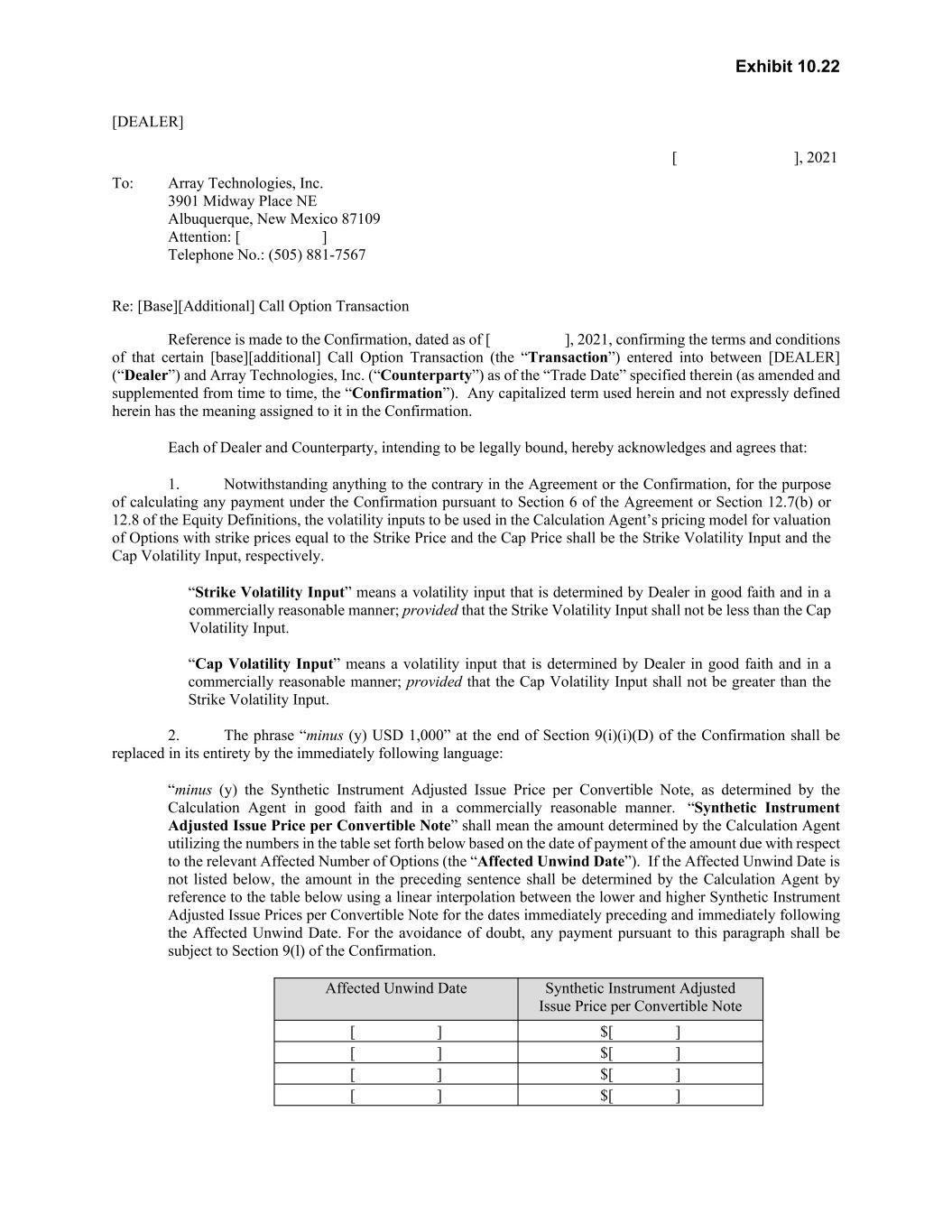

Exhibit 10.22 [DEALER] [ ], 2021 To: Array Technologies, Inc. 3901 Midway Place NE Albuquerque, New Mexico 87109 Attention: [ ] Telephone No.: (505) 881-7567 Re: [Base][Additional] Call Option Transaction Reference is made to the Confirmation, dated as of [ ], 2021, confirming the terms and conditions of that certain [base][additional] Call Option Transaction (the “Transaction”) entered into between [DEALER] (“Dealer”) and Array Technologies, Inc. (“Counterparty”) as of the “Trade Date” specified therein (as amended and supplemented from time to time, the “Confirmation”). Any capitalized term used herein and not expressly defined herein has the meaning assigned to it in the Confirmation. Each of Dealer and Counterparty, intending to be legally bound, hereby acknowledges and agrees that: 1. Notwithstanding anything to the contrary in the Agreement or the Confirmation, for the purpose of calculating any payment under the Confirmation pursuant to Section 6 of the Agreement or Section 12.7(b) or 12.8 of the Equity Definitions, the volatility inputs to be used in the Calculation Agent’s pricing model for valuation of Options with strike prices equal to the Strike Price and the Cap Price shall be the Strike Volatility Input and the Cap Volatility Input, respectively. “Strike Volatility Input” means a volatility input that is determined by Dealer in good faith and in a commercially reasonable manner; provided that the Strike Volatility Input shall not be less than the Cap Volatility Input. “Cap Volatility Input” means a volatility input that is determined by Dealer in good faith and in a commercially reasonable manner; provided that the Cap Volatility Input shall not be greater than the Strike Volatility Input. 2. The phrase “minus (y) USD 1,000” at the end of Section 9(i)(i)(D) of the Confirmation shall be replaced in its entirety by the immediately following language: “minus (y) the Synthetic Instrument Adjusted Issue Price per Convertible Note, as determined by the Calculation Agent in good faith and in a commercially reasonable manner. “Synthetic Instrument Adjusted Issue Price per Convertible Note” shall mean the amount determined by the Calculation Agent utilizing the numbers in the table set forth below based on the date of payment of the amount due with respect to the relevant Affected Number of Options (the “Affected Unwind Date”). If the Affected Unwind Date is not listed below, the amount in the preceding sentence shall be determined by the Calculation Agent by reference to the table below using a linear interpolation between the lower and higher Synthetic Instrument Adjusted Issue Prices per Convertible Note for the dates immediately preceding and immediately following the Affected Unwind Date. For the avoidance of doubt, any payment pursuant to this paragraph shall be subject to Section 9(l) of the Confirmation. Affected Unwind Date Synthetic Instrument Adjusted Issue Price per Convertible Note [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ]

