GeneDx Nasdaq: WGS J.P. Morgan Healthcare Conference January 2026 San Francisco, California .2

2 Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding our future performance and our market opportunity, including our expected full year 2025 reported revenue, fourth quarter and full year 2025 adjusted gross margin, and growth in exome and genome revenue and test result volumes and, expectations for full year 2026 revenue, exome and genome revenue and test volumes, adjusted gross margin and adjusted net income. . These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including but not limited to: (i) our ability to implement business plans, goals and forecasts, and identify and realize additional opportunities, (ii) the risk of downturns and a changing regulatory landscape in the highly competitive healthcare industry, (iii) the size and growth of the market in which we operate, and (iv) our ability to pursue our new strategic direction. The foregoing list of factors is not exhaustive. A further list and description of risks, uncertainties and other matters can be found in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2025, June 30, 2025 and September 30, 2025, and other documents filed by us from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations. We discuss these and other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our periodic reports and other filings we make with the SEC from time to time. Given these uncertainties, you should not place undue reliance on the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. We file reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information concerning us are available www.sec.gov. Requests for copies of such documents should be directed to our Investor Relations department at GeneDx Holdings Corp. 333 Ludlow Street, North Tower 7th Floor, Stamford, Connecticut, 06902. Our telephone number is 888-729-1206.

3 Empowering everyone to live their healthiest life through genomics

4 GeneDx is the global leader in rare disease diagnosis The largest and most diverse rare disease dataset to deliver highest accuracy Diagnosing more rare disease patients than anyone else and delivering 500+ new gene-disease discoveries over 25 years Preferred by 80% of geneticists with FDA Breakthrough Device designation The #1 genetic test Experience & TechnologyGeneDx InfinityTM 1. GeneDx Internal Data, data on file 2026 2. Claims data provided by Definitive Healthcare

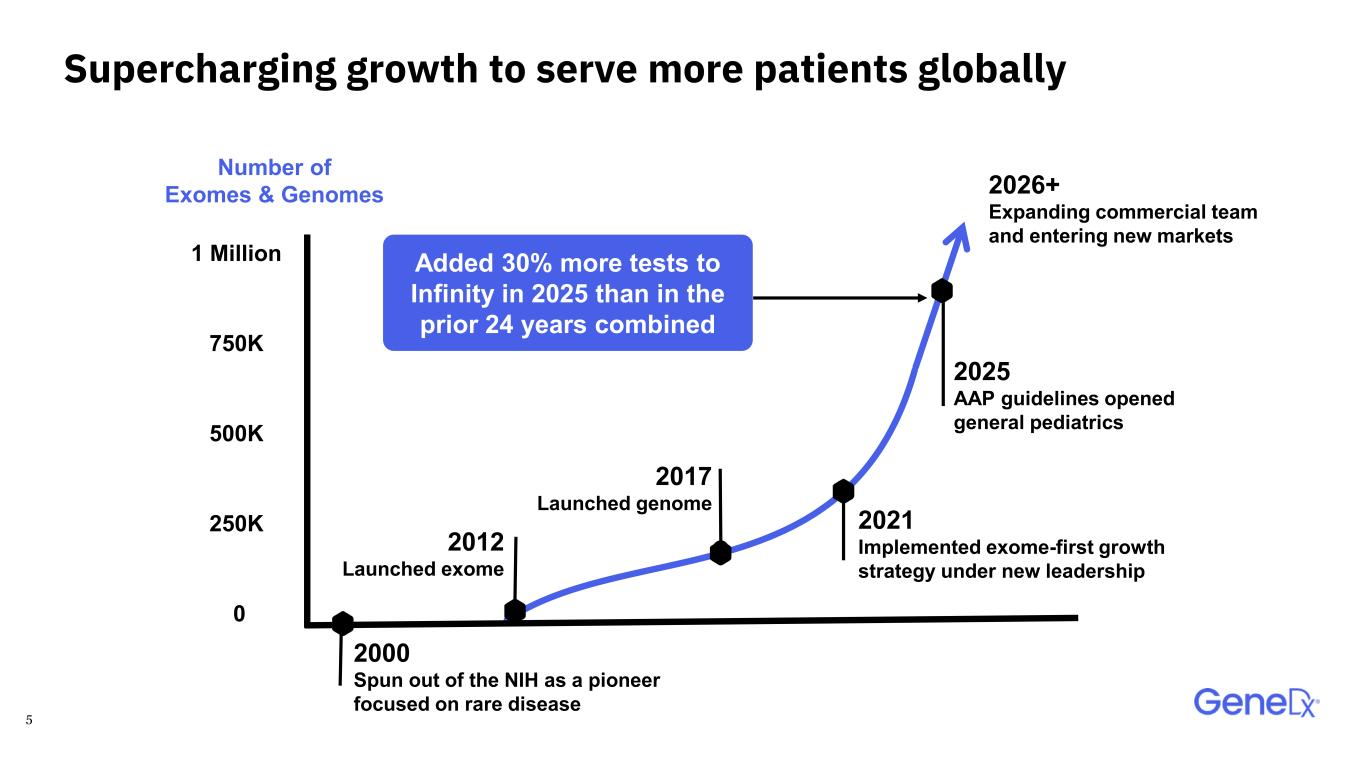

5 Supercharging growth to serve more patients globally Added 30% more tests to Infinity in 2025 than in the prior 24 years combined 1 Million 0 500K 250K 750K Number of Exomes & Genomes 2000 Spun out of the NIH as a pioneer focused on rare disease 2025 AAP guidelines opened general pediatrics 2021 Implemented exome-first growth strategy under new leadership 2026+ Expanding commercial team and entering new markets 2012 Launched exome 2017 Launched genome

6 An accurate genetic diagnosis is key to transforming healthcare Enabling precision genomic medicine Providing an early and accurate genetic diagnosis Fueling drug discovery

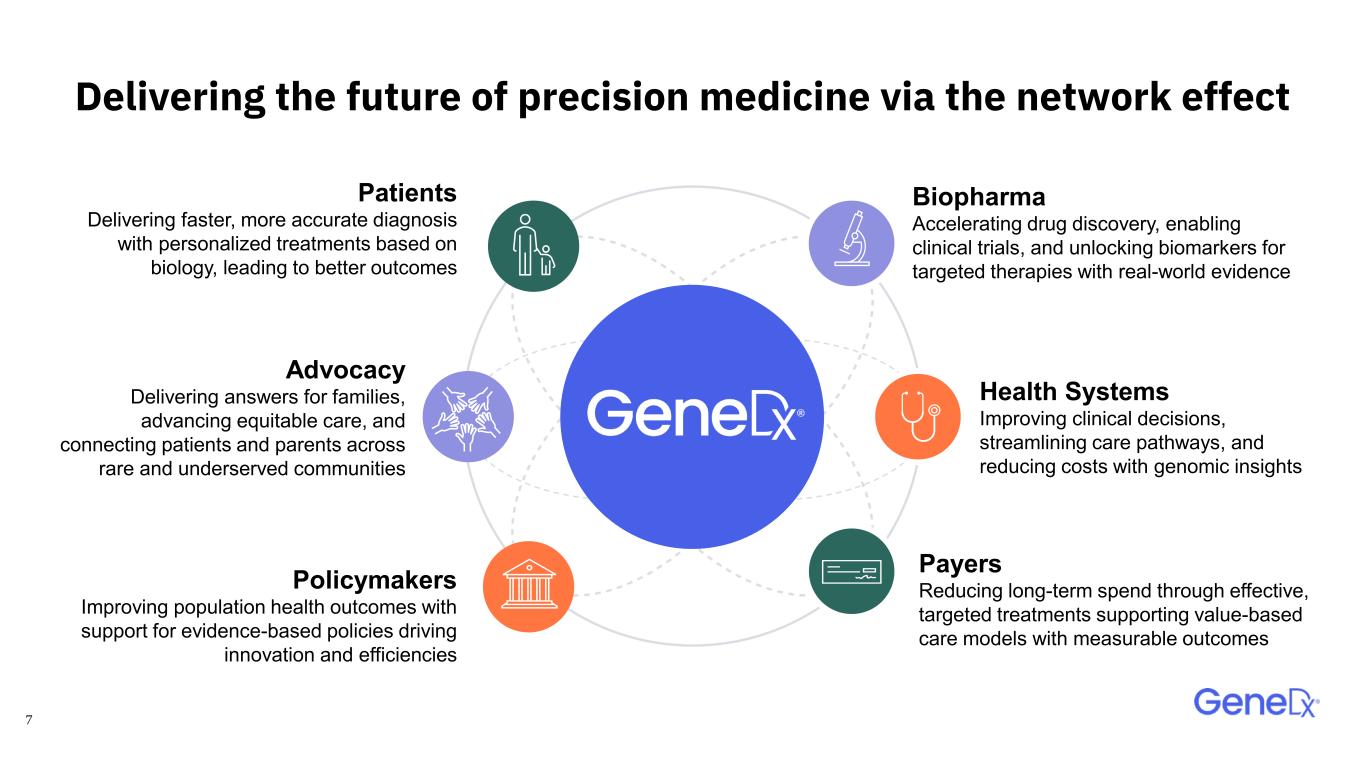

7 Delivering the future of precision medicine via the network effect Biopharma Accelerating drug discovery, enabling clinical trials, and unlocking biomarkers for targeted therapies with real-world evidence Policymakers Improving population health outcomes with support for evidence-based policies driving innovation and efficiencies Patients Delivering faster, more accurate diagnosis with personalized treatments based on biology, leading to better outcomes Health Systems Improving clinical decisions, streamlining care pathways, and reducing costs with genomic insights Payers Reducing long-term spend through effective, targeted treatments supporting value-based care models with measurable outcomes Advocacy Delivering answers for families, advancing equitable care, and connecting patients and parents across rare and underserved communities

