UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 10, 2026

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

TIM S.A.

FINANCIAL STATEMENTS

December 31, 2025

TIM S.A.

FINANCIAL STATEMENTS

December 31, 2025

Contents

| Independent auditors’ report on the financial statements | 1 |

| Financial statements | |

| Statement of financial position | 6 |

| Statements of profit and loss | 8 |

| Statements of comprehensive income | 9 |

| Statements of changes in shareholders’ equity | 10 |

| Statements of cash flows | 12 |

| Statements of value added | 14 |

| Management Report | 15 |

| Notes to the financial statements | 28 |

| Tax Council Opinion | 111 |

| Annual Report from Statutory Committee | 112 |

| Statement of the executive officers on the financial statements | 120 |

| Statement of the Executive Officers on the Independent auditors' report | 121 |

| TIM S.A. | ||||

| Statement of financial position | ||||

| December 31, 2025 and December 31, 2024 | ||||

| (In thousands of reais) | ||||

| Note | 2025 | 2024 | ||

| Assets | 56,939,179 | 56,327,311 | ||

| Current assets | 13,464,205 | 12,662,929 | ||

| Cash and cash equivalents | 4 | 3,610,324 | 3,258,743 | |

| Marketable securities | 5 | 2,274,316 | 2,434,441 | |

| Trade accounts receivable | 6 | 4,901,777 | 4,677,935 | |

| Inventories | 7 | 357,204 | 293,529 | |

| Recoverable income tax and social contribution | 8.a | 68,769 | 111,376 | |

| Recoverable taxes, fees and contributions | 9 | 1,138,888 | 946,103 | |

| Prepaid expenses | 10 | 329,362 | 280,851 | |

| Derivative financial instruments | 36 | 452,203 | 379,888 | |

| Leases | 17 | 34,098 | 33,717 | |

| Other assets | 13 | 297,264 | 246,346 | |

| Non-current assets | 43,474,974 | 43,664,382 | ||

| Long-term receivables | 4,450,514 | 4,625,808 | ||

| Marketable securities | 5 | 26,339 | 15,241 | |

| Trade accounts receivable | 6 | 137,306 | 137,815 | |

| Recoverable income tax and social contribution | 8.a | 258,415 | 214,880 | |

| Recoverable taxes, fees and contributions | 9 | 911,704 | 907,353 | |

| Deferred income tax and social contribution | 8.c | 1,355,604 | 1,081,633 | |

| Judicial deposits | 11 | 677,150 | 677,530 | |

| Prepaid expenses | 10 | 340,247 | 281,290 | |

| Derivative financial instruments | 36 | - | 522,822 | |

| Leases | 17 | 200,148 | 206,670 | |

| Other financial assets | 12 | 514,109 | 550,669 | |

| Other assets | 13 | 29,492 | 29,905 | |

| Investment | 14 | 1,260,486 | 1,368,286 | |

| Property, plant and equipment | 15 | 23,171,451 | 22,815,328 | |

| Intangible assets | 16 | 14,592,523 | 14,854,960 | |

The explanatory notes are an integral part of the financial statements.

| 6 |

| TIM S.A. | ||||

| Statement of financial position | ||||

| December 31, 2025 and December 31, 2024 | ||||

| (In thousands of reais) | ||||

| Note | 2025 | 2024 | ||

| Total liabilities and shareholders' equity | 56,939,179 | 56,327,311 | ||

| Total liabilities | 32,961,788 | 29,922,675 | ||

| Current liabilities | 15,201,168 | 12,827,248 | ||

| Suppliers | 18 | 5,138,780 | 4,986,912 | |

| Loans and financing | 20 | 925,626 | 348,353 | |

| Lease liabilities | 17 | 1,702,899 | 1,629,698 | |

| Derivative financial instruments | 36 | 168,711 | 224,275 | |

| Labor obligations | 361,271 | 353,256 | ||

| Income tax and social contribution payable | 8.b | 162,102 | 46,610 | |

| Taxes, fees and contributions payable | 21 | 4,855,551 | 3,888,568 | |

| Dividends and interest on shareholders' equity payable | 25 | 1,219,319 | 671,525 | |

| Authorizations payable | 19 | 321,761 | 299,354 | |

| Deferred revenues | 22 | 259,527 | 280,422 | |

| Other liabilities and provision | 85,621 | 98,275 | ||

| Non-current liabilities | 17,760,620 | 17,095,427 | ||

| Loans and financing | 20 | 1,853,097 | 2,687,148 | |

| Lease liabilities | 17 | 12,061,969 | 10,946,148 | |

| Income tax and social contribution payable | 8.b | 19,395 | - | |

| Taxes, fees and contributions payable | 21 | 33,208 | 38,286 | |

| Provision for legal and administrative proceedings | 23 | 1,559,687 | 1,564,293 | |

| Pension plan and other post-employment benefits | 37 | 4,485 | 3,461 | |

| Authorizations payable | 19 | 1,159,672 | 1,180,428 | |

| Deferred revenues | 22 | 506,184 | 559,445 | |

| Obligations to shareholders | 24 | 534,292 | 23,997 | |

| Other liabilities and provision | 28,631 | 92,221 | ||

| Shareholders' equity | 25 | 23,977,391 | 26,404,636 | |

| Share capital | 13,477,891 | 13,477,891 | ||

| Capital reserves | 388,236 | 373,020 | ||

| Profit reserves | 10,192,763 | 12,559,460 | ||

| Equity valuation adjustments | (2,960) | (2,284) | ||

| Treasury shares | (78,539) | (3,451) | ||

The explanatory notes are an integral part of the financial statements.

| 7 |

| TIM S.A. | |||||

| Statements of profit and loss | |||||

| Years ended December 31, 2025 and 2024 | |||||

| (In thousands of reais, unless otherwise indicated) | |||||

| Note | 2025 | 2024 | |||

| Net revenue | 27 | 26,624,721 | 25,447,930 | ||

| Costs of services rendered and goods sold | 28 | (12,266,584) | (11,893,115) | ||

| Gross income | 14,358,137 | 13,554,815 | |||

| Operating revenues (expenses): | |||||

| Selling expenses | 28 | (5,959,682) | (5,908,816) | ||

| General and administrative expenses | 28 | (1,734,484) | (1,798,005) | ||

| Equity in earnings | 14 | (107,800) | (82,526) | ||

| Other revenues (expenses), net | 29 | (212,139) | (258,781) | ||

| (8,014,105) | (8,048,128) | ||||

| Income before financial revenues and expenses | 6,344,032 | 5,506,687 | |||

| Financial revenues (expenses): | |||||

| Financial revenues | 30 | 1,629,877 | 861,759 | ||

| Financial expenses | 31 | (3,350,234) | (2,817,346) | ||

| Net foreign exchange variations | 32 | (63,664) | 71,363 | ||

| (1,784,021) | (1,884,224) | ||||

| Profit before income tax and social contribution | 4,560,011 | 3,622,463 | |||

| Income tax and social contribution | 8.d | (248,027) | (468,582) | ||

| Net profit for the year | 4,311,984 | 3,153,881 | |||

| Earnings per share attributable to the Company’s shareholders (expressed in R$ per share) | |||||

| Basic earnings per share | 33 | 1.79 | 1.30 | ||

| Diluted earnings per share | 33 | 1.78 | 1.30 | ||

The explanatory notes are an integral part of the financial statements.

| 8 |

| TIM S.A. | ||||

| STATEMENTS OF COMPREHENSIVE INCOME | ||||

| Years ended December 31, 2025 and 2024 | ||||

| (In thousands of reais) | ||||

| 2025 | 2024 | |||

| Net profit for the year | 4,311,984 | 3,153,881 | ||

| Other components of the comprehensive income | ||||

| Item that will not be reclassified to income (loss): | ||||

| Pension plans and other post-employment benefits | (1,024) | 1,558 | ||

| Deferred taxes | 348 | (529) | ||

| Total comprehensive income for the year | 4,311,308 | 3,154,910 | ||

The explanatory notes are an integral part of the financial statements.

