1 Q3 2025 Investor Letter EX-99.2

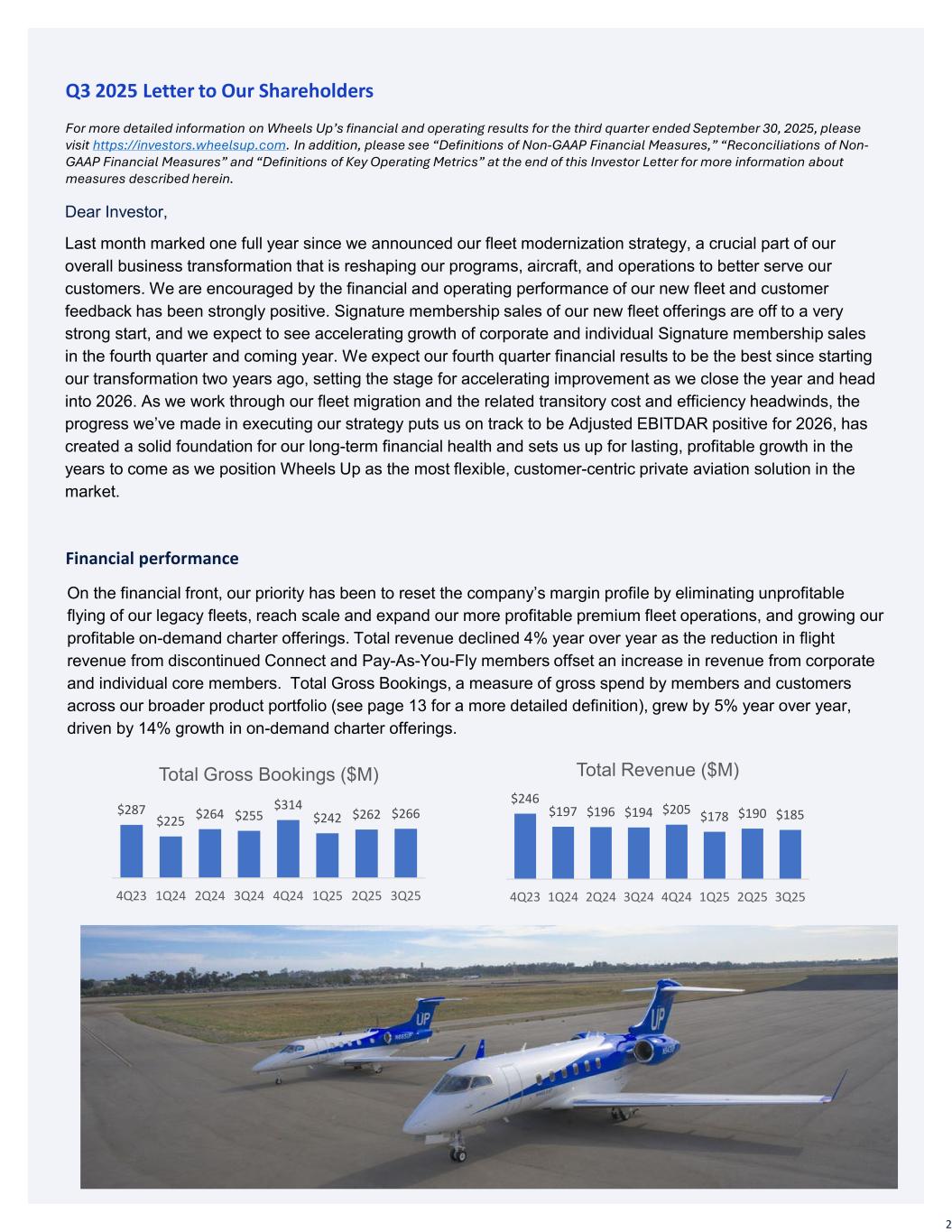

2 Dear Investor, Last month marked one full year since we announced our fleet modernization strategy, a crucial part of our overall business transformation that is reshaping our programs, aircraft, and operations to better serve our customers. We are encouraged by the financial and operating performance of our new fleet and customer feedback has been strongly positive. Signature membership sales of our new fleet offerings are off to a very strong start, and we expect to see accelerating growth of corporate and individual Signature membership sales in the fourth quarter and coming year. We expect our fourth quarter financial results to be the best since starting our transformation two years ago, setting the stage for accelerating improvement as we close the year and head into 2026. As we work through our fleet migration and the related transitory cost and efficiency headwinds, the progress we’ve made in executing our strategy puts us on track to be Adjusted EBITDAR positive for 2026, has created a solid foundation for our long-term financial health and sets us up for lasting, profitable growth in the years to come as we position Wheels Up as the most flexible, customer-centric private aviation solution in the market. Q3 2025 Letter to Our Shareholders For more detailed information on Wheels Up’s financial and operating results for the third quarter ended September 30, 2025, please visit https://investors.wheelsup.com. In addition, please see “Definitions of Non-GAAP Financial Measures,” “Reconciliations of Non- GAAP Financial Measures” and “Definitions of Key Operating Metrics” at the end of this Investor Letter for more information about measures described herein. On the financial front, our priority has been to reset the company’s margin profile by eliminating unprofitable flying of our legacy fleets, reach scale and expand our more profitable premium fleet operations, and growing our profitable on-demand charter offerings. Total revenue declined 4% year over year as the reduction in flight revenue from discontinued Connect and Pay-As-You-Fly members offset an increase in revenue from corporate and individual core members. Total Gross Bookings, a measure of gross spend by members and customers across our broader product portfolio (see page 13 for a more detailed definition), grew by 5% year over year, driven by 14% growth in on-demand charter offerings. Financial performance $246 $197 $196 $194 $205 $178 $190 $185 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Total Revenue ($M) $287 $225 $264 $255 $314 $242 $262 $266 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Total Gross Bookings ($M)

