Please wait

Spire Global Announces Second Quarter 2025 Results

Company to participate in upcoming investor events

VIENNA, VA, November 3, 2025 – Spire Global, Inc. (NYSE: SPIR) (“Spire” or “the Company”), a global provider of space-based data, analytics and space services, announced results for its quarter ended June 30, 2025.

Second Quarter 2025 Financial Highlights

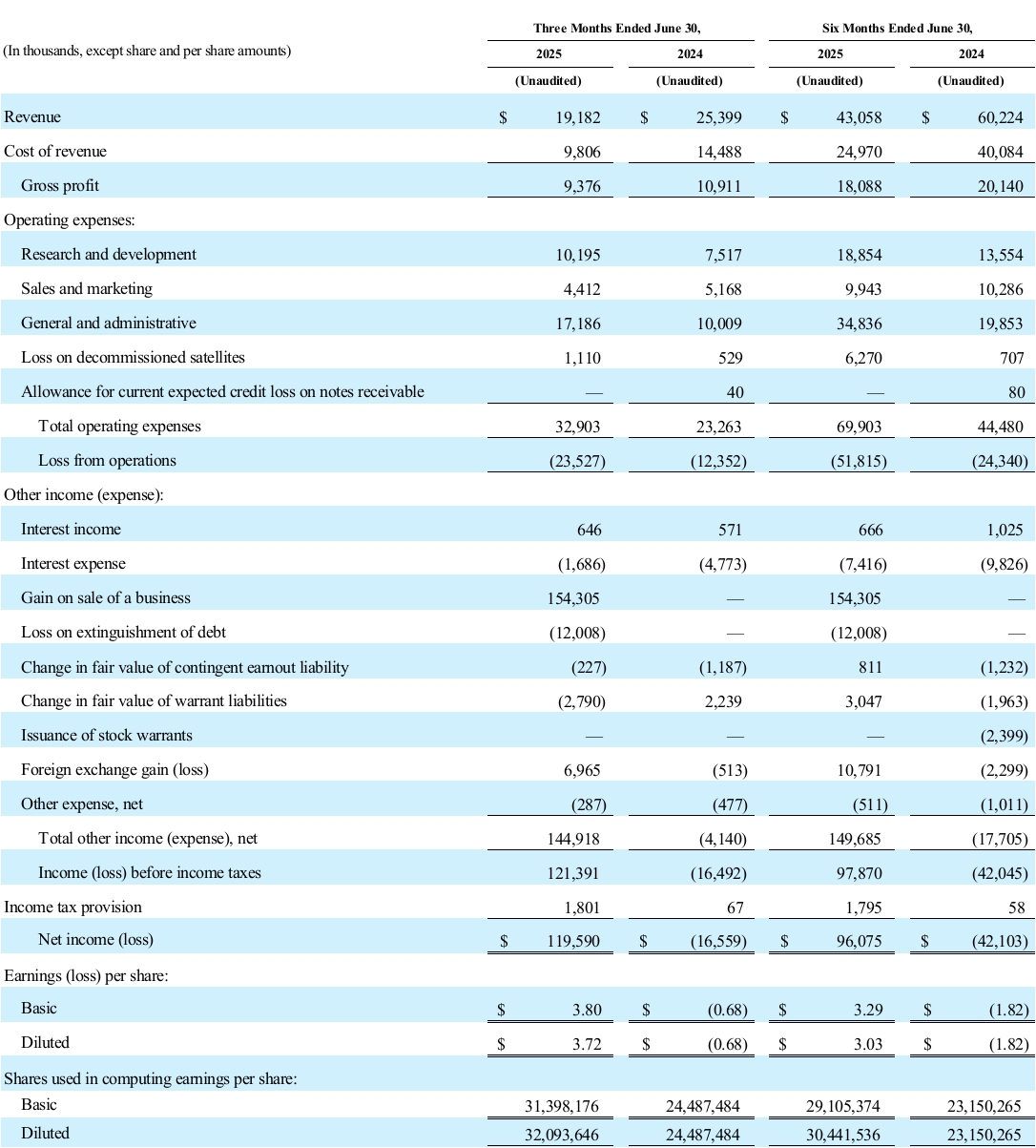

●Revenue of $19.2 million, achieving the midpoint of Spire’s second quarter guidance range and above the upper end of the preliminary, unaudited second quarter revenue range previously disclosed.

●Remaining performance obligations not yet recognized as revenue of $208.9 million.

●GAAP operating loss of $23.5 million and non-GAAP1 operating loss of $12.4 million.

