Blue Owl Capital Inc. Fourth Quarter 2025 Earnings February 5, 2026

2 About Blue Owl Blue Owl (NYSE: OWL) is a leading asset manager that is redefining alternatives®. With over $307 billion in assets under management as of December 31, 2025, we invest across three multi-strategy platforms: Credit, Real Assets and GP Strategic Capital. Anchored by a strong permanent capital base, we provide businesses with private capital solutions to drive long-term growth and offer institutional investors, individual investors, and insurance companies differentiated alternative investment opportunities that aim to deliver strong performance, risk-adjusted returns, and capital preservation. Together with approximately 1,365 experienced professionals globally, Blue Owl brings the vision and discipline to create the exceptional. To learn more, visit www.blueowl.com. Forward-Looking Statements Certain statements made in this presentation are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this presentation, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Blue Owl’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Any such forward-looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and speak only as of the date of this presentation. Blue Owl assumes no obligation to update or revise any such forward-looking statements except as required by law. Important factors, among others, that may affect actual results or outcomes include the inability to recognize the anticipated benefits of acquisitions; costs related to acquisitions; the inability to maintain the listing of Blue Owl’s shares on the New York Stock Exchange; Blue Owl’s ability to manage growth; Blue Owl’s ability to execute its business plan and meet its projections; potential litigation involving Blue Owl; changes in applicable laws or regulations; and the possibility that Blue Owl may be adversely affected by other economic, business, geopolitical and competitive factors. The information contained in this presentation is summary information that is intended to be considered in the context of Blue Owl’s filings with the Securities and Exchange Commission (“SEC”) and other public announcements that Blue Owl may make, by press release or otherwise, from time to time. Blue Owl also uses its website, its corporate X account (@BlueOwlCapital or www.x.com/BlueOwlCapital) and its corporate LinkedIn account (www.linkedin.com/company/blue-owl-capital) to distribute company information, including assets under management and performance information, and such information may be deemed material. Accordingly, investors should monitor Blue Owl’s website (www.blueowl.com), any alerts and social media channels. Blue Owl undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this presentation. These materials contain information about Blue Owl and its affiliates and certain of their respective personnel and affiliates, information about their respective historical performance and general information about the market. You should not view information related to the past performance of Blue Owl or information about the market, as indicative of future results, the achievement of which cannot be assured. Throughout this presentation, all current period amounts are preliminary and unaudited. Totals may not sum due to rounding. Disclosures

3 Disclosures Non-GAAP Financial Measures; Other Financial and Operational Data This presentation includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. Blue Owl believes that the use of these non-GAAP financial measures provides an additional tool for investors and potential investors to use in evaluating its ongoing operating results and trends. These non-GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. See the footnotes on the slides where these measures are discussed and reconciled to the most directly comparable GAAP measures. Exact net IRRs and multiples cannot be calculated for individual investments held by Blue Owl’s products, or a subset of such investments, due to the lack of a mechanism to precisely allocate fees, taxes, transaction costs, expenses and general partner carried interest. Valuations are as of the dates provided herein and do not take into account subsequent events, including the impact of inflation and rising interest rates, which can be expected to have an adverse effect on certain entities identified or contemplated herein. For the definitions of certain terms used in this presentation, please refer to the “Defined Terms” slides in the appendix. Important Notice No representations or warranties, express or implied are given in, or in respect of, this presentation. To the fullest extent permitted by law, in no circumstances will Blue Owl or any of its subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. This presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Blue Owl. Viewers of this presentation should each make their own evaluation of Blue Owl and of the relevance and adequacy of the information contained herein and should make sure other investigations as they deem necessary. This communication does not constitute an offer to sell, or the solicitation of an offer to buy or sell, any securities, investment funds, vehicles or accounts, investment advice or any other service by Blue Owl or any of its affiliates or subsidiaries. Nothing in this presentation constitutes the provision of tax, accounting, financial, investment, regulatory, legal or other advice by Blue Owl or its advisors. Industry and Market Data This presentation may contain information obtained from third parties, including ratings from credit ratings agencies such as Fitch, Moody's and Standard & Poor’s Ratings. Such information has not been independently verified and, accordingly, Blue Owl makes no representation or warranty in respect of this information. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice. Copyright© Blue Owl Capital Inc. 2026. All rights reserved.

4 • Equity fundraise $42.0 billion, over 50% increase from 2024 • Institutional equity fundraise $24.7 billion, 80% increase from 2024 • Fundraising for wealth dedicated products up 58% from 2024 • Net fundraising for wealth dedicated products up 38% from 2024 • Held first close of ODIT2 during the 4th quarter for $1.7 billion • To date, OWLCX is one of the largest interval fund launches and has already surpassed $1.25 billion raised in 2025 • Blue Owl Digital Infrastructure Fund III hit hard cap of $7 billion in 2025 • $4.5 billion raised to date in 2025 for the seventh vintage net lease product (60% of targeted hard cap) Key Highlights from 2025 Fundraising Success Across Business • Credit • OCIC 10.1% gross return for 2025 • OTIC 11.0% gross return for 2025 • ASOF VIII3,7 18.8% gross IRR • Real Assets • OREF IV4 17.8% gross IRR • ORENT5 13.4% gross return for 2025 • BODI I6 15.1% gross IRR • GP Strategic Capital • Blue Owl GP Stakes III7 28.3% gross IRR Strong Returns Across OWL Products1 Note 1. Includes non-traded BDCs and real estate investment trust, as well as the most mature product for specific strategies listed on the Product Performance slide (excludes products that have been deploying capital for less than two years as such information is generally not meaningful). Gross returns are presented for the year ended December 31, 2025. Net returns for OCIC, OTIC and ORENT were 7.4%, 8.4% and 10.9% for the year ended December 31, 2025, respectively. Net IRR since inception as of December 31, 2025, unless otherwise noted, for ASOF VIII, OREF IV, BODI I and Blue Owl GP Stakes III were 14.1%, 15.4%, 11.5% and 22.0%, respectively. Note 2. "ODIT" refers to Blue Owl Digital Infrastructure Trust. Note 3. "ASOF" refers to Atalaya Special Opportunities Fund. Note 4. "OREF" refers to Blue Owl Real Estate Fund. Note 5. “ORENT” refers to Blue Owl Real Estate Net Lease Trust, gross and net returns calculated for Class I shares. Note 6. "BODI" refers to Blue Owl Digital Infrastructure Fund, gross IRR and net IRR is presented on a realized basis through December 31, 2025. Note 7. Information for these vehicles is presented on a quarter lag. Past performance is not a guarantee of future results.

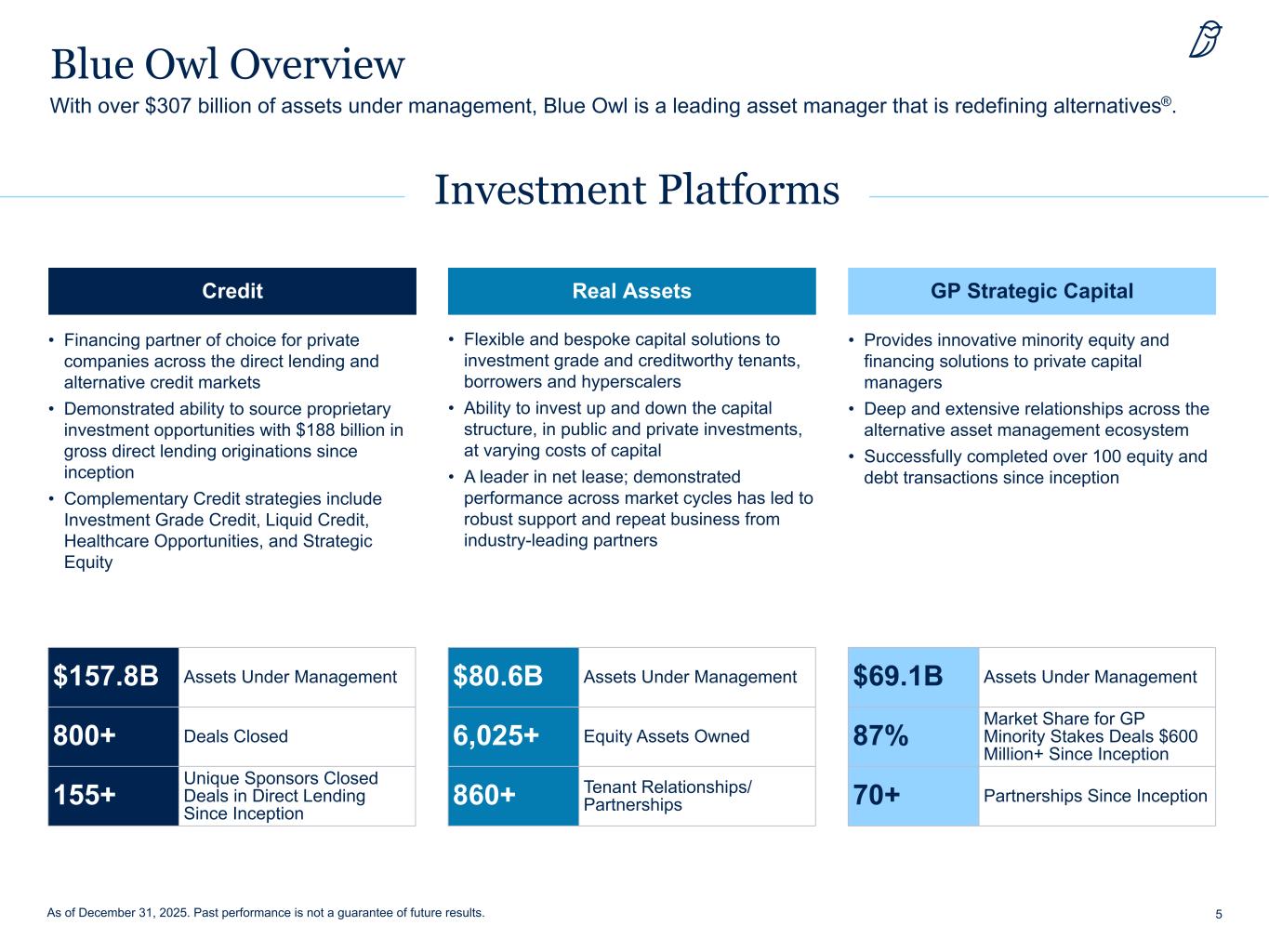

5As of December 31, 2025. Past performance is not a guarantee of future results. Blue Owl Overview With over $307 billion of assets under management, Blue Owl is a leading asset manager that is redefining alternatives®. • Provides innovative minority equity and financing solutions to private capital managers • Deep and extensive relationships across the alternative asset management ecosystem • Successfully completed over 100 equity and debt transactions since inception • Financing partner of choice for private companies across the direct lending and alternative credit markets • Demonstrated ability to source proprietary investment opportunities with $188 billion in gross direct lending originations since inception • Complementary Credit strategies include Investment Grade Credit, Liquid Credit, Healthcare Opportunities, and Strategic Equity GP Strategic CapitalCredit • Flexible and bespoke capital solutions to investment grade and creditworthy tenants, borrowers and hyperscalers • Ability to invest up and down the capital structure, in public and private investments, at varying costs of capital • A leader in net lease; demonstrated performance across market cycles has led to robust support and repeat business from industry-leading partners Real Assets Investment Platforms $157.8B Assets Under Management 800+ Deals Closed 155+ Unique Sponsors Closed Deals in Direct Lending Since Inception $69.1B Assets Under Management 87% Market Share for GP Minority Stakes Deals $600 Million+ Since Inception 70+ Partnerships Since Inception $80.6B Assets Under Management 6,025+ Equity Assets Owned 860+ Tenant Relationships/ Partnerships

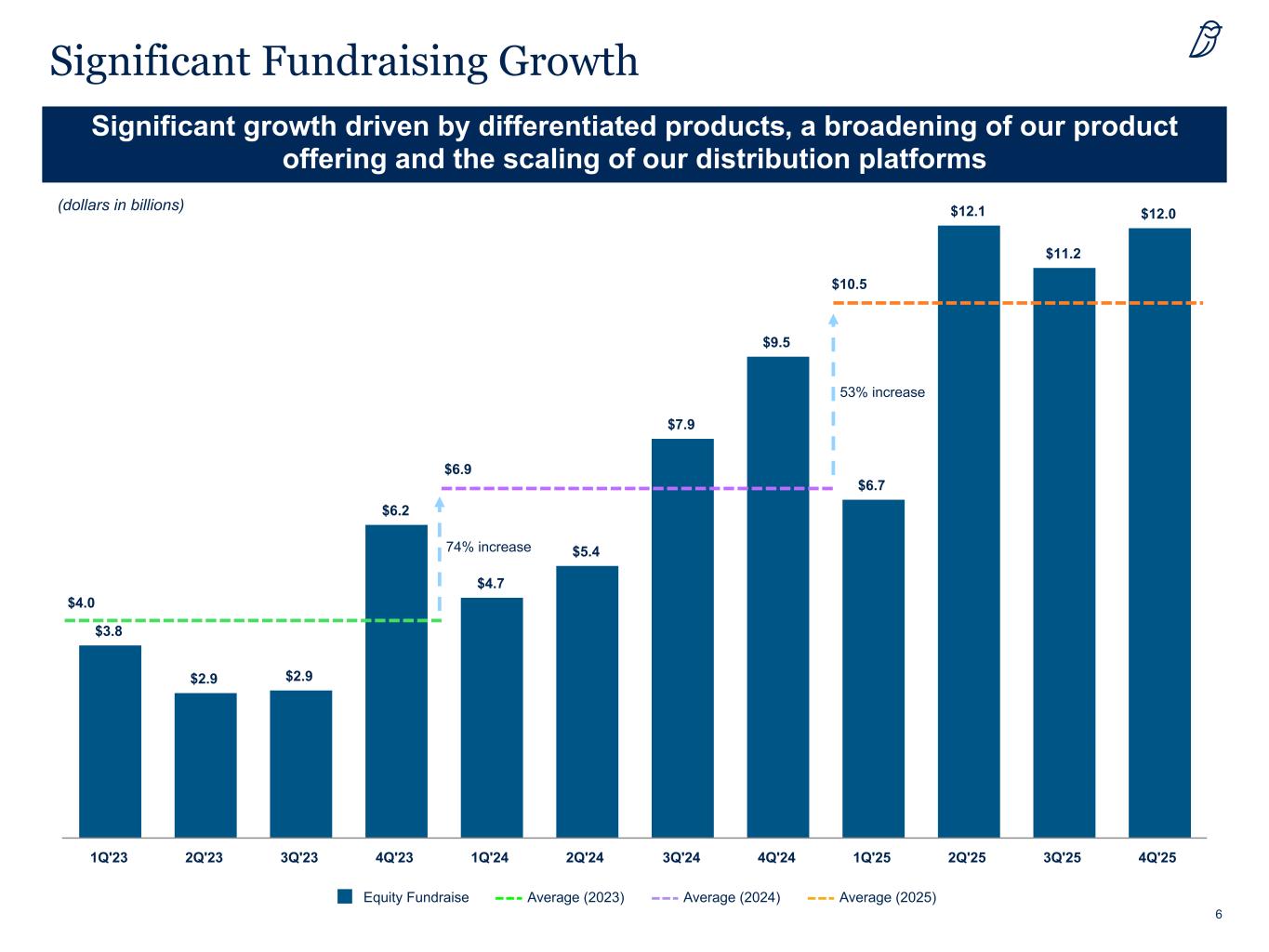

6 Significant growth driven by differentiated products, a broadening of our product offering and the scaling of our distribution platforms Significant Fundraising Growth $3.8 $2.9 $2.9 $6.2 $4.7 $5.4 $7.9 $9.5 $6.7 $12.1 $11.2 $12.0 Equity Fundraise Average (2023) Average (2024) Average (2025) 1Q'23 2Q'23 3Q'23 4Q'23 1Q'24 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 (dollars in billions) $4.0 $6.9 $10.5 74% increase 53% increase

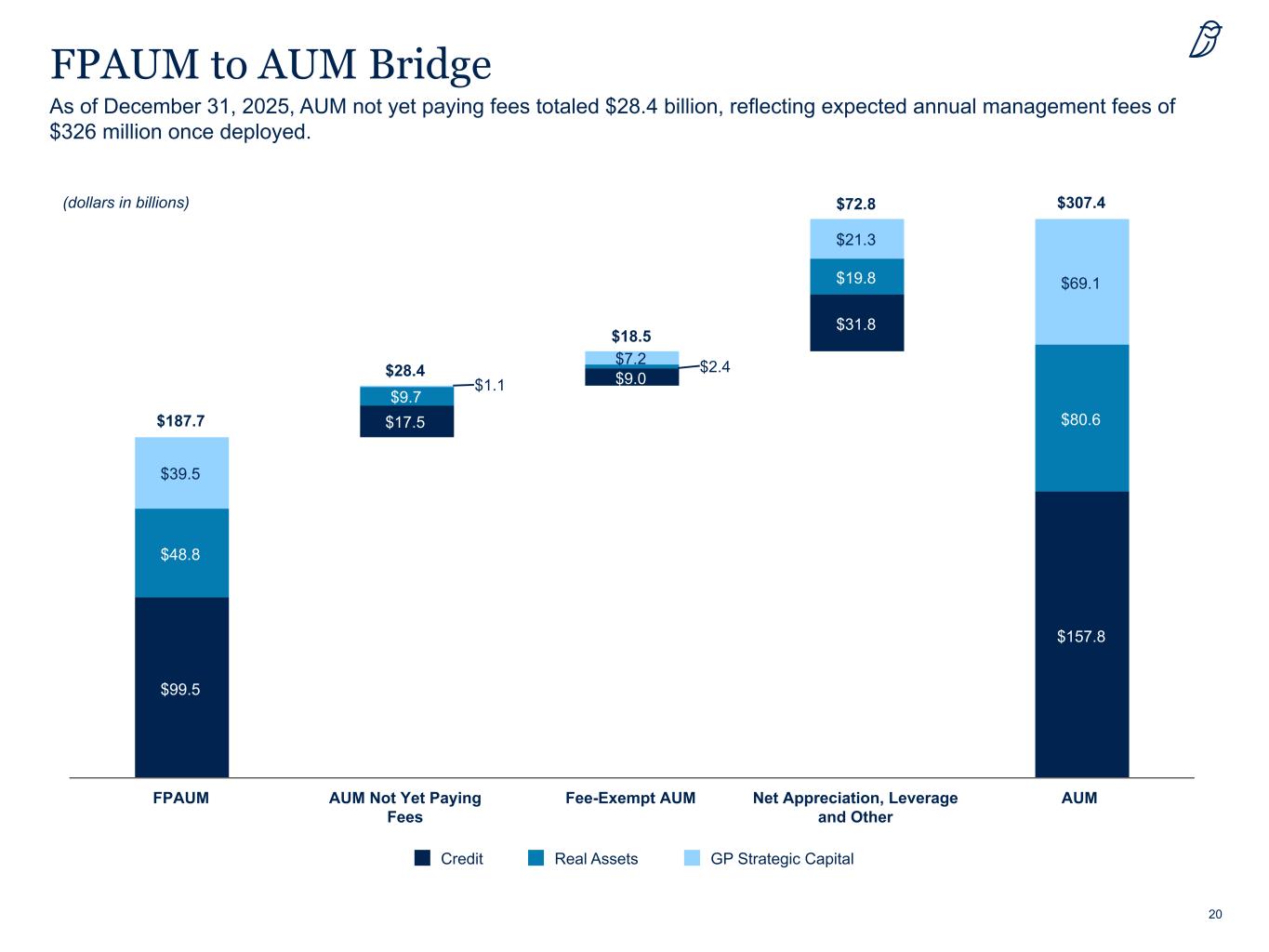

7 Fourth Quarter 2025 Highlights Financial Results • GAAP Net Income of $47.7 million, or $0.07 per basic and $0.07 per diluted Class A Share • Fee-Related Earnings of $416.6 million, or $0.27 per Adjusted Share • Distributable Earnings of $382.5 million, or $0.24 per Adjusted Share Capital Metrics • AUM of $307.4 billion, up 22% since December 31, 2024 ◦ FPAUM of $187.7 billion, up 17% since December 31, 2024 ◦ Permanent Capital of $222.8 billion, up 16% since December 31, 2024 ◦ AUM Not Yet Paying Fees of $28.4 billion, reflecting expected annual management fees of approximately $326 million once deployed • New Capital Commitments Raised of $17.3 billion ($12.0 billion new equity capital) in the quarter • FPAUM Raised and Deployed of $10.1 billion in the quarter Corporate For information on and reconciliation of the Company's non-GAAP measures, please see slides 27 to 31. • Annual Dividend of $0.92 per Class A Share announced for 2026 ($0.23 per share per quarter) ◦ Dividend of $0.225 per Class A Share declared for the fourth quarter • Share Repurchases of 3.6 million OWL shares for $52.0 million in the quarter

