their common shares. |

• | institute a more comprehensive compliance function, including for financial reporting and disclosures; |

• | continue to prepare and distribute periodic public reports in compliance with our obligations under federal securities laws; |

• | comply with rules promulgated by the NYSE; |

• | continue to prepare and distribute periodic public reports in compliance with our obligations under federal securities laws; |

• | enhance our investor relations function; |

• | establish new internal policies, such as those relating to insider trading; and |

• | involve and retain to a greater degree outside counsel and accountants in the above activities. |

• | the implementation of the Redomiciliation may be subject to litigation on any grounds, which may delay or otherwise frustrate the implementation of the Redomiciliation; |

• | the implementation of the Redomiciliation will be subject to stringent eligibility criteria set by Singapore’s Corporate Registry or other relevant authorities, which may delay or otherwise frustrate the implementation of the Redomiciliation; and |

• | the implementation of the Redomiciliation will be subject to receiving necessary approvals from relevant stakeholders, which may delay or otherwise frustrate the implementation of the Redomiciliation. |

• | our existing shareholders’ proportionate ownership interest in us may decrease; |

• | the market price of our common shares may decline; |

• | the amount of cash available for dividends or interest payments may decrease; |

• | the relative voting strength of previously issued outstanding securities may be diminished. |

INFORMATION ON THE COMPANY |

History and Development of the Company |

Business Overview |

• | Long Range II (“LR2”) (85,000 – 124,999 dwt) |

• | Long Range I (“LR1”) (55,000 – 84,999 dwt) |

• | Medium Range (“MR”) (40,000 – 54,999 dwt) |

• | Handy size (“Handy”) (25,000 – 39,999 dwt) |

• | Stainless steel 25k (“Stainless”) (25,000 dwt) |

• | Specialised size (“Specialised”) (5,000 – 19,999 dwt) |

| | | Combined Fleet | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| | Hafnia Fleet | | | | | | | | | | | | | ||||||||||||||||||||||||||||||||||||||||||||||||||

| | Hafnia Vessels (Owned) | | | Hafnia Vessels (Sale and lease-back) | | | TC Vessels | | | JV Vessels | | | Total | | | Commercial management (including Pool Vessels) | | | Total | ||||||||||||||||||||||||||||||||||||||||||||

| | | Fleet | | | NB* | | | Total | | | Fleet | | | NB* | | | Total | | | Fleet | | | NB* | | | Total | | | Fleet | | | NB* | | | Total | | | Fleet | | | NB* | | | Total | | | Fleet | | | NB* | | | Total | | | Fleet | | | NB* | | | Total | |

Specialised | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 15 | | | — | | | 15 | | | 15 | | | — | | | 15 |

Handy | | | 17 | | | — | | | 17 | | | 7 | | | — | | | 7 | | | — | | | — | | | — | | | — | | | — | | | — | | | 24 | | | — | | | 24 | | | 16(1) | | | — | | | 16 | | | 40 | | | — | | | 40 |

MR | | | 47 | | | — | | | 47 | | | 3 | | | — | | | 3 | | | 10 | | | — | | | 10 | | | 2(3) | | | 4(5) | | | 6 | | | 62 | | | 4 | | | 66 | | | 27(2) | | | — | | | 27 | | | 89 | | | 4 | | | 93 |

LR1 | | | 10 | | | — | | | 10 | | | 15 | | | — | | | 15 | | | 4 | | | — | | | 4 | | | 6(4) | | | — | | | 6 | | | 35 | | | — | | | 35 | | | 14 | | | — | | | 14 | | | 49 | | | — | | | 49 |

LR2 | | | 6 | | | — | | | 6 | | | — | | | — | | | — | | | — | | | — | | | — | | | 3(4) | | | 1(4) | | | 4 | | | 9 | | | 1 | | | 10 | | | 3 | | | — | | | 3 | | | 12 | | | 1 | | | 13 |

Total | | | 80 | | | — | | | 80 | | | 25 | | | — | | | 25 | | | 14 | | | — | | | 14 | | | 11 | | | 5 | | | 16 | | | 130 | | | 5 | | | 135 | | | 75 | | | — | | | 75 | | | 205 | | | 5 | | | 210 |

* | Newbuilds |

(1) | Inclusive of vessels in Handy and Chemical-Handy Pool. |

(2) | Inclusive of vessels in MR and Chemical-MR Pool. |

(3) | Owned through 50% ownership in the Andromeda Joint Venture. |

(4) | Owned through 50% ownership in the Vista Joint Venture. |

(5) | Owned through 50% ownership in the Ecomar Joint Venture. |

Vessel Name | | | Month/ Year built | | | Shipyard(*) | | | Cargo Capacity (dwt) | | | Flag | | | Ownership % | | | Classification Society(**) | | | IMO(***) | | | Employment Type |

BW Neso | | | Jul-19 | | | Daehan | | | 109,990 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR2 Pool |

BW Thalassa | | | Sep-19 | | | Daehan | | | 109,990 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR2 Pool |

Hafnia Despina | | | Jan-19 | | | Daehan | | | 109,990 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR2 Pool |

Hafnia Galatea | | | Mar-19 | | | Daehan | | | 109,990 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR2 Pool |

Hafnia Languedoc | | | Mar-23 | | | GSI | | | 109,999 | | | Singapore | | | 50%(1) | | | DNV | | | N/A | | | Time Charter |

