.2

Fourth Quarter and Full Year 2025 Earnings Organon

Disclaimer statement Cautionary Note Regarding Non - GAAP Financial Measures This presentation contains “non - GAAP financial measures,” which are financial measures that either exclude or include amounts t hat are correspondingly not excluded or included in the most directly comparable measures calculated and presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Specifically, th e c ompany makes use of the non - GAAP financial measures Adjusted EBITDA, Adjusted EBITDA margin, Adjusted gross margin, Adjusted gross profit, Adjusted net income, and Adjusted diluted EPS, which ar e n ot recognized terms under GAAP and are presented only as a supplement to the company’s GAAP financial statements. This presentation also provides certain measures that exclude the impact of foreign exc hange. We calculate foreign exchange by converting our current - period local currency financial results using the prior period average currency rates and comparing these adjusted amounts to our current - per iod results. The company believes that these non - GAAP financial measures help to enhance an understanding of the company’s financial performance. However, the presentation of these measures has limitatio ns as an analytical tool and should not be considered in isolation, or as a substitute for the company’s results as reported under GAAP. Because not all companies use identical calculations, the presentations of the se non - GAAP measures may not be comparable to other similarly titled measures of other companies. Please refer to Slides 19 - 21 of this presentation for additional information, including relevant definitions and reconciliations of non - GAAP financial measu res contained herein to the most directly comparable GAAP measures. In addition, the company’s full - year 2026 guidance measures (other than revenue) are provided on a non - GAAP basis because the co mpany is unable to reasonably predict certain items contained in the GAAP measures. Such items include, but are not limited to, acquisition - related expenses, restructuring and related expenses, stock - ba sed compensation, the ultimate outcome of legal proceedings, unusual gains and losses, the occurrence of matters creating GAAP tax impacts and other items not reflective of the company's ongoing operation s. The company’s management uses the non - GAAP financial measures described above to evaluate the company’s performance and to guide operational and financial decision making. Further, the company’s management believes that these non - GAAP financial measures, which exclude certain items, help to enhance its ability to meaningf ully communicate its underlying business performance, financial condition and results of operations. 2 See Slides 19 - 21 of this presentation for a reconciliation of non - GAAP measures.

Disclaimer statement, cont. Cautionary Note Regarding Forward - Looking Statements Except for historical information, this presentation includes “forward - looking statements” within the meaning of the safe harbo r provisions of the U.S. Private Securities Litigation Reform Act of 1995, including, but not limited to, statements about management’s expectations about the Audit Committee’s review described above, Organon’s full - year 2026 guidance estimates and predictions regarding other financial information and metrics, as well as expectations regarding Organon’s franchise and product performance and strategy expectations for future p eri ods. Forward - looking statements may be identified by words such as “guidance,” “potential,” “should,” “will,” “continue,” “expects,” “believes,” “future,” “estimates,” “opportunity,” “likely,” “pursue,” “ dri ve,” “intend,” “anticipate,” “be able to , ” or words of similar meaning. These statements are based upon the current beliefs and expectations of the company’s management and are subject to significant risks and uncertainties. If u nde rlying assumptions prove inaccurate, or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward - looking statements. Risks and uncertainties include, but are not limited to, the timing and completion of the Audit Committee’s review and result th ereof; pricing pressures globally, including rules and practices of managed care groups, judicial decisions and governmental laws and regulations related to or affecting Medicare, Medicaid and healthcare reform, ph arm aceutical pricing and reimbursement, access to our products, international reference pricing, including most - favored - nation drug pricing, and other pricing related initiatives and policy efforts; changes in govern ment laws and regulations in the United States and other jurisdictions, including laws and regulations governing the research, development, approval, clearance, manufacturing, supply, distribution, and/or marketing o f o ur products and related intellectual property, environmental regulations, and the enforcement thereof affecting the company’s business; the impact of tariffs and other trade restrictions or domestic sourcing re quirements; changes in tax laws including changes related to the taxation of foreign earnings; economic factors over which we have no control, including changes in inflation, interest rates, recessionary pressu res , and foreign currency exchange rates; the company’s inability to remediate the material weaknesses in its internal control over financial reporting; the company’s use of artificial intelligence technologies; the c omp any’s ability to execute on its capital allocation priorities and to deleverage its business; the impact of our substantial levels of indebtedness; expanded brand and class competition in the markets in which the company op era tes; difficulties with performance of third parties the company relies on for its business growth; the failure of any supplier to provide substances, materials, or services as agreed, or otherwise meet their obligati ons to the company; the increased cost of supply, manufacturing, packaging, and operations; difficulties developing and sustaining relationships with commercial counterparties; competition from generic products as the co mpany’s products lose patent protection; any failure by the company to retain market exclusivity for Nexplanon® (etonogestrel implant) or to obtain an additional period of exclusivity in the United States for Nexplanon® subsequent to the expiration of the rod patents in 2027; the continued impact of the September 2024 loss of exclusivity for Atozet (ezetimibe and atorvastatin); the success of the company’s efforts to adopt its business and sales strategies to address the ch anging market and regulatory landscape in order to achieve its business objectives and remain competitive; restructuring or other disruptions at the FDA, the U.S. Secu rit ies and Exchange Commission (the “SEC”) and other U.S. and comparable foreign government agencies; cyberattacks on, or other failures, accidents, or security breaches of, the company’s or third - party provid ers’ information technology systems, which could disrupt the company’s operations and those of third parties upon which it relies; increased focus on privacy issues in countries around the world, including the U nit ed States, the European Union, and China, and a more difficult legislative and regulatory landscape for privacy and data protection that continues to evolve with the potential to directly affect the company’s busine ss; difficulties and uncertainties inherent in the implementation of the company’s business development strategy or failure to recognize the benefits of strategic transactions; the impact of higher selling and promoti ona l costs; efficacy, safety or other quality concerns with respect to the company’s marketed products, whether or not scientifically justified, leading to product recalls, withdrawals, labeling changes or declining sal es; delays or failures to demonstrate adequate efficacy and safety of the company’s product candidates in pre - clinical and clinical trials, which may prevent or delay the development, approval, clearance, or commercializ ation of the company’s product candidates; future actions of third - parties, including significant changes in customer relationships or changes in the behavior and spending patterns of purchasers of healthcare pr odu cts and services, including delaying medical procedures, rationing prescription medications, reducing the frequency of physician visits and forgoing healthcare insurance coverage; legal factors, including pro duct liability claims, antitrust litigation and governmental investigations, including tax disputes, environmental claims and patent disputes with branded and generic competitors, any of which could preclude commerci ali zation of products or negatively affect the profitability of existing products; lost market opportunity resulting from delays and uncertainties in clinical trials and the approval or clearance process of the FDA and o the r regulatory authorities; the failure by the company or its third party collaborators and/or their suppliers to fulfill their or their regulatory or quality obligations, which could lead to a delay in regulatory approval or com mercial marketing of the company’s products; the impact of any future pandemic, epidemic, or similar public health threat on the company’s business, operations and financial performance; the company’s ability to hire a nd retain a permanent CEO, other members of the company’s senior management, or other key employees; changes in accounting pronouncements promulgated by standard - setting or regulatory bodies, including the Financia l Accounting Standards Board and the SEC, that are adverse to the company; volatility of commodity prices, fuel, and shipping rates that impact the costs and/or ability to supply the company’s product s; and uncertainties surrounding matters relating to the Audit Committee investigation and any related investigations, inquiries, claims, proceedings or actions. The company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, f uture events or otherwise. Additional factors that could cause results to differ materially from those described in the forward - looking statements can be found in the company’s filings with the SEC, including the company ’s most recent Annual Report on Form 10 - K (as amended), Quarterly Reports on Form 10 - Q (as amended), Current Reports on Form 8 - K, and other SEC filings, available at the SEC’s Internet site (www.sec.gov). 3

Operational highlights 4 • Full year 2025 results ◦ Revenue of $6.2 billion ◦ Diluted EPS of $0.72; Adj. Diluted EPS of $3.66 ◦ Adjusted EBITDA of $1.9 billion, representing 30.7% Adjusted EBITDA margin • Expect to deliver full year 2026 results in - line with 2025 ◦ Approximately $6.2 billion in revenue ◦ Approximately $1.9 billion of Adjusted EBITDA See Slides 19 - 21 of this presentation for a reconciliation of non - GAAP measures.