8 Trusted by the nation’s leading health systems

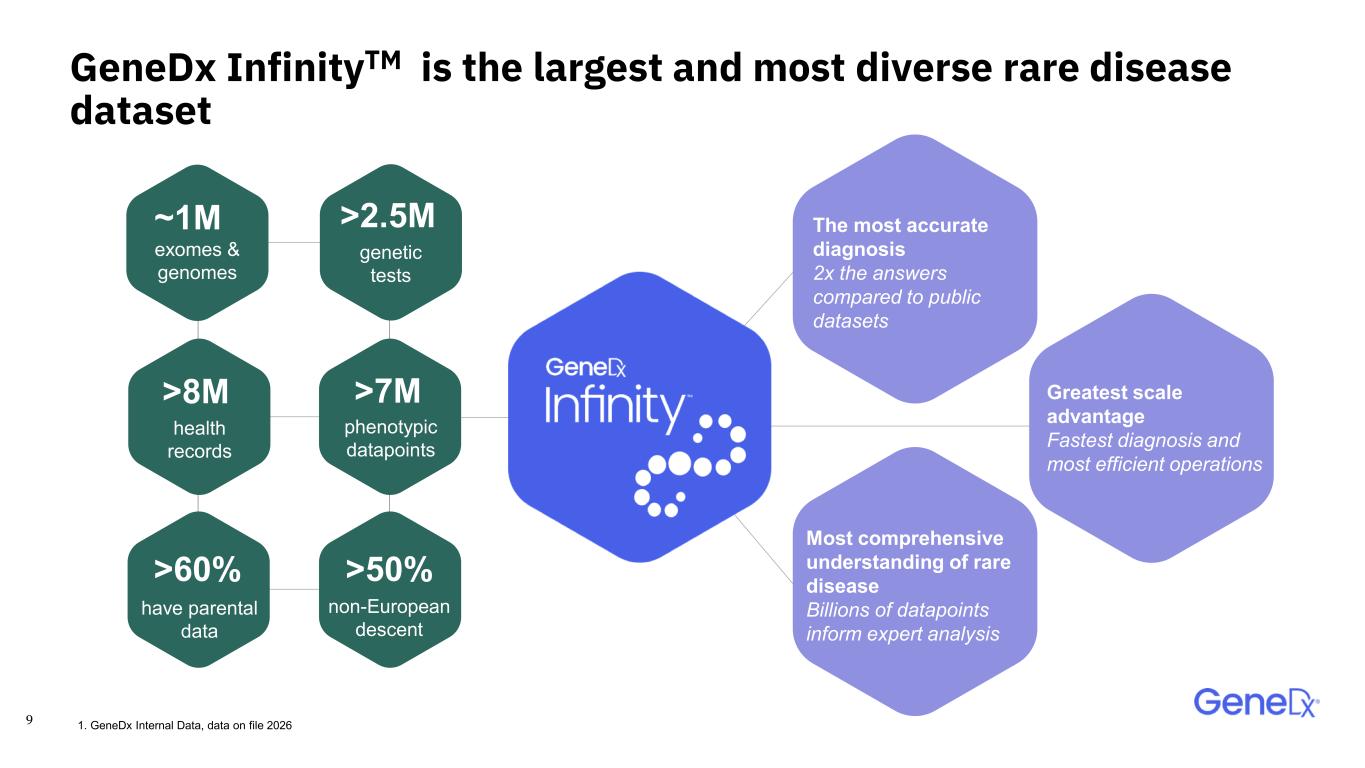

9 >2.5M >50% >8M ~1M >7M >60% genetic tests non-European descent health records exomes & genomes phenotypic datapoints have parental data GeneDx InfinityTM is the largest and most diverse rare disease dataset Greatest scale advantage Fastest diagnosis and most efficient operations Most comprehensive understanding of rare disease Billions of datapoints inform expert analysis The most accurate diagnosis 2x the answers compared to public datasets 1. GeneDx Internal Data, data on file 2026

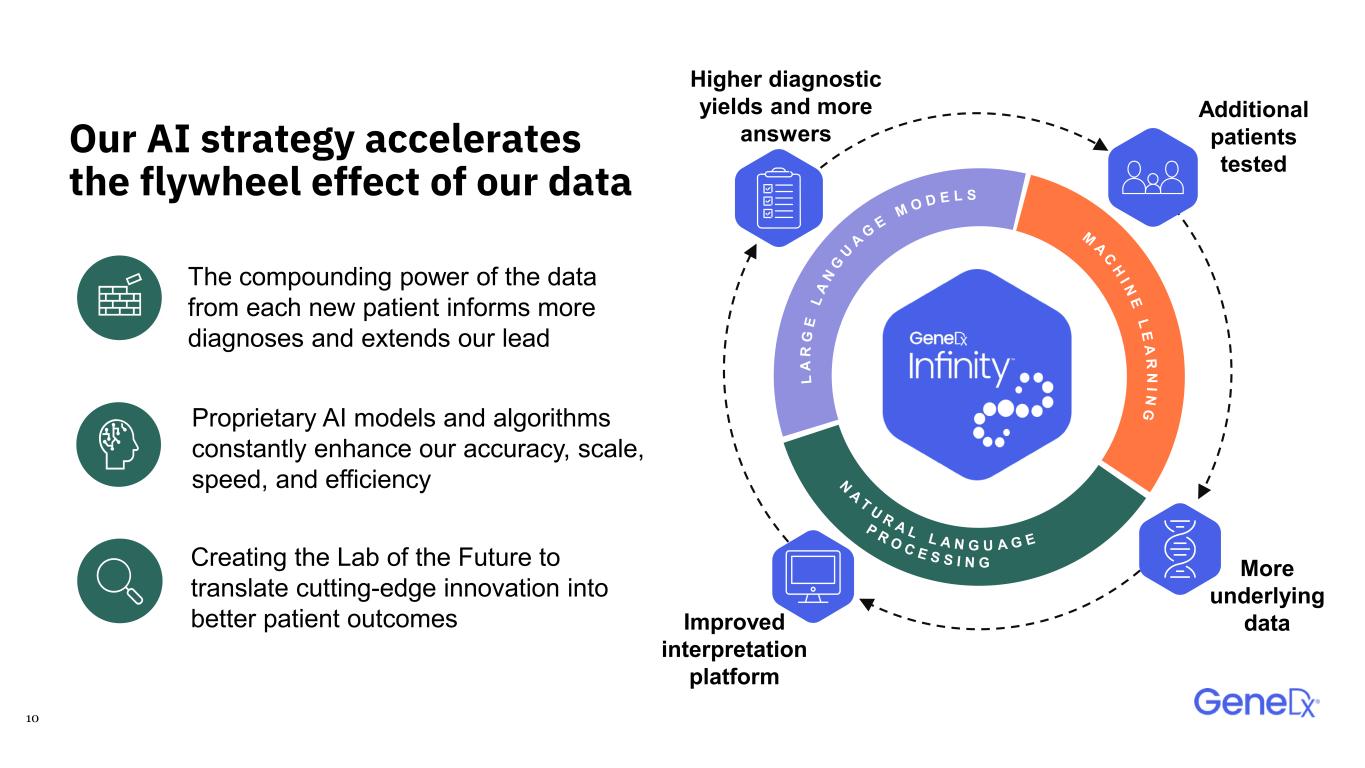

10 Our AI strategy accelerates the flywheel effect of our data Additional patients tested Improved interpretation platform Higher diagnostic yields and more answers More underlying data Creating the Lab of the Future to translate cutting-edge innovation into better patient outcomes The compounding power of the data from each new patient informs more diagnoses and extends our lead Proprietary AI models and algorithms constantly enhance our accuracy, scale, speed, and efficiency

