Q3 2025 Earnings Presentation October 29, 2025

This presentation (the “Presentation”) of OppFi Inc. (“OppFi” or the “Company”) is for information purposes only. Certain information contained herein has been derived from sces prepared by third parties. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. Trademarks and trade names referred to in this Presentation are the property of their respective owners. The information contained herein does not purport to be all-inclusive. This Presentation does not constitute investment, tax, or legal advice. No representation or warranty, express or implied, is or will be given by the Company or any of its respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this Presentation, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The information contained in this Presentation is preliminary in nature and is subject to change, and any such changes may be material. The Company disclaims any duty to update the information contained in this Presentation, which information is given only as of the date of this Presentation unless otherwise stated herein. Forward-Looking Statements This Presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “possible,” “continue,” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, without limitation, OppFi’s expectations with respect to its full year 2025 guidance, the future performance of OppFi’s platform, OppFi’s objectives, plans, strategies, and expectations for OppFi’s growth, new products, and future financial performance. These forward-looking statements are based on OppFi’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside OppFi’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the impact of general economic conditions, including economic slowdowns, inflation, interest rate changes, recessions, the impact of tariffs, and tightening of credit markets on OppFi’s business; the impact of challenging macroeconomic and marketplace conditions; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi’s bank partners will continue to lend in California and whether OppFi’s financing sources will continue to finance the purchase of participation rights in loans originated by OppFi’s bank partners in California; OppFi’s ability to scale and grow the Bitty business; the impact that events involving financial institutions or the financial services industry generally, such as actual concerns or events involving liquidity, defaults, or non-performance, may have on OppFi’s business; risks related to any material weakness in OppFi’s internal controls over financial reporting; the ability of OppFi to grow and manage growth profitably and retain its key employees; risks related to new products; risks related to evaluating and potentially consummating acquisitions; concentration risk; risks related to OppFi’s ability to comply with various covenants in its corporate and warehouse credit facilities; risks related to potential litigation; changes in applicable laws or regulations, including, but not limited to, impacts from the One Big Beautiful Bill Act; the possibility that OppFi may be adversely affected by other economic, business, and/or competitive factors; risks related to management transitions; and other risks and uncertainties indicated from time to time in OppFi’s filings with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned “Risk Factors.” OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures Certain financial information and data contained in this Presentation are unaudited and do not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any periodic filing, information or proxy statement, or prospectus or registration statement to be filed by OppFi with the SEC. Some of the financial information and data contained in this Presentation, such as Adjusted EBT, Adjusted Net Income and margin thereof, Adjusted EPS, and Free Cash Flow have not been prepared in accordance with United States generally acceptable accounting principles ("GAAP"). Adjusted EBT is defined as Net Income, adjusted for (1) income tax expense; (2) change in fair value of warrant liabilities; (3) other adjustments, net; and (4) other income. Adjusted Net Income is defined as Adjusted EBT as defined above, adjusted for taxes assuming a tax rate for each period presented that reflects the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. Adjusted Net Income Margin is defined as Adjusted Net Income as defined above divided by Total Revenue. Adjusted EPS is defined as Adjusted Net Income as defined above, divided by weighted average diluted shares outstanding, which represents shares of both classes of common stock outstanding and includes the impact of dilutive securities, such as restricted stock units, performance stock units, and stock options. Free Cash Flow is defined as net cash provided by operating activities minus net cash used in investing activities, other than the cash used for the acquisition of equity interests in Bitty Advance. These non-GAAP financial measures have not been prepared in accordance with accounting principles generally accepted in the United States and may be different from non-GAAP financial measures used by other companies. OppFi believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non- GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. A reconciliation of OppFi’s non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Appendix. A reconciliation of projected full year 2025 Adjusted Net Income and projected full year 2025 Adjusted EPS to the most directly comparable GAAP financial measures is not included in this Presentation because, without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. No Offer or Solicitation This Presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Website This Presentation contains reproductions and references to the Company’s website and mobile content. Website and mobile content are not incorporated into this Presentation. Any references to URLs for the websites are intended to be inactive textual references only. Disclaimer 2

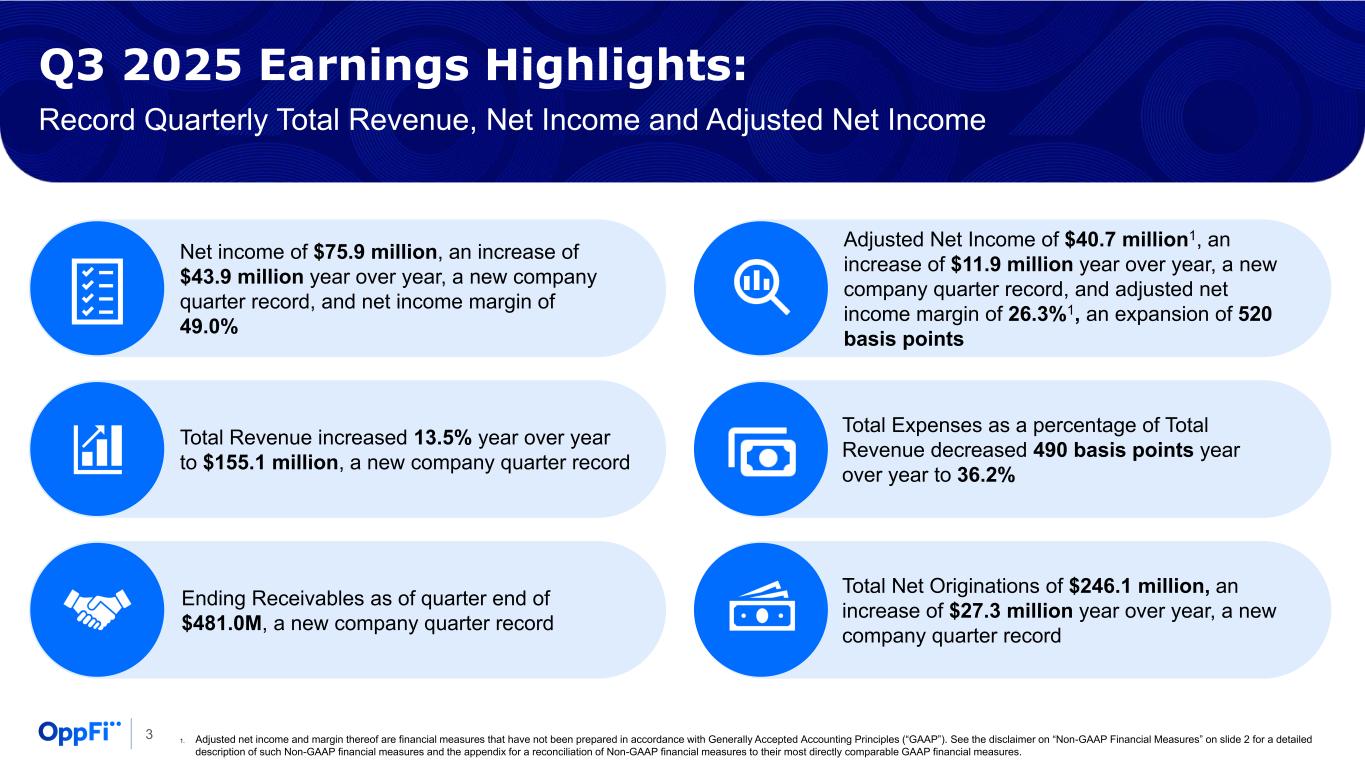

Q3 2025 Earnings Highlights: Record Quarterly Total Revenue, Net Income and Adjusted Net Income Net income of $75.9 million, an increase of $43.9 million year over year, a new company quarter record, and net income margin of 49.0% Total Revenue increased 13.5% year over year to $155.1 million, a new company quarter record Ending Receivables as of quarter end of $481.0M, a new company quarter record Adjusted Net Income of $40.7 million1, an increase of $11.9 million year over year, a new company quarter record, and adjusted net income margin of 26.3%1, an expansion of 520 basis points Total Expenses as a percentage of Total Revenue decreased 490 basis points year over year to 36.2% Total Net Originations of $246.1 million, an increase of $27.3 million year over year, a new company quarter record 1. Adjusted net income and margin thereof are financial measures that have not been prepared in accordance with Generally Accepted Accounting Principles (“GAAP”). See the disclaimer on “Non-GAAP Financial Measures” on slide 2 for a detailed description of such Non-GAAP financial measures and the appendix for a reconciliation of Non-GAAP financial measures to their most directly comparable GAAP financial measures. 3

4 A tech-enabled digital finance platform that partners with banks to offer financial products and services for everyday Americans. At-A-Glance 1. For Q3 2025 at the time of loan approval. 2. As of September 30, 2025. 3. 2015-2024. 4. Based on 19.0 million underbanked households and average household size of 2.51. Federal Deposit Insurance Corporation (FDIC), 2023 FDIC National Survey of Unbanked and Underbanked Households (November 2024); U.S. Census Bureau, “Average Number of People per Household, by Race and Hispanic Origin, Marital Status, Age, and Education of Householder: 2023”, Table AVG1, November 2023 Mission-driven Platform Significant Economic Scale Strong Fundamentals and Balance Sheet Providing best-in-class products and customer service with a 76 NPS Score1 Profitable Across Business Cycles Large Addressable Market Facilitated more than $8.2 billion in gross loan issuance covering over 4.5 million loans, since inception2 Operating efficiency drives strong free cash flow and a robust balance sheet which positions OppFi for growth 10 consecutive years of positive net income3 48 million Americans are underbanked and lack traditional credit options4

5 Outstanding Customer Satisfaction 76 Net Promoter Score (NPS) Results Selected Customer Testimonials “OppLoans has a great interest rate compared to many other pay day loan options. The loans make it so you can pay it back without being stuck in a dead end loan. Customer Service is excellent! I have used them for years as needed for lending in times of need. I recommend them 10/10!” October 2025, NPS “My experience with OppLoans has been really positive. The process was smooth, the team was helpful and professional, and everything was clearly explained from start to finish. I’d definitely recommend them to friends because they make it easy and stress-free to get the support you need.” October 2025, NPS “I’m truly grateful to OppLoans. During a difficult time, when no one else believed in me, they did. They offered me a fair loan with a clear, fast, and hassle-free process—no judgment, just support. Thanks to them, I was able to get back on track and meet my responsibilities. You can tell they genuinely care about helping people who need a second chance. I highly recommend OppLoans. Thank you for trusting me when I needed it the most!” August 2025, Trustpilot 4.80 11,961 reviews 4.4 5,283 reviews A+ Rating 1. Note: NPS is for Q3 2025 at the time of approval. Ratings reflect data as of October 14, 2025.

