Upon the executive’s qualifying termination not in connection with a CIC, all outstanding RSUs would continue to vest as if the executive had remained employed through each subsequent vesting date and all outstanding PSUs for which the performance period has not been completed will remain outstanding and eligible to vest based on actual achievement of the performance metrics through the applicable performance period, pro-rated to reflect the portion of the performance period during which the executive was employed by the Company.

In the event of a qualifying termination that occurs in connection with, or within 24 months following a CIC, the Executive Severance Plan provides cash severance to each executive of 200% of the sum of the executive’s (i) annual base salary and (ii) target bonus opportunity.

Additionally, subject to his or her timely election of COBRA coverage, the executive would be entitled to payment of the Company’s portion of monthly COBRA premiums for 24 months or until the executive becomes eligible for coverage under a subsequent employer’s health plan.

Upon the executive’s qualifying termination in connection with, or within 24 months after a CIC, except to the extent that the terms of the applicable award agreements evidencing awards granted prior to April 5, 2024 provide for different treatment, all outstanding RSUs would immediately become fully vested upon the date of termination, and all earned PSUs (as determined based on actual performance immediately prior to such CIC) would immediately become fully vested upon the date of termination.

In the event of a termination of the executive’s employment by reason of death or disability, all outstanding RSUs would immediately become fully vested upon the date of termination. The executive would not be entitled to receive any other benefits under the Executive Severance Plan.

For purposes of the Executive Severance Plan, the following definitions apply:

“Cause” is defined as: (i) the commission of a felony or other crime involving moral turpitude or the commission of any other act or omission involving dishonesty or fraud with respect to the Company or any of its affiliates or any of their customers, vendors or suppliers, (ii) reporting to work under the influence of alcohol or under the influence or in the possession of illegal drugs, (iii) substantial and repeated failure to perform duties as reasonably directed by the Board or any other person to whom the executive reports after notice of such failure and, if curable, an opportunity to permanently cure such failure within 30 days of such notice, (iv) breach of fiduciary duty, gross negligence or willful misconduct with respect to the Company or any of its affiliates, (v) a willful and material failure to observe policies or standards of the Company regarding employment practices (including nondiscrimination and sexual harassment policies) as prescribed thereby from time to time after notice of such failure and, if curable, an opportunity to permanently cure such failure within 30 days of such notice or (vi) any breach by the executive of any non-competition, non-solicitation, no-hire or confidentiality covenant between the executive and the Company or any of its affiliates or any material breach by the executive of any provision of the Executive Severance Plan, or any agreement to which the executive and the Company or any of its affiliates are parties after notice of such failure and, if curable, an opportunity to permanently cure such failure within 30 days of such notice.

“Change in Control” is defined as (i) an independent third party becoming the beneficial owner of securities of the Company representing at least 50% of the voting power of the Company’s securities, (ii) a merger, reorganization, or consolidation of the Company, unless the voting securities of the Company continue to represent more than 50% of the voting power of the Company or surviving entity, (iii) a change in the membership of our Board over a period of two consecutive years, in which incumbent directors and new directors whose election by the Board or nomination for election by our stockholders was approved by a vote of at least two-thirds of our directors, cease to constitute a majority of our Board membership and (iv) a complete liquidation or dissolution of the Company or sale of all or substantially all of the Company’s assets.

“Good Reason” is defined as (i) a material reduction in the executive’s annual base salary without the executive’s consent, (ii) a relocation of the executive’s principal place of employment, without his or her consent, to a location more than 50 miles from his or her then-current principal place of employment, or (iii) an adverse change in the executive’s position or title without his or her consent; provided, that, in any case, (x) written notice of the executive’s resignation for Good Reason must be delivered to the Company within 30 days after the occurrence of any such event in order for his or her resignation for Good Reason to be effective hereunder, (y) the Company shall have 30 days after receipt of such notice during which the Company may remedy the occurrence giving rise to the claim for Good Reason termination (if such occurrence is capable of being remedied), and, if the Company cures such occurrence within such 30-day period, there shall be no Good Reason, and (z) the executive must actually resign within 90 days following the event constituting Good Reason.

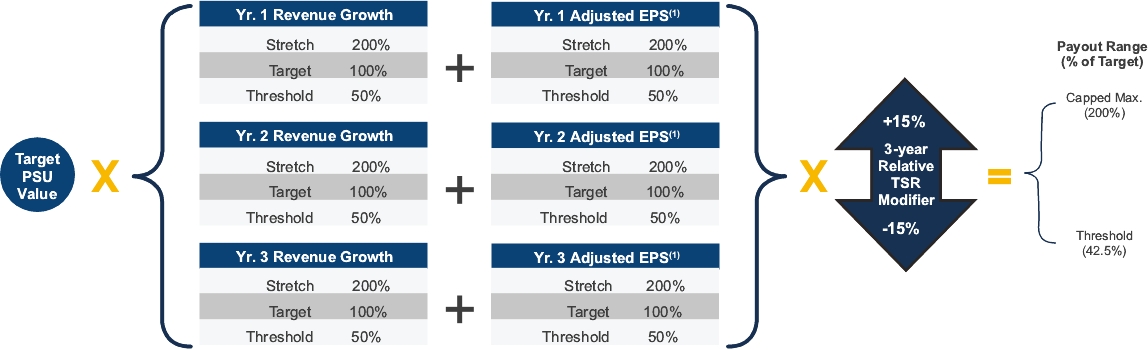

Pursuant to the PSU award agreements granted under the LTIP, if, prior to the end of the performance period, the NEO’s employment is terminated due to death or disability, the PSUs will vest as of the date of such termination at target performance, pro-rated to reflect the portion of the performance period during which the executive was employed by us. If, after the end of the performance period but before the applicable vesting date, the NEO’s employment is terminated due to death or disability, the PSUs will vest based on actual performance. Upon the occurrence of a change in control, any outstanding PSUs will be earned based on actual performance through the date of the change in control, with the earned PSUs continuing to vest based on the executive’s continued service. Upon the executive’s qualifying termination that occurs upon or within 24 months following a change in control, or the executive’s termination by reason of death or disability following a change in control, all earned PSUs will immediately become fully vested upon the date of termination.

(6)

(6)