Please wait

As filed with the Securities and Exchange Commission on January 28, 2026.

Registration No. 333-292657

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Veradermics, Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 2834 | 84-3304423 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

470 James St.

New Haven, CT 06513

(228) 372-3376

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Reid Waldman, M.D.

Chief Executive Officer

Veradermics, Incorporated

470 James St.

New Haven, CT 06513

(228) 372-3376

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| | | | | | | | |

Zachary Blume Nicholas Roper Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199-3600 (617) 951-7000 | Michael Greco General Counsel Veradermics, Incorporated 470 James St. New Haven, CT 06513 (228) 372-3376 | Divakar S. Gupta Ryan Sansom Madison A. Jones Cooley LLP 55 Hudson Yards New York, NY 10001 (212) 479-6000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 28, 2026

PRELIMINARY PROSPECTUS

13,350,000 Shares

Common Stock

We are offering 13,350,000 shares of our common stock. This is our initial public offering, and no public market currently exists for our common stock. We expect that the initial public offering price will be between $14.00 and $16.00 per share of our common stock. We have applied to list our common stock on the New York Stock Exchange under the symbol “MANE.” We believe that upon the consummation of this offering, we will meet the standards for listing on the New York Stock Exchange, and the consummation of this offering is contingent upon such listing.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | |

| PER SHARE | | TOTAL |

Initial Public Offering Price | $ | | $ |

Underwriting Discounts and Commissions(1) | | | |

Proceeds, Before Expenses, to Veradermics, Incorporated | | | |

| | | |

(1)See the section titled “Underwriting” for additional disclosure regarding underwriting compensation. Delivery of the shares of common stock is expected to be made on or about , 2026.

We have granted the underwriters an option for a period of 30 days to purchase up to an additional 2,002,500 shares of common stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $ , and the total proceeds to us, before expenses, will be $ .

Wellington Management (the “cornerstone investor”) has indicated an interest in purchasing up to $30.0 million in shares of common stock in this offering at the initial public offering price. The shares of common stock to be purchased by the cornerstone investor will not be subject to a lock-up agreement with the underwriters. Because this indication of interest is not a binding agreement or commitment to purchase, the cornerstone investor may determine to purchase more, less or no shares in this offering or the underwriters may determine to sell more, less or no shares to the cornerstone investor. The underwriters will receive the same underwriting discounts and commissions on any of our shares of common stock purchased by the cornerstone investor as they will from any other shares of common stock sold to the public in this offering. The number of shares of common stock available for sale to the public will be reduced to the extent that the cornerstone investor purchases shares of common stock in the offering.

| | | | | | | | | | | |

Jefferies | Leerink Partners | Citigroup | Cantor |

Prospectus dated , 2026.

TABLE OF CONTENTS

Neither we nor the underwriters have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

TRADEMARKS

This prospectus contains references to our trademarks and those trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entity.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations, market position and market opportunity, is based on our management’s estimates and research, as well as industry and general publications and research and studies conducted by third parties. We believe that the information from these third-party publications, research and studies included in this prospectus is reliable. However, we have not separately verified this data. Management’s estimates are derived from publicly available information, their knowledge of our industry and their assumptions based on such information and knowledge, which we believe to be reasonable; however, such research has not been verified by any third party. This data involves a number of assumptions and limitations which are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” These and other factors could cause our future performance to differ materially from our assumptions and estimates.

PROSPECTUS SUMMARY

This summary highlights information included elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our common stock. You should read and consider this entire prospectus carefully, including the sections titled “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in the prospectus, before making any investment decision. Except where the context otherwise requires or where otherwise indicated, the terms “Veradermics,” “we,” “us,” “our,” “the Company,” and “our business” refer to Veradermics, Incorporated and its consolidated subsidiaries. Overview

