Please wait

0001823608DEF 14AfalsePriscilla Sims BrownKeith MestrichLynne Foxiso4217:USDxbrli:pure00018236082024-01-012024-12-310001823608amal:PriscillaSimsBrownMember2024-01-012024-12-310001823608amal:PriscillaSimsBrownMember2023-01-012023-12-3100018236082023-01-012023-12-310001823608amal:PriscillaSimsBrownMember2022-01-012022-12-3100018236082022-01-012022-12-310001823608amal:PriscillaSimsBrownMember2021-01-012021-12-310001823608amal:KeithMestrichMember2021-01-012021-12-310001823608amal:LynneFoxMember2021-01-012021-12-3100018236082021-01-012021-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2024-01-012024-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2023-01-012023-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2022-01-012022-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:PriscillaSimsBrownMember2021-01-012021-12-310001823608amal:KeithMestrichMember2024-01-012024-12-310001823608amal:KeithMestrichMember2023-01-012023-12-310001823608amal:KeithMestrichMember2022-01-012022-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2024-01-012024-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2023-01-012023-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2022-01-012022-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:KeithMestrichMember2021-01-012021-12-310001823608amal:LynneFoxMember2024-01-012024-12-310001823608amal:LynneFoxMember2023-01-012023-12-310001823608amal:LynneFoxMember2022-01-012022-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2024-01-012024-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2023-01-012023-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2022-01-012022-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberamal:LynneFoxMember2021-01-012021-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:PnsnAdjsPrrSvcCstMemberecd:NonPeoNeoMember2021-01-012021-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001823608ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-31000182360812024-01-012024-12-31000182360822024-01-012024-12-31000182360832024-01-012024-12-31000182360842024-01-012024-12-31000182360852024-01-012024-12-31000182360862024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

Amalgamated Financial Corp.

(Name of Registrant as Specified In Its Charter)

______________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee paid previously with preliminary materials

[ ] Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

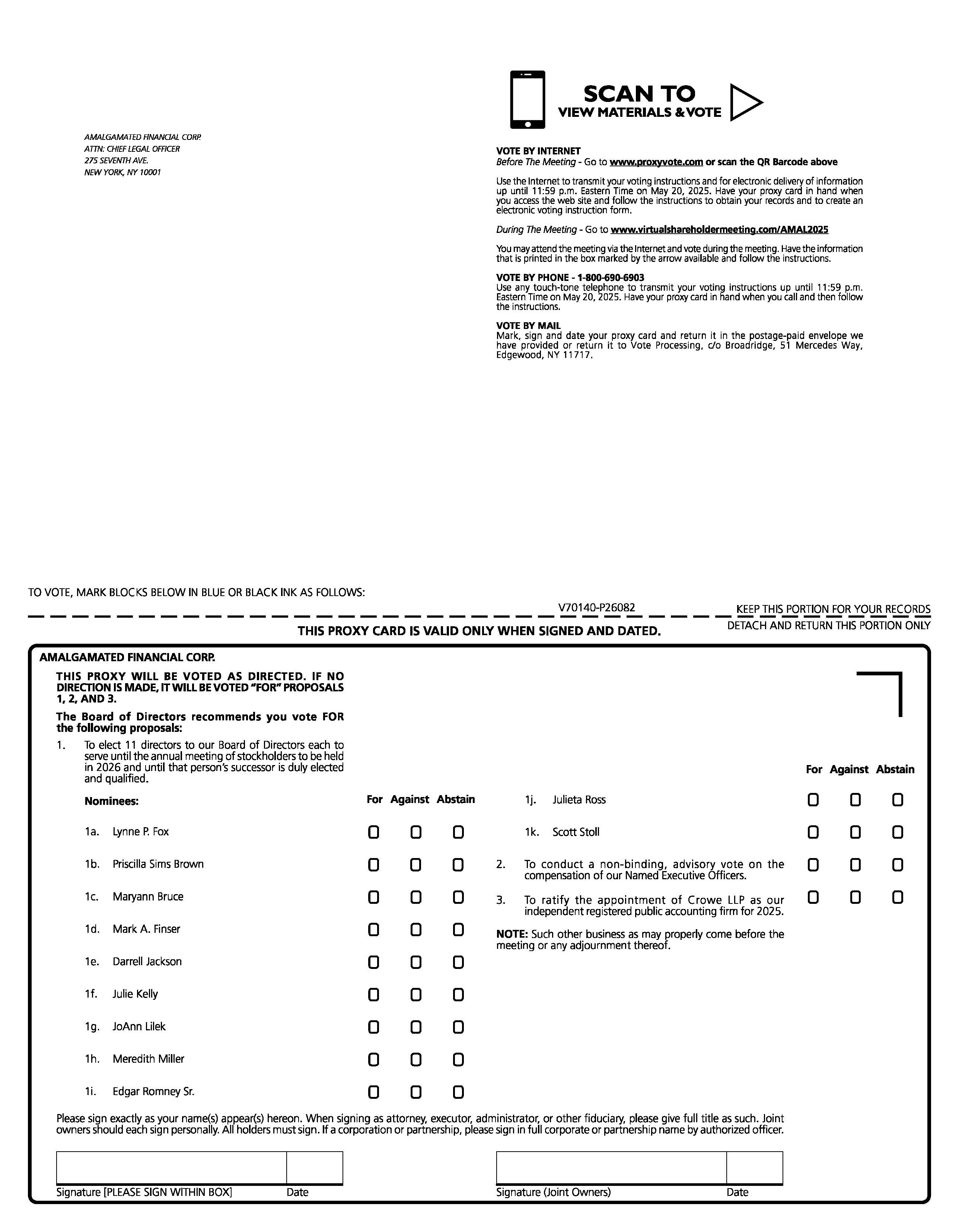

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 21, 2025

To the Stockholders of Amalgamated Financial Corp.:

You are cordially invited to attend the annual meeting of stockholders of Amalgamated Financial Corp. to be held at 9:00 a.m., Eastern Time, on May 21, 2025. The annual meeting will be a virtual meeting. Stockholders of record can attend the meeting via the Internet at www.virtualshareholdermeeting.com/AMAL2025 by using your 16-digit control number on your proxy card and the instructions included in the enclosed proxy statement. Stockholders who hold their shares in “street name” (i.e. through a bank, broker or other nominee) must first obtain a legal proxy from their bank, broker or other nominee to participate in the virtual meeting, as more fully described on page 4 of the enclosed proxy statement. The meeting will be held for the following purposes:

1.To elect 11 directors to our Board of Directors each to serve until the annual meeting of stockholders to be held in 2026 and until that person’s successor is duly elected and qualified;

2.To conduct a non-binding, advisory vote on the compensation of our Named Executive Officers;

3.To ratify the appointment of Crowe LLP as our independent registered public accounting firm for 2025; and

4.To transact such other business as may properly come before the annual meeting or any adjournment of the meeting.