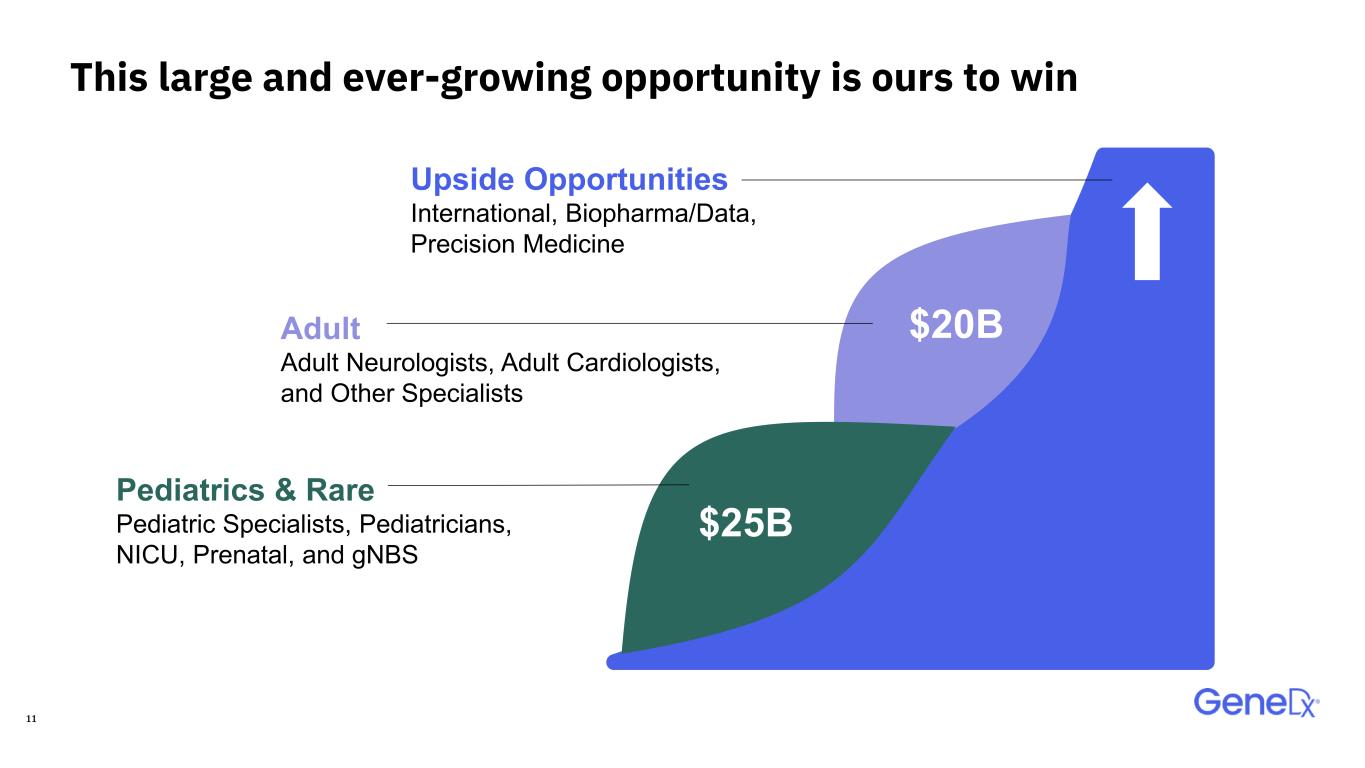

11 Upside Opportunities International, Biopharma/Data, Precision Medicine Pediatrics & Rare Pediatric Specialists, Pediatricians, NICU, Prenatal, and gNBS Adult Adult Neurologists, Adult Cardiologists, and Other Specialists $25B $20B This large and ever-growing opportunity is ours to win

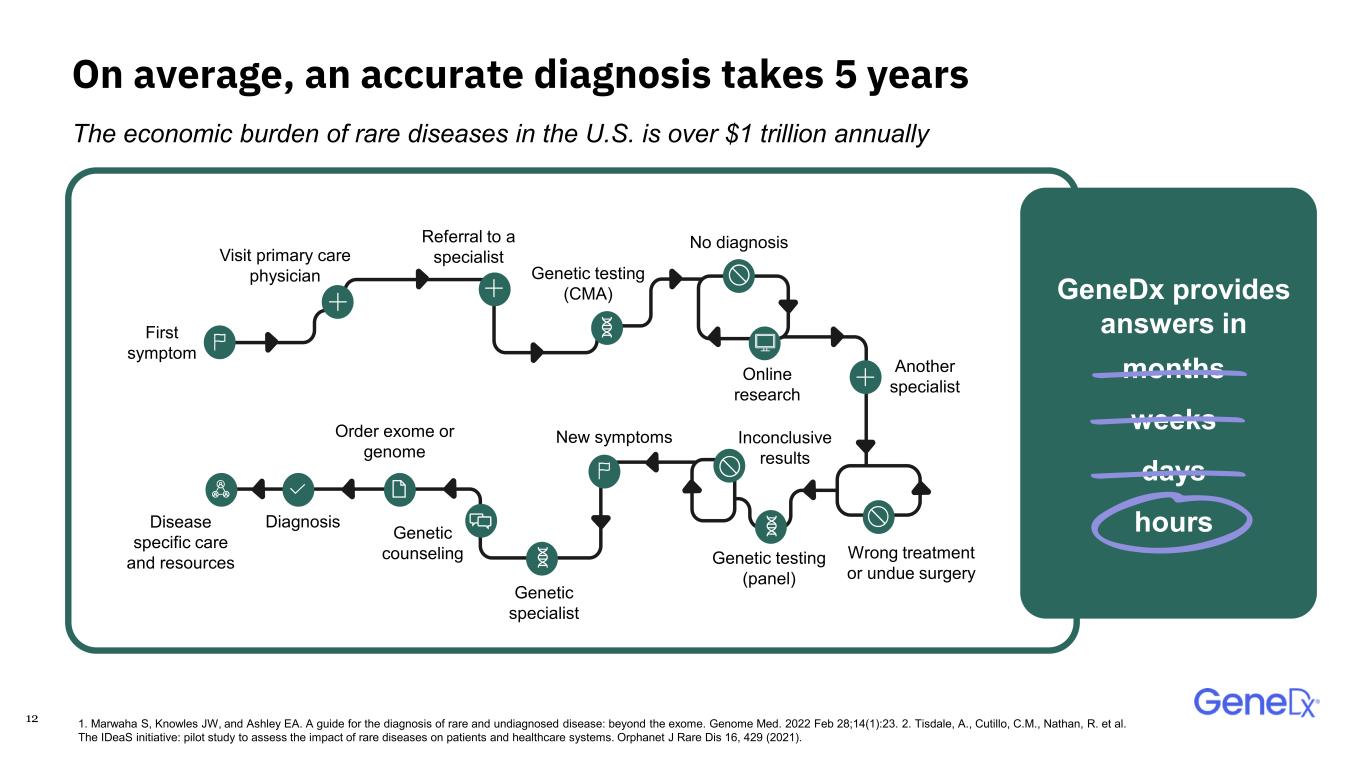

12 On average, an accurate diagnosis takes 5 years GeneDx provides answers in months weeks days hours First symptom Visit primary care physician Referral to a specialist Genetic testing (CMA) No diagnosis Online research Another specialist Wrong treatment or undue surgery Genetic testing (panel) Inconclusive results New symptoms Genetic specialist Genetic counseling Order exome or genome DiagnosisDisease specific care and resources The economic burden of rare diseases in the U.S. is over $1 trillion annually 1. Marwaha S, Knowles JW, and Ashley EA. A guide for the diagnosis of rare and undiagnosed disease: beyond the exome. Genome Med. 2022 Feb 28;14(1):23. 2. Tisdale, A., Cutillo, C.M., Nathan, R. et al. The IDeaS initiative: pilot study to assess the impact of rare diseases on patients and healthcare systems. Orphanet J Rare Dis 16, 429 (2021).

