SHAREHOLDER LETTER // SHAREHOLDER LETTER Q1 2025

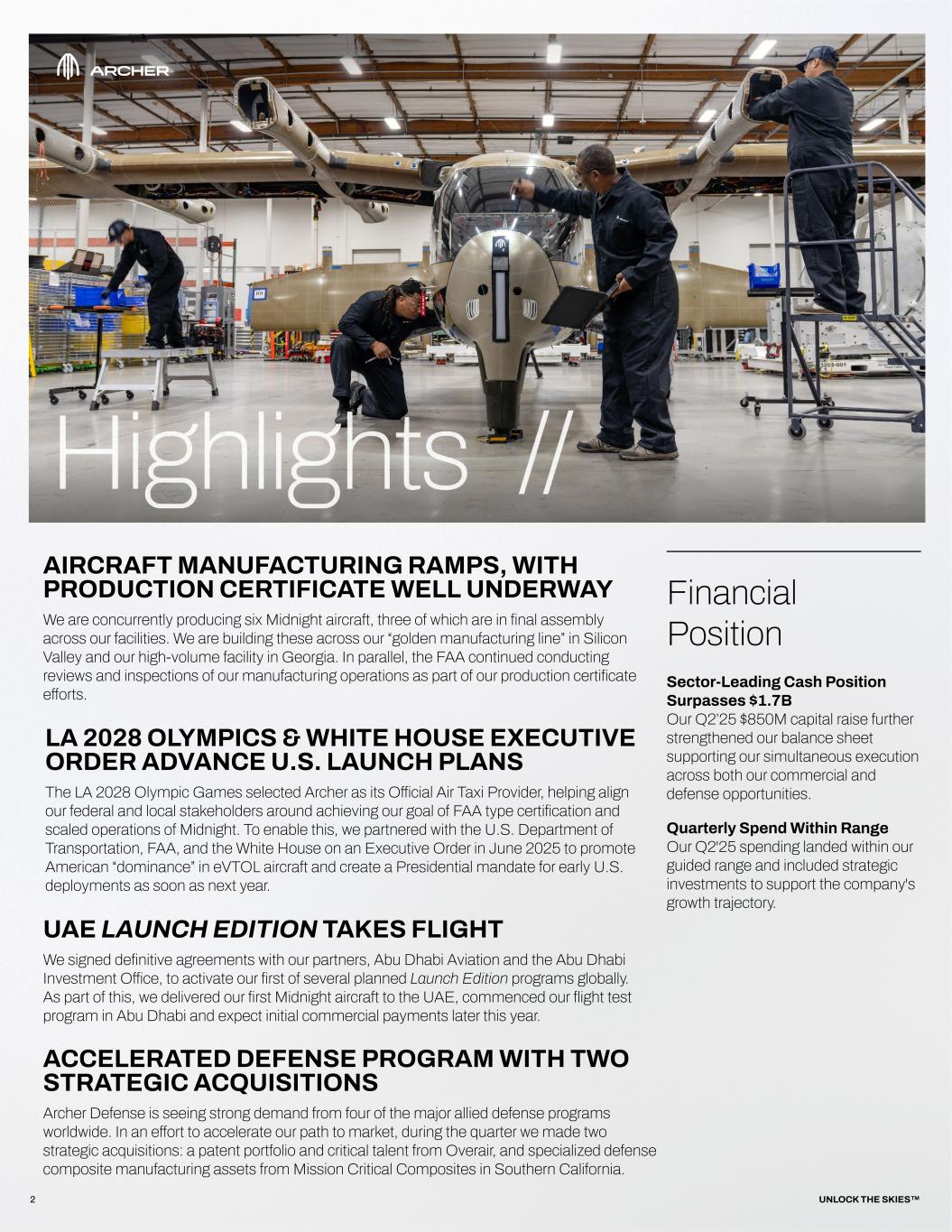

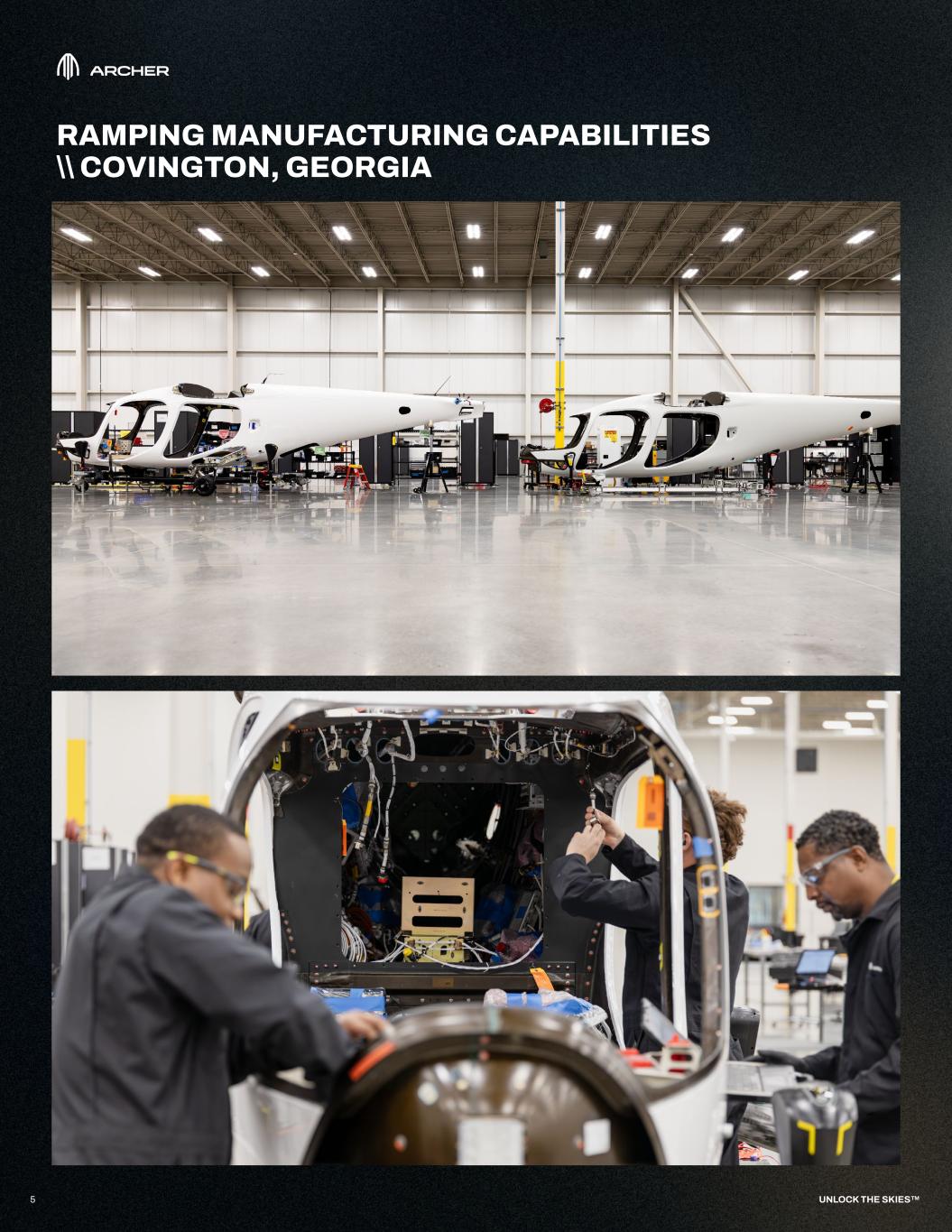

Financial Position Sector-Leading Cash Position Surpasses $1.7B Our Q2’25 $850M capital raise further strengthened our balance sheet supporting our simultaneous execution across both our commercial and defense opportunities. Quarterly Spend Within Range Our Q2'25 spending landed within our guided range and included strategic investments to support the company's growth trajectory. 2 LA 2028 OLYMPICS & WHITE HOUSE EXECUTIVE ORDER ADVANCE U.S. LAUNCH PLANS The LA 2028 Olympic Games selected Archer as its Official Air Taxi Provider, helping align our federal and local stakeholders around achieving our goal of FAA type certification and scaled operations of Midnight. To enable this, we partnered with the U.S. Department of Transportation, FAA, and the White House on an Executive Order in June 2025 to promote American “dominance” in eVTOL aircraft and create a Presidential mandate for early U.S. deployments as soon as next year. UNLOCK THE SKIES™ UAE LAUNCH EDITION TAKES FLIGHT We signed definitive agreements with our partners, Abu Dhabi Aviation and the Abu Dhabi Investment Office, to activate our first of several planned Launch Edition programs globally. As part of this, we delivered our first Midnight aircraft to the UAE, commenced our flight test program in Abu Dhabi and expect initial commercial payments later this year. AIRCRAFT MANUFACTURING RAMPS, WITH PRODUCTION CERTIFICATE WELL UNDERWAY We are concurrently producing six Midnight aircraft, three of which are in final assembly across our facilities. We are building these across our “golden manufacturing line” in Silicon Valley and our high-volume facility in Georgia. In parallel, the FAA continued conducting reviews and inspections of our manufacturing operations as part of our production certificate efforts. ACCELERATED DEFENSE PROGRAM WITH TWO STRATEGIC ACQUISITIONS Archer Defense is seeing strong demand from four of the major allied defense programs worldwide. In an effort to accelerate our path to market, during the quarter we made two strategic acquisitions: a patent portfolio and critical talent from Overair, and specialized defense composite manufacturing assets from Mission Critical Composites in Southern California.

