J.P. Morgan 44th Annual Healthcare Conference Corporate Overview January 2026 .2

Disclaimer and FLS This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, express or implied statements regarding Disc’s expectations with respect to its preclinical studies, clinical trials and research and development programs, in particular with respect to bitopertin, DISC-0974 and DISC-3405, and any developments or results in connection therewith; projected timelines for the initiation and completion of its clinical trials, anticipated timing of release of data, and other clinical activities; the registrational pathway for bitopertin, including the potential for accelerated approval, benefits of the CNPV, expected review period and timing of approval, if granted; anticipated discussions with regulatory agencies; Disc’s expectations with respect to the potential launch and commercialization of bitopertin, if approved; the market and potential opportunities for bitopertin, DISC-0974 and DISC-3405; the potential of Disc’s development programs in new indications; Disc’s preliminary unaudited cash, cash equivalents and marketable securities as of December 31, 2025; and the time period over which Disc’s capital resources will be sufficient to fund its anticipated operations. The use of words such as, but not limited to, “believe,” “expect,” “estimate,” “project,” “intend,” “future,” “potential,” “continue,” “may,” “might,” “plan,” “will,” “should,” “seek,” “anticipate,” or “could” or the negative of these terms and other similar words or expressions that are intended to identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on Disc’s current beliefs, expectations and assumptions regarding the future of Disc’s business, future plans and strategies, clinical results and other future conditions. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Disc may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and investors should not place undue reliance on these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements as a result of a number of material risks and uncertainties including but not limited to: the adequacy of Disc’s capital to support its future operations and its ability to successfully initiate and complete clinical trials; the nature, strategy and focus of Disc; the difficulty in predicting the time and cost of development of Disc’s product candidates; Disc’s plans to research, develop and commercialize its current and future product candidates; the timing of initiation of Disc’s planned preclinical studies and clinical trials; the timing of the availability of data from Disc’s clinical trials; Disc’s ability to identify additional product candidates with significant commercial potential and to expand its pipeline in hematological diseases; the timing and anticipated results of Disc’s preclinical studies and clinical trials and the risk that the results of Disc’s preclinical studies and clinical trials may not be predictive of future results in connection with future studies or clinical trials and may not support further development and marketing approval; the content and timing of decisions made by the FDA and other regulatory authorities; final audit adjustments and other developments that may arise that would cause Disc’s expectations with respect to the estimate of cash, cash equivalents and marketable securities as of December 31, 2025 to differ, perhaps materially, from the financial results that will be reflected in Disc’s audited consolidated financial statements for the fiscal year ended December 31, 2025; and the other risks and uncertainties described in Disc’s filings with the Securities and Exchange Commission, including in the “Risk Factors” section of Disc’s Annual Report on Form 10-K for the year ended December 31, 2024, and in subsequent Quarterly Reports on Form 10-Q. Any forward-looking statement speaks only as of the date on which it was made. None of Disc, nor its affiliates, advisors or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise, except as required by law.

Bitopertin, DISC-0974, and DISC-3405 are investigational agents and are not approved for use as therapies in any jurisdiction worldwide

Agenda Introduction Overview: Bitopertin for EPP Bitopertin Launch Strategy Pipeline Programs 2026/2027 Corporate Outlook Q&A

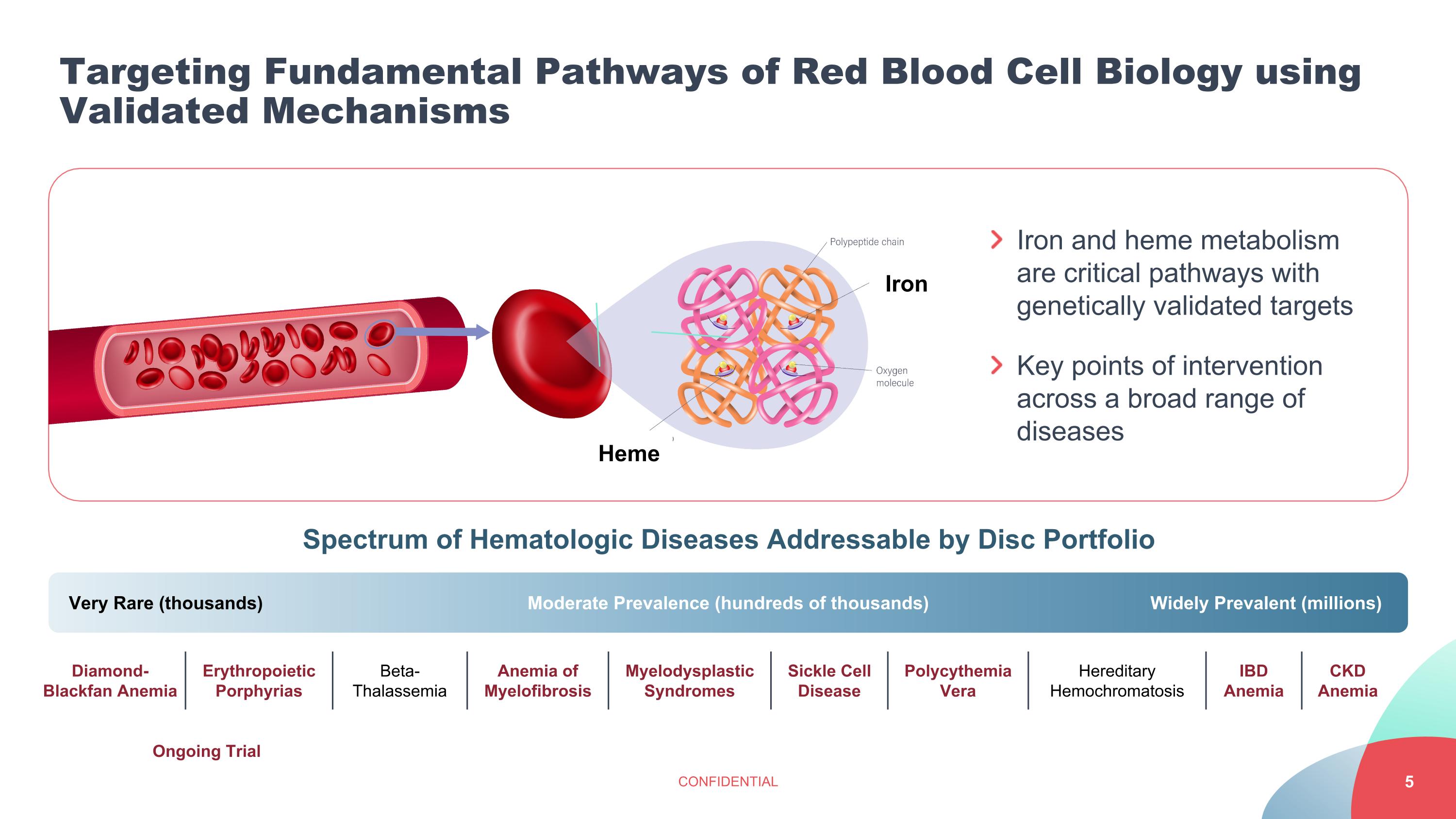

Targeting Fundamental Pathways of Red Blood Cell Biology using Validated Mechanisms CONFIDENTIAL Very Rare (thousands) Moderate Prevalence (hundreds of thousands) Widely Prevalent (millions) Erythropoietic Porphyrias Beta-Thalassemia Anemia of Myelofibrosis Myelodysplastic Syndromes Sickle Cell Disease Polycythemia Vera Hereditary Hemochromatosis IBD Anemia CKD Anemia Spectrum of Hematologic Diseases Addressable by Disc Portfolio Ongoing Trial Iron and heme metabolism are critical pathways with genetically validated targets Key points of intervention across a broad range of diseases Iron Heme Diamond-Blackfan Anemia

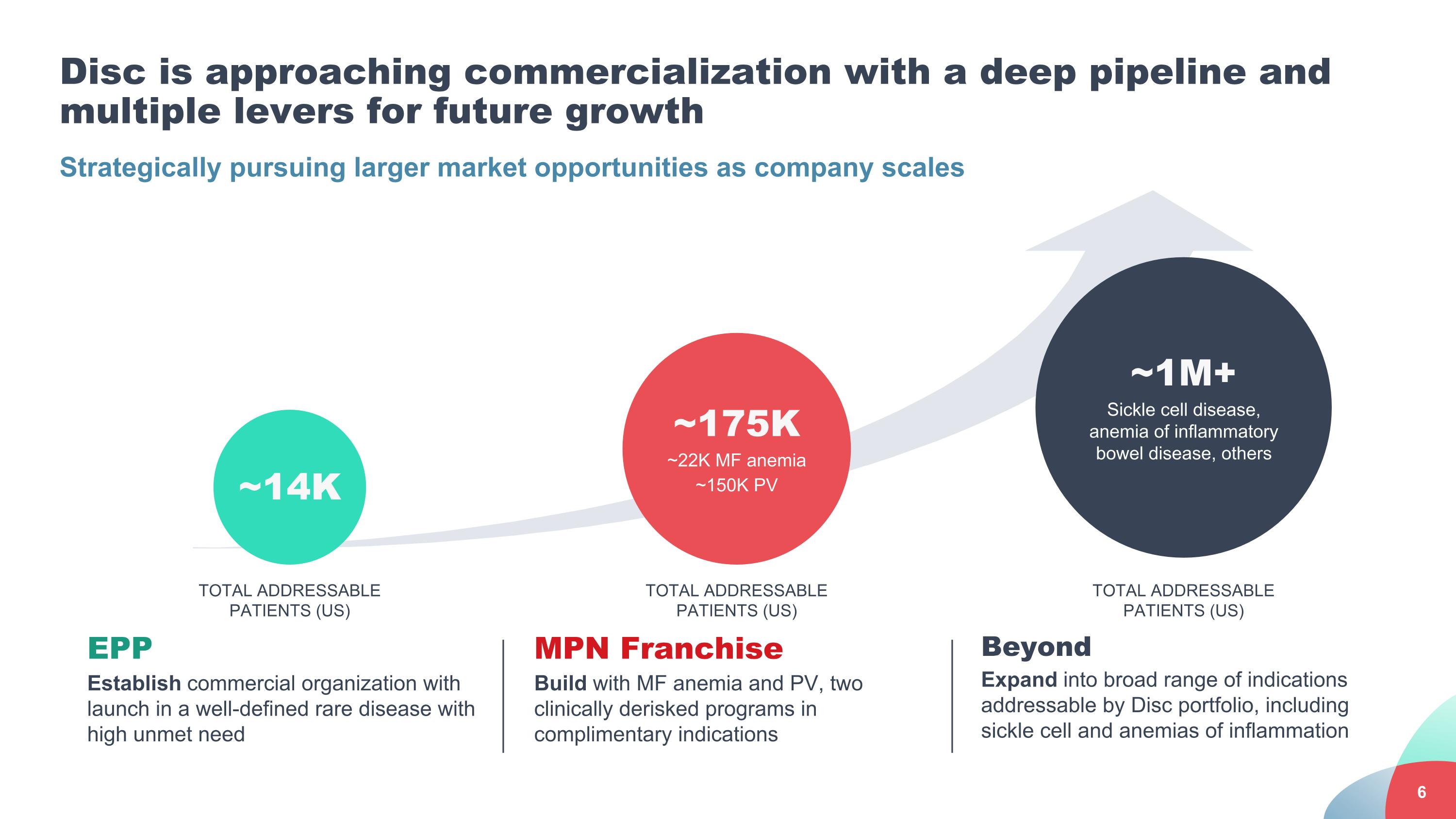

Strategically pursuing larger market opportunities as company scales Disc is approaching commercialization with a deep pipeline and multiple levers for future growth EPP Establish commercial organization with launch in a well-defined rare disease with high unmet need MPN Franchise Build with MF anemia and PV, two clinically derisked programs in complimentary indications Beyond Expand into broad range of indications addressable by Disc portfolio, including sickle cell and anemias of inflammation ~14K ~175K ~22K MF anemia ~150K PV ~1M+ Sickle cell disease, anemia of inflammatory bowel disease, others TOTAL ADDRESSABLE PATIENTS (US) TOTAL ADDRESSABLE PATIENTS (US) TOTAL ADDRESSABLE PATIENTS (US)

