Please wait

| | |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS |

CWT HOLDINGS, LLC AND SUBSIDIARIES

Page

Independent Auditor’s Report 1

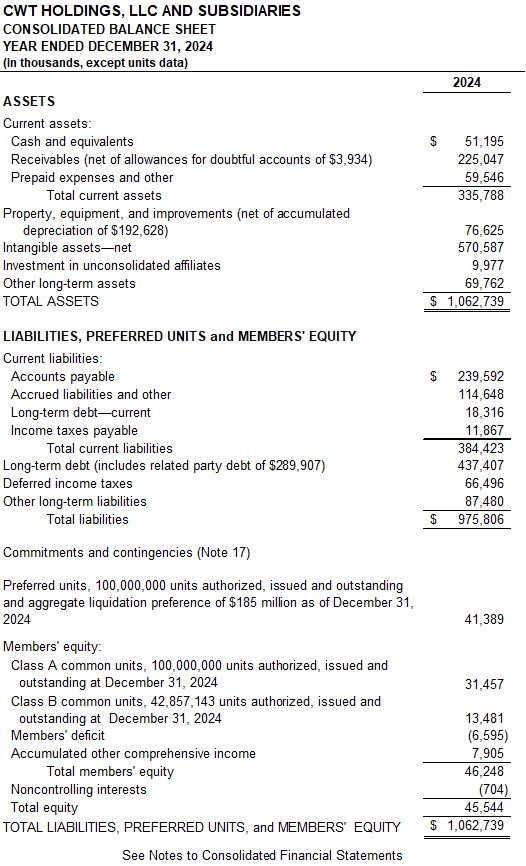

Consolidated Balance Sheet as of December 31, 2024 3

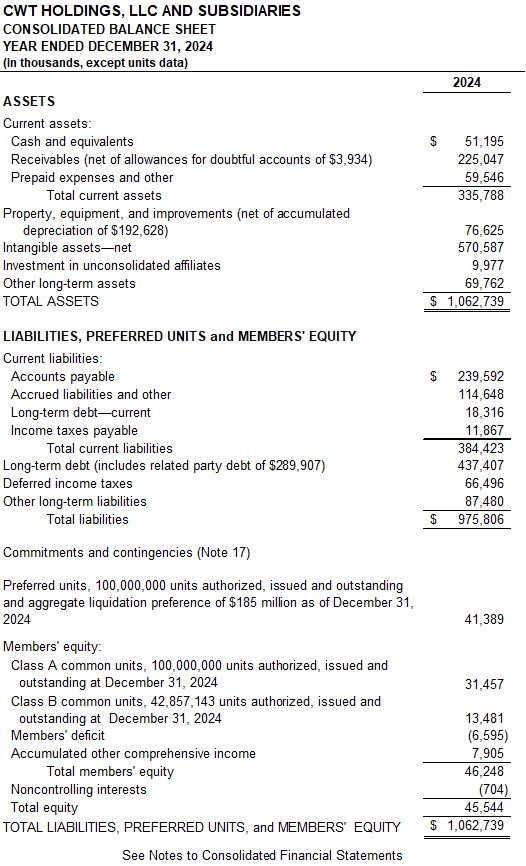

Consolidated Statement of Operations

for the years ended December 31, 2024 4

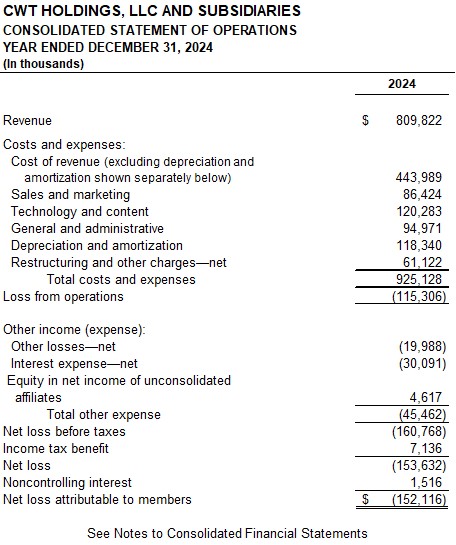

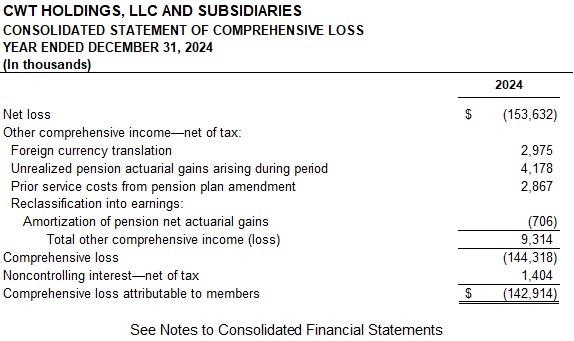

Consolidated Statement of Comprehensive Loss

for the years ended December 31, 2024 5

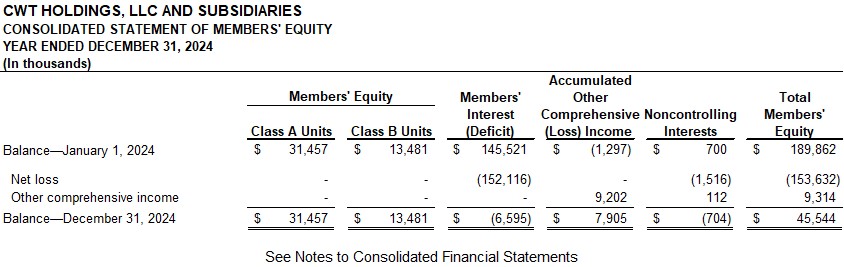

Consolidated Statement of Members’ Equity

for the years ended December 31, 2024 6

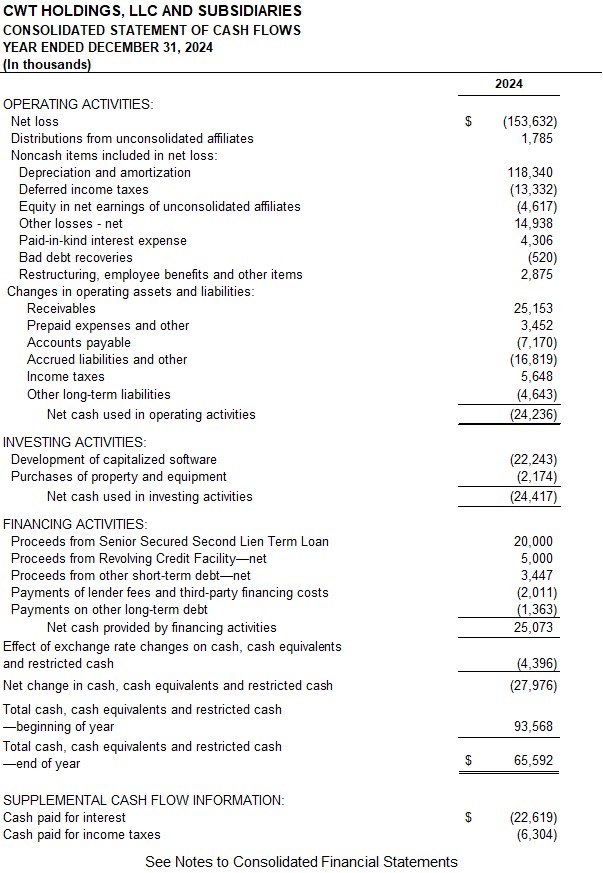

Consolidated Statement of Cash Flows

for the years ended December 31, 2024 7

Notes to Consolidated Financial Statements 8

INDEPENDENT AUDITOR’S REPORT

To the Board of Directors of CWT Holdings, LLC and subsidiaries,

Minneapolis, Minnesota

Opinion

We have audited the consolidated financial statements of CWT Holdings, LLC (formerly CWT Travel Holdings, Inc.) and its subsidiaries (the “Company”), which comprise the consolidated balance sheet as of December 31, 2024, and the related consolidated statements of operations, comprehensive loss, members’ and stockholders’ equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements (collectively referred to as the “financial statements”).

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2024, and the results of its operations and its cash flows for the year then ended, in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ Deloitte & Touche LLP

Minneapolis, Minnesota

April 30, 2025

CWT HOLDINGS, LLC AND SUBSIDIARIES

| | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

1.GENERAL AND BASIS OF PRESENTATION

CWT Holdings, LLC (successor group top holding company to CWT Travel Holdings, Inc.), together with its subsidiaries (the “Company”) provides travel booking and servicing across a wide range of service channels, including online, mobile, email, phone and messaging. It serves clients through a mix of directly operated companies, joint venture operations and partner markets in around 140 countries worldwide. Though it primarily provides travel management services to corporate clients, it has a number of businesses and product offerings that provide additional services to corporate and noncorporate clients. The Company’s primary services include business traveler services, hotel booking services, and meetings and events planning services. The Company also provides a comprehensive range of design, implementation, and travel program management services, including offline and online travel booking and customer support. It provides these services through local, regional, and global business travel centers, on-site travel counselors, third-party online booking platforms, and the Company’s chat, web, and mobile app.