3 We improved our Gross profit profile and expanded Adjusted Contribution Margins from essentially breakeven at the start of our transformation just over two years ago to mid-to-high teens margins over the last year. As a result, our Adjusted EBITDAR losses have reduced by approximately 25% year-to-date. We have driven this improved performance from modernization of our fleet, improvement of our product offering, and continued delivery of outstanding service and operational excellence. This performance is especially notable in light of the temporary operating and financial pressure caused by our fleet transition, which we estimate negatively impacted Adjusted Contribution Margin by approximately 4 points in the third quarter alone. We are in the process of executing $70 million of cost savings actions, an increase from the initial target of $50 million, as we anticipate streamlining our sales and operations organizations, achieving the initial efficiencies from fleet simplification, and better aligning our overhead cost structure. These actions are expected to be completed by the first quarter 2026, with the financial benefit expected to be realized on a rolling basis as they are completed, and the full run-rate impact expected by the third quarter 2026. As of third quarter end, we had $225 million in liquidity, including cash and cash equivalents and our $100 million undrawn Delta revolver. In the third quarter, we successfully raised equity capital by issuing approximately $50 million of common stock through an at-the-market offering program. The net proceeds from the offering were used to invest in our fleet modernization program and for general corporate purposes. 1.2% 1.0% 7.8% 14.8% 19.3% 12.6% 12.2% 12.7% 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Adjusted Contribution Margin ($55) ($41) ($29) ($12) ($3) ($19) ($25) ($20) 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Adjusted EBITDAR ($M) ($81) ($97) ($97) ($58) ($88) ($99) ($82) ($84) 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Net Loss ($M)