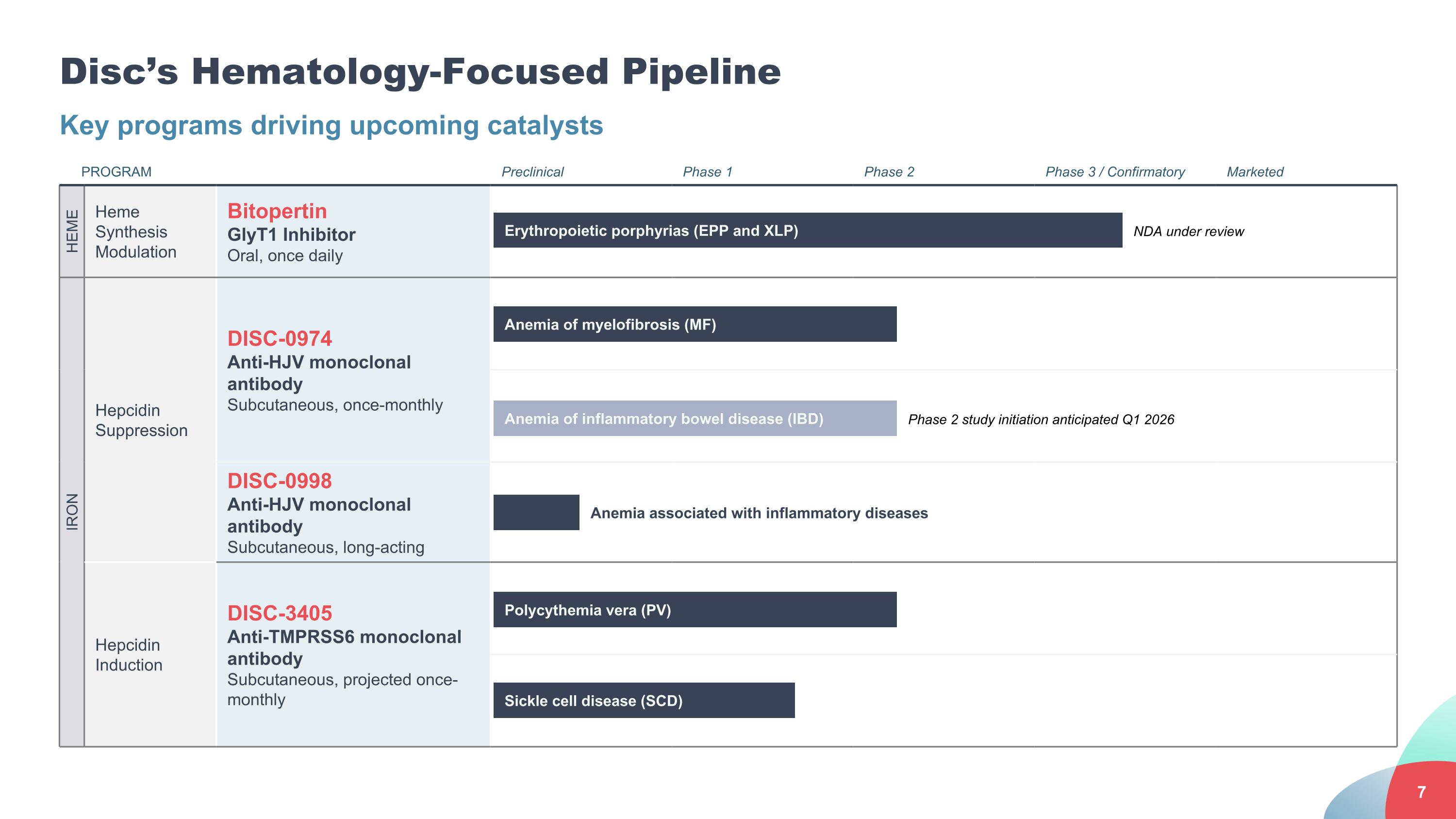

Disc’s Hematology-Focused Pipeline Key programs driving upcoming catalysts PROGRAM Preclinical Phase 1 Phase 2 Phase 3 / Confirmatory Marketed HEME Heme Synthesis Modulation Bitopertin GlyT1 Inhibitor Oral, once daily IRON Hepcidin Suppression DISC-0974 Anti-HJV monoclonal antibody Subcutaneous, once-monthly DISC-0998 Anti-HJV monoclonal antibody Subcutaneous, long-acting Hepcidin Induction DISC-3405 Anti-TMPRSS6 monoclonal antibody Subcutaneous, projected once-monthly Anemia of myelofibrosis (MF) Polycythemia vera (PV) Sickle cell disease (SCD) Anemia associated with inflammatory diseases Erythropoietic porphyrias (EPP and XLP) NDA under review Anemia of inflammatory bowel disease (IBD) Phase 2 study initiation anticipated Q1 2026

Agenda Introduction Overview: Bitopertin for EPP Bitopertin Launch Strategy Pipeline Programs 2026/2027 Corporate Outlook Q&A

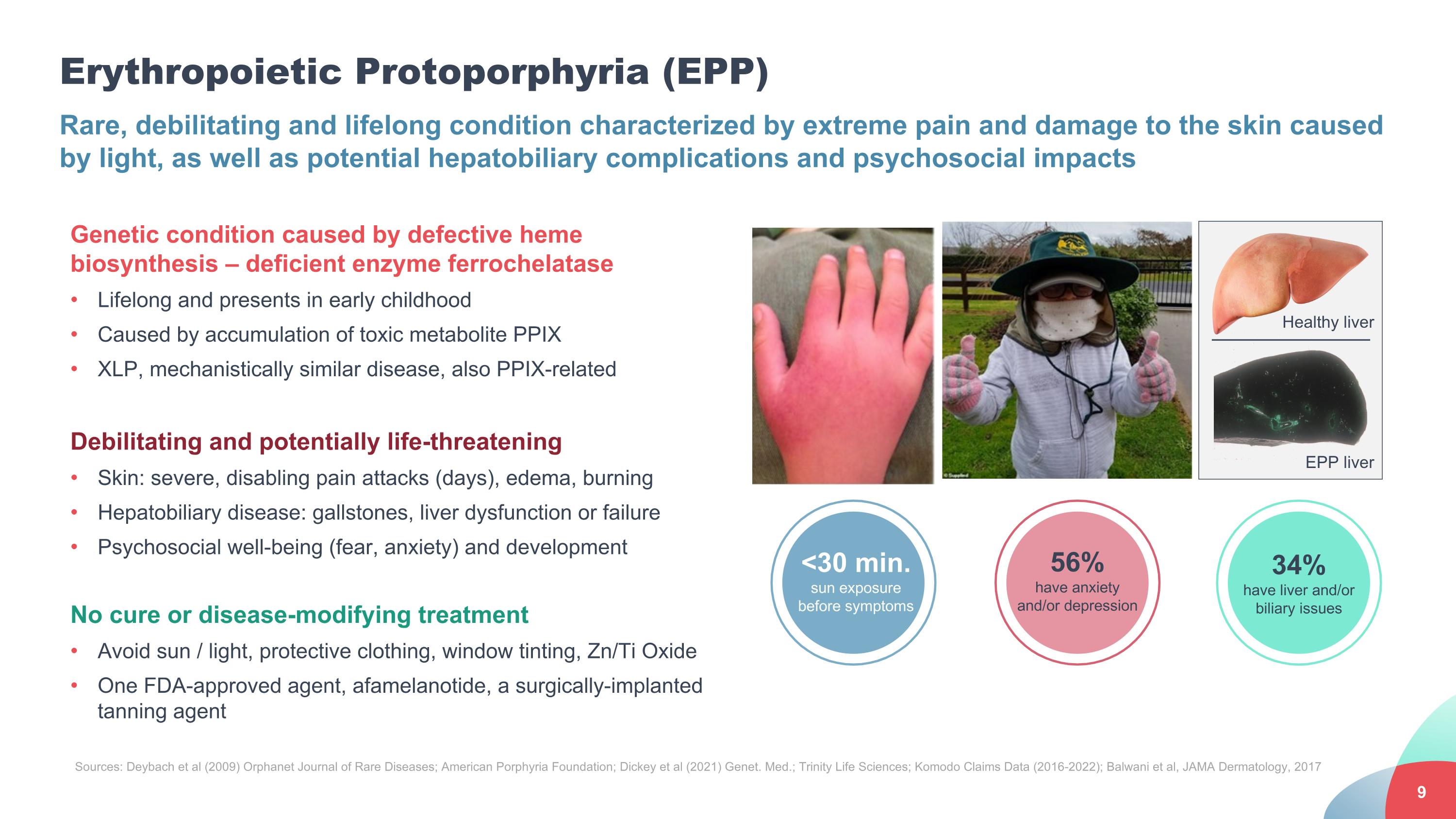

Erythropoietic Protoporphyria (EPP) Rare, debilitating and lifelong condition characterized by extreme pain and damage to the skin caused by light, as well as potential hepatobiliary complications and psychosocial impacts Genetic condition caused by defective heme biosynthesis – deficient enzyme ferrochelatase Lifelong and presents in early childhood Caused by accumulation of toxic metabolite PPIX XLP, mechanistically similar disease, also PPIX-related Debilitating and potentially life-threatening Skin: severe, disabling pain attacks (days), edema, burning Hepatobiliary disease: gallstones, liver dysfunction or failure Psychosocial well-being (fear, anxiety) and development No cure or disease-modifying treatment Avoid sun / light, protective clothing, window tinting, Zn/Ti Oxide One FDA-approved agent, afamelanotide, a surgically-implanted tanning agent Sources: Deybach et al (2009) Orphanet Journal of Rare Diseases; American Porphyria Foundation; Dickey et al (2021) Genet. Med.; Trinity Life Sciences; Komodo Claims Data (2016-2022); Balwani et al, JAMA Dermatology, 2017 34% have liver and/or biliary issues 56% have anxiety and/or depression <30 min. sun exposure before symptoms Healthy liver EPP liver