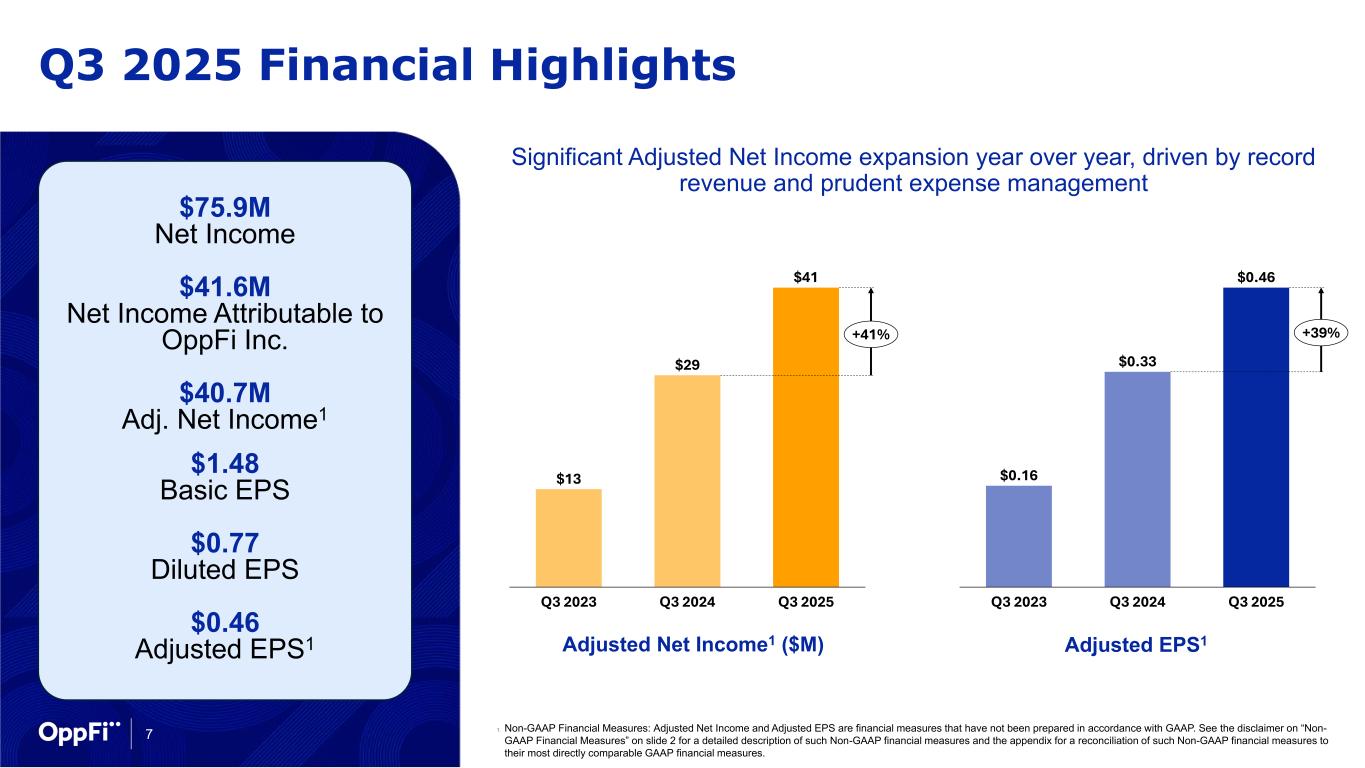

Financial Highlights

7 Q3 2025 Financial Highlights Adjusted Net Income1 ($M) Adjusted EPS1 Significant Adjusted Net Income expansion year over year, driven by record revenue and prudent expense management $75.9M Net Income $41.6M Net Income Attributable to OppFi Inc. $40.7M Adj. Net Income1 $1.48 Basic EPS $0.77 Diluted EPS $0.46 Adjusted EPS1 1. Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non- GAAP Financial Measures” on slide 2 for a detailed description of such Non-GAAP financial measures and the appendix for a reconciliation of such Non-GAAP financial measures to their most directly comparable GAAP financial measures. $13 $29 $41 Q3 2023 Q3 2024 Q3 2025 +41% $0.16 $0.33 $0.46 Q3 2023 Q3 2024 Q3 2025 +39%

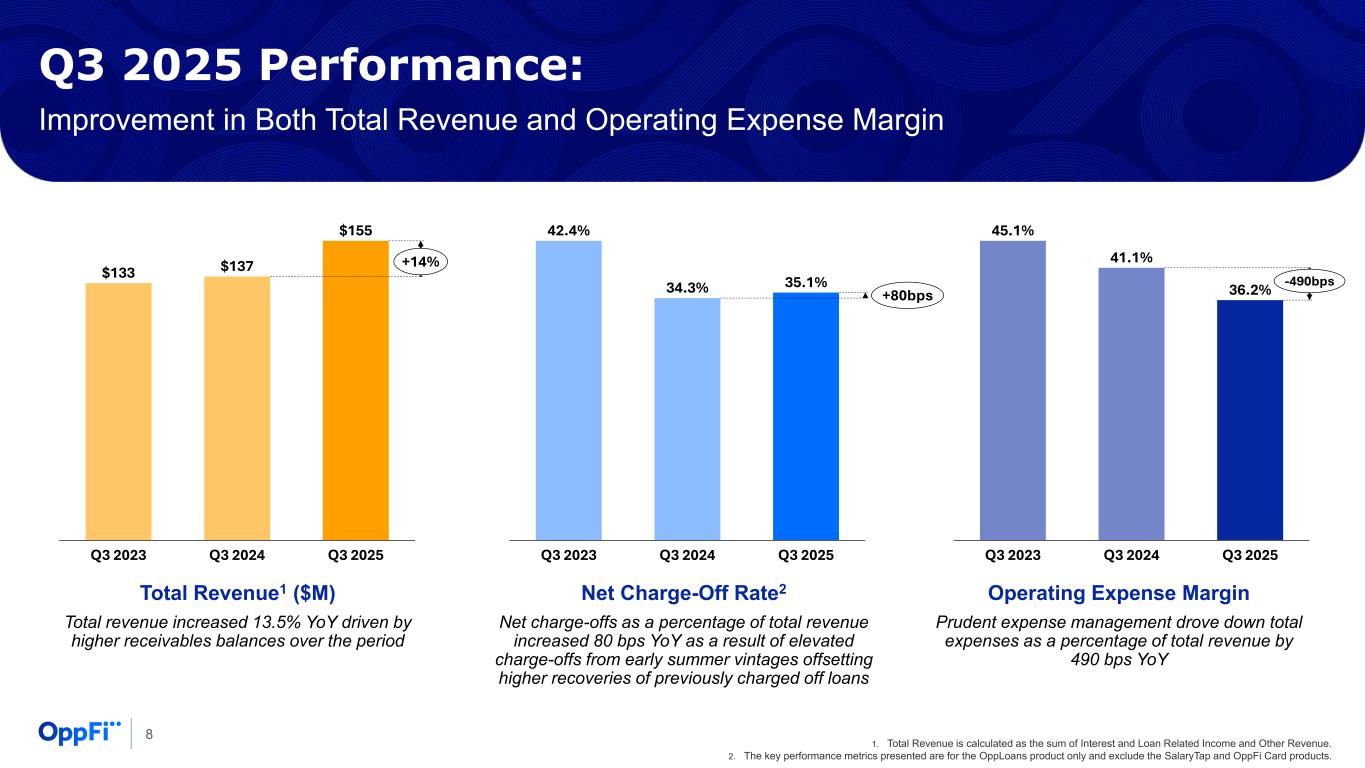

Total Revenue1 ($M) Total revenue increased 13.5% YoY driven by higher receivables balances over the period 8 Net Charge-Off Rate2 Net charge-offs as a percentage of total revenue increased 80 bps YoY as a result of elevated charge-offs from early summer vintages offsetting higher recoveries of previously charged off loans Operating Expense Margin Prudent expense management drove down total expenses as a percentage of total revenue by 490 bps YoY Q3 2025 Performance: Improvement in Both Total Revenue and Operating Expense Margin 1. Total Revenue is calculated as the sum of Interest and Loan Related Income and Other Revenue. 2. The key performance metrics presented are for the OppLoans product only and exclude the SalaryTap and OppFi Card products. $133 $137 $155 Q3 2023 Q3 2024 Q3 2025 +14% 42.4% 34.3% 35.1% Q3 2023 Q3 2024 Q3 2025 +80bps 45.1% 41.1% 36.2% Q3 2023 Q3 2024 Q3 2025 -490bps