All holders of our common stock, par value $0.01 per share, of record as of March 26, 2025, are entitled to notice of and to vote at the annual meeting. Each share of our common stock entitles the holder to one vote on all matters voted on at the meeting. The enclosed proxy statement provides you with detailed information regarding the business to be considered at the meeting. Your vote is important. We urge you to please vote your shares now whether or not you plan to virtually attend the meeting. You may revoke your proxy at any time before the proxy is voted by following the procedures described in the enclosed proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the 2025 Annual Meeting. Our 2025 proxy statement, proxy card and 2024 Annual Report to Stockholders are available free of charge at our website, www.amalgamatedbank.com, under the “Investor Relations” tab and then under the “Financial Information” tab.

Your virtual attendance at the meeting affords you the same rights and opportunities to participate as you would have at an in-person meeting.

By Order of the Board of Directors,

| | | | | |

April 11, 2025 | /s/ Lynne P. Fox Lynne P. Fox, Chair of the Board of Directors |

Table of Contents

PROXY STATEMENT FOR

THE ANNUAL MEETING OF STOCKHOLDERS

OF AMALGAMATED FINANCIAL CORP.

To be held on May 21, 2025

GENERAL INFORMATION AND VOTING PROCEDURES

The Board of Directors of Amalgamated Financial Corp., with its principal executive office located at 275 Seventh Avenue, New York, New York 10001, is furnishing this proxy statement to solicit proxies for use at our annual meeting of stockholders to be held in virtual-only format at 9:00 a.m., Eastern Time, on May 21, 2025. The purposes of the annual meeting and the matters to be acted upon are set forth in the accompanying Notice of Annual Meeting of Stockholders and this proxy statement. If the meeting is postponed or adjourned, we may also use the proxy at any later meetings for the purposes stated in the Notice of Annual Meeting and this proxy statement.

The accompanying Notice of Annual Meeting of Stockholders and this proxy statement were first mailed to our stockholders on or about April 11, 2025. In this proxy statement, “we,” “us,” “our,” “Amalgamated Financial,” or the “Company” refer to Amalgamated Financial Corp., the “Bank” refers to Amalgamated Bank, and “you” and “your” refer to each stockholder of Amalgamated Financial Corp.

What items will be voted on at the annual meeting?

Three matters are scheduled for a vote:

1.To elect 11 directors to our Board of Directors each to serve until the annual meeting of stockholders to be held in 2026 and until that person’s successor is duly elected and qualified;

2.To conduct a non-binding, advisory vote on the compensation of our Named Executive Officers; and

3.To ratify the appointment of Crowe LLP as our independent registered public accounting firm for 2025.

As of the date of this proxy statement, we are not aware of any other matters that will be presented for consideration at the annual meeting. If, however, other matters are properly presented, the persons named as proxies will vote the shares represented by properly executed proxies in accordance with their judgment with respect to those matters, including any proposal to adjourn or postpone the annual meeting.

How do your directors recommend that stockholders vote?

The directors recommend that you vote:

1.FOR the election of the 11 director nominees to our Board of Directors each to serve until the annual meeting of stockholders to be held in 2026 and until that person’s successor is duly elected and qualified;

2.FOR the non-binding, advisory approval of the compensation of our Named Executive Officers; and

3.FOR the ratification of the appointment of Crowe LLP as our independent registered public accounting firm for 2025.

How can I attend the annual meeting?

The meeting will be conducted online in a fashion similar to an in-person meeting. We designed the format of the virtual meeting to ensure that our stockholders who attend our annual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. Our Board members and executive officers will attend the meeting and be available for questions.

Access to the Audio Webcast of the Meeting: The live audio webcast of the meeting will begin promptly at 9:00 a.m. Eastern Time. Online access to the audio webcast will open approximately 60 minutes prior to the start of the meeting to allow time for you to log in and test the computer audio system. We encourage our stockholders to access the meeting prior to the start time to allow ample time to complete the online check-in process.

Log-in Instructions if You Hold Shares in Your Own Name: To attend the virtual meeting, log in at www.virtualshareholdermeeting.com/AMAL2025. Stockholders will need their unique 16-digit control number which appears on your proxy card and the instructions included in this proxy statement.

Log-in Instructions if Your Shares are Held in Street Name through a Bank, Broker or Other Nominee: If you hold your shares in street name and you wish to virtually attend and participate in the annual meeting, you must first obtain a valid legal proxy from your bank, broker or other nominee and then register in advance to attend the annual meeting. Follow the instructions from your bank, broker or other nominee included with the proxy statement, or contact your bank, broker or other nominee to request a legal proxy form.

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 14, 2025.

Once registered, follow the "Log-in Instructions if You Hold Shares in Your Own Name" above to attend the virtual meeting.

Can I attend the annual meeting as a guest?

No. Only stockholders of record are permitted to attend the annual meeting.

How can I ask questions during the meeting?

Stockholders may submit questions in real time during the meeting at www.virtualshareholdermeeting.com/AMAL2025 by typing their question into the “Ask a Question” field, and clicking “Submit.” We intend to respond to all questions submitted during the meeting in accordance with the annual meeting’s Rules of Conduct, and which are pertinent to the Company and the meeting matters, as time permits within the one hour allocated. The Rules of Conduct will be posted at the virtual meeting forum at www.virtualshareholdermeeting.com/AMAL2025. Responses to any such questions that are not addressed during the meeting will be published following the meeting on our website at www.amalgamatedbank.com under the “Investor Relations” tab. Questions and responses will be grouped by topic and substantially similar questions will be grouped and responded to once.

What can I do if I need technical assistance during the meeting?

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call 1-844-986-0822 (United States) or 1-303-562-9302 (International).

Who is eligible to vote?

Stockholders of record of our common stock at the close of business on March 26, 2025 are entitled to be present and to vote at the annual meeting or any adjourned meeting. We anticipate that the 2025 proxy statement, proxy card, and 2024 Annual Report will first be mailed to stockholders on or about April 11, 2025.

Why am I receiving this proxy statement and proxy card?

You are receiving a proxy statement and proxy card from us because on March 26, 2025, the record date for the annual meeting, you owned shares of our common stock. This proxy statement describes the matters that will be presented for consideration by the stockholders at the annual meeting. It also gives you information concerning these matters to assist you in making an informed decision.

When you sign the enclosed proxy card, you appoint the proxy holder as your representative at the meeting. The proxy holder will vote your shares as you have instructed in the proxy card, ensuring that your shares will be voted whether or not you virtually attend the meeting. Even if you plan to virtually attend the annual meeting, complete, sign and return your proxy card in advance of the annual meeting in case your plans change.

What are the rules for voting and how do I vote?

As of the record date, we had 30,687,354 shares of common stock outstanding and entitled to vote at the annual meeting. Each share of our common stock entitles the holder to one vote on all matters voted on at the meeting. All of the shares of our common stock vote as a single class.

