BRIGHT MINDS BIOSCIENCES INC.

ANNUAL INFORMATION FORM

For the Fiscal Year Ended September 30, 2025

Dated December 23, 2025

|

INTRODUCTORY NOTES |

3 |

|

Introduction |

3 |

|

Date of Information |

3 |

|

Currency and Exchange Rates |

3 |

|

Use of Market and Industry Data |

3 |

|

FORWARD-LOOKING INFORMATION |

3 |

|

GLOSSARY OF TERMS |

8 |

|

CORPORATE STRUCTURE |

11 |

|

Name, Address and Incorporation |

11 |

|

Intercorporate Relationships |

11 |

|

GENERAL DEVELOPMENT OF THE BUSINESS |

11 |

|

Overview |

11 |

|

Three-Year History |

12 |

|

DESCRIPTION OF THE BUSINESS |

14 |

|

Company Overview |

14 |

|

Principal Products and Services |

14 |

|

Production and Services |

17 |

|

Specialized Skill and Knowledge |

17 |

|

Competitive Conditions |

17 |

|

Intangible Properties |

18 |

|

Trademarks |

25 |

|

Web Domains |

25 |

|

Government Regulation |

25 |

|

Cycles |

30 |

|

Economic Dependence |

30 |

|

Changes to Contracts |

30 |

|

Environmental Protection |

30 |

|

Employees |

30 |

|

Foreign Operations |

30 |

|

Lending |

31 |

|

Bankruptcy and Similar Procedures |

31 |

|

Reorganizations |

31 |

|

Social or Environmental Policies |

31 |

|

RISK FACTORS |

32 |

|

Risks Related to the Business of the Company |

32 |

|

Risks Related to Our Common Shares |

48 |

|

DIVIDENDS AND DISTRIBUTIONS |

52 |

|

DESCRIPTION OF CAPITAL STRUCTURE |

52 |

|

Common Shares |

52 |

|

Warrants |

52 |

|

Options |

53 |

|

MARKET FOR SECURITIES |

53 |

|

Trading Price and Volume |

53 |

|

Prior Sales |

55 |

|

ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTIONS ON TRANSFER |

55 |

|

DIRECTORS AND OFFICERS |

55 |

|

Name, Occupation and Security Holding |

55 |

|

Term of Office |

56 |

|

Director and Officer Share Ownership |

56 |

|

Biographies |

56 |

|

Cease Trade Orders, Bankruptcies, Penalties or Sanctions |

59 |

|

Conflicts of Interest |

60 |

|

LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

60 |

|

PROMOTERS |

60 |

|

INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

60 |

|

AUDITOR, TRANSFER AGENT AND REGISTRAR |

61 |

|

Auditor |

61 |

|

Transfer Agent and Registrar |

61 |

|

MATERIAL CONTRACTS |

61 |

|

AUDIT COMMITTEE |

61 |

|

Audit Committee Charter |

61 |

|

Composition of the Audit Committee |

61 |

|

Relevant Education and Experience |

62 |

|

Audit Committee Oversight |

62 |

|

Pre-Approval Policies and Procedures |

62 |

|

External Auditor Service Fees |

63 |

|

INTERESTS OF EXPERTS |

63 |

|

Names of Experts |

63 |

|

Interests of Experts |

63 |

|

ADDITIONAL INFORMATION |

63 |

|

SCHEDULE A |

A-1 |

INTRODUCTORY NOTES

Introduction

This Annual Information Form (“AIF”) has been prepared in accordance with Form 51-102F2 – Annual Information Form and should be read in conjunction with Bright Minds Biosciences Inc.’s (the “Company” or “Bright Minds”) audited consolidated financial statements (and accompanying notes) for the year ended September 30, 2025, and Management’s Discussion and Analysis for the year ended September 30, 2025. These documents, along with additional information about the Company are available on its issuer profile on SEDAR+ at www.sedarplus.ca.

For an explanation of the capitalized terms and expressions and certain defined terms, please refer to the “GLOSSARY OF TERMS” below.

Date of Information

All information contained in this AIF is as of September 30, 2025, with subsequent events disclosed to December 23, 2025, unless otherwise indicated.

Currency and Exchange Rates

All dollar amounts herein are expressed in Canadian dollars unless otherwise indicated.

Use of Market and Industry Data

This AIF includes market and industry data that has been obtained from third party sources, including industry publications, as well as industry data prepared by the Company’s management on the bases of its knowledge of and experience in the industry in which the Company operates (including management’s estimates and assumptions relating to the industry based on that knowledge). Management’s knowledge of the industry has been developed through its experience and lengthy participation in the industry. Management believes that its industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance as to the accuracy or completeness of included information. Although the Company’s management believes it to be reliable, it has not independently verified any of the data from third party sources referred to in this AIF or ascertained the underlying economic assumptions relied upon by such sources.

FORWARD-LOOKING INFORMATION

This AIF contains certain statements, which may constitute “forward-looking information” within the meaning of Canadian securities law requirements. These forward-looking statements are made as of the date of this AIF and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation. Forward-looking statements relate to future events or future performance and reflect Company management’s expectations or beliefs regarding future events. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “pipeline”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. In this document, certain forward- looking statements are identified by words including “may”, “future”, “expected”, “intends” and “estimates”. By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The Company provides no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Certain forward-looking statements in this AIF include, but are not limited to the following:

|

● |

the Company’s expectations regarding the achievement of clinical and regulatory milestones; |

|

● |

the Company’s expectations regarding its revenue, expenses and research and development operations; |

|

● |

the Company’s anticipated cash needs and its needs for additional financing; |

|

● |

the Company’s intention to grow the business and its operations; |

|

● |

expectations with respect to the success of its research and development of serotonergic therapeutics; |

|

● |

expectations regarding growth rates, growth plans and strategies of the Company; |

|

● |

expectations that provisional patent applications will be converted to regular patent applications or refiled as new provisional patent applications 12 months from their filing dates; |

|

● |

expectations that prosecution of patent applications that have entered the national/regional phase will begin; |

|

● |

the Company’s strategy with respect to the expansion and protection of its intellectual property; |

|

● |

the medical benefits, safety, efficacy, dosing and consumer acceptance of serotonergic therapeutics; |

|

● |

the Company’s ability to comply with provincial, federal, local and regulatory agencies in the United States, Canada and other jurisdictions in which the Company operates; |

|

● |

the Company’s competitive position and the regulatory environment in which the Company operates; |

|

● |

the Company’s expected business objectives for the next 12 months; |

|

● |

the Company’s plans with respect to the payment of dividends; |

|

● |

beliefs and intentions regarding the ownership of material trademarks and domain names used in connection with the design, production, marketing, distribution and sale of the Company’s products and services; |

|

● |

the Company’s ability to obtain additional funds through the sale of equity or debt commitments; |

|

● |

the Company’s ability to obtain the necessary regulatory approvals; |

|

● |

expectations that regulatory requirements will be maintained; |

|

● |

expectations related to general business and economic conditions; |

|

● |

the Company’s ability to successfully execute its plans and intentions; |

|

● |

the availability of financing on reasonable terms to the Company; |

|

● |

the Company’s ability to attract and retain skilled staff; |

|

● |

expectations about market competition; |

|

● |

expectations about the products, services and technology offered by the Company’s competitors; and |

|

● |

expectations that the Company’s current good relationships with its suppliers, service providers and other third parties will be maintained. |

