\\\DC - 71532/300 - #1291878 v5 PURCHASE AGREEMENT Purchase Agreement, dated December 15, 2023 (the “Purchase Agreement”), between The Beauty Health Company (the “Purchaser”) and Goldman Sachs & Co. LLC (the “Dealer”). WHEREAS, Purchaser desires that Dealer purchase as principal up to $75 million principal amount of the Purchaser’s 1.25% Convertible Senior Notes due 2026, (the “Bonds”) for resale to the Purchaser; and WHEREAS, the parties intend that the purchases of Bonds made pursuant to this Purchase Agreement shall comply with the requirements of Rule 10b5-1(c)(1)(i) under the Securities Exchange Act of 1934 (“Exchange Act”), and that this Purchase Agreement shall be interpreted to comply with the requirements of that rule. NOW THEREFORE, the Purchaser and Dealer hereby agree as follows: 1. Dealer shall effect one or more purchases (each a “Purchase”) of Bonds as set forth on Annex A, and the Purchaser shall, upon each such Purchase, effect a purchase (each, a “Purchaser’s Purchase”) from Dealer of the Bonds that are the subject of such Purchase at the same price at which Dealer purchased such Bonds plus 0.25% (the “Spread”). Dealer’s sole compensation for services rendered under this Purchase Agreement shall be the Spread on each such purchase by the Purchaser. 2. This Purchase Agreement shall become effective on December 18, 2023 and shall terminate on the earliest of: (i) the date an aggregate principal amount of $75 million Bonds have been purchased pursuant to this Purchase Agreement; (ii) the date that any person publicly announces a tender or exchange offer with respect to the Bonds; (iii) the date of public announcement of a merger, acquisition, reorganization, recapitalization or comparable transaction

2 affecting the securities of the Purchaser as a result of which the Bonds are to be exchanged or converted into other securities or property; (iv) the date on which Dealer receives notice of the intended or actual commencement of any proceedings in respect of or triggered by Purchaser’s bankruptcy, insolvency or similar proceeding; (v) the date on which any event of termination described herein shall occur; (vi) promptly after the receipt of written notice of termination signed by a senior officer of Purchaser and confirmed by telephone, it being understood that any such termination shall not cause Purchases previously effected pursuant to this Purchase Agreement (or any corresponding purchases by the Purchaser) to fail to be entitled to the benefits of Rule 10b5- 1(c). Any such termination notice shall not indicate the reasons for the termination or contain any material non-public information; or (vii) March 31, 2024, the date in which the Repurchase Period ends. 3. Dealer may make purchases pursuant to this Purchase Agreement in the open market or through privately negotiated transactions. Purchaser agrees not to attempt to influence when or whether purchases are made by Dealer. 4. Purchaser represents, warrants and covenants that: (i) the Board of Directors of Purchaser has authorized the repurchase of the Bonds in compliance with Rule 10b5-1; (ii) As of the date hereof, Purchaser is not aware of material nonpublic information concerning Purchaser and is entering into this Purchase Agreement in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b5-1; and will act in good faith with respect to this Purchase Agreement. (iii) Purchaser will not, during the period this Purchase Agreement is in effect, enter into any comparable agreement with any other dealer if the period of such comparable agreement shall overlap with the period of this Purchase Agreement;

3 (iv) Purchases and Purchaser’s Purchases of Bonds pursuant to this Purchase Agreement are not prohibited or restricted by any legal, regulatory or contractual restriction or undertaking binding on the Purchaser; and (vi) Purchaser shall immediately notify Dealer if any of the statements contained in paragraphs 4(iii) or 4(iii) above become inaccurate prior to the termination of this Purchase Agreement. 5. Dealer shall provide Purchaser with written confirmation of Purchaser’s Purchases on a daily basis (showing the date of the transactions, the number of Bonds purchased, the price paid, the Spread for the purchases, and settlement dates), as well as other market data or account reports that Purchaser may reasonably request. Unless otherwise directed by Purchaser, such confirmation shall be delivered to Michael Monahan, Chief Financial Officer and Eduardo Rodriguez, Senior Director of M&A and Investor Relations. 6. Purchaser understands that Dealer may not be able to effect a Purchase due to a market disruption or a legal or regulatory restriction or a restriction under the terms of any contract applicable to Dealer (including any restriction, whether pursuant to a contract, internal policy or otherwise, applicable to Dealer when it is involved in a distribution of Bonds on behalf of Purchaser or another party) (a “Blackout”). Purchaser also understands that even in the absence of a Blackout, Dealer may be unable to effect Purchases consistent with ordinary principles of best execution due to insufficient volume of trading, failure of the Bonds to reach and sustain a limit order price, or other market factors in effect on the date of a Purchase set forth in Annex A (“Unfilled Purchases”). 7. Notwithstanding anything in this Agreement, during the term of its engagement hereunder Dealer may purchase Bonds from and sell Bonds to other parties for its own account or the account of others, at such prices and in such quantities as Dealer and such other parties may from time to time agree. For the avoidance of doubt, Dealer may, as part of its market making and risk management activities during the term of its engagement hereunder, purchase or sell Bonds for the benefit of, or in transactions with, parties other than Purchaser, whether or not