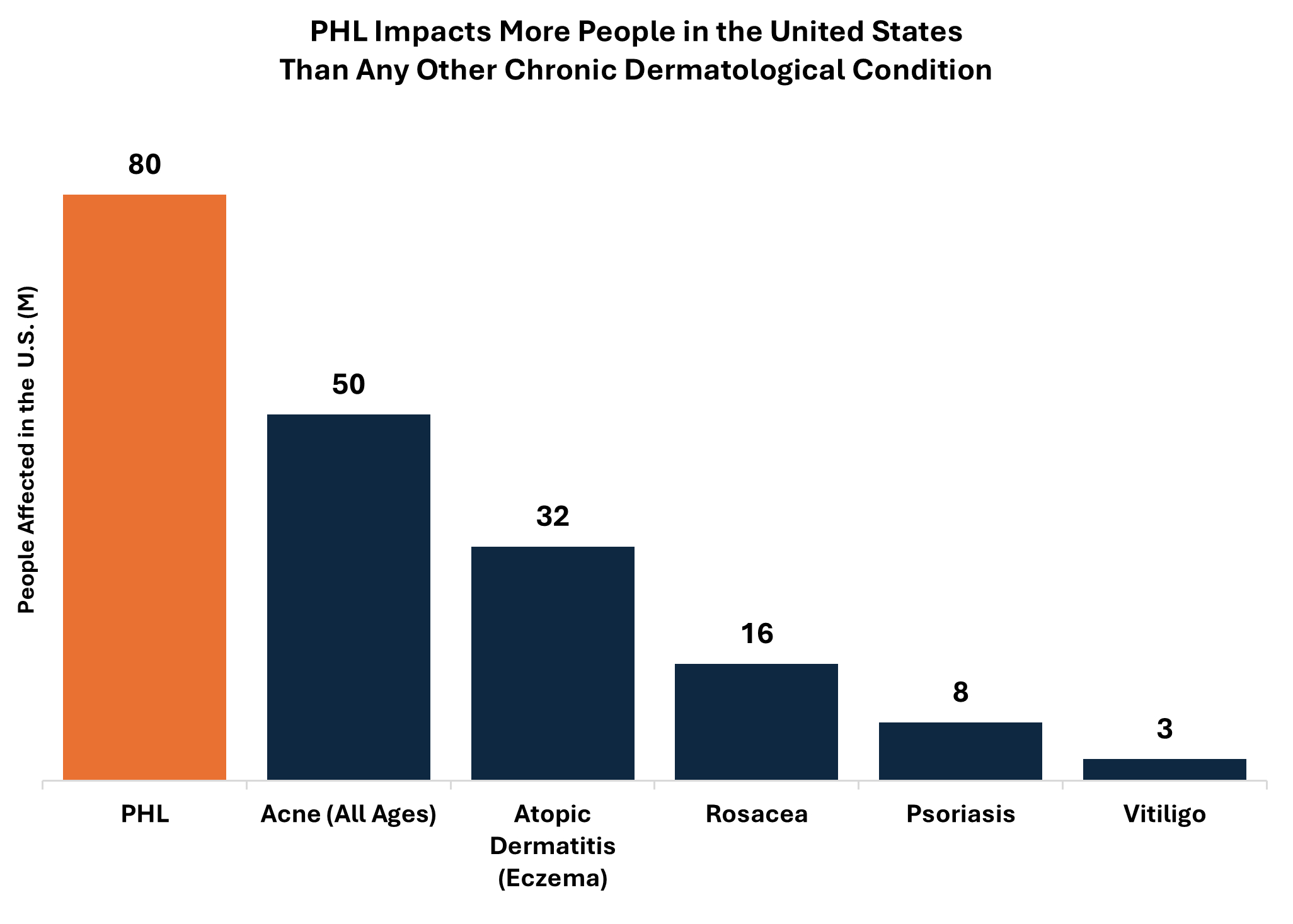

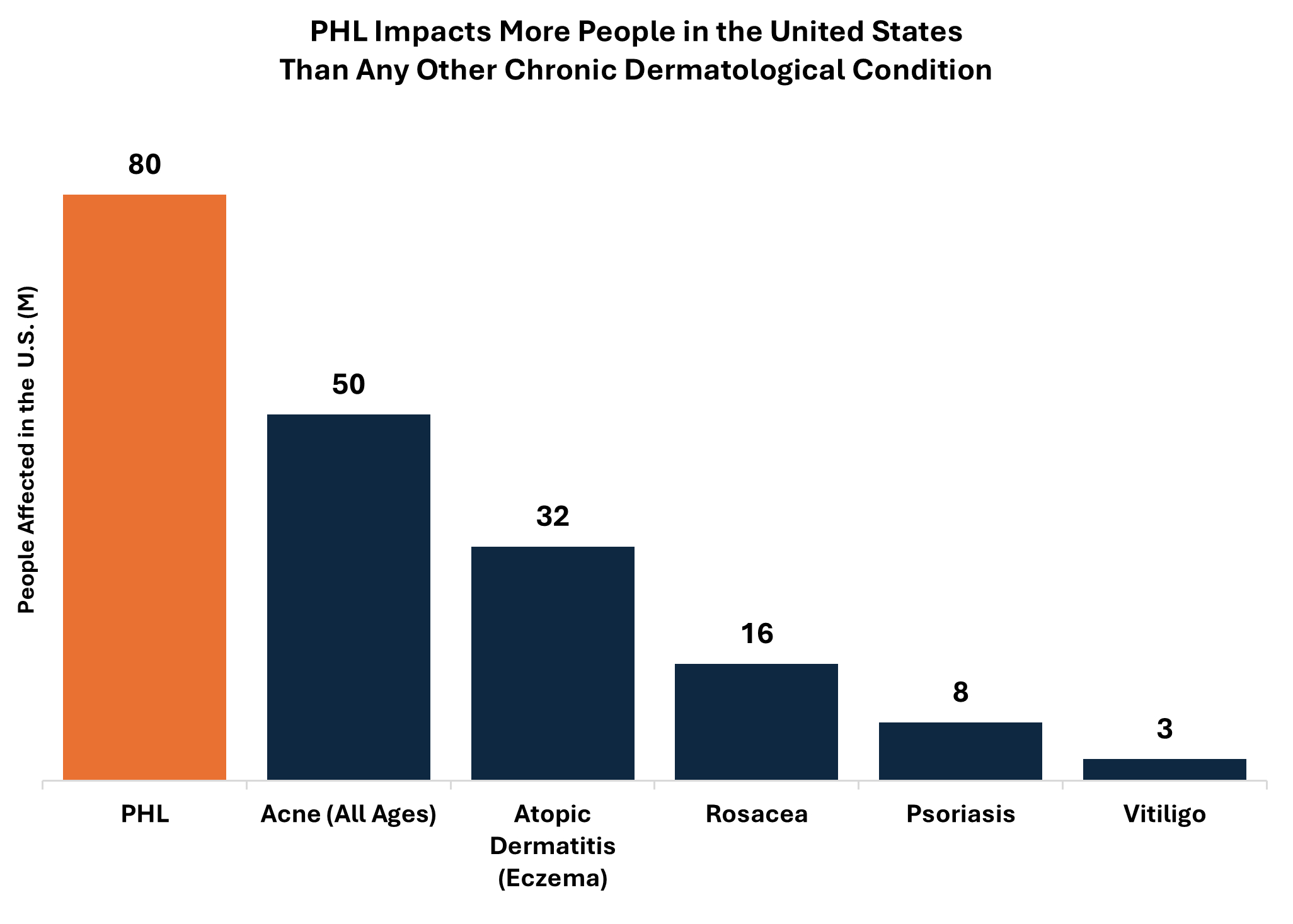

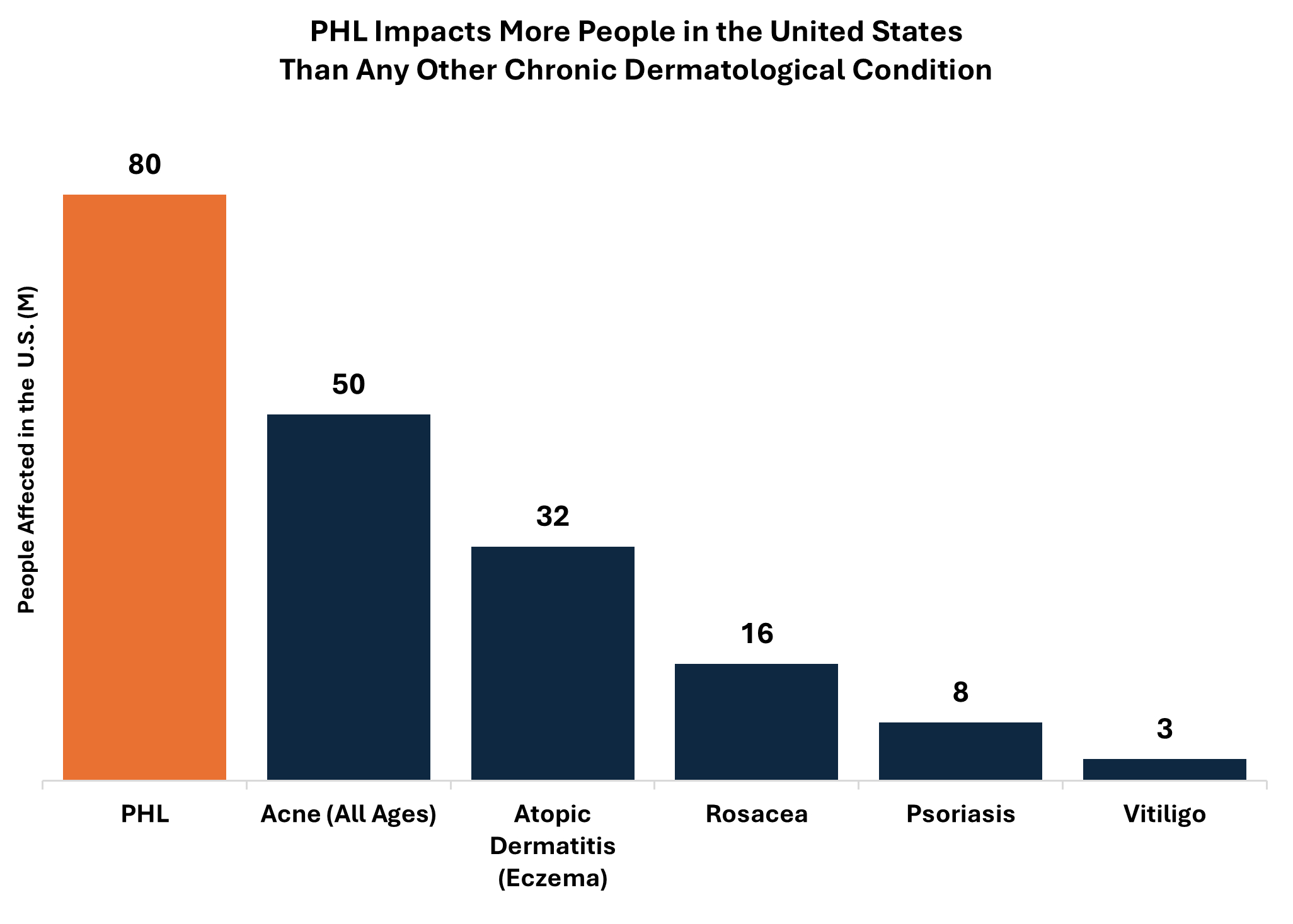

We are a dermatologist-founded, late clinical-stage biopharmaceutical company focused on developing innovative therapeutics to address pervasive treatment challenges in highly prevalent aesthetic and dermatological conditions. Our initial focus is developing better treatments for pattern hair loss, or PHL, a condition affecting approximately 50 million men and 30 million women in the United States. Current PHL treatment options are limited and therefore are consistently plagued with high rates of treatment failure, patient dissatisfaction and treatment discontinuation. Patients and healthcare providers routinely identify the following shortcomings with currently available treatment options:

nSlow onset of hair growth

nInconsistent results

nInsufficient density of hair growth for patient satisfaction

nTolerability issues related to hormonal, mood and cardiac side effects

nInconvenient administration

nLimited U.S. Food and Drug Administration, or FDA, approved treatment options, and no FDA-approved oral options for women

We are developing VDPHL01 as an oral, non-hormonal treatment for men and women with PHL to reduce the barriers to wide adoption of chronic hair loss therapy and potentially transform PHL treatment. We believe that a marketing application could initially seek approval in male patients, followed by a supplemental new drug application, or sNDA, for female patients, or could alternatively pursue approval in both male and female patients simultaneously depending on the timing of the completion of our clinical trials.