13 Our north star is to diagnose as many people as fast as possible

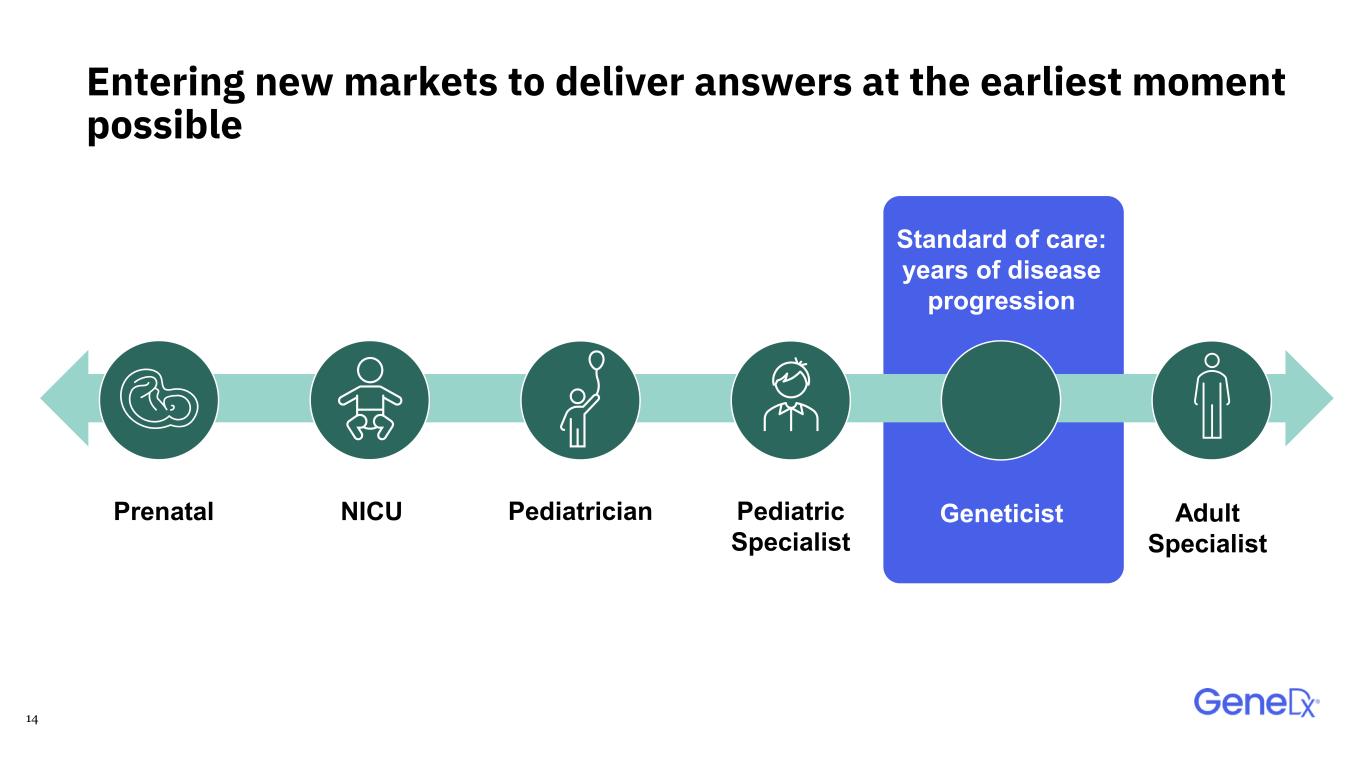

14 GeneticistPrenatal Standard of care: years of disease progression Pediatrician Entering new markets to deliver answers at the earliest moment possible NICU Adult Specialist Pediatric Specialist

15 Geneticists remain key customers and prefer GeneDx Geneticist recommendations reinforce our leadership in new markets Leading position: 80% market share driven by superior accuracy, broad access, and cutting-edge discovery Continued growth: Largest contributor to revenue today with room to grow via ongoing panel conversion Loyal advocates: As we continue to expand, these ~2,000 geneticists are key influencers for other clinicians 1. GeneDx Internal Data, data on file 2026 2. Claims data provided by Definitive Healthcare

16 Specialists drove a majority of 2025 growth and have strong momentum entering 2026 Significant share: Over 30% of pediatric neurologists now order from us with continued growth ahead Strong awareness: Greatest brand recognition of any genetics lab - over 80% of pediatric specialists know GeneDx Expanding our footprint: Continuing to add new call points and indications to serve the over 10,000 rare diseases Increased ordering and new customer activation driving expansion 1. GeneDx Internal Data, data on file 2026 2. Claims data provided by Definitive Healthcare 3. Fu MP, Merrill SM, Sharma M,et al. Rare diseases of epigenetic origin: Challenges and opportunities. Front Genet. 2023 Feb 6;14:1113086. doi: 10.3389/fgene.2023.1113086. PMID: 36814905.

17 Pediatricians are becoming the new front line of genomic medicine Massive market: 600K patients diagnosed with DD/ID by 25K pediatricians annually First mover to an untapped market with the #1 genetic test in hand Trusted partner & clear leader: Leading product, wraparound services, expert endorsements, and health system relationships Best customer experience: Pediatricians can integrate genomics into routine care with one-minute ordering Expansive reach: Dedicated team of ~50 sales reps expected to drive impact at the end of 2026 and into 2027 1. GeneDx Internal Data, data on file 2026 2. Claims data provided by Definitive Healthcare

18 The NICU is an untapped opportunity for early intervention and improved outcomes Taking a protocol-driven approach to benefit more patients and lower healthcare costs Large unmet need: Up to 60% NICU patients could benefit from rWGS per SeqFirst (~235k patients) but less than 5% of them receive genetic testing today 1. Wenger TL, Scott A, Kruidenier L, et al. SeqFirst: Building equity access to a precise genetic diagnosis in critically ill newborns. Am J Hum Genet. 2025 Mar 6;112(3):508-522. 2. Claims data provided by Definitive Healthcare 3. Kingsmore, Stephen F et al. NPJ genomic medicine vol. 9,1 17. 27 Feb. 2024 4. GeneDx Internal Data, data on file 2026 Deep relationships: 42 of the top 50 NICUs ordered rapid testing from us in 2025, positioning us to scale Fastest TAT: Leading rapid and ultrarapid genome tests deliver precise answers in as soon as 48 hours

19 GenomeDx Prenatal extends our industry-leading diagnostic capabilities into prenatal care Setting a new standard for prenatal genomic diagnoses Large unmet need: For patients with structural anomalies on prenatal ultrasound, impacting up to 4% of pregnancies Extensive prenatal experience: Building upon 10+ years of experience offering CMA and 4000+ prenatal exomes Timely answers: Delivering the most accurate and comprehensive diagnostic results in less than two weeks to guide critical care decisions 1.Salomon LJ, Alfirevic Z, Berghella V, et al. Practice guidelines for performance of the routine mid-trimester fetal ultrasound scan. Ultrasound Obstet Gynecol. 2011 Jan;37(1):116-26. 2. GeneDx Internal Data, data on file 2026

20 Adult specialists will unlock future growth and impact Putting commercial focus behind the organic growth in adult exome and genome testing New market: Expanding to neurologists in 2026 with a focus on clinicians already ordering genetic testing Green space: Strong demand and reimbursement for adults living with pediatric-onset conditions like epilepsy Long-term potential: Future opportunities could expand to cardiology, neurodegenerative disorders, and more, representing up to 5M patients 1. GeneDx Internal Data, data on file 2026 2. Claims data provided by Definitive Healthcare