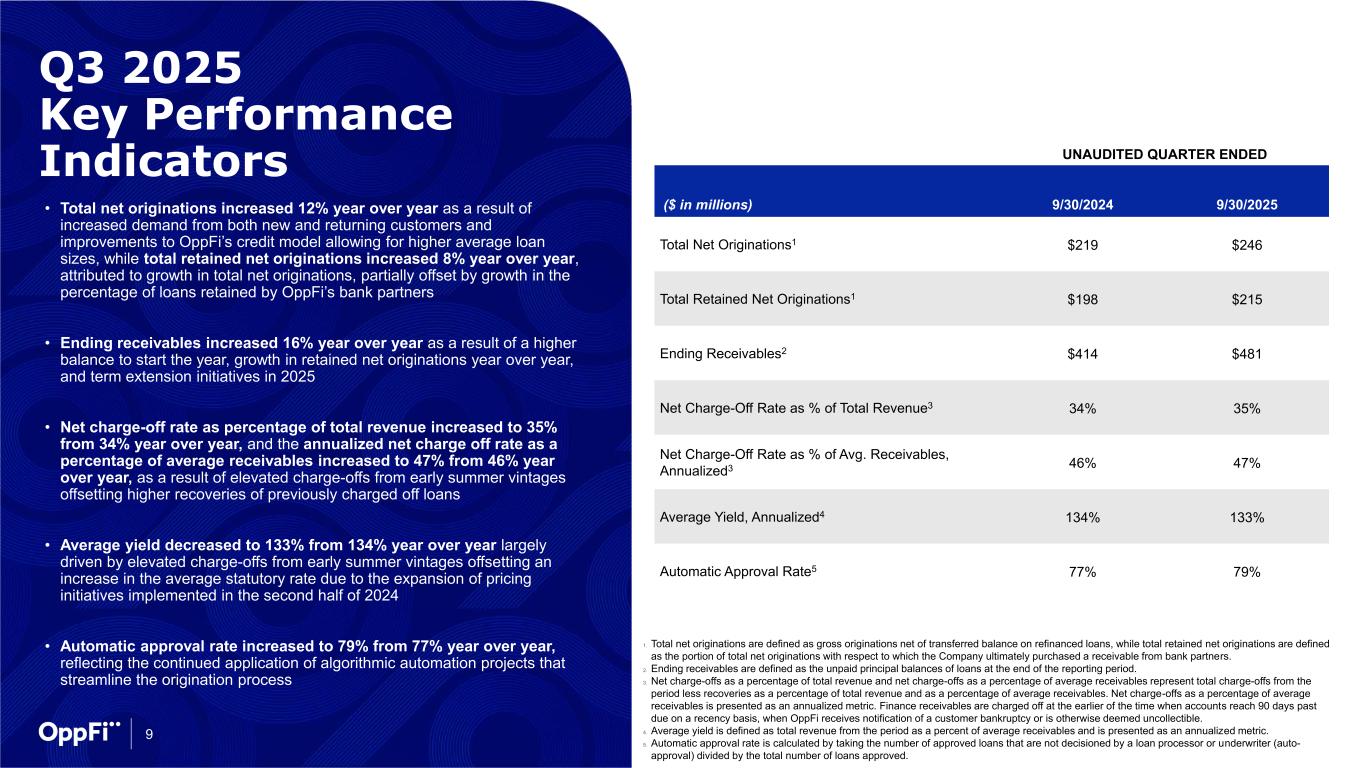

UNAUDITED QUARTER ENDED ($ in millions) 9/30/2024 9/30/2025 Total Net Originations1 $219 $246 Total Retained Net Originations1 $198 $215 Ending Receivables2 $414 $481 Net Charge-Off Rate as % of Total Revenue3 34% 35% Net Charge-Off Rate as % of Avg. Receivables, Annualized3 46% 47% Average Yield, Annualized4 134% 133% Automatic Approval Rate5 77% 79% Q3 2025 Key Performance Indicators • Total net originations increased 12% year over year as a result of increased demand from both new and returning customers and improvements to OppFi’s credit model allowing for higher average loan sizes, while total retained net originations increased 8% year over year, attributed to growth in total net originations, partially offset by growth in the percentage of loans retained by OppFi’s bank partners • Ending receivables increased 16% year over year as a result of a higher balance to start the year, growth in retained net originations year over year, and term extension initiatives in 2025 • Net charge-off rate as percentage of total revenue increased to 35% from 34% year over year, and the annualized net charge off rate as a percentage of average receivables increased to 47% from 46% year over year, as a result of elevated charge-offs from early summer vintages offsetting higher recoveries of previously charged off loans • Average yield decreased to 133% from 134% year over year largely driven by elevated charge-offs from early summer vintages offsetting an increase in the average statutory rate due to the expansion of pricing initiatives implemented in the second half of 2024 • Automatic approval rate increased to 79% from 77% year over year, reflecting the continued application of algorithmic automation projects that streamline the origination process 1. Total net originations are defined as gross originations net of transferred balance on refinanced loans, while total retained net originations are defined as the portion of total net originations with respect to which the Company ultimately purchased a receivable from bank partners. 2. Ending receivables are defined as the unpaid principal balances of loans at the end of the reporting period. 3. Net charge-offs as a percentage of total revenue and net charge-offs as a percentage of average receivables represent total charge-offs from the period less recoveries as a percentage of total revenue and as a percentage of average receivables. Net charge-offs as a percentage of average receivables is presented as an annualized metric. Finance receivables are charged off at the earlier of the time when accounts reach 90 days past due on a recency basis, when OppFi receives notification of a customer bankruptcy or is otherwise deemed uncollectible. 4. Average yield is defined as total revenue from the period as a percent of average receivables and is presented as an annualized metric. 5. Automatic approval rate is calculated by taking the number of approved loans that are not decisioned by a loan processor or underwriter (auto- approval) divided by the total number of loans approved. 9

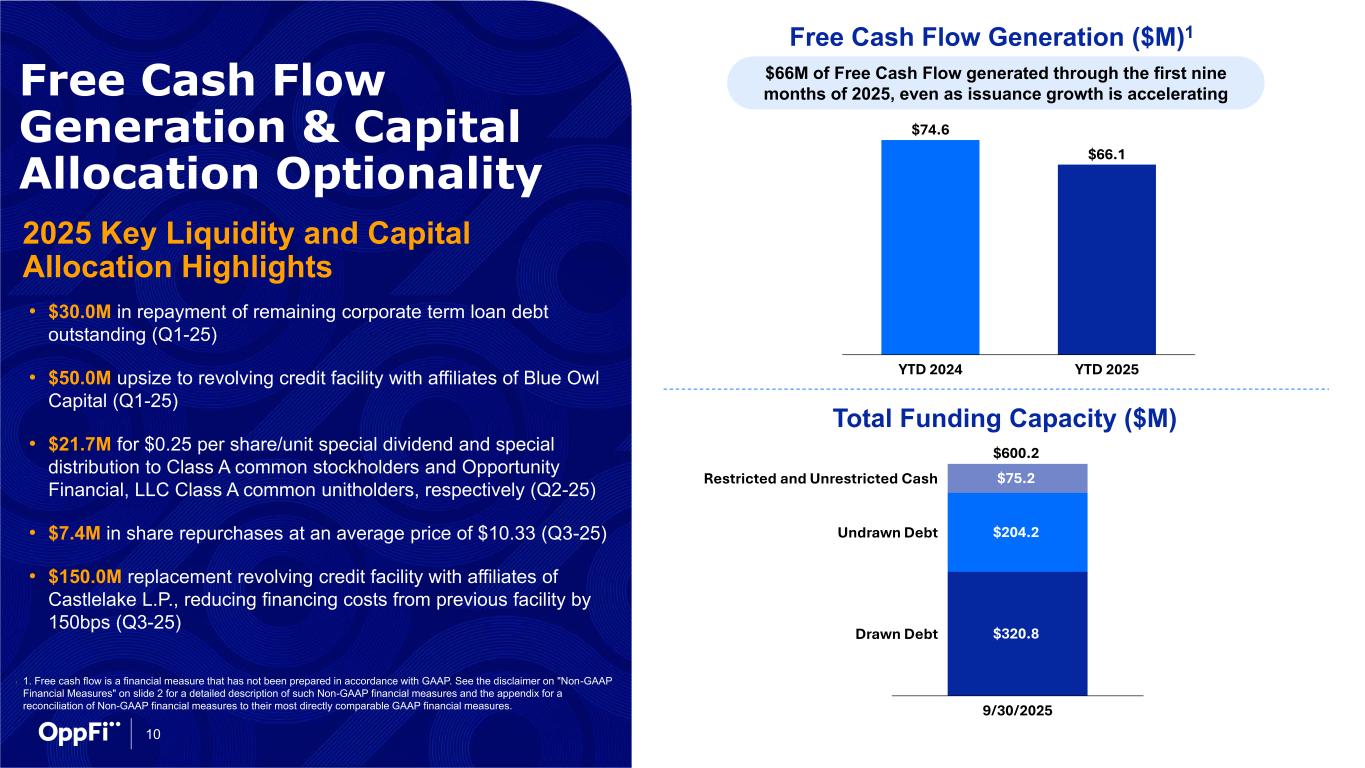

10 Free Cash Flow Generation & Capital Allocation Optionality 2025 Key Liquidity and Capital Allocation Highlights • $30.0M in repayment of remaining corporate term loan debt outstanding (Q1-25) • $50.0M upsize to revolving credit facility with affiliates of Blue Owl Capital (Q1-25) • $21.7M for $0.25 per share/unit special dividend and special distribution to Class A common stockholders and Opportunity Financial, LLC Class A common unitholders, respectively (Q2-25) • $7.4M in share repurchases at an average price of $10.33 (Q3-25) • $150.0M replacement revolving credit facility with affiliates of Castlelake L.P., reducing financing costs from previous facility by 150bps (Q3-25) 1. 1. Free cash flow is a financial measure that has not been prepared in accordance with GAAP. See the disclaimer on "Non-GAAP Financial Measures" on slide 2 for a detailed description of such Non-GAAP financial measures and the appendix for a reconciliation of Non-GAAP financial measures to their most directly comparable GAAP financial measures. Free Cash Flow Generation ($M)1 $66M of Free Cash Flow generated through the first nine months of 2025, even as issuance growth is accelerating Total Funding Capacity ($M) $320.8 $204.2 $75.2 9/30/2025 Restricted and Unrestricted Cash Undrawn Debt Drawn Debt $600.2 $74.6 $66.1 YTD 2024 YTD 2025

