November 3, 2025 Third Quarter 2025 Earnings Presentation

2 Forward Looking Statements This presentation contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although CompoSecure believes that its plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, CompoSecure cannot assure you that it will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning CompoSecure’s possible or assumed future actions, business strategies, events, results of operations, demand, the implementation of the CompoSecure Operating System, and guidance for 2025 and 2026, are forward-looking statements. In some instances, these statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or the negatives of these terms or variations of them or similar terminology. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. You should understand that the following important factors, among others, could affect CompoSecure’s future results and could cause those results or other outcomes to differ materially from those expressed or implied in CompoSecure’s forward-looking statements: the ability of CompoSecure to grow and manage growth profitably, maintain relationships with customers, compete within its industry and retain its key employees; the possibility that CompoSecure may be adversely impacted by other global economic, business, competitive and/or other factors, including tariffs; the outcome of any legal proceedings that may be instituted against CompoSecure or others; future exchange and interest rates; changes in our accounting and/or financial presentation; and other risks and uncertainties, including those under “Risk Factors” in filings that have been made or will be made with the Securities and Exchange Commission. CompoSecure undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. CompoSecure believes EBITDA, Adjusted EBITDA, Pro Forma Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, Consolidated Net Sales, Consolidated Gross Profit, Consolidated Gross Margin, Consolidated Total Cash, Consolidated Net Debt and related measures are useful to investors in evaluating CompoSecure’s financial performance. Specifically, we believe EBITDA, Adjusted EBITDA, and Pro Forma Adjusted EBITDA provide valuable insight into operational efficiency independent of capital structure and tax environment; Adjusted Net Income and Adjusted EPS offer investors a clearer view of ongoing profitability by excluding non-recurring and non-operational items and Consolidated Net Sales, Consolidated Gross Profit, Consolidated Gross Margin, Consolidated Total Cash, Consolidated Net Debt and related measures provide greater comparability with CompoSecure’s historical results, following the change in accounting presentation required as a result of the spin-off of Resolute Holdings Management, Inc (the “Spin-Off”). Due to the Spin-Off of and the resulting shift to equity method accounting under GAAP beginning February 28, 2025, CompoSecure is presenting a broader set of non-GAAP measures, including an Adjusted Statement of Operations (Unaudited), an Adjusted Balance Sheet (Unaudited), Adjusted Consolidated Net Sales, and Adjusted Consolidated Gross Profit, each on a consolidated basis, to provide investors with financial information that we believe allows for greater comparability with our historical financial reporting and better represents the underlying performance of the business across reporting periods. CompoSecure uses these non-GAAP measures internally to establish forecasts, budgets and operational goals to manage and monitor its business, as well as evaluate its underlying historical performance and/or measure incentive compensation. We believe that these non-GAAP financial measures depict the true performance of the business by encompassing only relevant and controllable events, enabling CompoSecure to evaluate and plan more effectively for the future. Due to the forward-looking nature of the financial guidance included herein, the amounts included or excluded from the non-GAAP financial measures, including with respect to depreciation, amortization, interest, and taxes that would be required to reconcile the non-GAAP financial measures to GAAP measures are inherently uncertain or difficult to predict, so it is not feasible to provide accurate forecasted non-GAAP reconciliations without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included, and no reconciliation of the forward-looking non-GAAP financial measures is included. Additionally, CompoSecure’s debt agreements contain covenants based on variations of these measures for purposes of determining debt covenant compliance. CompoSecure believes that investors should have access to the same set of tools that its management uses in analyzing operating results. These non-GAAP measures should not be considered as measures of financial performance under U.S. GAAP, and the items included or excluded are significant components in understanding and assessing CompoSecure’s financial performance. Accordingly, these key business metrics have limitations as an analytical tool. They should not be considered as an alternative to net income or any other performance measures derived in accordance with U.S. GAAP or as an alternative to cash flows from operating activities as a measure of CompoSecure’s liquidity. These non-GAAP measures may be different from similarly titled non-GAAP measures used by other companies. Please refer to the tables below for the reconciliation of GAAP measures to these non- GAAP measures. Industry and Market Information Statements in this presentation concerning our industry and the markets in which we operate, including our general expectations and competitive position, business opportunity and market size, growth and share, are based on information from independent industry organizations and other third-party sources, data from our internal research and management estimates. Management estimates are derived from publicly available information and the information and data referred to above and are based on assumptions and calculations made by us based upon our interpretation of such information and data. The information and data referred to above are imprecise and may prove to be inaccurate because the information cannot always be verified with complete certainty due to the limitations on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, please be aware that the data and statistical information in this presentation may differ from information provided by our competitors or from information found in current or future studies conducted by market research institutes, consultancy firms or independent sources. Disclaimers