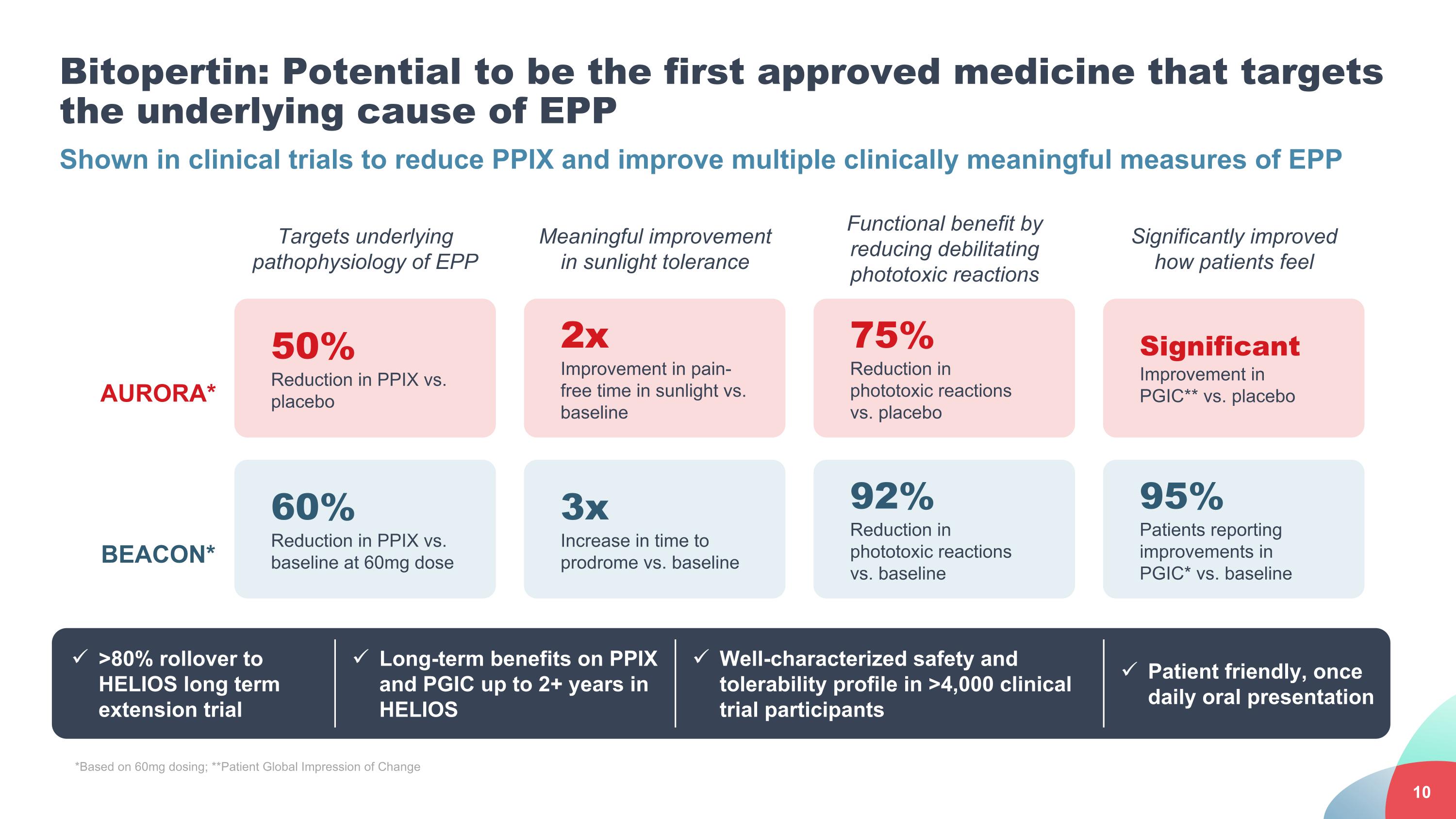

Bitopertin: Potential to be the first approved medicine that targets the underlying cause of EPP Shown in clinical trials to reduce PPIX and improve multiple clinically meaningful measures of EPP 50% Reduction in PPIX vs. placebo 60% Reduction in PPIX vs. baseline at 60mg dose Targets underlying pathophysiology of EPP 2x Improvement in pain-free time in sunlight vs. baseline 3x Increase in time to prodrome vs. baseline Meaningful improvement in sunlight tolerance 75% Reduction in phototoxic reactions vs. placebo 92% Reduction in phototoxic reactions vs. baseline Functional benefit by reducing debilitating phototoxic reactions Significant Improvement in PGIC** vs. placebo 95% Patients reporting improvements in PGIC* vs. baseline Significantly improved how patients feel AURORA* BEACON* Long-term benefits on PPIX and PGIC up to 2+ years in HELIOS Well-characterized safety and tolerability profile in >4,000 clinical trial participants Patient friendly, once daily oral presentation >80% rollover to HELIOS long term extension trial *Based on 60mg dosing; **Patient Global Impression of Change

Bitopertin US accelerated launch approach Disc is committed to making bitopertin available and accessible to patients who need it as quickly as possible, if approved NDA Accepted November 2025 Under accelerated approval pathway Currently Under FDA Review CNPV targets 1-2 months for NDA review Bitopertin selected for the FDA Commissioner’s National Priority Voucher (CNPV) pilot program Product Availability Access & Reimbursement Promotional Launch ANTICIPATED FDA APPROVAL Product available Patient services program launched Full promotional launch campaign Package Insert-based promotion Transition to reimbursed drug Early 2026 Mid 2026 2027+ Confirmatory APOLLO Trial Ongoing Early 2027 Topline data expected Account Engagement Sales team deployed Expanding reach

Agenda Introduction Overview: Bitopertin for EPP Bitopertin Launch Strategy Pipeline Programs 2026/2027 Corporate Outlook Q&A

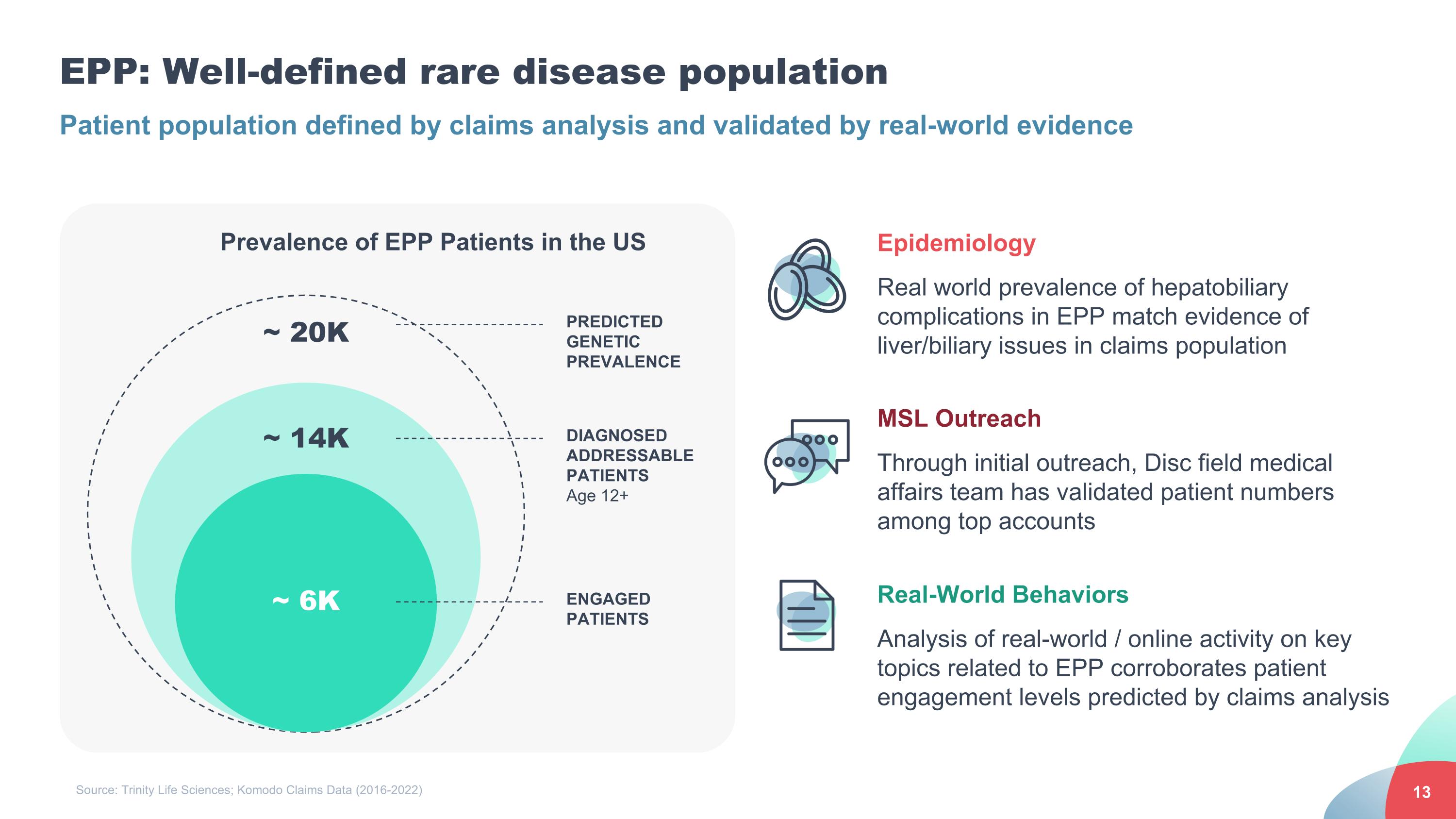

EPP: Well-defined rare disease population Epidemiology Real world prevalence of hepatobiliary complications in EPP match evidence of liver/biliary issues in claims population MSL Outreach Through initial outreach, Disc field medical affairs team has validated patient numbers among top accounts Real-World Behaviors Analysis of real-world / online activity on key topics related to EPP corroborates patient engagement levels predicted by claims analysis ~ 6K Prevalence of EPP Patients in the US ENGAGED PATIENTS ~ 14K ~ 20K DIAGNOSED ADDRESSABLE PATIENTS Age 12+ PREDICTED GENETIC PREVALENCE Source: Trinity Life Sciences; Komodo Claims Data (2016-2022) Patient population defined by claims analysis and validated by real-world evidence

