UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

|

|

Preliminary Proxy Statement |

☐ |

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

|

Definitive Proxy Statement |

☐ |

|

|

Definitive Additional Materials |

☐ |

|

|

Soliciting Material under §240.14a-12 |

Surrozen, Inc. |

(Name of Registrant as Specified in Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ |

|

|

No fee required. |

☐ |

|

|

Fee paid previously with preliminary materials |

☐ |

|

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

April 2, 2025

Dear Fellow Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the 2025 annual meeting of stockholders (the “Annual Meeting”) of Surrozen, Inc., which will be held on Wednesday, May 14, 2025, beginning at 10:00 a.m., Pacific Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast.

Attached to this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the Annual Meeting.

Your vote is important to us. Please act as soon as possible to vote your shares. It is important that your shares be represented at the meeting whether or not you plan to attend the Annual Meeting via the internet. Please vote electronically over the internet, by telephone or by returning your signed proxy card in the envelope provided. You may also vote your shares online during the Annual Meeting. Instructions on how to vote while participating at the meeting live via the internet are posted at www.virtualshareholdermeeting.com/SRZN2025.

On behalf of the Board of Directors and management, it is my pleasure to express our appreciation for your continued support.

|

|

|

/s/ Craig Parker |

|

|

|

Craig Parker |

|

|

|

President, Chief Executive Officer and Director |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 14, 2025

Notice is hereby given that the 2025 annual meeting of stockholders (the “Annual Meeting”) of Surrozen, Inc., a Delaware corporation, will be held on Wednesday, May 14, 2025, at 10:00 a.m., Pacific Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online by visiting www.virtualshareholdermeeting.com/SRZN2025. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the accompanying Proxy Statement in the section titled “General Information about the Annual Meeting and Voting – How can I attend and vote at the Annual Meeting?”

The Annual Meeting is being held:

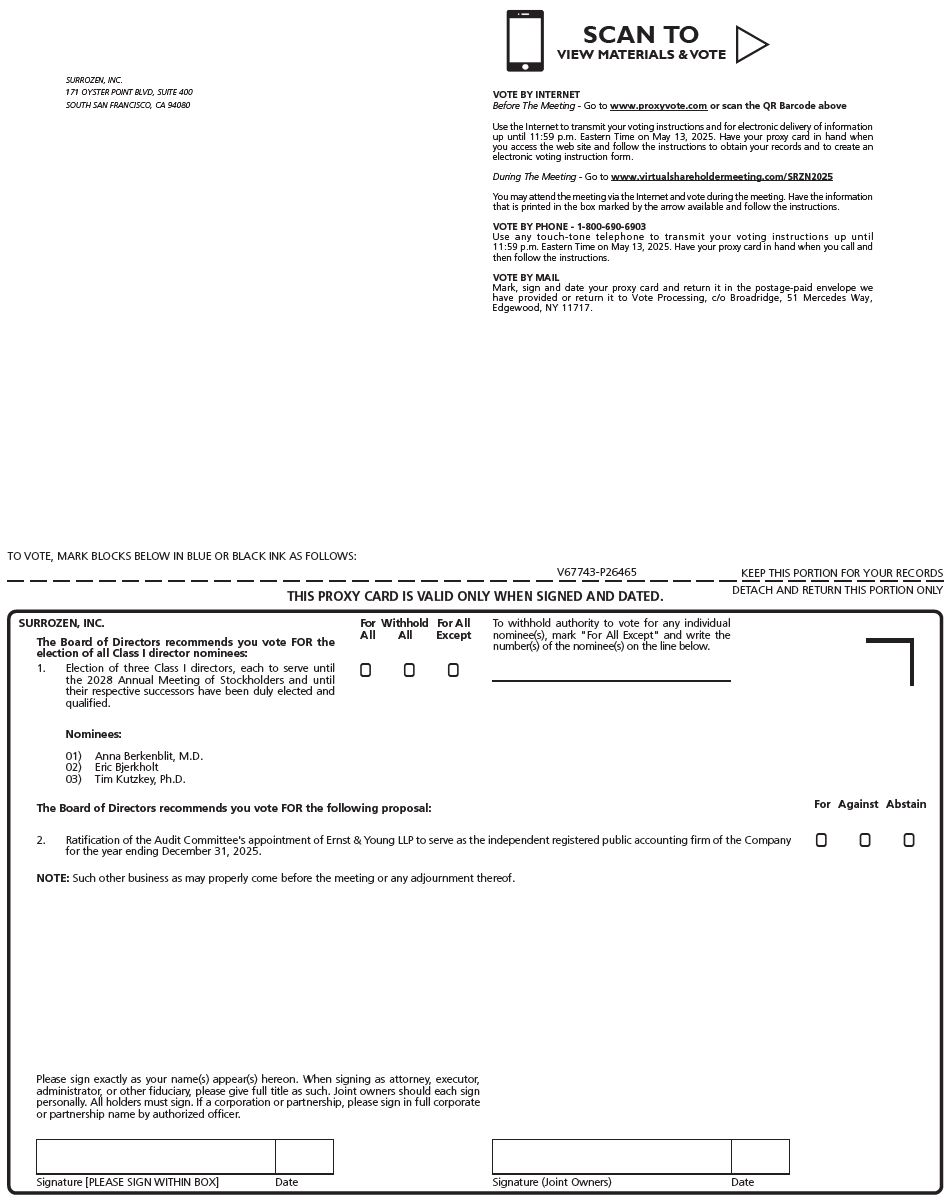

1. |

to elect our nominees, Anna Berkenblit, M.D., Eric Bjerkholt and Tim Kutzkey, Ph.D. as Class I directors to hold office until our annual meeting of stockholders to be held in 2027 or until their successors are duly elected and qualified, or until their earlier death, resignation or removal; |

2. |

to ratify, in a non-binding vote, the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2025; and |

3. |

to transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. |

These items of business are described in the Proxy Statement that follows this Notice. Holders of record of our common stock as of the close of business on March 19, 2025 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment thereof.

Your vote is important. Voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Please promptly vote your shares by completing, signing, dating and returning your proxy card or by internet or telephone voting as described on your proxy card.

|

|

|

By Order of the Board of Directors |

|

|

|

/s/ Charles Williams |

|

|

|

Charles Williams |

|

|

|

Chief Financial Officer, Chief Operating Officer and Corporate Secretary |

South San Francisco, California

April 2, 2025

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available,

as the case may be, on or about April 2, 2025.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting:

This Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2024 are available free of charge at www.proxyvote.com.

Surrozen, Inc. | 171 Oyster Point Blvd., Suite 400 | South San Francisco, California 94080

TABLE OF CONTENTS

|

Page |

1 |

|

6 |

|

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

10 |

12 |

|

13 |

14 |

|

22 |

|

26 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

28 |

31 |

|

34 |

|

35 |

|

35 |

i

Surrozen, Inc.