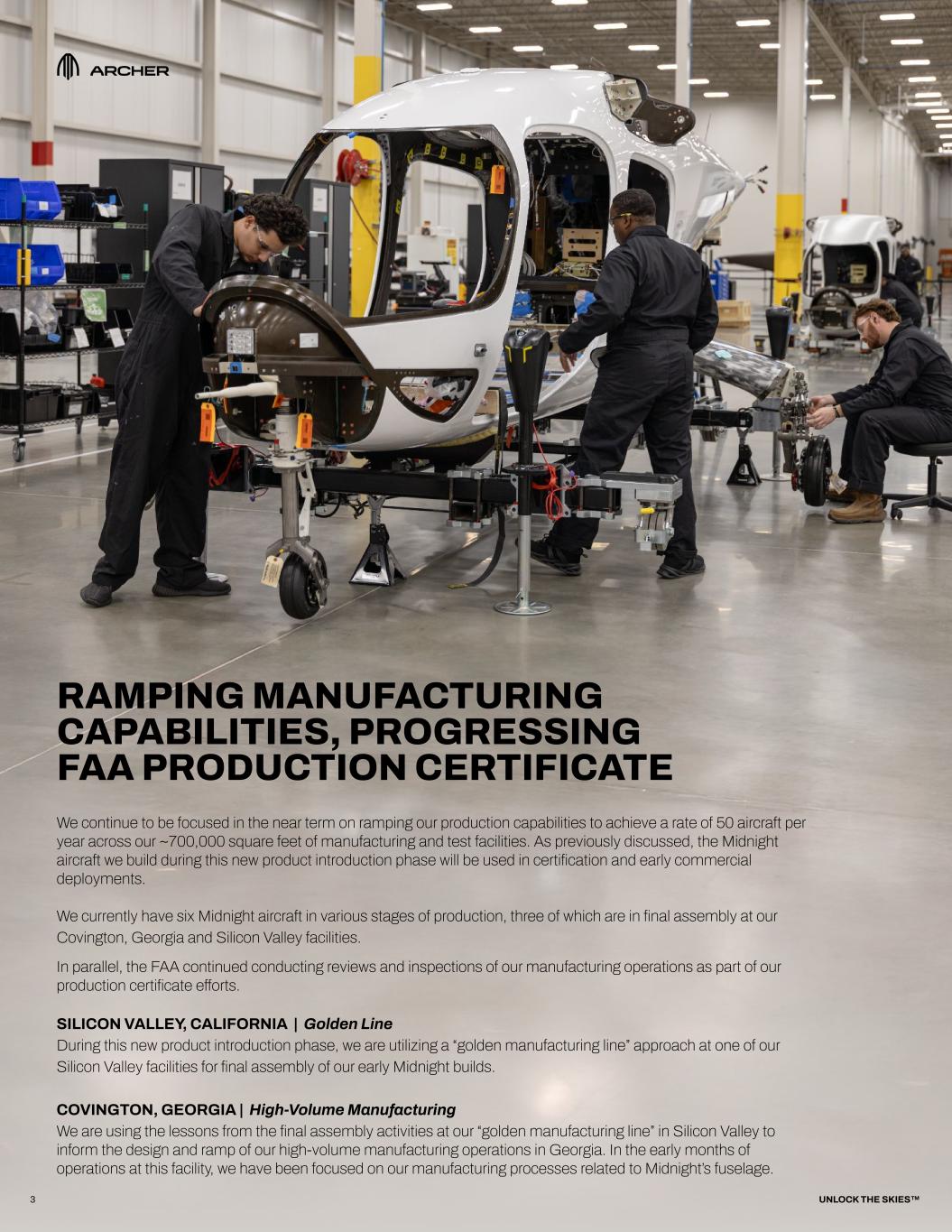

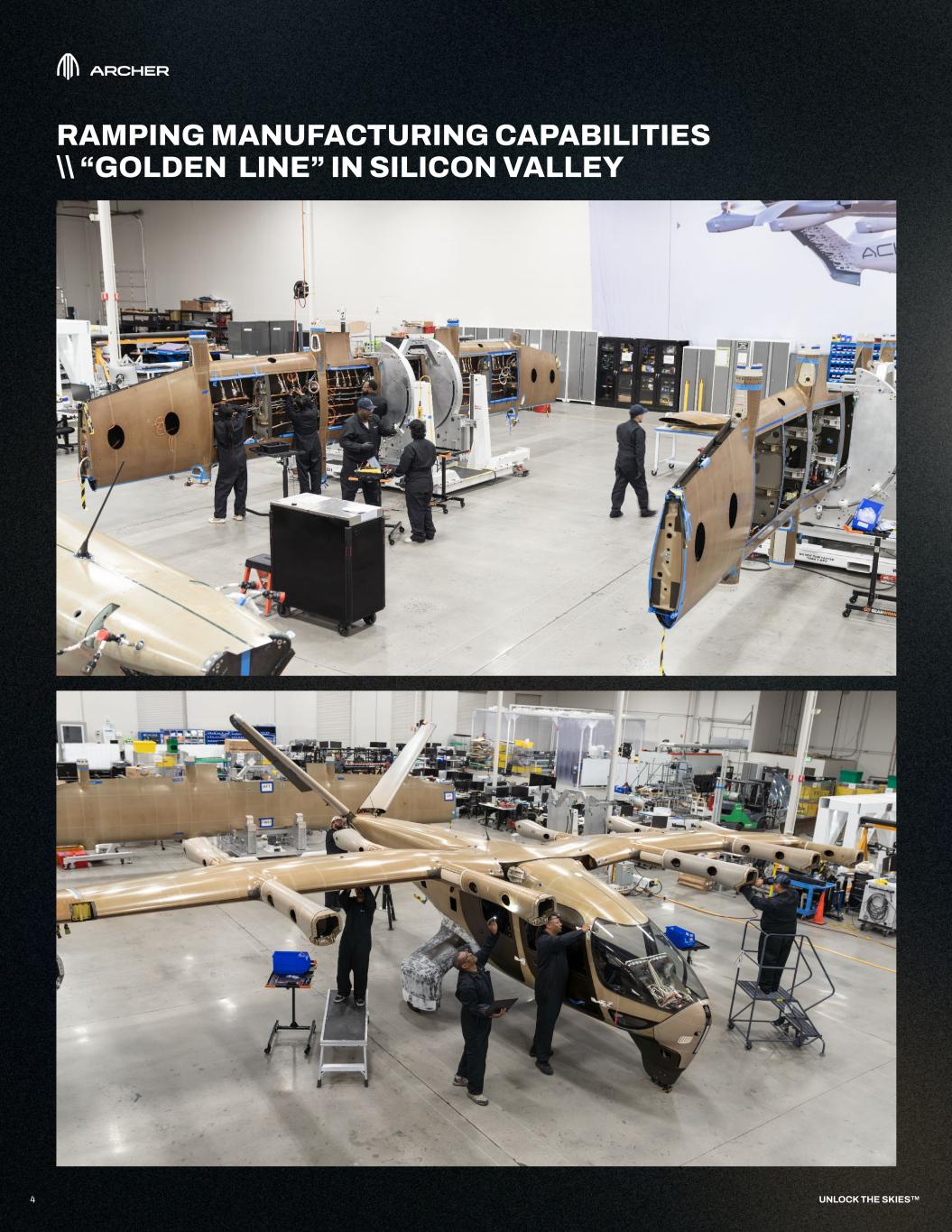

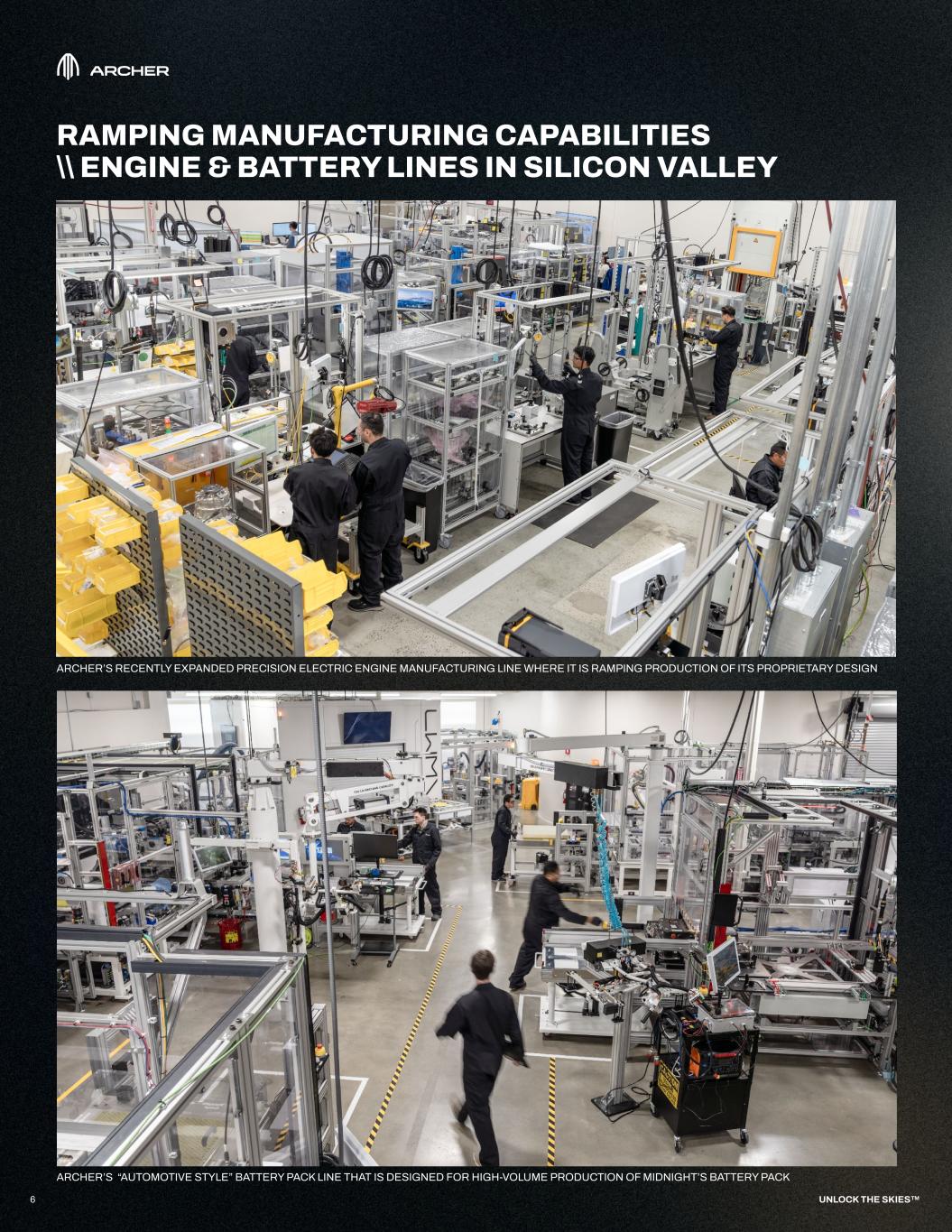

RAMPING MANUFACTURING CAPABILITIES, PROGRESSING FAA PRODUCTION CERTIFICATE We continue to be focused in the near term on ramping our production capabilities to achieve a rate of 50 aircraft per year across our ~700,000 square feet of manufacturing and test facilities. As previously discussed, the Midnight aircraft we build during this new product introduction phase will be used in certification and early commercial deployments. We currently have six Midnight aircraft in various stages of production, three of which are in final assembly at our Covington, Georgia and Silicon Valley facilities. In parallel, the FAA continued conducting reviews and inspections of our manufacturing operations as part of our production certificate efforts. SILICON VALLEY, CALIFORNIA | Golden Line During this new product introduction phase, we are utilizing a “golden manufacturing line” approach at one of our Silicon Valley facilities for final assembly of our early Midnight builds. COVINGTON, GEORGIA | High-Volume Manufacturing We are using the lessons from the final assembly activities at our “golden manufacturing line” in Silicon Valley to inform the design and ramp of our high-volume manufacturing operations in Georgia. In the early months of operations at this facility, we have been focused on our manufacturing processes related to Midnight’s fuselage. 3 UNLOCK THE SKIES™

RAMPING MANUFACTURING CAPABILITIES \\ “GOLDEN LINE” IN SILICON VALLEY 4 UNLOCK THE SKIES™

5 UNLOCK THE SKIES™ RAMPING MANUFACTURING CAPABILITIES \\ COVINGTON, GEORGIA

6 UNLOCK THE SKIES™ RAMPING MANUFACTURING CAPABILITIES \\ ENGINE & BATTERY LINES IN SILICON VALLEY ARCHER’S RECENTLY EXPANDED PRECISION ELECTRIC ENGINE MANUFACTURING LINE WHERE IT IS RAMPING PRODUCTION OF ITS PROPRIETARY DESIGN ARCHER’S “AUTOMOTIVE STYLE” BATTERY PACK LINE THAT IS DESIGNED FOR HIGH-VOLUME PRODUCTION OF MIDNIGHT’S BATTERY PACK

7 UNLOCK THE SKIES™ ARCHER SELECTED AS EXCLUSIVE AIR TAXI PROVIDER OF LA 2028 OLYMPIC GAMES FEDERAL GOVERNMENT SUPPORT In 2023, the FAA published their Innovate28 plan setting out their objective for piloted, passenger-carrying eVTOL aircraft operations to reach meaningful scale by 2028. The Trump Administration has continued to commit support and resources toward this goal. For example, earlier this month, President Trump commissioned a White House task force, and appointed himself as Chairman, to lead federal coordination for the Olympic events, including security and transportation. INFRASTRUCTURE To support the White House’s ambitions, we have secured a number of agreements with local partners across the Greater Los Angeles area to bring online take off and landing locations that we intend to use during the Games to provide air taxi services*. We’ve previously announced a number of those locations, including SoFi Stadium and USC. “The creation of this [White House] task force marks an important step forward in our planning efforts and reflects our shared commitment to delivering not just the biggest, but the greatest Games the world has ever seen.” CASEY WASSERMAN CHAIRMAN LA 2028 OLYMPIC & PARALYMPIC GAMES * These agreements include initial agreements that contemplate the parties entering into future definitive agreements related thereto.