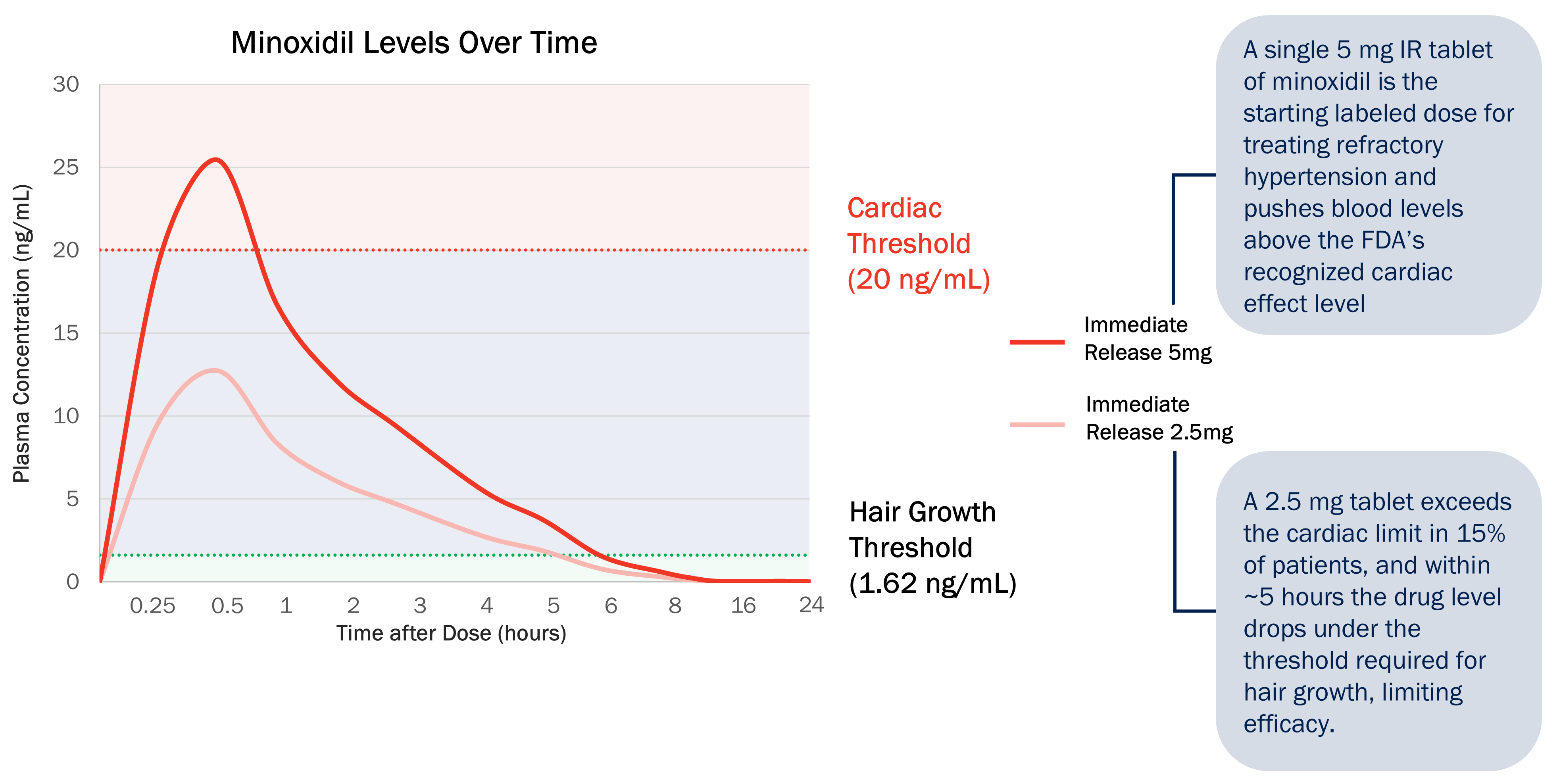

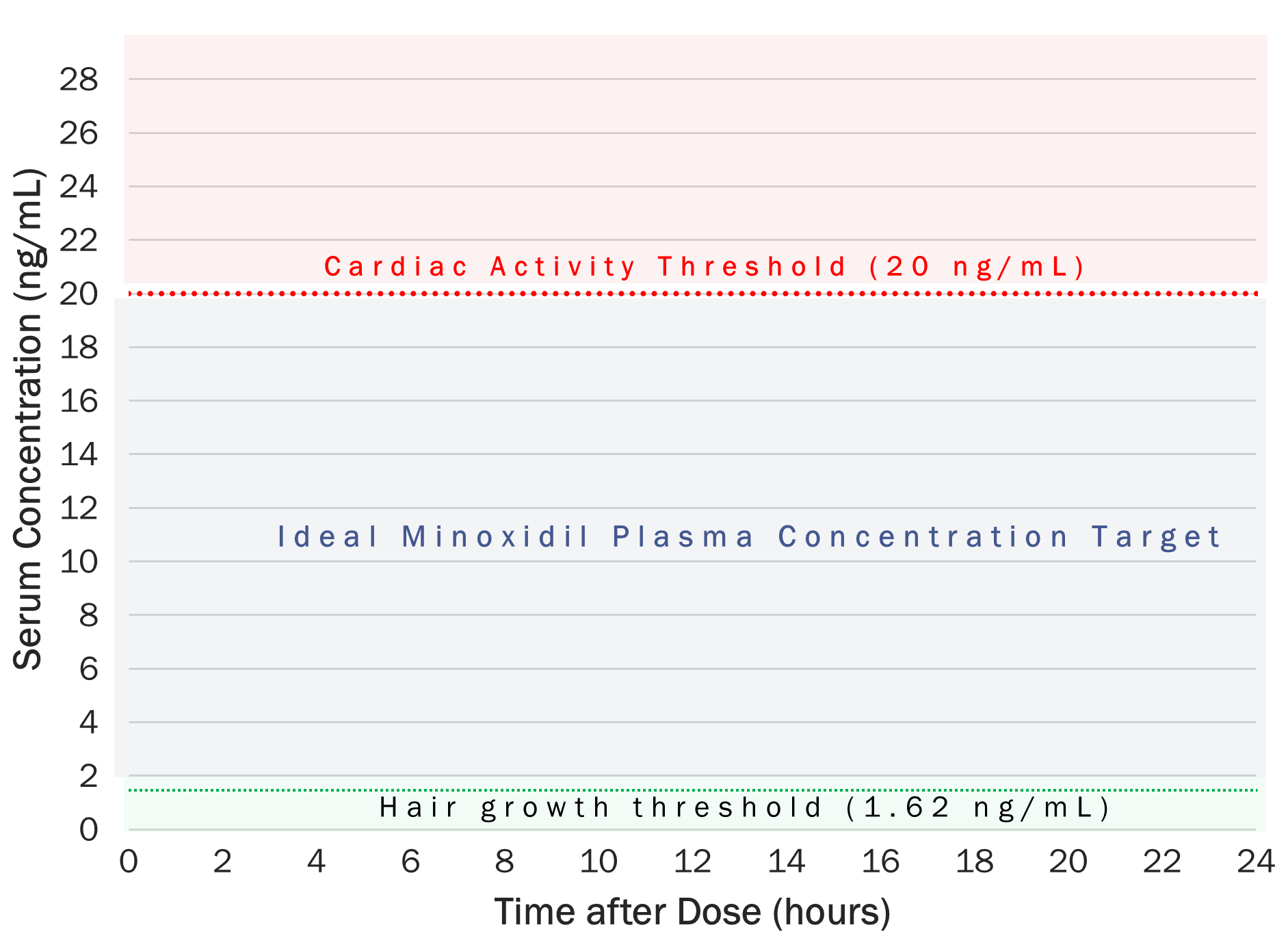

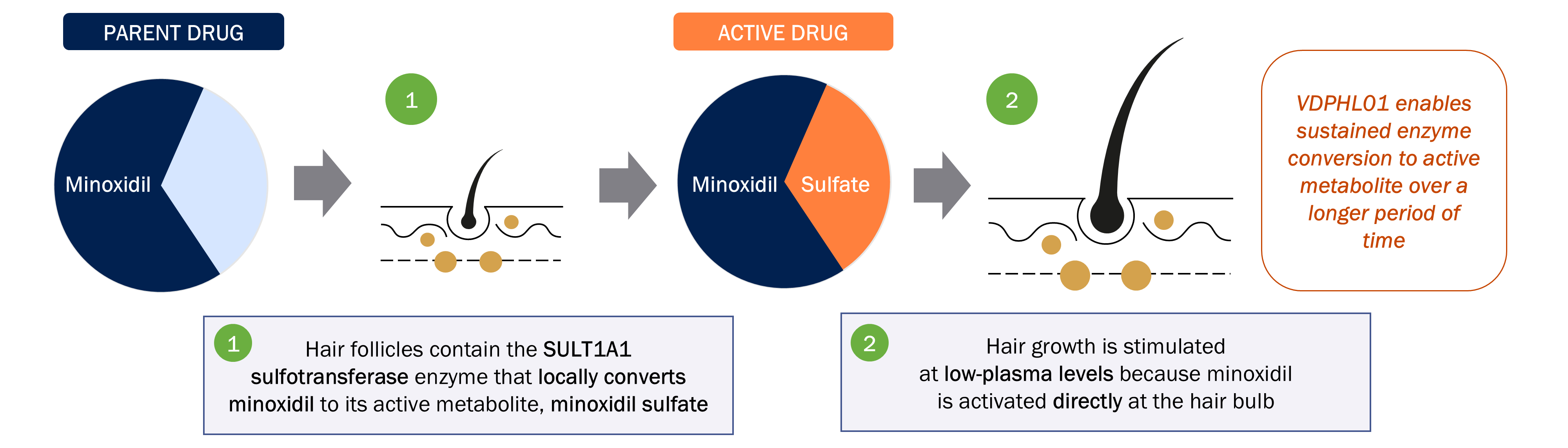

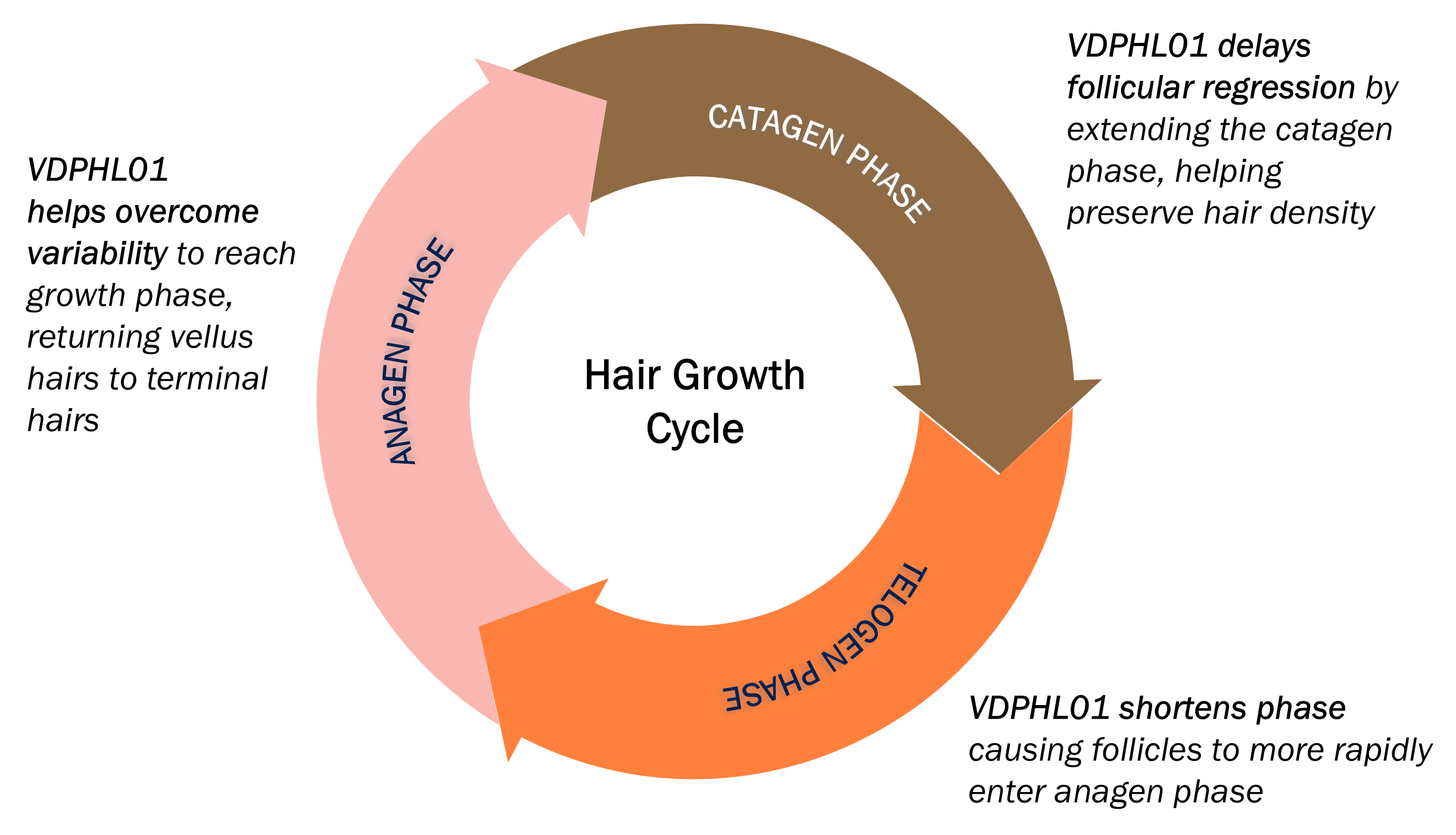

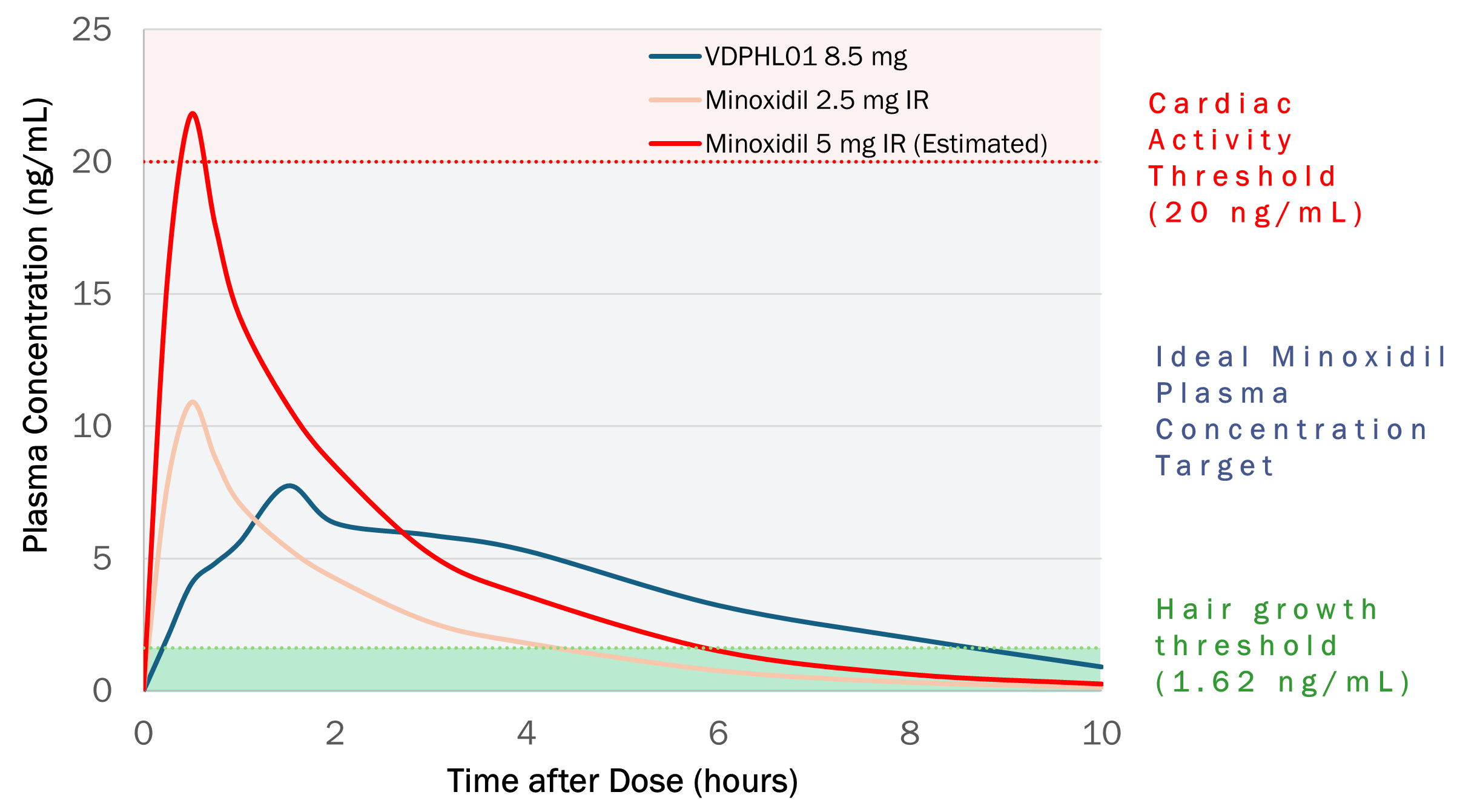

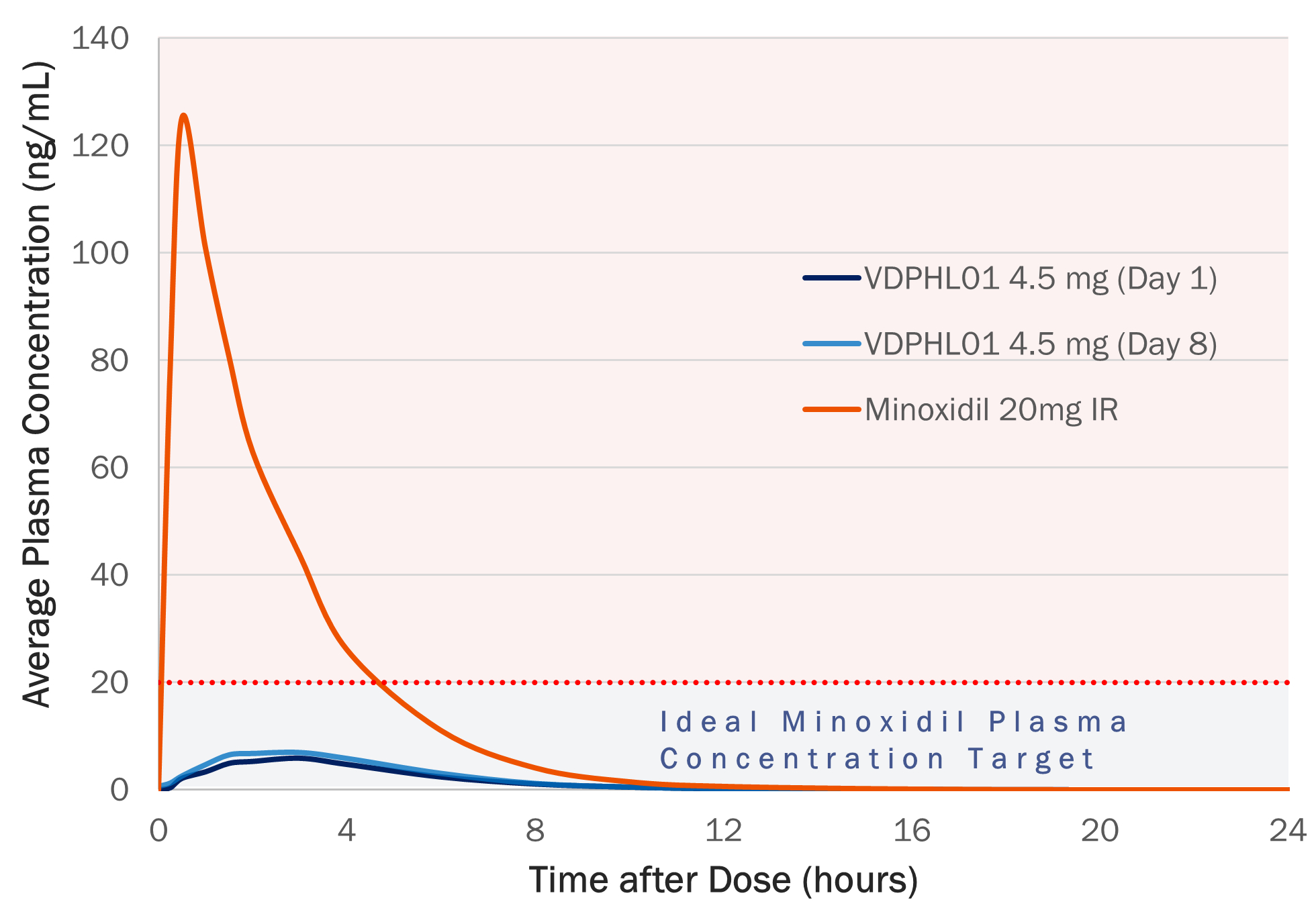

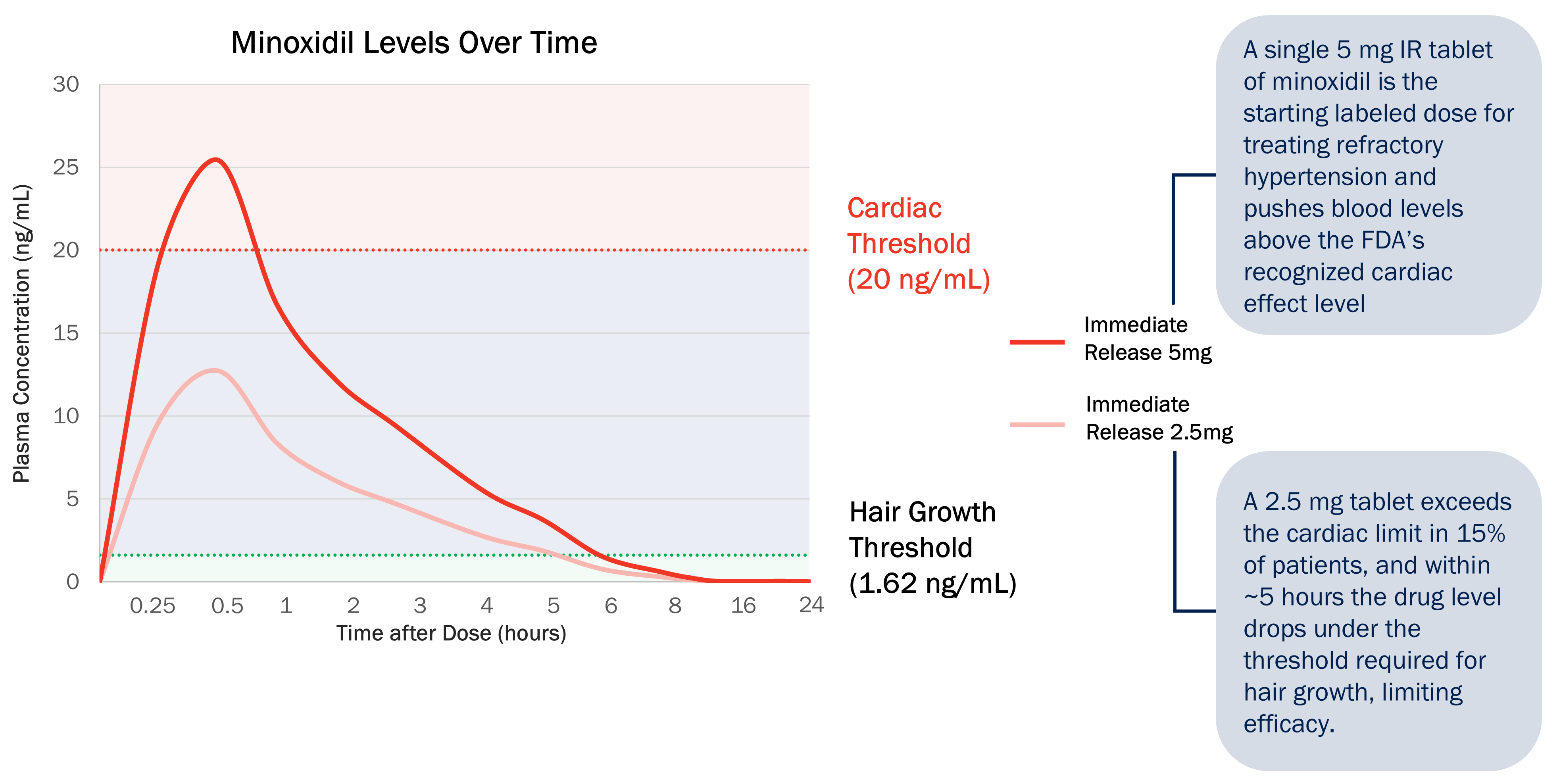

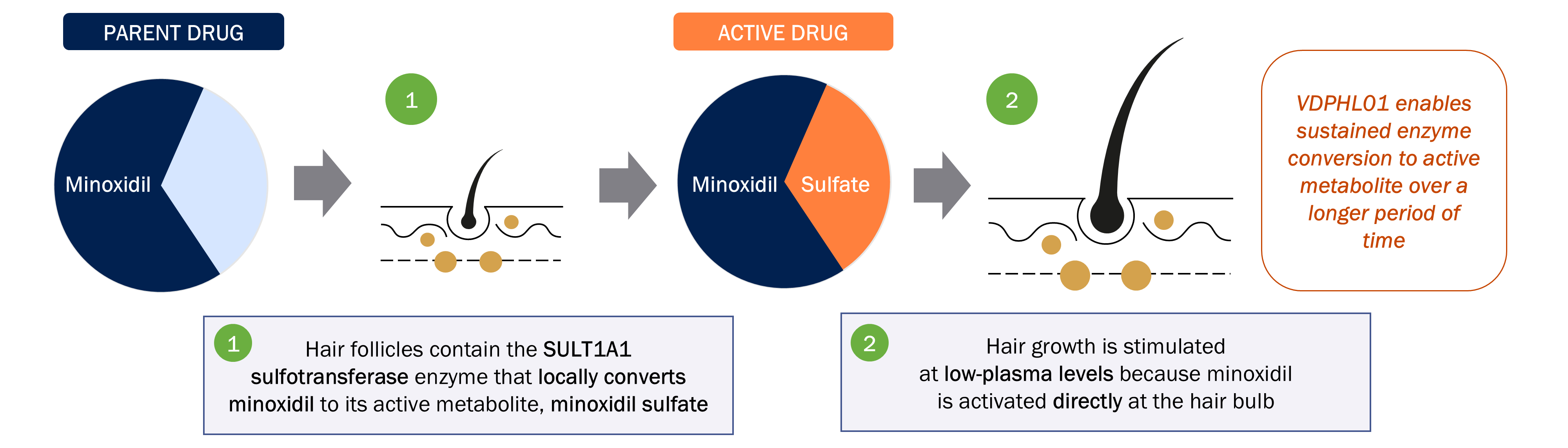

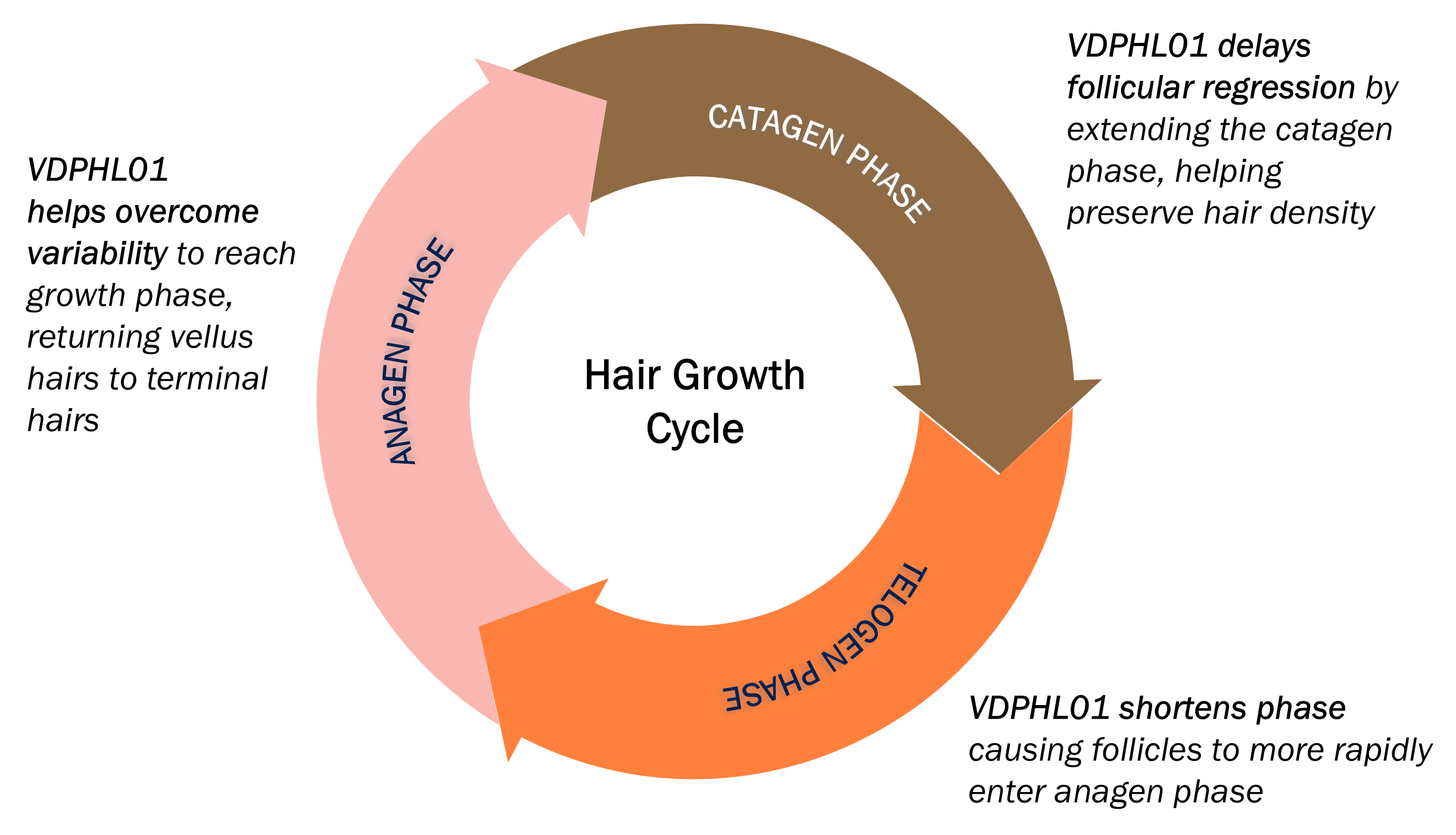

VDPHL01 is an oral, extended-release, or ER, formulation of minoxidil, a proven hair growth agent, designed to maximize minoxidil’s impact on hair restoration while minimizing the risk of cardiac activity. Though immediate-release, or IR, oral minoxidil was originally designed to treat resistant hypertension, it has been used off label as a treatment for PHL after hair growth was observed as a side effect. However, IR oral minoxidil’s release profile was not designed for hair growth as its short duration of circulation allows less time for follicular saturation and must be used at lower doses to reduce the likelihood of reaching off target cardiac stimulative levels. VDPHL01 builds on minoxidil’s validated hair growth biology via a novel and proprietary ER formulation designed to maximize the total plasma concentrations of minoxidil known to grow hair without inducing changes in cardiac activity. We believe that our efforts mark the first attempt to bring an ER formulation of minoxidil to patients with these optimized pharmacokinetic, or PK, and pharmacodynamic, or PD, qualities that raise the ceiling of hair growth.