On September 4, 2023 CWT Travel Holdings, Inc. and certain of its subsidiaries executed a) an amendment to its Super-Senior Priority First Lien Credit Agreement (the “1L Credit Agreement”), and b) a restructuring support agreement (as amended, the “Support Agreement”), with the lenders under the 1L Credit Agreement (the “First Lien Lenders”), certain holders of the 8.5% Senior Secured Notes (the “Notes”), certain holders of CWT Travel Holdings, Inc. series A convertible preferred stock, and certain holders of its common stock (collectively, the “Support Agreement Parties”). Execution of these agreements provided the Company with (i) $100 million of additional funding (the “FILO Term Loans”) provided by certain holders of the Company’s 8.5% Senior Secured Notes (the “FILO Term Lenders”) and (ii) a new $50 million facility provided by the lead First Lien Lender for the purpose of issuing letters of credit to support certain of the Company’s collateral requirements (the “2023 Revolving Commitment”). The Support Agreement required the Company, among other things, to commence certain actions to recapitalize the Company (the “Recapitalization Transactions” or the “Recapitalization”).

On November 8, 2023, having received sufficient consents from holders of the 8.5% Senior Secured Notes (the “Noteholders”), holders of CWT Travel Holdings, Inc. series A convertible preferred stock (the “Preferred Holders”), First Lien Lenders and holders of CWT Travel Holdings, Inc. common stock (the “Common Holders”), the Company executed the Recapitalization Transactions in accordance with the terms of the Support Agreement. Summary impacts include:

•The FILO Term Loans were exchanged for a senior secured second lien term loan facility (“Second Lien Term Loans”) with an initial principal amount equal to the then outstanding principal of the FILO Term Loans, plus accrued payable “in kind” (“PIK”) interest. In addition, the FILO Term Lenders received equity interests issued by the new parent holding company, CWT Holdings, LLC of a) 100% of the new preferred equity interest (the “Preferred Units”), b) 100% of the new class A common equity interests (the “Class A Common Units”), and c) 77% of the new class B common equity interest (the “Class B Common Units”). All existing preferred stock of CWT Travel Holdings, Inc. was cancelled while the existing common stock of CWT Travel Holdings, Inc. was cancelled following its dissolution on November 14, 2023.

•CWT Travel Group, Inc. completed an exchange offer and consent solicitation to secure consents from the Noteholders pursuant to the conditions set forth in the Support Agreement. Noteholders who consented to the Recapitalization Transactions exchanged their 8.5% Senior Secured Notes (the “Notes”) for a pro rata share of approximately 16% of the Class B Common Units. The remaining Notes held by the non-consenting Noteholders were redeemed for a nominal amount of cash.

The Recapitalization was accounted for as a reverse recapitalization under the provisions of Accounting Standards Codification (“ASC”) Topic 805-40. A reverse recapitalization does not result in a new basis of accounting, and these Consolidated Financial Statements reflect the historic results of CWT Travel Holdings, Inc. prior to the Recapitalization Transactions. See Note 4, “Recapitalization” for more details.

On March 24, 2024 (with subsequent amendments), the Company and Global Business Travel Group, Inc. (“AMEX GBT”) entered into an Agreement and Plan of Merger (the “Merger Agreement”). The Merger Agreement values the Company at approximately $540 million on a cash-free and debt-free basis, subject to certain assumptions and purchase price adjustments, implying an equity value of approximately $470 million. Subject to certain assumptions and purchase price adjustments, AMEX GBT expects at closing to issue to the Company’s equity holders an aggregate of approximately 50 million shares of its common stock at a price of $7.50 per share and pay the Company’s equity holders an aggregate of approximately $70 million.

The closing of the transaction is subject to the receipt of specified regulatory approvals and other customary closing conditions including, among other things, expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 as amended, and clearance from the Committee on Foreign Investment in the United States. The Merger Agreement contains representations, warranties and covenants by the parties that are customary for a transaction of this nature. See Note 23 “Subsequent Events.”

Basis of Presentation: The Company’s Consolidated Financial Statements include the accounts of CWT Holdings, LLC, its wholly-owned subsidiaries and entities controlled by CWT Holdings, LLC. The Company reports the non-controlling ownership interests in subsidiaries that are held by third-party owners as Noncontrolling interests on the Consolidated Balance Sheet. The portion of income or loss attributable to third-party owners for the reporting period is reported as Noncontrolling interest on the Consolidated Statement of Operations. The Company has eliminated intercompany transactions and balances in its Consolidated Financial Statements.

Use of Estimates: The preparation of Consolidated Financial Statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the Consolidated Financial Statements, the reported amounts of revenue and expense during the reporting period, and the disclosure of contingent assets and liabilities. Accounts affected by significant estimates include revenue, capitalized software, investment in unconsolidated subsidiaries, allowance for doubtful accounts, valuation of intangible assets, deferred revenue, valuation of pension obligations, and valuation of deferred tax assets and liabilities. Actual results could differ materially from those estimates.

2.SIGNIFICANT ACCOUNTING POLICIES

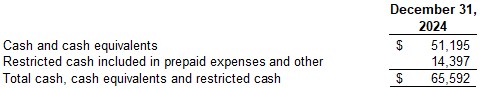

Cash and Equivalents: Cash and equivalents are highly liquid investments that generally have an original maturity of three months or less. The fair value of cash equivalents approximates their carrying value because of the short maturity of the instruments.

Restricted Cash: Restricted cash includes cash that is restricted through legal contracts or regulations. Restricted cash principally relates to amounts held as security for cash management and credit card arrangements. The following table reconciles cash, cash equivalents and restricted cash reported in the Consolidated Balance Sheet to the total amount shown in the Consolidated Statement of Cash Flows ($ in thousands):

Allowance for Doubtful Accounts: The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in its receivables; however, changes in circumstances relating to receivables may result in additional allowances in the future. The Company determines the allowance based on historical experience, current payment patterns and the Company’s assessment of its customers’ ability to pay outstanding balances.

The allowance for doubtful accounts was $3.9 million as of December 31, 2024.

Property, Equipment, and Improvements—Net: Property, equipment, and improvements consist of land, buildings, furniture, fixtures, and capitalized software, which are stated at cost or acquired fair value and are depreciated over their estimated useful lives ranging from 3 to 10 years, principally using the straight-line method for financial reporting purposes. Depreciation of leasehold improvements is based upon the lesser of the applicable lease term or the estimated useful lives of the assets, using the straight-line method. Repairs and maintenance costs are expensed as incurred.

Intangible Assets—Net: Intangible assets represent the fair value of identifiable intangible assets acquired in business combinations or the purchase of a specific asset group. Identifiable intangible assets with finite lives are amortized over their useful life determined based on customer demand, competition, contractual relationships, and other business factors. The Company does not have any intangible assets with indefinite lives.

Long-Lived Assets: Long-lived assets, including property, equipment, and improvements and finite life intangible assets, are reviewed periodically for possible impairment. The Company evaluates whether current facts or circumstances indicate that the carrying value of the assets may not be recoverable. If such circumstances are determined to exist, an estimate of undiscounted future cash flows produced by the long-lived asset, or the appropriate grouping of such assets, is compared to the carrying value to determine whether impairment exists. If an asset is determined to be impaired, the loss is measured based on quoted market prices in active markets, if available. If quoted market prices are not available, the estimate of fair value is based on various valuation techniques, including discounted value of estimated future cash flows. The Company reports assets pending disposal of at the lower of carrying value or estimated net realizable value.

The Company tests finite life intangible and other long-lived assets for impairment if events or changes in circumstances indicate that the asset might be impaired. The Company did not record any intangible asset or other long-lived asset impairment charges in 2024.

Deferred Meetings and Events (“M&E”) Bookings: Deferred M&E bookings are amounts received from M&E clients at or after the time of booking. The recorded balance primarily consists of amounts owed to third-party service providers for which the Company has received cash payments in advance of the meeting or event taking place. These meetings or events will take place within one year and as such, these amounts are included in the “Accrued liabilities and other” in the Consolidated Balance Sheet. (see Note 11, “Accrued Liabilities and Other”).

Deferred Revenue: Deferred revenue is amounts received from clients and suppliers in advance of the Company completing its performance obligations. It includes payments received from Global Distribution Systems (“GDS”) and hotels, such as signing bonuses, which are recognized as revenue as services are provided over the duration of the contract. The Company generally completes its performance obligations on client contracts within one year of cash receipt and on supplier and GDS contracts within ten years. Deferred revenue related to performance obligations to be completed within one year is included in “Accrued liabilities and other” in the Consolidated Balance Sheet. Deferred revenue related to performance obligations to be completed later than one year is included in “Other long-term liabilities” in the Consolidated Balance Sheet. (see Note 13, “Other Long-term Liabilities).” The Company recognized as revenue previously deferred GDS signing bonuses of $3.8 million in 2024 related to services provided over the term of the respective GDS contract. In addition, other immaterial amounts previously recorded in deferred revenue were recognized as revenue based on when the related consulting and other services were delivered to suppliers and clients.

