Please wait

CWT HOLDINGS, LLC AND SUBSIDIARIES

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

Page

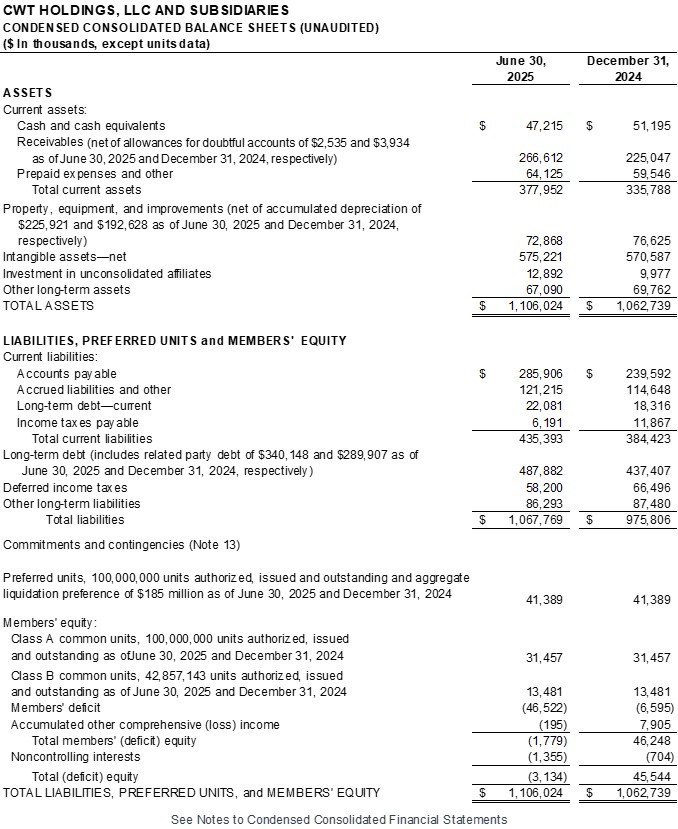

Unaudited Condensed Consolidated Balance Sheet as of June 30, 2025 2

and December 31, 2024

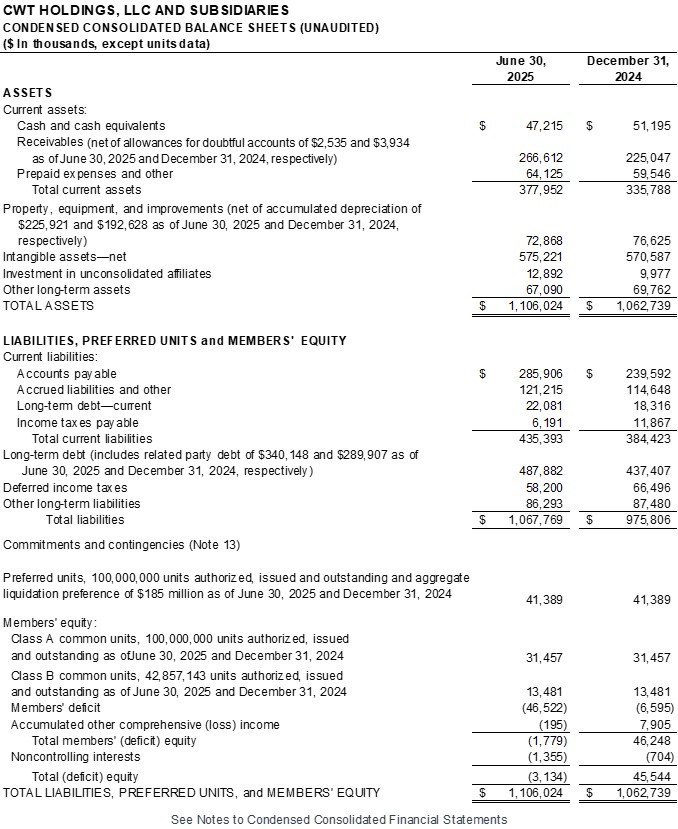

Unaudited Condensed Consolidated Statement of Operations for the 3

Six Months Ended June 30, 2025

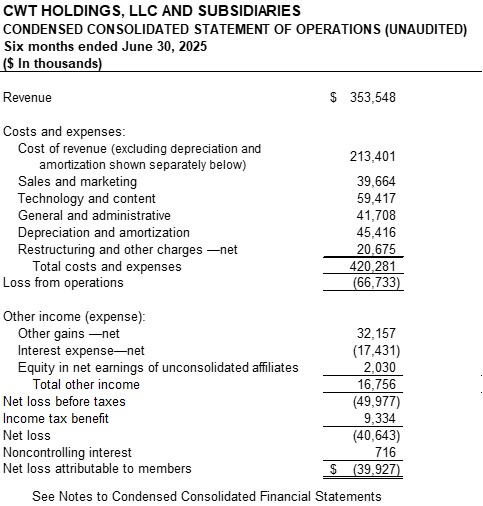

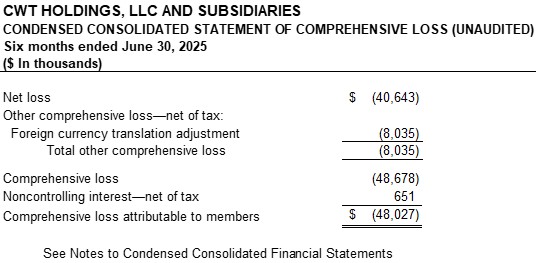

Unaudited Condensed Consolidated Statement of Comprehensive Loss for the 4

Six Months Ended June 30, 2025

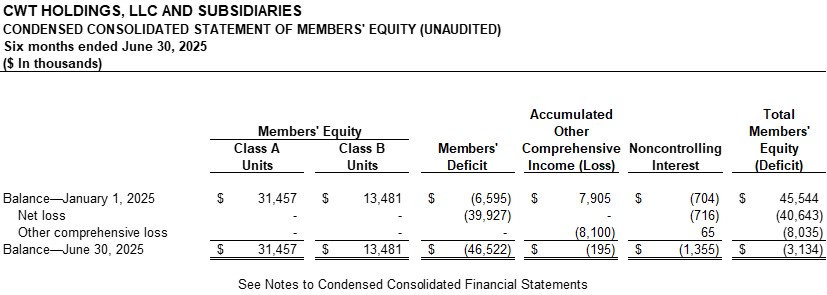

Unaudited Condensed Consolidated Statement of Members’ Equity for the 5

Six Months Ended June 30, 2025

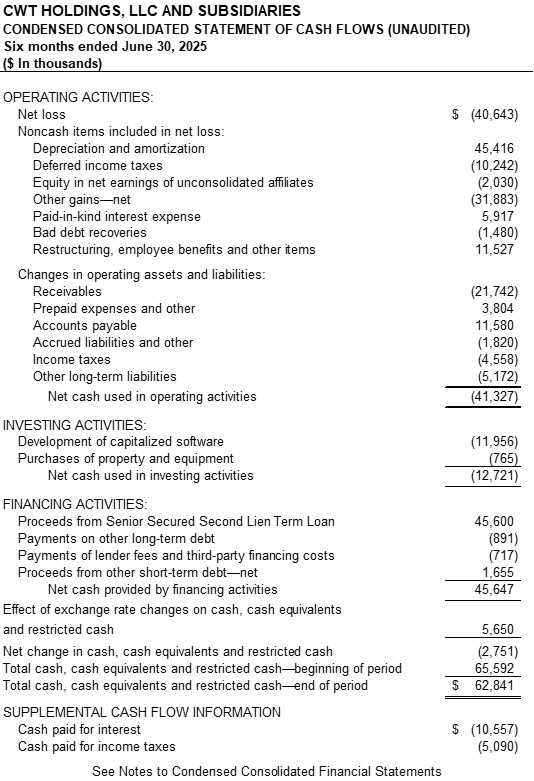

Unaudited Condensed Consolidated Statement of Cash Flows for the 6

Six Months Ended June 30, 2025

Notes to Unaudited Condensed Consolidated Financial Statements 7

CWT HOLDINGS, LLC AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. GENERAL AND BASIS OF PRESENTATION

CWT Holdings, LLC (successor group top holding company to CWT Travel Holdings, Inc.), together with its subsidiaries (the “Company”) provides travel booking and servicing across a wide range of service channels, including online, mobile, email, phone and messaging. It serves clients through a mix of directly operated companies, joint venture operations and partner markets in around 140 countries worldwide. Though it primarily provides travel management services to corporate clients, it has a number of businesses and product offerings that provide additional services to corporate and noncorporate clients. The Company’s primary services include business traveler services, hotel booking services, and meetings and events planning services. The Company also provides a comprehensive range of design, implementation, and travel program management services, including offline and online travel booking and customer support. It provides these services through local, regional, and global business travel centers, on-site travel counselors, third-party online booking platforms, and the Company’s chat, web, and mobile app.

