Confidential FEBRUARY 2026 Black Pearl Compute

2 This presentation contains certain forward - looking statements within the meaning of the federal securities laws of the United St ates. The Company intends such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995 and incl udes this statement for purposes of complying with these safe harbor provisions. Any statements made in this presentation that are not statements of historical fact, such as, statements about the Company’s beli efs and expectations regarding its future results of operations and financial position, its planned business model and strategy, its bitcoin mining and HPC data center development, timing and likelihood of success, ca pac ity, functionality and timing of operation of data centers, expectations regarding the operations of data centers, such as projected hashrate , potential strategic initiatives, such as joint ventures and partnerships, and management plans and objectives, are forward - loo king statements and should be evaluated as such. These forward - looking statements generally are identified by the words “may,” “will,” “should,” “ex pects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “strategy,” “future,” “forecasts,” “opportunity,” “predicts,” “potential,” “would,” “wi ll likely result,” “continue,” and similar expressions (including the negative versions of such words or expressions). These forward - looking statements are based upon estimates and assumptions that, while considered reasonable by Cipher and its ma nagement, are inherently uncertain. Such forward - looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Many factors could cause actual future even ts to differ materially from the forward - looking statements in this presentation, including but not limited to: volatility in the price of Cipher’s securities due to a variety of factors, including changes in the competit ive and regulated industry in which Cipher operates, Cipher’s evolving business model and strategy and efforts it may make to modify aspects of its business model or engage in various strategic initiatives, variatio ns in performance across competitors, changes in laws and regulations affecting Cipher’s business, and the ability to implement business plans, forecasts, and other expectations and to identify and realize addition al opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Cipher’s Annu al Report on Form 10 - K for the fiscal year ended December 31, 2024 filed with the Securities and Exchange Commission (“SEC”) on February 25, 2025, Cipher’s Quarterly Report on Form 10 - Q for the quarterly period ended June 30, 2025 filed with the SEC on August 7, 2025, Cipher’s Quarterly Report on Form 10 - Q for the quarterly period ended September 30, 2025 to be filed with the SEC, and in Cipher’s subsequent filings with the SEC . These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements. Forward - looking sta tements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward - looking statements, and Cipher assumes no obligation and, except as required by law, does not intend t o update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise. This presentation includes certain projected financial data. Such projected financial data may not be indicative of our futur e r esults. Such data is not a prediction, should not be relied upon as such and is premised on a number of factors, all of which are inherently uncertain and subject to numerous business, industry, market, regulatory, ge opolitical, competitive and financial risks that are outside of our control. Any such projected financial data is based on available information and certain assumptions that we believe are reasonable under the c irc umstances. However, there can be no assurance that the assumptions made in connection with such data will prove accurate, and actual results may differ materially. We make no representations to any pe rso n regarding projected financial data and we do not intend to update or otherwise revise any such data to reflect circumstances existing after the date when made or to reflect the occurrence of future events , e ven in the event that any or all of the assumptions underlying such data are later shown to be incorrect. If our assumptions prove to be inaccurate, our actual results may differ substantially and materially fro m these projections. Website Disclosure The company maintains a dedicated investor website at https://investors.ciphermining.com/investors (“Investors’ Website”). Financial and other important information regarding the Company is routinely posted on and accessible through the Investors’ Website. Cipher uses its Investors’ Website as a distribution channel of material in for mation about the Company, including through press releases, investor presentations, reports and notices of upcoming events. Cipher intends to utilize its Investors’ Website as a channel of distribution to reac h p ublic investors and as a means of disclosing material non - public information for complying with disclosure obligations under Regulation FD. In addition, you may sign up to automatically receive email alerts an d other information about the Company by visiting the “Email Alerts” option under the Investors Resources section of Cipher’s Investors’ Website and submitting your email address.