The above and other aspects of the Company’s anticipated future operations are forward-looking in nature and, as a result, are subject to certain risks and uncertainties. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them as actual results may differ materially from the forward-looking statements. Such forward-looking statements are estimates reflecting the Company’s best judgment based upon current information and involve a number of risks and uncertainties, and there can be no assurance that other factors will not affect the accuracy of such forward-looking statements. Such factors include but are not limited to:

|

● |

the Company’s limited operating history; |

|

● |

the Company’s actual financial position and results of operations may differ materially from the expectations of the Company’s management; |

|

● |

the Company may not be successful in its efforts to identify, license or discover additional product candidates; |

|

● |

the Company may be required to obtain and maintain certain permits, licenses, and approvals in the jurisdictions where its products or technologies are being researched, developed, or commercialized; |

|

● |

the Company may encounter substantial delays or difficulties with its current and future clinical trials; |

|

● |

clinical trials are very expensive, time consuming and difficult to design and implement; |

|

● |

the Company’s current and future clinical trials or those of its current or future collaborators may reveal significant adverse events not seen in pre-clinical and non-clinical studies and may result in a safety profile that could inhibit regulatory approval or market acceptance of any of the Company’s product candidates; |

|

● |

the Company has limited experience in completing clinical trials and has only completed one phase one drug trial to date; |

|

● |

if the Company experience delays or difficulties in the enrolment of patients in clinical trials, receipt of regulatory approvals could be delayed or prevented; |

|

● |

success in pre-clinical studies or clinical trials may not be predictive of results in future clinical trials; |

|

● |

interim, “topline,” and preliminary data from the Company’s clinical trials that the Company announces or publishes from time to time may change as more patient data becomes available and are subject to audit and verification procedures that could result in material changes in the final data; |

|

● |

the Company may not be successful in its efforts to identify, license or discover additional product candidates; |

|

● |

there is no assurance that the Company will turn a profit or generate immediate revenues; |

|

● |

the Company’s intellectual property and licenses thereto; |

|

● |

the Company may not achieve the timelines for project development set out in this AIF; |

|

● |

the Company may need additional capital for future operations; |

|

● |

the Company faces product liability exposure; |

|

● |

there may be health and safety issues related to the Company’s products; |

|

● |

the Company has international operations, which subject the Company to risks inherent with operations outside of Canada; |

|

● |

the Company may be adversely impacted by changes in U.S. and international trade policies; |

|

● |

the Company, its investors and its securities may be adversely impacted by changes in U.S. laws; |

|

● |

exchange rate fluctuations between the U.S. dollar and the Canadian dollar; |

|

● |

changes to patent laws or the interpretation of patent laws; |

|

● |

the Company may not be able to enforce its intellectual property rights throughout the world; |

|

● |

the lack of product for commercialization; |

|

● |

the failure to develop new and innovative products; |

|

● |

the lack of experience of the Company/management in marketing, selling, and distribution products; |

|

● |

the size of the Company’s target market is difficult to quantify; |

|

● |

ongoing sales of Common Shares will dilute current shareholders; |

|

● |

clinical and pre-clinical drug development is lengthy, costly and carries uncertain outcomes; |

|

● |

potentials for conflicts of interest for the Company’s officers and directors; |

|

● |

in certain circumstances, the Company’s reputation could be damaged; |

|

● |

negative operating cash flow; |

|

● |

forward-looking statements may prove to be inaccurate; |

|

● |

the potential for a material weakness in the Company’s internal controls over financial reporting; |

|

● |

difficulties with forecasts; |

|

● |

the Company’s executive officers and directors exercise a significant level of control; |

|

● |

market price of Common Shares and volatility; |

|

● |

the Company does not intend to pay dividends; |

|

● |

the ability to buy and sell Common Shares may be limited by FINRA’s sales practice requirements; |

|

● |

the Company is a foreign private issuer within the meaning of the rules under the Exchange Act and is exempt from certain disclosure provisions; |

|

● |

as an “emerging growth company”, the Company is subject to lessened disclosure requirements under U.S. securities laws; |

|

● |

costs of maintaining status as a public company; and |

|

● |

other risks as set out under “Risk Factors” below. |

[Remainder of Page Intentionally Left Blank]

GLOSSARY OF TERMS

The following is a glossary of certain terms used in this AIF:

“Agents” has the meaning ascribed thereto under “GENERAL DEVELOPMENT OF THE BUSINESS – Three-Year History – Financial Year Ended September 30, 2025”.

“AIF” means this annual information form of the Company dated December 23, 2025 for the year ended September 30, 2025.

“ATM” has the meaning ascribed thereto under “GENERAL DEVELOPMENT OF THE BUSINESS – Three-Year History – Financial Year Ended September 30, 2025”.

“Audit Committee” means a committee established by and among the Board for the purpose of assisting the Board in fulfilling its financial oversight responsibilities.

“Bankruptcy Code” means the Bankruptcy Code of the United States or any successor statute.

“Base Shelf Registration Statement” has the meaning ascribed thereto under “GENERAL DEVELOPMENT OF THE BUSINESS– Three-Year History– Financial Year Ended September 30, 2025”.

“BCBCA” means the Business Corporations Act (British Columbia).

“BCSC” means the British Columbia Securities Commission.

“BLA” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS– Government Regulation– United States Government Regulation.”

“Board of Directors” or “Board” means the board of directors of the Company.

“Code of Ethics” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS – “Social or Environmental Policies”.

“Common Shares” means common shares in the capital of the Company.

“Company” or “Bright Minds Biosciences” means Bright Minds Biosciences Inc.

“Complete Response Letter” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS – Government Regulation – The FDA’s Decision on an NDA or BLA.”

“CSE” means the Canadian Securities Exchange.

“December 2022 Unit Offering” has the meaning ascribed thereto under “GENERAL DEVELOPMENT OF THE BUSINESS– Three-Year History– Financial Year Ended September 30, 2023”.

“December 2023 Private Placement” has the meaning ascribed thereto under “GENERAL DEVELOPMENT OF THE BUSINESS– Three-Year History– Financial Year Ended September 30, 2024”.

“DMG” means DMG Blockchain Solutions Inc.

“Equity Distribution Agreement” has the meaning ascribed thereto under “GENERAL DEVELOPMENT OF THE BUSINESS– Three-Year History– Financial Year Ended September 30, 2025”.

“Exchange Act” means the United States Exchange Act of 1934.

“Exclusive License Agreement” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS– Intangible Properties- Patents and Patent Applications– Kozikowski-Roth Patents”.

“FDCA” means the United States Food, Drug and Cosmetics Act.

“FDA” means the United States Food and Drug Administration.

“FINRA” means the Financial Industry Regulation Authority.

“GCP” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS – Government Regulation–United States Government Regulation.”

“IFRS” means International Financial Reporting Standards.

“IND” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS – Government Regulation– United States Government Regulation.”

“Inventions” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS– Intangible Properties- Patents and Patent Applications– Kozikowski-Roth Patents”.

“IRB” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS – Government Regulation– United States Government Regulation.”

“JOBS Act” means the United States Jumpstart our Business Startups (JOBS) Act of 2012.

“License” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS– Intangible Properties- Patents and Patent Applications– Kozikowski-Roth Patents”.

“NASDAQ” means the Nasdaq Capital Market.

“NI 52-110” has the meaning ascribed thereto under “AUDIT COMMITTEE”.

“November 2024 Private Placement” has the meaning ascribed thereto under “GENERAL DEVELOPMENT OF THE BUSINESS– Three-Year History– Financial Year Ended September 30, 2025”.

“Options” means a stock option of the Company.

“PFWs” has the meaning ascribed thereto under “GENERAL DEVELOPMENT OF THE BUSINESS– Three-Year History– Financial Year Ended September 30, 2023”.

“Exclusive License Agreement” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS– Intangible Properties- Patents and Patent Applications– Kozikowski-Roth Patents”.

“NDA” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS – Government Regulation– United States Government Regulation.”

“NDS” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS – Government Regulation– Canadian Government Regulation.”

“Roth Kozikowski Agreement” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS– Intangible Properties- Patents and Patent Applications– Kozikowski-Roth Patents”.