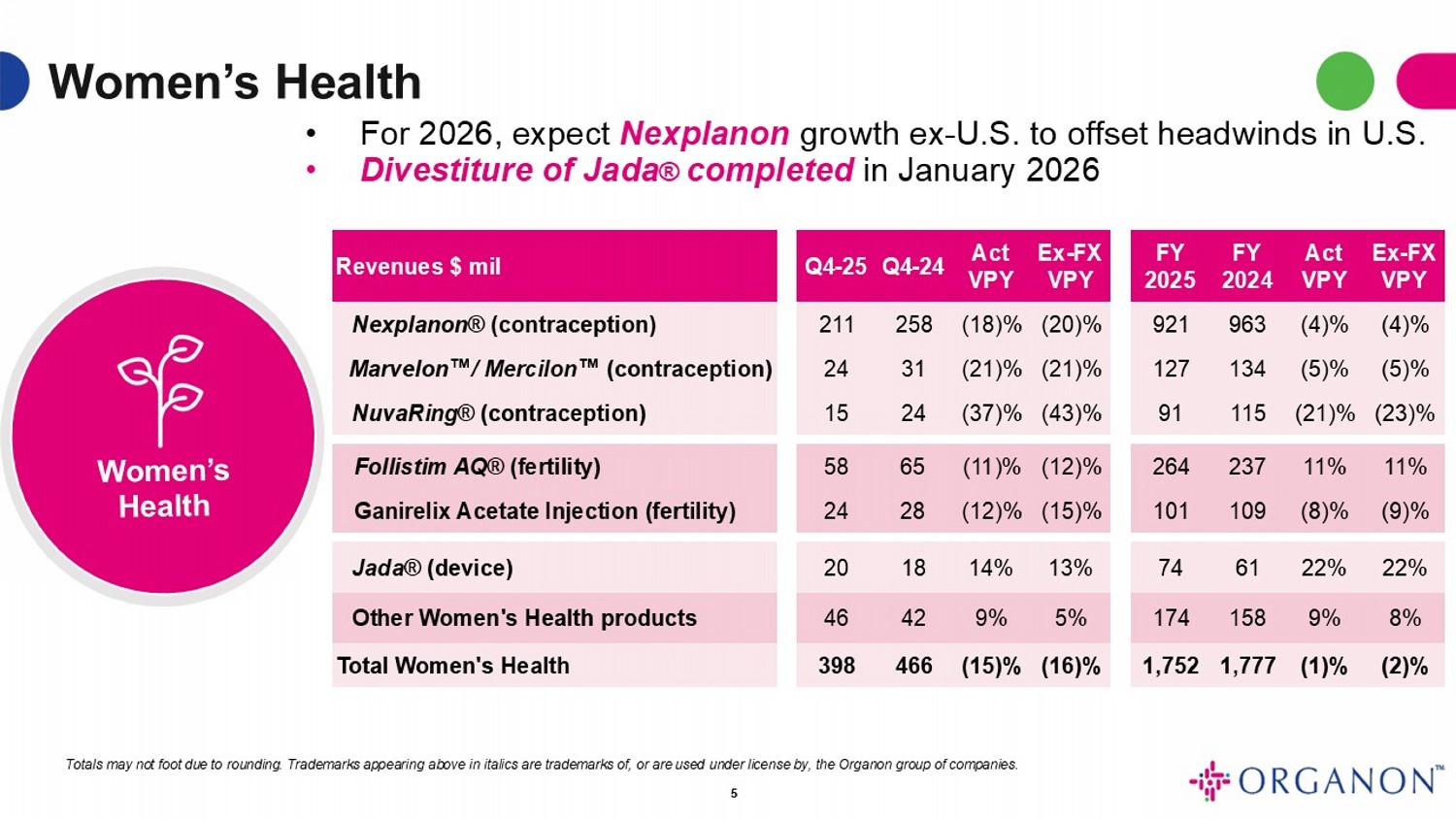

Women’s Health Ex - FX VPY Act VPY FY 2024 FY 2025 Ex - FX VPY Act VPY Q4 - 24 Q4 - 25 Revenues $ mil (4)% (4)% 963 921 (20)% (18)% 258 211 Nexplanon ® (contraception) (5)% (5)% 134 127 (21)% (21)% 31 24 Marvelon / Mercilon (contraception) (23)% (21)% 115 91 (43)% (37)% 24 15 NuvaRing ® (contraception) 11% 11% 237 264 (12)% (11)% 65 58 Follistim AQ ® (fertility) (9)% (8)% 109 101 (15)% (12)% 28 24 Ganirelix Acetate Injection (fertility) 22% 22% 61 74 13% 14% 18 20 Jada ® (device) 8% 9% 158 174 5% 9% 42 46 Other Women's Health products (2)% (1)% 1,777 1,752 (16)% (15)% 466 398 Total Women's Health • For 2026, expect Nexplanon growth ex - U.S. to offset headwinds in U.S. • Divestiture of Jada ® completed in January 2026 Totals may not foot due to rounding . Trademarks appearing above in italics are trademarks of, or are used under license by, the Organon group of companies . 5

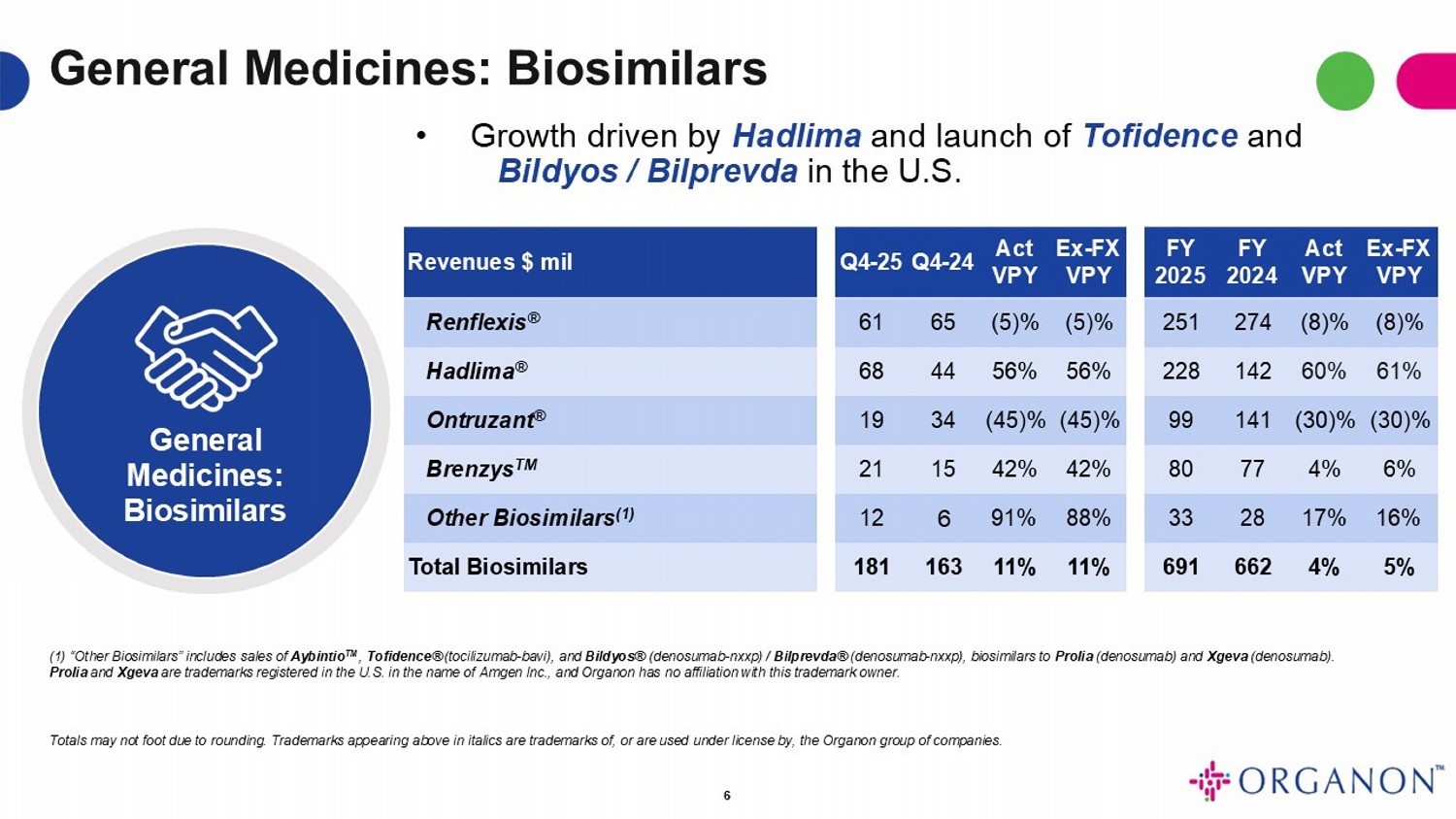

General Medicines: Biosimilars General Medicines: Biosimilars Ex - FX VPY Act VPY FY 2024 FY 2025 Ex - FX VPY Act VPY Q4 - 24 Q4 - 25 Revenues $ mil (8)% (8)% 274 251 (5)% (5)% 65 61 Renflexis ® 61% 60% 142 228 56% 56% 44 68 Hadlima ® (30)% (30)% 141 99 (45)% (45)% 34 19 Ontruzant ® 6% 4% 77 80 42% 42% 15 21 Brenzys TM 16% 17% 28 33 88% 91% 6 12 Other Biosimilars (1) 5% 4% 662 691 11% 11% 163 181 Total Biosimilars 6 • Growth driven by Hadlima and launch of Tofidence and Bildyos / Bilprevda in the U.S. ( 1 ) “Other Biosimilars” includes sales of Aybintio TM , Tofidence® (tocilizumab - bavi), and Bildyos® (denosumab - nxxp) / Bilprevda® (denosumab - nxxp), biosimilars to Prolia (denosumab) and Xgeva (denosumab) . Prolia and Xgeva are trademarks registered in the U . S . in the name of Amgen Inc . , and Organon has no affiliation with this trademark owner . Totals may not foot due to rounding . Trademarks appearing above in italics are trademarks of, or are used under license by, the Organon group of companies .

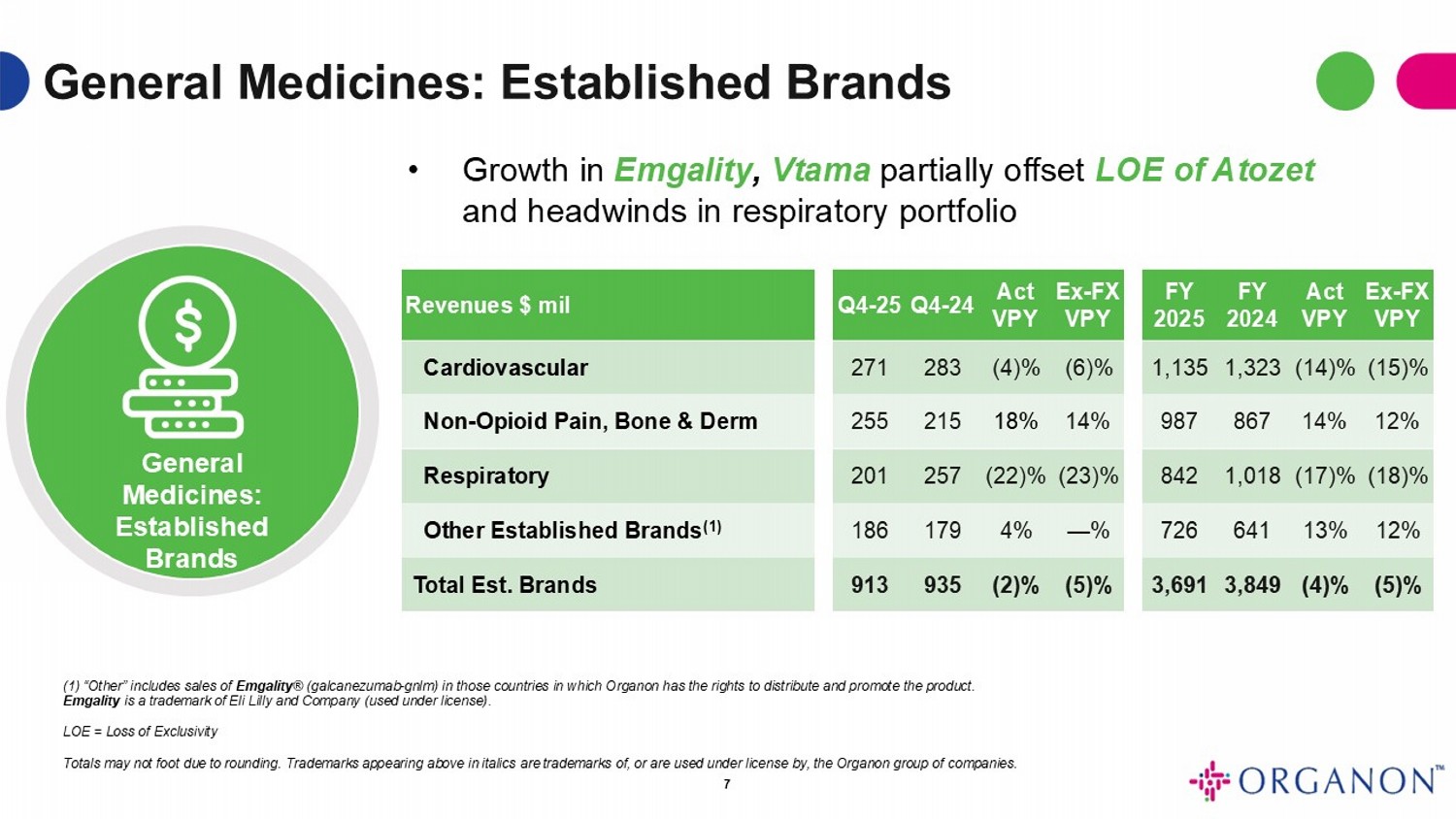

General Medicines: Established Brands General Medicines: Established Brands Ex - FX VPY Act VPY FY 2024 FY 2025 Ex - FX VPY Act VPY Q4 - 24 Q4 - 25 Revenues $ mil (15)% (14)% 1,323 1,135 (6)% (4)% 283 271 Cardiovascular 12% 14% 867 987 14% 18% 215 255 Non - Opioid Pain, Bone & Derm (18)% (17)% 1,018 842 (23)% (22)% 257 201 Respiratory 12% 13% 641 726 — % 4% 179 186 Other Established Brands (1) (5)% (4)% 3,849 3,691 (5)% (2)% 935 913 Total Est. Brands 7 • Growth in Emgality , Vtama partially offset LOE of Atozet and headwinds in respiratory portfolio (1) “Other” includes sales of Emgality ® (galcanezumab - gnlm) in those countries in which Organon has the rights to distribute and promote the product. Emgality is a trademark of Eli Lilly and Company (used under license) . LOE = Loss of Exclusivity Totals may not foot due to rounding . Trademarks appearing above in italics are trademarks of, or are used under license by, the Organon group of companies .

