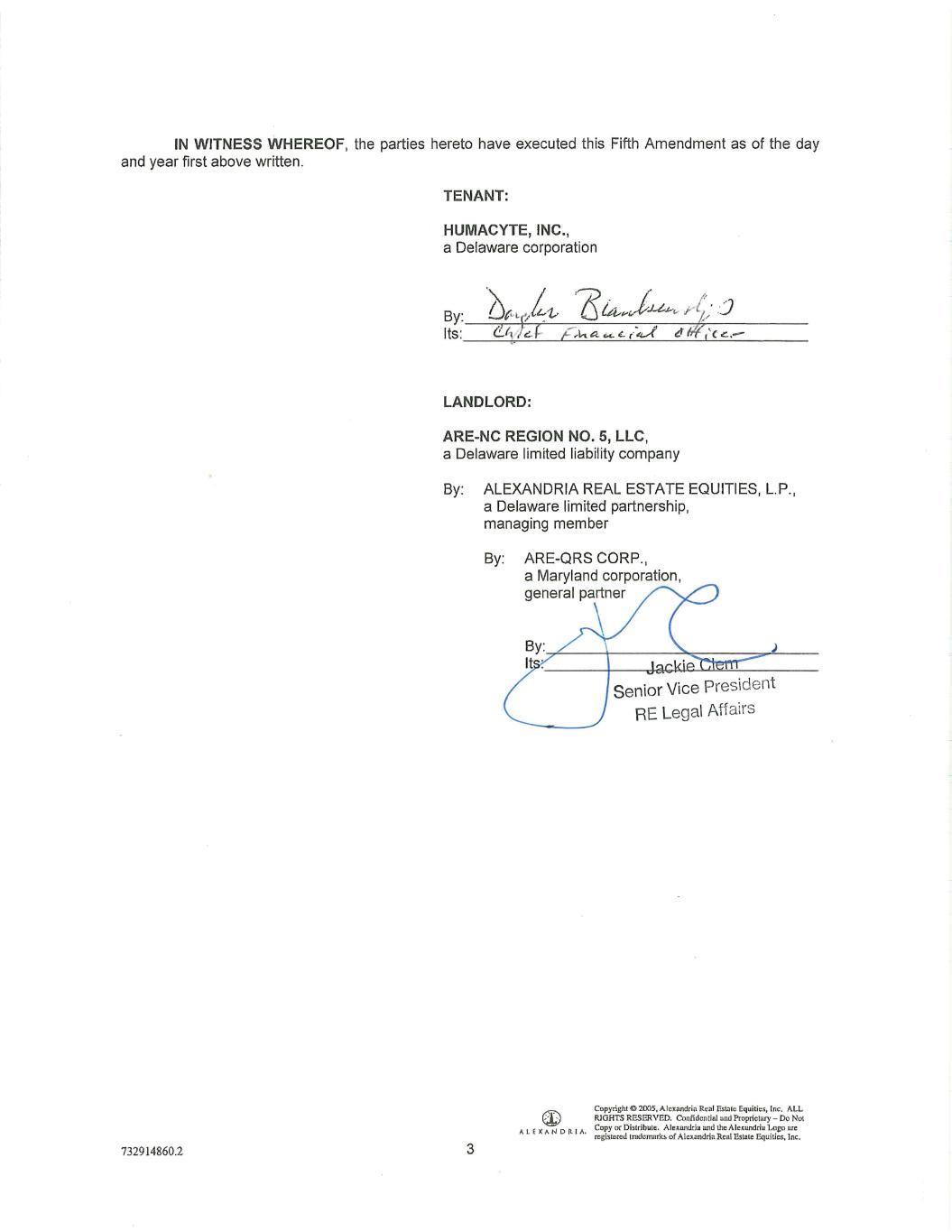

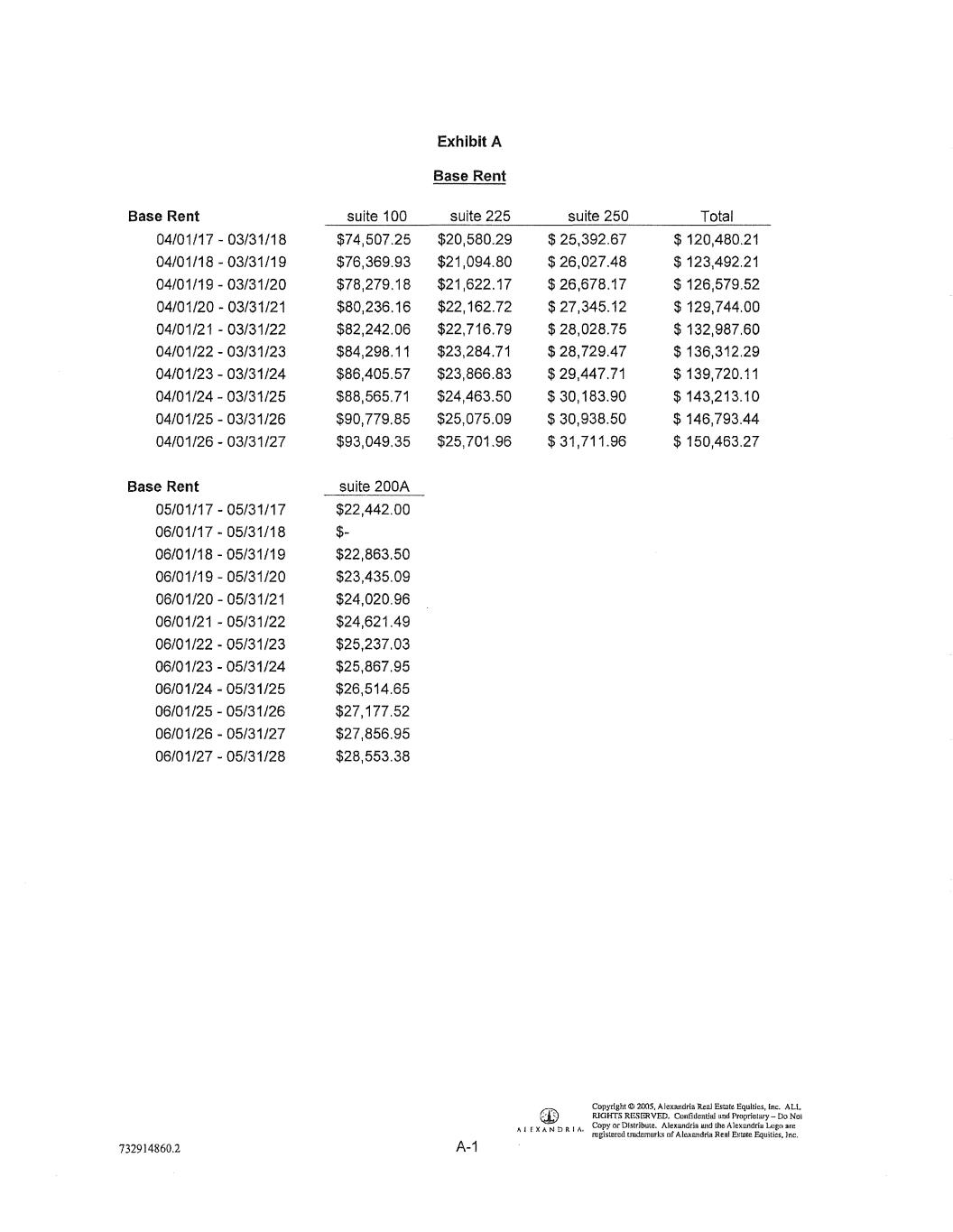

FIFTH AMENDMENT TO LEASE THIS FIFTH AMENDMENT TO LEASE (this "Fifth Amendment") is made as of September '/~ 2019, by and between ARE-NC REGION NO. 5, LLC, a Delaware limited liability company ("Landlord"), and HUMACYTE, INC., a Delaware corporation ("Tenant"). RECITALS A. Landlord and Tenant are parties to that certain Lease Agreement dated as of December 31, 2015, as amended by that certain letter agreement dated January 29, 2016, and as further amended by that certain First Amendment to Lease dated as of September 30, 2016, as further amended by that certain Second Amendment to Lease dated as of February 8, 2017 (the "Second Amendment"), as further amended by that certain Third Amendment to Lease dated as of April 21, 2017, and as further amended by that certain Fourth Amendment to Lease dated as of October 31, 2017 (as amended, the "Lease"). Pursuant to the Lease, Tenant leases that certain building located at 2525 E. NC Highway 54, Durham, North Carolina premises containing approximately 82,996 rentable square feet (the "Premises"). The Premises are more particularly described in the Lease. Capitalized terms used herein without definition shall have the meanings defined for such terms in the Lease. B. Landlord and Tenant desire, subject to the terms and conditions set forth below, to amend the Lease as provided for in this Fifth Amendment. NOW, THEREFORE, in consideration of the foregoing Recitals, which are incorporated herein by this reference, the mutual promises and conditions contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant hereby agree as follows: 1. Base Term. Commencing on the date of this Fifth Amendment, the defined term "Base Term" on page 1 of the Lease shall be·'deleted in its entirety and replaced with the following: "A term (i) beginning, with respect to the Original Premises and the Expansion Premises, on the Commencement Date and ending on March 31, 2027, and (ii) beginning, with respect to the Second Expansion Premises, on the Second Expansion Premises Commencement Date and ending on May 31, 2028." For the avoidance of doubt, the terms of Section 6 of the Second Amendment with respect to Tenant's election to exercise its Extension Right under Section 40 of the Lease shall continue to apply. , 2. Base Rent. Attached to this Fifth Amendment as Exhibit A is a schedule of Base Rent payable under the Lease. 3. Tl Allowances. Attached to this Fifth Amendment as Exhibit B is a schedule of the Additional Rent payable in connection with the Tl Allowance, the Additional Tl Allowance, the Second Expansion Premises Tl Allowance and the Additional Tl Fund. 4. OFAC. Tenant is and, to Tenant's knowledge, all beneficial owners of Tenant are currently (a) in compliance with and shall at all times during the Term of the Lease remain in compliance with the regulations of the Office of Foreign Assets Control ("OFAC") of the U.S. Department of Treasury and any statute, executive order, or regulation relating thereto (collectively, the 11 OFAC Rules"), (b) not listed on, and shall not during the term of the Lease be listed on, the Specially Designated Nationals and Blocked Persons List, Foreign Sanctions Evaders List, or the Sectoral Sanctions Identification List, which are all maintained by OFAC and/or on any other similar list maintained by OFAC or other governmental authority pursuant to any authorizing statute, executive order, or 732914860.2 (ffi:\ Copyright© 2005, Alexandria Real fatale Equities, Inc. ALL ~ RIGHTS RESERVED. Confidential und Propriet:iry - Do Nol A L E x A N D R I A. Copy Dt' Distribute. Ale:<:ru1driu and lhe Ale,andriu L(lgo :ire registered trodemnrks of Alru:nn<lrin Real Estate Equities, Inc.