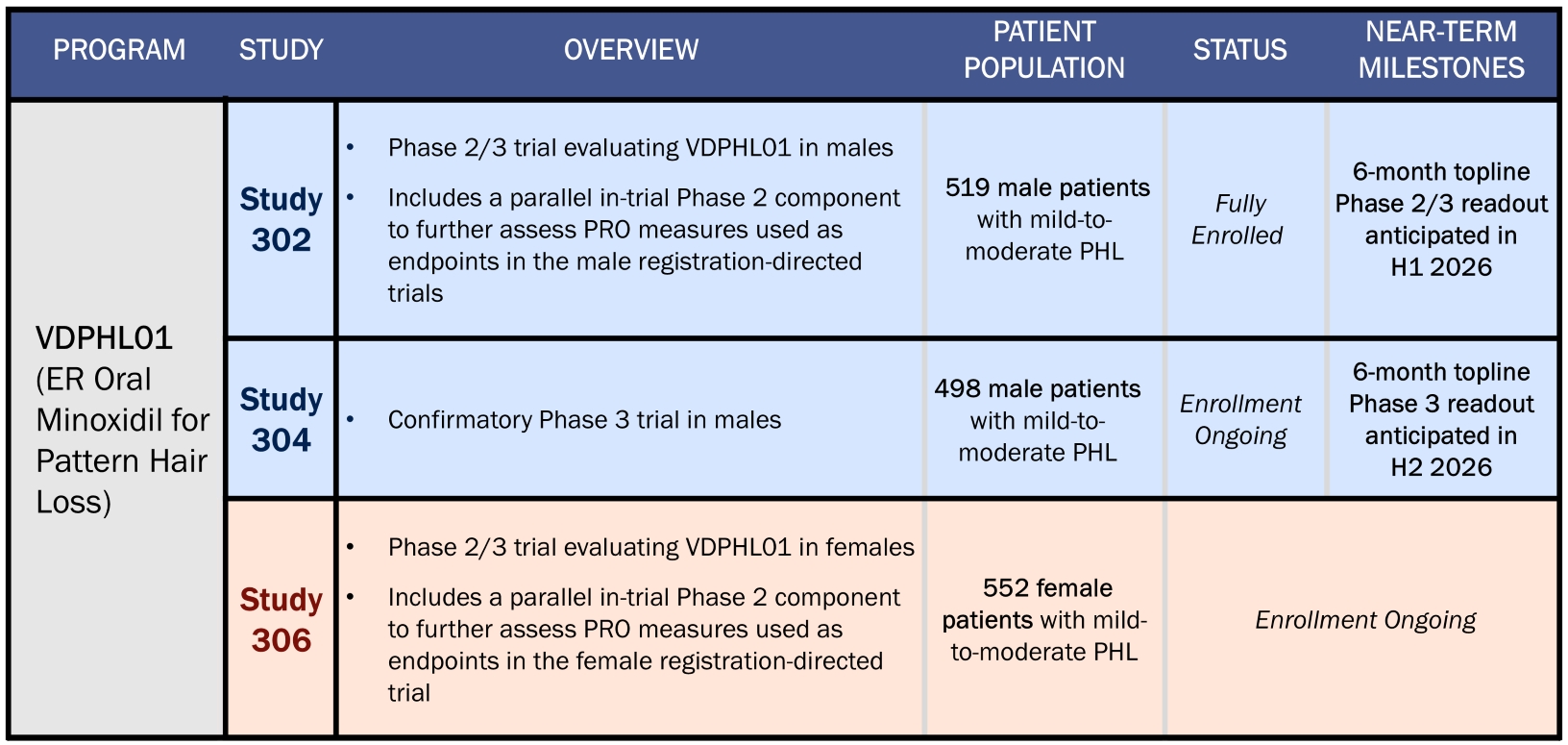

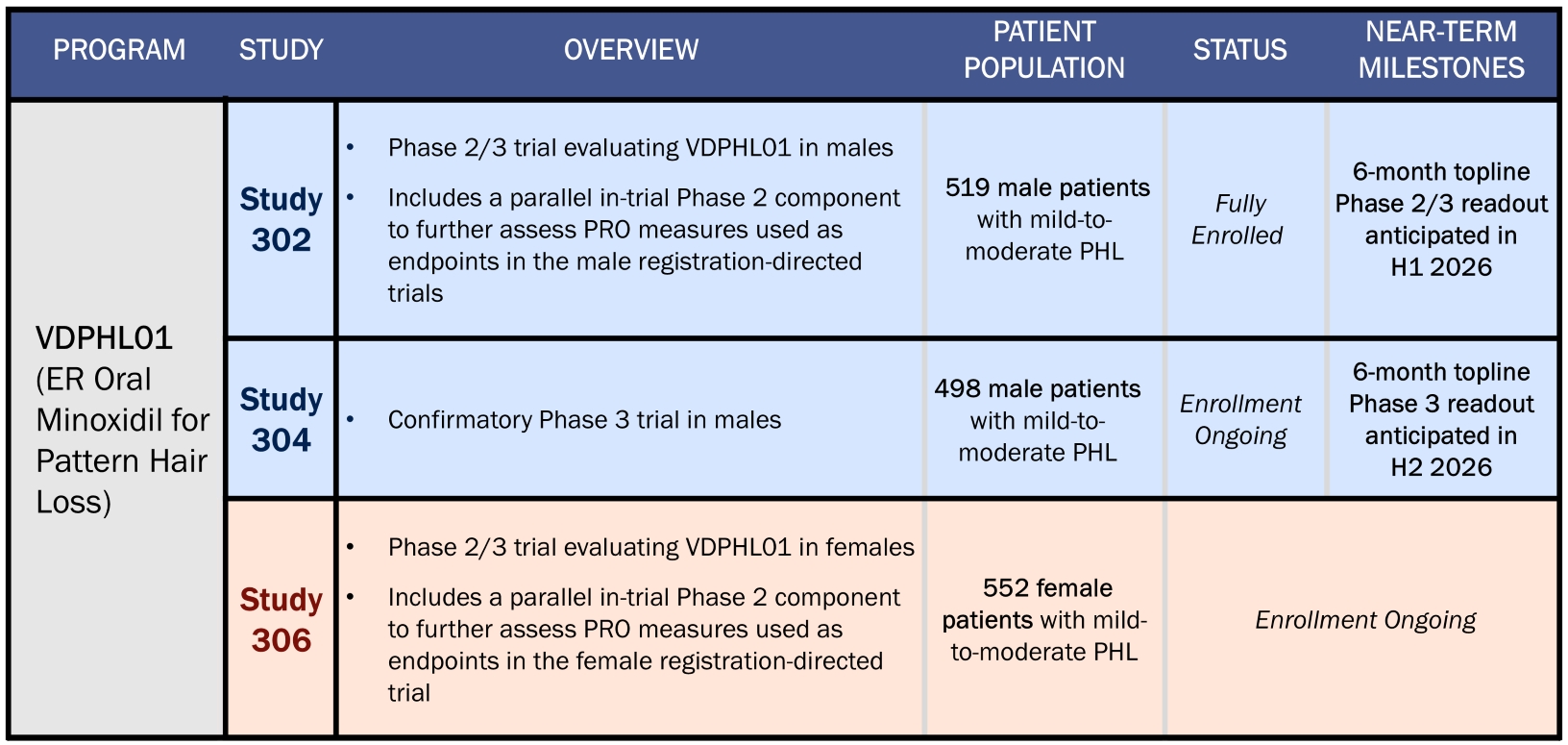

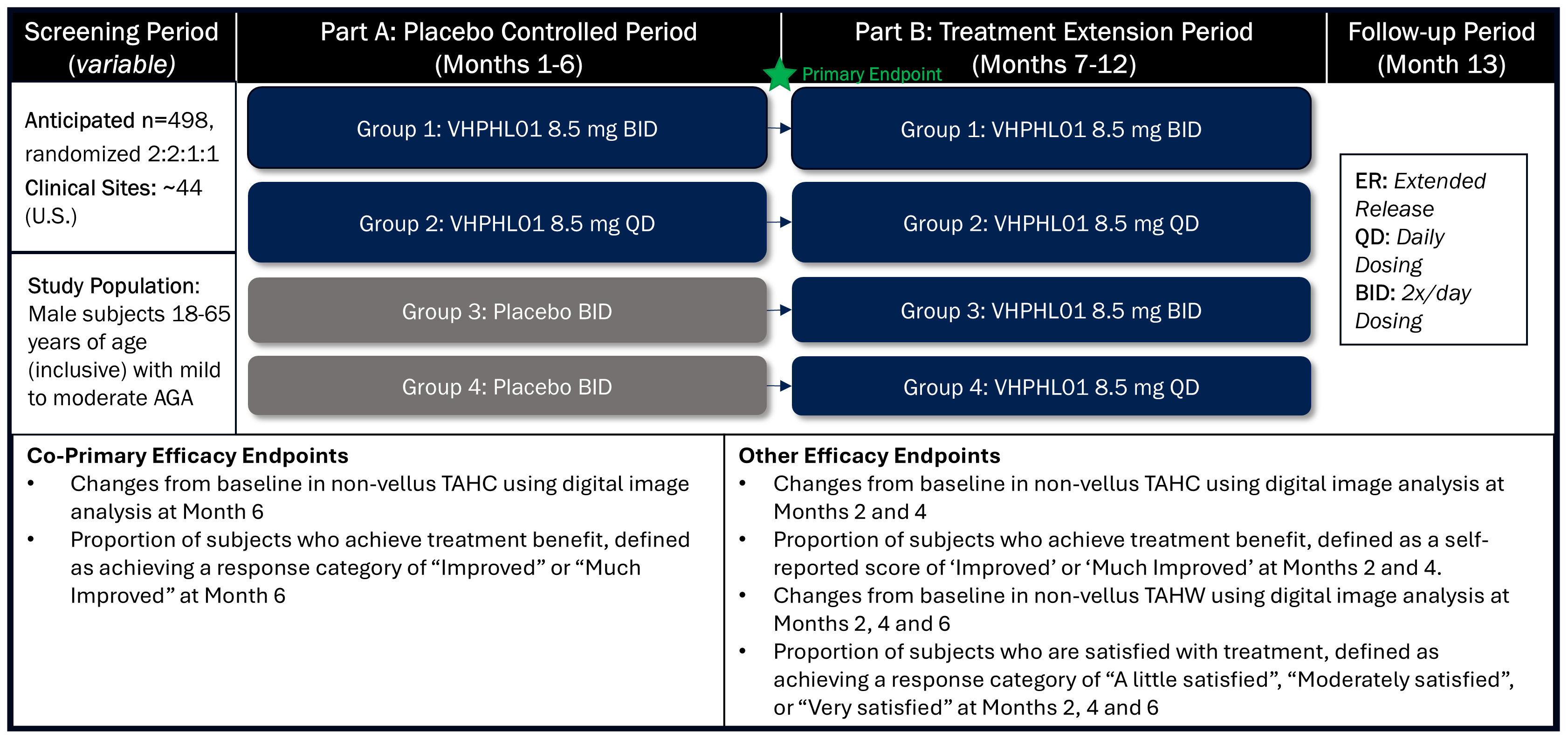

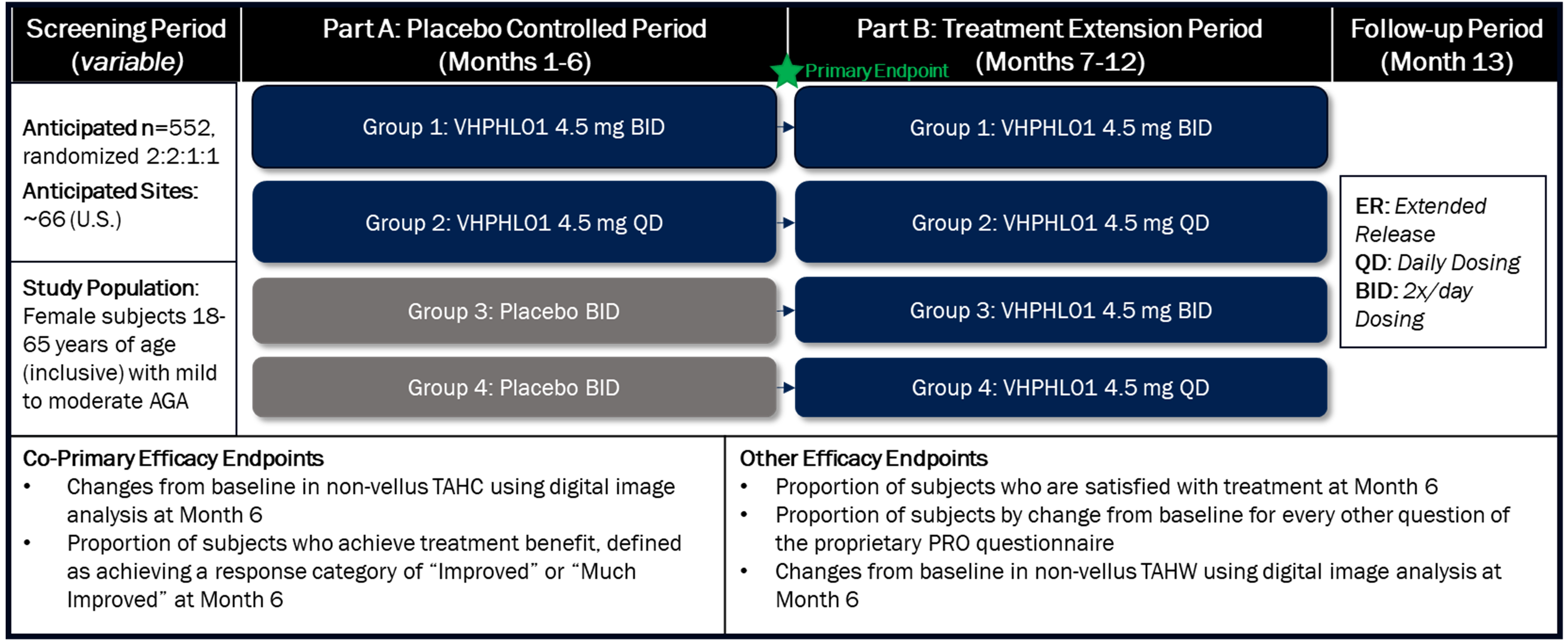

We are currently dosing patients with VDPHL01 in our registration-directed clinical program consisting of three pivotal, multi-center, randomized, double-blind, placebo-controlled clinical trials: two in male patients and one in female patients with PHL. These trials are designed to support our planned submissions to the FDA for regulatory approval across both male and female patient populations through a 505(b)(2) New Drug Application, or NDA. We have fully enrolled the first of these registration-directed clinical trials, a Phase 2/3 trial evaluating VDPHL01 in 519 male patients with mild-to-moderate PHL. This first trial assesses two dose regimens of VDPHL01 over 52 weeks of treatment. The co-primary endpoints are change in non-vellus hair count per square

centimeter and patient self-assessment of hair coverage benefit after 24 weeks from treatment initiation. We anticipate topline data from this clinical trial in the first half of 2026.

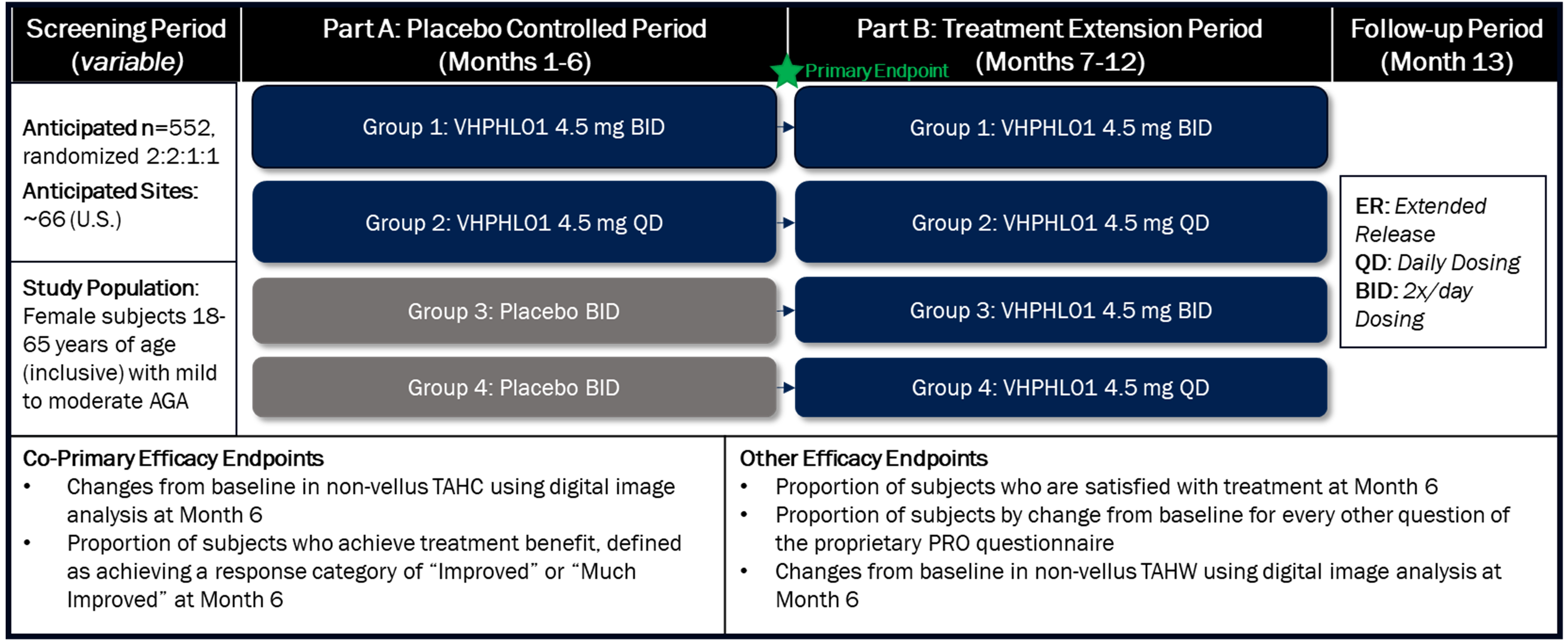

We have also initiated our confirmatory registration-directed Phase 3 trial targeting the enrollment of 498 male patients with mild-to-moderate PHL and our registrational-directed Phase 2/3 trial targeting the enrollment of 552 female patients with mild-to-moderate PHL. We expect to report data from this male Phase 3 trial in the second half of 2026. Enrollment in the female Phase 2/3 trial is ongoing and our projected time to topline data will be determined as the trial progresses. The clinical trials designated as Phase 2/3 are designed and conducted as registration-directed Phase 3 trials to support the planned marketing application, or NDA, for VDPHL01 for the treatment of PHL. The Phase 2/3 trials include a parallel Phase 2 component intended to further assess proprietary patient-reported outcome, or PRO, measures used as endpoints in all three registration-directed trials.

In a Phase 1 clinical trial, which we refer to as Study QSC300720, we studied VDPHL01 prototypes in doses up to 10 mg against a single reference dose of commercially available 2.5 mg IR oral minoxidil. When comparing the results of VDPHL01 8.5 mg with 2.5 mg IR oral minoxidil in male patients who were administered both dosage forms in this study, we found that VDPHL01 8.5 mg:

ndelivered nearly twice the total amount of minoxidil in plasma over 12 hours than the total amount delivered by the 2.5 mg IR oral minoxidil tablet;

nsustained plasma concentrations above minoxidil's hair growth threshold two times longer than a 2.5 mg IR oral minoxidil tablet;

nmaintained peak concentrations below the threshold at which signs of cardiac activity are typically observed; and

nwas generally well tolerated with no serious adverse events, or SAEs, observed.

As this study was exploratory, no formal sample size calculation was made related to statistical power. The data presented above are reflective of the study’s per-protocol primary objective, namely, to evaluate the PK profile and determine the relative bioavailability of VDPHL01 following single oral dosing of VDPHL01 versus the reference IR oral minoxidil formulation in healthy subjects.