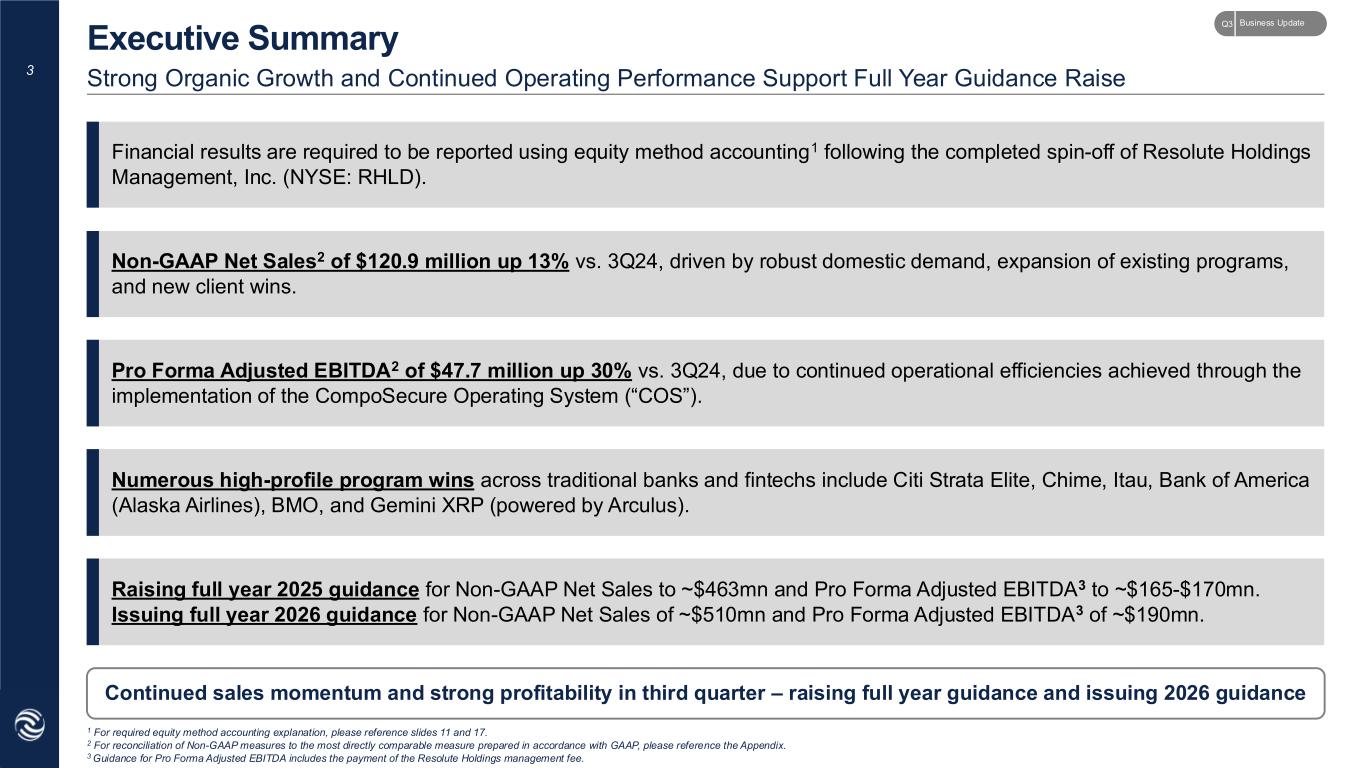

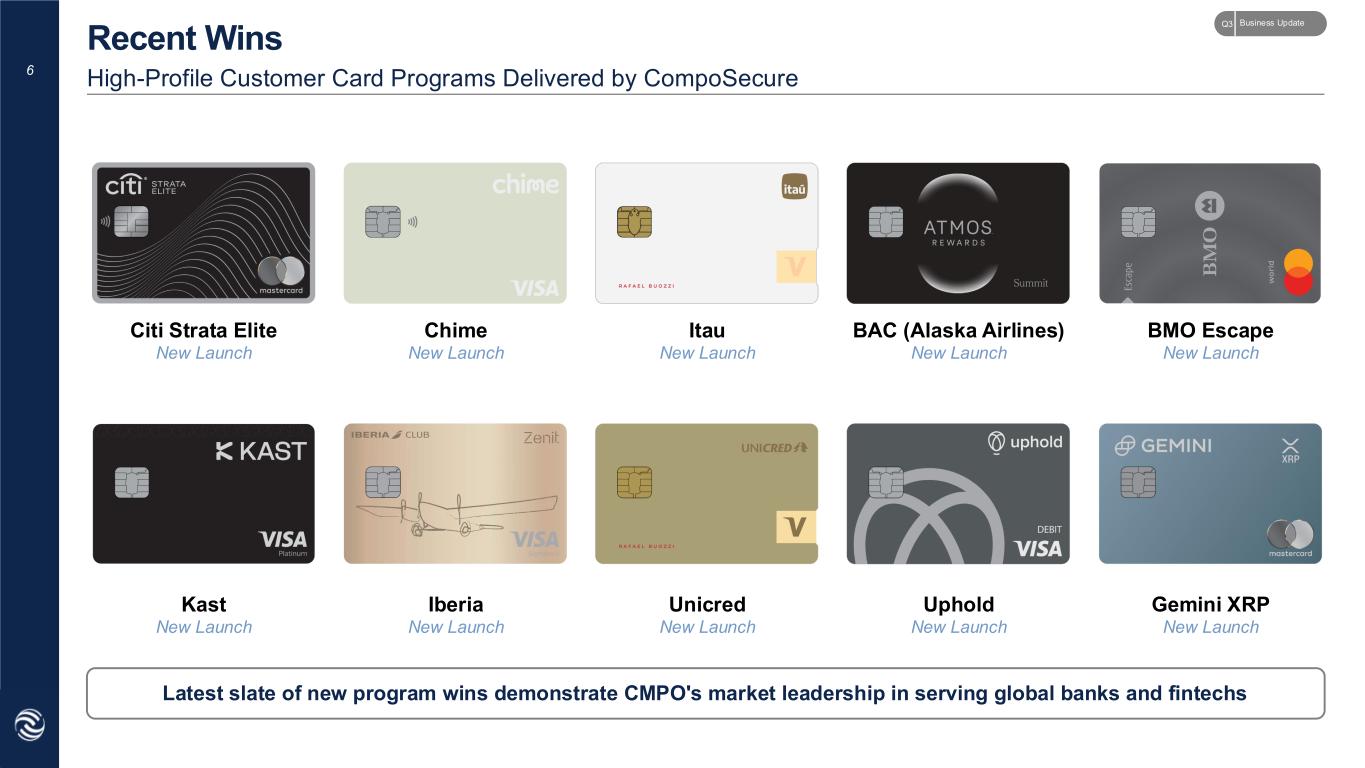

3 Continued sales momentum and strong profitability in third quarter – raising full year guidance and issuing 2026 guidance Financial results are required to be reported using equity method accounting1 following the completed spin-off of Resolute Holdings Management, Inc. (NYSE: RHLD). Non-GAAP Net Sales2 of $120.9 million up 13% vs. 3Q24, driven by robust domestic demand, expansion of existing programs, and new client wins. Pro Forma Adjusted EBITDA2 of $47.7 million up 30% vs. 3Q24, due to continued operational efficiencies achieved through the implementation of the CompoSecure Operating System (“COS”). Numerous high-profile program wins across traditional banks and fintechs include Citi Strata Elite, Chime, Itau, Bank of America (Alaska Airlines), BMO, and Gemini XRP (powered by Arculus). Raising full year 2025 guidance for Non-GAAP Net Sales to ~$463mn and Pro Forma Adjusted EBITDA3 to ~$165-$170mn. Issuing full year 2026 guidance for Non-GAAP Net Sales of ~$510mn and Pro Forma Adjusted EBITDA3 of ~$190mn. 1 For required equity method accounting explanation, please reference slides 11 and 17. 2 For reconciliation of Non-GAAP measures to the most directly comparable measure prepared in accordance with GAAP, please reference the Appendix. 3 Guidance for Pro Forma Adjusted EBITDA includes the payment of the Resolute Holdings management fee. Strong Organic Growth and Continued Operating Performance Support Full Year Guidance Raise Executive Summary Business UpdateQ3

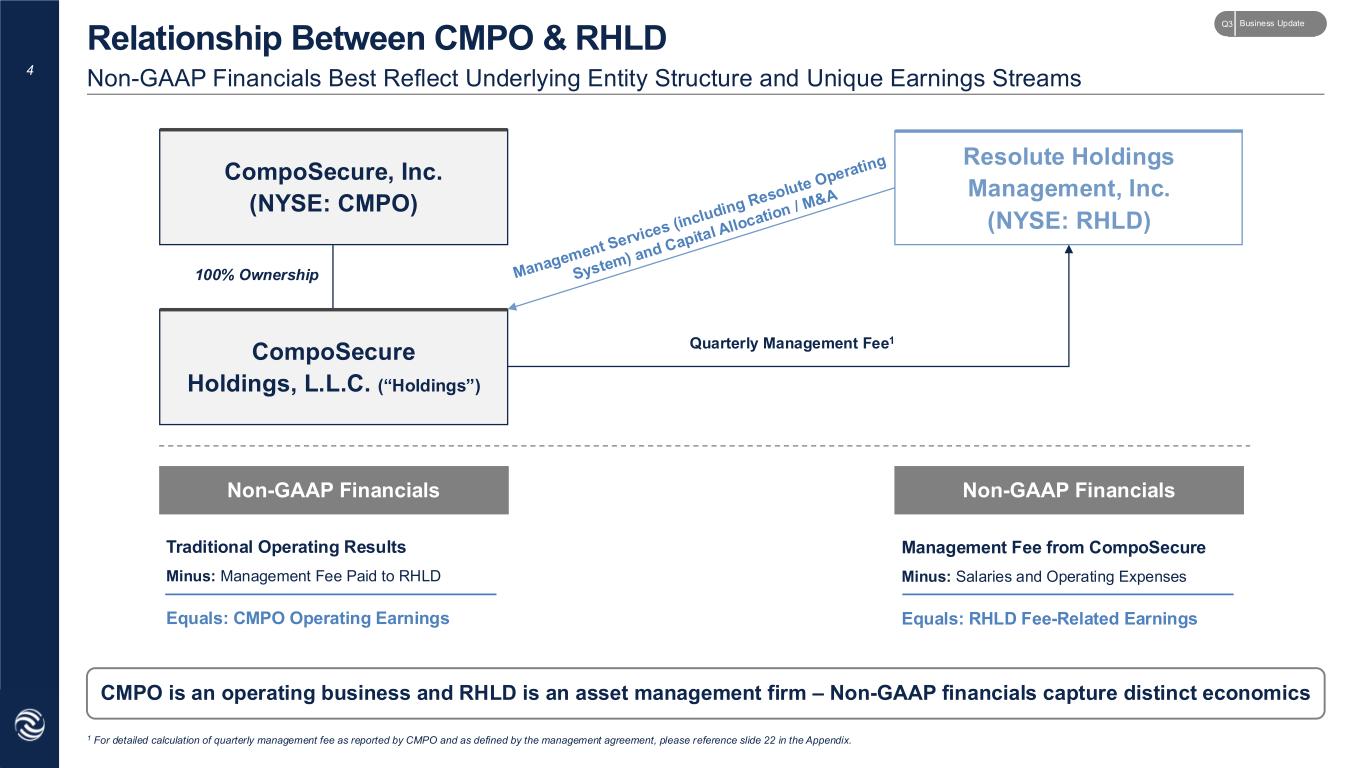

4 CMPO is an operating business and RHLD is an asset management firm – Non-GAAP financials capture distinct economics Non-GAAP Financials Best Reflect Underlying Entity Structure and Unique Earnings Streams Relationship Between CMPO & RHLD CompoSecure, Inc. (NYSE: CMPO) Resolute Holdings Management, Inc. (NYSE: RHLD) CompoSecure Holdings, L.L.C. (“Holdings”) 100% Ownership Quarterly Management Fee1 Non-GAAP Financials Non-GAAP Financials Traditional Operating Results Minus: Management Fee Paid to RHLD Equals: CMPO Operating Earnings Management Fee from CompoSecure Minus: Salaries and Operating Expenses Equals: RHLD Fee-Related Earnings 1 For detailed calculation of quarterly management fee as reported by CMPO and as defined by the management agreement, please reference slide 22 in the Appendix. Business UpdateQ3

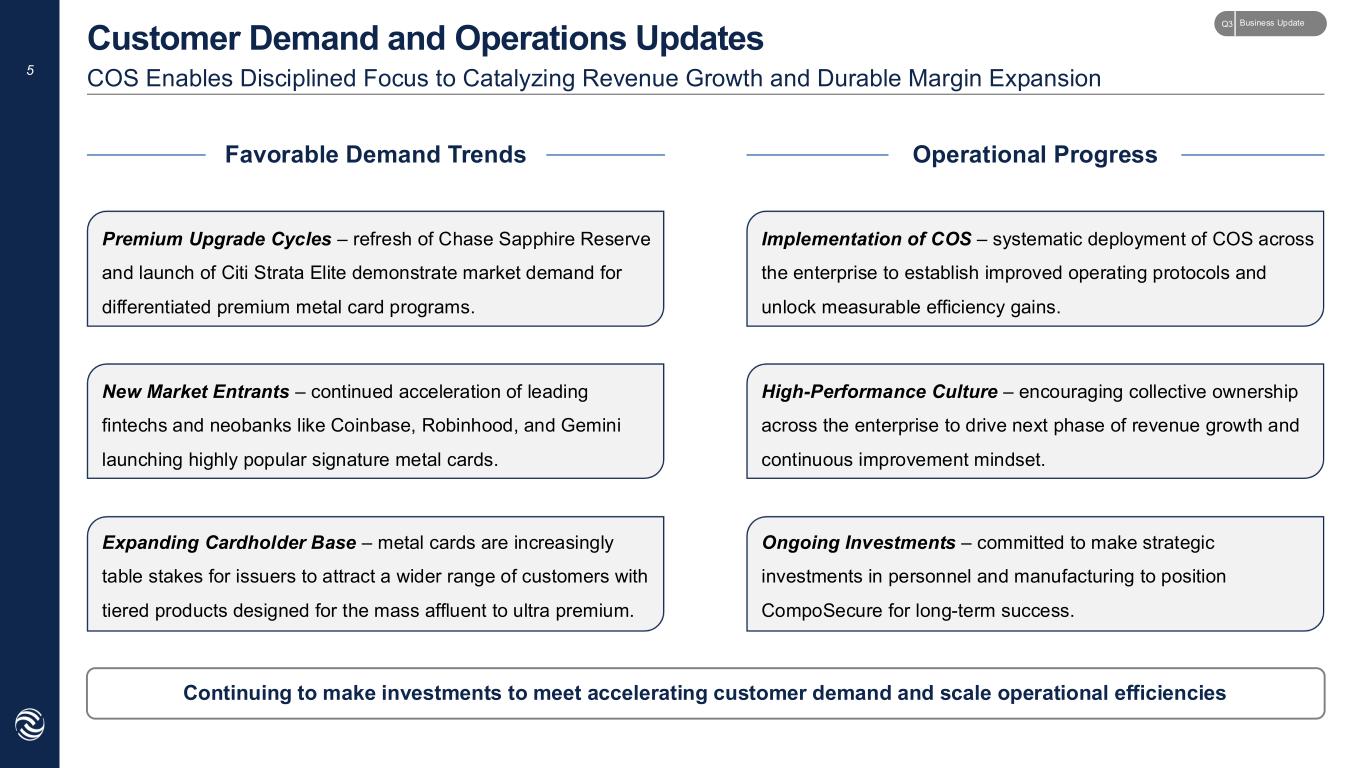

5 Continuing to make investments to meet accelerating customer demand and scale operational efficiencies Favorable Demand Trends Operational Progress Premium Upgrade Cycles – refresh of Chase Sapphire Reserve and launch of Citi Strata Elite demonstrate market demand for differentiated premium metal card programs. New Market Entrants – continued acceleration of leading fintechs and neobanks like Coinbase, Robinhood, and Gemini launching highly popular signature metal cards. Expanding Cardholder Base – metal cards are increasingly table stakes for issuers to attract a wider range of customers with tiered products designed for the mass affluent to ultra premium. Implementation of COS – systematic deployment of COS across the enterprise to establish improved operating protocols and unlock measurable efficiency gains. High-Performance Culture – encouraging collective ownership across the enterprise to drive next phase of revenue growth and continuous improvement mindset. Ongoing Investments – committed to make strategic investments in personnel and manufacturing to position CompoSecure for long-term success. COS Enables Disciplined Focus to Catalyzing Revenue Growth and Durable Margin Expansion Customer Demand and Operations Updates Business UpdateQ3

6 Citi Strata Elite New Launch Itau New Launch BAC (Alaska Airlines) New Launch BMO Escape New Launch Unicred New Launch Kast New Launch High-Profile Customer Card Programs Delivered by CompoSecure Recent Wins Latest slate of new program wins demonstrate CMPO's market leadership in serving global banks and fintechs Uphold New Launch Gemini XRP New Launch Chime New Launch Iberia New Launch Business UpdateQ3