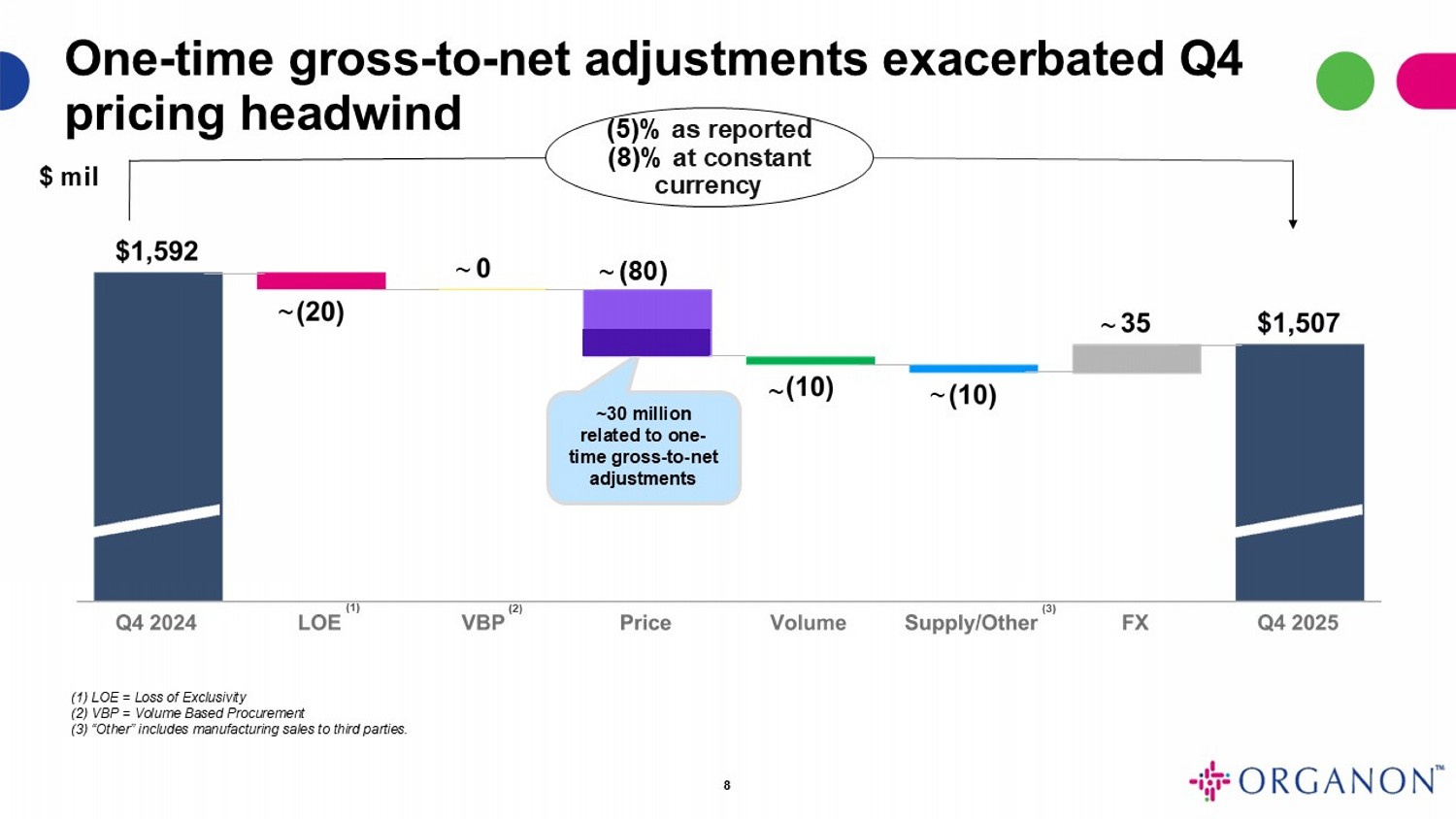

(5)% as reported (8)% at constant currency $ mil 8 (1) LOE = Loss of Exclusivity (2) VBP = Volume Based Procurement (3) “Other” includes manufacturing sales to third parties. (1) (2) ~ ~ ~ ~ One - time gross - to - net adjustments exacerbated Q4 pricing headwind ~ ~30 million related to one - time gross - to - net adjustments ~ (80) (3)

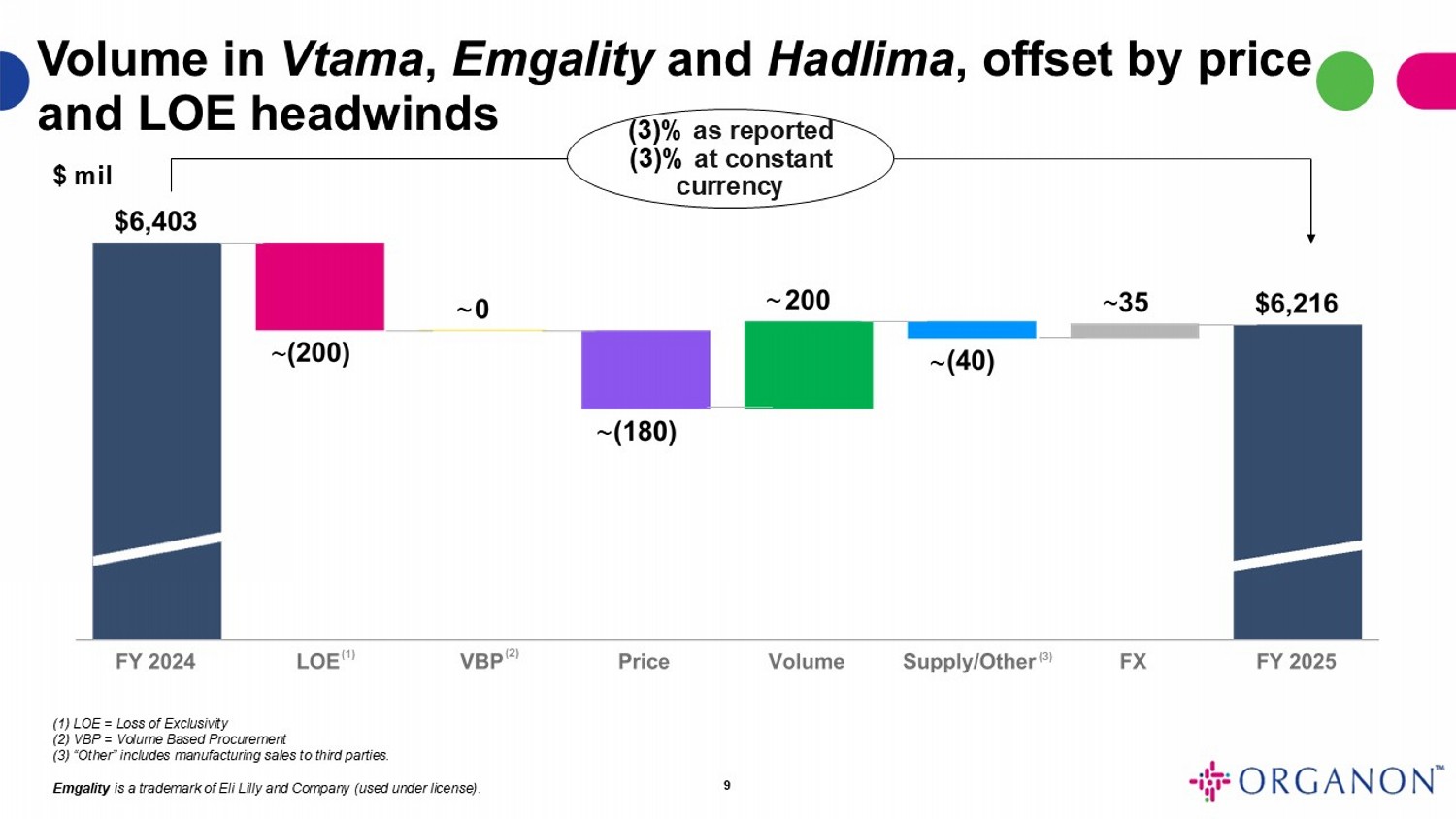

(3)% as reported (3)% at constant currency $ mil 9 (1) LOE = Loss of Exclusivity (2) VBP = Volume Based Procurement (3) “Other” includes manufacturing sales to third parties. Emgality is a trademark of Eli Lilly and Company (used under license) . (3) (1) (2) ~ ~ ~ ~ ~ Volume in Vtama , Emgality and Hadlima , offset by price and LOE headwinds ~