Hafnia Larissa | | | Apr-19 | | | Daehan | | | 109,990 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR2 Pool |

Hafnia Larvik | | | Oct-23 | | | GSI | | | 109,999 | | | Singapore | | | 50%(1) | | | DNV | | | N/A | | | Time Charter |

Hafnia Lillesand | | | Est. Feb-24 | | | GSI | | | 109,999 | | | Singapore | | | 50%(1) | | | DNV | | | N/A | | | Newbuild |

Hafnia Loire | | | May-23 | | | GSI | | | 109,999 | | | Singapore | | | 50%(1) | | | DNV | | | N/A | | | Time Charter |

Hafnia Triton | | | Oct-19 | | | Daehan | | | 109,990 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR2 Pool |

Total (10 vessels) | | | | | | | 1,099,936 | | | | | | | | | | |

(*) | In the above table, Daehan refers to Daehan Shipbuilding Co., Ltd. and GSI refers to Guangzhou Shipyard International Co. Ltd. |

(**) | For a discussion regarding Classification Society see the below section “– Classification Societies” in this Item 4. |

(***) | For a discussion of IMO ship types see the below section “– Environmental and Other Regulations in the Shipping Industry – Water Pollution – International – a. International Code for the Construction and Equipment of Ships Carrying Dangerous Chemicals in Bulk” in this Item 4. |

(1) | Owned through the Vista Joint Venture. |

Vessel Name | | | Month/ Year built | | | Shipyard(*) | | | Cargo Capacity (dwt) | | | Flag | | | Ownership % | | | Classification Society(**) | | | IMO(***) | | | Employment Type |

Hafnia Africa | | | May-10 | | | STX | | | 74,539 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Asia | | | Jun-10 | | | STX | | | 74,490 | | | Malta | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Australia | | | May-10 | | | STX | | | 74,539 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Beijing | | | Oct-19 | | | GSI | | | 74,999 | | | Malta | | | 50%(2) | | | DNV | | | 2/3 | | | LR1 Pool |

Hafnia Exceed | | | Feb-16 | | | STX | | | 74,665 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Excel | | | Nov-15 | | | STX | | | 74,547 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Excellence | | | May-16 | | | STX | | | 74,613 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Excelsior | | | Jan-16 | | | STX | | | 74,665 | | | Singapore | | | SLB(1) | | | ABS | | | N/A | | | LR1 Pool |

Hafnia Executive | | | May-16 | | | STX | | | 74,431 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Expedite | | | Jan-16 | | | STX | | | 74,634 | | | Singapore | | | SLB(1) | | | ABS | | | N/A | | | LR1 Pool |

Hafnia Experience | | | Mar-16 | | | STX | | | 74,669 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Express | | | May-16 | | | STX | | | 74,663 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Guangzhou | | | Jul-19 | | | GSI | | | 74,999 | | | Malta | | | 50%(2) | | | DNV | | | 2/3 | | | LR1 Pool |

Hafnia Hong Kong | | | Jan-19 | | | GSI | | | 74,999 | | | Malta | | | 50%(2) | | | DNV | | | 2/3 | | | LR1 Pool |

Hafnia Kallang | | | Jan-17 | | | STX | | | 74,189 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR1 Pool |

Hafnia Nanjing | | | Jan-21 | | | GSI | | | 74,999 | | | Singapore | | | 50%(2) | | | DNV | | | 2/3 | | | LR1 Pool |

Hafnia Nile | | | Aug-17 | | | STX | | | 74,189 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR1 Pool |

Hafnia Pioneer | | | Jun-13 | | | DSME | | | 81,305 | | | Singapore | | | 100% | | | LR | | | 2 | | | LR1 Pool |

Hafnia Precision | | | Oct-16 | | | SPP | | | 74,997 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Prestige | | | Nov-16 | | | SPP | | | 74,997 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Pride | | | Jul-16 | | | SPP | | | 74,997 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Providence | | | Aug-16 | | | SPP | | | 74,997 | | | Singapore | | | SLB(1) | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Seine | | | May-08 | | | Dalian | | | 74,998 | | | Singapore | | | 100% | | | ABS | | | N/A | | | LR1 Pool |

Hafnia Shanghai | | | Jan-19 | | | GSI | | | 74,999 | | | Malta | | | 50%(2) | | | DNV | | | 2/3 | | | LR1 Pool |

Hafnia Shenzhen | | | Aug-20 | | | GSI | | | 74,999 | | | Singapore | | | 50%(2) | | | DNV | | | 2/3 | | | LR1 Pool |

Vessel Name | | | Month/ Year built | | | Shipyard(*) | | | Cargo Capacity (dwt) | | | Flag | | | Ownership % | | | Classification Society(**) | | | IMO(***) | | | Employment Type |

Hafnia Shinano | | | Oct-08 | | | Dalian | | | 76,594 | | | Singapore | | | 100% | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Tagus | | | Mar-17 | | | STX | | | 74,151 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR1 Pool |

Hafnia Thames | | | Aug-08 | | | Dalian | | | 76,586 | | | Singapore | | | 100% | | | DNV | | | N/A | | | LR1 Pool |

Hafnia Yangtze | | | Jan-09 | | | Dalian | | | 74,996 | | | Singapore | | | 100% | | | ABS | | | N/A | | | LR1 Pool |

