Exhibit (c)(3)

PROJECT PACIFIC STRATEGIC PROCESS UPDATE JUNE 12, 2023 SVb Securities Confidential

Exhibit (c)(3)

PROJECT PACIFIC STRATEGIC PROCESS UPDATE JUNE 12, 2023 SVb Securities Confidential

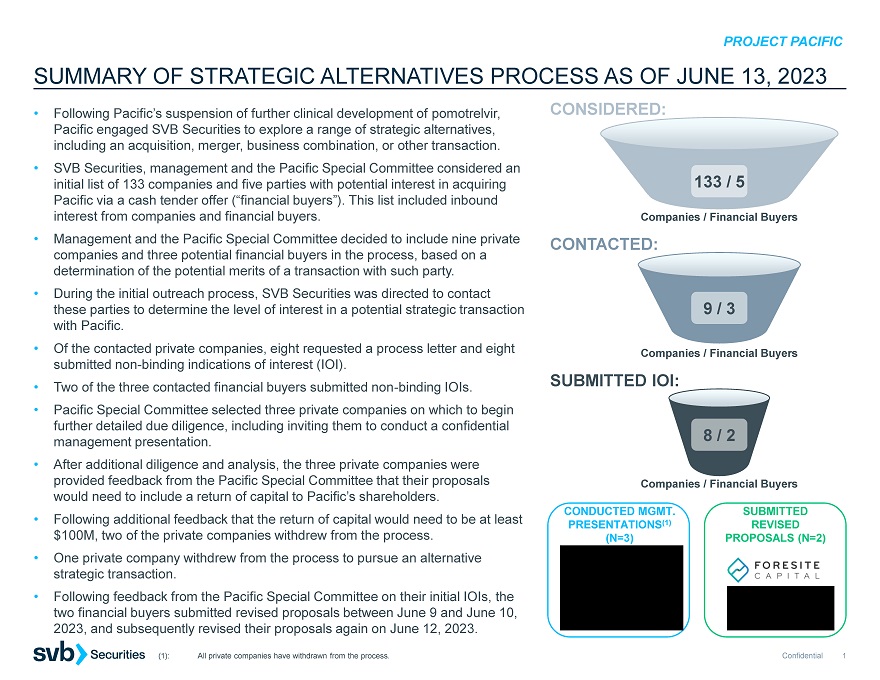

PROJECT PACIFIC (1):All private companies have withdrawn from the process. SUMMARY OF STRATEGIC ALTERNATIVES PROCESS AS OF JUNE 13, 2023 Following Pacific’s suspension of further clinical development of pomotrelvir, Pacific engaged SVB Securities to explore a range of strategic alternatives, including an acquisition, merger, business combination, or other transaction. SVB Securities, management and the Pacific Special Committee considered an initial list of 133 companies and five parties with potential interest in acquiring Pacific via a cash tender offer (“financial buyers”). This list included inbound interest from companies and financial buyers. Management and the Pacific Special Committee decided to include nine private companies and three potential financial buyers in the process, based on a determination of the potential merits of a transaction with such party. During the initial outreach process, SVB Securities was directed to contact these parties to determine the level of interest in a potential strategic transaction with Pacific. Of the contacted private companies, eight requested a process letter and eight submitted non-binding indications of interest (IOI). Two of the three contacted financial buyers submitted non-binding IOIs. Pacific Special Committee selected three private companies on which to begin further detailed due diligence, including inviting them to conduct a confidential management presentation. After additional diligence and analysis, the three private companies were provided feedback from the Pacific Special Committee that their proposals would need to include a return of capital to Pacific’s shareholders. Following additional feedback that the return of capital would need to be at least $100M, two of the private companies withdrew from the process. One private company withdrew from the process to pursue an alternative strategic transaction. Following feedback from the Pacific Special Committee on their initial IOIs, the two financial buyers submitted revised proposals between June 9 and June 10, 2023, and subsequently revised their proposals again on June 12, 2023. 9 / 3 8 / 2 CONSIDERED: CONTACTED: SUBMITTED IOI: 133 / 5 Companies / Financial Buyers Companies / Financial Buyers Companies / Financial Buyers CONDUCTED MGMT. PRESENTATIONS(1)(N=3) SUBMITTED REVISED PROPOSALS (N=2)1 Confidential