On March 24, 2024, the Company and Global Business Travel Group, Inc. (“AMEX GBT”) entered into an Agreement and Plan of Merger (as later amended, the “Merger Agreement” and the execution thereof the “Transaction”). The Merger Agreement values the Company at approximately $540 million on a cash-free and debt-free basis, subject to certain assumptions and purchase price adjustments, implying an equity value of approximately $470 million. Subject to certain assumptions and purchase price adjustments, AMEX GBT expects at closing to issue to the Company’s equity holders an aggregate of approximately 50 million shares of its common stock at a price of $7.50 per share and pay the Company’s equity holders an aggregate of approximately $70 million.

The closing of the Transaction is subject to the receipt of specified regulatory approvals and other customary closing conditions including, among other things, expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 as amended, and clearance from the Committee on Foreign Investment in the United States. The Merger Agreement contains representations, warranties and covenants by the parties that are customary for a transaction of this nature. In March 2025, the Merger Agreement was amended to, among other things, extend the Drop Dead Date (as defined in the Merger Agreement) to December 31, 2025, and to provide the parties with additional time to defend the lawsuit filed by the U.S. Department of Justice (see below).

In January 2025, the Antitrust Division of the U.S. Department of Justice, filed suit in the U.S. District Court for the Southern District of New York against the Company and AMEX GBT, seeking a permanent injunction preventing the execution of the Merger Agreement.

In March 2025, the Company received approval from the United Kingdom's Competition and Markets Authority (the “CMA”) to complete the execution of the Merger Agreement. The CMA concluded that the transaction does not create a Substantial Lessening of Competition.

On July 29, 2025, the Antitrust Division of the U.S. Department of Justice withdrew its opposition to the acquisition of the Company by AMEX GBT. Subsequently the U.S. District Court for the Southern District of New York dismissed the previously filed suit. The transaction is now expected to close in the third quarter of 2025, subject to the satisfaction of the remaining closing conditions.

Basis of Presentation

The Company’s Condensed Consolidated Financial Statements include the accounts of CWT Holdings, LLC, its wholly-owned subsidiaries and entities controlled by CWT Holdings, LLC. The Company reports the non-controlling ownership interests in subsidiaries that are held by third-party owners as Noncontrolling interests on the Condensed Consolidated Balance Sheet. The portion of income or loss attributable to third-party owners for the reporting period is reported as Noncontrolling interest on the Condensed Consolidated

Statement of Operations. The Company has eliminated intercompany transactions and balances in its Condensed Consolidated Financial Statements.

The accompanying unaudited Condensed Consolidated Financial Statements of the Company have been prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”) for interim financial reporting. As such, certain notes or other information that are normally required by U.S. GAAP have been omitted if they substantially duplicate the disclosures contained in the Company’s annual audited Condensed Consolidated Financial Statements. These interim unaudited Condensed Consolidated Financial Statements should be read in conjunction with the audited Condensed Consolidated Financial Statements and related notes for the year ended December 31, 2024. The Company has included all normal recurring items and adjustments necessary for a fair presentation of the results of the interim period. The Company’s interim unaudited Condensed Consolidated Financial Statements are not necessarily indicative of results that may be expected for any other interim period or for the full year.

Use of Estimates

The preparation of Condensed Consolidated Financial Statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the Condensed Consolidated Financial Statements, the reported amounts of revenue and expense during the reporting period, and the disclosure of contingent assets and liabilities. Accounts affected by significant estimates include revenue, capitalized software, investment in unconsolidated subsidiaries, allowance for doubtful accounts, valuation of intangible assets, deferred revenue, valuation of pension obligations, and valuation of deferred tax assets and liabilities. Actual results could differ materially from those estimates.

2. SIGNIFICANT ACCOUNTING POLICIES

Cash and Cash Equivalents

Cash and equivalents are highly liquid investments that generally have an original maturity of three months or less. The fair value of cash equivalents approximates their carrying value because of the short maturity of the instruments.

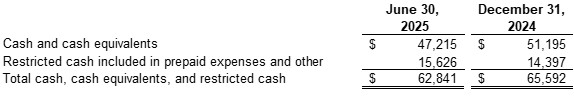

Restricted Cash

Restricted cash includes cash that is restricted through legal contracts or regulations. Restricted cash principally relates to amounts held as security for cash management and credit card arrangements. The following table reconciles cash, cash equivalents and restricted cash reported in the Condensed Consolidated Balance Sheet to the total amount shown in the Condensed Consolidated Statement of Cash Flows (in thousands):

Allowance for Doubtful Accounts

The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in its receivables; however, changes in circumstances relating to receivables may result in additional allowances in the future. The Company determines the allowance based on historical experience, current payment patterns and the Company’s assessment of its customers’ ability to pay outstanding balances. The Allowance for doubtful accounts was $2.6 million as of June 30, 2025.