UNLOCK THE SKIES™8 UNLOCK THE SKIES™ WHITE HOUSE EXECUTIVE ORDER CHARTS CLEAR PATHWAY FOR U.S. LAUNCH ADAM GOLDSTEIN FOUNDER & CEO ARCHER AVIATION SEAN P. DUFFY UNITED STATES SECRETARY OF TRANSPORTATION “Dozens of companies in the USA and China are paving the way to develop electric take‑off and landing vehicles for families and individuals … Just as the United States led the automobile revolution in the last century, I want to ensure that America, not China, leads the revolution in air mobility.” DONALD J. TRUMP UNITED STATES PRESIDENT “President Trump’s actions will unleash a new era of American aviation dominance, fostering innovation, driving economic growth, and protecting our national security. MICHAEL KRATSIOS DIRECTOR, WHITE HOUSE OFFICE OF SCIENCE & TECHNOLOGY POLICY — In June 2025, President Trump signed the “Unleashing American Drone Dominance” Executive Order, declaring that the United States must accelerate the safe commercialization of advanced aviation technologies. EVTOL INTEGRATION PILOT PROGRAM This order created the eVTOL Integration Pilot Program to create immediate pathways for us to test and deploy our eVTOL aircraft in real-world use cases — fast-tracking integration into U.S. airspace. We are discussing the potential for early deployments of our Midnight aircraft with the the DOT and FAA as soon as next year. We expect the locations for the pilot program to be announced later this year with flights expected to begin shortly afterward.

9 UNLOCK THE SKIES™ LAUNCH EDITION TAKES FLIGHT IN UAE LAUNCH PARTNERS We recently signed definitive agreements with Abu Dhabi Aviation and the Abu Dhabi Investment Office, as part of the activation of our first Launch Edition program FLIGHT TEST PROGRAM In partnership with the UAE General Civil Aviation Authority, last month we delivered our first Midnight aircraft to the UAE and commenced our flight test program in Abu Dhabi OPERATIONS TRAINING Our airline operations team continues to work alongside Etihad Aviation Training to build our operational readiness across pilot training, maintenance and security

10 Since announcing Archer Defense, we continue to see growing demand from four of the major allied defense programs worldwide. For example, the United States Pentagon submitted a FY26 $13.4B budget allocation request for autonomous and military systems1. In an effort to accelerate our path to market, during the quarter we made two strategic acquisitions: UNLOCK THE SKIES™ ACCELERATED DEFENSE PROGRAM WITH TWO STRATEGIC ACQUISITIONS OVERAIR We acquired a patent portfolio and hired critical employees from Overair, a spin-off of Karem Aircraft. Karem Aircraft developed and manufactured advanced fixed-wing and rotary-wing aircraft focused on the use of high-efficiency tiltrotors. MISSION CRITICAL COMPOSITES We acquired key composite manufacturing assets and an approximately ~60,000 square foot manufacturing facility from Mission Critical Composites, a specialized defense composite manufacturer in Southern California. These assets allow us to bring core composite fabrication capabilities in-house, supporting our defense program needs for rapid prototyping and iteration. 1 See U.S. Department of Defense’s Defense Budget Overview for FY’2026, Chapter 1, Page 5, available at: https://comptroller.defense.gov/Portals/45/Documents/defbudget/FY2026/FY2026_Budget_Request_Overview_Book.pdf,