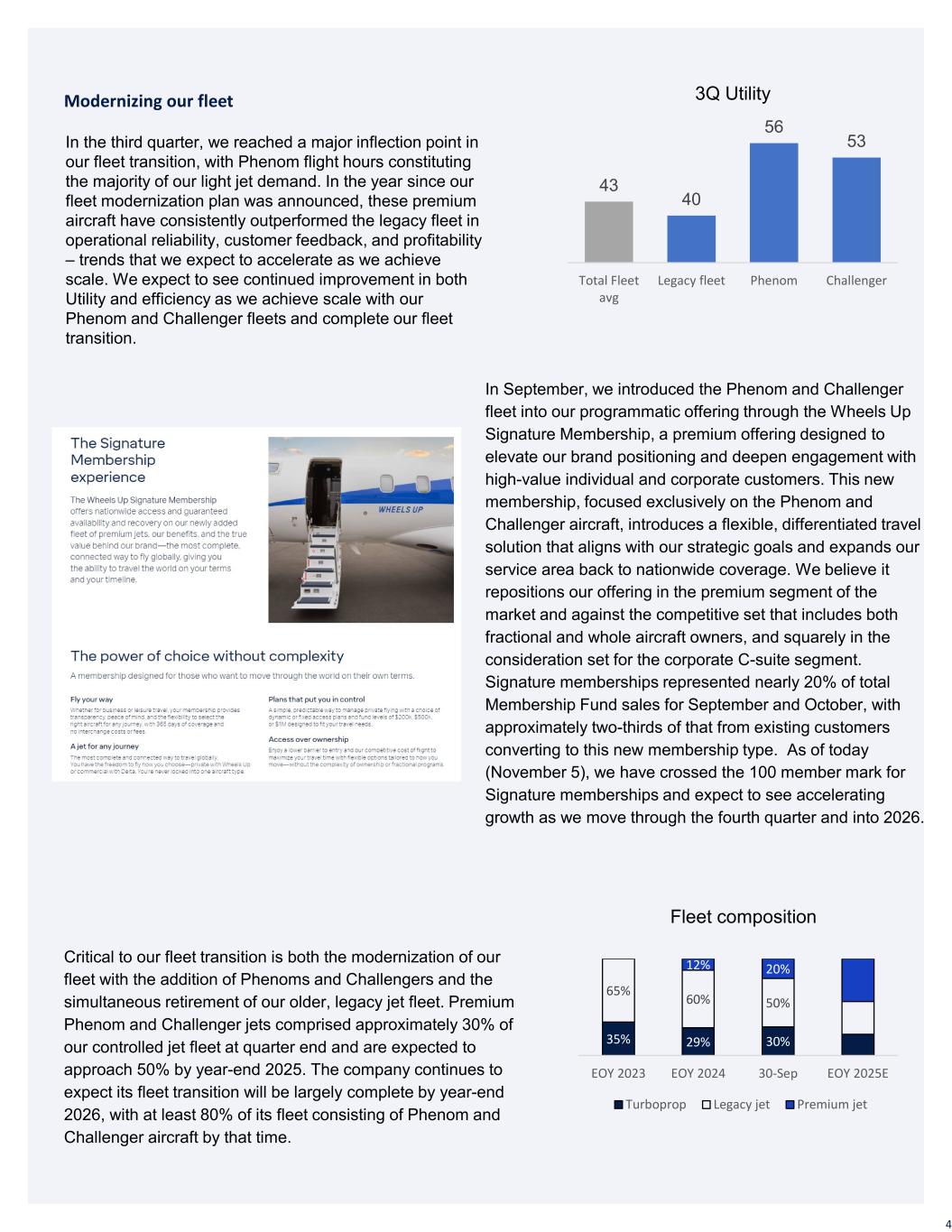

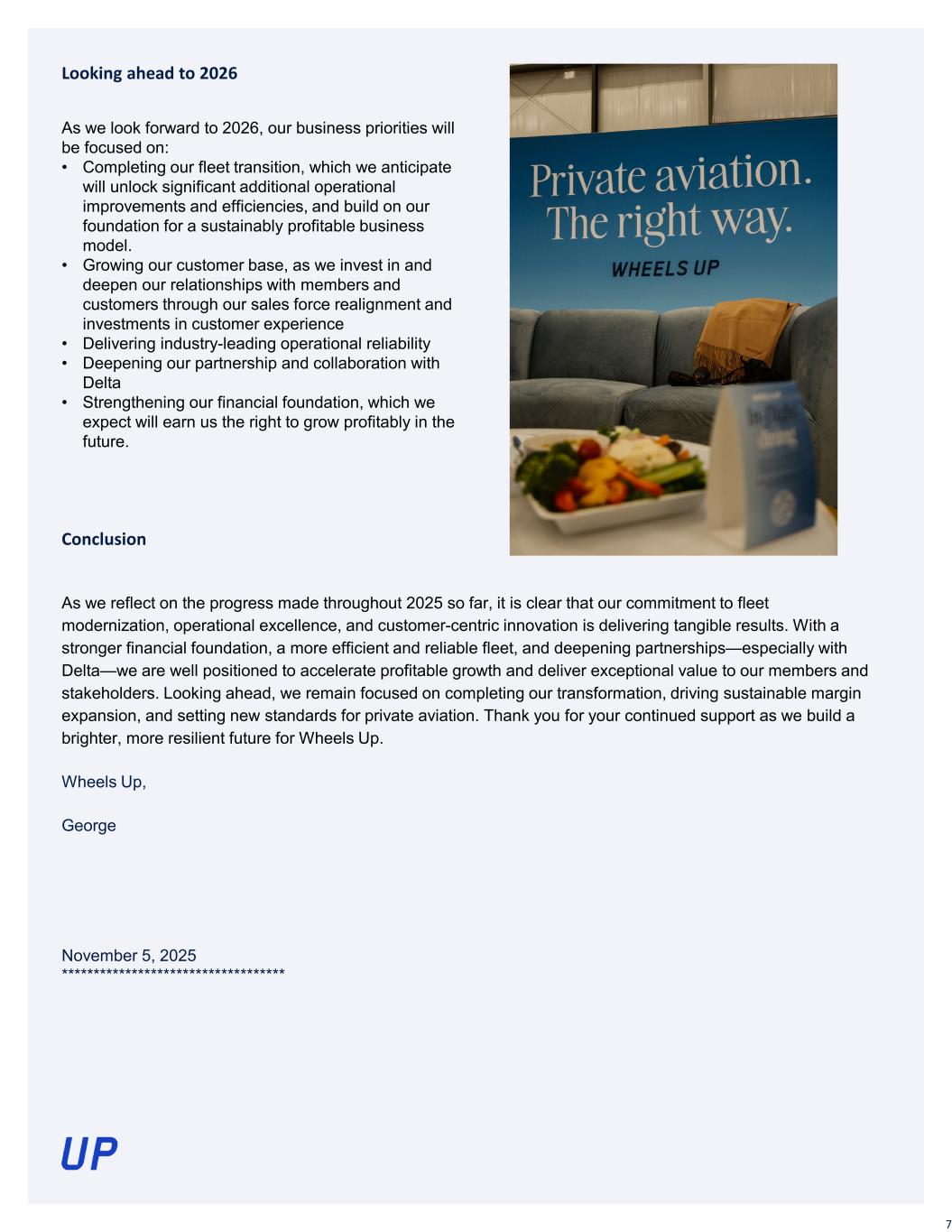

4 In the third quarter, we reached a major inflection point in our fleet transition, with Phenom flight hours constituting the majority of our light jet demand. In the year since our fleet modernization plan was announced, these premium aircraft have consistently outperformed the legacy fleet in operational reliability, customer feedback, and profitability – trends that we expect to accelerate as we achieve scale. We expect to see continued improvement in both Utility and efficiency as we achieve scale with our Phenom and Challenger fleets and complete our fleet transition. Modernizing our fleet In September, we introduced the Phenom and Challenger fleet into our programmatic offering through the Wheels Up Signature Membership, a premium offering designed to elevate our brand positioning and deepen engagement with high-value individual and corporate customers. This new membership, focused exclusively on the Phenom and Challenger aircraft, introduces a flexible, differentiated travel solution that aligns with our strategic goals and expands our service area back to nationwide coverage. We believe it repositions our offering in the premium segment of the market and against the competitive set that includes both fractional and whole aircraft owners, and squarely in the consideration set for the corporate C-suite segment. Signature memberships represented nearly 20% of total Membership Fund sales for September and October, with approximately two-thirds of that from existing customers converting to this new membership type. As of today (November 5), we have crossed the 100 member mark for Signature memberships and expect to see accelerating growth as we move through the fourth quarter and into 2026. Critical to our fleet transition is both the modernization of our fleet with the addition of Phenoms and Challengers and the simultaneous retirement of our older, legacy jet fleet. Premium Phenom and Challenger jets comprised approximately 30% of our controlled jet fleet at quarter end and are expected to approach 50% by year-end 2025. The company continues to expect its fleet transition will be largely complete by year-end 2026, with at least 80% of its fleet consisting of Phenom and Challenger aircraft by that time. 43 40 56 53 Total Fleet avg Legacy fleet Phenom Challenger 3Q Utility 35% 29% 30% 65% 60% 50% 12% 20% EOY 2023 EOY 2024 30-Sep EOY 2025E Turboprop Legacy jet Premium jet Fleet composition