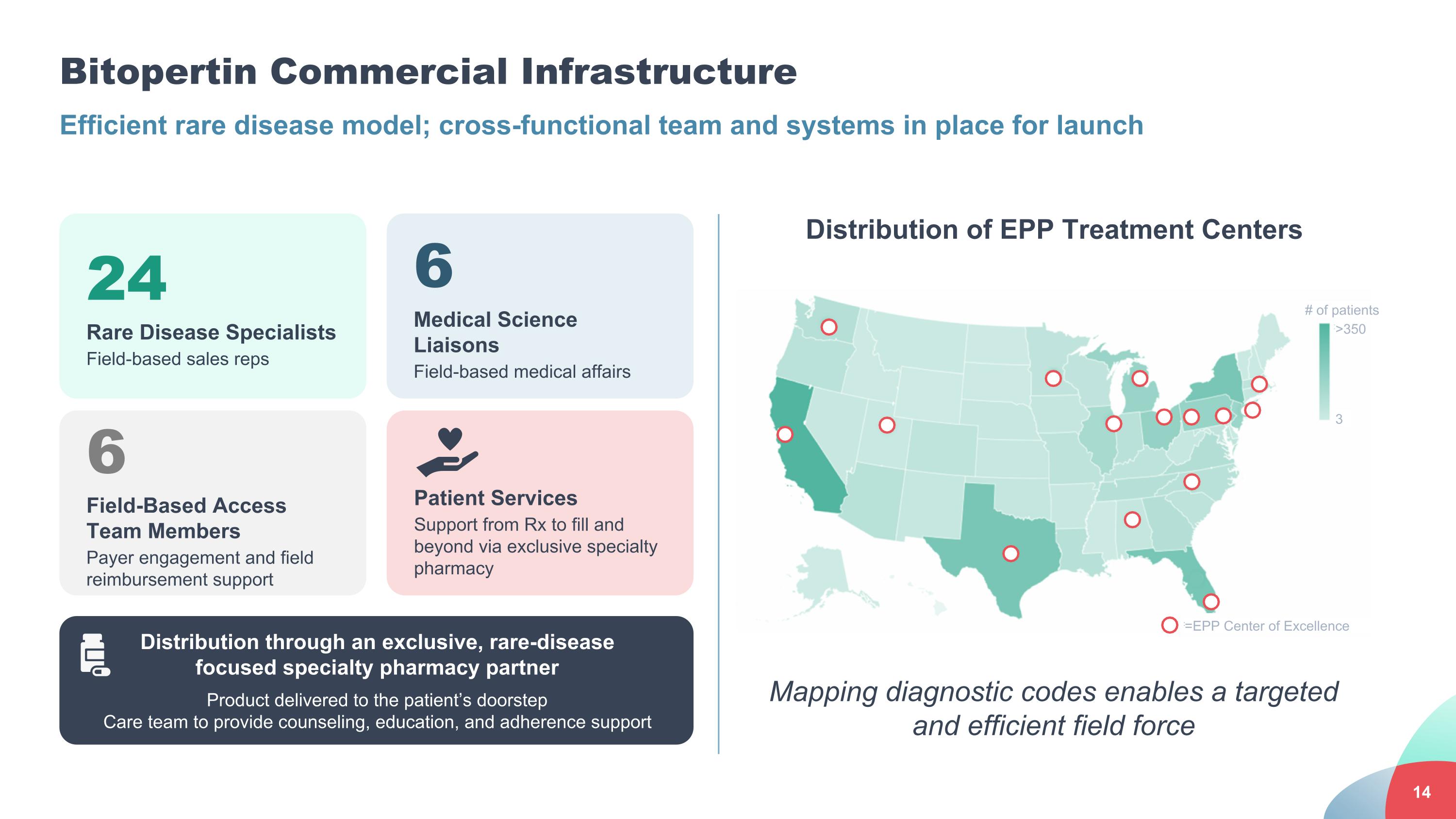

Efficient rare disease model; cross-functional team and systems in place for launch Mapping diagnostic codes enables a targeted and efficient field force Bitopertin Commercial Infrastructure Distribution of EPP Treatment Centers 24 Rare Disease Specialists Field-based sales reps 6 Medical Science Liaisons Field-based medical affairs 6 Field-Based Access Team Members Payer engagement and field reimbursement support Patient Services Support from Rx to fill and beyond via exclusive specialty pharmacy Distribution through an exclusive, rare-disease focused specialty pharmacy partner Product delivered to the patient’s doorstep Care team to provide counseling, education, and adherence support # of patients =EPP Center of Excellence 3 >350

Bitopertin Go-to-Market Strategy Defined patient population allows for targeting of sizeable number of patients with an efficient field force focused initially on specialists and high-volume accounts 15 Centers of Excellence Porphyria specialists Clinical trial sites ~600 105 High Volume Accounts Large academic institutions and group practices ~1,000 1,500 Community Specialists Dermatologists and hematologists with EPP claim(s) ~4,000 Other Treaters General practitioners with EPP claim(s) ~8,400 24 Field Sales Reps Digital / Lead Generation TOTAL EPP PATIENTS

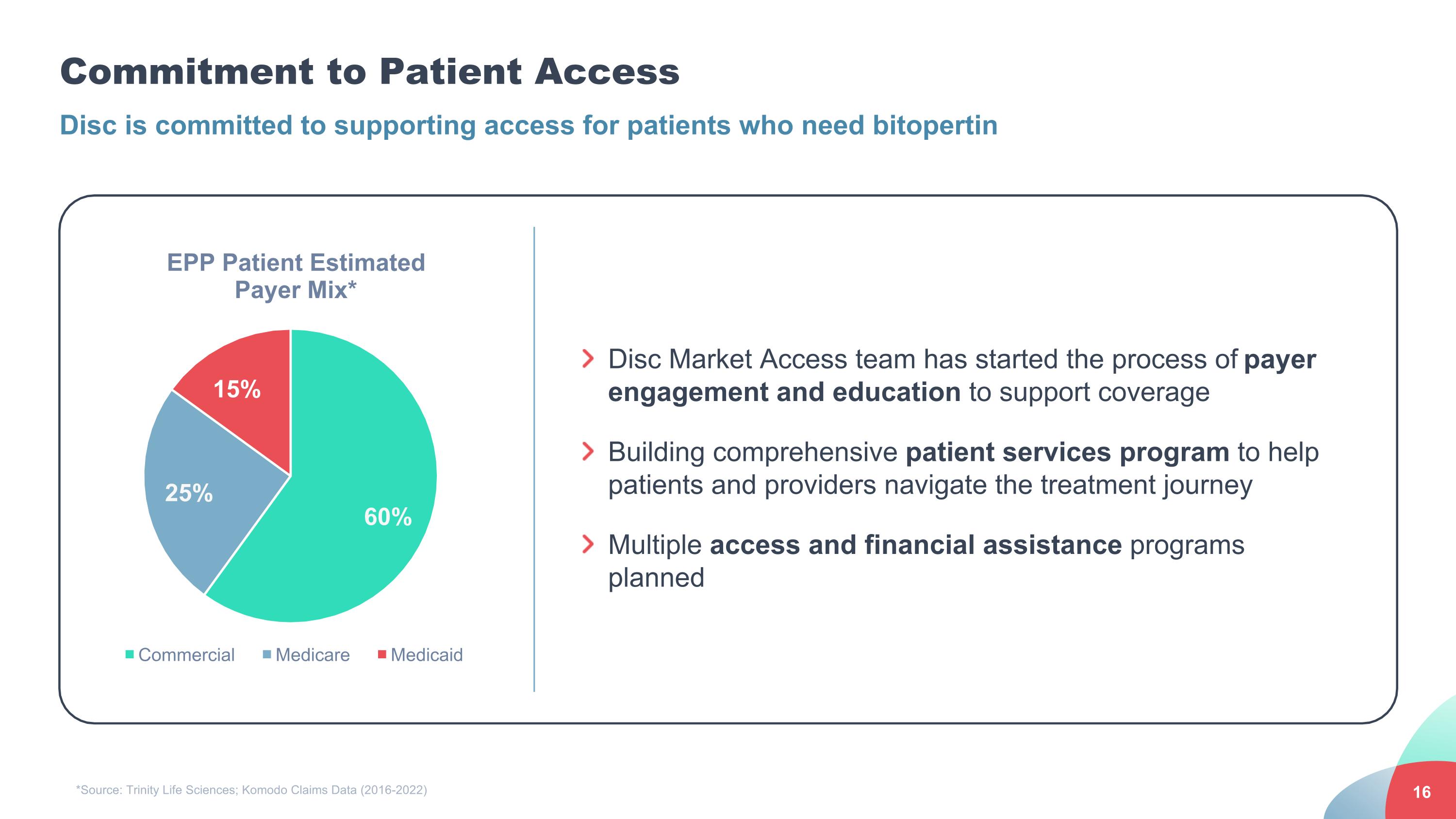

Commitment to Patient Access Disc Market Access team has started the process of payer engagement and education to support coverage Building comprehensive patient services program to help patients and providers navigate the treatment journey Multiple access and financial assistance programs planned Disc is committed to supporting access for patients who need bitopertin *Source: Trinity Life Sciences; Komodo Claims Data (2016-2022)

Agenda Introduction Overview: Bitopertin for EPP Bitopertin Launch Strategy Pipeline Programs 2026/2027 Corporate Outlook Q&A

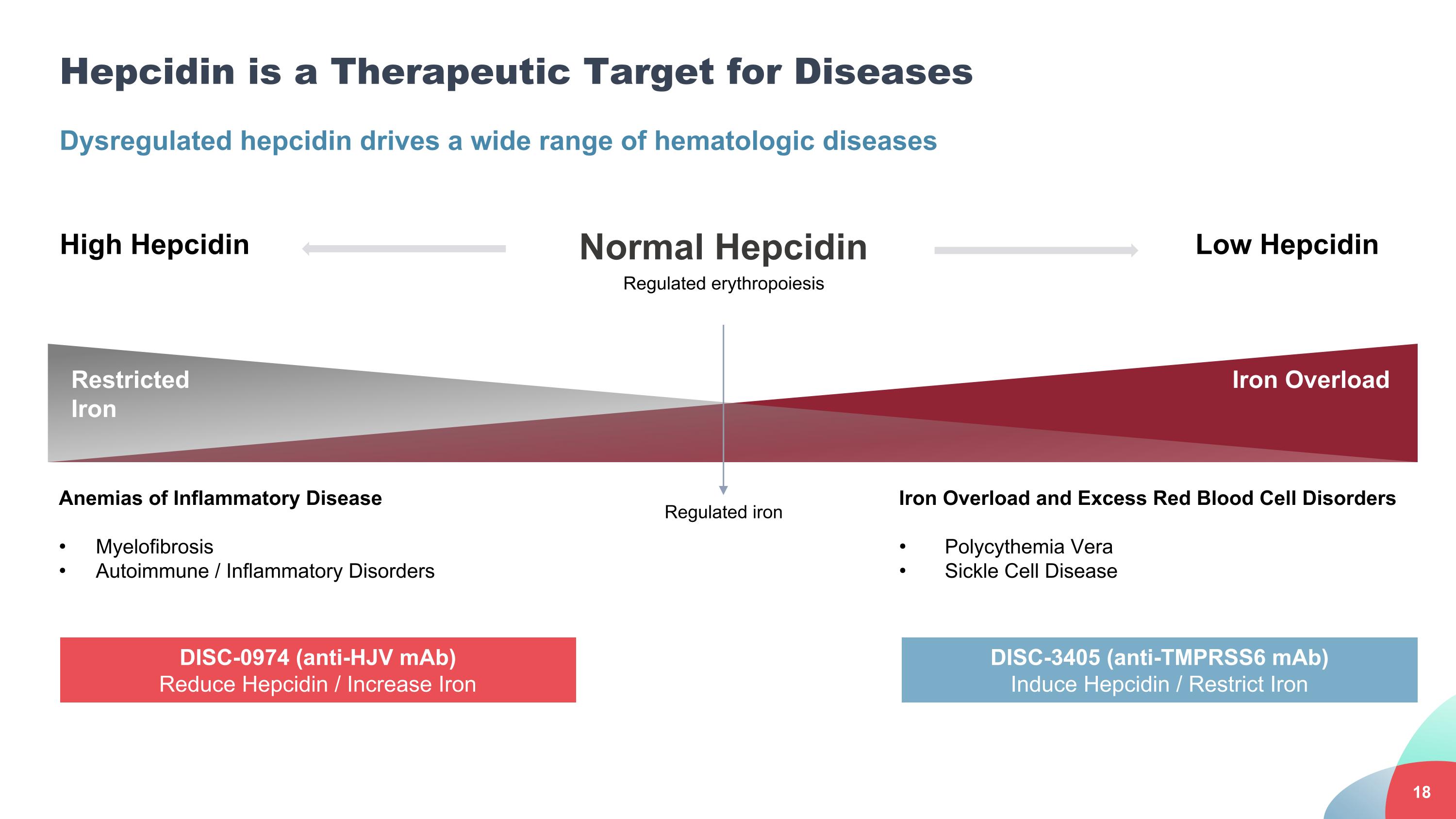

Hepcidin is a Therapeutic Target for Diseases Dysregulated hepcidin drives a wide range of hematologic diseases Anemias of Inflammatory Disease Myelofibrosis Autoimmune / Inflammatory Disorders Iron Overload and Excess Red Blood Cell Disorders Polycythemia Vera Sickle Cell Disease High Hepcidin Normal Hepcidin Low Hepcidin Regulated erythropoiesis Regulated iron Restricted Iron Iron Overload DISC-0974 (anti-HJV mAb) Reduce Hepcidin / Increase Iron DISC-3405 (anti-TMPRSS6 mAb) Induce Hepcidin / Restrict Iron