7 Sources: Company filings. Accelerating penetration of metal within growing payment card market creates significant opportunity for CompoSecure Visa and Mastercard Credit & Charge Cards in Global Circulation '21 - '25 CAGR Consistent Growth in Domestic and International Payment Cards Creates Stable Replacement Base Favorable Market Backdrop for Payment Cards 5.2% 4.2% 7.7% Visa and Mastercard Credit, Charge, & Debit Cards in Global Circulation '21 - '25 CAGR 7.5% 7.1% 8.7% (cards in millions) (cards in millions) 2,123 2,230 2,325 2,451 2,601 6,020 6,445 6,949 7,516 8,039 Business UpdateQ3

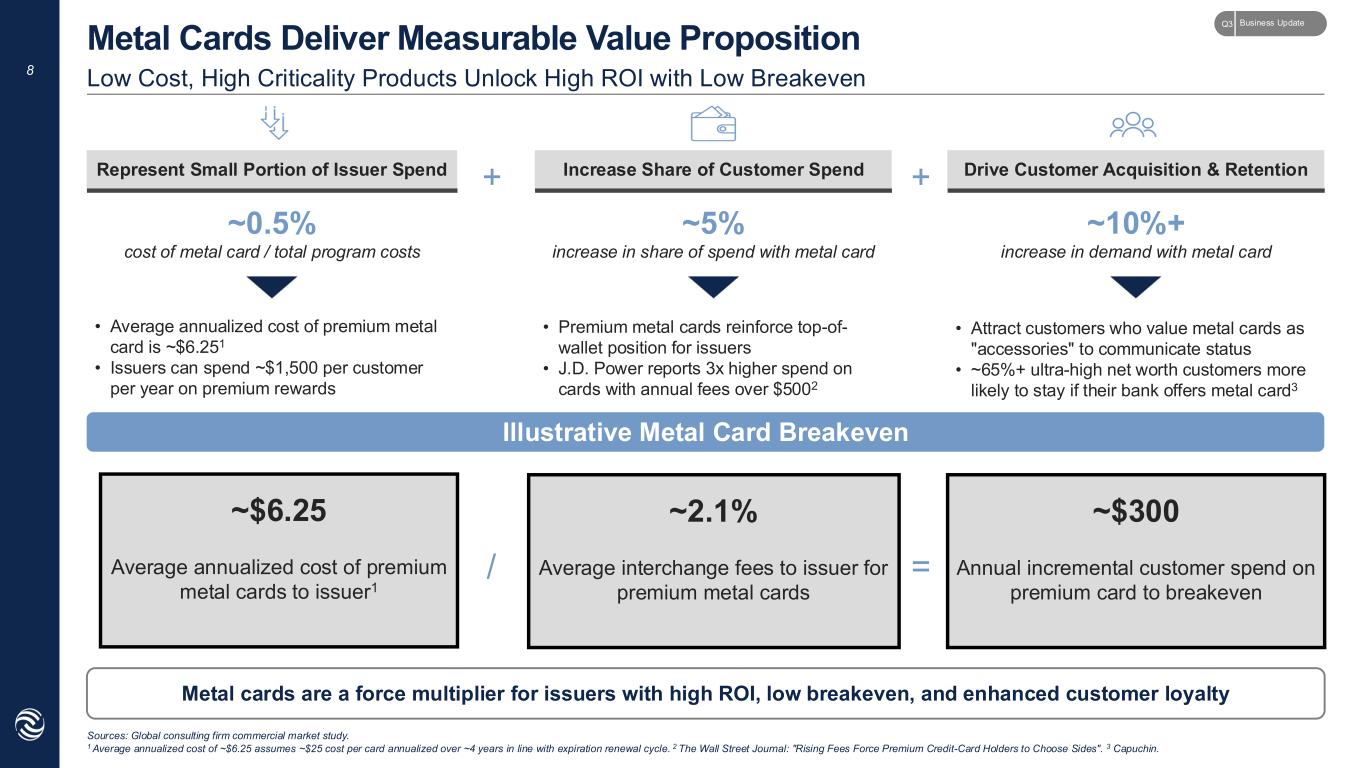

8 Sources: Global consulting firm commercial market study. 1 Average annualized cost of ~$6.25 assumes ~$25 cost per card annualized over ~4 years in line with expiration renewal cycle. 2 The Wall Street Journal: "Rising Fees Force Premium Credit-Card Holders to Choose Sides". 3 Capuchin. Metal cards are a force multiplier for issuers with high ROI, low breakeven, and enhanced customer loyalty Low Cost, High Criticality Products Unlock High ROI with Low Breakeven Metal Cards Deliver Measurable Value Proposition Illustrative Metal Card Breakeven ~2.1% Average interchange fees to issuer for premium metal cards ~$300 Annual incremental customer spend on premium card to breakeven ~$6.25 Average annualized cost of premium metal cards to issuer1 / = Represent Small Portion of Issuer Spend Increase Share of Customer Spend Drive Customer Acquisition & Retention+ + ~0.5% cost of metal card / total program costs • Average annualized cost of premium metal card is ~$6.251 • Issuers can spend ~$1,500 per customer per year on premium rewards ~5% increase in share of spend with metal card • Premium metal cards reinforce top-of- wallet position for issuers • J.D. Power reports 3x higher spend on cards with annual fees over $5002 ~10%+ increase in demand with metal card • Attract customers who value metal cards as "accessories" to communicate status • ~65%+ ultra-high net worth customers more likely to stay if their bank offers metal card3 Business UpdateQ3

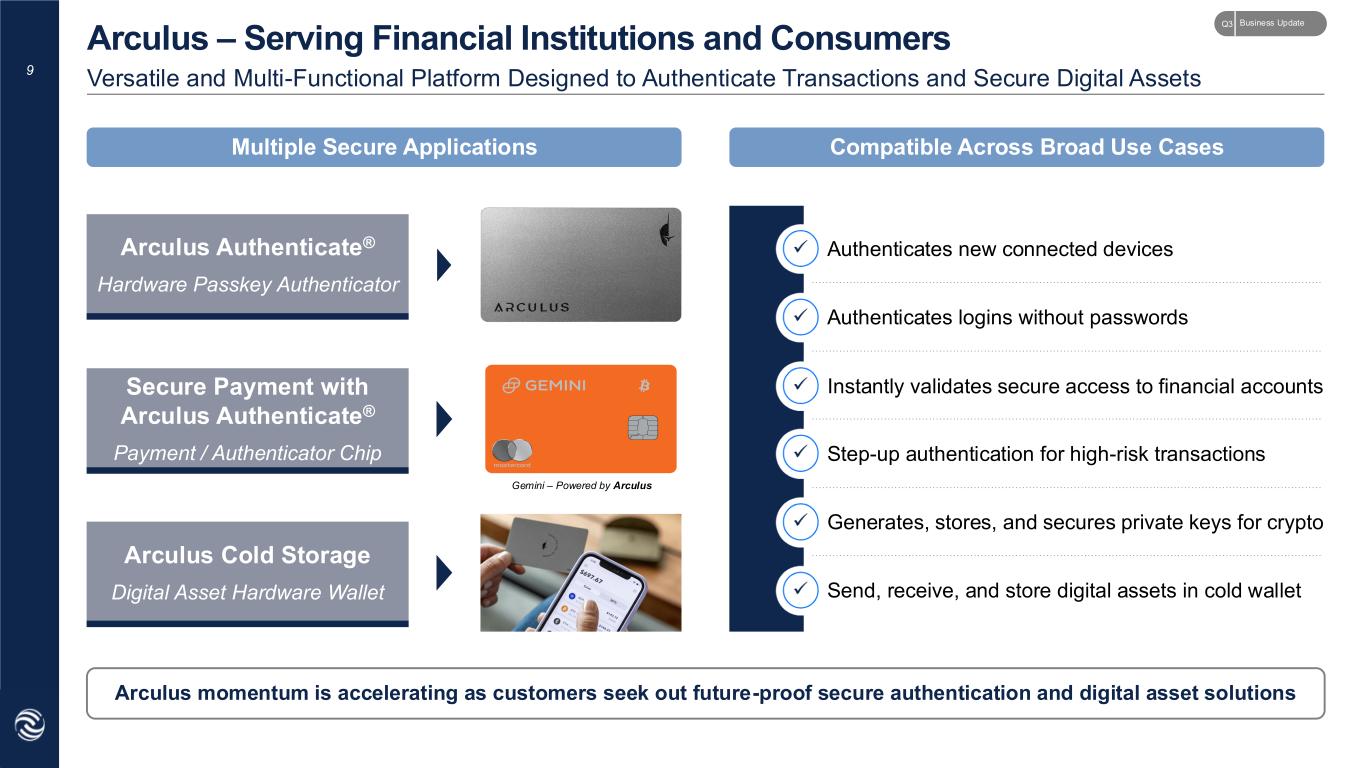

9 Arculus momentum is accelerating as customers seek out future-proof secure authentication and digital asset solutions Multiple Secure Applications Arculus Cold Storage Digital Asset Hardware Wallet Arculus Authenticate® Hardware Passkey Authenticator Authenticates new connected devices Authenticates logins without passwords Instantly validates secure access to financial accounts Step-up authentication for high-risk transactions Generates, stores, and secures private keys for crypto Send, receive, and store digital assets in cold wallet Compatible Across Broad Use Cases Versatile and Multi-Functional Platform Designed to Authenticate Transactions and Secure Digital Assets Arculus – Serving Financial Institutions and Consumers Gemini – Powered by Arculus Secure Payment with Arculus Authenticate® Payment / Authenticator Chip Business UpdateQ3