Revenue Recognition: The Company recognizes revenue from contracts with clients, suppliers, and GDSs. Substantially all the Company’s revenues are derived from providing travel reservation services, which principally allows travelers to book travel reservations with travel service providers through the Company’s online platform or offline travel counselors. Generally, the Company’s contracts with clients and suppliers allow the Company to facilitate reservations without assuming responsibility to deliver the travel service. The travel supplier is primarily responsible for providing the underlying travel services and the Company does not control the service provided to the clients. Therefore, these revenues are presented on a net basis in the Consolidated Statement of Operations. However, under certain M&E contracts, the Company is responsible for providing the underlying services. Such revenues are presented on a gross basis in the Consolidated Statement of Operations.

The Company’s contracts generally contain a single performance obligation which is to arrange for travel services. This performance obligation is satisfied during each distinct period over the term of the contract during which the Company stands ready, and when called upon, provides travel arrangement services. Variable consideration in these contracts meets the criteria to be allocated to the distinct time periods to which it relates, because (i) it is due to the activities performed to satisfy the performance obligation during that period and (ii) it represents the consideration to which the Company expects to be entitled.

As part of the arrangements with clients, the Company may be contractually obligated to share with them the commissions collected from travel suppliers that are directly attributable to the Company’s business with that client. Additionally, in certain contractual agreements with its clients, the Company promises consideration to them in the form of credits or upfront payments. The Company accrues or capitalizes such consideration payments to its clients and recognizes it ratably over the period of contract as a reduction of revenue. The accrued or capitalized upfront payments are included in current assets or liabilities on the Company’s Consolidated Balance Sheet.

In addition, certain contracts have elements where consideration is determined over multiple service periods – for example, annual rebates or credits due to clients. Revenue earned for these elements is estimated and allocated to the applicable service periods. Estimates may involve projecting service activity over the remaining contract period and could be based on the Company’s historical results, current market trends, and current activity levels.

The primary sources of revenues consist of the following:

•Clients: Clients engage the Company to provide travel management services, ranging from design, implementation and program management to travel booking and customer support. The Company primarily earns revenue from clients on a transaction or management fee structure.

–Under a transaction fee structure, the Company earns a fee per transaction (air, hotel, rail, and car reservations). The Company receives nonrefundable transaction fees from clients each time a travel transaction is processed. Transaction fee revenue is generally allocated to and recognized in the period the transaction is processed.

–Under a management fee structure, the Company typically receives management fees (that cover a specified service period) and reimbursement of direct operating expenses. Revenues from management fees and cost reimbursements are recognized over the applicable service period.

•Suppliers: Suppliers consist of airlines, hotels, ground transportation providers and other travel or travel-related providers that are ultimately responsible for providing travel services to a client. The Company receives compensation from suppliers for content distribution, marketing services and business development, which generally comes in the form of fees for services provided. Each supplier contract is unique in how revenue is calculated and earned, with compensation levels that are based on mutually agreed performance criteria. Fees from travel suppliers are generally recognized upon fulfillment of the reservation as the performance obligation is not satisfied until the delivery of the travel service. The Company receives incentives from air travel suppliers for flown incremental bookings above minimum targeted thresholds. The Company allocates the variable consideration to the flown bookings during the incentive period and recognizes revenue to the extent that it is probable that a subsequent change in the estimate would not result in a significant revenue reversal.

•GDS: In certain transactions, a GDS receives commission revenues from travel suppliers in exchange for distributing its content and distributes a portion of these commissions to the Company as an incentive for the Company to utilize its platform. These fees are based on the number of segments and/or volume booked on the related GDS system. This fee is generally tiered and includes minimum volume thresholds. The Company recognizes these commissions in revenue as travel bookings are made through the GDS platform. As discussed above under “Deferred Revenue”, certain GDSs have paid signing bonuses to the Company under multi-year agreements. Some of these agreements contain minimum volume thresholds whereby penalty payments are due to the GDS if those thresholds are not achieved. Estimated penalties are accrued as reductions to revenue in the periods in which they are incurred.

Government Wage Subsidies: The Company records amounts received in government wage subsidies as a reduction in Costs and Expenses in the Consolidated Statement of Operations. These are generally recorded at the time of cash receipt, with an appropriate liability established if it is probable the subsidy will be refunded at a future date. The Company recognized government wage subsidies, primarily related to its international operations of $4.0 million in 2024. Certain subsidies are subject to post-payment eligibility audits. As of December 31, 2024 there were no amounts accrued for potential refunds due under such audits.

Leases: The Company determines whether an arrangement that provides control over the use of an asset to the Company is a lease. The Company recognizes a lease liability and corresponding right-of-use asset in the Consolidated Balance Sheet based on the present value of future lease payments, and it recognizes lease expense on a straight-line basis over the lease term. Leases with an initial term of 12 months or less are not recorded in the Consolidated Balance Sheet.

The Company has elected the practical expedient of not separating payments for lease components from non-lease components for all asset classes. Lease agreements may include extension, termination, or purchase options, all of which are considered in calculating the lease liability and right-of-use asset when it is reasonably certain the Company will exercise the option or, in the case of termination options, it is reasonably certain the Company will not exercise the option. Most leases do not explicitly state the discount rate implicit in the lease, therefore, the Company’s incremental borrowing rate on the lease commencement date is used to calculate the present value of future payments for most leases. This rate is determined using a portfolio approach based on the rate of interest the Company would pay to borrow an amount equal to the lease payments on a collateralized basis over a similar term. The Company uses interest rate spreads quoted by financial institutions for companies with similar credit ratings and adds these to U.S. Treasury rates to derive the incremental borrowing rate.

Income Taxes: The Company accounts for income taxes under the asset and liability method, which requires the recognition of deferred tax assets (“DTAs”) and liabilities (“DTLs”) for the expected future tax consequences of events that have been included in the Consolidated Financial Statements. Under this

method, DTAs and DTLs are determined based on the differences between the Consolidated Financial Statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on DTAs and DTLs is recognized in income in the period that includes the enactment date.

The Company records net DTAs to the extent the Company believes these assets will more likely than not be realized. In making such a determination, the Company considers all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, tax-planning strategies, carryback potential if permitted under the tax law, and results of recent operations.

The Company’s income tax returns are periodically audited by U.S. federal, state, local and foreign authorities. At any given time, multiple tax years may be subject to audit by various tax authorities. In evaluating the exposures associated with its tax filing positions, the Company may record a liability for such exposure. The Company initially recognizes the financial statement effect of a tax position when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. A tax position that meets the more likely than not recognition threshold is initially and subsequently measured at the largest amount that is more than 50% likely of being realized when effectively settled.

Fair Value Measurement: The Company determines the fair market values of its financial assets and liabilities, as well as non-financial assets and liabilities that are recognized or disclosed at fair value on a recurring basis, based on the fair value hierarchy established in U.S. GAAP. The Company measures its financial assets and liabilities using inputs from the following three levels of the fair value hierarchy.

The three levels are as follows:

•Level 1 - Quoted prices for identical instruments in active markets.

•Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs or significant value-drivers are observable in active markets.

•Level 3 - Model-derived valuations in which one or more significant inputs or significant value-drivers are unobservable.

Recurring Fair Value Measurements - There were no financial assets or liabilities measured at fair value on a recurring basis as of December 31, 2024.

Nonrecurring Fair Value Measurements - Certain assets are measured at fair value on a nonrecurring basis. These assets are not measured at fair value on an ongoing basis but are subject to fair value adjustments only in certain circumstances. These include certain long-lived assets that are written down to fair value when they are held for sale or determined to be impaired, and goodwill and intangible assets that are written down to fair value when they are determined to be impaired.

Fair Value of Financial Instruments - Financial instruments, other than those presented in the defined benefit plan assets described in Note 15, “Defined Benefit Plans,” include cash and equivalents, accounts receivable, accounts payable, accrued liabilities, and debt. The fair values of cash and equivalents, accounts receivable, accounts payable, and accrued liabilities approximate their carrying values because of the short-term nature of these instruments. For most of the Company’s debt, the carrying value approximates fair value since it was recently transacted on an arm’s length basis, and its interest rate adjusts regularly to market conditions. The carrying value of the Company’s Second Lien Initial Term Loans significantly exceed their fair value due the impact of accounting under ASC 470-60 “Troubled Debt Restructuring with Debtors” (see Note 4, “Recapitalization”). This requires the carrying amount to include all future cash flows related to the instrument, including future interest and redemption premium payments. The Company estimates the fair value of the Second Lien Initial Term Loans at December 31, 2024 is approximately equal to the contractual principal due to the Second Lien Term Loan lenders at that date, which was $122.1 million. (see Note 12, “Debt”).

Foreign Currency: The functional currency of the Company’s non-US subsidiaries is generally their respective local currency. Assets and liabilities are translated to U.S. dollars at the rate of exchange existing at the balance sheet date. Income and expense items are translated at average rates of exchange prevailing during the period. Asset and liability translation gains and losses are included as a component of “Accumulated other comprehensive income” in the Consolidated Balance Sheet.