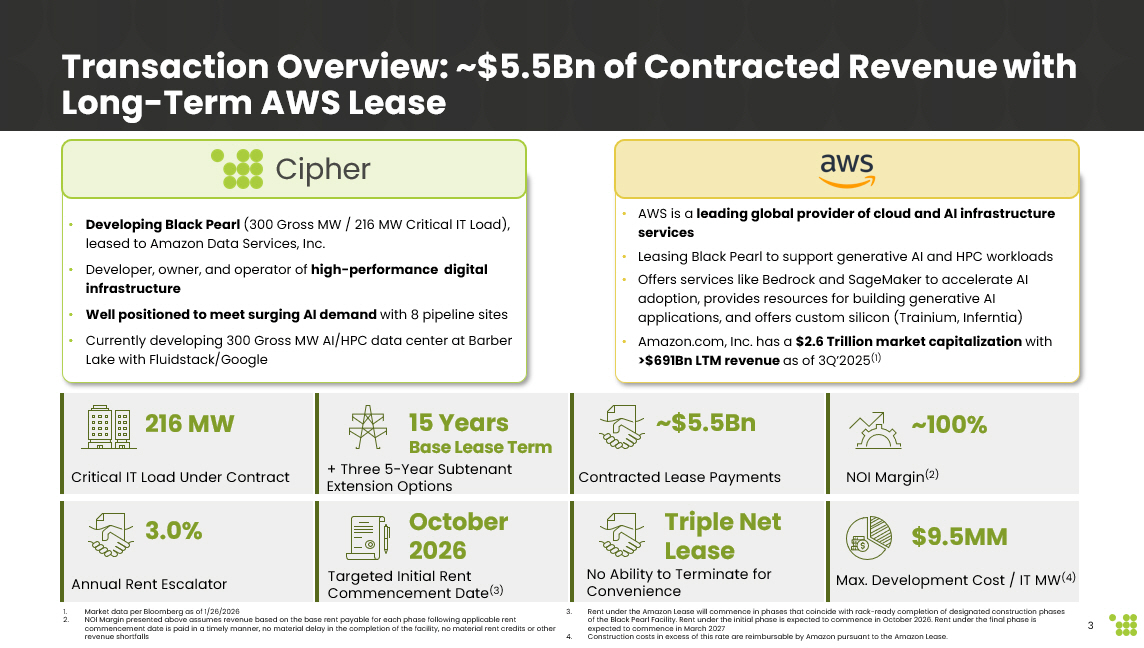

3 Transaction Overview: ~$5.5Bn of Contracted Revenue with Long - Term AWS Lease 216 MW Critical IT Load Under Contract 15 Years Base Lease Term + Three 5 - Year Subtenant Extension Options $9.5MM Max. Development Cost / IT MW (4) ~$ 5.5 Bn Contracted Lease Payments October 2026 Targeted Initial Rent Commencement Date (3) ~100% • Developing Black Pearl (300 Gross MW / 216 MW Critical IT Load), leased to Amazon Data Services, Inc. • Developer, owner, and operator of high - performance digital infrastructure • Well positioned to meet surging AI demand with 8 pipeline sites • Currently developing 300 Gross MW AI/HPC data center at Barber Lake with Fluidstack/Google • AWS is a leading global provider of cloud and AI infrastructure services • Leasing Black Pearl to support generative AI and HPC workloads • Offers services like Bedrock and SageMaker to accelerate AI adoption, provides resources for building generative AI applications, and offers custom silicon ( Trainium , Inferntia ) • Amazon.com, Inc. has a $2.6 Trillion market capitalization with >$691Bn LTM revenue as of 3Q’2025 (1) Cipher 3.0% Annual Rent Escalator Triple Net Lease 1. Market data per Bloomberg as of 1/26/2026 2. NOI Margin presented above assumes revenue based on the base rent payable for each phase following applicable rent commencement date is paid in a timely manner, no material delay in the completion of the facility, no material rent credits o r o ther revenue shortfalls 3. Rent under the Amazon Lease will commence in phases that coincide with rack - ready completion of designated construction phases of the Black Pearl Facility. Rent under the initial phase is expected to commence in October 2026. Rent under the final phase is expected to commence in March 2027 4. Construction costs in excess of this rate are reimbursable by Amazon pursuant to the Amazon Lease. NOI Margin (2) No Ability to Terminate for Convenience

