2025 Third Quarter Results Earnings Presentation

GCM GROSVENOR | 2 “Our strong results in the third quarter reflect the significant momentum we're seeing across our business,” said Michael Sacks, GCM Grosvenor's Chairman and Chief Executive Officer. "Our investment performance has been strong, our fundraising over the last twelve months was at a record-level, and we continue to enjoy operating leverage and margin expansion opportunity." GCM Grosvenor Reports Q3 2025 Results CHICAGO, November 5, 2025 – GCM Grosvenor (Nasdaq: GCMG), a leading global alternative asset management solutions provider, today reported results for the third fiscal quarter ended September 30, 2025. Dividend GCM Grosvenor's Board of Directors approved a $0.12 per share dividend payable on December 15, 2025 to shareholders on record December 1, 2025. Conference Call Management will host a webcast and conference call at 10:00 a.m. ET today to discuss the company’s results. The conference call will also be available via public webcast from the Public Shareholders section of GCM Grosvenor’s website at www.gcmgrosvenor.com/public- shareholders and a replay will be available on the website soon after the call’s completion. To listen to the live broadcast, participants are encouraged to go to the site 15 minutes prior to the scheduled call time in order to register. The call can also be accessed by dialing (800) 341-3130 / (929) 477-0493 and using the passcode: 1508900. About GCM Grosvenor GCM Grosvenor (Nasdaq: GCMG) is a global alternative asset management solutions provider with approximately $87 billion in assets under management across private equity, infrastructure, real estate, credit, and absolute return investment strategies. The firm has specialized in alternatives for more than 50 years and is dedicated to delivering value for clients by leveraging its cross-asset class and flexible investment platform. GCM Grosvenor’s experienced team of approximately 560 professionals serves a global client base of institutional and individual investors. The firm is headquartered in Chicago, with offices in New York, Toronto, London, Frankfurt, Tokyo, Hong Kong, Seoul and Sydney. For more information, visit: www.gcmgrosvenor.com.

GCM GROSVENOR | 3 THIS PRESENTATION CONTAINS CERTAIN FORWARD- LOOKING STATEMENTS within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the expected future performance of GCM Grosvenor’s business. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward- looking statements in this presentation, including without limitation, the historical performance of GCM Grosvenor's funds may not be indicative of GCM Grosvenor's future results; risks related to redemptions and termination of engagements; the variable nature of GCM Grosvenor's revenues; competition in GCM Grosvenor's industry; effects of government regulation or compliance failures; market, geopolitical and economic conditions; identification and availability of suitable investment opportunities; risks relating to our internal control over financial reporting; and risks related to the performance of GCM Grosvenor's investments. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” sections of the Annual Report on Form 10-K filed by GCM Grosvenor Inc. on February 20, 2025 and its other filings with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward- looking statements. Past performance is not a guarantee or necessarily indicative of future results. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and GCM Grosvenor assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Forward Looking Statements Media Contacts Tom Johnson and Abigail Ruck H/Advisors Abernathy tom.johnson@h-advisors.global/ abigail.ruck@h-advisors.global 212-371-5999 Public Shareholders Contact Stacie Selinger Head of Investor Relations sselinger@gcmlp.com 312-506-6583

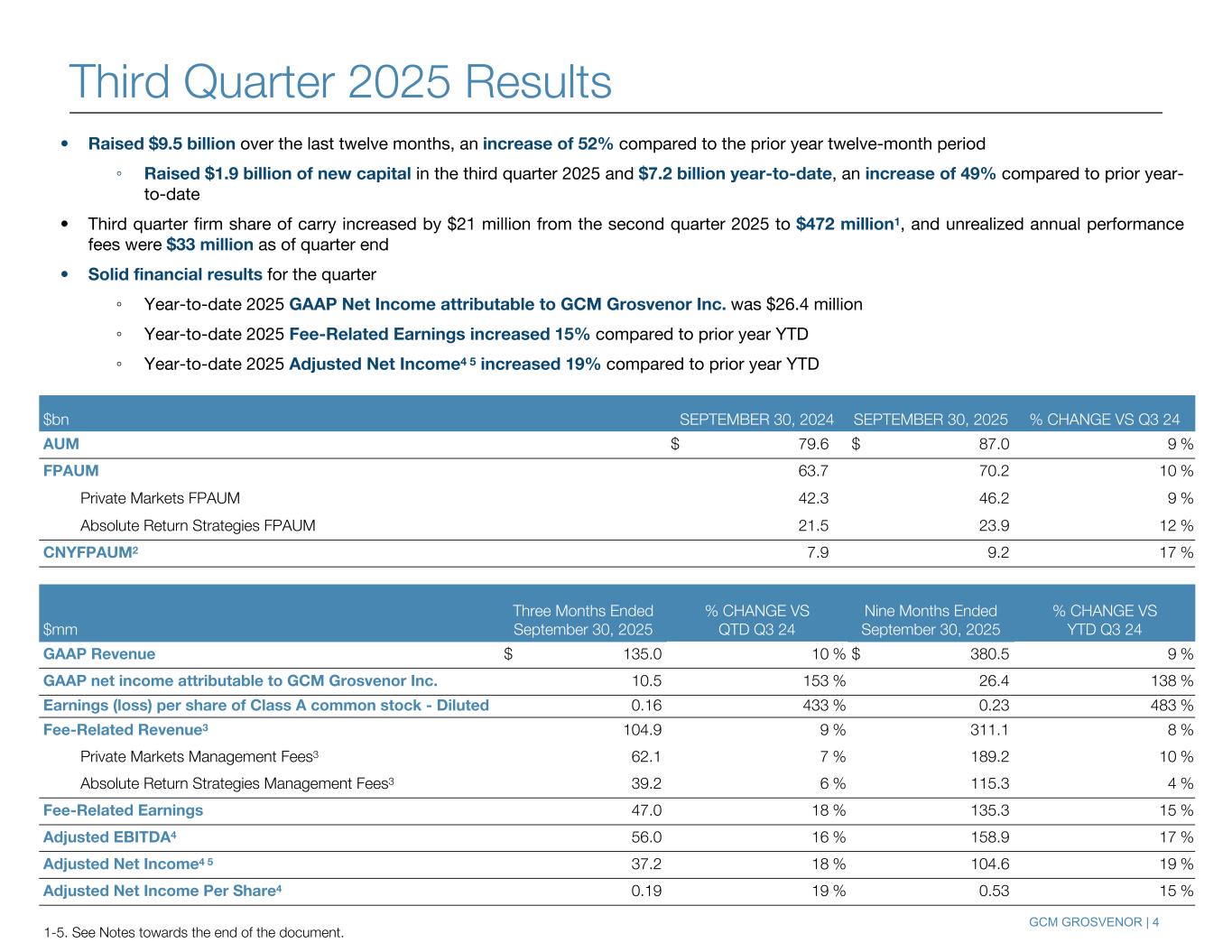

GCM GROSVENOR | 4 $bn SEPTEMBER 30, 2024 SEPTEMBER 30, 2025 % CHANGE VS Q3 24 AUM $ 79.6 $ 87.0 9 % FPAUM 63.7 70.2 10 % Private Markets FPAUM 42.3 46.2 9 % Absolute Return Strategies FPAUM 21.5 23.9 12 % CNYFPAUM2 7.9 9.2 17 % $mm Three Months Ended September 30, 2025 % CHANGE VS QTD Q3 24 Nine Months Ended September 30, 2025 % CHANGE VS YTD Q3 24 GAAP Revenue $ 135.0 10 % $ 380.5 9 % GAAP net income attributable to GCM Grosvenor Inc. 10.5 153 % 26.4 138 % Earnings (loss) per share of Class A common stock - Diluted 0.16 433 % 0.23 483 % Fee-Related Revenue3 104.9 9 % 311.1 8 % Private Markets Management Fees3 62.1 7 % 189.2 10 % Absolute Return Strategies Management Fees3 39.2 6 % 115.3 4 % Fee-Related Earnings 47.0 18 % 135.3 15 % Adjusted EBITDA4 56.0 16 % 158.9 17 % Adjusted Net Income4 5 37.2 18 % 104.6 19 % Adjusted Net Income Per Share4 0.19 19 % 0.53 15 % • Raised $9.5 billion over the last twelve months, an increase of 52% compared to the prior year twelve-month period ◦ Raised $1.9 billion of new capital in the third quarter 2025 and $7.2 billion year-to-date, an increase of 49% compared to prior year- to-date • Third quarter firm share of carry increased by $21 million from the second quarter 2025 to $472 million1, and unrealized annual performance fees were $33 million as of quarter end • Solid financial results for the quarter ◦ Year-to-date 2025 GAAP Net Income attributable to GCM Grosvenor Inc. was $26.4 million ◦ Year-to-date 2025 Fee-Related Earnings increased 15% compared to prior year YTD ◦ Year-to-date 2025 Adjusted Net Income4 5 increased 19% compared to prior year YTD 1-5. See Notes towards the end of the document. Third Quarter 2025 Results

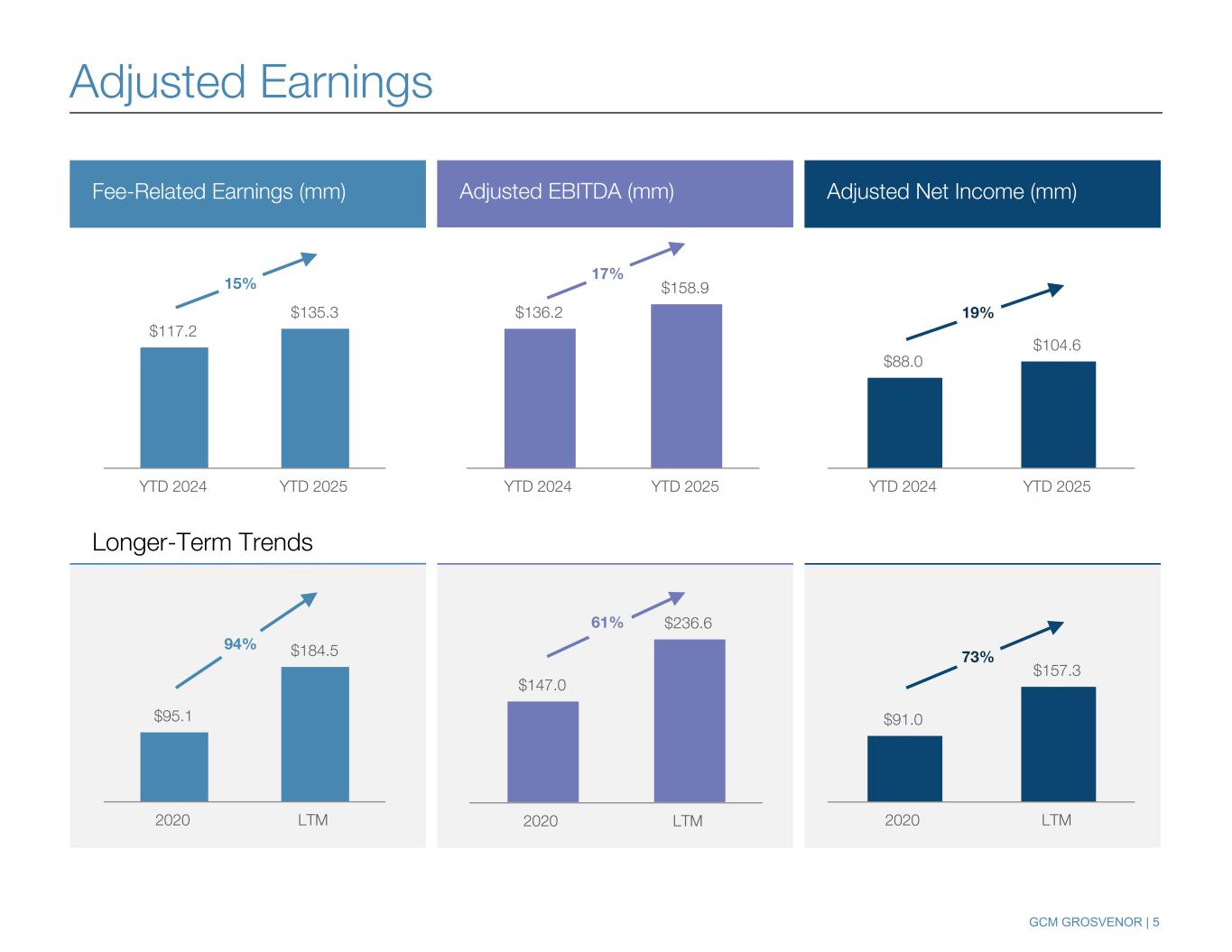

GCM GROSVENOR | 5 Adjusted Earnings Fee-Related Earnings (mm) Adjusted EBITDA (mm) Adjusted Net Income (mm) Longer-Term Trends $91.0 $157.3 91.0 157.3 2020 LTM $95.1 $184.5 2020 LTM $147.0 $236.6 2020 LTM 61% 73% 94% $88.0 $104.6 88.0 104.6 YTD 2024 YTD 2025 $117.2 $135.3 YTD 2024 YTD 2025 $136.2 $158.9 YTD 2024 YTD 2025 17% 19% 15%

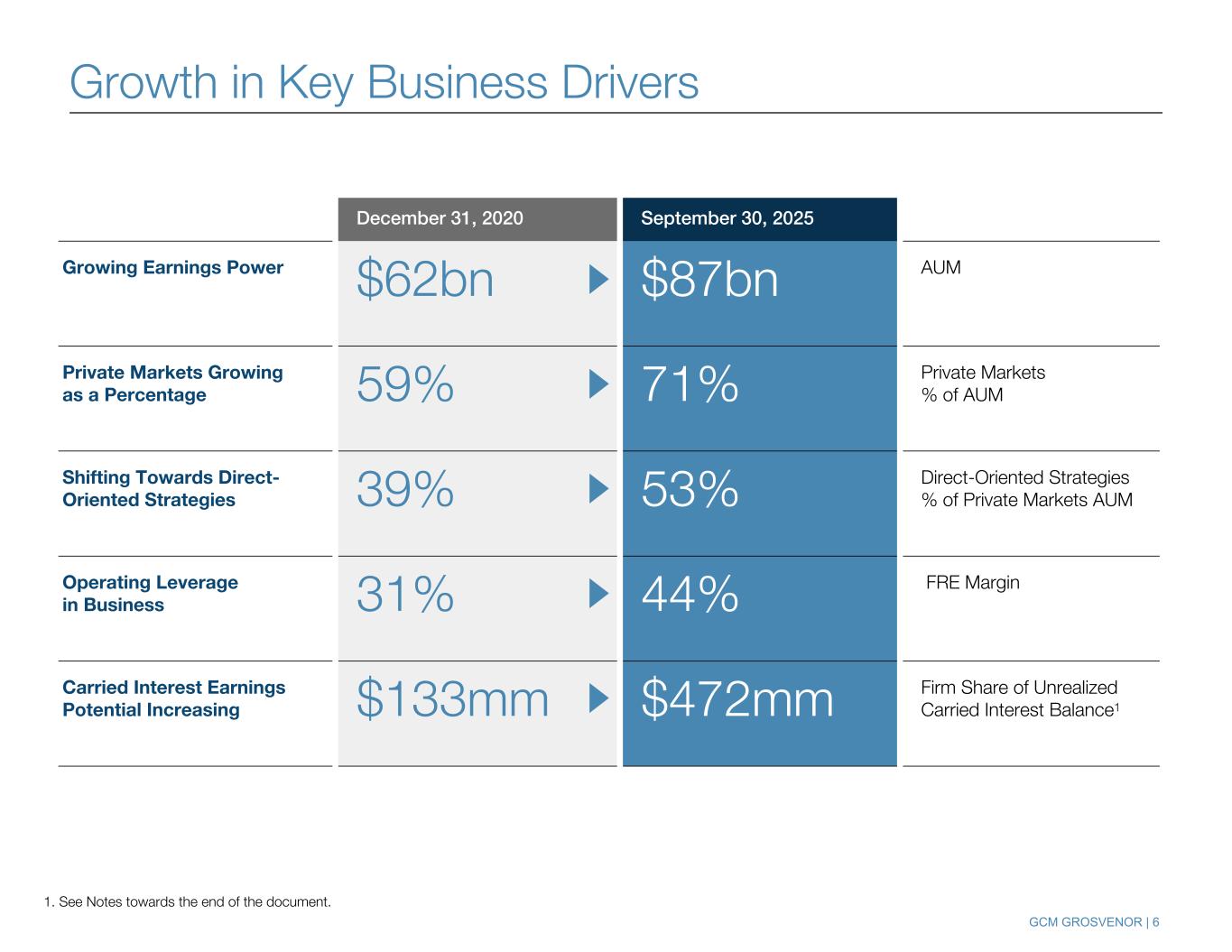

GCM GROSVENOR | 6 Growth in Key Business Drivers December 31, 2020 September 30, 2025 Growing Earnings Power $62bn $87bn AUM Private Markets Growing as a Percentage 59% 71% Private Markets % of AUM Shifting Towards Direct- Oriented Strategies 39% 53% Direct-Oriented Strategies % of Private Markets AUM Operating Leverage in Business 31% 44% FRE Margin Carried Interest Earnings Potential Increasing $133mm $472mm Firm Share of Unrealized Carried Interest Balance1 1. See Notes towards the end of the document.