Intangible Assets, Net

Intangible assets represent the fair value of identifiable intangible assets acquired in business combinations or the purchase of a specific asset group. Identifiable intangible assets with finite lives are amortized over their useful life determined based on customer demand, competition, contractual relationships, and other business factors. The Company does not have any intangible assets with indefinite lives.

Other Long-lived Assets

Long-lived assets, including property, equipment, and improvements and finite life intangible assets, are reviewed periodically for possible impairment. The Company evaluates whether current facts or circumstances indicate that the carrying value of the assets may not be recoverable. If such circumstances are determined to exist, an estimate of undiscounted future cash flows produced by the long-lived asset, or the appropriate grouping of such assets, is compared to the carrying value to determine whether impairment exists. If an asset is determined to be impaired, the loss is measured based on quoted market prices in active markets, if available. If quoted market prices are not available, the estimate of fair value is based on various valuation techniques, including discounted value of estimated future cash flows. The Company reports assets pending disposal of at the lower of carrying value or estimated net realizable value.

The Company tests finite life intangible and other long-lived assets for impairment if events or changes in circumstances indicate that the asset might be impaired. The Company did not record any intangible asset impairment or other long-lived asset impairment charges in the six months ended June 30, 2025.

Fair Value Measurement

The Company determines the fair market values of its financial assets and liabilities, as well as non-financial assets and liabilities that are recognized or disclosed at fair value on a recurring basis, based on the fair value hierarchy established in U.S. GAAP. The Company measures its financial assets and liabilities using inputs from the following three levels of the fair value hierarchy.

The three levels are as follows:

•Level 1 - Quoted prices for identical instruments in active markets.

•Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs or significant value-drivers are observable in active markets.

•Level 3 - Model-derived valuations in which one or more significant inputs or significant value-drivers are unobservable.

Recurring Fair Value Measurements - There were no financial assets or liabilities measured at fair value on a recurring basis as of June 30, 2025.

Nonrecurring Fair Value Measurements - Certain assets are measured at fair value on a nonrecurring basis. These assets are not measured at fair value on an ongoing basis but are subject to fair value adjustments only in certain circumstances. These include certain long-lived assets that are written down to fair value when they are held for sale or determined to be impaired, and goodwill and intangible assets that are written down to fair value when they are determined to be impaired.

Fair Value of Financial Instruments - Financial instruments, other than those included in the defined benefit plan assets include cash and equivalents, accounts receivable, accounts payable, accrued liabilities, and debt. The fair values of cash and equivalents, accounts receivable, accounts payable, and accrued liabilities approximate their carrying values because of the short-term nature of these instruments. For most of the Company’s debt, the carrying value approximates fair value since it was recently transacted on an arm’s length basis, and its interest rate adjusts regularly to market conditions. The carrying value of the Company’s Second Lien Initial Term Loans significantly exceed their fair value due to the impact of accounting under ASC 470-60 “Troubled Debt Restructuring with Debtors”. This requires the carrying amount to include all future cash flows related to the instrument, including future interest and redemption premium payments. The

Company estimates the fair value of the Second Lien Initial Term Loans as of June 30, 2025 is approximately equal to the contractual principal due to the Second Lien Term Loan lenders at that date, which was $131.6 million. See Note 10, “Debt.”

Going Concern

The accompanying Condensed Consolidated Financial Statements are prepared in accordance with generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

The Company has experienced recurring operating losses, recurring negative cash flows, and insufficient liquidity and working capital to fund operations and remain in compliance with the provisions of loan agreements. These conditions and events raise substantial doubt about the Company’s ability to continue as a going concern.

In response to these conditions, Management has implemented a number of initiatives to increase revenue, control costs, and improve profitability. In addition, the Company believes the Merger Agreement with AMEX GBT will close by the end of the third quarter 2025. However, the merger with AMEX GBT and the attainment of improved profitability are subject to market conditions and other factors outside of Management’s control and therefore cannot be deemed probable. As a result, the Company has concluded that management’s plans do not alleviate substantial doubt about the Company’s ability to continue as a going concern.

The Condensed Consolidated Financial Statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of this uncertainty.