“RSU” means a restricted share unit of the Company.

“SEC” means the United States Securities and Exchange Commission.

“Shareholders” means the holders of the Common Shares.

“TPD” has the meaning ascribed thereto under “DESCRIPTION OF THE BUSINESS – Government Regulation– Canadian Government Regulation.”

“TSXV” means the TSX Venture Exchange.

“UIC” means the University of Illinois

“Unit” means a unit in the capital of the Company.

“U.S. Securities Act” means the United States Securities Act of 1933.

“Warrant” means a Common Share purchase warrant in the capital of the Company.

“Warrant Share” means a Common Share to be issued upon the exercise of a Warrant.

[Remainder of Page Intentionally Left Blank]

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated on May 31, 2019 under the BCBCA as “1210954 B.C. Ltd.” On March 6, 2020, the Company changed its name to “Bright Minds Biosciences Inc.” The Company’s Canadian headquarters is located at 1122 Mainland St #228, Vancouver, BC V6B 5L1. The Company’s US headquarters is located at 400 N Aberdeen St Suite 900, Chicago, IL 60642. The Company also has offices at 19 Vestry Street, New York, NY 10013

The Company’s registered and records office is located at Suite 1500, 1055 West Georgia Street, P.O. Box 11117, Vancouver, BC V6E 4N7. The Company’s telephone number is 604-661-9496 and its website address is www.brightmindsbio.com.

The Company’s Common Shares are listed on the CSE and the NASDAQ under the trading symbol “DRUG”. The Company is a reporting issuer in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador.

Intercorporate Relationships

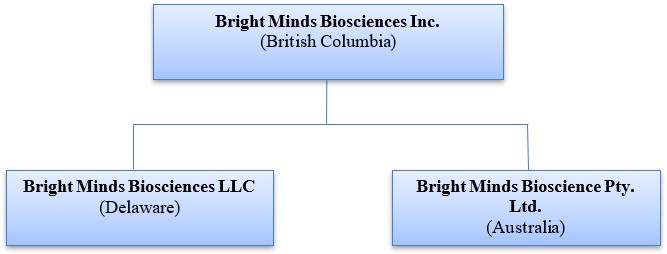

The Company has two wholly owned subsidiaries. The Company’s corporate structure is set out below:

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

The Company is a biotechnology company developing innovative therapeutics to improve the lives of patients with severe and life-altering neurological and psychiatric disorders. The Bright Minds pipeline includes novel compounds targeting key receptors in the brain to address conditions with high unmet medical need, including epilepsy, depression, and other central nervous system (CNS) disorders. The Company is focused on delivering breakthrough therapies that can transform patients’ lives. The Company has developed a unique platform of highly selective serotonergic agonists exhibiting selectivity at different serotonergic receptors. This has provided a rich portfolio of new chemical entity (NCE) programs within neurology and psychiatry.

See “DESCRIPTION OF THE BUSINESS” below for additional information on the Company.

Three-Year History

Financial Year Ended September 30, 2023

On December 1, 2022, the Company appointed Mark A. Smith, M.D., Ph.D., as Chief Medical Officer.

On December 2, 2022, the Company closed a non-brokered private placement of (i) 133,200 pre-funded warrants of the Company (“PFWs”) at a price of $6.245 per PFW, and (ii) 194,800 Units at a price of $6.25 per Unit (collectively, the “December 2022 Unit Offering”), for aggregate gross proceeds of $2,049,334. Each PFW was exercisable into one Unit at an exercise price of $0.005 per Unit on the date that is the earlier of (a) the date the holder thereof elects to exercise the PFWs and pays the exercise price therefor, and (b) December 2, 2024. Each Unit was comprised of one Common Share and Warrant. Each Warrant issued in the December 2022 Unit Offering entitled the holder thereof to acquire a Warrant Share at a price of $6.75 per Warrant Share until December 2, 2024.

On December 1, 2022, the Company granted 60,000 Options to Mark A. Smith, M.D., Ph.D., the Company’s Chief Medical Officer. The Options are exercisable at an exercise price of $8.25 for a period of five (5) years from the date of grant.

On December 1, 2022, the Company granted an aggregate of 220,000 RSUs to Ian McDonald, the Company’s Chief Executive Officer, and Jan Pedersen, the Company’s Chief Scientific Officer. The RSUs are subject to vesting provisions pursuant to which 25% will vest annually, commencing on the date of grant.

On January 9, 2023, the Company announced the resignation of Dr. Doug Williamson from its Board of Directors.

On February 17, 2023, the Company announced the appointment of David Weiner, MD to its Board of Directors.

On July 14, 2023, the Company completed the consolidation of its Common Shares on the basis of five (5) pre-consolidation Common Shares to one (1) post-consolidation Common Share.

On August 8, 2023, the Company announced positives results of the qEEG (Quantitative Electroencephalogram) data in Cohort 4 of its first-in-human Phase 1 study of its lead compound, BMB-101.

Financial Year Ended September 30, 2024

On December 22, 2023, the Company closed a fully management-subscribed, non-brokered private placement of 661,765 Units at a price of $1.36 per Unit for aggregate gross proceeds of $900,000 (the “December 2023 Private Placement”). Each Unit consisted of one Common Share and one Warrant. Each Warrant issued in the December 2023 Private Placement grants the holder the right to acquire one Warrant Share at a price of $1.70 per Warrant Share until December 22, 2028. Ian McDonald, the CEO and a director of the Company, was the sole subscriber in the December 2023 Private Placement.

On March 27, 2024, the Company announced the grant of 130,000 Options to three directors and an employee of the Company. The Options are exercisable at an exercise price of $1.84 for a period of five (5) years from the date of grant.

On September 12, 2024, the Company announced the initiation of the BREAKTHROUGH Study, an open-label Phase 2 clinical trial evaluating the safety, tolerability, and efficacy of BMB-101, a highly selective 5-HT2C receptor agonist, in adult patients with classic Absence Epilepsy and Developmental Epileptic Encephalopathy (DEE).

Financial Year Ended September 30, 2025

On October 3, 2024, the Company announced the grant of 70,000 Options to employees and members of the Board of Directors. The Options are exercisable at an exercise price of $1.65 for a period of five (5) years from the date of grant.

On October 16, 2024, the Company announced positive data from the preclinical testing of BMB-201 completed with National Institute of Health pain screening (PSPP) program.

On October 21, 2024, the Company announced a collaboration with Firefly Neuroscience, Inc., an artificial intelligence company developing innovative solutions that improve brain health outcomes for patients with neurological and mental disorders, to provide a full analysis of the electroencephalogram (EEG) data in the Company’s BREAKTHROUGH study, an open-label Phase 2 clinical trial evaluating the safety, tolerability, and efficacy of BMB-101, a highly selective 5-HT2C receptor agonist, in adult patients with classic Absence Epilepsy and Developmental Epileptic Encephalopathy (DEE).

On November 4, 2024, the Company closed a non-brokered private placement of 1,612,902 Common Shares at a price of USD$21.70 per Common Share for aggregate gross proceeds of USD$35,000,000 (the “November 2024 Private Placement”).

On January 7, 2025, the Company appointed Stephen D. Collins, M.D., Ph.D., as Chief Medical Officer. Mark A. Smith, M.D., Ph.D., the Company’s former Chief Medical Officer, retired from his role but continued to serve the Company in an advisory capacity.

On February 5, 2025, the Company filed a registration statement on Form F-3 to register the 1,612,902 Common Shares issued pursuant to the November 2024 Private Placement.

On May 13, 2025, the Company announced positive findings from its DBA/2 mouse model study. BMB-101, the Company’s novel scaffold 5-HT2C Gq-protein biased agonist, demonstrated a complete elimination of drop attacks in the DBA/2 mouse model.