171 Oyster Point Blvd., Suite 400

South San Francisco, California 94080

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 14, 2025

This Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2024 (the “Annual Report”) are being furnished by and on behalf of our Board of Directors (the “Board”) in connection with our 2025 annual meeting of stockholders (the “Annual Meeting”). The Notice of Annual Meeting of Stockholders and this Proxy Statement are first being distributed or made available, as the case may be, on or about April 2, 2025.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to first mail the Notice and make this proxy statement and the form of proxy available to stockholders on or about April 2, 2025.

When and where will the Annual Meeting be held?

The Annual Meeting will be held on Wednesday, May 14, 2025 at 10:00 a.m., Pacific Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online by visiting www.virtualshareholdermeeting.com/SRZN2025 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote or access the list of stockholders as of the close of business on March 19, 2025 (the “Record Date”). We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:45 a.m., Pacific Time, and you should allow ample time for the check-in procedures.

What are the purposes of the Annual Meeting?

The purpose of the Annual Meeting is to vote on the following items described in this Proxy Statement:

• |

Proposal No. 1: Election of the three director nominees listed in this Proxy Statement. |

• |

Proposal No. 2: Ratification of the appointment of Ernst & Young as our independent registered public accounting firm for the year ending December 31, 2025. |

Are there any matters to be voted on at the Annual Meeting that are not included in this Proxy Statement?

At the date this Proxy Statement went to press, we did not know of any matters to be properly presented at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting or any adjournment or postponement thereof for consideration, and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

1

What does it mean if I receive more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy by phone, via the internet, or by signing, dating and returning the enclosed proxy card in the enclosed envelope.

Who is entitled to vote at the Annual Meeting?

Holders of record of shares of our common stock as of the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement or adjournment thereof.

At the close of business on the Record Date, there were 3,281,169 shares of our common stock issued and outstanding and entitled to vote. Each share of our common stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting. You will need to obtain your own internet access if you choose to attend the Annual Meeting and/or vote over the internet.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder (also called a “registered holder”) holds shares in his or her name. Shares held in “street name” means that shares are held in the name of a bank, broker or other nominee on the holder’s behalf.

What do I do if my shares are held in “street name”?

If your shares are held in a brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” The proxy materials have been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The holders of at least one-third in voting power of our capital stock issued and outstanding and entitled to vote, present electronically or represented by proxy constitutes a quorum. If you sign and return your paper proxy card or authorize a proxy to vote electronically or telephonically, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote as indicated in the proxy materials.

Broker non-votes will also be considered present for the purpose of determining whether there is a quorum for the Annual Meeting.

What are “broker non-votes”?

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because the broker has not received voting instructions from the stockholder who beneficially owns the shares and the broker lacks the authority to vote the shares at their discretion. Proposal No. 1 is considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposal. Proposal No. 2 is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on this proposal.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present or represented at the scheduled time of the Annual Meeting, the Chair of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present electronically or represented by proxy, may adjourn the Annual Meeting but no other business shall be transacted.

How do I vote my shares without attending the Annual Meeting?

We recommend that stockholders vote by proxy even if they plan to attend the Annual Meeting and vote electronically. If you are a stockholder of record, there are three ways to vote by proxy:

• |

by telephone – You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card; |

• |

by internet – You can vote over the internet at www.proxyvote.com by following the instructions on the proxy card; or |

2

• |

by mail – You can vote by mail by signing, dating and mailing the proxy card. |

Telephone and internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on May 13, 2025.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions on how to vote from the bank, broker or holder of record. You must follow the instructions of such bank, broker or holder of record in order for your shares to be voted.

How can I attend and vote at the Annual Meeting?

We will be hosting the Annual Meeting live via audio webcast. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/SRZN2025. If you were a stockholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

• |

Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/SRZN2025. |

• |

Assistance with questions regarding how to attend and participate via the internet will be provided at www.virtualshareholdermeeting.com/SRZN2025 on the day of the Annual Meeting. |

• |

Webcast starts at 10:00 a.m., Pacific Time. |

• |

You will need your 16-Digit Control Number to enter the Annual Meeting. |

To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote or access the list of stockholders as of the Record Date.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page.

How does the Board recommend that I vote?

The Board recommends that you vote:

3

What vote is required for adoption or approval of each proposal and how will votes be counted?

Proposal Number |

Proposal Description |

Vote Required for Approval |

Voting Options |

Effect of Abstentions or Withhold votes, as applicable |

Effect of Broker Non-Votes |

Board Recommendation |

1 |

Election of Directors named in this Proxy Statement |

The three nominees receiving the most “FOR” votes of the shares present online or represented by proxy at the Annual Meeting will be elected. |

FOR or WITHHOLD |

No Effect |

No Effect |

FOR all nominees |

2 |

Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2025 |

“FOR” votes from a majority of the shares present online or represented by proxy at the Annual Meeting and entitled to vote on the matter is required for approval of this proposal. |

FOR, AGAINST or ABSTAIN |

Against |

Not Applicable

|

FOR |

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are set forth above, as well as with the description of each proposal in this Proxy Statement.

Who will count the votes?

Representatives of Broadridge Investor Communications Services (“Broadridge”) will tabulate the votes.

Can I revoke or change my vote after I submit my proxy?

Yes. Whether you have voted by internet, telephone or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by:

• |

sending a written statement to that effect to the attention of our Corporate Secretary at our corporate offices, provided such statement is received no later than May 13, 2025; |

• |

voting again by internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m., Eastern Time, on May 13, 2025; |

• |

submitting a properly signed proxy card with a later date that is received no later than May 13, 2025; or |

• |

attending the Annual Meeting, revoking your proxy and voting again. |

4

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy online at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Your most recent proxy card or telephone or internet proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to us before your proxy is voted or you vote online at the Annual Meeting.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

Why hold a virtual meeting?

We wish to continue using the latest technology to provide expanded access, improved communication and cost savings for us and our stockholders while providing stockholders the same rights and opportunities to participate as they would have at an in-person meeting. Furthermore, we believe that a virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world.

5

PROPOSAL NO. 1 ELECTION OF DIRECTORS

Board Size and Structure

Our certificate of incorporation, as currently in effect (“Certificate of Incorporation”) provides that the number of directors shall be fixed exclusively by resolutions adopted by a majority of the authorized number of directors. We currently have nine directors serving on our Board.

Our Certificate of Incorporation provides that our Board be divided into three classes, designated as Class I, Class II and Class III. Each class should consist, as nearly as may be possible, of one-third of the total number of directors constituting the entire Board. Each class of directors must stand for re-election no later than the third annual meeting of stockholders subsequent to their initial appointment or election to our Board, provided that the term of each director will continue until the election and qualification of his or her successor and is subject to his or her earlier death, resignation or removal. Generally, vacancies or newly created directorships on our Board will be filled only by vote of a majority of the directors then in office and will not be filled by the stockholders, unless our Board determines by resolution that any such vacancy or newly created directorship will be filled by the stockholders. A director appointed by our Board to fill a vacancy will hold office until the next election of the class for which such director was chosen, subject to the election and qualification of his or her successor or his or her earlier death, resignation or removal.