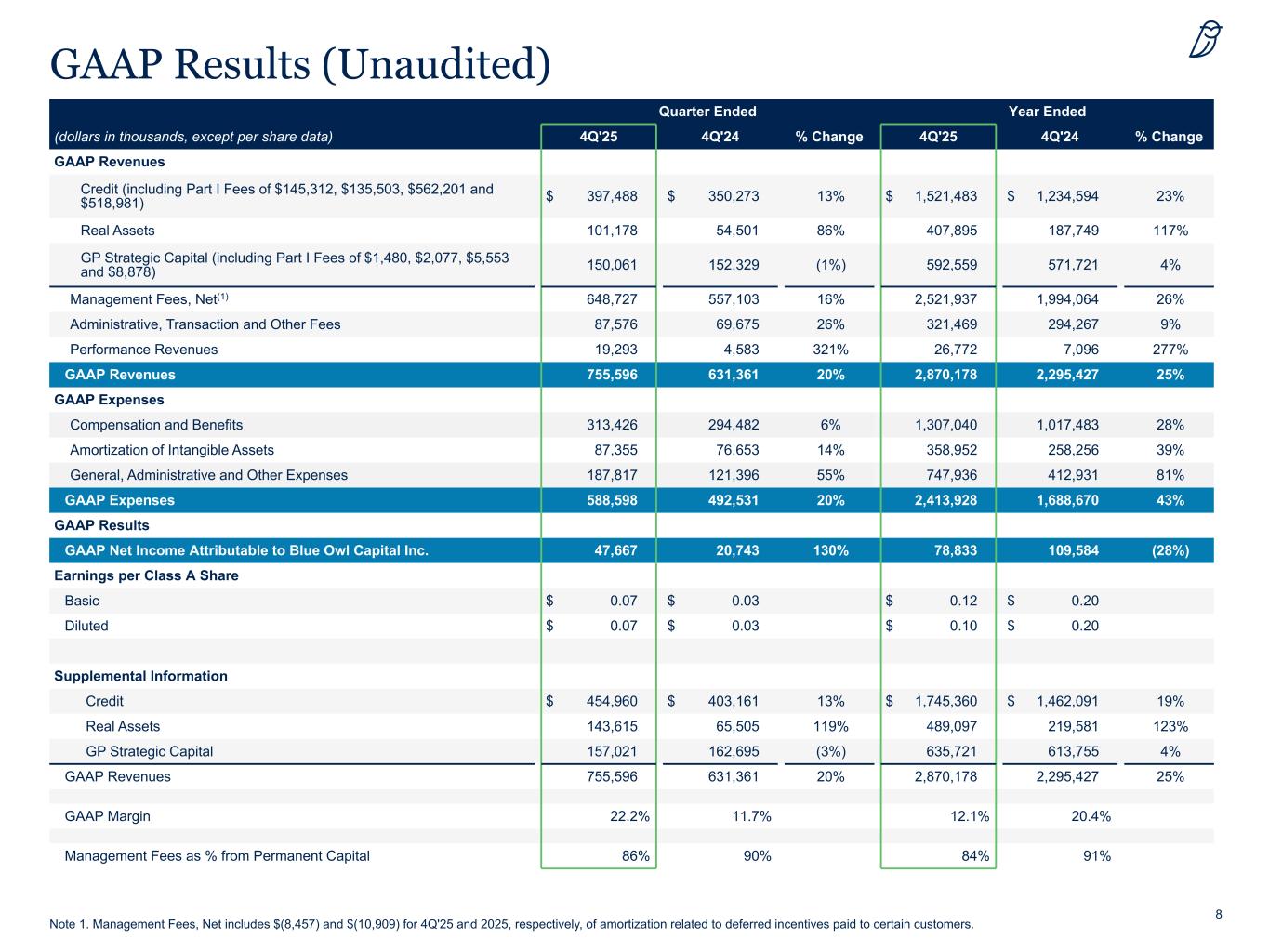

8 GAAP Results (Unaudited) Quarter Ended Year Ended (dollars in thousands, except per share data) 4Q'25 4Q'24 % Change 4Q'25 4Q'24 % Change GAAP Revenues Credit (including Part I Fees of $145,312, $135,503, $562,201 and $518,981) $ 397,488 $ 350,273 13% $ 1,521,483 $ 1,234,594 23% Real Assets 101,178 54,501 86% 407,895 187,749 117% GP Strategic Capital (including Part I Fees of $1,480, $2,077, $5,553 and $8,878) 150,061 152,329 (1%) 592,559 571,721 4% Management Fees, Net(1) 648,727 557,103 16% 2,521,937 1,994,064 26% Administrative, Transaction and Other Fees 87,576 69,675 26% 321,469 294,267 9% Performance Revenues 19,293 4,583 321% 26,772 7,096 277% GAAP Revenues 755,596 631,361 20% 2,870,178 2,295,427 25% GAAP Expenses Compensation and Benefits 313,426 294,482 6% 1,307,040 1,017,483 28% Amortization of Intangible Assets 87,355 76,653 14% 358,952 258,256 39% General, Administrative and Other Expenses 187,817 121,396 55% 747,936 412,931 81% GAAP Expenses 588,598 492,531 20% 2,413,928 1,688,670 43% GAAP Results GAAP Net Income Attributable to Blue Owl Capital Inc. 47,667 20,743 130% 78,833 109,584 (28%) Earnings per Class A Share Basic $ 0.07 $ 0.03 $ 0.12 $ 0.20 Diluted $ 0.07 $ 0.03 $ 0.10 $ 0.20 Supplemental Information Credit $ 454,960 $ 403,161 13% $ 1,745,360 $ 1,462,091 19% Real Assets 143,615 65,505 119% 489,097 219,581 123% GP Strategic Capital 157,021 162,695 (3%) 635,721 613,755 4% GAAP Revenues 755,596 631,361 20% 2,870,178 2,295,427 25% GAAP Margin 22.2% 11.7% 12.1% 20.4% Management Fees as % from Permanent Capital 86% 90% 84% 91% Note 1. Management Fees, Net includes $(8,457) and $(10,909) for 4Q'25 and 2025, respectively, of amortization related to deferred incentives paid to certain customers.

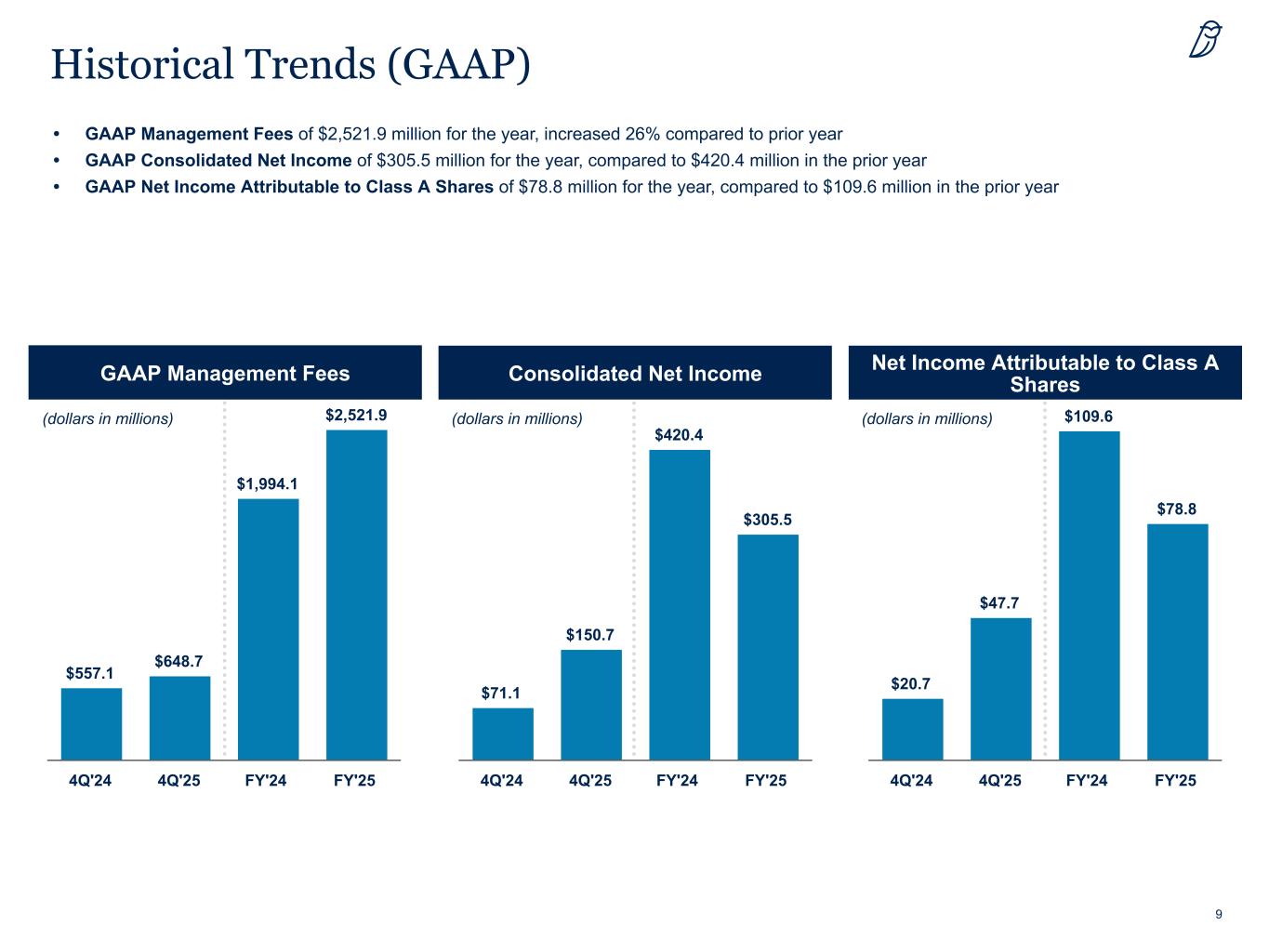

9 Historical Trends (GAAP) • GAAP Management Fees of $2,521.9 million for the year, increased 26% compared to prior year • GAAP Consolidated Net Income of $305.5 million for the year, compared to $420.4 million in the prior year • GAAP Net Income Attributable to Class A Shares of $78.8 million for the year, compared to $109.6 million in the prior year GAAP Management Fees Net Income Attributable to Class A SharesConsolidated Net Income (dollars in millions) (dollars in millions) (dollars in millions) $557.1 $648.7 $1,994.1 $2,521.9 4Q'24 4Q'25 FY'24 FY'25 $20.7 $47.7 $109.6 $78.8 4Q'24 4Q'25 FY'24 FY'25 $71.1 $150.7 $420.4 $305.5 4Q'24 4Q'25 FY'24 FY'25

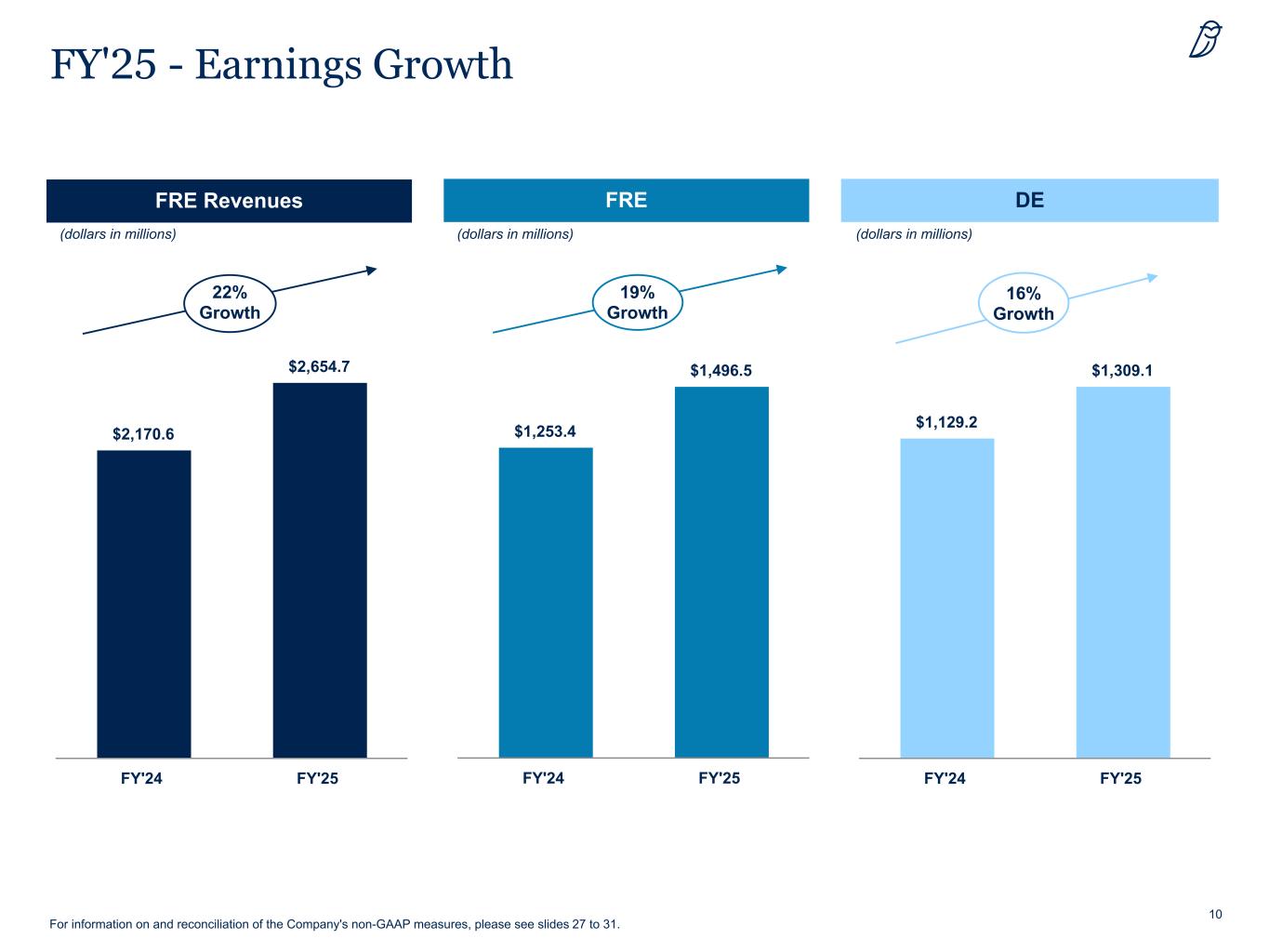

10 FY'25 - Earnings Growth 22% Growth 19% Growth 16% Growth $2,170.6 $2,654.7 FY'24 FY'25 $1,129.2 $1,309.1 FY'24 FY'25 $1,253.4 $1,496.5 FY'24 FY'25 FRE DEFRE Revenues For information on and reconciliation of the Company's non-GAAP measures, please see slides 27 to 31. (dollars in millions) (dollars in millions)(dollars in millions)