Net losses from foreign currency operating transactions are recorded “Other losses—net in the Consolidated Statement of Operations and totaled $1.8 million in 2024. (see Note 19, “Other losses—net”).

3.NEW ACCOUNTING PRONOUNCEMENTS

Income Taxes—In December 2023, the FASB issued ASU No. 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures”. This standard requires the Company to provide (i) further disaggregation for specific categories on the effective tax rate reconciliation, as well as additional information about federal, state and local and foreign income taxes, and (ii) annually disclose its income taxes paid (net of refunds received), disaggregated by jurisdiction. The standard is required for private companies with fiscal years beginning after December 15, 2025, with early adoption permitted. The standard is required to be applied on a prospective basis with optional retrospective application permitted. The standard will require additional footnote disclosures related to the Company's income taxes and have no impact on the Consolidated Financial Statements. CWT intends to adopt this standard for the 2025 Consolidated Financial Statements. We do not anticipate implementation will result in significant changes to the current footnote disclosures.

Disaggregated Expenses—In November 2024, the FASB issued ASU No. 2024-03 “Disaggregation of Income Statement Expenses” which provides guidance on additional disclosures about specific types of expenses included in the expense captions presented on the face of the income statement as well as disclosures about selling expenses. The ASU is effective for fiscal years beginning after December 15, 2026, and interim periods within fiscal years beginning after December 15, 2027, with early adoption permitted. The update is to be applied on a prospective basis, although optional retrospective application is permitted. While the update will require additional disclosures related to the Company’s expenses, it is not expected to have any impact on the Company’s consolidated operating results, financial condition or cash flows.

4.RECAPITALIZATION

On September 4, 2023, CWT Travel Holdings, Inc. and certain of its subsidiaries executed a) an amendment to its 1L Credit Agreement, and b) the Support Agreement with the Support Agreement Parties. Execution of these agreements provided the Company with (i) the FILO Term Loans provided by the FILO Term Lenders, and (ii) the 2023 Revolving Commitment.

On November 8, 2023, having received sufficient consents from the Noteholders, Preferred Holders, First Lien Lenders and Common Holders, the Company executed the Recapitalization Transactions in accordance with the terms of the Support Agreement. The significant components of the Recapitalization Transactions are as follows:

•The 1L Credit Agreement was amended in accordance with the First Lien Credit Agreement Amendment Term Sheet annexed to the Support Agreement, including adding CWT Group, LLC as the successor lead borrower to CWT Travel Group, Inc. and the termination of the FILO Term Loan Facility.

•The FILO Term Lenders received their pro rata share of (i) 100% of new Preferred Units issued by the new parent holding company, CWT Holdings, LLC, (ii) 100% of its Class A Common Units, (iii) 77% of its Class B Common Units, and (iv) 100% of the Second Lien Term Loans with an initial principal amount equal to the then outstanding principal of the FILO Term Loans, plus accrued PIK interest.

•CWT Travel Group, Inc. executed an exchange offer and consent solicitation with the Noteholders. Consenting Noteholders exchanged their Notes for a pro rata share of approximately 16% of the

Class B Common Units and approved modifications to the Notes’ indenture, including modifications to the interest rate and the optional redemption provision. The remaining Notes not exchanged for Class B Common Units were redeemed by CWT Travel Group, Inc. for a nominal amount of cash.

•The lead First Lien Lender received the remaining portion of the Class B Common Units.

•The Preferred Units of CWT Holdings, LLC are not entitled to vote. The Class A Common Units and the Class B Common Units vote as a single class.

•CWT Travel Holdings, Inc. received consents from 100% of the Preferred Holders thereby agreeing to surrender their series A convertible preferred stock(which was immediately cancelled).

•The Series A and Series B warrants previously issued by CWT Travel Holdings, Inc. automatically expired, terminated, and became void for no further consideration.

•On November 14, 2023, CWT Travel Holdings, Inc, CWT Travel Holdings II, Inc. and CWT Travel Group, Inc. were dissolved in accordance with Delaware law. CWT Travel Holdings, Inc. common stock was cancelled in connection with its dissolution.

The Company evaluated for compliance with ASC 470, Debt: a) the settlement of the FILO Term Loans, b) the settlement of the Notes, and c) the amendments to the 1L Credit Agreement.

Under ASC 470, the settlements of the FILO Term Loans and Notes were evaluated on a combined basis, since these transactions were negotiated as an overall package, and there was significant crossover between their lender groups. In accordance with ASC 470-50, the evaluation concluded that debt held by all FILO Term Lenders and debt held by most Noteholders qualified as a troubled debt restructuring (“TDR Debt”). For each of those lenders, the Company’s effective borrowing rate on the restructured debt decreased due to the significant amount of debt forgiveness.

In accordance with ASC 470-60 “Troubled Debt Restructuring with Debtors”, the carrying value of the TDR Debt prior to the Recapitalization was first reduced by the fair value of the Company equity granted and cash paid to the lenders of $86.2 million and $28 thousand, respectively. Since this adjusted carrying value still exceeded the future undiscounted cash flows of the Second Lien Term Loans, the carrying value was further written down to equal this amount. This write-down, considered a troubled debt restructuring gain, was $368.0 million (net of applicable third-party fees). Additionally, this gain is deemed to be from a related party transaction due to a) the predominance of equity ownership among the Noteholders and FILO Term Lenders and b) the identical restructuring terms received by all creditors for the respective debt instruments. As such, it was recorded to Additional Paid-In Capital and not earnings. Following this adjustment, the carrying value of the Second Lien Term Loans was $268.2 million which reflected the future undiscounted cash flows related to its repayment, including principal, interest, and redemption premiums of $102.7 million, $130.5 million, and $35.0 million, respectively. All future principal, interest and redemption premium payments to the Second Lien Lenders will be recorded as reductions in the carrying amount of the debt with no interest expense recognized in the Statement of Operations.

The First Lien Term Lender, in addition to loans outstanding under 1L Credit Agreement, held Notes of $8.9 million prior to the Recapitalization. Under ASC 470, the settlement of these Notes and the amendments to the terms of the 1L Credit Agreement were evaluated on a combined basis since these transactions were with the same lender and were negotiated as an overall package. In accordance with ASC 470-50, the evaluation concluded that these transactions should be accounted for as a debt modification. As such, the carrying value of debt held by the First Lien Term Lender prior to Recapitalization was reduced by the fair value of Company equity they received. This resulted in the carrying value of the First Lien Loans having a premium of $8.2 million over the remaining outstanding principal balance. This premium will be amortized over the remaining term of the debt using the effective interest method.

As part of the Recapitalization, the Company capitalized third-party fees of $7.4 million related to the establishment of the $50 million 2023 Revolving Commitment and modifications to the $60 million revolving credit facility under the 1L Credit Agreement. This is reported in “Prepaid expenses and other” in the Consolidated Balance Sheet and is amortized into interest expense through the maturity date of the

applicable facility. Third-party fees associated with the extinguishment of the old debt were $11.5 million which were deducted in the determination of the troubled debt restructuring gain referenced above. The Company also wrote-off previously deferred and unamortized debt issuance costs of $10.2 million which were also deducted in the determination of the troubled debt restructuring gain.

5.RISKS AND UNCERTAINTIES

In early 2020, the World Health Organization declared the COVID-19 outbreak a global pandemic. In response to the pandemic, throughout 2020 and into 2021 the majority of countries in which the Company operates implemented containment measures, and businesses significantly limited or suspended their travel. Starting later in 2021 these containment measures were relaxed and business travel steadily recovered but at an uneven pace. The impact of the pandemic combined with structural changes to the business travel industry has resulted in the Company’s business travel bookings remaining below 2019 levels. The decline in business travel has had an unprecedented and materially adverse impact on the Company’s financial position, results of operations and cash flows.

The Company has taken and continues to take significant actions to reduce its cost structure, preserve cash and manage liquidity, including the following:

•reducing employee-related costs (to the extent legally allowed) and other operating expenses;

•closely managing non-essential capital projects and other discretionary spend;

•renegotiating lease and other contractual commitments;

•renegotiating vendor payment terms and elongating vendor payment cycles;

•where practical, discontinuing the practice of being a settlement intermediary between the Company’s clients and suppliers, which typically increases working capital requirements; and

•actively managing accounts receivable balances to maximize timely collections.

Although demand continues to improve, the Company expects its business travel bookings to remain below 2019 levels for an extended period. The Company cannot reliably predict changes to business travel behavior and spending, and its impact on the Company’s transaction volume and/or revenues. As a result, current financial information may not be necessarily indicative of future operating results. As the situation requires, the Company may take additional significant actions to reduce its cost structure, preserve cash and manage liquidity.