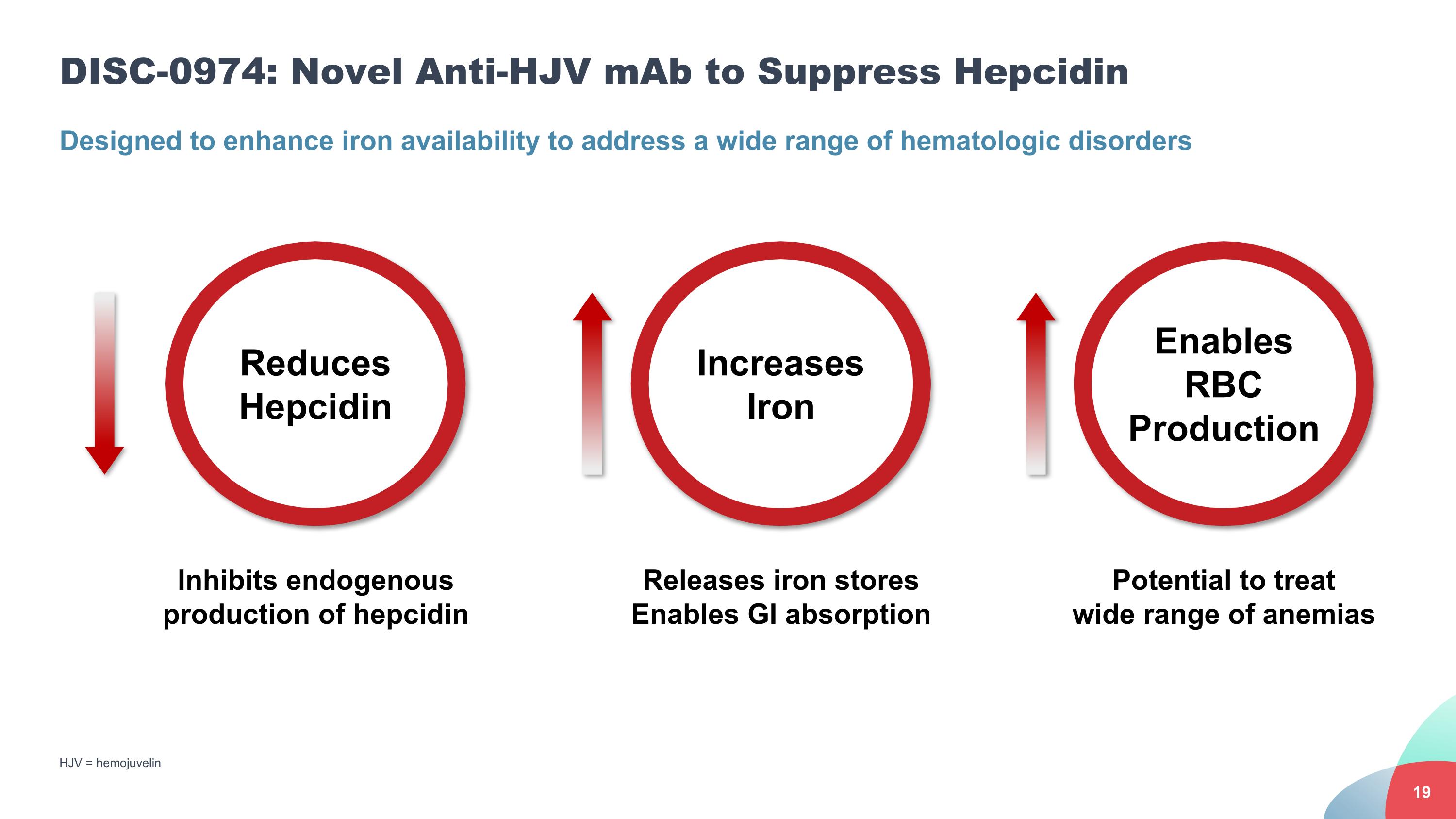

DISC-0974: Novel Anti-HJV mAb to Suppress Hepcidin HJV = hemojuvelin Designed to enhance iron availability to address a wide range of hematologic disorders Releases iron stores Enables GI absorption Increases Iron Reduces Hepcidin Inhibits endogenous production of hepcidin Potential to treat wide range of anemias Enables RBC Production

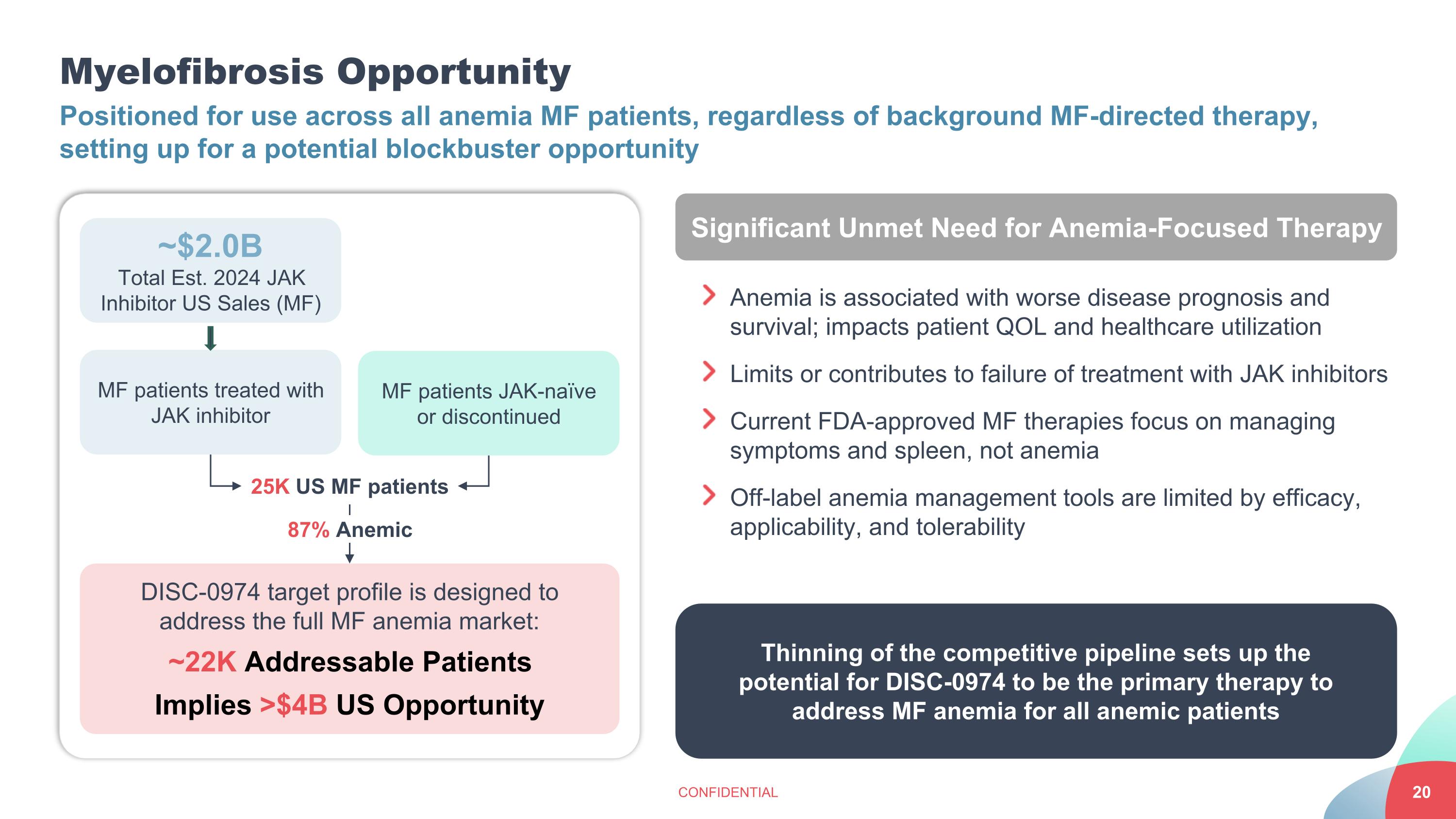

Myelofibrosis Opportunity CONFIDENTIAL Positioned for use across all anemia MF patients, regardless of background MF-directed therapy, setting up for a potential blockbuster opportunity ~$2.0B Total Est. 2024 JAK Inhibitor US Sales (MF) DISC-0974 target profile is designed to address the full MF anemia market: ~22K Addressable Patients Implies >$4B US Opportunity MF patients treated with JAK inhibitor MF patients JAK-naïve or discontinued 25K US MF patients 87% Anemic Significant Unmet Need for Anemia-Focused Therapy Anemia is associated with worse disease prognosis and survival; impacts patient QOL and healthcare utilization Limits or contributes to failure of treatment with JAK inhibitors Current FDA-approved MF therapies focus on managing symptoms and spleen, not anemia Off-label anemia management tools are limited by efficacy, applicability, and tolerability Thinning of the competitive pipeline sets up the potential for DISC-0974 to be the primary therapy to address MF anemia for all anemic patients