Financial Overview

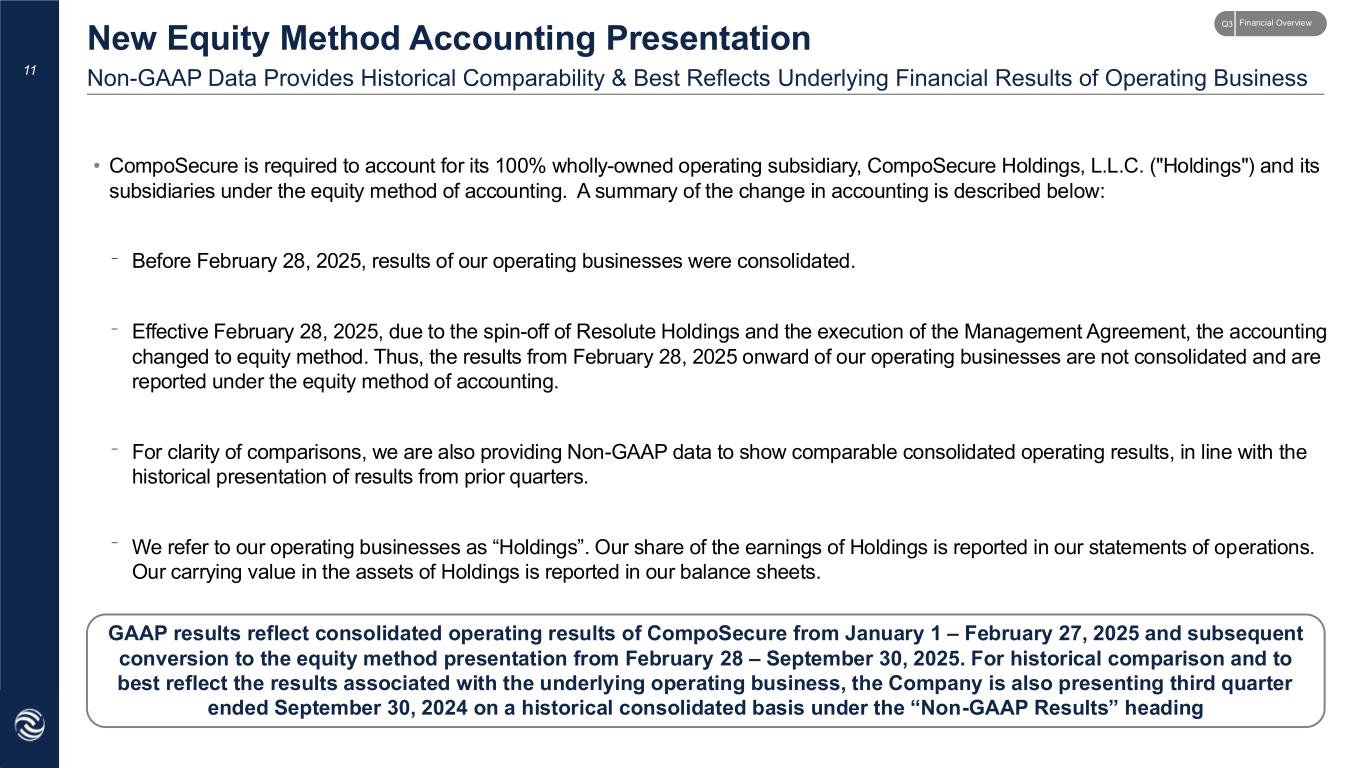

• CompoSecure is required to account for its 100% wholly-owned operating subsidiary, CompoSecure Holdings, L.L.C. ("Holdings") and its subsidiaries under the equity method of accounting. A summary of the change in accounting is described below: Before February 28, 2025, results of our operating businesses were consolidated. Effective February 28, 2025, due to the spin-off of Resolute Holdings and the execution of the Management Agreement, the accounting changed to equity method. Thus, the results from February 28, 2025 onward of our operating businesses are not consolidated and are reported under the equity method of accounting. For clarity of comparisons, we are also providing Non-GAAP data to show comparable consolidated operating results, in line with the historical presentation of results from prior quarters. We refer to our operating businesses as “Holdings”. Our share of the earnings of Holdings is reported in our statements of operations. Our carrying value in the assets of Holdings is reported in our balance sheets. GAAP results reflect consolidated operating results of CompoSecure from January 1 – February 27, 2025 and subsequent conversion to the equity method presentation from February 28 – September 30, 2025. For historical comparison and to best reflect the results associated with the underlying operating business, the Company is also presenting third quarter ended September 30, 2024 on a historical consolidated basis under the “Non-GAAP Results” heading 11 New Equity Method Accounting Presentation _ _ _ _ Non-GAAP Data Provides Historical Comparability & Best Reflects Underlying Financial Results of Operating Business Financial OverviewQ3

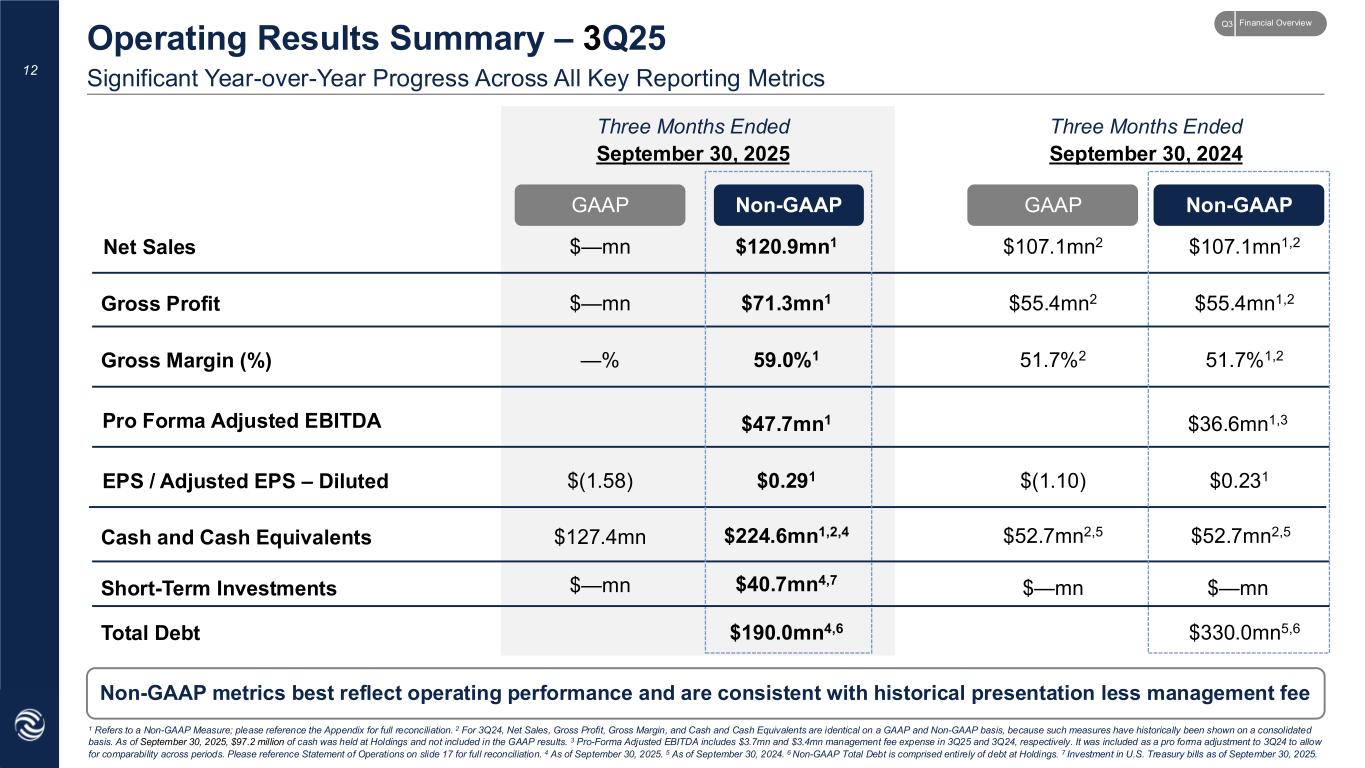

12 Significant Year-over-Year Progress Across All Key Reporting Metrics Operating Results Summary – 3Q25 Non-GAAP metrics best reflect operating performance and are consistent with historical presentation less management fee 1 Refers to a Non-GAAP Measure; please reference the Appendix for full reconciliation. 2 For 3Q24, Net Sales, Gross Profit, Gross Margin, and Cash and Cash Equivalents are identical on a GAAP and Non-GAAP basis, because such measures have historically been shown on a consolidated basis. As of September 30, 2025, $97.2 million of cash was held at Holdings and not included in the GAAP results. 3 Pro-Forma Adjusted EBITDA includes $3.7mn and $3.4mn management fee expense in 3Q25 and 3Q24, respectively. It was included as a pro forma adjustment to 3Q24 to allow for comparability across periods. Please reference Statement of Operations on slide 17 for full reconciliation. 4 As of September 30, 2025. 5 As of September 30, 2024. 6 Non-GAAP Total Debt is comprised entirely of debt at Holdings. 7 Investment in U.S. Treasury bills as of September 30, 2025. Net Sales Gross Profit Gross Margin (%) Pro Forma Adjusted EBITDA EPS / Adjusted EPS – Diluted Cash and Cash Equivalents Total Debt Three Months Ended September 30, 2025 GAAP Non-GAAP Three Months Ended September 30, 2024 GAAP Non-GAAP $—mn $120.9mn1 $71.3mn1$—mn 59.0%1—% $47.7mn1 $(1.58) $0.291 $127.4mn $224.6mn1,2,4 $190.0mn4,6 $107.1mn2 $107.1mn1,2 $55.4mn2 $55.4mn1,2 51.7%2 51.7%1,2 $36.6mn1,3 $(1.10) $0.231 $52.7mn2,5 $52.7mn2,5 $330.0mn5,6 Short-Term Investments $—mn $—mn $—mn$40.7mn4,7 Financial OverviewQ3

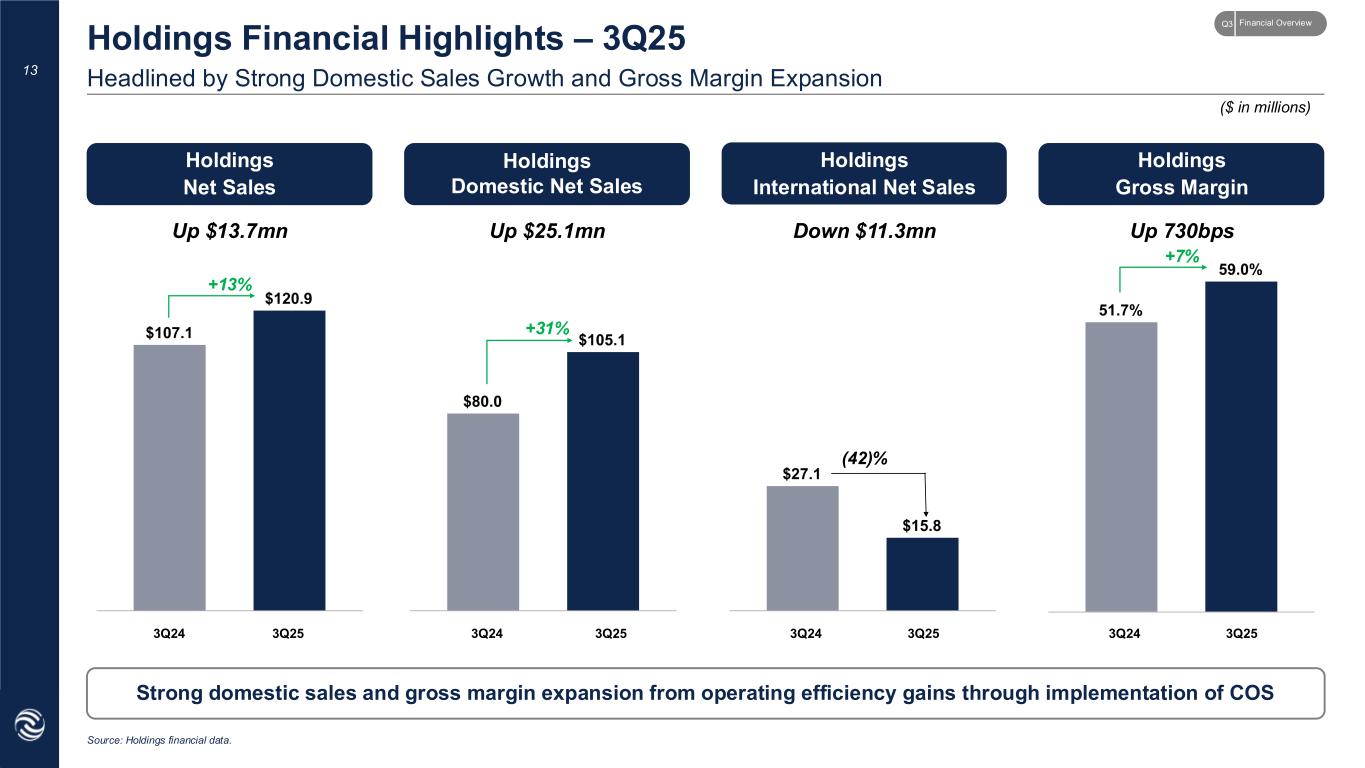

Holdings Net Sales Holdings Gross Margin Holdings International Net Sales Up $13.7mn Up 730bps Down $11.3mn ($ in millions) Holdings Domestic Net Sales Up $25.1mn 13 Headlined by Strong Domestic Sales Growth and Gross Margin Expansion Holdings Financial Highlights – 3Q25 Strong domestic sales and gross margin expansion from operating efficiency gains through implementation of COS +13% +31% (42)% +7% Source: Holdings financial data. 3Q24 3Q24 3Q24 3Q243Q25 3Q25 3Q25 3Q25 Financial OverviewQ3