5 Operationally, we are delivering the highest levels of reliability (On-Time Performance (D-60) and Completion Rate) since beginning our business transformation in September 2023, despite continuing to operate our legacy aircraft as we continue our push towards complete fleet modernization. For the third quarter, that meant operating at a 99% Completion Rate (up 1 point year-over-year), 89% On-Time Performance (D-60) (up 4 points year-over-year), and with 24 “Brand Days”, or days with no cancellations. As we streamline jet fleet types down to two, build fleet scale, and benefit from the improved operational reliability we are already seeing in our Challenger and Phenom fleets, there will be continued opportunities to improve on our performance. Operational performance Operational excellence and a strong product offering are the foundational elements that we expect will enable us to build and deliver an elevated and personalized customer experience. We plan to enhance the overall customer experience in the coming year, with a branded and refurbished fleet, state-of-the-art satellite Wi-Fi connectivity, curated culinary offerings, ground transportation offerings, and more. The company expects that nearly half of its premium jet fleet will have new livery and interior work completed or in process by the end of 2025. During the quarter, Gogo’s Galileo HDX Wi-Fi system received certification for installation on Embraer Phenom aircraft. We’ve begun installation of this system and our first Phenom with high-speed, satellite Wi-Fi is expected to enter service by the end of the year. For the Challenger fleet we are expecting FAA certification by the end of the year, allowing us to begin installation of high-speed Wi-Fi on this fleet by early 2026. We also announced a strategic partnership with AtYourJet and their culinary advisor, Chef Robert Irvine, to transform the standard of private jet dining. Together, we will elevate the in-flight experience with chef curated cuisine, exceptional hospitality, and bespoke touches tailored to our members, all of which are complimentary for Wheels Up Signature Members and available for purchase by legacy or charter flyers to personalize their journey. Elevated, personalized customer experience Our on-demand charter offerings grew 14% year-over-year in the third quarter and nearly 30% as compared to the third quarter of 2023. Compared to the third quarter 2024, we saw strong growth in on-demand private jet bookings to Wheels Up and Delta customers. The Wheels Up cross-sell growth is a strong indicator that our customers are utilizing our full product portfolio at an increasing rate and the Delta growth shows the benefits from corporate and travel agency opportunities. In addition, we’ve continued to see strong growth with new customers, demonstrating the broad appeal of on-demand offerings in the private aviation market. Growing our higher margin, on-demand private jet, group charter and cargo business

6 We are in the process of unifying the Wheels Up and Air Partner brands and commercial teams, with the intent to seamlessly deliver personalized service and customer engagement across the full range of our offering. As we work to integrate the Wheels Up and Air Partner sales teams in the coming months, we are taking the opportunity to reimagine the entire sales process, shifting to a more personalized, “trusted advisor” model selling tailored aviation solutions across our on-fleet membership program, global charter, and hybrid travel connected to Delta. Integration of Wheels Up Membership and Air Partner Global Charter The Delta partnership has been and continues to be a significant differentiator for Wheels Up, contributing to our progress across the enterprise. We have benefitted from Delta’s expertise as we have worked to turn around the operation. Commercially, our partnership with Delta corporate sales has been delivering ahead of plan and is our fastest growing channel. The third quarter saw $62 million of corporate Membership Fund sales – a quarterly all-time high for that customer segment and an increase of more than 15 percent year over year. Corporate membership fund mix was 49% for the quarter, up 4 points sequentially from the second quarter and 12 points over the prior year period. We believe we are in the early stages of realizing the full potential of our Delta partnership, as we introduce corporate customer-preferred aircraft to our programs, expand our cross-selling activities, build out our loyalty and partner strategies, and create greater seamlessness between our offerings and technology platforms. Delta partnership $32 $45 $106 $156 $199 $225 2020 2021 2022 2023 2024 2025E Corporate Membership Fund Sales ($M)

7 As we reflect on the progress made throughout 2025 so far, it is clear that our commitment to fleet modernization, operational excellence, and customer-centric innovation is delivering tangible results. With a stronger financial foundation, a more efficient and reliable fleet, and deepening partnerships—especially with Delta—we are well positioned to accelerate profitable growth and deliver exceptional value to our members and stakeholders. Looking ahead, we remain focused on completing our transformation, driving sustainable margin expansion, and setting new standards for private aviation. Thank you for your continued support as we build a brighter, more resilient future for Wheels Up. Wheels Up, George November 5, 2025 *********************************** Conclusion Looking ahead to 2026 As we look forward to 2026, our business priorities will be focused on: • Completing our fleet transition, which we anticipate will unlock significant additional operational improvements and efficiencies, and build on our foundation for a sustainably profitable business model. • Growing our customer base, as we invest in and deepen our relationships with members and customers through our sales force realignment and investments in customer experience • Delivering industry-leading operational reliability • Deepening our partnership and collaboration with Delta • Strengthening our financial foundation, which we expect will earn us the right to grow profitably in the future.