AUG 12 CANACCORD 45TH ANNUAL GROWTH CONFERENCE Boston AUG 13 JP MORGAN AUTOS CONFERENCE New York AUG 18 14TH ANNUAL NEEDHAM INDUSTRIAL, TECH & CLEANTECH CONFERENCE Virtual SEP 3 NEEDHAM TRANSPORTATION CONFERENCE New York SEP 4 DEUTSCHE BANK 15TH ANNUAL AVIATION FORUM New York SEP 8 H.C. WAINWRIGHT 27TH ANNUAL GLOBAL INVESTMENT CONFERENCE New York SEP 9-11 GLOBAL AEROSPACE SUMMIT Washington D.C. UPCOMING EVENTS // TIME 2 PM PT (5 PM ET) WEBCAST Accessible via our IR website (investors.archer.com) CONFERENCE 404-975-4839 (domestic) CALL +1 833-470-1428 (international) Access code: 100811 TODAY’S WEBCAST & CONFERENCE CALL DETAILS // 11 UNLOCK THE SKIES™

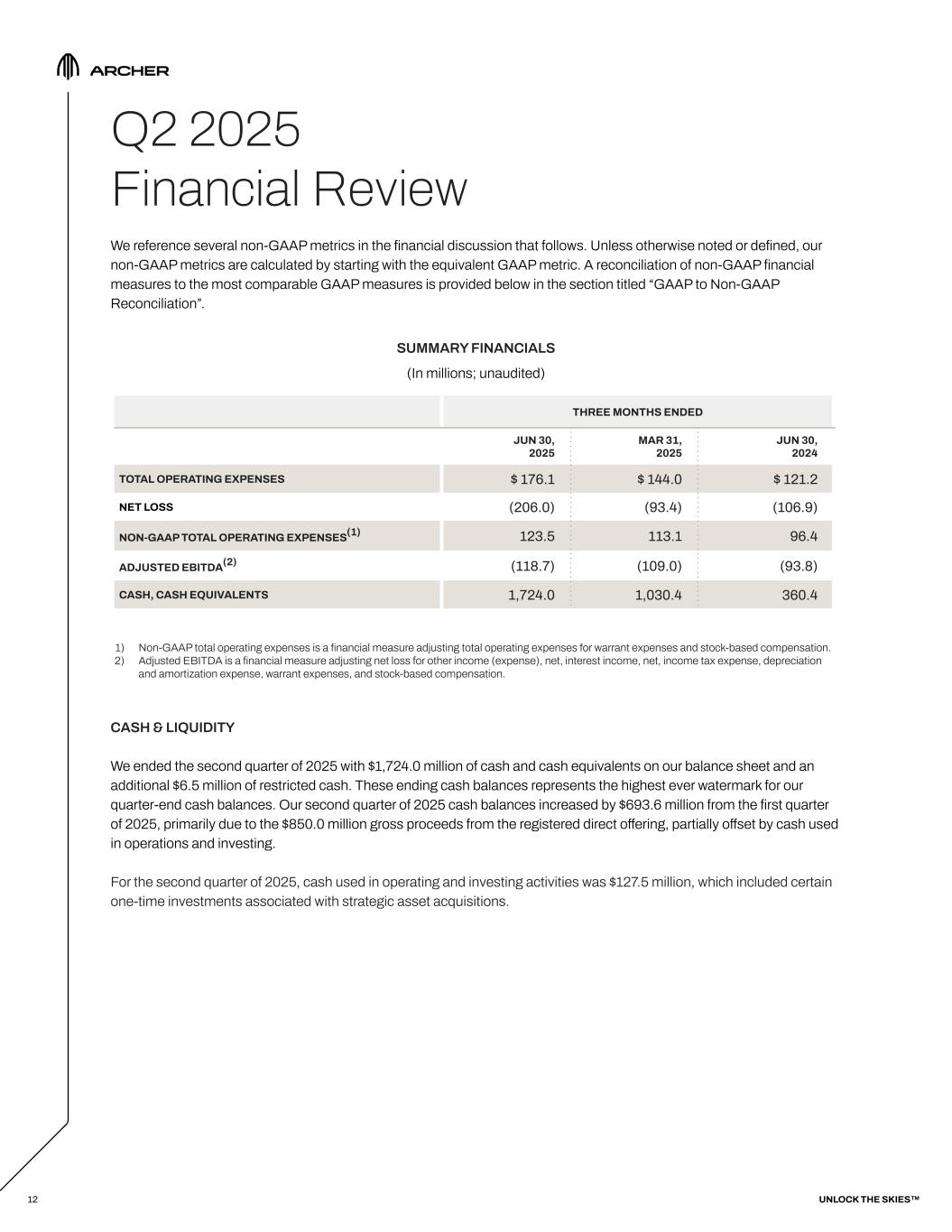

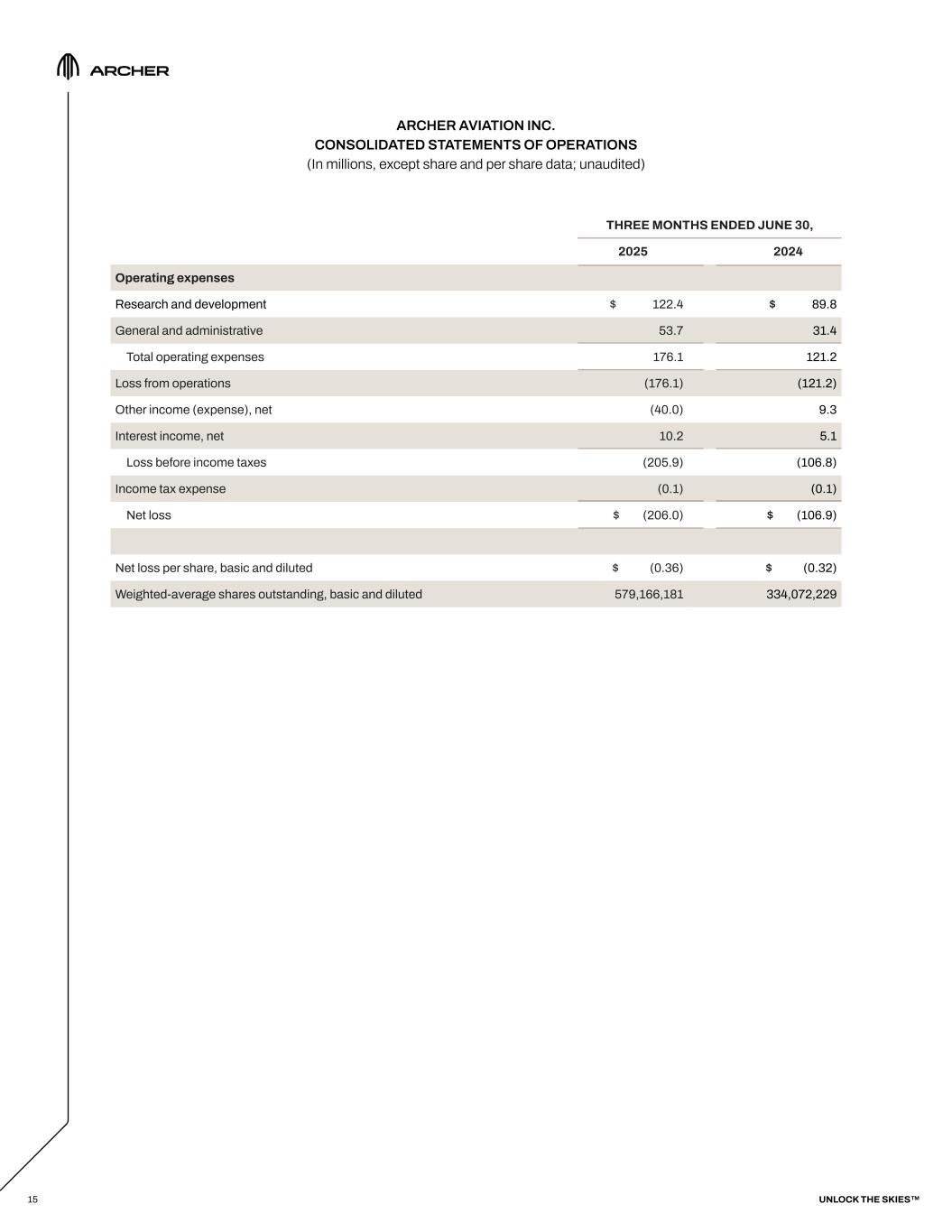

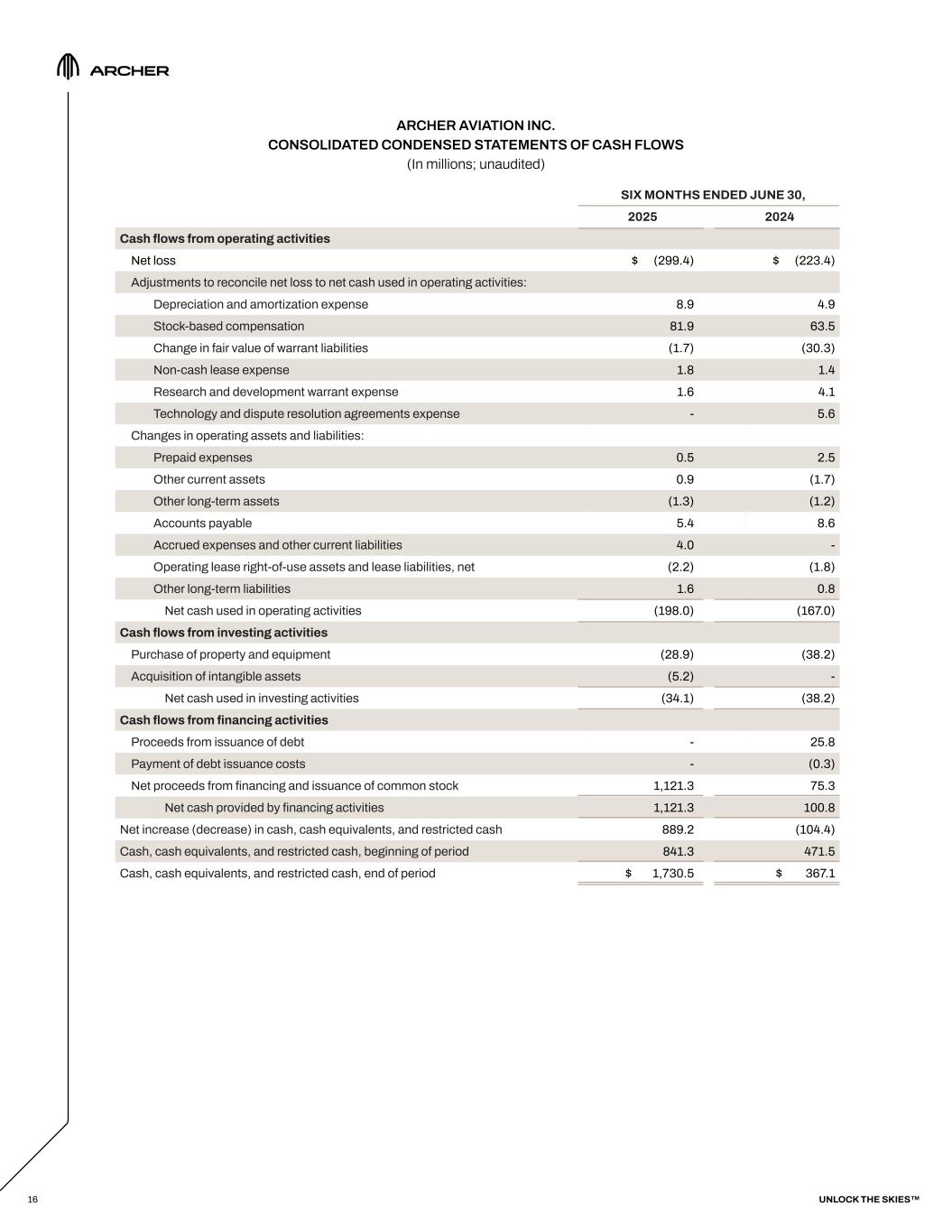

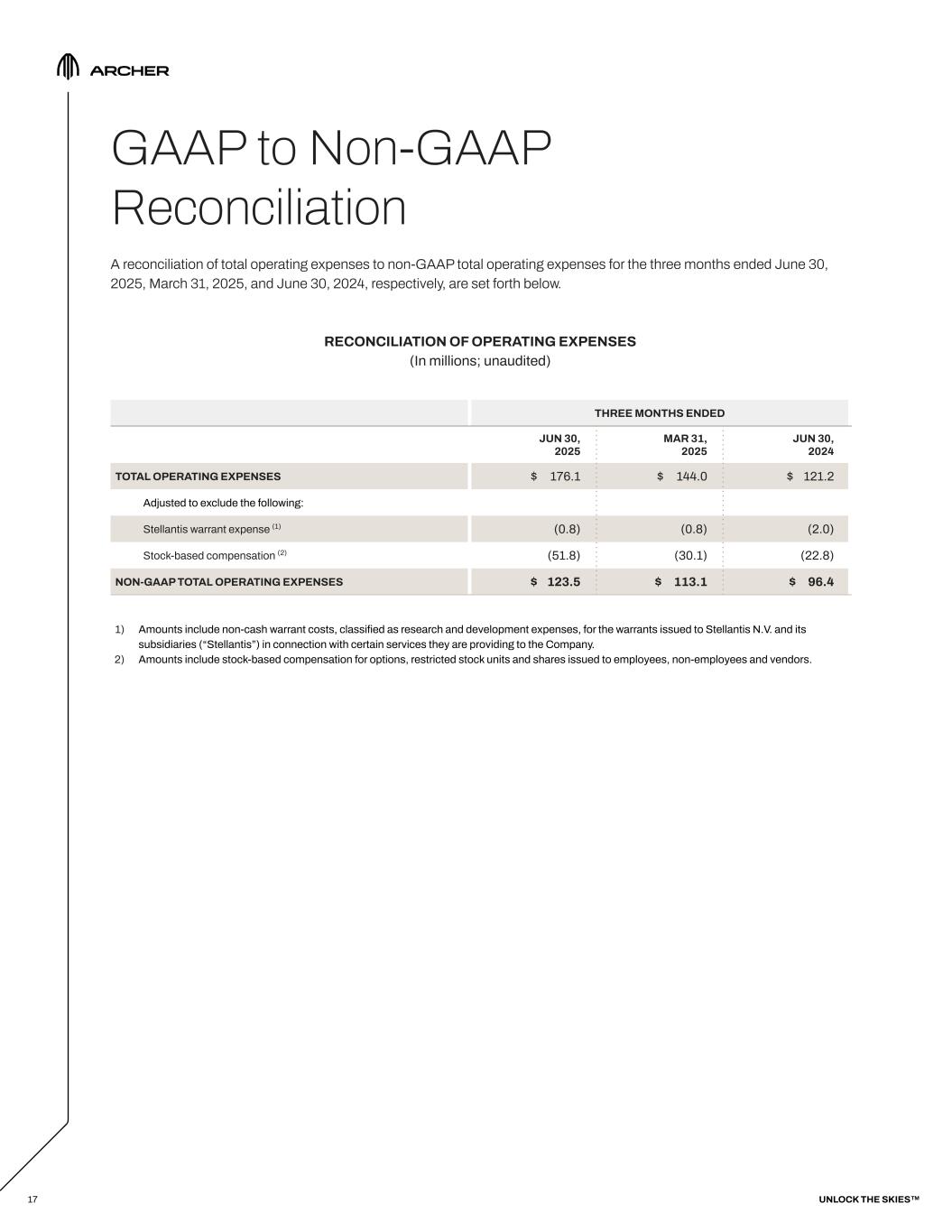

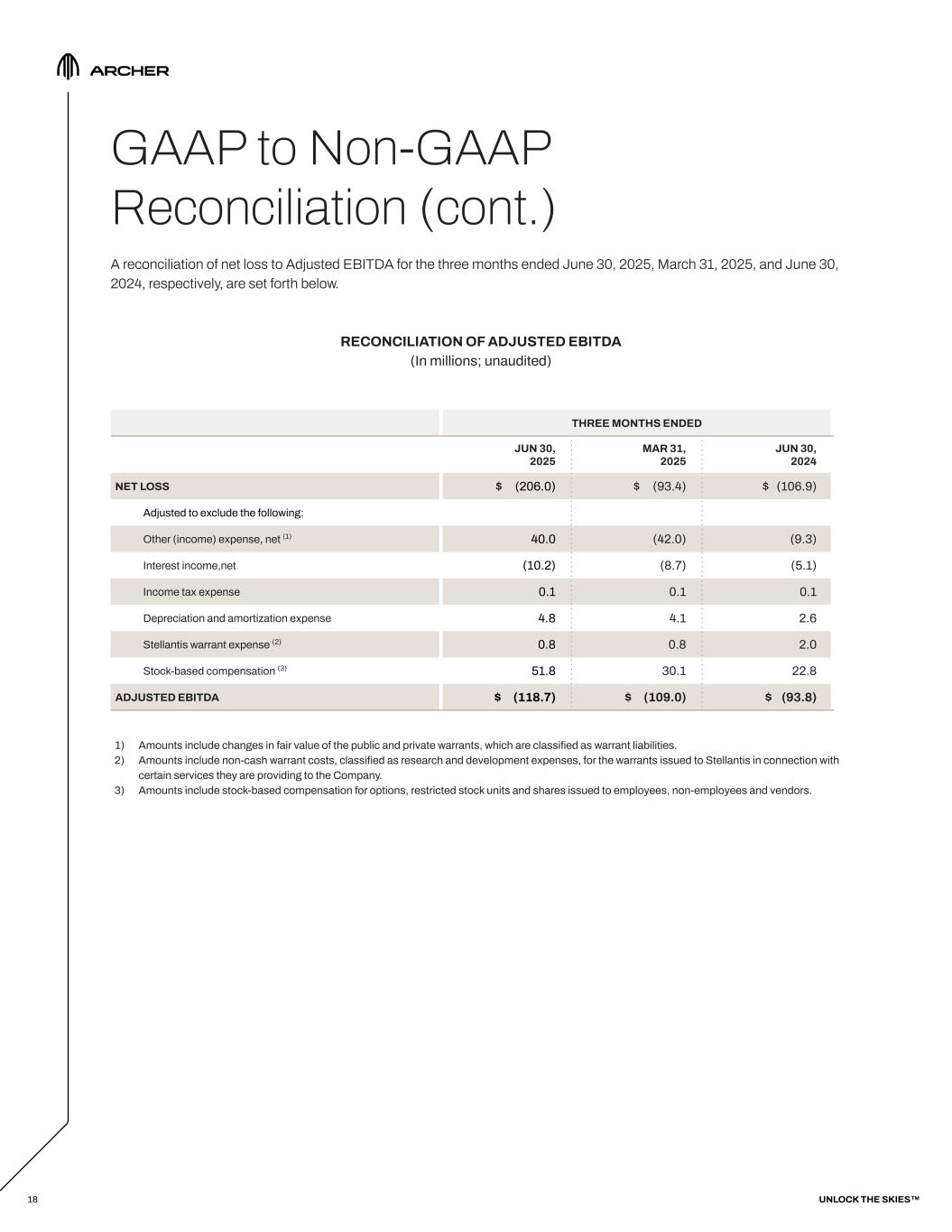

Q2 2025 Financial Review We reference several non-GAAP metrics in the financial discussion that follows. Unless otherwise noted or defined, our non-GAAP metrics are calculated by starting with the equivalent GAAP metric. A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided below in the section titled “GAAP to Non-GAAP Reconciliation”. SUMMARY FINANCIALS (In millions; unaudited) 1) Non-GAAP total operating expenses is a financial measure adjusting total operating expenses for warrant expenses and stock-based compensation. 2) Adjusted EBITDA is a financial measure adjusting net loss for other income (expense), net, interest income, net, income tax expense, depreciation and amortization expense, warrant expenses, and stock-based compensation. CASH & LIQUIDITY We ended the second quarter of 2025 with $1,724.0 million of cash and cash equivalents on our balance sheet and an additional $6.5 million of restricted cash. These ending cash balances represents the highest ever watermark for our quarter-end cash balances. Our second quarter of 2025 cash balances