regulation, and (c) not a person or entity with whom a U.S. person is prohibited from conducting business under the OFAC Rules. 5. Brokers. Landlord and Tenant each represents and warrants that it has not dealt with any broker, agent or other person (collectively, "Broker") in connection with the transaction reflected in this Fifth Amendment and that no Broker brought about this transaction. Landlord and Tenant each hereby agrees to indemnify and hold the other harmless from and against any claims by any Broker claiming a commission or other form of compensation by virtue of having dealt with Tenant or Landlord, as applicable, with regard to this Fifth Amendment. 6. Miscellaneous. a. This Fifth Amendment is the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous oral and written agreements and discussions. This Fifth Amendment may be amended only by an agreement in writing, signed by the parties hereto. b. This Fifth Amendment is binding upon and shall inure to the benefit of the parties hereto, and their respective successors and assigns. c. This Fifth Amendment may be executed in 2 or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic signature process complying with the U.S. federal ESIGN Act of 2000) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes. Electronic signatures shall be deemed original signatures for purposes of this Fifth Amendment and all matters related thereto, with such electronic signatures having the same legal effect as original signatures. d. Except as amended by this Fifth Amendment, the Lease is hereby ratified and confirmed and all other terms of the Lease shall remain in full force and effect, unaltered and unchanged by this Fifth Amendment. In the event of any conflict between the provisions of this Fifth Amendment and the provisions of the Lease, the provisions of this Fifth Amendment shall prevail. Whether or not specifically amended by this Fifth Amendment, all of the terms and provisions of the Lease are hereby amended to the extent necessary to give effect to the purpose and intent of this Fifth Amendment. 732914860.2 [Signatures are on the next page] 2 Pl"\ Copyright@ 2005, Ale~andria Real Estaic Equities, Inc. ALL ~ RIGHTS RESERVED. Conficlcntiill and Proprietary-Do Nol AL t x AN D RI A, Cofy or DisLribule. AleKwidria ~cl the Ale~andria ~go are regtslcrccl trudcmnrks of Alcxnndna Reul Esmte Eqmtics, Inc.

IN WITNESS W HEREOF, the parties hereto have executed this Fifth Amendment as of the day and year first above written. 732914860.2 TENANT: HUMACYTE, INC., a Delaware corporation By:_·b~r"--rl..~-----·l"--_ 1.,, ,6_· u_· _j;.,J._-~--,--· ~_"'_· · 'P"r'"";.::_:J _ _ _ lts: __ ~_,,t+.y"-1"c._ ..c__t:_ t:.__--_ ...h._~_"-_·_e.....:,.(_4A _ c_ W__,__,··c_·;::.._. _ _ __ _ LANDLORD: ARE-NC REGION NO. 5, LLC, a Delaware limited liability company By: ALEXANDRIA REAL ESTATE EQUITIES, L.P., a Delaware limited partnership, 3 managing member By: ARE-QRS CORP., a Maryland corporation, general partner \ Senior Vice President RE Legal Affairs nf:\ Copyright @2005, Alexandria Real Estate Equilic:.s, [nc. ALL ~ RIGHTS RESERVED. Confidential und Proprietnry - Do Not A L r: X" N D It 1 "· Copy or Distribute. Ale~nm!ria and \he Alernndriu Logo ure registered trncfomnrks of Alexandria Reul Estate Equities, lnc ,