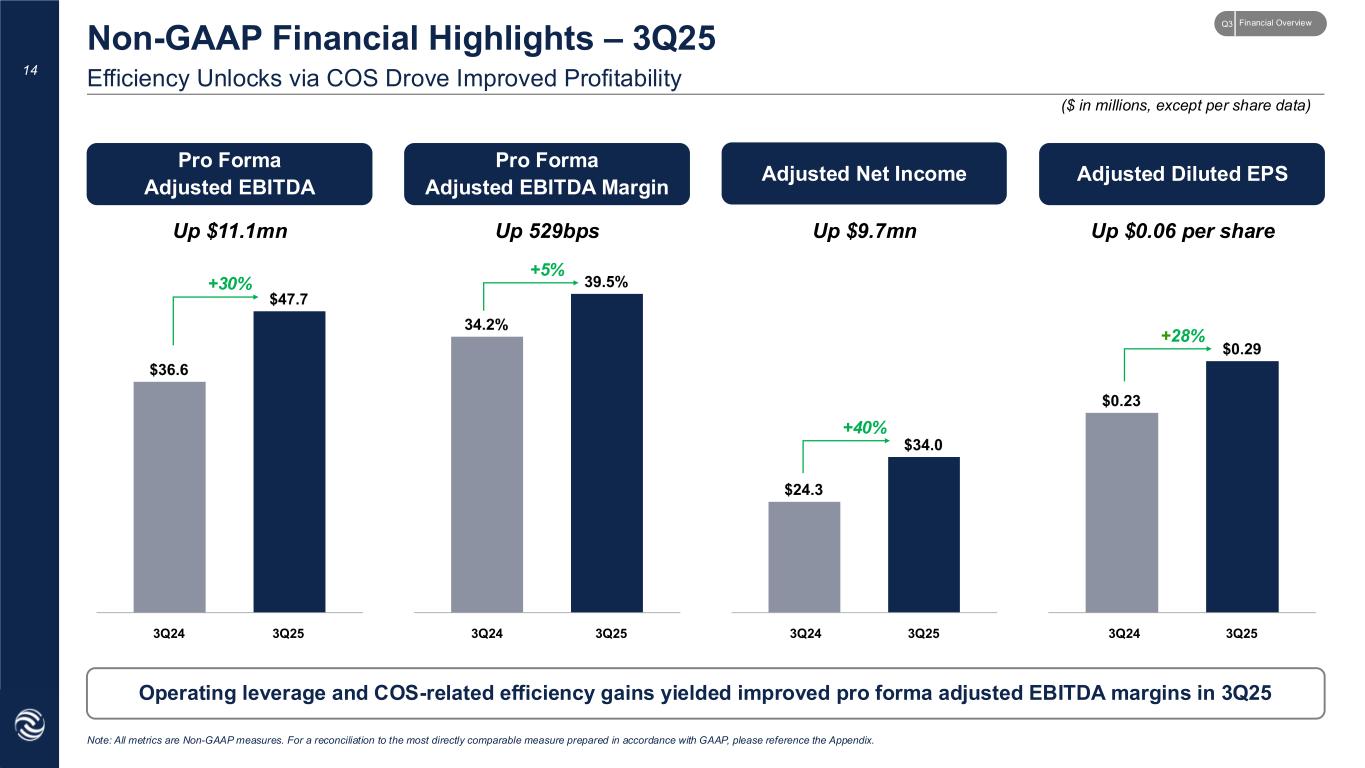

14 Efficiency Unlocks via COS Drove Improved Profitability Non-GAAP Financial Highlights – 3Q25 ($ in millions, except per share data) Pro Forma Adjusted EBITDA Adjusted Diluted EPSAdjusted Net Income Up $11.1mn Up $0.06 per shareUp $9.7mn Pro Forma Adjusted EBITDA Margin Up 529bps Note: All metrics are Non-GAAP measures. For a reconciliation to the most directly comparable measure prepared in accordance with GAAP, please reference the Appendix. Operating leverage and COS-related efficiency gains yielded improved pro forma adjusted EBITDA margins in 3Q25 +5% +40% +28% +30% 3Q24 3Q24 3Q24 3Q243Q25 3Q25 3Q25 3Q25 Financial OverviewQ3

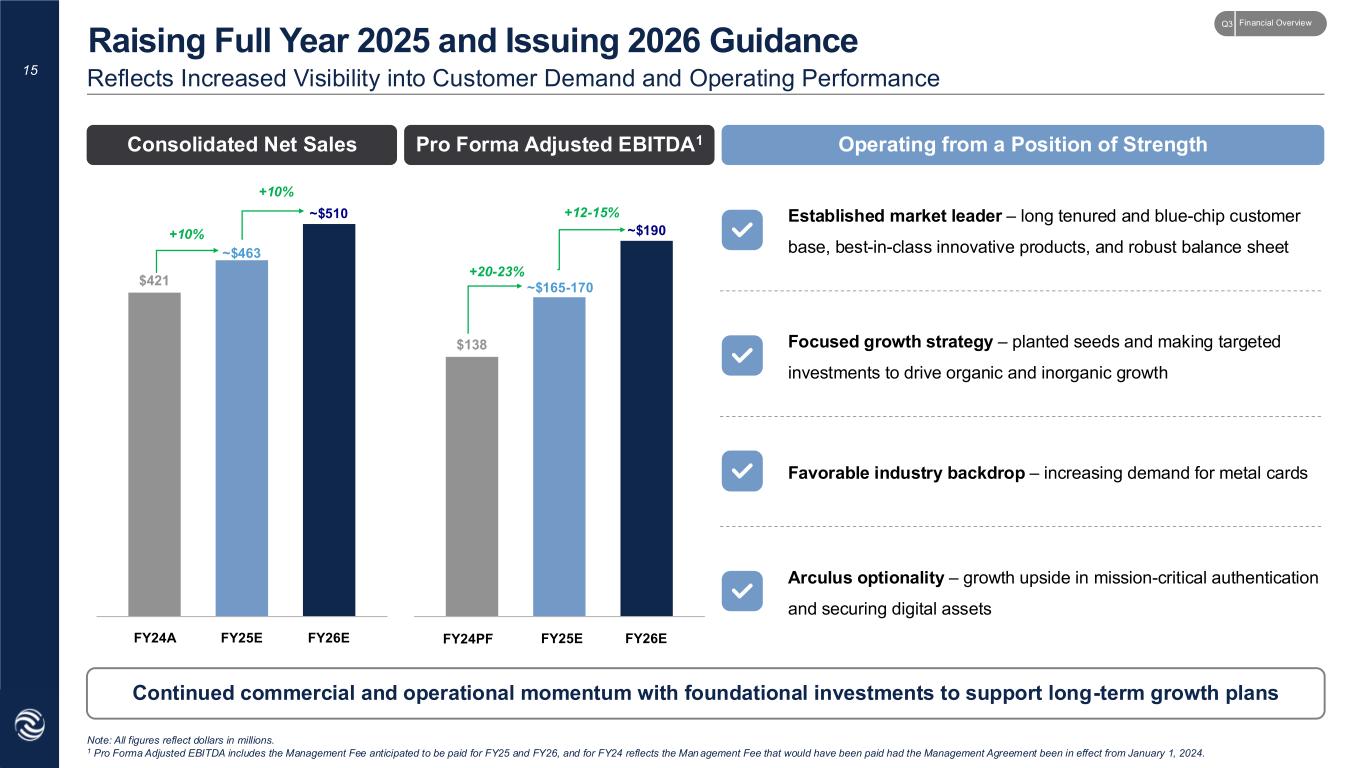

15 Continued commercial and operational momentum with foundational investments to support long-term growth plans Consolidated Net Sales Pro Forma Adjusted EBITDA1 Note: All figures reflect dollars in millions. 1 Pro Forma Adjusted EBITDA includes the Management Fee anticipated to be paid for FY25 and FY26, and for FY24 reflects the Man agement Fee that would have been paid had the Management Agreement been in effect from January 1, 2024. Operating from a Position of Strength Reflects Increased Visibility into Customer Demand and Operating Performance Raising Full Year 2025 and Issuing 2026 Guidance Established market leader – long tenured and blue-chip customer base, best-in-class innovative products, and robust balance sheet Focused growth strategy – planted seeds and making targeted investments to drive organic and inorganic growth Favorable industry backdrop – increasing demand for metal cards Arculus optionality – growth upside in mission-critical authentication and securing digital assets +10% +20-23% FY24A FY26E +10% +12-15% FY25E FY24PF FY26EFY25E Financial OverviewQ3 ~$463 ~$510 ~$165-170 ~$190