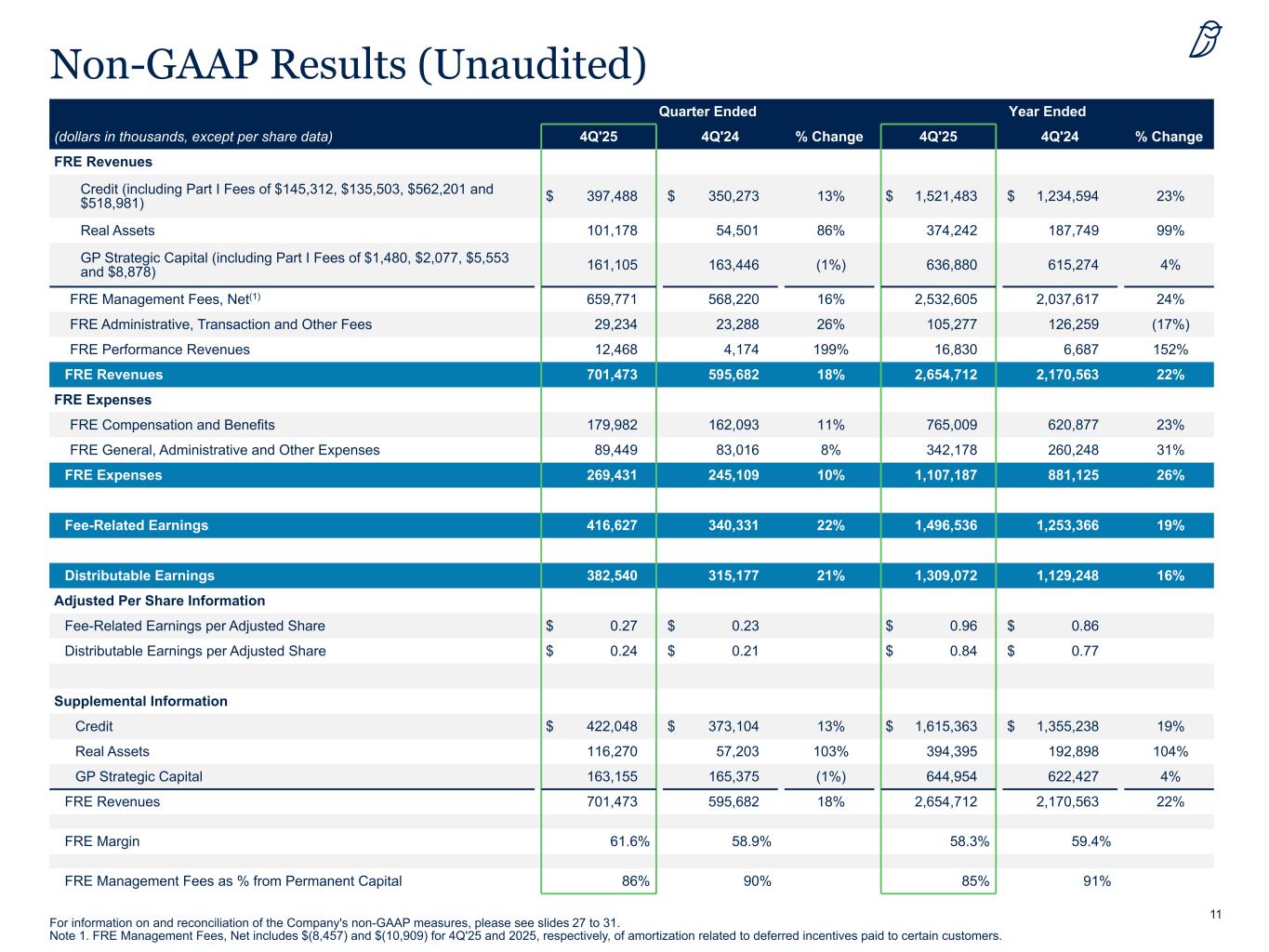

11 Non-GAAP Results (Unaudited) Quarter Ended Year Ended (dollars in thousands, except per share data) 4Q'25 4Q'24 % Change 4Q'25 4Q'24 % Change FRE Revenues Credit (including Part I Fees of $145,312, $135,503, $562,201 and $518,981) $ 397,488 $ 350,273 13% $ 1,521,483 $ 1,234,594 23% Real Assets 101,178 54,501 86% 374,242 187,749 99% GP Strategic Capital (including Part I Fees of $1,480, $2,077, $5,553 and $8,878) 161,105 163,446 (1%) 636,880 615,274 4% FRE Management Fees, Net(1) 659,771 568,220 16% 2,532,605 2,037,617 24% FRE Administrative, Transaction and Other Fees 29,234 23,288 26% 105,277 126,259 (17%) FRE Performance Revenues 12,468 4,174 199% 16,830 6,687 152% FRE Revenues 701,473 595,682 18% 2,654,712 2,170,563 22% FRE Expenses FRE Compensation and Benefits 179,982 162,093 11% 765,009 620,877 23% FRE General, Administrative and Other Expenses 89,449 83,016 8% 342,178 260,248 31% FRE Expenses 269,431 245,109 10% 1,107,187 881,125 26% Fee-Related Earnings 416,627 340,331 22% 1,496,536 1,253,366 19% Distributable Earnings 382,540 315,177 21% 1,309,072 1,129,248 16% Adjusted Per Share Information Fee-Related Earnings per Adjusted Share $ 0.27 $ 0.23 $ 0.96 $ 0.86 Distributable Earnings per Adjusted Share $ 0.24 $ 0.21 $ 0.84 $ 0.77 Supplemental Information Credit $ 422,048 $ 373,104 13% $ 1,615,363 $ 1,355,238 19% Real Assets 116,270 57,203 103% 394,395 192,898 104% GP Strategic Capital 163,155 165,375 (1%) 644,954 622,427 4% FRE Revenues 701,473 595,682 18% 2,654,712 2,170,563 22% FRE Margin 61.6% 58.9% 58.3% 59.4% FRE Management Fees as % from Permanent Capital 86% 90% 85% 91% For information on and reconciliation of the Company's non-GAAP measures, please see slides 27 to 31. Note 1. FRE Management Fees, Net includes $(8,457) and $(10,909) for 4Q'25 and 2025, respectively, of amortization related to deferred incentives paid to certain customers.

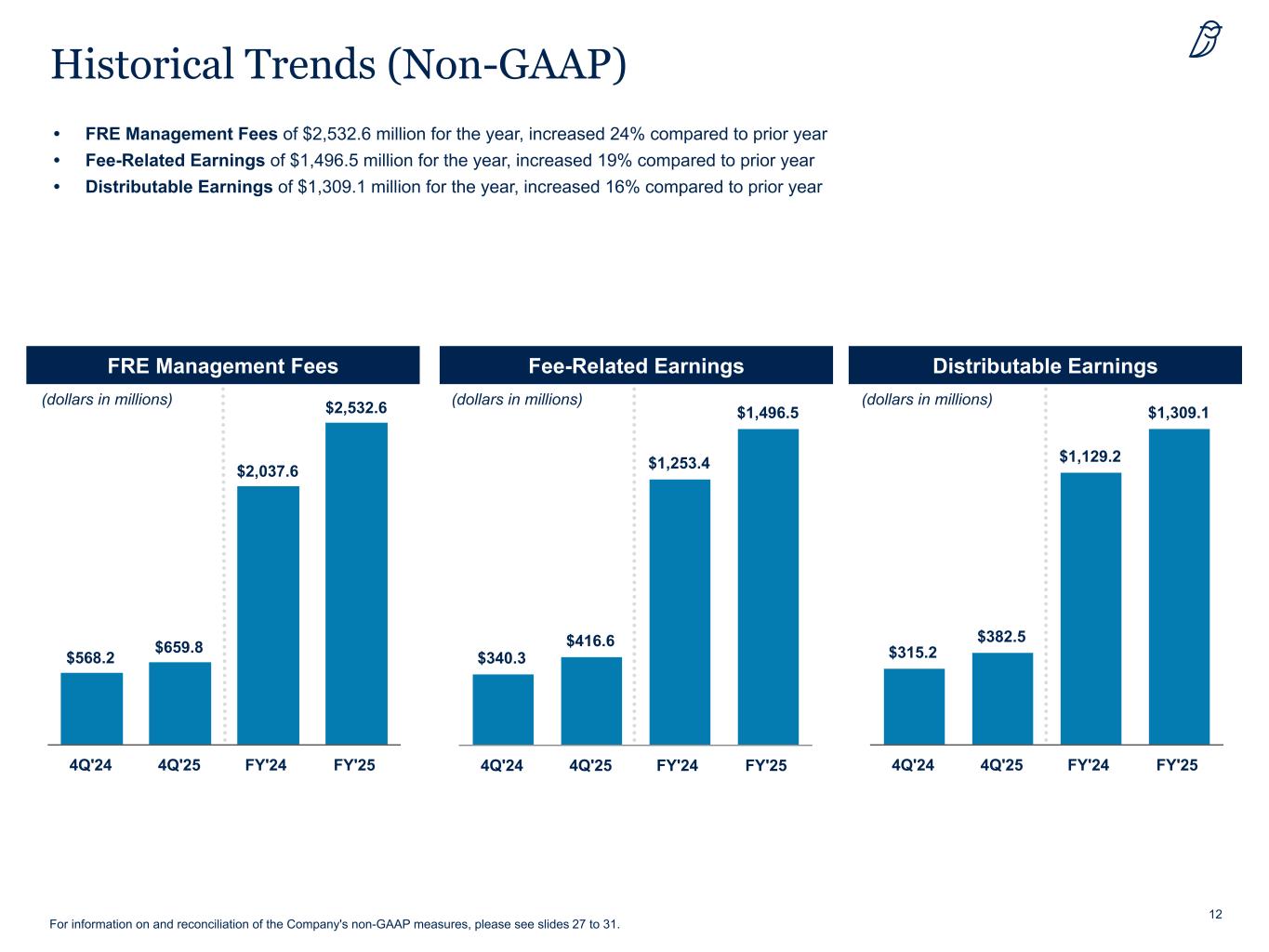

12 Historical Trends (Non-GAAP) • FRE Management Fees of $2,532.6 million for the year, increased 24% compared to prior year • Fee-Related Earnings of $1,496.5 million for the year, increased 19% compared to prior year • Distributable Earnings of $1,309.1 million for the year, increased 16% compared to prior year FRE Management Fees Distributable EarningsFee-Related Earnings (dollars in millions) (dollars in millions) (dollars in millions) $315.2 $382.5 $1,129.2 $1,309.1 4Q'24 4Q'25 FY'24 FY'25 $340.3 $416.6 $1,253.4 $1,496.5 4Q'24 4Q'25 FY'24 FY'25 $568.2 $659.8 $2,037.6 $2,532.6 4Q'24 4Q'25 FY'24 FY'25 For information on and reconciliation of the Company's non-GAAP measures, please see slides 27 to 31.

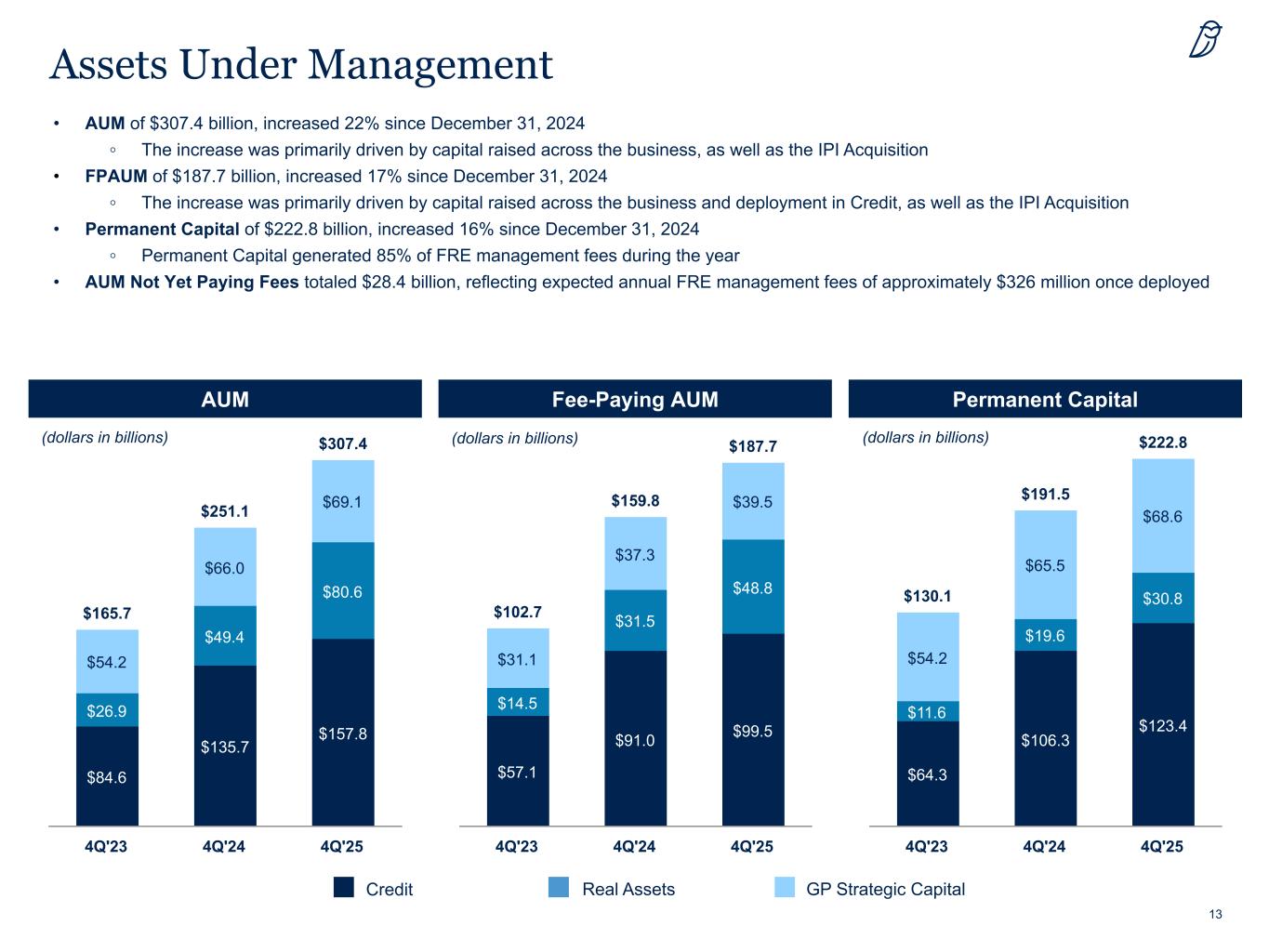

13 Assets Under Management • AUM of $307.4 billion, increased 22% since December 31, 2024 ◦ The increase was primarily driven by capital raised across the business, as well as the IPI Acquisition • FPAUM of $187.7 billion, increased 17% since December 31, 2024 ◦ The increase was primarily driven by capital raised across the business and deployment in Credit, as well as the IPI Acquisition • Permanent Capital of $222.8 billion, increased 16% since December 31, 2024 ◦ Permanent Capital generated 85% of FRE management fees during the year • AUM Not Yet Paying Fees totaled $28.4 billion, reflecting expected annual FRE management fees of approximately $326 million once deployed AUM Fee-Paying AUM Permanent Capital Credit GP Strategic CapitalReal Assets (dollars in billions) (dollars in billions) (dollars in billions) $165.7 $251.1 $307.4 $84.6 $135.7 $157.8 $26.9 $49.4 $80.6 $54.2 $66.0 $69.1 4Q'23 4Q'24 4Q'25 $102.7 $159.8 $187.7 $57.1 $91.0 $99.5 $14.5 $31.5 $48.8 $31.1 $37.3 $39.5 4Q'23 4Q'24 4Q'25 $130.1 $191.5 $222.8 $64.3 $106.3 $123.4 $11.6 $19.6 $30.8 $54.2 $65.5 $68.6 4Q'23 4Q'24 4Q'25

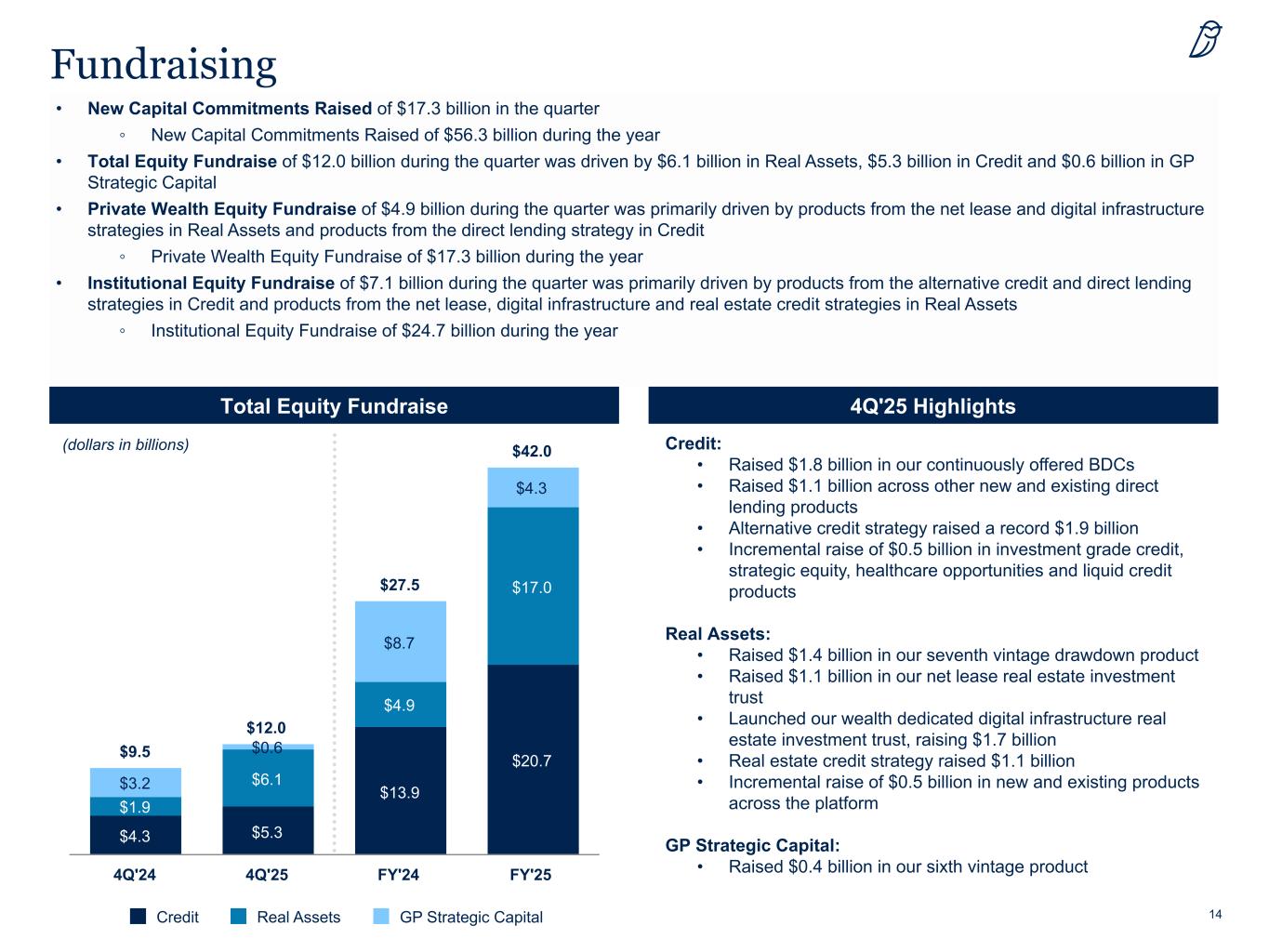

14 Fundraising • New Capital Commitments Raised of $17.3 billion in the quarter ◦ New Capital Commitments Raised of $56.3 billion during the year • Total Equity Fundraise of $12.0 billion during the quarter was driven by $6.1 billion in Real Assets, $5.3 billion in Credit and $0.6 billion in GP Strategic Capital • Private Wealth Equity Fundraise of $4.9 billion during the quarter was primarily driven by products from the net lease and digital infrastructure strategies in Real Assets and products from the direct lending strategy in Credit ◦ Private Wealth Equity Fundraise of $17.3 billion during the year • Institutional Equity Fundraise of $7.1 billion during the quarter was primarily driven by products from the alternative credit and direct lending strategies in Credit and products from the net lease, digital infrastructure and real estate credit strategies in Real Assets ◦ Institutional Equity Fundraise of $24.7 billion during the year Total Equity Fundraise (dollars in billions) $9.5 $12.0 $27.5 $42.0 $4.3 $5.3 $13.9 $20.7 $1.9 $6.1 $4.9 $17.0 $3.2 $0.6 $8.7 $4.3 Credit Real Assets GP Strategic Capital 4Q'24 4Q'25 FY'24 FY'25 4Q'25 Highlights Credit: • Raised $1.8 billion in our continuously offered BDCs • Raised $1.1 billion across other new and existing direct lending products • Alternative credit strategy raised a record $1.9 billion • Incremental raise of $0.5 billion in investment grade credit, strategic equity, healthcare opportunities and liquid credit products Real Assets: • Raised $1.4 billion in our seventh vintage drawdown product • Raised $1.1 billion in our net lease real estate investment trust • Launched our wealth dedicated digital infrastructure real estate investment trust, raising $1.7 billion • Real estate credit strategy raised $1.1 billion • Incremental raise of $0.5 billion in new and existing products across the platform GP Strategic Capital: • Raised $0.4 billion in our sixth vintage product