On August 25, 2025, the Company filed a registration statement on Form F-3 with the SEC containing a base shelf prospectus and an at-the-market offering prospectus supplement (the “Base Shelf Registration Statement”). As a result of this filing, the Company is permitted to publicly offer up to USD$250,000,000 of common shares, common share purchase warrants, or units consisting of common shares and warrants to investors in the United States during the period the Base Shelf Registration Statement is effective. On the same date, the Company entered into an equity distribution agreement (the “Equity Distribution Agreement”) providing for an at-the-market equity offering program (“ATM”) with Piper Sandler & Co. and Cantor Fitzgerald & Co. (collectively, the “Agents”). The ATM allow Bright Minds, through the Agents, to offer and sell from time to time in the United States, through the facilities of NASDAQ, or any other method permitted by law as defined under Rule 415 of the U.S. Securities Act, such number of Common Shares as would have an aggregate offering price of up to USD$100 million. The sale of Common Shares through the ATM will be made pursuant to the Base Shelf Registration Statement, which was made effective on September 2, 2025. The ATM will expire on September 2, 2028, unless terminated earlier in accordance with the terms of the Equity Distribution Agreement. The timing and extent of the use of the ATM will be at the discretion of the Company.

Current Financial Year to the date of this AIF

During the current financial year, the Company expects to continue clinical development of BMB-101 in epilepsy indications (Phase 2/3 studies), and may utilize its existing Base Shelf Registration Statement to conduct capital raises, subject to market conditions and operational needs.

On November 6, 2025, the Company announced the initiation of Prader-Willi Syndrome (“PWS”) program and exploratory Phase 2 clinical study with BMB-101 in PWS. The Company expects to advance its preclinical candidate BMB-105 to Phase 1 clinical studies.

DESCRIPTION OF THE BUSINESS

Company Overview

The Company is a biotechnology company developing innovative treatments for patients with neurological and psychiatric disorders. The Bright Minds pipeline includes novel compounds targeting key receptors in the brain to address conditions with high unmet medical need, including epilepsy, depression, and other central nervous system (CNS) disorders. The Company is focused on delivering breakthrough therapies that can transform patients’ lives. The Company has developed a unique platform of highly selective serotonergic agonists exhibiting selectivity at different serotonergic receptors. This has provided a rich portfolio of new chemical entity (NCE) programs within neurology and psychiatry.

Principal Products and Services

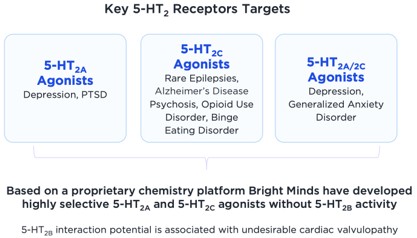

Serotonin (5-HT) is the most prominent neurotransmitter in the brain and modulates many biological functions. Dysfunction of serotonin receptors, transporters, and associated neurocircuits is fundamental to many diseases including epilepsies and neuro-psychiatric disorders such as depression. The class of medications known as selective serotonin reuptake inhibitors, such as Prozac®, Zoloft®, and Lexapro®, are widely used in the treatment of depression with a market of USD$14.3 Billion1. Similarly, other serotoninergic drugs are widely used in the treatment of pain (Triptans in migraine)2, Alzheimer’s and Parkinson’s disease related psychosis (Pimavanserin)3, and seizures (Fintepla)4. The off-label use of psilocybin extracts in depression and cluster headache, as well as encouraging clinical trial data with psilocybin and MDMA in depression and PTSD illustrate the potential for advancing serotoninergic therapies in neuropsychiatry and pain. The full potential of serotonin-based therapeutics has not been achieved due to the lack of medications that are selective and specific to certain serotonin receptor subtypes that are fundamental to disease pathology, without non-specific effects, or other off-target effects on other serotonin receptors in the body that are associated with cardiac toxicities and have resulted in previous drugs being withdrawn from the market.

|

1 |

Research and Markets, “Global Antidepressants Market (2020 to 2030) - COVID-19 Implications and Growth” (21 April 2020), online: Intrado GlobeNewswire <https://www.globenewswire.com/news-release/2020/04/21/2019282/0/en/Global-Antidepressants-Market-2020-to-2030-COVID-19-Implications-and-Growth.html>. |

|

2 |

Samar Nicolas & Diala Nicolas, “Triptans” (26 May 2020), online: National Center for Biotechnology Information <https://www.ncbi.nlm.nih.gov/books/NBK554507/>. |

|

3 |

Cerner Multum, “Pimavanserin” (5 February 2020), online: Drugs.com <https://www.drugs.com/mtm/pimavanserin.html>. |

|

4 |

Fintepla FDA Approval History” (accessed 5 May 2021), online: Drugs.com <https://www.drugs.com/history/fintepla.html>. |

Bright Minds has a portfolio of patented, selective serotonin (5-HT2C and 5-HT2C/A-receptor subtypes) agonists that were identified using high-throughput screening methods in combination with advanced molecular modeling techniques to interrogate the interaction between the drug and its targeted receptors to increase downstream signaling while avoiding off-target effects.

The Company’s lead program is 5-HT2C selective agonist BMB-101. It is a novel scaffold 5-HT2C agonist developed using structure-based drug design. Biased agonism at the 5-HT2C receptor is one of its key features and adds another layer of functional selectivity within a well-validated target. BMB-101 works exclusively via the Gq-protein signaling pathway and avoids beta-arrestin activation, which is crucial to minimize the risk of receptor desensitization and tolerance development. This provides a novel mechanism, anti-epileptic drug designed to provide sustained seizure relief in hard-to-treat patient populations. In preclinical studies, BMB-101 has demonstrated efficacy in animal models of Dravet Syndrome and animal models of generalized seizures.

In Phase 1 clinical studies, BMB-101was tested in healthy volunteers in a Single Ascending Dose (SAD), Multiple Ascending Dose (MAD) and food-effects study. BMB-101 was demonstrated to be safe and well tolerated at all doses. No Serious Adverse Events (SAEs) were observed, and Adverse Events (AEs) were mild in nature and in line with on-target effects for serotonergic drugs.

An extensive target-engagement study was conducted using both fluid biomarkers (transient prolactin release) and physical biomarkers (Quantitative Electroencephalogram, qEEG). Both methods confirmed robust central target engagement. A qEEG signature typicalfor anti-epileptic drugs was observed, with a selective depression of EEG power at frequencies observed during epileptic seizures. Furthermore, a potentiation of frontal gamma-power was observed in this study which could indicate the potential for improved cognition.

Phase 2 clinical trials of BMB-101 were initiated in 2024 in a group of drug-resistant epilepsies including Developmental and Epileptic Encephalopathies and Absence epilepsies.

The Company plans to explore the utility of its highly selective 5-HT2C agonists in PWS, and exploratory Phase 2 study of BMB-101 in PWS patients is planned in 2026.

Lead candidates in other programs include BMB-105, novel 5-HT2C agonist, and BMB-201 and BMB-202, selective 5-HT2A agonists for neuropsychiatry and neurology indications, undergoing IND-enabling studies.

Stage of Development of Principal Products

|

Drug candidate |

Program |

Medical indications |

Status

|

|

BMB-101 |

5-HT2C agonist |

DEE

Absence Seizures

Prader Willi Syndrome |

Preclinical characterisation: IND-enabling package completed

API and Drug Product manufacturing: Completed. Optimization and drug product resupply is ongoing.