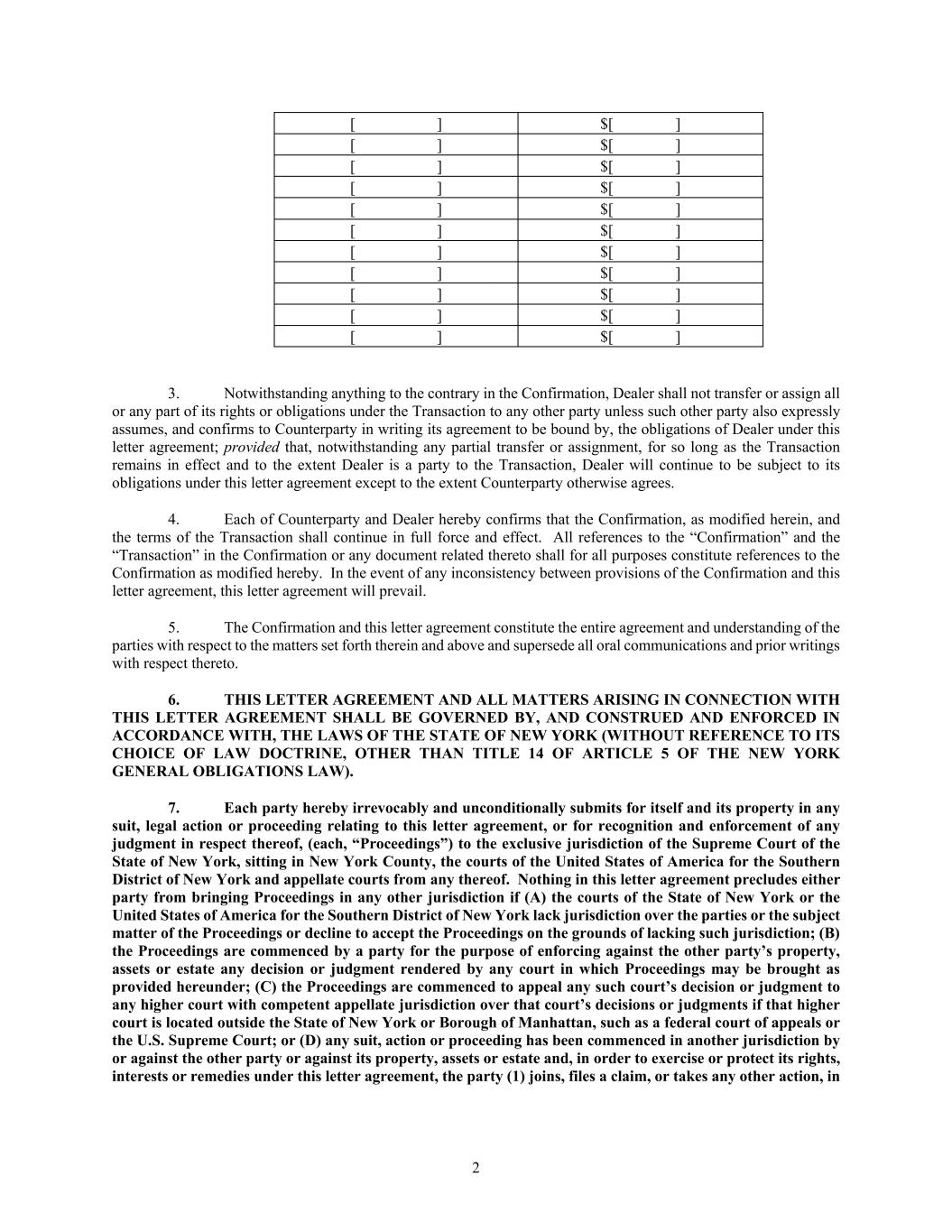

2 [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ] [ ] $[ ] 3. Notwithstanding anything to the contrary in the Confirmation, Dealer shall not transfer or assign all or any part of its rights or obligations under the Transaction to any other party unless such other party also expressly assumes, and confirms to Counterparty in writing its agreement to be bound by, the obligations of Dealer under this letter agreement; provided that, notwithstanding any partial transfer or assignment, for so long as the Transaction remains in effect and to the extent Dealer is a party to the Transaction, Dealer will continue to be subject to its obligations under this letter agreement except to the extent Counterparty otherwise agrees. 4. Each of Counterparty and Dealer hereby confirms that the Confirmation, as modified herein, and the terms of the Transaction shall continue in full force and effect. All references to the “Confirmation” and the “Transaction” in the Confirmation or any document related thereto shall for all purposes constitute references to the Confirmation as modified hereby. In the event of any inconsistency between provisions of the Confirmation and this letter agreement, this letter agreement will prevail. 5. The Confirmation and this letter agreement constitute the entire agreement and understanding of the parties with respect to the matters set forth therein and above and supersede all oral communications and prior writings with respect thereto. 6. THIS LETTER AGREEMENT AND ALL MATTERS ARISING IN CONNECTION WITH THIS LETTER AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED AND ENFORCED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK (WITHOUT REFERENCE TO ITS CHOICE OF LAW DOCTRINE, OTHER THAN TITLE 14 OF ARTICLE 5 OF THE NEW YORK GENERAL OBLIGATIONS LAW). 7. Each party hereby irrevocably and unconditionally submits for itself and its property in any suit, legal action or proceeding relating to this letter agreement, or for recognition and enforcement of any judgment in respect thereof, (each, “Proceedings”) to the exclusive jurisdiction of the Supreme Court of the State of New York, sitting in New York County, the courts of the United States of America for the Southern District of New York and appellate courts from any thereof. Nothing in this letter agreement precludes either party from bringing Proceedings in any other jurisdiction if (A) the courts of the State of New York or the United States of America for the Southern District of New York lack jurisdiction over the parties or the subject matter of the Proceedings or decline to accept the Proceedings on the grounds of lacking such jurisdiction; (B) the