Hafnia Yarra | | | Jul-17 | | | STX | | | 74,189 | | | Singapore | | | 100% | | | LR | | | N/A | | | LR1 Pool |

Hafnia Zambesi | | | Jan-10 | | | Dalian | | | 74,995 | | | Singapore | | | 100% | | | ABS | | | N/A | | | LR1 Pool |

Kamome Victoria | | | May-11 | | | MNSB | | | 74,908 | | | Panama | | | TC-in(3) | | | ClassNK | | | N/A | | | LR1 Pool |

Karimata | | | Aug-19 | | | Onomichi | | | 79,885 | | | Panama | | | TC-in(3) | | | ABS | | | N/A | | | LR1 Pool |

Peace Victoria | | | Oct-19 | | | Tsuneishi | | | 77,378 | | | Liberia | | | TC-in(3) | | | LR | | | N/A | | | LR1 Pool |

Sunda | | | Jul-19 | | | Onomichi | | | 79,902 | | | Panama | | | TC-in(3) | | | ABS | | | N/A | | | LR1 Pool |

Total (35 vessels) | | | | | | | 2,638,702 | | | | | | | | | | |

(*) | In the above table, STX refers to K Shipbuilding Co. Ltd. (formerly “STX Offshore and Shipbuilding Co. Ltd.”); GSI refers to Guangzhou Shipyard International Co. Ltd.; DSME refers to Daewoo Shipbuilding & Marine Engineering Co., Ltd., Dalian refers to Dalian Shipbuilding Industry; MSNB refers to Minaminippon Shipbuilding Co. Ltd.; Tsuneishi refers to Tsuneishi Group (Zhoushan) Shipbuilding Inc.; Onomichi refers to Onomichi Dockyard Co. Ltd., and SPP refers to SPP Shipbuilding Co. Ltd. |

(**) | For a discussion regarding Classification Society see the below section “– Classification Societies” in this Item 4. |

(***) | For a discussion of IMO ship types see the below section “Environmental and Other Regulations in the Shipping Industry – Water Pollution – International – a. International Code for the Construction and Equipment of Ships Carrying Dangerous Chemicals in Bulk” in this Item 4. |

(1) | SLB = Sale and lease-back. |

(2) | Owned through our Vista Joint Venture. |

(3) | TC-in = Time charter in. |

Vessel Name | | | Month/ Year built | | | Shipyard(*) | | | Cargo Capacity (DWT) | | | Flag | | | Ownership % | | | Classification Society(**) | | | IMO(***) | | | Employment Type |

Basset | | | Nov-19 | | | JMU | | | 49,875 | | | Singapore | | | TC-in(3) | | | ClassNK | | | 2/3 | | | MR Pool |

Beagle | | | Mar-19 | | | JMU | | | 49,850 | | | Panama | | | TC-in(3) | | | ClassNK | | | 2/3 | | | MR Pool |

Boxer | | | Jun-19 | | | JMU | | | 49,852 | | | Singapore | | | TC-in(3) | | | ClassNK | | | 2/3 | | | MR Pool |

Bulldog | | | Feb-20 | | | JMU | | | 49,856 | | | Singapore | | | TC-in(3) | | | ClassNK | | | 2/3 | | | MR Pool |

BW Bobcat | | | Aug-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

BW Cheetah | | | Feb-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | ABS | | | 2/3 | | | Time Charter |

BW Egret | | | Nov-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | ABS | | | 2/3 | | | MR Pool |

BW Falcon | | | Feb-15 | | | SPP | | | 34,999 | | | Singapore | | | 100% | | | ABS | | | 2/3 | | | Time Charter |

BW Hawk | | | Jun-15 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | ABS | | | 2/3 | | | MR Pool |

BW Jaguar | | | Mar-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

BW Kestrel | | | Aug-15 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | ABS | | | 2/3 | | | Time Charter |

BW Leopard | | | Jan-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

BW Lioness | | | Jan-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

BW Merlin | | | Sep-15 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | DNV | | | 2/3 | | | Time Charter |

BW Osprey | | | Oct-15 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | DNV | | | 2/3 | | | MR Pool |

BW Tiger | | | Mar-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

BW Wren | | | Mar-16 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | DNV | | | 2/3 | | | MR Pool |

Challenge Procyon | | | Apr-11 | | | SKDY | | | 45,996 | | | Singapore | | | TC-in(1) | | | ClassNK | | | N/A | | | MR Pool |

Clearocean Ginkgo | | | Aug-21 | | | HMD | | | 44,999 | | | Singapore | | | TC-in(1) | | | ABS | | | 2/3 | | | MR Pool |

Clearocean Milano | | | Oct-21 | | | HMD | | | 50,485 | | | Philippines | | | TC-in(1) | | | BV | | | 2/3 | | | MR Pool |

Dee4 Larch | | | Aug-16 | | | HVS | | | 49,737 | | | Denmark | | | TC-in(1) | | | ABS | | | 2/3 | | | Spot Charters |

Hafnia Andrea | | | Jun-15 | | | HMD | | | 49,999 | | | Singapore | | | 100% | | | ABS | | | 2/3 | | | MR Pool |

Vessel Name | | | Month/ Year built | | | Shipyard(*) | | | Cargo Capacity (DWT) | | | Flag | | | Ownership % | | | Classification Society(**) | | | IMO(***) | | | Employment Type |

