SHAREHOLDER LETTER // HAWTHORNE AIRPORT, LOS ANGELES, CA

Financial Position Reinforced Our Sector-Leading Balance Sheet Raised $650M of new equity capital, reinforcing our sector-leading balance sheet taking our total liquidity to now over $2B. Quarterly Spend Within Range Our Q3'25 spending landed within our guided range and included planned investments to support the company's growth trajectory. 2 UNLOCK THE SKIES™ ACQUISITION OF LOS ANGELES AIRPORT AS STRATEGIC AIR TAXI NETWORK HUB AND AI TESTBED Signed definitive agreements to acquire control of one-of-a-kind aviation asset in L.A., Hawthorne Airport, for $126M1 in cash. The airport is located in the heart of the city, less than three miles from LAX, and the closest airport to some of the city’s biggest destinations — SoFi Stadium, The Forum, Intuit Dome, and Downtown L.A.. We plan for the airport to serve as the operational hub for our planned L.A. air taxi network and, as a testbed for the AI-powered aviation technologies we are developing and plan to deploy with our airline and technology partners. MIDNIGHT ACHIEVES RECORD FLIGHT MILESTONES TOWARD CERTIFICATION We’ve recently showcased several key performance milestones with our Midnight aircraft— including flights surpassing 50 miles in range and 10,000 feet of altitude. Additionally, Midnight flew demonstration flights on both days of the California International Airshow allowing tens of thousands of spectators to experience how quiet the aircraft is in flight. UAE COMMERCIAL DEPLOYMENT UNDERWAY & STRONG DEMAND ACROSS APAC In the UAE, we delivered and began flying Midnight in Abu Dhabi over the summer alongside our partner, Abu Dhabi Aviation. Following the commencement of our in-country flight testing, in October, we hosted the UAE General Civil Aviation Authority at our HQ to continue to rapidly advance our UAE regulatory pathway. Across Asia, we strengthened our international reach through marquee partnership announcements with Korean Air, as well as Japan Airlines’ and Sumitomo’s joint venture, Soracle, in Tokyo & Osaka. LILIUM PATENT PORTFOLIO ACQUISITION Closed acquisition of Lilium’s portfolio for $21M, giving Archer access to key next-generation technology in ducted fans, high-voltage systems, flight controls, electric engines, and propellers. This acquisition expands Archer’s global portfolio to over 1,000 assets, giving it one of the strongest portfolios in the industry. 1 Acquisition price includes the acquisition of the master lease of the Hawthorne Airport, as well as certain subleases held by the seller parties with tenants at the airport. The acquisition price does not include Archer’s rights to purchase a controlling stake in the fixed base operator (FBO) at the airport, develop additional hangar space at the airport, the potential performance based earnout to certain seller parties or certain bank debt to be assumed as part of the acquisition. For more information, see “Management’s Discussion and Analysis - Recent Developments” in Archer’s Form 10-Q filed on November 6, 2025. The acquisition remains subject to the satisfaction of certain agreed-upon closing conditions.

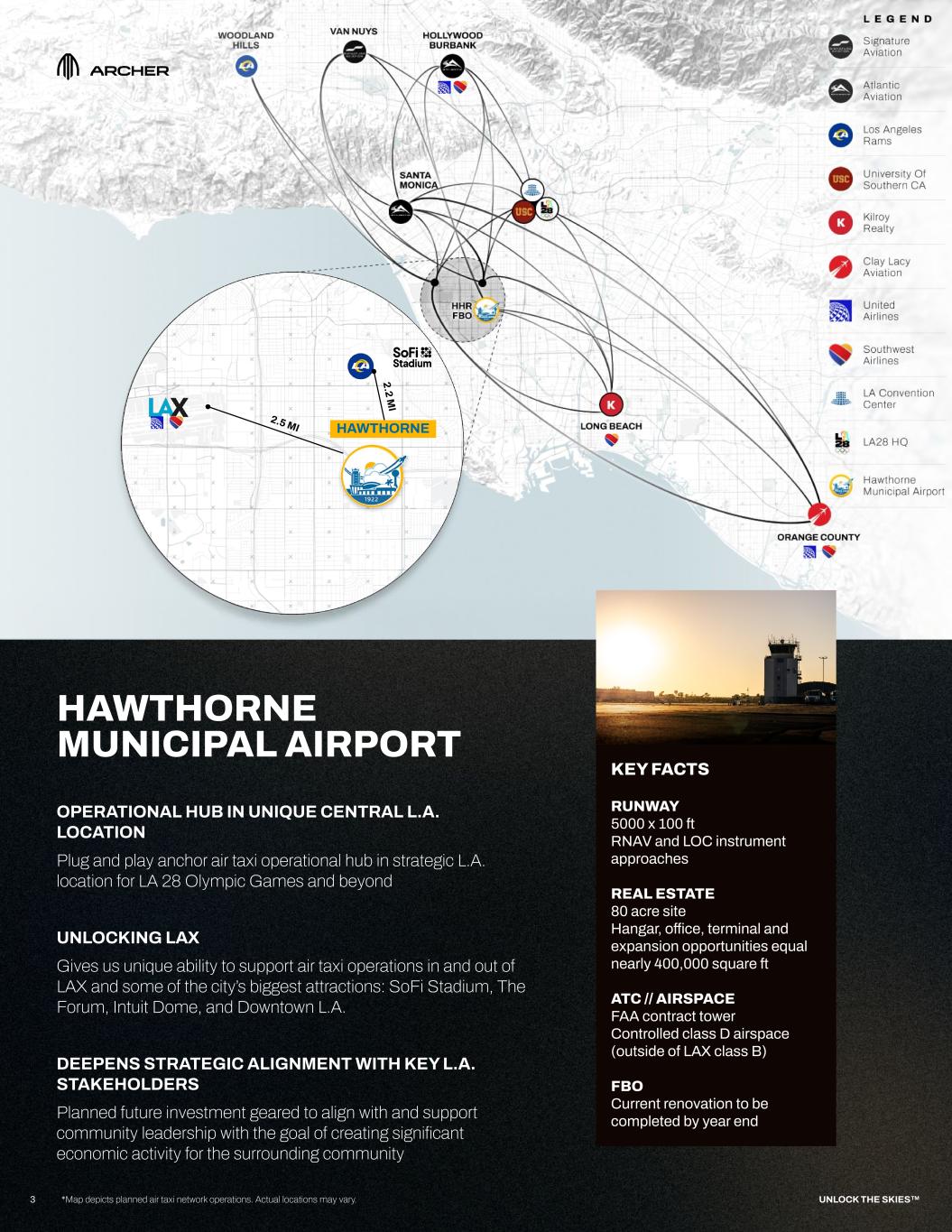

2.5 MI HAWTHORNE 2.2 M I 3 UNLOCK THE SKIES™ HAWTHORNE MUNICIPAL AIRPORT OPERATIONAL HUB IN UNIQUE CENTRAL L.A. LOCATION Plug and play anchor air taxi operational hub in strategic L.A. location for LA 28 Olympic Games and beyond UNLOCKING LAX Gives us unique ability to support air taxi operations in and out of LAX and some of the city’s biggest attractions: SoFi Stadium, The Forum, Intuit Dome, and Downtown L.A. DEEPENS STRATEGIC ALIGNMENT WITH KEY L.A. STAKEHOLDERS Planned future investment geared to align with and support community leadership with the goal of creating significant economic activity for the surrounding community *Map depicts planned air taxi network operations. Actual locations may vary. KEY FACTS RUNWAY 5000 x 100 ft RNAV and LOC instrument approaches REAL ESTATE 80 acre site Hangar, office, terminal and expansion opportunities equal nearly 400,000 square ft ATC // AIRSPACE FAA contract tower Controlled class D airspace (outside of LAX class B) FBO Current renovation to be completed by year end