3. NEW ACCOUNTING PRONOUNCEMENTS

Income Taxes—In December 2023, the FASB issued ASU No. 2023-09, "Income Taxes (Topic 740): Improvements to Income Tax Disclosures". This standard requires the Company to provide (i) further disaggregation for specific categories on the effective tax rate reconciliation, as well as additional information about federal, state and local and foreign income taxes, and (ii) annually disclose its income taxes paid (net of refunds received), disaggregated by jurisdiction. It is effective for fiscal years beginning after December 15, 2025 for private companies, with early adoption permitted. It is to be applied on a prospective basis, although optional retrospective application is permitted. The standard will require additional footnote disclosures related to the Company's income taxes and will have no impact on the Condensed Consolidated Financial Statements. The Company intends to adopt this standard for its annual 2025 Consolidated Financial Statements. We do not anticipate implementation will result in significant changes to the current footnote disclosures.

Disaggregated Expenses—In November 2024, the FASB issued ASU No. 2024-03 “Disaggregation of Income Statement Expenses” which provides guidance on additional disclosures about specific types of expenses included in the expense captions presented on the face of the income statement as well as disclosures about selling expenses. The standard is effective for fiscal years beginning after December 15, 2026, and interim periods within fiscal years beginning after December 15, 2027, with early adoption permitted. It is to be applied on a prospective basis, although optional retrospective application is permitted. While the standard will require additional disclosures related to the Company’s expenses, it is not expected to have any impact on the Company’s consolidated operating results, financial condition or cash flows.

4. RISKS AND UNCERTAINTIES

In early 2020, the World Health Organization declared the COVID-19 outbreak a global pandemic. In response to the pandemic, throughout 2020 and into 2021 the majority of countries in which the Company operates implemented containment measures, and businesses significantly limited or suspended their travel. Starting later in 2021 these containment measures were relaxed and business travel steadily recovered but at an uneven pace. The impact of the pandemic combined with structural changes to the business travel industry has resulted in the Company’s business travel bookings remaining below 2019 levels. The decline in business travel has had an unprecedented and materially adverse impact on the Company’s financial position, results of operations and cash flows.

The Company has taken and continues to take significant actions to reduce its cost structure, preserve cash and manage liquidity, including the following:

•reducing employee-related costs (to the extent legally allowed) and other operating expenses;

•closely managing non-essential capital projects and other discretionary spend;

•renegotiating lease and other contractual commitments;

•renegotiating vendor payment terms and elongating vendor payment cycles;

•where practical, discontinuing the practice of being a settlement intermediary between the Company’s clients and suppliers, which typically increases working capital requirements; and

•actively managing accounts receivable balances to maximize timely collections.

The Company expects its business travel bookings to remain below 2019 levels for an extended period. The Company cannot reliably predict changes to business travel behavior and spending, and its impact on the Company’s transaction volume and/or revenues. As a result, current financial information may not be necessarily indicative of future operating results. As the situation requires, the Company may take additional significant actions to reduce its cost structure, preserve cash and manage liquidity.

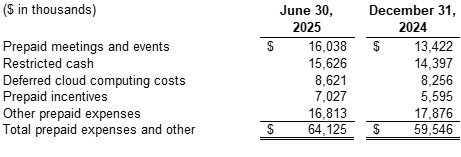

5. PREPAID EXPENSES AND OTHER

Prepaid expenses and other consist of the following:

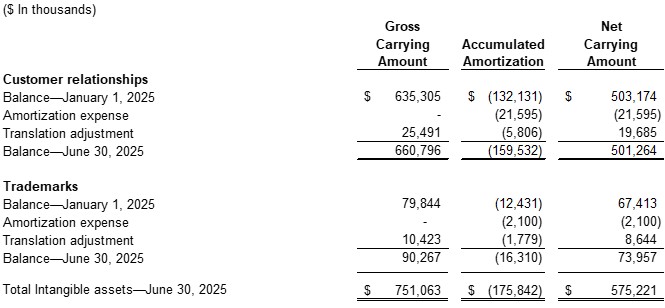

6. INTANGIBLE ASSETS—NET

Intangible assets consist of the following:

Intangible assets consist of customer relationships and trademarks which are being amortized over a period of 15 and 20 years, respectively. The weighted-average useful life of all intangible assets is 12 years.

Intangible asset amortization expense was $23.7 million for the six months ended June 30, 2025. The Company did not record an intangible asset impairment charge in the six months ended June 30, 2025.