8 About Wheels Up Wheels Up is a leading provider of on-demand private aviation in the U.S. with a large, diverse fleet and a global network of safety-vetted charter operators, all committed to safety and service. Customers access charter and membership programs and commercial travel benefits through a strategic partnership with Delta Air Lines. Wheels Up also provides freight, safety, security, and managed services to a range of s, including individuals and government organizations. With the Wheels Up app and website, members can easily search, book, and fly. For more information, visit www.wheelsup.com. Cautionary Note Regarding Forward-Looking Statements This investor letter contains certain “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements provide current expectations of future circumstances or events based on certain assumptions and include any statement, projection or forecast that does not directly relate to any historical or current fact. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside of the control of Wheels Up Experience Inc. (“Wheels Up”, “we”, “us”, “our” or the "Company"), that could cause actual results to differ materially from the results discussed in the forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding: (i) Wheels Up’s growth plans, the size, demand, competition in and growth potential of the markets for Wheels Up’s service offerings and the degree of market adoption of Wheels Up’s membership program, charter offerings and any future services it may offer; (ii) the potential impact of Wheels Up’s cost reduction and operational efficiency and productivity initiatives on its business and results of operations, including timing, magnitude and possible effects on liquidity levels and working capital; (iii) Wheels Up’s fleet modernization strategy, its ability to execute such strategy on the timeline that it currently anticipates and the expected commercial, financial and operational impacts to Wheels Up, including due to changes in the market for purchases and sales of aircraft; (iv) Wheels Up’s liquidity and future cash flows, certain restrictions related to its indebtedness obligations and its ability to perform under its contractual and indebtedness obligations; (v) Wheels Up’s ability to achieve its financial goals in the future on the most recent schedule that it has announced; (vi) the potential impacts or benefits from pursuing strategic actions involving Wheels Up or its subsidiaries or affiliates, including, among others, acquisitions and divestitures, new debt or equity financings, refinancings of existing indebtedness, stock repurchases and commercial partnerships or arrangements; and (vii) the impacts of general economic and geopolitical conditions on Wheels Up’s business and the aviation industry, including due to, among others, fluctuations in interest rates, inflation, foreign currencies, taxes, tariffs and trade policies, government shutdowns or funding changes, and consumer and business spending decisions. The words “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward-looking. We have identified certain known material risk factors applicable to Wheels Up in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the U.S. Securities and Exchange Commission (“SEC”) on March 11, 2025 (“Annual Report”) and our other filings with the SEC. It is not always possible for us to predict how new risks and uncertainties that arise from time to time may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Except as required by law, we do not intend to update any of these forward-looking statements after the date of this investor letter.