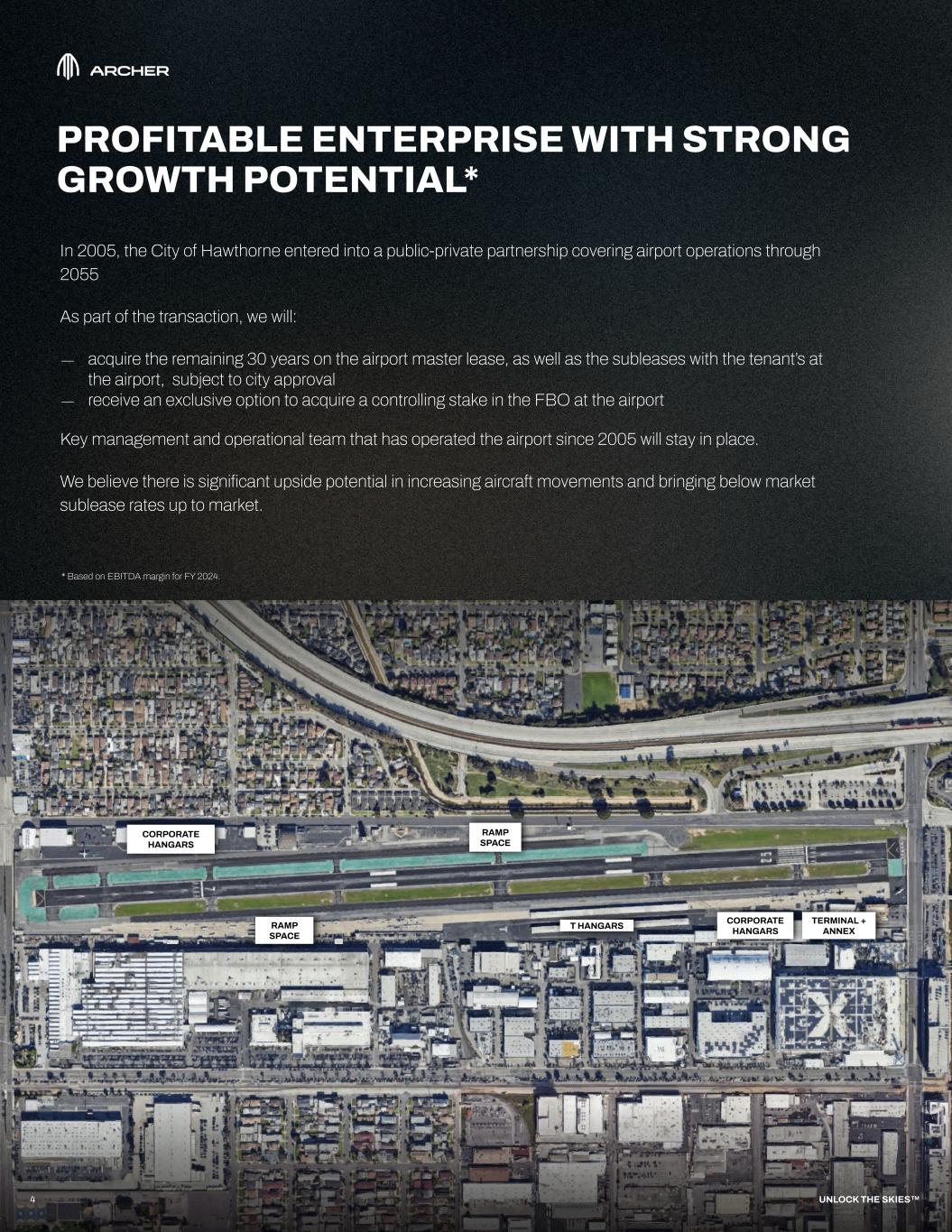

TERMINAL + ANNEXT HANGARS CORPORATE HANGARS RAMP SPACE RAMP SPACE CORPORATE HANGARS PROFITABLE ENTERPRISE WITH STRONG GROWTH POTENTIAL* 4 UNLOCK THE SKIES™ In 2005, the City of Hawthorne entered into a public-private partnership covering airport operations through 2055 As part of the transaction, we will: — acquire the remaining 30 years on the airport master lease, as well as the subleases with the tenant’s at the airport, subject to city approval — receive an exclusive option to acquire a controlling stake in the FBO at the airport Key management and operational team that has operated the airport since 2005 will stay in place. We believe there is significant upside potential in increasing aircraft movements and bringing below market sublease rates up to market. * Based on EBITDA margin for FY 2024.

BUILDING A PLATFORM FOR THE FUTURE IN L.A. AT HAWTHORNE AIRPORT 5 UNLOCK THE SKIES™ FLAGSHIP L.A. AIR TAXI HUB We plan to use this airport as our flagship air taxi hub in L.A., strategically positioned near LAX Intl Airport and SoFi Stadium, with opportunity to directly link Downtown L.A., Orange County, Hollywood, and major Olympic venues by air taxi. TESTBED FOR AI-POWERED TECHNOLOGIES We also plan to utilize the airport as an innovation testbed for the next-generation AI-powered aviation technologies that we are developing and planning to deploy with our airline and technology partners. This includes AI-powered air traffic and ground operations management, in addition to other key technologies. *Images depict planned air taxi network operations. Actual locations may vary. Completion of acquisition is subject to closing conditions and governmental approval. SoFi STADIUM ORANGE COUNTY LOS ANGELES INT’L DOWNTOWN LA HAWTHORNE AIRPORT “Archer’s trajectory validates our conviction that eVTOLs are part of the next generation of air traffic technology that will fundamentally reshape aviation.Their vision for an AI-enabled operations platform isn't just about eVTOLs, it's also about leveraging cutting-edge technology to better enable moving people safely and efficiently in our most congested airspaces. Through United’s investment arm, United Airlines Ventures, we're investing in companies like Archer that pioneer technologies that will define and support aviation infrastructure for decades to come.” — MICHAEL LESKINEN CHIEF FINANCIAL OFFICER UNITED AIRLINES

PHASE 1 GOALS \\\ CAPTURE NEAR-TERM VALUE BY BUILDING AN ADVANCED AIR MOBILITY CENTER OF EXCELLENCE 6 UNLOCK THE SKIES™ ADDITIONAL VALUE CREATION INITIATIVES – Seek extension of remaining 30-year lease with City of Hawthorne – Implement customs for international arrivals – Upgrade tenant base to include leading names from industry and entertainment with goal of unlocking premium hangar rents REDEVELOP HANGARS + LA28 PREP – Redevelop up to ~200,000 sq ft of hangar space – Prepare site for L.A. air taxi operations (potential for aircraft testing, storage, maintenance, repair, charging, etc.) EXERCISE OPTION TO ACQUIRE CONTROL OF THE FBO: – Intend to acquire 75% stake* to create a vertically integrated platform for fuel, aircraft handling, and air taxi services – Drive meaningful increase in fuel and aircraft handling revenue streams PHASE 2 GOALS \\\ BUILD PLATFORM OF THE FUTURE CRITICAL L.A. INFRASTRUCTURE – Showcase reduced noise operations – Extend runway to support variety in aircraft operations – Improved connectivity across L.A., including between LAX and other regional airports AVIATION TECH & OPS – AI air traffic & surface management – Mixed-fleet “digital apron” – Smart, sensor-embedded runway – Autonomous ground vehicles PASSENGER & CREW EXPERIENCE – Digital terminal for seamless passenger arrival and departure operations – Next-gen security and customs – Mixed-use retail and brand integrations *Option extends through the end of 2026 **Image depicts potential future redevelopment of Hawthorne airport, including simulated air taxi operations. Phase 2 may require additional capital and other resources for implementation.

MILES 55 FT ALTITUDE 10,000 MINUTES 30+ RECENT FLIGHT MILESTONES MPH 150+ SHOWCASE AT CALIFORNIA INTERNATIONAL AIR SHOW OCTOBER 4, 2025 VIDEO LINK MIDNIGHT FLIGHT TEST CAMPAIGN ACHIEVES RECORD MILESTONES 7 UNLOCK THE SKIES™ Following a successful VTOL campaign in 2024, Midnight is now almost through its rigorous CTOL flight regimen to ensure its operational readiness across distance, speed, time, and altitude. Midnight flight test pilots continue to expand speed and duration, and test mission profiles that map to early commercial operations.