Current Directors and Terms

Our current directors and their respective classes and terms are set forth below.

Class I Director – Current Term Ending at 2025 Annual Meeting |

|

|

Class II Director – Current Term Ending at 2026 Annual Meeting |

|

|

Class III Director – Current Term Ending at 2027 Annual Meeting |

Anna Berkenblit, M.D. |

|

|

Shao-Lee Lin, M.D., Ph.D. |

|

|

Christopher Y. Chai |

Eric Bjerkholt |

|

|

Mace Rothenberg, M.D. |

|

|

Mary Haak-Frendscho, Ph.D. |

Tim Kutzkey, Ph.D. |

|

|

David J. Woodhouse, Ph.D. |

|

|

Craig Parker |

Nominees for Director

Dr. Berkenblit, Mr. Bjerkholt and Dr. Kutzkey have been nominated by our Board to stand for election. As directors assigned to Class I, Dr. Berkenblit’s and Mr. Bjerkholt’s current terms of service will expire at the Annual Meeting. If elected by the stockholders at the Annual Meeting, Dr. Berkenblit, Mr. Bjerkholt and Dr. Kutzkey will each serve for a term expiring at our annual meeting of stockholders to be held in 2028 or the election and qualification of their successors or until their earlier death, resignation or removal.

Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any of the nominees will be unable to serve. If, however, prior to the Annual Meeting, our Board should learn that a nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for such nominee will be voted for a substitute nominee as selected by our Board. Alternatively, the proxies, at our Board’s discretion, may be voted for no nominees as a result of the inability of a nominee to serve. Our Board has no reason to believe that any of the nominees will be unable to serve.

Information About Board Nominees and Continuing Directors

The following pages contain certain biographical information for each nominee for director and each director whose term as a director will continue after the Annual Meeting, including all positions he or she holds, his or her principal occupation and business experience for the past five years, and the names of other publicly held companies of which the director or nominee currently serves as a director or has served as a director during the past five years.

We believe that all of our directors and the nominees have or display: personal and professional integrity; satisfactory levels of education and/or business experience; broad-based business acumen; an appropriate level of understanding of our business and its industry and other industries relevant to our business; the ability and willingness to devote adequate time to the work of our Board and its committees, as applicable; skills and personality that complement those of our other directors that helps build a board that is effective, collegial and responsive to our needs; strategic thinking and a willingness to share ideas; a diversity of experiences, expertise and background; and the ability to represent the interests of all of our stockholders. The information presented below regarding the

6

nominees and continuing directors also sets forth specific experience, qualifications, attributes and skills that led our Board to the conclusion that such individual should serve as a director in light of our business and structure.

Nominees for Election to Three-Year Terms Expiring at the 2028 Annual Meeting

Class I Director |

|

|

Age |

|

|

Current Position at Surrozen |

Anna Berkenblit, M.D. |

|

|

55 |

|

|

Director |

Eric Bjerkholt |

|

|

65 |

|

|

Director |

Tim Kutzkey, Ph.D. |

|

|

49 |

|

|

Director |

Anna Berkenblit, M.D. has served on our Board since August 2018. Dr. Berkenblit is currently Chief Scientific and Medical Officer at the Pancreatic Cancer Action Network. She previously served as the Senior Vice President and Chief Medical Officer at ImunnoGen, Inc., a biotechnology company, from April 2015 to August 2023. Prior to ImmunoGen, Dr. Berkenblit served as Senior Vice President Head of Clinical Development at H3, Biomedicine Inc., a developer of targeted anti-cancer compounders, from 2013 to 2015. From 2011 to 2013, she served as Head of Clinical Research at AVEO Pharmaceuticals, Inc., a biopharmaceutical company, where she led the clinical development of oncology product candidates spanning early testing to registration trials. From January 2007 to September 2011, Dr. Berkenblit held various positions of increasing responsibility at Pfizer Inc., a biopharmaceutical company. Dr. Berkenblit is currently a member of the board of directors of Nested Therapeutics, Inc., a private biotechnology company. Dr. Berkenblit received an M.D. from Harvard Medical School and an M.M.S. degree in the Clinical Investigator Training Program of Harvard/MIT Health Sciences and Technology. We believe that Dr. Berkenblit’s extensive leadership and scientific experience, especially in the clinical development of biopharmaceuticals, provide her with the qualifications and skills to serve as a director of our company.

Eric Bjerkholt has served on our Board since April 2023. Mr. Bjerkholt has served as the Chief Financial Officer of Mirum Pharmaceuticals, Inc., a publicly traded company, since September 2023. At Mirum, Mr. Bjerkholt oversees the legal, financial reporting, budgeting, internal controls, investor relations, facilities and information technology functions. He previously served as the Chief Financial Officer of Chinook Therapeutics, Inc. from November 2020 to September 2023. Prior to Chinook Therapeutics, Inc., he served as the Chief Financial Officer of Aimmune Therapeutics, Inc., from 2017 to 2020. Prior to Aimmune Therapeutics, he spent 13 years at Sunesis Pharmaceuticals, Inc. from 2004 until 2017, where in addition to his role as Chief Financial Officer, Mr. Bjerkholt served in various capacities, including Executive Vice President of Corporate Development and Finance, Corporate Secretary and Chief Compliance Officer. Previously, Mr. Bjerkholt held senior executive finance roles at IntraBiotics Pharmaceuticals, Inc., LifeSpring Nutrition, Inc. and Age Wave, LLC and spent seven years in healthcare investment banking at J.P. Morgan & Company, Inc. He served on the board of directors of Graybug Vision, Inc. (acquired by CalciMedica in 2023), a publicly traded biotechnology company, from 2020 to 2025. He is currently a member of the board of directors and Chair of the audit committee and a member of the compensation and nominating committees of Metagenomi, Inc., a publicly traded biotechnology company, and a member of the board of directors and Chair of the audit committee of Cerus Corporation, a publicly traded biotechnology company. Mr. Bjerkholt holds an M.B.A. from Harvard Business School and a Cand.Oecon from the University of Oslo in Norway. We believe that Mr. Bjerkholt’s extensive business leadership experience across a broad range of roles provide him with the qualifications and skills to serve as a director of our company.

Tim Kutzkey, Ph.D. served on our Board from April 2016 to June 2024, and was reappointed to the Board in March 2025. Dr. Kutzkey served as our interim Chief Executive Officer from inception to April 2018. Dr. Kutzkey serves as Managing Partner of The Column Group, LLC, a venture capital partnership, where he has served in various roles since 2007. Prior to The Column Group, Dr. Kutzkey served as a scientist at Kai Pharmaceuticals, Inc. Dr. Kutzkey also serves on the board of directors of several privately-held biotechnology companies. Dr. Kutzkey obtained a Ph.D. in molecular and cell biology from the University of California, Berkeley and completed his undergraduate degree in biological sciences from Stanford University. We believe that Dr. Kutzkey’s scientific training and experience as a director of other publicly-traded and privately-held biotechnology companies provide him with the qualifications and skills to serve as a director of our company.

