|

|

| 1 Letter to Our Shareholders Q2 2025 Dear Shareholders, We had another strong quarter with significant progress achieved on key product, revenue, development and profitability milestones. And recently in the third quarter, we continued that momentum to grow our profitability and revenue through an agreement to acquire an established player in the energy storage space (“ESS”) that leverages our strengths in Molecular Universe battery materials discovery and safety monitoring capabilities. In the first quarter since the public release of Molecular Universe, I’m pleased to see that we now have more than 30 companies that have begun trial testing the Enterprise level with many more in the pipeline. Our mission is to accelerate the world’s energy transition through material discovery and battery management. We are excited to see Molecular Universe helping human scientists to be more creative and develop new products much faster. Since our launch of “All-in on AI” a year ago, we have been progressing through four stages: 1. Chatbot We achieved this milestone with the original launch of Molecular Universe 0. Molecular Universe is a powerful LLM specifically trained on the world’s most comprehensive battery domain expertise combined with the world’s largest and most accurate battery-relevant molecule property databases. 2. AI Agent We achieved this milestone with last month’s introduction of Deep Space in Molecular Universe 0.5. An agentic capability that can conduct senior scientist level battery research, Deep Space can reduce product development time from years to just tens of minutes. The return on investment on this capability for battery development teams is tremendous. 3. Physical AI This is where we are right now. Physical AI is the integration of Molecular Universe with physical systems including drones, humanoid robotics, EV, UAM, and the largest of all – ESS. We are on track with EV B-sample development with our EV OEM customers and growing revenue from our AI-enhanced Li-ion and Li-Metal cells for drones and UAM. And our recent agreement to acquire UZ Energy launches us into ESS Physical AI by providing the opportunity to integrate UZ’s ESS hardware with Molecular Universe’s material discovery platform (LFP and Na-ion for ESS) and our precise battery health monitoring system. |

