1 Amalgamated Financial Corp. Renewables Lending Portfolio Presentation November 2025

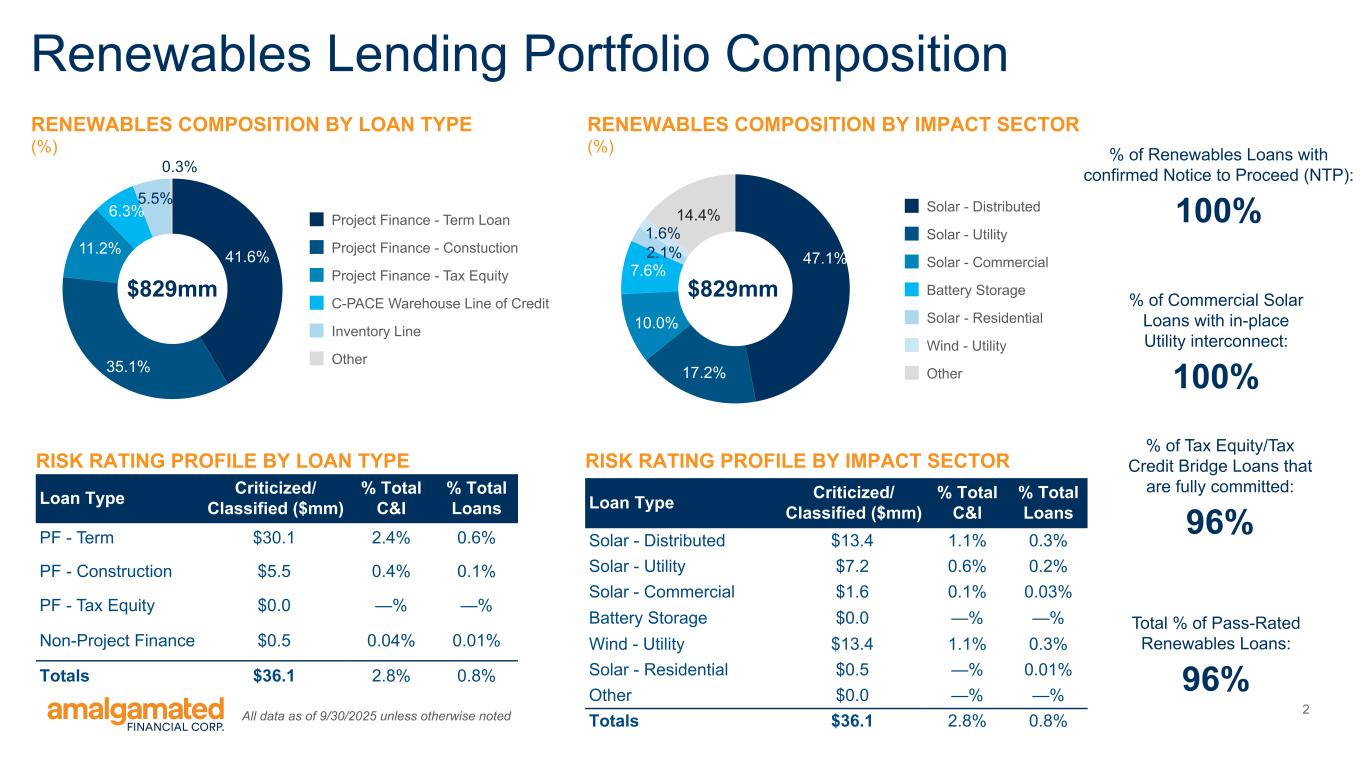

2 41.6% 35.1% 11.2% 6.3% 5.5% 0.3% Project Finance - Term Loan Project Finance - Constuction Project Finance - Tax Equity C-PACE Warehouse Line of Credit Inventory Line Other Renewables Lending Portfolio Composition RENEWABLES COMPOSITION BY LOAN TYPE (%) $829mm RISK RATING PROFILE BY LOAN TYPE Loan Type Criticized/ Classified ($mm) % Total C&I % Total Loans PF - Term $30.1 2.4% 0.6% PF - Construction $5.5 0.4% 0.1% PF - Tax Equity $0.0 —% —% Non-Project Finance $0.5 0.04% 0.01% Totals $36.1 2.8% 0.8% 47.1% 17.2% 10.0% 7.6% 2.1% 1.6% 14.4% Solar - Distributed Solar - Utility Solar - Commercial Battery Storage Solar - Residential Wind - Utility Other $829mm RENEWABLES COMPOSITION BY IMPACT SECTOR (%) RISK RATING PROFILE BY IMPACT SECTOR Loan Type Criticized/ Classified ($mm) % Total C&I % Total Loans Solar - Distributed $13.4 1.1% 0.3% Solar - Utility $7.2 0.6% 0.2% Solar - Commercial $1.6 0.1% 0.03% Battery Storage $0.0 —% —% Wind - Utility $13.4 1.1% 0.3% Solar - Residential $0.5 —% 0.01% Other $0.0 —% —% Totals $36.1 2.8% 0.8% Total % of Pass-Rated Renewables Loans: 96% % of Renewables Loans with confirmed Notice to Proceed (NTP): 100% % of Commercial Solar Loans with in-place Utility interconnect: 100% % of Tax Equity/Tax Credit Bridge Loans that are fully committed: 96% All data as of 9/30/2025 unless otherwise noted