7

Class II Directors Whose Terms Expire at the 2026 Annual Meeting of Stockholders

Class II Directors |

|

|

Age |

|

|

Current Position at Surrozen |

Shao-Lee Lin, M.D., Ph.D. |

|

|

58 |

|

|

Director |

Mace Rothenberg, M.D. |

|

|

68 |

|

|

Director |

David J. Woodhouse, Ph.D. |

|

|

55 |

|

|

Chair of the Board |

Shao-Lee Lin, M.D., Ph.D. has served on our Board since January 2021. Dr. Lin co-founded and served as the Chief Executive Officer of ACELYRIN, Inc until May 2024. From January 2018 to January 2020, she served as Executive Vice President, Research and Development and Chief Scientific Officer at Horizon Pharma plc, a biopharmaceutical company. From April 2015 to December 2017, she served as a corporate officer and Vice President, Therapeutic Areas, Development Excellence and International Development at Abbvie Inc., a biopharmaceutical company. Prior to Abbvie, Dr. Lin served as Vice President, Inflammation and Respiratory Development at Gilead Sciences, Inc. from August 2012 to February 2015 and served in various roles of increasing responsibility at Amgen Inc. from April 2004 to August 2012. Dr. Lin served on the board of directors of Principia Biopharma Inc., a biopharmaceutical company, from April 2019 until it was acquired in September 2020. Dr. Lin has also been faculty as a Clinical Scholar at The Rockefeller University and adjunct faculty at the medical schools of Cornell University, The University of California, Los Angeles, Stanford University and Northwestern University. Dr. Lin received her B.S. in chemical engineering and biochemistry from Rice University and holds an M.D. and Ph.D. from The Johns Hopkins University School of Medicine. We believe that Dr. Lin’s scientific training, work experience, and experience as a director of other publicly traded biopharmaceutical companies provide her with the qualifications and skills to serve as a director of our company.

Mace Rothenberg, M.D. has served on our Board since April 2021. Dr. Rothenberg served as Chief Medical Officer of Pfizer Inc., a biopharmaceutical company from January 2019 to January 2021, where he led Pfizer’s Worldwide Medical & Safety organization that is responsible for ensuring that patients, physicians, and regulatory agencies are provided with information on the safe and appropriate use of Pfizer medications. From January 2019 to March 2021, Dr. Rothenberg also served as a member of Pfizer’s Portfolio Strategy and Investment Committee, Worldwide Research, Development, and Medical Leadership Team, and Blueprint Leaders Forum. Prior to becoming Pfizer’s Chief Medical Officer, Dr. Rothenberg led Pfizer’s oncology clinical drug development efforts. During his ten years in this role, Dr. Rothenberg’s organization obtained FDA approval for eleven cancer medicines. He received his B.A. from the University of Pennsylvania and his M.D. from the New York University School of Medicine. Dr. Rothenberg received his post-graduate training in Internal Medicine at Vanderbilt University and in Medical Oncology at the National Cancer Institute. In addition, Dr. Rothenberg currently serves as a member of the board of directors for Tango Therapeutics and Aulos Bioscience, both biopharmaceutical companies. We believe that Dr. Rothenberg’s scientific training, work experience, and experience as a director of other biopharmaceutical companies provide him with the qualifications and skills to serve as a director of our company.

David J. Woodhouse, Ph.D. has served on our Board since September 2020 and has served as Chair of our Board since April 2023. Dr. Woodhouse has served as the Chief Executive Officer and director of NGM Biopharmaceuticals, Inc. (“NGM”) since September 2018. Dr. Woodhouse also served as Chief Financial Officer from March 2015 until September 2018 and acting Chief Financial Officer from September 2018 until June 2020 at NGM. From 2002 to 2015, he was an investment banker at Goldman Sachs & Co. LLC, most recently as a managing director in the healthcare investment banking group and co-head of biotechnology investment banking. Earlier in his career, Dr. Woodhouse worked at Dynavax Technologies Corporation and also as a research assistant at Amgen, Inc. Dr. Woodhouse received a B.A. in pharmacology from the University of California, Santa Barbara, an M.B.A. from the Tuck School of Business at Dartmouth and a Ph.D. in molecular pharmacology from Stanford University School of Medicine. We believe that Dr. Woodhouse’s extensive financial and executive experience provide him with the qualifications and skills to serve as a director of our company.

Class III Directors Whose Terms Expire at the 2027 Annual Meeting of Stockholders

Class III Directors |

|

|

Age |

|

|

Current Position at Surrozen |

Christopher Y. Chai |

|

|

58 |

|

|

Director |

Mary Haak-Frendscho, Ph.D. |

|

|

68 |

|

|

Director |

Craig Parker |

|

|

63 |

|

|

President, Chief Executive Officer and Director |

Christopher Y. Chai has served on our Board since April 2021. Mr. Chai has served as a venture partner at SR One Capital Management, LP since January 2021, where he works with portfolio companies on their engagement with Wall Street and their overall financing strategy and execution. Prior to joining SR One, Mr. Chai served as Chief Financial Officer of Principia Biopharma Inc. from 2013 to 2020, where he led the company from an early-stage private venture-backed company to its acquisition by Sanofi S.A.

8

Mr. Chai previously served as Chief Financial Officer at MAP Pharmaceuticals, Inc. (acquired by Allergan, Inc.) and Vice President, Treasury and Investor Relations at CV Therapeutics, Inc. (acquired by Gilead Sciences, Inc.). Mr. Chai received his B.S. in operations research and industrial engineering from Cornell University. We believe that Mr. Chai’s extensive financial and executive experience provide him with the qualifications and skills to serve as a director of our company.

Mary Haak-Frendscho, Ph.D. has served on our Board since March 2021. Dr. Haak-Frendscho has served as the President and Chief Executive Officer of Spotlight Therapeutics, Inc., a privately held biotechnology company, since January 2019. Prior to Spotlight, from January 2017 to January 2019, she was a venture partner with Versant Venture Management, LLC and, from January 2016 to January 2019, she served as the Chief Executive Officer of Blueline Bioscience, Versant’s vehicle for new company creation in Canada. Earlier, Dr. Haak-Frendscho established and served as the Chair of Compugen USA, Inc. from 2012 to 2016, was the Chief Executive Officer of Igenica Biotherapeutics, Inc. from 2012 to 2014, and was the Founding President and Chief Scientific Officer of Takeda San Francisco, Inc. from 2008 to 2012. She received her B.S. from the University of Michigan, M.L.A. from Washington University, M.S. from SUNY-Stony Brook, C.S.E.P. from Columbia University Graduate School of Business, and Ph.D. from the University of Wisconsin. We believe that Dr. Haak-Frendscho’s scientific training, work experience, and experience as a director of other biopharmaceutical companies provide her with the qualifications and skills to serve as a director of our company.