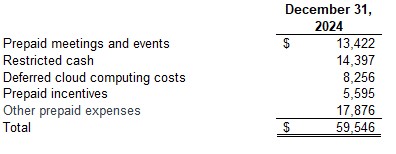

6.PREPAID EXPENSES AND OTHER

Prepaid expenses and other consist of the following ($ in thousands):

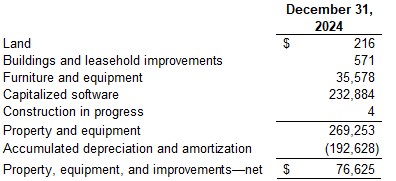

7.PROPERTY, EQUIPMENT, AND IMPROVEMENTS—NET

Property, equipment, and improvements—net consist of the following ($ in thousands):

Depreciation and amortization expense related to property, equipment and improvements was $71 million in 2024. The Company did not recognize any significant impairment losses on property, equipment, and improvements in 2024.

8.GOODWILL AND INTANGIBLE ASSETS-NET

In 2023, the Company fully impaired all previously recorded goodwill.

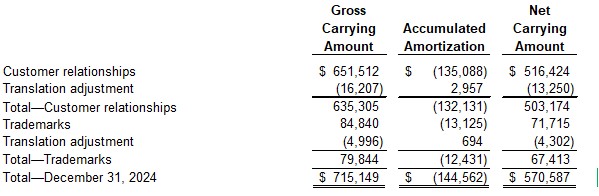

Amortizable intangible assets consist of the following at December 31, 2024 ($ in thousands):

Intangible assets consist of customer relationships and trademarks which are being amortized over their useful lives of 15 and 20 years, respectively. The weighted average useful life of all intangible assets is 15.6 years.

Intangible asset amortization expense was $47 million for 2024. Estimated future amortization expense for the intangible assets as of December 31, 2024 is approximately $48 million for each of the next five years.

The Company did not record any intangible asset impairment charges in 2024.

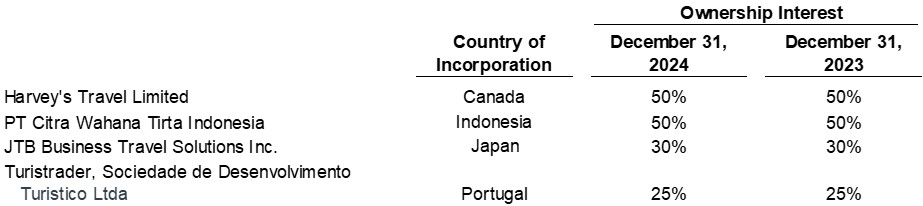

9.INVESTMENTS IN UNCONSOLIDATED AFFILIATES

Investments in unconsolidated affiliates consist of the following:

Changes in the carrying value of investments in unconsolidated affiliates is as follows ($ in thousands):

The Company annually reviews its investments in unconsolidated subsidiaries for impairment, comparing the estimated fair value of each investment to its net book value. The Company did not record any impairment charges related to investments in unconsolidated affiliates in 2024.

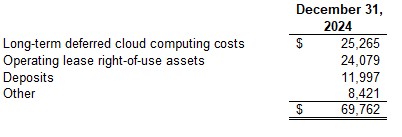

10.OTHER LONG-TERM ASSETS

Other long-term assets consist of the following ($ in thousands):

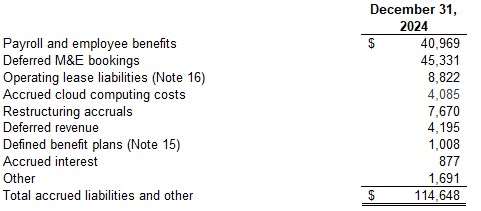

11.ACCRUED LIABILITIES AND OTHER

Accrued liabilities and other consist of the following ($ in thousands):

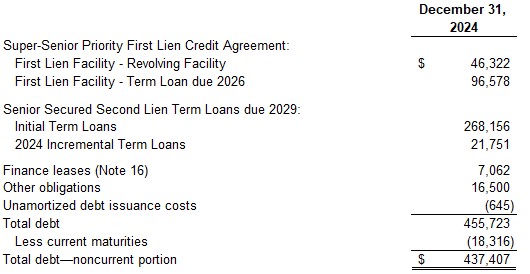

12.DEBT

Debt consists of the following ($ in thousands):

In 2021, CWT Travel Group, Inc. entered into a $150 million Super-Senior Priority First Lien Credit Agreement (the “1L Credit Agreement”) with the lenders party thereto (“First Lien Lenders”) and Alter Domus (US) LLC as administrative agent and collateral agent. Under this 1L Credit Agreement, CWT Travel Group, Inc. and its subsidiaries drew down a $90 million term loan, and had access to up to $60 million available under a revolving facility (‘Revolving Facility” and collectively, the “First Lien Loans”).

On September 4, 2023, CWT Travel Group, Inc., CWT Holdings II, Inc, and certain CWT Travel Group, Inc. subsidiaries in their capacity as borrowers and/or guarantors entered into Amendment No. 5 to the 1L Credit Agreement (“Amendment No. 5”) with the First Lien Lenders and a group of new lenders. Amendment No. 5 established a new $100 million FILO Term Loan Facility with new lenders comprised of certain holders of the Company’s 8.5% Senior Secured Notes (the “FILO Term Lenders”). In addition, Amendment No. 5 established the $50 million 2023 Revolving Commitment solely for the purpose of issuing letters of credit to support the Company’s collateral requirements for the International Air Transport Association (IATA). The Company paid a $1.5 million non-refundable upfront fee to the lead First Lien Lender for this facility.

Under Amendment No. 5 the applicable margin on the First Lien Loans increased, for Alternative Base Rate (“ABR”) loans to 5.25% cash interest plus 1.25% PIK interest, and for Secured Overnight Financing Rate

(“SOFR”) loans to 6.25% cash interest plus 1.25% PIK interest. Interest that is PIK is added to the aggregate principal amount of the First Lien Loans on the applicable interest payment date. There is a commitment fee of 3.50% on unused portions of the Revolving Facility. Loans under the 1L Credit Agreement are guaranteed by CWT Holdings II, Inc. and certain of its direct and indirect subsidiaries and are secured by liens over certain shares and assets of those subsidiaries on a first priority basis.

On November 8, 2023, Amendment No. 6 to the 1L Credit Agreement (“Amendment No. 6”) was executed, adding CWT Group, LLC as the successor lead borrower to CWT Travel Group, Inc. The FILO Term Loans were fully settled and exchanged for (i) preferred and common equity interest in the Company (as described in Note 4, “Recapitalization”), and (ii) new term loans established under the Senior Secured Second Lien Term Loan Credit Agreement (the “Second Lien Term Loans”, see below). In addition, the lead First Lien Lender received approximately 7% of the Class B Common Units.

Also on November 8, 2023, CWT Group, LLC entered into a Senior Secured Second Lien Term Loan Agreement (the “2L Credit Agreement”) with the lenders party thereto (“Second Lien Lenders”) and Wilmington Trust as administrative agent and collateral agent. The Second Lien Lenders were comprised of the former FILO Term Lenders. The initial principal amount of the loans issued thereunder (the “Second Lien Term Loans”) was $103 million. Their maturity date is May 7, 2029 with interest accruing at a rate of 15% per annum payable “in kind” (“PIK”). This PIK interest is added to the aggregate principal amount of the loans on the applicable interest payment date. Amounts borrowed under the 2L Credit Agreement are guaranteed by CWT Holdings II, LLC and certain subsidiaries of the Company and are secured by liens provided by those subsidiaries on certain shares and assets of those subsidiaries on a second priority basis after borrowings under the 1L Credit Agreement. A redemption premium of 15% is due upon repayment of all, or any part, of the principal balance regardless of when paid, including at maturity. The 2L Credit Agreement includes provisions whereby the Company is required to repay all outstanding loans (including the redemption premium) plus accrued interest following a change of control or upon or the occurrence of certain asset sales.

As described in Note 4, “Recapitalization”, the carrying value of the term loan under the 1L Credit Agreement reflects a premium over the outstanding principal balance as a result of a debt modification. As of December 31, 2024, this premium was $5.2 million to be amortized over the remaining term of the loan using the effective interest method. The maturity date of the First Lien Loans is the earlier of November 19, 2026, and the date that is six months prior to the maturity date of the Second Lien Term Loans. Additionally, as a result of a troubled debt restructuring, the carrying value of the Second Lien Term Loans of $268.2 million reflects the future undiscounted cash flows related to its repayment, including principal, interest, and redemption premiums of $122.1 million, $111.1 million, and $35.0 million, respectively.

On June 27, 2024, the First Incremental Joinder Agreement to the 2L Credit Agreement (the “Amendment”) was executed. The Amendment provided for a first-out delayed draw term loan facility in an aggregate principal amount equal to $20 million (the “2024 Incremental Term Loans”). The 2024 Incremental Term Loans may be borrowed from time to time, subject to certain conditions, including consent of certain of the lenders. The 2024 Incremental Term Loans accrue interest at a rate of 18.50% per annum, payable solely in kind, and shall mature on the same date as the Initial Term Loans. Upon any repayment, including voluntary and mandatory prepayments or any restructuring event, of the 2024 Incremental Term Loans, a premium applies in an amount that will ensure that the total return on invested capital to the lenders is at least 50% of the original 2024 Incremental Term Loan principal. At December 31, 2024 the Company had drawn the entire $20.0 million under the Amendment. There is a commitment fee on undrawn portions of the 2024 Incremental Term Loans of 5.00% per annum, payable solely in kind.