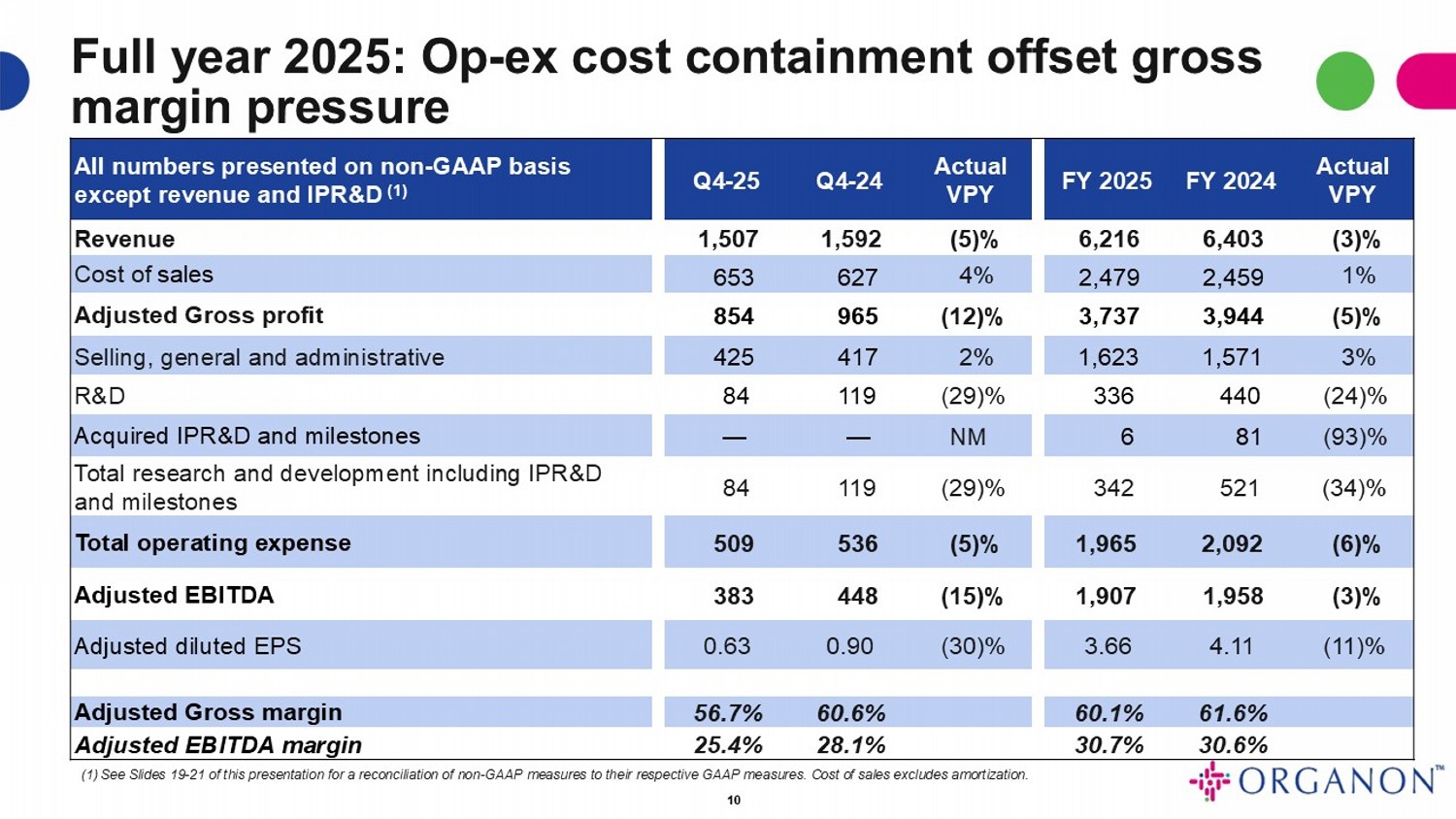

Full year 2025: Op - ex cost containment offset gross margin pressure Actual VPY FY 2024 FY 2025 Actual VPY Q4 - 24 Q4 - 25 All numbers presented on non - GAAP basis except revenue and IPR&D (1) (3)% 6,403 6,216 (5)% 1,592 1,507 Revenue 1% 2,459 2,479 4% 627 653 Cost of sales (5)% 3,944 3,737 (12)% 965 854 Adjusted Gross profit 3% 1,571 1,623 2% 417 425 Selling, general and administrative (24)% 440 336 (29)% 119 84 R&D (93)% 81 6 NM — — Acquired IPR&D and milestones (34)% 521 342 (29)% 119 84 Total research and development including IPR&D and milestones (6)% 2,092 1,965 (5)% 536 509 Total operating expense (3)% 1,958 1,907 (15)% 448 383 Adjusted EBITDA (11)% 4.11 3.66 (30)% 0.90 0.63 Adjusted diluted EPS 61.6% 60.1% 60.6% 56.7% Adjusted Gross margin 30.6% 30.7% 28.1% 25.4% Adjusted EBITDA margin (1) See Slides 19 - 21 of this presentation for a reconciliation of non - GAAP measures to their respective GAAP measures. Cost of sales excludes amorti zation. 10

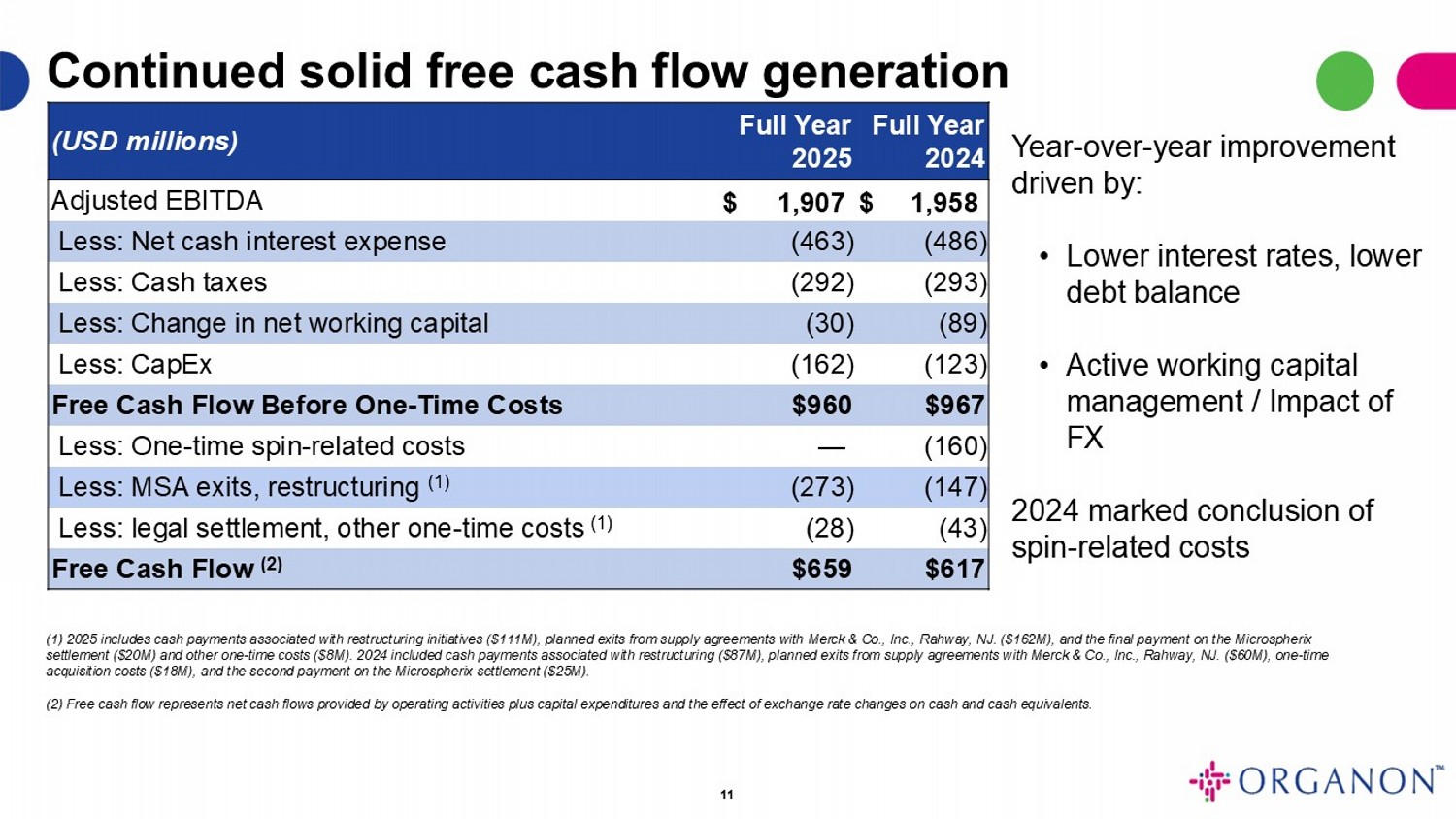

11 Full Year 2024 Full Year 2025 (USD millions) $ 1,958 $ 1,907 Adjusted EBITDA (486) (463) Less: Net cash interest expense (293) (292) Less: Cash taxes (89) (30) Less: Change in net working capital (123) (162) Less: CapEx $967 $960 Free Cash Flow Before One - Time Costs (160) — Less: One - time spin - related costs (147) (273) Less: MSA exits, restructuring (1) (43) (28) Less: legal settlement, other one - time costs (1) $617 $659 Free Cash Flow (2) Continued solid free cash flow generation (1) 2025 includes cash payments associated with restructuring initiatives ($111M), planned exits from supply agreements with Mer ck & Co., Inc., Rahway, NJ. ($162M), and the final payment on the Microspherix settlement ($20M) and other one - time costs ($8M). 2024 included cash payments associated with restructuring ($87M), planned exit s from supply agreements with Merck & Co., Inc., Rahway, NJ. ($60M), one - time acquisition costs ($18M), and the second payment on the Microspherix settlement ($25M). (2) Free cash flow represents net cash flows provided by operating activities plus capital expenditures and the effect of exc han ge rate changes on cash and cash equivalents. Year - over - year improvement driven by: • Lower interest rates, lower debt balance • Active working capital management / Impact of FX 2024 marked conclusion of spin - related costs