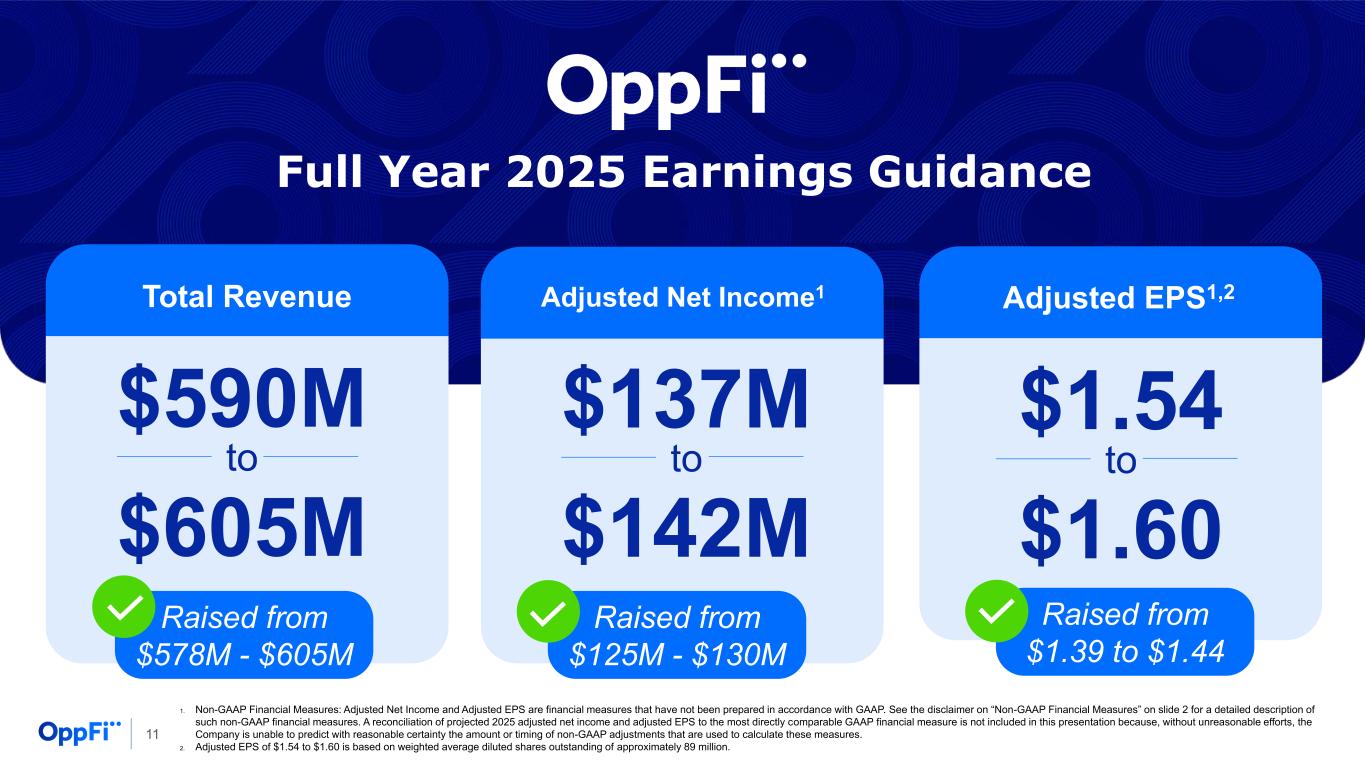

11 Full Year 2025 Earnings Guidance $590M $605M to Total Revenue Adjusted Net Income1 Adjusted EPS1,2 $137M $142M to $1.54 $1.60 to Raised from $578M - $605M Raised from $125M - $130M Raised from $1.39 to $1.44 1. Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non-GAAP Financial Measures” on slide 2 for a detailed description of such non-GAAP financial measures. A reconciliation of projected 2025 adjusted net income and adjusted EPS to the most directly comparable GAAP financial measure is not included in this presentation because, without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. 2. Adjusted EPS of $1.54 to $1.60 is based on weighted average diluted shares outstanding of approximately 89 million.

Appendix

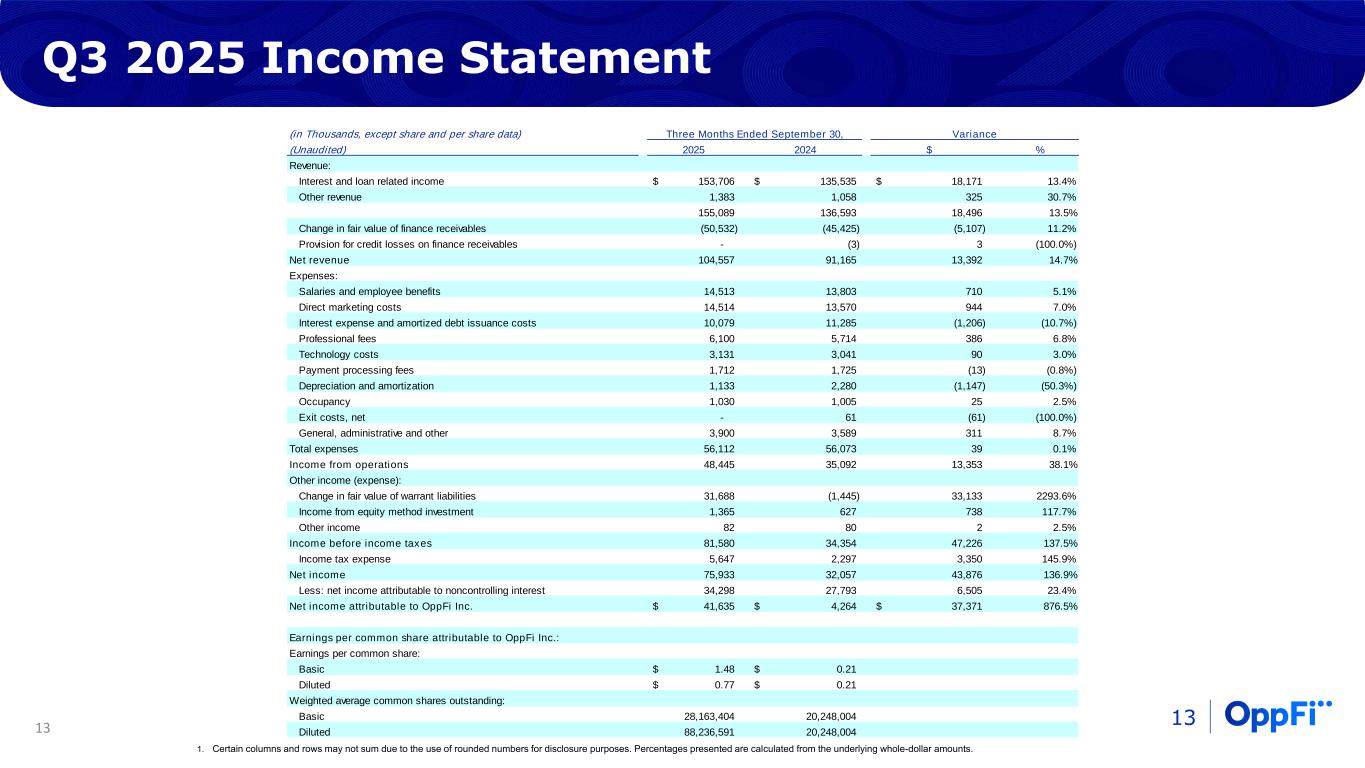

13 (in Thousands, except share and per share data) (Unaudited) 2025 2024 $ % Revenue: Interest and loan related income 153,706$ 135,535$ 18,171$ 13.4% Other revenue 1,383 1,058 325 30.7% 155,089 136,593 18,496 13.5% Change in fair value of finance receivables (50,532) (45,425) (5,107) 11.2% Provision for credit losses on finance receivables - (3) 3 (100.0%) Net revenue 104,557 91,165 13,392 14.7% Expenses: Salaries and employee benefits 14,513 13,803 710 5.1% Direct marketing costs 14,514 13,570 944 7.0% Interest expense and amortized debt issuance costs 10,079 11,285 (1,206) (10.7%) Professional fees 6,100 5,714 386 6.8% Technology costs 3,131 3,041 90 3.0% Payment processing fees 1,712 1,725 (13) (0.8%) Depreciation and amortization 1,133 2,280 (1,147) (50.3%) Occupancy 1,030 1,005 25 2.5% Exit costs, net - 61 (61) (100.0%) General, administrative and other 3,900 3,589 311 8.7% Total expenses 56,112 56,073 39 0.1% Income from operations 48,445 35,092 13,353 38.1% Other income (expense): Change in fair value of warrant liabilities 31,688 (1,445) 33,133 2293.6% Income from equity method investment 1,365 627 738 117.7% Other income 82 80 2 2.5% Income before income taxes 81,580 34,354 47,226 137.5% Income tax expense 5,647 2,297 3,350 145.9% Net income 75,933 32,057 43,876 136.9% Less: net income attributable to noncontrolling interest 34,298 27,793 6,505 23.4% Net income attributable to OppFi Inc. 41,635$ 4,264$ 37,371$ 876.5% Earnings per common share attributable to OppFi Inc.: Earnings per common share: Basic 1.48$ 0.21$ Diluted 0.77$ 0.21$ Weighted average common shares outstanding: Basic 28,163,404 20,248,004 Diluted 88,236,591 20,248,004 Three Months Ended September 30, Variance Q3 2025 Income Statement 13 1. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts.