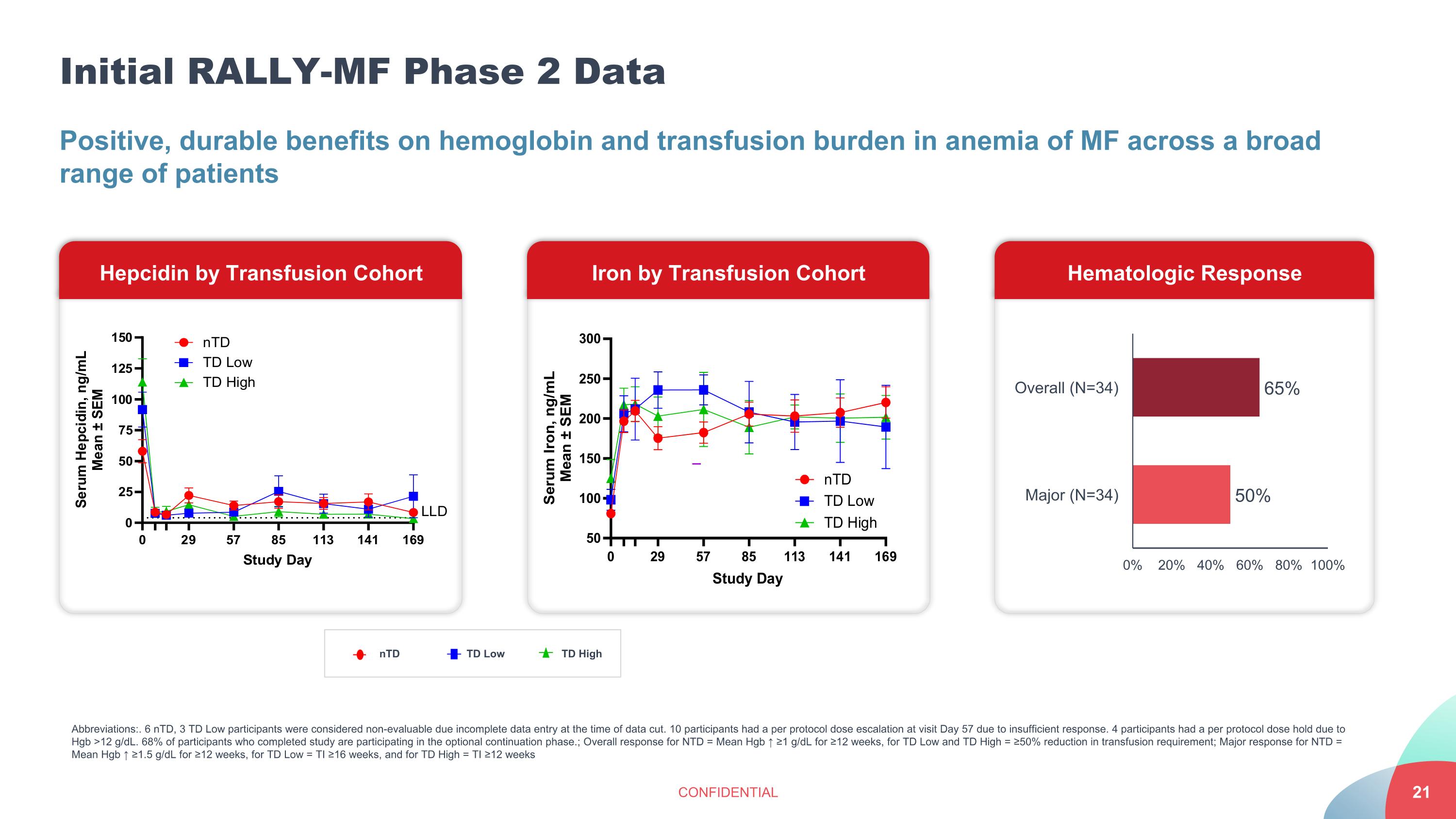

Initial RALLY-MF Phase 2 Data CONFIDENTIAL Positive, durable benefits on hemoglobin and transfusion burden in anemia of MF across a broad range of patients Hematologic Response Hepcidin by Transfusion Cohort Iron by Transfusion Cohort nTD TD Low TD High Abbreviations:. 6 nTD, 3 TD Low participants were considered non-evaluable due incomplete data entry at the time of data cut. 10 participants had a per protocol dose escalation at visit Day 57 due to insufficient response. 4 participants had a per protocol dose hold due to Hgb >12 g/dL. 68% of participants who completed study are participating in the optional continuation phase.; Overall response for NTD = Mean Hgb ↑ ≥1 g/dL for ≥12 weeks, for TD Low and TD High = ≥50% reduction in transfusion requirement; Major response for NTD = Mean Hgb ↑ ≥1.5 g/dL for ≥12 weeks, for TD Low = TI ≥16 weeks, and for TD High = TI ≥12 weeks

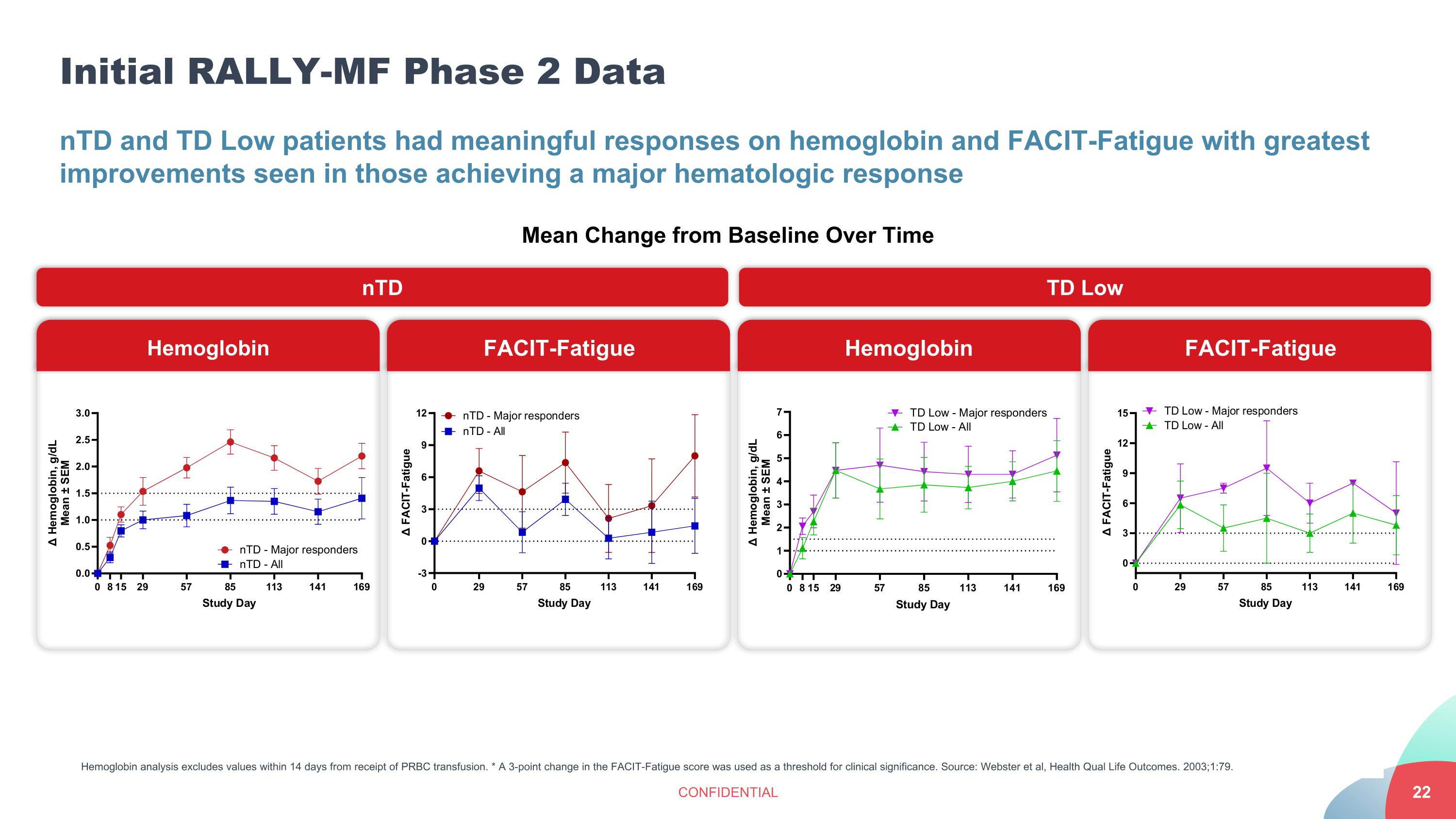

Initial RALLY-MF Phase 2 Data CONFIDENTIAL nTD and TD Low patients had meaningful responses on hemoglobin and FACIT-Fatigue with greatest improvements seen in those achieving a major hematologic response Hemoglobin analysis excludes values within 14 days from receipt of PRBC transfusion. * A 3-point change in the FACIT-Fatigue score was used as a threshold for clinical significance. Source: Webster et al, Health Qual Life Outcomes. 2003;1:79. Hemoglobin FACIT-Fatigue Hemoglobin FACIT-Fatigue Mean Change from Baseline Over Time nTD TD Low

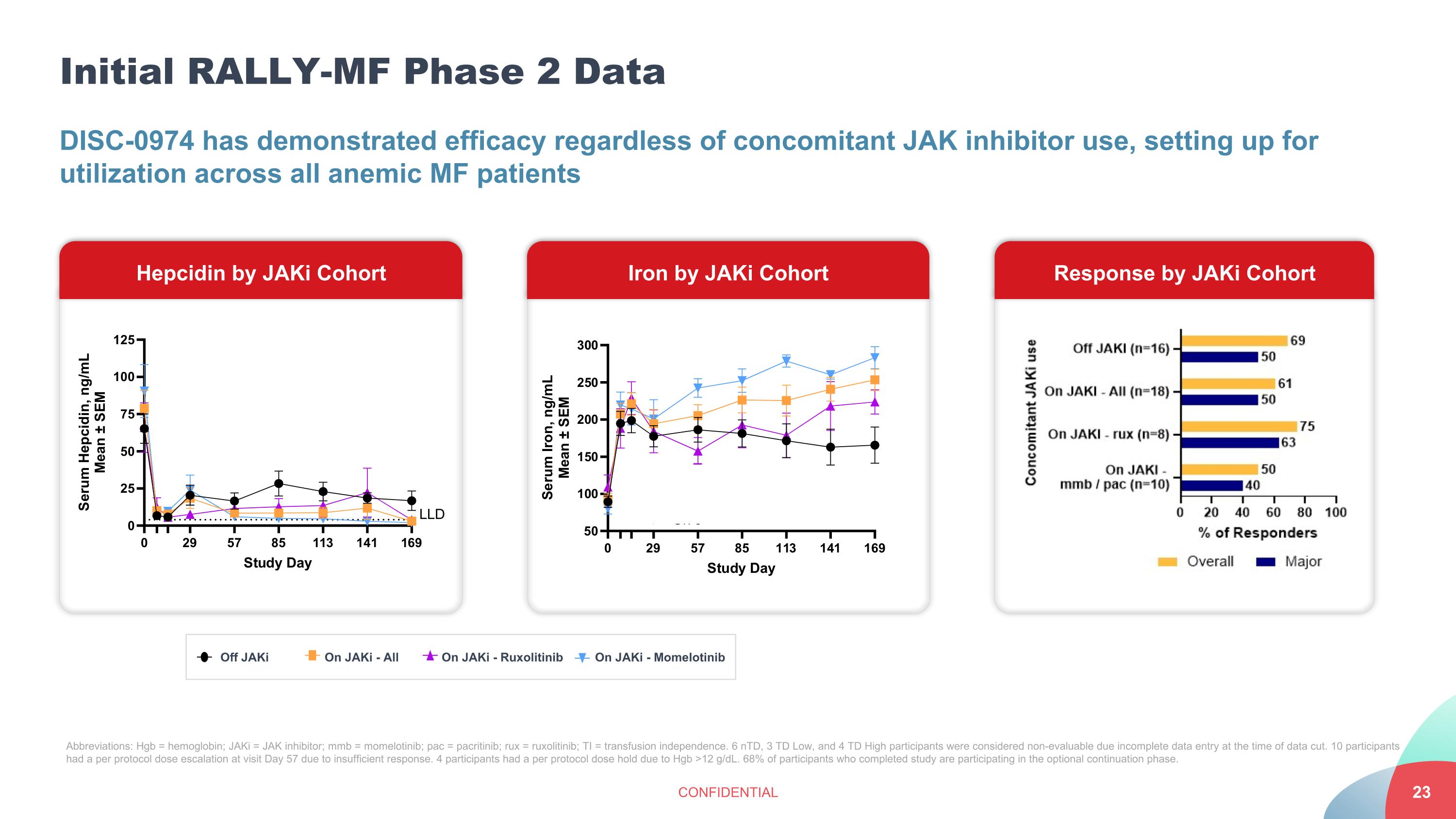

Initial RALLY-MF Phase 2 Data CONFIDENTIAL DISC-0974 has demonstrated efficacy regardless of concomitant JAK inhibitor use, setting up for utilization across all anemic MF patients Response by JAKi Cohort Abbreviations: Hgb = hemoglobin; JAKi = JAK inhibitor; mmb = momelotinib; pac = pacritinib; rux = ruxolitinib; TI = transfusion independence. 6 nTD, 3 TD Low, and 4 TD High participants were considered non-evaluable due incomplete data entry at the time of data cut. 10 participants had a per protocol dose escalation at visit Day 57 due to insufficient response. 4 participants had a per protocol dose hold due to Hgb >12 g/dL. 68% of participants who completed study are participating in the optional continuation phase. Off JAKi On JAKi - All On JAKi - Ruxolitinib On JAKi - Momelotinib Hepcidin by JAKi Cohort Iron by JAKi Cohort

Anti-HJV Franchise: Next Steps and Future Development CONFIDENTIAL Additional RALLY-MF data expected H2 2026 End of Phase 2 Meeting with FDA expected H2 2026 Phase 3 Pivotal trial initiation expected H1 2027 Anemia of Myelofibrosis Signal-seeking Phase 2 study in anemia of IBD with DISC-0974 expected to initiate early 2026 Exploratory work in additional anemia indications Continued IND-enabling activities for the long-acting anti-HJV (DISC-0998) Other Anemias of Inflammation