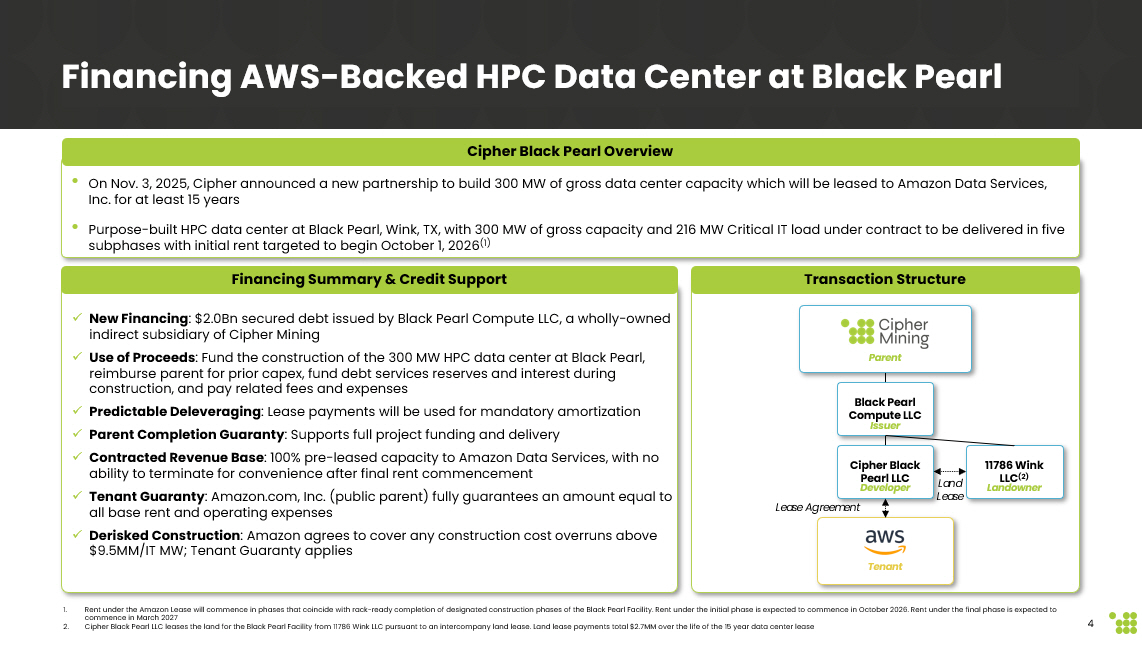

4 Financing AWS - Backed HPC Data Center at Black Pearl • On Nov. 3, 2025, Cipher announced a new partnership to build 300 MW of gross data center capacity which will be leased to Ama zon Data Services, Inc. for at least 15 years • Purpose - built HPC data center at Black Pearl, Wink, TX, with 300 MW of gross capacity and 216 MW Critical IT load under contract to be delivered in five subphases with initial rent targeted to begin October 1, 2026 (1) x New Financing : $2.0Bn secured debt issued by Black Pearl Compute LLC, a wholly - owned indirect subsidiary of Cipher Mining x Use of Proceeds : Fund the construction of the 300 MW HPC data center at Black Pearl, reimburse parent for prior capex, fund debt services reserves and interest during construction, and pay related fees and expenses x Predictable Deleveraging : Lease payments will be used for mandatory amortization x Parent Completion Guaranty : Supports full project funding and delivery x Contracted Revenue Base : 100% pre - leased capacity to Amazon Data Services, with no ability to terminate for convenience after final rent commencement x Tenant Guaranty : Amazon.com, Inc. (public parent) fully guarantees an amount equal to all base rent and operating expenses x Derisked Construction : Amazon agrees to cover any construction cost overruns above $9.5MM/IT MW; Tenant Guaranty applies Cipher Black Pearl Overview Financing Summary & Credit Support Transaction Structure Lease Agreement Tenant Parent Black Pearl Compute LLC Issuer Cipher Black Pearl LLC Developer 1. Rent under the Amazon Lease will commence in phases that coincide with rack - ready completion of designated construction phases o f the Black Pearl Facility. Rent under the initial phase is expected to commence in October 2026. Rent under the final phase is expected to commence in March 2027 2. Cipher Black Pearl LLC leases the land for the Black Pearl Facility from 11786 Wink LLC pursuant to an intercompany land leas e. Land lease payments total $2.7MM over the life of the 15 year data center lease 11786 Wink LLC (2) Landowner Land Lease