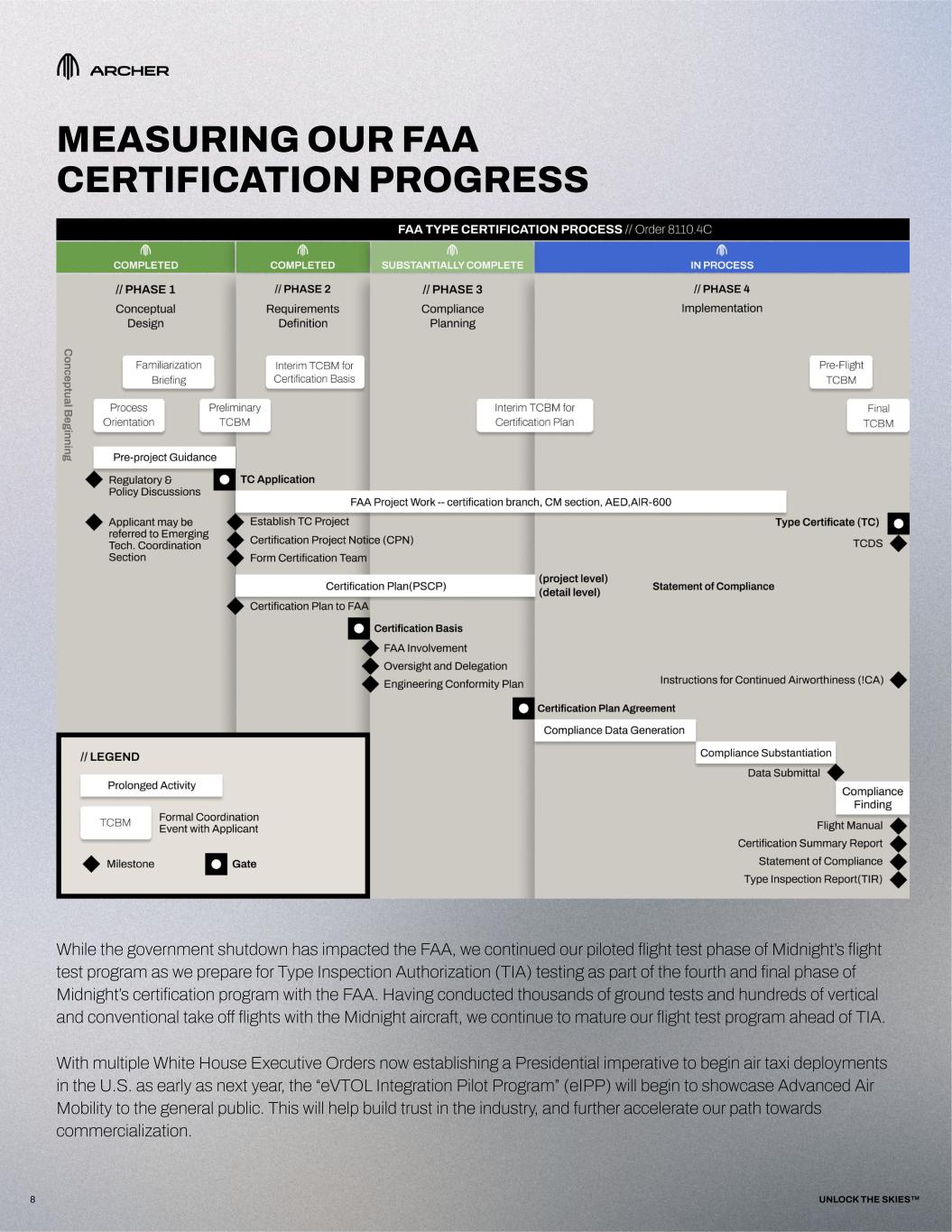

MEASURING OUR FAA CERTIFICATION PROGRESS 8 UNLOCK THE SKIES™ While the government shutdown has impacted the FAA, we continued our piloted flight test phase of Midnight’s flight test program as we prepare for Type Inspection Authorization (TIA) testing as part of the fourth and final phase of Midnight’s certification program with the FAA. Having conducted thousands of ground tests and hundreds of vertical and conventional take off flights with the Midnight aircraft, we continue to mature our flight test program ahead of TIA. With multiple White House Executive Orders now establishing a Presidential imperative to begin air taxi deployments in the U.S. as early as next year, the “eVTOL Integration Pilot Program” (eIPP) will begin to showcase Advanced Air Mobility to the general public. This will help build trust in the industry, and further accelerate our path towards commercialization.

UAE COMMERCIAL DEPLOYMENT UNDERWAY 9 UNLOCK THE SKIES™ LAUNCH PARTNERS We have now begun receiving first payments under our definitive agreements with Abu Dhabi Aviation and ADIO as part of our Launch Edition program FLIGHT TEST PROGRAM Deployed first Midnight aircraft to the UAE this summer and have been advancing our flight test program in Abu Dhabi OPERATIONS TRAINING Our airline operations team is continuing to work alongside Etihad Aviation Training to mature our operational readiness across pilot training & maintenance REGULATORY SUPPORT UAE General Civil Aviation Authority continues to advance Midnight’s regulatory pathway in the UAE

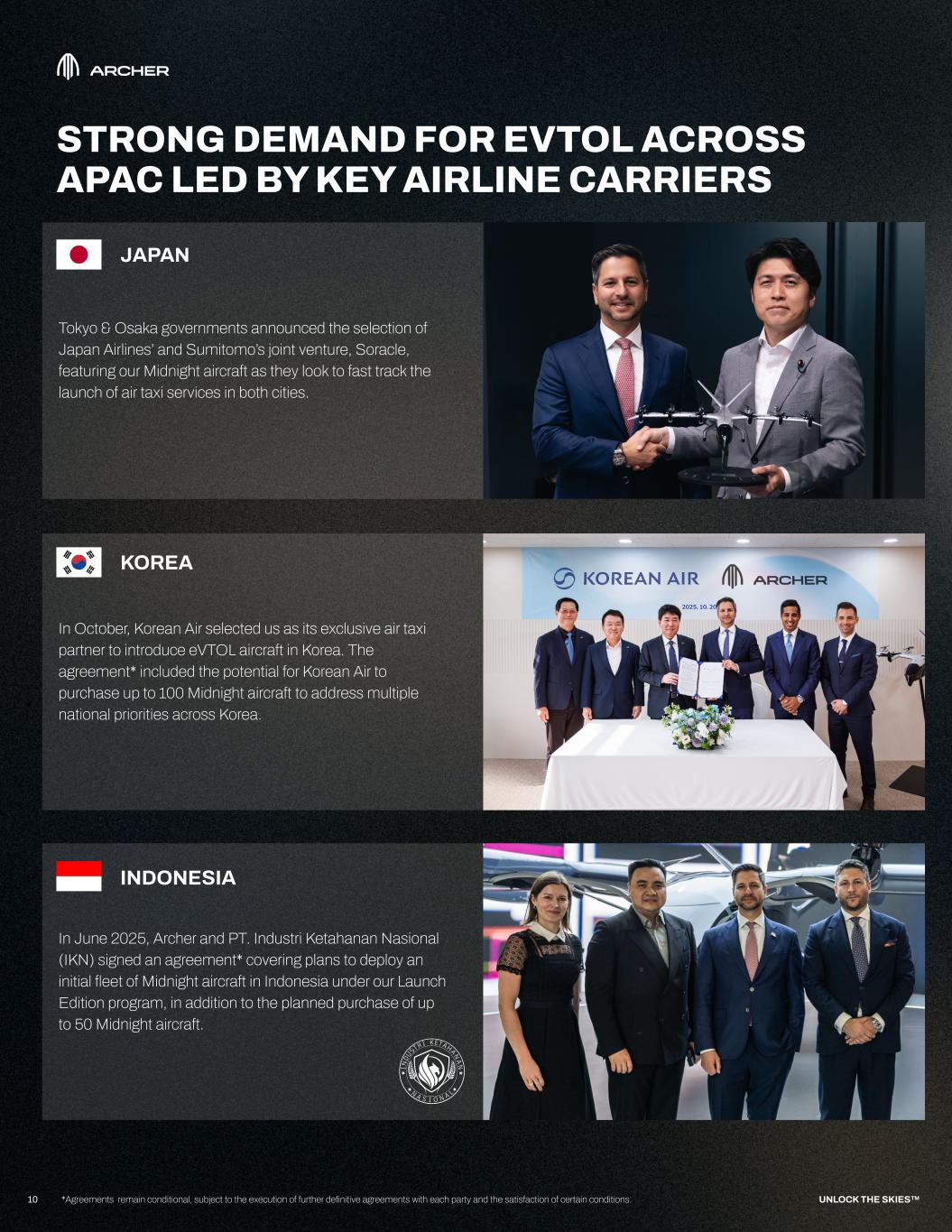

STRONG DEMAND FOR EVTOL ACROSS APAC LED BY KEY AIRLINE CARRIERS 10 UNLOCK THE SKIES™*Agreements remain conditional, subject to the execution of further definitive agreements with each party and the satisfaction of certain conditions. JAPAN Tokyo & Osaka governments announced the selection of Japan Airlines’ and Sumitomo’s joint venture, Soracle, featuring our Midnight aircraft as they look to fast track the launch of air taxi services in both cities. KOREA In June 2025, Archer and PT. Industri Ketahanan Nasional (IKN) signed an agreement* covering plans to deploy an initial fleet of Midnight aircraft in Indonesia under our Launch Edition program, in addition to the planned purchase of up to 50 Midnight aircraft. In October, Korean Air selected us as its exclusive air taxi partner to introduce eVTOL aircraft in Korea. The agreement* included the potential for Korean Air to purchase up to 100 Midnight aircraft to address multiple national priorities across Korea. INDONESIA

NOV 10-12 DRIFTX Abu Dhabi, UAE NOV 12 BAIRD GLOBAL INDUSTRIALS Chicago, IL NOV 13 JP MORGAN U.S. OPPORTUNITIES FORUM Miami, FL NOV 17-20 DUBAI AIR SHOW Dubai, UAE DEC 5 BANK OF AMERICA DEFENSE TECH FORUM Los Angeles, CA DEC 10 H. C. WAINWRIGHT AERONEXT 2025 Virtual UPCOMING EVENTS // TIME 2 PM PT (5 PM ET) WEBCAST Accessible via our IR website (investors.archer.com) CONFERENCE 646-844-6383 (domestic) CALL +1 833-470-1428 (international) Access code: 726657 TODAY’S WEBCAST & CONFERENCE CALL DETAILS // 11 UNLOCK THE SKIES™