If you hold shares in your own name, you may vote by selecting any of the following options:

•By Internet: Go to www.voteproxy.com and follow the on-screen instructions.

•By Mail: Complete the enclosed proxy card, date and sign it, and return it in the postage-paid envelope provided.

•Vote via the Internet During the Meeting: You may choose to vote electronically via the Internet at www.virtualshareholdermeeting.com/AMAL2025 during the virtual meeting. Stockholders will need their unique 16-digit control number which appears on the proxy card and the instructions included in this proxy statement.

If you hold your shares in street name, your brokerage firm may vote your shares under certain circumstances. Brokerage firms have authority under stock exchange rules to vote their customers’ unvoted shares on certain “routine” matters. We expect that brokers will be allowed to exercise discretionary authority for beneficial owners who have not provided voting instructions ONLY with respect to Proposal Three—the ratification of the appointment of Crowe LLP as our independent registered public accounting firm for 2025 but not with respect to any of the other proposals to be voted on at the annual meeting. If you hold your shares in street name, please provide voting instructions to your bank, broker or other nominee so that your shares may be voted on all other proposals.

If your shares are held in the name of a bank, broker or other holder of record, you are considered the beneficial owner of shares held in “street name,” and you will receive instructions from such holder of record that you must follow for your shares to be voted. Please follow their instructions carefully.

If you hold your shares in street name and you wish to virtually vote via the Internet during the annual meeting, you must first obtain a valid legal proxy from your bank, broker or other nominee and then register in advance to attend the annual meeting. Follow the instructions under "How can I attend the annual meeting?"

Shares represented by signed proxies will be voted as instructed. If you sign the proxy but do not mark your vote, your shares will be voted as the directors have recommended. Voting results will be tabulated and certified by Broadridge Financial Solutions.

As of the date of this proxy statement, we are not aware of any other matters to be presented or considered at the meeting, but your shares will be voted at the discretion of the proxies appointed by the Board of Directors on any of the following matters:

•any matter about which we did not receive written notice a reasonable time before we mailed these proxy materials to our stockholders; and

•matters incident to the conduct of the meeting.

What constitutes a quorum?

We will have a quorum and will be able to conduct the business of the annual meeting if the holders of a majority of our issued and outstanding shares entitled to vote are present in person or by proxy at the annual meeting. In determining whether we have a quorum at the annual meeting for purposes of all matters to be voted on, all votes and all abstentions will be counted. When a brokerage firm votes its customers’ unvoted shares on routine matters, these shares are counted for purposes of establishing a quorum to conduct business at the meeting. If a brokerage firm indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular matter, then those shares will be treated as “broker non-votes.” Shares represented by broker non-votes will be counted in determining whether there is a quorum.

How are votes counted?

•Stockholder voting generally. Each share of our common stock entitles the holder to one vote on all matters voted on at the annual meeting.

•Proposal One: Election of Directors. Our directors will be elected by a majority of the votes cast by the holders of shares of our common stock entitled to vote at the annual meeting. A majority of the votes cast means that the number of shares voted "for" a nominee must exceed the votes cast "against" such nominee's election. There is no cumulative voting with respect to the election of directors.

•Proposal Two: Approval on a Non-Binding Advisory Basis of the Compensation of Our Named Executive Officers. Approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers requires the affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote at the annual meeting.

•Proposal Three: Ratification of the Appointment of Crowe LLP. Ratification of the appointment of Crowe LLP as our independent registered public accounting firm for 2025 requires the affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote at the annual meeting.

How are abstentions and broker non-votes treated?

With respect to each proposal, you may vote “FOR” or “AGAINST” the proposals. You may “ABSTAIN” from voting on the proposals.

Proposal One: Election of Directors. Broker non-votes and abstentions will have no effect on determining whether the affirmative vote constitutes a majority of the votes cast with respect to Proposal One.

Proposal Two: Approval on a Non-Binding Advisory Basis of the Compensation of Our Named Executive Officers. Abstentions will have the same effect as a vote AGAINST Proposal Two. Broker non-votes will have no effect on determining whether the affirmative vote constitutes a majority of shares present in person or represented by proxy at the meeting and entitled to vote with respect to Proposal Two.

Proposal Three: Ratification of the Appointment of Crowe LLP. Abstentions will have the same effect as a vote AGAINST Proposal Three. A broker or other nominee may generally vote on this proposal and therefore no broker non-votes are expected in connection with Proposal Three.

How can I revoke my proxy?

If you are a stockholder of record (i.e., you hold your shares directly instead of through a brokerage account) and you change your mind after you return your proxy, you may revoke it and change your vote at any time before the polls close at the meeting. You may do this by:

•signing, dating and returning another proxy with a later date;

•submitting a proxy via the Internet with a later date; or

•attending the meeting and voting via the Internet during the live audio webcast of the meeting.

If you hold your shares in a street name, you must contact your bank, broker or other nominee to revoke your proxy.

How will we solicit proxies, and who will pay for the cost of the solicitation?

We will pay for the cost of this proxy solicitation. We do not intend to solicit proxies otherwise than by use of the mail or website posting, but certain of our directors, officers and other employees, without additional compensation, may solicit proxies personally or by telephone, facsimile or email on our behalf.

Who will count the vote?

At the meeting, the voting results will be tabulated and certified by Broadridge Financial Solutions. It is expected that a representative of Broadridge Financial Solutions, an independent inspector of election, will sign an oath to faithfully execute with impartiality the duties of inspector, which will include determining the number of shares outstanding and the voting power of each, the shares represented at the meeting, the presence of a quorum and the validity and effect of the proxies.

What happens if the meeting is postponed or adjourned?

Your proxy will remain valid and may be voted at the postponed or adjourned annual meeting. You will still be able to change or revoke your proxy until it is voted.

How can a stockholder propose business to be brought before next year’s annual meeting?

Any stockholder desiring to include a proposal pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) in our 2026 proxy statement for action at our 2026 annual meeting must deliver the proposal to our executive offices no later than December 15, 2025. Only proper proposals that are timely received and in compliance with Rule 14a-8 will be included in our 2026 proxy statement.

Under our Bylaws, stockholder proposals not intended for inclusion in our 2026 annual meeting proxy statement pursuant to Rule 14a-8 but intended to be raised at our 2026 annual meeting, including nominations for election of directors other than the Board of Directors’ nominees, must be received no earlier than 120 days and no later than 90 days prior to the first anniversary of the 2025 annual meeting and must comply with the procedural, informational and other requirements outlined in our bylaws. To be timely for the 2026 annual meeting, a stockholder proposal or director nomination must be delivered to the Secretary of the Company, at 275 Seventh Avenue, New York, New York 10001, no earlier than January 21, 2026 and no later than February 20, 2026.

To comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19(b) under the Exchange Act no earlier than January 21, 2026 and no later than February 20, 2026.