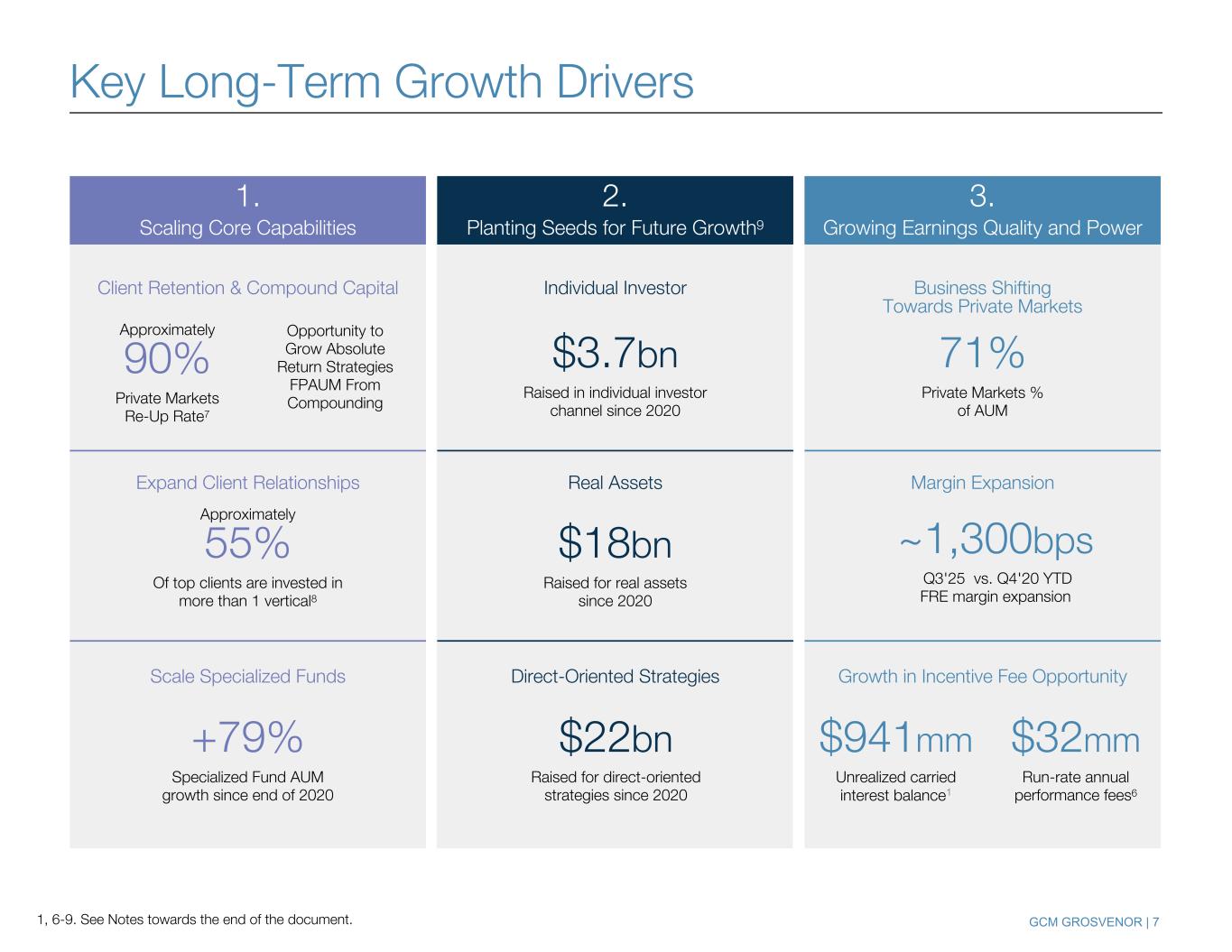

GCM GROSVENOR | 7 Business Shifting Towards Private Markets 1, 6-9. See Notes towards the end of the document. Expand Client Relationships Approximately 55% Of top clients are invested in more than 1 vertical8 ~1,300bps Q3'25 vs. Q4'20 YTD FRE margin expansion Real Assets Margin Expansion Individual Investor 1. Scaling Core Capabilities +79% Specialized Fund AUM growth since end of 2020 Approximately 90% Private Markets Re-Up Rate7 Opportunity to Grow Absolute Return Strategies FPAUM From Compounding Key Long-Term Growth Drivers 2. Planting Seeds for Future Growth9 3. Growing Earnings Quality and Power Scale Specialized Funds Direct-Oriented Strategies Growth in Incentive Fee Opportunity Client Retention & Compound Capital $3.7bn Raised in individual investor channel since 2020 $18bn Raised for real assets since 2020 $22bn Raised for direct-oriented strategies since 2020 71% Private Markets % of AUM $941mm Unrealized carried interest balance1 $32mm Run-rate annual performance fees6

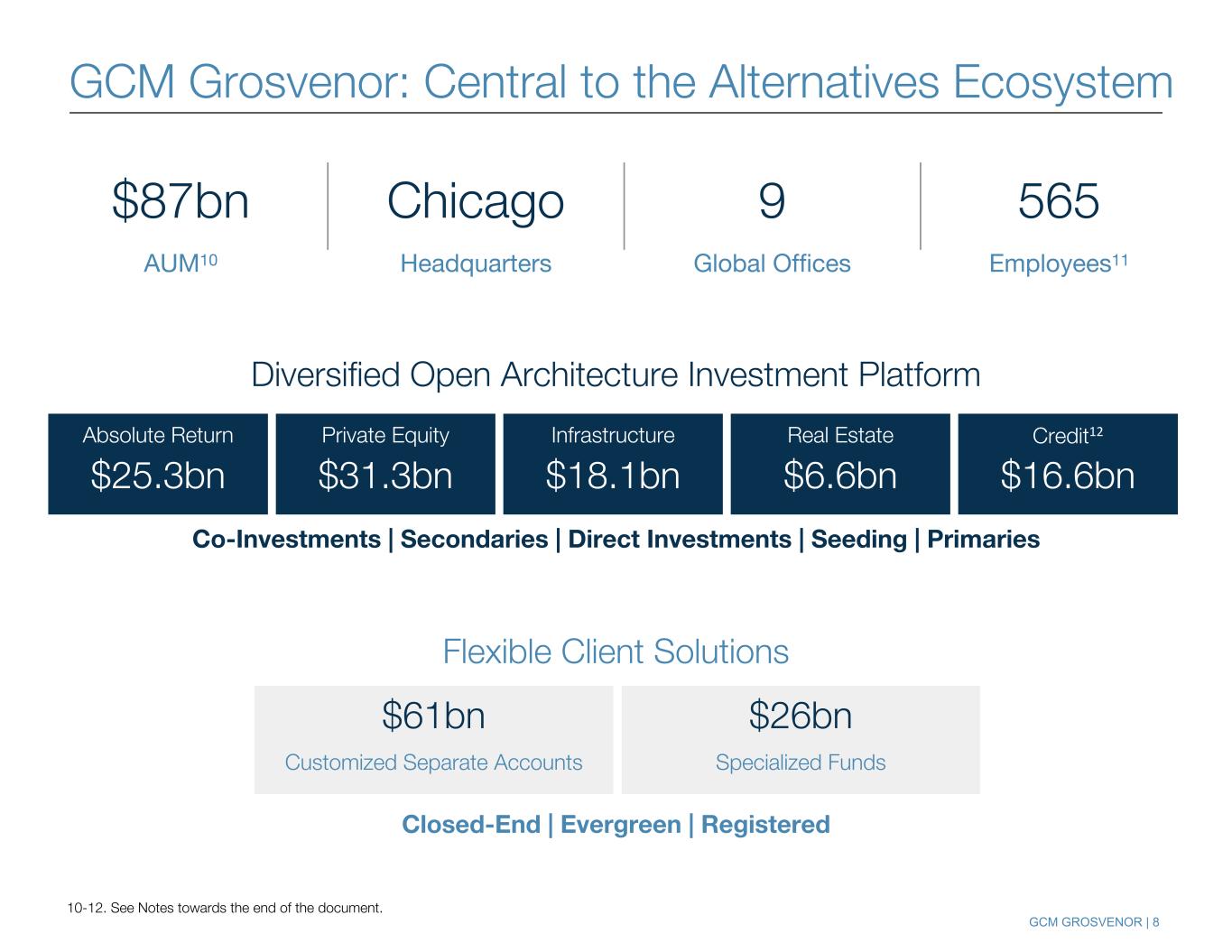

GCM GROSVENOR | 8 Private Equity $31.3bn Credit12 $16.6bn Infrastructure $18.1bn Absolute Return $25.3bn Real Estate $6.6bn Flexible Client Solutions Diversified Open Architecture Investment Platform GCM Grosvenor: Central to the Alternatives Ecosystem Co-Investments | Secondaries | Direct Investments | Seeding | Primaries 10-12. See Notes towards the end of the document. $87bn Chicago 9 565 AUM10 Headquarters Global Offices Employees11 $61bn Customized Separate Accounts $26bn Specialized Funds Closed-End | Evergreen | Registered

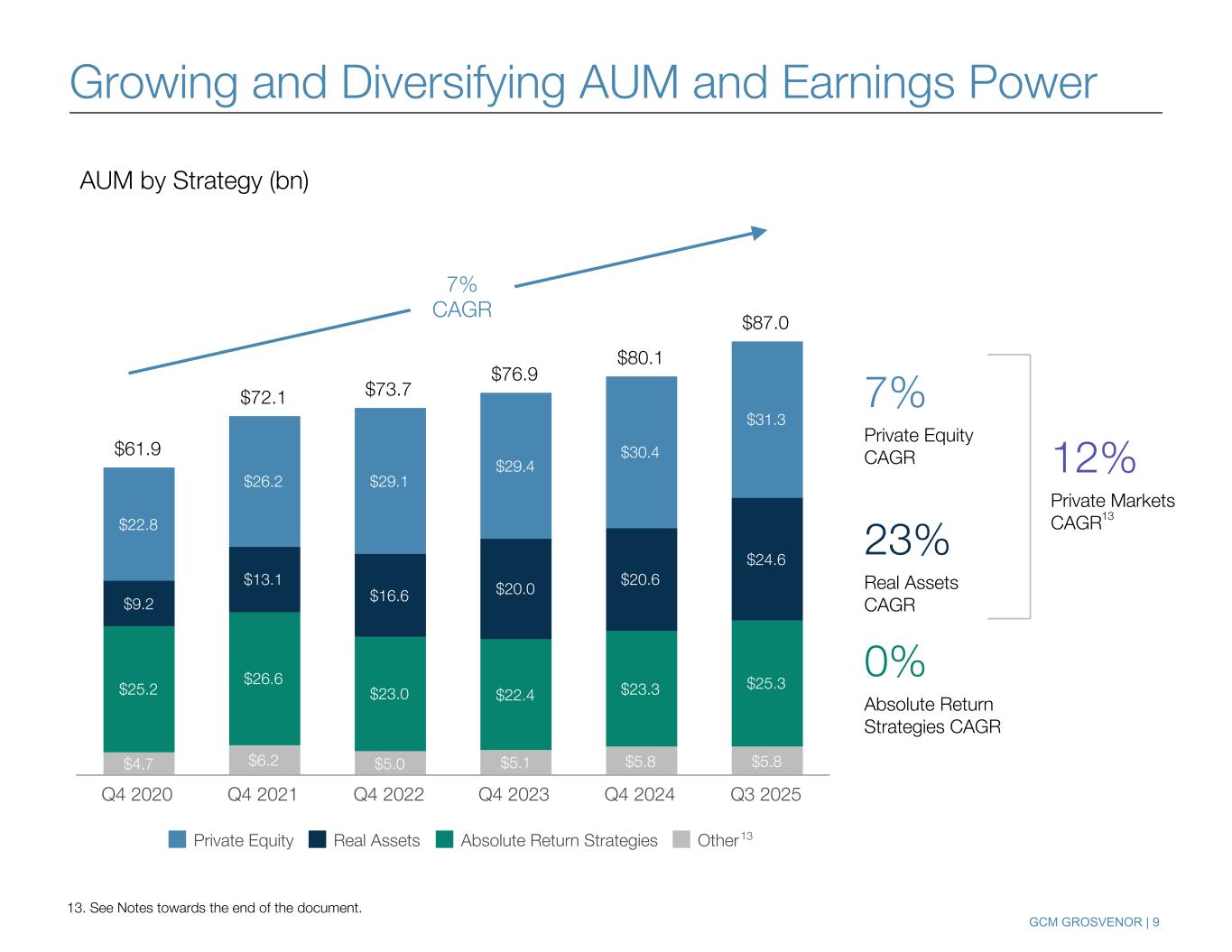

GCM GROSVENOR | 9 Growing and Diversifying AUM and Earnings Power $61.9 $72.1 $73.7 $76.9 $80.1 $87.0 $4.7 $6.2 $5.0 $5.1 $5.8 $5.8 $25.2 $26.6 $23.0 $22.4 $23.3 $25.3 $9.2 $13.1 $16.6 $20.0 $20.6 $24.6 $22.8 $26.2 $29.1 $29.4 $30.4 $31.3 Private Equity Real Assets Absolute Return Strategies Other Q4 2020 Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q3 2025 7% Private Equity CAGR 0% Absolute Return Strategies CAGR 23% Real Assets CAGR AUM by Strategy (bn) 13. See Notes towards the end of the document. 7% CAGR 12% Private Markets CAGR 13 13

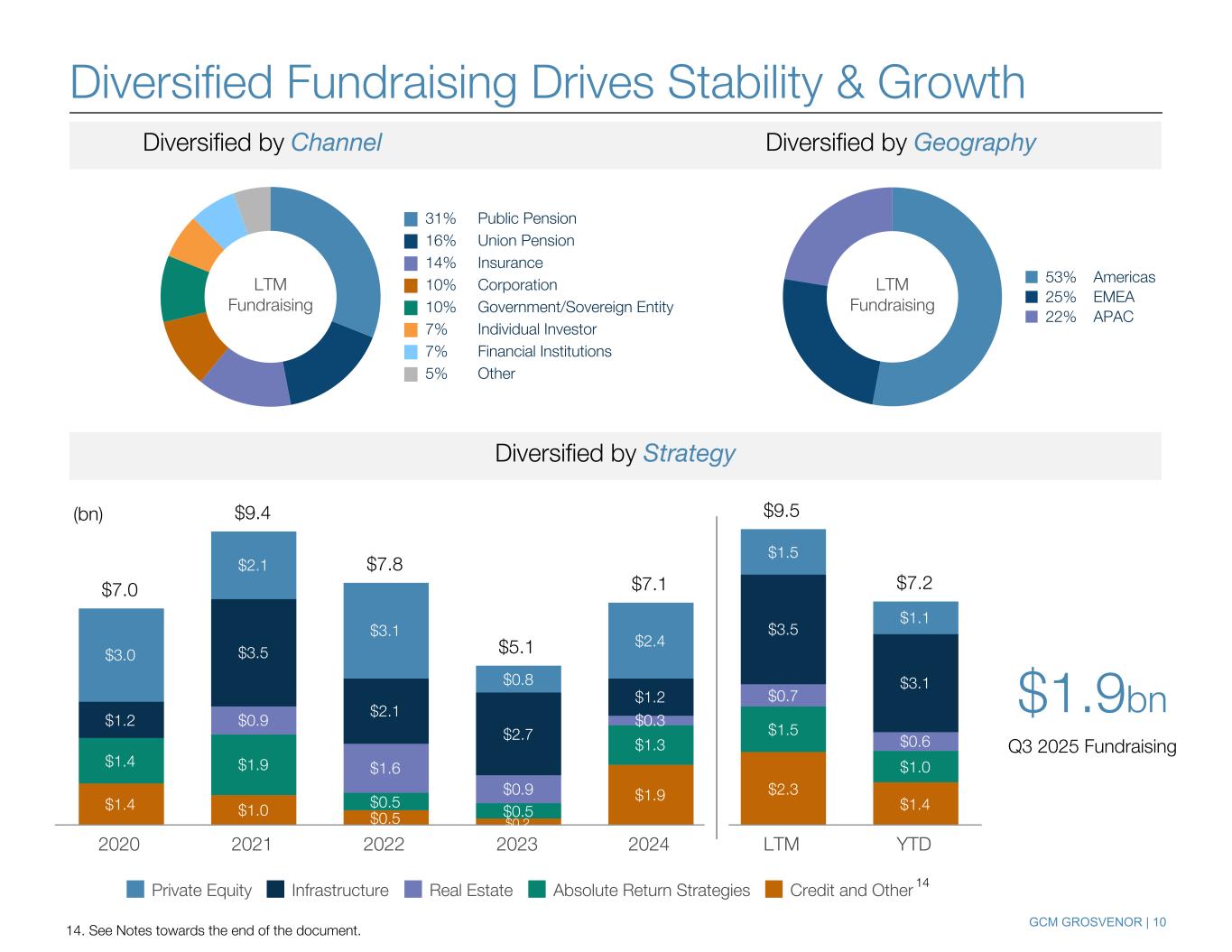

GCM GROSVENOR | 10 Diversified Fundraising Drives Stability & Growth $7.0 $9.4 $7.8 $5.1 $7.1 $9.5 $7.2 $1.4 $1.0 $0.5 $0.2 $1.9 $2.3 $1.4 $1.4 $1.9 $0.5 $0.5 $1.3 $1.5 $1.0 $0.9 $1.6 $0.9 $0.3 $0.7 $0.6 $1.2 $3.5 $2.1 $2.7 $1.2 $3.5 $3.1 $3.0 $2.1 $3.1 $0.8 $2.4 $1.5 $1.1 Private Equity Infrastructure Real Estate Absolute Return Strategies Credit and Other 2020 2021 2022 2023 2024 LTM YTD 14. See Notes towards the end of the document. 31% Public Pension 16% Union Pension 14% Insurance 10% Corporation 10% Government/Sovereign Entity 7% Individual Investor 7% Financial Institutions 5% Other 53% Americas 25% EMEA 22% APAC LTM Fundraising LTM Fundraising 14 Diversified by Strategy Diversified by Channel Diversified by Geography (bn) $1.9bn Q3 2025 Fundraising