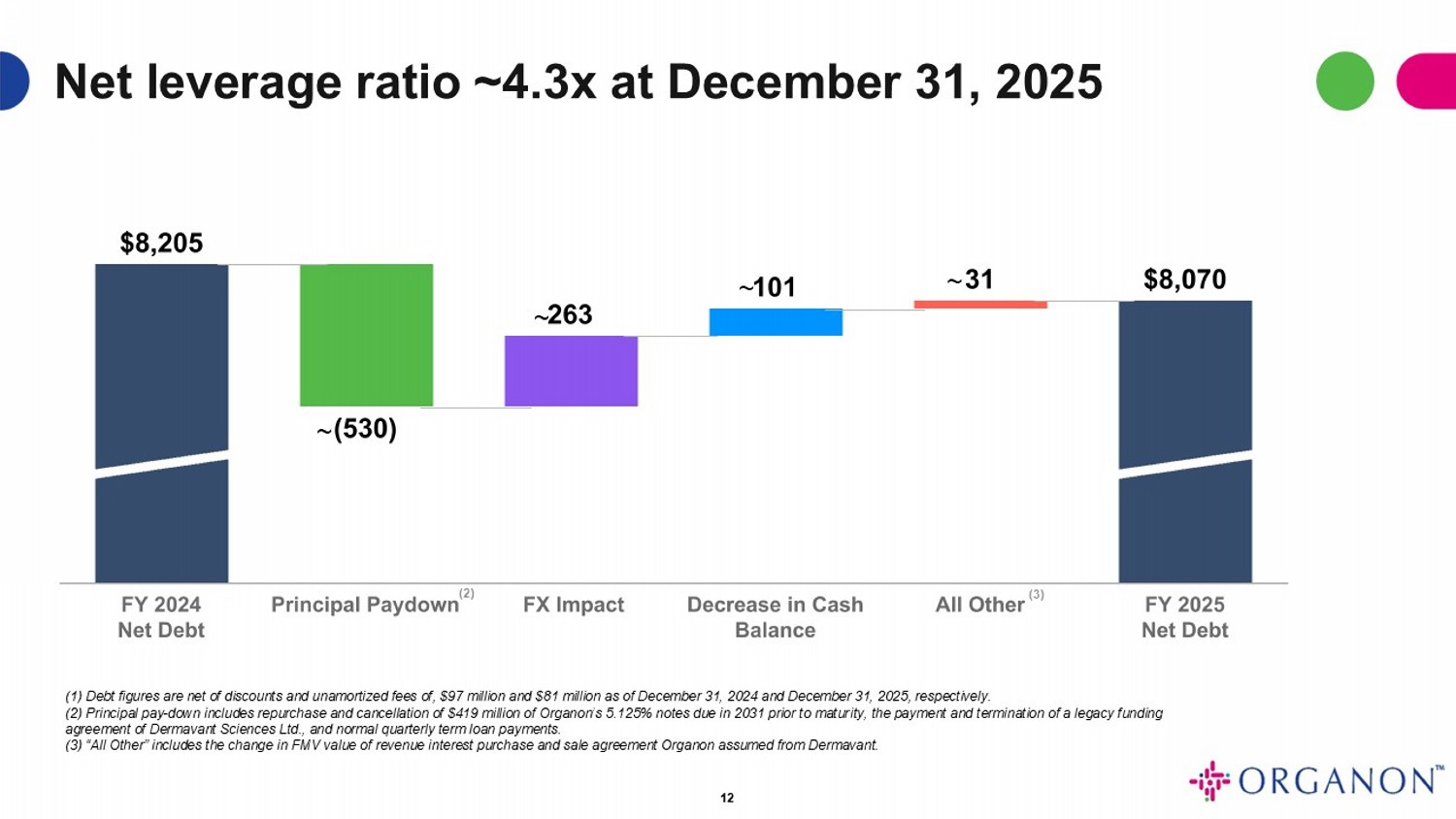

12 Net leverage ratio ~4.3x at December 31, 2025 (1) Debt figures are net of discounts and unamortized fees of, $97 million and $81 million as of December 31, 2024 and December 31, 2025, respectively. (2) Principal pay - down includes repurchase and cancellation of $419 million of Organon’s 5.125% notes due in 2031 prior to matur ity, the payment and termination of a legacy funding agreement of Dermavant Sciences Ltd., and normal quarterly term loan payments. (3) “All Other” includes the change in FMV value of revenue interest purchase and sale agreement Organon assumed from Dermava nt. ~ ~ ~ ~ (2) (3)

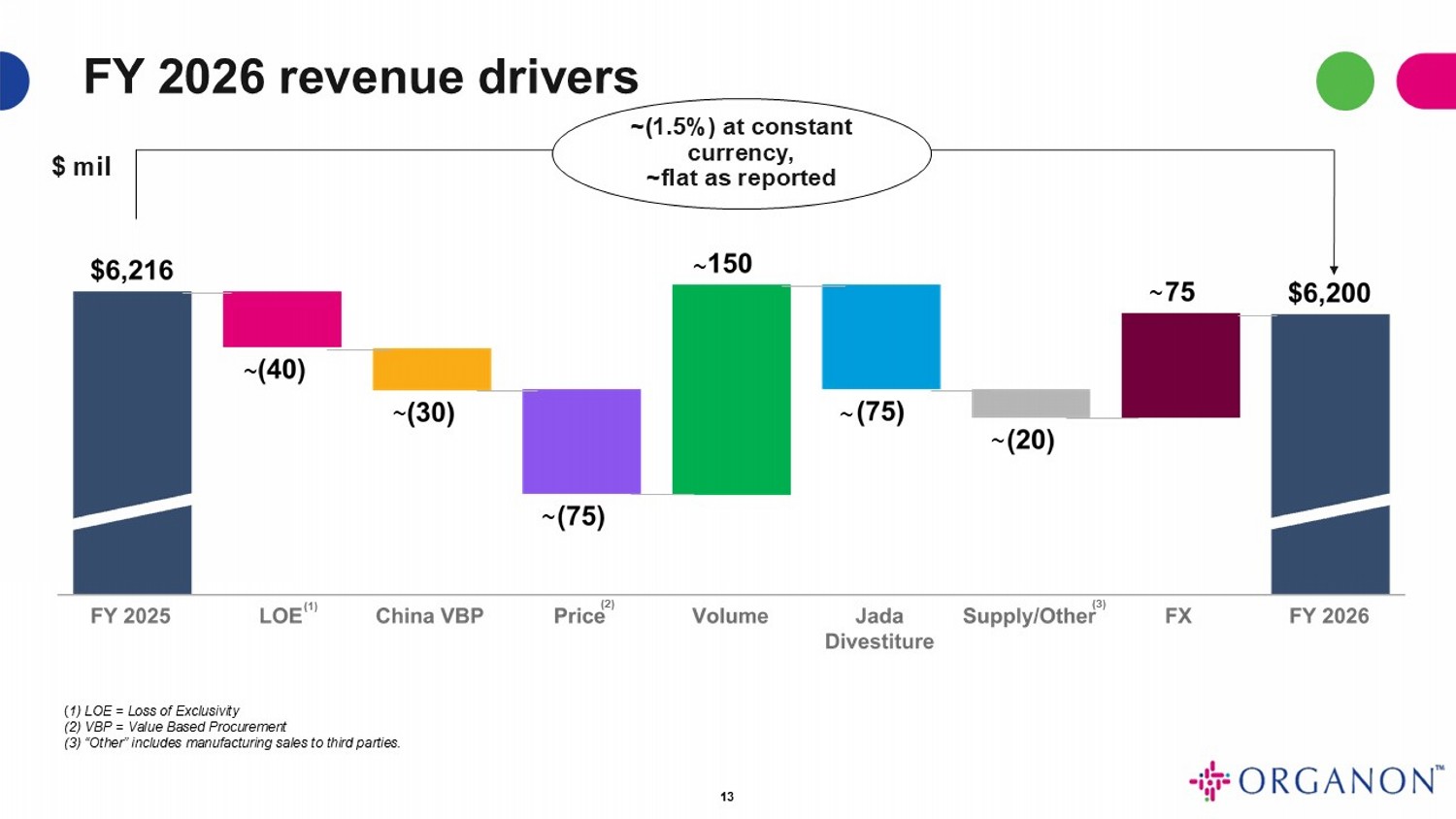

FY 2026 revenue drivers $ mil 13 ( 1) LOE = Loss of Exclusivity (2) VBP = Value Based Procurement (3) “Other” includes manufacturing sales to third parties. (1) (2) (3) ~( 1.5%) at constant currency, ~flat as reported ~ ~ ~ ~ ~ ~ ~

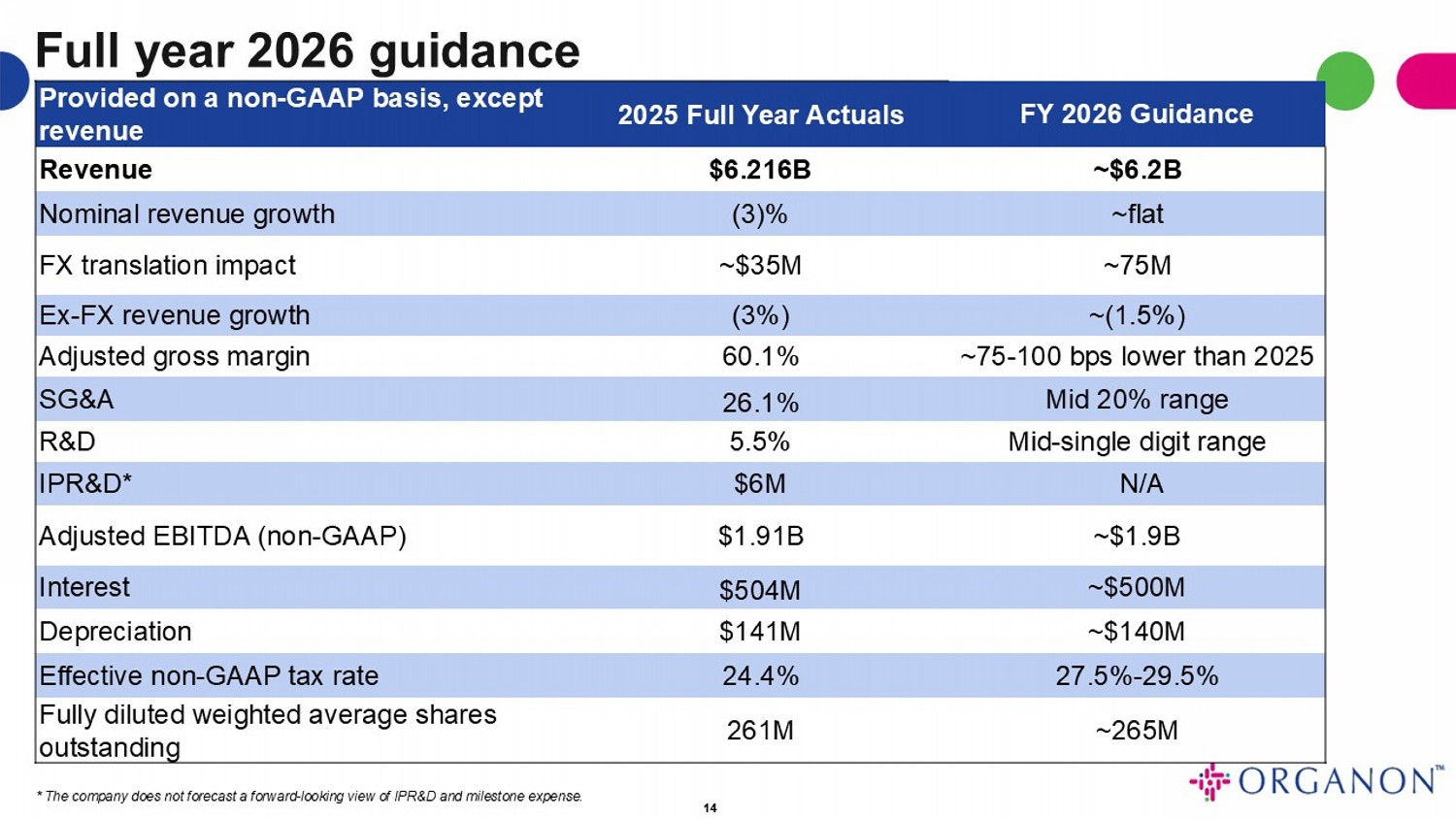

Full year 2026 guidance 14 FY 2026 Guidance 2025 Full Year Actuals Provided on a non - GAAP basis, except revenue ~$6.2B $6.216B Revenue ~flat (3)% Nominal revenue growth ~75M ~$35M FX translation impact ~(1.5%) (3%) Ex - FX revenue growth ~75 - 100 bps lower than 2025 60.1% Adjusted gross margin Mid 20% range 26.1% SG&A Mid - single digit range 5.5% R&D N/A $6M IPR&D* ~$1.9B $1.91B Adjusted EBITDA (non - GAAP) ~$500M $504M Interest ~$140M $141M Depreciation 27.5% - 29.5% 24.4% Effective non - GAAP tax rate ~265M 261M Fully diluted weighted average shares outstanding * The company does not forecast a forward - looking view of IPR&D and milestone expense.