| 9 |

| TIM S.A. | ||||||||||||||||||||

| STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY | ||||||||||||||||||||

| Year ended December 31, 2025 | ||||||||||||||||||||

| (In thousands of reais) | ||||||||||||||||||||

| Profit reserves | ||||||||||||||||||||

| Share capital | Capital reserve | Legal reserve | Expansion reserve | Additional dividends/interest on shareholders’ equity proposed | Tax incentive reserve | Equity valuation adjustments | Treasury shares | Retained earnings | Total | |||||||||||

| Balances on January 01, 2025 | 13,477,891 | 373,020 | 1,521,086 | 6,285,419 | 2,050,000 | 2,702,955 | (2,284) | (3,451) | - | 26,404,636 | ||||||||||

| Total comprehensive income for the year | ||||||||||||||||||||

| Net profit for the year | - | - | - | - | - | - | - | - | 4,311,984 | 4,311,984 | ||||||||||

| Post-employment benefit amount recorded directly in shareholders' equity | - | - | - | - | - | (676) | - | (676) | ||||||||||||

| Total comprehensive income for the year | - | - | - | - | - | - | - | - | (676) | - | 4,311,984 | 4,311,308 | ||||||||

| Total contribution from shareholders and distribution to shareholders | ||||||||||||||||||||

| Long-term incentive plan | - | 16,998 | - | - | - | - | - | - | - | 16,998 | ||||||||||

| Change in share value on grant date x fair value | - | - | - | (3,167) | - | - | - | 3,167 | - | - | ||||||||||

| Lapsed fractional shares (Note 25.b) | - | 23,997 | - | 23,997 | ||||||||||||||||

| Purchase of treasury shares, net of disposals (Note 25.e) | - | - | - | - | - | - | - | (748,268) | - | (748,268) | ||||||||||

| Cancellation of treasury shares (Note 25.e) | - | - | - | (644,234) | 644,234 | - | ||||||||||||||

| Transfer of shares - long-term incentive plan (Note 25.e) | - | (25,779) | - | - | - | - | 25,779 | - | - | |||||||||||

| Interest on Shareholders’ Equity (Note 25.d) | - | - | - | (490,000) | - | - | - | - | - | (490,000) | ||||||||||

| Dividends | - | - | - | (410,808) | - | - | - | - | - | (410,808) | ||||||||||

| Allocation of net profit for the year: | ||||||||||||||||||||

| Legal reserve (Note 25.d) | - | - | 193,492 | - | - | - | - | (193,492) | - | |||||||||||

| Dividends (Note 25.d) | - | - | - | - | - | - | - | - | (1,379,192) | (1,379,192) | ||||||||||

| Interest on Shareholders’ Equity (Note 25.d) | - | - | - | - | (1,720,000) | (1,720,000) | ||||||||||||||

| Allocation to tax benefit reserve (note 25) | - | - | - | - | - | 440,088 | - | - | (440,088) | - | ||||||||||

| Additional dividends/interest on shareholders’ equity distributed (Note 25.d) | - | - | - | (2,050,000) | - | - | - | - | (2,050,000) | |||||||||||

| Distribution (allocation) to expansion reserve (Note 25) | - | - | - | 2,629,212 | (2,050,000) | - | (579,212) | - | ||||||||||||

| Unclaimed dividends (note 25) | - | - | - | 18,720 | - | - | 18,720 | |||||||||||||

| Total contribution from shareholders and distribution to shareholders | - | 15,216 | 193,492 | (950,277) | (2,050,000) | 440,088 | - | (75,088) | (4,311,984) | (6,738,553) | ||||||||||

| Balances on December 31, 2025 | 13,477,891 | 388,236 | 1,714,578 | 5,335,142 | - | 3,143,043 | (2,960) | (78,539) | - | 23,977,391 | ||||||||||

The explanatory notes are an integral part of the financial statements.

| 10 |

| TIM S.A. | |||||||||||||||||||||

| STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY | |||||||||||||||||||||

| Year ended December 31, 2024 2023 | |||||||||||||||||||||

| (In thousands of reais) | |||||||||||||||||||||

| Profit reserves | |||||||||||||||||||||

| Share capital | Capital reserve | Legal reserve | Expansion reserve | Additional dividends/interest on shareholders’ equity proposed | Tax incentive reserve | Equity valuation adjustments | Treasury shares | Retained earnings | Total | ||||||||||||

| Balances on January 1, 2024 | 13,477,891 | 384,311 | 1,380,427 | 7,107,369 | 1,310,000 | 2,362,239 | (3,313) | (2,984) | - | 26,015,940 | |||||||||||

| Total comprehensive income for the year | |||||||||||||||||||||

| Net profit for the year | - | - | - | - | - | - | - | - | 3,153,881 | 3,153,881 | |||||||||||

| Total contribution from shareholders and distribution to shareholders | - | - | - | - | - | - | - | - | - | - | |||||||||||

| Post-employment benefit amount recorded directly in shareholders' equity | - | - | - | - | - | 1,029 | - | 1,029 | |||||||||||||

| Total comprehensive income for the year | - | - | - | - | - | - | - | - | 1,029 | - | 3,153,881 | 3,154,910 | |||||||||

| Total contribution from shareholders and distribution to shareholders | |||||||||||||||||||||

| Long-term incentive plan | - | 22,354 | - | - | - | - | - | - | 22,354 | ||||||||||||

| Change in share value on grant date x fair value | 10,892 | (10,892) | - | ||||||||||||||||||

| Purchase of treasury shares, net of disposals | - | - | - | - | - | - | (45,004) | - | (45,004) | ||||||||||||

| Transfer of shares - long-term incentive plan | (44,537) | - | - | - | - | - | 44,537 | - | - | ||||||||||||

| Allocation of net profit for the year: | |||||||||||||||||||||

| Legal reserve (Note 25.d) | - | - | 140,659 | - | - | - | - | - | (140,659) | - | |||||||||||

| Interest on Shareholders’ Equity (Note 25.d) | - | - | - | - | - | (1,450,000) | (1,450,000) | ||||||||||||||

| Constitution of tax incentive reserve (Note 25) | - | - | - | - | - | 340,716 | - | - | (340,716) | - | |||||||||||

| Additional dividends/interest on shareholders’ equity distributed (Note 25.d) | - | - | - | (3,360,000) | 2,050,000 | - | - | - | - | (1,310,000) | |||||||||||

| Distribution (allocation) to expansion reserve (Note 25) | - | - | - | 2,532,506 | (1,310,000) | - | (1,222,506) | - | |||||||||||||

| Unclaimed dividends (note 25) | - | - | - | 16,436 | - | - | 16,436 | ||||||||||||||

| Total contribution from shareholders and distribution to shareholders | - | (11,291) | 140,659 | (821,950) | 740,000 | 340,716 | - | (467) | (3,153,881) | (2,766,214) | |||||||||||

| Balances on December 31, 2024 | 13,477,891 | 373,020 | 1,521,086 | 6,285,419 | 2,050,000 | 2,702,955 | (2,284) | (3,451) | - | 26,404,636 | |||||||||||

The explanatory notes are an integral part of the financial statements.

| 11 |

| TIM S.A. | |||||

| STATEMENT OF CASH FLOWS | |||||

| Year ended December 31, 2025 and 2024 | |||||

| (In thousands of reais) | |||||

| Note | 2025 | 2024 | |||

| Operating activities | |||||

| Profit before income tax and social contribution | 4,560,011 | 3,622,463 | |||

| Adjustments to reconcile income to net cash generated by operating activities: | |||||

| Depreciation and amortization | 28 | 7,077,687 | 7,026,035 | ||

| Equity in earnings | 14 | 107,800 | 82,526 | ||

| Residual value of written-off property, plant and equipment and intangible assets | 14,818 | 13,887 | |||

| Interest on asset retirement obligation | 2,982 | 12,400 | |||

| Provision for legal and administrative proceedings | 23 | 267,041 | 276,811 | ||

| Inflation adjustment on judicial deposits and legal and administrative proceedings | 59,824 | 175,946 | |||

| Interest, monetary and exchange rate variations on loans and other financial adjustments | 774,861 | 749,515 | |||

| Yield from marketable securities | (361,735) | (181,717) | |||

| Interest on lease liabilities | 31 | 1,617,383 | 1,432,764 | ||

| Lease interest | 30 | (28,955) | (28,428) | ||

| Provision for expected credit losses | 28 | 765,783 | 693,122 | ||

| Income (loss) from operations with other derivatives | 31 | 165,780 | |||

| Long-term incentive plans | 16,998 | 22,354 | |||

| 15,040,278 | 13,897,678 | ||||

| Decrease (increase) in operating assets | |||||

| Trade accounts receivable | (988,139) | (1,605,774) | |||

| Recoverable taxes, fees and contributions | 10,725 | 344,110 | |||

| Inventories | (63,675) | 38,254 | |||

| Prepaid expenses | (107,468) | (184,736) | |||

| Judicial deposits | 31,073 | 32,242 | |||

| Other assets | (49,159) | 90,931 | |||

| Increase (decrease) in operating liabilities | |||||

| Labor obligations | 8,015 | (33,092) | |||

| Suppliers | 185,370 | 304,243 | |||

| Taxes, fees and contributions payable | 484,799 | 375,228 | |||

| Authorizations payable | (59,018) | (163,612) | |||

| Payments for legal and administrative proceedings | 23 | (362,163) | (318,796) | ||

| Deferred revenues | (74,156) | (61,135) | |||

| Other liabilities | (303,967) | (294,106) | |||

| Cash generated by operations | 13,752,515 | 12,421,435 | |||

| Income tax and social contribution paid | (312,446) | (89,892) | |||

| Net cash generated by operating activities | 13,440,069 | 12,331,543 | |||

| 12 |

| TIM S.A. | ||||||||||

| STATEMENT OF CASH FLOWS | ||||||||||

| Year ended December 31, 2025 and 2024 | ||||||||||

| (In thousands of reais) | ||||||||||

| Note | 2025 | 2024 | ||||||||

| Investment activities | ||||||||||

| Redemptions of marketable securities | 8,002,980 | 7,196,354 | ||||||||

| Investments on marketable securities | (7,492,217) | (7,492,880) | ||||||||

| Capital contribution 5G Fund | (84,984) | (131,348) | ||||||||

| Additions to property, plant and equipment and intangible assets | (4,541,495) | (4,550,379) | ||||||||

| Receipt - Agreement with Banco C6 | 6 | 520,000 | - | |||||||

| Other | 35,095 | 24,381 | ||||||||

| Net cash used in investment activities | (3,560,621) | (4,953,872) | ||||||||

| Financing activities | ||||||||||

| Inflows on loans and financing | 36 | - | 503,351 | |||||||

| Amortization of loans and financing | 36 | (387,312) | (1,413,497) | |||||||

| Interest paid - Loans and financing | 36 | (106,401) | (143,518) | |||||||

| Payment of lease liability | 36 | (1,563,393) | (1,838,667) | |||||||

| Interest paid on lease liabilities | 36 | (1,646,393) | (1,460,208) | |||||||

| Income from reverse stock split and stock split operations | 24 | 455,691 | - | |||||||

| Payments for reverse stock split and stock split operations | 24 | (79,233) | - | |||||||

| Lease incentives received | 77,918 | 89,431 | ||||||||

| Derivative financial instruments | (170,393) | (168,652) | ||||||||

| Purchase of treasury shares, net of disposals | 25 | (748,268) | (45,004) | |||||||

| Dividends and interest on shareholders’ equity paid | 25 | (5,360,083) | (2,720,095) | |||||||

| Net cash used in financing activities | (9,527,867) | (7,196,859) | ||||||||

| Increase (decrease) in cash and cash equivalents | 351,581 | 180,812 | ||||||||

| Cash and cash equivalents at the beginning of the year | 3,258,743 | 3,077,931 | ||||||||

| Cash and cash equivalents at the end of the year | 3,610,324 | 3,258,743 | ||||||||