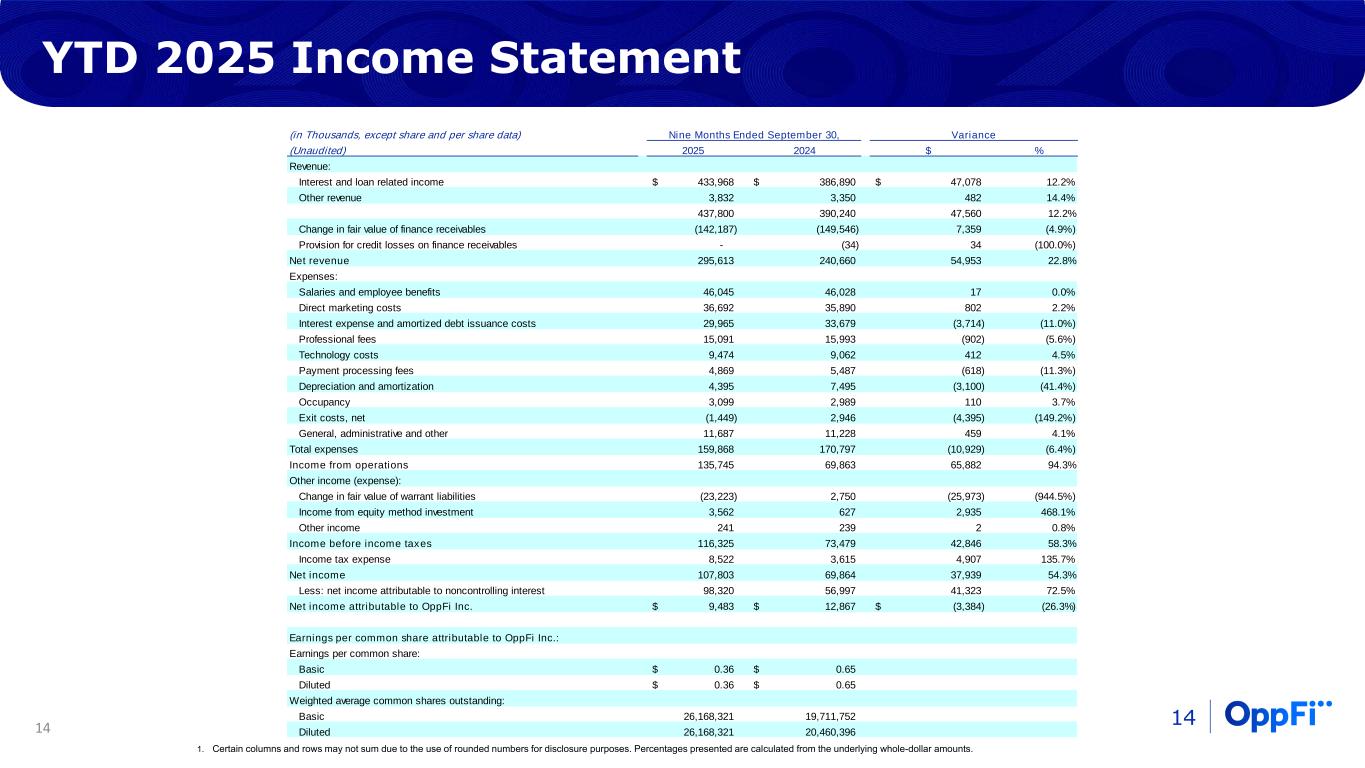

14 (in Thousands, except share and per share data) (Unaudited) 2025 2024 $ % Revenue: Interest and loan related income 433,968$ 386,890$ 47,078$ 12.2% Other revenue 3,832 3,350 482 14.4% 437,800 390,240 47,560 12.2% Change in fair value of finance receivables (142,187) (149,546) 7,359 (4.9%) Provision for credit losses on finance receivables - (34) 34 (100.0%) Net revenue 295,613 240,660 54,953 22.8% Expenses: Salaries and employee benefits 46,045 46,028 17 0.0% Direct marketing costs 36,692 35,890 802 2.2% Interest expense and amortized debt issuance costs 29,965 33,679 (3,714) (11.0%) Professional fees 15,091 15,993 (902) (5.6%) Technology costs 9,474 9,062 412 4.5% Payment processing fees 4,869 5,487 (618) (11.3%) Depreciation and amortization 4,395 7,495 (3,100) (41.4%) Occupancy 3,099 2,989 110 3.7% Exit costs, net (1,449) 2,946 (4,395) (149.2%) General, administrative and other 11,687 11,228 459 4.1% Total expenses 159,868 170,797 (10,929) (6.4%) Income from operations 135,745 69,863 65,882 94.3% Other income (expense): Change in fair value of warrant liabilities (23,223) 2,750 (25,973) (944.5%) Income from equity method investment 3,562 627 2,935 468.1% Other income 241 239 2 0.8% Income before income taxes 116,325 73,479 42,846 58.3% Income tax expense 8,522 3,615 4,907 135.7% Net income 107,803 69,864 37,939 54.3% Less: net income attributable to noncontrolling interest 98,320 56,997 41,323 72.5% Net income attributable to OppFi Inc. 9,483$ 12,867$ (3,384)$ (26.3%) Earnings per common share attributable to OppFi Inc.: Earnings per common share: Basic 0.36$ 0.65$ Diluted 0.36$ 0.65$ Weighted average common shares outstanding: Basic 26,168,321 19,711,752 Diluted 26,168,321 20,460,396 Nine Months Ended September 30, Variance YTD 2025 Income Statement 14 1. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts.

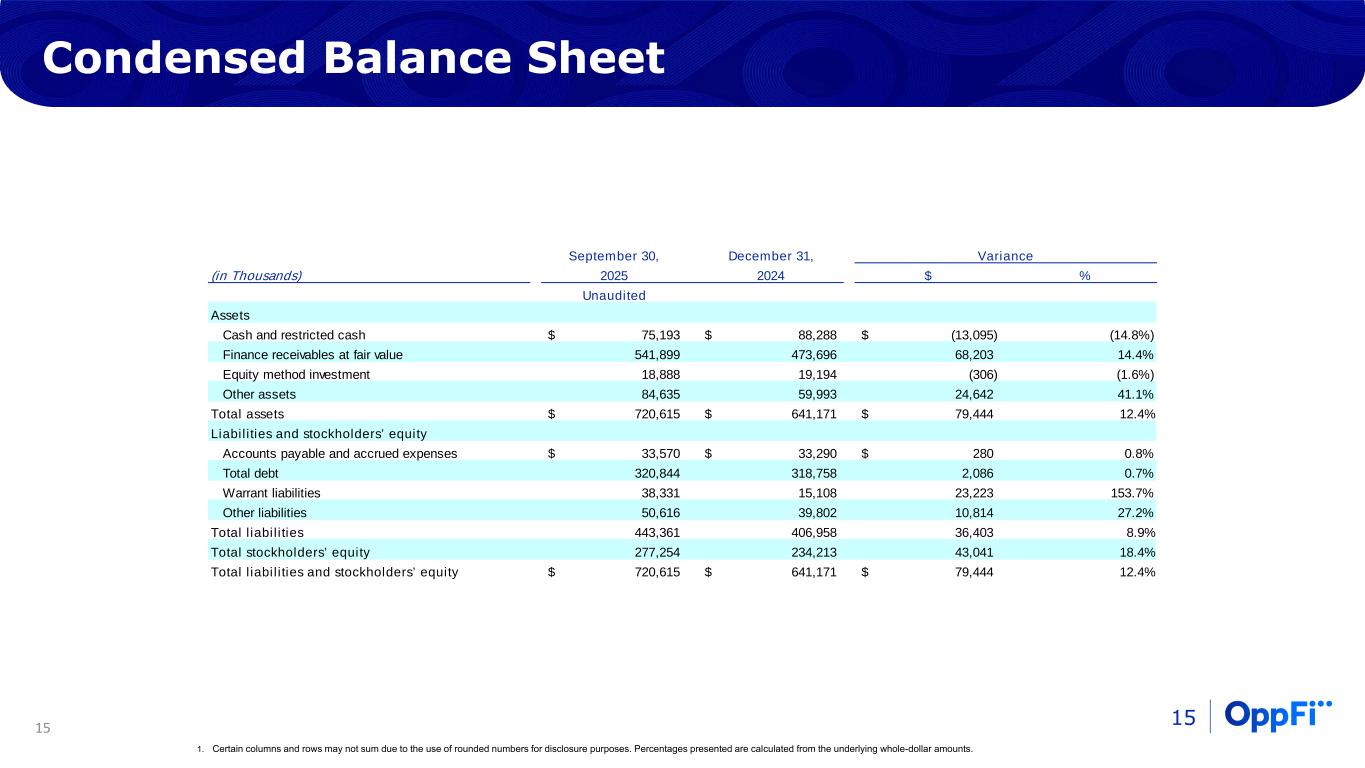

15 Condensed Balance Sheet 15 1. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts. September 30, December 31, (in Thousands) 2025 2024 $ % Unaudited Assets Cash and restricted cash 75,193$ 88,288$ (13,095)$ (14.8%) Finance receivables at fair value 541,899 473,696 68,203 14.4% Equity method investment 18,888 19,194 (306) (1.6%) Other assets 84,635 59,993 24,642 41.1% Total assets 720,615$ 641,171$ 79,444$ 12.4% Liabilities and stockholders’ equity Accounts payable and accrued expenses 33,570$ 33,290$ 280$ 0.8% Total debt 320,844 318,758 2,086 0.7% Warrant liabilities 38,331 15,108 23,223 153.7% Other liabilities 50,616 39,802 10,814 27.2% Total liabilities 443,361 406,958 36,403 8.9% Total stockholders’ equity 277,254 234,213 43,041 18.4% Total liabilities and stockholders’ equity 720,615$ 641,171$ 79,444$ 12.4% Variance