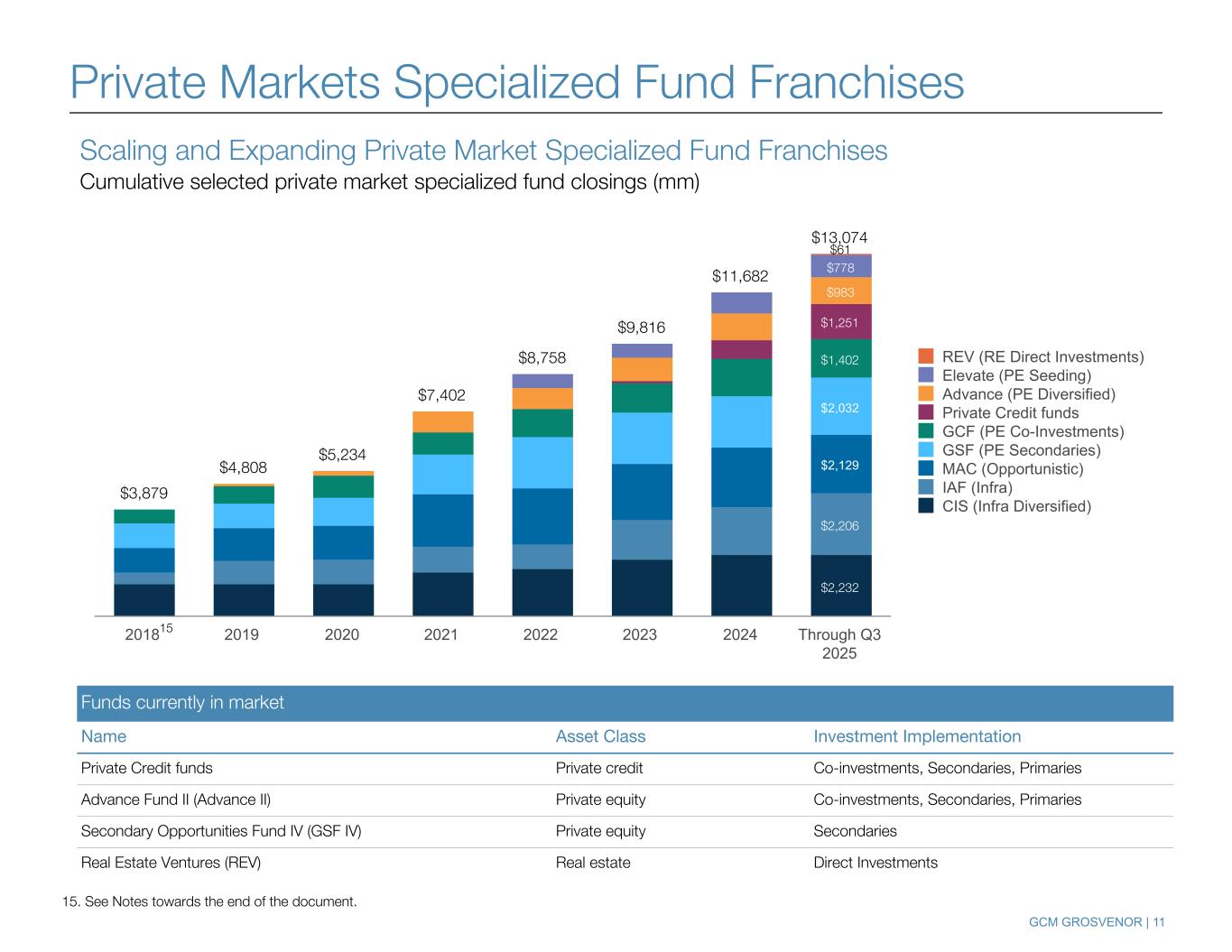

GCM GROSVENOR | 11 $3,879 $4,808 $5,234 $7,402 $8,758 $9,816 $11,682 $13,074 $2,232 $2,206 $2,129 $2,032 $1,402 $1,251 $983 $778 REV (RE Direct Investments) Elevate (PE Seeding) Advance (PE Diversified) Private Credit funds GCF (PE Co-Investments) GSF (PE Secondaries) MAC (Opportunistic) IAF (Infra) CIS (Infra Diversified) 2018 2019 2020 2021 2022 2023 2024 Through Q3 2025 Scaling and Expanding Private Market Specialized Fund Franchises Cumulative selected private market specialized fund closings (mm) Funds currently in market Name Asset Class Investment Implementation Private Credit funds Private credit Co-investments, Secondaries, Primaries Advance Fund II (Advance II) Private equity Co-investments, Secondaries, Primaries Secondary Opportunities Fund IV (GSF IV) Private equity Secondaries Real Estate Ventures (REV) Real estate Direct Investments 15 $61 15. See Notes towards the end of the document. Private Markets Specialized Fund Franchises

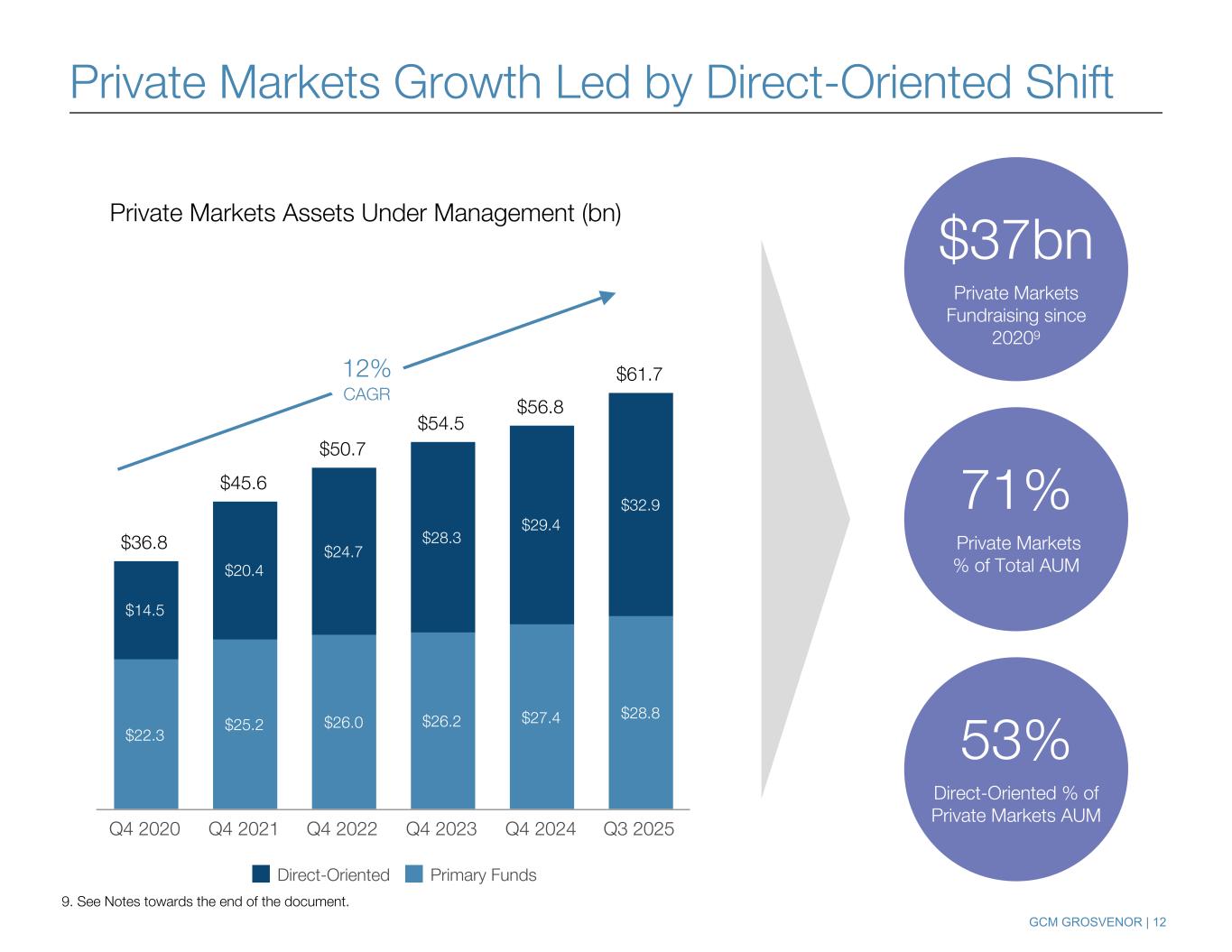

GCM GROSVENOR | 12 Private Markets Growth Led by Direct-Oriented Shift Private Markets Assets Under Management (bn) 71% Private Markets % of Total AUM $37bn Private Markets Fundraising since 20209 $36.8 $45.6 $50.7 $54.5 $56.8 $61.7 $22.3 $25.2 $26.0 $26.2 $27.4 $28.8 $14.5 $20.4 $24.7 $28.3 $29.4 $32.9 Direct-Oriented Primary Funds Q4 2020 Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q3 2025 12% CAGR 53% Direct-Oriented % of Private Markets AUM 9. See Notes towards the end of the document.

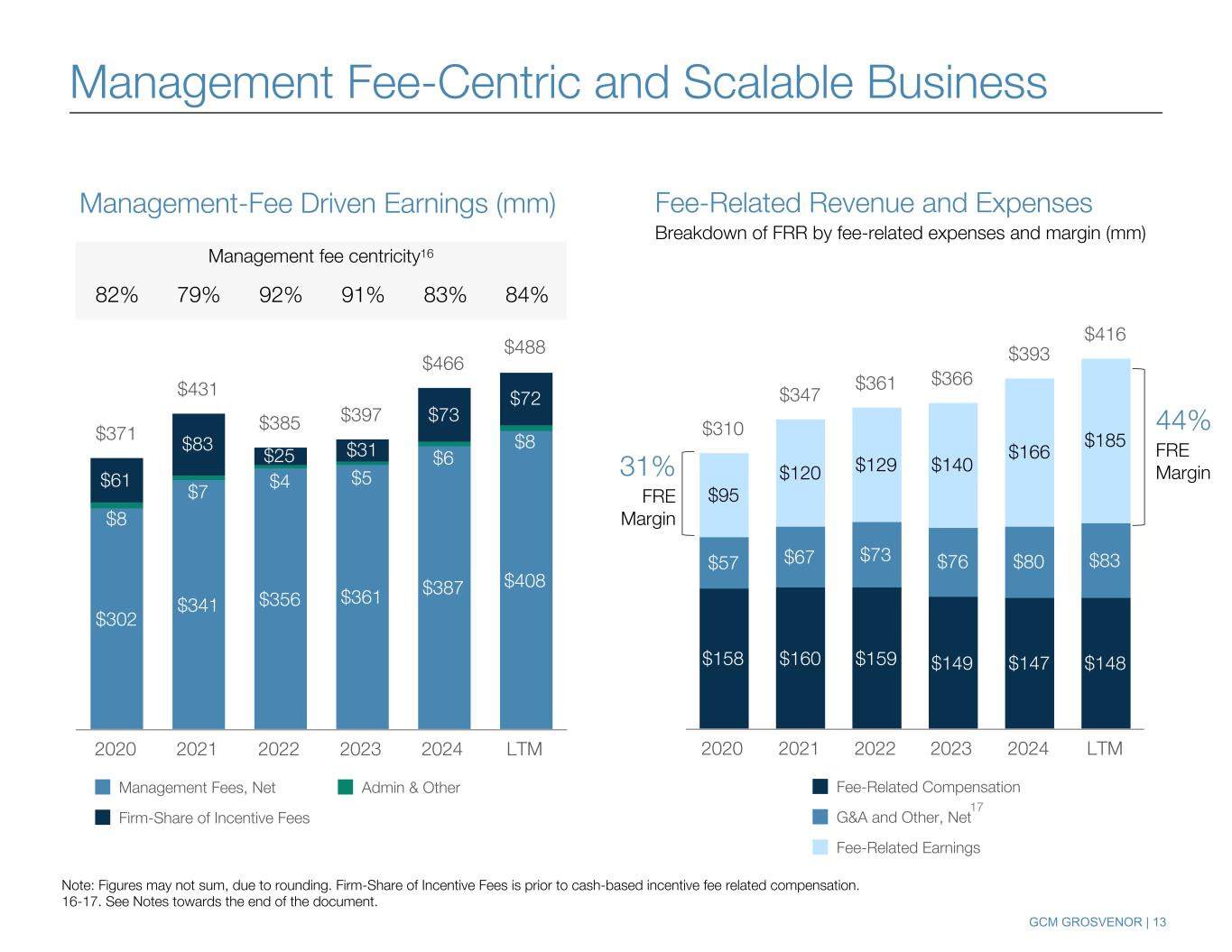

GCM GROSVENOR | 13 Management Fee-Centric and Scalable Business $302 $341 $356 $361 $387 $408 $8 $7 $4 $5 $6 $8 $61 $83 $25 $31 $73 $72 $371 $431 $385 $397 $466 $488 Management Fees, Net Admin & Other Firm-Share of Incentive Fees 2020 2021 2022 2023 2024 LTM $158 $160 $159 $149 $147 $148 $57 $67 $73 $76 $80 $83 $95 $120 $129 $140 $166 $185 $310 $347 $361 $366 $393 $416 Fee-Related Compensation G&A and Other, Net Fee-Related Earnings 2020 2021 2022 2023 2024 LTM Fee-Related Revenue and Expenses Breakdown of FRR by fee-related expenses and margin (mm) Management-Fee Driven Earnings (mm) Management fee centricity16 82% 79% 92% 91% 83% 84% 31% FRE Margin 44% FRE Margin Note: Figures may not sum, due to rounding. Firm-Share of Incentive Fees is prior to cash-based incentive fee related compensation. 16-17. See Notes towards the end of the document. 17

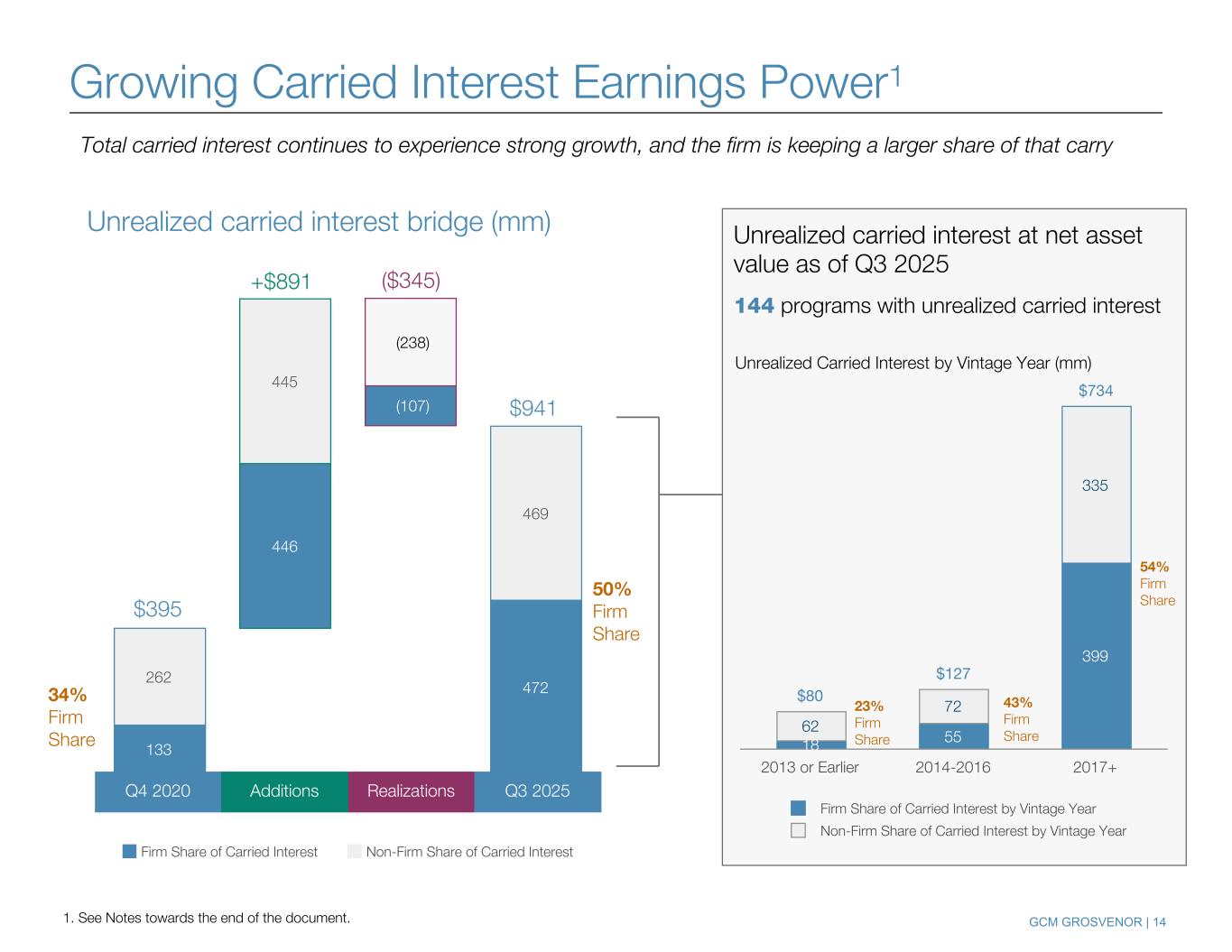

GCM GROSVENOR | 14 133 446 472 262 445 469 Firm Share of Carried Interest Non-Firm Share of Carried Interest 1. See Notes towards the end of the document. Unrealized carried interest at net asset value as of Q3 2025 144 programs with unrealized carried interest Unrealized Carried Interest by Vintage Year (mm) $ million 50% Firm Share 34% Firm Share Gr wing Carried Interest Earnings Power1 Total carried interest continues to experience strong growth, and the firm is keeping a larger share of that carry Unrealized carried interest bridge (mm) $80 $127 $734 18 55 399 62 72 335 Firm Share of Carried Interest by Vintage Year Non-Firm Share of Carried Interest by Vintage Year 2013 or Earlier 2014-2016 2017+ 43% Firm Share 54% Firm Share 23% Firm Share Q4 2020 Additions Realizations Q3 2025 $395 ($345) (107) (238) +$891 $941