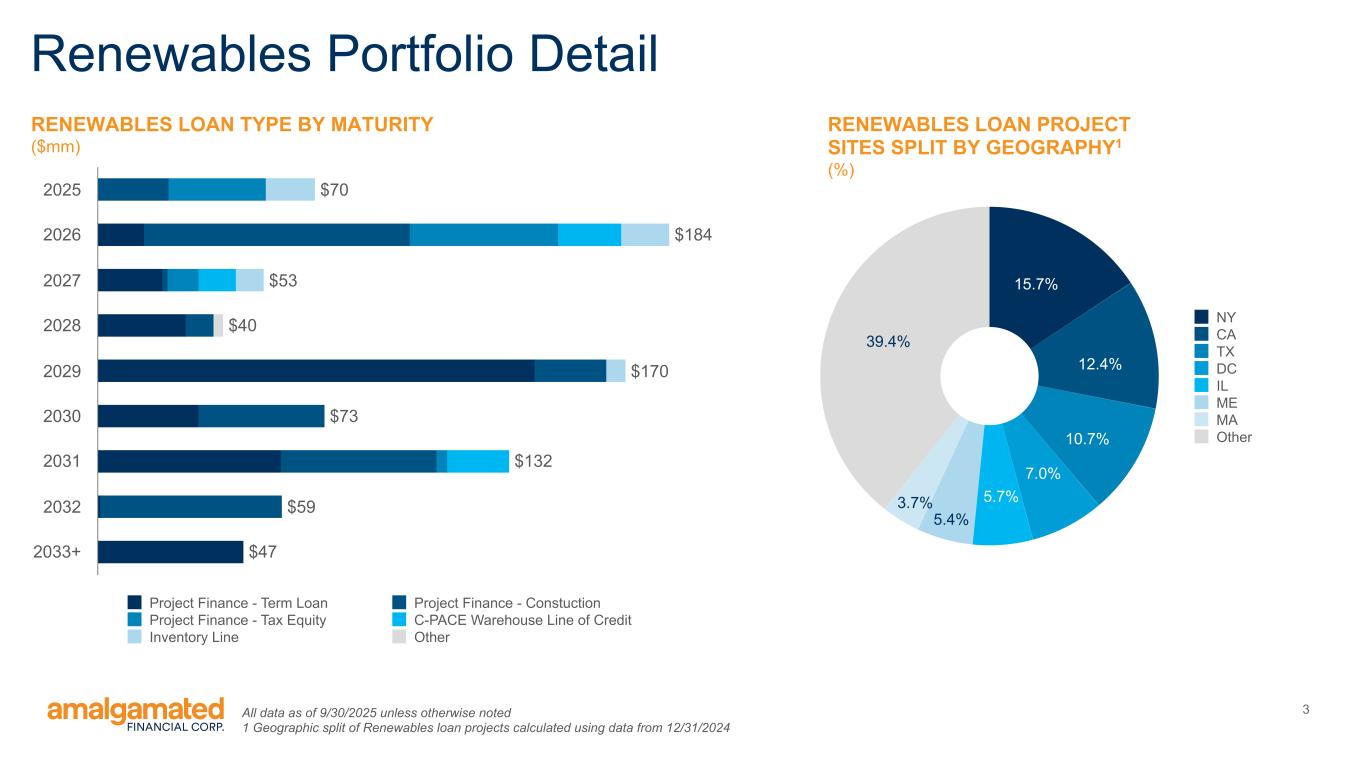

3 15.7% 12.4% 10.7% 7.0% 5.7% 5.4% 3.7% 39.4% NY CA TX DC IL ME MA Other Renewables Portfolio Detail RENEWABLES LOAN PROJECT SITES SPLIT BY GEOGRAPHY1 (%) RENEWABLES LOAN TYPE BY MATURITY ($mm) $70 $184 $53 $40 $170 $73 $132 $59 $47 Project Finance - Term Loan Project Finance - Constuction Project Finance - Tax Equity C-PACE Warehouse Line of Credit Inventory Line Other 2025 2026 2027 2028 2029 2030 2031 2032 2033+ All data as of 9/30/2025 unless otherwise noted 1 Geographic split of Renewables loan projects calculated using data from 12/31/2024