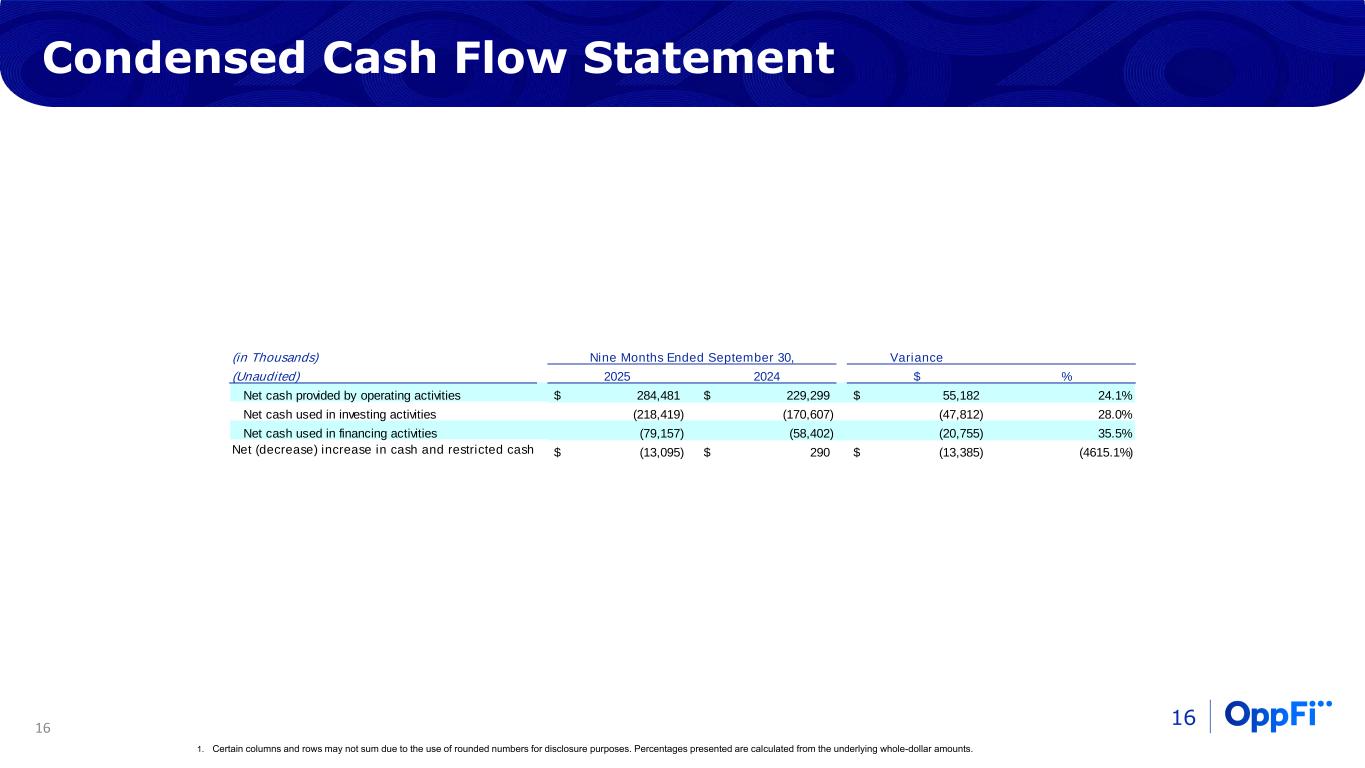

16 Condensed Cash Flow Statement 16 1. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts. (in Thousands) Variance (Unaudited) 2025 2024 $ % Net cash provided by operating activities 284,481$ 229,299$ 55,182$ 24.1% Net cash used in investing activities (218,419) (170,607) (47,812) 28.0% Net cash used in financing activities (79,157) (58,402) (20,755) 35.5% Net (decrease) increase in cash and restricted cash (13,095)$ 290$ (13,385)$ (4615.1%) Nine Months Ended September 30,

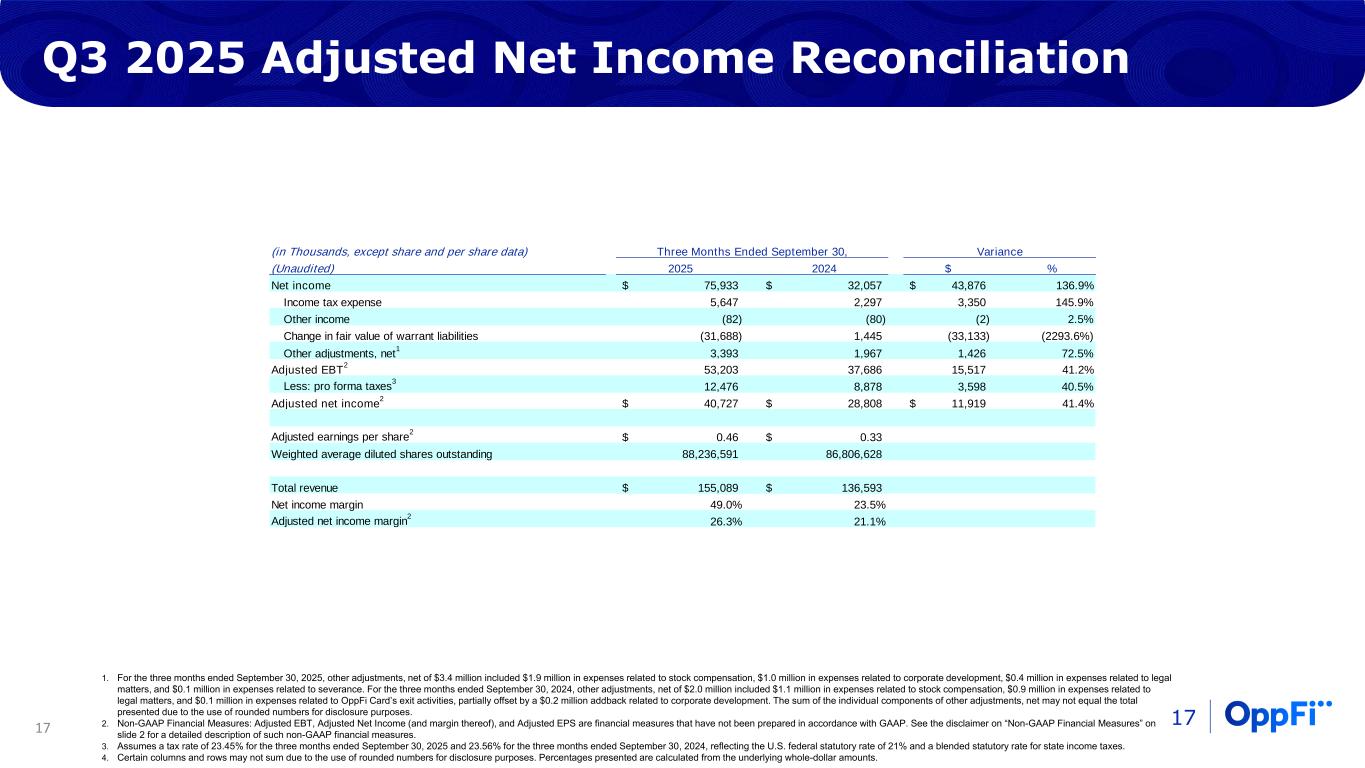

17 Q3 2025 Adjusted Net Income Reconciliation 17 1. For the three months ended September 30, 2025, other adjustments, net of $3.4 million included $1.9 million in expenses related to stock compensation, $1.0 million in expenses related to corporate development, $0.4 million in expenses related to legal matters, and $0.1 million in expenses related to severance. For the three months ended September 30, 2024, other adjustments, net of $2.0 million included $1.1 million in expenses related to stock compensation, $0.9 million in expenses related to legal matters, and $0.1 million in expenses related to OppFi Card’s exit activities, partially offset by a $0.2 million addback related to corporate development. The sum of the individual components of other adjustments, net may not equal the total presented due to the use of rounded numbers for disclosure purposes. 2. Non-GAAP Financial Measures: Adjusted EBT, Adjusted Net Income (and margin thereof), and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non-GAAP Financial Measures” on slide 2 for a detailed description of such non-GAAP financial measures. 3. Assumes a tax rate of 23.45% for the three months ended September 30, 2025 and 23.56% for the three months ended September 30, 2024, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. 4. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts. (in Thousands, except share and per share data) (Unaudited) 2025 2024 $ % Net income 75,933$ 32,057$ 43,876$ 136.9% Income tax expense 5,647 2,297 3,350 145.9% Other income (82) (80) (2) 2.5% Change in fair value of warrant liabilities (31,688) 1,445 (33,133) (2293.6%) Other adjustments, net1 3,393 1,967 1,426 72.5% Adjusted EBT2 53,203 37,686 15,517 41.2% Less: pro forma taxes3 12,476 8,878 3,598 40.5% Adjusted net income2 40,727$ 28,808$ 11,919$ 41.4% Adjusted earnings per share2 0.46$ 0.33$ Weighted average diluted shares outstanding 88,236,591 86,806,628 Total revenue 155,089$ 136,593$ Net income margin 49.0% 23.5% Adjusted net income margin2 26.3% 21.1% Three Months Ended September 30, Variance