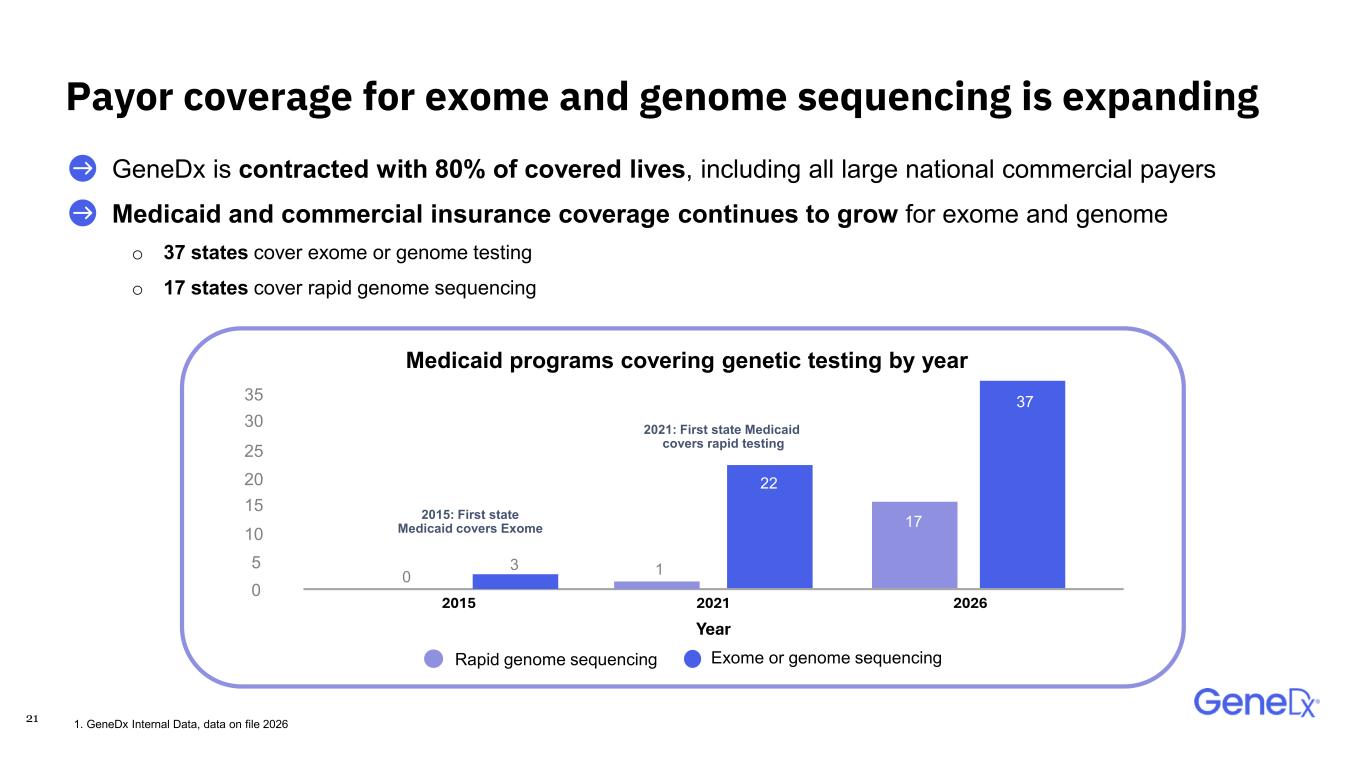

21 〉 GeneDx is contracted with 80% of covered lives, including all large national commercial payers 〉 Medicaid and commercial insurance coverage continues to grow for exome and genome o 37 states cover exome or genome testing o 17 states cover rapid genome sequencing Payor coverage for exome and genome sequencing is expanding 1. GeneDx Internal Data, data on file 2026 Medicaid programs covering genetic testing by year 2015: First state Medicaid covers Exome 2021: First state Medicaid covers rapid testing 30 25 20 15 10 5 0 0 3 1 37 2015 2021 2026 Year Rapid genome sequencing Exome or genome sequencing 22 17 35

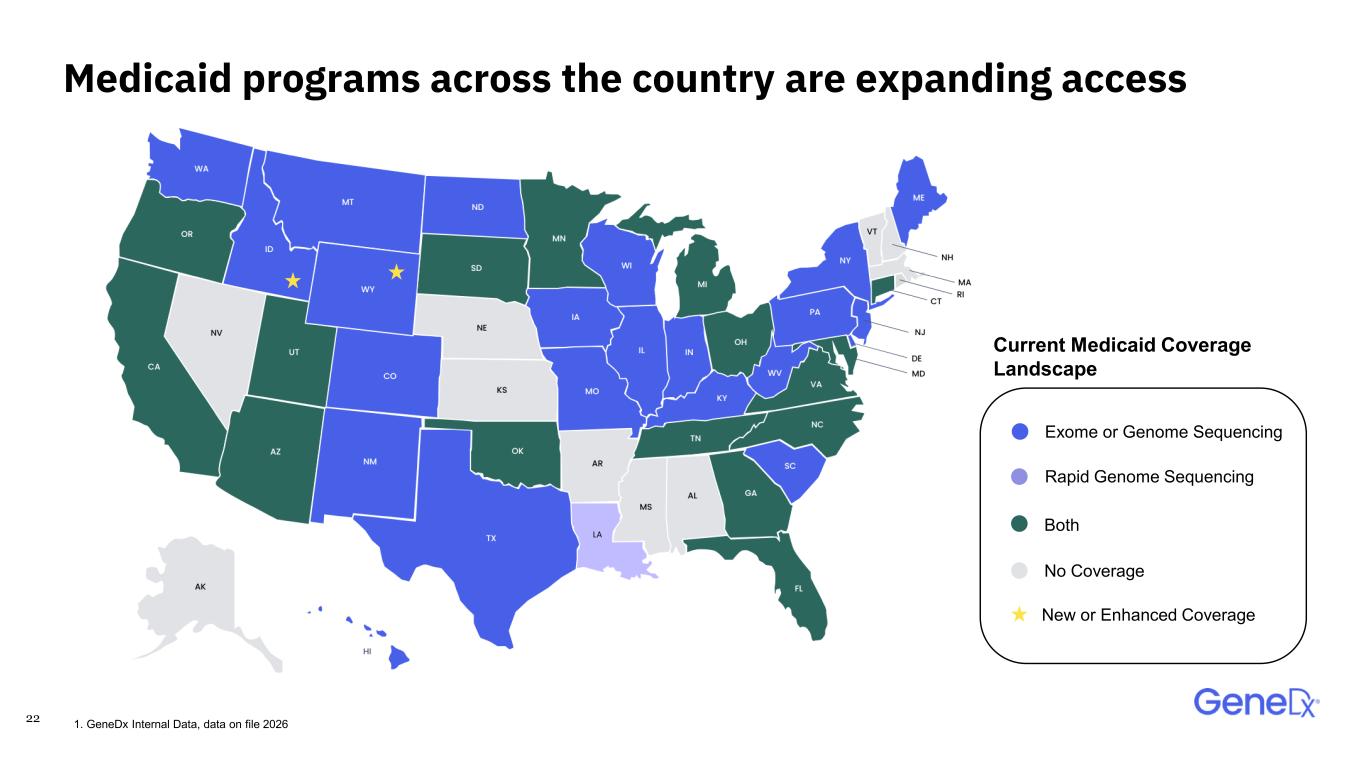

22 Medicaid programs across the country are expanding access Exome or Genome Sequencing Rapid Genome Sequencing Both No Coverage Current Medicaid Coverage Landscape 1. GeneDx Internal Data, data on file 2026 New or Enhanced Coverage

23 Our experience in rare disease diagnosis has laid the foundation for us to enable precision genomic medicine at scale

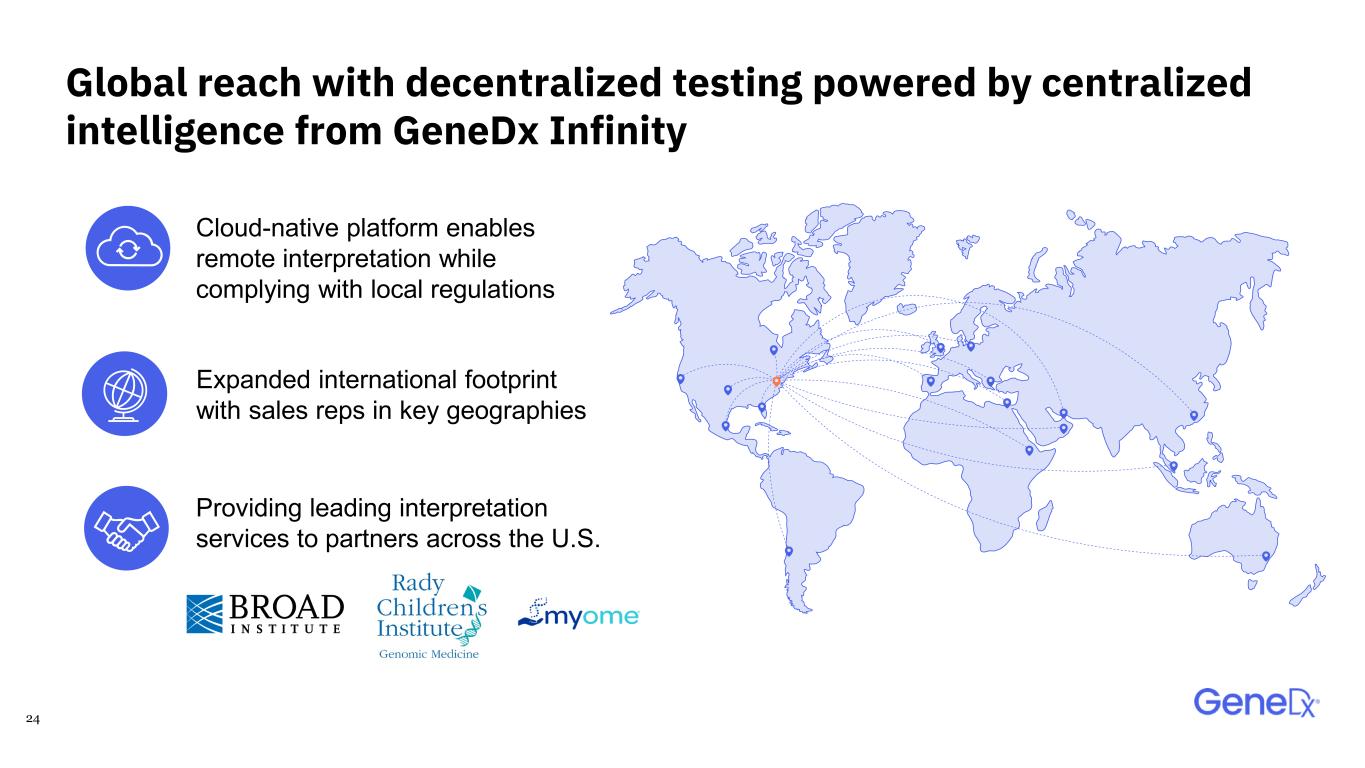

24 Global reach with decentralized testing powered by centralized intelligence from GeneDx Infinity Cloud-native platform enables remote interpretation while complying with local regulations Providing leading interpretation services to partners across the U.S. Expanded international footprint with sales reps in key geographies