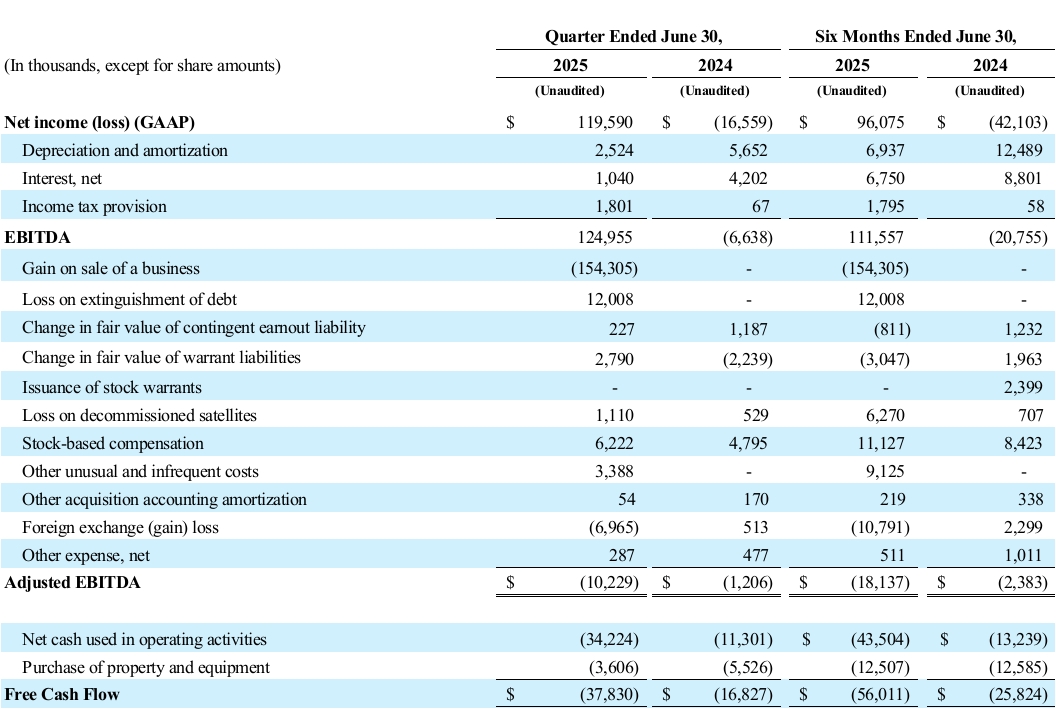

●Net income of $119.6 million and adjusted EBITDA1 of negative $10.2 million.

●Cash, cash equivalents, and marketable securities of $117.6 million for the quarter ended June 30, 2025, and 32.7 million shares outstanding as of October 24, 2025.

Financial Outlook

Spire expects to provide select third quarter 2025 financial highlights for the period ended September 30, 2025 and full year 2025 guidance in connection with a business and financial update conference call in early December 2025.

Upcoming Investor Events

Event: 16th Annual Craig-Hallum Alpha Select Conference

Date: November 18, 2025

Location: Sheraton New York Times Square Hotel

Event: Deutsche Bank Global Space Summit

Date: November 19, 2025

Location: Deutsche Bank Center, New York

For more information about the above events or to schedule a one-on-one meeting with Spire Global, please contact your sales representative at the sponsoring firm.