4 such Bonds could otherwise have been purchased for the benefit of and/or sold to Purchaser in accordance with the instructions set forth on Annex A. For additional information, please refer to the Order Handling section of Goldman Sachs’ Terms of Dealing, as amended from time to time, available at https://www.goldmansachs.com/disclosures/gs-terms-of-dealing.pdf. 8. Dealer agrees that if Purchaser enters into a transaction that results, in Purchaser’s good faith determination, in the imposition of trading restrictions on the Purchaser (each, a “Purchaser Restriction”), and if Purchaser shall provide Dealer prior notice, then Dealer will cease effecting Purchases under this Purchase Agreement until notified by Purchaser that such restrictions have terminated. All required notifications to Dealer under this paragraph 8 shall be made in writing (signed by Purchaser) and confirmed by telephone as follows: (Attn: Corporate Repurchase Desk, c/o. David Gross; tel: (312)-655-5873; email: David.Gross@gs.com). Dealer shall resume effecting Purchases in accordance with this Purchase Agreement as soon as practicable after the cessation or termination of a Blackout or Purchaser Restriction. Any Unfilled Purchase, and any Purchases that would have been executed in accordance with the terms of Annex A but are not executed due to the existence of a Blackout or Purchaser Restriction, shall be deemed to be cancelled and shall not be effected pursuant to this Purchase Agreement. 9. Purchaser agrees that it shall not, directly or indirectly, communicate any information or ask any questions relating either to Purchaser or the Bonds (or any trading activity in the Bonds, whether for, with or on behalf of Purchaser or any other party) to any employee of Dealer or its affiliates who is involved, directly or indirectly, in executing this Purchase Agreement at any time while this Purchase Agreement is in effect. Purchaser shall be solely responsible for complying with all reporting or filing requirements, or with any laws not mentioned herein, that may apply to Purchases under this Purchase Agreement. 10. Purchaser agrees that, in the absence of bad faith, Dealer and its affiliates and their directors, officers, employees and agents (collectively, “Dealer Persons”) shall not have any liability whatsoever to the Purchaser for any action taken or omitted to be taken in connection with this Purchase Agreement, the making of any Purchase or any Purchaser’s Purchase. Purchaser further agrees to hold each Dealer Person free and harmless from any and all losses,

5 damages, liabilities or expenses (including reasonable attorneys’ fees and costs) incurred or sustained by such Dealer Person in connection with or arising out of any suit, action or proceeding relating to this Purchase Agreement (each an “Action”) and to reimburse each Dealer Person for such Dealer Person’s expenses, as they are incurred, in connection with any Action, unless such loss, damage, liability or expense is determined in a non-appealable order of a court of competent jurisdiction to be solely the result of such Dealer Person’s bad faith. This paragraph 10 shall survive termination of this Purchase Agreement. 11. This Purchase Agreement is not assignable or transferable, and constitutes the entire agreement between the parties, superseding any prior written or oral agreements or understandings with regard to this Purchase Agreement. This Purchase Agreement may be executed in one or more counterparts, each of which when so executed and delivered shall constitute a single, binding instrument. 12. This Purchase Agreement shall be governed by and construed in accordance with the laws of the State of New York without regard to conflict of law principles that would result in the application of any law other than the law of the State of New York and may be modified or amended only by a writing signed by the parties hereto and provided that any such modification or amendment shall only be permitted at a time when the Purchaser is not aware of material nonpublic information concerning the Purchaser or its securities. In the event of a modification or amendment to this Purchase Agreement, no purchases shall be effected during the ten business days immediately following such modification or amendment (other than Purchases already provided for in this Purchase Agreement prior to modification or amendment).