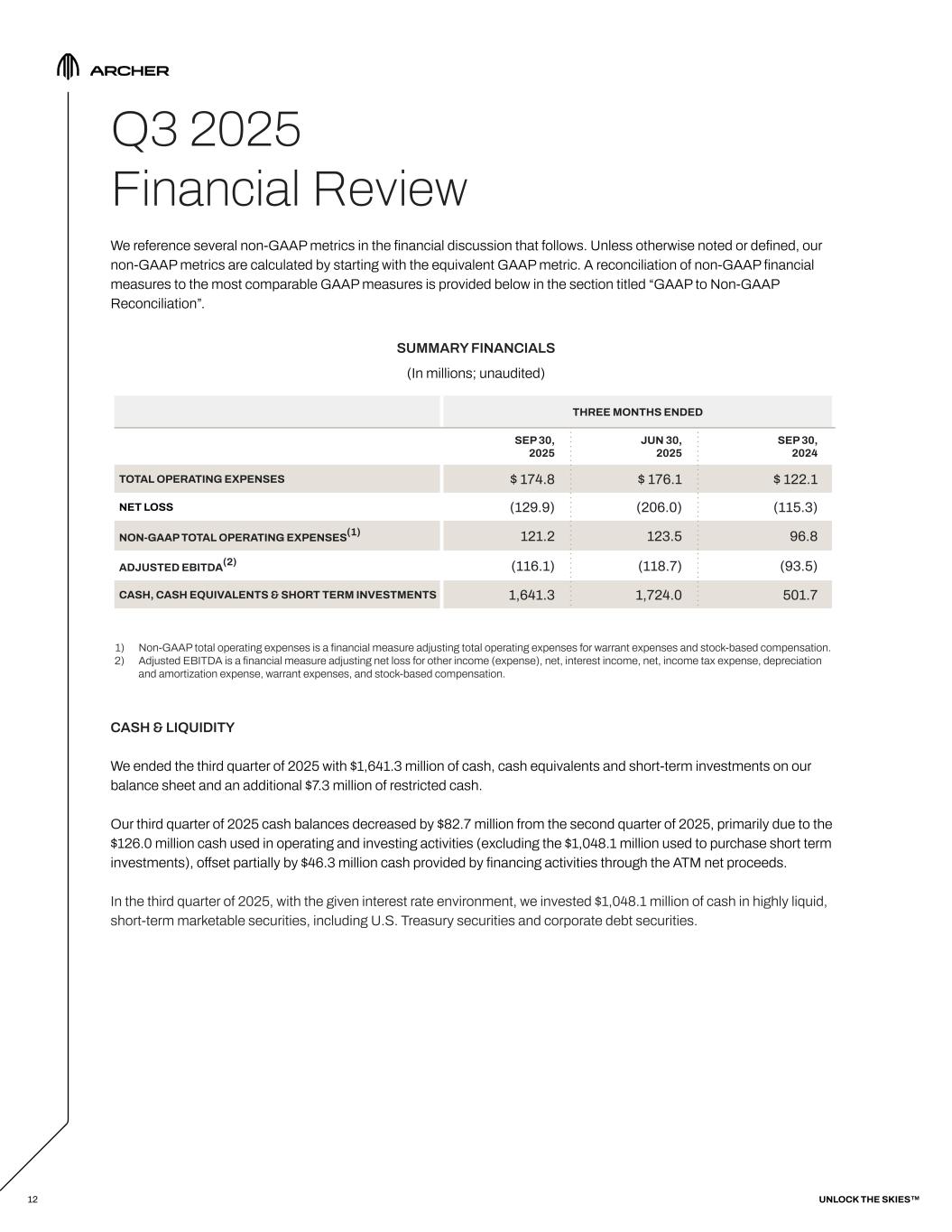

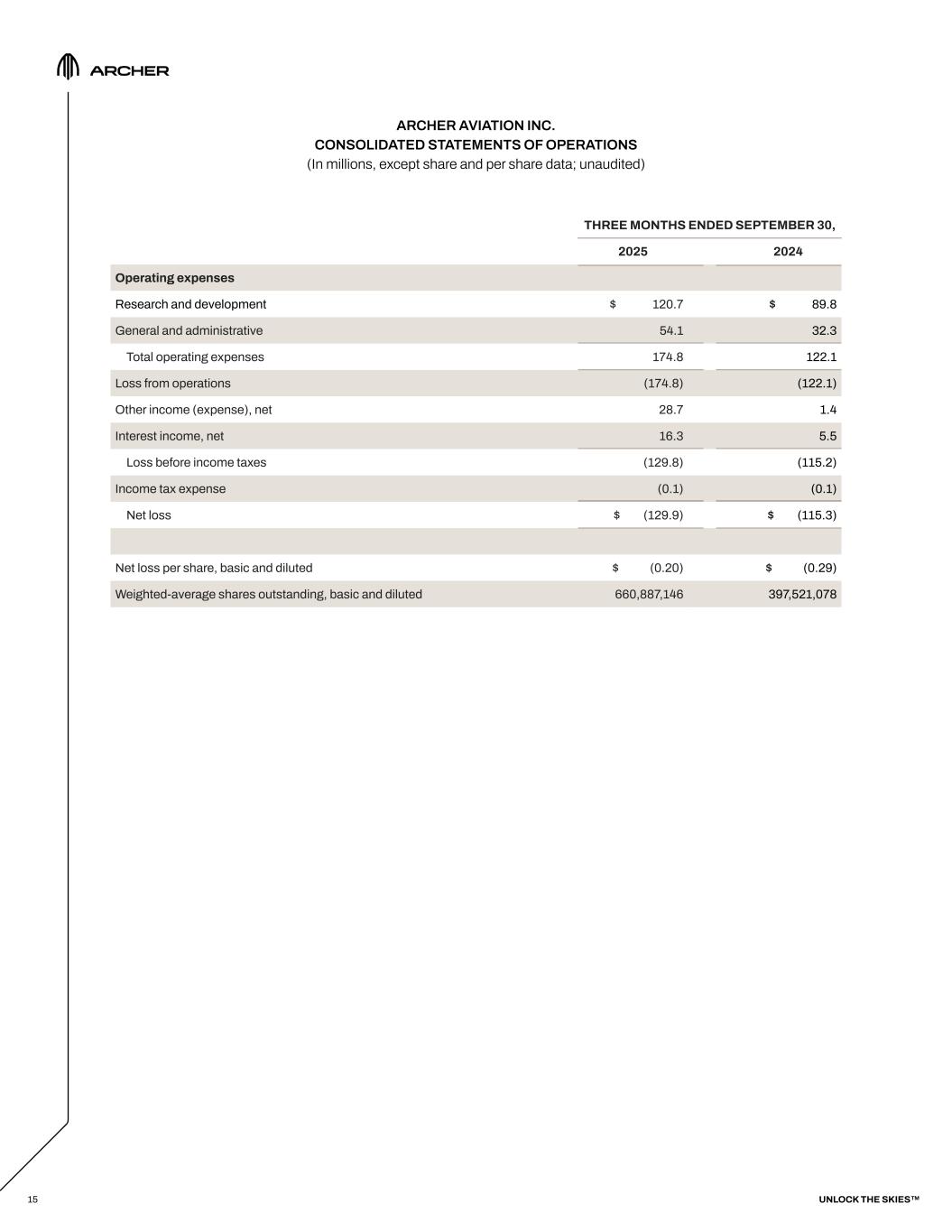

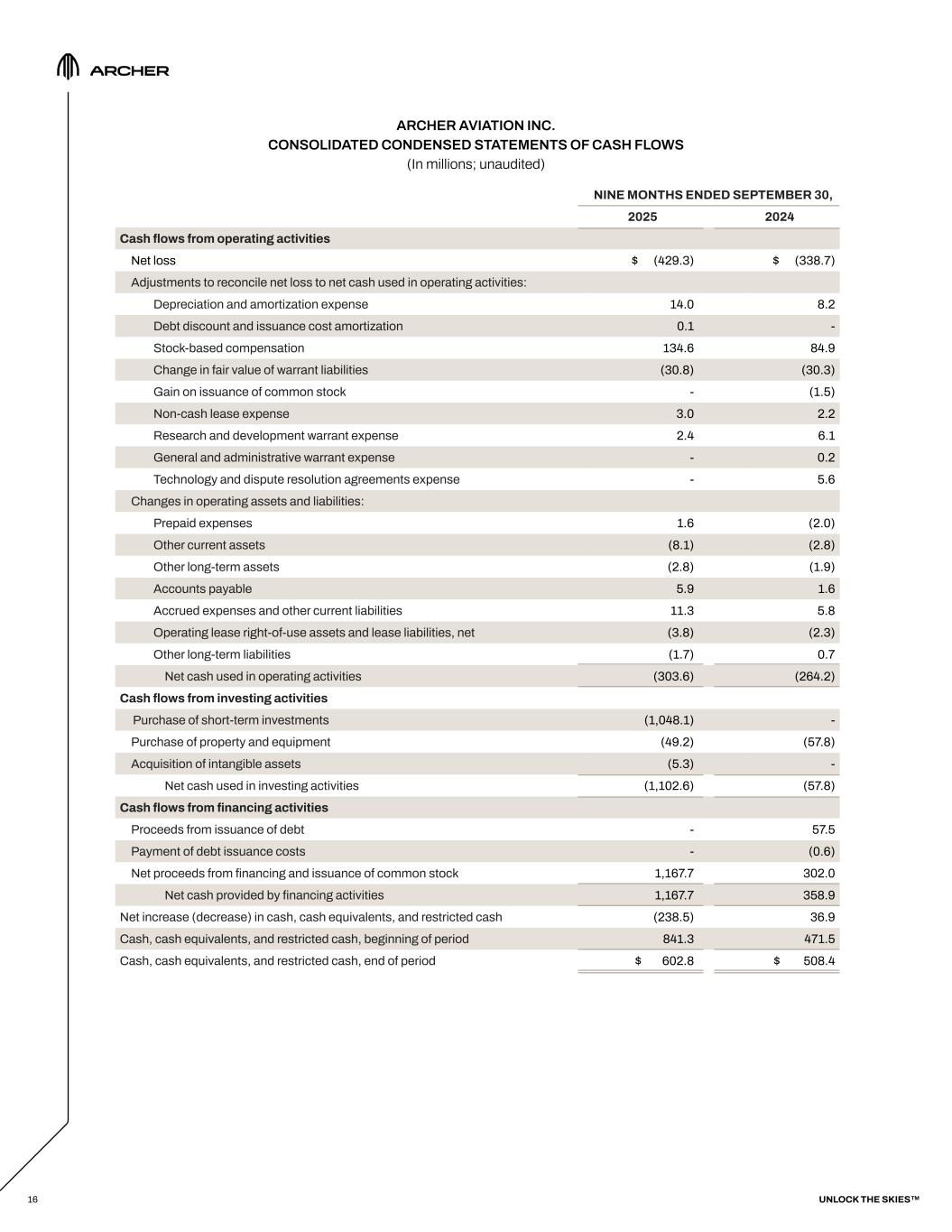

Q3 2025 Financial Review We reference several non-GAAP metrics in the financial discussion that follows. Unless otherwise noted or defined, our non-GAAP metrics are calculated by starting with the equivalent GAAP metric. A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided below in the section titled “GAAP to Non-GAAP Reconciliation”. SUMMARY FINANCIALS (In millions; unaudited) 1) Non-GAAP total operating expenses is a financial measure adjusting total operating expenses for warrant expenses and stock-based compensation. 2) Adjusted EBITDA is a financial measure adjusting net loss for other income (expense), net, interest income, net, income tax expense, depreciation and amortization expense, warrant expenses, and stock-based compensation. CASH & LIQUIDITY We ended the third quarter of 2025 with $1,641.3 million of cash, cash equivalents and short-term investments on our balance sheet and an additional $7.3 million of restricted cash. Our third quarter of 2025 cash balances decreased by $82.7 million from the second quarter of 2025, primarily due to the $126.0 million cash used in operating and investing activities (excluding the $1,048.1 million used to purchase short term investments), offset partially by $46.3 million cash provided by financing activities through the ATM net proceeds. In the third quarter of 2025, with the given interest rate environment, we invested $1,048.1 million of cash in highly liquid, short-term marketable securities, including U.S. Treasury securities and corporate debt securities. 12 THREE MONTHS ENDED SEP 30, 2025 JUN 30, 2025 SEP 30, 2024 TOTAL OPERATING EXPENSES $ 174.8 $ 176.1 $ 122.1 NET LOSS (129.9) (206.0) (115.3) NON-GAAP TOTAL OPERATING EXPENSES(1) 121.2 123.5 96.8 ADJUSTED EBITDA(2) (116.1) (118.7) (93.5) CASH, CASH EQUIVALENTS & SHORT TERM INVESTMENTS 1,641.3 1,724.0 501.7 UNLOCK THE SKIES™