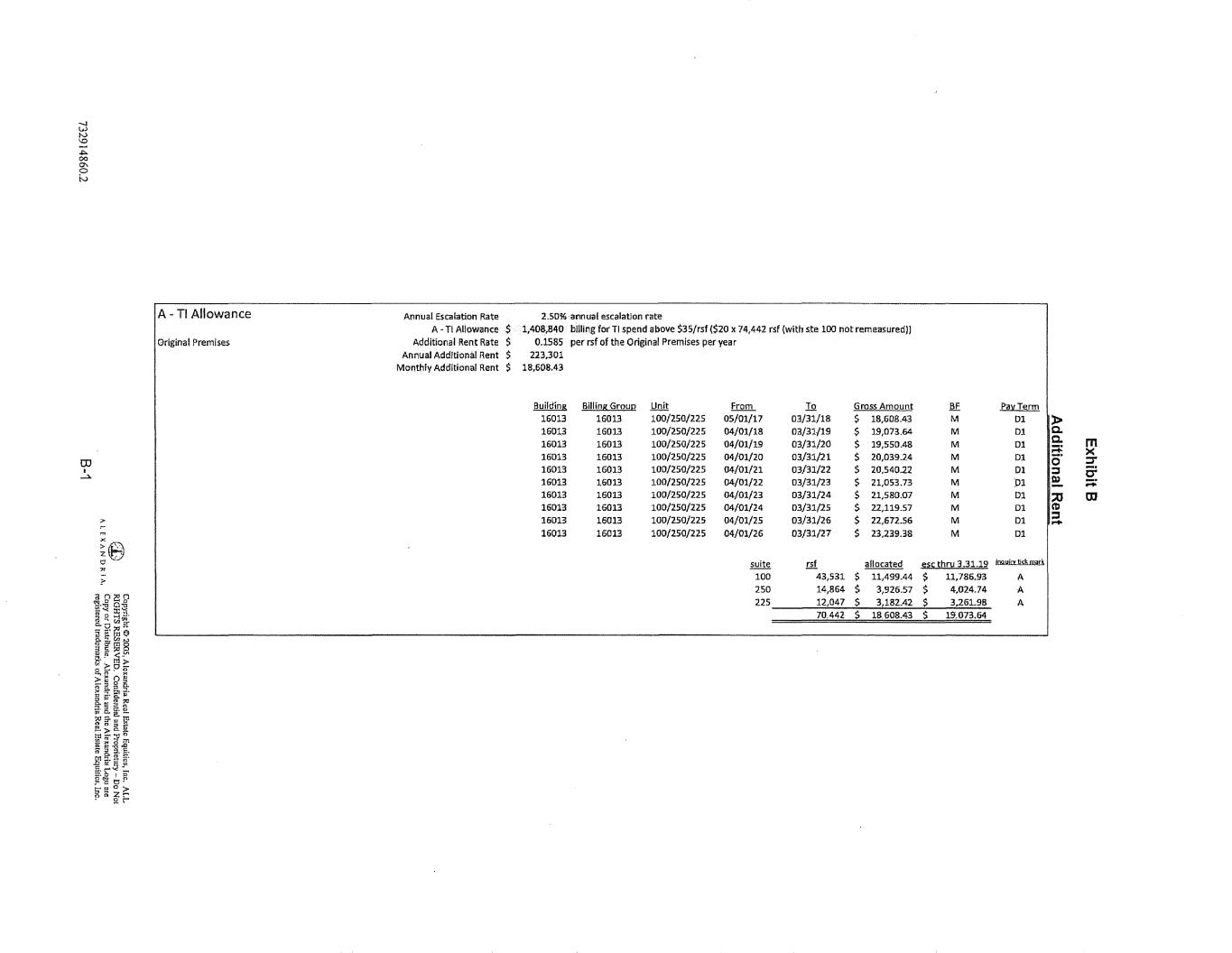

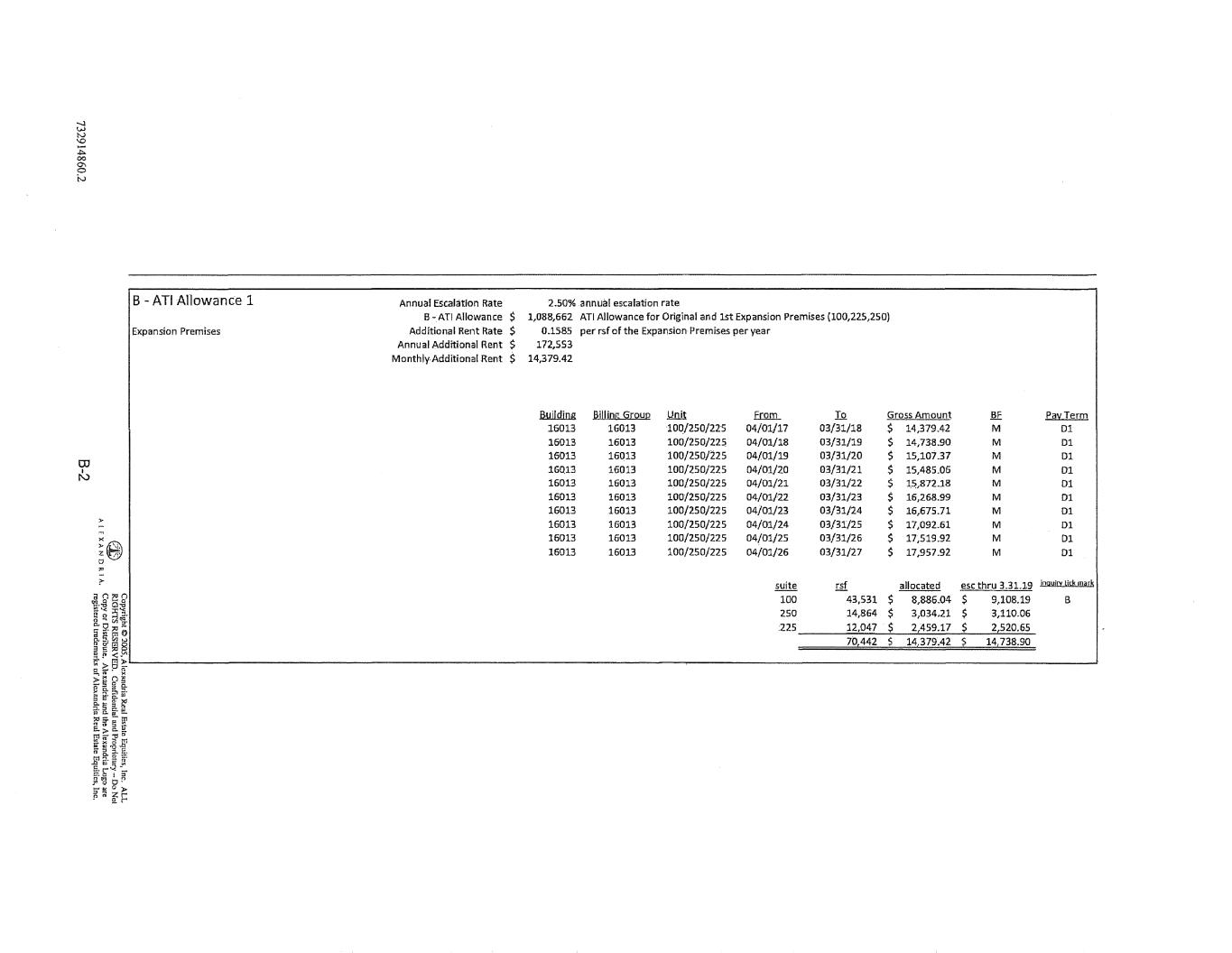

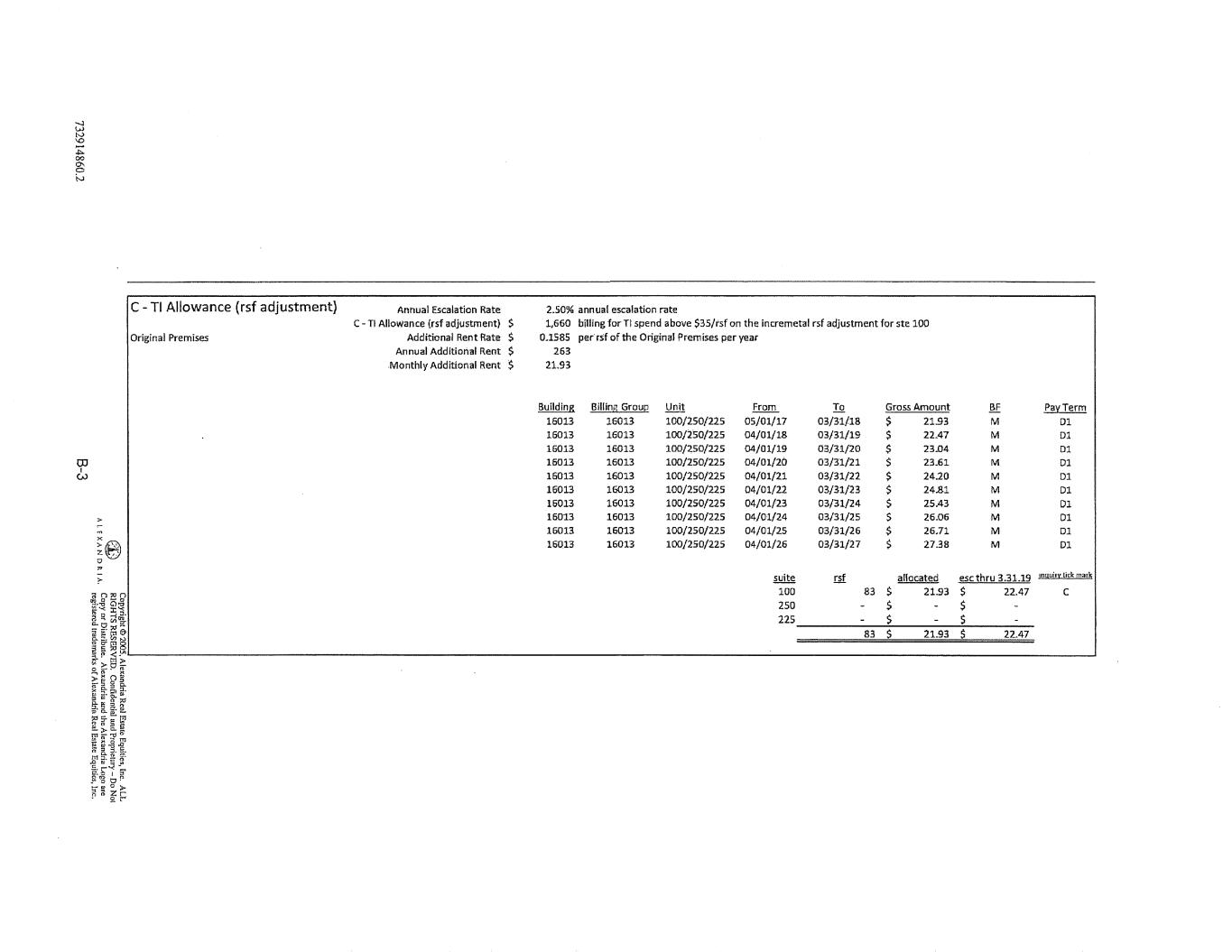

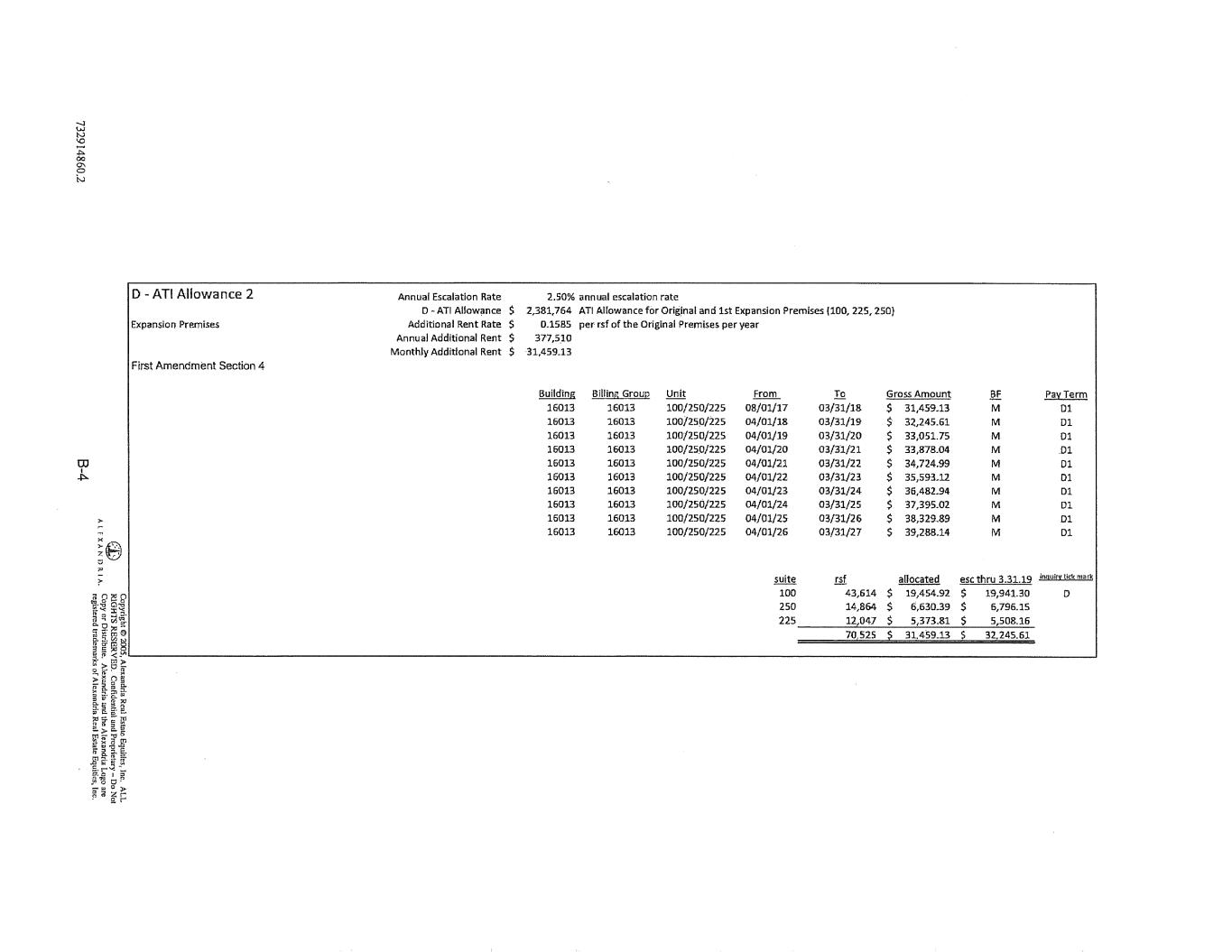

Base Rent suite 100 04/01 /17 - 03/31 /18 $74,507.25 04/01/18 - 03/31/19 $76,369.93 04/01/19 - 03/31/20 $78,279.18 04/01/20 - 03/31/21 $80,236.16 04/01/21 - 03/31/22 $82,242.06 04/01/22 - 03/31/23 $84,298.11 04/01/23 - 03/31/24 $86,405.57 04/01/24 - 03/31/25 $88,565.71 04/01/25 - 03/31/26 $90,779.85 04/01/26 - 03/31/27 $93,049.35 Base Rent suite 200A 05/01/17 - 05/31/17 $22,442.00 06/01/17 - 05/31/18 $- 06/01/18 - 05/31/19 $22,863.50 06/01/19 - 05/31/20 $23,435.09 06/01/20 - 05/31/21 $24,020.96 06/01 /21 - 05/31 /22 $24,621.49 06/01 /22 - 05/31 /23 $25,237.03 06/01 /23 - 05/31 /24 $25,867.95 06/01/24 - 05/31/25 $26,514.65 06/01 /25 - 05/31 /26 $27,177.52 06/01 /26 - 05/31 /27 $27,856.95 06/01 /27 - 05/31 /28 $28,553.38 732914860.2 Exhibit A Base Rent suite 225 $20,580.29 $21,094.80 $21,622.17 $22,162.72 $22,716.79 $23,284.71 $23,866.83 $24,463.50 $25,075.09 $25,701.96 A-1 suite 250 Total $25,392.67 $120,480.21 $26,027.48 $ 123,492.21 $26,678.17 $ 126,579.52 $27,345.12 $129,744.00 $28,028.75 $132,987.60 $28,729.47 $136,312.29 $29,447.71 $139,720.11 $30,183.90 $143,213.10 $30,938.50 $ 146,793.44 $31,711.96 $ 150,463.27 ~ Copyright© 2005, Alexandria Real Esta lo Equities, Inc. ALL ~ RIGHTS RESERVED. Confidential "nd Proprietary- Do Nol A I Ex AN D R I A, Copy or Dislrioule. Ale,undrla and U1e Alexundria Luso are registered tmdcmarks uf Alexandria Real E.~tate Equities, Jnc.