Clinical:

Phase 1 clinical trials (SAD/MAD/Food effects) completed

Phase 2 clinical trials in DEE and absence seizures patients – ongoing

Future Phase 2/3 clinical trials in epilepsy indications – preparatory activities ongoing

Phase 2 clinical trial in PWS patients – preparatory activities ongoing

|

|

BMB-105 |

5-HT2C agonist |

Prader Willi Syndrome |

Preclinical characterisation: IND-enabling package ongoing

API and Drug Product manufacturing: Ongoing

|

|

BMB-201 |

5-HT2A/2C agonist |

Pain / psychiatry indication |

Preclinical characterisation: IND-enabling package ongoing

|

|

BMB-202 |

5-HT2A agonist |

Psychiatry indication |

Preclinical characterisation: IND-enabling package ongoing

|

The Company has completed a Phase 1 clinical trial on its leading product candidate, 5-HT2C agonist, as follows:

|

Product |

Indications |

Clinical Trial |

Major Objective |

Outcome |

||

|

BMB-101 |

Undisclosed Seizure Disorder |

Phase 1 SAD, MAD and Food Effects |

● |

Safety, PK/PD and Exploratory Effect markers |

●

|

Based on safety results, BMB-101 was safe and well-tolerated by healthy subjects. |

| ● | Prolactin and qEEG changes were indicative of central target engagement of central 5-HT2c receptors by BMB-101. | |||||

|

Absence Epilepsy and DEE |

BREAKTHROUGH Study: A Phase 2 Trial of BMB-101 in Absence Epilepsy and Developmental Epileptic Encephalopathy |

● |

Assess the safety, tolerability and efficacy of BMB-101 |

● |

Ongoing study NCT06401538 | |

Production and Services

Currently, the Company has no commercial production and is in the process of developing its principal products and completing clinical trials. Upon the successful development of one of the Company’s principal products the Company will establish a method of production.

Specialized Skill and Knowledge

The nature of the Company’s business requires specialized skill and knowledge, including expertise in medicine and healthcare. The Company’s management and Scientific Advisory Board has expertise drug development and therapeutics. The required skills and knowledge to succeed in our industry are available to Bright Minds through certain members of the company’s management, directors, officers, and advisory teams. See “DIRECTORS AND OFFICERS”.

Competitive Conditions

The biotechnology and biopharmaceutical industries, and the neurological subsector, are characterized by rapid evolution of technologies, fierce competition, and strong defense of intellectual property. Any product candidates that the Company successfully develop and commercialize will have to compete with existing therapies and new therapies that may become available in the future. While the Company believes that their rational approach to drug design, along with their scientific expertise in the field of serotonergic drugs and central nervous system (CNS) function, provide the Company with competitive advantages, a wide variety of institutions, including large biopharmaceutical companies, specialty biotechnology companies, academic research departments, and public and private research institutions, are actively developing potentially competitive products and technologies. The Company’s competitors generally fall within the following categories:

|

● |

Developmental and Epileptic Encephalopathy/Epilepsy. UCB, Jazz Pharmaceuticals, H. Lundbeck A/S, Biocodex, Xenon Pharmaceuticals, Praxis Therapeutics, SK Life Science, Ovid Therapeutics, Supernus Pharmaceuticals, Harmony Biosciences, Takeda Pharmaceuticals, Eisai. |

|

● |

Prader-Willi Syndrome: Soleno Therapeutics, Aardvark Therapeutics, Rhythm Pharmaceuticals, Acadia Pharmaceuticals, Harmony Biosciences, Neuren Pharmaceuticals |

|

● |

Antidepressants and anxiolytics. AbbVie Inc., AstraZeneca, Bristol-Myers Squibb, Eli Lilly and Company, GlaxoSmithKline, H. Lundbeck A/S, Johnson & Johnson, Merck, Novartis, Otsuka Pharmaceutical, Pfizer Inc., Sanofi, Takeda Pharmaceutical Company Ltd. |

Intangible Properties

Patents and Patent Applications

Kozikowski-Roth Patents

The Company has exclusively licensed a family of patents based on PCT/US2011/023535, which is co-owned by the Board of Trustees of UIC and the University of North Carolina at Chapel Hill. This family of licensed patents includes patents granted in Australia (AU Pat No 2011212930), Canada (CA Pat No 2788416), Europe (EU Pat No 2531485), Japan (JP Pat No 5810099), United States (US Pat No 8492591 and US Pat No 8754132). In addition, the Company has exclusively licensed a family of patents based on PCT/US2016/015019, which is solely owned by the Board of Trustees of UIC. This family of licensed patents includes patents applied for or granted in China (CN Publication No 107810175), Europe (EU Publication No 3250549), Hong Kong SAR (HK Publication No 1251831), and the United States (US Pat No 10407381). The latest patent to issue is US Pat No 10407381 which will expire on January 27, 2036.

These patents were based on the past research completed by Dr. Alan Kozikowski and Dr. Bryan Roth that is documented in United States publication number US20090203750A1 “5-HT2C Receptor Agonists as Anorectic Agents”. The invention related to the discovery of novel selective 5-HT2C and 5-HT2C/A agonists that could be used for the treatment of multiple neurological conditions.

On May 26, 2020, the Company entered into an option agreement (the “Roth Kozikowski Agreement”) with the Board of Trustees of UIC in which UIC granted the Company, in consideration for an option fee, an exclusive option to: (i) evaluate the inventions described in PCT/US2011/023535 and all counterpart patents related thereto and described in PCT/US2016/015019 and all counterpart patents related thereto (collectively, the “Inventions”); and (ii) obtain an exclusive license to the Inventions. On April 23, 2021, the Company and UIC entered into a First Amendment to the Roth Kozikowski Agreement for the purpose of amending certain terms in the Roth Kozikowski Agreement.

On April 23, 2021, the Company entered into an exclusive license agreement (the “Exclusive License Agreement”) with UIC pursuant to the exercise of its option under the Roth Kozikowski Agreement and the First Amendment to the Roth Kozikowski Agreement. Pursuant to the terms and conditions of the Exclusive License Agreement, UIC granted the Company an exclusive license to the Inventions (the “License”). In consideration for the License, the Company (i) paid UIC a signing fee of USD$100,000, less USD$15,000 paid by the Company pursuant to the Roth Kozikowski Agreement; and (ii) issued 63,000 Common Shares at a deemed price of $5.85 per Common Share to the UIC (part of which was received by UIC on behalf of the University of North Carolina at Chapel Hill). Additionally, the Company agreed to pay UIC a royalty on net sales of products derived from the Inventions and a portion of all revenue received by the Company from sublicensees.

The Company may terminate the Exclusive License Agreement at any time on written notice to UIC at least ninety (90) days prior to the termination date specified in the notice. The notice of termination must also include the Company’s reason for such termination. UIC may terminate the Exclusive License Agreement if the Company: (a) fails to pay any amount, or provide any other consideration, or make any report when required, and the Company does not cure such failure within ninety (90) days after receiving notice thereof; (b) is in breach of any provision of the Exclusive License Agreement not covered by (a) and the Company does not cure such failure within forty-five (45) days after receiving notice thereof; (c) is in breach of any obligations that the Company has to UIC under any other agreement between the Company and UIC and the Company does not cure such failure within ninety (90) days after receiving notice thereof, however, should the Company be aware it is unable to remedy such breach within ninety (90) days, the Company shall have the option to provide written notice to UIC after which the Company and UIC shall negotiate in good faith to determine an appropriate extension to said ninety (90) day time frame; (d) makes any materially false report and receives written notice from UIC; (e) to the extent not prohibited by applicable law commences a voluntary case as a debtor under the Bankruptcy Code, or if an involuntary case is commenced against the Company under the Bankruptcy Code, or if an order for relief shall be entered in such case, or if the same or any similar circumstance shall occur under the laws of any foreign jurisdiction; and/or (f) takes any action that purports to cause or causes any of the patent rights or technical information subject to the Exclusive License Agreement to be subject to any lien or encumbrance, and such termination shall be upon written notice to the Company.