For a complete description of the procedures and disclosure requirements to be complied with by stockholders in connection with submitting stockholder proposals, stockholders should refer to our bylaws.

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees for Election as Directors

Our bylaws provide for a Board of Directors consisting of not fewer than seven nor more than 21 individuals with the exact number to be fixed by the Board of Directors. Our Board of Directors has fixed the number of directors constituting the entire board at 11, following the 2025 annual meeting. In accordance with our tenure policy outlined in our Corporate Governance Guidelines, Mr. Robert G. Romasco will not stand for re-election, and he will retire from the Board of Directors after the 2025 annual meeting.

Under an agreement with Workers United and numerous joint boards, locals or similar organizations authorized under the constitution of Workers United (the "Workers United Related Parties"), the Workers United Related Parties have the right to designate nominees to our Board of Directors. For further detail on these director nomination rights, see “Certain Relationships and Related Party Transactions.”

The Workers United Related Parties have designated Maryann Bruce, Lynne P. Fox, Julie Kelly, Meredith Miller and Edgar Romney Sr. to serve on our Board of Directors.

Biographical Information

If elected, all nominees will serve for a term commencing on the date of the annual meeting and continuing until the 2026 annual meeting of stockholders and until each person’s successor is duly elected and qualified. Each nominee has consented to being named as a nominee and agreed to serve if elected. If any named nominee is unable to serve, then the proxies may vote for a substitute. Information about each of the director nominees is provided below. Each director is currently serving as a director of the Company.

| | | | | |

Lynne P. Fox | |

Age 67 | |

Chair of the Board | |

Director Since February 2000 | |

| Lynne P. Fox has served as Chair of our Board of Directors since May 2016. Ms. Fox is an attorney and is the elected President and Chair of the General Executive Board of Workers United, a position she has held since May 2016. Prior to that, she served as an Executive VP of Workers United from March 2009 to May 2016. She is also the elected Manager of the Philadelphia Joint Board of Workers United (and its predecessor labor organizations), a position she has held since December 1999. She is a Vice President of the Service Employees International Union. She is responsible for overseeing a $5 million budget, strategic planning, and for representing approximately 75,000 members in the U.S. and Canada. She has served as chief labor negotiator for |

innumerable collective bargaining agreements that, among other things, provide for health and pension benefits, and has responsibility for oversight of the investigation and processing of labor grievances. Ms. Fox brings to the Board an intimate understanding of the Bank’s business, organization, and mission, as well as substantial leadership ability, Board and management experience, all of which qualify her to serve on the Board of Directors. |

| | |

Board Service: Ms. Fox serves as Chair of the Amalgamated Life Insurance Company, Chair of the Consolidated Retirement Fund, Chair of the Sidney Hillman Medical Center in Philadelphia, President of the Sidney Hillman Medical Center Apartments for the Elderly, Inc. in Philadelphia and is a member of the Economic and Community Advisory Council of the Federal Reserve Bank of Philadelphia and the Philadelphia Airport Advisory Board. She previously was the Chair of the Investment Committee of the National Retirement Fund from 2016 to 2018 and is now the Chair of the National Retirement Fund. She is President of the Philadelphia Jewish Labor Committee, and Chair of the John Fox Scholarship Fund in Philadelphia. She also served as a Board member for the State Employee Retirement System in Pennsylvania from 2006 to 2011, which is a $28.3 billion fund. She also serves as Chair of the National Plus Plan and serves as Chair and/or trustee on various other insurance and employee benefit funds. |

| | | | | |

Priscilla Sims Brown | |

Age 67 | |

President and Chief Executive Officer | |

Director Since June 2021 | |

| Priscilla Sims Brown has served as our President and Chief Executive Officer and on our Board of Directors since June 2021. Ms. Brown has served as a multi-national board director and C-suite executive with over 30 years of financial services experience. Prior to joining, she was the Group Executive for Marketing and Corporate Affairs at Commonwealth Bank of Australia from July 2019 to June 2021, where she focused on rebuilding trust and pride in the bank with direct responsibility for end-to-end marketing, branding, stakeholder insights, government and public affairs, and environment and social policy. From October 2017 to July 2019, she served as Chief Executive Officer of Emerge.me, a digital health insurance broker. Ms. Brown has |

held senior positions at AXA Financial, Inc., Sun Life Financial, and Lincoln Financial Group. She was a member of the AXA Financial US Executive Committee, serving as Chief Marketing Officer ("CMO"), where she directed all aspects of US marketing and led global digital marketing initiatives. Prior to AXA Financial, Ms. Brown served as CMO at AmeriHealth Caritas, where she developed a new go-to-market strategy for the largest Blue Cross/Blue Shield Medicaid company in response to the Affordable Care Act. At Sun Life, Ms. Brown served as CMO and Chief Strategist, where she negotiated and managed Sun Life Stadium naming rights, Pro Bowl, Super Bowl, and other major events with the Miami Dolphins NFL football team. During her 18-year tenure at Lincoln Financial Group, Ms. Brown held numerous leadership positions where she integrated acquired companies, established new businesses, and led the consumer brand. She established the firm’s first investment management profit center, targeting midsized insurance companies. She also started and chaired Lincoln’s first family of standalone mutual funds and served as president of the broker-dealer. Ms. Brown also led the investor relations function, before expanding her responsibilities to include corporate and strategic marketing. Ms. Brown’s personal and professional experiences have enabled her to reach across cultural boundaries to ensure collaboration among diverse teams and drive successful outcomes for organizations, all of which qualify her to serve on our Board of Directors. Board Service: Prior to joining us, she served as a member of the Board of Trustees of Teachers Insurance and Annuity Association of America (“TIAA”). She served on the TIAA Investment, Nominating and Governance, and Corporate Governance and Social Responsibility committees, as well as Trustee and CEO selection subcommittees. |

| | | | | |

Maryann Bruce | |

Age 65 | |

Independent Director Since August 2018 | |

| Maryann Bruce has over 30 years of experience in the financial services industry and is recognized for her outstanding leadership and expertise. Ms. Bruce has earned numerous accolades, including being named one of Directors & Board’s “20 Accomplished Female Board Members in Directors to Watch” and appearing on US Banker’s list of “The 25 Most Powerful Women in Banking.” Since 2007, Ms. Bruce has served as President of Turnberry Advisory Group, a private consulting firm. From 2008 to 2010, she was President of Aquila Distributors Inc., a subsidiary of Aquila Investment Management. Earlier in her career, she was President of Evergreen Investments Services, Inc., a division of Wachovia (now Wells Fargo & |