The explanatory notes are an integral part of the financial statements.

| 13 |

| TIM S.A. | |||

| STATEMENT OF VALUE ADDED | |||

| Years ended December 31, 2025 and 2024 | |||

| (In thousands of reais) | |||

| 2025 | 2024 | ||

| Revenues | |||

| Gross operating revenue | 40,279,063 | 36,731,708 | |

| Losses on doubtful accounts | (765,783) | (693,122) | |

| Discounts granted, returns and others | (9,609,197) | (7,269,433) | |

| 29,904,083 | 28,769,153 | ||

| Inputs acquired from third parties | |||

| Cost of services rendered and goods sold | (4,685,143) | (4,394,555) | |

| Materials, energy, outsourced services and other | (3,551,191) | (3,689,242) | |

| (8,236,334) | (8,083,797) | ||

| Withholding | |||

| Depreciation and amortization | (7,077,687) | (7,026,035) | |

| Net value added produced | 14,590,062 | 13,659,321 | |

| Value added received in transfer | |||

| Equity in earnings | (107,800) | (82,526) | |

| Financial revenues | 1,837,141 | 1,166,950 | |

| 1,729,341 | 1,084,424 | ||

| Total value added payable | 16,319,403 | 14,743,745 | |

| Distribution of value added | |||

| Personnel and charges | |||

| Direct remuneration | 799,707 | 821,211 | |

| Benefits | 318,603 | 278,698 | |

| FGTS (Severance Pay Fund) | 80,258 | 78,741 | |

| Other | 54,665 | 61,711 | |

| 1,253,233 | 1,240,361 | ||

| Taxes, fees and contributions | |||

| Federal | 2,615,964 | 2,924,712 | |

| State | 3,047,800 | 2,985,924 | |

| Municipal | 122,670 | 103,440 | |

| 5,786,434 | 6,014,076 | ||

| Third-party capital remuneration | |||

| Interest | 3,587,269 | 3,058,095 | |

| Rentals | 1,371,530 | 1,268,258 | |

| 4,958,799 | 4,326,353 | ||

| Other | |||

| Social investment | 8,953 | 9,074 | |

| 8,953 | 9,074 | ||

| Shareholders’ Equity Remuneration | |||

| Dividends and interest on shareholders’ equity | 3,099,192 | 1,450,000 | |

| Retained earnings | 1,212,792 | 1,703,881 | |

| 4,311,984 | 3,153,881 | ||

The explanatory notes are an integral part of the financial statements.

| 14 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

Dear Shareholders,

The Management of TIM S.A. (“TIM S.A.”, “Company” or “TIM”) hereby presents its Management Report and 2025 Earnings Analysis, along with the Individual and Consolidated Financial Statements accompanied by the Independent Auditors’ Report for the fiscal year ended December 31, 2025.

The financial statements were prepared in accordance with accounting practices adopted in Brazil, which include the Brazilian Corporate Law, the rules of the Brazilian Securities and Exchange Commission (CVM) and the pronouncements of the Accounting Pronouncement Committee (CPC) and International Financial Reporting Standards (IFRS) issued by International Accounting Standards Board (IASB).

The operating and financial information for the year ended in December 31, 2025, unless otherwise stated, is presented in Brazilian reais (R$), based on consolidated amounts and pursuant to the Brazilian Corporation Law.

Message from Management1

We ended 2025 with satisfaction in presenting robust results in a year marked by intense competitive dynamics and important strategic advances. TIM maintained its sustainable growth trajectory, fully meeting its annual targets and reinforcing its leadership position in the Brazilian telecommunications market.

Our services revenue continued to advance consistently throughout the year, supported by strong performance in the mobile, broadband and B2B segments. Operational evolution, combined with rigorous cost discipline and efficient capital allocation, has resulted in historic margins and a continuous cycle of value generation for our shareholders.

The Company ended 2025 delivering:

| • | Solid service revenue growth, in line with guidance, driven by a skilled customer base and sustainable monetization strategies. |

| • | EBITDA expanding, with a margin above 50%, reflecting operational efficiency and continuous digitalization of processes. |

1 All financial figures are normalized to non-recurring items to better represent business dynamics.

| 15 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

| • | Investment discipline, preserving efficient capex and directed to the most relevant opportunities, including the expansion of 5G network coverage and capacity. |

| • | Significant progress in Operating Cash Flow generation, supporting the maintenance of healthy leverage levels. |

| • | One of the highest historical levels of net income, reinforcing the consistency of financial performance. |

We also maintained a strong commitment to shareholder remuneration, interest on equity, dividends and an accelerated buyback program, in line with our sustainable capital return strategy.

In addition, we continue to strengthen our competitive position through improvements in the customer experience, continuous network evolution and expansion of strategic partnerships, including relevant initiatives in the B2B segment and in digital solutions, such as advanced connectivity projects in large corporate operations.

With the results on track and having fully met the 2025 targets, TIM enters 2026 prepared to move forward on its growth journey.

Business

Mobile

In 2025, the mobile operation maintained its strengthening, driven by the strategy of monetizing the base through the migration to higher-value plans. As a result, the company recorded an 8.4% growth in the postpaid base and a 4.7% increase in ex-M2M Postpaid ARPU throughout the year.

This performance reflects the company's focus on reinforcing its key attributes. In 2025, we accelerated the national expansion of 5G, reaching almost 1,000 cities throughout Brazil, in addition to advancing in the modernization of the network in São Paulo and Minas. As a result, TIM was recognized for the fourth consecutive year as a leader in Consistent Quality in OpenSignal's Mobile Network Experience Report.

The company also continues to stand out for its excellence in service: we remain the first company in Brazil to achieve and maintain the Procon-SP Efficiency Seal for 30 consecutive months, being the only one to preserve this certification. In addition, we maintain the RA1000 seal of Reclame Aqui, with a resolution rate of 91.2%, reinforcing our commitment to the customer.

| 16 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

Ultrafiber

TIM UltraFibra ended 2025 with 850 thousand connections, increasing the customer base by 60 thousand accesses (an increase of 7.6% year-on-year), reestablishing its growth trajectory, with the FTTH base as the main lever. Higher value plans, with speeds of 400 Mbps or more, continue to gain more relevance, reaching 90% of the total base as of December 31, 2025.

Corporate

In the corporate sector, we continue to work to increase our B2B market share, through the improvement of the traditional mobile and ICT portfolio, in addition to the launch of new solutions. The expansion of the B2B market will drive a wave of productivity in key industries in Brazil. By capitalizing on the expansion of IoT connectivity as a foundation, we seek to leverage a variety of solutions and services. By establishing strategic partnerships with leaders in four key sectors – agriculture, logistics, utilities and industry – our goal is to lead and catalyze digital transformation in Brazilian industry. Our commitment is to promote innovation and efficiency in sectors that are vital to the country's economic progress.

We have strengthened our position as a leading force in the digital transformation of Brazilian rural areas, highways, and cities, expanding connectivity to previously underserved regions and enabling significant gains in productivity, efficiency, and social impact. In agribusiness, NBIoT coverage grew by more than 25%, while 4G coverage for rural IoT reached 26.2 million hectares, advancing by more than 32% and reinforcing our role in automation and operational intelligence across the sector. In logistics, we expanded coverage to 10,259 kilometers of highways — an increase of 83% — enabling advanced tracking, telemetry and security solutions. From a socio-environmental perspective, we connected 2.6 million people in rural areas, expanded the service to more than 53,000 farms, and recorded a 38.7% increase in smart street lighting, totaling 472,000 installed points, demonstrating how our IoT infrastructure accelerates development in historically underserved regions.