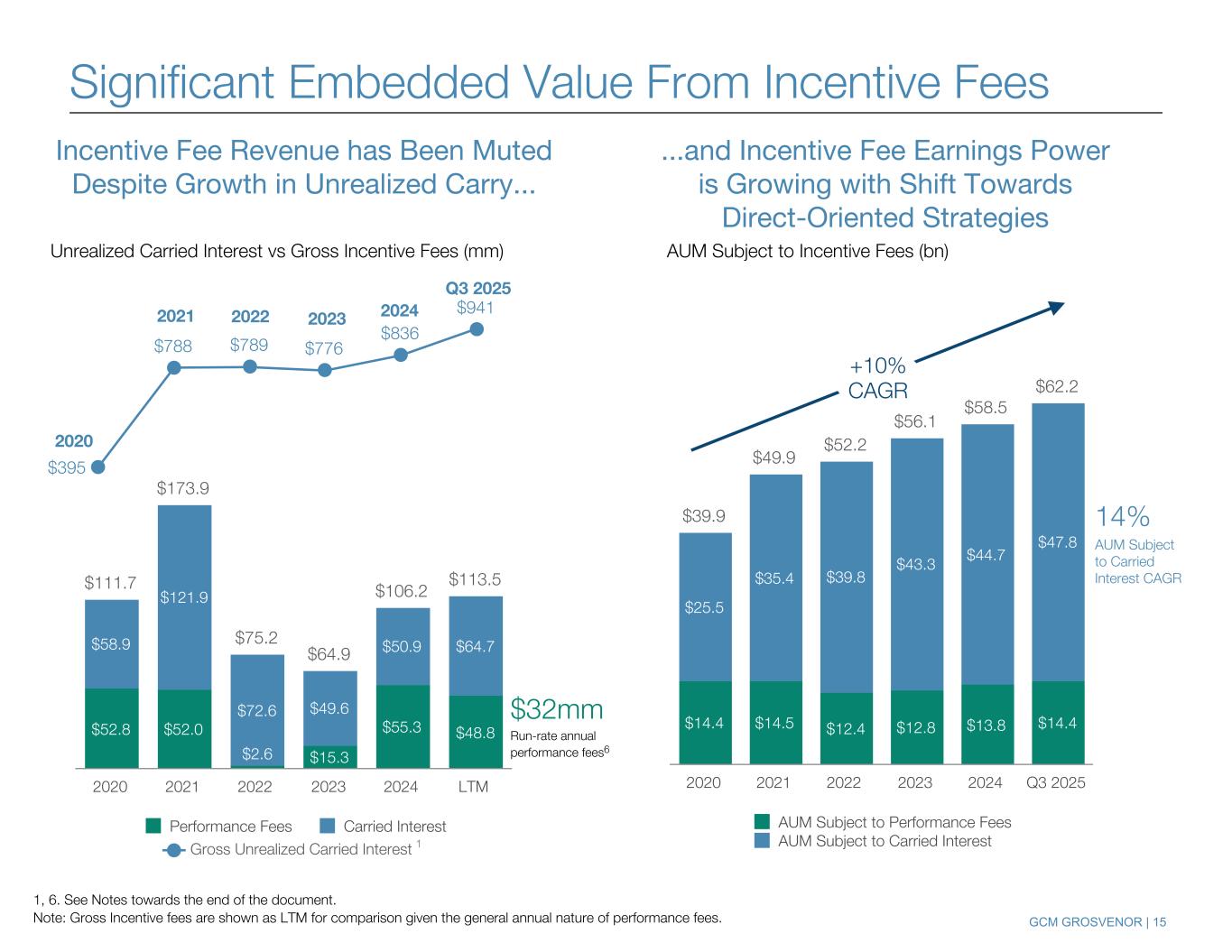

GCM GROSVENOR | 15 $395 $788 $789 $776 $836 $941 Gross Unrealized Carried Interest $111.7 $173.9 $75.2 $64.9 $106.2 $113.5 $52.8 $52.0 $2.6 $15.3 $55.3 $48.8 $58.9 $121.9 $72.6 $49.6 $50.9 $64.7 Performance Fees Carried Interest 2020 2021 2022 2023 2024 LTM Significant Embedded Value From Incentive Fees 1, 6. See Notes towards the end of the document. Note: Gross Incentive fees are shown as LTM for comparison given the general annual nature of performance fees. 2024202320222021 2020 1 $39.9 $49.9 $52.2 $56.1 $58.5 $62.2 $14.4 $14.5 $12.4 $12.8 $13.8 $14.4 $25.5 $35.4 $39.8 $43.3 $44.7 $47.8 AUM Subject to Performance Fees AUM Subject to Carried Interest 2020 2021 2022 2023 2024 Q3 2025 +10% CAGR $32mm Run-rate annual performance fees6 14% AUM Subject to Carried Interest CAGR Incentive Fee Revenue has Been Muted Despite Growth in Unrealized Carry... ...and Incentive Fee Earnings Power is Growing with Shift Towards Direct-Oriented Strategies Unrealized Carried Interest vs Gross Incentive Fees (mm) AUM Subject to Incentive Fees (bn) Q3 2025

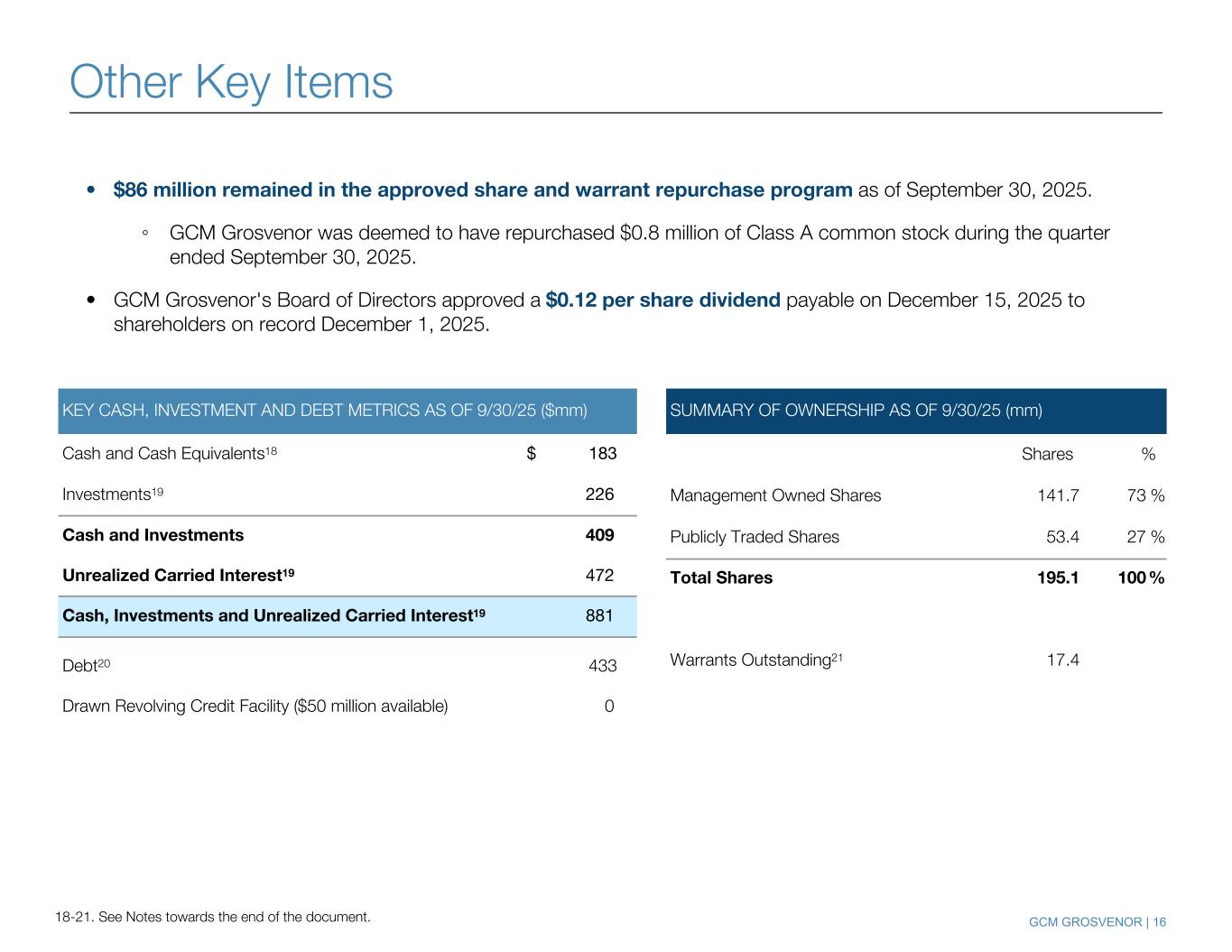

GCM GROSVENOR | 1618-21. See Notes towards the end of the document. • $86 million remained in the approved share and warrant repurchase program as of September 30, 2025. ◦ GCM Grosvenor was deemed to have repurchased $0.8 million of Class A common stock during the quarter ended September 30, 2025. • GCM Grosvenor's Board of Directors approved a $0.12 per share dividend payable on December 15, 2025 to shareholders on record December 1, 2025. SUMMARY OF OWNERSHIP AS OF 9/30/25 (mm) Shares % Management Owned Shares 141.7 73 % Publicly Traded Shares 53.4 27 % Total Shares 195.1 100 % Warrants Outstanding21 17.4 Other Key Items KEY CASH, INVESTMENT AND DEBT METRICS AS OF 9/30/25 ($mm) Cash and Cash Equivalents18 $ 183 Investments19 226 Cash and Investments 409 Unrealized Carried Interest19 472 Cash, Investments and Unrealized Carried Interest19 881 Debt20 433 Drawn Revolving Credit Facility ($50 million available) 0

GCM GROSVENOR | 17 Supplemental Information

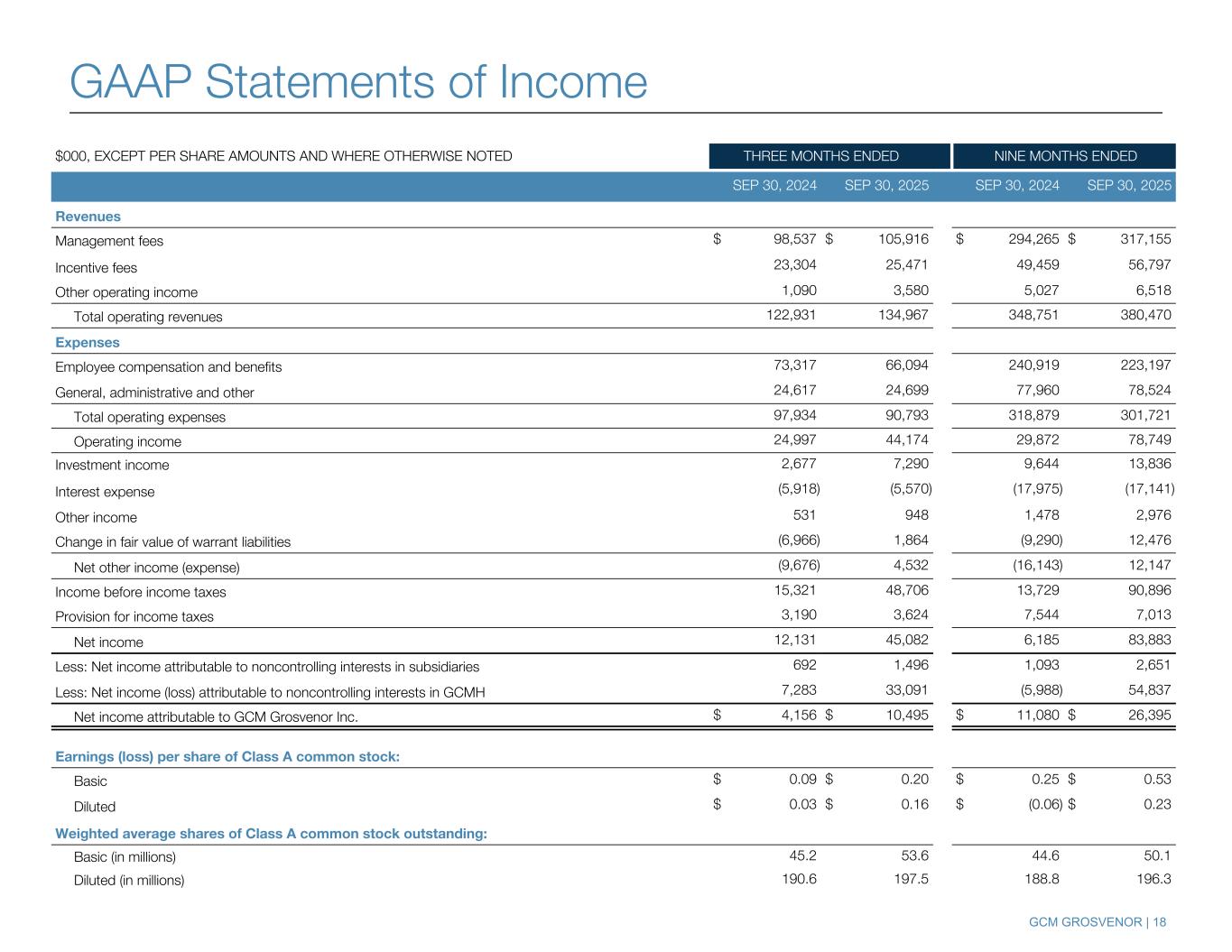

GCM GROSVENOR | 18 $000, EXCEPT PER SHARE AMOUNTS AND WHERE OTHERWISE NOTED THREE MONTHS ENDED NINE MONTHS ENDED SEP 30, 2024 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Revenues Management fees $ 98,537 $ 105,916 $ 294,265 $ 317,155 Incentive fees 23,304 25,471 49,459 56,797 Other operating income 1,090 3,580 5,027 6,518 Total operating revenues 122,931 134,967 348,751 380,470 Expenses Employee compensation and benefits 73,317 66,094 240,919 223,197 General, administrative and other 24,617 24,699 77,960 78,524 Total operating expenses 97,934 90,793 318,879 301,721 Operating income 24,997 44,174 29,872 78,749 Investment income 2,677 7,290 9,644 13,836 Interest expense (5,918) (5,570) (17,975) (17,141) Other income 531 948 1,478 2,976 Change in fair value of warrant liabilities (6,966) 1,864 (9,290) 12,476 Net other income (expense) (9,676) 4,532 (16,143) 12,147 Income before income taxes 15,321 48,706 13,729 90,896 Provision for income taxes 3,190 3,624 7,544 7,013 Net income 12,131 45,082 6,185 83,883 Less: Net income attributable to noncontrolling interests in subsidiaries 692 1,496 1,093 2,651 Less: Net income (loss) attributable to noncontrolling interests in GCMH 7,283 33,091 (5,988) 54,837 Net income attributable to GCM Grosvenor Inc. $ 4,156 $ 10,495 $ 11,080 $ 26,395 Earnings (loss) per share of Class A common stock: Basic $ 0.09 $ 0.20 $ 0.25 $ 0.53 Diluted $ 0.03 $ 0.16 $ (0.06) $ 0.23 Weighted average shares of Class A common stock outstanding: Basic (in millions) 45.2 53.6 44.6 50.1 Diluted (in millions) 190.6 197.5 188.8 196.3 GAAP Statements of Income