Filed Patent Applications

Based upon molecular modeling studies in concert with data available from published research articles, the Bright Minds chemistry team designed novel analogs of psilocin that they believed would retain 5-HT2A activity while having no propensity to activate the 5‑HT2B receptors. These new chemical entities were thus anticipated to retain the brain re-booting activity of psilocin while showing no propensity to cause valvulopathy issues.

On March 12, 2020, Bright Minds filed a United States provisional application that was assigned a serial number of US 62/988,926. This patent application focused on psilocin analogs that have been decorated with functionality appropriate to achieving the goals of maintaining the desired 5-HT2A activity while being devoid of 5-HT2B activity. On March 12, 2021, Bright Minds filed a Patent Cooperation Treaty patent application that claims priority to US 62/988,926. Such Patent Cooperation Treaty patent application was assigned a serial number of PCT/CA2021/050336. In September 2022, PCT/CA2021/050336 entered the national phase in the United States of America; the United States application, which has been assigned a serial number of 17/911,022, is currently pending. In October 2022, PCT/CA2021/050336 entered the national phase in the European Union; the European Union application, which has been assigned a serial number of 21768153.5, is currently pending.

On May 26, 2021, Bright Minds filed a United States provisional application that was assigned a serial number of US 63/193,062. This patent application focused on substitutions at a particular position on an indole structure. On May 25, 2022, Bright Minds filed a Patent Cooperation Treaty patent application that claims priority to US 63/193,062. Such Patent Cooperation Treaty patent application has been assigned a serial number of PCT/CA2022/050833. PCT/CA2022/050833 has entered the national/regional phase in the United States of America (assigned application number 18/562,587), Canada (assigned application number 3,219,940), Japan (assigned application number 2023-573064), the European Union (assigned application number 22810004.6), South Korea (assigned application number 10-2023-7044608), and China (assigned application number 202280052820.8).

On January 4, 2022, Bright Minds filed a United States provisional application that has been assigned a serial number of US 63/296,430. This patent application focuses on phenethylamine compounds. On November 4, 2022, Bright Minds filed a second United States provisional application focused on phenethylamine compounds; this provisional application has been assigned a serial number of US 63/422,730. On January 4, 2023, Bright Minds filed a Patent Cooperation Treaty patent application that claims priority to US 63/296,430 and US 63/422,730. Such Patent Cooperation Treaty patent application has been assigned a serial number of PCT/CA2023/050003. PCT/CA2022/050003 has entered the national/regional phase in Canada (assigned application number 3,242,928), the United States of America (assigned application number 18/726,389), Australia (assigned application number 2023205941), Japan (assigned application number 2024-540591), the European Union (assigned application number 23736951.7), South Korea (assigned application number 10-2024-7026278), and China (assigned application number 202380022140.6).

On May 6, 2022, Bright Minds filed a United States provisional application that has been assigned a serial number of US 63/338,889. This patent application focuses on substitutions at a particular position on an indole structure. On May 2, 2023, Bright Minds filed a Patent Cooperation Treaty patent application that claims priority to US 63/338,889. Such Patent Cooperation Treaty patent application has been assigned a serial number of PCT/CA2023/050595. PCT/CA2023/050595 has entered the national/regional phase in Canada (assigned application number 3,252,369), Japan (application number to be assigned), Australia (assigned application number 2023264112), the United States of America (assigned application number 18/863,516), and the European Union (assigned application number 23799069.2). Bright Minds also intends for PCT/CA2023/050595 to enter the national phase in China, and the deadline to enter the Chinese national phase is January 6, 2025.

Bright Minds is currently listed as an applicant in the following publicly disclosed matters:

|

Patent Application Number |

Region |

Title |

Inventors |

Applicant |

Filing Date |

Status |

|

17/911,0225 |

USA |

3-(2-(AMINOETHYL)-INDOL-4-OL DERIVATIVES, METHODS OF PREPARATION THEREOF, AND THE USE AS 5-HT2 RECEPTOR MODULATORS |

Alan KOZIKOWSKI Gideon SHAPIRO Werner TUECKMANTEL John McCORVY |

Bright Minds Biosciences Inc.; The Medical College of Wisconsin, Inc. |

March 12, 2021 (national phase entry of PCT/CA2021/050336 having an international filing date of March 12, 2021, which claims priority to US 62/988,926 filed March 12, 2020) |

Pending |

|

21768153.56 |

European Union |

3-(2-(AMINOETHYL)-INDOL-4-OL DERIVATIVES, METHODS OF PREPARATION THEREOF, AND THE USE AS 5-HT2 RECEPTOR MODULATORS |

Alan KOZIKOWSKI Gideon SHAPIRO Werner TUECKMANTEL John McCORVY |

Bright Minds Biosciences Inc.; The Medical College of Wisconsin, Inc. |

March 12, 2021 (national phase entry of PCT/CA2021/050336 having an international filing date of March 12, 2021, which claims priority to US 62/988,926 filed March 12, 2020) |

Pending |

|

5 |

Pursuant to an inter-institutional agreement effective as of December 16, 2022, entered into between the Company and The Medical College of Wisconsin, Inc. (“MCW”), MCW is responsible for prosecuting and maintaining this application and negotiating licenses relating to the application. |

| 6 |

See note 2. |

|

18/562,587 |

USA |

Heterocyclic Compounds and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL John MCCORVY Uros LABAN |

Bright Minds Biosciences Inc.; The Medical College of Wisconsin, Inc. |

May 25, 2022 (national phase entry of PCT/CA2022/050833 having an international filing date of May 25 2022, which claims priority to US 63/193,062 filed May 26, 2021 and US 63/309,735 filed February 14, 2022) |

Pending |

|

3,219,940 |

Canada |

Heterocyclic Compounds and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL John MCCORVY Uros LABAN |

Bright Minds Biosciences Inc.; The Medical College of Wisconsin, Inc. |

May 25, 2022 (national phase entry of PCT/CA2022/050833 having an international filing date of May 25 2022, which claims priority to US 63/193,062 filed May 26, 2021 and US 63/309,735 filed February 14, 2022) |

Pending |

|

2023-573064 |

Japan |

Heterocyclic Compounds and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL John MCCORVY Uros LABAN |

Bright Minds Biosciences Inc.; The Medical College of Wisconsin, Inc. |

May 25, 2022 (national phase entry of PCT/CA2022/050833 having an international filing date of May 25 2022, which claims priority to US 63/193,062 filed May 26, 2021 and US 63/309,735 filed February 14, 2022) |

Pending |

|

22810004.6 |

European Union |

Heterocyclic Compounds and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL John MCCORVY Uros LABAN |

Bright Minds Biosciences Inc.; The Medical College of Wisconsin, Inc. |

May 25, 2022 (national phase entry of PCT/CA2022/050833 having an international filing date of May 25 2022, which claims priority to US 63/193,062 filed May 26, 2021 and US 63/309,735 filed February 14, 2022) |

Pending |

|

10-2023-7044608 |

South Korea |

Heterocyclic Compounds and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL John MCCORVY Uros LABAN |

Bright Minds Biosciences Inc.; The Medical College of Wisconsin, Inc. |

May 25, 2022 (national phase entry of PCT/CA2022/050833 having an international filing date of May 25 2022, which claims priority to US 63/193,062 filed May 26, 2021 and US 63/309,735 filed February 14, 2022) |

Pending |

|

202280052820.8 |

China |

Heterocyclic Compounds and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL John MCCORVY Uros LABAN |

Bright Minds Biosciences Inc.; The Medical College of Wisconsin, Inc. |

May 25, 2022 (national phase entry of PCT/CA2022/050833 having an international filing date of May 25 2022, which claims priority to US 63/193,062 filed May 26, 2021 and US 63/309,735 filed February 14, 2022) |