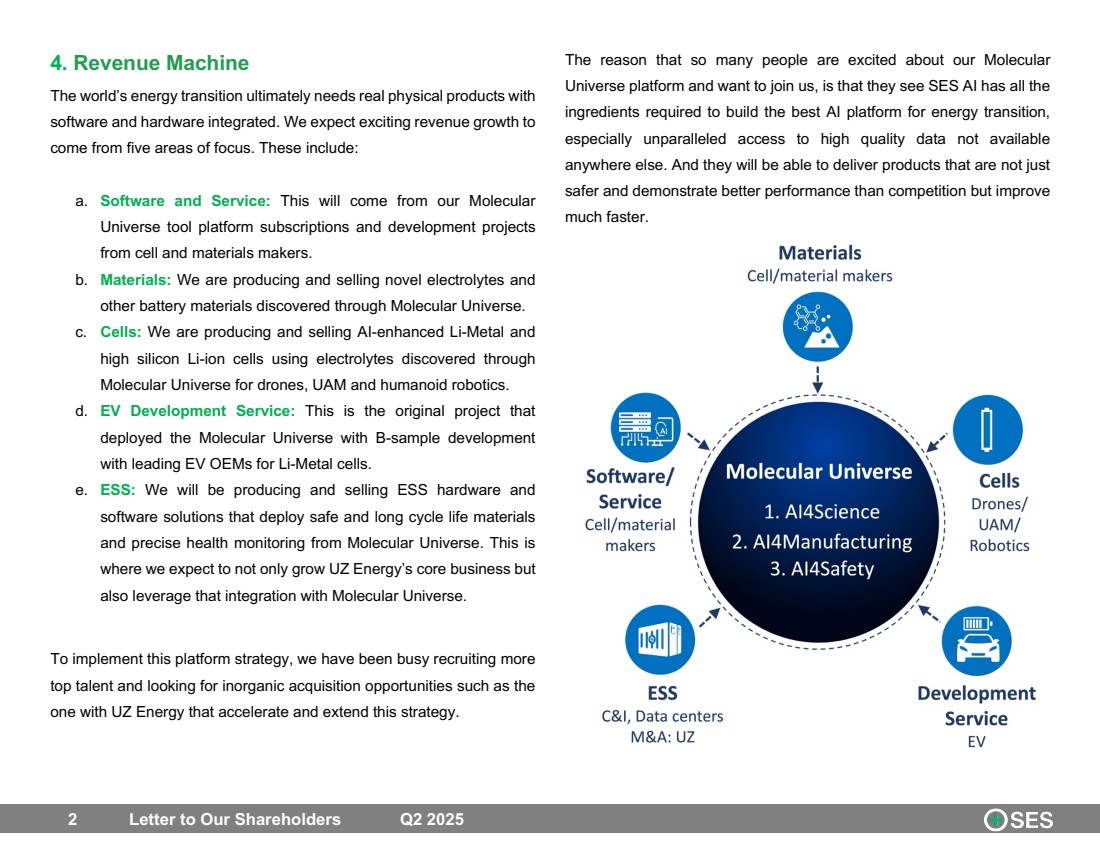

| 2 Letter to Our Shareholders Q2 2025 4. Revenue Machine The world’s energy transition ultimately needs real physical products with software and hardware integrated. We expect exciting revenue growth to come from five areas of focus. These include: a. Software and Service: This will come from our Molecular Universe tool platform subscriptions and development projects from cell and materials makers. b. Materials: We are producing and selling novel electrolytes and other battery materials discovered through Molecular Universe. c. Cells: We are producing and selling AI-enhanced Li-Metal and high silicon Li-ion cells using electrolytes discovered through Molecular Universe for drones, UAM and humanoid robotics. d. EV Development Service: This is the original project that deployed the Molecular Universe with B-sample development with leading EV OEMs for Li-Metal cells. e. ESS: We will be producing and selling ESS hardware and software solutions that deploy safe and long cycle life materials and precise health monitoring from Molecular Universe. This is where we expect to not only grow UZ Energy’s core business but also leverage that integration with Molecular Universe. To implement this platform strategy, we have been busy recruiting more top talent and looking for inorganic acquisition opportunities such as the one with UZ Energy that accelerate and extend this strategy. The reason that so many people are excited about our Molecular Universe platform and want to join us, is that they see SES AI has all the ingredients required to build the best AI platform for energy transition, especially unparalleled access to high quality data not available anywhere else. And they will be able to deliver products that are not just safer and demonstrate better performance than competition but improve much faster. |

| 3 Letter to Our Shareholders Q2 2025 Financial Highlights and Outlook Revenue for the second quarter was $3.5 million with a 74% gross margin. Our second quarter revenue was primarily driven by contracts with our automotive OEM customers to develop AI-enhanced Li-Metal and Li-ion battery materials for EV applications. As noted in our pre-announcement, we affirmed our full-year 2025 revenue guidance of $15 million to $25 million. We utilized $10.8 million in cash for operations in the second quarter, which was a 51% decrease from 2Q24 and a 53% decrease from 1Q25. We have been emphasizing our operational discipline for the past few quarters, and the significant reduction in cash usage in operations is a result of executing our plan to deploy capital effectively while growing our top-line. We concluded the quarter with a strong liquidity position of $229 million with no debt. Acquisition Annoucement We also announced an agreement to acquire UZ Energy and are very excited about this strategic move to provide us the foothold in the fast-growing global ESS market. We expect that it will propel us forward as we expedite the implementation of intelligent energy storage solutions to address the escalating power needs of the AI era. We have a tremendous opportunity to grow the UZ Energy business from approximately $10 million to $15 million in projected revenue for the full year 2025 to exponentially larger growth in the coming years together with market share gains in the $300 billion global ESS market. Plans for 2025 and Beyond We will continue to allocate our capital to focus on our AI platform enhancements and growth to support our global commercial readiness through 2025 and beyond through organic growth and acquisitions. We have also allocated capital to share repurchases. While we did not complete any repurchases during the second quarter, to date in the third quarter we have already repurchased and cancelled 871,754 shares for a total investment of $1.1 million, or roughly $1.27 per share. In summary, we remain financially disciplined, with substantial liquidity and no debt, positioning us for scalable and long-term growth. Qichao Hu Founder, CEO and Chairman Jing Nealis Chief Financial Officer |