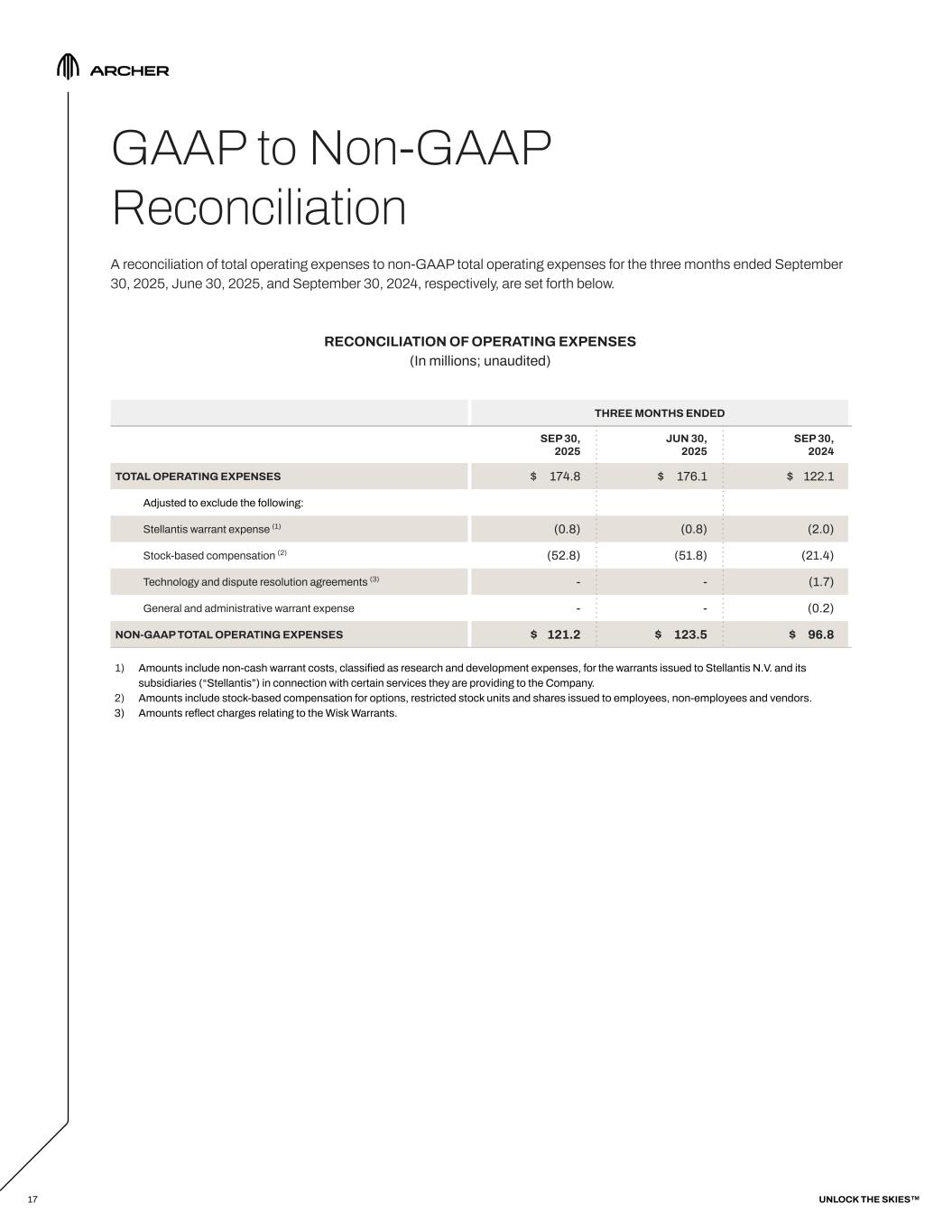

13 TOTAL OPERATING EXPENSES Our third quarter 2025 total operating expenses represent investments required to achieve the key elements of our commercialization plan. We continued to invest in the development, test, certification and production activities for our aircraft. We also expanded investments in our go-to-market strategy and support infrastructure to enable the early bring-up of our air taxi operations globally. Total GAAP operating expenses for the third quarter of 2025 were $174.8 million, which decreased by $1.3 million from the second quarter of 2025, driven by reduction in parts & materials spend which vary quarter by quarter, offset partially by the investments in people related spend to support our current phase of development, testing efforts and operational scale up. Total GAAP operating expenses for the third quarter of 2025 increased by $52.7 million from the third quarter of 2024, due to similar reasons mentioned above. Total non-GAAP operating expenses (which are GAAP operating expenses less stock-based compensation and warrant expenses, a reconciliation for which is provided in the financial statement section of this letter) for the third quarter of 2025 were $121.2 million, which decreased by $2.3 million from the second quarter of 2025 due to reasons discussed above, and increased $24.4 million from the third quarter of 2024, primarily due to the investments made in people-related costs in support of achieving our commercialization plans. NET LOSS AND ADJUSTED EBITDA Net loss for the third quarter of 2025 was $129.9 million, which decreased by $76.1 million from the second quarter of 2025, primarily due to the $68.7 million non-cash increase in other income (expense), net driven by the favorable change in fair value of warrant liability, and the $6.1 million increase in interest income, net due to higher average cash balances in the third quarter of 2025. Net loss for the third quarter of 2025 increased by $14.6 million from the third quarter of 2024, primarily due to the $52.7 million increase in total operating expenses as mentioned above, partially offset by the $27.3 million non-cash increase in other income (expense), net, and the $10.8 million increase in interest income, net. For the third quarter of 2025, adjusted EBITDA was a loss of $116.1 million, a decrease of $2.6 million from the second quarter of 2025, due to the timing of the spend on parts and materials as mentioned above as we continued to execute to our aircraft program development milestones and manufacturing ramp. Adjusted EBITDA loss increased by $22.6 million from the third quarter of 2024 primarily due to the investments we have made in people-related spend to support our current phase of development, testing efforts and manufacturing scale up. Q4 2025 FINANCIAL ESTIMATES We anticipate Adjusted EBITDA to be a loss of $110 million to $140 million for the fourth quarter of 2025. We have not reconciled our Adjusted EBITDA estimates because certain items that impact non-GAAP metrics are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense and change in fair value of warrants is impacted by the future fair market value of our common stock and warrants along with other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2025 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of non-GAAP metrics is not available without unreasonable effort. UNLOCK THE SKIES™

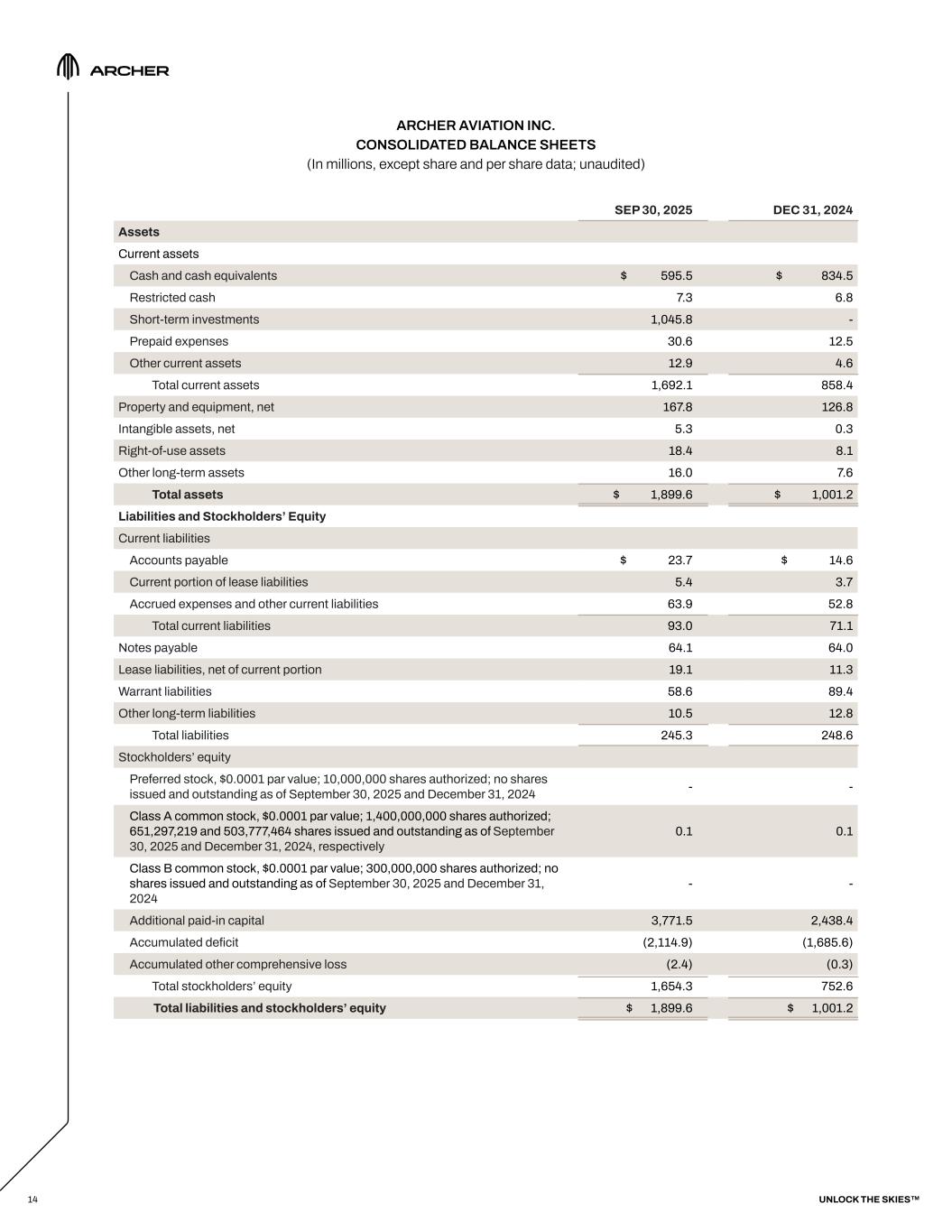

ARCHER AVIATION INC. CONSOLIDATED BALANCE SHEETS (In millions, except share and per share data; unaudited) 14 SEP 30, 2025 DEC 31, 2024 Assets Current assets Cash and cash equivalents $ 595.5 $ 834.5 Restricted cash 7.3 6.8 Short-term investments 1,045.8 - Prepaid expenses 30.6 12.5 Other current assets 12.9 4.6 Total current assets 1,692.1 858.4 Property and equipment, net 167.8 126.8 Intangible assets, net 5.3 0.3 Right-of-use assets 18.4 8.1 Other long-term assets 16.0 7.6 Total assets $ 1,899.6 $ 1,001.2 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 23.7 $ 14.6 Current portion of lease liabilities 5.4 3.7 Accrued expenses and other current liabilities 63.9 52.8 Total current liabilities 93.0 71.1 Notes payable 64.1 64.0 Lease liabilities, net of current portion 19.1 11.3 Warrant liabilities 58.6 89.4 Other long-term liabilities 10.5 12.8 Total liabilities 245.3 248.6 Stockholders’ equity Preferred stock, $0.0001 par value; 10,000,000 shares authorized; no shares issued and outstanding as of September 30, 2025 and December 31, 2024 - - Class A common stock, $0.0001 par value; 1,400,000,000 shares authorized; 651,297,219 and 503,777,464 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively 0.1 0.1 Class B common stock, $0.0001 par value; 300,000,000 shares authorized; no shares issued and outstanding as of September 30, 2025 and December 31, 2024 - - Additional paid-in capital 3,771.5 2,438.4 Accumulated deficit (2,114.9) (1,685.6) Accumulated other comprehensive loss (2.4) (0.3) Total stockholders’ equity 1,654.3 752.6 Total liabilities and stockholders’ equity $ 1,899.6 $ 1,001.2 UNLOCK THE SKIES™

ARCHER AVIATION INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share and per share data; unaudited) 15 THREE MONTHS ENDED SEPTEMBER 30, 2025 2024 Operating expenses Research and development $ 120.7 $ 89.8 General and administrative 54.1 32.3 Total operating expenses 174.8 122.1 Loss from operations (174.8) (122.1) Other income (expense), net 28.7 1.4 Interest income, net 16.3 5.5 Loss before income taxes (129.8) (115.2) Income tax expense (0.1) (0.1) Net loss $ (129.9) $ (115.3) Net loss per share, basic and diluted $ (0.20) $ (0.29) Weighted-average shares outstanding, basic and diluted 660,887,146 397,521,078 UNLOCK THE SKIES™