increased by $693.6 million from the first quarter of 2025, primarily due to the $850.0 million gross proceeds from the registered direct offering, partially offset by cash used in operations and investing. For the second quarter of 2025, cash used in operating and investing activities was $127.5 million, which included certain one-time investments associated with strategic asset acquisitions. 12 THREE MONTHS ENDED JUN 30, 2025 MAR 31, 2025 JUN 30, 2024 TOTAL OPERATING EXPENSES $ 176.1 $ 144.0 $ 121.2 NET LOSS (206.0) (93.4) (106.9) NON-GAAP TOTAL OPERATING EXPENSES(1) 123.5 113.1 96.4 ADJUSTED EBITDA(2) (118.7) (109.0) (93.8) CASH, CASH EQUIVALENTS 1,724.0 1,030.4 360.4 UNLOCK THE SKIES™

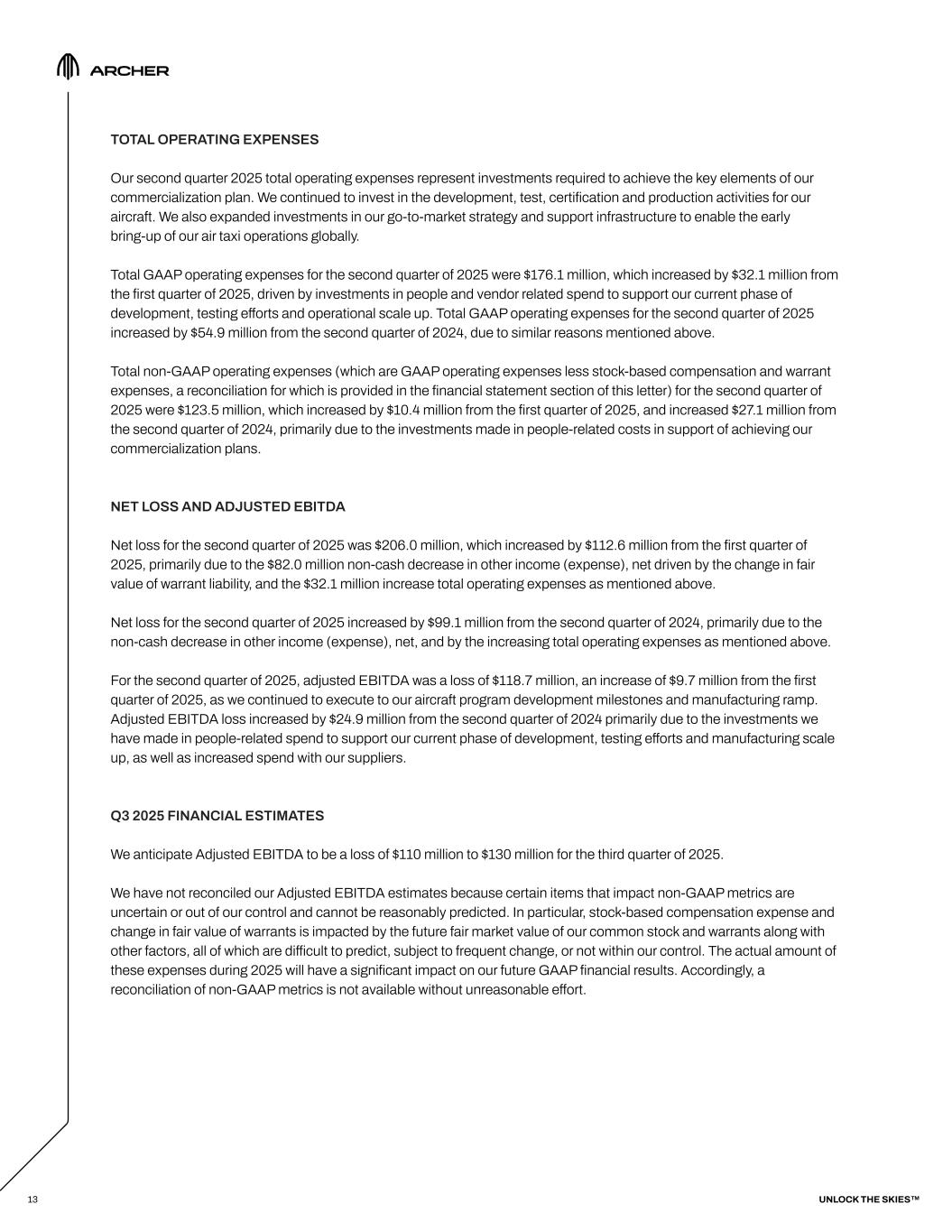

13 TOTAL OPERATING EXPENSES Our second quarter 2025 total operating expenses represent investments required to achieve the key elements of our commercialization plan. We continued to invest in the development, test, certification and production activities for our aircraft. We also expanded investments in our go-to-market strategy and support infrastructure to enable the early bring-up of our air taxi operations globally. Total GAAP operating expenses for the second quarter of 2025 were $176.1 million, which increased by $32.1 million from the first quarter of 2025, driven by investments in people and vendor related spend to support our current phase of development, testing efforts and operational scale up. Total GAAP operating expenses for the second quarter of 2025 increased by $54.9 million from the second quarter of 2024, due to similar reasons mentioned above. Total non-GAAP operating expenses (which are GAAP operating expenses less stock-based compensation and warrant expenses, a reconciliation for which is provided in the financial statement section of this letter) for the second quarter of 2025 were $123.5 million, which increased by $10.4 million from the first quarter