Proceedings are commenced by a party for the purpose of enforcing against the other party’s property, assets or estate any decision or judgment rendered by any court in which Proceedings may be brought as provided hereunder; (C) the Proceedings are commenced to appeal any such court’s decision or judgment to any higher court with competent appellate jurisdiction over that court’s decisions or judgments if that higher court is located outside the State of New York or Borough of Manhattan, such as a federal court of appeals or the U.S. Supreme Court; or (D) any suit, action or proceeding has been commenced in another jurisdiction by or against the other party or against its property, assets or estate and, in order to exercise or protect its rights, interests or remedies under this letter agreement, the party (1) joins, files a claim, or takes any other action, in

3 any such suit, action or proceeding, or (2) otherwise commences any Proceeding in that other jurisdiction as the result of that other suit, action or proceeding having commenced in that other jurisdiction. 8. EACH OF COUNTERPARTY AND DEALER HEREBY IRREVOCABLY WAIVES (ON ITS OWN BEHALF AND, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ON BEHALF OF ITS STOCKHOLDERS) ALL RIGHT TO TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM (WHETHER BASED ON CONTRACT, TORT OR OTHERWISE) ARISING OUT OF OR RELATING TO THIS LETTER AGREEMENT. 9. No amendment, modification or waiver in respect of this letter agreement will be effective unless in writing (including a writing evidenced by a facsimile transmission) and executed by each of the parties. This letter agreement (and any amendment, modification and waiver in respect of it) may be executed in several counterparts (including by facsimile transmission), each of which shall be deemed an original but all of which together shall constitute one and the same instrument. 10. Counterparty (A) is capable of evaluating investment risks independently, both in general and with regard to the Transaction; (B) will exercise independent judgment in evaluating the recommendations, if any, of Dealer or its associated persons in connection with the Transaction, unless it has otherwise notified Dealer in writing; and (C) has total assets of at least USD 50 million. [Remainder of page left blank intentionally.]

[Signature Page to Base Capped Call Side Letter] Please confirm that the foregoing correctly sets forth the terms of our agreement by executing this letter agreement and returning it to Dealer. Very truly yours, [DEALER] By: Name: Title:

[Signature Page to Base Capped Call Side Letter] Accepted and confirmed as of the date first written above: Array Technologies, Inc. By: Name: Title: