Corporate Policy 11: Insider Trading What You Need to Know We don’t trade in the securities of Organon & Co. (“Company,” “we,” “us,” or “our”) — or tip others to do so — based on material, non-public (or “inside”) information. We recognize that Insider Trading undermines investor confidence in the fairness and integrity of the securities markets, and is not only unethical, but also illegal and can result in significant civil and criminal fines for any person who violates the federal insider trading laws as well as civil fines for the Company. This policy sets forth the restrictions, guidelines, and our expectations regarding compliance with United States federal and state securities laws and other such laws in applicable jurisdictions relating to trading in securities. In order to avoid even the appearance of impropriety, any violation of this policy may subject you to disciplinary action, up to and including termination of employment for cause, whether or not the relevant conduct constitutes a violation of law. All executives, directors, and employees (which we refer to as “founders”) must follow not only the letter, but the spirit of this policy and the laws and policies in the countries where we do business and seek help anytime there is a question. Who Does this Policy Apply To This policy applies to the Company and all of its executives, founders, and directors (and those of our subsidiaries). This policy also applies to family members and controlled entities of such persons. We may also determine that other persons should be subject to this policy, such as contractors or consultants who have access to inside information. What You Need to Do at a High Level Know the definition of inside information and the types of information that could be considered inside information. Be alert to situations that are governed by this policy — it applies when buying or selling securities, including common stock, options for common stock or any other securities that we may issue, such as preferred stock, convertible debentures and warrants, etc., as well as derivative securities that are not issued by us, or that may be issued by public companies with which we do business. What You Need to Do in Your Everyday Work Protect inside information. Don’t engage in transactions or trade on it and don’t tip others who could trade on it. Know and adhere to the following key operating principles of this policy: 1. Inside Information. Your work at, or service on the Board of Directors of, our Company may expose you to inside information about our Company or companies with which we do business. You may not trade in our Company securities based on inside information, and you may not trade in the securities of companies with which we work if you are exposed to inside information about those companies. 2. Tipping. Don’t disclose inside information to anyone who does not have a clear business need to know the information. This applies to family members as well as business associates (inside or outside of our Company). In addition, you should take care before trading on the recommendation of others to ensure that the recommendation is not the result of an illegal “tip”.

Corporate Policy 11: Insider Trading 3. Transaction Timing. To ensure compliance and avoid liability, if you possess inside information, don’t trade until the beginning of the second full trading day after such information has been communicated to the public through an official announcement (such as our public filings with the SEC, inclusion in an issued Company press release, or otherwise widely disseminated in the media, such as through a financial news service like Yahoo! Finance, BusinessWire, or PR Newswire, carried in a general news service like the Associated Press, or carried by a national news service such as The New York Times, the Wall St. Journal, CNN, CNBC, or the Fox Business Channel). Please note that the fact that rumors, speculation, or statements attributed to unidentified sources are public is insufficient to make information “public” within the meaning of this policy even when the rumored information turns out to be accurate. Certain “Restricted Persons” will receive notification from the Office of General Counsel imposing additional restrictions. If you are a “Restricted Person,” you must follow the restrictions outlined in that notification. For your protection and the protection of our Company, contact the Director, Legal—Securities, in the Office of General Counsel if you are unsure whether a transaction may be permissible. 4. Hedging, Pledging and Speculative Transactions. All Section 16 officers, members of the Board of Directors and founders in Bands 400-700, as well as any of their family members and controlled entities, are prohibited from engaging in speculative transactions, short sales, publicly traded options, hedging transactions, pledging and trading on margin. 5. Safeguarding Non-Public Information. We have strict policies relating to protecting the confidentiality of our internal, proprietary information. These policies include procedures regarding identifying, marking and safeguarding confidential information and founder confidentiality agreements, including our Code of Conduct, Disclosing Information About Organon Policy, and Information Management and Protection Policy. You should comply with these policies at all times. 6. Speak up. You are our Company. Protect the reputation we seek to establish as a company that operates with integrity and report any conduct that could put our reputation at risk. If you see or suspect employee misconduct, unethical or illegal activity, talk to your manager, another Company resource (e.g., Compliance, Legal, or Human Resources) or, where permitted by law, Speak Up at www.organon.com/integrity to address your questions or concerns confidentially without fear of retaliation. To uphold the Company's commitment to ethics, integrity and compliance with laws, regulations, Company policy and the Company's Code of Conduct, actions inconsistent with this policy shall be subject to Corporate Policy 15: Reporting and Responding to Misconduct. If you are a Restricted Person, additional requirements apply to you. Please see “Additional Restrictions that Apply to Directors, Executive Officers, and Other Restricted Persons” below for more information.

Corporate Policy 11: Insider Trading Additional Restrictions that Apply to Directors, Executive Officers, and Other Restricted Persons To help prevent inadvertent violations of the federal securities laws and avoid even the appearance of trading on the basis of inside information, additional provisions apply to Restricted Persons. These include: Window Periods — Restricted Persons may only trade in Organon’s securities during the four “Window Periods” that occur each fiscal year. Preclearance Requirement — Restricted Persons must receive pre-approval from the Director, Legal – Securities in the Office of General Counsel prior to conducting any transaction in our securities. Window Periods Quarterly Window Periods. If you are a “Restricted Person,” you may only trade in our securities from the date that is two full trading days after our earnings release1 to the end of business on the date that is two weeks prior to the end of each quarter (such period, the “Window Period”). If, however, the Window Period closes on a non-trading day (i.e., a Saturday, Sunday or NYSE holiday), the first day of the closed Window Period will be treated as the next trading day. However, even if the Window Period is open, you may not trade in our securities if you are aware of inside information about us. In addition, you must preclear all transactions in our securities even if you initiate them when the Window Period is open. The only exception are trades through an existing Rule 10b5-1 plan, as described below. Special Closings of Certain or All Window Periods. From time to time, we may close the Window Period for Restricted Persons due to developments involving inside information. In such events, we may notify particular individuals that they should not engage in any transactions involving the purchase or sale of our securities and should not disclose to others the fact that the Window Period has been closed for such affected Restricted Persons. Exceptions. Even if the Window Period is closed, you may exercise Company stock options if no shares are to be sold (or exercise a tax withholding right pursuant to which you elect to have us withhold shares subject to an option to satisfy tax withholding obligations). You may not, however, effect sales of stock issued upon the exercise of stock options (including same-day sales and cashless exercises). Preclearance Please contact the Director, Legal – Securities in the Office of General Counsel in advance of effecting any purchase, sale, or other trading of our securities (including a stock plan transaction, such as an option exercise followed by a sale, a gift, a loan, a contribution to a trust or any other transfer) and obtain prior approval of the transaction from the Office of General Counsel. Note, however, that receipt of preclearance does not protect you from the consequences of illegal insider trading.

Corporate Policy 11: Insider Trading All preclearance requests must be submitted to the Director, Legal – Securities in the Office of General Counsel (or, in the case of the Director, Legal - Securities, to the General Counsel) at least two business days in advance of the proposed transaction using the Preclearance Notice and Certification form set forth at the following link: Pre-clearance and certification form. The Office of General Counsel will then determine whether the transaction may proceed. This preclearance policy applies even if you are initiating a transaction while a Window Period is open. If a transaction is approved, the transaction must be executed within three business days after the approval is obtained, but regardless may not be executed if preclearance is revoked, if you learn inside information concerning the Company, or if the Window Period closes during such time. If a transaction is not completed within the period described above, the transaction must be approved again before it may be executed. If a proposed transaction is not approved under the preclearance policy, you must refrain from initiating any transaction in our securities, and you should not inform anyone within or outside of the Company of the restriction. Any transactions in the Company’s securities by a Restricted Person (including transactions effected pursuant to an Approved Rule 10b5-1 Plan, as described below) must be reported to the Director, Legal — Securities in the Office of General Counsel on the same day that such transaction occurs. Does this Policy Apply to Post-Separation Transactions This policy will continue to apply to your transactions in our securities after your employment or service has terminated with the Company until such time as you are no longer aware of inside information or until that information has been publicly disclosed or is no longer material. What Are 10b5-1 Plans In light of the above-summarized restrictions, if you expect a need to sell our securities at a specific time in the future, you may wish to consider entering into a prearranged Rule 10b5-1 trading plan. Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, provides for an affirmative defense against insider trading liability if trades occur pursuant to a prearranged “trading plan” that meets specified conditions. Generally, transactions pursuant to properly established Rule 10b5-1 trading plans may occur notwithstanding the other prohibitions included in this policy. Please note that all directors and Section 16 executive officers are still subject to the requirements of Section 16 of the Exchange Act (including the requirement to timely file a report on Form 4 for trades in our securities). For additional information about Rule 10b5-1 trading plans, please contact the Director, Legal — Securities in the Office of General Counsel. Questions About this Policy Contact: Tarnetta Jones, Director, Legal – Securities in the Office of General Counsel Be aware that procedures for applying our policy may vary from location to location. Whenever a local law, regulation, or industry code reflects a more restrictive standard, follow the more restrictive standard.

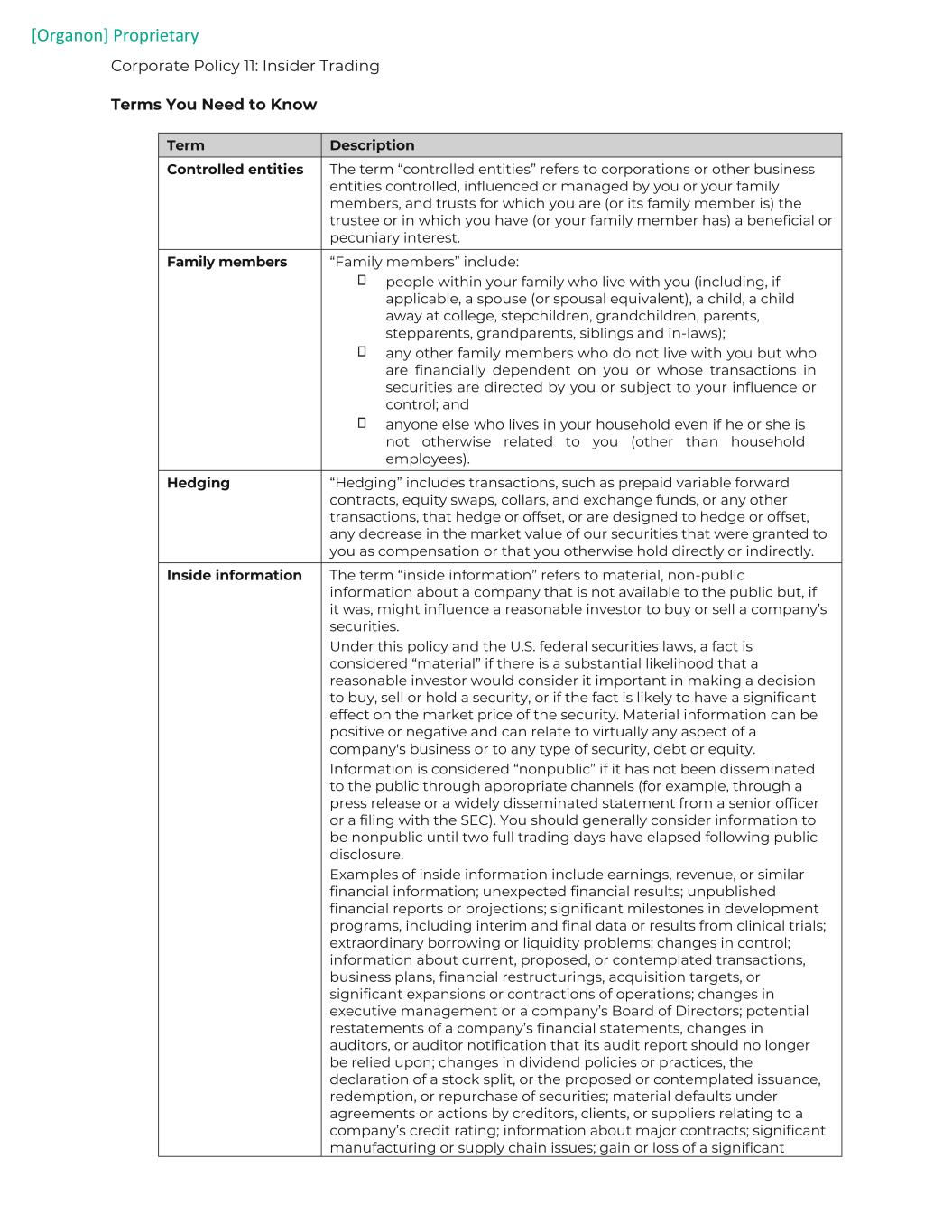

Corporate Policy 11: Insider Trading Terms You Need to Know Term Description Controlled entities The term “controlled entities” refers to corporations or other business entities controlled, influenced or managed by you or your family members, and trusts for which you are (or its family member is) the trustee or in which you have (or your family member has) a beneficial or pecuniary interest. Family members “Family members” include: people within your family who live with you (including, if applicable, a spouse (or spousal equivalent), a child, a child away at college, stepchildren, grandchildren, parents, stepparents, grandparents, siblings and in-laws); any other family members who do not live with you but who are financially dependent on you or whose transactions in securities are directed by you or subject to your influence or control; and anyone else who lives in your household even if he or she is not otherwise related to you (other than household employees). Hedging “Hedging” includes transactions, such as prepaid variable forward contracts, equity swaps, collars, and exchange funds, or any other transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our securities that were granted to you as compensation or that you otherwise hold directly or indirectly. Inside information The term “inside information” refers to material, non-public information about a company that is not available to the public but, if it was, might influence a reasonable investor to buy or sell a company’s securities. Under this policy and the U.S. federal securities laws, a fact is considered “material” if there is a substantial likelihood that a reasonable investor would consider it important in making a decision to buy, sell or hold a security, or if the fact is likely to have a significant effect on the market price of the security. Material information can be positive or negative and can relate to virtually any aspect of a company's business or to any type of security, debt or equity. Information is considered “nonpublic” if it has not been disseminated to the public through appropriate channels (for example, through a press release or a widely disseminated statement from a senior officer or a filing with the SEC). You should generally consider information to be nonpublic until two full trading days have elapsed following public disclosure. Examples of inside information include earnings, revenue, or similar financial information; unexpected financial results; unpublished financial reports or projections; significant milestones in development programs, including interim and final data or results from clinical trials; extraordinary borrowing or liquidity problems; changes in control; information about current, proposed, or contemplated transactions, business plans, financial restructurings, acquisition targets, or significant expansions or contractions of operations; changes in executive management or a company’s Board of Directors; potential restatements of a company’s financial statements, changes in auditors, or auditor notification that its audit report should no longer be relied upon; changes in dividend policies or practices, the declaration of a stock split, or the proposed or contemplated issuance, redemption, or repurchase of securities; material defaults under agreements or actions by creditors, clients, or suppliers relating to a company’s credit rating; information about major contracts; significant manufacturing or supply chain issues; gain or loss of a significant

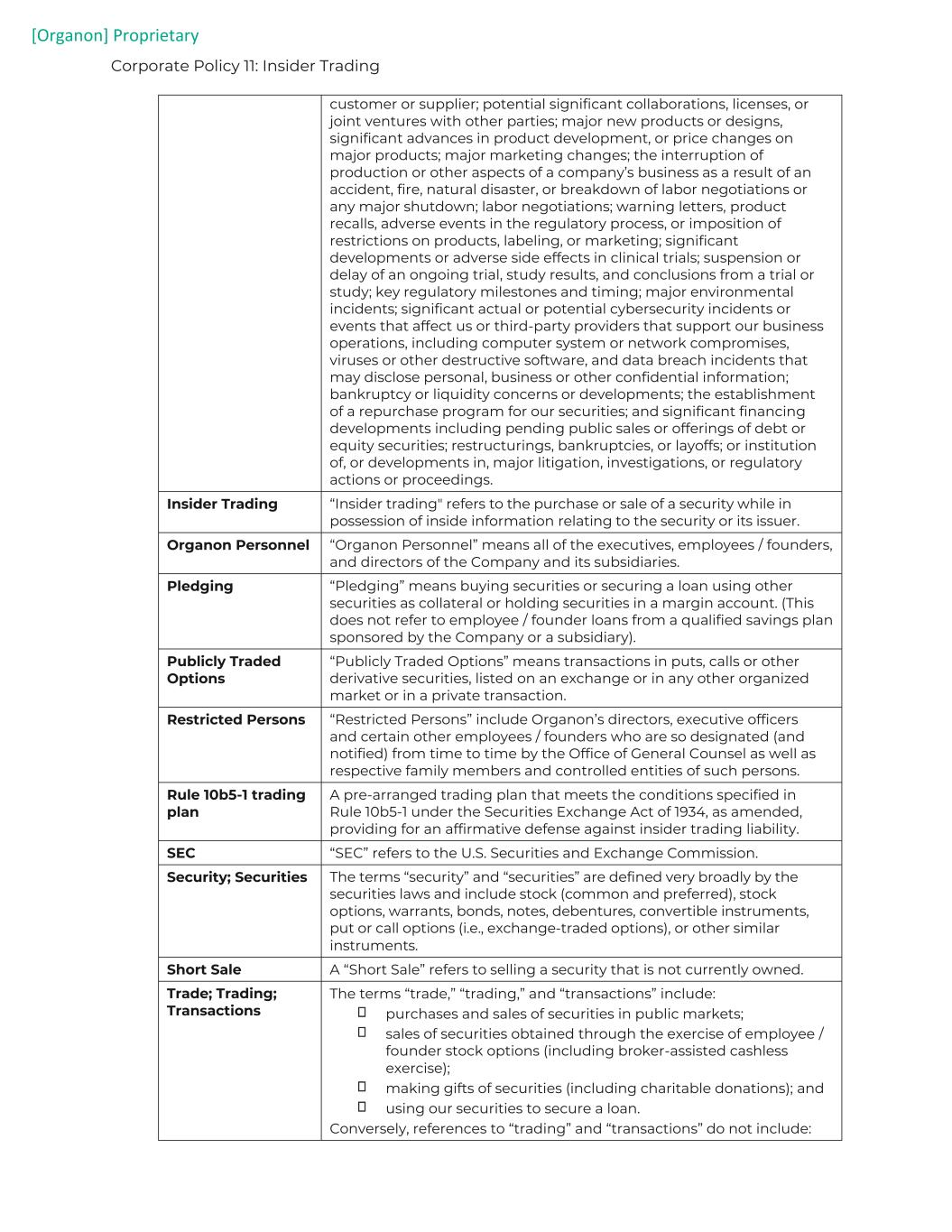

Corporate Policy 11: Insider Trading customer or supplier; potential significant collaborations, licenses, or joint ventures with other parties; major new products or designs, significant advances in product development, or price changes on major products; major marketing changes; the interruption of production or other aspects of a company’s business as a result of an accident, fire, natural disaster, or breakdown of labor negotiations or any major shutdown; labor negotiations; warning letters, product recalls, adverse events in the regulatory process, or imposition of restrictions on products, labeling, or marketing; significant developments or adverse side effects in clinical trials; suspension or delay of an ongoing trial, study results, and conclusions from a trial or study; key regulatory milestones and timing; major environmental incidents; significant actual or potential cybersecurity incidents or events that affect us or third-party providers that support our business operations, including computer system or network compromises, viruses or other destructive software, and data breach incidents that may disclose personal, business or other confidential information; bankruptcy or liquidity concerns or developments; the establishment of a repurchase program for our securities; and significant financing developments including pending public sales or offerings of debt or equity securities; restructurings, bankruptcies, or layoffs; or institution of, or developments in, major litigation, investigations, or regulatory actions or proceedings. Insider Trading “Insider trading" refers to the purchase or sale of a security while in possession of inside information relating to the security or its issuer. Organon Personnel “Organon Personnel” means all of the executives, employees / founders, and directors of the Company and its subsidiaries. Pledging “Pledging” means buying securities or securing a loan using other securities as collateral or holding securities in a margin account. (This does not refer to employee / founder loans from a qualified savings plan sponsored by the Company or a subsidiary). Publicly Traded Options “Publicly Traded Options” means transactions in puts, calls or other derivative securities, listed on an exchange or in any other organized market or in a private transaction. Restricted Persons “Restricted Persons” include Organon’s directors, executive officers and certain other employees / founders who are so designated (and notified) from time to time by the Office of General Counsel as well as respective family members and controlled entities of such persons. Rule 10b5-1 trading plan A pre-arranged trading plan that meets the conditions specified in Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, providing for an affirmative defense against