of 2025, and increased $27.1 million from the second quarter of 2024, primarily due to the investments made in people-related costs in support of achieving our commercialization plans. NET LOSS AND ADJUSTED EBITDA Net loss for the second quarter of 2025 was $206.0 million, which increased by $112.6 million from the first quarter of 2025, primarily due to the $82.0 million non-cash decrease in other income (expense), net driven by the change in fair value of warrant liability, and the $32.1 million increase total operating expenses as mentioned above. Net loss for the second quarter of 2025 increased by $99.1 million from the second quarter of 2024, primarily due to the non-cash decrease in other income (expense), net, and by the increasing total operating expenses as mentioned above. For the second quarter of 2025, adjusted EBITDA was a loss of $118.7 million, an increase of $9.7 million from the first quarter of 2025, as we continued to execute to our aircraft program development milestones and manufacturing ramp. Adjusted EBITDA loss increased by $24.9 million from the second quarter of 2024 primarily due to the investments we have made in people-related spend to support our current phase of development, testing efforts and manufacturing scale up, as well as increased spend with our suppliers. Q3 2025 FINANCIAL ESTIMATES We anticipate Adjusted EBITDA to be a loss of $110 million to $130 million for the third quarter of 2025. We have not reconciled our Adjusted EBITDA estimates because certain items that impact non-GAAP metrics are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense and change in fair value of warrants is impacted by the future fair market value of our common stock and warrants along with other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2025 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of non-GAAP metrics is not available without unreasonable effort. UNLOCK THE SKIES™