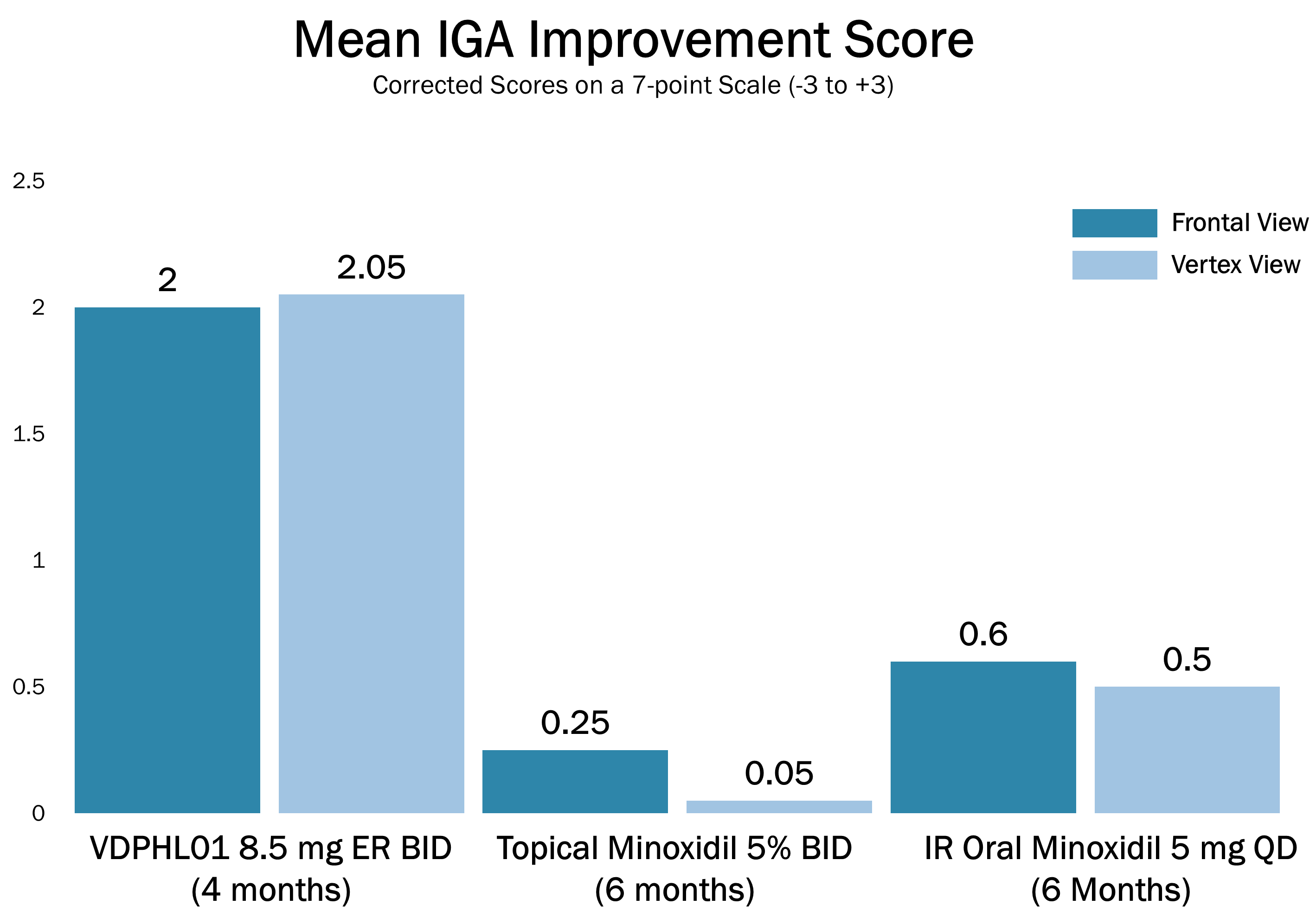

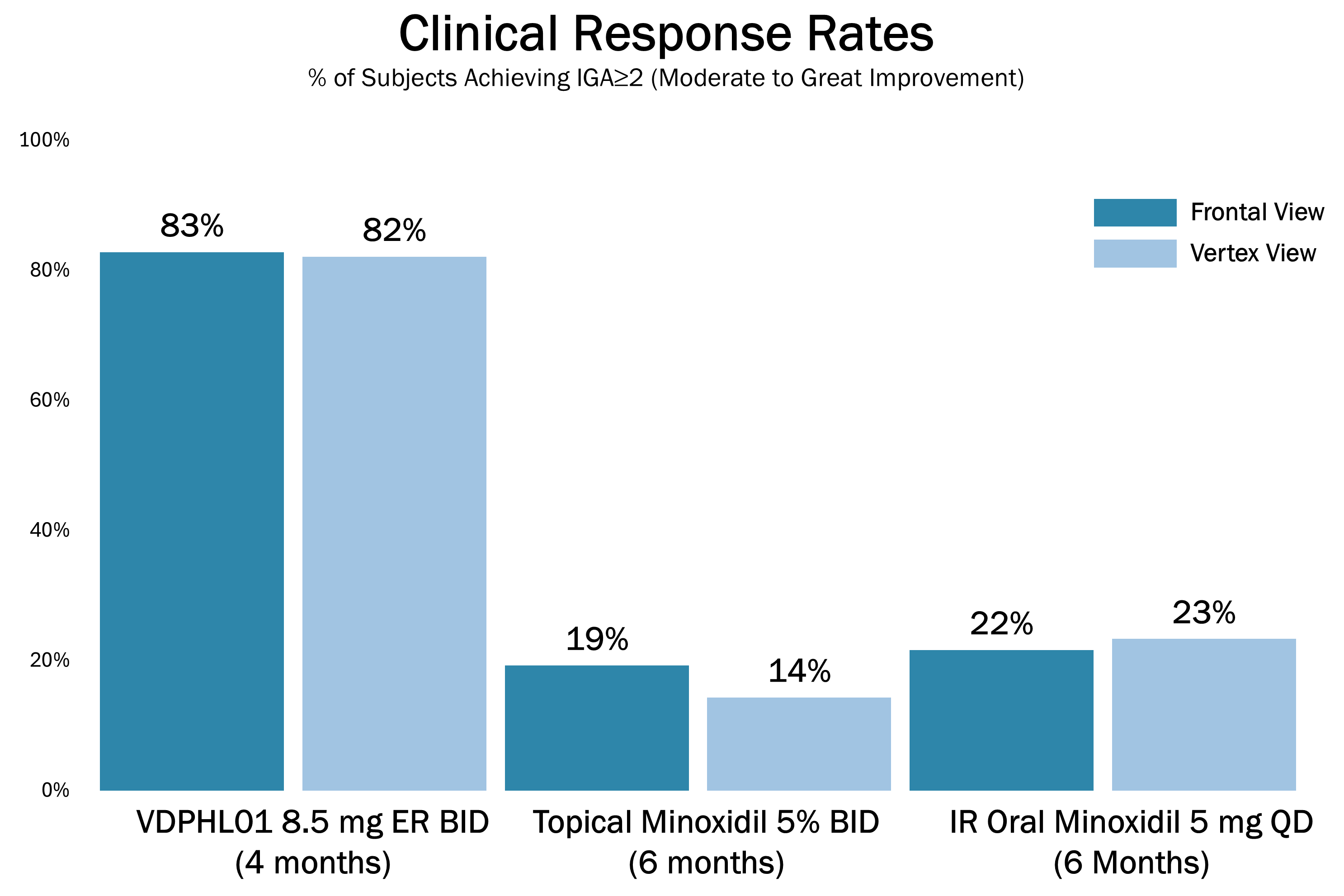

We are currently conducting a Phase 2 clinical trial evaluating VDPHL01 in male patients and female patients with mild-to-moderate PHL. As this trial is exploratory, no formal sample size calculation was made related to statistical power. Therefore, all trial endpoints, including objective hair count measures and subjective patient and investigator assessments, are exploratory and are planned to be reported as descriptive statistics. In October 2025, we announced preliminary data from the male cohort for those who had completed four months of treatment in this trial (n=21; the female cohort, currently with 22 subjects dosing, initiated enrollment in this trial later than males, and similar data is not yet available).

The preliminary data show that VDPHL01 drove favorable outcomes, which we believe underscores its potential to deliver a convenient, oral treatment that provides visible hair regrowth to the majority of users as early as two months, while maintaining a favorable tolerability profile. We believe that the results of this trial support the emerging product profile for VDPHL01 with the following key attributes:

nSpeed: Visibly noticeable hair growth as early as two months after treatment in a majority of patients based on PRO, and an Investigator Global Assessment, or an IGA.

nConsistency: 90.5% treatment response at four months based on PRO of participants reporting “improved” or “much improved” hair coverage.

nIntensity: Average non-vellus (greater than 30 microns) hair count change of 47.3 hairs per cm2, with double digit absolute non-vellus hair count changes in greater than 90% of patients completing four months of treatment.

nSafety: Generally well tolerated, with no treatment-related SAEs, including no cardiac or hormonal-related issues to date.

nConvenience: Preference for oral over topical administration supported by third-party research.

nMarketability: Potential to be the first oral, non-hormonal FDA-approved therapy for PHL.