Q&A

Appendix

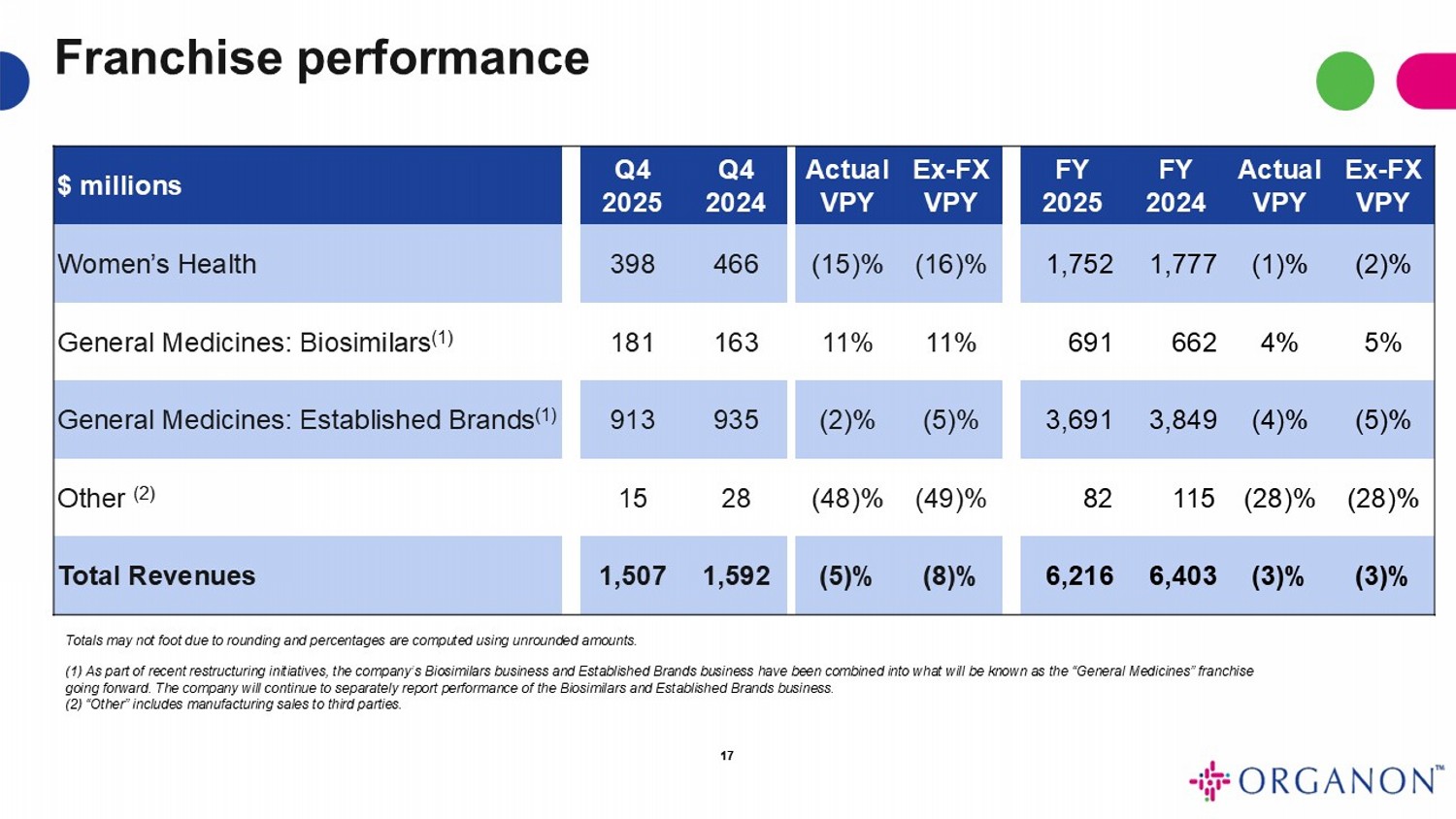

Ex - FX VPY Actual VPY FY 2024 FY 2025 Ex - FX VPY Actual VPY Q4 2024 Q4 2025 $ millions (2)% (1)% 1,777 1,752 (16)% (15)% 466 398 Women’s Health 5% 4% 662 691 11% 11% 163 181 General Medicines: Biosimilars (1) (5)% (4)% 3,849 3,691 (5)% (2)% 935 913 General Medicines: Established Brands (1) (28)% (28)% 115 82 (49)% (48)% 28 15 Other (2) (3)% (3)% 6,403 6,216 (8)% (5)% 1,592 1,507 Total Revenues Totals may not foot due to rounding and percentages are computed using unrounded amounts. (1) As part of recent restructuring initiatives, the company’s Biosimilars business and Established Brands business have been co mbined into what will be known as the “General Medicines” franchise going forward. The company will continue to separately report performance of the Biosimilars and Established Brands business. (2) “Other” includes manufacturing sales to third parties. 17 Franchise performance

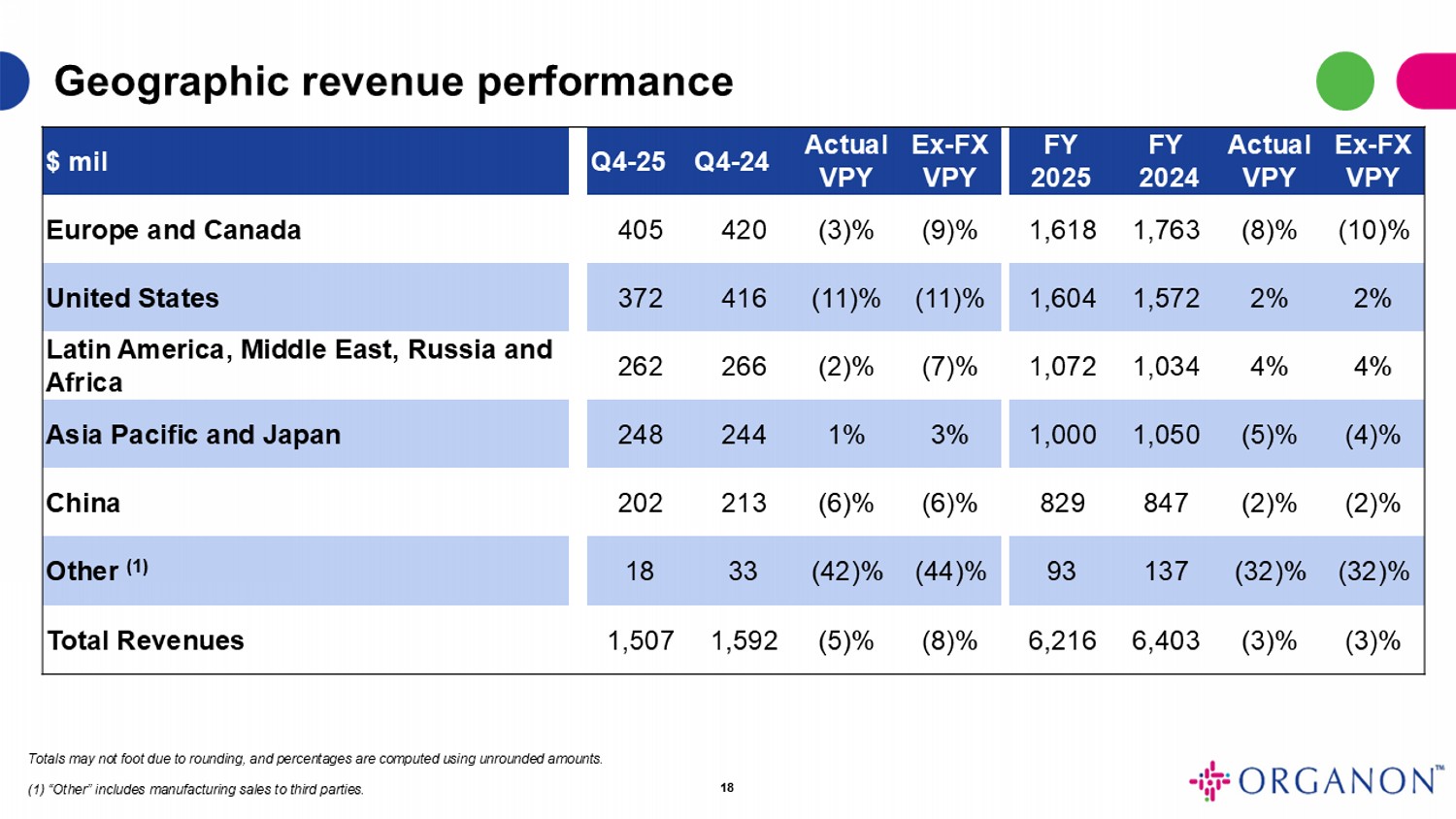

Ex - FX VPY Actual VPY FY YTD FY 2025 Ex - FX VPY Actual VPY Q4 - 24 Q4 - 25 $ mil (10)% (8)% 1,763 1,618 (9)% (3)% 420 405 Europe and Canada 2% 2% 1,572 1,604 (11)% (11)% 416 372 United States 4% 4% 1,034 1,072 (7)% (2)% 266 262 Latin America, Middle East, Russia and Africa (4)% (5)% 1,050 1,000 3% 1% 244 248 Asia Pacific and Japan (2)% (2)% 847 829 (6)% (6)% 213 202 China (32)% (32)% 137 93 (44)% (42)% 33 18 Other (1) (3)% (3)% 6,403 6,216 (8)% (5)% 1,592 1,507 Total Revenues Totals may not foot due to rounding, and percentages are computed using unrounded amounts. (1) “Other” includes manufacturing sales to third parties. Geographic revenue performance 18