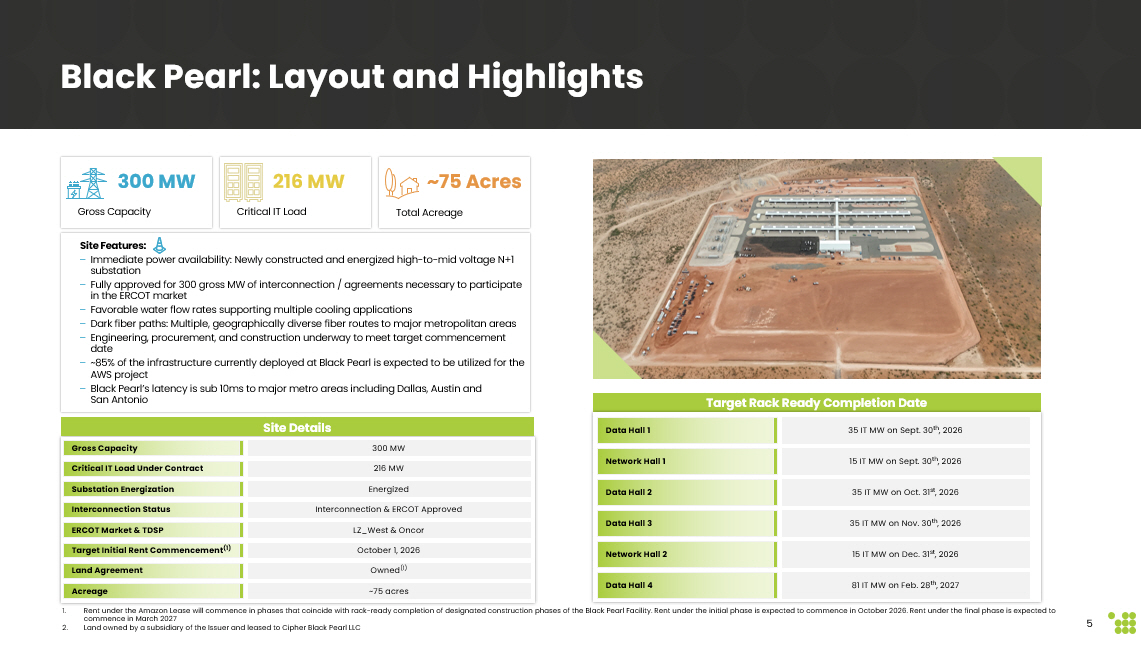

5 Total Acreage Gross Capacity ~75 Acres 300 MW Black Pearl: Layout and Highlights Site Features: – Immediate power availability: Newly constructed and energized high - to - mid voltage N+1 substation – Fully approved for 300 gross MW of interconnection / agreements necessary to participate in the ERCOT market – Favorable water flow rates supporting multiple cooling applications – Dark fiber paths: Multiple , geographically diverse fiber routes to major metropolitan areas – Engineering, procurement, and construction underway to meet target commencement date – ~85% of the infrastructure currently deployed at Black Pearl is expected to be utilized for the AWS project – Black Pearl’s latency is sub 10ms to major metro areas including Dallas, Austin and San Antonio Site Details 300 MW 216 MW Energized Interconnection & ERCOT Approved LZ_West & Oncor October 1, 2026 Owned (1) ~75 acres Gross Capacity Critical IT Load Under Contract Substation Energization Interconnection Status ERCOT Market & TDSP Target Initial Rent Commencement (1) Land Agreement Acreage Critical IT Load 216 MW 1. Rent under the Amazon Lease will commence in phases that coincide with rack - ready completion of designated construction phases o f the Black Pearl Facility. Rent under the initial phase is expected to commence in October 2026. Rent under the final phase is expected to commence in March 2027 2. Land owned by a subsidiary of the Issuer and leased to Cipher Black Pearl LLC Target Rack Ready Completion Date 35 IT MW on Sept. 30 th , 2026 Data Hall 1 15 IT MW on Sept. 30 th , 2026 Network Hall 1 35 IT MW on Oct. 31 st , 2026 Data Hall 2 35 IT MW on Nov. 30 th , 2026 Data Hall 3 15 IT MW on Dec. 31 st , 2026 Network Hall 2 81 IT MW on Feb. 28 th , 2027 Data Hall 4