-l u.> Iv 'Cl .i:,. 00 °' 0 N co I -l,. X >ill ~IQ ?' ;;in~Q ~-~ ~~ !sq;i~ "-oc!~ ~ ~-~~ g- 5' f¾l 8 ~*at Cf;;. o., fa.ti'• X ~§~l ~~~;; Re ~ o ~-o..[E.. :,;, s:-'" Ul O fl ;:I 6'" a>o..o Uln_gi * s ]. ~: ..81 et;;; l), §. ~9 ;' ii'"a or> ;;.~;~ !' o gr A-Tl Allowance Original Premises Annual Escalation Rate A - Tl Allowance $ Additional Rent Rate $ Annual Additional Rent $ Monthly Additional Rent $ 2.50% annual escalation rate 1,408,840 billing for Tl spend above $35/rsf ($20 x 74,442 rsf (with ste 100 not remeasured)) 0.1585 per rsf of the Original Premises per year 223,301 18,608.43 Building BillingGrou12 Unit From To Gross Amount 16013 16013 100/250/225 05/01/17 03/31/18 $ 18,608.43 16013 16013 100/250/225 04/01/18 03/31/19 $ 19,073.64 16013 16013 100/250/225 04/01/19 03/31/20 $ 19,550.48 16013 16013 100/250/225 04/01/20 03/31/21 $ 20,039.24 16013 16013 100/250/225 04/01/21 03/31/22 $ 2.0,540.22 16013 16013 100/250/225 04/01/22 03/31/23 $ 21,053.73 16013 16013 100/250/225 04/01/23 03/31/24 $ 21,580.07 16013 16013 100/250/225 04/01/24 03/31/25 $ 22,119.57 16013 16013 100/250/225 04/01/25 03/31/26 $ 22,672.56 16013 16013 100/250/225 04/01/26 03/31/27 $ 23,239.38 suite ill allocated 100 43,531 $ 11,499.44 250 14,864 $ 3,926.57 225 12,047 $ 3,182.42 70.442 $ 18.608.43 fil. Pay Term M 01 )> M D1 C. M Dl C. m ;:; M D1 s· >< ::r M D1 :::, a: M Dl !. ;:; M Dl ::0 OJ M D1 (D M D1 :::, -M D1 esqbru 3.31.19 illlluici~~~mark $ 11,786.93 A $ 4,024.74 A s 3,261.98 A $ ... ~073.64

-...l w tv \0 ~ 00 °' 0 iv co I N ~~ 0~ ,. ;i n~Q ~-~ ~~ ! g v1~ i~~@ ~i~~ 3 "' :,it;; IP fi <• is. r:,:,,. B_~!='[ ► H>g_ [~ 51 ~- H

-...J w ts ~ 00 °' 0 N OJ I <.,..) ;:~ ;0 C - Tl Allowance ( rsf adjustment} Annual Escalation Rate C- Tl Allowance {rsf adjustment} $ Original Premises Additional Rent Rate $ Annual Additional Rent $ Monthly Additional Rent $ 2.50% annual escalation rate 1,660 billing for Tl spend above $35/rsf on the incremetal rsf adjustment for ste 100 0.1585 perrsf of the Original Premises per year 263 21.93 Building Billing Graue Unit From To Gross Amount 16013 16013 100/2.50/225 05/01/17 03/31/18 $ 21.93 16013 16013 100/250/225 04/01/18 03/31/19 $ 22.47 16013 16013 100/250/225 04/01/19 03/31/20 $ 23.04 16013 16013 100/250/225 04/01/20 03/31/21 $ 23.61 16013 16013 100/250/225 04/01/21 03/31/22 $ 24.20 16013 16013 100/250/225 04/01/22 03/31/23 $ 24.81 16013 16013 100/250/2.25 04/01/23 03/31/24 $ 25.43 16013 16013 100/250/225 04/01/24 03/Sl/25 s 26.06 16013 16013 100/250/225 04/01/25 03/31/26 $ 26.71 16013 16013 100/250/225 04/01/26 03/31/27 $ 27.38 suite rsf allocated fil Pay Term M D1 M D1 M D1 M D1 M 01 M D1 M D1 M 01 M D1 M D1 esc thru 3.31.19 myuirx tick rnark 100 83 $ 21.93 $ 22.47 250 $ $ 225 $ s 83 ~ 21.93 $ 22.47 H~i--------------------------------------'-~====---------- ~ Et ~,g- c., 0 g- ;;i ~- (g@ g- 5' !ll 8 P;;i; C v.>c,- ~[~~ fiP1i a~·~; HF l:11:i-,, ~ a.;;.E.~ i[lf i.~l! g·i ~~ -;__t=' 0 > ~~~~

--..;J w N '-0 ~ 00 0\ 0 N OJ I .i::>-, ~E)--· ~ ,.1 0 "' > cl Qt:9 Q ,~ §l] a~ tiit ~~~~ H~g :l = ~ lJt ~~§~ ~n· ~ ~!lQ[ ~ §: ~ ~~ 5- t!' g ~ g-b·e. :,d 5- ;;- ~ [;a~ ni.w i; g_ :I.§, f.f!-~ :... ~ 0 ► P~r:: D -ATI Allowance 2 Annual Escalation Rate D - ATI Allow~nce $ Expansion Premises Additional Rent Rate $ Annual Additional Rent $ Monthly Additional Rent $ First Amendment Section 4 I 2.50% annual escalation rate 2,381,764 ATI AHowance for Original and 1st Expansion Premises (100,225,250} 0.1585 per rsf of the Original Premises per year 377,5,10 31,459_13 Building Billing Group Unit From IQ Gross Amount fil: Pay Term 16013 16013 100/250/225 08/01/17 03/31/18 $ 31,459.13 M D1 16013 16013 100/25p/225 04/01/18 03/31/19 $ 32,245.61 M D1 16013 16013 100/250/225 04/01/19 03/31/20 $ 33,051.75 M D1 16013 16013 100/25,0/225 04/01/20 03/31/21 $ 33,878.04 M Dl 16013 16013 100/250/225 04/01/21 03/31/22 $ 34,724.99 M D1 16013 16013 100/250/225 04/01/22 03/31/23 $ 35,593.12 M 01 16013 16013 100/250/225 04/01/23 03/31/24 $ 36,482.94 M D1 16013 16013 100/250/225 04/01/24 03/31/25 $ 37,395.02 M Dl 16013 16013 100/250/225 04/01/25 03/31/26 $ 38,329-89 M D1 16013 16013 100/250/225 04/01/26 03/31/27 s 39,288.14 M D1 suite rsf allocated esc thru 3 .31.19 inquiry tick m:irk 100 43,614 $ 19,454.92 $ 19,941.30 D 250 14,864 $ 6,630_39 $ 6,796.15 225 12,04.7 $ 5,373.81 s 5,508.16 70~ 31,459_13 $ 32,245.61