7. INVESTMENTS IN UNCONSOLIDATED AFFILIATES

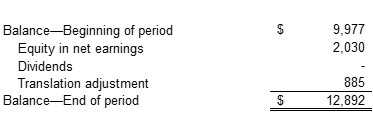

Investments in unconsolidated affiliates consist of the following:

Changes in the carrying value of investments in unconsolidated affiliates for the six months ended June 30, 2025 is as follows ($ in thousands):

The Company annually reviews its investments in unconsolidated subsidiaries for impairment, comparing the estimated fair value of each investment to its net book value. The Company did not record an impairment charge related to investments in unconsolidated affiliates in the six months ended June 30, 2025.

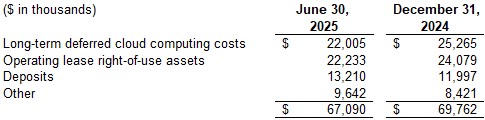

8. OTHER LONG-TERM ASSETS

Other long-term assets consist of the following:

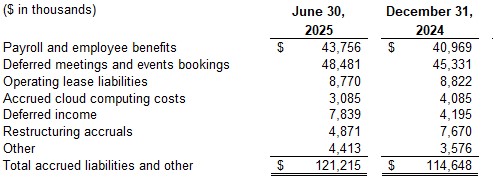

9. ACCRUED LIABILITIES AND OTHER

Accrued liabilities and other consist of the following:

10. DEBT

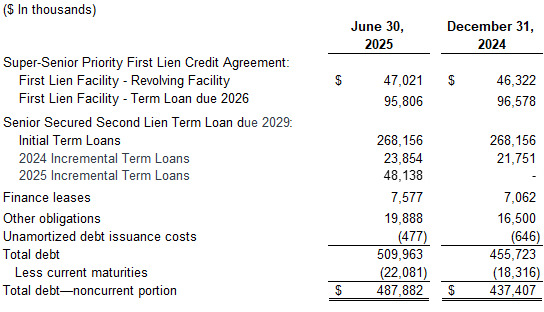

Debt consists of the following:

In 2021, CWT Travel Group, Inc. entered into a $150 million Super-Senior Priority First Lien Credit Agreement (the “1L Credit Agreement”) with the lenders party thereto (“First Lien Lenders”) and Alter Domus (US) LLC as administrative agent and collateral agent. Under this 1L Credit Agreement, CWT Travel Group, Inc. and its subsidiaries drew down a $90 million term loan and had access to up to $60 million available under a revolving facility (‘Revolving Facility” and collectively, the “First Lien Loans”).

On September 4, 2023, CWT Travel Group, Inc., CWT Holdings II, Inc., and certain CWT Travel Group, Inc. subsidiaries in their capacity as borrowers and/or guarantors entered into Amendment No. 5 to the 1L Credit Agreement (“Amendment No. 5”) with the First Lien Lenders and a group of new lenders. Amendment No. 5 established a new $100 million FILO Term Loan Facility with new lenders comprised of certain holders of the Company’s 8.5% Senior Secured Notes (the “FILO Term Lenders”). In addition, Amendment No. 5 established the $50 million 2023 Revolving Commitment solely for the purpose of issuing letters of credit to support the Company’s collateral requirements for the International Air Transport Association (IATA). The Company paid a $1.5 million non-refundable upfront fee to the lead First Lien Lender for this facility.

Under Amendment No. 5 the applicable margin on the First Lien Loans increased, for Alternative Base Rate (“ABR”) loans to 5.25% cash interest plus 1.25% payable “in kind” (“PIK”) interest, and for Secured Overnight Financing Rate (“SOFR”) loans to 6.25% cash interest plus 1.25% PIK interest. Interest that is PIK is added to the aggregate principal amount of the First Lien Loans on the applicable interest payment date. There is a commitment fee of 3.50% on unused portions of the Revolving Facility. Loans under the 1L Credit Agreement are guaranteed by CWT Holdings II, Inc. and certain of its direct and indirect subsidiaries and are secured by liens over certain shares and assets of those subsidiaries on a first priority basis.

On November 8, 2023, Amendment No. 6 to the 1L Credit Agreement (“Amendment No. 6”) was executed, adding CWT Group, LLC as the successor lead borrower to CWT Travel Group, Inc. The FILO Term Loans were fully settled and exchanged for (i) preferred and common equity interest in the Company, and (ii) new term loans established under the Senior Secured Second Lien Term Loan Credit Agreement (the “Second Lien Term Loans”, see below). In addition, the lead First Lien Lender received approximately 7% of the Class B Common Units.