Company), focused on investment management and diversified financial services. Ms. Bruce is passionately committed to advancing women’s leadership in business and boardrooms. She earned the CERT Certificate in Cybersecurity Oversight from the National Association of Corporate Directors (NACD) and Carnegie Mellon University’s Software Engineering Institute, demonstrating her dedication to cybersecurity governance. Her career has spanned a wide range of executive leadership roles across strategy, sales and distribution, marketing, product development, client service, risk management, and regulatory oversight. With a proven track record of growing and scaling businesses and a deep understanding of financial markets, Ms. Bruce brings invaluable insight and a strategic perspective to her role as a Board Member. Board Service: Ms. Bruce is Chair of the Board of The Pop Venture Fund, a closed-end interval fund for privately held companies, and Wrestle Like A Girl. Her previous board experience includes serving as an Independent Director at NextPoint Financial, where she chaired the Corporate Governance & Nominating Committee, served on the Executive, Audit, and Compensation Committees, and successfully led the company through a strategic review, restructuring, and a going concern sale. Ms. Bruce also served as an Independent Director at MBIA (NYSE: MBI), where she was a member of the Audit & Compliance and Compensation & Governance Committees, an Independent Director for Atlanta Life Financial Group, where she chaired the Compensation Committee, and Trustee for the Allianz Global Investors and PNC Funds. Additionally, Ms. Bruce serves on the advisory boards of Divershefy, a global women’s organization, and the Directors Development Initiative, which connects aspiring board members with for-profit and nonprofit boards. She is also a founding member of NACD’s Carolinas Chapter and has previously chaired the C200 Foundation, an organization that brings together C-suite executives and trailblazing entrepreneurs. |

| | | | | |

Mark A. Finser | |

Age 65 | |

Independent Director Since May 2018 | |

| Mark A. Finser was a founding member of New Resource Bank and served as its Chair until our acquisition of New Resource Bank in 2018. Mr. Finser started his career in social finance in 1984 as a founder of RSF Social Finance (“RSF”), an organization focused on developing innovative social finance tools to serve the unmet needs of clients and partners. He served as President and Chief Executive Officer of RSF until 2007, during which time he led the growth of the organization’s assets to $120 million. In 2007, he transitioned to Chairman of the Board of Trustees of RSF and served in that role until 2018. Mr. Finser also works with high-net-worth individuals and families to develop a strategy to align financial resources with personal |

| | | | | |

values. As part of this work, Mr. Finser serves as an independent trustee for families and multigenerational beneficiaries. Mr. Finser’s extensive business experience, including his experience as a Bank Director, and knowledge of our mission and markets that we serve qualify him to serve on our Board of Directors and enhance his ability to contribute as a Director. Board Service: As an active member of the social finance community, Mr. Finser has served on several boards, including B Lab, Living Lands Trust, and Gaia Herbs. Mr. Finser also works with high-net-worth individuals and families to develop a strategy to align financial resources with personal values. |

| | | | | |

Darrell Jackson | |

Age 67 | |

Independent Director Since August 2021 | |

| Darrell Jackson brings an extensive background driving growth and operational initiatives for financial services providers throughout the US. In his 35+ years in the financial sector, he has held leadership positions such as President, CEO and Board Director with consistent success in creating innovative business strategies. Since 2018, Mr. Jackson has served as President and CEO of the Efficace Group. Prior to this, Mr. Jackson held the position of President, CEO and Inside Director for Seaway Bank and Trust in Chicago from 2014 to 2015. Previously he held several management positions at The Northern Trust Corporation from 1995 to 2014, concluding his tenure with the position of Executive President and Co-President of Wealth Management – |

Illinois. In addition to this corporate governance expertise, Mr. Jackson’s extensive executive leadership experience and experience as a bank director qualifies him to serve on our Board of Directors and provide valuable perspectives to our discussions and oversight of the Bank. Board Service: Since 2022, Mr. Jackson has served as a Trustee for the Janus Henderson Mutual Funds Board. Since April 2020, Mr. Jackson has served as one of three outside directors for Gray-Scott-Bowen, a professional consulting firm specializing in the delivery of transportation projects in the Greater Bay Area of California. From November 2016 until July 2018, Mr. Jackson served as one of four outside directors for Delaware Place Bank and its holding company in Chicago and as Chair of the Executive Loan Committee. Mr. Jackson has also served as Chairman of the Board, Chairman of Audit, Finance, Governance and Management Development & Compensation committees for several high-profile non-profit organizations. |

| | | | | |

Julie Kelly | |

Age 58 | |

Director Since April 2010 | |

| Julie Kelly is the General Manager of the New York New Jersey Regional Joint Board of Workers United and an International Vice President and member of the General Executive Board of Workers United, positions she has held since 2010. She has worked in the labor movement since 1989 and has been with Workers United and its predecessor organizations in a number of capacities since 2000. During her tenure as a Director for over ten years, Ms. Kelly has developed knowledge of the Bank’s business, history, organization, mission, and executive management, which qualify her to serve on the Board of Directors and enhance her ability to contribute as a Director. Board Service: Ms. Kelly is President of the New York New |

| | | | | |

Jersey Regional Joint Board Holding Company, Inc., a director of Amalgamated Life Insurance Company, and a trustee of the Amalgamated National Health Fund, Amalgamated Retail Retirement Fund, Consolidated Retirement Fund, the National Retirement Fund, Consortium for Worker Education Audit Committee, and the Union Health Center. She also served as former President of the Clothing Workers Center, a historic organization that has provided a home for tens of thousands of Amalgamated Clothing and Textile Workers Union ("ACTWU") workers for over a century. |

| | | | | |

JoAnn Lilek |

|

Age 68 | |

Independent Director Since April 2021 | |

| JoAnn Lilek has more than 30 years combined experience as a Chief Financial Officer and operations leader in consulting, commercial banking, and supply chain management. From 2010 to 2018, she served as Chief Financial Officer and Chief Operating Officer of Accretive Solutions, Inc., a private equity owned company. From 2008 to 2010, Ms. Lilek served as Executive Vice-President, Chief Financial Officer and Corporate Secretary of Midwest Banc Holdings, Inc. (NASDAQ: MBHI) where she was part of the turnaround team commissioned to recapitalize its subsidiary, Midwest Bank, during the global financial crisis of 2008. From 2001 to 2008, Ms. Lilek was Chief Financial Officer for DSC Logistics (DSC), a well-known, |

privately held national provider of third-party logistics and supply chain management services. Prior to DSC, Ms. Lilek had a 23-year career in financial leadership at ABN Amro North America. She played an instrumental role in ABN Amro North America’s growth to become the largest foreign bank in the United States. She held the positions of Group Senior Vice-President and Corporate Controller for North America from 1991 to 1999 and Executive Vice-President and Chief Financial Officer Wholesale Banking for North America from 1999 to 2000. Both Directors & Boards in 2007 and Private Company Director in 2019 highlighted Ms. Lilek’s accomplishments in their “Directors to Watch” articles. She is a Founding Member of the Private Directors Association and a member of the National Association of Corporate Directors and Women Corporate Directors. In addition to her corporate governance expertise, Ms. Lilek’s extensive executive leadership experience in commercial banks and middle market companies qualifies her to serve on our Board of Directors and provide valuable perspectives to our discussions and oversight of the Bank. Board Service: Ms. Lilek currently serves as an independent Trustee and Audit Committee Chair of the Datum One Series Trust, a series of mutual funds. She served as a board member of the Hinsdale Bank and Trust Company, a subsidiary of Wintrust Corporation (NASDAQ: WTFC), from 2011 to 2016 where she also served as Audit Committee Chair and as a credit and risk management committee member. In addition, from 2005 to 2009, she served as board Chair for the Lou Holland Trust Mutual Fund. She has 14 years of board service at the YWCA Metropolitan Chicago, including board President and Treasurer. She currently serves on the advisory board of MGX Beverage Group, a private family-owned wholesale distribution and third-party logistics business. |