6 IN WITNESS WHEREOF, the undersigned have executed and delivered this Purchase Agreement as of the date first written above. THE BEAUTY HEALTH COMPANY Name: Title: GOLDMAN SACHS & CO. LLC Name: Title: Michael Monahan CFO Mike Voris Managing Director /s/ Michael Monahan /s/ Mike Voris

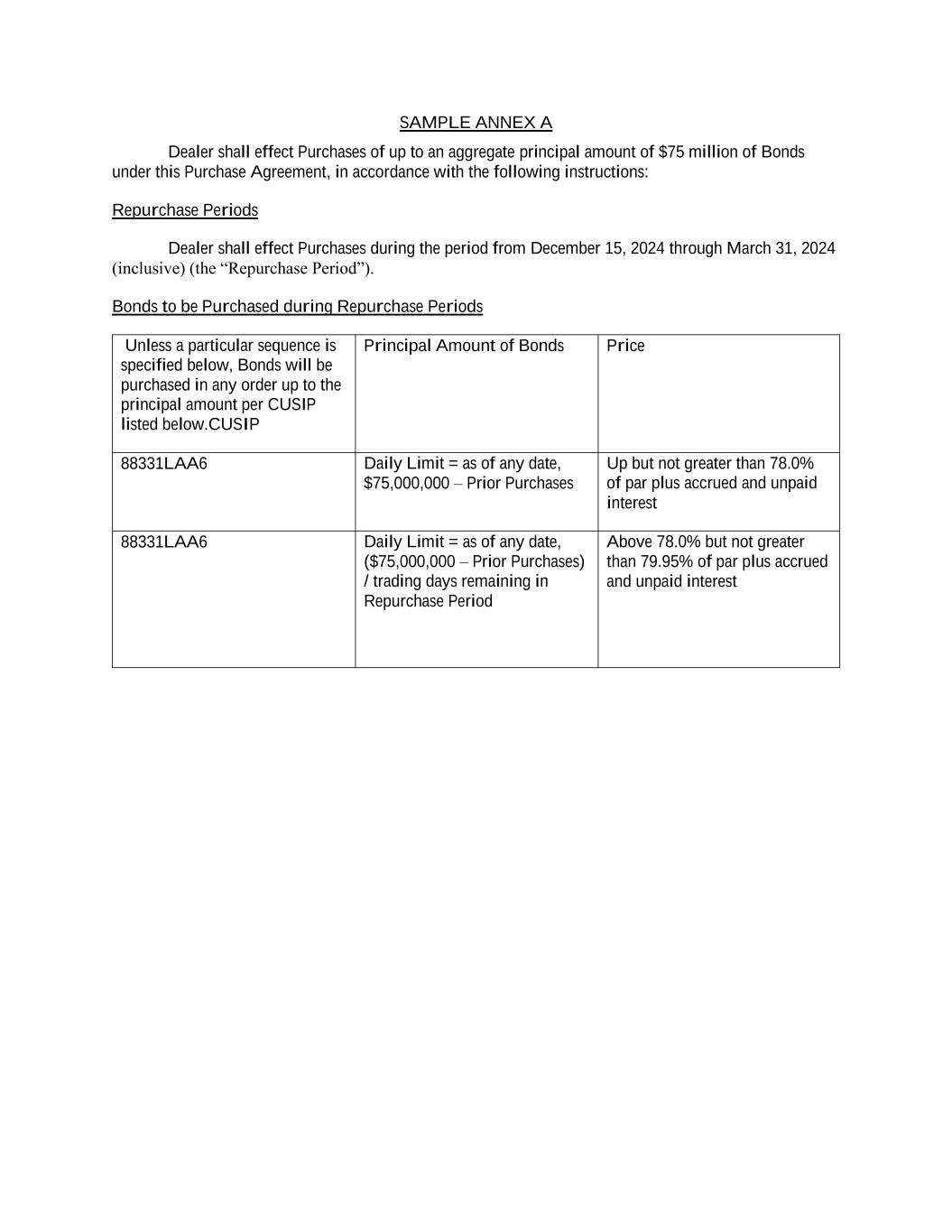

SAMPLE ANNEX A Dealer shall effect Purchases of up to an aggregate principal amount of $75 million of Bonds under this Purchase Agreement, in accordance with the following instructions: Repurchase Periods Dealer shall effect Purchases during the period from December 15, 2024 through March 31, 2024 (inclusive) (the “Repurchase Period”). Bonds to be Purchased during Repurchase Periods Unless a particular sequence is specified below, Bonds will be purchased in any order up to the principal amount per CUSIP listed below.CUSIP Principal Amount of Bonds Price 88331LAA6 Daily Limit = as of any date, $75,000,000 – Prior Purchases Up but not greater than 78.0% of par plus accrued and unpaid interest 88331LAA6 Daily Limit = as of any date, ($75,000,000 – Prior Purchases) / trading days remaining in Repurchase Period Above 78.0% but not greater than 79.95% of par plus accrued and unpaid interest