On August 14, 2024, Amendment No. 7 to the 1L Credit Agreement (“Amendment No. 7”) was executed extending the maturity date of the $50 million 2023 Revolving Commitment to December 5, 2025. The Company agreed to pay a $1.75 million non-refundable fee to the lead First Lien Lender for this extension, due on the earlier of the extended maturity date of the 2023 Revolving Commitment or the date the 2023 Revolving Commitment is terminated under the terms of the 1L Credit Agreement. As described in Note 23, “Subsequent Events”, in April 2025 the maturity date was subsequently extended to July 5, 2026.

As of December 31, 2024, the available capacity under the Revolving Facility was $1.0 million. Usage thereof includes $14.5 million issued for various letters of credit, bank guarantees or card programs. In addition, the 2023 Revolving Commitment was fully utilized having issued a $50 million letter of credit.

The 1L Credit Agreement, as amended, has covenants and restrictions around certain payments, asset sales and indebtedness; required the Company to maintain liquidity (unrestricted cash plus unused revolving facility) of at least $40 million tested on a quarterly basis; and established additional financial reporting requirements. The 2L Credit Agreement contains covenants materially consistent with those in the 1L Credit Agreement. As of December 31, 2024, the Company was in compliance with all required covenants under the 1L and 2L Credit Agreements.

“Other obligations” in the table above primarily consist of borrowings under revolving credit facilities in China and other short-term debt.

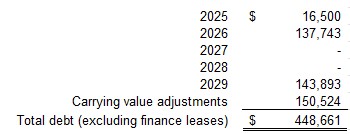

Future Debt Payments—As of December 31, 2024, future principal payments on long-term debt obligations (based on contractual repayment terms) excluding finance leases, by year due are as follows ($ in thousands):

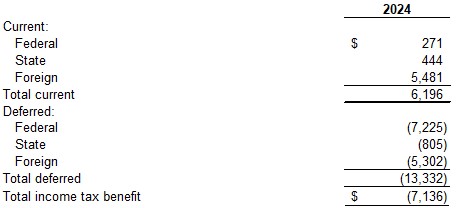

13.INCOME TAXES

Income tax benefit for 2024 consists of the following ($ in thousands):

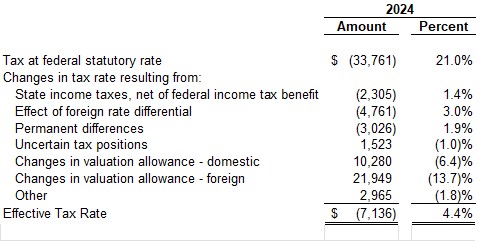

A reconciliation of income taxes computed at the federal statutory rate for 2024 to the effective tax rate in the Consolidated Statement of Operations is as follows ($ in thousands):

The Company’s income tax benefit in 2024 was $7.1 million on losses before income taxes of $160.8 million. The primary drivers of the tax benefit include losses from operations offset by an increase in valuation allowance of tax attributable to certain deferred tax assets, and an increase in the valuation allowance for uncertain tax positions.

As described in Note 4 “Recapitalization”, on November 8, 2023, the Company executed certain Recapitalization Transactions. Prior to the Recapitalization Transactions, CWT Travel, Inc., and its U.S. subsidiaries were members of a consolidated group of which CWT Travel Holdings, Inc. was the common parent. As part of the Recapitalization Transaction, CWT Travel Group, Inc. sold 100% of the stock of CWT Travel, Inc. to a wholly owned subsidiary of CWT Holdings, LLC. CWT Holdings, LLC become the parent company of the new consolidated group. Prior to the Recapitalization Transactions, changes in the Company’s stock ownership resulted in an ownership change for purposes of Internal Revenue Code section 382, which imposes a limitation on the Company’s ability to utilize existing tax attributes on the date of the ownership change. As a result of this limitation, the Company recorded a reduction to its U.S. net operating loss carryforwards and section 163(j) interest expense carryforwards. Also, as a result of the Recapitalization Transactions, the Company included $14 million of taxable income from cancellation of indebtedness. The Company’s remaining tax attributes, after the reduction for the section 382 limitation, as of the date of the Recapitalization Transactions, other than section 163(j) interest expense carryforwards, were eliminated in connection with the cancellation of indebtedness income. The Company recorded tax expense of $57.7 million in 2023 due to the loss of attributes stemming from section 382 limitations, as well as the elimination of attributes associated with the cancellation of indebtedness income.

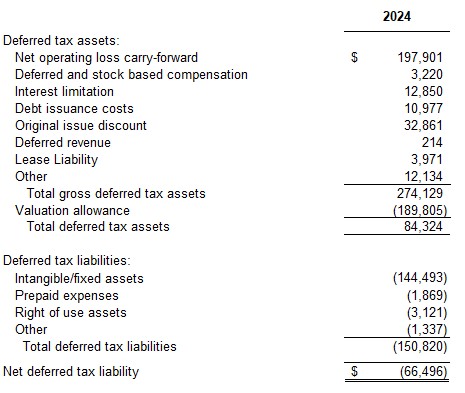

Significant components of the Company’s Deferred taxes as of December 31, 2024 are as follows ($ in thousands):

Deferred tax assets primarily relate to net operating losses, and certain financial accruals not currently deductible for income tax reporting purposes. Deferred tax liabilities primarily relate to intangible assets. Deferred tax assets and liabilities are reported in “Deferred income taxes” in the Consolidated Balance Sheet.

As of December 31, 2024 the Company had potential tax benefits from foreign net operating loss carryforwards totaling $198 million. Foreign net operating losses generally do not expire with certain exceptions. The Company analyzed all available positive and negative evidence and concluded that it is more likely than not that the deferred tax assets related to foreign losses will not be fully utilized and therefore recorded a valuation allowance as of December 31, 2024 of $170 million.

As of December 31, 2024 the Company had no tax benefits from U.S. federal and state net operating loss carryforwards and had tax benefits from U.S. federal interest expense carryforwards of $5.1 million. Interest expense carryforward attributes do not expire. In addition, in connection with the Recapitalization Transaction, the Company recognized a deferred tax asset (“DTA”) in 2023 attributable to the difference between accounting and tax treatment of the First and Second Lien Notes. The DTA had a corresponding increase to the Company’s equity on the balance sheet in 2023. The reversal of these DTAs results in additional interest expense deductions in 2024 and future years for tax purposes. The Company recorded a valuation allowance of $20 million with regards to this DTA as of December 31, 2024.

As of December 31, 2024, the DTA is $28 million. The Company analyzed all available positive and negative evidence and concluded that it is more likely than not that the deferred tax assets related to interest expense carryforwards will be fully utilized and therefore the Company recorded no valuation allowance as of December 31, 2024.

On December 22, 2017, H.R.1 (the “Tax Act”) was enacted. The Company elected to pay the resulting transition tax liability in installments over an eight-year period. There was no long-term liability as of December 31, 2024.

On August 16, 2022, the Inflation Reduction Act of 2022 (the “IRA”) was enacted. The IRA includes numerous tax provisions, clean-energy related tax incentives, and funding for IRS enforcement, among other

initiatives. New corporate taxes, including a 15% alternative minimum tax and a 1% excise tax on stock repurchases by certain publicly traded corporations, were introduced in the IRA. The alternative minimum tax and excise tax imposed on repurchases of stock are applied in periods beginning after December 31, 2022. The Company does not expect the provisions of the IRA to have a material impact on the Consolidated Financial Statements.

In October 2021, the Organization for Economic Co-operation and Development (“OECD”) finalized the significant components of a two-pillar global tax reform plan, which has now been agreed to by the majority of OECD members. Pillar One allows countries to reallocate amongst other taxing jurisdictions a portion of residual profits earned by multinational enterprises (“MNE”), with annual global revenue exceeding €20 billion and a profit margin over 10%. The adoption of Pillar One and its potential effective date remain uncertain. Pillar Two requires MNEs with annual global revenue exceeding €750 million to pay a global minimum tax of 15%. On January 13, 2025, the OECD published additional administrative guidance on Pillar Two regarding deferred tax accounting for loss carryforwards and tax credits. The Company has determined that based on revenue thresholds, Pillar Two will not apply for the period ended December 31, 2024. The Company will continue to evaluate the effect of these provisions in future periods.

The Company files income tax returns in the U.S. federal jurisdiction, and various state and foreign jurisdictions. The determination of income tax benefit takes into consideration amounts which may be needed to cover exposures for open tax years (uncertain tax positions or “UTPs”).

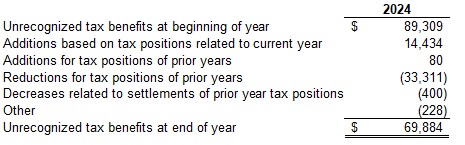

Unrecognized tax benefits are as follows ($ in thousands):

Substantially all the uncertain tax positions, if recognized in future periods, would impact the effective tax rate. To the extent penalties and interest would be assessed on any underpayment of income tax, the Company’s policy is to accrue such amounts as a component of “Income tax expense” in the Consolidated Statement of Operations and in “Oher long-term liabilities” in the Consolidated Balance Sheet.