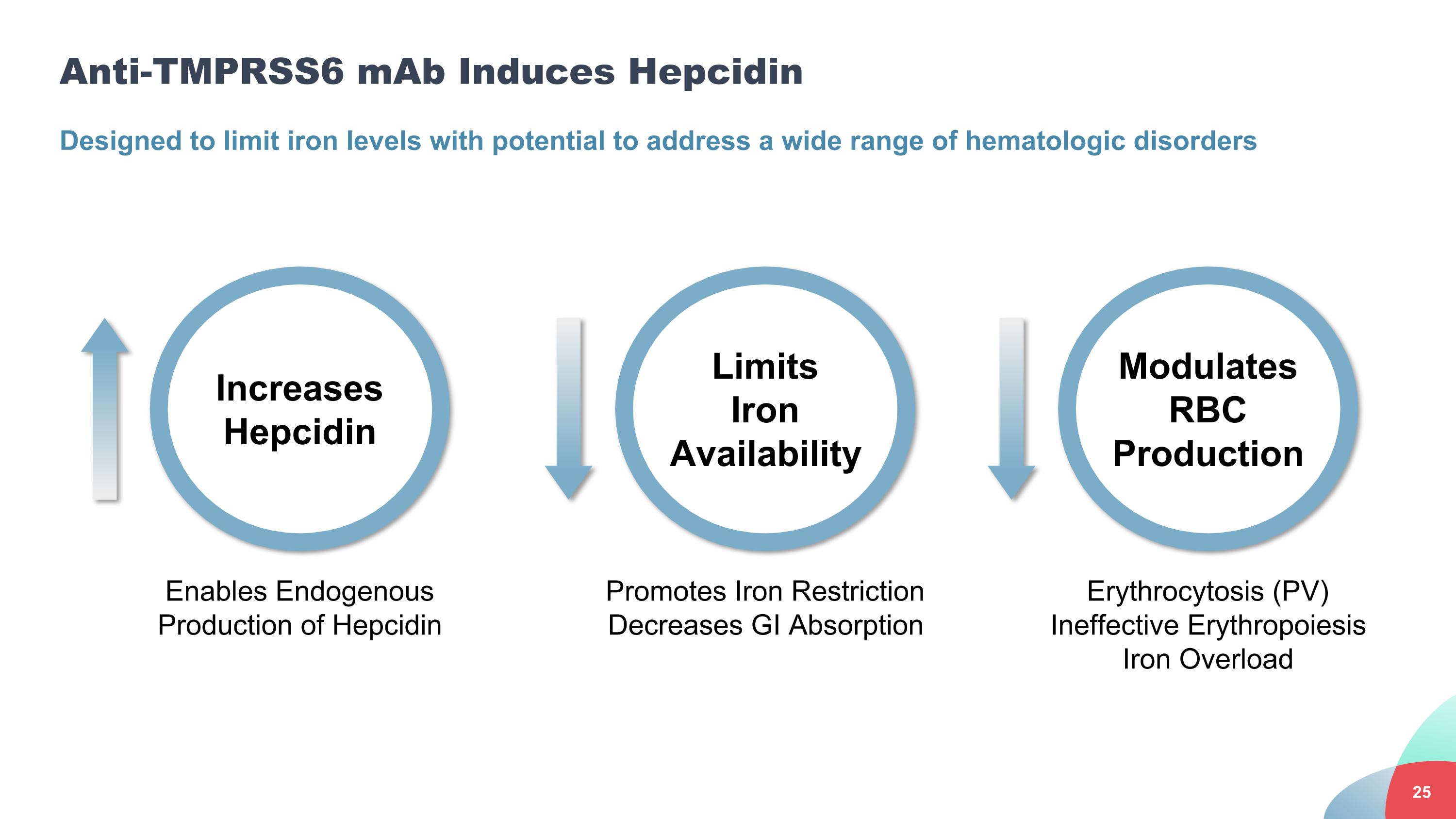

Anti-TMPRSS6 mAb Induces Hepcidin Designed to limit iron levels with potential to address a wide range of hematologic disorders Promotes Iron Restriction Decreases GI Absorption Limits Iron Availability Increases Hepcidin Enables Endogenous Production of Hepcidin Erythrocytosis (PV) Ineffective Erythropoiesis Iron Overload Modulates RBC Production

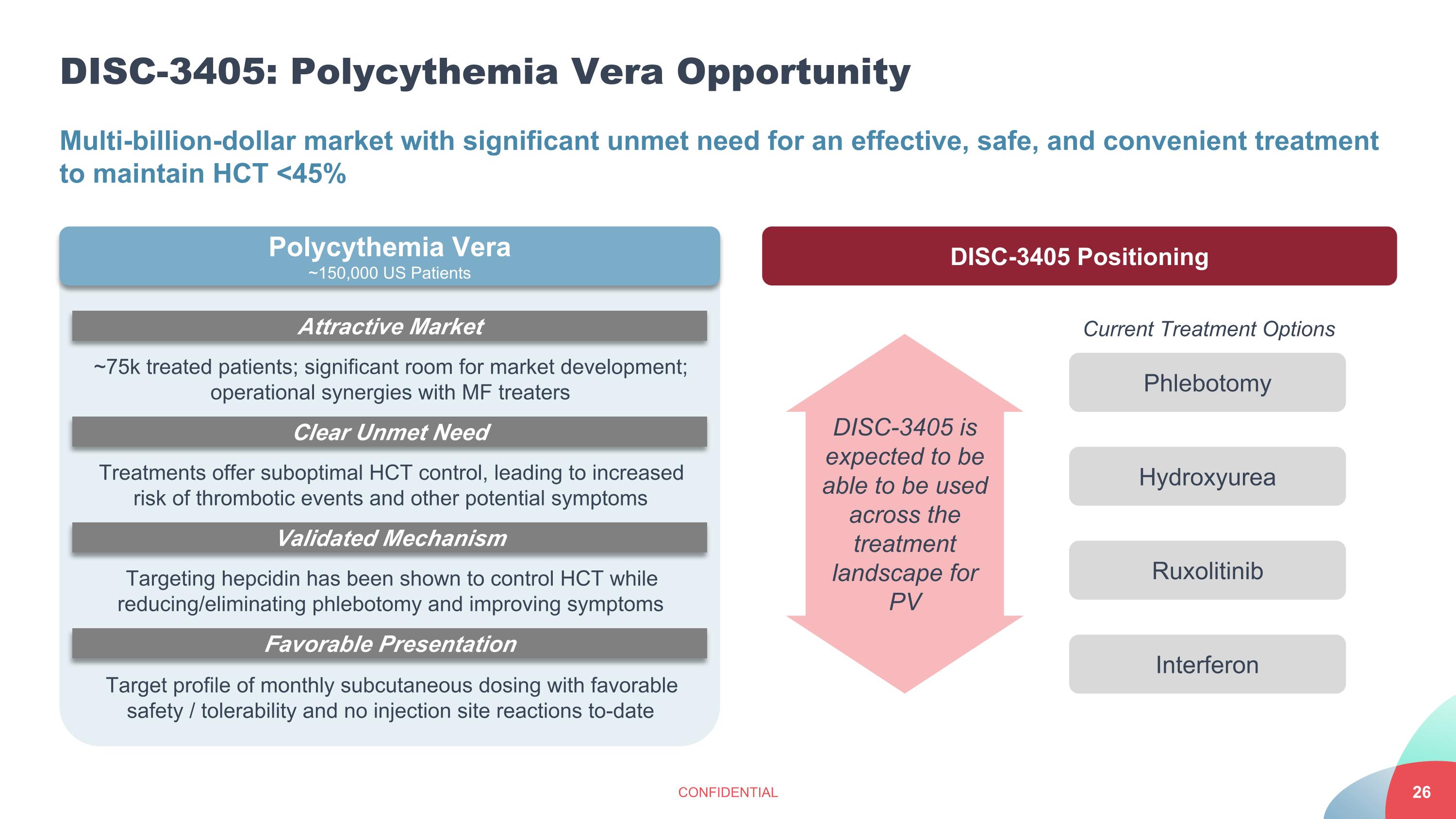

DISC-3405: Polycythemia Vera Opportunity CONFIDENTIAL Multi-billion-dollar market with significant unmet need for an effective, safe, and convenient treatment to maintain HCT <45% Polycythemia Vera ~150,000 US Patients ~75k treated patients; significant room for market development; operational synergies with MF treaters Treatments offer suboptimal HCT control, leading to increased risk of thrombotic events and other potential symptoms Targeting hepcidin has been shown to control HCT while reducing/eliminating phlebotomy and improving symptoms Attractive Market Clear Unmet Need Validated Mechanism Favorable Presentation Target profile of monthly subcutaneous dosing with favorable safety / tolerability and no injection site reactions to-date DISC-3405 Positioning Phlebotomy Hydroxyurea Ruxolitinib Interferon Current Treatment Options DISC-3405 is expected to be able to be used across the treatment landscape for PV

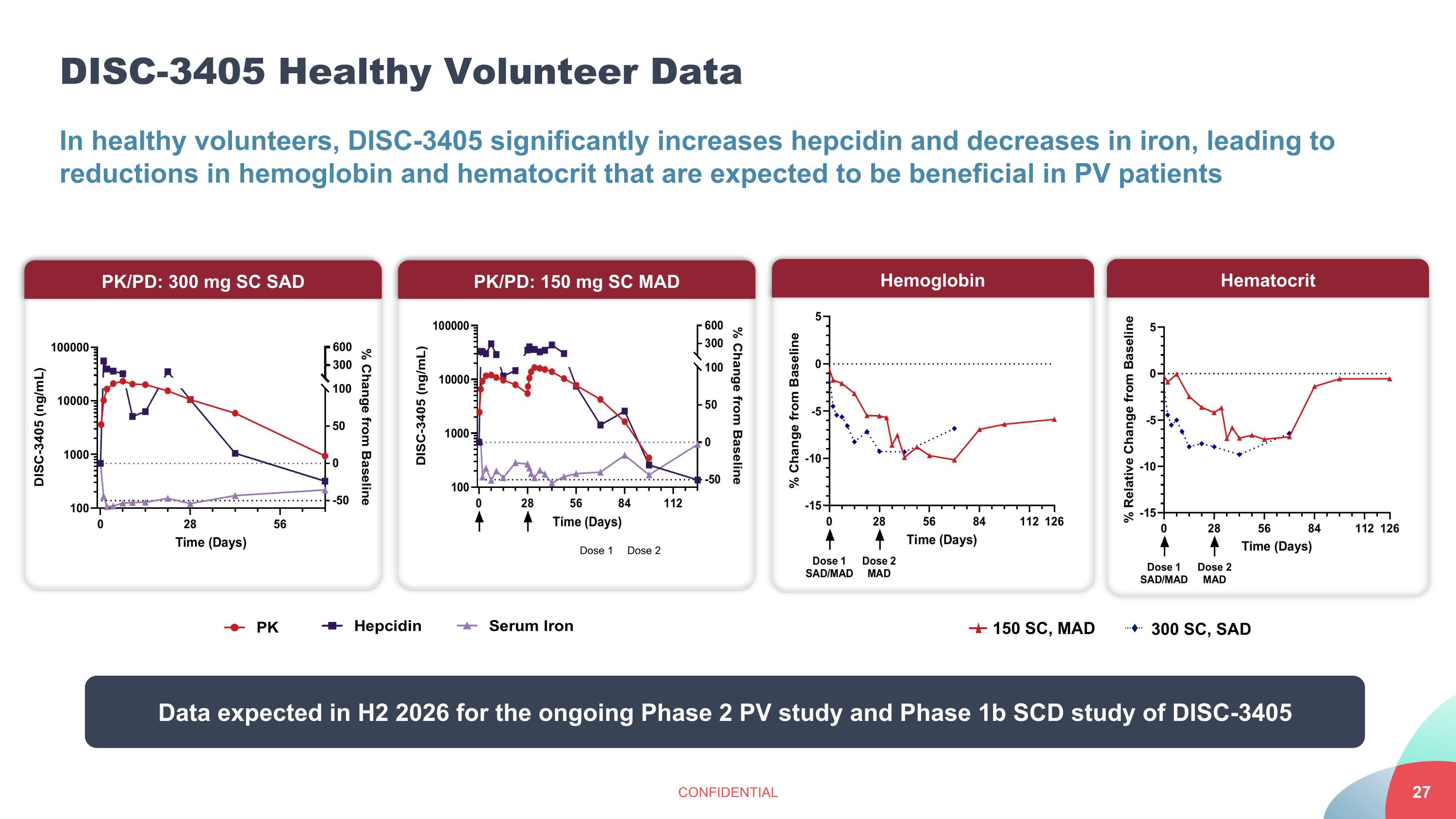

DISC-3405 Healthy Volunteer Data CONFIDENTIAL In healthy volunteers, DISC-3405 significantly increases hepcidin and decreases in iron, leading to reductions in hemoglobin and hematocrit that are expected to be beneficial in PV patients PK/PD: 300 mg SC SAD PK/PD: 150 mg SC MAD Dose 1 Dose 2 Hemoglobin Hematocrit 150 SC, MAD 300 SC, SAD Data expected in H2 2026 for the ongoing Phase 2 PV study and Phase 1b SCD study of DISC-3405