ARCHER AVIATION INC. CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (In millions; unaudited) 16 NINE MONTHS ENDED SEPTEMBER 30, 2025 2024 Cash flows from operating activities Net loss $ (429.3) $ (338.7) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization expense 14.0 8.2 Debt discount and issuance cost amortization 0.1 - Stock-based compensation 134.6 84.9 Change in fair value of warrant liabilities (30.8) (30.3) Gain on issuance of common stock - (1.5) Non-cash lease expense 3.0 2.2 Research and development warrant expense 2.4 6.1 General and administrative warrant expense - 0.2 Technology and dispute resolution agreements expense - 5.6 Changes in operating assets and liabilities: Prepaid expenses 1.6 (2.0) Other current assets (8.1) (2.8) Other long-term assets (2.8) (1.9) Accounts payable 5.9 1.6 Accrued expenses and other current liabilities 11.3 5.8 Operating lease right-of-use assets and lease liabilities, net (3.8) (2.3) Other long-term liabilities (1.7) 0.7 Net cash used in operating activities (303.6) (264.2) Cash flows from investing activities Purchase of short-term investments (1,048.1) - Purchase of property and equipment (49.2) (57.8) Acquisition of intangible assets (5.3) - Net cash used in investing activities (1,102.6) (57.8) Cash flows from financing activities Proceeds from issuance of debt - 57.5 Payment of debt issuance costs - (0.6) Net proceeds from financing and issuance of common stock 1,167.7 302.0 Net cash provided by financing activities 1,167.7 358.9 Net increase (decrease) in cash, cash equivalents, and restricted cash (238.5) 36.9 Cash, cash equivalents, and restricted cash, beginning of period 841.3 471.5 Cash, cash equivalents, and restricted cash, end of period $ 602.8 $ 508.4 UNLOCK THE SKIES™

GAAP to Non-GAAP Reconciliation A reconciliation of total operating expenses to non-GAAP total operating expenses for the three months ended September 30, 2025, June 30, 2025, and September 30, 2024, respectively, are set forth below. RECONCILIATION OF OPERATING EXPENSES (In millions; unaudited) 1) Amounts include non-cash warrant costs, classified as research and development expenses, for the warrants issued to Stellantis N.V. and its subsidiaries (“Stellantis”) in connection with certain services they are providing to the Company. 2) Amounts include stock-based compensation for options, restricted stock units and shares issued to employees, non-employees and vendors. 3) Amounts reflect charges relating to the Wisk Warrants. 17 THREE MONTHS ENDED SEP 30, 2025 JUN 30, 2025 SEP 30, 2024 TOTAL OPERATING EXPENSES $ 174.8 $ 176.1 $ 122.1 Adjusted to exclude the following: Stellantis warrant expense (1) (0.8) (0.8) (2.0) Stock-based compensation (2) (52.8) (51.8) (21.4) Technology and dispute resolution agreements (3) - - (1.7) General and administrative warrant expense - - (0.2) NON-GAAP TOTAL OPERATING EXPENSES $ 121.2 $ 123.5 $ 96.8 UNLOCK THE SKIES™