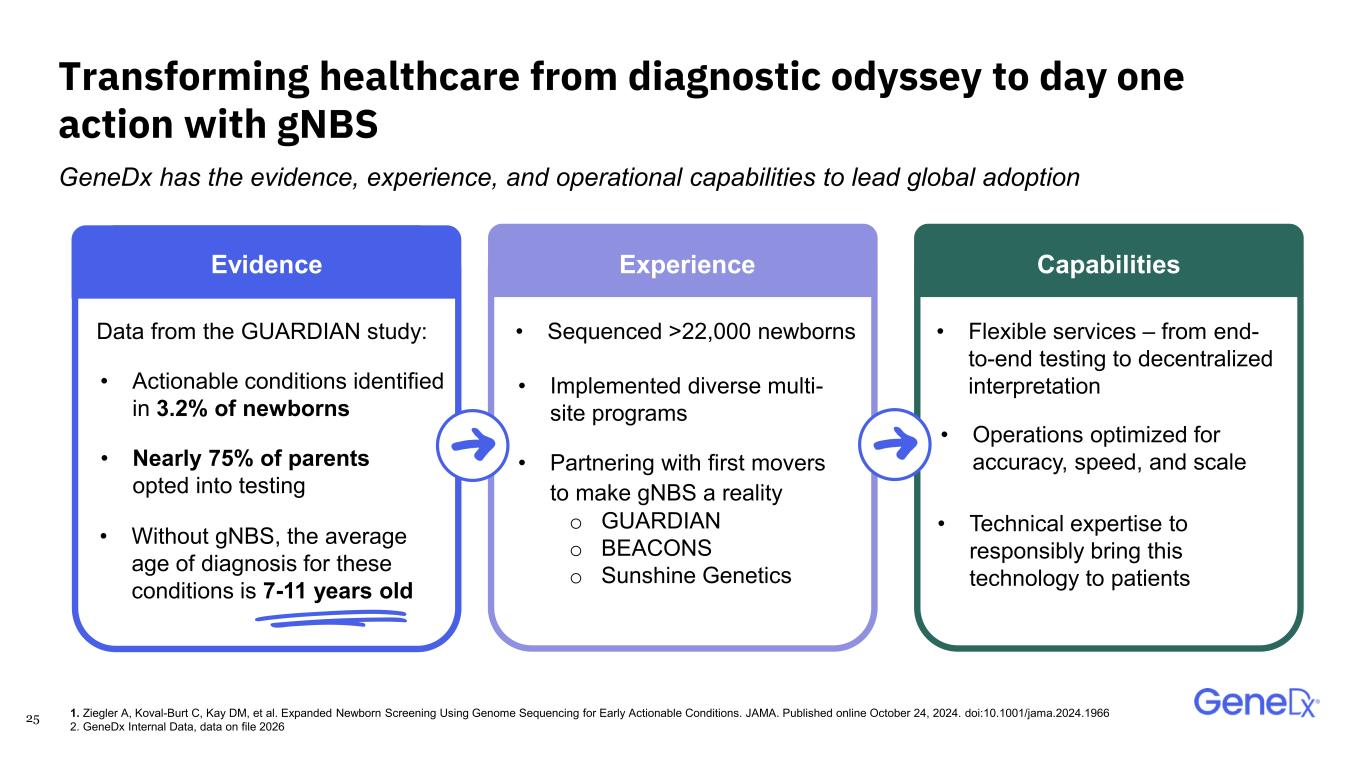

25 Transforming healthcare from diagnostic odyssey to day one action with gNBS GeneDx has the evidence, experience, and operational capabilities to lead global adoption • Partnering with first movers to make gNBS a reality o GUARDIAN o BEACONS o Sunshine Genetics • Without gNBS, the average age of diagnosis for these conditions is 7-11 years old Data from the GUARDIAN study: • Nearly 75% of parents opted into testing • Implemented diverse multi- site programs Evidence Experience Capabilities • Actionable conditions identified in 3.2% of newborns • Sequenced >22,000 newborns • Operations optimized for accuracy, speed, and scale • Flexible services – from end- to-end testing to decentralized interpretation • Technical expertise to responsibly bring this technology to patients 1. Ziegler A, Koval-Burt C, Kay DM, et al. Expanded Newborn Screening Using Genome Sequencing for Early Actionable Conditions. JAMA. Published online October 24, 2024. doi:10.1001/jama.2024.1966 2. GeneDx Internal Data, data on file 2026

26 Pioneering new channels and partnerships to deliver on the promise of precision genomic medicine

27 Unlocking biopharma breakthroughs to translate answers into action

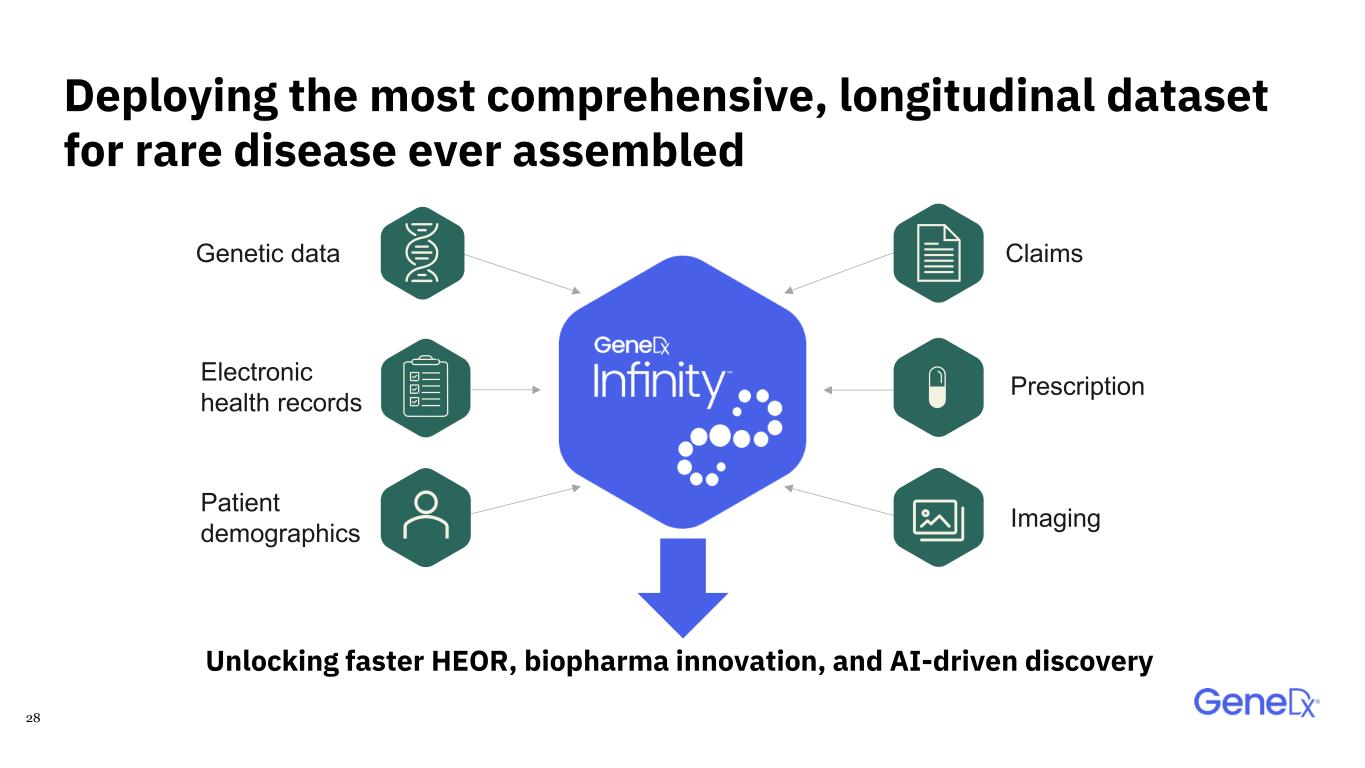

28 Unlocking faster HEOR, biopharma innovation, and AI-driven discovery Genetic data Electronic health records Patient demographics Claims Prescription Imaging Deploying the most comprehensive, longitudinal dataset for rare disease ever assembled