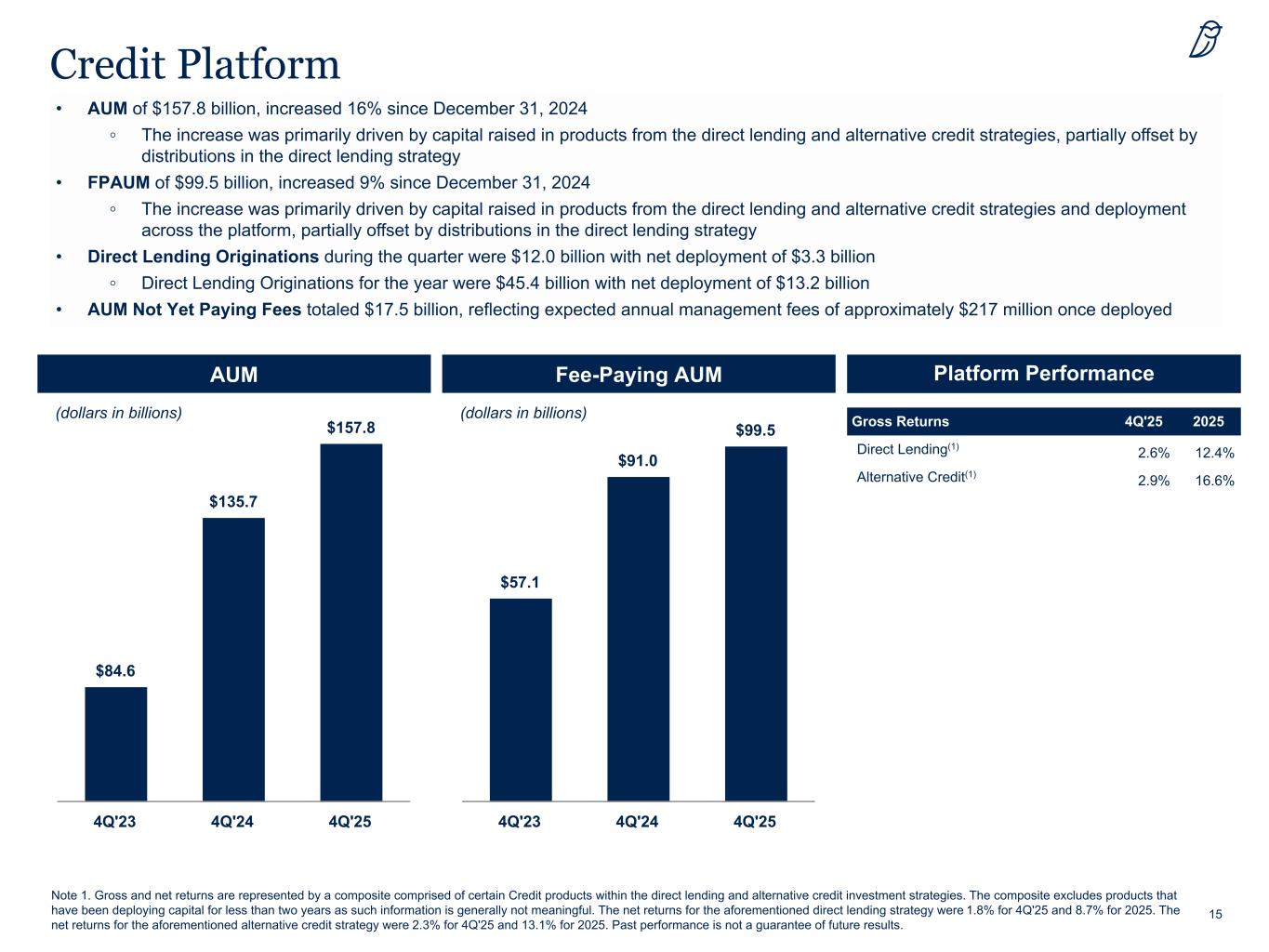

15 Credit Platform • AUM of $157.8 billion, increased 16% since December 31, 2024 ◦ The increase was primarily driven by capital raised in products from the direct lending and alternative credit strategies, partially offset by distributions in the direct lending strategy • FPAUM of $99.5 billion, increased 9% since December 31, 2024 ◦ The increase was primarily driven by capital raised in products from the direct lending and alternative credit strategies and deployment across the platform, partially offset by distributions in the direct lending strategy • Direct Lending Originations during the quarter were $12.0 billion with net deployment of $3.3 billion ◦ Direct Lending Originations for the year were $45.4 billion with net deployment of $13.2 billion • AUM Not Yet Paying Fees totaled $17.5 billion, reflecting expected annual management fees of approximately $217 million once deployed AUM (dollars in billions) (dollars in billions) Fee-Paying AUM Note 1. Gross and net returns are represented by a composite comprised of certain Credit products within the direct lending and alternative credit investment strategies. The composite excludes products that have been deploying capital for less than two years as such information is generally not meaningful. The net returns for the aforementioned direct lending strategy were 1.8% for 4Q'25 and 8.7% for 2025. The net returns for the aforementioned alternative credit strategy were 2.3% for 4Q'25 and 13.1% for 2025. Past performance is not a guarantee of future results. Platform Performance Gross Returns 4Q'25 2025 Direct Lending(1) 2.6% 12.4% Alternative Credit(1) 2.9% 16.6% $84.6 $135.7 $157.8 4Q'23 4Q'24 4Q'25 $57.1 $91.0 $99.5 4Q'23 4Q'24 4Q'25

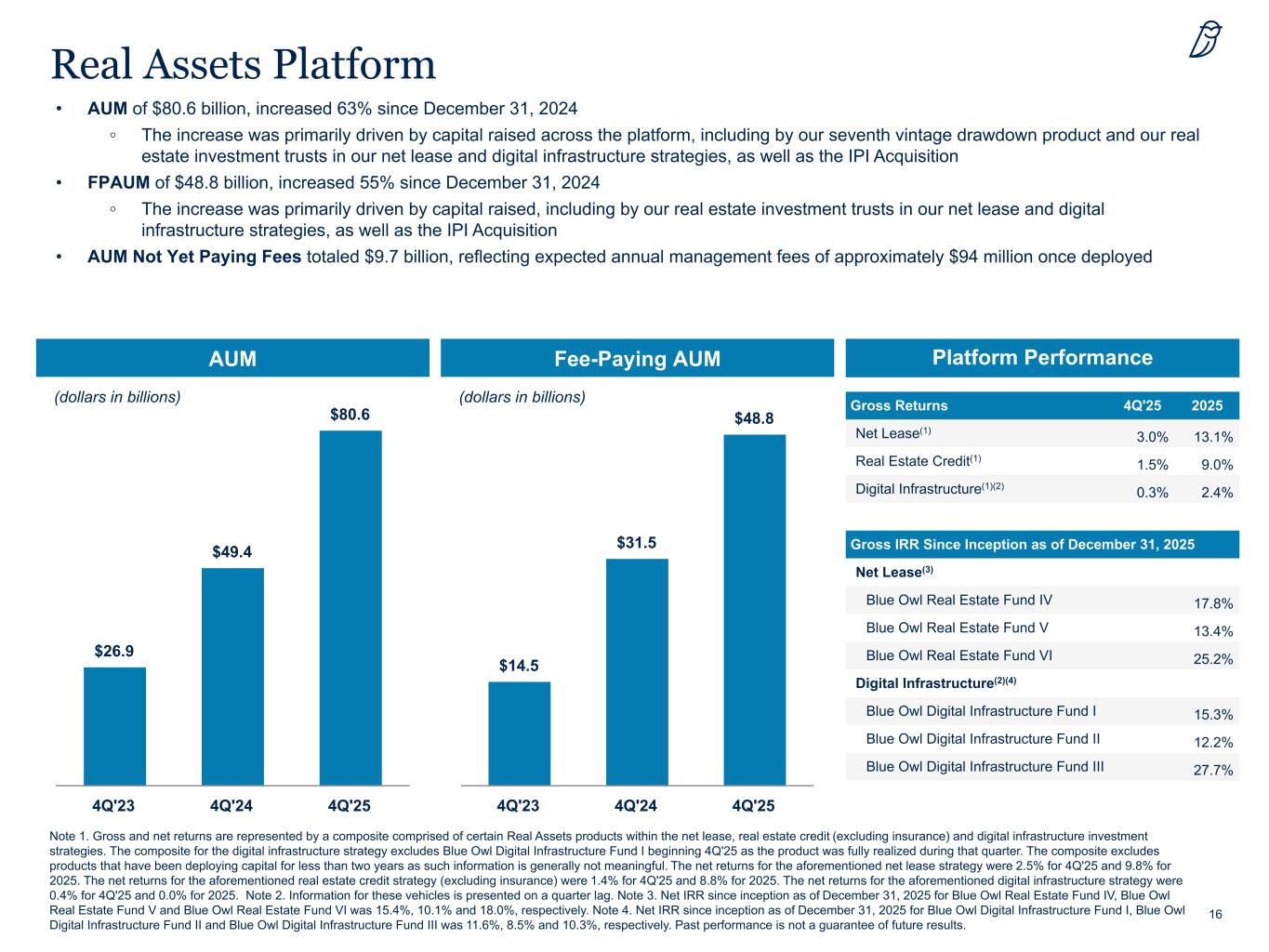

16 Note 1. Gross and net returns are represented by a composite comprised of certain Real Assets products within the net lease, real estate credit (excluding insurance) and digital infrastructure investment strategies. The composite for the digital infrastructure strategy excludes Blue Owl Digital Infrastructure Fund I beginning 4Q'25 as the product was fully realized during that quarter. The composite excludes products that have been deploying capital for less than two years as such information is generally not meaningful. The net returns for the aforementioned net lease strategy were 2.5% for 4Q'25 and 9.8% for 2025. The net returns for the aforementioned real estate credit strategy (excluding insurance) were 1.4% for 4Q'25 and 8.8% for 2025. The net returns for the aforementioned digital infrastructure strategy were 0.4% for 4Q'25 and 0.0% for 2025. Note 2. Information for these vehicles is presented on a quarter lag. Note 3. Net IRR since inception as of December 31, 2025 for Blue Owl Real Estate Fund IV, Blue Owl Real Estate Fund V and Blue Owl Real Estate Fund VI was 15.4%, 10.1% and 18.0%, respectively. Note 4. Net IRR since inception as of December 31, 2025 for Blue Owl Digital Infrastructure Fund I, Blue Owl Digital Infrastructure Fund II and Blue Owl Digital Infrastructure Fund III was 11.6%, 8.5% and 10.3%, respectively. Past performance is not a guarantee of future results. Real Assets Platform • AUM of $80.6 billion, increased 63% since December 31, 2024 ◦ The increase was primarily driven by capital raised across the platform, including by our seventh vintage drawdown product and our real estate investment trusts in our net lease and digital infrastructure strategies, as well as the IPI Acquisition • FPAUM of $48.8 billion, increased 55% since December 31, 2024 ◦ The increase was primarily driven by capital raised, including by our real estate investment trusts in our net lease and digital infrastructure strategies, as well as the IPI Acquisition • AUM Not Yet Paying Fees totaled $9.7 billion, reflecting expected annual management fees of approximately $94 million once deployed AUM Fee-Paying AUM $26.9 $49.4 $80.6 4Q'23 4Q'24 4Q'25 $14.5 $31.5 $48.8 4Q'23 4Q'24 4Q'25 (dollars in billions) (dollars in billions) Platform Performance Gross Returns 4Q'25 2025 Net Lease(1) 3.0% 13.1% Real Estate Credit(1) 1.5% 9.0% Digital Infrastructure(1)(2) 0.3% 2.4% Gross IRR Since Inception as of December 31, 2025 Net Lease(3) Blue Owl Real Estate Fund IV 17.8% Blue Owl Real Estate Fund V 13.4% Blue Owl Real Estate Fund VI 25.2% Digital Infrastructure(2)(4) Blue Owl Digital Infrastructure Fund I 15.3% Blue Owl Digital Infrastructure Fund II 12.2% Blue Owl Digital Infrastructure Fund III 27.7%

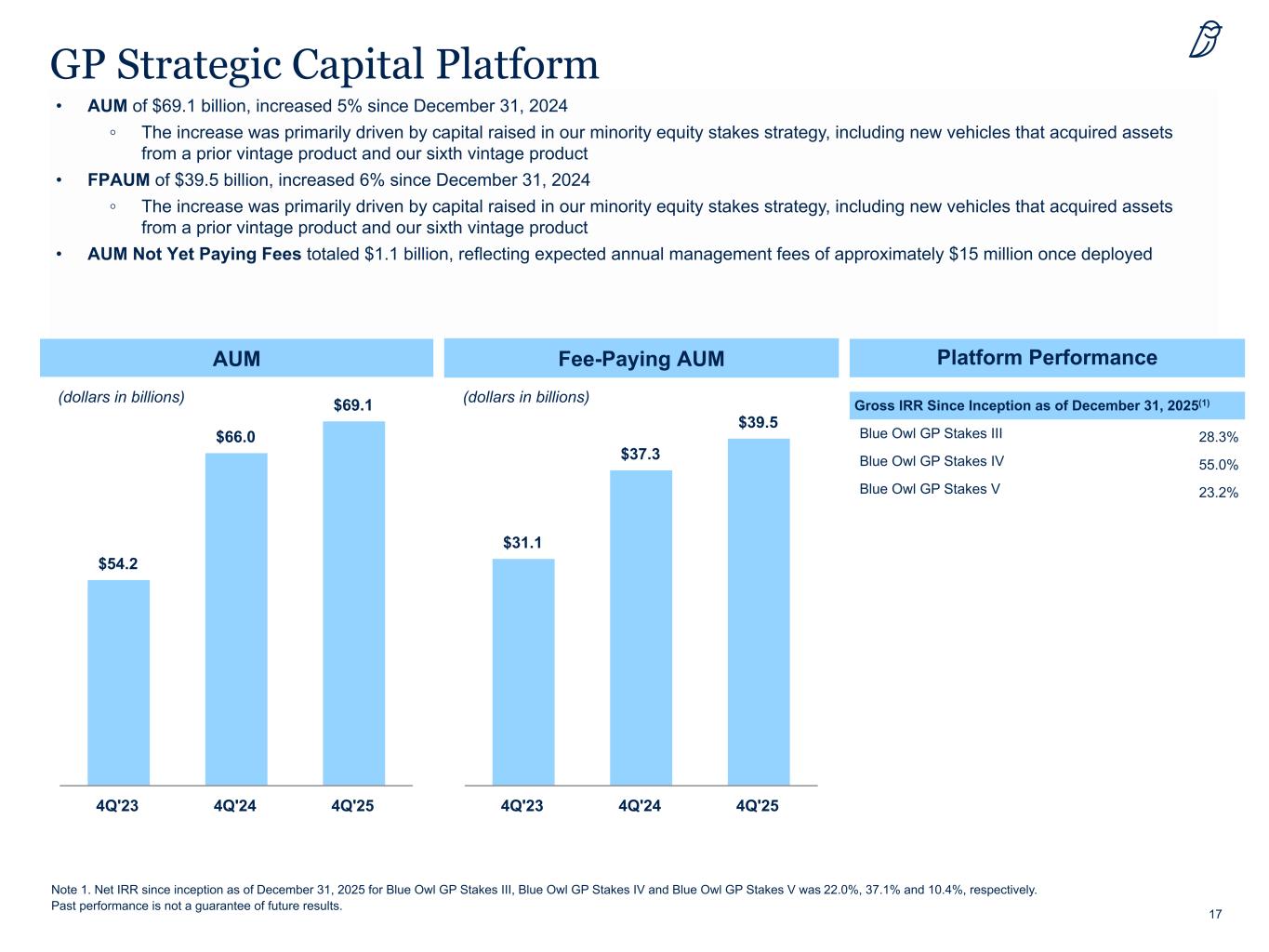

17 Note 1. Net IRR since inception as of December 31, 2025 for Blue Owl GP Stakes III, Blue Owl GP Stakes IV and Blue Owl GP Stakes V was 22.0%, 37.1% and 10.4%, respectively. Past performance is not a guarantee of future results. GP Strategic Capital Platform • AUM of $69.1 billion, increased 5% since December 31, 2024 ◦ The increase was primarily driven by capital raised in our minority equity stakes strategy, including new vehicles that acquired assets from a prior vintage product and our sixth vintage product • FPAUM of $39.5 billion, increased 6% since December 31, 2024 ◦ The increase was primarily driven by capital raised in our minority equity stakes strategy, including new vehicles that acquired assets from a prior vintage product and our sixth vintage product • AUM Not Yet Paying Fees totaled $1.1 billion, reflecting expected annual management fees of approximately $15 million once deployed AUM Fee-Paying AUM $54.2 $66.0 $69.1 4Q'23 4Q'24 4Q'25 $31.1 $37.3 $39.5 4Q'23 4Q'24 4Q'25 (dollars in billions) (dollars in billions) Platform Performance Gross IRR Since Inception as of December 31, 2025(1) Blue Owl GP Stakes III 28.3% Blue Owl GP Stakes IV 55.0% Blue Owl GP Stakes V 23.2%