Also on November 8, 2023, CWT Group, LLC entered into a Senior Secured Second Lien Term Loan Agreement (the “2L Credit Agreement”) with the lenders party thereto (“Second Lien Lenders”) and Wilmington Trust as administrative agent and collateral agent. The Second Lien Lenders were comprised of the former FILO Term Lenders. The initial principal amount of the loans issued thereunder (the “Second Lien Term Loans”) was $103 million. Their maturity date is May 7, 2029 with interest accruing at a rate of 15% per annum payable “in kind” (“PIK”). This PIK interest is added to the aggregate principal amount of the loans on the applicable interest payment date. Amounts borrowed under the 2L Credit Agreement are guaranteed by CWT Holdings II, LLC and certain subsidiaries of the Company and are secured by liens provided by those subsidiaries on certain shares and assets of those subsidiaries on a second priority basis after borrowings under the 1L Credit Agreement. A redemption premium of 15% is due upon repayment of all, or any part, of the principal balance regardless of when paid, including at maturity. The 2L Credit Agreement includes provisions whereby the Company is required to repay all outstanding loans (including the redemption premium) plus accrued interest following a change of control or upon or the occurrence of certain asset sales.

The carrying value of the term loan under the 1L Credit Agreement reflects a premium over the outstanding principal balance as a result of a debt modification. As of June 30, 2025, this premium was $3.8 million to be amortized over the remaining term of the loan using the effective interest method. The maturity date of the First Lien Loans is the earlier of November 19, 2026, and the date that is six months prior to the maturity date of the Second Lien Term Loans. Additionally, as a result of the troubled debt restructuring, the carrying value of the Initial Term Loans under the 2L Credit Agreement of $268.2 million reflects the future undiscounted cash flows related to its repayment, including principal, interest, and redemption premiums at June 30, 2025 of $131.6 million, $101.6 million, and $35.0 million, respectively.

On June 27, 2024, the First Incremental Joinder Agreement to the 2L Credit Agreement (the “Amendment”) was executed. The Amendment provided for a first-out delayed draw term loan facility in an aggregate principal amount equal to $20 million (the “2024 Incremental Term Loans”). The 2024 Incremental Term Loans accrue interest at a rate of 18.50% per annum, payable solely in kind, and shall mature on the same date as the Initial Term Loans. Upon any repayment, including voluntary and mandatory prepayments or any restructuring event, of the 2024 Incremental Term Loans, a premium applies in an amount that will ensure that the total return on invested capital to the lenders is at least 50% of the original 2024 Incremental Term Loan principal. As of June 30, 2025, the Company had drawn the entire $20.0 million under the Amendment.

On August 14, 2024, Amendment No. 7 to the 1L Credit Agreement (“Amendment No. 7”) was executed extending the maturity date of 2023 Revolving Commitment to December 5, 2025. The Company agreed to pay a $1.75 million non-refundable fee to the lead First Lien Lender for this extension, due on the earlier of the extended maturity date of the 2023 Revolving Commitment or the date the 2023 Revolving Commitment is terminated under the terms of the 1L Credit Agreement. In April 2025, Amendment No. 8 to the 1L Credit Agreement was executed extending the maturity date of the 2023 Revolving Commitment to the earliest of July 5, 2026 and the date six months prior to the scheduled maturity date of the Second Lien Term Loans.

On January 15, 2025, March 24, 2025 and August 4, 2025, the Second, Third and Fourth Incremental Joinder Agreements to the 2L Credit Agreement were executed, respectively (collectively, the “2025 Amendments”). The 2025 Amendments provided for first-out delayed draw term loan facilities in an aggregate principal amount equal to approximately $85 million (the “2025 Incremental Term Loans”). The 2025 Incremental Term Loans may be borrowed from time to time and accrue interest at a rate of 18.50% per annum, payable solely in kind, and shall mature on the same date as the Initial Term Loans. Upon any repayment, including voluntary and mandatory prepayments or any restructuring event, of the 2025 Incremental Term Loans, a premium applies in an amount that will ensure that the total return on invested capital to the lenders is at least 100%. There is a commitment fee on undrawn portions of the 2025 Incremental Term Loans of 5.00% per annum, payable solely in kind. As of the date of issuance of these Condensed Consolidated Financial Statements the Company had drawn $70.0 million under the 2025 Incremental Term Loans.