29 Transforming every stage of drug development Research & Development Clinical Trials Market Authorization & Access Target Validation & Modeling Patient Matching & Recruitment Diverse Longitudinal DataCommercialization Launch & Post-Marketing

30 Turning insight into biopharma impact

31 We've built a high growth business that is purpose driven and profitable

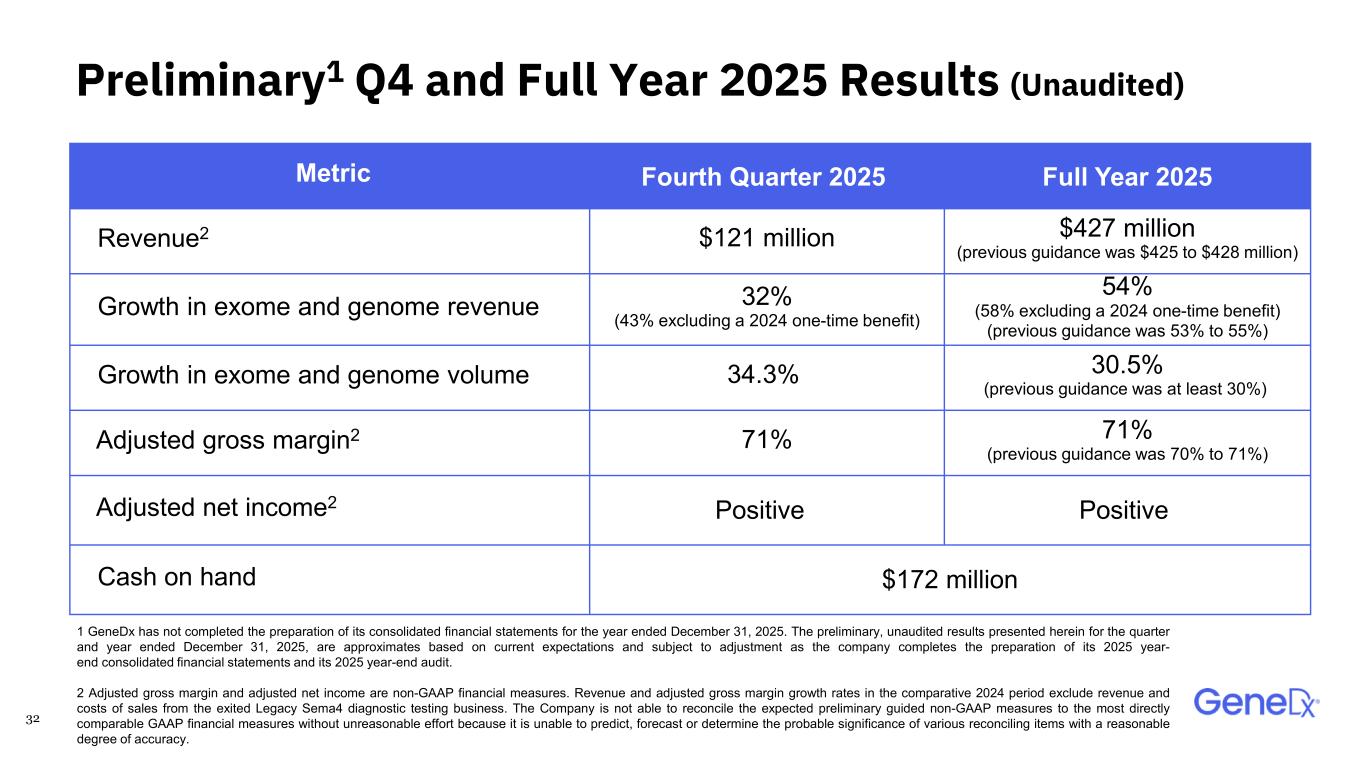

32 Preliminary1 Q4 and Full Year 2025 Results (Unaudited) Metric Fourth Quarter 2025 Full Year 2025 Revenue2 $121 million $427 million (previous guidance was $425 to $428 million) Growth in exome and genome revenue 32% (43% excluding a 2024 one-time benefit) 54% (58% excluding a 2024 one-time benefit) (previous guidance was 53% to 55%) Growth in exome and genome volume 34.3% 30.5% (previous guidance was at least 30%) Adjusted gross margin2 71% 71% (previous guidance was 70% to 71%) Adjusted net income2 Positive Positive Cash on hand $172 million 1 GeneDx has not completed the preparation of its consolidated financial statements for the year ended December 31, 2025. The preliminary, unaudited results presented herein for the quarter and year ended December 31, 2025, are approximates based on current expectations and subject to adjustment as the company completes the preparation of its 2025 year- end consolidated financial statements and its 2025 year-end audit. 2 Adjusted gross margin and adjusted net income are non-GAAP financial measures. Revenue and adjusted gross margin growth rates in the comparative 2024 period exclude revenue and costs of sales from the exited Legacy Sema4 diagnostic testing business. The Company is not able to reconcile the expected preliminary guided non-GAAP measures to the most directly comparable GAAP financial measures without unreasonable effort because it is unable to predict, forecast or determine the probable significance of various reconciling items with a reasonable degree of accuracy.

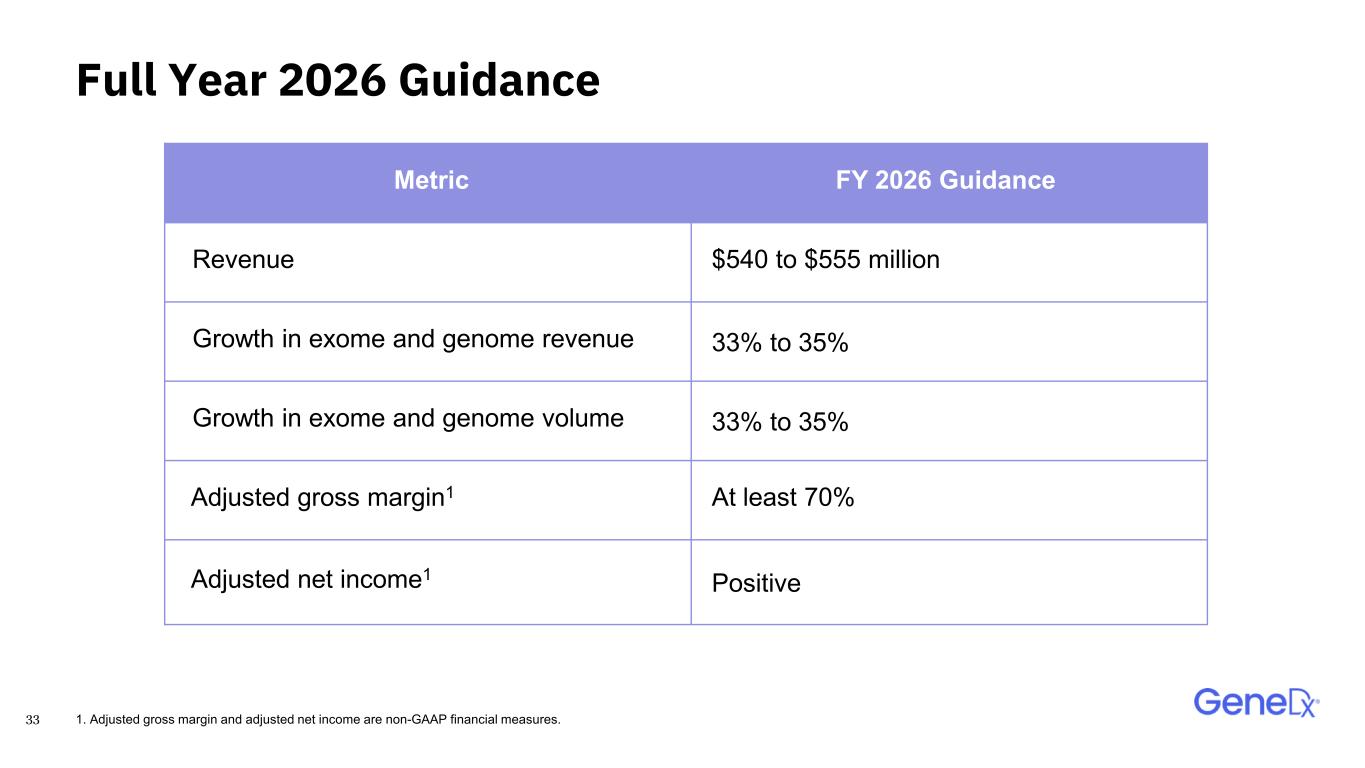

33 Full Year 2026 Guidance Metric FY 2026 Guidance Revenue $540 to $555 million Growth in exome and genome revenue 33% to 35% Growth in exome and genome volume 33% to 35% Adjusted gross margin1 At least 70% Adjusted net income1 Positive 1. Adjusted gross margin and adjusted net income are non-GAAP financial measures.