Craig Parker has served as our President and Chief Executive Officer since March 2018 and as a member of our Board since April 2018. Mr. Parker has served as a venture partner at The Column Group since July 2024. From August 2014 to March 2018, Mr. Parker served as Senior Vice President of Corporate Development at Jazz Pharmaceuticals plc, a biopharmaceutical company. From 2012 to 2014, Mr. Parker served as Executive Vice President of Corporate Development and Scientific Affairs at Geron Corporation and from 2011 to 2012 as Senior Vice President of Strategy and Corporate Development at Human Genome Sciences Inc. (“HGS”) until its acquisition by GlaxoSmithKline plc. Prior to HGS, Mr. Parker worked in various positions at J.P. Morgan and other Wall Street financial institutions. Mr. Parker served on the board of directors of vTv Therapeutics Inc., a biopharmaceutical company, from July 2015 to February 2019. Mr. Parker is a member of the Scientific Advisory Board and chairs the Leadership Council of the Life Sciences Institute, University of Michigan and has been a member since 2005. Mr. Parker received a A.B. in biological sciences from the University of Chicago, an M.B.A. from the University of Michigan and attended the Georgetown University School of Medicine. We believe that Mr. Parker’s extensive scientific, business and leadership experience in both public and privately-held companies in the life sciences industry provide him with the qualifications and skills to serve on our Board and as our President and Chief Executive Officer.

Board Recommendation

The Board unanimously recommends a vote FOR the election of each of Dr. Berkenblit, Mr. Bjerkholt and Dr. Kutzkey as Class I directors to hold office until the 2028 Annual Meeting of Stockholders or until their successors are duly elected and qualified, or until their earlier death, resignation or removal.

9

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Appointment of Independent Registered Public Accounting Firm

Our audit committee appoints our independent registered public accounting firm. In this regard, our audit committee evaluates the qualifications, performance and independence of our independent registered public accounting firm and determines whether to re-engage our current firm. As part of its evaluation, our audit committee considers, among other factors, the quality and efficiency of the services provided by the firm, including the performance, technical expertise, industry knowledge and experience of the lead audit partner and the audit team assigned to our account; the overall strength and reputation of the firm; the firm’s global capabilities relative to our business; and the firm’s knowledge of our operations. Ernst & Young LLP has served as our independent registered public accounting firm since 2020. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors and providing audit and permissible non-audit related services. Upon consideration of these and other factors, our audit committee has appointed Ernst & Young LLP to serve as our independent registered public accounting firm for the year ending December 31, 2025.

Although ratification is not required by our amended and restated bylaws or otherwise, our Board is submitting the selection of Ernst & Young LLP to our stockholders for ratification because we value our stockholders’ views on our independent registered public accounting firm and it is a good corporate governance practice. If our stockholders do not ratify the selection, it will be considered as notice to our Board and audit committee to consider the selection of a different firm. Even if the selection is ratified, our audit committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests and the best interests of our stockholders.

Audit, Audit-Related, Tax and All Other Fees

The following table sets forth the aggregate fees billed by Ernst & Young LLP, our independent registered public accounting firm, for professional services rendered with respect to the years ended December 31, 2024 and 2023 (in thousands).

|

|

Year Ended December 31, |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Audit Fees(1) |

|

$ |

981 |

|

|

$ |

961 |

|

Audit-Related Fees |

|

|

— |

|

|

|

— |

|

Tax Fees |

|

|

— |

|

|

|

— |

|

All Other Fees |

|

|

— |

|

|

|

— |

|

Total Fees |

|

$ |

981 |

|

|

$ |

961 |

|

___________________

All services performed and related fees billed by Ernst & Young LLP during 2024 and 2023 were pre-approved by our audit committee pursuant to the pre-approval policies and procedures discussed below.

Audit Committee Pre-Approval Policies and Procedures

Our audit committee must review and pre-approve all audit and non-audit services provided by Ernst & Young LLP, our independent registered public accounting firm, and has adopted a Pre-Approval Policy. In conducting reviews of audit and non-audit services, our audit committee will determine whether the provision of such services would impair the auditor’s independence. The term of any pre-approval is 12 months from the date of pre-approval, unless our audit committee specifically provides for a different period. Any proposed services exceeding pre-approved fee ranges or limits must be specifically pre-approved by our audit committee.

Requests or applications to provide services that require pre-approval by our audit committee must be accompanied by a statement of the independent auditors as to whether, in the auditor’s view, the request or application is consistent with the SEC’s and the Public Company Accounting Oversight Board’s (“PCAOB”) rules on auditor independence. Each pre-approval request or application must also be accompanied by documentation regarding the specific services to be provided.

10

Board Recommendation

Our Board unanimously recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2025.

11

AUDIT COMMITTEE REPORT

The audit committee operates pursuant to a charter which is reviewed annually by the audit committee. Additionally, a brief description of the primary responsibilities of the audit committee is included in this Proxy Statement under the heading “Corporate Governance - Audit Committee”. Under the audit committee charter, management is responsible for the preparation, presentation and integrity of the company’s financial statements, the appropriateness of accounting principles and financial reporting policies and for establishing and maintaining our internal control over financial reporting. The independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States.

In the performance of its oversight function, the audit committee reviewed and discussed with management and Ernst & Young LLP, as the company’s independent registered public accounting firm, the company’s audited financial statements for 2024. The audit committee also discussed with the company’s independent registered public accounting firm the matters required to be discussed by the applicable requirements of the PCAOB and the SEC. In addition, the audit committee received and reviewed the written disclosures and the letters from the company’s independent registered public accounting firm required by applicable requirements of the PCAOB, regarding such independent registered public accounting firm’s communications with the audit committee concerning independence, and discussed with the company’s independent registered public accounting firm their independence from the company.

Based upon the review and discussions described in the preceding paragraph, the audit committee recommended to the Board that the company’s audited financial statements be included in its Annual Report filed with the SEC.

Submitted by the Audit Committee

Christopher Y. Chai (Chair)

David J. Woodhouse, Ph.D.

Eric Bjerkholt

This report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended (“Securities Act”), or the Securities Exchange Act of 1934, as amended (“Exchange Act”), whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent specifically incorporated by reference therein.

12

EXECUTIVE OFFICERS

The table below identifies and sets forth certain biographical and other information regarding our executive officers. There are no family relationships among any of our executive officers or directors.