6 Strategic Endorsement from AWS: Scale, Stability & Long - Term Visibility Direct Lease with AA Credit Hyperscaler Amazon is working with Cipher to secure long - term HPC capacity, underscoring the strategic value of Black Pearl for AI infrastructure growth Amazon Parent Fully Guaranteeing Lease Cash Flows 15 - Year Triple Net Lease with no ability to terminate for convenience after final rent commencement. Amazon parent providing guarantee in an amount equal to rent and opex for the life of the lease Unique Strategic Partnership Between Cipher and AWS Scales HPC Strategy Marks the second HPC lease for Cipher after its ~$3.8Bn lease with Fluidstack/Google at Barber Lake, advancing its HPC strategy by leasing directly to a hyperscaler

7 Strong Contractual Economics and Free Cash Flow Profile Cash Flows Backed by Amazon Credit • Parties • Landlord: Cipher Black Pearl LLC (Landlord Guarantor: Cipher Mining Inc.) • Tenant: Amazon Data Services, Inc. (Tenant Guarantor: Amazon.com, Inc.) • Terms: • MW IT Load: 216 MW • Tenor: 15 - year lease with three 5 - year tenant extension options • Triple Net Lease: Tenant pays 100% of recoverable operating expenses, taxes, insurance premiums, and any non - recurring costs related to tenant - driven change orders • Tenant Termination Rights: Casualty, condemnation, material interference, landlord sale to a restricted entity, 120 - day delay in delivery with 30 - day cure period or a violation of the anti - bribery provisions – Tenant also reserves the right to terminate with a prolonged grid power outage exceeding 180 consecutive days (excluding tena nt fault), with termination right extinguished upon full restoration prior to exercising termination notice • Premises: • Phase 1: Three data halls, one network hall, and O&M building on 137,000 sq. ft already constructed premises, to be retrofitt ed • Phase 2: One newly constructed data hall and network hall 2 • Tenant Guaranty: • Amazon.com, Inc. unconditionally guarantees an amount equal to all base rent and operating expenses due by the tenant as requ ire d by the lease • Construction Spend Cap: • Tenant responsible for all construction costs above the Capex Allowance of $9.5MM/IT MW, inclusive of initial capex basis; Te nan t Guaranty applies (1)(2) Highly Visible NNN Lease Cash Flows Backed by Amazon Credit Support 1. Provided such construction costs are not unreasonable or the result of negligence or wrongful acts by landlord 2. $578MM makes up the Initial Capex Basis as agreed upon by Amazon under the lease, which is comprised of lease hold / property im provements and legacy compute and is used to calculate Amazon’s remaining Capex Allowance. Such credited amount would be redu ced by the value, not to exceed $288.0 million, recaptured by Cipher Black Pearl from the sale, lease or other repurposing by Cip her Black Pearl of existing bitcoin mining equipment. Such recaptured proceeds are required to be deposited into the Notes Procee ds Account to be used solely to fund the construction and development of the project