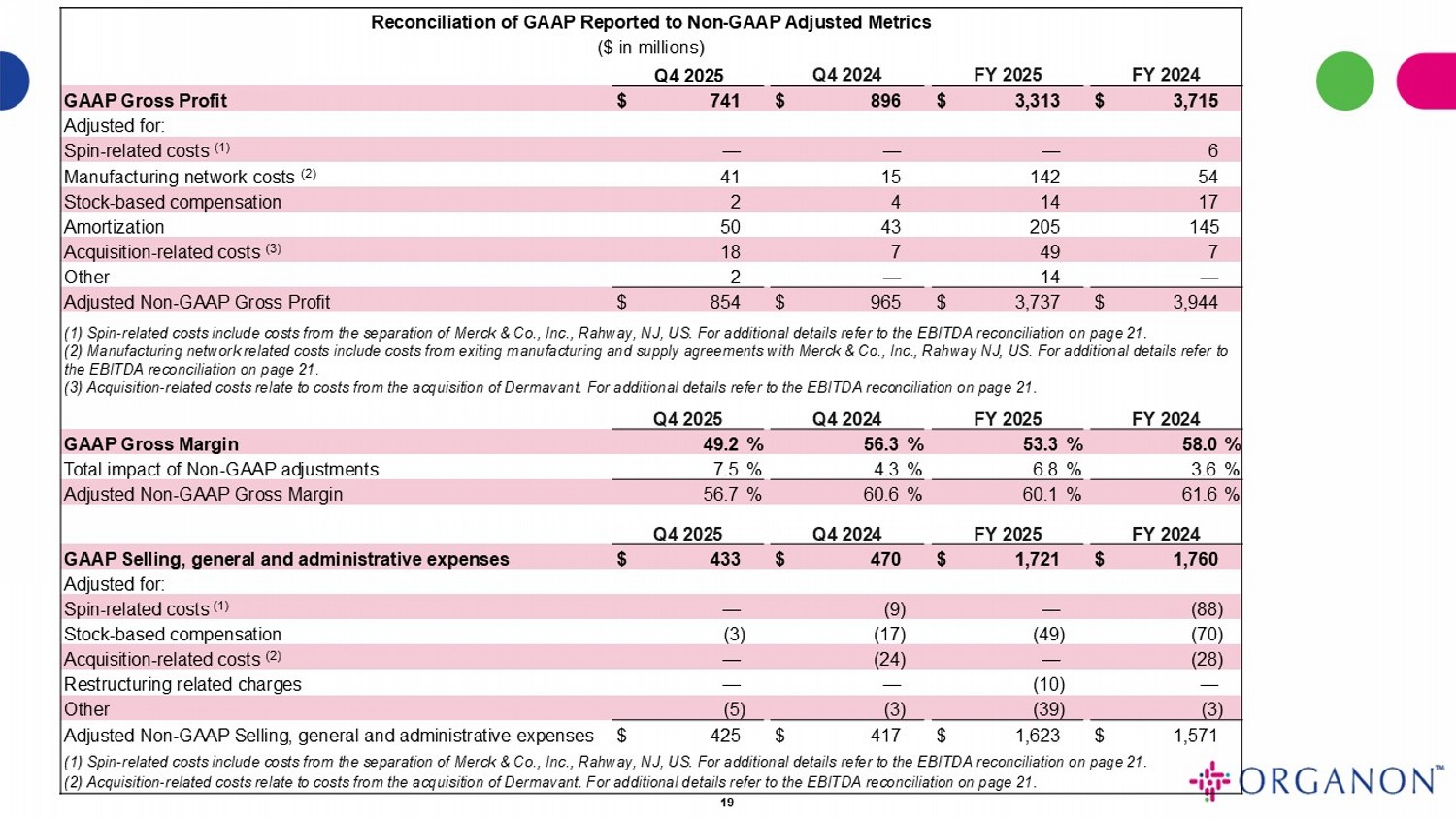

Reconciliation of GAAP Reported to Non - GAAP Adjusted Metrics ($ in millions) FY 2024 FY 2025 Q4 2024 Q4 2025 $ 3,715 $ 3,313 $ 896 $ 741 GAAP Gross Profit Adjusted for: 6 — — — Spin - related costs (1) 54 142 15 41 Manufacturing network costs (2) 17 14 4 2 Stock - based compensation 145 205 43 50 Amortization 7 49 7 18 Acquisition - related costs (3) — 14 — 2 Other $ 3,944 $ 3,737 $ 965 $ 854 Adjusted Non - GAAP Gross Profit (1) Spin - related costs include costs from the separation of Merck & Co., Inc., Rahway, NJ, US. For additional details refer to t he EBITDA reconciliation on page 21 . (2) Manufacturing network related costs include costs from exiting manufacturing and supply agreements with Merck & Co., Inc. , R ahway NJ, US. For additional details refer to the EBITDA reconciliation on page 21 . (3) Acquisition - related costs relate to costs from the acquisition of Dermavant. For additional details refer to the EBITDA reco nciliation on page 21 . FY 2024 FY 2025 Q4 2024 Q4 2025 58.0 % 53.3 % 56.3 % 49.2 % GAAP Gross Margin 3.6 % 6.8 % 4.3 % 7.5 % Total impact of Non - GAAP adjustments 61.6 % 60.1 % 60.6 % 56.7 % Adjusted Non - GAAP Gross Margin FY 2024 FY 2025 Q4 2024 Q4 2025 $ 1,760 $ 1,721 $ 470 $ 433 GAAP Selling, general and administrative expenses Adjusted for: (88) — (9) — Spin - related costs (1) (70) (49) (17) (3) Stock - based compensation (28) — (24) — Acquisition - related costs (2) — (10) — — Restructuring related charges (3) (39) (3) (5) Other $ 1,571 $ 1,623 $ 417 $ 425 Adjusted Non - GAAP Selling, general and administrative expenses (1) Spin - related costs include costs from the separation of Merck & Co., Inc., Rahway, NJ, US. For additional details refer to t he EBITDA reconciliation on page 21 . (2) Acquisition - related costs relate to costs from the acquisition of Dermavant . For additional details refer to the EBITDA reconciliation on page 21 . 19

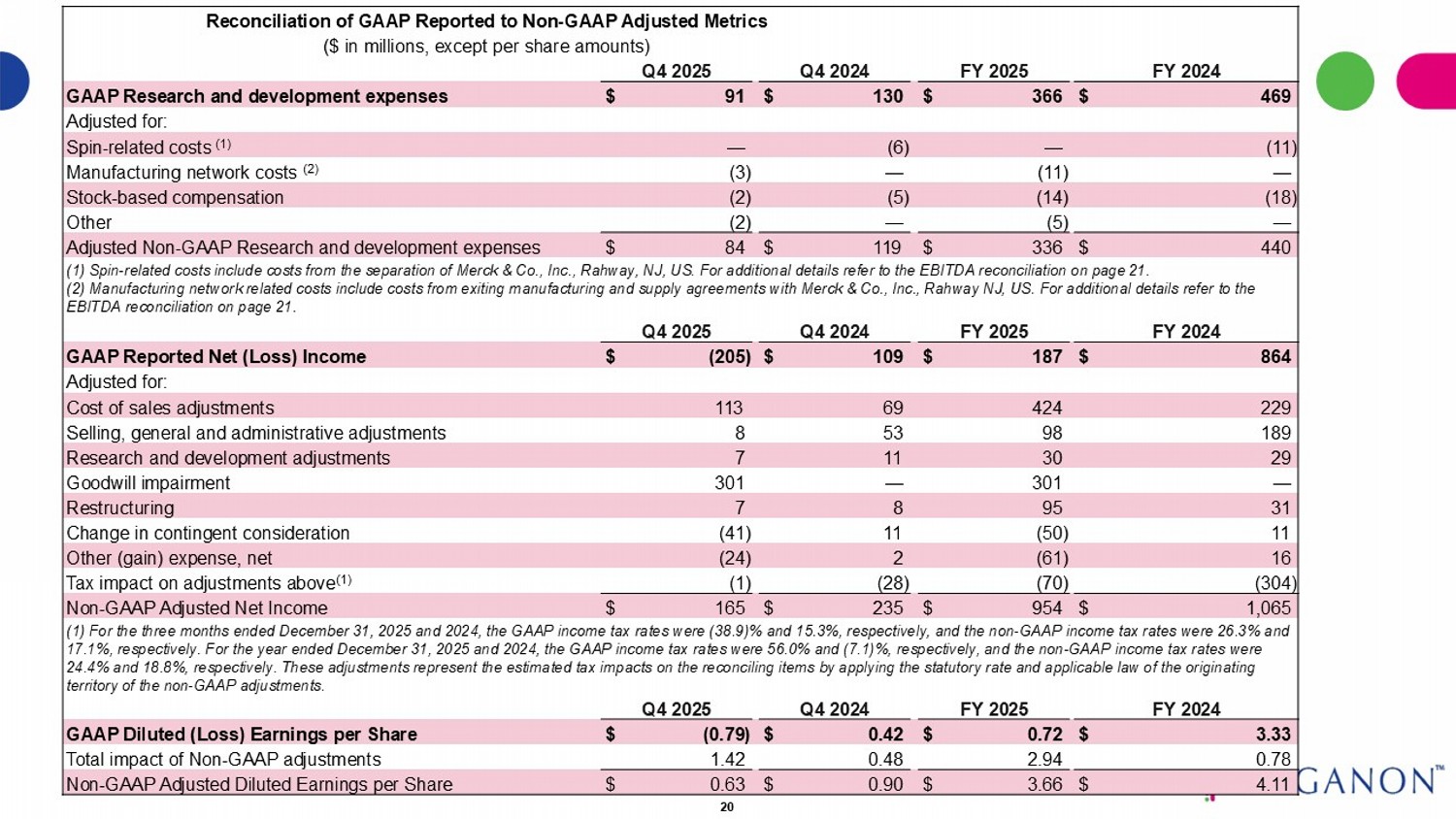

Reconciliation of GAAP Reported to Non - GAAP Adjusted Metrics ($ in millions, except per share amounts) FY 2024 FY 2025 Q4 2024 Q4 2025 $ 469 $ 366 $ 130 $ 91 GAAP Research and development expenses Adjusted for: (11) — (6) — Spin - related costs (1) — (11) — (3) Manufacturing network costs (2) (18) (14) (5) (2) Stock - based compensation — (5) — (2) Other $ 440 $ 336 $ 119 $ 84 Adjusted Non - GAAP Research and development expenses (1) Spin - related costs include costs from the separation of Merck & Co., Inc., Rahway, NJ, US. For additional details refer to t he EBITDA reconciliation on page 21 . (2) Manufacturing network related costs include costs from exiting manufacturing and supply agreements with Merck & Co., Inc. , R ahway NJ, US. For additional details refer to the EBITDA reconciliation on page 21 . FY 2024 FY 2025 Q4 2024 Q4 2025 $ 864 $ 187 $ 109 $ (205) GAAP Reported Net (Loss) Income Adjusted for: 229 424 69 113 Cost of sales adjustments 189 98 53 8 Selling, general and administrative adjustments 29 30 11 7 Research and development adjustments — 301 — 301 Goodwill impairment 31 95 8 7 Restructuring 11 (50) 11 (41) Change in contingent consideration 16 (61) 2 (24) Other (gain) expense, net (304) (70) (28) (1) Tax impact on adjustments above (1) $ 1,065 $ 954 $ 235 $ 165 Non - GAAP Adjusted Net Income (1) For the three months ended December 31, 2025 and 2024, the GAAP income tax rates were (38.9)% and 15.3%, respectively, and t he non - GAAP income tax rates were 26.3% and 17.1%, respectively. For the year ended December 31, 2025 and 2024, the GAAP income tax rates were 56.0% and (7.1)%, respectivel y, and the non - GAAP income tax rates were 24.4% and 18.8%, respectively. These adjustments represent the estimated tax impacts on the reconciling items by applying the st atutory rate and applicable law of the originating territory of the non - GAAP adjustments. FY 2024 FY 2025 Q4 2024 Q4 2025 $ 3.33 $ 0.72 $ 0.42 $ (0.79) GAAP Diluted (Loss) Earnings per Share 0.78 2.94 0.48 1.42 Total impact of Non - GAAP adjustments $ 4.11 $ 3.66 $ 0.90 $ 0.63 Non - GAAP Adjusted Diluted Earnings per Share 20