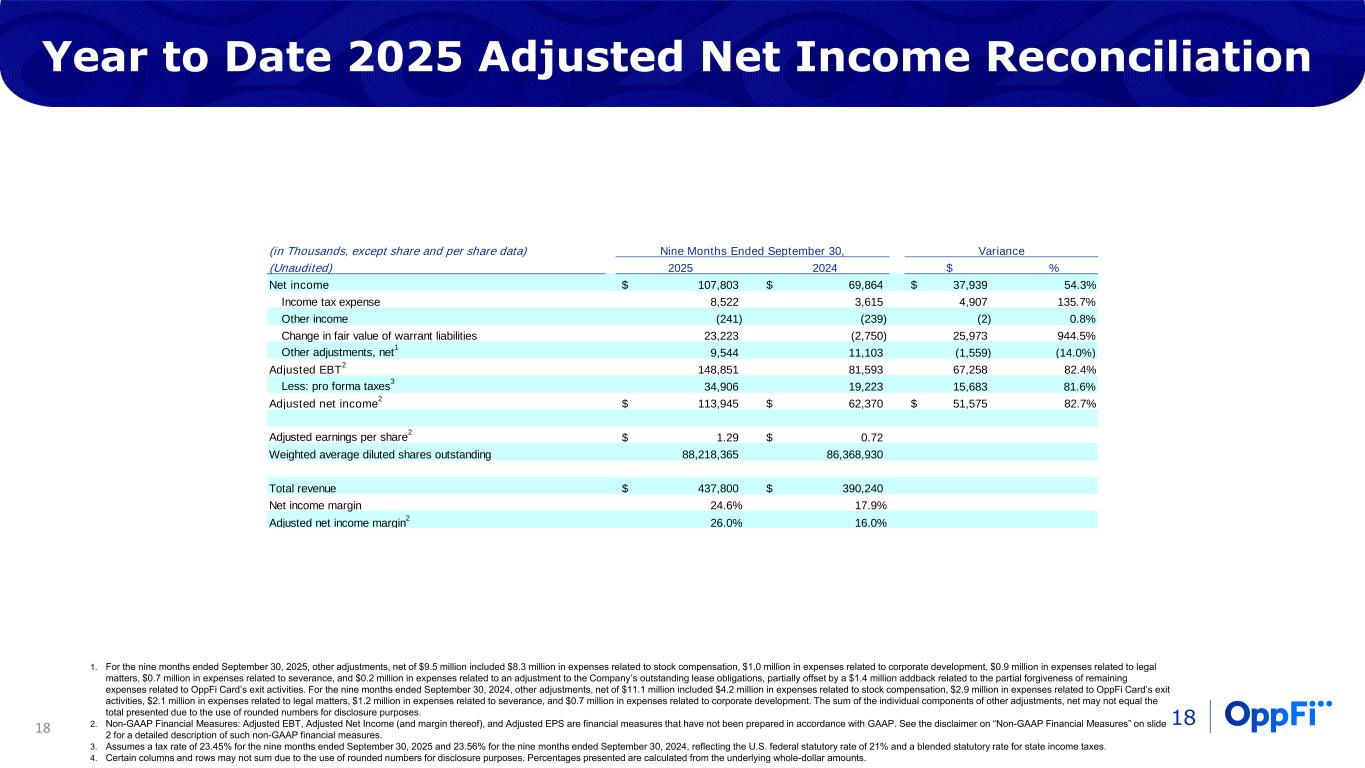

18 Year to Date 2025 Adjusted Net Income Reconciliation 18 1. For the nine months ended September 30, 2025, other adjustments, net of $9.5 million included $8.3 million in expenses related to stock compensation, $1.0 million in expenses related to corporate development, $0.9 million in expenses related to legal matters, $0.7 million in expenses related to severance, and $0.2 million in expenses related to an adjustment to the Company’s outstanding lease obligations, partially offset by a $1.4 million addback related to the partial forgiveness of remaining expenses related to OppFi Card’s exit activities. For the nine months ended September 30, 2024, other adjustments, net of $11.1 million included $4.2 million in expenses related to stock compensation, $2.9 million in expenses related to OppFi Card’s exit activities, $2.1 million in expenses related to legal matters, $1.2 million in expenses related to severance, and $0.7 million in expenses related to corporate development. The sum of the individual components of other adjustments, net may not equal the total presented due to the use of rounded numbers for disclosure purposes. 2. Non-GAAP Financial Measures: Adjusted EBT, Adjusted Net Income (and margin thereof), and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non-GAAP Financial Measures” on slide 2 for a detailed description of such non-GAAP financial measures. 3. Assumes a tax rate of 23.45% for the nine months ended September 30, 2025 and 23.56% for the nine months ended September 30, 2024, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. 4. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts. (in Thousands, except share and per share data) (Unaudited) 2025 2024 $ % Net income 107,803$ 69,864$ 37,939$ 54.3% Income tax expense 8,522 3,615 4,907 135.7% Other income (241) (239) (2) 0.8% Change in fair value of warrant liabilities 23,223 (2,750) 25,973 944.5% Other adjustments, net1 9,544 11,103 (1,559) (14.0%) Adjusted EBT2 148,851 81,593 67,258 82.4% Less: pro forma taxes3 34,906 19,223 15,683 81.6% Adjusted net income2 113,945$ 62,370$ 51,575$ 82.7% Adjusted earnings per share2 1.29$ 0.72$ Weighted average diluted shares outstanding 88,218,365 86,368,930 Total revenue 437,800$ 390,240$ Net income margin 24.6% 17.9% Adjusted net income margin2 26.0% 16.0% Nine Months Ended September 30, Variance

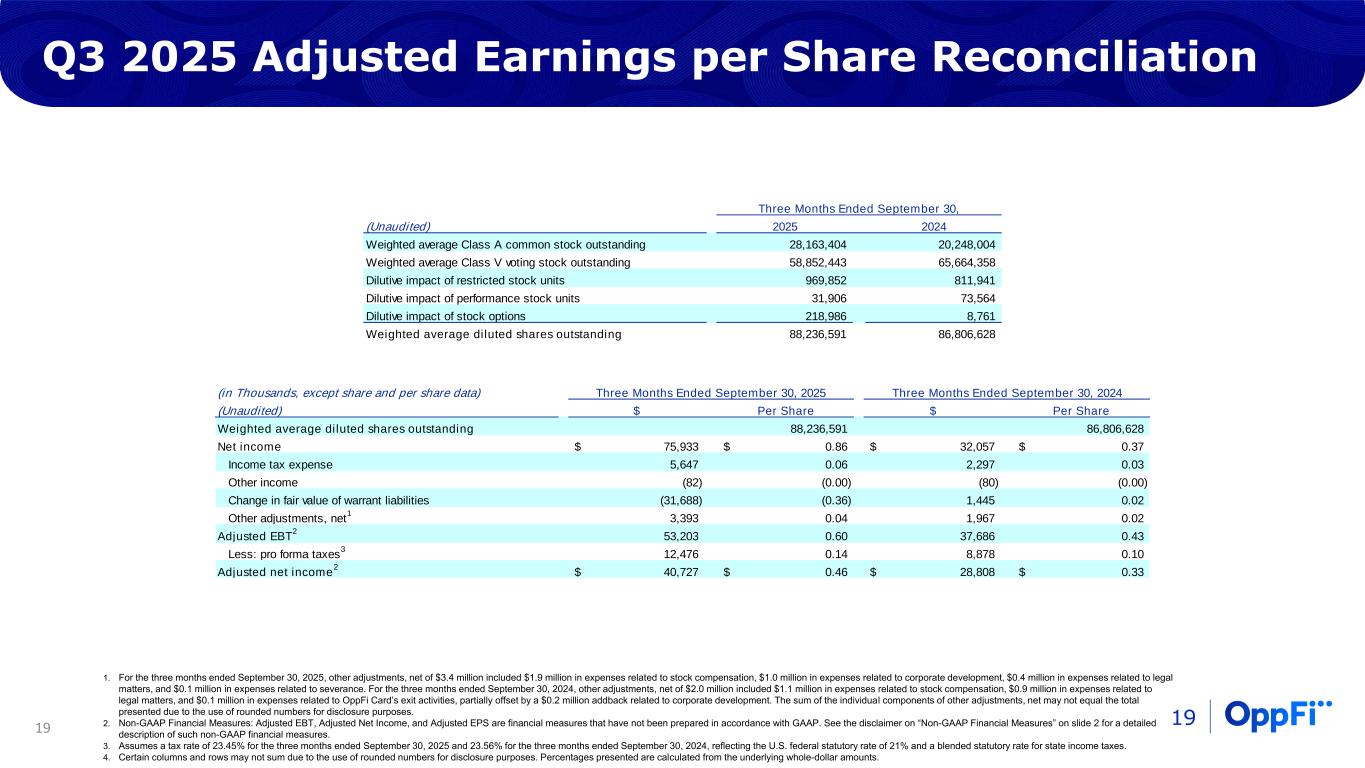

19 Q3 2025 Adjusted Earnings per Share Reconciliation 19 (in Thousands, except share and per share data) (Unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 88,236,591 86,806,628 Net income 75,933$ 0.86$ 32,057$ 0.37$ Income tax expense 5,647 0.06 2,297 0.03 Other income (82) (0.00) (80) (0.00) Change in fair value of warrant liabilities (31,688) (0.36) 1,445 0.02 Other adjustments, net1 3,393 0.04 1,967 0.02 Adjusted EBT2 53,203 0.60 37,686 0.43 Less: pro forma taxes3 12,476 0.14 8,878 0.10 Adjusted net income2 40,727$ 0.46$ 28,808$ 0.33$ Three Months Ended September 30, 2025 Three Months Ended September 30, 2024 (Unaudited) 2025 2024 Weighted average Class A common stock outstanding 28,163,404 20,248,004 Weighted average Class V voting stock outstanding 58,852,443 65,664,358 Dilutive impact of restricted stock units 969,852 811,941 Dilutive impact of performance stock units 31,906 73,564 Dilutive impact of stock options 218,986 8,761 Weighted average diluted shares outstanding 88,236,591 86,806,628 Three Months Ended September 30, 1. For the three months ended September 30, 2025, other adjustments, net of $3.4 million included $1.9 million in expenses related to stock compensation, $1.0 million in expenses related to corporate development, $0.4 million in expenses related to legal matters, and $0.1 million in expenses related to severance. For the three months ended September 30, 2024, other adjustments, net of $2.0 million included $1.1 million in expenses related to stock compensation, $0.9 million in expenses related to legal matters, and $0.1 million in expenses related to OppFi Card’s exit activities, partially offset by a $0.2 million addback related to corporate development. The sum of the individual components of other adjustments, net may not equal the total presented due to the use of rounded numbers for disclosure purposes. 2. Non-GAAP Financial Measures: Adjusted EBT, Adjusted Net Income, and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non-GAAP Financial Measures” on slide 2 for a detailed description of such non-GAAP financial measures. 3. Assumes a tax rate of 23.45% for the three months ended September 30, 2025 and 23.56% for the three months ended September 30, 2024, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. 4. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts.