Awards and Achievements

| · | Recognized for S&P for a decade of international commitment to ESG indices: Active Contribution and S&P Global ESG score 81; |

| · | For the 3rd consecutive year, TIM is the climate leader of the "A List" by CDP; |

| · | The only Telecom in B3's ESG indexes: transparent reports on climate management and sustainability integrated into the business, remaining in the ISE B3 portfolio for 17 years |

| 17 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

Macroeconomic Environment

The year 2025 was marked by a still challenging economic environment in Brazil, although with signs of moderation in relation to the pressures observed in 2024. The Extended National Consumer Price Index (IPCA) ended December 2025 with a monthly change of 0.33%, accumulating a rise of 4.26% in the last 12 months. The inflationary deceleration was mainly due to the partial normalization of food and commodity prices, although some groups, especially services, maintained above-average variations due to the still heated demand in part of the year.

The Central Bank of Brazil (BCB) maintained a restrictive stance for much of 2025, keeping the basic interest rate (SELIC) high at 15% per year, the highest level in almost two decades. At the end of the year, this rate remained stable, with indications that cuts could begin throughout 2026, if the data realigns with inflation targets

The exchange rate showed relevant fluctuations in the exchange rate. Unlike the strong devaluation recorded in 2024, the year 2025 was marked by appreciation of the real against the dollar, with the exchange rate closing the year at R$5.50. Throughout 2025, the price ranged from highs above R$6.30 at the beginning ofthe year to lows close to R$5.27 in November.

Financial Highlights

Operational Revenue

| 18 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

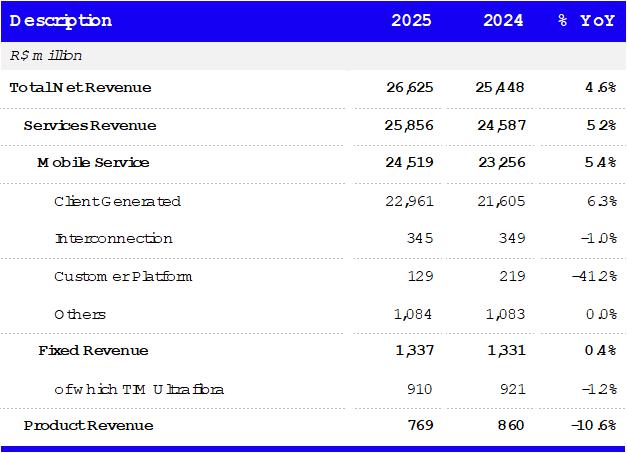

In 2025, Total Net Revenue and Services Revenue increased by 4.6% YoY and 5.2% YoY, respectively, driven by the solid performance of Mobile Services revenue in 2025, outperforming inflation in 2025 (IPCA 2025: 4.26%).

Operating Costs and Expenses

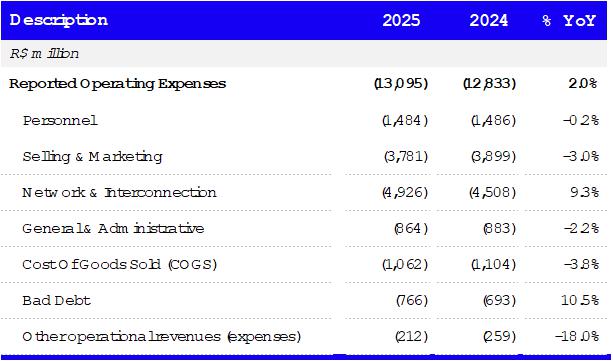

Operating Costs and Expenses reached R$13,095 million in 2025, remaining considerably below the inflation recorded in the year (4.26%). The result once again reinforces the effectiveness of the actions carried out by the Company for greater efficiency and control of Opex.

| 19 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

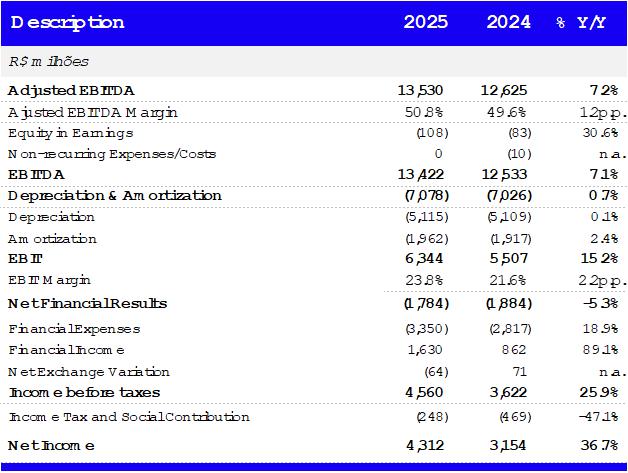

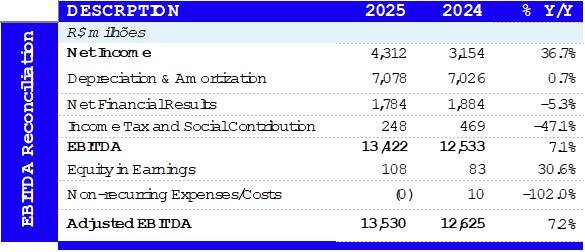

From EBITDA to Net Income

Adjusted EBITDA (EBITDA – Earnings before Interest, Taxes, Depreciation, Amortization and Equity Ratio)

Adjusted EBITDA at the end of 2025 totaled R$ 13,530 million, an increase of 7.2% YoY, reflecting the combination of a consistent evolution in service revenue combined with disciplined management to control operating costs. The Adjusted EBITDA Margin ended 2025 at 50.8%, increasing the result obtained in 2024 by 1.2 p.p.

| 20 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

Depreciation and Amortization (D&A) / EBIT

In 2025, D&A recorded a slight increase of 0.7% YoY, due to the increase in depreciation of transmission equipment and higher amortization of software.

EBIT closed 2025 with a total of R$ 6,344 million, increasing by 15.2% compared to the end of 2024, with a margin of 23.8%.

Net Financial Result

In 2025, the Financial Result improved by 5.3% YoY, impacted by a higher yield on financial investments, supported by a more robust cash position and the increase in the basic interest rate in the last 12 months, added to the favorable effect of the mark-to-market of derivative contracts and increased by the appreciation of the 5G Fund, albeit partially limited by the adverse impact of the increase in interest charges on leases and the termination of the strategic partnership in financial services.

Income Tax and Social Contribution

In 2025, the IR/CS totaled -R$248 million compared to -R$469 million in 2024, also influenced by the higher volume of Interest on Equity declared in 2025, the increase in tax benefits and the effect of the agreement to close the strategic partnership in financial services.

Net Income

Net Income totaled R$ 4,312 million in 2025, compared to R$ 3,154 million in 2024. This result represented an expansion of 36.7% YoY.

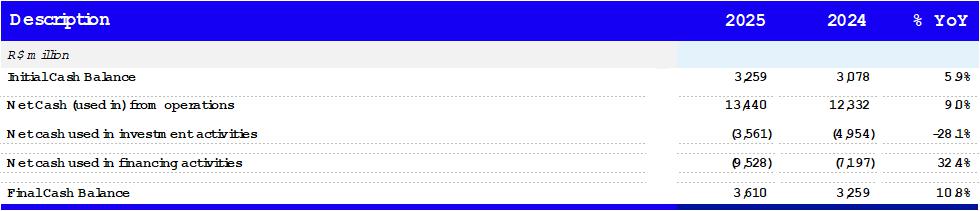

Cash Flow, Debt and CAPEX

In 2025, OFCF totaled R$5,349 million, a robust growth of 16% YoY, driven by a 15.7% YoY increase in operating cash flow and a reduction in lease payments.

| 21 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

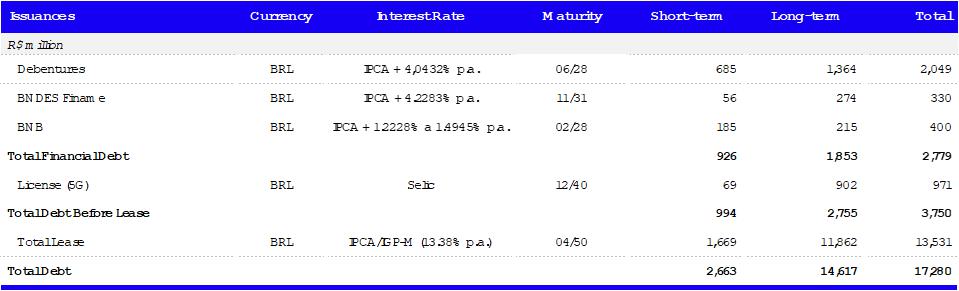

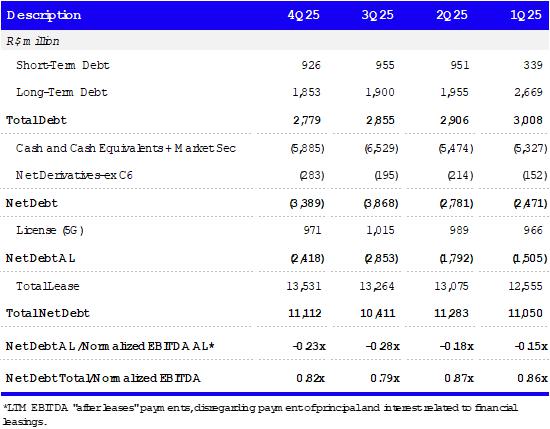

DEBT AND CASH

Debt Profile

Net Debt

| 22 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

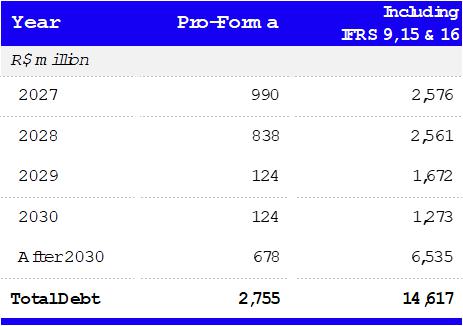

Debt by maturity

Total post-hedge debt (including net derivatives in the amount of R$283 million) totaled R$16,997 million at the end of December 2025, an increase of R$791 million vs. 4Q24. The increase in debt results from the combination of the increase in leases and the partial reduction of the total financial debt.