Executive Officer |

|

|

Age |

|

|

Position |

Craig Parker |

|

|

63 |

|

|

President, Chief Executive Officer and Director |

Charles Williams |

|

|

46 |

|

|

Chief Financial Officer, Chief Operating Officer and Corporate Secretary |

Yang Li, Ph.D. |

|

|

56 |

|

|

Executive Vice President of Research |

Craig Parker. Biographical information for Mr. Parker is included above with the director biographies under the section titled “Proposal No. 1 Election of Directors”.

Charles Williams has served as our Chief Financial Officer since November 2020, our Corporate Secretary since February 2023, and our Chief Operating Officer since February 2024. From 2013 to November 2020, he served as Head of Corporate Development at Jazz Pharmaceuticals plc. From 2008 to 2013, he served as Director of Corporate and Business Development at MAP Pharmaceuticals, Inc., which was acquired by Allergan, Inc. Prior to MAP, Mr. Williams held various roles related to business development, finance and strategic planning at CV Therapeutics, Inc., which was acquired by Gilead Sciences, Inc. Mr. Williams received a B.A. in economics from Cornell University.

Yang Li, Ph.D. has served as our Executive Vice President of Research since July 2023. He served as our Senior Vice President, Biology from January 2021 to June 2023, and Vice President, Biology from October 2017 to December 2020. He has over 25 years of experience in the biopharmaceutical industry with successes in advancing drug molecules from concept to clinic. Prior to Surrozen, Dr. Li was Scientific Director at Amgen Inc., where his teams helped advance multiple programs into the clinic in various disease indications. Dr. Li holds a Ph.D. degree in cell biology from Stanford University and dual B.S. degrees in chemistry and molecular and cell biology from Pennsylvania State University.

13

CORPORATE GOVERNANCE

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines. A copy of these Corporate Governance Guidelines can be found in the “Governance” section of the “Investors & Media” page of our website located at www.surrozen.com.

Among the topics addressed in our Corporate Governance Guidelines are:

• |

|

|

Board size, independence and qualifications |

|

|

• |

|

|

Stock ownership |

• |

|

|

Executive sessions of independent directors |

|

|

• |

|

|

Board access to senior management |

• |

|

|

Board leadership structure |

|

|

• |

|

|

Board access to independent advisors |

• |

|

|

Selection of new directors |

|

|

• |

|

|

Board self-evaluations |

• |

|

|

Director orientation and continuing education |

|

|

• |

|

|

Board meetings |

• |

|

|

Limits on board service |

|

|

• |

|

|

Meeting attendance by directors and non-directors |

• |

|

|

Change of principal occupation |

|

|

• |

|

|

Meeting materials |

• |

|

|

Term limits |

|

|

• |

|

|

Board committees, responsibilities and independence |

• |

|

|

Director responsibilities |

|

|

• |

|

|

Succession planning |

• |

|

|

Director compensation |

|

|

• |

|

|

Risk management |

Board Leadership Structure

Our Corporate Governance Guidelines provide our Board with flexibility to combine or separate the positions of Chair of the Board and Chief Executive Officer in accordance with its determination that having one or the other structure would be in our best interests and the best interests of our stockholders.

The positions of our Chair of the Board and our Chief Executive Officer are currently served by two separate persons. Dr. Woodhouse serves as Chair of the Board, and Mr. Parker serves as our Chief Executive Officer.

Our Board believes that our current leadership structure of Chief Executive Officer and Chair of the Board being held by two separate individuals is in our best interests and the best interests of our stockholders and strikes the appropriate balance between the Chief Executive Officer’s responsibility for the strategic direction, day-to day-leadership and performance of our company and the Chair of the Board’s responsibility to guide our overall strategic direction and provide oversight of our corporate governance and guidance to our Chief Executive Officer and to set the agenda for and preside over Board meetings. We recognize that different leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. Accordingly, our Board will continue to periodically review our leadership structure and make such changes in the future as it deems appropriate and in our best interests and the best interests of our stockholders.

Director Independence

Under our Corporate Governance Guidelines and the applicable Nasdaq listing standards, a director is not independent unless our Board affirmatively determines that he or she does not have a relationship with us that could compromise his or her ability to exercise independent judgement in carrying out his or her responsibilities as a director. In addition, the director must not be precluded from qualifying as independent under the per se bars set forth in the applicable Nasdaq listing standards.

Our Board has undertaken a review of its composition, the composition of its committees and the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board has determined that no director, except for Craig Parker, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of our directors, except for Mr. Parker, has qualified as “independent” as that term is defined under the applicable Nasdaq listing standards.

14

In making this determination, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances our Board deemed relevant in determining their independence, including the director’s beneficial ownership of our common stock and the relationships of our non-employee directors with certain of our significant stockholders.

Board Committees

Our Board has three standing committees: an audit committee, a compensation committee, and a nominating and corporate governance committee, each of which has the composition and the responsibilities described below. In addition, from time to time, special committees may be established under the direction of our Board when necessary to address specific issues. Each of our audit committee, compensation committee, and nominating and corporate governance committee operates under a written charter.

Director |

|

|

Audit Committee |

|

|

Compensation Committee |

|

|

Nominating and Corporate Governance Committee |

Anna Berkenblit, M.D. (1) |

|

|

— |

|

|

X |

|

|

X |

Christopher Y. Chai |

|

|

Chair |

|

|

— |

|

|

X |

Mary Haak-Frendscho, Ph.D. |

|

|

— |

|

|

Chair |

|

|

— |

Tim Kutzkey, Ph.D. (2) |

|

|

— |

|

|

— |

|

|

Chair |

Shao-Lee Lin, M.D., Ph.D. |

|

|

— |

|

|

X |

|

|

— |

Craig Parker |

|

|

— |

|

|

— |

|

|

— |

Mace Rothenberg, M.D. (3) |

|

|

— |

|

|

— |

|

|

Chair |

David J. Woodhouse, Ph.D. |

|

|

X |

|

|

— |

|

|

— |

Eric Bjerkholt |

|

|

X |

|

|

— |

|

|

— |

(1) Dr. Berkenblit was appointed to the nominating and corporate governance committee in May 2024.

(2) Tim Kutzkey, Ph.D. resigned as a member of the Board and as chair of the nominating and corporate governance committee, effective June 30, 2024 and was reappointed to the Board effective March 26, 2025.

(3) Dr. Rothenberg was appointed as a member and as chair of the nominating and corporate governance committee in May 2024.

Audit Committee

Our audit committee consists of the following members: Christopher Y. Chai, David J. Woodhouse, Ph.D. and Eric Bjerkholt. Our Board has determined that each member of our audit committee satisfies the independence requirements under the applicable Nasdaq listing standards and Rule 10A-3(b)(1) of the Exchange Act. The Chair of our audit committee is Christopher Y. Chai. Our Board has determined that each of Christopher Y. Chai, Eric Bjerkholt and David J. Woodhouse are each an “audit committee financial expert” within the meaning of SEC regulations. All members of our audit committee meet the requirements for financial literacy under the applicable Nasdaq listing standards. In arriving at these determinations, our Board has examined each audit committee member’s scope of experience and the nature of their employment.