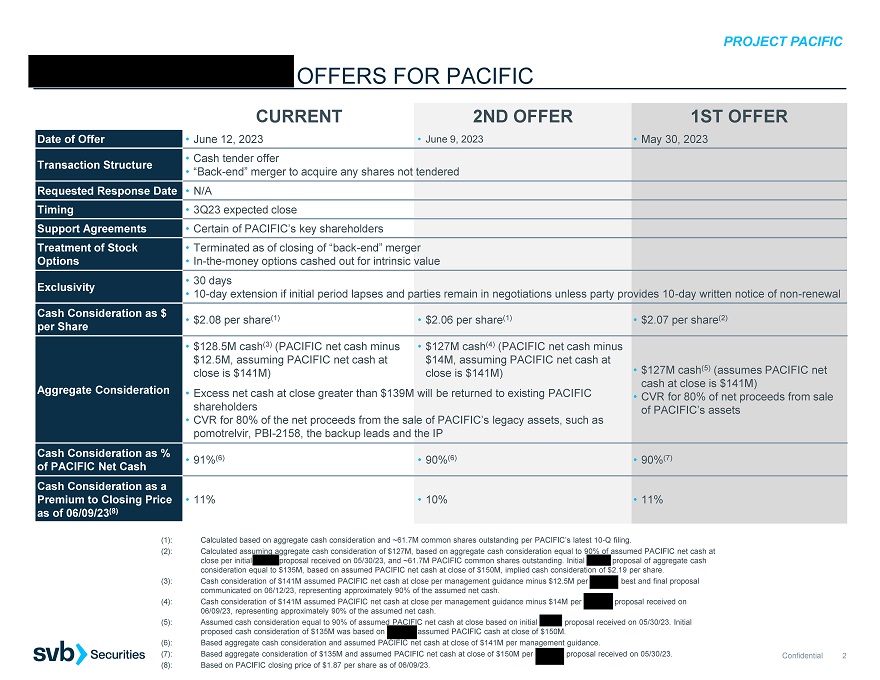

PROJECT PACIFIC XOMA CORPORATION’S OFFERS FOR PACIFICCURRENT 2ND OFFER 1ST OFFER Date of Offer June 12, 2023 June 9, 2023 May 30, 2023 Transaction Structure Cash tender offer “Back-end” merger to acquire any shares not tendered Requested Response Date N/A Timing 3Q23 expected close Support Agreements Certain of PACIFIC’s key shareholders Treatment of Stock Options Terminated as of closing of “back-end” merger In-the-money options cashed out for intrinsic value Exclusivity 30 days 10-day extension if initial period lapses and parties remain in negotiations unless party provides 10-day written notice of non-renewal Cash Consideration as $ per Share $2.08 per share(1) $2.06 per share(1) $2.07 per share(2) Aggregate Consideration $128.5M cash(3)(PACIFIC net cash minus $12.5M, assuming PACIFIC net cash at close is $141M) $127M cash(4)(PACIFIC net cash minus $14M, assuming PACIFIC net cash at close is $141M) $127M cash(5)(assumes PACIFIC net cash at close is $141M) CVR for 80% of net proceeds from sale of PACIFIC’s assets Excess net cash at close greater than $139M will be returned to existing PACIFIC shareholders CVR for 80% of the net proceeds from the sale of PACIFIC’s legacy assets, such as pomotrelvir, PBI-2158, the backup leads and the IP Cash Consideration as % of PACIFIC Net Cash 91%(6) 90%(6) 90%(7) Cash Consideration as a Premium to Closing Price as of 06/09/23(8) 11% 10% 11%

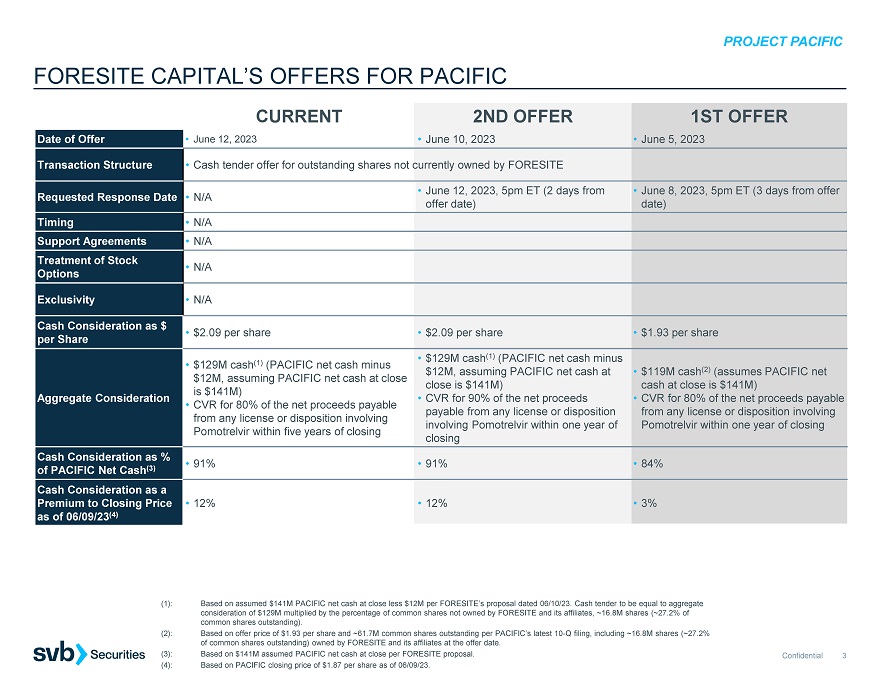

PROJECT PACIFIC FORESITE CAPITAL’SOFFERS FOR PACIFICCURRENT 2ND OFFER 1ST OFFER Date of Offer June 12, 2023 June 10, 2023 June 5, 2023 Transaction Structure Cash tender offer for outstanding shares not currently owned by FORESITE Requested Response Date N/A June 12, 2023, 5pm ET (2 days from offer date) June 8, 2023, 5pm ET (3 days from offer date) Timing N/A Support Agreements N/A Treatment of Stock Options N/A Exclusivity N/A Cash Consideration as $ per Share $2.09 per share $2.09 per share $1.93 per share Aggregate Consideration $129M cash(1)(PACIFIC net cash minus $12M, assuming PACIFIC net cash at close is $141M) CVR for 80% of the net proceeds payable from any license or disposition involving Pomotrelvirwithin five years of closing $129M cash(1)(PACIFIC net cash minus $12M, assuming PACIFIC net cash at close is $141M) CVR for 90% of the net proceeds payable from any license or disposition involving Pomotrelvirwithin one year of closing $119M cash(2)(assumes PACIFIC net cash at close is $141M) CVR for 80% of the net proceeds payable from any license or disposition involving Pomotrelvirwithin one year of closing Cash Consideration as % of PACIFIC Net Cash(3) 91% 91% 84% Cash Consideration as a Premium to Closing Price as of 06/09/23(4) 12% 12% 3%