Depositary Shares of the Issuer (the “ADSs”) and the underlying Shares which any ADS represents.

(v) | Cash Settlement Amount: Upon any valid exercise of Exercise Rights with respect to one or more Securities, the Issuer shall exchange the Securities of the exercising Security Holders at their Cash Settlement Amount by no later than the fifth Hong Kong business day after the end of the relevant Cash Settlement Calculation Period (for the avoidance of doubt, regardless of whether such date falls before, on, or after the Maturity Date). |

The Cash Settlement Amount shall be paid by the Issuer by transfer to a U.S. dollar account maintained by the payee in accordance with the instructions given by the relevant Security Holder in the relevant Exercise Notice. For the avoidance of doubt, such payment shall be made by the Issuer to the relevant Security Holder directly and none of the Agents shall have any duties or obligations in respect of such payment of Cash Settlement Amount.

The Issuer’s obligations to satisfy any Exercise Right in respect of the relevant Exercise Notice shall be discharged only upon payment in full of the relevant Cash Settlement Amount. Upon payment in full of the relevant Cash Settlement Amounts in satisfaction of the Exercise Right of any exercising Security Holder, the right of such exercising Security Holder to any repayment of the principal, premium (if any), interest or any other amounts under the Securities in respect of which Exercise Rights have been exercised shall be extinguished.

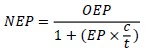

“Cash Settlement Amount” means, for the relevant Exercise Period, in respect of any exercise of the Exercise Right, an amount calculated by the Issuer in accordance with the following formula and which shall be payable to a Security Holder as provided in these Conditions upon an exercise of an Exercise Right:

(a) Initial Exercise Period:

CSA | = | the Cash Settlement Amount; |

S | = | the Cash Settled Shares; |

Pn | = | on the relevant Trading Day, the Volume Weighted Average Price of a Share on such Trading Day falling in the corresponding Cash Settlement Calculation Period, translated into U.S. dollars at the Prevailing Rate on such Trading Day; and |

N | = | 60, being the number of Trading Days in the Cash Settlement Calculation Period. |

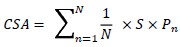

(b) Final Exercise Period:

CSA | = | the Cash Settlement Amount; |

S | = | the Cash Settled Shares; |

Pn | = | on the relevant Trading Day, the higher of (i) the applicable Exercise Price and (ii) the Volume Weighted Average Price of a Share on such Trading Day falling in the corresponding Cash Settlement Calculation Period, translated into U.S. dollars at the Prevailing Rate on such Trading Day; and |

59