Appendix

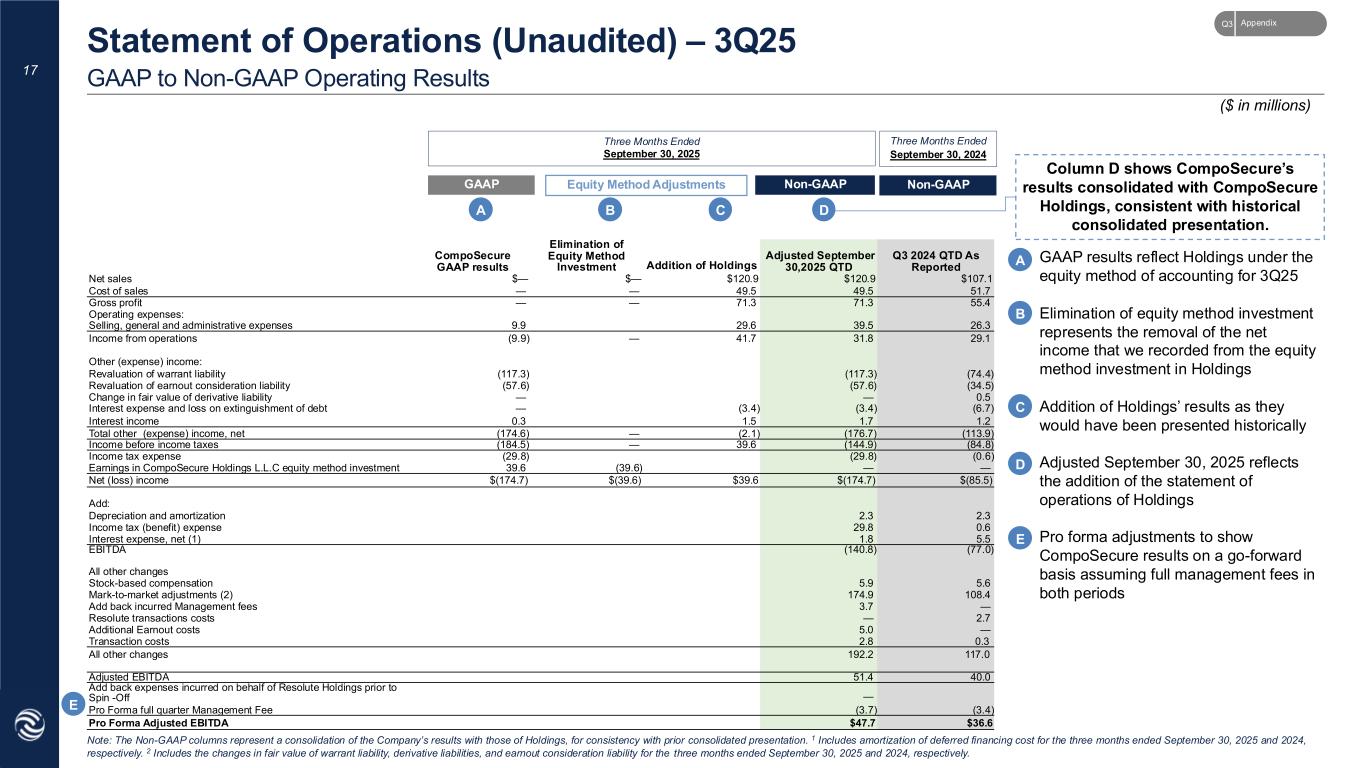

17 GAAP to Non-GAAP Operating Results Statement of Operations (Unaudited) – 3Q25 GAAP results reflect Holdings under the equity method of accounting for 3Q25 Elimination of equity method investment represents the removal of the net income that we recorded from the equity method investment in Holdings Addition of Holdings’ results as they would have been presented historically Adjusted September 30, 2025 reflects the addition of the statement of operations of Holdings Pro forma adjustments to show CompoSecure results on a go-forward basis assuming full management fees in both periods B C D A D Non-GAAPGAAP Non-GAAP Three Months Ended September 30, 2025 Three Months Ended September 30, 2024 Column D shows CompoSecure’s results consolidated with CompoSecure Holdings, consistent with historical consolidated presentation. Equity Method Adjustments ($ in millions) Note: The Non-GAAP columns represent a consolidation of the Company’s results with those of Holdings, for consistency with prior consolidated presentation. 1 Includes amortization of deferred financing cost for the three months ended September 30, 2025 and 2024, respectively. 2 Includes the changes in fair value of warrant liability, derivative liabilities, and earnout consideration liability for the three months ended September 30, 2025 and 2024, respectively. CompoSecure GAAP results Elimination of Equity Method Investment Addition of Holdings Adjusted September 30,2025 QTD Q3 2024 QTD As Reported Net sales $— $— $120.9 $120.9 $107.1 Cost of sales — — 49.5 49.5 51.7 Gross profit — — 71.3 71.3 55.4 Operating expenses: Selling, general and administrative expenses 9.9 29.6 39.5 26.3 Income from operations (9.9) — 41.7 31.8 29.1 Other (expense) income: Revaluation of warrant liability (117.3) (117.3) (74.4) Revaluation of earnout consideration liability (57.6) (57.6) (34.5) Change in fair value of derivative liability — — 0.5 Interest expense and loss on extinguishment of debt — (3.4) (3.4) (6.7) Interest income 0.3 1.5 1.7 1.2 Total other (expense) income, net (174.6) — (2.1) (176.7) (113.9) Income before income taxes (184.5) — 39.6 (144.9) (84.8) Income tax expense (29.8) (29.8) (0.6) Earnings in CompoSecure Holdings L.L.C equity method investment 39.6 (39.6) — — Net (loss) income $(174.7) $(39.6) $39.6 $(174.7) $(85.5) Add: Depreciation and amortization 2.3 2.3 Income tax (benefit) expense 29.8 0.6 Interest expense, net (1) 1.8 5.5 EBITDA (140.8) (77.0) All other changes Stock-based compensation 5.9 5.6 Mark-to-market adjustments (2) 174.9 108.4 Add back incurred Management fees 3.7 — Resolute transactions costs — 2.7 Additional Earnout costs 5.0 — Transaction costs 2.8 0.3 All other changes 192.2 117.0 Adjusted EBITDA 51.4 40.0 Add back expenses incurred on behalf of Resolute Holdings prior to Spin -Off — Pro Forma full quarter Management Fee (3.7) (3.4) Pro Forma Adjusted EBITDA $47.7 $36.6 AppendixQ3 E C B A E

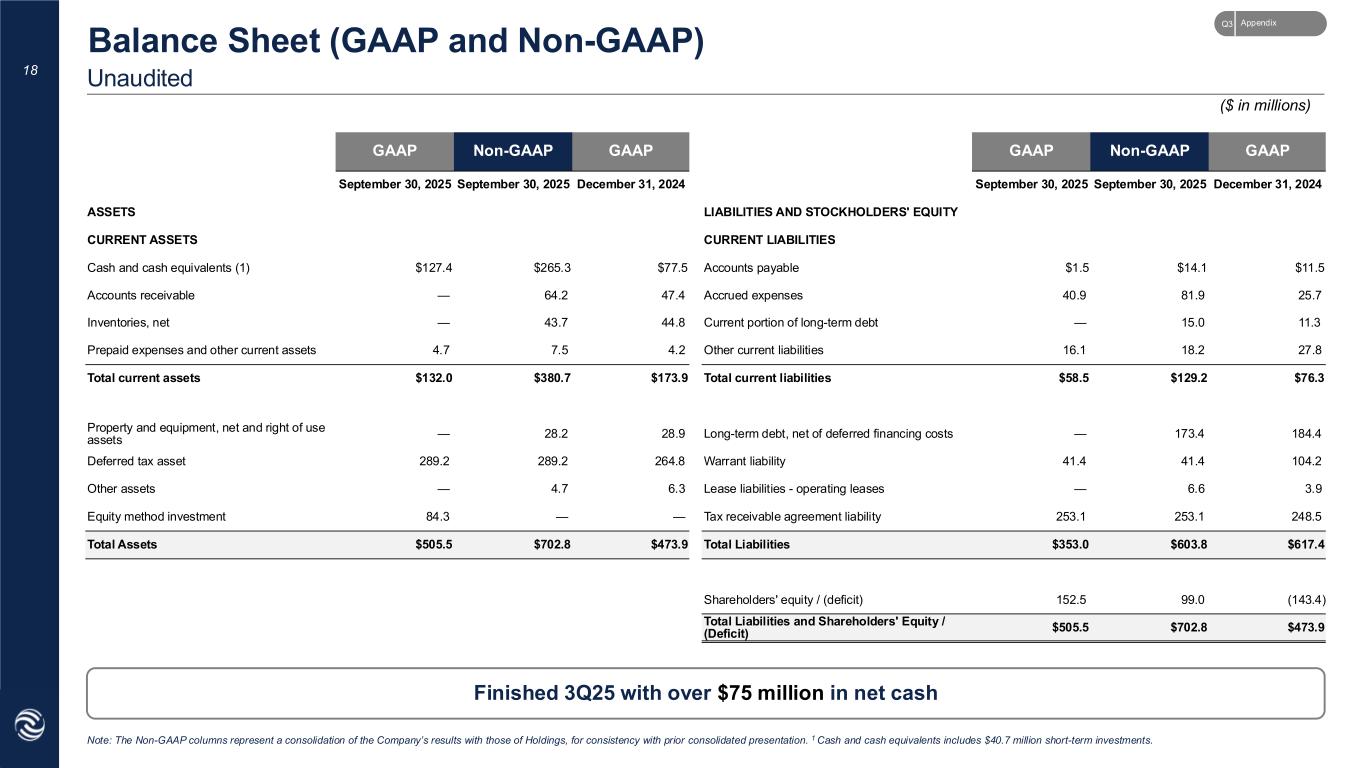

GAAP Non-GAAP GAAP GAAP Non-GAAP GAAP September 30, 2025 September 30, 2025 December 31, 2024 September 30, 2025 September 30, 2025 December 31, 2024 ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT ASSETS CURRENT LIABILITIES Cash and cash equivalents (1) $127.4 $265.3 $77.5 Accounts payable $1.5 $14.1 $11.5 Accounts receivable — 64.2 47.4 Accrued expenses 40.9 81.9 25.7 Inventories, net — 43.7 44.8 Current portion of long-term debt — 15.0 11.3 Prepaid expenses and other current assets 4.7 7.5 4.2 Other current liabilities 16.1 18.2 27.8 Total current assets $132.0 $380.7 $173.9 Total current liabilities $58.5 $129.2 $76.3 Property and equipment, net and right of use assets — 28.2 28.9 Long-term debt, net of deferred financing costs — 173.4 184.4 Deferred tax asset 289.2 289.2 264.8 Warrant liability 41.4 41.4 104.2 Other assets — 4.7 6.3 Lease liabilities - operating leases — 6.6 3.9 Equity method investment 84.3 — — Tax receivable agreement liability 253.1 253.1 248.5 Total Assets $505.5 $702.8 $473.9 Total Liabilities $353.0 $603.8 $617.4 Shareholders' equity / (deficit) 152.5 99.0 (143.4) Total Liabilities and Shareholders' Equity / (Deficit) $505.5 $702.8 $473.9 18 Unaudited Balance Sheet (GAAP and Non-GAAP) Finished 3Q25 with over $75 million in net cash ($ in millions) Note: The Non-GAAP columns represent a consolidation of the Company’s results with those of Holdings, for consistency with prior consolidated presentation. 1 Cash and cash equivalents includes $40.7 million short-term investments. AppendixQ3