| | | | | |

Meredith Miller | |

Age 69 | |

Independent Director Since July 2022 | |

| Meredith Miller brings an extensive background in corporate governance and sustainable investment leadership with considerable board and management experience. Ms. Miller served as Managing Member of Corporate Governance and Sustainable Strategies LLC from November 2021 to December 2024. Previously, she served as Chief Corporate Governance Officer for the UAW Retiree Medical Benefits Trust from 2010 to 2021. In that role she covered over 600,000 participants with $62 billion in assets under management. Ms. Miller also has 27 years of experience in health and pension benefits as well as policy making through her roles as Assistant Treasurer for Policy at the Office of Connecticut State Treasurer (1999-2010), Deputy |

Assistant Secretary and Acting Assistant Secretary for the Pension and Benefits Welfare Administration at the U.S. Department of Labor (1993-1999), Assistant Director for the American Federation of Labor and Congress of Industrial Organization (1988-1993), and Assistant Director of Research for SEIU. Ms. Miller’s background in investment management, ESG business strategies, and asset stewardship qualify her to serve on our Board of Directors. Board Service: Ms. Miller has been a Member of the Investment Integration Project Advisory Council and currently serves on the nonprofit Board of Directors of For the Long Term. She also previously served on the boards of the Washtenaw Community College Foundation, The Global Reporting Initiative, The Council of Institutional Investors and The Thirty Percent Coalition. |

| | | | | |

Edgar Romney Sr. |

|

Age 82 | |

Director Since July 1995 | |

| Edgar Romney, Sr. briefly became President of Workers United upon its formation in March 2009 and has been its Secretary-Treasurer since July 2009. He is also a member of the General Executive Board of Workers United and Vice President of Service Employees International Union, positions he has held since September 2009. Mr. Romney, Sr. joined the former International Ladies’ Garment Workers’ Union (ILGWU) in 1962 as a shipping clerk. He later became an Organizer and Business Agent with Local 99 ILGWU and, in 1976, was asked to serve as Director of Organization for the largest ILGWU affiliate – Local 23-25. Two years later, he was elected Assistant Manager of Local 23-25, and in 1983, became the local’s Manager-Secretary |

and an ILGWU Vice President. Mr. Romney, Sr. served as Manager-Secretary of Local 23- 25 until 2004, when he became Manager of the New York Metropolitan Area Joint Board, formed by the consolidation of the five local unions that represent apparel workers in the New York area. In 1989, Mr. Romney, Sr. was elected ILGWU Executive Vice President, becoming the first African American to hold that position, and in 1995, he became Executive Vice President of UNITE – the union that grew out of the merger of the ILGWU and ACTWU. He was elected to the position of Secretary-Treasurer of UNITE in 2003. With the merger of UNITE and HERE in 2004, Mr. Romney, Sr. became Executive Vice President of UNITE HERE, a position he held until the separation of UNITE 12 and HERE in 2009. Mr. Romney, Sr. served as Secretary-Treasurer of the Change to Win Coalition from September 2003 until 2009. Mr. Romney, Sr. is the father of Mr. Romney, Jr., who is the Chief Strategy and Administrative Officer. |

| | | | | |

Mr. Romney, Sr. brings to the board an intimate understanding of the Bank’s business, mission, and organization, as well as substantial leadership ability, all of which qualify him to serve on our Board of Directors and enhance his ability to provide valuable perspectives to our discussions and oversight of the Bank. Board Service: Mr. Romney, Sr. continues to serve on numerous boards of directors and is National Secretary of the A. Philip Randolph Institute; Vice President of IndustriALL and the New York State AFL-CIO; and an executive board member of the New York City Central Labor Council and the Workmen’s Circle. Mr. Romney, Sr. is also a Director of Amalgamated Life Insurance Company, a board member of the Sidney Hillman Foundation, and a trustee of each of the Consolidated Retirement Fund and the National Retirement Fund. Mr. Romney, Sr. also serves as Chairman of the Consortium for Worker Education (CWE). |

| | | | | |

Julieta Ross |

|

Age 55 | |

Independent Director Since November 2023 | |

| With over 20 years of global banking technology leadership and experience, Dr. Julieta Ross offers a vast understanding of the broader financial services risk management landscape along with new technology perspectives including building market-leading banking platforms and digital capabilities. Dr. Ross is the Co-Founder and Chief Executive Officer of Okee Labs, an AI startup launched in 2019. She oversees all aspects of the company's operations, including product development, research, and customer acquisition. Prior to this role, Dr. Ross was the Global Chief Technology Officer at Banco Santander from 2017 to 2019, Global Chief Technology Officer at M&T Bank from 2014 to 2017 and held various international roles for Citi (known as |

Citigroup prior to 2007) from 2000 to 2014 ultimately being named Chief Technology Officer for Latin America. She has a proven track record building and scaling businesses, leveraging digital technologies to reduce cost, drive customer experiences and improve productivity. Dr. Ross is a member of Women Corporate Directors (WCD) and of the National Association of Corporate Directors (NACD). She became a NACD Certified Director (NACD.DC) in 2024. She is also NACD certified in Adaptive Governance, Long Term Value Creation, and Financial Oversight. Dr. Ross has also earned her Cyber Risk and Strategy Oversight certification from Diligent Institute in 2023. Board Service: Dr. Ross has served on the boards of public, private, and non-profit companies including Santander Consumer Finance, Mastercard Advisory Board, AAA Western and Central New York, Sheltered Harbor, Roswell Park Comprehensive Cancer Center Technology Committee and Row New York. She has been an advisor, judge and mentor for the Big Ideas Program at the University of California, Berkeley, since 2017. Dr. Ross is a founding member of the Sheltered Harbor Board. |

| | | | | |

Scott Stoll |

|

Age 64 | |

Independent Director Since November 2023 | |

| After working with Ernst & Young LLP (“EY”) for over 36 years, Scott Stoll retired as a partner in 2018. From 2010 to 2018, Mr. Stoll’s role at EY focused on financial services and quality assurance, as he was responsible for EY’s non-audit advisory work at a global systematically important bank while based in San Francisco. From 2004 to 2010, Mr. Stoll’s partner role focused on banking, capital markets and insurance when he played a leadership role in the expansion of Ernst & Young LLP’s financial services consulting capabilities in Zurich, Switzerland. Prior to relocating to Zurich, Mr. Stoll was based in New York from the years 2000 to 2004 where he was one of EY's lead advisory partners serving global banks and insurance/ |