Agenda Introduction Overview: Bitopertin for EPP Bitopertin Launch Strategy Pipeline Programs 2026/2027 Corporate Outlook Q&A

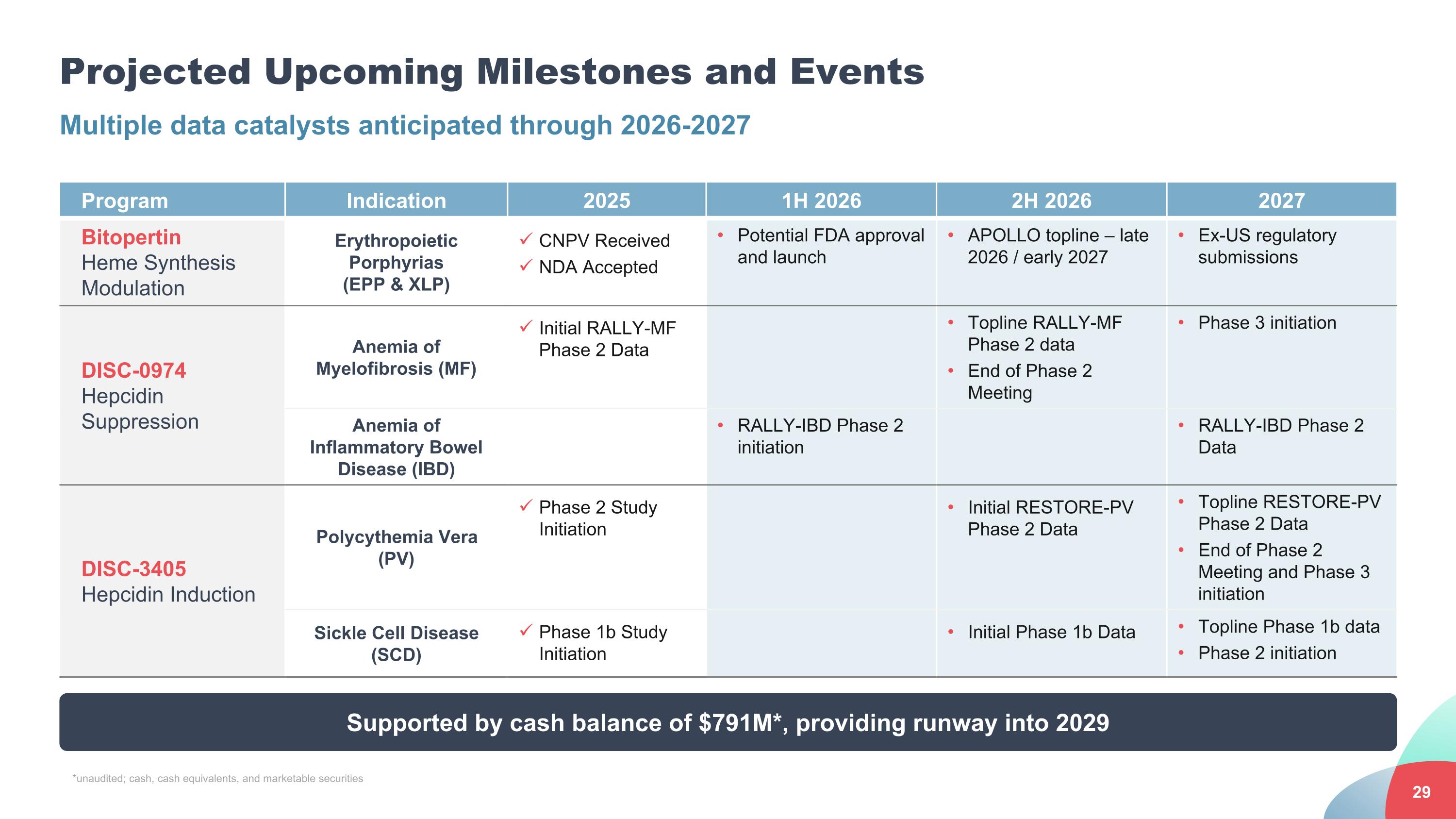

Projected Upcoming Milestones and Events Multiple data catalysts anticipated through 2026-2027 Program Indication 2025 1H 2026 2H 2026 2027 Bitopertin Heme Synthesis Modulation Erythropoietic Porphyrias (EPP & XLP) CNPV Received NDA Accepted Potential FDA approval and launch APOLLO topline – late 2026 / early 2027 Ex-US regulatory submissions DISC-0974 Hepcidin Suppression Anemia of Myelofibrosis (MF) Initial RALLY-MF Phase 2 Data Topline RALLY-MF Phase 2 data End of Phase 2 Meeting Phase 3 initiation Anemia of Inflammatory Bowel Disease (IBD) RALLY-IBD Phase 2 initiation RALLY-IBD Phase 2 Data DISC-3405 Hepcidin Induction Polycythemia Vera (PV) Phase 2 Study Initiation Initial RESTORE-PV Phase 2 Data Topline RESTORE-PV Phase 2 Data End of Phase 2 Meeting and Phase 3 initiation Sickle Cell Disease (SCD) Phase 1b Study Initiation Initial Phase 1b Data Topline Phase 1b data Phase 2 initiation Supported by cash balance of $791M*, providing runway into 2029 *unaudited; cash, cash equivalents, and marketable securities

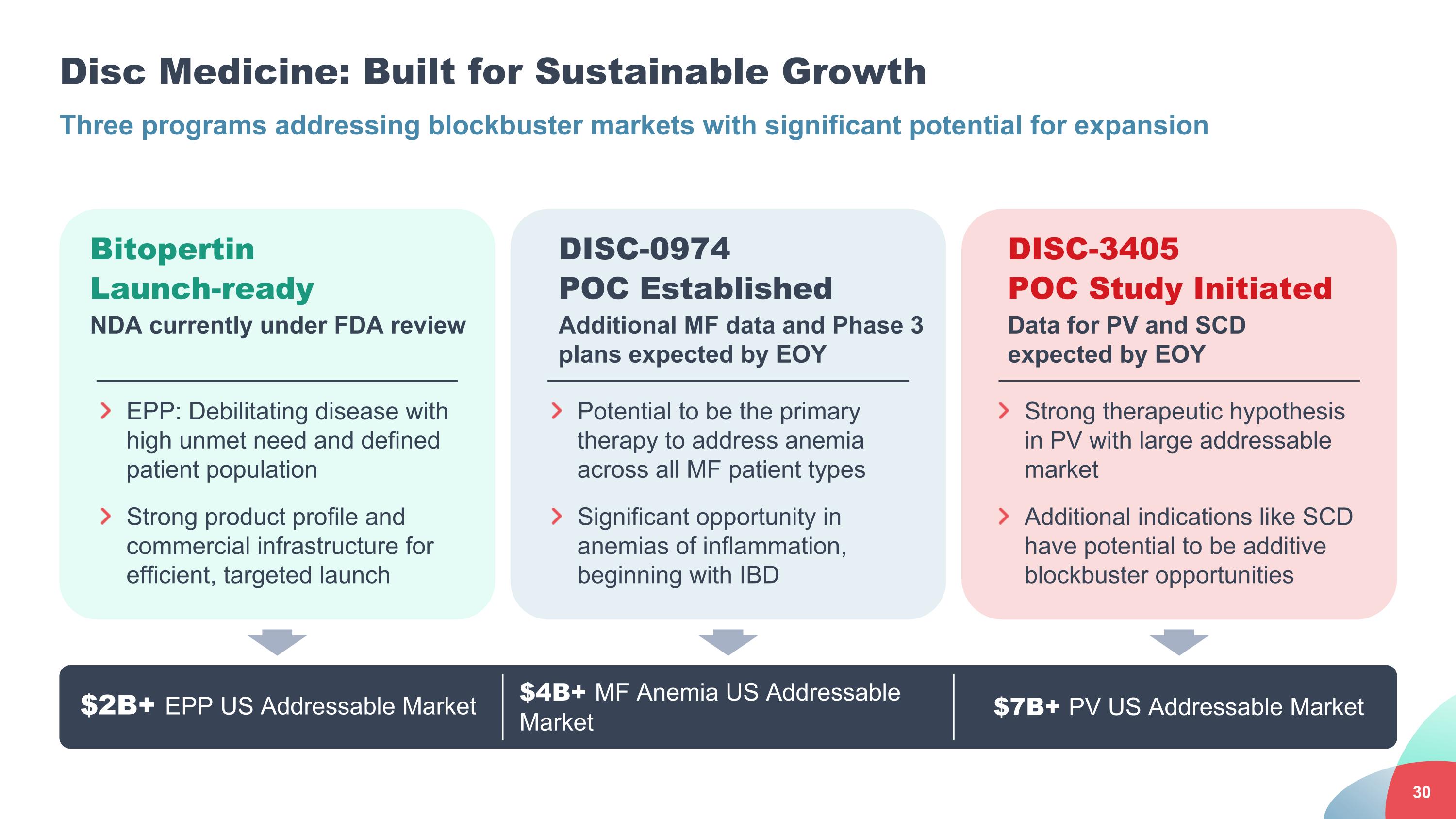

Disc Medicine: Built for Sustainable Growth Three programs addressing blockbuster markets with significant potential for expansion $2B+ EPP US Addressable Market $4B+ MF Anemia US Addressable Market Bitopertin Launch-ready NDA currently under FDA review DISC-3405 POC Study Initiated Data for PV and SCD expected by EOY EPP: Debilitating disease with high unmet need and defined patient population Strong product profile and commercial infrastructure for efficient, targeted launch DISC-0974 POC Established Additional MF data and Phase 3 plans expected by EOY Potential to be the primary therapy to address anemia across all MF patient types Significant opportunity in anemias of inflammation, beginning with IBD Strong therapeutic hypothesis in PV with large addressable market Additional indications like SCD have potential to be additive blockbuster opportunities $7B+ PV US Addressable Market

Q&A