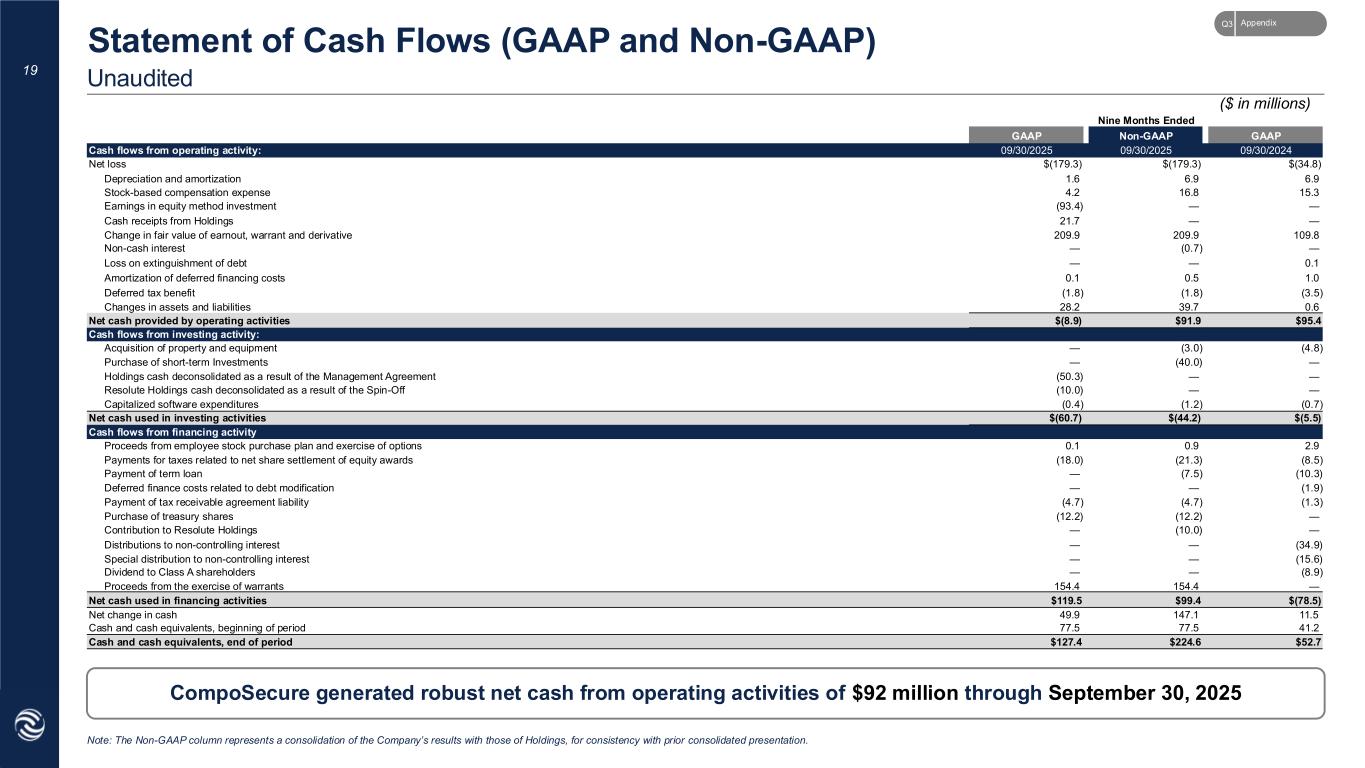

19 Unaudited Statement of Cash Flows (GAAP and Non-GAAP) CompoSecure generated robust net cash from operating activities of $92 million through September 30, 2025 Note: The Non-GAAP column represents a consolidation of the Company’s results with those of Holdings, for consistency with prior consolidated presentation. Nine Months Ended GAAP Non-GAAP GAAP Cash flows from operating activity: 09/30/2025 09/30/2025 09/30/2024 Net loss $(179.3) $(179.3) $(34.8) Depreciation and amortization 1.6 6.9 6.9 Stock-based compensation expense 4.2 16.8 15.3 Earnings in equity method investment (93.4) — — Cash receipts from Holdings 21.7 — — Change in fair value of earnout, warrant and derivative 209.9 209.9 109.8 Non-cash interest — (0.7) — Loss on extinguishment of debt — — 0.1 Amortization of deferred financing costs 0.1 0.5 1.0 Deferred tax benefit (1.8) (1.8) (3.5) Changes in assets and liabilities 28.2 39.7 0.6 Net cash provided by operating activities $(8.9) $91.9 $95.4 Cash flows from investing activity: Acquisition of property and equipment — (3.0) (4.8) Purchase of short-term Investments — (40.0) — Holdings cash deconsolidated as a result of the Management Agreement (50.3) — — Resolute Holdings cash deconsolidated as a result of the Spin-Off (10.0) — — Capitalized software expenditures (0.4) (1.2) (0.7) Net cash used in investing activities $(60.7) $(44.2) $(5.5) Cash flows from financing activity Proceeds from employee stock purchase plan and exercise of options 0.1 0.9 2.9 Payments for taxes related to net share settlement of equity awards (18.0) (21.3) (8.5) Payment of term loan — (7.5) (10.3) Deferred finance costs related to debt modification — — (1.9) Payment of tax receivable agreement liability (4.7) (4.7) (1.3) Purchase of treasury shares (12.2) (12.2) — Contribution to Resolute Holdings — (10.0) — Distributions to non-controlling interest — — (34.9) Special distribution to non-controlling interest — — (15.6) Dividend to Class A shareholders — — (8.9) Proceeds from the exercise of warrants 154.4 154.4 — Net cash used in financing activities $119.5 $99.4 $(78.5) Net change in cash 49.9 147.1 11.5 Cash and cash equivalents, beginning of period 77.5 77.5 41.2 Cash and cash equivalents, end of period $127.4 $224.6 $52.7 ($ in millions) AppendixQ3

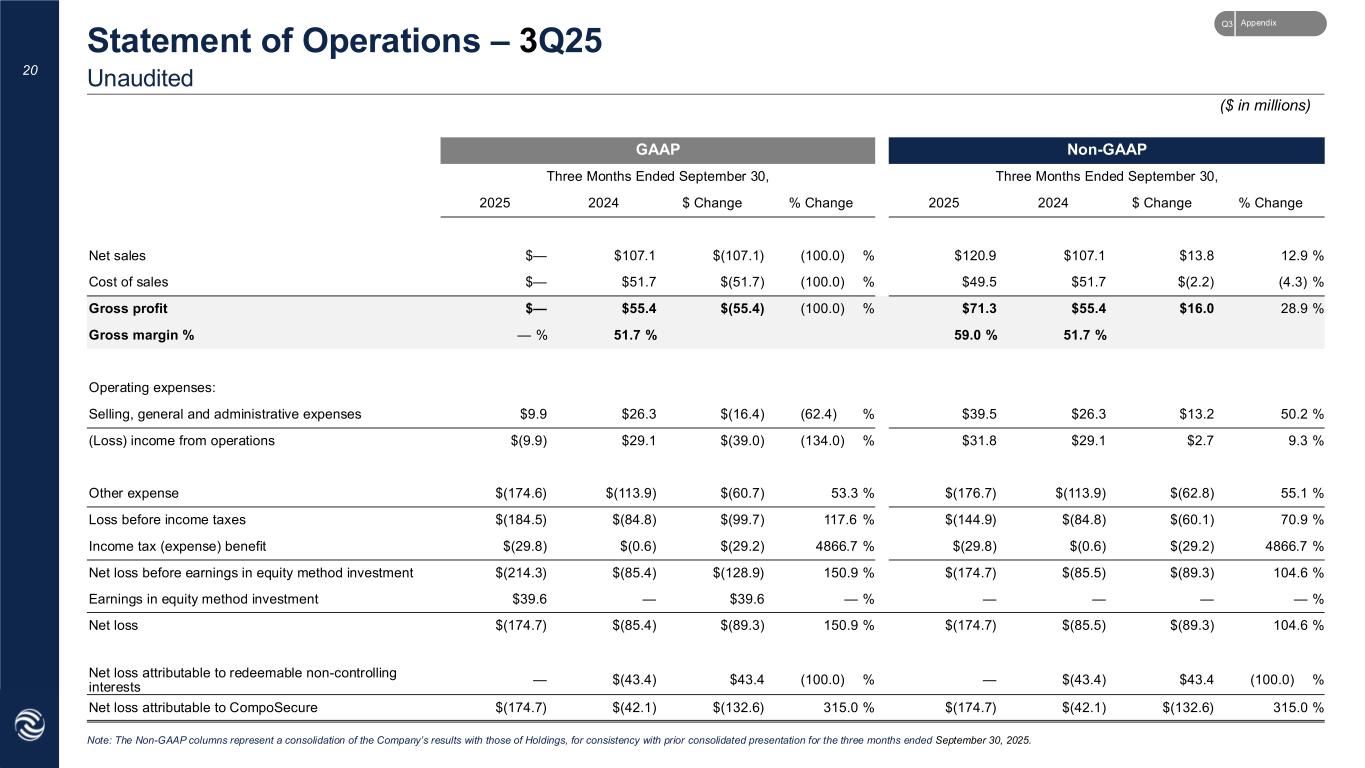

GAAP Non-GAAP Three Months Ended September 30, Three Months Ended September 30, 2025 2024 $ Change % Change 2025 2024 $ Change % Change Net sales $— $107.1 $(107.1) (100.0) % $120.9 $107.1 $13.8 12.9 % Cost of sales $— $51.7 $(51.7) (100.0) % $49.5 $51.7 $(2.2) (4.3) % Gross profit $— $55.4 $(55.4) (100.0) % $71.3 $55.4 $16.0 28.9 % Gross margin % — % 51.7 % 59.0 % 51.7 % Operating expenses: Selling, general and administrative expenses $9.9 $26.3 $(16.4) (62.4) % $39.5 $26.3 $13.2 50.2 % (Loss) income from operations $(9.9) $29.1 $(39.0) (134.0) % $31.8 $29.1 $2.7 9.3 % Other expense $(174.6) $(113.9) $(60.7) 53.3 % $(176.7) $(113.9) $(62.8) 55.1 % Loss before income taxes $(184.5) $(84.8) $(99.7) 117.6 % $(144.9) $(84.8) $(60.1) 70.9 % Income tax (expense) benefit $(29.8) $(0.6) $(29.2) 4866.7 % $(29.8) $(0.6) $(29.2) 4866.7 % Net loss before earnings in equity method investment $(214.3) $(85.4) $(128.9) 150.9 % $(174.7) $(85.5) $(89.3) 104.6 % Earnings in equity method investment $39.6 — $39.6 — % — — — — % Net loss $(174.7) $(85.4) $(89.3) 150.9 % $(174.7) $(85.5) $(89.3) 104.6 % Net loss attributable to redeemable non-controlling interests — $(43.4) $43.4 (100.0) % — $(43.4) $43.4 (100.0) % Net loss attributable to CompoSecure $(174.7) $(42.1) $(132.6) 315.0 % $(174.7) $(42.1) $(132.6) 315.0 % 20 Unaudited Statement of Operations – 3Q25 Note: The Non-GAAP columns represent a consolidation of the Company’s results with those of Holdings, for consistency with prior consolidated presentation for the three months ended September 30, 2025. ($ in millions) AppendixQ3