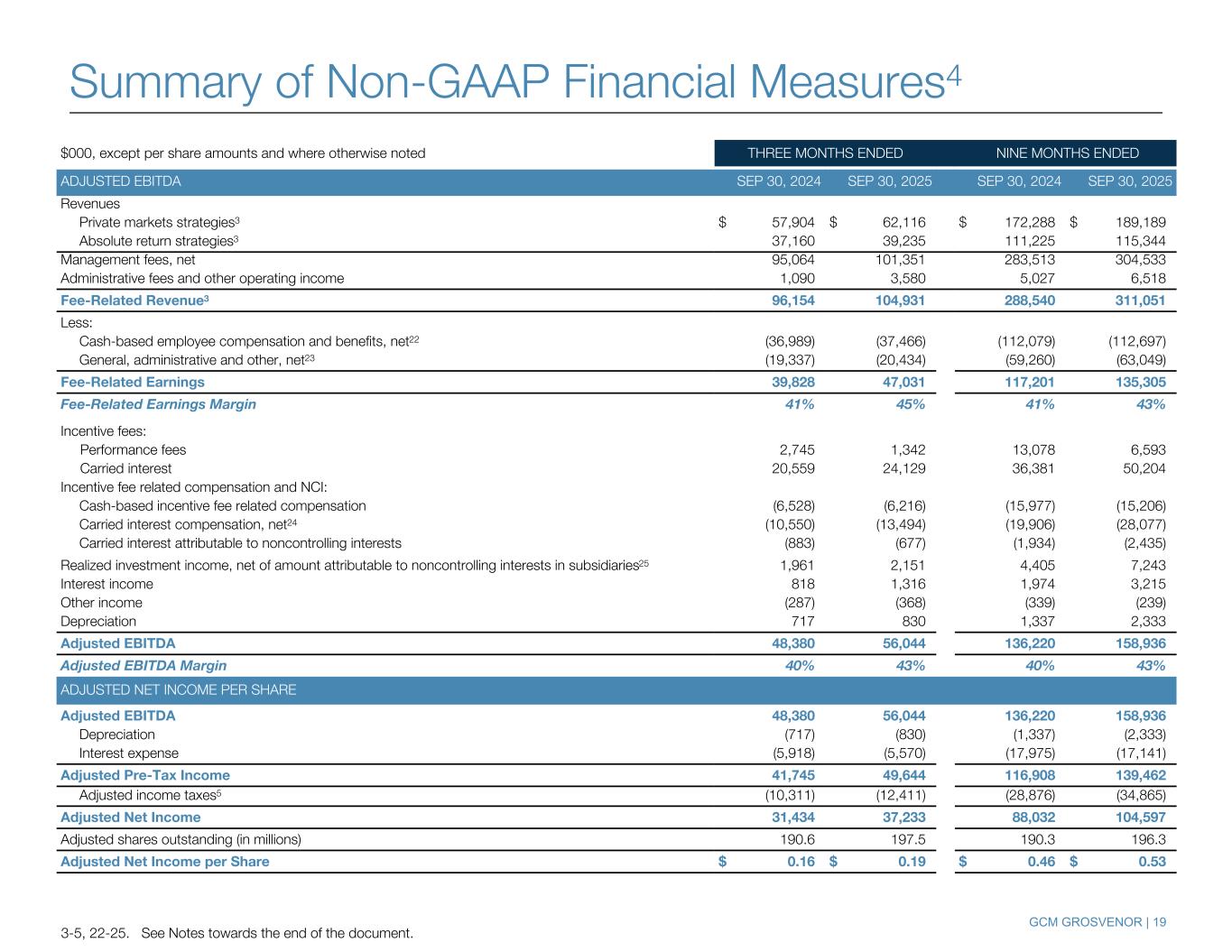

GCM GROSVENOR | 19 3-5, 22-25. See Notes towards the end of the document. $000, except per share amounts and where otherwise noted THREE MONTHS ENDED NINE MONTHS ENDED ADJUSTED EBITDA SEP 30, 2024 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Revenues Private markets strategies3 $ 57,904 $ 62,116 $ 172,288 $ 189,189 Absolute return strategies3 37,160 39,235 111,225 115,344 Management fees, net 95,064 101,351 283,513 304,533 Administrative fees and other operating income 1,090 3,580 5,027 6,518 Fee-Related Revenue3 96,154 104,931 288,540 311,051 Less: Cash-based employee compensation and benefits, net22 (36,989) (37,466) (112,079) (112,697) General, administrative and other, net23 (19,337) (20,434) (59,260) (63,049) Fee-Related Earnings 39,828 47,031 117,201 135,305 Fee-Related Earnings Margin 41 % 45 % 41 % 43 % Incentive fees: Performance fees 2,745 1,342 13,078 6,593 Carried interest 20,559 24,129 36,381 50,204 Incentive fee related compensation and NCI: Cash-based incentive fee related compensation (6,528) (6,216) (15,977) (15,206) Carried interest compensation, net24 (10,550) (13,494) (19,906) (28,077) Carried interest attributable to noncontrolling interests (883) (677) (1,934) (2,435) Realized investment income, net of amount attributable to noncontrolling interests in subsidiaries25 1,961 2,151 4,405 7,243 Interest income 818 1,316 1,974 3,215 Other income (287) (368) (339) (239) Depreciation 717 830 1,337 2,333 Adjusted EBITDA 48,380 56,044 136,220 158,936 Adjusted EBITDA Margin 40 % 43 % 40 % 43 % ADJUSTED NET INCOME PER SHARE Adjusted EBITDA 48,380 56,044 136,220 158,936 Depreciation (717) (830) (1,337) (2,333) Interest expense (5,918) (5,570) (17,975) (17,141) Adjusted Pre-Tax Income 41,745 49,644 116,908 139,462 Adjusted income taxes5 (10,311) (12,411) (28,876) (34,865) Adjusted Net Income 31,434 37,233 88,032 104,597 Adjusted shares outstanding (in millions) 190.6 197.5 190.3 196.3 Adjusted Net Income per Share $ 0.16 $ 0.19 $ 0.46 $ 0.53 Summary of Non-GAAP Financial Measures4

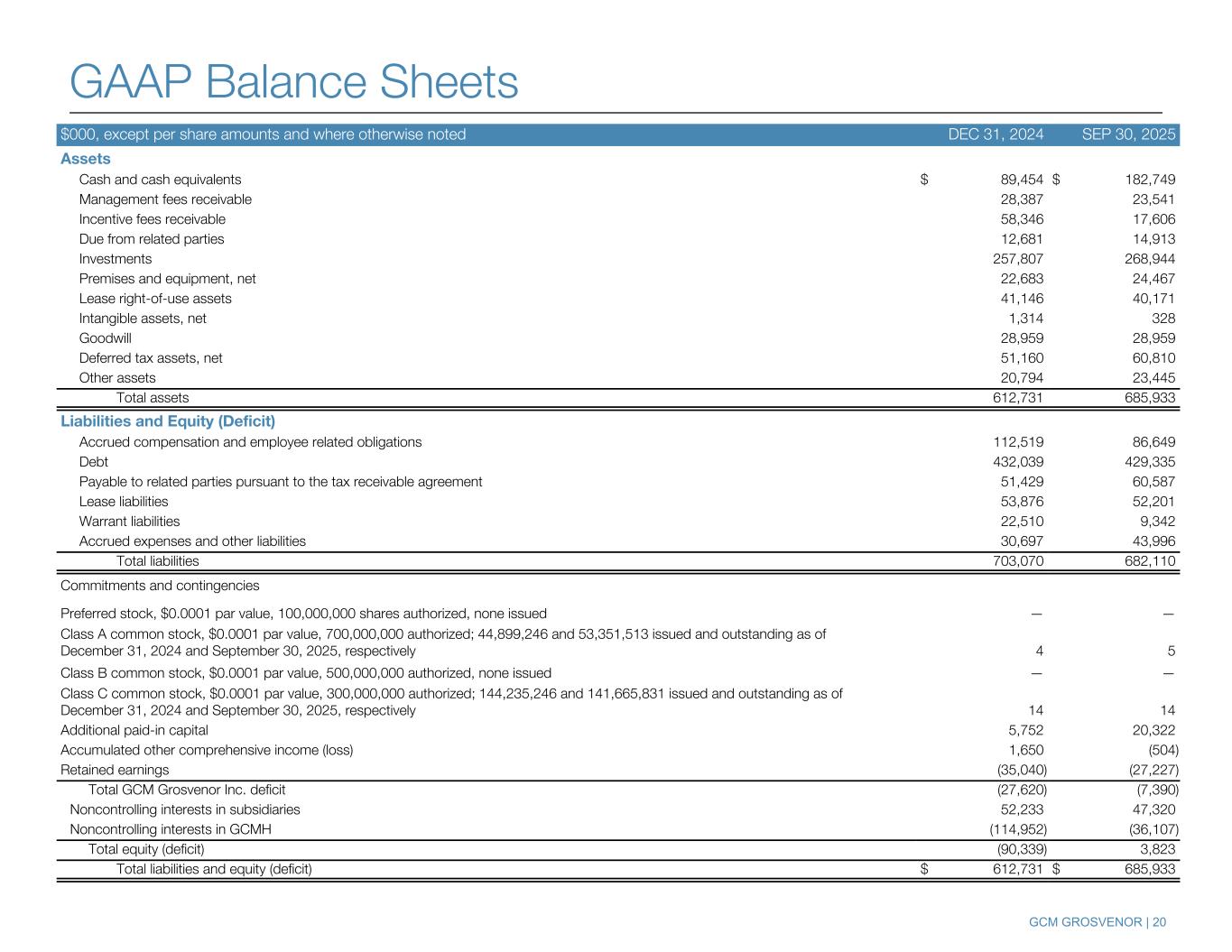

GCM GROSVENOR | 20 $000, except per share amounts and where otherwise noted DEC 31, 2024 SEP 30, 2025 Assets Cash and cash equivalents $ 89,454 $ 182,749 Management fees receivable 28,387 23,541 Incentive fees receivable 58,346 17,606 Due from related parties 12,681 14,913 Investments 257,807 268,944 Premises and equipment, net 22,683 24,467 Lease right-of-use assets 41,146 40,171 Intangible assets, net 1,314 328 Goodwill 28,959 28,959 Deferred tax assets, net 51,160 60,810 Other assets 20,794 23,445 Total assets 612,731 685,933 Liabilities and Equity (Deficit) Accrued compensation and employee related obligations 112,519 86,649 Debt 432,039 429,335 Payable to related parties pursuant to the tax receivable agreement 51,429 60,587 Lease liabilities 53,876 52,201 Warrant liabilities 22,510 9,342 Accrued expenses and other liabilities 30,697 43,996 Total liabilities 703,070 682,110 Commitments and contingencies Preferred stock, $0.0001 par value, 100,000,000 shares authorized, none issued — — Class A common stock, $0.0001 par value, 700,000,000 authorized; 44,899,246 and 53,351,513 issued and outstanding as of December 31, 2024 and September 30, 2025, respectively 4 5 Class B common stock, $0.0001 par value, 500,000,000 authorized, none issued — — Class C common stock, $0.0001 par value, 300,000,000 authorized; 144,235,246 and 141,665,831 issued and outstanding as of December 31, 2024 and September 30, 2025, respectively 14 14 Additional paid-in capital 5,752 20,322 Accumulated other comprehensive income (loss) 1,650 (504) Retained earnings (35,040) (27,227) Total GCM Grosvenor Inc. deficit (27,620) (7,390) Noncontrolling interests in subsidiaries 52,233 47,320 Noncontrolling interests in GCMH (114,952) (36,107) Total equity (deficit) (90,339) 3,823 Total liabilities and equity (deficit) $ 612,731 $ 685,933 GAAP Balance Sheets

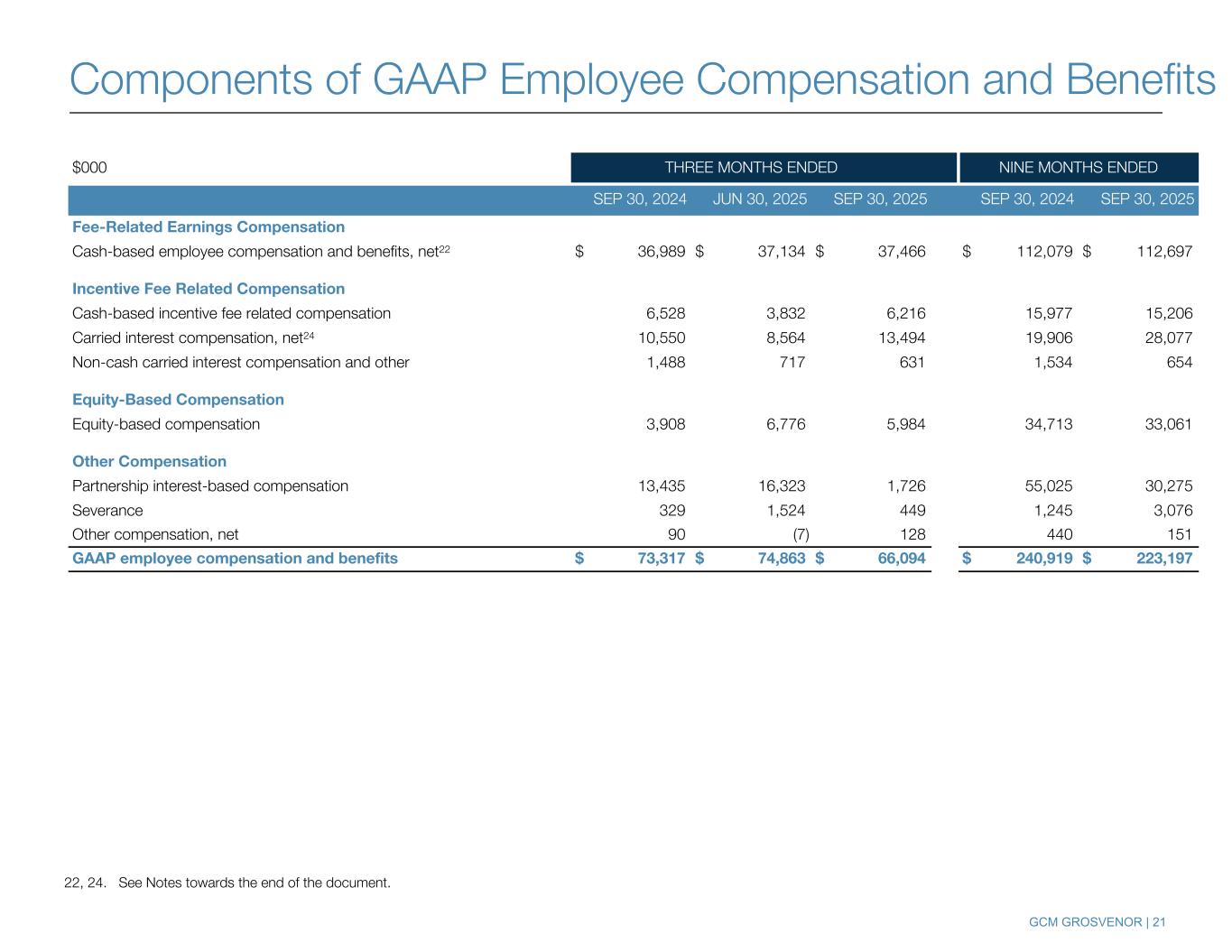

GCM GROSVENOR | 21 $000 THREE MONTHS ENDED NINE MONTHS ENDED SEP 30, 2024 JUN 30, 2025 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Fee-Related Earnings Compensation Cash-based employee compensation and benefits, net22 $ 36,989 $ 37,134 $ 37,466 $ 112,079 $ 112,697 Incentive Fee Related Compensation Cash-based incentive fee related compensation 6,528 3,832 6,216 15,977 15,206 Carried interest compensation, net24 10,550 8,564 13,494 19,906 28,077 Non-cash carried interest compensation and other 1,488 717 631 1,534 654 Equity-Based Compensation Equity-based compensation 3,908 6,776 5,984 34,713 33,061 Other Compensation Partnership interest-based compensation 13,435 16,323 1,726 55,025 30,275 Severance 329 1,524 449 1,245 3,076 Other compensation, net 90 (7) 128 440 151 GAAP employee compensation and benefits $ 73,317 $ 74,863 $ 66,094 $ 240,919 $ 223,197 22, 24. See Notes towards the end of the document. Components of GAAP Employee Compensation and Benefits

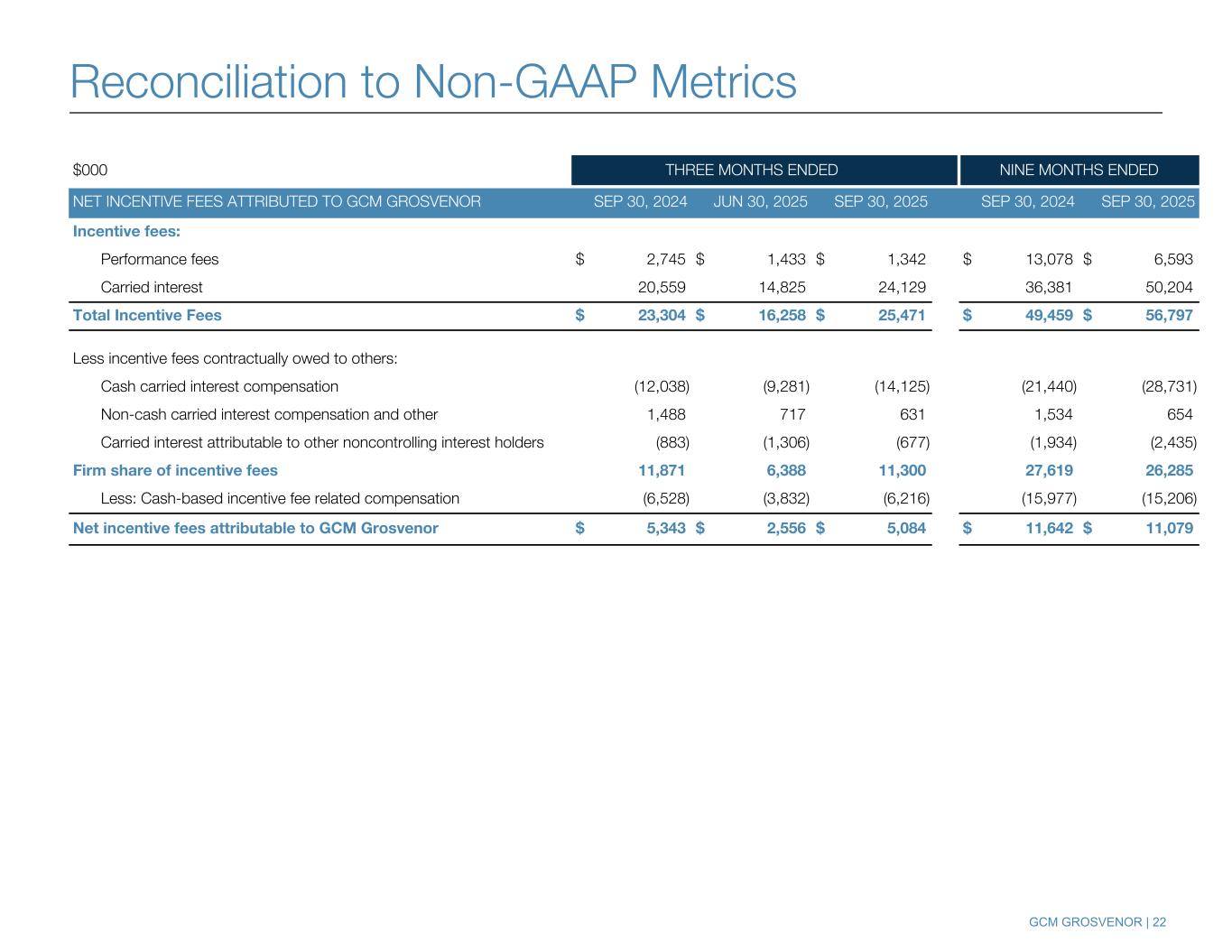

GCM GROSVENOR | 22 $000 THREE MONTHS ENDED NINE MONTHS ENDED NET INCENTIVE FEES ATTRIBUTED TO GCM GROSVENOR SEP 30, 2024 JUN 30, 2025 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Incentive fees: Performance fees $ 2,745 $ 1,433 $ 1,342 $ 13,078 $ 6,593 Carried interest 20,559 14,825 24,129 36,381 50,204 Total Incentive Fees $ 23,304 $ 16,258 $ 25,471 $ 49,459 $ 56,797 Less incentive fees contractually owed to others: Cash carried interest compensation (12,038) (9,281) (14,125) (21,440) (28,731) Non-cash carried interest compensation and other 1,488 717 631 1,534 654 Carried interest attributable to other noncontrolling interest holders (883) (1,306) (677) (1,934) (2,435) Firm share of incentive fees 11,871 6,388 11,300 27,619 26,285 Less: Cash-based incentive fee related compensation (6,528) (3,832) (6,216) (15,977) (15,206) Net incentive fees attributable to GCM Grosvenor $ 5,343 $ 2,556 $ 5,084 $ 11,642 $ 11,079 Reconciliation to Non-GAAP Metrics