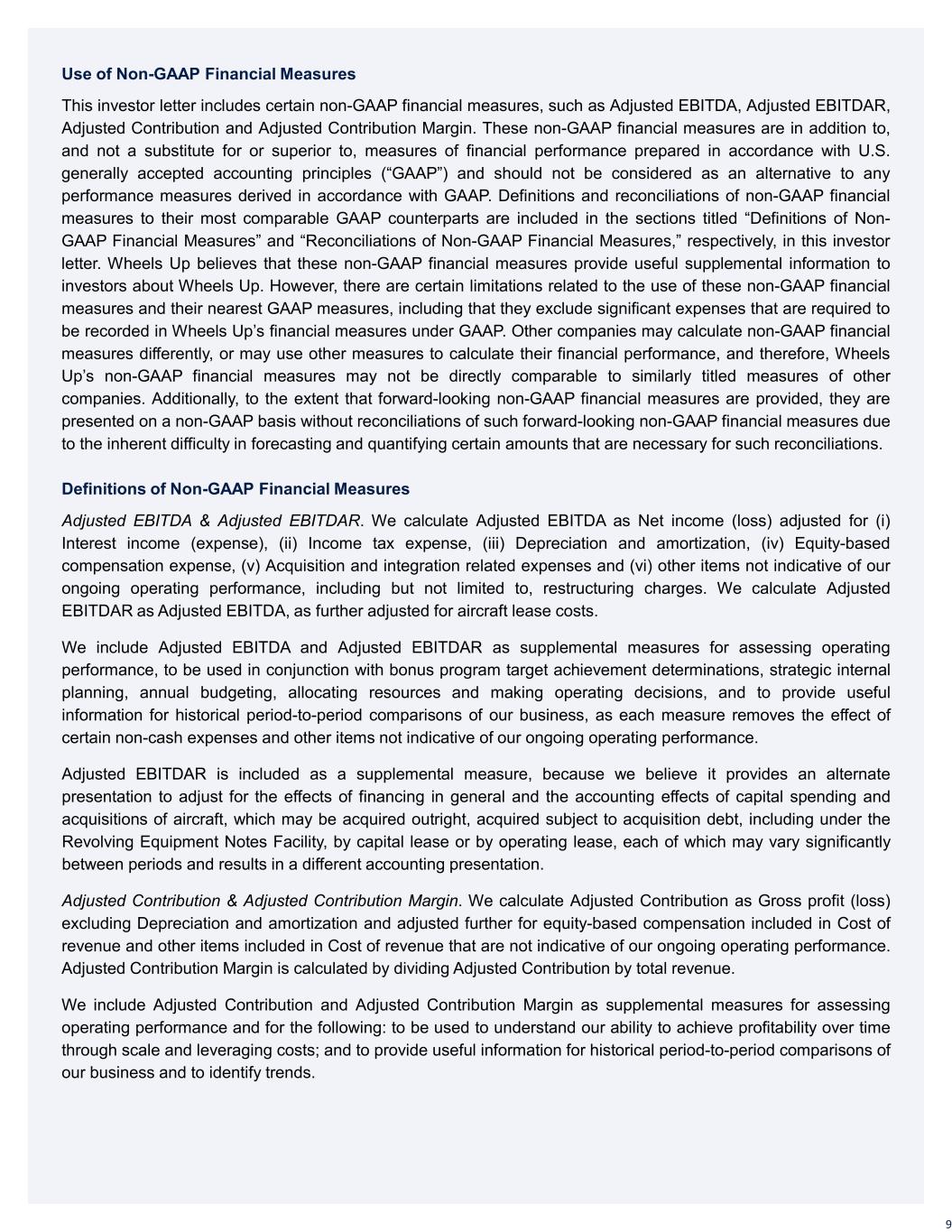

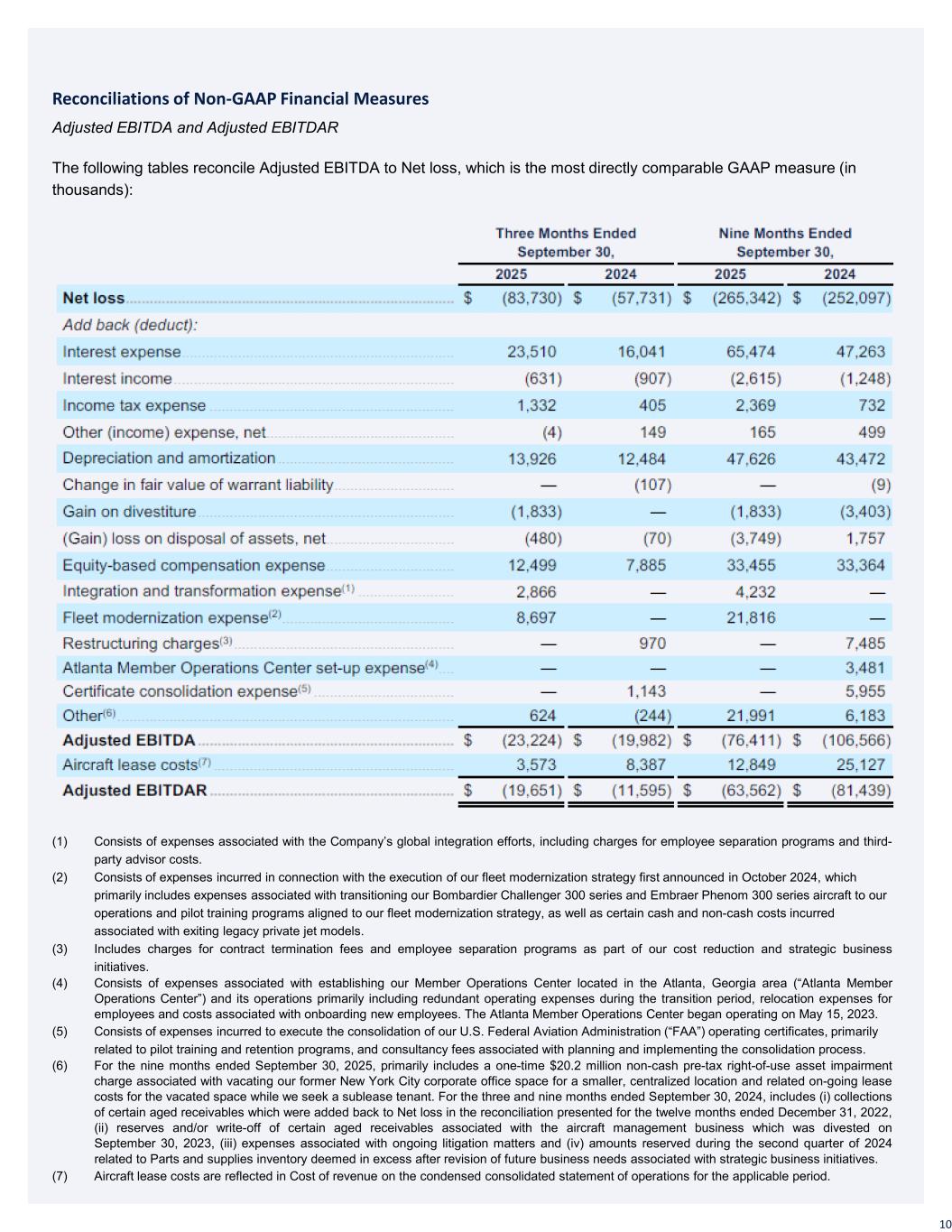

9 Use of Non-GAAP Financial Measures This investor letter includes certain non-GAAP financial measures, such as Adjusted EBITDA, Adjusted EBITDAR, Adjusted Contribution and Adjusted Contribution Margin. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and should not be considered as an alternative to any performance measures derived in accordance with GAAP. Definitions and reconciliations of non-GAAP financial measures to their most comparable GAAP counterparts are included in the sections titled “Definitions of Non- GAAP Financial Measures” and “Reconciliations of Non-GAAP Financial Measures,” respectively, in this investor letter. Wheels Up believes that these non-GAAP financial measures provide useful supplemental information to investors about Wheels Up. However, there are certain limitations related to the use of these non-GAAP financial measures and their nearest GAAP measures, including that they exclude significant expenses that are required to be recorded in Wheels Up’s financial measures under GAAP. Other companies may calculate non-GAAP financial measures differently, or may use other measures to calculate their financial performance, and therefore, Wheels Up’s non-GAAP financial measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP financial measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Definitions of Non-GAAP Financial Measures Adjusted EBITDA & Adjusted EBITDAR. We calculate Adjusted EBITDA as Net income (loss) adjusted for (i) Interest income (expense), (ii) Income tax expense, (iii) Depreciation and amortization, (iv) Equity-based compensation expense, (v) Acquisition and integration related expenses and (vi) other items not indicative of our ongoing operating performance, including but not limited to, restructuring charges. We calculate Adjusted EBITDAR as Adjusted EBITDA, as further adjusted for aircraft lease costs. We include Adjusted EBITDA and Adjusted EBITDAR as supplemental measures for assessing operating performance, to be used in conjunction with bonus program target achievement determinations, strategic internal planning, annual budgeting, allocating resources and making operating decisions, and to provide useful information for historical period-to-period comparisons of our business, as each measure removes the effect of certain non-cash expenses and other items not indicative of our ongoing operating performance. Adjusted EBITDAR is included as a supplemental measure, because we believe it provides an alternate presentation to adjust for the effects of financing in general and the accounting effects of capital spending and acquisitions of aircraft, which may be acquired outright, acquired subject to acquisition debt, including under the Revolving Equipment Notes Facility, by capital lease or by operating lease, each of which may vary significantly between periods and results in a different accounting presentation. Adjusted Contribution & Adjusted Contribution Margin. We calculate Adjusted Contribution as Gross profit (loss) excluding Depreciation and amortization and adjusted further for equity-based compensation included in Cost of revenue and other items included in Cost of revenue that are not indicative of our ongoing operating performance. Adjusted Contribution Margin is calculated by dividing Adjusted Contribution by total revenue. We include Adjusted Contribution and Adjusted Contribution Margin as supplemental measures for assessing operating performance and for the following: to be used to understand our ability to achieve profitability over time through scale and leveraging costs; and to provide useful information for historical period-to-period comparisons of our business and to identify trends.