Pending |

|

3,242,928 |

Canada |

Phenethylamines and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

January 4, 2023 (national phase entry of PCT/CA2023/050003 having an international filing date of January 4, 2023, which claims priority to US63/296,430 filed January 4, 2022 and US63/422,730 filed November 4, 2022) |

Pending |

|

18/726,389 |

USA |

Phenethylamines and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

July 2, 2024 (national phase entry of PCT/CA2023/050003 having an international filing date of January 4, 2023, which claims priority to US63/296,430 filed January 4, 2022 and US63/422,730 filed November 4, 2022) |

Pending |

|

2023205941 |

Australia |

Phenethylamines and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

January 4, 2023 (national phase entry of PCT/CA2023/050003 having an international filing date of January 4, 2023, which claims priority to US63/296,430 filed January 4, 2022 and US63/422,730 filed November 4, 2022) |

Pending |

|

2024-540591 |

Japan |

Phenethylamines and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

January 4, 2023 (national phase entry of PCT/CA2023/050003 having an international filing date of January 4, 2023, which claims priority to US63/296,430 filed January 4, 2022 and US63/422,730 filed November 4, 2022) |

Pending |

|

23736951.7 |

European Union |

Phenethylamines and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

January 4, 2023 (national phase entry of PCT/CA2023/050003 having an international filing date of January 4, 2023, which claims priority to US63/296,430 filed January 4, 2022 and US63/422,730 filed November 4, 2022) |

Pending |

|

10-2024-7026278 |

South Korea |

Phenethylamines and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

January 4, 2023 (national phase entry of PCT/CA2023/050003 having an international filing date of January 4, 2023, which claims priority to US63/296,430 filed January 4, 2022 and US63/422,730 filed November 4, 2022) |

Pending |

|

202380022140.6 |

China |

Phenethylamines and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

January 4, 2023 (national phase entry of PCT/CA2023/050003 having an international filing date of January 4, 2023, which claims priority to US63/296,430 filed January 4, 2022 and US63/422,730 filed November 4, 2022) |

Pending |

|

3,252,369 |

Canada |

Azepinoindoles and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

May 2, 2023 (national phase entry of PCT/CA2023/050595 having an international filing date of May 2, 2023, which claims priority to US 63/338,889 filed May 6, 2022) |

Pending |

|

2024-565127 |

Japan |

Azepinoindoles and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

May 2, 2023 (national phase entry of PCT/CA2023/050595 having an international filing date of May 2, 2023, which claims priority to US 63/338,889 filed May 6, 2022) |

Pending |

|

2023264112 |

Australia |

Azepinoindoles and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

May 2, 2023 (national phase entry of PCT/CA2023/050595 having an international filing date of May 2, 2023, which claims priority to US 63/338,889 filed May 6, 2022) |

Pending |

|

18/863,516 |

USA |

Azepinoindoles and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

May 2, 2023 (national phase entry of PCT/CA2023/050595 having an international filing date of May 2, 2023, which claims priority to US 63/338,889 filed May 6, 2022) |

Pending |

|

23799069.2 |

European Union |

Azepinoindoles and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

May 2, 2023 (national phase entry of PCT/CA2023/050595 having an international filing date of May 2, 2023, which claims priority to US 63/338,889 filed May 6, 2022) |

Pending |

|

202380051305.2 |

China |

Azepinoindoles and Methods of Preparation Thereof |

Alan KOZIKOWSKI Werner TUECKMANTEL |

Bright Minds Biosciences Inc. |

May 2, 2023 (national phase entry of PCT/CA2023/050595 having an international filing date of May 2, 2023, which claims priority to US 63/338,889 filed May 6, 2022) |

Pending |

The Company continues research and development (“R&D”) related to highly selective 5-HT2 agonists for neurological and neuropsychiatric indications. As a part of its ongoing R&D programs, the Company has filed and anticipates that it will continue to file additional patents to protect its intellectual property.

Trademarks

Bright Minds has the following trademark registrations:

|

Trademark |

Country |

Application Number (Registration Number) |

Filing Date (Registration Date) |

Status |

|

BRIGHT MINDS |

Canada |

2,016,213 (TMA1202388) |

2020-03-06 (2023-10-11) |

Registered |

|

BRIGHT MINDS |

United States of America |

90/245,748 (7,424,235) |

2020-10-09 (2024-06-25) |

Registered |

Web Domains

Bright Minds has use and control over the following domain name: brightmindsbio.com.

Government Regulation

Regulatory Framework

Drug products must be approved by the appropriate governing body before it can be sold in that country or area. The FDA approves products for the United States market and Health Canada approves products for the Canadian market. The European Medicines Agency approves products for the European Union. While the process by which products are approved by the FDA and Health Canada is very similar, each regulatory body has its own unique requirements for a product. In both cases, the development of a product through to approval can be a lengthy process and, in some cases, can take over 10 years. While early studies conducted in one jurisdiction will usually be accepted in the other, further and somewhat modified studies may be required to have a product approved in another jurisdiction.

Canadian Government Regulation

Drug products in Canada are regulated by Health Canada under the Food and Drugs Act and the Food and Drugs Regulations. Health Canada regulates, among other things, research and development activities and the testing, approval, manufacture, quality control, safety, effectiveness, labeling, storage, record keeping, advertising and promotion of any product candidates or commercial products. For a drug product to be approved in Canada, it must provide sufficient evidence of safety, efficacy and chemical quality based on preclinical investigation and Phase I, II and III clinical trials using approved and compliant manufacturing and clinical sites.

To obtain approval to market a drug in Canada, a sponsor usually requests a pre-submission meeting with the review division of Health Canada responsible for the therapeutic field. If the meeting is granted, the sponsor must submit a Pre-Submission Information package to the Therapeutic Products Directorate (“TPD”) to meet with the review division. This process occurs prior to submitting the New Drug Submission (“NDS”) application. The purpose of the pre-submission meeting is to review the evidence (non-clinical and clinical research, quality information, indication) that will be submitted in the NDS application.

During the drug development process, the sponsor prepares study reports. Once the sponsor releases the last study required for the submission, the sponsor completes the NDS application and submits it to the TPD. Prior to submitting the NDS and, if applicable, based on the intended use of the product in the identified patient population, the sponsor may submit in advance a request for priority review status.

After submitting the NDS application, the file undergoes a screening process prior to being accepted for review. TPD has 45 calendar days from receipt to complete the screening review process. If granted a priority review, the screening period is reduced to 25 calendar days.

After a comprehensive review of an NDS application, Health Canada will issue a Notice of Compliance if the product is approved or a Notice of Non-Compliance if further questions remain. If a Notice of Compliance is issued, a Drug Identification Number is also issued that is required to be printed on each label of the product, as well as the final version of the Product Monograph that has been agreed to between Health Canada and the sponsor.

The average target time for reaching a first decision on an NDS is 300 calendar days, unless the submission has received a priority review in which case the time is 180 calendar days. Fees are levied for a review of an NDS application.

The regulatory approval process is generally lengthy and expensive, with no guarantee of a positive result. Once approved, Health Canada continues to monitor the product and license holders have obligations related to reporting to Health Canada, record keeping and ensuring continued safety and efficacy of the product. Failure to comply with any of the above applicable regulations, regulatory authorities or other requirements may result in civil or criminal penalties, recall or seizure of products, injunctive relief including partial or total suspension of production, or withdrawal of a product from the market.

United States Government Regulation

In the United States, the FDA regulates drugs under the FDCA, and its implementing regulations, and biologics under the FDCA and the Public Health Service Act, and its implementing regulations. FDA approval is required before any new unapproved drug or biologic or dosage form, including a new use of a previously approved drug, can be marketed in the United States. In some cases, changes to aspects of an approved drug product also require pre-approval prior to implementation of these changes. Drugs and biologics are also subject to other federal, state, and local statutes and regulations. If Bright Minds fails to comply with applicable FDA or other requirements at any time during the product development process, clinical testing, the approval process or after approval, Bright Minds may become subject to administrative or judicial sanctions. These sanctions could include the FDA’s refusal to approve pending applications, license suspension or revocation, withdrawal of an approval, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, civil monetary penalties or criminal prosecution. Any FDA enforcement action could have a material adverse effect on Bright Minds.