As of June 30, 2025, the available capacity under the Revolving Facility was $1.2 million. Its usage includes $14.3 million issued for various letters of credit, bank guarantees or card programs. In addition, the 2023 Revolving Commitment was fully utilized having issued a $50 million letter of credit.

The 1L Credit Agreement, as amended, has covenants and restrictions around certain payments, asset sales and indebtedness; required the Company to maintain liquidity (unrestricted cash plus unused revolving facility) of at least $40 million tested on a quarterly basis; and established additional financial reporting requirements. The 2L Credit Agreement contains covenants materially consistent with those in the 1L Credit Agreement. As of June 30, 2025, the Company was in compliance with all required covenants under the 1L and 2L Credit Agreements.

“Other obligations” in the table above primarily consist of borrowings under revolving credit facilities in China and other short-term debt.

11. INCOME TAXES

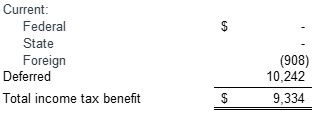

The income tax benefit for the six months ended June 30, 2025 consists of the following ($ in thousands):

The Company’s effective tax rate for the six months ended June 30, 2025 was 18.7% which is lower than the U.S. federal statutory corporate income tax rate of 21%. This is due primarily to a valuation allowance applied against deferred tax benefits associated with current year operating losses in certain international jurisdictions.

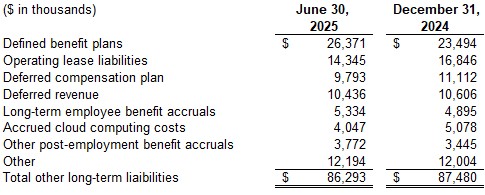

12. OTHER LONG-TERM LIABILITIES

Other long-term liabilities consist of the following:

13. COMMITMENTS AND CONTINGENCIES

The Company is involved in certain disputes and legal action arising in the normal course of business. Management believes that the ultimate resolution of these matters will not have a material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows.

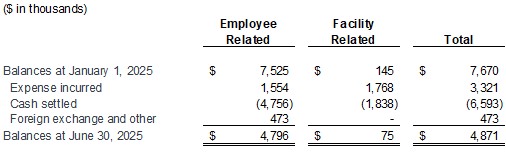

14. RESTRUCTURING AND OTHER CHARGES—NET

The Company incurred net restructuring and other charges of $20.7 million for the six months ended June 30, 2025.

Restructuring Charges- The Company incurred restructuring charges of $3.3 million for the six months ended June 30, 2025. Since the onset of the COVID-19 pandemic in 2020, the Company has taken and continues to take significant actions to reduce its cost structure (see Note 4, “Risks and Uncertainties”). The table below sets forth accrued restructuring costs included in “Accrued liabilities and other” in the Condensed Consolidated Balance Sheet for the six months ended June 30, 2025:

Other Charges- The Company incurred other unusual or infrequent charges of $17.4 million for the six months ended June 30, 2025. This included $ $15.8 million to support the execution of the AMEX GBT Merger Agreement (see Note 1, “General and Basis of Presentation”).

All significant restructuring and other charges are expected to be settled within twelve months following the end of the year in which the charge is recorded.

15. OTHER GAINS—NET

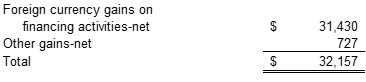

Other gains—net for the six months ended June 30, 2025 consist of the following ($ in thousands):

Foreign currency losses on financing activities include the impact of foreign currency exchange rate changes on various intercompany financing activities.

16. SUBSEQUENT EVENTS

Management has evaluated subsequent events pursuant to the requirements of ASC Topic 855, from the balance sheet date through August 29, 2025, the date the Condensed Consolidated Financial Statements were available to be issued and has determined that there are no material subsequent events that require disclosure in these Condensed Consolidated Financial Statements other than the following.

On July 29, 2025, the Antitrust Division of the U.S. Department of Justice withdrew its opposition to the acquisition of the Company by Global Business Travel Group, Inc. Subsequently the U.S. District Court for the Southern District of New York dismissed the previously filed suit. The transaction is now expected to close in the third quarter of 2025, subject to the satisfaction of the remaining closing conditions. See Note 1, “General and Basis of Presentation.”

In August 2025, the Fourth Incremental Joinder Agreement to the 2L Credit Agreement was executed providing for a first-out delayed draw term loan facility in an aggregate principal amount equal to $35 million. Through the issuance date of the Condensed Consolidated Financial Statements, the Company drew $20.0 million against this facility. See Note 10, “Debt.”