10 Adjusted EBITDA and Adjusted EBITDAR The following tables reconcile Adjusted EBITDA to Net loss, which is the most directly comparable GAAP measure (in thousands): Reconciliations of Non-GAAP Financial Measures (1) Consists of expenses associated with the Company’s global integration efforts, including charges for employee separation programs and third- party advisor costs. (2) Consists of expenses incurred in connection with the execution of our fleet modernization strategy first announced in October 2024, which primarily includes expenses associated with transitioning our Bombardier Challenger 300 series and Embraer Phenom 300 series aircraft to our operations and pilot training programs aligned to our fleet modernization strategy, as well as certain cash and non-cash costs incurred associated with exiting legacy private jet models. (3) Includes charges for contract termination fees and employee separation programs as part of our cost reduction and strategic business initiatives. (4) Consists of expenses associated with establishing our Member Operations Center located in the Atlanta, Georgia area (“Atlanta Member Operations Center”) and its operations primarily including redundant operating expenses during the transition period, relocation expenses for employees and costs associated with onboarding new employees. The Atlanta Member Operations Center began operating on May 15, 2023. (5) Consists of expenses incurred to execute the consolidation of our U.S. Federal Aviation Administration (“FAA”) operating certificates, primarily related to pilot training and retention programs, and consultancy fees associated with planning and implementing the consolidation process. (6) For the nine months ended September 30, 2025, primarily includes a one-time $20.2 million non-cash pre-tax right-of-use asset impairment charge associated with vacating our former New York City corporate office space for a smaller, centralized location and related on-going lease costs for the vacated space while we seek a sublease tenant. For the three and nine months ended September 30, 2024, includes (i) collections of certain aged receivables which were added back to Net loss in the reconciliation presented for the twelve months ended December 31, 2022, (ii) reserves and/or write-off of certain aged receivables associated with the aircraft management business which was divested on September 30, 2023, (iii) expenses associated with ongoing litigation matters and (iv) amounts reserved during the second quarter of 2024 related to Parts and supplies inventory deemed in excess after revision of future business needs associated with strategic business initiatives. (7) Aircraft lease costs are reflected in Cost of revenue on the condensed consolidated statement of operations for the applicable period.

11 (1) Consists of expenses associated with the Company’s global integration efforts including charges for employee separation programs. (2) Consists of expenses incurred in connection with the execution of our fleet modernization strategy first announced in October 2024, which primarily includes expenses associated with transitioning our Bombardier Challenger 300 series and Embraer Phenom 300 series aircraft to our operations and pilot training programs aligned to our fleet modernization strategy, as well as certain cash and non-cash costs incurred associated with exiting legacy private jet models. (3) Primarily includes charges for employee separation programs as part of our ongoing cost reduction and strategic business initiatives. (4) Consists of expenses associated with establishing the Atlanta Member Operations Center and its operations primarily including redundant operating expenses during the transition period, relocation expenses for employees and costs associated with onboarding new employees. The Atlanta Member Operations Center began operating on May 15, 2023. (5) Consists of expenses incurred to execute the consolidation of our FAA operating certificates, primarily including pilot training and retention programs and consultancy fees associated with planning and implementing the consolidation process. (6) Consists of amounts recovered on Parts and supplies inventory reserved during prior periods related to Parts and supplies inventory deemed in excess after revision of future business needs associated with strategic business initiatives, including fleet modernization. Adjusted Contribution and Adjusted Contribution Margin The following tables reconcile Adjusted Contribution to Gross profit (loss), which is the most directly comparable GAAP measure (in thousands):