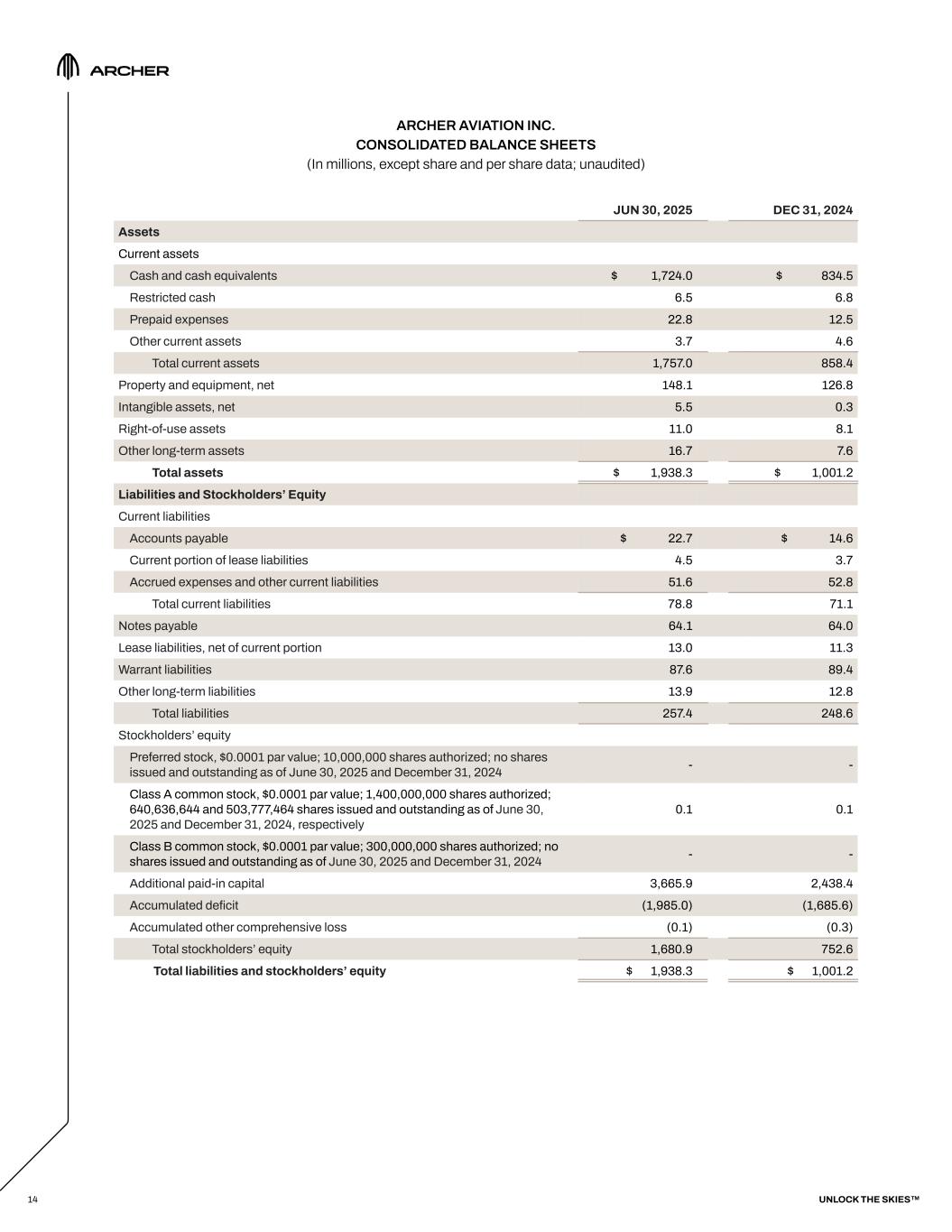

ARCHER AVIATION INC. CONSOLIDATED BALANCE SHEETS (In millions, except share and per share data; unaudited) 14 JUN 30, 2025 DEC 31, 2024 Assets Current assets Cash and cash equivalents $ 1,724.0 $ 834.5 Restricted cash 6.5 6.8 Prepaid expenses 22.8 12.5 Other current assets 3.7 4.6 Total current assets 1,757.0 858.4 Property and equipment, net 148.1 126.8 Intangible assets, net 5.5 0.3 Right-of-use assets 11.0 8.1 Other long-term assets 16.7 7.6 Total assets $ 1,938.3 $ 1,001.2 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 22.7 $ 14.6 Current portion of lease liabilities 4.5 3.7 Accrued expenses and other current liabilities 51.6 52.8 Total current liabilities 78.8 71.1 Notes payable 64.1 64.0 Lease liabilities, net of current portion 13.0 11.3 Warrant liabilities 87.6 89.4 Other long-term liabilities 13.9 12.8 Total liabilities 257.4 248.6 Stockholders’ equity Preferred stock, $0.0001 par value; 10,000,000 shares authorized; no shares issued and outstanding as of June 30, 2025 and December 31, 2024 - - Class A common stock, $0.0001 par value; 1,400,000,000 shares authorized; 640,636,644 and 503,777,464 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively 0.1 0.1 Class B common stock, $0.0001 par value; 300,000,000 shares authorized; no shares issued and outstanding as of June 30, 2025 and December 31, 2024 - - Additional paid-in capital 3,665.9 2,438.4 Accumulated deficit (1,985.0) (1,685.6) Accumulated other comprehensive loss (0.1) (0.3) Total stockholders’ equity 1,680.9 752.6 Total liabilities and stockholders’ equity $ 1,938.3 $ 1,001.2 UNLOCK THE SKIES™

ARCHER AVIATION INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share and per share data; unaudited) 15 THREE MONTHS ENDED JUNE 30, 2025 2024 Operating expenses Research and development $ 122.4 $ 89.8 General and administrative 53.7 31.4 Total operating expenses 176.1 121.2 Loss from operations (176.1) (121.2) Other income (expense), net (40.0) 9.3 Interest income, net 10.2 5.1 Loss before income taxes (205.9) (106.8) Income tax expense (0.1) (0.1) Net loss $ (206.0) $ (106.9) Net loss per share, basic and diluted $ (0.36) $ (0.32) Weighted-average shares outstanding, basic and diluted 579,166,181 334,072,229 UNLOCK THE SKIES™

ARCHER AVIATION INC. CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (In millions; unaudited) 16 SIX MONTHS ENDED JUNE 30, 2025 2024 Cash flows from operating activities Net loss $ (299.4) $ (223.4) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization expense 8.9 4.9 Stock-based compensation 81.9 63.5 Change in fair value of warrant liabilities (1.7) (30.3) Non-cash lease expense 1.8 1.4 Research and development warrant expense 1.6 4.1 Technology and dispute resolution agreements expense - 5.6 Changes in operating assets and liabilities: Prepaid expenses 0.5 2.5 Other current assets 0.9 (1.7) Other long-term assets (1.3) (1.2) Accounts payable 5.4 8.6 Accrued expenses and other current liabilities 4.0 - Operating lease right-of-use assets and lease liabilities, net (2.2) (1.8) Other long-term liabilities 1.6 0.8 Net cash used in operating activities (198.0) (167.0) Cash flows from investing activities Purchase of property and equipment (28.9) (38.2) Acquisition of intangible assets (5.2) - Net cash used in investing activities (34.1) (38.2) Cash flows from financing activities Proceeds from issuance of debt - 25.8 Payment of debt issuance costs - (0.3) Net proceeds from financing and issuance of common stock 1,121.3 75.3 Net cash provided by financing activities 1,121.3 100.8 Net increase (decrease) in cash, cash equivalents, and restricted cash 889.2 (104.4) Cash, cash equivalents, and restricted cash, beginning of period 841.3 471.5 Cash, cash equivalents, and restricted cash, end of period $ 1,730.5 $ 367.1 UNLOCK THE SKIES™