Cash and Securities positions totaled R$5,885 million at the end of December 2025, representing an increase of 3.4% YoY, due to operating cash generation in the period.

Environmental, Social and Governance (ESG or ESG)

TIM has a solid track record in ESG, being recognized nationally and internationally for its practices in sustainability, governance and social responsibility. In 2025, TIM was the only company in the telecommunications sector to be recognized by B3 during COP30, in Belém, for simultaneously integrating the three main ESG indices in the Brazilian market: ISE, ICO2 and IDIVERSA. The tribute highlighted the Company's commitment to sustainable practices and reinforced the importance of the ESG agenda as a fundamental pillar for the business.

In addition, the Company demonstrates strong environmental performance, reporting emissions to CDP since 2010 and for the third consecutive

year, it is part of the CDP Climate Change A-List, maintaining its leadership in climate change management. To provide transparency

to its practices and actions, TIM has been publishing sustainability reports since 2007 following GRI guidelines and has been independently

assured since 2009.

As a signatory to the UN Global Compact since 2008 and to UN Women since 2021, the Company develops projects connected to the Sustainable Development Goals (SDGs) and recognizes the rights to data privacy, secure internet, access to information and freedom of expression as essential and non-negotiable. It also maintains its policies on topics such as Diversity, Environment, Climate Change Management, Corporate Risk Management, Anti-Corruption, Supplier Relations, Occupational Health and Safety, Privacy, among others, for free consultation by its stakeholders. In its materiality matrix updated in 2024, TIM highlights nine essential themes, which include innovation and technology, digital inclusion, data privacy and security, energy efficiency and ethics and compliance, reinforcing its strategy oriented to double materiality and stakeholder engagement.

| 23 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

For more information on the management of ESG aspects at TIM, see the ESG Reports in https://ri.tim.com.br/esg/relatorios-esg/.

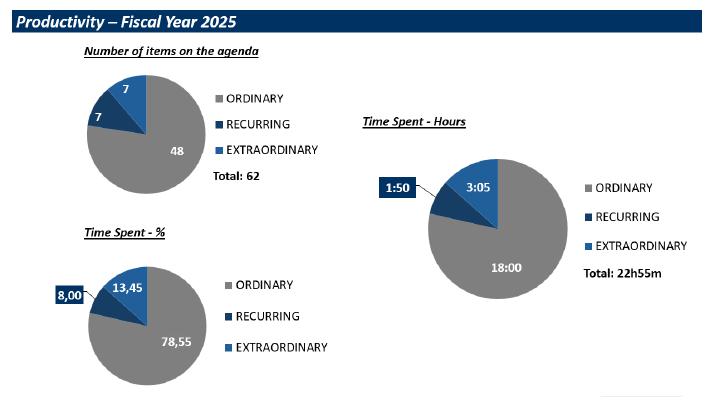

Corporate Governance

The Company adopts a corporate governance system in line with national and international best practices, compatible with its status as a publicly-held company listed on B3's Novo Mercado and registered with the U.S. Securities and Exchange Commission (SEC).

The governance structure aims to ensure adequate management supervision, integrity and transparency of the financial statement preparation process, the effectiveness of internal controls and the responsible management of corporate risks, sustaining the creation of value in the long term.

Governance is exercised by a Board of Directors, a Statutory Board of Executive Officers and a Fiscal Council of permanent operation. In the exercise of its duties, the Board of Directors is advised by specialized committees, namely: the Statutory Audit Committee, the Control and Risk Committee, the Compensation Committee and the Environmental, Social & Governance Committee, responsible for supporting the body in relevant matters and in improving the decision-making process.

The duties and responsibilities and prerogatives of these bodies are provided for in the Brazilian corporate law, in the Company's Bylaws, in the Novo Mercado Regulations and in the Internal Regulations of each corporate body.

The performance of the Company and its managers is guided by the principles of transparency, integrity, ethics and corporate responsibility, which guide the conduct of business, the relationship with stakeholders and the disclosure of reliable and timely information to the market, in compliance with the guidelines of the Company's Code of Ethics and Conduct.

The Board of Directors is composed of at least five (5) and at most nineteen (19) members, elected by the Shareholders' Meeting, with a two-year term of office, with reelection permitted. On December 31, 2025, the CDA was formed by ten (10) members, of which four (4) were independent, meeting the requirements of the Novo Mercado and contributing to collegiate decisions with technical and impartial judgment.

| 24 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

The Executive Board is composed of at least three (3) and at most twelve (12) officers, elected by the Board of Directors for a two-year term, with reelection allowed and may be removed at any time. On December 31, 2025, the Board of Directors was composed of six (6) members.

The Fiscal Council is composed of three (3) to five (5) sitting members, with their respective alternates, elected by the General Meeting. On December 31, 2025, the Company's Fiscal Council was composed of three (3) sitting members and an equal number of alternates, all independent professionals recognized by the market

Shareholder Remuneration

Dividends and interest on equity

The table below summarizes all the amounts approved as Interest on Equity ("Interest on Equity") realized by TIM S.A. throughout 2025:

| Approval Date | Payment Date | Ex-right date | Nature | Unit Price (R$) | Total Amount (R$) |

| 10/02/2025 | 22/04/2025 | 18/02/2025 | JSCP | 0,082624038 | 200.000.000 |

| 24/03/2025 | 30/06/2026 | 01/04/2025 | JSCP | 0,202495716 | 490.000.000 |

| 05/05/2025 | 23/07/2025 | 22/05/2025 | JSCP | 0,124084855 | 300.000.000 |

| 22/07/2025 | 21/10/2025 | 26/07/2025 | JSCP | 0,132315100 | 320.000.000 |

| 23/09/2025 | 21/01/2026 | 29/09/2025 | JSCP | 0,199459574 | 480.000.000 |

| 16/12/2025 | 30/06/2026 | 23/12/2025 | JSCP | 0,175576044 | 420.000.000 |

| 16/12/2025 | 30/12/2026 | 22/12/2025 | Dividends | 0,7482883774 | 1.790.000.000 |

| Total | R$ 4,000,000,000 | ||||

Thus, TIM declared a total amount of R$ 2.210 billion in JCP in 2025. In addition, dividends were paid for the 2025 fiscal year, in the amount of R$1.790 billion, totaling R$4 billion in deliberated dividends throughout the year.

Buyback Program

In 2025, the Company totaled 33.5 million shares repurchased under the Share Buyback Program currently in force, with the main objective of increasing shareholder value through the efficient use of available cash resources, optimizing TIM's capital allocation. On December 16, 2025, the Company disclosed a Material Fact, informing the market of the cancellation of 28,678,509 shares.

| 25 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

Recent and Subsequent Events

Remuneration to Shareholders

On December 16, 2025, the Board of Directors of TIM S.A. approved the distribution of Interest on Equity in the amounts of R$ 480 million, in addition to approving the distribution of Dividends in the amount of R$ 1.790 million. For more details, visit the Investor Relations website of TIM S.A.

Cancellation of Treasury Shares

On December 16, 2025, TIM S.A. informed the market that the Company's Board of Directors approved the cancellation of 28,678,509 shares held in treasury, without reduction of capital stock, which were acquired under its Buyback Program. Due to the cancellation of the shares, the Company's capital stock is now divided into 2,392,125,889 common shares. For more details, visit the Investor Relations website of TIM S.A.element.

V8 acquisition. TECH

On November 27, 2025, TIM S.A. informed the market that the Company's Board of Directors approved the execution of a Share Purchase and Sale Agreement ("Agreement") for the acquisition of 100% of the capital stock of V8 Consulting S.A. ("V8. Tech"). The Transaction reinforces TIM's strategy focused on B2B, significantly expanding the Company's ability to offer complete digital transformation solutions. For more details, visit the Investor Relations website of TIM S.A..

Independent Audit

In 2023, Ernst & Young Auditores Independentes Ltda. provided audit services of our financial statements and other non-audit services, which are related to the review of the Company’s Sustainability Report.

Such services did not exceed the level of 5% of the total fees related to the external audit service. In line with the external auditors’ understanding, the provision of other professional services not related to the external audit, as described above, does not affect the independence or objectivity in conducting the audit exams carried out. The independent auditors have internal processes to ensure that these other services are assessed internally, as well as pre-approved before submitting any proposal to TIM.