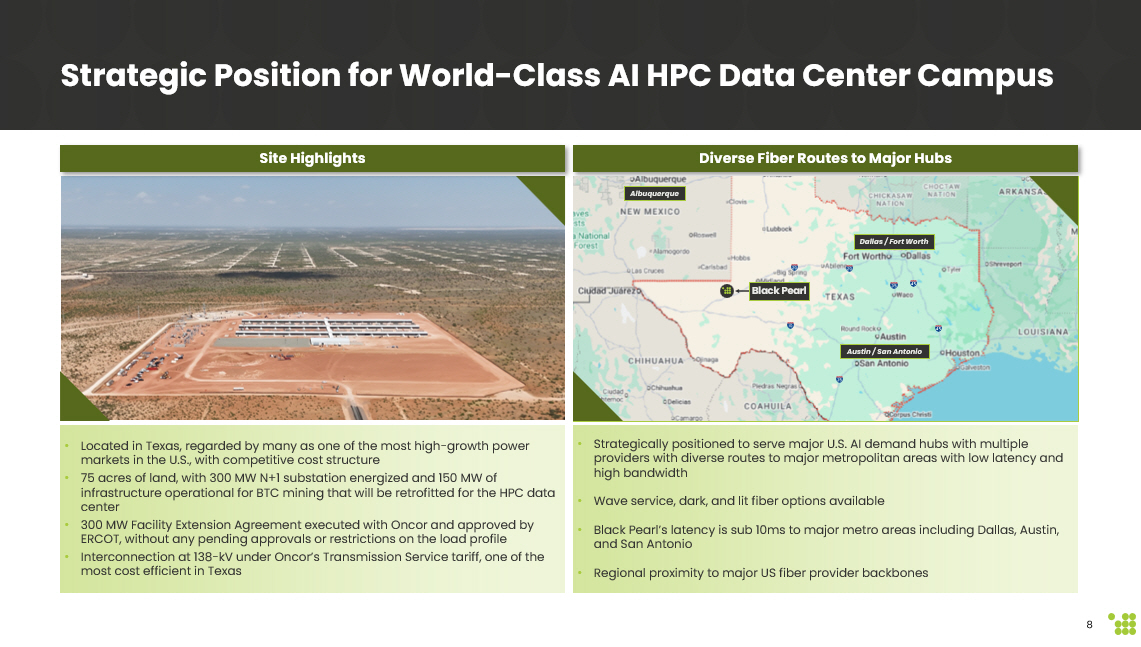

8 • Strategically positioned to serve major U.S. AI demand hubs with multiple providers with diverse routes to major metropolitan areas with low latency and high bandwidth • Wave service, dark, and lit fiber options available • Black Pearl’s latency is sub 10ms to major metro areas including Dallas, Austin, and San Antonio • Regional proximity to major US fiber provider backbones • Located in Texas, regarded by many as one of the most high - growth power markets in the U.S., with competitive cost structure • 75 acres of land, with 300 MW N+1 substation energized and 150 MW of infrastructure operational for BTC mining that will be retrofitted for the HPC data center • 300 MW Facility Extension Agreement executed with Oncor and approved by ERCOT, without any pending approvals or restrictions on the load profile • Interconnection at 138 - kV under Oncor’s Transmission Service tariff, one of the most cost efficient in Texas Site Highlights Diverse Fiber Routes to Major Hubs Strategic Position for World - Class AI HPC Data Center Campus Black Pearl Dallas / Fort Worth Austin / San Antonio Albuquerque

9 Experienced Team with Proven Track Record in Power Infrastructure & Hyperscale Data Center Delivery Cipher Data Center Team & Capabilities • Project leadership team with extensive hyperscale data center delivery experience , including multiple senior hires from Google’s data center construction and operations groups , overseeing Black Pearl’s development and operations • Internal construction & operations leadership with track records delivering Tier III - spec data centers on accelerated schedules • In - house site selection, permitting, and power origination expertise — team sources sites years in advance, evaluates interconnect and regulatory dynamics, and drives execution through COD • Strong operational discipline, leveraging proprietary curtailment tech and standardized design to ensure reliability and efficiency 300 More than 300 strategic operating centers across U.S., Canada & Australia 2025 ENR #1 Specialty Contractor Solar Worlds Top Solar & Storages Contractor Select List of Quanta Subsidiaries #1 #1 Black Pearl Developer and Owner EPC 25%+ 25% of utility - scale wind, solar, and energy storage capacity in the U.S. were constructed by our companies 74,000 Largest specialized equipment fleet in North America: approximately 74,000 pieces of equipment $30Bn Record backlog of $30Bn reflects collaboration with customers & advancement of long - term strategies 5 sites 477MW Cipher Developed Sites All sites completed on time based on original guidance 600MW of capacity under development with Quanta 8 sites ~3.4GW Cipher Pipeline Currently interconnection approved or late stage of approval process Best In - Class Team Team has worked at hyperscalers and built / operated data centers for hyperscalers Combined ~2.6GW of data center deployment and ~$32Bn+ of global project experience