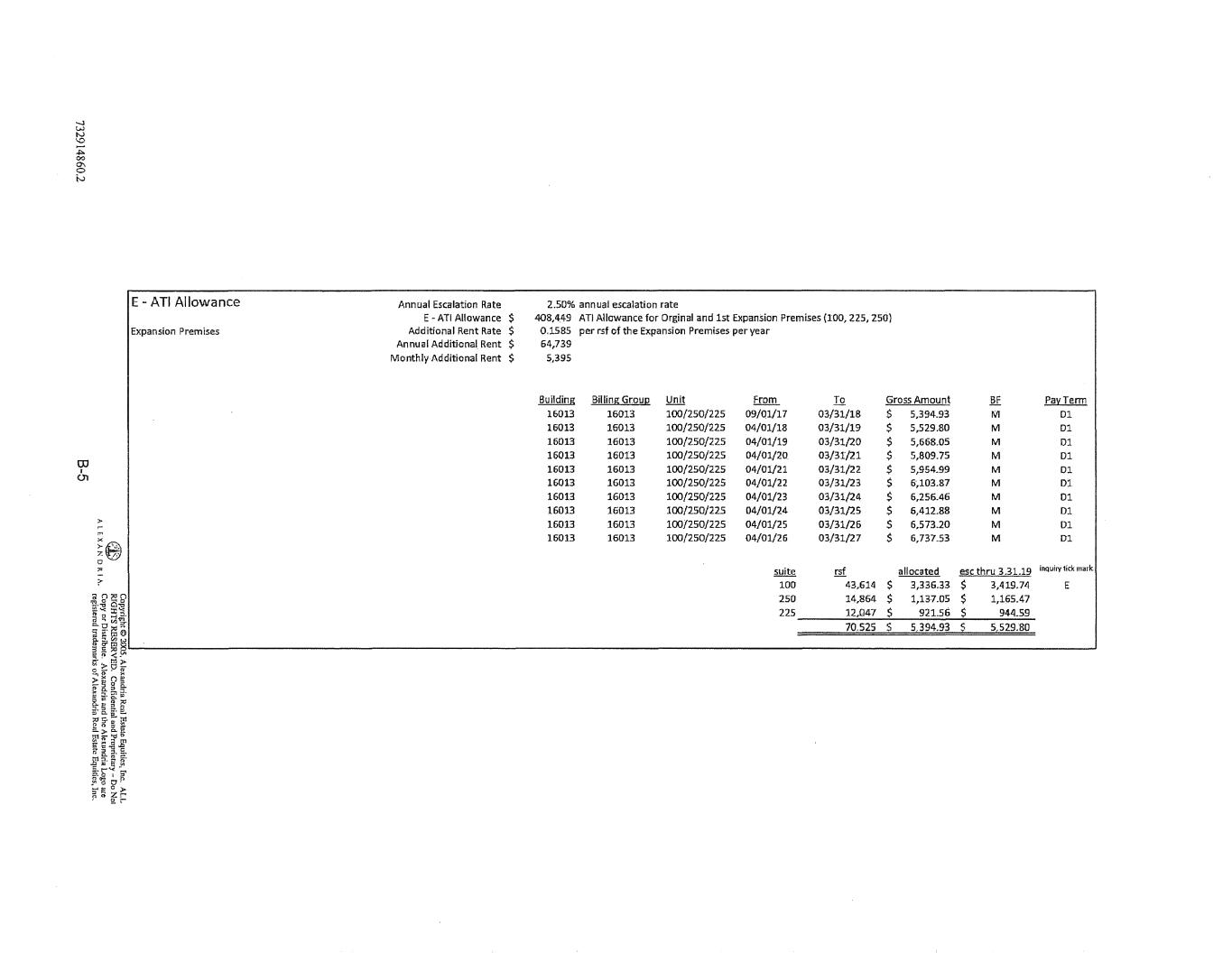

-.J w N '-0 :;;: 00 0\ 0 t,,J co I 01 ~~ 0 ,. E -ATI Allowance Expansion Premises Annual Escalation Rate E - ATI Allowance $ Additional Rent Rate $ Annual Additional Rent $ Monthly Additional Rent $ 2.50% annual escalation rate 408,449 ATI Allowance for Orginal and 1st Expansion Premises (100, 225, 250} 0.1585 per rsf of the Expansion Premises per year 64,739 5,395 Building BillingGroui;i Unit From To Gross Amouot 16013 16013 100/250/225 09/Ql/17 03/31/18 $ 5,394.93 16013 16013 100/250/225 04/01/18 03/31/19 $ 5,529.80 16013 16013 100 /250/22.5 04/01/19 03/31/20 $ 5,668.05 16013 16013 100/250/225 04/01/20 03/31/21 $ 5,809.75 16013 16013 100/250/225 04/01/21 03/31/22 $ 5,954.99 16013 16013 100/250/225 04/01/22 03/31/23 $ 6,103.87 16013 16013 100/250/225 04/01/23 03/31/24 $ 6,256.46 16013 16013 100/250/225 04/01/24 03/31/25 $ 6,412.88 16013 16013 100/250/225 04/01/25 03/31/26 $ 6,573.20 16013 16013 100/250/225 04/01/26 03/31/27 $ 6,737.53 suite rsf allocated fil: Pay Term M D1 M D1 M D1 M D1 M Dl M D1 M D1 M D1 M D1 M Dl esc thru 3.31.19 inquiJy1ick mark 100 43,614 $ 3,336.33 $ 3,419.74 E 250 14,864 $ 1,137.05 $ 1,165.47 225 12,047 $ 921.56 $ 944.59 70.525 $ 5,394.93 _S 5,529.80 ?" ~.~a.g i;"" :X:'-< i~~~ ;;iii.";@ n~8-----~:~; -------------------------------------------------~~===~~~i~~~~~~~=~~~~--~- ~GP[ HH r.: :?. ~ fil~ ~gp ::J a.;·~ Hif t11;;->os ~iH'. f~f~ )" '\3 0 f' ,;<i; 0 ► po~~