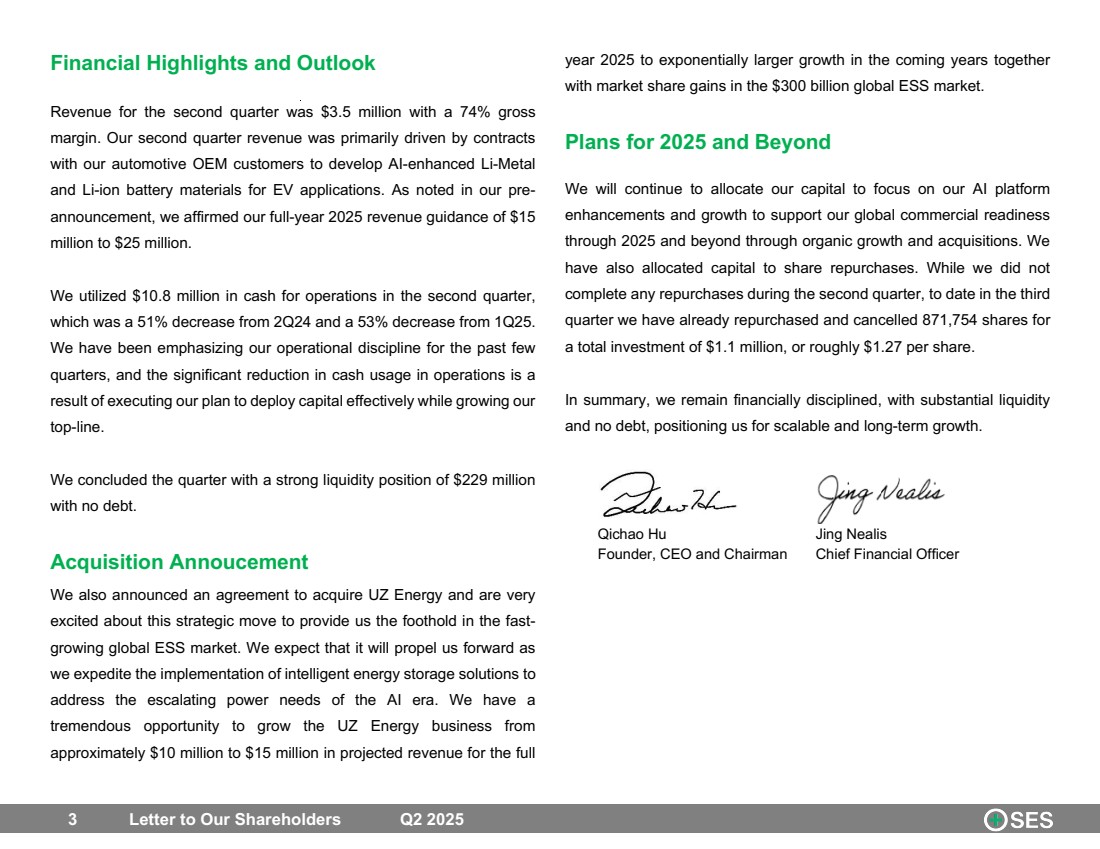

| 4 Letter to Our Shareholders Q2 2025 SES AI Corporation Condensed Consolidated Balance Sheets (Unaudited) (in thousands, except share and per share amounts) June 30, 2025 December 31, 2024 Assets Current Assets Cash and cash equivalents $ 11,757 $ 128,796 Short-term investments 217,123 133,748 Accounts receivable 3,009 950 Inventories 114 212 Prepaid expenses and other assets 10,960 13,198 Total current assets 242,963 276,904 Property and equipment, net 34,089 38,165 Intangible assets, net 1,153 1,217 Right-of-use assets, net 8,744 9,927 Deferred tax assets 1,335 1,335 Other assets, non-current 2,176 2,237 Total assets $ 290,460 $ 329,785 Liabilities and Stockholders’ Equity Current Liabilities Accounts payable $ 1,981 $ 1,901 Operating lease liabilities 2,732 2,585 Accrued expenses and other current liabilities 14,788 18,329 Total current liabilities 19,501 22,815 Sponsor Earn-Out liabilities 3,036 9,472 Operating lease liabilities, non-current 6,573 7,977 Unearned government grant 9,509 8,606 Other liabilities, non-current 2,614 2,605 Total liabilities 41,233 51,475 Stockholders’ Equity Common stock: Class A shares, $0.0001 par value, 2,100,000,000 shares authorized; 322,168,676 and 317,676,034 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively; Class B shares, $0.0001 par value, 200,000,000 shares authorized; 43,881,251 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively 37 36 Additional paid-in capital 585,688 579,378 Accumulated deficit (333,954) (298,871) Accumulated other comprehensive loss (2,544) (2,233) Total stockholders' equity 249,227 278,310 Total liabilities and stockholders' equity $ 290,460 $ 329,785 |