Hafnia Andromeda | | | May-11 | | | GSI | | | 50,386 | | | Malta | | | 100% | | | LR | | | 2/3 | | | MR Pool |

Hafnia Ane | | | Nov-15 | | | GSI | | | 49,999 | | | Malta | | | 100% | | | DNV | | | 2/3 | | | MR Pool |

Hafnia Atlantic | | | Dec-17 | | | GSI | | | 49,614 | | | Singapore | | | 100% | | | LR | | | 2 | | | Chemical-MR Pool |

Hafnia Caterina | | | Aug-15 | | | HMD | | | 49,999 | | | Singapore | | | 100% | | | ABS | | | 2/3 | | | MR Pool |

Hafnia Cougar | | | Jan-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

Hafnia Crux | | | Feb-12 | | | GSI | | | 52,550 | | | Denmark | | | 100% | | | LR | | | 2 | | | MR Pool |

Hafnia Daisy | | | Aug-16 | | | GSI | | | 49,899 | | | Malta | | | 100% | | | DNV | | | 2/3 | | | Time Charter |

Hafnia Eagle | | | Jul-15 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

Hafnia Henriette | | | Jun-16 | | | GSI | | | 49,999 | | | Malta | | | 100% | | | DNV | | | 2/3 | | | MR Pool |

Hafnia Kirsten | | | Jan-17 | | | GSI | | | 49,999 | | | Malta | | | 100% | | | DNV | | | 2/3 | | | MR Pool |

Hafnia Lene | | | Jul-15 | | | GSI | | | 49,999 | | | Malta | | | 100% | | | DNV | | | 2/3 | | | Time Charter |

Hafnia Leo | | | Nov-13 | | | GSI | | | 52,318 | | | Malta | | | 100% | | | LR | | | 2 | | | MR Pool |

Hafnia Libra | | | May-13 | | | GSI | | | 52,385 | | | Denmark | | | 100% | | | LR | | | 2 | | | MR Pool |

Hafnia Lise | | | Sep-16 | | | GSI | | | 49,875 | | | Malta | | | 100% | | | DNV | | | 2/3 | | | Time Charter |

Hafnia Lotte | | | Jan-17 | | | GSI | | | 49,999 | | | Malta | | | 100% | | | DNV | | | 2/3 | | | MR Pool |

Hafnia Lupus | | | Apr-12 | | | GSI | | | 52,550 | | | Denmark | | | 100% | | | LR | | | 3 | | | MR Pool |

Hafnia Lynx | | | Nov-13 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

Hafnia Mikala | | | May-17 | | | GSI | | | 49,999 | | | Malta | | | 100% | | | DNV | | | 2/3 | | | MR Pool |

Hafnia Myna | | | Oct-15 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | Time Charter |

Hafnia Nordica | | | Mar-10 | | | SKDY | | | 53,520 | | | Malta | | | 100% | | | ClassNK | | | N/A | | | MR Pool |

Hafnia Pacific | | | Dec-17 | | | GSI | | | 49,686 | | | Singapore | | | 100% | | | LR | | | 2 | | | Chemical-MR Pool |

Hafnia Panther | | | Jun-14 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | MR Pool |

Hafnia Pegasus | | | Oct-10 | | | GSI | | | 49,999 | | | Denmark | | | 100% | | | LR | | | 2/3 | | | MR Pool |

Hafnia Petrel | | | Jan-16 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | DNV | | | 2/3 | | | Time Charter |

Hafnia Phoenix | | | Jul-13 | | | GSI | | | 49,999 | | | Denmark | | | 100% | | | LR | | | 2 | | | MR Pool |

Hafnia Puma | | | Nov-13 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | ABS | | | 2/3 | | | MR Pool |

Hafnia Raven | | | Nov-15 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | DNV | | | 2/3 | | | Time Charter |

Hafnia Swift | | | Jan-16 | | | SPP | | | 49,999 | | | Singapore | | | 100% | | | DNV | | | 2/3 | | | MR Pool |

Hafnia Tanzanite | | | Nov-16 | | | STX | | | 49,478 | | | Marshall Islands | | | SLB(2) | | | ABS | | | 2 | | | Chemical-MR Pool |

Hafnia Taurus | | | Jun-11 | | | GSI | | | 49,999 | | | Malta | | | 100% | | | LR | | | 2/3 | | | MR Pool |

Hafnia Topaz | | | Jul-16 | | | STX | | | 44,999 | | | Marshall Islands | | | SLB(2) | | | ABS | | | 2 | | | Chemical-MR Pool |

Hafnia Tourmaline | | | Oct-16 | | | STX | | | 49,513 | | | Marshall Islands | | | SLB(2) | | | ABS | | | 2 | | | Chemical-MR Pool |

Hafnia Turquoise | | | Apr-16 | | | STX | | | 49,516 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-MR Pool |

Hafnia Valentino | | | May-15 | | | HVS | | | 49,126 | | | Singapore | | | 100% | | | DNV | | | 2 | | | Chemical-MR Pool |

Hafnia Violette | | | Mar-15 | | | HVS | | | 49,126 | | | Marshall Islands | | | 100%(3) | | | ABS | | | 2 | | | Chemical-MR Pool |

Hafnia Viridian | | | Jan-15 | | | HVS | | | 49,126 | | | Marshall Islands | | | 100%(3) | | | ABS | | | 2 | | | Chemical-MR Pool |