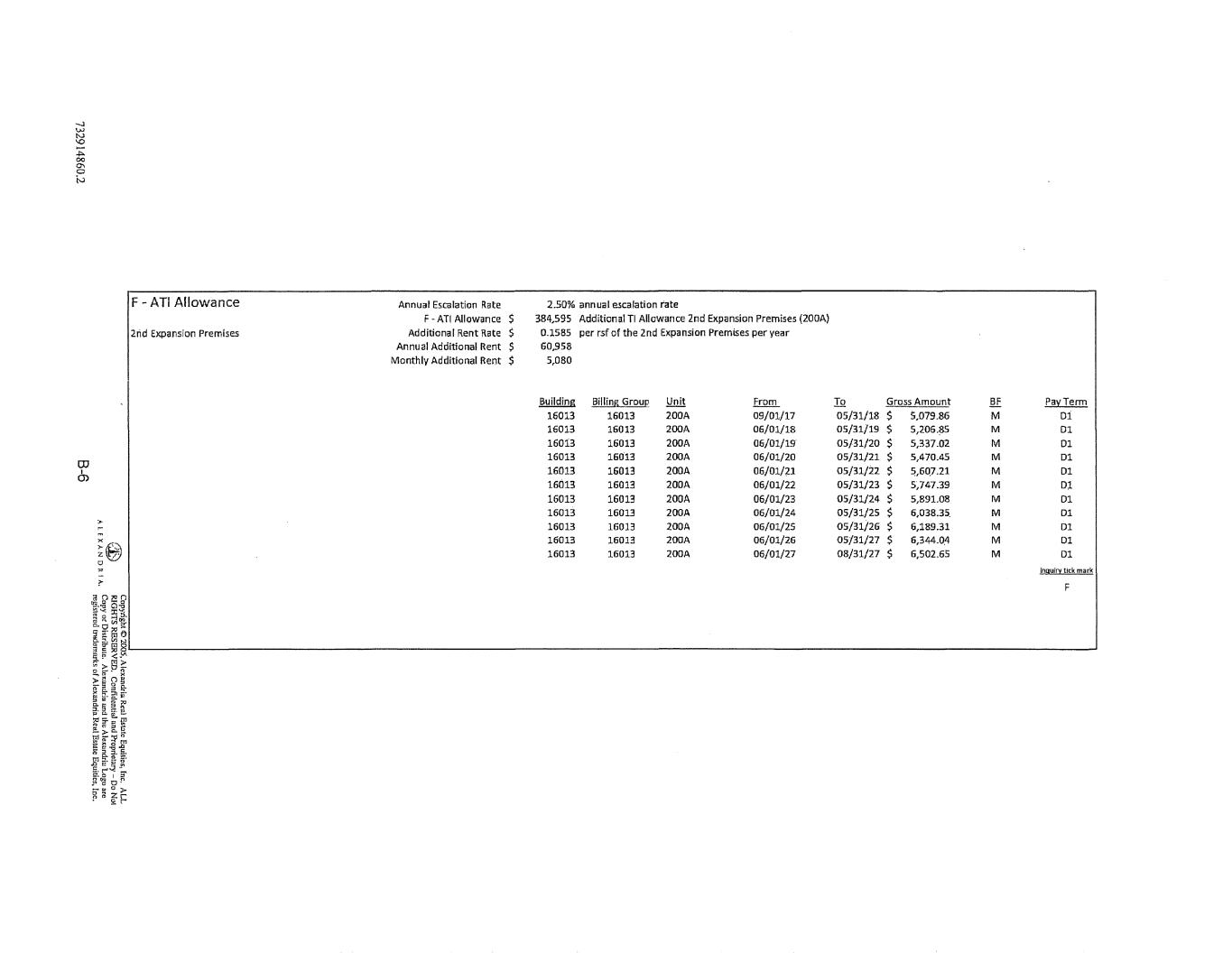

--..I w N '-0 :;;:: 00 O"I 0 tv a:, I CJ) ;:: ;~ ZI@ 0 ?- F -ATI Allowance 2.rid Expansion Premises Annual Escalation Rate F-ATI Allowance $ Additional Rent Rate $ Annual Additional Rent $ Monthly Additional Rent $ 2.50% annual escalation rate 384,595 Additional Tl Allowance 2nd Expansion Premises (200A) 0.1585 per rsf of the 2nd Expansion Premises per year 60,958 5,080 Building Billing Groui:; Unit From 16013 16013 200A 09/01/17 16013 16013 200A 06/01/18 160i3 16013 200A 06/01/19 16013 16013 200A 06/01/20 16013 16013 200A 06/01/?.1 16013 16013 200A 06/01/22 16013 16013 200A 06/01/23 16013 16013 200A 06/01/24 16013 16013 200A 06/01/25 16013 16013 200A 06/01/26 16013 16013 200A 06/01/27 IQ Gross Amount .fil: Pay Term 05/31/18 $ 5,079.86 M 01 05/31/19 $ 5,206.85 M D1 05/31/20 $ 5,337.02 M D1 05/31/21 $ 5,470.45 M D1 05/31/i2 $ 5,60,7.21 M D1 05/31/23 $ SJ47.39 M D1 05/31/24 $ 5,891.08 M D1 05/31/25 $ 6,038.35, M D1 05/31/26 $ 6,189.31 M DI 05/31/27 $ 6,344.0,4 M D1 08/31/27 $ 6,502.65 M DI ilJ!l.!!lrl.!i!:kmark F ~ti~~ l _____________________________________________________________________________ _ fg ~J c..o ~ [~·ilj@ G g' !2 8 !H~ "';,,gj::: ~f~§ :!.':§ g g. H ~ ~ g. [ i e. l<lS:-., U1 !~P i §1.f f~f~ ~°a o· -;.....e,:, a ► ~ 0 fF