| 5 Letter to Our Shareholders Q2 2025 SES AI Corporation Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited) Three Months Ended June 30, Six Months Ended June 30, (in thousands, except share and per share amounts) 2025 2024 2025 2024 Revenue from contracts with customers: Revenue $ 3,527 $ — $ 9,320 $ — Cost of revenues 927 — 2,163 — Gross profit 2,600 — 7,157 — Operating expenses: Research and development 19,087 15,057 39,597 26,822 General and administrative 6,520 9,570 13,840 19,076 Total operating expenses 25,607 24,627 53,437 45,898 Loss from operations (23,007) (24,627) (46,280) (45,898) Other income: (Loss) Gain on change in fair value of Sponsor Earn-Out liabilities (1,443) 1,411 6,436 2,286 Interest income 2,367 3,995 5,037 8,157 Miscellaneous income (expense), net 100 (580) 396 294 Total other income, net 1,024 4,826 11,869 10,737 Loss before income taxes (21,983) (19,801) (34,411) (35,161) Provision for income taxes (668) (96) (672) (293) Net loss (22,651) (19,897) (35,083) (35,454) Other comprehensive loss, net of tax: Foreign currency translation adjustment (283) (93) (236) (550) Unrealized loss on short-term investments (55) (59) (75) (358) Total other comprehensive loss, net of tax (338) (152) (311) (908) Total comprehensive loss $ (22,989) $ (20,049) $ (35,394) $ (36,362) Net loss per share attributable to common stockholders: Basic and diluted $ (0.07) $ (0.06) $ (0.11) $ (0.11) Weighted-average shares outstanding: Basic and diluted 331,731,923 320,833,854 330,539,801 319,812,287 |

| 6 Letter to Our Shareholders Q2 2025 SES AI Corporation Condensed Consolidated Statements of Cash Flows (Unaudited) Six Months Ended June 30, (in thousands) 2025 2024 Cash Flows From Operating Activities Net loss $ (35,083) $ (35,454) Adjustments to reconcile net loss to net cash used in operating activities: Gain from change in fair value of Sponsor Earn-Out liabilities (6,436) (2,286) Stock-based compensation 6,686 9,586 Depreciation and amortization 5,043 3,666 Accretion income from available-for-sale short-term investments (1,734) (3,889) Other 103 (1,478) Changes in operating assets and liabilities: Receivable from related party — 3,321 Accounts receivable (2,059) — Inventories 103 22 Prepaid expenses and other assets 2,338 (2,548) Right-of-use assets 1,272 1,802 Accounts payable (25) (274) Lease liabilities (1,350) (1,715) Accrued expenses and other liabilities (2,512) (1,824) Net cash used in operating activities (33,654) (31,071) Cash Flows From Investing Activities Purchases of property and equipment (1,720) (10,454) Purchase of short-term investments (162,267) (133,999) Proceeds from the maturities of short-term investments 80,800 145,000 Net cash (used in) provided by investing activities (83,187) 547 Cash Flows From Financing Activities Payments for taxes withheld to cover vested restricted stock (358) — Proceeds from stock option exercises 13 128 Net cash (used in) provided by financing activities (345) 128 Effect of exchange rates on cash 199 (501) Net decrease in cash, cash equivalents and restricted cash (116,987) (30,897) Cash, cash equivalents and restricted cash at beginning of period 129,395 86,966 Cash, cash equivalents and restricted cash at end of period $ 12,408 $ 56,069 Supplemental Cash and Non-Cash Information: Income taxes paid $ — $ 203 Accounts payable and accrued expenses related to purchases of property and equipment $ 1,005 $ 2,081 |

| 7 Letter to Our Shareholders Q2 2025 Forward-Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” “project” and “pursue” or the negative of these terms or similar expressions. These statements are based on the beliefs and assumptions of the management of the Company. You should not place undue reliance on these forward-looking statements. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, it cannot provide assurance that it will achieve or realize these plans, intentions or expectations. Should one or more of a number of known and unknown risks and uncertainties materialize, or should any of our assumptions prove incorrect, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include, but are not limited to, among other things, that conditions to the closing of the acquisition of Shenzhen UZ Energy Co. Ltd. and its related entities (“UZ Energy”) may not be satisfied, the potential impact on the business of the Company due to the announcement of the acquisition of UZ Energy, the occurrence of any event, change or other circumstances that could give rise to the termination of the purchase agreement therefor, changes in the financial condition, business or prospects of UZ Energy or the Company’s discovery of additional information relating thereto, general economic conditions, risks related to the development and commercialization of SES AI’s battery technology and the timing and achievement of expected business milestones, risks relating to the uncertainty of achieving and maintaining profitability, the ability of SES to integrate its products into electric vehicles and Urban Air Mobility, drones, energy storage systems, robotics and other applications, the risk that the market for SES AI’s AI-based services, including Molecular Universe, is still emerging, and such programs may not achieve the growth potential SES AI expects and other factors described in our filings with the Securities and Exchange Commission (the “SEC”), including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our most recently filed Annual Report on Form 10-K, Quarterly Report on Form 10-Q and other documents that we have filed, or that we will file, with the SEC. Any forward-looking statements made by us in this letter speak only as of the date on which they are made and subsequent events may cause these expectations to change. We disclaim any obligations to update or alter these forward-looking statements in the future, whether as a result of new information, future events or otherwise, except as required by law. |