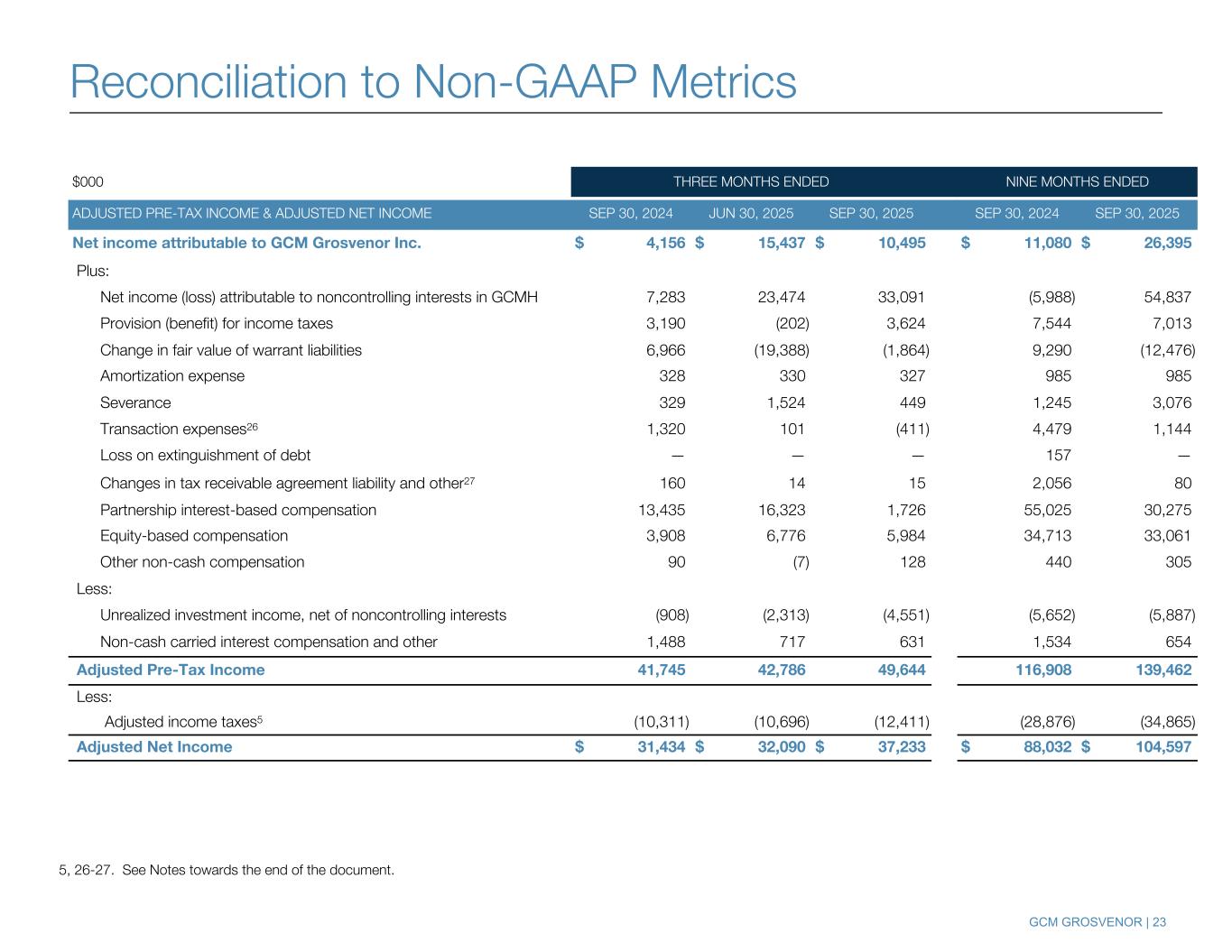

GCM GROSVENOR | 23 $000 THREE MONTHS ENDED NINE MONTHS ENDED ADJUSTED PRE-TAX INCOME & ADJUSTED NET INCOME SEP 30, 2024 JUN 30, 2025 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Net income attributable to GCM Grosvenor Inc. $ 4,156 $ 15,437 $ 10,495 $ 11,080 $ 26,395 Plus: Net income (loss) attributable to noncontrolling interests in GCMH 7,283 23,474 33,091 (5,988) 54,837 Provision (benefit) for income taxes 3,190 (202) 3,624 7,544 7,013 Change in fair value of warrant liabilities 6,966 (19,388) (1,864) 9,290 (12,476) Amortization expense 328 330 327 985 985 Severance 329 1,524 449 1,245 3,076 Transaction expenses26 1,320 101 (411) 4,479 1,144 Loss on extinguishment of debt — — — 157 — Changes in tax receivable agreement liability and other27 160 14 15 2,056 80 Partnership interest-based compensation 13,435 16,323 1,726 55,025 30,275 Equity-based compensation 3,908 6,776 5,984 34,713 33,061 Other non-cash compensation 90 (7) 128 440 305 Less: Unrealized investment income, net of noncontrolling interests (908) (2,313) (4,551) (5,652) (5,887) Non-cash carried interest compensation and other 1,488 717 631 1,534 654 Adjusted Pre-Tax Income 41,745 42,786 49,644 116,908 139,462 Less: Adjusted income taxes5 (10,311) (10,696) (12,411) (28,876) (34,865) Adjusted Net Income $ 31,434 $ 32,090 $ 37,233 $ 88,032 $ 104,597 5, 26-27. See Notes towards the end of the document. Reconciliation to Non-GAAP Metrics

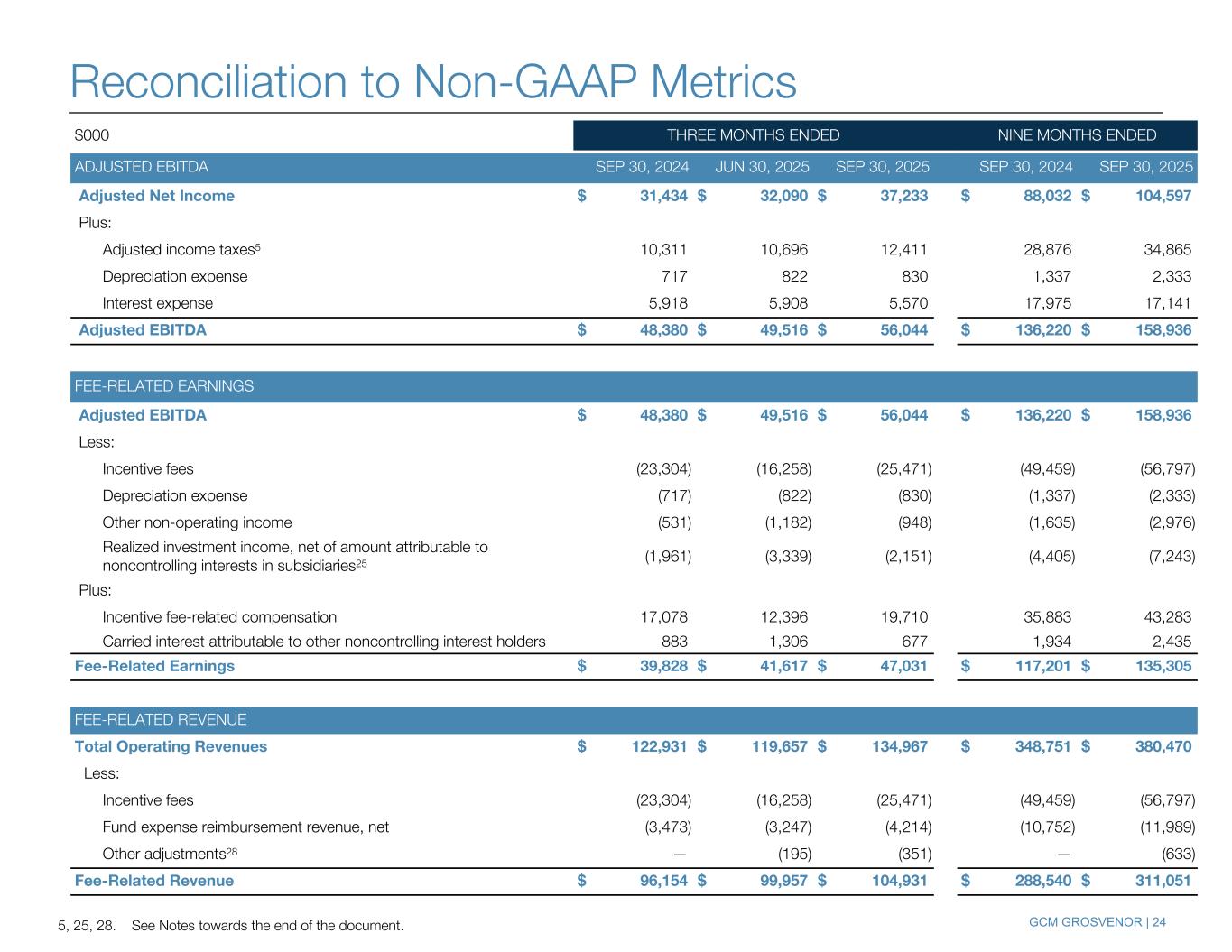

GCM GROSVENOR | 24 $000 THREE MONTHS ENDED NINE MONTHS ENDED ADJUSTED EBITDA SEP 30, 2024 JUN 30, 2025 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Adjusted Net Income $ 31,434 $ 32,090 $ 37,233 $ 88,032 $ 104,597 Plus: Adjusted income taxes5 10,311 10,696 12,411 28,876 34,865 Depreciation expense 717 822 830 1,337 2,333 Interest expense 5,918 5,908 5,570 17,975 17,141 Adjusted EBITDA $ 48,380 $ 49,516 $ 56,044 $ 136,220 $ 158,936 FEE-RELATED EARNINGS Adjusted EBITDA $ 48,380 $ 49,516 $ 56,044 $ 136,220 $ 158,936 Less: Incentive fees (23,304) (16,258) (25,471) (49,459) (56,797) Depreciation expense (717) (822) (830) (1,337) (2,333) Other non-operating income (531) (1,182) (948) (1,635) (2,976) Realized investment income, net of amount attributable to noncontrolling interests in subsidiaries25 (1,961) (3,339) (2,151) (4,405) (7,243) Plus: Incentive fee-related compensation 17,078 12,396 19,710 35,883 43,283 Carried interest attributable to other noncontrolling interest holders 883 1,306 677 1,934 2,435 Fee-Related Earnings $ 39,828 $ 41,617 $ 47,031 $ 117,201 $ 135,305 FEE-RELATED REVENUE Total Operating Revenues $ 122,931 $ 119,657 $ 134,967 $ 348,751 $ 380,470 Less: Incentive fees (23,304) (16,258) (25,471) (49,459) (56,797) Fund expense reimbursement revenue, net (3,473) (3,247) (4,214) (10,752) (11,989) Other adjustments28 — (195) (351) — (633) Fee-Related Revenue $ 96,154 $ 99,957 $ 104,931 $ 288,540 $ 311,051 5, 25, 28. See Notes towards the end of the document. Reconciliation to Non-GAAP Metrics

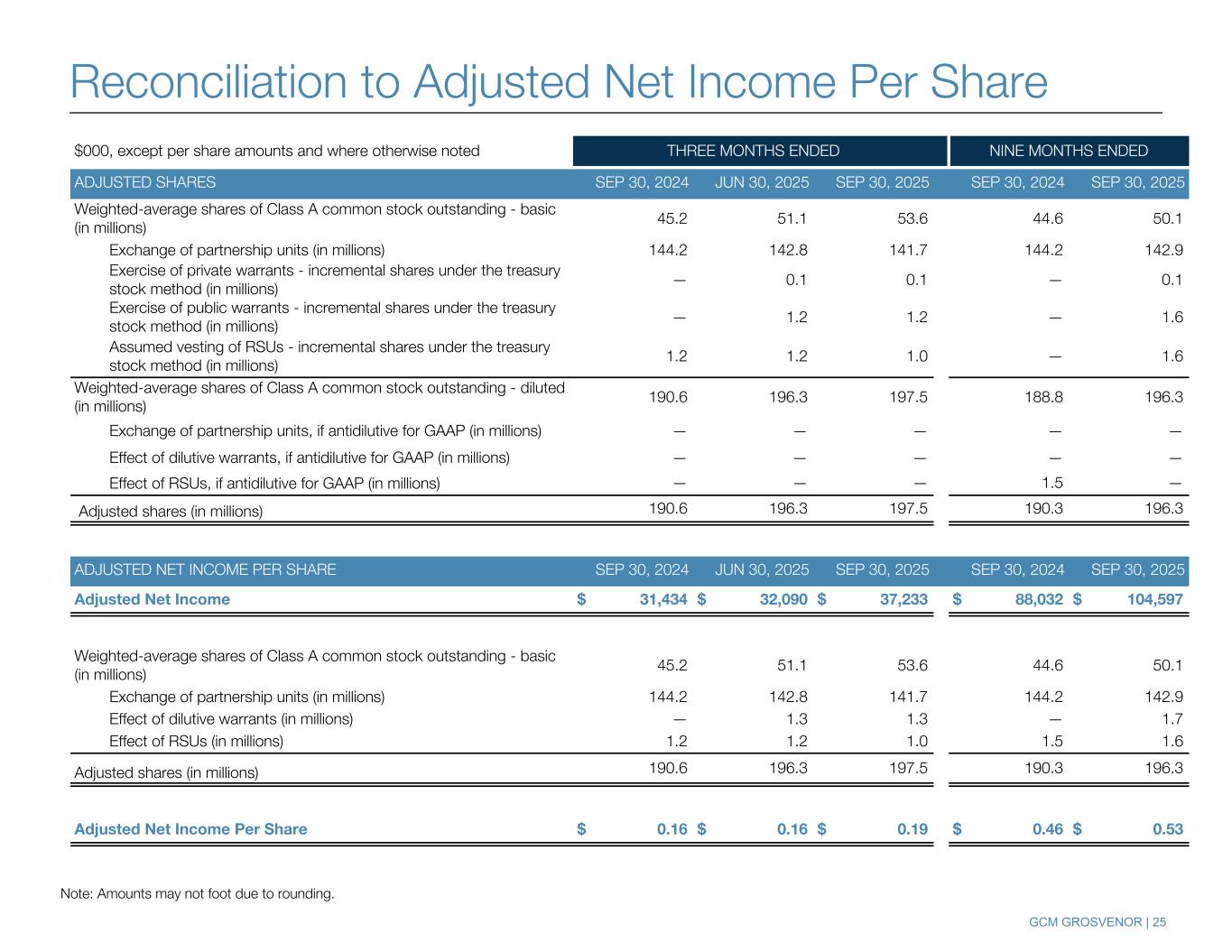

GCM GROSVENOR | 25 Note: Amounts may not foot due to rounding. $000, except per share amounts and where otherwise noted THREE MONTHS ENDED NINE MONTHS ENDED ADJUSTED SHARES SEP 30, 2024 JUN 30, 2025 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Weighted-average shares of Class A common stock outstanding - basic (in millions) 45.2 51.1 53.6 44.6 50.1 Exchange of partnership units (in millions) 144.2 142.8 141.7 144.2 142.9 Exercise of private warrants - incremental shares under the treasury stock method (in millions) — 0.1 0.1 — 0.1 Exercise of public warrants - incremental shares under the treasury stock method (in millions) — 1.2 1.2 — 1.6 Assumed vesting of RSUs - incremental shares under the treasury stock method (in millions) 1.2 1.2 1.0 — 1.6 Weighted-average shares of Class A common stock outstanding - diluted (in millions) 190.6 196.3 197.5 188.8 196.3 Exchange of partnership units, if antidilutive for GAAP (in millions) — — — — — Effect of dilutive warrants, if antidilutive for GAAP (in millions) — — — — — Effect of RSUs, if antidilutive for GAAP (in millions) — — — 1.5 — Adjusted shares (in millions) 190.6 196.3 197.5 190.3 196.3 ADJUSTED NET INCOME PER SHARE SEP 30, 2024 JUN 30, 2025 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Adjusted Net Income $ 31,434 $ 32,090 $ 37,233 $ 88,032 $ 104,597 Weighted-average shares of Class A common stock outstanding - basic (in millions) 45.2 51.1 53.6 44.6 50.1 Exchange of partnership units (in millions) 144.2 142.8 141.7 144.2 142.9 Effect of dilutive warrants (in millions) — 1.3 1.3 — 1.7 Effect of RSUs (in millions) 1.2 1.2 1.0 1.5 1.6 Adjusted shares (in millions) 190.6 196.3 197.5 190.3 196.3 Adjusted Net Income Per Share $ 0.16 $ 0.16 $ 0.19 $ 0.46 $ 0.53 Reconciliation to Adjusted Net Income Per Share