Event: Spire Third Quarter 2025 Business and Financial Update

Date: TBD

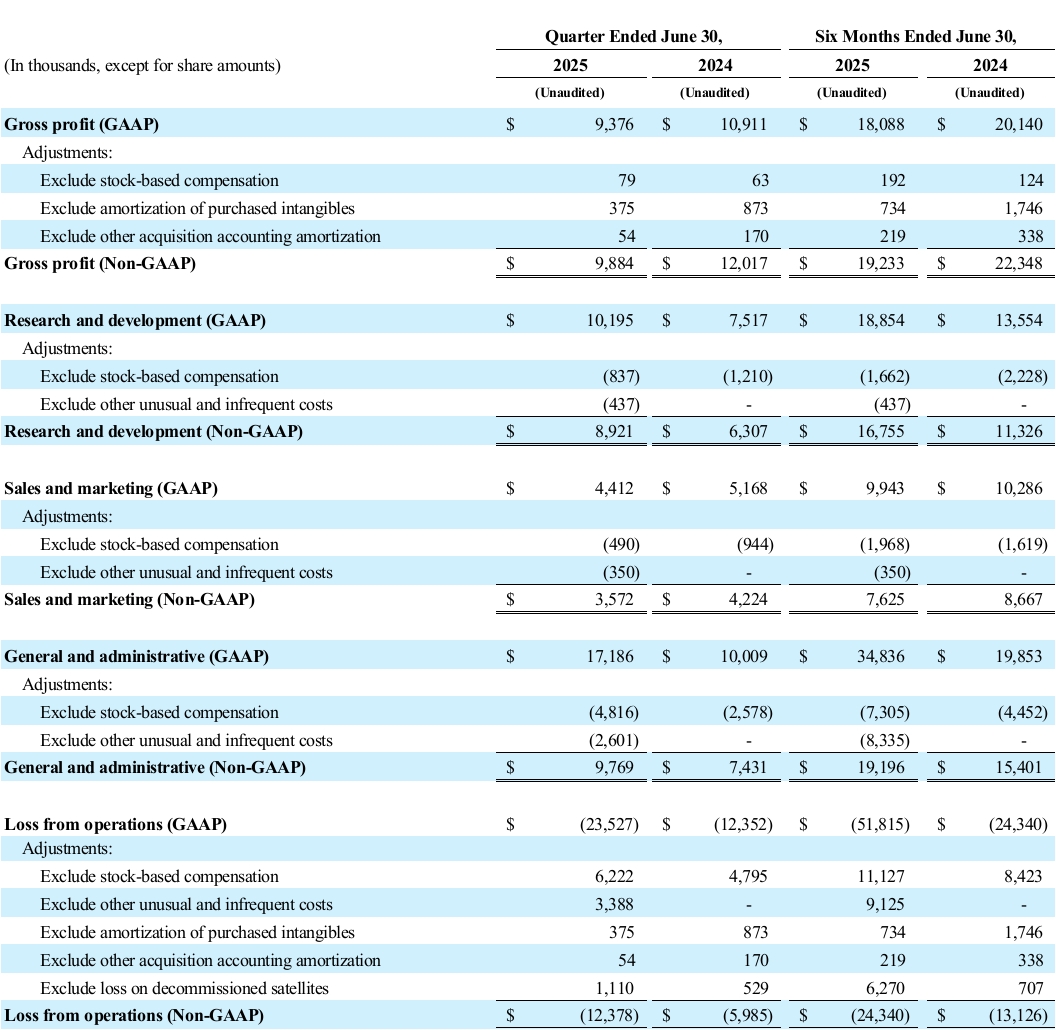

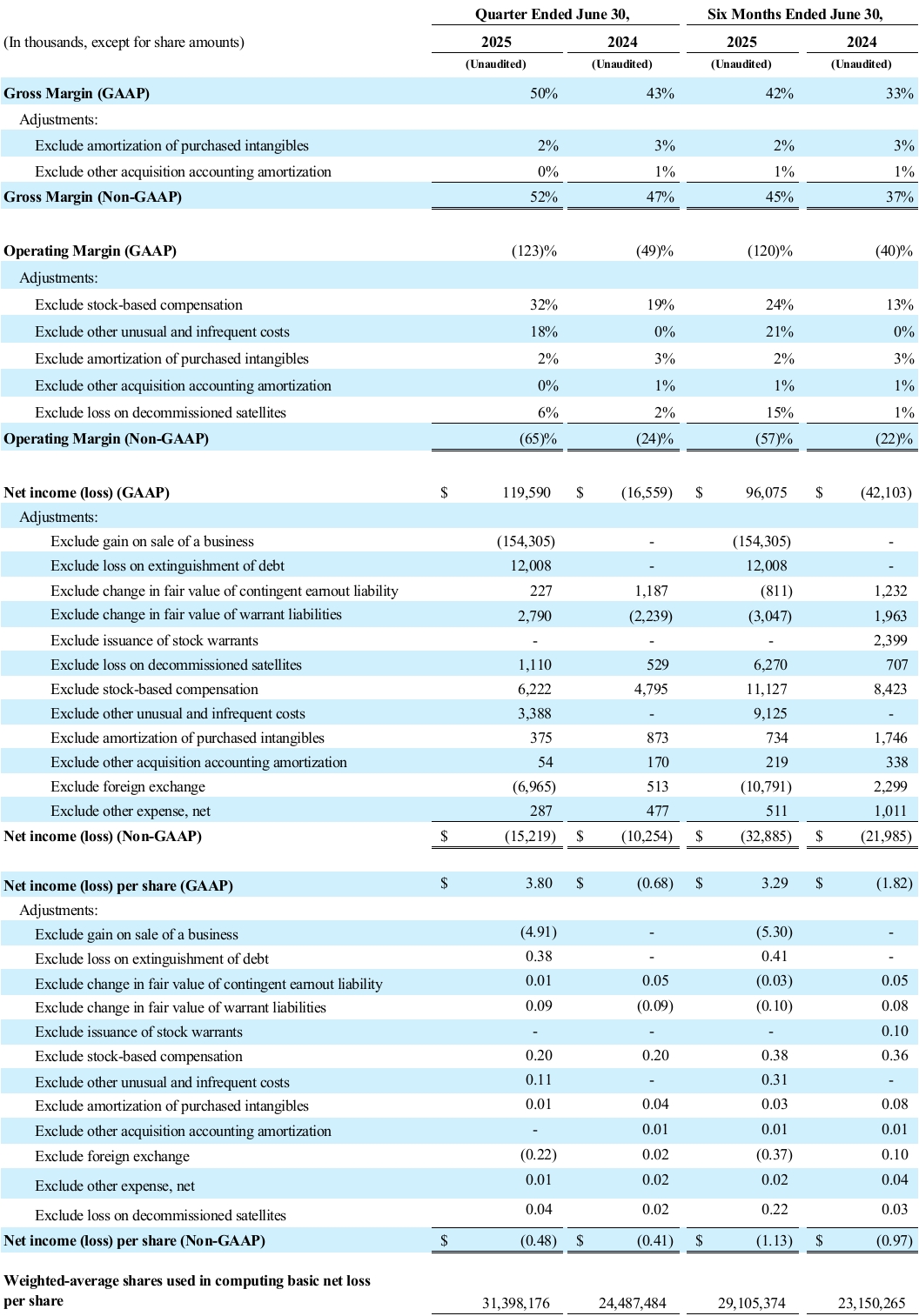

Non-GAAP Financial Measures

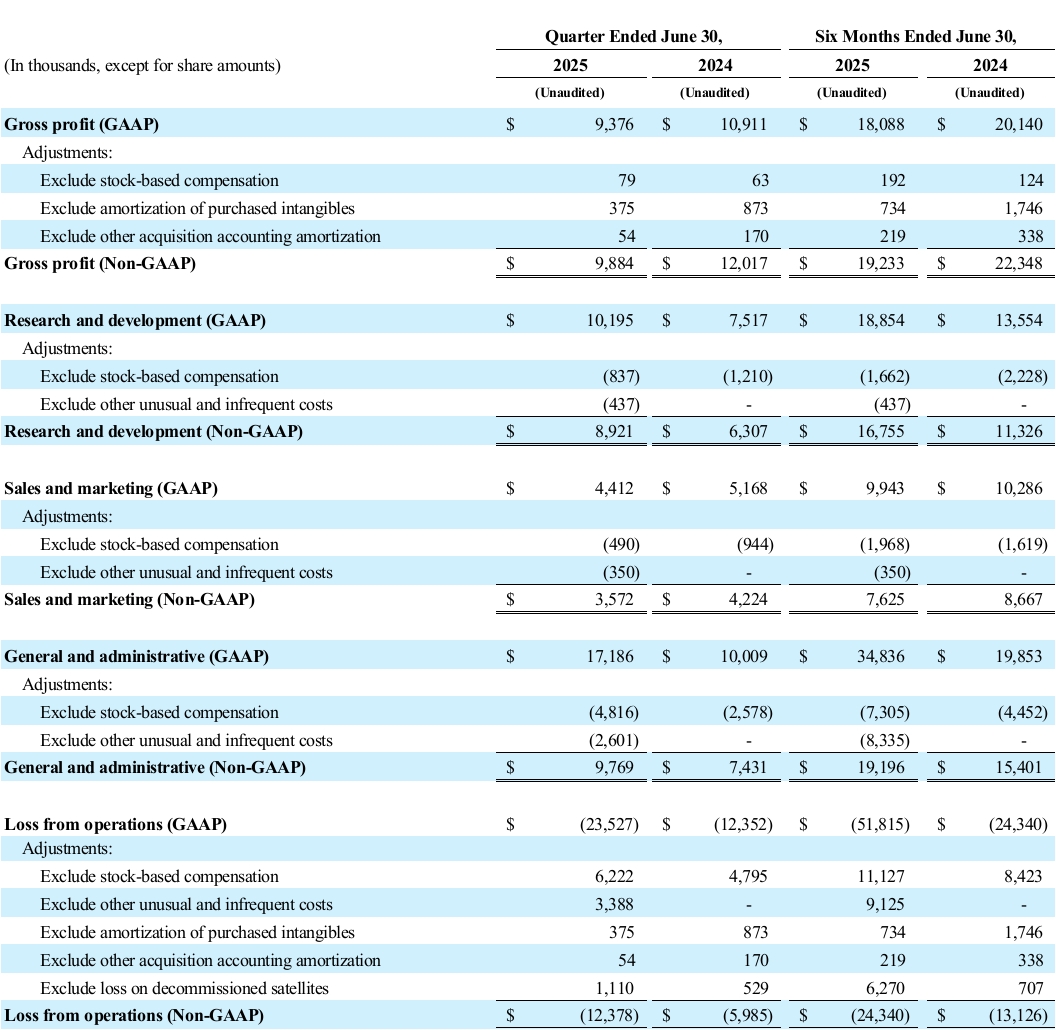

In addition to financial measures prepared in accordance with GAAP, this press release and the accompanying tables contain non-GAAP financial measures, including free cash flow, non-GAAP gross profit, non-GAAP gross margins, non-GAAP research and development, non-GAAP sales and marketing, non-GAAP general and administrative expenses, non-GAAP operating loss/income, non-GAAP operating margin, EBITDA, Adjusted EBITDA, non-GAAP net loss/income, and non-GAAP net loss/income per share. Spire’s management uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to the corresponding GAAP financial measures, in evaluating its ongoing operational performance and trends and in comparing its financial measures with other companies in the same industry, many of which present similar non-GAAP financial measures to help investors understand the operational performance of their businesses. However, it is important to note that the particular items Spire excludes from, or includes in, its non-GAAP financial measures may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry. In addition, other companies may utilize metrics that are not similar to Spire’s. The non-GAAP financial information is presented for supplemental informational purposes only and is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. There are material limitations associated with the use of non-GAAP

1 Non-GAAP Financial Measure, please see section titled Non-GAAP Financial Measures for the definition of such measures and the reconciliation tables at the end of this release for reconciliation to the most directly comparable GAAP measure.

financial measures since they exclude significant expenses and income that are required by GAAP to be recorded in Spire’s financial statements. Investors should note that the excluded items may have had, and may in the future have, a material impact on our reported financial results. Please see the reconciliation tables at the end of this release for the reconciliation of GAAP and non-GAAP results. Management encourages investors and others to review Spire’s financial information in its entirety and not rely on a single financial measure.

Spire adjusts the following items from one or more of its non-GAAP financial measures:

Gain on sale of a business. Spire excludes this as a material unusual item that does not reflect the ongoing operational results of its business.

Loss on extinguishment of debt. Spire excludes this as it is not typical of the ongoing servicing of its debt and do not reflect the operational results of its business.

Change in fair value of contingent earnout liabilities and warrant liabilities. Spire excludes this as it does not reflect the underlying cash flows or operational results of the business.

Issuance of stock warrants. Spire excludes this as it does not reflect the underlying cash flows or operational results of the business.

Foreign exchange gain/loss. Spire is exposed to foreign currency gains or losses on outstanding foreign currency denominated receivables and payables related to certain customer sales agreements, product costs and other operating expenses. As Spire does not actively hedge these currency exposures, changes in the underlying currency rates relative to the U.S. dollar may result in realized and unrealized foreign currency gains and losses between the time these receivables and payables arise and the time that they are settled in cash. Since such realized and unrealized foreign currency gains and losses are the result of macro-economic factors and can vary significantly from one period to the next, Spire believes that exclusion of such realized and unrealized gains and losses is useful to management and investors in evaluating the performance of its ongoing operations on a period-to-period basis.