reinsurance companies. Prior to this, Mr. Stoll’s role focused on commercial banking risk management and asset liability management from 1994 to 2000. He founded EY's asset liability management advisory practice and was a founding member of EY's U.S. financial services consulting practice serving numerous super regional banks across the U.S. From 1982 to 1994, Mr. Stoll worked on audit engagements for a variety of public company financial services clients. Mr. Stoll brings to the board his extensive experience at EY working in the banking industry, the insurance industry as well as the asset management industry. Board Service: Since 2019, Mr. Stoll has been serving as the Audit Committee Chair of Farmers Group, Inc., as well as the Audit Committee Chair and member of the Executive Committee of its wholly owned subsidiary Farmers New World Life Insurance Company. Previously, Mr. Stoll was actively involved on the Board of the National Bureau of Asian Research from 2015 to 2020, a non-partisan, not-for-profit research institution whose mission is to inform and strengthen Asian-Pacific policy. During this time, Mr. Stoll was the Treasurer, the Chair of the Finance and Audit Committees and a member of the Executive Committee. Mr. Stoll is a member of the Leadership Council of the Schmidthorst College of Business at his alma mater, Bowling Green State University, where he advises on strategic initiatives, curricula plan, student mentorship and faculty engagement. He previously chaired the Strategic Planning Committee of the Leadership Council. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE ABOVE NOMINEES.

Biographical Information for Our Executive Officers

We have provided biographical information for each of our other executive officers besides Ms. Brown, whose information is provided along with our other directors.

Sam Brown

Age 43

Senior Executive Vice President and Chief Banking Officer

Sam Brown has served as our Senior Executive Vice President and Chief Banking Officer since August 2022. Mr. Brown joined us as Executive Vice President, Business Development in 2014, and in 2015, Mr. Brown became our Executive Vice President, Director of Commercial Banking. Prior to joining us, Mr. Brown served as Director of the White House Business Council in the White House’s Office of Public Engagement, a position he held from 2013 to 2014. As President Barack H. Obama’s liaison to the private sector, Mr. Brown worked on economic policies to help America’s working families and businesses succeed. Before leading the Business Council, Mr. Brown held various positions between 2007 and 2012 serving President Obama. Mr. Brown also served as the founding Chief Operating Officer of Organizing for Action and Finance Chief of Staff for the Obama-Biden 2012 campaign. Mr. Brown holds a bachelor’s degree from University of Southern California.

Jason Darby

Age 53

Senior Executive Vice President and Chief Financial Officer

Jason Darby has served as our Senior Executive Vice President and Chief Financial Officer since May 2021, as our Chief Accounting Officer and Controller and Executive Vice President from 2018 to 2021, and as our Controller and Senior Vice President from 2015 to 2018. Prior to joining us, he held roles at Capital One, Esquire Bank, and North Fork Bank. Early in his career, Mr. Darby spent five years at KPMG and two years at American Express. Mr. Darby is a licensed CPA in New York and holds a bachelor’s degree in accounting from St. Bonaventure University and an M.B.A. from the University of Pittsburgh.

Adrian Glace

Age 48

Senior Vice President and Chief Technology Officer

Adrian Glace has served as our Senior Vice President and Chief Technology Officer since October 2023. He is responsible for the Bank’s technology solutions, strategy, roadmap, and critical technology vendor relationships. He joins Amalgamated Bank from Valley National Bank where he was most recently Director of Product and Platform Engineering from April 2022 to October 2023, focusing on process improvement, platform integration, solution architecture and AML support. Prior to Valley National, Adrian served as the Head of Application Management at Bank Leumi from March 2015 to April 2022, where he was responsible for the digital and customer facing, credit risk, loan origination, compliance, fraud, payments, and core processing platforms. Prior to Leumi, Adrian worked for Fidelity Information Services from April 2002 to March 2015, where he provided technology solutions to banking clients. Adrian holds several IT certifications and has a B.A. in Computer Information Science and Finance from Franciscan University of Steubenville, Ohio. He also holds an M.B.A. in Finance and Operations Management from New York University.

Tyrone Graham

Age 61

Executive Vice President and Chief Human Resources Officer

Tyrone Graham has served as our Executive Vice President and Chief Human Resources Officer since November 2021. Mr. Graham is responsible for Amalgamated’s human resources strategy; a plan focused on building culture and attracting, developing, retaining, and engaging our most valued asset, our colleagues. This includes talent acquisition and development, compensation, benefits, payroll, and internal communications. Prior to joining Amalgamated, Mr. Graham previously served as Senior Vice President of Talent Management at Eastern Bank from

2015 to 2021. He has also held senior HR roles at GE Capital, Sun Life Financial U.S., Bank of America, and Citizens Financial Group. He started his HR career at USTrust Bank, Boston, where he served as Vice President of Corporate Training & Development. Mr. Graham is a graduate of Emmanuel College, Boston, where he received his Bachelor of Science in Business Administration.

Margaret Lanning

Age 71

Executive Vice President and Chief Credit Risk Officer

Margaret Lanning has served as our Executive Vice President, Chief Credit Risk Officer since July 2022. She brings to this role 40 years of extensive leadership experience in credit risk management, credit administration and governance. Ms. Lanning leads the credit risk management of Amalgamated Bank's lending activities and is responsible for the development of a credit culture and credit policies that reflect the risk appetite established by executive management and the board. From 2017 to 2022, Ms. Lanning served as Executive Vice President and Chief Credit Officer at Investors Bank, where she developed and enhanced the bank's credit culture and led the credit risk management for all the bank's lending activities and oversight of the loan portfolios. From 2015 to 2017, Margaret served as Chief Credit Officer at OceanFirst Bank, and prior to that, she spent more than two decades at Wells Fargo in positions of increasing authority in both Commercial Lending and Credit Risk Management. Ms. Lanning was one of the Founding Members of the Women in Banking Conferences in New York and New Jersey and has been a frequent speaker at the events. Over the span of her career, she has been the recipient of numerous awards and accolades for her banking and finance achievements. She is currently a member of the Banking Advisory Board of Moody's and a member of the Advisory Board for the Institute for Women's Leadership at Rutgers University. Margaret most recently was a member of the Board of Trustees for the Liberty Science Center and previously served on the Board of Associates of Randolph-Macon College.