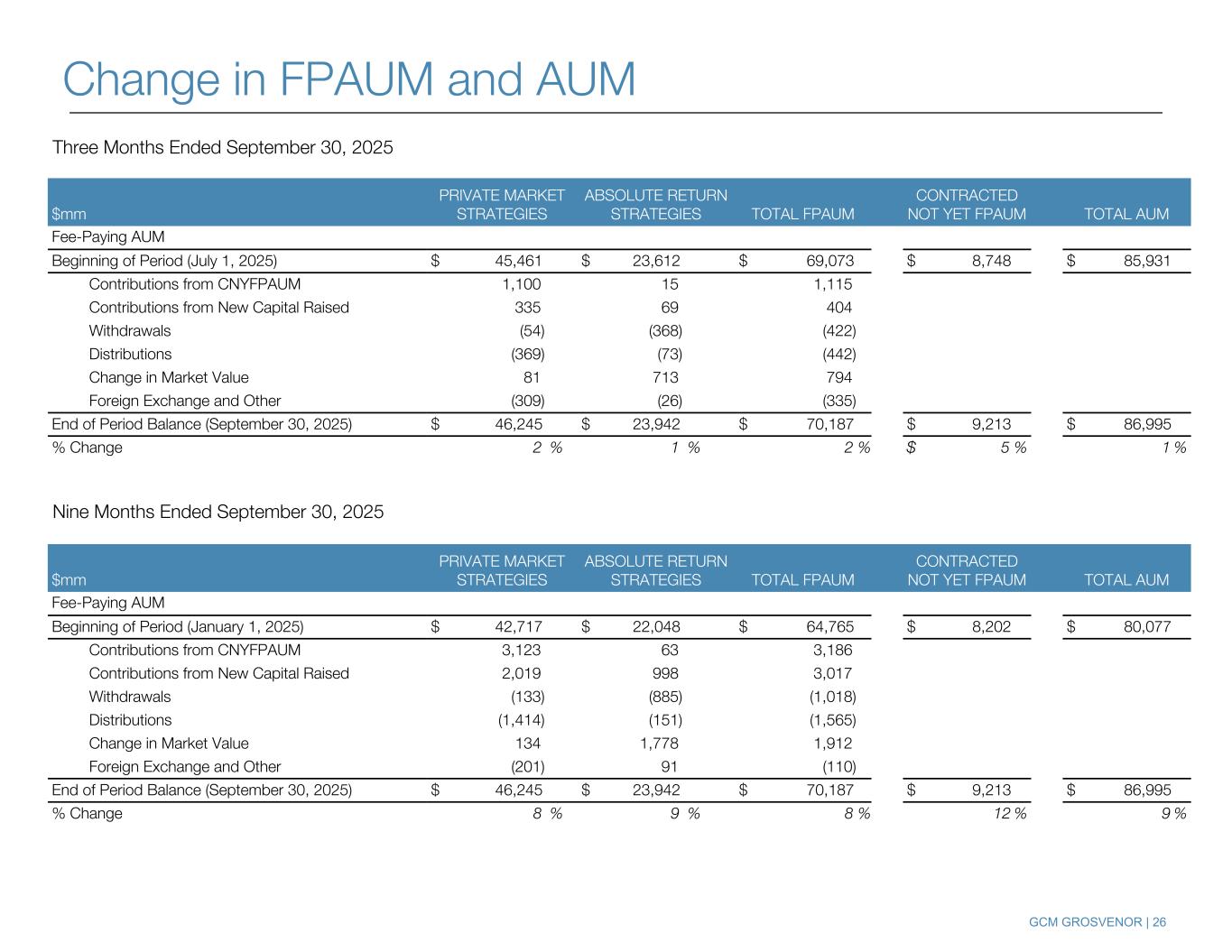

GCM GROSVENOR | 26 $mm PRIVATE MARKET STRATEGIES ABSOLUTE RETURN STRATEGIES TOTAL FPAUM CONTRACTED NOT YET FPAUM TOTAL AUM Fee-Paying AUM Beginning of Period (July 1, 2025) $ 45,461 $ 23,612 $ 69,073 $ 8,748 $ 85,931 Contributions from CNYFPAUM 1,100 15 1,115 Contributions from New Capital Raised 335 69 404 Withdrawals (54) (368) (422) Distributions (369) (73) (442) Change in Market Value 81 713 794 Foreign Exchange and Other (309) (26) (335) End of Period Balance (September 30, 2025) $ 46,245 $ 23,942 $ 70,187 $ 9,213 $ 86,995 % Change 2 % 1 % 2 % $ 5 % 1 % Three Months Ended September 30, 2025 Change in FPAUM and AUM $mm PRIVATE MARKET STRATEGIES ABSOLUTE RETURN STRATEGIES TOTAL FPAUM CONTRACTED NOT YET FPAUM TOTAL AUM Fee-Paying AUM Beginning of Period (January 1, 2025) $ 42,717 $ 22,048 $ 64,765 $ 8,202 $ 80,077 Contributions from CNYFPAUM 3,123 63 3,186 Contributions from New Capital Raised 2,019 998 3,017 Withdrawals (133) (885) (1,018) Distributions (1,414) (151) (1,565) Change in Market Value 134 1,778 1,912 Foreign Exchange and Other (201) 91 (110) End of Period Balance (September 30, 2025) $ 46,245 $ 23,942 $ 70,187 $ 9,213 $ 86,995 % Change 8 % 9 % 8 % 12 % 9 % Nine Months Ended September 30, 2025

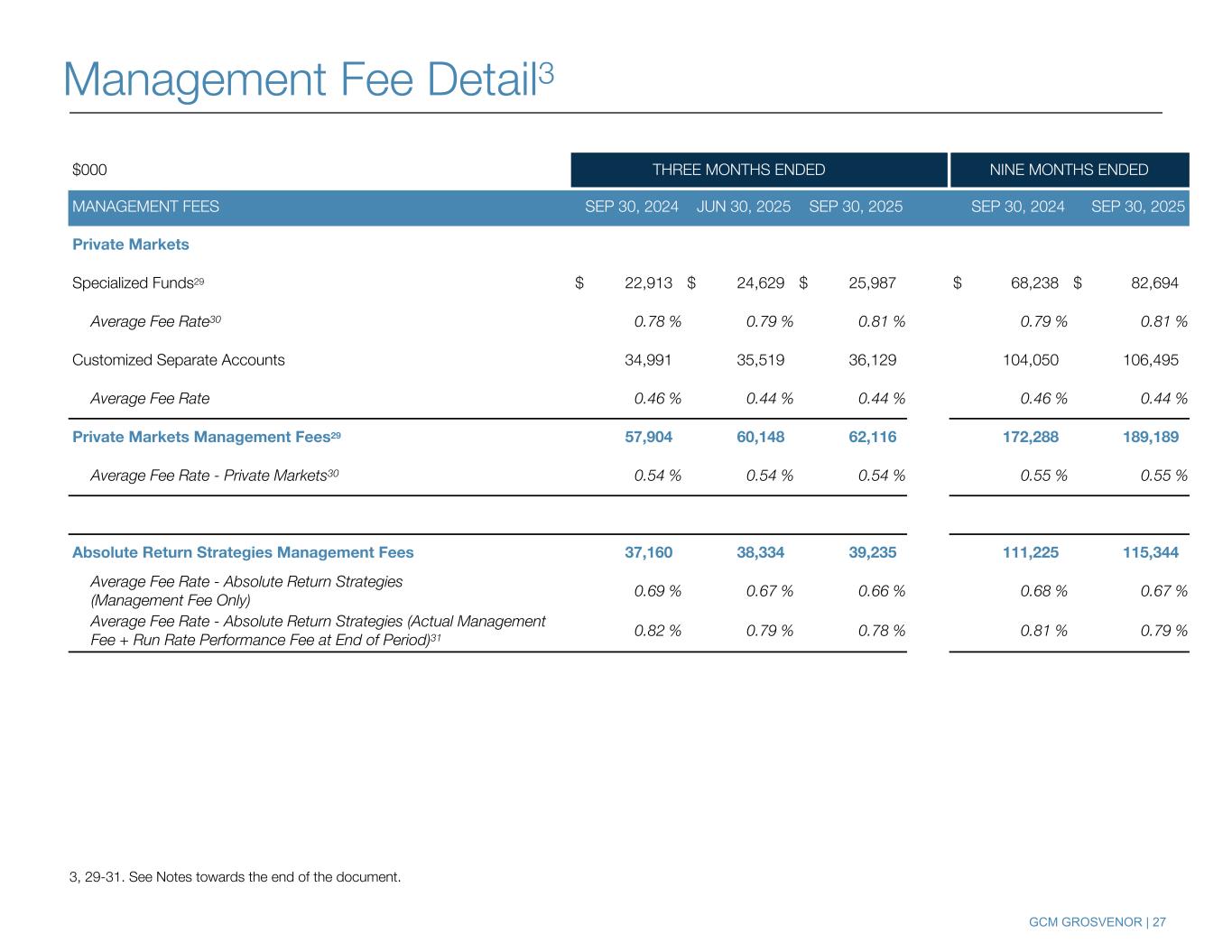

GCM GROSVENOR | 27 $000 THREE MONTHS ENDED NINE MONTHS ENDED MANAGEMENT FEES SEP 30, 2024 JUN 30, 2025 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 Private Markets Specialized Funds29 $ 22,913 $ 24,629 $ 25,987 $ 68,238 $ 82,694 Average Fee Rate30 0.78 % 0.79 % 0.81 % 0.79 % 0.81 % Customized Separate Accounts 34,991 35,519 36,129 104,050 106,495 Average Fee Rate 0.46 % 0.44 % 0.44 % 0.46 % 0.44 % Private Markets Management Fees29 57,904 60,148 62,116 172,288 189,189 Average Fee Rate - Private Markets30 0.54 % 0.54 % 0.54 % 0.55 % 0.55 % Absolute Return Strategies Management Fees 37,160 38,334 39,235 111,225 115,344 Average Fee Rate - Absolute Return Strategies (Management Fee Only) 0.69 % 0.67 % 0.66 % 0.68 % 0.67 % Average Fee Rate - Absolute Return Strategies (Actual Management Fee + Run Rate Performance Fee at End of Period)31 0.82 % 0.79 % 0.78 % 0.81 % 0.79 % 3, 29-31. See Notes towards the end of the document. Management Fee Detail3

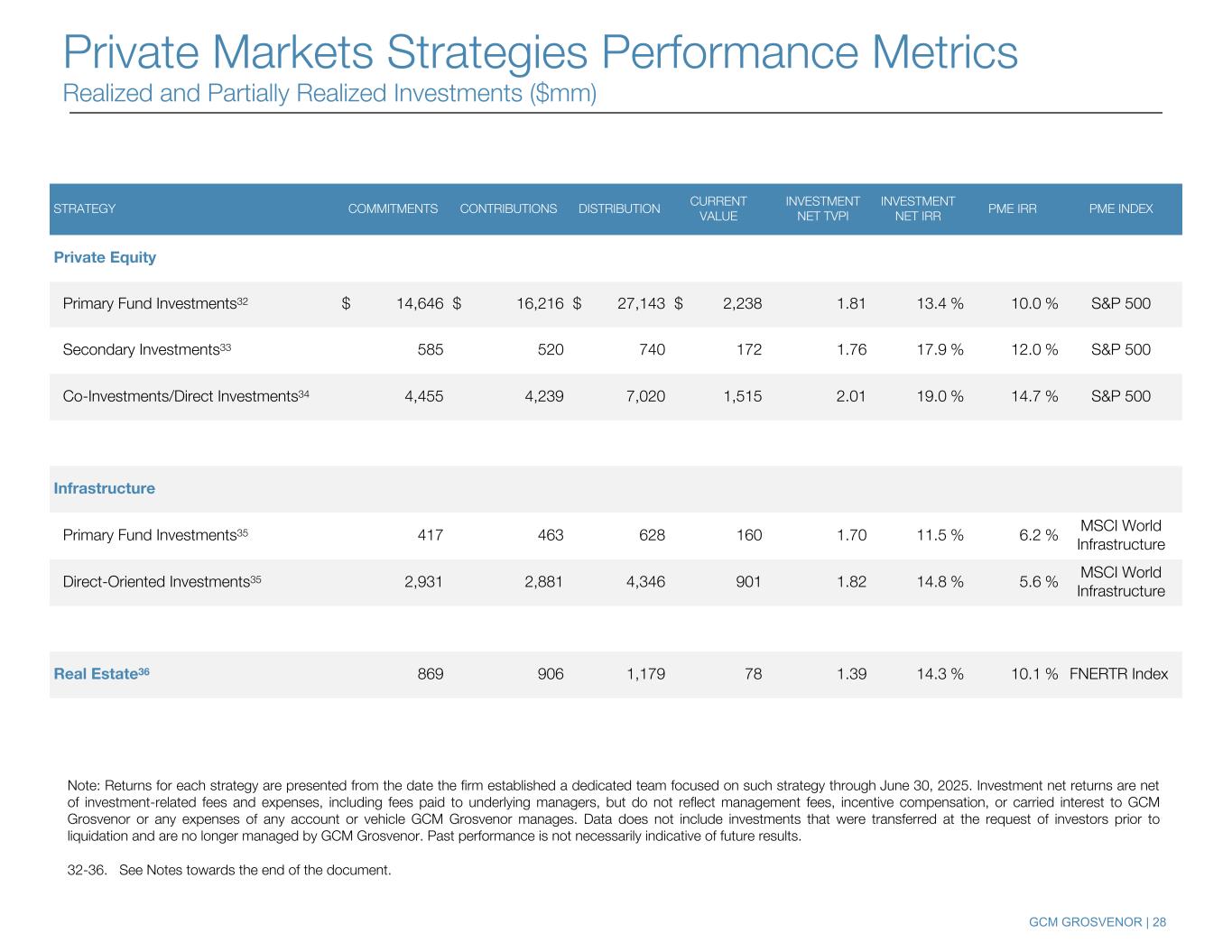

GCM GROSVENOR | 28 STRATEGY COMMITMENTS CONTRIBUTIONS DISTRIBUTION CURRENT VALUE INVESTMENT NET TVPI INVESTMENT NET IRR PME IRR PME INDEX Private Equity Primary Fund Investments32 $ 14,646 $ 16,216 $ 27,143 $ 2,238 1.81 13.4 % 10.0 % S&P 500 Secondary Investments33 585 520 740 172 1.76 17.9 % 12.0 % S&P 500 Co-Investments/Direct Investments34 4,455 4,239 7,020 1,515 2.01 19.0 % 14.7 % S&P 500 Infrastructure Primary Fund Investments35 417 463 628 160 1.70 11.5 % 6.2 % MSCI World Infrastructure Direct-Oriented Investments35 2,931 2,881 4,346 901 1.82 14.8 % 5.6 % MSCI World Infrastructure Real Estate36 869 906 1,179 78 1.39 14.3 % 10.1 % FNERTR Index Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through June 30, 2025. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, incentive compensation, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor. Past performance is not necessarily indicative of future results. 32-36. See Notes towards the end of the document. Private Markets Strategies Performance Metrics Realized and Partially Realized Investments ($mm)

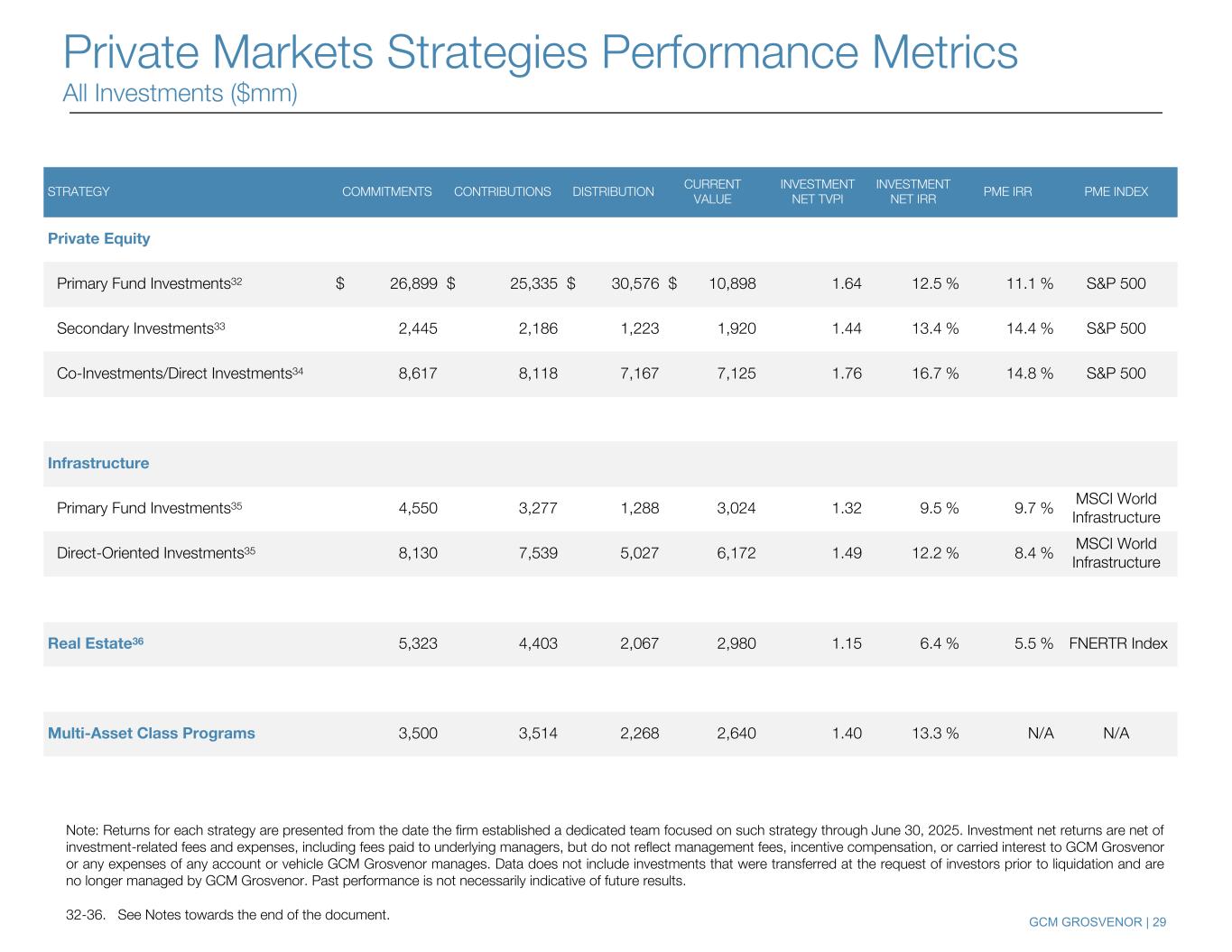

GCM GROSVENOR | 29 STRATEGY COMMITMENTS CONTRIBUTIONS DISTRIBUTION CURRENT VALUE INVESTMENT NET TVPI INVESTMENT NET IRR PME IRR PME INDEX Private Equity Primary Fund Investments32 $ 26,899 $ 25,335 $ 30,576 $ 10,898 1.64 12.5 % 11.1 % S&P 500 Secondary Investments33 2,445 2,186 1,223 1,920 1.44 13.4 % 14.4 % S&P 500 Co-Investments/Direct Investments34 8,617 8,118 7,167 7,125 1.76 16.7 % 14.8 % S&P 500 Infrastructure Primary Fund Investments35 4,550 3,277 1,288 3,024 1.32 9.5 % 9.7 % MSCI World Infrastructure Direct-Oriented Investments35 8,130 7,539 5,027 6,172 1.49 12.2 % 8.4 % MSCI World Infrastructure Real Estate36 5,323 4,403 2,067 2,980 1.15 6.4 % 5.5 % FNERTR Index Multi-Asset Class Programs 3,500 3,514 2,268 2,640 1.40 13.3 % N/A N/A Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through June 30, 2025. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, incentive compensation, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor. Past performance is not necessarily indicative of future results. 32-36. See Notes towards the end of the document. All Investments ($ million) Private Markets Strategies Performance Metrics All Invest ents ($mm)