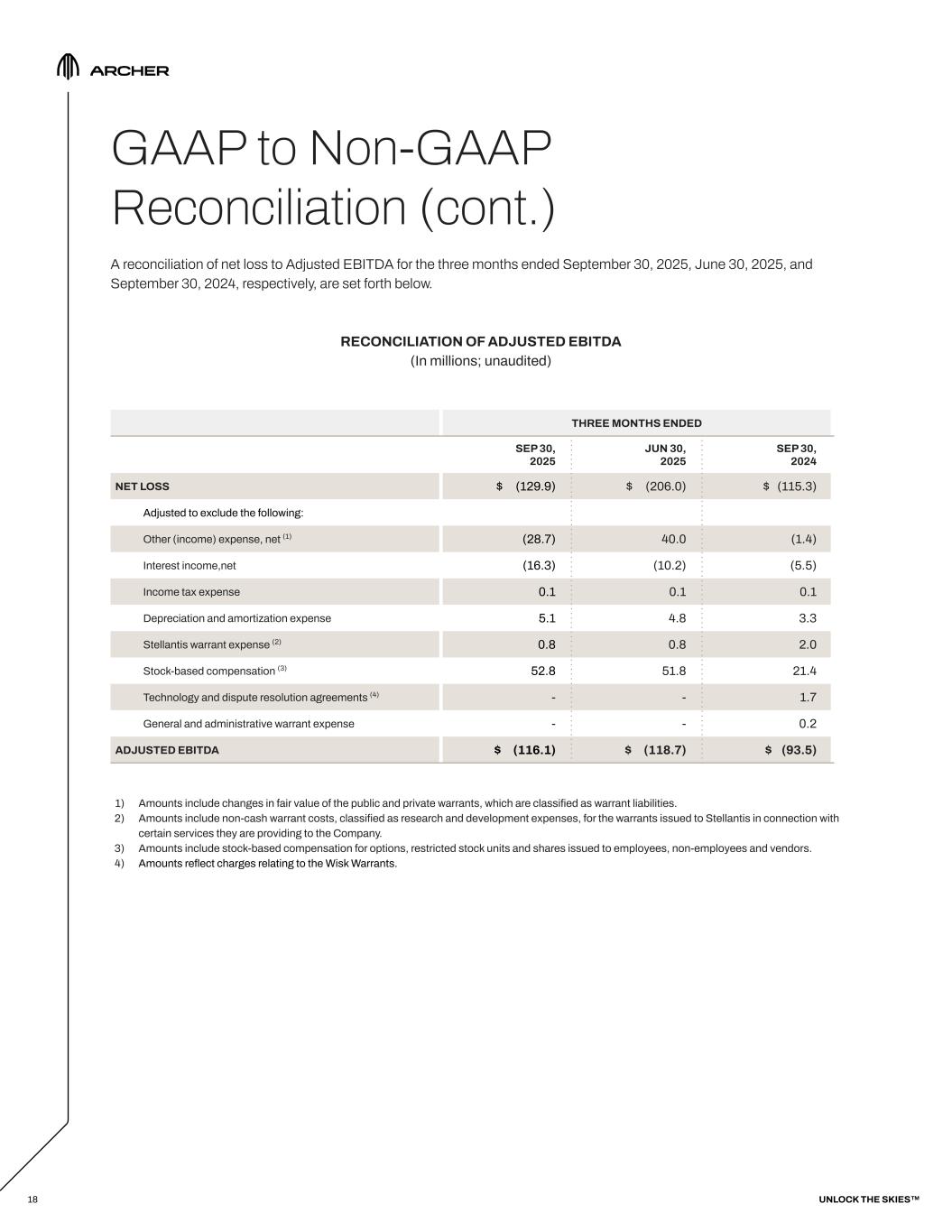

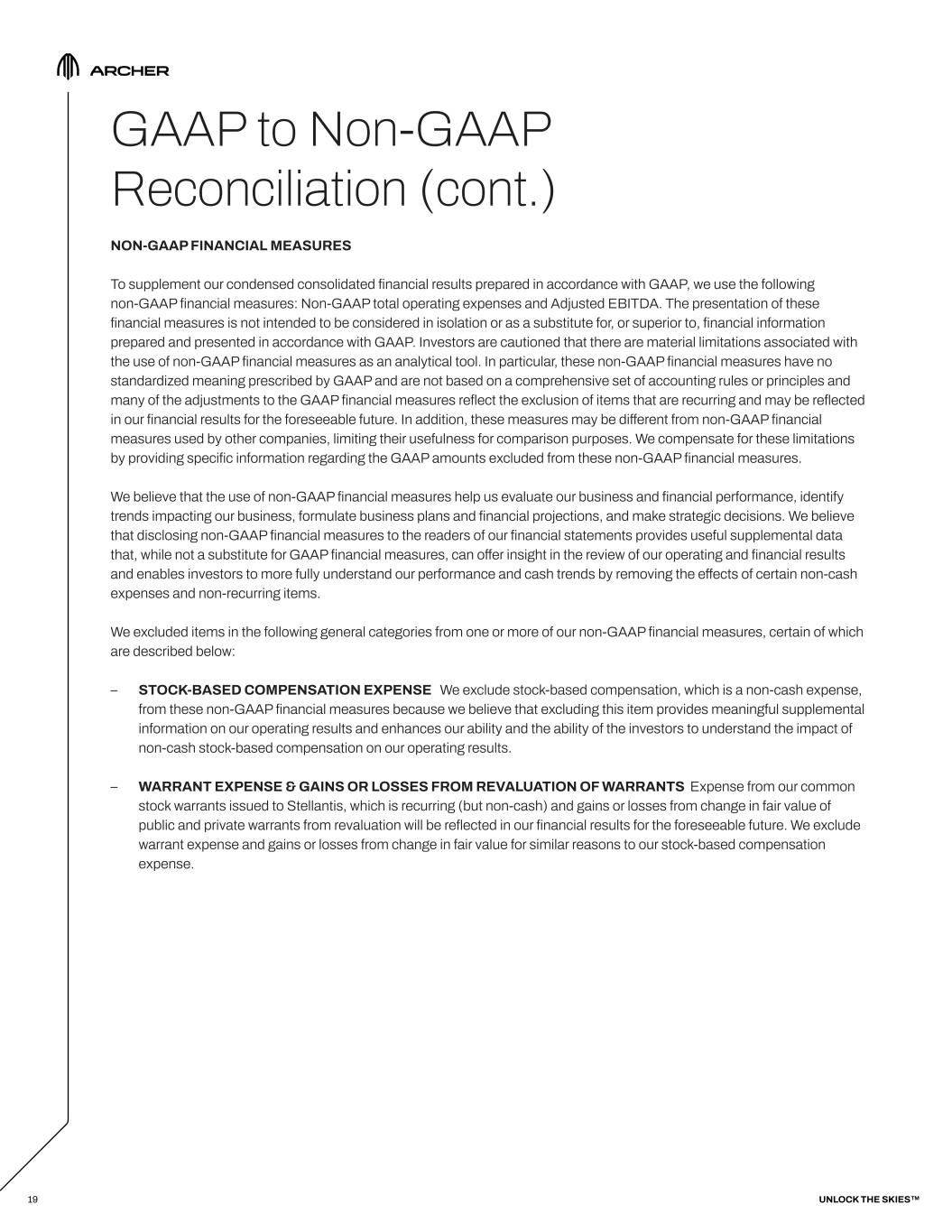

18 GAAP to Non-GAAP Reconciliation (cont.) A reconciliation of net loss to Adjusted EBITDA for the three months ended September 30, 2025, June 30, 2025, and September 30, 2024, respectively, are set forth below. RECONCILIATION OF ADJUSTED EBITDA (In millions; unaudited) 1) Amounts include changes in fair value of the public and private warrants, which are classified as warrant liabilities. 2) Amounts include non-cash warrant costs, classified as research and development expenses, for the warrants issued to Stellantis in connection with certain services they are providing to the Company. 3) Amounts include stock-based compensation for options, restricted stock units and shares issued to employees, non-employees and vendors. 4) Amounts reflect charges relating to the Wisk Warrants. THREE MONTHS ENDED SEP 30, 2025 JUN 30, 2025 SEP 30, 2024 NET LOSS $ (129.9) $ (206.0) $ (115.3) Adjusted to exclude the following: Other (income) expense, net (1) (28.7) 40.0 (1.4) Interest income,net (16.3) (10.2) (5.5) Income tax expense 0.1 0.1 0.1 Depreciation and amortization expense 5.1 4.8 3.3 Stellantis warrant expense (2) 0.8 0.8 2.0 Stock-based compensation (3) 52.8 51.8 21.4 Technology and dispute resolution agreements (4) - - 1.7 General and administrative warrant expense - - 0.2 ADJUSTED EBITDA $ (116.1) $ (118.7) $ (93.5) UNLOCK THE SKIES™

19 GAAP to Non-GAAP Reconciliation (cont.) NON-GAAP FINANCIAL MEASURES To supplement our condensed consolidated financial results prepared in accordance with GAAP, we use the following non-GAAP financial measures: Non-GAAP total operating expenses and Adjusted EBITDA. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, these non-GAAP financial measures have no standardized meaning prescribed by GAAP and are not based on a comprehensive set of accounting rules or principles and many of the adjustments to the GAAP financial measures reflect the exclusion of items that are recurring and may be reflected in our financial results for the foreseeable future. In addition, these measures may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures. We believe that the use of non-GAAP financial measures help us evaluate our business and financial performance, identify trends impacting our business, formulate business plans and financial projections, and make strategic decisions. We believe that disclosing non-GAAP financial measures to the readers of our financial statements provides useful supplemental data that, while not a substitute for GAAP financial measures, can offer insight in the review of our operating and financial results and enables investors to more fully understand our performance and cash trends by removing the effects of certain non-cash expenses and non-recurring items. We excluded items in the following general categories from one or more of our non-GAAP financial measures, certain of which are described below: – STOCK-BASED COMPENSATION EXPENSE We exclude stock-based compensation, which is a non-cash expense, from these non-GAAP financial measures because we believe that excluding this item provides meaningful supplemental information on our operating results and enhances our ability and the ability of the investors to understand the impact of non-cash stock-based compensation on our operating results. – WARRANT EXPENSE & GAINS OR LOSSES FROM REVALUATION OF WARRANTS Expense from our common stock warrants issued to Stellantis, which is recurring (but non-cash) and gains or losses from change in fair value of public and private warrants from revaluation will be reflected in our financial results for the foreseeable future. We exclude warrant expense and gains or losses from change in fair value for similar reasons to our stock-based compensation expense. UNLOCK THE SKIES™

20 Forward-Looking Statements & Disclaimers This shareholder letter includes forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1955, These statements include, but are not limited to, statements regarding our future business plans, expectations, and opportunities. These statements include those regarding its expected financial results for the fourth quarter of 2025, the design and target specifications of our aircraft, the pace of design, development, certification, testing, manufacturing and commercialization of our planned eVTOL aircraft, or its ability to do so at all; timeline, ramp-up and production volume of our manufacturing facilities; air taxi network buildout; closing of our acquisition of Hawthorne Airport, which is subject to conditions, including approval from the City of Hawthorne; expansion of our planned lines of business and development of new business opportunities, such as operating Hawthorne Airport and using it as a testbed for next-generation AI-powered aviation technologies; plans and anticipated benefits of acquisitions, strategic investments, and collaborations with third parties; government incentives; projected demand for our products and services, including our “Launch Edition” program and associated deployment of aircraft and timing of commercial payments; Archer Defense; and international expansion. In addition, this shareholder letter refers to agreements that remain conditional, subject to the future execution of definitive agreements and the satisfaction of certain conditions. Such agreements may not be completed or may contain different terms than those currently contemplated. Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date hereof, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: the early stage nature of our business and our past and projected future losses; our ability to design, manufacture and deliver our aircraft; risks associated with indicative orders from certain third parties for our aircraft, which are subject to the satisfaction of certain conditions and/or further negotiation and reaching mutual agreement on certain material terms, and the risk that such parties cancel such orders or never place them; risks associated with being in the early stages of developing our defense program, and our inability to ensure that we will achieve some or any of the expected benefits of the program or that we will be successful in winning a bid to develop aircraft for the U.S. Department of Defense or any other military agency; our ability to realize operating and financial results forecasts which rely in large part upon assumptions and analyses that we have developed; our ability to effectively market electric air transportation following receipt of governmental operating authority; our ability to compete effectively with existing and new competitors in existing and new markets; risks related to the operation of our UAM networks in densely populated metropolitan areas and heavily regulated airports; our ability to obtain any required certifications, licenses, approvals, or authorizations from governmental authorities; our ability to achieve business milestones, such as commercial-scale manufacturing ramp up and launching products and services in a timely manner, or at all; our dependence on suppliers for the parts and components in our aircraft, which are subject to uncertainties that could affect our operating results, including tariffs or other trade restrictions; regulatory requirements and other obstacles outside of our control that impact our business operations; our ability to recruit, train and retain qualified personnel and key employees; natural disasters, public health outbreaks, economic, social, weather, growth constraints and regulatory conditions or other circumstances affecting metropolitan areas; the potential for losses and adverse publicity stemming from any aircraft accidents, especially those involving electric aircraft or lithium-ion batteries, or our aircraft test flights; risks associated with indexed price escalation clauses in aircraft contracts, which could subject us to losses if we have cost overruns or if increases in costs exceed the applicable escalation rate; our ability to address a wide variety of extensive and evolving laws and regulations; our ability to protect our intellectual property rights from unauthorized use by third parties; our ability to obtain additional capital; continued federal government shutdown; and cybersecurity risks. UNLOCK THE SKIES™

21 Forward-Looking Statements & Disclaimers (cont.) The indicative operational goals referenced in this document reflect numerous estimates and assumptions with respect to general business, economic, regulatory, market and financial conditions and other future events, as well as matters specific to the our business, all of which are difficult to predict and many of which are beyond the our control including, among other things, the timing of the receipt of required certifications, licenses, approvals or authorizations from governmental authorities, the ramping up of manufacturing at our manufacturing facilities, the actual price paid per aircraft, and the costs of manufacturing the aircraft, consumer demand for our aircraft and the other matters described above. These operational goals should not be relied upon as being indicative of future economic performance or results. The inclusion of the operational goals in this document is not an admission or representation that such information is material. The assumptions and estimates underlying the operational goals are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual operating results to differ materially from those presented. There can be no assurance that these goals are indicative of our future performance or that actual results will not differ materially from those presented in the operational goals. Inclusion of the operational goals in this document should not be regarded as a representation by any person that the operational goals will be achieved. The information concerning our operational goals is subjective in many respects and thus is susceptible to multiple interpretations and periodic revisions based on actual experience and business developments. Additional risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed in our filings with the Securities and Exchange Commission (“SEC”), including our most recent Annual Report on Form 10-K, Current Report on Form 8-K filed on June 13, 2025 and most recent Form 10-Q, which is or will be available on our investor relations website at http://investors.archer.com and on the SEC website at www.sec.gov. All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this shareholder letter or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on forward-looking statements. UNLOCK THE SKIES™