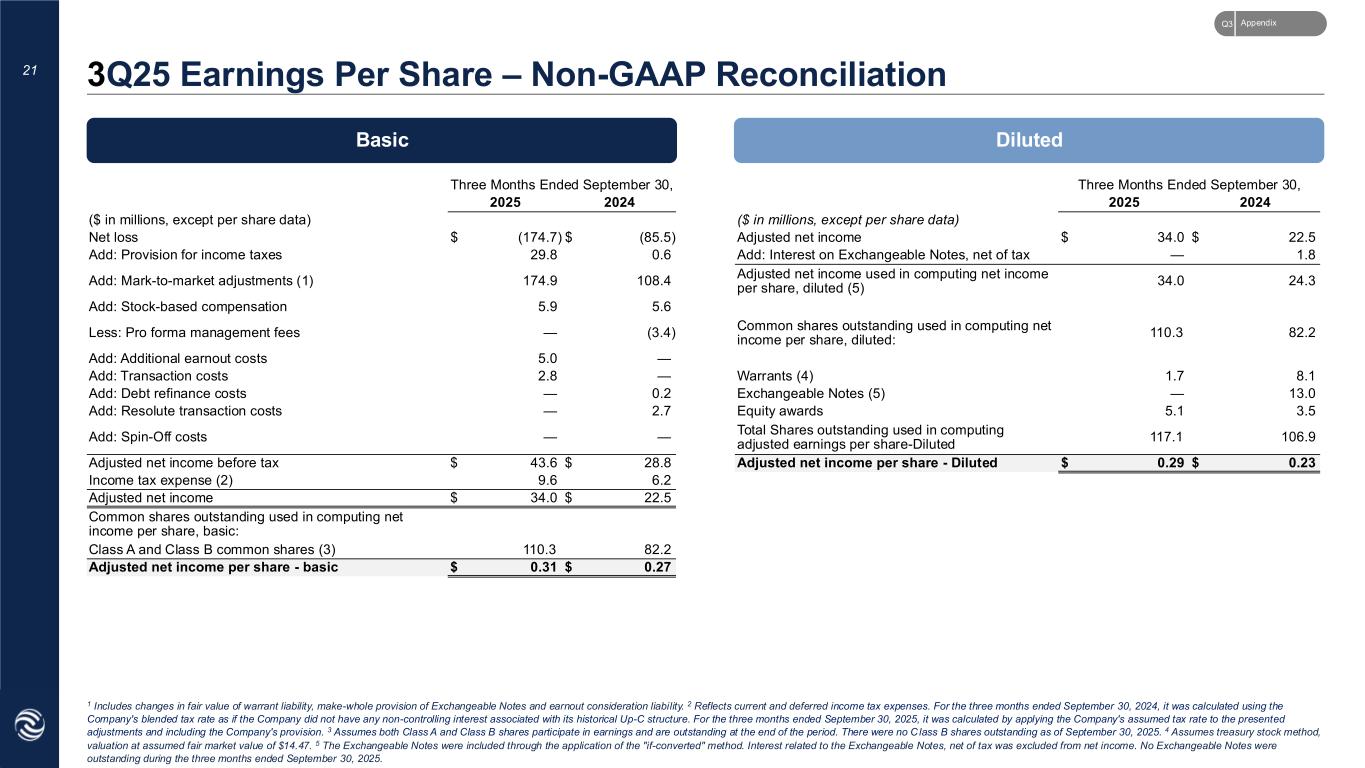

Basic Diluted Three Months Ended September 30, Three Months Ended September 30, 2025 2024 2025 2024 ($ in millions, except per share data) ($ in millions, except per share data) Net loss $ (174.7) $ (85.5) Adjusted net income $ 34.0 $ 22.5 Add: Provision for income taxes 29.8 0.6 Add: Interest on Exchangeable Notes, net of tax — 1.8 Add: Mark-to-market adjustments (1) 174.9 108.4 Adjusted net income used in computing net income per share, diluted (5) 34.0 24.3 Add: Stock-based compensation 5.9 5.6 Less: Pro forma management fees — (3.4) Common shares outstanding used in computing net income per share, diluted: 110.3 82.2 Add: Additional earnout costs 5.0 — Add: Transaction costs 2.8 — Warrants (4) 1.7 8.1 Add: Debt refinance costs — 0.2 Exchangeable Notes (5) — 13.0 Add: Resolute transaction costs — 2.7 Equity awards 5.1 3.5 Add: Spin-Off costs — — Total Shares outstanding used in computing adjusted earnings per share-Diluted 117.1 106.9 Adjusted net income before tax $ 43.6 $ 28.8 Adjusted net income per share - Diluted $ 0.29 $ 0.23 Income tax expense (2) 9.6 6.2 Adjusted net income $ 34.0 $ 22.5 Common shares outstanding used in computing net income per share, basic: Class A and Class B common shares (3) 110.3 82.2 Adjusted net income per share - basic $ 0.31 $ 0.27 21 3Q25 Earnings Per Share – Non-GAAP Reconciliation 1 Includes changes in fair value of warrant liability, make-whole provision of Exchangeable Notes and earnout consideration liability. 2 Reflects current and deferred income tax expenses. For the three months ended September 30, 2024, it was calculated using the Company's blended tax rate as if the Company did not have any non-controlling interest associated with its historical Up-C structure. For the three months ended September 30, 2025, it was calculated by applying the Company's assumed tax rate to the presented adjustments and including the Company's provision. 3 Assumes both Class A and Class B shares participate in earnings and are outstanding at the end of the period. There were no C lass B shares outstanding as of September 30, 2025. 4 Assumes treasury stock method, valuation at assumed fair market value of $14.47. 5 The Exchangeable Notes were included through the application of the "if-converted" method. Interest related to the Exchangeable Notes, net of tax was excluded from net income. No Exchangeable Notes were outstanding during the three months ended September 30, 2025. AppendixQ3

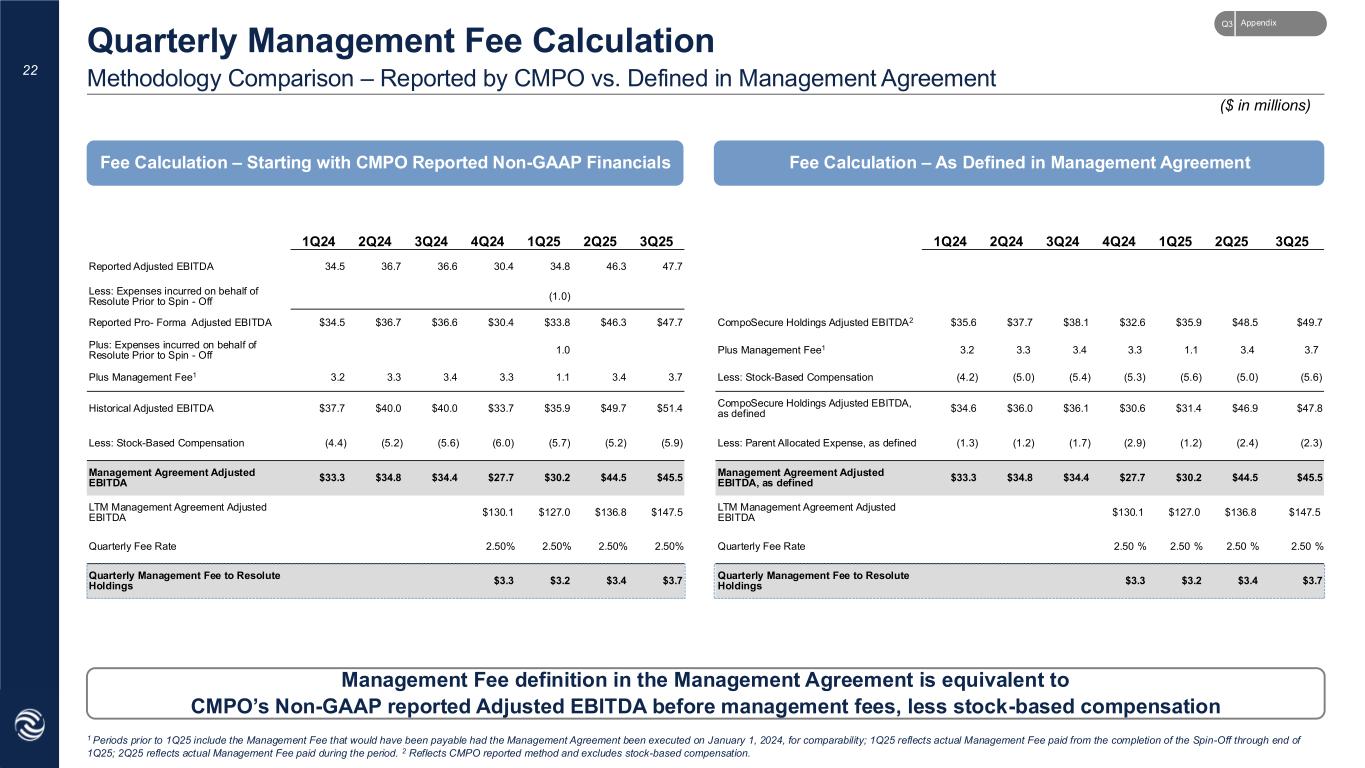

22 Methodology Comparison – Reported by CMPO vs. Defined in Management Agreement Quarterly Management Fee Calculation 1 Periods prior to 1Q25 include the Management Fee that would have been payable had the Management Agreement been executed on January 1, 2024, for comparability; 1Q25 reflects actual Management Fee paid from the completion of the Spin-Off through end of 1Q25; 2Q25 reflects actual Management Fee paid during the period. 2 Reflects CMPO reported method and excludes stock-based compensation. Fee Calculation – Starting with CMPO Reported Non-GAAP Financials Fee Calculation – As Defined in Management Agreement Management Fee definition in the Management Agreement is equivalent to CMPO’s Non-GAAP reported Adjusted EBITDA before management fees, less stock-based compensation ($ in millions) 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Reported Adjusted EBITDA 34.5 36.7 36.6 30.4 34.8 46.3 47.7 Less: Expenses incurred on behalf of Resolute Prior to Spin - Off (1.0) Reported Pro- Forma Adjusted EBITDA $34.5 $36.7 $36.6 $30.4 $33.8 $46.3 $47.7 CompoSecure Holdings Adjusted EBITDA2 $35.6 $37.7 $38.1 $32.6 $35.9 $48.5 $49.7 Plus: Expenses incurred on behalf of Resolute Prior to Spin - Off 1.0 Plus Management Fee1 3.2 3.3 3.4 3.3 1.1 3.4 3.7 Plus Management Fee1 3.2 3.3 3.4 3.3 1.1 3.4 3.7 Less: Stock-Based Compensation (4.2) (5.0) (5.4) (5.3) (5.6) (5.0) (5.6) Historical Adjusted EBITDA $37.7 $40.0 $40.0 $33.7 $35.9 $49.7 $51.4 CompoSecure Holdings Adjusted EBITDA, as defined $34.6 $36.0 $36.1 $30.6 $31.4 $46.9 $47.8 Less: Stock-Based Compensation (4.4) (5.2) (5.6) (6.0) (5.7) (5.2) (5.9) Less: Parent Allocated Expense, as defined (1.3) (1.2) (1.7) (2.9) (1.2) (2.4) (2.3) Management Agreement Adjusted EBITDA $33.3 $34.8 $34.4 $27.7 $30.2 $44.5 $45.5 Management Agreement Adjusted EBITDA, as defined $33.3 $34.8 $34.4 $27.7 $30.2 $44.5 $45.5 LTM Management Agreement Adjusted EBITDA $130.1 $127.0 $136.8 $147.5 LTM Management Agreement Adjusted EBITDA $130.1 $127.0 $136.8 $147.5 Quarterly Fee Rate 2.50% 2.50% 2.50% 2.50% Quarterly Fee Rate 2.50 % 2.50 % 2.50 % 2.50 % Quarterly Management Fee to Resolute Holdings $3.3 $3.2 $3.4 $3.7 Quarterly Management Fee to Resolute Holdings $3.3 $3.2 $3.4 $3.7 AppendixQ3

Investor Relations Contact Sean Mansouri 720-330-2829 ir@composecure.com