Supplemental Information

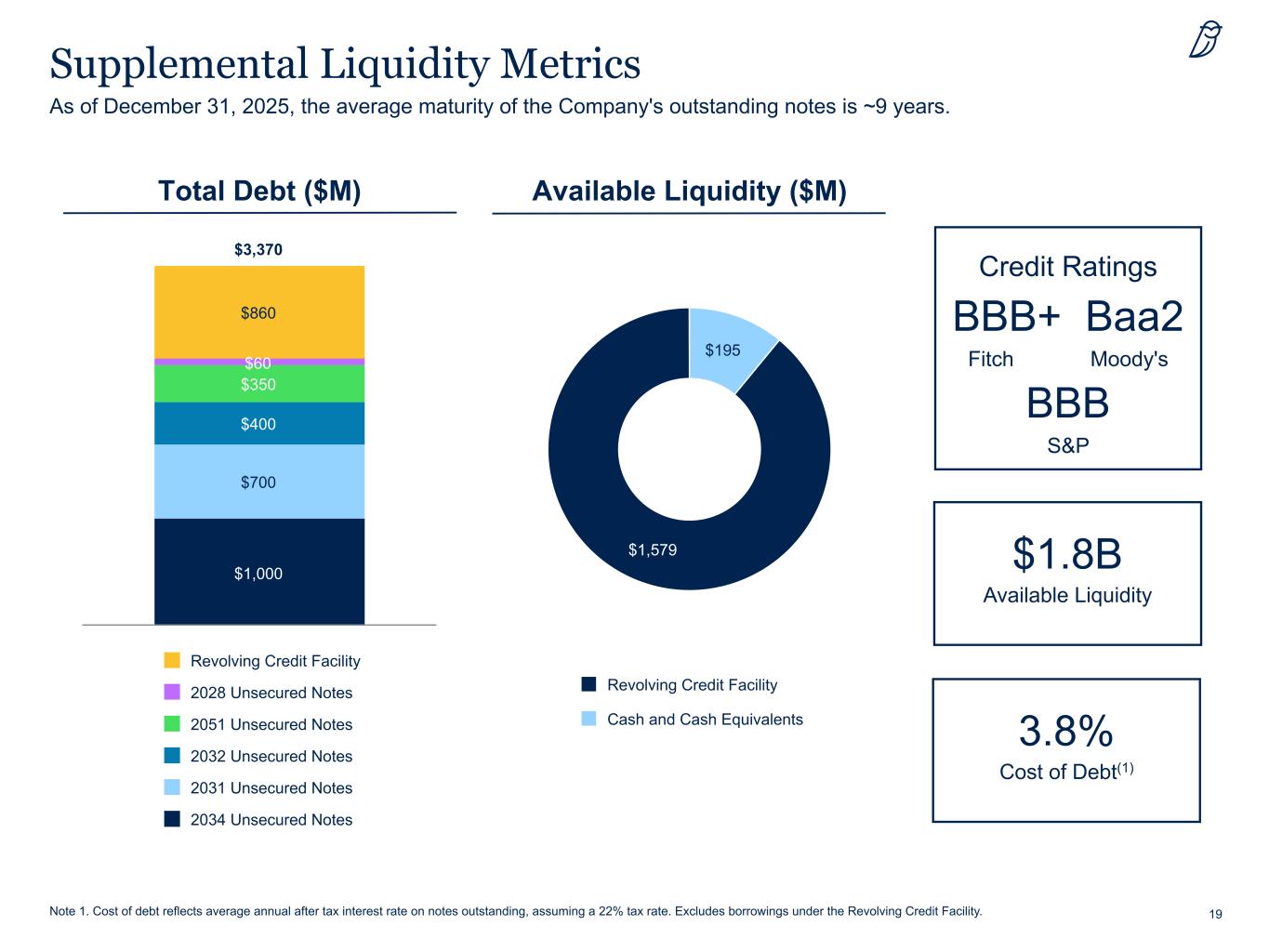

19 As of December 31, 2025, the average maturity of the Company's outstanding notes is ~9 years. Note 1. Cost of debt reflects average annual after tax interest rate on notes outstanding, assuming a 22% tax rate. Excludes borrowings under the Revolving Credit Facility. Supplemental Liquidity Metrics Credit Ratings BBB+ Baa2 Fitch Moody's BBB S&P Total Debt ($M) Available Liquidity ($M) 3.8% Cost of Debt(1) $759 $195 $1,579 Revolving Credit Facility Cash and Cash Equivalents $3,370 $1,000 $700 $400 $350 $60 $860 Revolving Credit Facility 2028 Unsecured Notes 2051 Unsecured Notes 2032 Unsecured Notes 2031 Unsecured Notes 2034 Unsecured Notes $1.8B Available Liquidity

20 As of December 31, 2025, AUM not yet paying fees totaled $28.4 billion, reflecting expected annual management fees of $326 million once deployed. FPAUM to AUM Bridge $51.2 $71.6 $28.6 $187.7 $307.4 $99.5 $17.5 $9.0 $31.8 157.8 $48.8 $9.7 $19.8 $80.6 $39.5 $7.2 $21.3 $69.1 $28.4 $18.5 $72.8 Credit Real Assets GP Strategic Capital FPAUM AUM Not Yet Paying Fees Fee-Exempt AUM Net Appreciation, Leverage and Other AUM $2.4 $1.1 (dollars in billions)

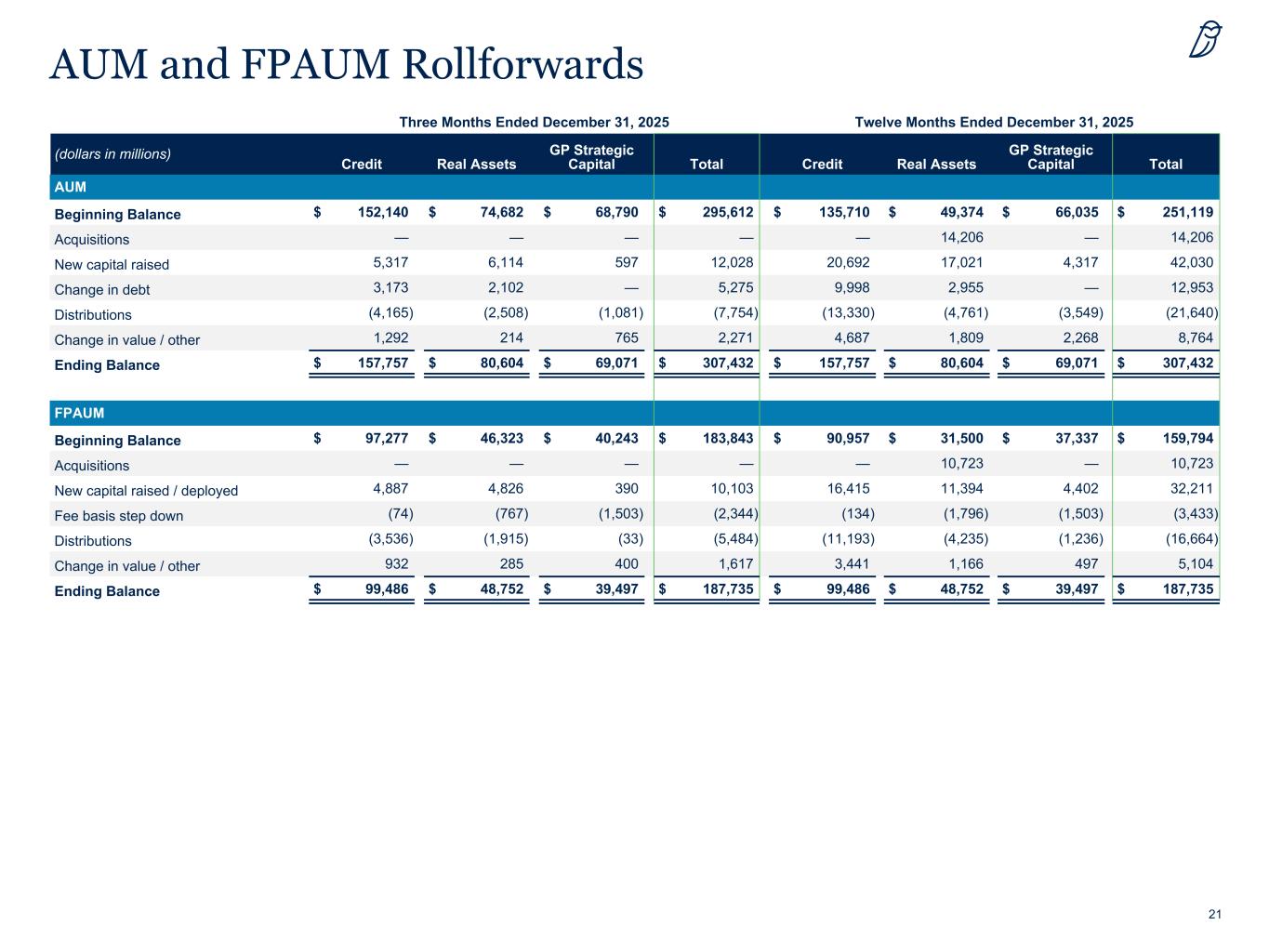

21 AUM and FPAUM Rollforwards Three Months Ended December 31, 2025 Twelve Months Ended December 31, 2025 (dollars in millions) Credit Real Assets GP Strategic Capital Total Credit Real Assets GP Strategic Capital Total AUM Beginning Balance $ 152,140 $ 74,682 $ 68,790 $ 295,612 $ 135,710 $ 49,374 $ 66,035 $ 251,119 Acquisitions — — — — — 14,206 — 14,206 New capital raised 5,317 6,114 597 12,028 20,692 17,021 4,317 42,030 Change in debt 3,173 2,102 — 5,275 9,998 2,955 — 12,953 Distributions (4,165) (2,508) (1,081) (7,754) (13,330) (4,761) (3,549) (21,640) Change in value / other 1,292 214 765 2,271 4,687 1,809 2,268 8,764 Ending Balance $ 157,757 $ 80,604 $ 69,071 $ 307,432 $ 157,757 $ 80,604 $ 69,071 $ 307,432 FPAUM Beginning Balance $ 97,277 $ 46,323 $ 40,243 $ 183,843 $ 90,957 $ 31,500 $ 37,337 $ 159,794 Acquisitions — — — — — 10,723 — 10,723 New capital raised / deployed 4,887 4,826 390 10,103 16,415 11,394 4,402 32,211 Fee basis step down (74) (767) (1,503) (2,344) (134) (1,796) (1,503) (3,433) Distributions (3,536) (1,915) (33) (5,484) (11,193) (4,235) (1,236) (16,664) Change in value / other 932 285 400 1,617 3,441 1,166 497 5,104 Ending Balance $ 99,486 $ 48,752 $ 39,497 $ 187,735 $ 99,486 $ 48,752 $ 39,497 $ 187,735

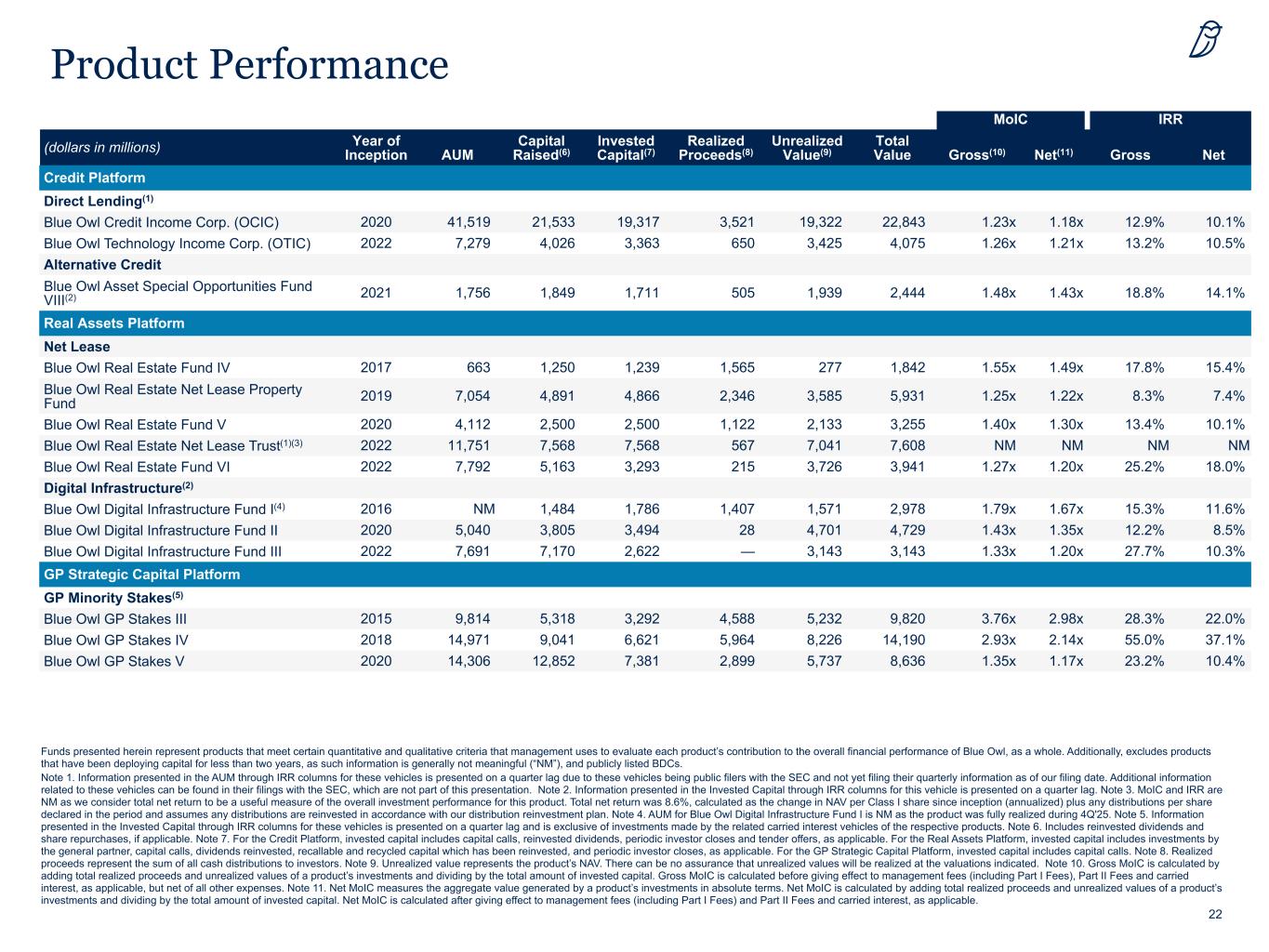

22 Product Performance MoIC IRR (dollars in millions) Year of Inception AUM Capital Raised(6) Invested Capital(7) Realized Proceeds(8) Unrealized Value(9) Total Value Gross(10) Net(11) Gross Net Credit Platform Direct Lending(1) Blue Owl Credit Income Corp. (OCIC) 2020 41,519 21,533 19,317 3,521 19,322 22,843 1.23x 1.18x 12.9% 10.1% Blue Owl Technology Income Corp. (OTIC) 2022 7,279 4,026 3,363 650 3,425 4,075 1.26x 1.21x 13.2% 10.5% Alternative Credit Blue Owl Asset Special Opportunities Fund VIII(2) 2021 1,756 1,849 1,711 505 1,939 2,444 1.48x 1.43x 18.8% 14.1% Real Assets Platform Net Lease Blue Owl Real Estate Fund IV 2017 663 1,250 1,239 1,565 277 1,842 1.55x 1.49x 17.8% 15.4% Blue Owl Real Estate Net Lease Property Fund 2019 7,054 4,891 4,866 2,346 3,585 5,931 1.25x 1.22x 8.3% 7.4% Blue Owl Real Estate Fund V 2020 4,112 2,500 2,500 1,122 2,133 3,255 1.40x 1.30x 13.4% 10.1% Blue Owl Real Estate Net Lease Trust(1)(3) 2022 11,751 7,568 7,568 567 7,041 7,608 NM NM NM NM Blue Owl Real Estate Fund VI 2022 7,792 5,163 3,293 215 3,726 3,941 1.27x 1.20x 25.2% 18.0% Digital Infrastructure(2) Blue Owl Digital Infrastructure Fund I(4) 2016 NM 1,484 1,786 1,407 1,571 2,978 1.79x 1.67x 15.3% 11.6% Blue Owl Digital Infrastructure Fund II 2020 5,040 3,805 3,494 28 4,701 4,729 1.43x 1.35x 12.2% 8.5% Blue Owl Digital Infrastructure Fund III 2022 7,691 7,170 2,622 — 3,143 3,143 1.33x 1.20x 27.7% 10.3% GP Strategic Capital Platform GP Minority Stakes(5) Blue Owl GP Stakes III 2015 9,814 5,318 3,292 4,588 5,232 9,820 3.76x 2.98x 28.3% 22.0% Blue Owl GP Stakes IV 2018 14,971 9,041 6,621 5,964 8,226 14,190 2.93x 2.14x 55.0% 37.1% Blue Owl GP Stakes V 2020 14,306 12,852 7,381 2,899 5,737 8,636 1.35x 1.17x 23.2% 10.4% Funds presented herein represent products that meet certain quantitative and qualitative criteria that management uses to evaluate each product’s contribution to the overall financial performance of Blue Owl, as a whole. Additionally, excludes products that have been deploying capital for less than two years, as such information is generally not meaningful (“NM”), and publicly listed BDCs. Note 1. Information presented in the AUM through IRR columns for these vehicles is presented on a quarter lag due to these vehicles being public filers with the SEC and not yet filing their quarterly information as of our filing date. Additional information related to these vehicles can be found in their filings with the SEC, which are not part of this presentation. Note 2. Information presented in the Invested Capital through IRR columns for this vehicle is presented on a quarter lag. Note 3. MoIC and IRR are NM as we consider total net return to be a useful measure of the overall investment performance for this product. Total net return was 8.6%, calculated as the change in NAV per Class I share since inception (annualized) plus any distributions per share declared in the period and assumes any distributions are reinvested in accordance with our distribution reinvestment plan. Note 4. AUM for Blue Owl Digital Infrastructure Fund I is NM as the product was fully realized during 4Q'25. Note 5. Information presented in the Invested Capital through IRR columns for these vehicles is presented on a quarter lag and is exclusive of investments made by the related carried interest vehicles of the respective products. Note 6. Includes reinvested dividends and share repurchases, if applicable. Note 7. For the Credit Platform, invested capital includes capital calls, reinvested dividends, periodic investor closes and tender offers, as applicable. For the Real Assets Platform, invested capital includes investments by the general partner, capital calls, dividends reinvested, recallable and recycled capital which has been reinvested, and periodic investor closes, as applicable. For the GP Strategic Capital Platform, invested capital includes capital calls. Note 8. Realized proceeds represent the sum of all cash distributions to investors. Note 9. Unrealized value represents the product’s NAV. There can be no assurance that unrealized values will be realized at the valuations indicated. Note 10. Gross MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Gross MoIC is calculated before giving effect to management fees (including Part I Fees), Part II Fees and carried interest, as applicable, but net of all other expenses. Note 11. Net MoIC measures the aggregate value generated by a product’s investments in absolute terms. Net MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Net MoIC is calculated after giving effect to management fees (including Part I Fees) and Part II Fees and carried interest, as applicable.