The Company is in tax litigations in India and Mexico related to its tax years 2008 through 2024 and 2010, respectively. The Company cannot predict the timing or outcome regarding the resolution of these tax examinations. The Company’s income tax provision including penalty and interest related to India and Mexico is $7 million and $1 million, respectively.

The Company operates under tax holidays in the Philippines and Costa Rica, which are effective until 2024 and 2031, respectively. These holidays may be extended if certain additional requirements are satisfied. The tax holidays are conditioned upon the Company meeting certain employment and investment thresholds. The impact of these tax holidays did not have a material effect in these jurisdictions due to losses generated in 2024 and 2023.

As of December 31, 2024, the Company generated losses in most foreign subsidiaries, and therefore these subsidiaries have relied on cash funding from its U.S. operations. Earnings have previously been subject to the one-time transition tax on foreign earnings required by the 2017 Act. Any additional taxes due with respect to such earnings or the excess of the amount for financial reporting over the tax basis of the Company’s foreign investments would generally be limited to foreign and state taxes. The Company intends, however, to indefinitely reinvest these earnings and expect future U.S. cash generation to be sufficient to meet future U.S. cash needs. Cash paid for taxes was as follows ($ in thousands):

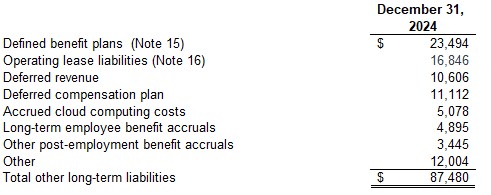

14.OTHER LONG-TERM LIABILITIES

Other long-term liabilities consist of the following ($ in thousands):

Long-Term Employee Benefits—In addition to the Company’s defined benefit plans (see Note 15, “Defined Benefit Plans”), the Company accrues costs associated with various long-term, post-employment, and deferred compensation employee benefits. Related to these benefits, the Company recognized expense of $7 million in 2024, which is included in “Costs and expenses” in the Consolidated Statement of Operations.

15.DEFINED BENEFIT PLANS

Included in the Consolidated Balance Sheet are assets and liabilities related to defined benefit plans covering certain non-U.S. employees. These plans primarily cover retirement pensions (amounts based on the number of years a person is employed) and widow pensions (amounts that are fixed or a percentage of a person’s wages). The employee must be registered in the applicable plan for a certain number of years to receive full retirement benefits.

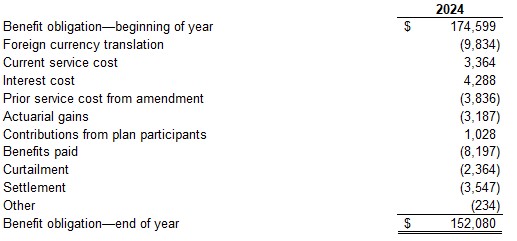

The Company uses a December 31 measurement date for its defined benefit plans. A reconciliation of changes in the projected benefit obligation (“PBO”) is as follows ($ in thousands):

The primary reason for actuarial gains in 2024 was due to changes to the discount rate used in the determination of the PBO. The prior service cost and settlement as well as the curtailment were triggered by actions to reduce employees in certain international subsidiaries.

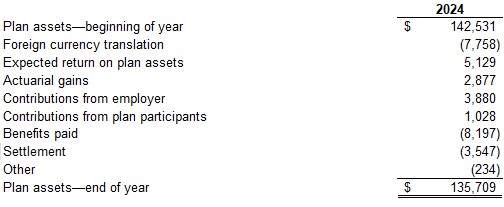

A reconciliation of changes in the plan assets is as follows ($ in thousands):

Plan funded status is as follows ($ in thousands):

Net pension assets and obligations are reflected in the Consolidated Balance Sheet as follows ($ in thousands):

The accumulated benefit obligation is the actuarial present value of benefits earned based on service and compensation prior to the valuation date. As of December 31, 2024, the accumulated benefit obligation was $145 million.

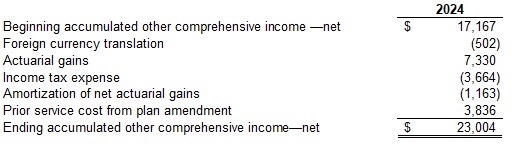

A reconciliation of changes in accumulated other comprehensive income related to defined benefit pension plan obligations is as follows ($ in thousands):

The components of the net periodic pension expense are as follows ($ in thousands):

The determination of plan obligations and expense is based on a number of assumptions. Changes in one or more of these assumptions will have an impact on the PBO, funded status, and benefit expense. Changes in the plans’ funded status resulting from changes in the PBO and fair value of plan assets will have a corresponding impact on accumulated other comprehensive income (loss). One of our plans is in the United Kingdom. In July 2024, the United Kingdom Court of Appeal upheld a ruling in the Virgin Media vs NTL Pension Trustee case, a decision that we were not a party to or involved in, that certain historical amendments for contracted-out defined benefit schemes were invalid if they were not accompanied by the correct actuarial confirmation. Since there remain significant areas of uncertainty, we were not yet able to determine the impact of the ruling, if any, on our pension plan obligations as of December 31, 2024.

The weighted average of key actuarial assumptions used to determine the obligations and expenses are as follows:

The discount rate assumption is developed by determining a constant effective yield that produces the same result as discounting projected plan cash flows using high quality (AA) bond yields of corresponding maturities as of the measurement date. The expected long-term rate of return for plan assets has been determined using historical returns for the different asset classes held by the Company’s trusts and its asset allocation, as well as inputs from internal and external sources regarding expected capital market return, inflation and other variables.

Investment objectives, policies and strategies are generally set by the independent custodians of the pension plans. The overall investment strategy for plan assets is to provide and maintain sufficient assets to fund pension payment obligations. The assets of the plans are managed in the long-term interests of the participants and beneficiaries of the plans. The investments and their allocation strategy is determined by the independent custodians of the pension plans with the assistance of independent professional investment managers.

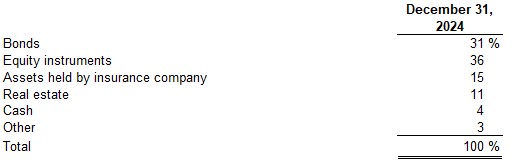

The plan asset allocation is as follows:

Certain plan assets are part of common funds managed by insurance companies, invested mostly in equity and debt. Within the fair value hierarchy, insurance contracts are measured using Level 2 inputs; cash, equity, and bonds are measured using Level 1 inputs; and real estate is measured using Level 3 inputs. See Note 2, “Significant Accounting Policies” for a discussion of the three levels in the hierarchy of fair value inputs.

Future benefit payments by year as of December 31, 2024, are as follows ($ in thousands):

The expected contribution to defined benefit plans in 2025 is $3.2 million.

16.LEASES

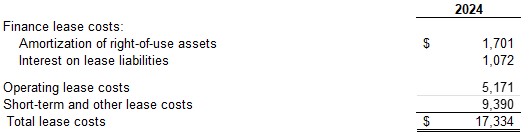

The Company enters into operating and finance leases for certain real estate properties, information technology equipment, vehicles and other office equipment. The Company’s finance and operating lease costs were as follows ($ in thousands):

Finance lease costs, Operating lease costs and Short-term and other lease costs are included in “Costs and expenses” and “Interest expense-net” in the Consolidated Statement of Operations.

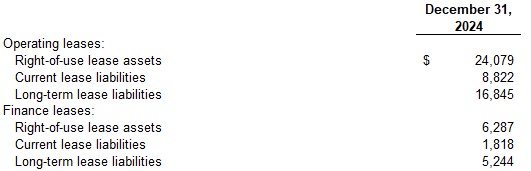

Supplemental balance sheet information for the Company’s operating and finance leases is as follows ($

in thousands):

For operating leases, the Right-of-use lease assets are included in “Other long-term assets”, and the Current lease liabilities and the Long-term lease liabilities are included in “Accrued liabilities and other,” and “Other long-term liabilities,” respectively, in the Consolidated Balance Sheet. For finance leases, the Right-of-use assets are included in “Other long-term assets,” and the Current lease liabilities and the Long-term lease liabilities are included in “Long-term debt-current” and “Long-term debt,” respectively, in the Consolidated Balance Sheet.