Other expense, net. Spire excludes other expense, net because it includes items that do not reflect the underlying cash flows or operational results of its business. Examples of such expenses include equity investment loss and disposal of assets.

Stock-based compensation. Spire excludes stock-based compensation expenses primarily because they are non-cash expenses that it excludes from its internal management reporting processes. Spire also finds it useful to exclude these expenses when management assesses the appropriate level of various operating expenses and resource allocations when budgeting, planning, and forecasting future periods. Moreover, because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use under FASB ASC Topic 718, Stock Compensation, Spire believes excluding stock-based compensation expenses allows investors to make meaningful comparisons between its recurring core business results of operations and those of other companies.

Loss on decommissioned satellites. Spire excludes loss on decommissioned satellites because if there was no loss, the expense would be accounted for as depreciation and would also be excluded as part of its EBITDA calculation.

Amortization of purchased intangibles. Spire incurs amortization expense for purchased intangible assets in connection with acquisitions of certain businesses and technologies. Amortization of intangible assets is a non-cash expense and is inconsistent in amount and frequency because it is significantly affected by the timing, size of acquisitions and the inherent subjective nature of purchase price allocations. Because these costs have already been incurred and cannot be recovered, and are non-cash expenses, Spire excludes these expenses for its internal management reporting processes. Spire's management also finds it useful to exclude these charges when assessing the appropriate level of various operating expenses and resource allocations when budgeting, planning and forecasting future periods. It is important to

note that while this amortization expense is excluded for purposes of non-GAAP presentation, the revenue of the acquired businesses is reflected in the non-GAAP measures and that the assets contribute to revenue generation.

Other unusual and infrequent costs. Spire excludes these as they are unusual items that do not reflect the ongoing operational results of its business. Examples of these types of expenses include accounting, legal and other professional fees associated with the financial restatement.

Other acquisition accounting amortization. Spire amortizes prepaid expense for purchased data rights in connection with the acquisition of exactEarth and certain technologies. The prepaid amortization of this asset is a non-cash expense that can be significantly affected by the inherent subjective nature of the assigned value and useful life. Spire excludes this amortized prepaid expense for its internal management reporting processes because it has already been incurred and is a non-cash expense. Spire's management also finds it useful to exclude this charge when assessing the appropriate level of various operating expenses and resource allocations when budgeting, planning and forecasting future periods. It is important to note that while this expense is excluded for purposes of non-GAAP presentation, the revenue of the acquired companies is reflected in the non-GAAP measures and that the assets contribute to revenue generation.

Our additional non-GAAP measures include:

Free Cash Flow. Spire defines free cash flow as net cash provided by/used in operating activities less purchases of property and equipment.

EBITDA. Spire defines EBITDA as net income (loss), plus depreciation and amortization expense, plus interest expense, and plus the provision for (or minus benefit from) income taxes.

Adjusted EBITDA. Spire defines Adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, further adjusted for any gain on sale of division, loss on extinguishment of debt, change in fair value of contingent earnout liability, change in fair value of warrant liabilities, issuance of stock warrants, foreign exchange (gain) loss, other expense, net, stock-based compensation, loss on decommissioned satellites, other unusual and infrequent costs, and other acquisition accounting amortization. Spire believes Adjusted EBITDA can be useful in providing an understanding of the underlying results of operations and trends, an enhanced overall understanding of our financial performance and prospects for the future. While Adjusted EBITDA is not a recognized measure under GAAP, management uses this financial measure to evaluate and forecast business performance. Adjusted EBITDA is not intended to be a measure of liquidity or cash flows from operations or a measure comparable to net income (loss) as it does not take into account certain requirements, such as capital expenditures and related depreciation, interest payments, tax benefits, stock-based compensation, other unusual and infrequent costs, and other acquisition accounting amortization. Adjusted EBITDA is not a presentation made in accordance with GAAP, and Spire’s use of the term Adjusted EBITDA may vary from the use of similarly titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation.

Additional non-GAAP measures utilized by Spire incorporate the adjustments described in the reconciliation tables below.

Safe Harbor Statement

This press release contains forward-looking statements, including information about management's view of Spire’s future expectations, plans and prospects, including our views regarding future execution within our business, and the opportunity we see in our industry, within the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors which may cause the results of Spire to be materially different than those expressed or implied in such statements. Certain of these risk factors and others are included in documents Spire files with

the Securities and Exchange Commission, including but not limited to, Spire’s Annual Report on Form 10-K/A for the year ended December 31, 2024, as well as subsequent reports filed with the Securities and Exchange Commission. Other unknown or unpredictable factors also could have material adverse effects on Spire’s future results. The forward-looking statements included in this presentation are made only as of the date hereof. Spire cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, Spire expressly disclaims any intent or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

About Spire Global, Inc.

Spire (NYSE: SPIR) is a global provider of space-based data, analytics and space services, offering unique datasets and powerful insights about Earth so that organizations can make decisions with confidence in a rapidly changing world. Spire builds, owns, and operates a fully deployed satellite constellation that observes the Earth in real time using radio frequency technology. The data acquired by Spire’s satellites provides global weather intelligence, ship and plane movements, and spoofing and jamming detection to better predict how their patterns impact economies, global security, business operations and the environment. Spire also offers Space as a Service solutions that empower customers to leverage its established infrastructure to put their business in space. Spire has offices across the U.S., Canada, UK, Luxembourg and Germany. To learn more, visit spire.com.

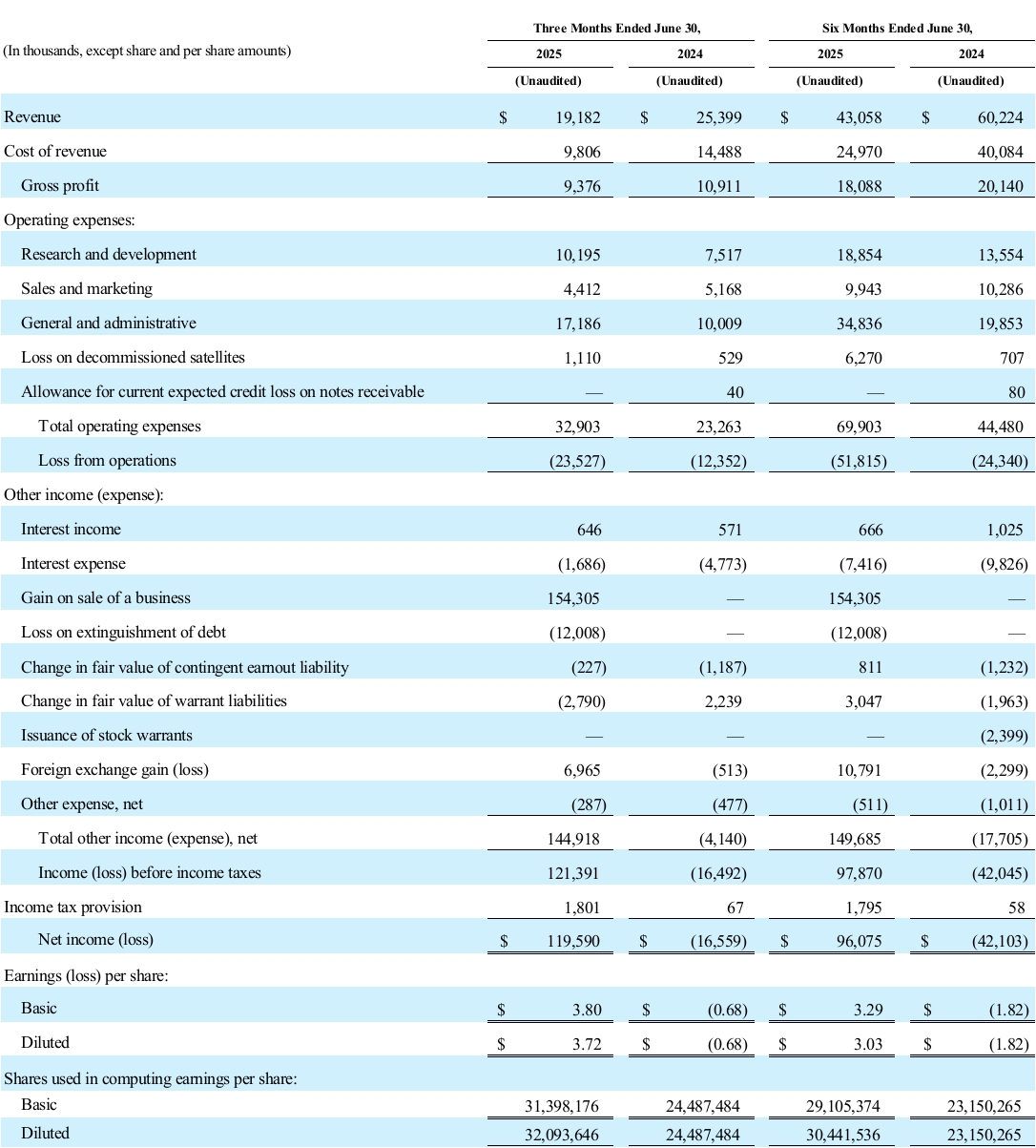

CONSOLIDATED STATEMENTS OF OPERATIONS

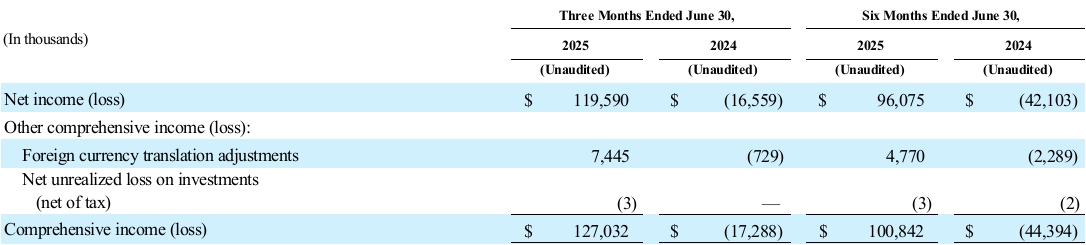

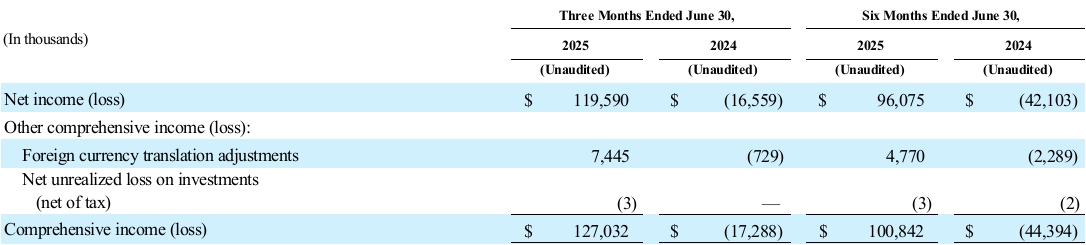

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

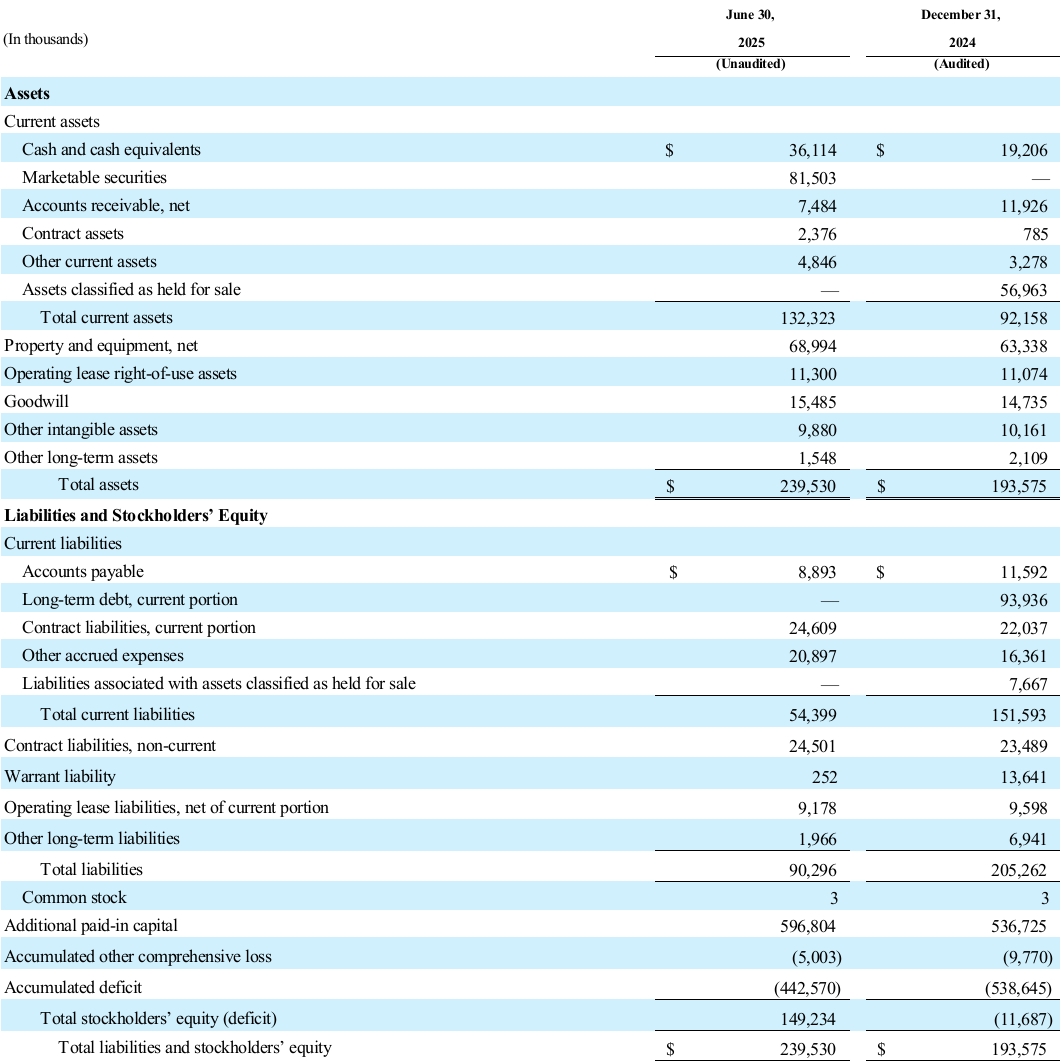

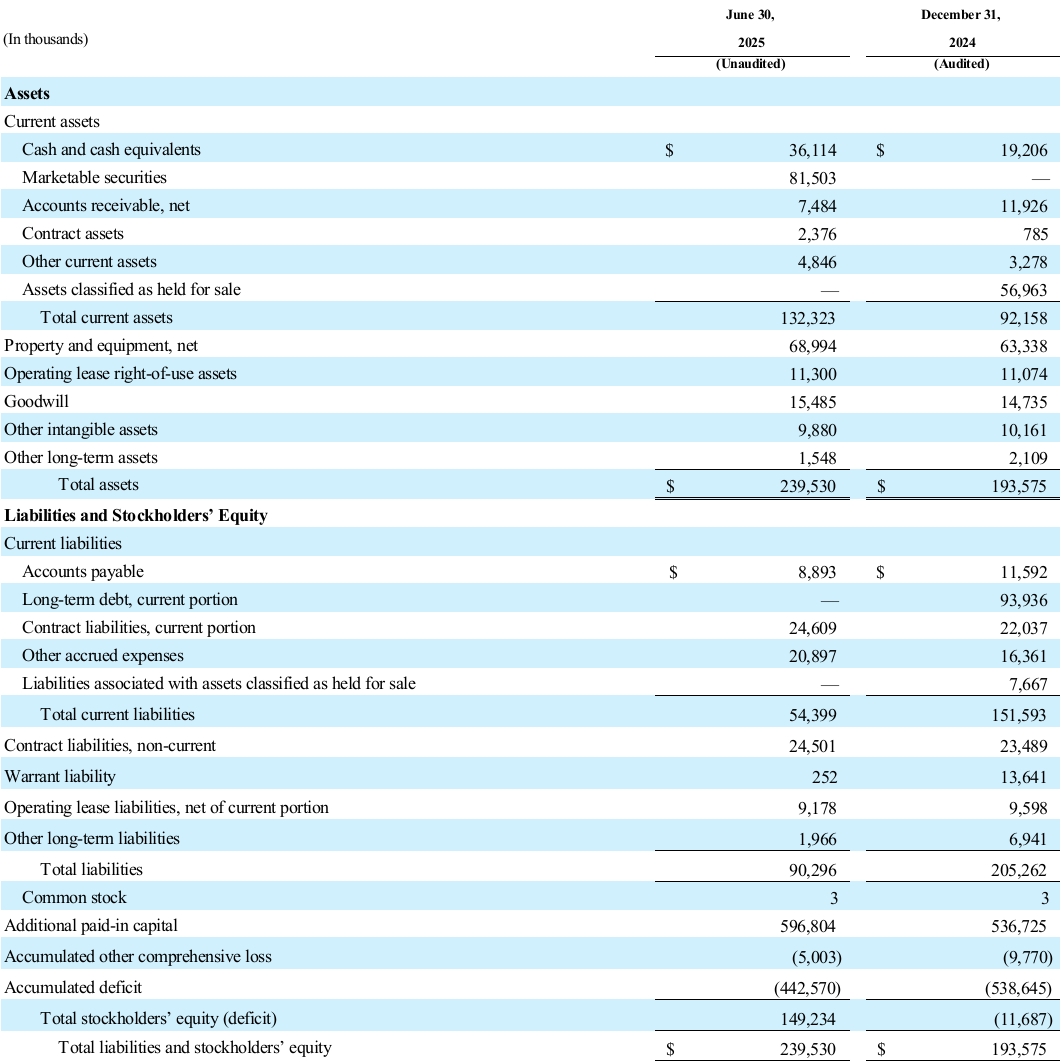

CONSOLIDATED BALANCE SHEETS

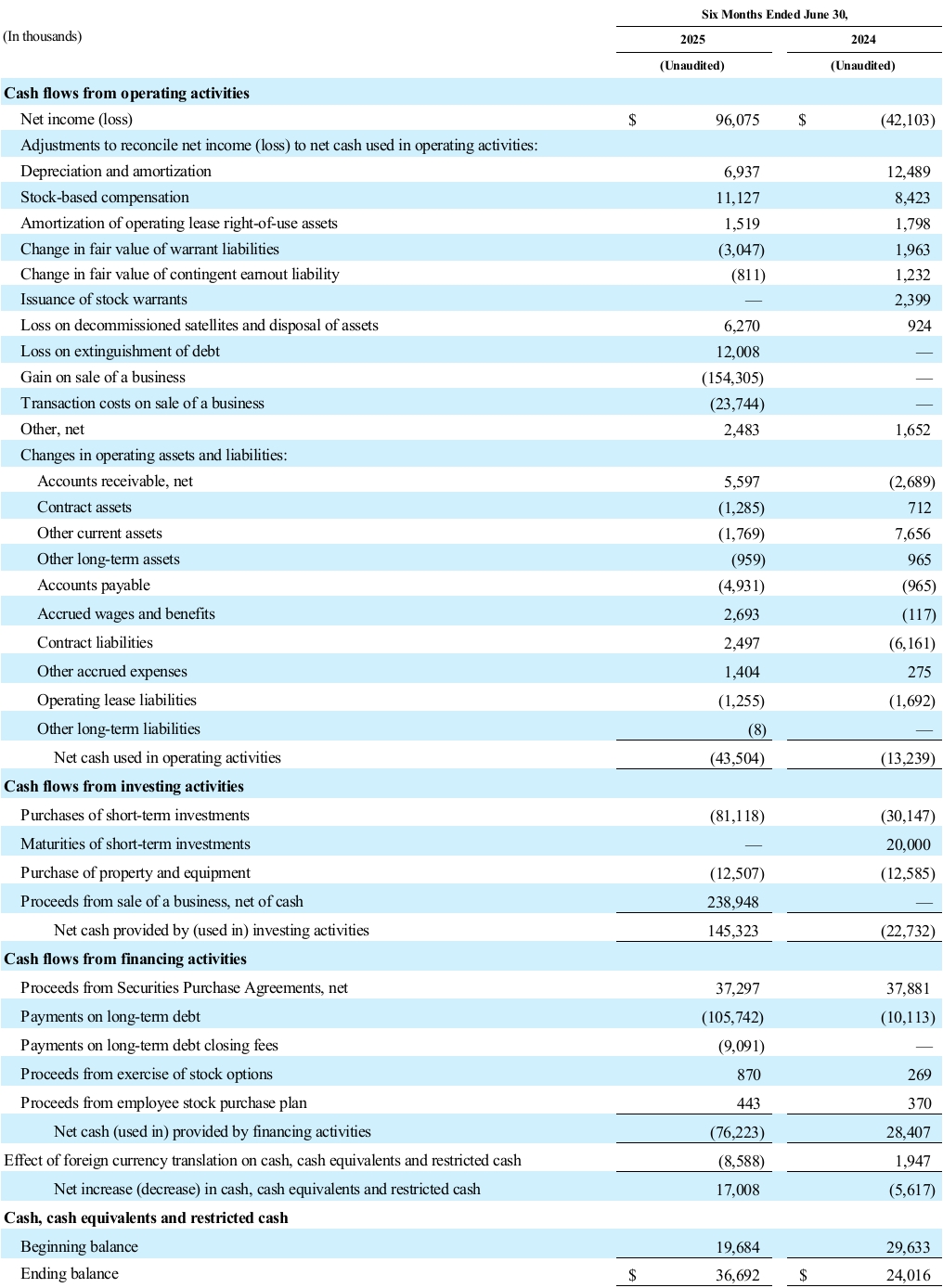

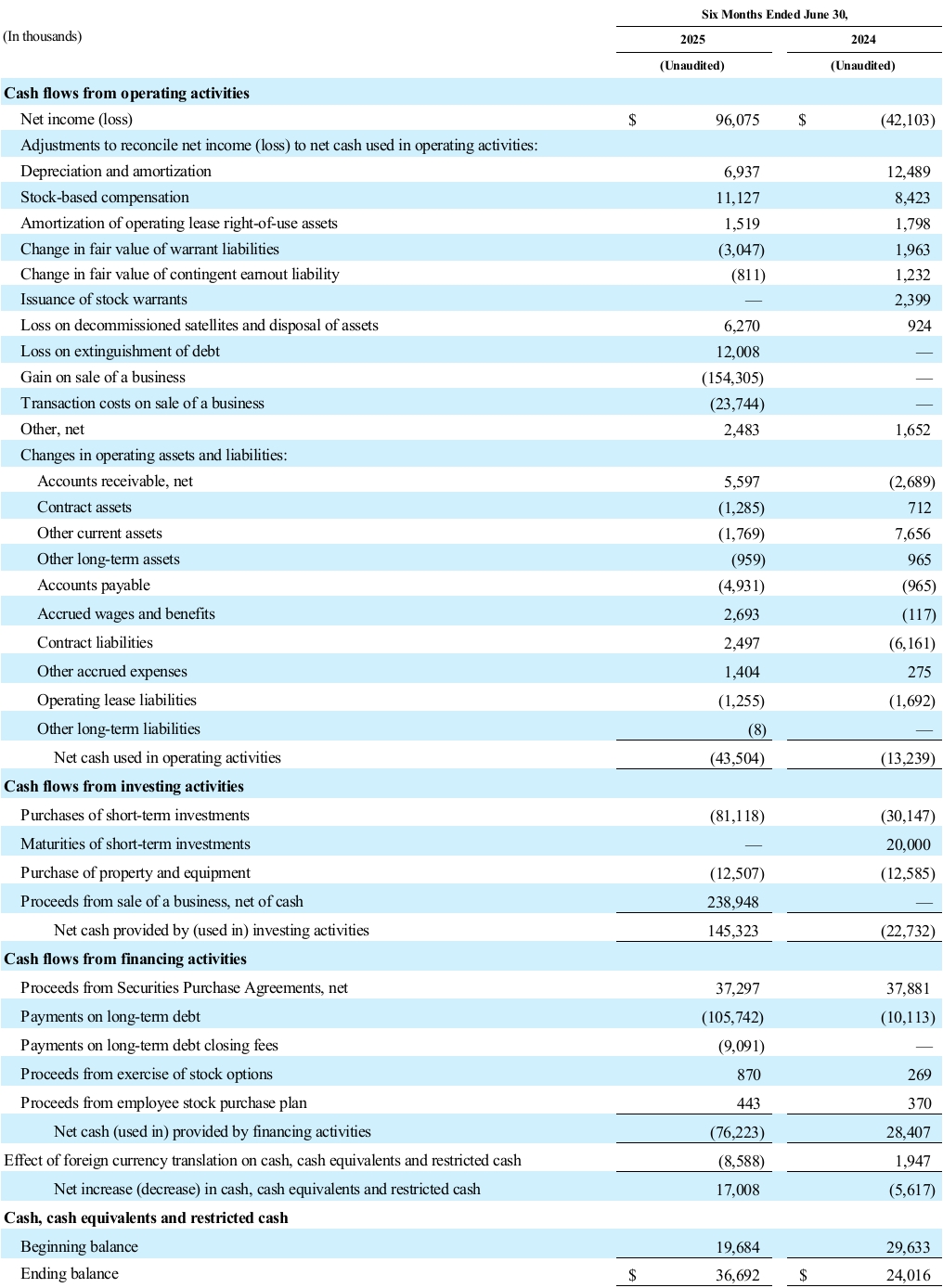

CONSOLIDATED STATEMENTS OF CASH FLOWS

GAAP to Non-GAAP Reconciliations

Contacts

For Media:

Sarah Freeman

Senior Communications Manager

Sarah.Freeman@spire.com

For Investors:

Benjamin Hackman

Head of Investor Relations

Benjamin.Hackman@spire.com