GAAP to Non-GAAP Reconciliation A reconciliation of total operating expenses to non-GAAP total operating expenses for the three months ended June 30, 2025, March 31, 2025, and June 30, 2024, respectively, are set forth below. RECONCILIATION OF OPERATING EXPENSES (In millions; unaudited) 1) Amounts include non-cash warrant costs, classified as research and development expenses, for the warrants issued to Stellantis N.V. and its subsidiaries (“Stellantis”) in connection with certain services they are providing to the Company. 2) Amounts include stock-based compensation for options, restricted stock units and shares issued to employees, non-employees and vendors. 17 THREE MONTHS ENDED JUN 30, 2025 MAR 31, 2025 JUN 30, 2024 TOTAL OPERATING EXPENSES $ 176.1 $ 144.0 $ 121.2 Adjusted to exclude the following: Stellantis warrant expense (1) (0.8) (0.8) (2.0) Stock-based compensation (2) (51.8) (30.1) (22.8) NON-GAAP TOTAL OPERATING EXPENSES $ 123.5 $ 113.1 $ 96.4 UNLOCK THE SKIES™

18 GAAP to Non-GAAP Reconciliation (cont.) A reconciliation of net loss to Adjusted EBITDA for the three months ended June 30, 2025, March 31, 2025, and June 30, 2024, respectively, are set forth below. RECONCILIATION OF ADJUSTED EBITDA (In millions; unaudited) 1) Amounts include changes in fair value of the public and private warrants, which are classified as warrant liabilities. 2) Amounts include non-cash warrant costs, classified as research and development expenses, for the warrants issued to Stellantis in connection with certain services they are providing to the Company. 3) Amounts include stock-based compensation for options, restricted stock units and shares issued to employees, non-employees and vendors. THREE MONTHS ENDED JUN 30, 2025 MAR 31, 2025 JUN 30, 2024 NET LOSS $ (206.0) $ (93.4) $ (106.9) Adjusted to exclude the following: Other (income) expense, net (1) 40.0 (42.0) (9.3) Interest income,net (10.2) (8.7) (5.1) Income tax expense 0.1 0.1 0.1 Depreciation and amortization expense 4.8 4.1 2.6 Stellantis warrant expense (2) 0.8 0.8 2.0 Stock-based compensation (3) 51.8 30.1 22.8 ADJUSTED EBITDA $ (118.7) $ (109.0) $ (93.8) UNLOCK THE SKIES™

19 GAAP to Non-GAAP Reconciliation (cont.) NON-GAAP FINANCIAL MEASURES To supplement our condensed consolidated financial results prepared in accordance with GAAP, we use the following non-GAAP financial measures: Non-GAAP total operating expenses and Adjusted EBITDA. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, these non-GAAP financial measures have no standardized meaning prescribed by GAAP and are not based on a comprehensive set of accounting rules or principles and many of the adjustments to the GAAP financial measures reflect the exclusion of items that are recurring and may be reflected in our financial results for the foreseeable future. In addition, these measures may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures. We believe that the use of non-GAAP financial measures help us evaluate our business and financial performance, identify trends impacting our business, formulate business plans and financial projections, and make strategic decisions. We believe that disclosing non-GAAP financial measures to the readers of our financial statements provides useful supplemental data that, while not a substitute for GAAP financial measures, can offer insight in the review of our operating and financial results and enables investors to more fully understand our performance and cash trends by removing the effects of certain non-cash expenses and non-recurring items. We excluded items in the following general categories from one or more of our non-GAAP financial measures, certain of which are described below: – STOCK-BASED COMPENSATION EXPENSE We exclude stock-based compensation, which is a non-cash expense, from these non-GAAP financial measures because we believe that excluding this item provides meaningful supplemental information on our operating results and enhances our ability and the ability of the investors to understand the impact of non-cash stock-based compensation on our operating results. – WARRANT EXPENSE & GAINS OR LOSSES FROM REVALUATION OF WARRANTS Expense from our common stock warrants issued to Stellantis, which is recurring (but non-cash) and gains or losses from change in fair value of public and private warrants from revaluation will be reflected in our financial results for the foreseeable future. We exclude warrant expense and gains or losses from change in fair value for similar reasons to our stock-based compensation expense. UNLOCK THE SKIES™

20 Forward-Looking Statements & Disclaimers This shareholder letter includes forward-looking statements. These statements include, but are not limited to, statements regarding our future performance and expectations, including statements regarding our expected financial results for the third quarter of 2025, business strategy and plans, aircraft performance, the design and target specifications of our aircraft, the pace at which Archer intends to design, develop, certify, conduct test flights, manufacture and commercialize its planned eVTOL aircraft, business opportunities, the production timeline, ramp-up and volume of its manufacturing facilities, air taxi network buildout, plans and anticipated benefits with respect to its collaborations with between Archer and third parties, government incentives, projected demand for Archer’s aircraft and services, including our “Launch Edition” commercialization program and associated deployment of aircraft and timing of commercial payments, Archer Defense, and international expansion. In addition, this shareholder letter refers to initial agreements that contemplate the future execution by the parties of additional binding definitive agreements incorporating the terms outlined in each memorandum of understanding, which definitive agreements may not be completed or may contain different terms than those set forth in each initial agreement. Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date hereof, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: the early stage nature of our business and our past and projected future losses; our ability to design, manufacture and deliver our aircraft; risks associated with indicative orders from certain third parties for our aircraft, which are subject to the satisfaction of certain conditions and/or further negotiation and reaching mutual agreement on certain material terms, and the risk that such parties cancel such orders or never place them; risks associated with being in the early stages of developing our defense program, and our inability to ensure that we will achieve some or any of the expected benefits of the program or that we will be successful in winning a bid to develop aircraft for the U.S. Department of Defense or any other military agency; risks associated with the expansion of our planned lines of business; risks associated with the current and future international expansion of our business and operations; our ability to realize operating and financial results forecasts which rely in large part upon assumptions and analyses that we have developed; our ability to effectively market electric air transportation as a substitute for conventional methods of transportation, following receipt of governmental operating authority; our ability to compete effectively in the UAM and eVTOL industries; risks related to the operation of our UAM ecosystem in densely populated metropolitan areas and heavily regulated airports; our ability to obtain any required certifications, licenses, approvals, or authorizations from governmental authorities; our ability to achieve our business milestones, such as commencing the manufacturing of our aircraft and launching products and services, on anticipated timelines; our dependence on suppliers for the parts and components in our aircraft, which are subject to uncertainties that could affect our operating results, including tariffs or other trade restrictions; our ability to ramp up to commercial-scale manufacturing capabilities; regulatory requirements and other obstacles outside of our control that slow market adoption of electric aircraft, such as the inability to obtain and maintain adequate vertiport infrastructure; our ability to attract, integrate, manage, train and retain qualified personnel and key employees; natural disasters, outbreaks and pandemics, economic, social, weather, growth constraints and regulatory conditions or other circumstances affecting metropolitan areas; the potential for losses and adverse publicity stemming from any accidents involving small aircraft, helicopters or charter flights, and in particular from accidents involving electric aircraft or lithium-ion battery cells, or test flights of our prototype eVTOL aircraft; risks associated with indexed price escalation clauses in aircraft contracts, which could subject us to losses if we have cost overruns or if increases in costs exceed the applicable escalation rate; our ability to address a wide variety of extensive and evolving laws and regulations, including data privacy and security laws; our ability to protect our intellectual property rights from unauthorized use by third parties; our ability to obtain additional capital to pursue our business objectives and respond to business opportunities, challenges or unforeseen circumstances; cybersecurity risks to our various systems and software. UNLOCK THE SKIES™

21 Forward-Looking Statements & Disclaimers (cont.) The indicative operational goals referenced in this document reflect numerous estimates and assumptions with respect to general business, economic, regulatory, market and financial conditions and other future events, as well as matters specific to the our business, all of which are difficult to predict and many of which are beyond the our control including, among other things, the timing of the receipt of required certifications, licenses, approvals or authorizations from governmental authorities, the ramping up of manufacturing at our manufacturing facilities, the actual price paid per aircraft, and the costs of manufacturing the aircraft, consumer demand for our aircraft and the other matters described above. These operational goals should not be relied upon as being indicative of future economic performance or results. The inclusion of the operational goals in this document is not an admission or representation that such information is material. The assumptions and estimates underlying the operational goals are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual operating results to differ materially from those presented. There can be no assurance that these goals are indicative of our future performance or that actual results will not differ materially from those presented in the operational goals. Inclusion of the operational goals in this document should not be regarded as a representation by any person that the operational goals will be achieved. The information concerning our operational goals is subjective in many respects and thus is susceptible to multiple interpretations and periodic revisions based on actual experience and business developments. Additional risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed in our filings with the Securities and Exchange Commission (“SEC”), including our most recent Annual Report on Form 10-K and our Current Report on Form 8-K filed on June 13, 2025, which is or will be available on our investor relations website at http://investors.archer.com and on the SEC website at www.sec.gov. All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this shareholder letter or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on forward-looking statements. UNLOCK THE SKIES™