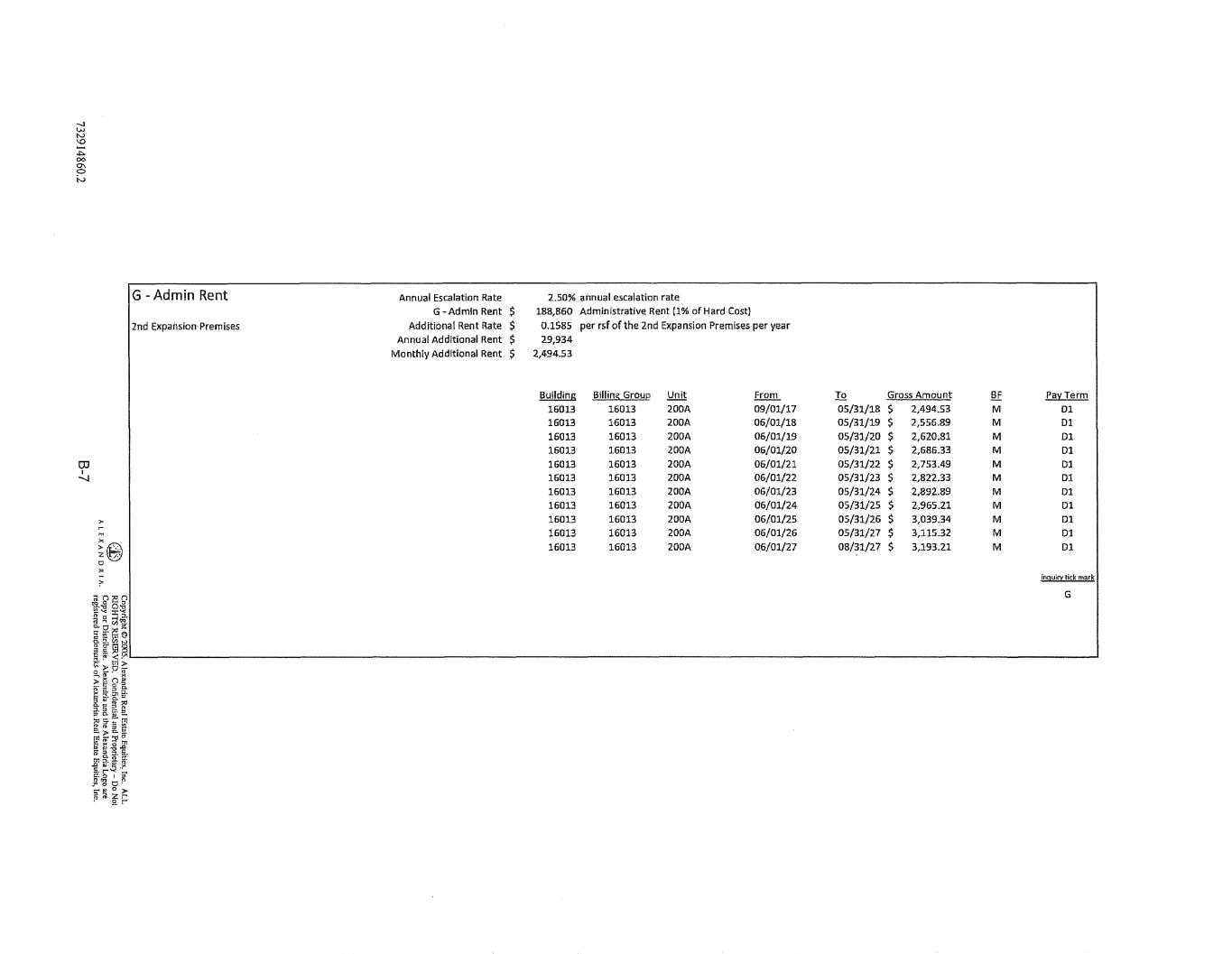

-.J w N I.O :j;'. 00 0\ 0 iv OJ I ---1 ~ ;~.-: .. z~ Cl "' > ;; Q2:!Q ~-~ g~ a g ~~ ~ ¥- ~ e} g_ 5. !ii 8 H~Y' hi:ii ..., ~ (l ~ ~l~g: [ ~- g~ ~·8. [[ ?O 5-:, ~ e.;. ~ ~ ffl-g i;::, ::1. -· ll1~]J il bi ·s-a z f'.: p E. t""" G - Admin Rent Annual Escalation Rate G-Admln Rent $ 2nd Expansion Premises Additional Rent Rate $ Annual Additional Rent $ Monthly Additional Rent $ 2.50% annual escalation rate 188,860 Administrative Rent (1% of Hard Cost) 0.1585 per rsf of the 2nd Expansion Premises per year 29,934 2,494.53 Building Billing GrOU[! Unit From 16013 16013 200A 09/01/17 16013 16013 200A 06/01/18 16013 16013 200A 06/01/19 16013 16013 200A 06/0i/20 16013 16013 200A 06/01/21 16013 16013 200A 06/01/22 16013 16013 200A 06/01/23 16013 16013 200A 06/01/24 16013 16013 200A 06/01/25 16013 16013 200A 06/01/26 16013 16013 200A 06/01/27 IQ Gross Amount fil Pay Term 05/31/18 $ 2,494.53 M 01 05/31/19 $ 2,556.89 M D1 05/31/20 $ 2,620.81 M Dl 05/31/21 $ 2,685.33 M Dl 05/31/22 $ 2,753.49 M D1 05/31/23 $ 2,822.33 M 01 05/31/24 $ 2,892.89 M 01 05/31/25 $ 2,965.21 M 01 OS/31/26 $ 3,039.34 M 01 05/31/27 $ 3:,115.32 M 01 08/31/27 $ 3,193.21 M D1 ;.,~ G

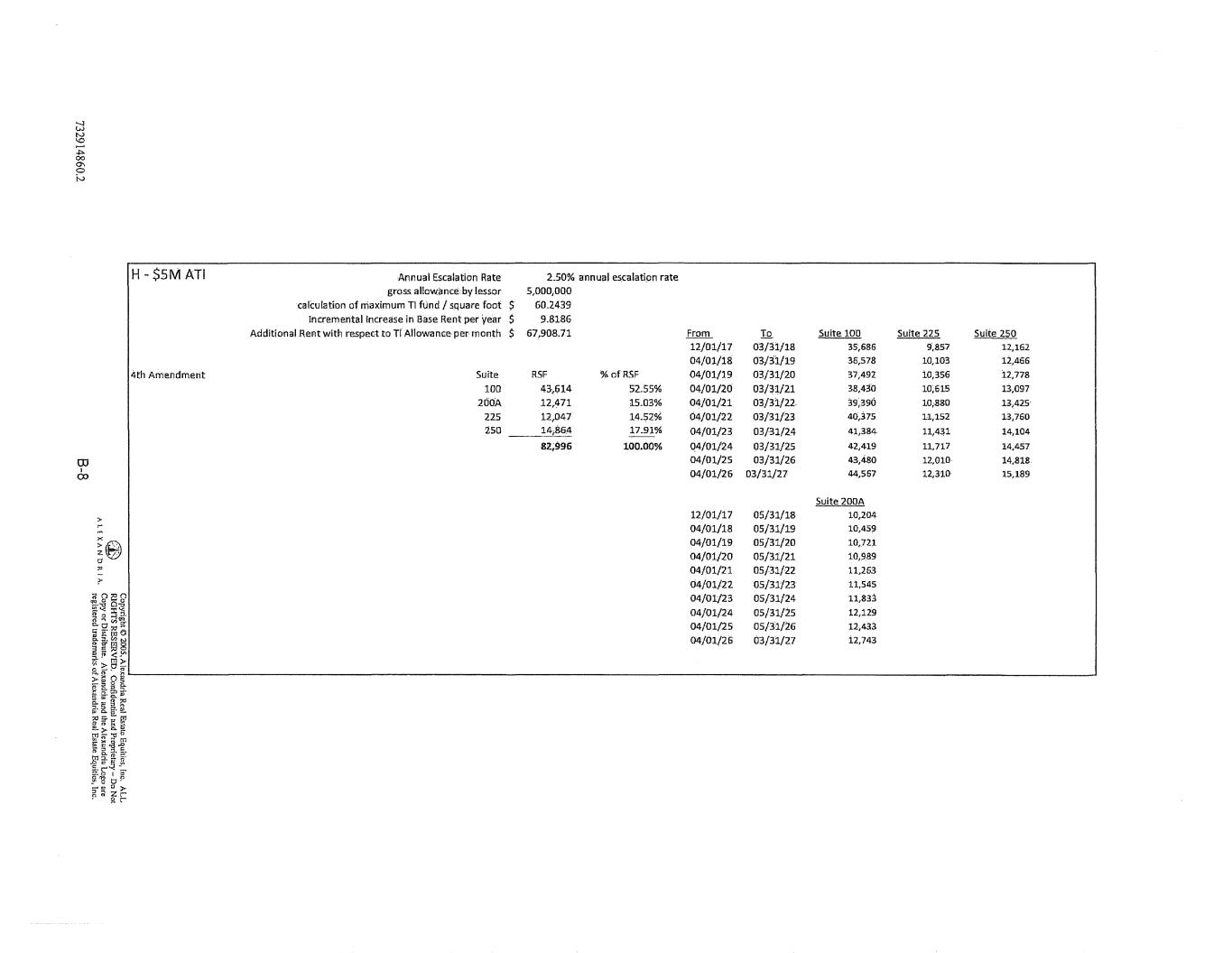

-.l w C5 '.j;'. 00 CJ\ 0 l'-1 rn I 0) X >£8\ ~w "' > .g 1?c1Q ;;;·~ g~ "_ ., n. [~(/)~ H-$5M ATI 4th Amendment ii' a·;e1 g-g, !;] 8 ~ i <:1" hB;'-----·~~ ~g_ H~~ °'s g" ~·c. [~ :tlS-.,, l);l ~~~~ J~j.f f}!{ :..-i~c ► ~ ri ~ f= Annual Escalation Rate gross allowance by lessor calculation of maximum Tl ftlnd / square foot $ Incremental Increase in Base Rent per year $ Additional Rent with respect to Tl Allowance per month $ Suite 100 200A 225 250 2.50% annual es~alation rate 5,000,000 60.2439 9.8186 67,908.71 From RSF 43,614 12,471 12,047 14;864 82;996 %ofRSF 52.55% 15.03% 14.52% 17.91% 100.00% 12/01/17 04/01/18 04/01/19 04/01/20 04/01/21 04/01/22 04/01/23 Q4/0l/24 04/01/25 04/01/26 12/01/17 04/01/18 04/01/19 04/01/20 04/01/21 04/01/22 04/01/23 04/01/24 04/01/25 04/01/26 To 03/31/18 03/3'1/19 03/31/20 03/~1/21 03/31/22- 03/31/23 03/31/24 03/31/25 03/31/26 03/31/27 05/31/18 05/31/19 05/31/20 05/31/21 05/31/22 05/31/23 05/31/24 05/31/25 05/31/26 03/31/27 Suitel00 35;686 36,578 37,492 38,430 39,390 40,375 41,384 42,419 43,480 44,567 Suite 200A 10,204 10,45~ 10,72;1. 10,989 11,253 11,545 11,833 12,129 12,433 iZ,743 Suite 225 9;as1 10,103 i0,356 10;615 10;880 11,152 11,431 11,717 12,010 12,3-10 Suite 250 12,162 12,466 12,778 13,097 13,425· 13,760 14,104 14,457 14,818 15,189