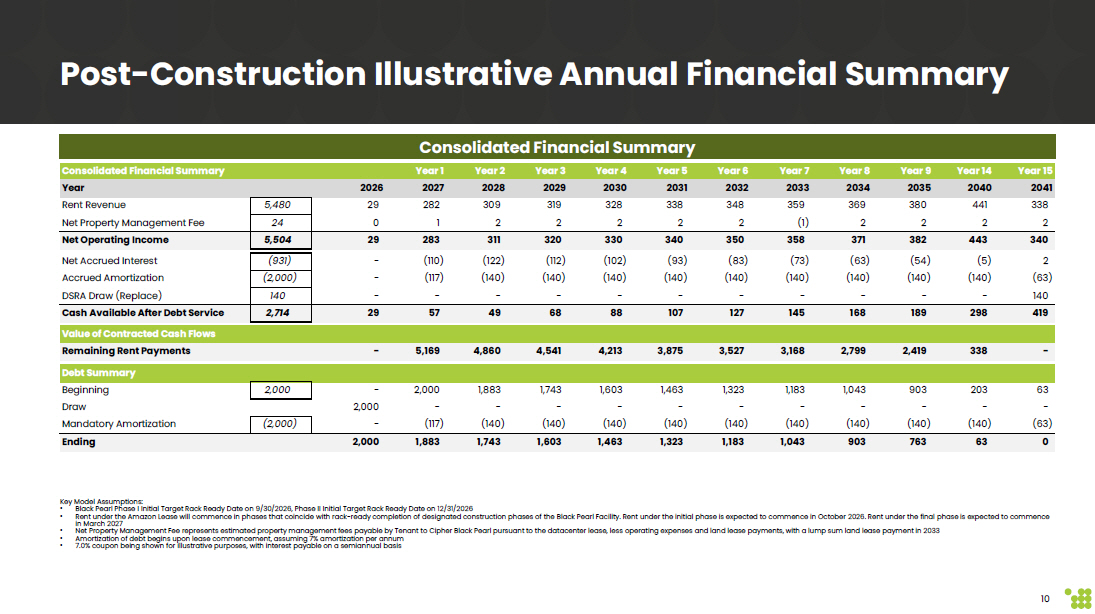

10 Consolidated Financial Summary Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 14 Year 15 Year 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2040 2041 Rent Revenue 5,480 29 282 309 319 328 338 348 359 369 380 441 338 Net Property Management Fee 24 0 1 2 2 2 2 2 (1) 2 2 2 2 Net Operating Income 5,504 29 283 311 320 330 340 350 358 371 382 443 340 Net Accrued Interest (931) - (110) (122) (112) (102) (93) (83) (73) (63) (54) (5) 2 Accrued Amortization (2,000) - (117) (140) (140) (140) (140) (140) (140) (140) (140) (140) (63) DSRA Draw (Replace) 140 - - - - - - - - - - - 140 Cash Available After Debt Service 2,714 29 57 49 68 88 107 127 145 168 189 298 419 Value of Contracted Cash Flows Remaining Rent Payments - 5,195 4,886 4,568 4,241 3,904 3,557 3,199 2,830 2,451 376 - Debt Summary Beginning 2,000 - 2,000 1,883 1,743 1,603 1,463 1,323 1,183 1,043 903 203 63 Draw 2,000 - - - - - - - - - - - Mandatory Amortization (2,000) - (117) (140) (140) (140) (140) (140) (140) (140) (140) (140) (63) Ending 2,000 1,883 1,743 1,603 1,463 1,323 1,183 1,043 903 763 63 0 Lease Support Coverage Ratio - 2.76x 2.80x 2.85x 2.90x 2.95x 3.01x 3.07x 3.13x 3.21x N/A N/A Post - Construction Illustrative Annual Financial Summary Key Model Assumptions: • Black Pearl Phase I Initial Target Rack Ready Date on 9/30/2026, Phase II Initial Target Rack Ready Date on 12/31/2026 • Rent under the Amazon Lease will commence in phases that coincide with rack - ready completion of designated construction phases o f the Black Pearl Facility. Rent under the initial phase is expected to commence in October 2026. Rent under the final phase is expected to commence in March 2027 • Net Property Management Fee represents estimated property management fees payable by Tenant to Cipher Black Pearl pursuant to th e datacenter lease, less operating expenses and land lease payments, with a lump sum land lease payment in 2033 • Amortization of debt begins upon lease commencement, assuming 7% amortization per annum • 7.0% coupon being shown for illustrative purposes, with interest payable on a semiannual basis Consolidated Financial Summary

Black Pearl Compute