Orient Challenge | | | Jun-17 | | | HVS | | | 49,972 | | | Singapore | | | TC-in(1) | | | ClassNK | | | 2/3 | | | MR Pool |

Orient Innovation | | | Jul-17 | | | HVS | | | 49,997 | | | Singapore | | | TC-in(1) | | | ClassNK | | | 2/3 | | | MR Pool |

PS Stars | | | Jan-22 | | | HMD | | | 49,999 | | | Marshall Islands | | | 50%(4) | | | LR | | | 2/3 | | | Time charter |

Yellow Stars | | | Jul-21 | | | HMD | | | 49,999 | | | Marshall Islands | | | 50%(4) | | | LR | | | 2/3 | | | Time charter |

Total 62 vessels | | | | | | | 3,079,251 | | | | | | | | | | |

(*) | In the above table, JMU refers to Japan Marine United Corporation; SPP refers to SPP Shipbuilding Co. Ltd.; GSI refers to Guangzhou Shipyard International Co. Ltd.; SKDY refers to Shin Kurushima Dockyard Co. Ltd.; STX refers to K Shipbuilding Co. Ltd. (formerly “STX Offshore and Shipbuilding Co. Ltd”); HVS refers to Hyundai-Vietnam Shipbuilding Co. Ltd. (formerly “Hyundai Vinashin Shipyard Co. Ltd.”); and HMD refers to Hyundai Mipo Dockyard Co. Ltd. |

(**) | For a discussion regarding Classification Society see the below section “Classification Societies” in this Item 4. |

(***) | For a discussion of IMO ship types see the below section “Environmental and Other Regulations in the Shipping Industry – Water Pollution – International – a. International Code for the Construction and Equipment of Ships Carrying Dangerous Chemicals in Bulk” in this Item 4. |

(1) | TC-in = Time charter-in. |

(2) | SLB = Sale and lease-back. |

(3) | As at December 31, 2023, these vessels were bareboat chartered in under a sale and lease-back arrangement with JFL; however, we exercised purchase options on these vessels in January 2024 and at the date of the Registration Statement have a 100% ownership interest in these vessels. |

(4) | Owned through the Andromeda Joint Venture. |

Vessel Name | | | Month/ Year built | | | Shipyard(*) | | | Cargo Capacity (DWT) | | | Flag | | | Ownership % | | | Classification Society (**) | | | IMO(***) | | | Employment Type |

Hafnia Achroite | | | Jan-16 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100%(1) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Adamite | | | Sep-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Alabaster | | | Nov-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100%(1) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Almandine | | | Feb-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Amazonite | | | May-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Amber | | | Feb-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Amessi | | | Jul-15 | | | HMD | | | 38,506 | | | Singapore | | | SLB(2) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Amethyst | | | Mar-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Ametrine | | | Apr-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Ammolite | | | Aug-15 | | | HMD | | | 38,506 | | | Singapore | | | SLB(2) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Andesine | | | May-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Aquamarine | | | Jun-15 | | | HMD | | | 38,506 | | | Singapore | | | SLB(2) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Aragonite | | | Oct-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100%(1) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Aronaldo | | | Jun-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | SLB(2) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Aventurine | | | Apr-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | 100% | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Axinite | | | Jul-15 | | | HMD | | | 38,506 | | | Singapore | | | SLB(2) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Azotic | | | Sep-15 | | | HMD | | | 38,506 | | | Marshall Islands | | | SLB(2) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Azurite | | | Aug-15 | | | HMD | | | 38,506 | | | Singapore | | | SLB(2) | | | ABS | | | 2 | | | Chemical-Handy Pool |

Hafnia Bering | | | Apr-15 | | | HMD | | | 39,067 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | Time Charter |

Hafnia Magellan | | | May-15 | | | HMD | | | 39,067 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | Time Charter |

Hafnia Malacca | | | Jul-15 | | | HMD | | | 39,067 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | Handy Pool |

Hafnia Soya | | | Nov-15 | | | HMD | | | 39,067 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | Handy Pool |

Hafnia Sunda | | | Sep-15 | | | HMD | | | 39,067 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | Handy Pool |

Hafnia Torres | | | May-16 | | | HMD | | | 39,067 | | | Singapore | | | 100% | | | LR | | | 2/3 | | | Handy Pool |

Total 24 vessels | | | | | | | 927,510 | | | | | | | | | | |

(*) | In the above table, HMD refers to Hyundai Mipo Dockyard Co. Ltd. |

(**) | For a discussion regarding Classification Society see the below section “Classification Societies” in this Item 4. |

(***) | For a discussion of IMO ship types see the below section “Environmental and Other Regulations in the Shipping Industry – Water Pollution – International – a. International Code for the Construction and Equipment of Ships Carrying Dangerous Chemicals in Bulk” in this Item 4. |

(1) | As at December 31, 2023, these vessels were bareboat chartered in under a sale and lease-back arrangement with CSSC; however, we expect to exercise the purchase options on the vessels in February 2024 and at the date of the Registration Statement have a 100% ownership interest in these vessels. |

(2) | SLB = Sale and lease-back. |

Vessel Name | | | Type of vessel | | | To be delivered | | | Shipyard(*) | | | Capacity | | | Flag | | | Ownership % | | | Classification Society(**) | | | IMO(***) |