Our audit committee is responsible for, among other things:

15

Compensation Committee

Our compensation committee consists of the following members: Mary Haak-Frendscho, Ph.D., Anna Berkenblit, M.D. and Shao-Lee Lin, M.D., Ph.D. The Chair of our compensation committee is Mary Haak-Frendscho, Ph.D. Our Board has determined that each member of our compensation committee satisfies the independence requirements under the applicable Nasdaq listing standards and is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act.

The primary purpose of our compensation committee is to discharge the responsibilities of our Board in overseeing our compensation policies, plans and programs and to review and determine the compensation to be paid to our executive officers, directors and other senior management, as appropriate.

Specific responsibilities of our compensation committee include:

Our compensation committee generally considers the Chief Executive Officer’s recommendations when making decisions regarding the compensation of non-employee directors and executive officers (other than the Chief Executive Officer). In addition, our compensation committee has created a subcommittee, the Equity Award Committee, and has appointed Craig Parker as the sole member of the subcommittee. The Equity Award Committee is responsible for reviewing and approving equity awards, subject to certain grant size and position level limitations. The Equity Award Committee may only grant awards to new hires and those who hold a position below the level of vice president. No individual grantee may receive awards from the Equity Award Committee covering more than 1,666 shares of our common stock per calendar year.

Pursuant to our compensation committee’s charter, our compensation committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors to assist in carrying out its responsibilities. Before selecting any such consultant, counsel or advisor, our compensation committee reviews and considers the independence of such consultant, counsel or advisor in accordance with applicable Nasdaq listing standards. We must provide appropriate funding for the payment of reasonable compensation to any consultant, counsel or advisor retained by our compensation committee.

16

Compensation Consultants

Our compensation committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, our compensation committee has engaged the services of AON as an outside compensation consultant.

As requested by our compensation committee, in 2024, AON’s services to our compensation committee included, assisting us in developing our peer group composition, analyzing benchmarking data with respect to our executives’ overall individual compensation and providing information regarding current trends and developments in executive compensation, equity-based awards, severance agreements and employee stock purchase programs based on our peer group.

All executive compensation services provided by AON during 2024 were conducted under the direction or authority of our compensation committee, and all work performed by AON was pre-approved by our compensation committee. Neither AON nor any of its affiliates maintains any other direct or indirect business relationships with us or any of our subsidiaries. Our compensation committee evaluated whether any work provided by AON raised any conflict of interest for services performed during 2024 and determined that it did not.

Additionally, during 2024, AON did not provide any services to us other than services related to (i) executive and director compensation and (ii) broad-based plans that do not discriminate in scope, terms, or operation, in favor of our executive officers or directors, and that are available generally to all salaried employees.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of the following members: Mace Rothenberg, M.D., Christopher Y. Chai and Anna Berkenblit, M.D. The Chair of our nominating and corporate governance committee is Mace Rothenberg, M.D. Our Board has determined that each member of our nominating and corporate governance committee satisfies the independence requirements under the applicable Nasdaq listing standards.

Specific responsibilities of our nominating and corporate governance committee include:

Board and Board Committee Meetings and Attendance

In 2024, our Board met ten times, our audit committee met five times, our compensation committee met four times, and our nominating and corporate governance committee met twice. In 2024, each director attended at least 75% of the aggregate of (i) all meetings of our Board and (ii) all meetings of the committees on which the director served, during the period in which he or she served as a director or committee member; except for Dr. Kutzkey who attended three of five (60%) Board meetings during his tenure during 2024. Dr. Kutzkey was not present at one of such Board meetings as the primary agenda item was a discussion of the proposed strategic research collaboration with TCGFB, Inc. from which Dr. Kutzkey was recused due to the related party nature of the transaction. Had Dr. Kutzkey joined such meeting and then recused himself, his attendance would have been 80%. Please see the section titled “Certain Transactions with Related Persons - Research Collaboration Agreement with TCGFB, Inc.” for information regarding this transaction.

Executive Sessions

Executive sessions, which are meetings of the non-management members of our Board, are regularly scheduled throughout the year. In addition, at least twice a year, the independent directors meet in a private session that excludes management and any non-independent directors. At each of these meetings, the non-management and independent directors in attendance, as applicable, determine which member will preside at such session.

17

Director Attendance at Annual Meeting of Stockholders

We do not have a formal policy regarding the attendance of our Board members at our annual meetings of stockholders, but we expect all directors to make every effort to attend any meeting of stockholders.

Director Nominations Process

Our nominating and corporate governance committee is responsible for recommending candidates to serve on our Board and its committees. In considering whether to recommend any particular candidate to serve on our Board or its committees or for inclusion in our Board’s slate of recommended director nominees for election at the annual meeting of stockholders, our nominating and corporate governance committee considers the criteria set forth in our Corporate Governance Guidelines. Specifically, our nominating and corporate governance committee may take into account many factors, including: personal and professional integrity, ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; strong finance experience; relevant social policy concerns; experience relevant to our industry; experience as a board member or executive officer of another publicly held company; relevant academic expertise or other proficiency in an area of our operations; diversity of expertise and experience in substantive matters pertaining to our business relative to other Board members; diversity of background and perspective, including, but not limited to, with respect to age, gender, race, place of residence and specialized experience; practical and mature business judgment, including, but not limited to, the ability to make independent analytical inquiries; and any other relevant qualifications, attributes or skills. In determining whether to recommend a director for re-election, our nominating and corporate governance committee may also consider potential conflicts of interest with the candidates, other personal and professional pursuits, the director’s past attendance at meetings and participation in and contributions to the activities of our Board.

We consider diversity, such as gender, race, ethnicity and membership of underrepresented communities, among those meaningful factors in identifying and considering director nominees, but do not have a formal diversity policy. Our Board evaluates each individual in the context of our Board as a whole, with the objective of assembling a group that has the necessary tools to perform its oversight function effectively in light of our business and structure.

In identifying prospective director candidates, our nominating and corporate governance committee may seek referrals from other members of our Board, management, stockholders and other sources, including third party recommendations. Our nominating and corporate governance committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation. When considering director candidates, our nominating and corporate governance committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance our Board’s effectiveness. In connection with its annual recommendation of a slate of nominees, our nominating and corporate governance committee also may assess the contributions of those directors recommended for re-election in the context of our Board evaluation process and other perceived needs of our Board.

In determining to nominate each director nominee at this Annual Meeting, our nominating and corporate governance committee and Board evaluated each nominee in accordance with our standard review process for director candidates in connection with a director’s initial appointment and his or her nomination for election or re-election, as applicable, at the Annual Meeting.

When considering whether the directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable our Board to satisfy its oversight responsibilities effectively in light of our business and structure, our Board focused primarily on the information discussed in each of our Board member’s biographical information set forth above. We believe that our directors provide an appropriate mix of experience and skills relevant to the size and nature of our business. This process resulted in our Board’s nomination of the incumbent directors named in this Proxy Statement and proposed for election by you at the Annual Meeting.