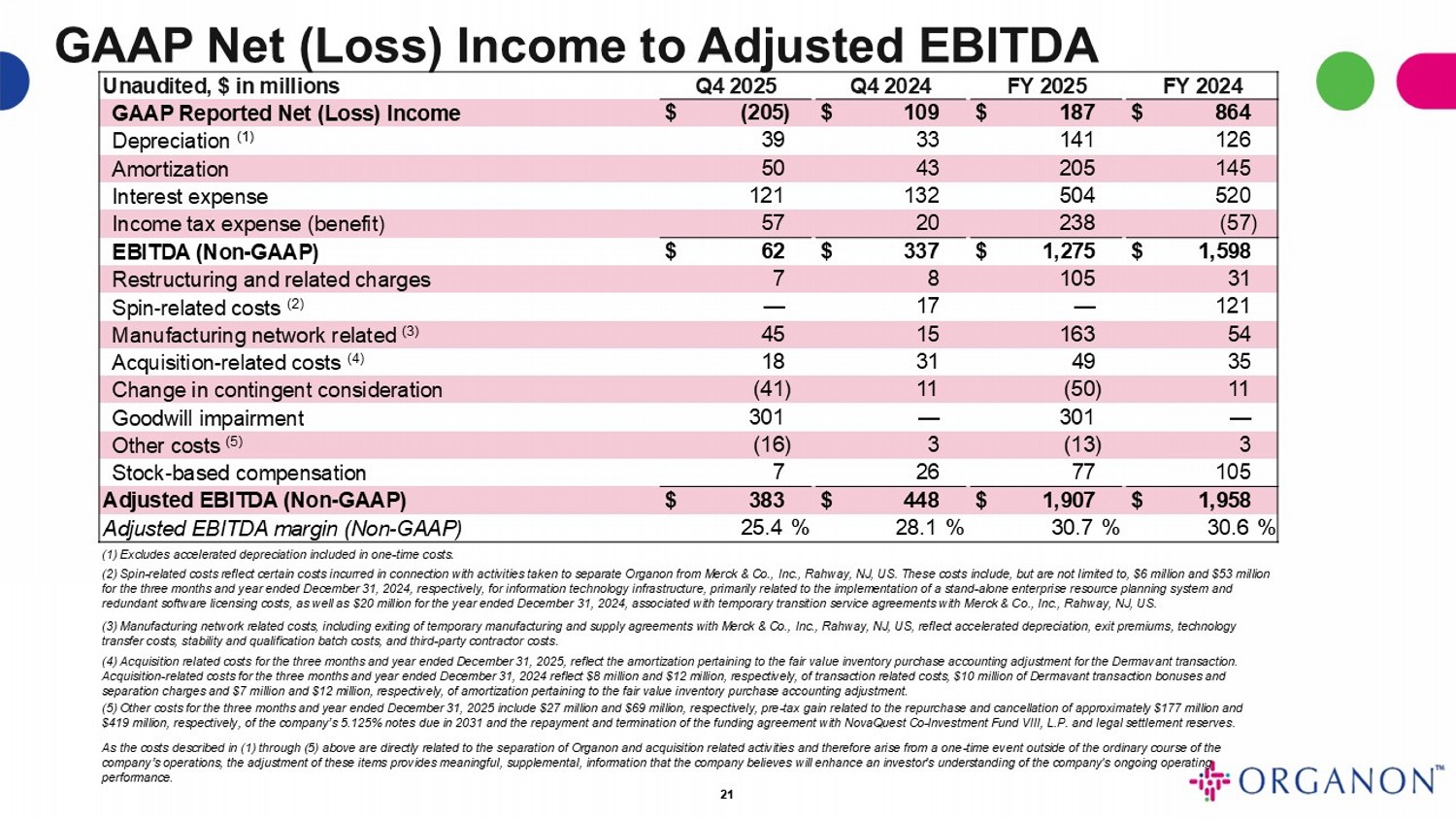

GAAP Net (Loss) Income to Adjusted EBITDA FY 2024 FY 2025 Q4 2024 Q4 2025 Unaudited, $ in millions $ 864 $ 187 $ 109 $ (205) GAAP Reported Net (Loss) Income 126 141 33 39 Depreciation (1) 145 205 43 50 Amortization 520 504 132 121 Interest expense (57) 238 20 57 Income tax expense (benefit) $ 1,598 $ 1,275 $ 337 $ 62 EBITDA (Non - GAAP) 31 105 8 7 Restructuring and related charges 121 — 17 — Spin - related costs (2) 54 163 15 45 Manufacturing network related (3) 35 49 31 18 Acquisition - related costs (4) 11 (50) 11 (41) Change in contingent consideration — 301 — 301 Goodwill impairment 3 (13) 3 (16) Other costs (5) 105 77 26 7 Stock - based compensation $ 1,958 $ 1,907 $ 448 $ 383 Adjusted EBITDA (Non - GAAP) 30.6 % 30.7 % 28.1 % 25.4 % Adjusted EBITDA margin (Non - GAAP) 21 (1) Excludes accelerated depreciation included in one - time costs. (2) Spin - related costs reflect certain costs incurred in connection with activities taken to separate Organon from Merck & Co., Inc., Rahway, NJ, US. These costs include, but are not limited to, $6 million and $53 million for the three months and year ended December 31, 2024, respectively, for information technology infrastructure, primarily rel ate d to the implementation of a stand - alone enterprise resource planning system and redundant software licensing costs, as well as $20 million for the year ended December 31, 2024, associated with temporary tr ans ition service agreements with Merck & Co., Inc., Rahway, NJ, US. (3) Manufacturing network related costs, including exiting of temporary manufacturing and supply agreements with Merck & Co., In c., Rahway, NJ, US, reflect accelerated depreciation, exit premiums, technology transfer costs, stability and qualification batch costs, and third - party contractor costs. (4) Acquisition related costs for the three months and year ended December 31, 2025, reflect the amortization pertaining to the fair value inventory purchase accounting adjustment for the Dermavant transaction. Acquisition - related costs for the three months and year ended December 31, 2024 reflect $8 million and $12 million, respectively , of transaction related costs, $10 million of Dermavant transaction bonuses and separation charges and $7 million and $12 million, respectively, of amortization pertaining to the fair value inventory purch ase accounting adjustment. (5) Other costs for the three months and year ended December 31, 2025 include $27 million and $69 million, respectively, pre - tax gain related to the repurchase and cancellation of approximately $177 million and $419 million, respectively, of the company’s 5.125% notes due in 2031 and the repayment and termination of the funding agreem ent with NovaQuest Co - Investment Fund VIII, L.P. and legal settlement reserves. As the costs described in (1) through (5) above are directly related to the separation of Organon and acquisition related act ivi ties and therefore arise from a one - time event outside of the ordinary course of the company’s operations, the adjustment of these items provides meaningful, supplemental, information that the company believes wil l enhance an investor's understanding of the company's ongoing operating performance.

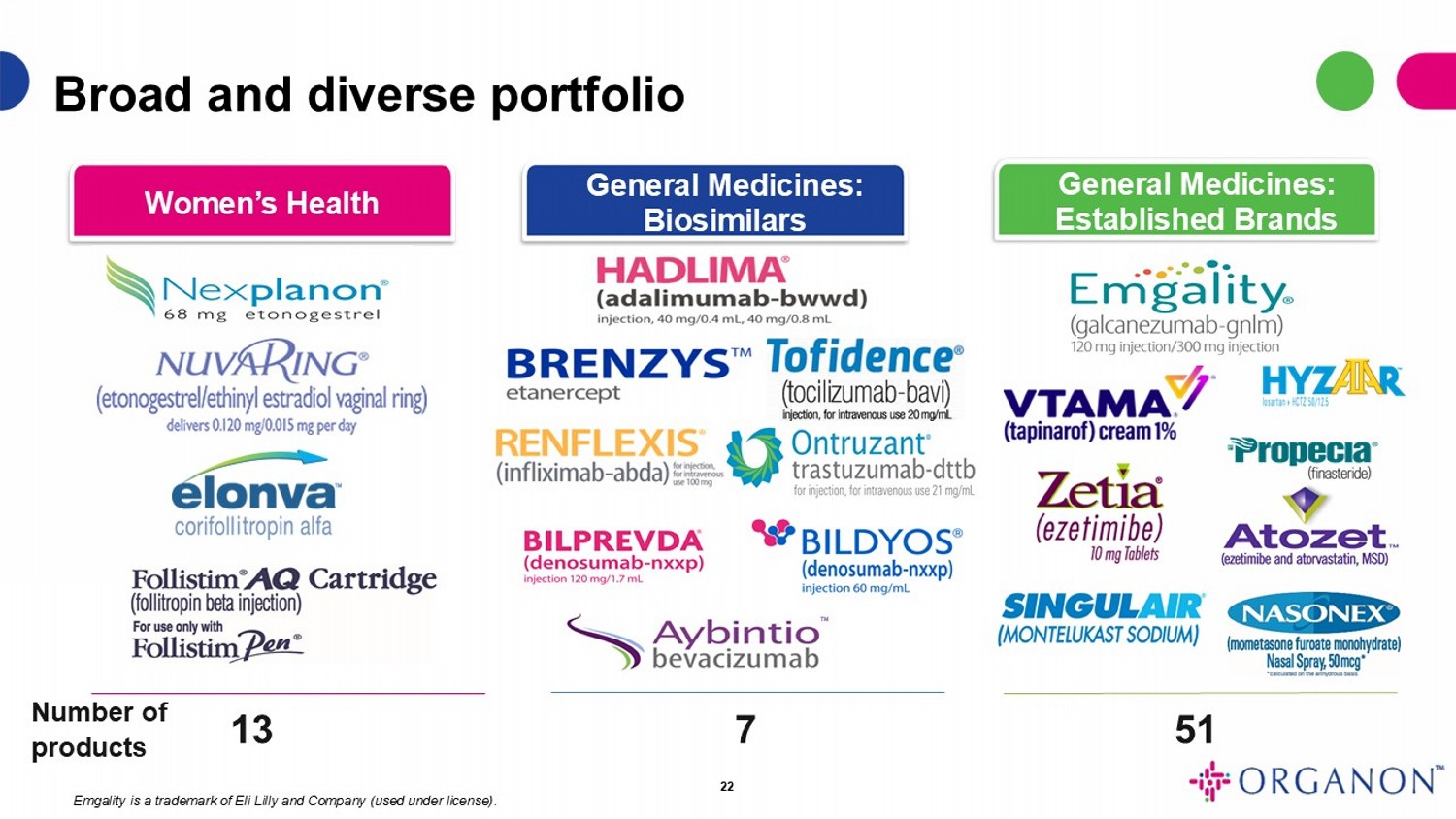

Number of products 13 7 51 Women’s Health General Medicines: Biosimilars General Medicines: Established Brands Broad and diverse portfolio 22 Emgality is a trademark of Eli Lilly and Company (used under license) . TM TM