Hull 21110074 | | | MR | | | Apr-25 | | | GSI | | | 49,800 | | | TBD | | | 50%(1) | | | BV | | | 2 |

Hull 21110075 | | | MR | | | Sep-25 | | | GSI | | | 49,800 | | | TBD | | | 50%(1) | | | BV | | | 2 |

Hull 23110004 | | | MR | | | Nov-25 | | | GSI | | | 49,800 | | | TBD | | | 50%(1) | | | BV | | | 2 |

Hull 23110005 | | | MR | | | Jul-26 | | | GSI | | | 49,800 | | | TBD | | | 50%(1) | | | BV | | | 2 |

Total (4 newbuilds) | | | | | | | | | 199,200 | | | | | | | | |

(*) | GSI refers to Guangzhou Shipyard International Co. Ltd. |

(**) | For a discussion regarding Classification Society see the below section “Classification Societies” in this Item 4. |

(***) | For a discussion of IMO ship types see the below section “Environmental and Other Regulations in the Shipping Industry – Water Pollution – International – a. International Code for the Construction and Equipment of Ships Carrying Dangerous Chemicals in Bulk” in this Item 4. |

(1) | Owned through the Ecomar Joint Venture. |

Pool | | | Vessel name | | | Year Built | | | Capacity (dwt) | | | Pool entry | | | Registered Owner | | | IMO(*) | | | Flag |

LR2 Pool | | | Norddolphin | | | 2017 | | | 113,955 | | | Sep-22 | | | MT Norddolphin Shipping Management | | | N/A | | | Portugal |

LR2 Pool | | | Nordmarlin | | | 2017 | | | 113,959 | | | Nov-22 | | | MT Nordmarlin Shipping Management B.V. | | | N/A | | | Portugal |

LR2 Pool | | | Seaways Shenandoah | | | 2014 | | | 112,691 | | | Jul-23 | | | Mindanao Tanker Corporation | | | N/A | | | Marshall Islands |

| | | | | | | | | | | | | | | ||||||||

LR1 Pool | | | Avra Patros | | | 2008 | | | 74,998 | | | Jul-22 | | | Agios Athanasious Shipping Enterprises Inc. | | | N/A | | | Liberia |

LR1 Pool | | | Bluebird | | | 2016 | | | 74,074 | | | Feb-17 | | | Larine Tankers Pte. Ltd. | | | N/A | | | Singapore |

LR1 Pool | | | Chemtrans Arctic | | | 2005 | | | 73,911 | | | Jun-20 | | | Sparrow 2 Shipping Inc. | | | N/A | | | Marshall Islands |

LR1 Pool | | | Chemtrans Baltic | | | 2005 | | | 73,897 | | | Aug-20 | | | Sparrow 1 Shipping Inc. | | | N/A | | | Marshall Islands |

LR1 Pool | | | Chemtrans Ionian | | | 2007 | | | 76,580 | | | Jul-22 | | | Sparrow 7 Shipping Inc. | | | N/A | | | Marshall Islands |

LR1 Pool | | | Estia | | | 2007 | | | 73,711 | | | Apr-22 | | | Fred Maritime S.A. | | | N/A | | | Bahamas |

LR1 Pool | | | Evridiki | | | 2008 | | | 73,740 | | | Apr-17 | | | Evridiki Maritime S.A. | | | N/A | | | Bahamas |

LR1 Pool | | | Jag Amisha | | | 2009 | | | 74,889 | | | Dec-23 | | | The Great Eastern Shipping Company Ltd | | | N/A | | | India |

LR1 Pool | | | Jag Aparna | | | 2009 | | | 74,859 | | | Feb-22 | | | The Great Eastern Shipping Company Ltd | | | N/A | | | India |

LR1 Pool | | | Mindoro Star | | | 2009 | | | 73,677 | | | Oct-18 | | | Troy Shipping Corp | | | 3 | | | Marshall Islands |

LR1 Pool | | | Pelagic Turbot | | | 2009 | | | 73,394 | | | Mar-23 | | | Pelagic Maritime Ltd. | | | N/A | | | Cyprus |

LR1 Pool | | | Starling | | | 2016 | | | 74,033 | | | Feb-17 | | | Larine Tankers Pte. Ltd. | | | N/A | | | Singapore |

LR1 Pool | | | Two Million Ways | | | 2008 | | | 73,965 | | | Jan-23 | | | MT TMW Shipping Management B.V | | | N/A | | | Cyprus |

| | | | | | | | | | | | | | | ||||||||

MR Pool | | | Aegean Star | | | 2019 | | | 50,506 | | | Jun-19 | | | Saltini Shipping Corporation | | | 2/3 | | | Marshall Islands |

MR Pool | | | Alcyone T | | | 2010 | | | 45,951 | | | Jan-23 | | | Alcyone Tankers Ltd | | | N/A | | | Marshall Islands |

MR Pool | | | Aldabra | | | 2008 | | | 47,399 | | | Sep-22 | | | Maritime Aldabra LLC | | | N/A | | | Marshall Islands |

MR Pool | | | Alpine Marina | | | 2010 | | | 46,162 | | | Jul-23 | | | Tornado Navigations Inc. | | | 3 | | | Marshall Islands |

Pool | | | Vessel name | | | Year Built | | | Capacity (dwt) | | | Pool entry | | | Registered Owner | | | IMO(*) | | | Flag |