Our nominating and corporate governance committee will consider director candidates recommended by stockholders, and such candidates will be considered and evaluated under the same criteria described above. Any recommendation submitted to us should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected and must otherwise comply with the requirements under our Bylaws for stockholders to recommend director nominees. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of our Corporate Secretary, Surrozen, Inc., 171 Oyster Point Blvd., Suite 400, South San Francisco, California 94080. All recommendations for director nominations received by our Corporate Secretary that satisfy our bylaw requirements relating to such director nominations will be presented to our nominating and corporate governance committee for its consideration. Stockholders also must satisfy the notification, timeliness, consent and information requirements set forth in our Bylaws. These timing requirements are also described under the caption “Stockholder Proposals and Director Nominations”.

18

Board Diversity

Our Board believes that a diverse board is better able to effectively oversee our management and strategy, and position us to deliver long-term value for our stockholders. Our Board considers diversity, including gender and ethnic diversity, as adding to the overall mix of perspectives of our Board as a whole. With the assistance of our nominating and corporate governance committee, our Board regularly reviews trends in board composition, including trends relating to director diversity.

The table below reports self-identified gender and demographic statistics for our Board, as constituted as of March 26, 2025.

|

Board Diversity Matrix as of March 26, 2025

|

|||||||||

|

Total Number of Directors |

|

|

9 |

||||||

|

|

|

|

Female |

|

|

Male |

|

Non-Binary |

Did Not Disclose Gender |

|

Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

Directors |

|

|

3 |

|

|

6 |

|

|

|

|

Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

African American or Black |

|

|

0 |

|

|

0 |

|

0 |

0 |

|

Alaskan Native or American Indian |

|

|

0 |

|

|

0 |

|

0 |

0 |

|

Asian |

|

|

1 |

|

|

1 |

|

0 |

0 |

|

Hispanic or Latinx |

|

|

0 |

|

|

0 |

|

0 |

0 |

|

Native Hawaiian or Pacific Islander |

|

|

0 |

|

|

0 |

|

0 |

0 |

|

White |

|

|

2 |

|

|

5 |

|

0 |

0 |

|

Two or More Races or Ethnicities |

|

|

0 |

|

|

0 |

|

0 |

0 |

|

LGBTQ+ |

|

|

2 |

||||||

|

Did Not Disclose Demographic Background |

|

|

0 |

||||||

Board Role in Risk Oversight

Our Board has overall responsibility for risk oversight, including, as part of regular Board and committee meetings, general oversight of executives’ management of risks relevant to us. A fundamental part of risk oversight is not only understanding the material risks a company faces and the steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. The involvement of our Board in reviewing our business strategy is an integral aspect of our Board’s assessment of management’s tolerance for risk and its determination of what constitutes an appropriate level of risk for us. While our full Board has overall responsibility for risk oversight, it is supported in this function by our audit committee, compensation committee and nominating and corporate governance committee. Each of the committees regularly reports to our Board.

Our audit committee assists our Board in fulfilling its risk oversight responsibilities by periodically reviewing our accounting, reporting and financial practices, including the integrity of our financial statements, the surveillance of administrative and financial controls, our compliance with legal and regulatory requirements and our enterprise risk management program (including, without limitation, cybersecurity and data protection). Through its regular meetings with management, including the finance, legal, internal audit, tax, compliance, and information technology functions, our audit committee reviews and discusses significant areas of our business and summarizes for our Board areas of risk and the appropriate mitigating factors. Our compensation committee assists our

19

Board by overseeing and evaluating risks related to our compensation structure and compensation programs, including the formulation, administration and regulatory compliance with respect to compensation matters, and coordinating, along with our Board’s Chair, succession planning discussions. Our nominating and corporate governance committee assists our Board by overseeing and evaluating programs and risks associated with Board organization, membership and structure, and corporate governance. In addition, our Board receives periodic detailed operating performance reviews from management.

Committee Charters and Corporate Governance Guidelines

Our Corporate Governance Guidelines, charters of our audit committee, compensation committee and nominating and corporate governance committee and other corporate governance information are available under the Corporate Governance section of the Investors page of our website located at www.surrozen.com.

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee is currently or has been at any time one of our officers or employees. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee. Additionally, none of the members who serves or served on the compensation committee of our board of directors had any relationship as set forth in Item 404 of Regulation S-K under the Securities Act of 1933, as amended.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics (the “Code of Conduct”) that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer or controller, or persons performing similar functions. Our Code of Conduct is available under the Corporate Governance section of the Investors page of our website at www.surrozen.com. In addition, we intend to post on our website all disclosures that are required by law or the applicable Nasdaq listing standards concerning any amendments to, or waivers of, any provisions of our Code of Conduct.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than 10% of our common shares, to file reports regarding ownership of, and transactions in, our securities with the SEC and to provide us with copies of those filings.

We have reviewed all forms provided to us or filed with the SEC. Based on that review and on written information given to us by our executive officers and directors, we believe that all Section 16(a) filings during 2024 were filed on a timely basis and that all directors, executive officers and 10% beneficial owners have fully complied with such requirements during the past year, other than the report on Form 4 filed by Craig Parker on February 7, 2024, which was filed late.

Insider Trading Policy

Our insider trading policy governs transactions in our securities and applies to the Board and our employees, contractors, and consultants. We believe our Insider Trading Policy is reasonably designed to promote compliance with insider trading laws, rules, and regulations applicable to Surrozen. Our directors and officers must obtain preclearance of transactions in our stock. In addition, we comply with applicable laws and regulations relating to insider trading with respect to transactions in our securities.

Anti-Hedging Policy

Our insider trading policy prohibits our directors, officers and employees from engaging in short sales, transactions in put or call options, hedging transactions, margin accounts, pledges, or other inherently speculative transactions with respect to our stock at any time. All such transactions involving our equity securities, whether such securities were granted as compensation or are otherwise held, directly or indirectly, are prohibited.

Communications with our Board

Any stockholder or any other interested party who desires to communicate with our Board, our non-management directors or any specified individual director, may do so by directing such correspondence to the attention of our Corporate Secretary, Surrozen, Inc., 171 Oyster Point Blvd., Suite 400, South San Francisco, California 94080. Our Corporate Secretary will forward the communication to the appropriate director or directors as appropriate.

20

Limitations of Liability and Indemnification Matters

Our Certificate of Incorporation limits the liability of our current and former directors for monetary damages to the fullest extent permitted by Delaware law. Delaware law provides that directors of a corporation will not be personally liable for monetary damages for any breach of fiduciary duties as directors, except liability for:

Such limitation of liability does not apply to liabilities arising under federal securities laws and does not affect the availability of equitable remedies such as injunctive relief or rescission.