Ina Narula

Age 49

Executive Vice President and Chief Risk Officer

Ina Narula has served as Executive Vice President, Chief Risk Officer (CRO) since April 2023. As CRO, Ms. Narula oversees all risk management practices, which safeguard our customers, investors, reputation, and assets. A 20-year veteran in the financial services industry, Ms. Narula brings extensive experience in risk management and in-depth knowledge of the banking industry. Before joining Amalgamated, from 2017 to 2023, Ms. Narula acted as chief risk officer in Supervision & Regulation for the Federal Reserve Bank of New York where she strengthened risk management practices to ensure the safety and soundness of financial institutions in New York State. She has also held risk management positions at Deutsche Bank and American Express, as well as audit and analysis positions at Proctor & Gamble, Fifth Third Bank, and Federal Mogul. She holds a bachelor's degree in business administration from the University of Delhi and is a certified public accountant.

Edgar Romney, Jr.

Age 45

Executive Vice President and Chief Strategy and Administrative Officer

Edgar Romney Jr., has served as the Bank's Executive Vice President, Chief Strategy and Administrative Officer since April, 2023. Mr. Romney is responsible for leading the Bank's strategic agenda, assisting the CEO in evaluating strategic growth opportunities, overseeing progress on key business goals, and leading innovation to maintain the Bank's competitiveness. In addition, Mr. Romney is tasked with serving as the spokesperson for communicating enterprise strategy to key stakeholders. He previously served as the Interim Chief Audit Executive from April 2024 to October of 2024 while the Company searched to fill this role. Prior to this role, he served as the Bank's Chief Revenue Officer from 2022 to 2023, in this role, Mr. Romney was responsible for the execution of the business strategy for deposit, lending and investment portfolios as well as achieving budget goals for the Bank's banking and investment team. From 2018 to 2022, Mr. Romney also held the role of Regional Sales Director, leading the Bank's commercial sales team in the northeast. Lastly, in his 16 years with the bank, Mr. Romney also

held the role of Chief Risk and Compliance Officer and Deputy General Counsel. Mr. Romney received his J.D. from St. John's University School of Law and his Bachelor's Degree from Cornell University.

Sean Searby

Age 43

Executive Vice President and Chief Operations Officer

Sean Searby served as our Executive Vice President, Chief Operations Officer from April of 2022 until February of 2025, when he became our Executive Vice President, Chief Information and Operations Officer. He was our Executive Vice President, Operations and Program Management from 2020 to 2022. Prior to that, he served as the Director of Product Management from 2018 to 2020, and as the Director of Product & Client Services within Commercial Banking from 2015 to 2018. Before joining us, Mr. Searby worked in Global Transaction Banking at HSBC on the USD Clearing Team, providing foreign financial institutions and multinational corporations access to the USD market. Before HSBC, Mr. Searby was in the Strategic Planning Group at Cathay Bank. Earlier in his career, he held a number of positions in Product Management, Service and Operations within Transaction Banking.

Mandy Tenner

Age 45

Executive Vice President and Chief Legal Officer

Mandy Tenner has served as our Executive Vice President and Chief Legal Officer, since December 2023, previously having held the title of Executive Vice President and General Counsel since April 2022. Before that she served as our Deputy General Counsel from April 2018 to April 2022, and as our Assistant General Counsel from April 2016 until April 2018. Before joining us, she served as counsel for ContourGlobal, a global power company from November 2010 to March 2016. Earlier in her career, she worked at Guggenheim Partners in their Leveraged Debt Group. She holds a bachelor's degree in History and Political Science from Brandeis University, an M.A. in French from Middlebury College, and a J.D. degree from Brooklyn Law School. She currently sits on the Advisory Board of Bank on Women.

Leslie Veluswamy

Age 40

Executive Vice President and Chief Accounting Officer

Leslie Veluswamy has served as our Executive Vice President and Chief Accounting Officer since November 2022. Previously, she served as the Senior Vice President and Chief Accounting Officer at Dime Community Bancshares, Inc. ("DCB") from 2019 until 2022. Prior to that, Ms. Veluswamy served as Senior Vice President and Director of Financial Reporting at DCB from 2016 to 2019. Ms. Veluswamy is a licensed CPA in New York and holds a B.S. in Accounting and a Master's degree in Accounting from the University of Florida.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information about the beneficial ownership of our common stock as of March 26, 2025, the record date:

•each person known to us to be the beneficial owner of more than 5% of our common stock;

•each Named Executive Officer;

•each of our directors;

•each of our director nominees; and

•all of our executive officers and directors as a group.

Unless otherwise noted in the footnotes below, the address of each beneficial owner listed in the table is c/o Amalgamated Financial Corp., 275 Seventh Avenue, New York, New York 10001. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the tables below have sole voting and investment power with respect to all shares of our common stock that they beneficially own, subject to applicable community property laws. We have based our calculation of the percentage of beneficial ownership on 30,687,354 shares of our common stock outstanding as of March 26, 2025.

In computing the number of shares of our common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding their restricted stock and restricted stock units that will vest within 60 days of March 26, 2025, as well as shares of our common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of March 26, 2025. We, however, did not deem these shares outstanding for the purpose of computing the percentage ownership of any other person.

| | | | | | | | |

| Shares of Common Stock Beneficially Owned |

| Name of Beneficial Owner | Number | Percentage |

| Named Executive Officers, Directors, and Director Nominees |

Priscilla Sims Brown(1) | 159,349.80 | * |

| | |

Jason Darby(1) | 35,623.36 | * |

Sam Brown(1) | 22,817.33 | * |

Sean Searby(1) | 4,068.18 | * |

Mandy Tenner(1) | 5,225 | * |

Lynne P. Fox(2)(3) | 17,735 | * |

Maryann Bruce(3) | 18,319 | * |

Mark A. Finser(3) | 16,521 | * |

JoAnn S. Lilek(3) | 10,278 | * |

Darrell Jackson(3) | 8,140 | * |

Julie Kelly(2)(3)(4) | 14,681 | * |

Meredith Miller(3) | 5,393 | * |

Robert G. Romasco(2)(3) | 36,120 | * |

Edgar Romney Sr.(2)(3) | 14,681 | * |

Julieta Ross | 1,954 | * |

Scott Stoll | 1,954 | * |

All directors and executive officers as a group (22 persons) | 396,770.36 | 1.29% |

| | |

| Greater than 5% Stockholders | | |

Workers United Related Parties(5) | 11,471,913.98 | 37.38% |

Blackrock, Inc.(6) | 1,679,568 | 5.47% |

* Represents less than 1% of total outstanding shares, including exercisable options.

(1)In addition to the shares of common stock included in the table above, our NEOs also hold unvested PRSUs which vest outside of 60 days subject to the achievement of corporate goals. A summary of unvested PRSUs follows:

| | | | | | | | | | | | | | |

| Name | Minimum Number of Units That Will Vest | Number of Units That Will Vest at Target Performance | Maximum Number of Units That Will Vest |

| Priscilla Sims Brown | 0 | 106,017 | 159,026 |

| Jason Darby | 0 | 22,324 | 33,486 |

| Sam Brown | 0 | 19,432 | 29,148 |

| Sean Searby | 0 | 11,180 | 16,770 |

| Mandy Tenner | 0 | 10,819 | 16,229 |