The process required by the FDA before drug products may be marketed in the United States generally involves the following:

|

● |

Completion of extensive preclinical laboratory tests and preclinical animal studies, some performed in accordance with the GLP regulations; |

|

● |

submission to the FDA of an Investigational New Drug (“IND”) Application, which must be reviewed by the FDA and become active before human clinical trials may begin and must be updated annually; |

|

● |

approval by an independent review board (“IRB”) or ethics committee representing each clinical site before each clinical trial may be initiated; |

|

● |

performance of adequate and well-controlled human clinical trials conducted under Good Clinical Practices (“GCP”) to establish the safety and efficacy of the product candidate for each proposed indication; |

|

● |

preparation of and submission to the FDA of a New Drug Application (“NDA”) or Biologics License Application (“BLA”) after completion of all pivotal clinical trials; |

|

● |

a determination by the FDA within 60 days of its receipt of an NDA or BLA to file the application for review; |

|

● |

potential review of the product application by an FDA advisory committee, where appropriate and if applicable; |

|

● |

satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities where the proposed product is produced to assess compliance with current GMP; |

|

● |

a potential FDA audit of the preclinical research and clinical trial sites that generated the data in support of the NDA or BLA; and |

|

● |

FDA review and approval of an NDA or BLA prior to any commercial marketing or sale of the product in the United States. |

The preclinical research, clinical testing and approval process require substantial time, effort, and financial resources, and Bright Minds cannot be certain that any approvals for the Company’s product candidates will be granted on a timely basis, if at all. An IND is a request for authorization from the FDA to administer an investigational new drug product to humans in clinical trials. The central focus of an IND submission is on the general investigational plan and the protocol(s) for human clinical trials. The IND also includes results of animal studies assessing the toxicology, pharmacokinetics, pharmacology, and pharmacodynamic characteristics of the product; chemistry, manufacturing, and controls information; and any available human data or literature to support the use of the investigational new drug.

An IND must become effective before human clinical trials may begin in the US. An IND will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to the proposed clinical trials. In such a case, the IND may be placed on clinical hold and the IND sponsor and the FDA must resolve any outstanding concerns or questions before clinical trials can begin. Accordingly, submission of an IND may or may not result in the FDA allowing clinical trials to commence. As drug product programs continue in development, clinical trial protocols, additional preclinical testing results, and manufacturing information is submitted with the IND to facilitate discussions with the FDA and approval of additional clinical trials.

Clinical Trials

Clinical trials involve the administration of the IND to human subjects under the supervision of qualified investigators in accordance with GCPs, which include the requirement that all research subjects provide their informed consent for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objectives of the study, the parameters to be used in monitoring safety, and the efficacy criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. Additionally, approval must also be obtained from each clinical trial site’s IRB or ethics committee, before the trials may be initiated, and the IRB or ethics committee must monitor the trial until completed. All subjects must provide informed consent prior to participating in the trial. There are also requirements governing the reporting of ongoing clinical trials and clinical trial results to public registries.

The clinical investigation of a drug is generally divided into three or four phases. Although the phases are usually conducted sequentially, they may overlap or be combined.

|

● |

Phase I. The drug is initially introduced into healthy human subjects or, in some cases, patients with the target disease or condition. These studies are designed to evaluate the safety, tolerance, metabolism, pharmacokinetic and pharmacologic actions of the investigational new drug in humans, and the side effects associated with increasing doses. |

|

● |

Phase II. The drug is administered to a limited patient population to evaluate safety and optimal dose levels for safety and efficacy, identify possible adverse side effects and safety risks, and preliminarily evaluate efficacy. |

|

● |

Phase III. The drug is administered to an expanded patient population, generally at geographically dispersed clinical trial sites to generate sufficient data to statistically evaluate dose levels, clinical effectiveness and safety, to establish the overall benefit-risk relationship of the IND product, and to provide an adequate basis for physician labeling. |

|

● |

Phase IV. In some cases, the FDA may conditionally approve an NDA or BLA for a drug product with the sponsor's agreement to conduct additional clinical trials after approval. In other cases, a sponsor may voluntarily conduct additional clinical trials after approval to gain more information about the drug. Such post-approval studies are typically referred to as Phase IV clinical trials. |

Clinical trial sponsors must also report to the FDA, within certain timeframes: (i) serious and unexpected adverse reactions, (ii) any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator’s brochure, or (iii) any findings from other studies or animal testing that suggest a significant risk in humans exposed to the product candidate. The FDA, the IRB, the ethics committee or the clinical trial sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Additionally, some clinical trials are overseen by an independent group of qualified experts organized by the clinical trial sponsor, known as a data safety monitoring board or committee. This group provides authorization for whether or not a trial may move forward at designated check points based on access to certain data from the trial.

The clinical trial process can take years to complete, and there can be no assurance that the data collected will support FDA approval or licensing of the product. Results from one trial are not necessarily predictive of results from later trials. The Company may also suspend or terminate a clinical trial based on evolving business objectives and/or competitive climate.

Submission of an NDA or BLA to the FDA

Assuming successful completion of all required preclinical studies and clinical testing in accordance with all applicable regulatory requirements, detailed IND product information is submitted to the FDA in the form of an NDA or BLA requesting approval to market the product for one or more indications. Under federal law, the submission of most NDAs and BLAs is subject to an application user fee. Applications for Oppositional Defiant Disorder products are exempted from the NDA and BLA application user fee, unless the application includes an indication for other than a rare disease or condition and may be exempted from product and establishment user fees under certain conditions. An NDA or BLA must include all relevant data available from pertinent preclinical studies and clinical trials, including negative or ambiguous results as well as positive findings, together with detailed information relating to the product’s chemistry, manufacturing, controls, and proposed labeling, among other things. Data comes from company-sponsored clinical trials intended to test the safety and effectiveness of a use of a product, and may also come from several alternative sources, including clinical trials initiated by investigators. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety and effectiveness of the investigational new drug product to the satisfaction of the FDA.

Once an NDA or BLA has been submitted, the FDA’s goal is to review the application within ten months after it accepts the application for filing, or, if the application relates to an unmet medical need in a serious or life-threatening indication, six months after the FDA accepts the application for filing. The review process is often significantly extended by the FDA’s requests for additional information or clarification. Before approving an NDA or BLA, the FDA typically will inspect the facility or facilities where the product is manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are following current GMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving an NDA or BLA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP and related regulations.

The FDA is required to refer an NDA or BLA for a novel drug (in which no active ingredient has been approved in any other application) to an advisory committee or explain why such referral was not made. Typically, an advisory committee is a panel of independent experts, including clinicians and other scientific experts, that reviews, evaluates and provides a recommendation as to whether the application should be approved and the conditions thereof. The FDA is not bound by the recommendations of an advisory committee, but it considers such recommendations carefully when making decisions.

The FDA’s Decision on an NDA or BLA

After the FDA evaluates the NDA or BLA and conducts inspections of manufacturing facilities where the product will be produced, the FDA will issue either an approval letter or a complete response letter (“Complete Response Letter”). An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications. A Complete Response Letter indicates that the review cycle of the application is complete, and the application is not ready for approval. To satisfy deficiencies identified in a Complete Response Letter, additional clinical data and/or an additional Phase III clinical trial(s), and/or other significant, expensive and time-consuming requirements related to clinical trials, preclinical studies or manufacturing may be required for the drug product.