Appendix

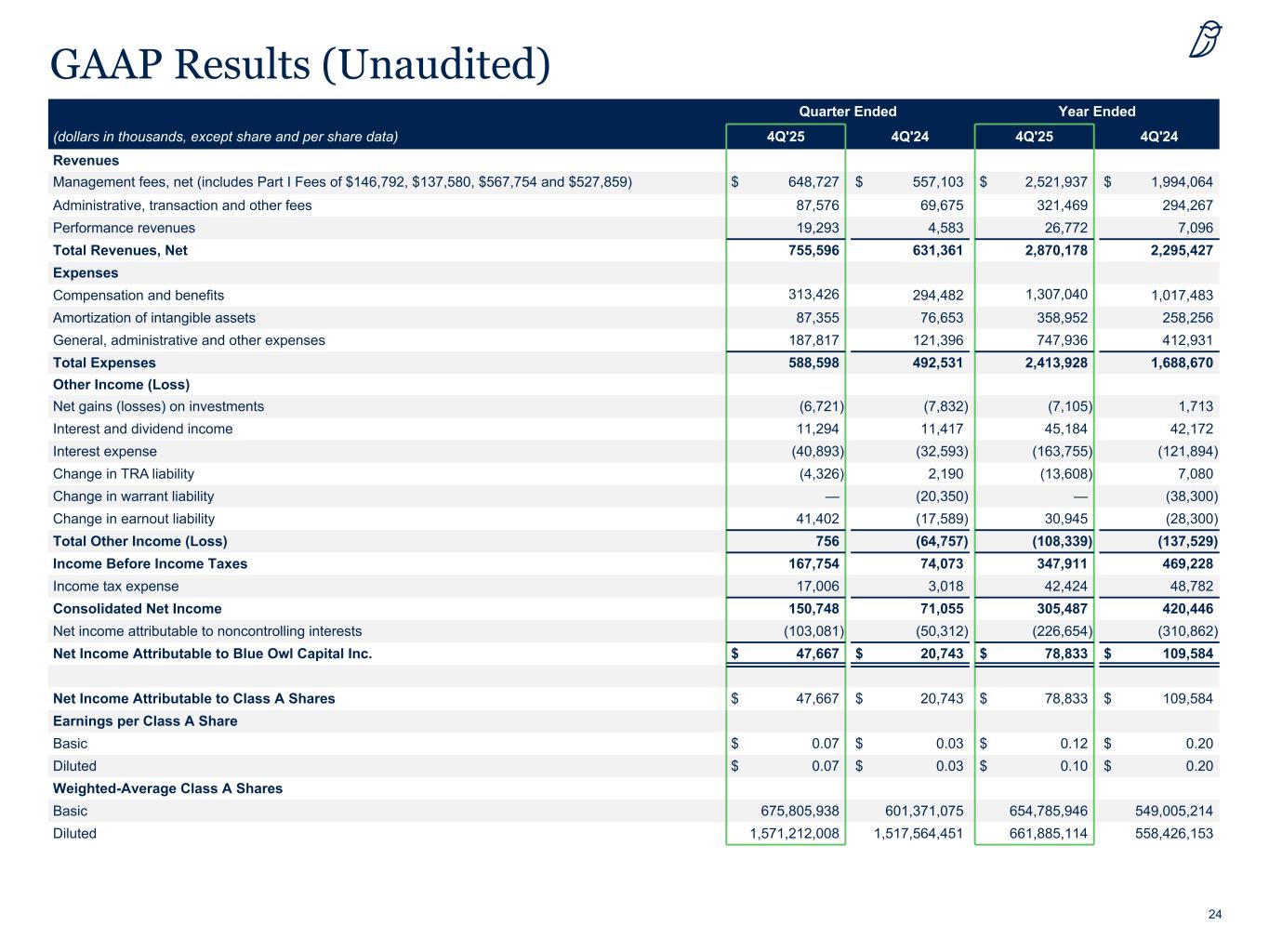

24 GAAP Results (Unaudited) Quarter Ended Year Ended (dollars in thousands, except share and per share data) 4Q'25 4Q'24 4Q'25 4Q'24 Revenues Management fees, net (includes Part I Fees of $146,792, $137,580, $567,754 and $527,859) $ 648,727 $ 557,103 $ 2,521,937 $ 1,994,064 Administrative, transaction and other fees 87,576 69,675 321,469 294,267 Performance revenues 19,293 4,583 26,772 7,096 Total Revenues, Net 755,596 631,361 2,870,178 2,295,427 Expenses Compensation and benefits 313,426 294,482 1,307,040 1,017,483 Amortization of intangible assets 87,355 76,653 358,952 258,256 General, administrative and other expenses 187,817 121,396 747,936 412,931 Total Expenses 588,598 492,531 2,413,928 1,688,670 Other Income (Loss) Net gains (losses) on investments (6,721) (7,832) (7,105) 1,713 Interest and dividend income 11,294 11,417 45,184 42,172 Interest expense (40,893) (32,593) (163,755) (121,894) Change in TRA liability (4,326) 2,190 (13,608) 7,080 Change in warrant liability — (20,350) — (38,300) Change in earnout liability 41,402 (17,589) 30,945 (28,300) Total Other Income (Loss) 756 (64,757) (108,339) (137,529) Income Before Income Taxes 167,754 74,073 347,911 469,228 Income tax expense 17,006 3,018 42,424 48,782 Consolidated Net Income 150,748 71,055 305,487 420,446 Net income attributable to noncontrolling interests (103,081) (50,312) (226,654) (310,862) Net Income Attributable to Blue Owl Capital Inc. $ 47,667 $ 20,743 $ 78,833 $ 109,584 Net Income Attributable to Class A Shares $ 47,667 $ 20,743 $ 78,833 $ 109,584 Earnings per Class A Share Basic $ 0.07 $ 0.03 $ 0.12 $ 0.20 Diluted $ 0.07 $ 0.03 $ 0.10 $ 0.20 Weighted-Average Class A Shares Basic 675,805,938 601,371,075 654,785,946 549,005,214 Diluted 1,571,212,008 1,517,564,451 661,885,114 558,426,153

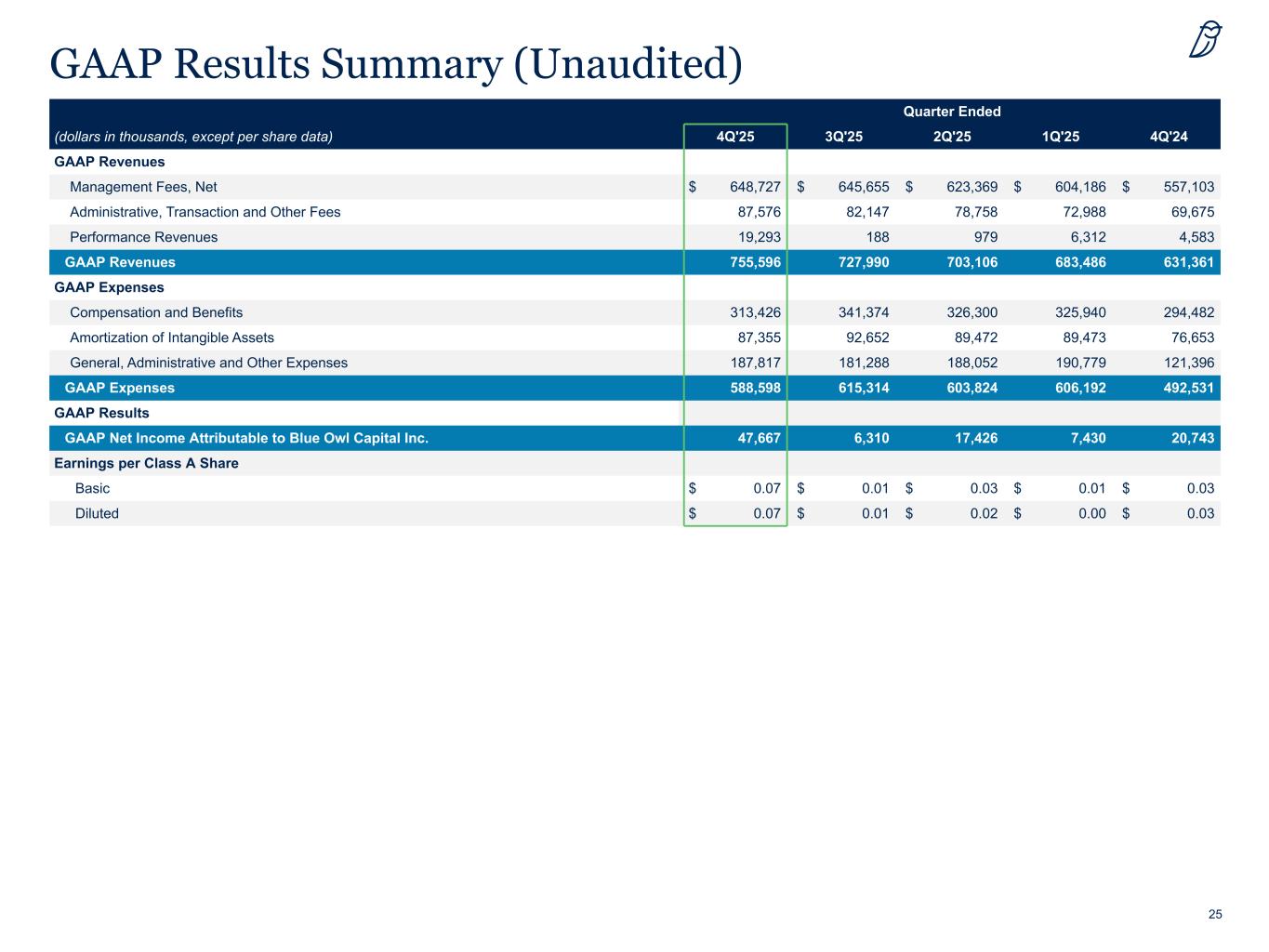

25 Quarter Ended (dollars in thousands, except per share data) 4Q'25 3Q'25 2Q'25 1Q'25 4Q'24 GAAP Revenues Management Fees, Net $ 648,727 $ 645,655 $ 623,369 $ 604,186 $ 557,103 Administrative, Transaction and Other Fees 87,576 82,147 78,758 72,988 69,675 Performance Revenues 19,293 188 979 6,312 4,583 GAAP Revenues 755,596 727,990 703,106 683,486 631,361 GAAP Expenses Compensation and Benefits 313,426 341,374 326,300 325,940 294,482 Amortization of Intangible Assets 87,355 92,652 89,472 89,473 76,653 General, Administrative and Other Expenses 187,817 181,288 188,052 190,779 121,396 GAAP Expenses 588,598 615,314 603,824 606,192 492,531 GAAP Results GAAP Net Income Attributable to Blue Owl Capital Inc. 47,667 6,310 17,426 7,430 20,743 Earnings per Class A Share Basic $ 0.07 $ 0.01 $ 0.03 $ 0.01 $ 0.03 Diluted $ 0.07 $ 0.01 $ 0.02 $ 0.00 $ 0.03 GAAP Results Summary (Unaudited)

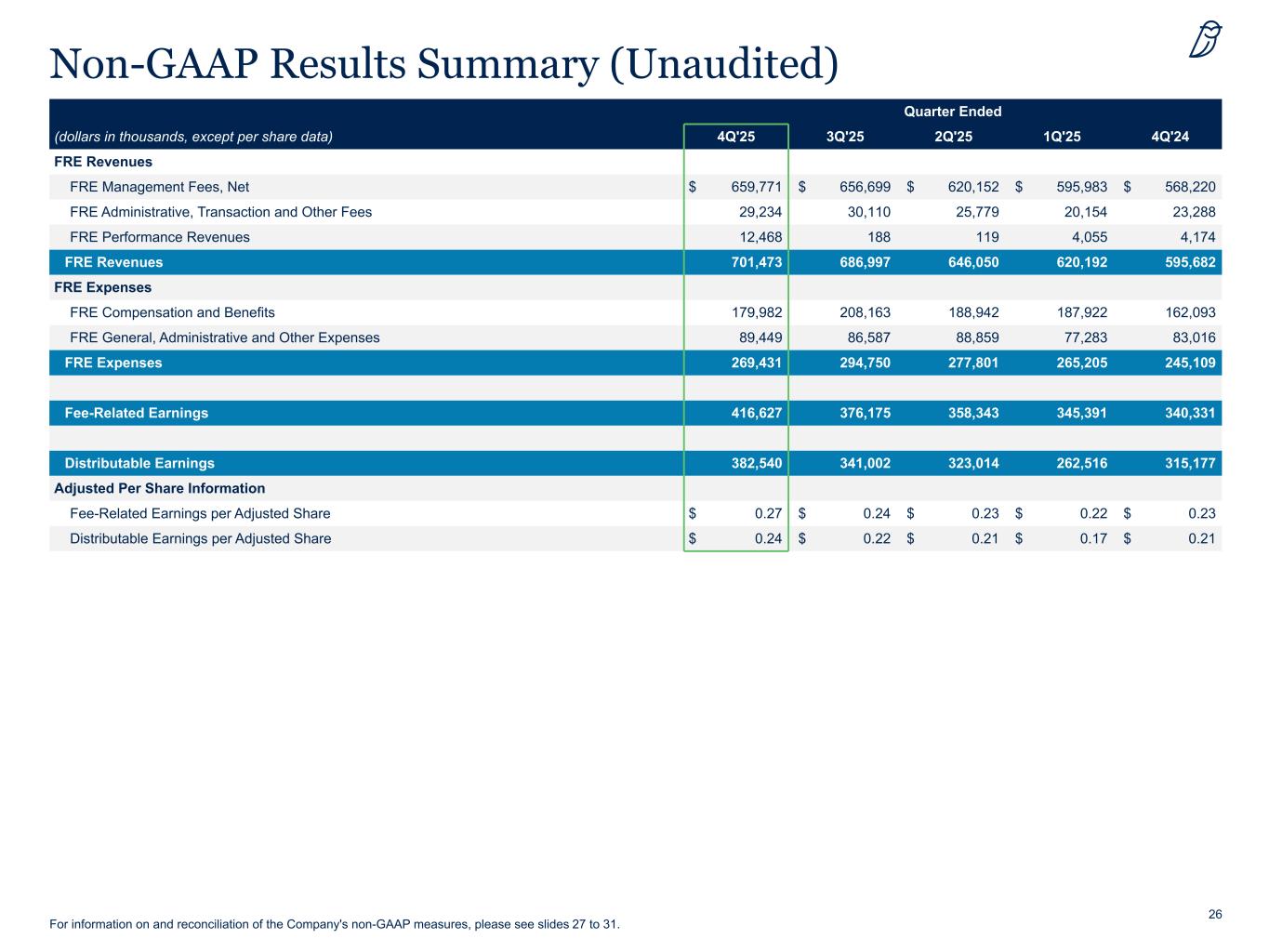

26 Quarter Ended (dollars in thousands, except per share data) 4Q'25 3Q'25 2Q'25 1Q'25 4Q'24 FRE Revenues FRE Management Fees, Net $ 659,771 $ 656,699 $ 620,152 $ 595,983 $ 568,220 FRE Administrative, Transaction and Other Fees 29,234 30,110 25,779 20,154 23,288 FRE Performance Revenues 12,468 188 119 4,055 4,174 FRE Revenues 701,473 686,997 646,050 620,192 595,682 FRE Expenses FRE Compensation and Benefits 179,982 208,163 188,942 187,922 162,093 FRE General, Administrative and Other Expenses 89,449 86,587 88,859 77,283 83,016 FRE Expenses 269,431 294,750 277,801 265,205 245,109 Fee-Related Earnings 416,627 376,175 358,343 345,391 340,331 Distributable Earnings 382,540 341,002 323,014 262,516 315,177 Adjusted Per Share Information Fee-Related Earnings per Adjusted Share $ 0.27 $ 0.24 $ 0.23 $ 0.22 $ 0.23 Distributable Earnings per Adjusted Share $ 0.24 $ 0.22 $ 0.21 $ 0.17 $ 0.21 Non-GAAP Results Summary (Unaudited) For information on and reconciliation of the Company's non-GAAP measures, please see slides 27 to 31.