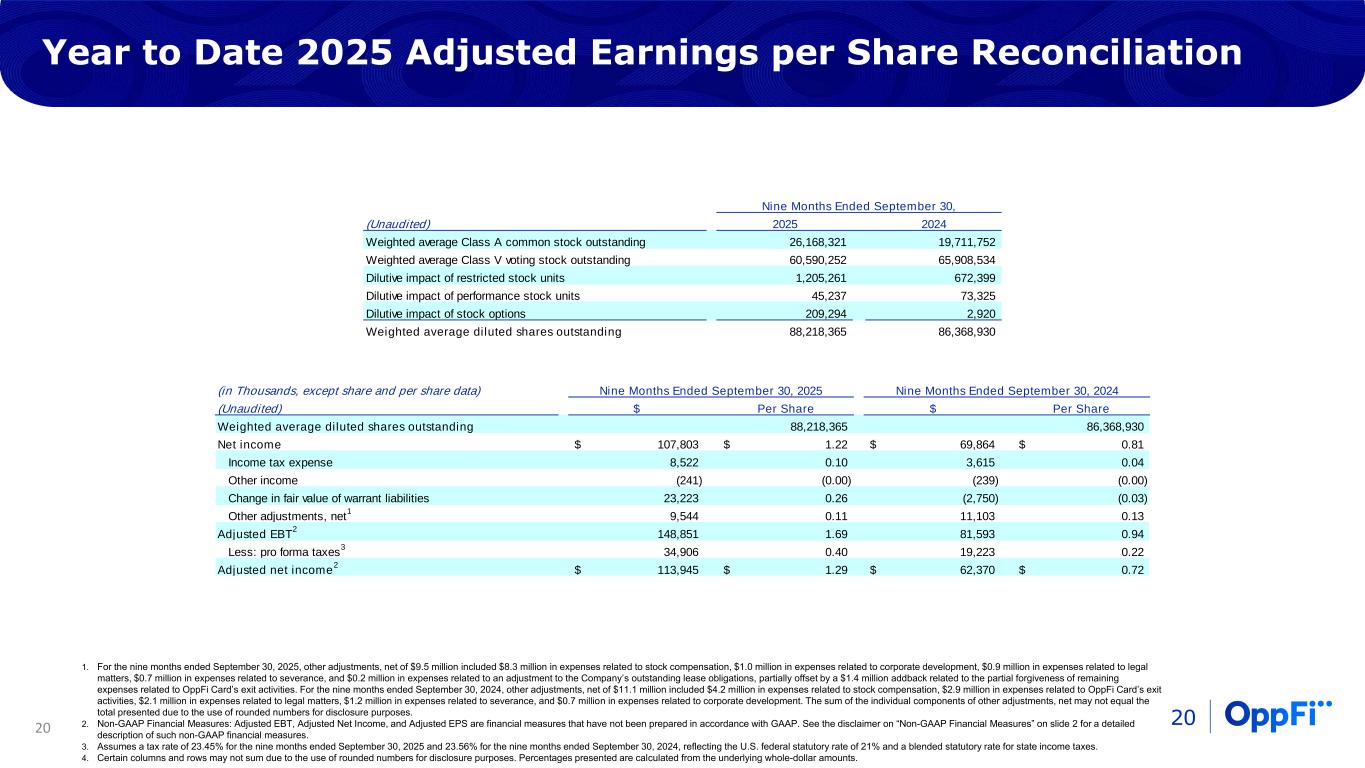

20 Year to Date 2025 Adjusted Earnings per Share Reconciliation 20 (Unaudited) 2025 2024 Weighted average Class A common stock outstanding 26,168,321 19,711,752 Weighted average Class V voting stock outstanding 60,590,252 65,908,534 Dilutive impact of restricted stock units 1,205,261 672,399 Dilutive impact of performance stock units 45,237 73,325 Dilutive impact of stock options 209,294 2,920 Weighted average diluted shares outstanding 88,218,365 86,368,930 Nine Months Ended September 30, (in Thousands, except share and per share data) (Unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 88,218,365 86,368,930 Net income 107,803$ 1.22$ 69,864$ 0.81$ Income tax expense 8,522 0.10 3,615 0.04 Other income (241) (0.00) (239) (0.00) Change in fair value of warrant liabilities 23,223 0.26 (2,750) (0.03) Other adjustments, net1 9,544 0.11 11,103 0.13 Adjusted EBT2 148,851 1.69 81,593 0.94 Less: pro forma taxes3 34,906 0.40 19,223 0.22 Adjusted net income2 113,945$ 1.29$ 62,370$ 0.72$ Nine Months Ended September 30, 2025 Nine Months Ended September 30, 2024 1. For the nine months ended September 30, 2025, other adjustments, net of $9.5 million included $8.3 million in expenses related to stock compensation, $1.0 million in expenses related to corporate development, $0.9 million in expenses related to legal matters, $0.7 million in expenses related to severance, and $0.2 million in expenses related to an adjustment to the Company’s outstanding lease obligations, partially offset by a $1.4 million addback related to the partial forgiveness of remaining expenses related to OppFi Card’s exit activities. For the nine months ended September 30, 2024, other adjustments, net of $11.1 million included $4.2 million in expenses related to stock compensation, $2.9 million in expenses related to OppFi Card’s exit activities, $2.1 million in expenses related to legal matters, $1.2 million in expenses related to severance, and $0.7 million in expenses related to corporate development. The sum of the individual components of other adjustments, net may not equal the total presented due to the use of rounded numbers for disclosure purposes. 2. Non-GAAP Financial Measures: Adjusted EBT, Adjusted Net Income, and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See the disclaimer on “Non-GAAP Financial Measures” on slide 2 for a detailed description of such non-GAAP financial measures. 3. Assumes a tax rate of 23.45% for the nine months ended September 30, 2025 and 23.56% for the nine months ended September 30, 2024, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. 4. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts.

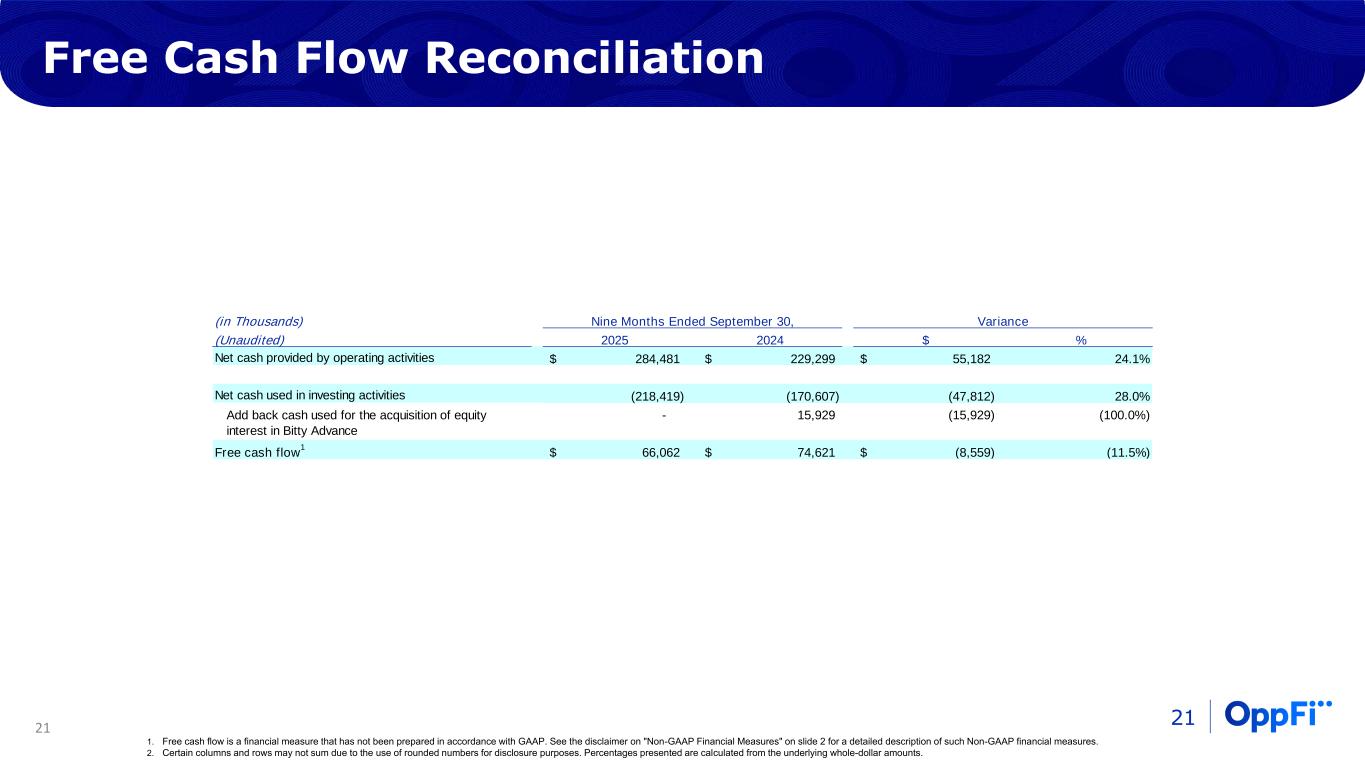

21 Free Cash Flow Reconciliation 21 1. Free cash flow is a financial measure that has not been prepared in accordance with GAAP. See the disclaimer on "Non-GAAP Financial Measures" on slide 2 for a detailed description of such Non-GAAP financial measures. 2. Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts. (in Thousands) (Unaudited) 2025 2024 $ % Net cash provided by operating activities 284,481$ 229,299$ 55,182$ 24.1% Net cash used in investing activities (218,419) (170,607) (47,812) 28.0% - 15,929 (15,929) (100.0%) Free cash flow1 66,062$ 74,621$ (8,559)$ (11.5%) Add back cash used for the acquisition of equity interest in Bitty Advance Nine Months Ended September 30, Variance

Thank You