MR Pool | | | Angel Star | | | 2006 | | | 48,635 | | | Dec-21 | | | Selitsa Shipping Corporation | | | N/A | | | Marshall Islands |

MR Pool | | | Bantry Bay | | | 2023 | | | 49,999 | | | Dec-23 | | | AL TANKER I SHIPPING PTE. LTD. | | | 2 | | | Singapore |

MR Pool | | | Centennial Matsuyama | | | 2008 | | | 47,165 | | | Feb-23 | | | Meiji Shipping B.V. | | | N/A | | | Malta |

MR Pool | | | Chios Star | | | 2018 | | | 50,506 | | | Mar-19 | | | Lousios Shipping Corporation | | | 2/3 | | | Marshall Islands |

MR Pool | | | Coetivy | | | 2010 | | | 45,994 | | | Oct-22 | | | Maritime Coetivy LLC | | | N/A | | | Marshall Islands |

MR Pool | | | Ionian Star | | | 2019 | | | 50,506 | | | Mar-19 | | | Yliki Shipping Corporation | | | 2/3 | | | Marshall Islands |

MR Pool | | | Jag Parth | | | 2008 | | | 46,197 | | | Nov-23 | | | The Great Eastern Shipping Co. Ltd. | | | 2 | | | India |

MR Pool | | | Jag Pooja | | | 2005 | | | 48,539 | | | Nov-22 | | | The Great Eastern Shipping Co. Ltd. | | | N/A | | | India |

MR Pool | | | Jag Prakash | | | 2007 | | | 47,848 | | | Aug-22 | | | The Great Eastern Shipping Co. Ltd. | | | N/A | | | India |

MR Pool | | | Jag Prerana | | | 2007 | | | 47,848 | | | Jun-22 | | | The Great Eastern Shipping Co. Ltd. | | | 2 | | | India |

MR Pool | | | Jag Punit | | | 2016 | | | 49,717 | | | Jun-22 | | | The Great Eastern Shipping Co. Ltd. | | | 2 | | | India |

MR Pool | | | Jag Pushpa | | | 2007 | | | 47,848 | | | Sep-22 | | | The Great Eastern Shipping Co. Ltd. | | | 3 | | | India |

MR Pool | | | Kardiani | | | 2008 | | | 44,999 | | | May-22 | | | Magnolia Shiptrade S.A. | | | 2 | | | Malta |

MR Pool | | | Kouros | | | 2008 | | | 49,999 | | | Jul-17 | | | Kouros Maritime S.A. | | | 2/3 | | | Liberia |

MR Pool | | | Lysias | | | 2008 | | | 49,999 | | | Jun-17 | | | Lysias Maritime S.A. | | | 3 | | | Malta |

MR Pool | | | MP MR Tanker 1 | | | 2011 | | | 49,999 | | | Apr-21 | | | M Pallonji Shipping Singapore Pte Ltd | | | 2 | | | Singapore |

MR Pool | | | Oinoussian Star | | | 2018 | | | 50,506 | | | Feb-20 | | | Louros Shipping Corporation | | | 2/3 | | | Marshall Islands |

MR Pool | | | OKEE John T | | | 2006 | | | 53,712 | | | Nov-22 | | | OKEE Ship Thirteen GmbH & Co. KG | | | N/A | | | Liberia |

MR Pool | | | OKEE Ulf | | | 2006 | | | 53,688 | | | Nov-22 | | | OKEE Ship Twelve Limited | | | N/A | | | Liberia |

MR Pool | | | Rich Rainbow | | | 2021 | | | 39,999 | | | Nov-23 | | | Rich Ocean Shipping Inc. | | | 2/3 | | | Panama |

MR Pool | | | Star Merlin | | | 2007 | | | 53,755 | | | Jun-22 | | | Star Merlin LLC | | | N/A | | | Portugal |

| | | | | | | | | | | | | | | ||||||||

Handy Pool | | | Anael | | | 2007 | | | 39,988 | | | Feb-22 | | | Merville Ventures Inc. | | | 3 | | | Liberia |

Handy Pool | | | Hafnia Bering | | | 2015 | | | 39,067 | | | Sep-23 | | | Hafnia Tankers Shipholding Singapore Pte. Ltd.(1) | | | 2/3 | | | Singapore |

Handy Pool | | | Prelude | | | 2007 | | | 39,988 | | | Jun-22 | | | Verda Enterprises Company | | | 3 | | | Liberia |

Handy Pool | | | VS Glory | | | 2006 | | | 34,671 | | | Nov-21 | | | Valloeby Glory Limited | | | 3 | | | Isle of Man |

Handy Pool | | | VS Leia | | | 2006 | | | 38,461 | | | Mar-19 | | | Valloeby Leia Limited | | | N/A | | | Isle of Man |

Handy Pool | | | VS Lisbeth | | | 2006 | | | 38,492 | | | Apr-18 | | | Valloeby Lisbeth Limited | | | N/A | | | Isle of Man |

Handy Pool | | | VS Remlin | | | 2003 | | | 34,530 | | | Dec-21 | | | Valloeby Remlin Limited | | | N/A | | | Isle of Man |

Handy Pool | | | VS Spirit | | | 2007 | | | 34,671 | | | Mar-20 | | | Valloeby Spirit Limited | | | 3 | | | Isle of Man |