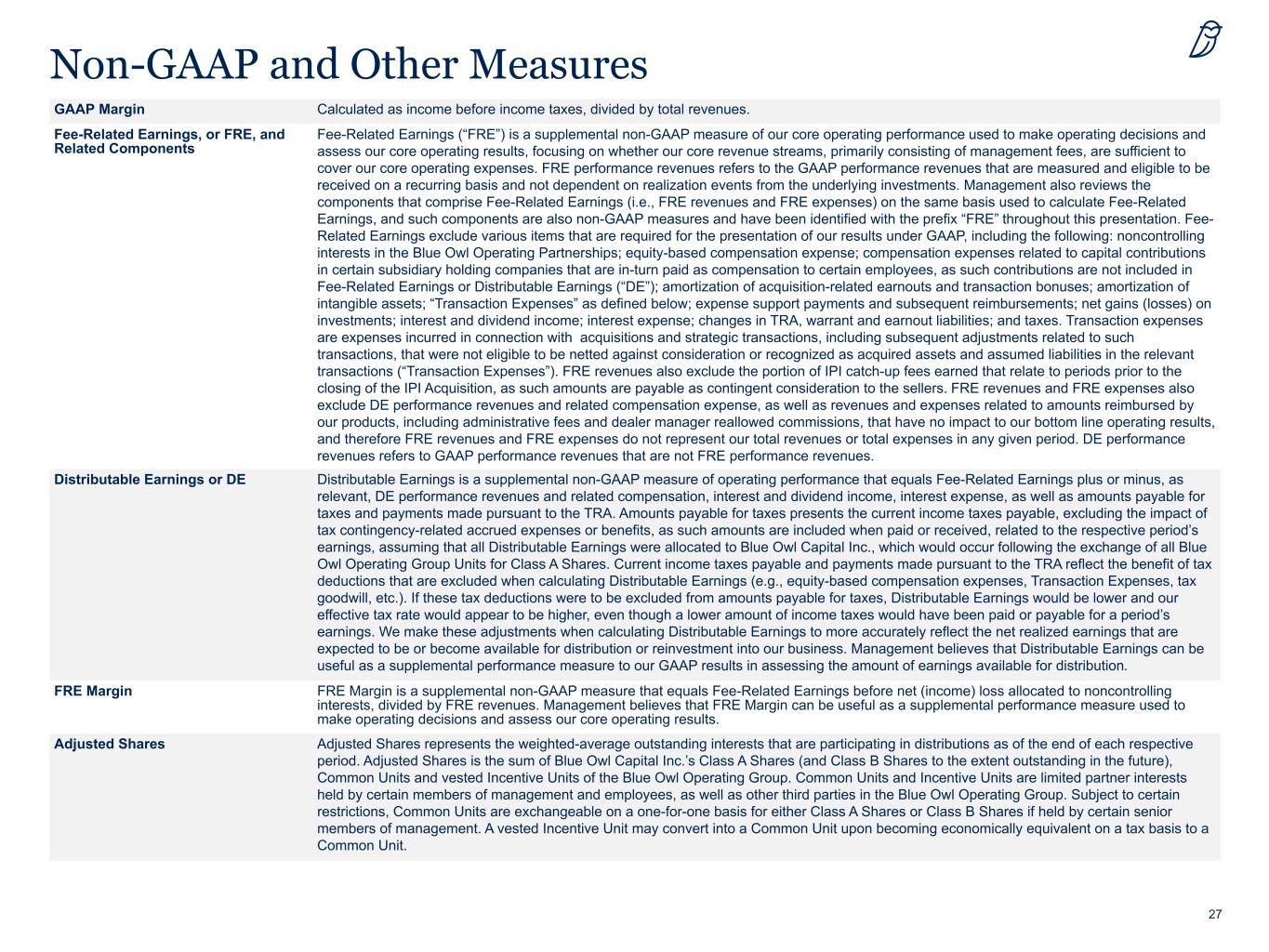

27 Non-GAAP and Other Measures GAAP Margin Calculated as income before income taxes, divided by total revenues. Fee-Related Earnings, or FRE, and Related Components Fee-Related Earnings (“FRE”) is a supplemental non-GAAP measure of our core operating performance used to make operating decisions and assess our core operating results, focusing on whether our core revenue streams, primarily consisting of management fees, are sufficient to cover our core operating expenses. FRE performance revenues refers to the GAAP performance revenues that are measured and eligible to be received on a recurring basis and not dependent on realization events from the underlying investments. Management also reviews the components that comprise Fee-Related Earnings (i.e., FRE revenues and FRE expenses) on the same basis used to calculate Fee-Related Earnings, and such components are also non-GAAP measures and have been identified with the prefix “FRE” throughout this presentation. Fee- Related Earnings exclude various items that are required for the presentation of our results under GAAP, including the following: noncontrolling interests in the Blue Owl Operating Partnerships; equity-based compensation expense; compensation expenses related to capital contributions in certain subsidiary holding companies that are in-turn paid as compensation to certain employees, as such contributions are not included in Fee-Related Earnings or Distributable Earnings (“DE”); amortization of acquisition-related earnouts and transaction bonuses; amortization of intangible assets; “Transaction Expenses” as defined below; expense support payments and subsequent reimbursements; net gains (losses) on investments; interest and dividend income; interest expense; changes in TRA, warrant and earnout liabilities; and taxes. Transaction expenses are expenses incurred in connection with acquisitions and strategic transactions, including subsequent adjustments related to such transactions, that were not eligible to be netted against consideration or recognized as acquired assets and assumed liabilities in the relevant transactions (“Transaction Expenses”). FRE revenues also exclude the portion of IPI catch-up fees earned that relate to periods prior to the closing of the IPI Acquisition, as such amounts are payable as contingent consideration to the sellers. FRE revenues and FRE expenses also exclude DE performance revenues and related compensation expense, as well as revenues and expenses related to amounts reimbursed by our products, including administrative fees and dealer manager reallowed commissions, that have no impact to our bottom line operating results, and therefore FRE revenues and FRE expenses do not represent our total revenues or total expenses in any given period. DE performance revenues refers to GAAP performance revenues that are not FRE performance revenues. Distributable Earnings or DE Distributable Earnings is a supplemental non-GAAP measure of operating performance that equals Fee-Related Earnings plus or minus, as relevant, DE performance revenues and related compensation, interest and dividend income, interest expense, as well as amounts payable for taxes and payments made pursuant to the TRA. Amounts payable for taxes presents the current income taxes payable, excluding the impact of tax contingency-related accrued expenses or benefits, as such amounts are included when paid or received, related to the respective period’s earnings, assuming that all Distributable Earnings were allocated to Blue Owl Capital Inc., which would occur following the exchange of all Blue Owl Operating Group Units for Class A Shares. Current income taxes payable and payments made pursuant to the TRA reflect the benefit of tax deductions that are excluded when calculating Distributable Earnings (e.g., equity-based compensation expenses, Transaction Expenses, tax goodwill, etc.). If these tax deductions were to be excluded from amounts payable for taxes, Distributable Earnings would be lower and our effective tax rate would appear to be higher, even though a lower amount of income taxes would have been paid or payable for a period’s earnings. We make these adjustments when calculating Distributable Earnings to more accurately reflect the net realized earnings that are expected to be or become available for distribution or reinvestment into our business. Management believes that Distributable Earnings can be useful as a supplemental performance measure to our GAAP results in assessing the amount of earnings available for distribution. FRE Margin FRE Margin is a supplemental non-GAAP measure that equals Fee-Related Earnings before net (income) loss allocated to noncontrolling interests, divided by FRE revenues. Management believes that FRE Margin can be useful as a supplemental performance measure used to make operating decisions and assess our core operating results. Adjusted Shares Adjusted Shares represents the weighted-average outstanding interests that are participating in distributions as of the end of each respective period. Adjusted Shares is the sum of Blue Owl Capital Inc.’s Class A Shares (and Class B Shares to the extent outstanding in the future), Common Units and vested Incentive Units of the Blue Owl Operating Group. Common Units and Incentive Units are limited partner interests held by certain members of management and employees, as well as other third parties in the Blue Owl Operating Group. Subject to certain restrictions, Common Units are exchangeable on a one-for-one basis for either Class A Shares or Class B Shares if held by certain senior members of management. A vested Incentive Unit may convert into a Common Unit upon becoming economically equivalent on a tax basis to a Common Unit.

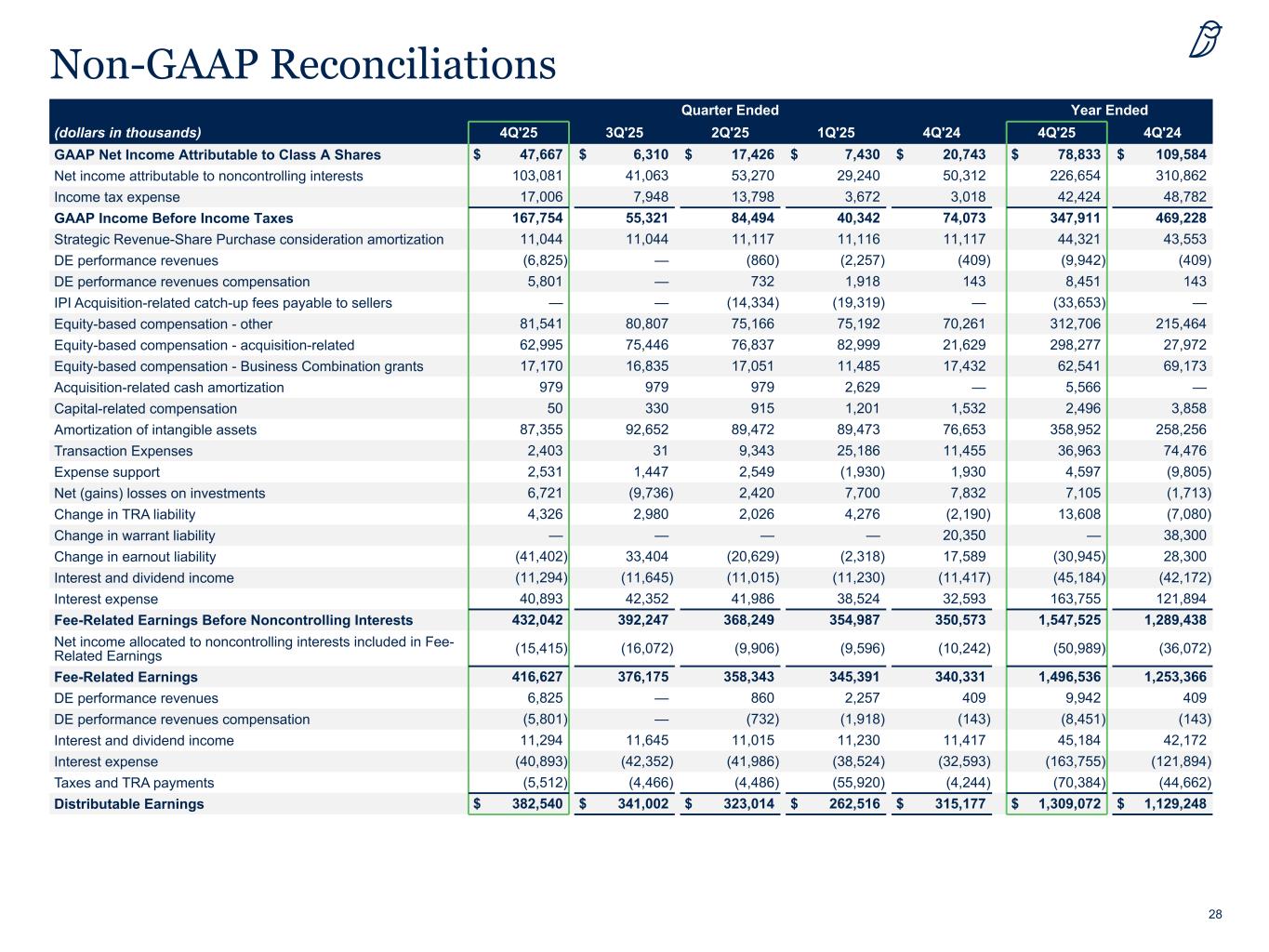

28 Non-GAAP Reconciliations Quarter Ended Year Ended (dollars in thousands) 4Q'25 3Q'25 2Q'25 1Q'25 4Q'24 4Q'25 4Q'24 GAAP Net Income Attributable to Class A Shares $ 47,667 $ 6,310 $ 17,426 $ 7,430 $ 20,743 $ 78,833 $ 109,584 Net income attributable to noncontrolling interests 103,081 41,063 53,270 29,240 50,312 226,654 310,862 Income tax expense 17,006 7,948 13,798 3,672 3,018 42,424 48,782 GAAP Income Before Income Taxes 167,754 55,321 84,494 40,342 74,073 347,911 469,228 Strategic Revenue-Share Purchase consideration amortization 11,044 11,044 11,117 11,116 11,117 44,321 43,553 DE performance revenues (6,825) — (860) (2,257) (409) (9,942) (409) DE performance revenues compensation 5,801 — 732 1,918 143 8,451 143 IPI Acquisition-related catch-up fees payable to sellers — — (14,334) (19,319) — (33,653) — Equity-based compensation - other 81,541 80,807 75,166 75,192 70,261 312,706 215,464 Equity-based compensation - acquisition-related 62,995 75,446 76,837 82,999 21,629 298,277 27,972 Equity-based compensation - Business Combination grants 17,170 16,835 17,051 11,485 17,432 62,541 69,173 Acquisition-related cash amortization 979 979 979 2,629 — 5,566 — Capital-related compensation 50 330 915 1,201 1,532 2,496 3,858 Amortization of intangible assets 87,355 92,652 89,472 89,473 76,653 358,952 258,256 Transaction Expenses 2,403 31 9,343 25,186 11,455 36,963 74,476 Expense support 2,531 1,447 2,549 (1,930) 1,930 4,597 (9,805) Net (gains) losses on investments 6,721 (9,736) 2,420 7,700 7,832 7,105 (1,713) Change in TRA liability 4,326 2,980 2,026 4,276 (2,190) 13,608 (7,080) Change in warrant liability — — — — 20,350 — 38,300 Change in earnout liability (41,402) 33,404 (20,629) (2,318) 17,589 (30,945) 28,300 Interest and dividend income (11,294) (11,645) (11,015) (11,230) (11,417) (45,184) (42,172) Interest expense 40,893 42,352 41,986 38,524 32,593 163,755 121,894 Fee-Related Earnings Before Noncontrolling Interests 432,042 392,247 368,249 354,987 350,573 1,547,525 1,289,438 Net income allocated to noncontrolling interests included in Fee- Related Earnings (15,415) (16,072) (9,906) (9,596) (10,242) (50,989) (36,072) Fee-Related Earnings 416,627 376,175 358,343 345,391 340,331 1,496,536 1,253,366 DE performance revenues 6,825 — 860 2,257 409 9,942 409 DE performance revenues compensation (5,801) — (732) (1,918) (143) (8,451) (143) Interest and dividend income 11,294 11,645 11,015 11,230 11,417 45,184 42,172 Interest expense (40,893) (42,352) (41,986) (38,524) (32,593) (163,755) (121,894) Taxes and TRA payments (5,512) (4,466) (4,486) (55,920) (4,244) (70,384) (44,662) Distributable Earnings $ 382,540 $ 341,002 $ 323,014 $ 262,516 $ 315,177 $ 1,309,072 $ 1,129,248

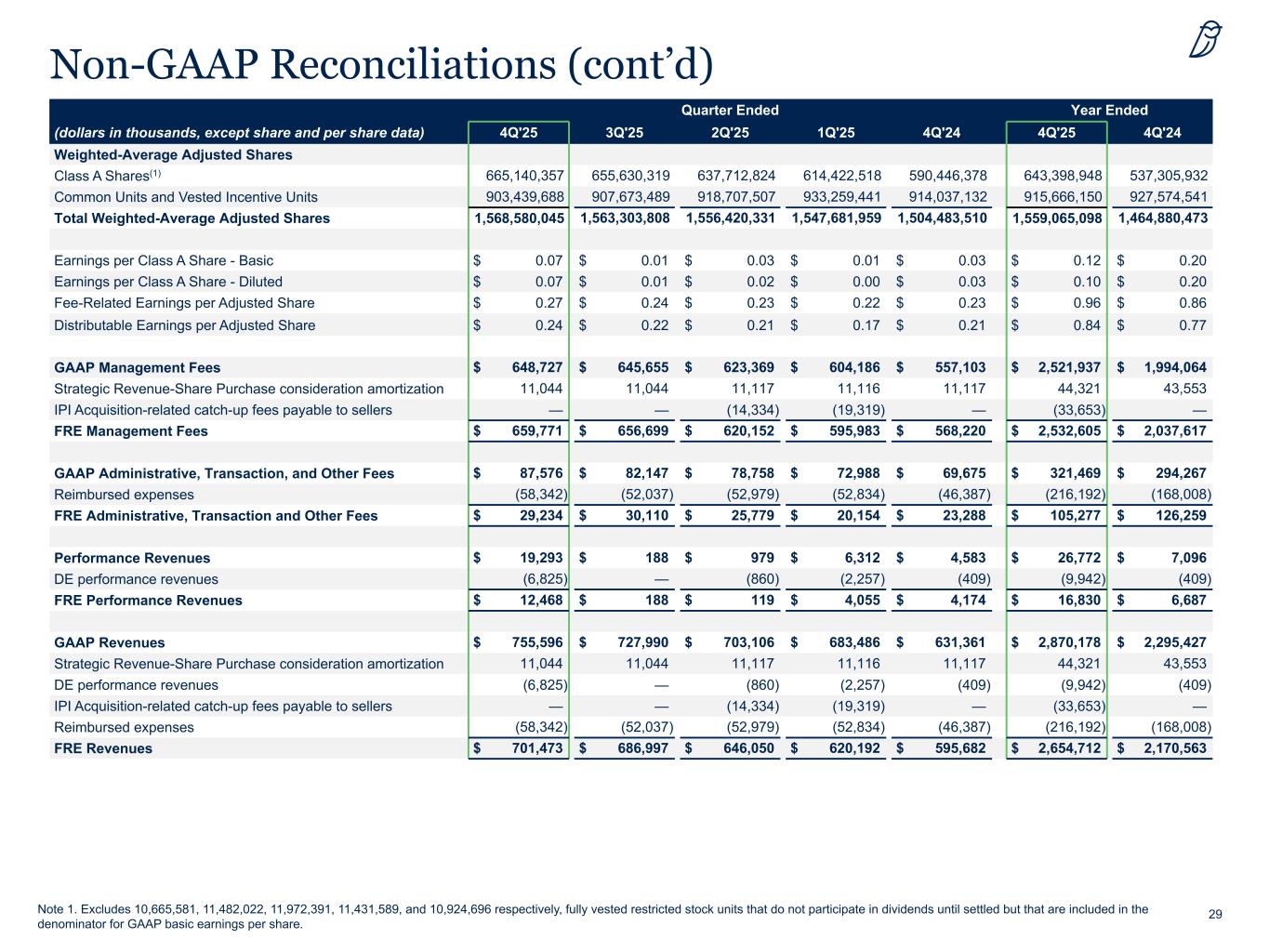

29 Non-GAAP Reconciliations (cont’d) Quarter Ended Year Ended (dollars in thousands, except share and per share data) 4Q'25 3Q'25 2Q'25 1Q'25 4Q'24 4Q'25 4Q'24 Weighted-Average Adjusted Shares Class A Shares(1) 665,140,357 655,630,319 637,712,824 614,422,518 590,446,378 643,398,948 537,305,932 Common Units and Vested Incentive Units 903,439,688 907,673,489 918,707,507 933,259,441 914,037,132 915,666,150 927,574,541 Total Weighted-Average Adjusted Shares 1,568,580,045 1,563,303,808 1,556,420,331 1,547,681,959 1,504,483,510 1,559,065,098 1,464,880,473 Earnings per Class A Share - Basic $ 0.07 $ 0.01 $ 0.03 $ 0.01 $ 0.03 $ 0.12 $ 0.20 Earnings per Class A Share - Diluted $ 0.07 $ 0.01 $ 0.02 $ 0.00 $ 0.03 $ 0.10 $ 0.20 Fee-Related Earnings per Adjusted Share $ 0.27 $ 0.24 $ 0.23 $ 0.22 $ 0.23 $ 0.96 $ 0.86 Distributable Earnings per Adjusted Share $ 0.24 $ 0.22 $ 0.21 $ 0.17 $ 0.21 $ 0.84 $ 0.77 GAAP Management Fees $ 648,727 $ 645,655 $ 623,369 $ 604,186 $ 557,103 $ 2,521,937 $ 1,994,064 Strategic Revenue-Share Purchase consideration amortization 11,044 11,044 11,117 11,116 11,117 44,321 43,553 IPI Acquisition-related catch-up fees payable to sellers — — (14,334) (19,319) — (33,653) — FRE Management Fees $ 659,771 $ 656,699 $ 620,152 $ 595,983 $ 568,220 $ 2,532,605 $ 2,037,617 GAAP Administrative, Transaction, and Other Fees $ 87,576 $ 82,147 $ 78,758 $ 72,988 $ 69,675 $ 321,469 $ 294,267 Reimbursed expenses (58,342) (52,037) (52,979) (52,834) (46,387) (216,192) (168,008) FRE Administrative, Transaction and Other Fees $ 29,234 $ 30,110 $ 25,779 $ 20,154 $ 23,288 $ 105,277 $ 126,259 Performance Revenues $ 19,293 $ 188 $ 979 $ 6,312 $ 4,583 $ 26,772 $ 7,096 DE performance revenues (6,825) — (860) (2,257) (409) (9,942) (409) FRE Performance Revenues $ 12,468 $ 188 $ 119 $ 4,055 $ 4,174 $ 16,830 $ 6,687 GAAP Revenues $ 755,596 $ 727,990 $ 703,106 $ 683,486 $ 631,361 $ 2,870,178 $ 2,295,427 Strategic Revenue-Share Purchase consideration amortization 11,044 11,044 11,117 11,116 11,117 44,321 43,553 DE performance revenues (6,825) — (860) (2,257) (409) (9,942) (409) IPI Acquisition-related catch-up fees payable to sellers — — (14,334) (19,319) — (33,653) — Reimbursed expenses (58,342) (52,037) (52,979) (52,834) (46,387) (216,192) (168,008) FRE Revenues $ 701,473 $ 686,997 $ 646,050 $ 620,192 $ 595,682 $ 2,654,712 $ 2,170,563 Note 1. Excludes 10,665,581, 11,482,022, 11,972,391, 11,431,589, and 10,924,696 respectively, fully vested restricted stock units that do not participate in dividends until settled but that are included in the denominator for GAAP basic earnings per share.