The Company also highlights that it is subject to a policy, approved by the Board of Directors as of September 24, 2021, which regulates the process of hiring external auditors, as well as any services not related to the audit of the financial statements, establishing, among other aspects, that the contracting must be submitted to the prior analysis of the Statutory Audit Committee of the Parent Company. This document also defines an illustrative list of services not related to audit whose contracting is prohibited.

| 26 |

2025 MANAGEMENT REPORT AND EARNINGS ANALYSIS

COMMENTS TO FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2025

|

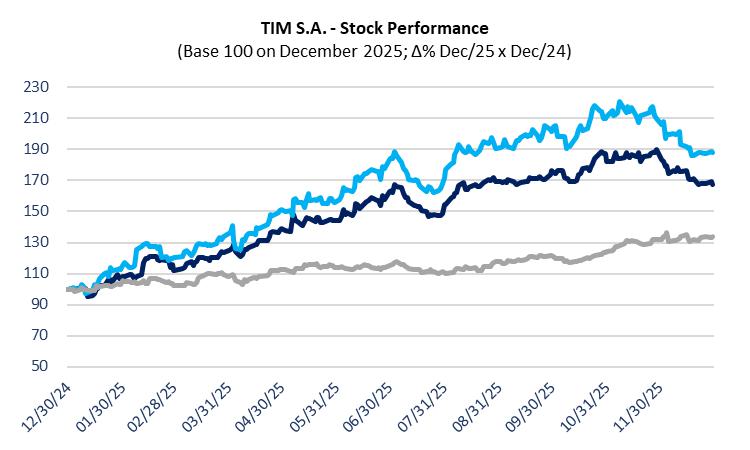

Capital Markets

The common shares of TIM S.A. are traded on the São Paulo Stock Exchange (B3) under the ticker TIMS3 and the ADRs, American Depositary Receipts, on the New York Stock Exchange (NYSE), under the ticker TIMB.

The São Paulo Stock Exchange Index (Ibovespa) ended 2025 at 161,125 points, accumulating an appreciation of 33.95% when compared to the previous year. The Brazilian stock exchange recorded 32 closing records throughout the year.

The Company ended 2025 with its common shares quoted at R$21.34 on B3, an appreciation of 67.1% YoY, while the ADRs on the NYSE closed at a price of US$19.50, an appreciation of 88.9% YoY. In market value, TIM closed the year valued at R$59.0 billion or US$11 billion.

Final Considerations

TIM S.A., with the permanent objective of maintaining continuous, balanced and sustainable growth, would like to thank its customers for their loyalty and reiterates its commitment to tirelessly seek mechanisms to reciprocate the preference through quality and differentiated service. We would also like to thank our commercial partners, suppliers and financial institutions for their support and trust and, particularly, our employees, without whom the objectives would not have been achieved and, finally, the shareholders for their support and trust in the company’s management.

The Administration

| 27 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

| 1. | Operations |

1.1. Corporate structure

TIM S.A. (“TIM” or “Company”) is a public limited company with Registered office in the city of Rio de Janeiro, RJ, and a subsidiary of TIM Brasil Serviços e Participações S.A. (“TIM Brasil”). TIM Brasil is a subsidiary of the Telecom Italia Group that holds 67.48% of the share capital of TIM S.A. on December 31, 2025 (66.59% on December 31, 2024).

The Company holds an authorization for Landline Switched Telephone Service (“STFC”) in Local, National Long-Distance and International Long-Distance modes, as well as Personal Mobile Service (“SMP”) and Multimedia Communication Service (“SCM”), in all Brazilian states and in the Federal District.

The Company’s shares are traded on B3 – Brasil, Bolsa, Balcão (“B3”). Additionally, TIM has American Depositary Receipts (ADRs), Level II, traded on the New York Stock Exchange (NYSE) – USA. As a result, the company is subject to the rules of the Brazilian Securities and Exchange Commission (“CVM”) and the Brazilian Securities and Exchange Commission (“SEC”). In order to comply with good market practices, the company adopts as a principle the simultaneous disclosure of its financial information in both markets, in reais, in Portuguese and English.

On December 31, 2025, TIM holds a 49% equity interest (49% on December 31, 2024) in the company I-Systems (associated company).

| 2. | Basis of preparation and presentation of financial statements |

The financial statements were prepared and are being presented according to the accounting practices adopted in Brazil, which comprise the CVM standards and pronouncements, guidance and interpretations issued by the Accounting Pronouncement Committee (“CPC”) and in compliance with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB).

Additionally, the Company considered the guidelines provided for in Technical Guideline OCPC 07 - Evidencing upon Disclosure of General Purpose Financial-Accounting Reports in the preparation of its financial statements. Accordingly, relevant information of the financial statements is being evidenced and corresponds to the information used by management when administrating.

The material accounting policies applied in the preparation of these financial statements are below and/or presented in its respective notes. Those policies were consistently applied in the periods presented.

| 28 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

a. General criteria for preparation and disclosure

The financial statements were prepared considering the historical cost as value basis, except regarding the derivative financial instruments that were measured at fair value.

Assets and liabilities are classified according to their degree of liquidity and collectability. They are reported as current when they are likely to be realized or settled over the next 12 months. Otherwise, they are stated as non-current. The exception to this procedure involves deferred income tax and social contribution balances (assets and liabilities) and provision for lawsuits and administrative proceedings that are fully classified as non-current.

In connection with the preparation of these financial statements, Management concluded that there is no evidence of uncertainties about the Company’s going concern. Therefore, the financial statements were prepared based on the going concern assumption.

The presentation of the Statement of Value Added is required by Brazilian corporate law and the accounting practices adopted in Brazil applicable to publicly-held companies. The DVA was prepared according to the criteria set forth in CPC Technical Pronouncement No. 09 - “Statement of Value Added”. The IFRS do not require the presentation of this statement. Accordingly, in conformity with IFRS, this statement is presented as supplementary information, without prejudice to the financial statements as a whole.

Interests paid from loans and financing are classified as financing cash flow in the statement of cash flow as it represents costs of obtaining financial resources.

b. Functional and presentation currency

The currency of presentation of the financial statements is the Real (R$), which is also the functional currency of the Company and its associated company.

Transactions in foreign currency are recognized by the exchange rate on the date of transaction. Monetary items in foreign currency are translated into Brazilian reais at the foreign exchange rate prevailing on the balance sheet date, informed by the Central Bank of Brazil. Foreign exchange gains and losses linked to these items are recorded in the statement of income.

| c. | Segment information |

Operating segments are components of the entity that carry out business activities from which revenues can be obtained and expenses incurred. Its operating results are regularly reviewed by the entity's main operations manager, who makes decisions on resource allocation and evaluates segment performance. For the segment to exist, individualized financial information is required.

The main operational decision maker in the Company, responsible for the allocation of resources and periodically evaluating performance, is the Executive Board, which, along with the Board of Directors, are responsible for making the strategic decisions of the company and its management.

| 29 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

The Company’s strategy is focused on optimizing results. Although there are diverse operating activities, decision makers understand that the company represents only one business segment and do not contemplate specific strategies focused only on one service line. All decisions regarding strategic, financial planning, purchases, investments and investment of resources are made on a consolidated basis. The aim is to maximize the result obtained by operating the SMP, STFC and SCM licenses.

| d. | Business combination and goodwill |

Business combinations are accounted for under the acquisition method. The cost of an acquisition is measured for the consideration amount transferred, which is valuated on fair value basis on the acquisition date, including the value of any non-controlling interest in the acquiree, regardless of their proportion. For each business combination the Company chooses to measure the non-controlling interest in the acquiree at the fair value or based on its proportional interest in the net assets identifiable of the acquiree. Costs directly attributable to the acquisition are accounted for as expense when incurred.

On acquiring a business, the Company assesses the financial assets and liabilities assumed in order to rate and to allocate them in accordance with contractual terms, economic circumstances and pertinent conditions on the acquisition date, which includes segregation by the acquired entity of built-in derivatives existing in the acquired entity’s host contracts.

Any contingent payments to be transferred by the acquiree will be recognized at fair value on the acquisition date. Subsequent changes to the fair value of the contingent consideration which is deemed to be a liability should be recognized in accordance with CPC 48 in the statement of income.

Initially, goodwill is initially measured as being the excess of consideration transferred in relation to net assets acquired (acquired identifiable assets and assumed liabilities) measured at fair value on acquisition date. If consideration is lower than fair value of net assets acquired, the difference must be recognized as gain in bargain purchase in the statement of income on the acquisition date.

After initial recognition, the goodwill is carried at cost less any accumulated impairment losses. For impairment testing purposes, goodwill acquired in a business combination is, from the acquisition date, allocated to each cash-generating units of the Company that are expected to benefit by the synergies of combination, regardless of other assets or liabilities of the acquiree being allocated to those units.

When the goodwill is part of a cash generating unit and a portion of this unit is disposed of, the goodwill associated with the disposed portion should be included in the cost of the operation when calculating gains or losses in the disposal. The goodwill disposed under these circumstances of this operation is determined based on the proportional values of the portion disposed of, in relation to the cash generating unit maintained.

| e. | Approval of financial statements |

These financial statements were approved by the Board of Directors of the Company on February 10, 2026.

| 30 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

| f. | New standards, amendments and interpretations of standards |

f.1 The following new standards/amendments were issued by the Accounting Pronouncement Committee (“CPC”) and International Accounting Standards Board (IASB), are effective for the period ended December 31, 2025.

IAS 21/CPC 02 (R2) – Effects of changes in exchange rates and translation of financial statements

In March 2024, the IASB issued an amendment regarding Lack of Exchangeability, seeking to define the concept of convertible currency and provide guidance on procedures for non-convertible currencies, determining that convertibility should be assessed at the measurement date based on the purpose of the transaction. If the currency is not convertible, the entity must estimate the exchange rate that reflects market conditions. In situations with multiple rates, the one that best represents the settlement of the cash flows should be used.