Handy Pool | | | Wise | | | 2009 | | | 34,996 | | | Apr-23 | | | Minsheng Yangshun (Tianjin) Shipping Leasing Company Limited | | | N/A | | | Singapore |

Chemical-Handy Pool | | | TRF Mandal | | | 2016 | | | 37,596 | | | Nov-22 | | | WLR/TRF HMN8 Holdings I LLC | | | 2 | | | Marshall Islands |

Chemical-Handy Pool | | | TRF Marquette | | | 2016 | | | 37,596 | | | Dec-22 | | | WLR/TRF HMN8 Holdings II LLC | | | 2 | | | Marshall Islands |

Chemical-Handy Pool | | | TRF Memphis | | | 2016 | | | 37,596 | | | Aug-22 | | | WLR/TRF HMN8 Holdings III LLC | | | 2 | | | Marshall Islands |

Chemical-Handy Pool | | | TRF Mobile | | | 2016 | | | 37,596 | | | Sep-22 | | | WLR/TRF HMN8 Holdings IV LLC | | | 2 | | | Marshall Islands |

Chemical-Handy Pool | | | TRF Mongstad | | | 2016 | | | 37,596 | | | Sep-22 | | | WLR/TRF HMN8 Holdings V LLC | | | 2 | | | Marshall Islands |

Chemical-Handy Pool | | | TRF Moss | | | 2016 | | | 37,596 | | | Jun-22 | | | WLR/TRF HMN8 Holdings VI LLC | | | 2 | | | Marshall Islands |

| | | | | | | | | | | | | | | ||||||||

Specialised Pool | | | Amur Star | | | 2010 | | | 13,019 | | | Aug-20 | | | Valloeby Amur Star Ltd. | | | 2 | | | Malta |

Specialised Pool | | | Colorado Star | | | 2010 | | | 13,021 | | | Aug-20 | | | Valloeby Colorado Star Ltd. | | | 2 | | | Malta |

Specialised Pool | | | Ganges Star | | | 2010 | | | 13,013 | | | Aug-20 | | | Valloeby Ganges Star Ltd. | | | 2 | | | Malta |

Specialised Pool | | | Kongo Star | | | 2010 | | | 13,011 | | | Aug-20 | | | Valloeby Kongo Star Ltd. | | | 2 | | | Malta |

Specialised Pool | | | Lacanau | | | 2007 | | | 11,674 | | | Apr-22 | | | Sea-tankers Shipping SAS | | | 2 | | | Isle of Man. |

Specialised Pool | | | Lamentin | | | 2007 | | | 11,320 | | | Jun-21 | | | Valloeby Lamentin Ltd. | | | 1 | | | Malta |

Specialised Pool | | | Lascaux | | | 2007 | | | 11,674 | | | Apr-22 | | | Valloeby Lascaux Ltd. | | | 2 | | | Malta |

Specialised Pool | | | Mississippi Star | | | 2010 | | | 13,054 | | | Aug-20 | | | Valloeby Mississippi Star Ltd. | | | 2 | | | Malta |

Specialised Pool | | | Murray Star | | | 2011 | | | 13,006 | | | Aug-20 | | | Valloeby Murray Star Ltd. | | | 2 | | | Malta |

Specialised Pool | | | Pechora Star | | | 2011 | | | 13,021 | | | Aug-20 | | | Valloeby Pechora Star Ltd. | | | 2 | | | Malta |

Specialised Pool | | | Shannon Star | | | 2010 | | | 13,023 | | | Aug-20 | | | Valloeby Shannon Star Ltd. | | | 2 | | | Malta |

Specialised Pool | | | ST Sara | | | 2007 | | | 8,019 | | | Jul-21 | | | Valloeby Sara Ltd. | | | 2 | | | Malta |

Pool | | | Vessel name | | | Year Built | | | Capacity (dwt) | | | Pool entry | | | Registered Owner | | | IMO(*) | | | Flag |

Specialised Pool | | | VS Lara | | | 2006 | | | 11,276 | | | Jun-21 | | | Valloeby Lara Ltd. | | | 2 | | | Malta |

Specialised Pool | | | VS Salma | | | 2008 | | | 8,011 | | | May-21 | | | Valloeby Salma Ltd. | | | 2 | | | Malta |

Specialised Pool | | | VS Salome | | | 2007 | | | 7,915 | | | May-21 | | | Valloeby Salome Ltd. | | | 2 | | | Malta |

Total 71 Pool Vessels | | | | | | | 3,258,385 | | | | | | | | |

(*) | For a discussion of IMO ship types see “Environmental and Other Regulations in the Shipping Industry – Water Pollution – International – a. International Code for the Construction and Equipment of Ships Carrying Dangerous Chemicals in Bulk” in this Item 4. |

• | Voyage charters in the spot market. The spot market generally refers to the segment of the market where vessels are employed for a single voyage. A vessel earns income from each individual voyage and the owner pays the voyage expenses, including bunker and port costs. Spot market pricing, which can be volatile, is influenced by a number of factors, including the number of competing vessels, the number of cargoes available, oil pricing and arbitrage, worldwide events, and weather. Idle time between voyages is possible depending on the availability of cargo and positioning of the vessel. Under a spot market voyage charter, the vessel owner pays for both the voyage expenses (less specified amounts covered by the contract) and vessel operating costs. |