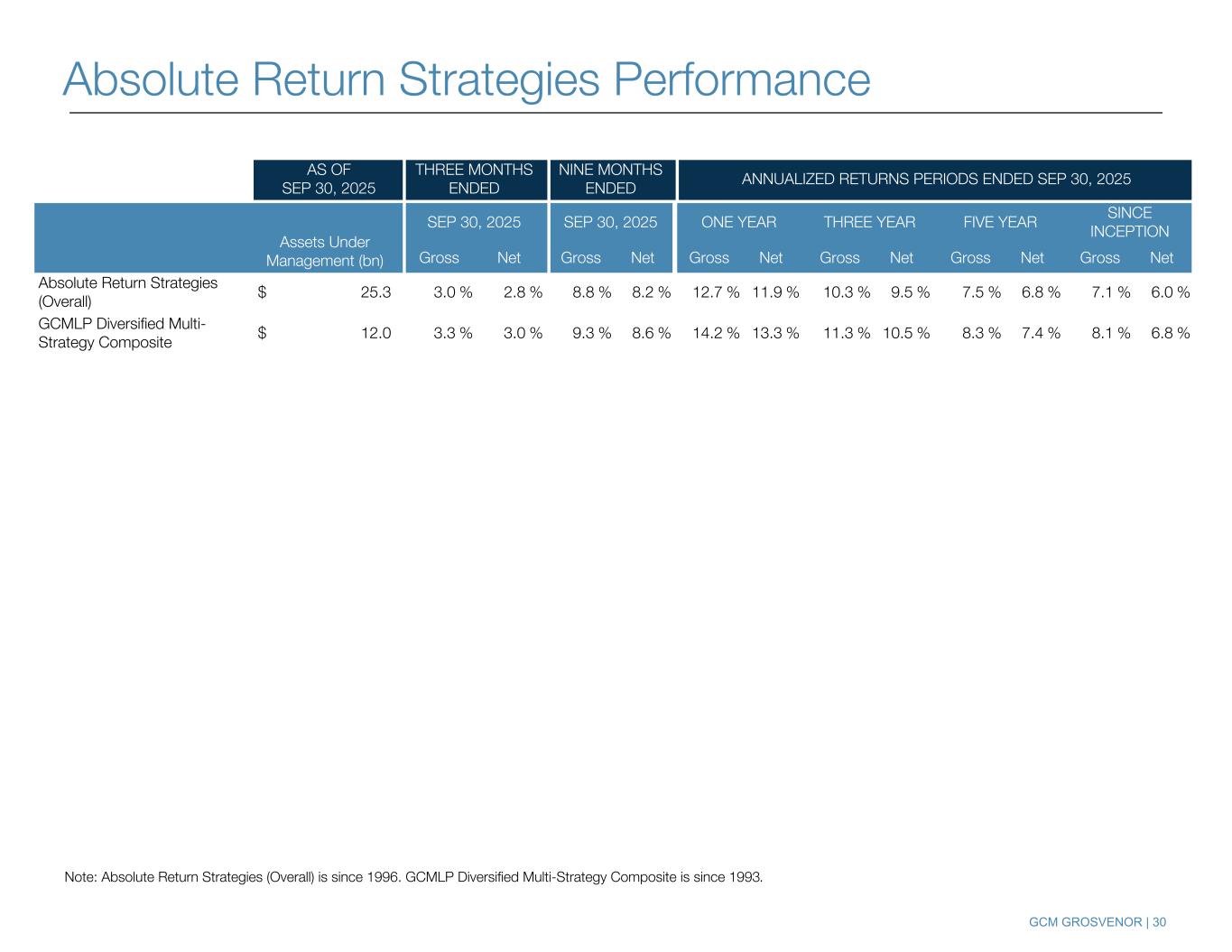

GCM GROSVENOR | 30 AS OF SEP 30, 2025 THREE MONTHS ENDED NINE MONTHS ENDED ANNUALIZED RETURNS PERIODS ENDED SEP 30, 2025 Assets Under Management (bn) SEP 30, 2025 SEP 30, 2025 ONE YEAR THREE YEAR FIVE YEAR SINCE INCEPTION Gross Net Gross Net Gross Net Gross Net Gross Net Gross Net Absolute Return Strategies (Overall) $ 25.3 3.0 % 2.8 % 8.8 % 8.2 % 12.7 % 11.9 % 10.3 % 9.5 % 7.5 % 6.8 % 7.1 % 6.0 % GCMLP Diversified Multi- Strategy Composite $ 12.0 3.3 % 3.0 % 9.3 % 8.6 % 14.2 % 13.3 % 11.3 % 10.5 % 8.3 % 7.4 % 8.1 % 6.8 % Note: Absolute Return Strategies (Overall) is since 1996. GCMLP Diversified Multi-Strategy Composite is since 1993. Absolute Return Strategies Performance

GCM GROSVENOR | 31 Data in the presentation is as of September 30, 2025 unless otherwise noted. 1. Represents consolidated view, including all NCI and compensation related awards. 2. Of the $9.2 billion CNYFPAUM as of September 30, 2025, approximately $2.2 billion is subject to an agreed upon fee ramp in schedule that will result in management fees being charged on approximately $0.1 billion of such amount in the remainder of 2025, approximately $0.8 billion of such amount in 2026, and remaining approximately $1.3 billion in 2027 and beyond. With respect to approximately $7.0 billion of the $9.2 billion, management fees will be charged as such capital is invested, which will depend on a number of factors, including the availability of eligible investment opportunities. 3. Excludes fund expense reimbursement revenue, net and net revenue of noncontrolling interests in consolidated subsidiary. 4. Adjusted EBITDA, Adjusted Net Income and Adjusted Net Income per share are non-GAAP financial measures. See Appendix for the reconciliations of our non-GAAP financial measures to the most comparable GAAP metric. 5. Reflects a corporate and blended statutory tax rate of 24.7% and 25.0% applied to Adjusted Pre-Tax Income for the three and nine months ended September 30, 2024 and 2025, respectively. The 24.7% and 25.0% are based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 3.7% and 4.0%, respectively. 6. Run-Rate Annual Performance Fees reflect the potential annual performance fees generated by performance fee-eligible AUM before any loss carryforwards, if applicable, at an 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies, and before cash-based incentive fee related compensation. The majority of run-rate annual performance fees relate to ARS. 7. Re-up % for Private Markets customized separate accounts from January 1, 2018 through September 30, 2025. 8. Based on 50 largest clients by AUM as of September 30, 2025. 9. Fundraising from January 1, 2020 through September 30, 2025. 10. AUM as of September 30, 2025. 11. Employee data as of October 1, 2025. Individuals with dual responsibilities are counted only once. 12. Credit Investments overlap with investments in other strategies. 13. Other includes credit and opportunistic strategies and is included in private markets CAGR. 14. Other includes opportunistic strategies. 15. Cumulative selected private market specialized fund closings from 2009 to 2018. 16. Calculated as management fees, net divided by fee-related revenue plus the firm-share of incentive fee revenue. 17. G&A and Other, Net is a non-GAAP financial measure. See GAAP to Non-GAAP Reconciliations section for the reconciliations of our non-GAAP financial measures to the most comparable GAAP metric. 18. Reflects GAAP cash including $34 million of cash held at consolidated carry plan entities. 19. Represents firm share of Net Asset Value as of September 30, 2025. 20. Debt principal at pricing of Term SOFR + 225bps as of September 30, 2025, subject to a Term SOFR floor of 50bps. 21. Warrants strike at $11.50 and are subject to early redemption or exercise at $18.00 per share. 22. Excludes severance expenses of $0.3 million, $1.5 million and $0.4 million for the three months ended September 30, 2024, June 30, 2025 and September 30, 2025, respectively, and $1.2 million and $3.1 million for the nine months ended September 30, 2024 and September 30, 2025, respectively. Notes

GCM GROSVENOR | 32 24. Includes the impact of non-cash carried interest compensation and other of $(1.5) million, $(0.7) million and $(0.6) million for the three months ended September 30, 2024, June 30, 2025 and September 30, 2025, respectively, and $(1.5) million and $(0.7) million for the nine months ended September 30, 2024 and September 30, 2025, respectively. 25. Investment income or loss is generally realized when the Company redeems all or a portion of its investment or when the Company receives or is due cash, such as from dividends or distributions. 26. Represents 2024 expenses incurred related to a debt amendment and extension and 2025 expenses related to completed and contemplated corporate transactions. 27. Includes $0.1 million and $1.9 million of office relocation costs for the three and nine months ended September 30, 2024, respectively. 28. Represents net revenue of noncontrolling interests in consolidated subsidiary. 29. Includes catch-up management fees of $1.0 million, $0.1 million and $0.1 million for the three months ended September 30, 2024, June 30, 2025, and September 30, 2025, respectively, and $2.8 million and $7.8 million for the nine months ended September 30, 2024 and September 30, 2025, respectively. Year to date catch-up management fees exclude intra-year amounts. 30. Average fee rate excludes effect of catch-up management fees and temporary fund expense reimbursements. 31. The run rate on annual performance fees reflects potential annual performance fees generated by performance fee-eligible AUM before any loss carryforwards, if applicable, at an 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies, and before cash-based incentive fee related compensation. The metric is calculated as the actual management fees during the period, plus the run rate performance fee from the end of the period, divided by the average fee-paying AUM over the period. 32. Reflects primary fund investments since 2000. Excludes certain private markets credit fund investments outside of private equity programs. 33. GCM Grosvenor established a dedicated private equity secondaries vertical in September 2014. Track record reflects all secondaries investments since the new vertical was formed. 34. GCM Grosvenor established a dedicated Private Equity Co-Investment Sub-Committee and adopted a more targeted, active co-investment strategy in December 2008. Track record reflects co-investments/direct investments made since 2009. 35. Reflects infrastructure investments since 2009, when we formalized our global approach and launched the first infrastructure specialized fund. Infrastructure investments exclude labor impact investments. 36. Reflects real estate investments since 2010. In 2010, GCM Grosvenor established a dedicated Real Estate team and adopted a more targeted, active real estate strategy. $000 THREE MONTHS ENDED NINE MONTHS ENDED COMPONENTS OF GENERAL, ADMINISTRATIVE AND OTHER, NET SEP 30, 2024 SEP 30, 2025 SEP 30, 2024 SEP 30, 2025 General, administrative and other $ (24,617) $ (24,699) $ (77,960) $ (78,524) Plus: Transaction expenses 1,320 (411) 4,479 1,144 Fund reimbursement expense 3,473 4,214 10,752 12,142 Amortization expense 328 327 985 985 Non-core items 159 135 2,484 1,204 Total general, administrative and other, net $ (19,337) $ (20,434) $ (59,260) $ (63,049) 23. General, administrative and other, net is comprised of the following: Notes (Continued)

GCM GROSVENOR | 33 Adjusted Net Income is a non-GAAP measure that we present on a pre-tax and after-tax basis to evaluate our profitability. Adjusted Pre-Tax Income represents net income attributable to GCM Grosvenor Inc. including (a) net income (loss) attributable to GCMH, excluding (b) provision (benefit) for income taxes, (c) amortization expense, (d) partnership interest-based and non-cash compensation, (e) equity-based compensation, including cash-settled equity awards (as we view the cash settlement as a separate capital transaction), (f) unrealized investment income, (g) changes in tax receivable agreement liability, (h) certain other items that we believe are not indicative of our core performance, including charges related to corporate transactions, employee severance, office relocation costs and loss on extinguishment of debt. Adjusted Net Income represents Adjusted Pre-Tax Income fully taxed at each period's blended statutory tax rate. Adjusted Net Income Per Share is a non-GAAP measure that is calculated by dividing Adjusted Net Income by adjusted shares outstanding. Adjusted Shares outstanding assumes the hypothetical full exchange of limited partnership interests in GCMH into Class A common stock of GCM Grosvenor Inc., the dilution from outstanding warrants for Class A common stock of GCM Grosvenor Inc. and the dilution from outstanding equity-based compensation. We believe Adjusted Net Income Per Share and Adjusted Shares is useful to investors because it enables them to better evaluate per-share performance across reporting periods. Adjusted EBITDA is a non-GAAP measure which represents Adjusted Net Income excluding (a) adjusted income taxes, (b) depreciation and amortization expense and (c) interest expense on our outstanding debt. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of our total operating revenues, net of fund expense reimbursements. We believe Adjusted Pre-Tax Income, Adjusted Net Income and Adjusted EBITDA are useful to investors because they provide additional insight into the operating profitability of our core business across reporting periods. These measures (1) present a view of the economics of the underlying business as if GCMH Equityholders converted their interests to shares of Class A common stock and (2) adjust for certain non-cash and other activity in order to provide more comparable results of the core business across reporting periods. These measures are used by management in budgeting, forecasting and evaluating operating results. Fee-Related Revenue (“FRR”) is a non-GAAP measure used to highlight revenues from recurring management fees and administrative fees. FRR represents total operating revenues less (a) incentive fees, (b) net revenue of noncontrolling interests in consolidated subsidiary and (c) fund expense reimbursement revenue, net. We believe FRR is useful to investors because it provides additional insight into our relatively stable management fee base separate from incentive fee revenues, which tend to have greater variability. Fee-Related Earnings (“FRE”) is a non-GAAP measure used to highlight earnings from recurring management fees and administrative fees. FRE represents Adjusted EBITDA further adjusted to exclude (a) incentive fees, (b) other non-operating income, (c) depreciation expense and (d) realized investment income, net of amount attributable to noncontrolling interests in subsidiaries, and to include (a) incentive fee-related compensation and (b) carried interest attributable to other noncontrolling interest holders, net. We believe FRE is useful to investors because it provides additional insights into the management fee driven operating profitability of our business. FRE Margin represents FRE as a percentage of our management fee and other operating revenue, net of fund expense reimbursements. Net Incentive Fees Attributable to GCM Grosvenor is a non-GAAP measure used to highlight fees earned from incentive fees that are attributable to GCM Grosvenor. Net incentive fees represent incentive fees excluding (a) incentive fees contractually owed to others and (b) cash-based incentive fee related compensation. Net incentive fees provide investors useful information regarding the amount that such fees contribute to the Company’s earnings and are used by management in making compensation and capital allocation decisions. Certain Definitions and Use of Non-GAAP Financials and Key Performance Indicators

GCM GROSVENOR | 34 Fee-Paying Assets Under Management (“FPAUM” or “Fee-Paying AUM”) is a key performance indicator we use to measure the assets from which we earn management fees. Our FPAUM comprises the assets in our customized separate accounts and specialized funds from which we derive management fees. We classify customized separate account revenue as management fees if the client is charged an asset-based fee, which includes the vast majority of our discretionary AUM accounts. The FPAUM for our private market strategies typically represents committed, invested or scheduled capital during the investment period and invested capital following the expiration or termination of the investment period. Substantially all of our private markets strategies funds earn fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Our FPAUM for our absolute return strategy is based on net asset value. Our calculations of FPAUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Our definition of FPAUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage. Contracted, Not Yet Fee-Paying AUM (“CNYFPAUM”) represents limited partner commitments which are expected to be invested and begin charging fees over the ensuing five years. Contributions from New Capital Raised is new limited partner commitments where fees are charged immediately at the initial commitment date. Assets Under Management (“AUM”) reflects the sum of (a) FPAUM, (b) CNYFPAUM and (c) other mark-to-market, insider capital and non-fee-paying assets under management. GCM Grosvenor refers to the combined accounts of (a) Grosvenor Capital Management Holdings, LLLP (“LLLP” or “GCMH”), an Delaware limited liability limited partnership, and its consolidated subsidiaries and (b) GCM, L.L.C., a Delaware limited liability company. GCM Grosvenor Inc. is a Delaware corporation listed on the Nasdaq under the symbol “GCMG” NM Not Meaningful LTM Last Twelve Months Certain Definitions and Use of Non-GAAP Financials and Key Performance Indicators (Continued)

GCM GROSVENOR | 35 Non-GAAP Financial Measures The non-GAAP financial measures contained in this presentation are not GAAP measures of GCM Grosvenor’s financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. A reconciliation of such non-GAAP measures to their most directly comparable GAAP measure is included elsewhere in this presentation. You are encouraged to evaluate each adjustment to non-GAAP financial measures and the reasons management considers it appropriate for supplemental analysis. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non- recurring items. In addition, these measures may not be comparable to similarly titled measures used by other companies in our industry or across different industries. This presentation includes certain projections of non-GAAP financial measures including fee-related earnings. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, GCM Grosvenor is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward looking non GAAP financial measures is included. Share Repurchase Plan Authorization GCMG’s Board of Directors previously authorized a share repurchase plan, which may be used to repurchase outstanding Class A common stock and warrants in open market transactions, in privately negotiated transactions including with employees or otherwise, as well as to retire (by cash settlement or the payment of tax withholding amounts upon net settlement) equity-based awards granted under the Company’s Amended and Restated 2020 Incentive Award Plan (or any successor equity plan thereto). The Company is not obligated under the terms of plan to repurchase any of its Class A common stock or warrants, and the size and timing of these repurchases will depend on legal requirements, price, market and economic conditions and other factors. The plan has no expiration date and the plan may be suspended or terminated by the Company at any time without prior notice. Any outstanding shares of Class A common stock and any warrants repurchased as part of this plan will be cancelled. As of September 30, 2025, the total share repurchase plan authorization was $220.0 million. Disclosures