The pronouncement also highlights the importance of disclosures about non-convertible currencies, so that users of the financial statements understand the financial impacts, risks involved and criteria used in estimating the exchange rate.

The amendments are effective for financial statement periods starting on or after January 1, 2025.

The Company assessed and did not identify any impact on its financial statements.

CPC 18 (R3) - Investment in associated company, subsidiary and joint venture

In September 2024, the Accounting Pronouncements Committee (CPC) amended Technical Pronouncement CPC 18 (R3) to align Brazilian accounting standards with the IASB’s international standards.

CPC 18 currently allows the equity method (MEP) in the measurement of investments in subsidiaries in the Separate Financial Statements, following changes in international standards. This convergence harmonizes the accounting practices adopted in Brazil with the international ones, without generating material impacts, only editorial and normative adjustments.

The amendments are effective for financial statement periods starting on or after January 1, 2025.

The Company assessed and did not identify any impact on its financial statements.

International Tax Reform - Pillar Two Model Rules - Amendments to IAS 12

The amendments to IAS 12 (equivalent to CPC 32 – Income Taxes) were introduced in response to the OECD Pillar Two rules on BEPS and include the following:

| · | A mandatory temporary exception to the recognition and disclosure of deferred taxes arising from jurisdictional implementation of Pillar Two model rules; and |

| · | Disclosure requirements for affected entities to help users of financial statements better understand an entity’s exposure to Pillar Two income taxes arising from such legislation, especially before the effective date. |

Pursuant to paragraphs 88C and 88D of CPC 32 - Income Taxes, the Company informs that it is assessing the possible impacts arising from the Pillar Two legislation, a global initiative of the Organization for Economic Cooperation and Development (“OECD”). This legislation establishes a minimum tax rate for large corporate groups that fall within the scope of said rules, which must calculate their effective tax rate in each country where they operate. In the context of this regulation, this rate is called the “GloBE Effective Tax Rate”.

| 31 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

If the GloBE Effective Tax Rate of any entity in the economic group, considered by jurisdiction in which the group operates, is lower than the minimum rate of 15%, the multinational will undertake to pay an additional tax on income, referring to the difference between its effective GloBE rate and the established minimum rate.

This rule was initially introduced by Provisional Act 1262 of October 3, 2024 and was subsequently subject to Law 15079 of December 27, 2024, which creates the Additional Social Contribution on Net Profit (CSLL) in the process of adapting Brazilian legislation to the Global Rules Against Base Erosion –- GloBE Rules as of 2025.

The aforementioned rules applied to our group as of 2025, given that its constituent entities have earned revenues in excess of seven hundred and fifty million euros (€ 750,000,000.00) in the Consolidated Financial Statements of the Final Investing Entity (Telecom Italia) in the last four (4) years. The Company continues to carry out studies to assess potential impacts from the application of Pillar Two arising from the operations of the Telecom Italia Group in Brazil. For the year 2025, based on studies conducted to date, there were no significant impacts, as the Company met the established thresholds.

f.2 The following new standards were issued by Comitê de Pronunciamentos Contábeis [Accounting Pronouncement Committee] (CPC) and the International Accounting Standards Board (IASB), but are not in effect for the period ended on December 31, 2025. The Company intends to adopt these new and amended standards and interpretations, if applicable, when they come into force.

IFRS 18: Presentation and disclosure of financial statements

In April 2024, the IASB issued IFRS 18, which replaces IAS 1 (equivalent to CPC 26 (R1) - Presentation of Financial Statements. IFRS 18 introduces new requirements for presentation within the statement of income, including specified totals and subtotals. Moreover+, entities are required to classify all revenues and expenses within the statement of income in one of five categories: operating, investment, financing, income taxes and discontinued operations, of which the first three are new.

The standard also requires the disclosure of performance measures defined by management, subtotals of revenues and expenses, and includes new requirements for the aggregation and disaggregation of financial information based on the identified “functions” of the primary financial statements (PFS) and notes.

Furthermore, restricted scope amendments were made to IAS 7 (equivalent to CPC 03 (R2) - Statement of Cash Flows), which include changing the starting point for determining cash flows from operations using the indirect method, from “income or loss for the period” to “operating income +r loss” and removing the option to classify cash flows from dividends and interest. In addition, there are consequent amendments in several other standards.

The adoption of IFRS 18 does not change the values of assets, liabilities, or shareholders’ equity, but it significantly impacts the way the financial statements are presented. The main change occurs in the Statement of Income, which now presents revenues and expenses classified into operational, investment, and financing categories, in addition to the inclusion of the mandatory subtotals of Operating Profit and Profit before Financing and Income Tax. This restructuring implies the reallocation of items previously presented as financial income (loss), according to the new definitions.

In the cash flow statement, reconciliation using the indirect method will now begin with Operating Profit, reflecting the new structure of the statement of income and ensuring greater alignment between categories.

| 32 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

In summary, the expected effects on the Company focus on the presentation and transparency of information, with no impact on net profit or shareholders’ equity, but with a need to adjust the notes and internal systems for the classification of transactions according to the new categories.

The Company is currently working to identify all the impacts that the changes will have on the primary financial statements and notes to the financial statements. The initial expected material impacts on the Company’s financial statements are as follows:

• The foreign exchange variation differences will be classified in the category of the statement of income (revenue and expenses) in which the items that gave rise to such exchange differences are located.

• New announcements will be included, comprising: (a) Management-defined performance measures (MPMs); (b) specific expenses by nature, if expenses are presented by function in the operating category of the statement of income; and (c) a reconciliation, for each line of the statement of income, between the restated amounts in accordance with IFRS 18 and the amounts previously presented in accordance with IAS 1 (CPC 26 (R1).

• Interest received and interest paid will be classified, respectively, in investing activities and financing activities in the statement of cash flow, according to CPC 03 (R2) – Statement of Cash Flows.

IFRS 18 and the amendments to the other standards will come into force for reporting periods beginning on or after January 1, 2027, with early adoption permitted, and must be disclosed, although in Brazil early adoption is not allowed. IFRS 18 will be applied retrospectively.

| 33 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

Amendments to IFRS 9 and IFRS 7 - Amendments to the Classification and Measurement of Financial Instruments

In May 2024, the International Accounting Standards Board (IASB) issued amendments to IFRS 9 and IFRS 7 – Amendments to the Classification and Measurement of Financial Instruments, which introduce relevant modifications to the classification, measurement, and disclosure requirements of financial instruments. In line with these changes, the Accounting Pronouncement Committee - CPC should incorporate the changes through future revisions of the CPC 48 – Financial Instruments and CPC 40 (R1) – Financial Instruments: Evidencing

The main changes introduced are as follows:

• A clarification that a financial liability is written off on the “settlement date” and the introduction of an accounting policy option (when certain conditions are met) to write off financial liabilities settled through an electronic payment system before the settlement date.

• Additional guidance on how contractual cash flows from financial assets with environmental, social and corporate governance (ESG) and similar characteristics should be evaluated.

• Clarifications on what constitutes “non-recourse characteristics” and what are the characteristics of contractually binding instruments.

• Introduction of new disclosure requirements for financial instruments with contingent characteristics and additional disclosure requirements for equity instruments measured at fair value through other comprehensive income (OCI).

The amendments are applicable for annual periods beginning on or after January 1, 2026, with early adoption allowed only for the classification of financial assets and the related disclosures.

The Company is assessing the impacts to ensure that all information complies with the standard.

Amendment IAS 21 – Conversion of financial statements to a non-hyperinflationary currency

In November 2025, the IASB issued amendments to IAS 21, providing additional guidance on how entities should convert financial statements prepared in a non-hyperinflationary currency to a hyperinflationary presentation currency.

These specific changes aim to improve the quality of information and reduce the diversity of practices, providing greater consistency in the preparation of reports in hyperinflationary economies.

The amendments to IAS 21 – Effects of Changes in Foreign Exchange Rates – are effective for annual periods beginning on or after January 1, 2027, with early adoption permitted.

The Company assessed and did not identify any impact on its financial statements.

| 34 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

Annual Improvements to IFRS Standards – Volume 11

In July 2024, the IASB issued nine narrow-scope amendments as part of its periodic maintenance of the IFRS standards. The amendments include clarifications, simplifications, corrections, or modifications intended to improve the consistency of the following standards: IFRS 1 – First-time Adoption of International Financial Reporting Standards (equivalent to CPC 37 (R1) – First-time Adoption of International Accounting Standards), IFRS 7 – Financial Instruments: Disclosure (equivalent to CPC 40 (R1) – Financial Instruments: Disclosure) and its Guidance for the Implementation of IFRS 7, IFRS 9 – Financial Instruments (equivalent to CPC 48 – Financial Instruments), IFRS 10 – Consolidated Financial Statements (equivalent to CPC 36 (R3) – Consolidated Statements) and IAS 7 – Statement of Cash Flow (equivalent to CPC 03 (R2) – Statement of Cash Flow).

In line with these updates, the Accounting Pronouncement Committee - CPC should reflect such changes in future revisions of the corresponding technical pronouncements. The amendments will be effective for reporting periods starting on or after January 1, 2026. Early adoption is permitted, which must be disclosed.