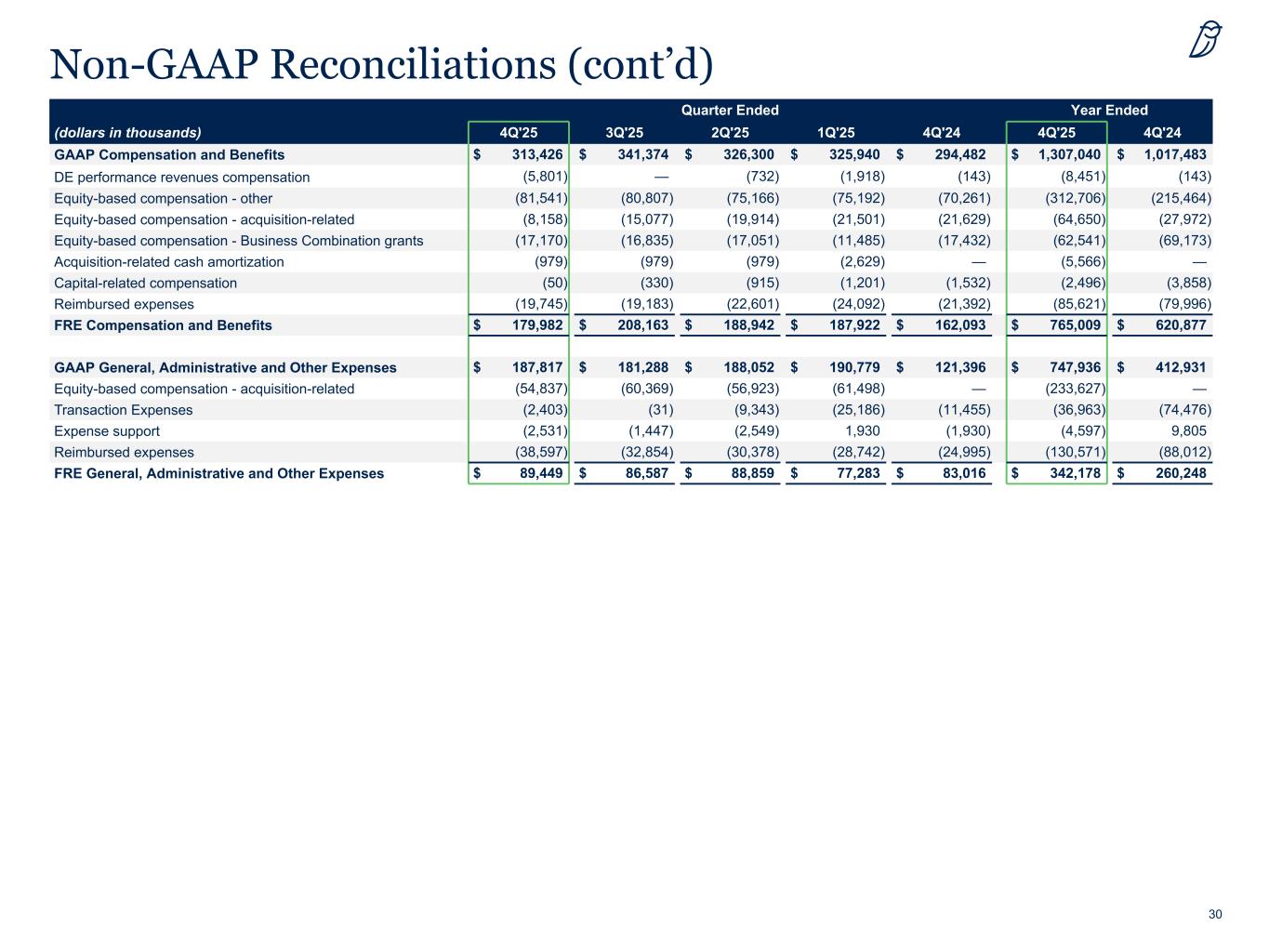

30 Non-GAAP Reconciliations (cont’d) Quarter Ended Year Ended (dollars in thousands) 4Q'25 3Q'25 2Q'25 1Q'25 4Q'24 4Q'25 4Q'24 GAAP Compensation and Benefits $ 313,426 $ 341,374 $ 326,300 $ 325,940 $ 294,482 $ 1,307,040 $ 1,017,483 DE performance revenues compensation (5,801) — (732) (1,918) (143) (8,451) (143) Equity-based compensation - other (81,541) (80,807) (75,166) (75,192) (70,261) (312,706) (215,464) Equity-based compensation - acquisition-related (8,158) (15,077) (19,914) (21,501) (21,629) (64,650) (27,972) Equity-based compensation - Business Combination grants (17,170) (16,835) (17,051) (11,485) (17,432) (62,541) (69,173) Acquisition-related cash amortization (979) (979) (979) (2,629) — (5,566) — Capital-related compensation (50) (330) (915) (1,201) (1,532) (2,496) (3,858) Reimbursed expenses (19,745) (19,183) (22,601) (24,092) (21,392) (85,621) (79,996) FRE Compensation and Benefits $ 179,982 $ 208,163 $ 188,942 $ 187,922 $ 162,093 $ 765,009 $ 620,877 GAAP General, Administrative and Other Expenses $ 187,817 $ 181,288 $ 188,052 $ 190,779 $ 121,396 $ 747,936 $ 412,931 Equity-based compensation - acquisition-related (54,837) (60,369) (56,923) (61,498) — (233,627) — Transaction Expenses (2,403) (31) (9,343) (25,186) (11,455) (36,963) (74,476) Expense support (2,531) (1,447) (2,549) 1,930 (1,930) (4,597) 9,805 Reimbursed expenses (38,597) (32,854) (30,378) (28,742) (24,995) (130,571) (88,012) FRE General, Administrative and Other Expenses $ 89,449 $ 86,587 $ 88,859 $ 77,283 $ 83,016 $ 342,178 $ 260,248

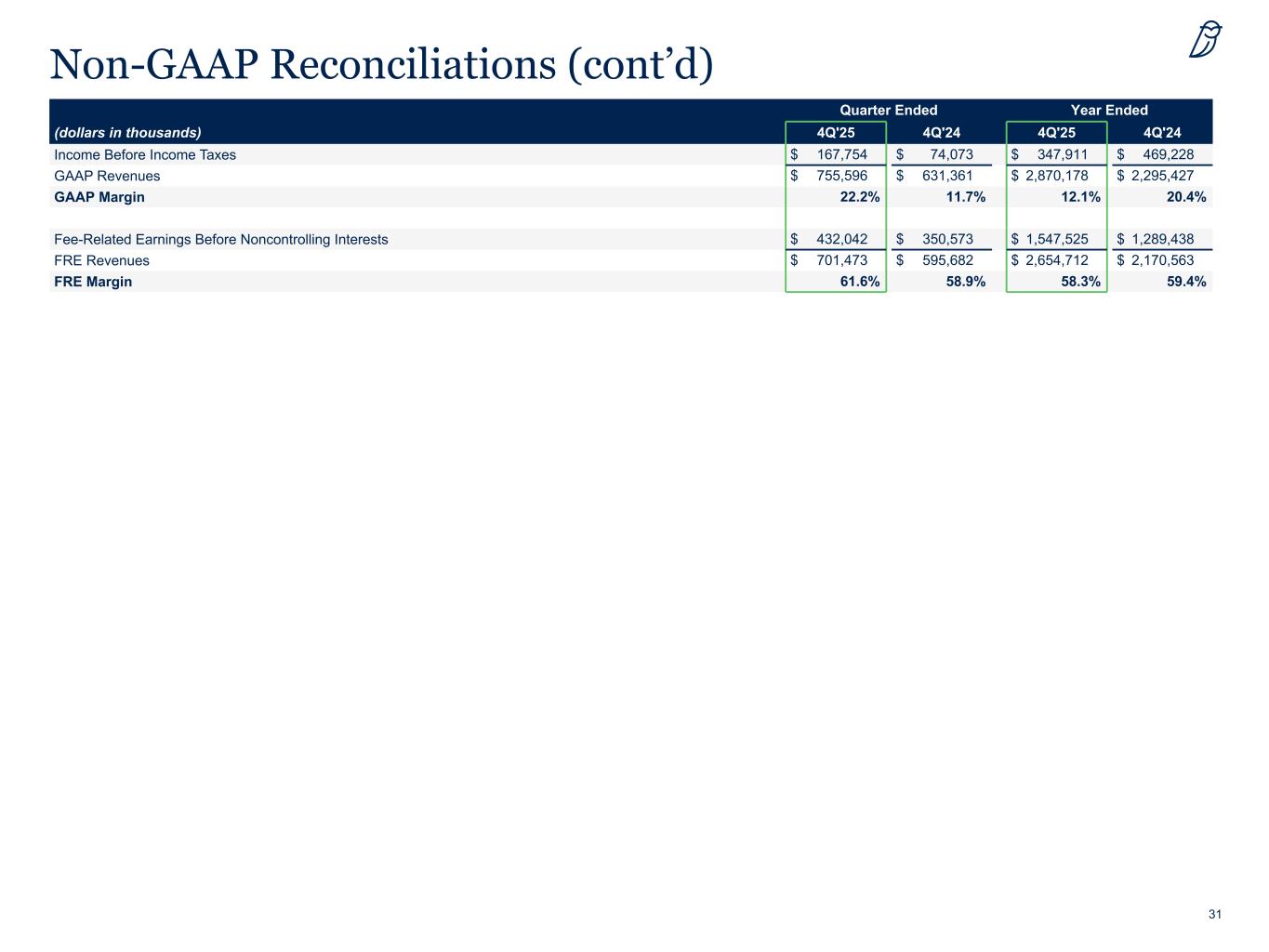

31 Non-GAAP Reconciliations (cont’d) Quarter Ended Year Ended (dollars in thousands) 4Q'25 4Q'24 4Q'25 4Q'24 Income Before Income Taxes $ 167,754 $ 74,073 $ 347,911 $ 469,228 GAAP Revenues $ 755,596 $ 631,361 $ 2,870,178 $ 2,295,427 GAAP Margin 22.2% 11.7% 12.1% 20.4% Fee-Related Earnings Before Noncontrolling Interests $ 432,042 $ 350,573 $ 1,547,525 $ 1,289,438 FRE Revenues $ 701,473 $ 595,682 $ 2,654,712 $ 2,170,563 FRE Margin 61.6% 58.9% 58.3% 59.4%

32 Defined Terms Assets Under Management or AUM Refers to the assets that we manage, and is generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Credit and Real Assets products; and (v) par value of collateral for collateralized loan obligations (“CLOs”) and other securitizations. our BDCs Refers to the business development companies (“BDCs”) we manage, as regulated under the Investment Company Act of 1940, as amended (the “Investment Company Act”): Blue Owl Capital Corporation (NYSE: OBDC) (“OBDC”), Blue Owl Capital Corporation II (“OBDC II”), Blue Owl Technology Finance Corp. (NYSE: OTF) (“OTF”), Blue Owl Credit Income Corp. (“OCIC”), Blue Owl Technology Income Corp. (“OTIC”), until January 13, 2025, Blue Owl Capital Corporation III (“OBDE”) and, until March 24, 2025, Blue Owl Technology Finance Corp. II (“OTF II”). Blue Owl, the Company, the firm, we, us, and our Refers to Blue Owl Capital Inc. and its consolidated subsidiaries. Blue Owl Operating Group Refers collectively to Blue Owl Capital Holdings LP (“Blue Owl Holdings”) and its consolidated subsidiaries and any future Blue Owl Operating Partnership. Blue Owl Operating Group Units Refers collectively to a unit in each entity constituting the Blue Owl Operating Group. Blue Owl Operating Partnerships Prior to the Internal Reorganization, referred collectively to Blue Owl Holdings and Blue Owl Capital Carry LP (“Blue Owl Carry”). Following the Internal Reorganization, refers to Blue Owl Holdings and any future entity designated by our board of directors in its sole discretion as a Blue Owl Operating Partnership, unless context indicates otherwise. Business Combination Refers to the transactions contemplated by the business combination agreement dated as of December 23, 2020 (as the same has been or may be amended, modified, supplemented or waived from time to time), by and among Altimar Acquisition Corporation, Owl Rock Capital Group LLC, Owl Rock Capital Feeder LLC, Owl Rock Capital Partners LP and Neuberger Berman Group LLC, which transactions were completed on May 19, 2021. Credit Refers to our Credit platform that includes (i) our direct lending strategy, which offers private credit solutions to primarily upper-middle-market companies through differentiated access points; (ii) alternative credit, which targets credit-oriented investments in markets underserved by traditional lenders or the broader capital markets, with deep expertise investing across specialty finance, private corporate credit and equipment leasing; (iii) investment grade credit, which focuses on generating capital-efficient investment income through asset-backed finance, private corporate credit, and structured products; and (iv) liquid credit, which focuses on the management of CLOs. Our Credit platform also includes our other adjacent investment strategies (e.g., strategic equity and healthcare opportunities). Fee-Paying AUM or FPAUM Refers to the AUM on which management fees and/or FRE performance revenues are earned. For our Regulated Products, FPAUM is generally equal to total assets (including assets acquired with debt but excluding cash). For our other Credit products, excluding CLOs, FPAUM is generally equal to NAV, investment cost, market value or statutory book value. FPAUM also includes uncalled committed capital for products where we earn management fees thereon. For CLOs and other securitizations, FPAUM is generally equal to the par value of collateral. For Real Assets, FPAUM is generally equal to a combination of capital commitments, the cost of unrealized investments during the investment period and the cost of unrealized investments after the investment period; however, for certain Real Assets products, FPAUM is based on NAV, market value or statutory book value. For our GP Strategic Capital products, FPAUM for the GP minority stakes strategy is generally equal to capital commitments during the investment period and the cost of unrealized investments after the investment period. For GP Strategic Capital’s other strategies, FPAUM is generally equal to investment cost. Fitch Refers to Fitch Ratings credit rating agency. GP Strategic Capital Refers to our GP Strategic Capital platform that primarily focuses on acquiring equity stakes in, and providing debt financing to, large, multi- product private equity and private credit firms through two investment strategies: GP minority stakes and GP debt financing, and also includes our professional sports minority stakes strategy.

33 Defined Terms (cont’d) Gross IRR Refers to an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees (including Part I Fees), Part II Fees and carried interest, as applicable, but net of all other expenses. Gross Return Refers to a return that is equal to the percentage change in the value of a product's portfolio, adjusted for all contributions and withdrawals (cash flows) before the effects of management fees, incentive fees and carried interest allocated to the general partner of special limited partners, or other fees and expenses. Institutional Equity Fundraise Includes insurance, internal fundraise and GP commitments. Internal Reorganization Refers to the internal reorganization that occurred on April 1, 2025, pursuant to which, among other things, Blue Owl Carry became a wholly owned subsidiary of Blue Owl Holdings. IPI Acquisition Refers to the acquisition of the business of digital infrastructure fund manager IPI Partners, LLC that was completed on January 3, 2025. Moody's Refers to Moody's credit rating agency. Net IRR Refers to an annualized since inception net internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Net IRRs reflect returns to all investors. Net IRRs are calculated after giving effect to management fees (including Part I Fees), Part II Fees and carried interest, as applicable, and all other expenses. An individual investor’s IRR may differ from the reported IRR based on the timing of capital transactions. Net Return Refers to a return that is equal to the percentage change in the value of a product's portfolio, adjusted for all contributions and withdrawals (cash flows) after the effects of management fees, incentive fees and carried interest allocated to the general partner of special limited partners, or other fees and expenses. OWLCX Refers to Blue Owl Alternative Credit Fund, a non-diversified, closed-end management investment company registered under the Investment Company Act that is operated as an “interval fund.” Part I Fees Refers to quarterly performance income on the net investment income of our BDCs, OWLCX and similarly structured products, subject to a fixed hurdle rate. These fees are classified as management fees throughout this presentation, as they are predictable and recurring in nature, not subject to repayment, and cash-settled each quarter. Part II Fees Generally refers to fees from our BDCs and similarly structured products that are paid in arrears as of the end of each measurement period when the cumulative aggregate realized capital gains exceed the cumulative aggregate realized capital losses and aggregate unrealized capital depreciation, less the aggregate amount of Part II Fees paid in all prior years since inception. Part II Fees are classified as performance revenues throughout this presentation. Permanent Capital Refers to AUM in products that have an indefinite term and do not have a requirement to exit investments and return the proceeds to investors after a prescribed period. Some of these products, however, may be required or can elect to return all or a portion of capital gains and investment income, and some may have periodic tender offers or redemptions. Permanent Capital includes certain products that are subject to management fee step downs or roll-offs or both over time. Real Assets Refers, unless context indicates otherwise, to our Real Assets platform that includes our net lease strategy, which focuses on acquiring net- leased real estate occupied by investment grade and creditworthy tenants; real estate credit, which offers a diverse range of competitive financing solutions; and digital infrastructure, which focuses on acquiring, financing, developing, and operating data centers and related digital infrastructure assets. our Regulated Products Refers to our BDCs and OWLCX. S&P Refers to Standard & Poor's credit rating agency. Tax Receivable Agreement or TRA Refers to the Second Amended and Restated Tax Receivable Agreement, dated as of April 1, 2025, as may be amended from time to time by and among the Registrant, Blue Owl Capital GP LLC, Blue Owl Holdings, Blue Owl Carry (solely for purposes of Section 7.18(b) thereof) and each of the Partners (as defined therein) party thereto.