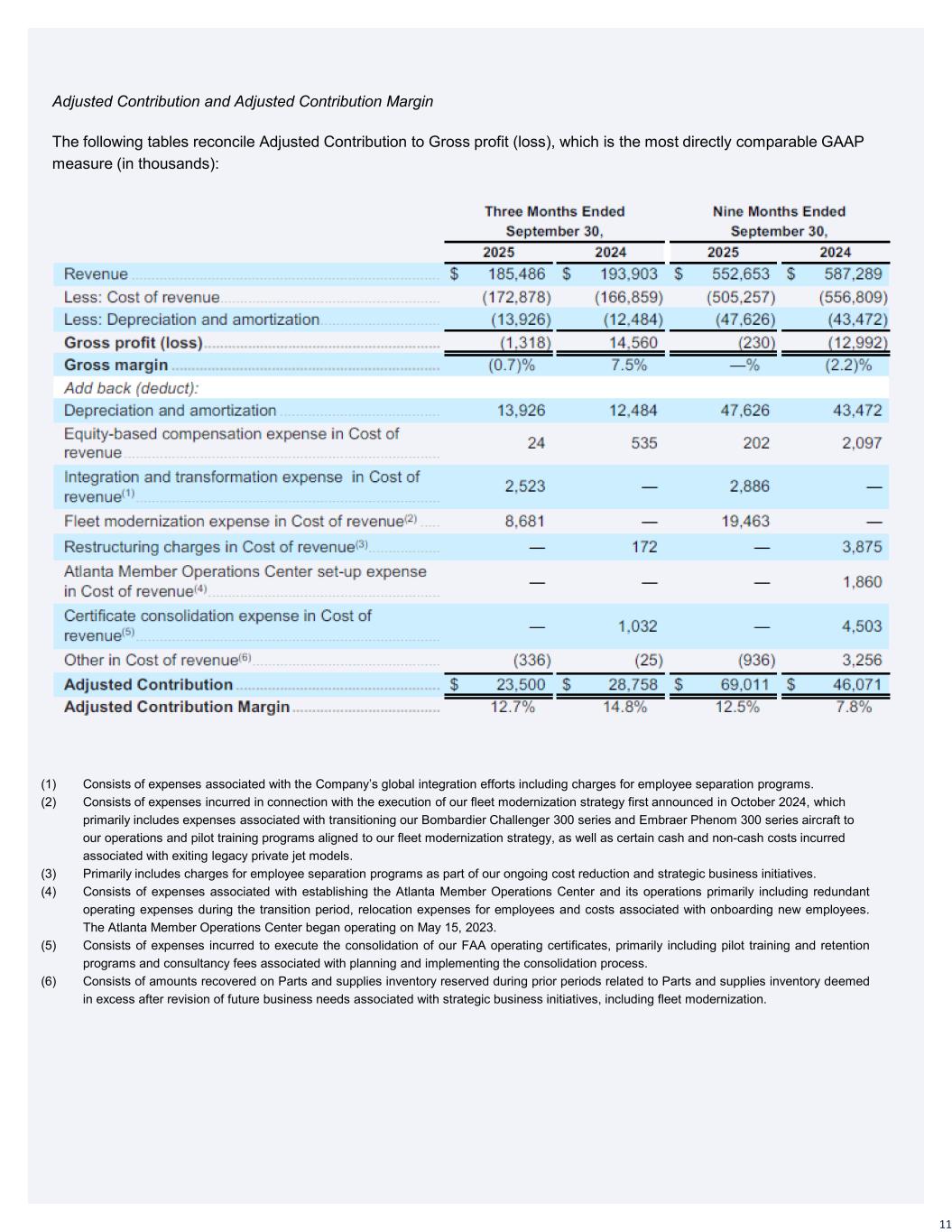

12 Key Operating Metrics In addition to financial measures, we regularly review certain key operating metrics to evaluate our business, determine the allocation of resources and make decisions regarding business strategies. We believe that these metrics can be useful for understanding the underlying trends in our business. The following table summarizes our key operating metrics: __________ (1) For the three months ended September 30, 2025, Utility for the Embraer Phenom 300 series, Bombardier Challenger 300 series and legacy fleet aircraft in our controlled fleet were 56, 53 and 40 hours, respectively. Wheels Up did not have any Embraer Phenom 300 series or Bombardier Challenger 300 series aircraft in its controlled fleet during the three months ended September 30, 2024, and Utility for that period reflects the legacy fleet aircraft that Wheels Up operated during that period.

13 Total Gross Bookings and Private Jet Gross Bookings. We define Total Gross Bookings as the total gross spend by our members and customers on all private jet flight services under our membership program and charter offerings, all group charter flights, which are charter flights with 15 or more passengers (“Group Charter Flights”), and all cargo flight services (“Cargo Services”). We believe Total Gross Bookings provides useful information about the scale of the overall global aviation solutions that we provide our members and customers. We define Private Jet Gross Bookings as the total gross spend by our members and customers on all private jet flight services under our membership program and charter offerings (excluding Group Charter Flights and Cargo Services). We believe Private Jet Gross Bookings provides useful information about the aggregate amount our members and customers spend with Wheels Up versus our competitors. For each of Total Gross Bookings and Private Jet Gross Bookings, the total gross spend by our members and customers is the amount invoiced to the member or customer and includes the cost of the flight and related services, such as catering, ground transportation, certain taxes, fees and surcharges. We use Total Gross Bookings and Private Jet Gross Bookings to provide useful information for historical period-to-period comparisons of our business and to identify trends, including relative to our competitors. Our calculation of Total Gross Bookings and Private Jet Gross Bookings may not be comparable to similarly titled measures reported by other companies. Live Flight Legs. We define Live Flight Legs as the number of completed one-way revenue generating private jet flight legs in the applicable period, excluding empty repositioning legs and owner legs related to aircraft under management. We believe Live Flight Legs is a useful metric to measure the scale and usage of our platform and our ability to generate Flight revenue. Private Jet Gross Bookings per Live Flight Leg. We use Private Jet Gross Bookings per Live Flight Leg to measure the average gross spend by our members and customers on all private jet flight services under our membership program and charter offerings (excluding Group Charter Flights and Cargo Services) for each Live Flight Leg. Utility. We define Utility for the applicable period as the total revenue generating flight hours flown on our controlled aircraft fleet, excluding empty repositioning legs, divided by the monthly average number of available aircraft in our controlled aircraft fleet. Utility is expressed as a monthly average. We measure the revenue generating flight hours for a given flight on our controlled aircraft as the actual flight time from takeoff to landing. We determine the number of aircraft in our controlled aircraft fleet available for revenue generating flights at the end of the applicable month and exclude aircraft then classified as held for sale. We use Utility to measure the efficiency of our operations, our ability to generate a return on our assets and the impact of our fleet modernization strategy. Completion Rate. We define Completion Rate as the percentage of total scheduled flights operated and completed, excluding customer-initiated flight cancellations. On-Time Performance (D-60). We define On-Time Performance (D-60) as the percentage of total flights flown that departed within 60 minutes of the scheduled time, inclusive of air traffic control, weather, maintenance and customer delays, excluding all cancelled flights. Beginning with the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2025, we changed the presentation of Completion Rate and On-Time Performance (D-60) to include wholesale flights, which we believe better aligns those metrics to information that we use internally to evaluate our operations and reported Live Flight Legs, which includes wholesale flights. Completion Rate and On-Time Performance (D-60) for the three and nine months ended September 30, 2025 and 2024 reported in the table above includes wholesale flights, which were previously excluded from such metrics in the Company’s filings with the SEC beginning with the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2024 through and including our Annual Report. Completion Rate and On-Time Performance (D-60) reported in the Company’s previously filed Quarterly Report on Form 10-Q for the three months ended September 30, 2024, which excluded wholesale flight activity, were 98% and 82%, respectively.