insider trading liability. SEC “SEC” refers to the U.S. Securities and Exchange Commission. Security; Securities The terms “security” and “securities” are defined very broadly by the securities laws and include stock (common and preferred), stock options, warrants, bonds, notes, debentures, convertible instruments, put or call options (i.e., exchange-traded options), or other similar instruments. Short Sale A “Short Sale” refers to selling a security that is not currently owned. Trade; Trading; Transactions The terms “trade,” “trading,” and “transactions” include: purchases and sales of securities in public markets; sales of securities obtained through the exercise of employee / founder stock options (including broker-assisted cashless exercise); making gifts of securities (including charitable donations); and using our securities to secure a loan. Conversely, references to “trading” and “transactions” do not include:

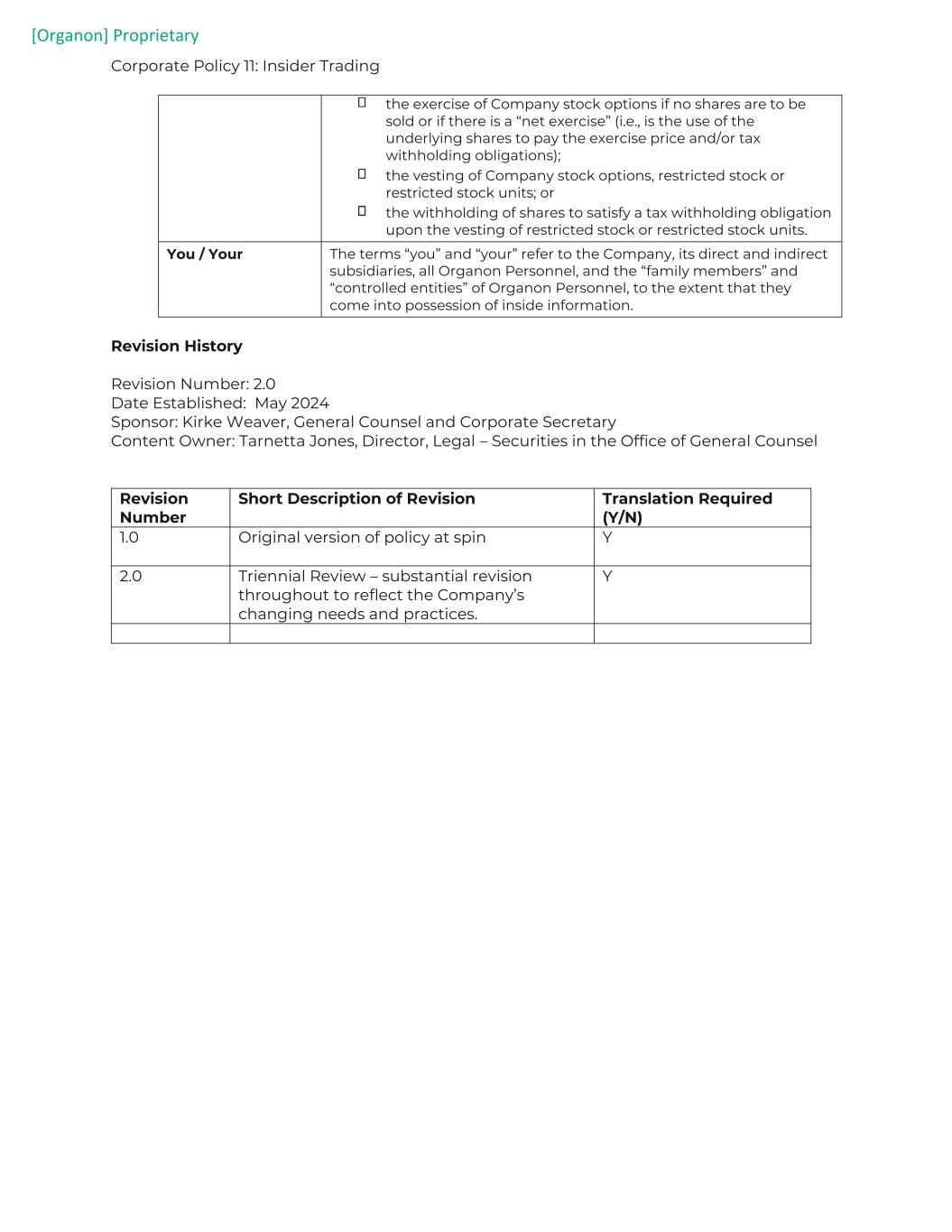

Corporate Policy 11: Insider Trading the exercise of Company stock options if no shares are to be sold or if there is a “net exercise” (i.e., is the use of the underlying shares to pay the exercise price and/or tax withholding obligations); the vesting of Company stock options, restricted stock or restricted stock units; or the withholding of shares to satisfy a tax withholding obligation upon the vesting of restricted stock or restricted stock units. You / Your The terms “you” and “your” refer to the Company, its direct and indirect subsidiaries, all Organon Personnel, and the “family members” and “controlled entities” of Organon Personnel, to the extent that they come into possession of inside information. Revision History Revision Number: 2.0 Date Established: May 2024 Sponsor: Kirke Weaver, General Counsel and Corporate Secretary Content Owner: Tarnetta Jones, Director, Legal – Securities in the Office of General Counsel Revision Number Short Description of Revision Translation Required (Y/N) 1.0 Original version of policy at spin Y 2.0 Triennial Review – substantial revision throughout to reflect the Company’s changing needs and practices. Y