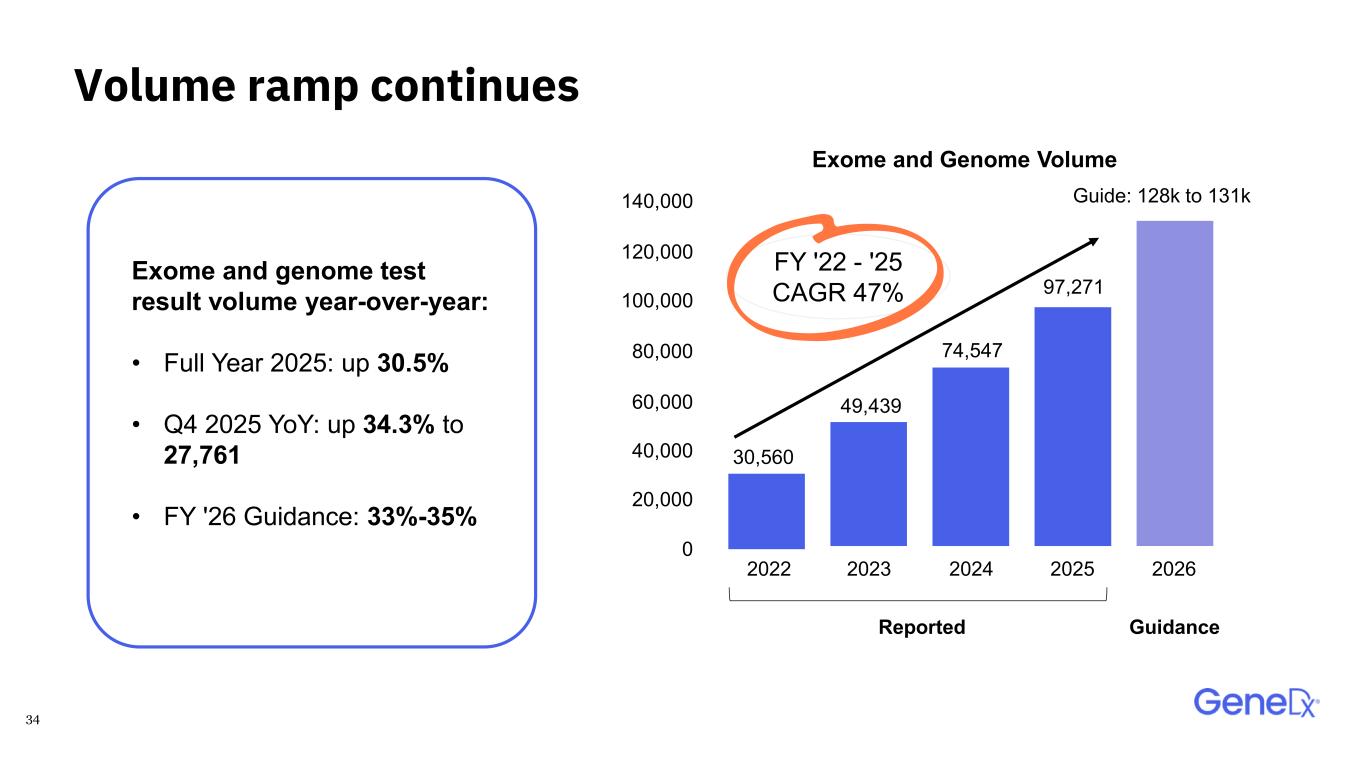

34 Volume ramp continues Exome and genome test result volume year-over-year: • Full Year 2025: up 30.5% • Q4 2025 YoY: up 34.3% to 27,761 • FY '26 Guidance: 33%-35% FY '22 - '25 CAGR 47% Guide: 128k to 131k 2022 Exome and Genome Volume 2023 2024 2025 2026 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 Reported Guidance 97,271 74,547 30,560 49,439

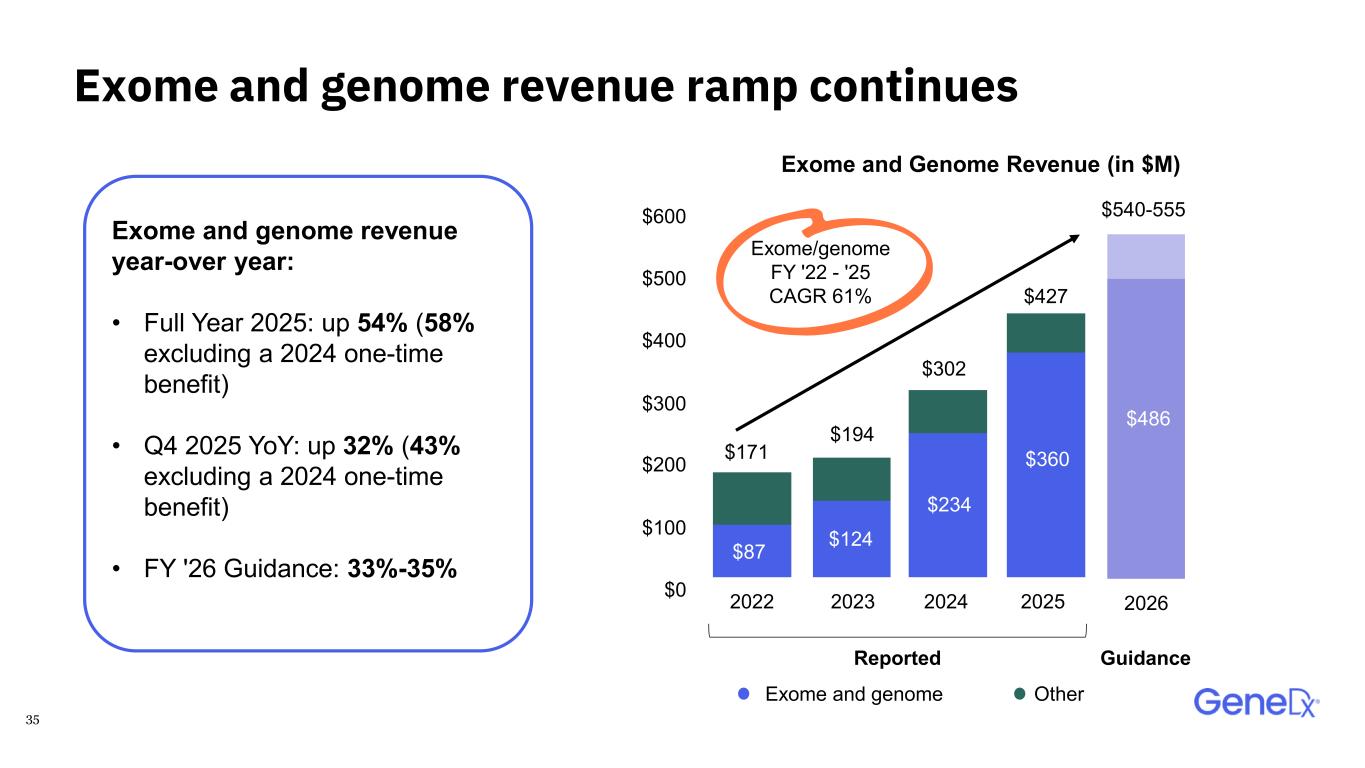

35 Exome and genome revenue ramp continues Exome and genome revenue year-over year: • Full Year 2025: up 54% (58% excluding a 2024 one-time benefit) • Q4 2025 YoY: up 32% (43% excluding a 2024 one-time benefit) • FY '26 Guidance: 33%-35% Exome/genome FY '22 - '25 CAGR 61% $171 $427 $302 $194 $540-555 $124$87 $234 $360 $486 2022 2023 2024 2025 2026$0 $100 $200 $300 $400 $500 $600 Exome and genome Other Reported Guidance Exome and Genome Revenue (in $M)

36 Proven leadership driving high-growth and operational excellence at scale Heidi Chen Chief Legal Officer Linda Genen Chief Medical Officer Jami Biliboaca Head of People Strategy Martin Reese President, Fabric Genomics Katherine Stueland Chief Executive Officer Kevin Feeley Chief Financial Officer Bryan Dechairo Chief Operating Officer Melanie Duquette Chief Growth Officer Lisa Gurry Chief Business Officer Mimi Lee Chief of Precision Genetic Medicine

37 Massive TAM and expanding serviceable market Leadership position Differentiated technology A rare opportunity to transform healthcare fueled by unmatched data and momentum Emerging guidelines and improving payer landscape Scale advantage Proven management team

38 GeneDx enables a future that is predictive, preventative, and ultimately curative. That future always begins with a single answer. And that answer changes everything.