The changes are not expected to have a material impact on the Group’s financial statements

| 3. | Estimates and areas where judgment is significant in the application of the Company's accounting policies |

Accounting estimates and judgments are continuously assessed based on the Company's historical experience and on other factors, such as expectations of future events, considering the circumstances present on the base date of financial statements.

By definition, resulting accounting estimates are seldom equal to the respective actual income (loss). The estimates and assumptions that present a significant risk, with the probability of causing a material adjustment to the book values of assets and liabilities for the fiscal period, are covered below.

(a) Provision for legal and tax administrative proceedings

The legal and tax administrative proceedings are analyzed by the Management along with its legal advisors (internal and external). The Company considers factors in its analysis such as hierarchy of laws, precedents available, recent court judgments, their relevance in the legal system and payment history. These assessments involve Management’s judgment (note 23).

(b) Fair value of derivatives and other financial instruments

The financial instruments presented in the balance sheet at fair value are measured using valuation techniques that consider observable data or observable data derived from market (Note 36).

(c) Unbilled revenues

Since some cut dates for billing occur at intermediate dates within the months of the year, as the end of each month there are revenues earned by the Company, but not actually invoiced to its customers. These unbilled revenues are recorded based on estimate that takes into consideration historical consumption data, number of days elapsed since the last billing date, among others (note 27).

| 35 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

(d) Leases

The Company has a significant number of the lease contracts in which it acts a lessee (Note 17), and with the adoption of the accounting standard IFRS 16 / CPC 06 (R2) – Leases, on January 1, 2019, certain judgments were exercised by Company’s management in measuring lease liabilities and right-of-use assets, such as: (i) estimate of the lease term, considering non-cancellable period and the period covered by options to extend the contract term, when the exercise depends only from the Company, and this exercise is reasonably certain; and (ii) using certain assumptions to calculate the discount rate.

The company is not able to readily determine the interest rate implicit on the lease and, therefore, considers its incremental rate on loans to measure lease liabilities. Incremental rate on the lessee’s loan is the interest rate that the lessee would have to pay when borrowing, for a similar term and with a similar guarantee, the resources necessary to obtain the asset with a value similar to the right of use asset in a similar economic environment. The Company estimates the incremental rate using observable data (such as market interest rates) when available and considers aspects that are specific to the Company (such as the cost of debt) in this estimate.

| 4. | Cash and cash equivalents |

Cash and cash equivalents are financial assets measured at amortized cost or at fair value through profit or loss, respectively.

Company’s Management classifies its financial assets upon initial recognition.

|

2025 |

2024 | |||

| Cash and banks | 85,873 | 81,177 | ||

| Free availability financial investments: | ||||

| CDB | 3,524,451 | 3,177,566 | ||

| 3,610,324 | 3,258,743 |

Bank certificates of deposit (“CDBs”) are nominative securities issued by banks and sold to the public as a form of fund raising. These securities can be traded during the contracted term, at any time, which gives them high liquidity, their adjustment is linked to the percentage of the Interbank Deposit Certificate (CDI), there is no risk of significant impairment in their value and they are used to fulfill the Company’s short-term obligations.

The average remuneration of CDB investments in the year ended December 31, 2025 is 100.49% p.a. (101.09% on December 31, 2024) of the variation of the Interbank Deposit Certificate - CDI.

| 36 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

| 5. | Marketable securities |

Comprise financial assets measured at fair value through profit or loss.

| 2025 | 2024 | |||

| FUNCINE(i) | 26,339 | 15,241 | ||

| Fundo Soberano(ii) | 1,518 | 2,404 | ||

| FIC: (iii) | ||||

| Government bonds(a) | 1,609,536 | 1,716,706 | ||

| CDB(b) | 3,583 | 18,897 | ||

| Financial bills(c) | 343,824 | 394,343 | ||

| Other (d) | 315,855 | 302,091 | ||

| 2,300,655 | 2,449,682 | |||

| Current portion | (2,274,316) | (2,434,441) | ||

| Non-current portion | 26,339 | 15,241 |

i) Since 2017, the Company, with the aim of supporting the National Film Industry Financing Fund, as well as using tax deductibility benefit for income tax purposes, started investing in the National Film Industry Financing Fund (FUNCINE). The average remuneration for the year ended December 31, 2025, was 0.17% p.a. (1.47% p.a. on December 31, 2024).

(ii) Fundo Soberano is composed only of federal government bonds. The average remuneration of FICs in the year ended December 31, 2025 was 99.30% p.a. of the variation of the Interbank Deposit Certificate - CDI (99.20% p.a. on December 31, 2024).

(iii) The Company invests in exclusive FICs (Quota Investment Fund). Funds are mostly made up of federal government bonds and papers from financial institutions, mostly AAA (highest quality). The average remuneration of FICs in the year ended December 31, 2025 was 101.99% p.a. of the variation of the Interbank Deposit Certificate - CDI (105.14% p.a. on December 31, 2024).

(a) Government bonds are fixed income financial instruments issued by the National Treasury to finance the activities of the Federal Government.

(b) CDBs are securities issued by banks with the commitment of buyback by the bank itself, having their correction linked to the percentage of the Interbank Deposit Certificate (CDI).

(c) The Financial bills is a fix income tittle emitted by financial institutions.

(d) Is represented by: Debentures, FIDC, commercial notes, promissory notes, bank credit note.

| 37 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

| 6. | Trade accounts receivable |

These are financial assets measured at amortized cost, and refer to accounts receivable from users of telecommunications services, from network use (interconnection) and from sales of handsets and accessories. Accounts receivable are recorded at the price charged at the time of the transaction. The balances of accounts receivable also include services provided and not billed (“unbilled”) up to the balance sheet date. Trade accounts receivable are initially recognized at fair value and, subsequently, measured at amortized cost using the effective interest rate method less provision for expected credit losses (“impairment”).

The provision for expected credit losses was recognized as a decrease in accounts receivable based on the profile of the subscriber portfolio, the aging of overdue accounts receivable, the economic situation, the risks involved in each case and the collection curve, at an amount deemed sufficient by Management, as adjusted to reflect current and prospective information on macroeconomic factors that affect the customers’ ability to settle the receivables.

The fair value of trade accounts receivable is close to the book value recorded on December 31, 2025 and December 31, 2024.

Amounts expected to be received in more than 12 months are classified as long-term.

The average rate considered in calculating the present value of accounts receivable recorded in the long term is 0.58% p.m. (0.58% p.m. on December 31, 2024).

| 2025 | 2024 | ||

| Trade accounts receivable | 5,039,083 | 4,815,750 | |

| Gross accounts receivable | 5,741,906 | 5,486,319 | |

| Billed services | 2,695,504 | 2,481,786 | |

| Unbilled services | 1,418,994 | 1,302,906 | |

| Network use (interconnexion) | 997,297 | 992,414 | |

| Sale of goods | 603,882 | 684,858 | |

| Contractual assets (Note 22) | 25,898 | 24,027 | |

| Other accounts receivable | 331 | 328 | |

| Provision for expected credit losses | (702,823) | (670,569) | |

| Current portion | (4,901,777) | (4,677,935) | |

| Non-current portion | 137,306 | 137,815 | |

Due to the financial partnership between TIM and Banco C6 S.A. from 2020 to February 2025, there were accounts receivable balances for TIM related to activation fees for C6 customers. The Agreement signed between TIM and Banco C6 on February 11, 2025, aimed to end the partnership and resolve all ongoing disputes, including four arbitration proceedings. After the approval of CIMA (Cayman Islands Monetary Authority) in March 2025, the shares (Note 12) and outstanding subscription warrants held by TIM (Note 36) had their write-off fully executed and became part of the Company’s accounts receivable balance (R$ 520 million). On December 31, 2025, the amount of R$ 520 million was fully received, settling the agreement.

| 38 |

TIM S.A.

NOTES TO THE FINANCIAL STATEMENTS - Continued December 31, 2025 (In thousands of reais, unless otherwise indicated)

|

The movement of the provision for expected credit losses, accounted for as an asset reduction account, was as follows:

| 2025 | 2024 | ||

| Opening balance | 670,569 | 629,739 | |

| Supplement to expected losses | 765,783 | 693,122 | |

| Write-offs of provision | (733,529) | (652,292) | |

| Closing balance | 702,823 | 670,569 | |

The aging of accounts receivable is as follows:

| 2025 | 2024 | ||

| Total | 5,741,906 | 5,486,319 | |

| Falling due | 4,239,134 | 3,917,182 | |

| Overdue (days): | |||

| ≤30 | 428,654 | 372,836 | |

| ≤60 | 139,462 | 123,183 | |

| ≤90 | 127,781 | 149,653 | |

| ≤120 | 121,913 | 105,426 | |

| >120 | 684,962 | 818,039 |

| 7. | Inventories |

Inventories are presented at the average acquisition cost. A loss is recognized to adjust the cost of Handsets and accessories to the net realizable value (selling price), when this value is less than the average acquisition cost.

| 2025 | 2024 | ||

| Total inventory | 357,204 | 293,529 | |

| Inventories | 376,768 | 310,054 | |

| Cell phones and tablets | 269,596 | 187,866 | |

| Accessories and prepaid cards | 88,601 | 98,868 | |

| TIM chips | 18,571 | 23,320 | |

| Losses on adjustment to realizable value | (19,564) | (16,525) | |

| 39 |

TIM S.A.