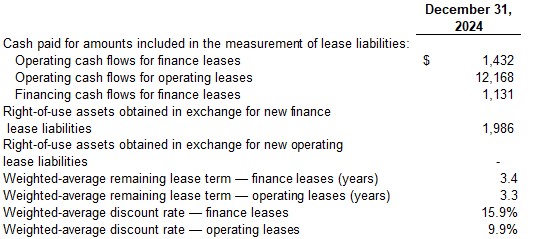

Additional information related to the Company’s leases is as follows ($ in thousands, except lease terms and discount rates):

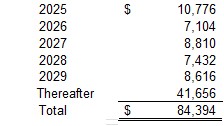

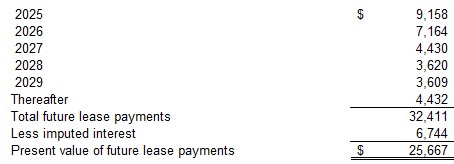

As of December 31, 2024, future payments for operating leases having an initial term of more than one year are as follows ($ in thousands):

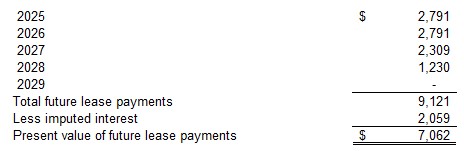

As of December 31, 2024, future payments for finance leases are as follows ($ in thousands):

17.COMMITMENTS AND CONTINGENCIES

Legal Contingencies: The Company is involved in certain disputes and legal action arising in the normal course of business. Management believes that the ultimate resolution of these matters will not have a material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows.

Purchase Commitments: In the ordinary course of business, the Company makes various commitments to purchase goods and services from specific suppliers, including those related to capital expenditures. As of December 31, 2024, the Company had approximately $68 million of outstanding non-cancellable purchase commitments, primarily relating to service, hosting, licensing and other information technology contracts, of which $29 million relates to the year ending December 31, 2025. These purchase commitments extend through 2029.

18.RESTRUCTURING AND OTHER CHARGES-NET

The Company incurred net restructuring and other charges of $61.1 million in 2024.

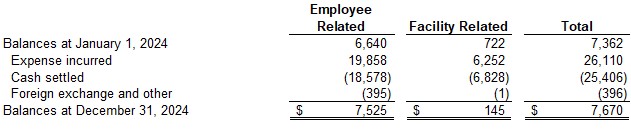

Restructuring Charges- The Company incurred restructuring charges of $26.1 million in 2024. Since the onset of the COVID-19 pandemic in 2020, the Company has taken and continues to take significant actions to reduce its cost structure (see Note 5, “Risks and Uncertainties”).

The table below sets forth accrued restructuring reported as a component of “Accrued liabilities and other” in the Consolidated Balance Sheet for the year ended December 31, 2024 ($ in thousands):

Other Charges- The Company incurred other unusual or infrequent charges of $35.0 million in 2024 which included $26.2 million costs to support the execution of the AMEX GBT Merger Agreement (see Note 1, “General and Basis of Presentation”).

All significant restructuring and other charges are expected to be settled within twelve months following the end of the year in which the charge is recorded.

19.OTHER LOSSES—NET

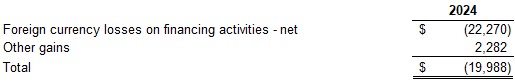

Other losses—net are as follows ($ in thousands):

Foreign currency losses on financing activities include the impact of foreign currency exchange rate changes on various intercompany financing activities. Other gains include the amortization of pension plan actuarial gains and plan curtailment gains from the Company’s defined benefit plans (see Note 15, “Defined Benefit Plans”).

20.ACCUMULATED OTHER COMPREHENSIVE INCOME

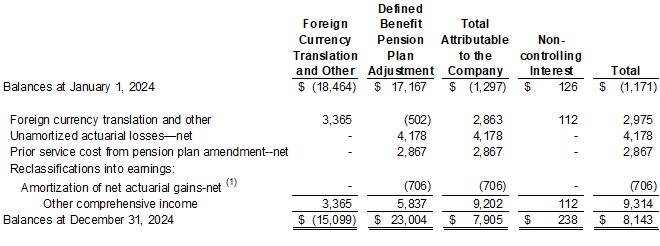

A reconciliation of the components of accumulated other comprehensive income, net of tax is as follows ($ in thousands):

(1) Amortization of net actuarial gains are included with “Other losses—net” in the Consolidated Statement of Operations.

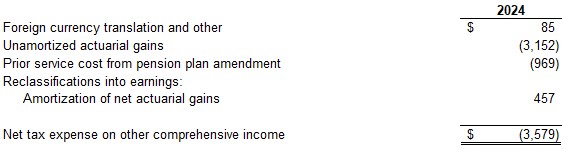

The impact of income tax expense on the components of other comprehensive income is as follows ($ in thousands):

21.RELATED-PARTY TRANSACTIONS

Note 4, “Recapitalization” and Note 12, “Debt”, discuss transactions involving certain current or former equity holders of the Company. Other than those transactions, the Company is not a party to any material affiliate transactions. The Company provides some of its current and former equity holders with business travel and meetings and events services under arms-length service agreements in the ordinary course of business.

22.CWT HOLDINGS, LLC MEMBERS’ PREFERRED UNITS AND MEMBERS’ EQUITY

On November 8, 2023, CWT Holdings, LLC was established as the Company’s new top-level holding entity (See in Note 1, “General and Basis of Presentation”). Its initial capital consisted of a) 100,000,000 preferred member units (the “Preferred Units”), b) 100,000,000 class A common member units (the “Class A Common Units”), and c) 42,857,143 class B common member units (the “Class B Common Units” and collectively, the “New Equity”). As part of the Recapitalization Transactions, the New Equity was granted to certain former lenders of CWT Travel Holdings, Inc. in settlement of outstanding debt. See in Note 4, “Recapitalization” for more details of the Recapitalization Transactions. Under ASC 470 “Debt”, because the New Equity was issued in settlement of debt, it is recorded at its fair value on the settlement date, less third-party issuance costs.

The board members of CWT Holdings, LLC may approve distributions to the holders of the New Equity (“Members”), but any distributions must first be paid to the holders of Preferred Units (“Preferred Holders”) until an aggregate $185 million liquidation preference (the “Liquidation Preference”) is paid in

full. The Company has the option to redeem the outstanding Preferred Units for the Liquidation Preference less any distributions previously paid to the Preferred Holders (with certain limitations). Additionally, upon the occurrence of a sale transaction, initial public offering, or insolvency event (a “Liquidation Event”), the Preferred Units shall be redeemed for the Liquidation Preference less any distributions previously paid to Preferred Holders. The Liquidation Preference is junior to the Company’s First Lien Loans and Second Lien Term Loans, and senior to the Class A and Class B Common Units. Given the contingent redemption rights upon a Liquidation Event, the Company reports the outstanding Preferred Units as temporary equity in the Consolidated Balance Sheet.

The Preferred Units are not entitled to voting rights. The Class A Common Units and the Class B Common Units vote as a single class with each member unit having equal voting rights.

23.SUBSEQUENT EVENTS

Management has evaluated subsequent events pursuant to the requirements of ASC Topic 855, from the balance sheet date through the date the Consolidated Financial Statements were available to be issued and has determined that there are no material subsequent events that require disclosure in these Consolidated Financial Statements other than the following.

On January 15, 2025, the Second Incremental Joinder Agreement to the 2L Credit Agreement was executed. On March 24, 2025, the Third Incremental Joinder Agreement to the 2L Credit Agreement was executed (collectively, the “2025 Amendments”). The 2025 Amendments provided for a first-out delayed draw term loan facilities in an aggregate principal amount equal to $50 million (the “2025 Incremental Term Loans”). The 2025 Incremental Term Loans may be borrowed from time to time, and accrue interest at a rate of 18.50% per annum, payable solely in kind, and shall mature on the same date as the Initial Term Loans. Upon any repayment, including voluntary and mandatory prepayments or any restructuring event, of the 2025 Incremental Term Loans, a premium applies in an amount that will ensure that the total return on invested capital to the lenders is at least 100%. There is a commitment fee on undrawn portions of the 2025 Incremental Term Loans of 5.00% per annum, payable solely in kind. As of the date of issuance of these Consolidated Financial Statements the Company had drawn $25.6 million under the 2025 Incremental Term Loans.

In January 2025, the Antitrust Division of the U.S. Department of Justice, filed suit in the U.S. District Court for the Southern District of New York against the Company and AMEX GBT, seeking a permanent injunction preventing the execution of the Merger Agreement.

In March 2025, the Company received approval from the United Kingdom's Competition and Markets Authority (the “CMA”) to complete the execution of the Merger Agreement. The CMA concluded that the transaction does not create a Substantial Lessening of Competition (“SLC”).

In March 2025, the Merger Agreement with AMEX GBT was amended to adjust the consideration paid to the Company’s equity holders from approximately 72 million shares of AMEX GBT common stock at a price of $6.00 per share in the original Merger Agreement, to approximately 50 million shares at a price of $7.50 per share. Cash paid to the Company’s equity holders remains at $70 million. In addition, the Drop Dead Date (as defined in the Merger Agreement) was extended to December 31, 2025, to provide the parties with additional time to defend the lawsuit filed by the U.S. Department of Justice.

In April 2025, Amendment No. 8 to the 1L Credit Agreement was executed extending the maturity date of the $50 million 2023 Revolving Commitment to the earliest of (i) July 5, 2026 and (ii) the date six months prior to the scheduled maturity date of the Second Lien Term Loans.

******