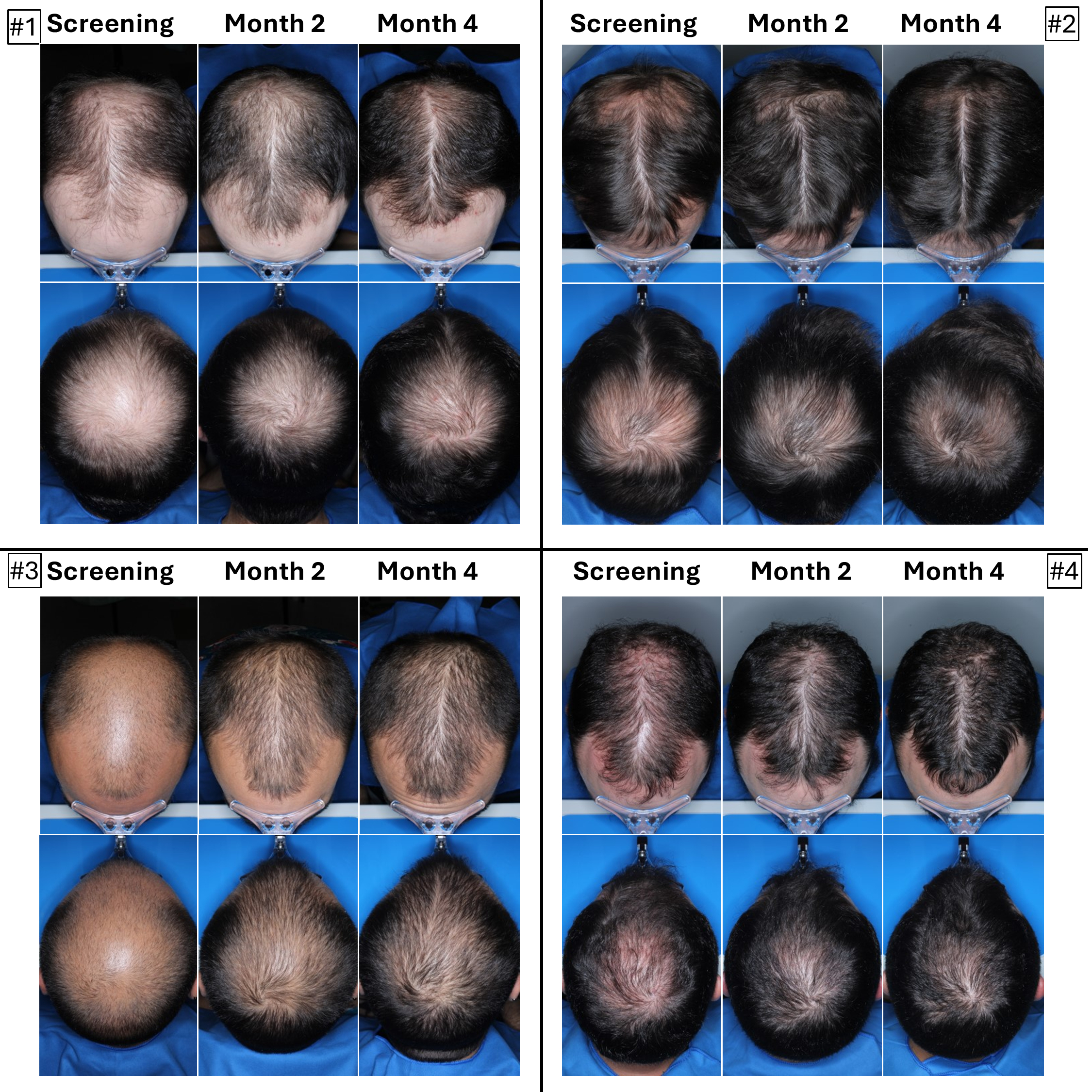

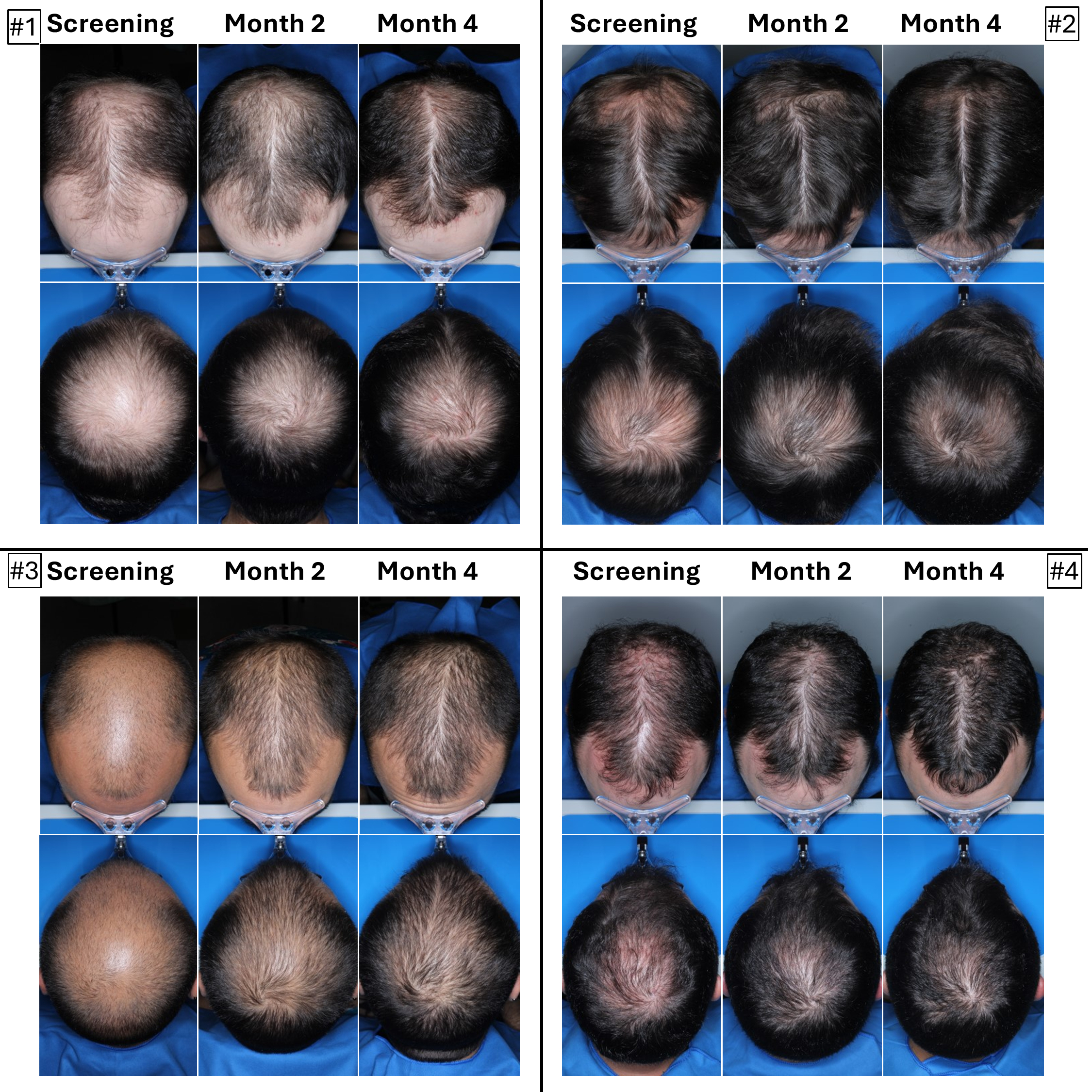

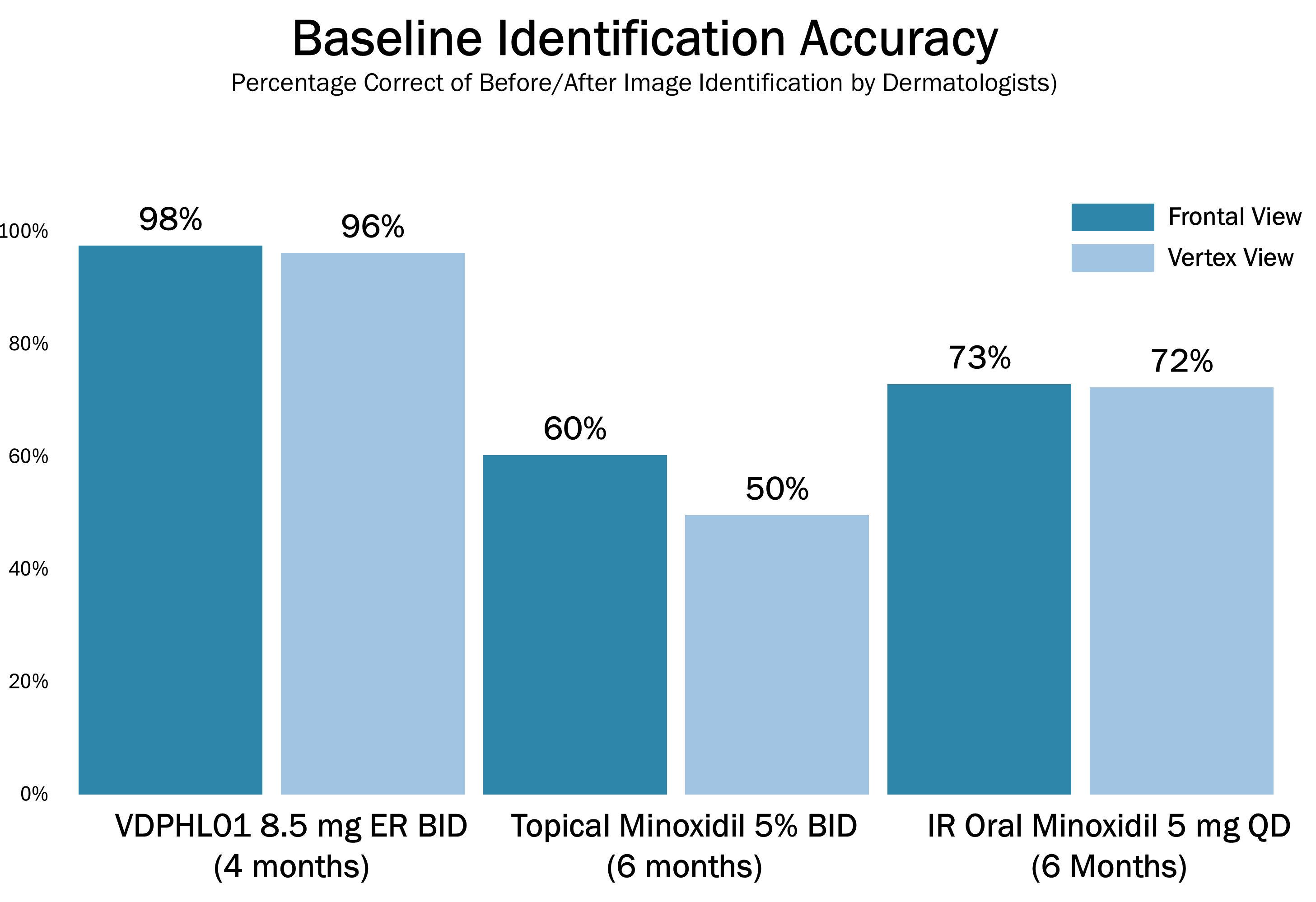

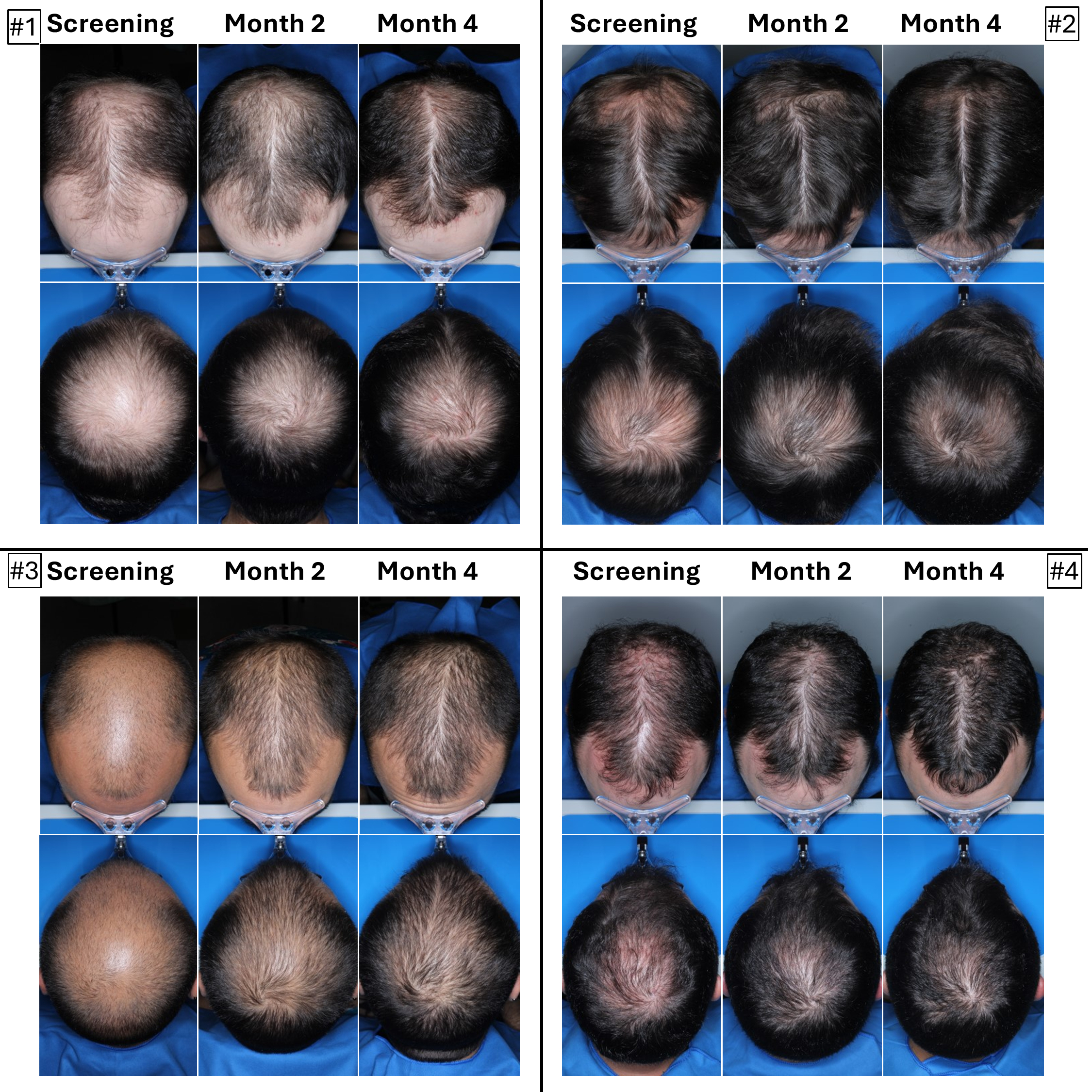

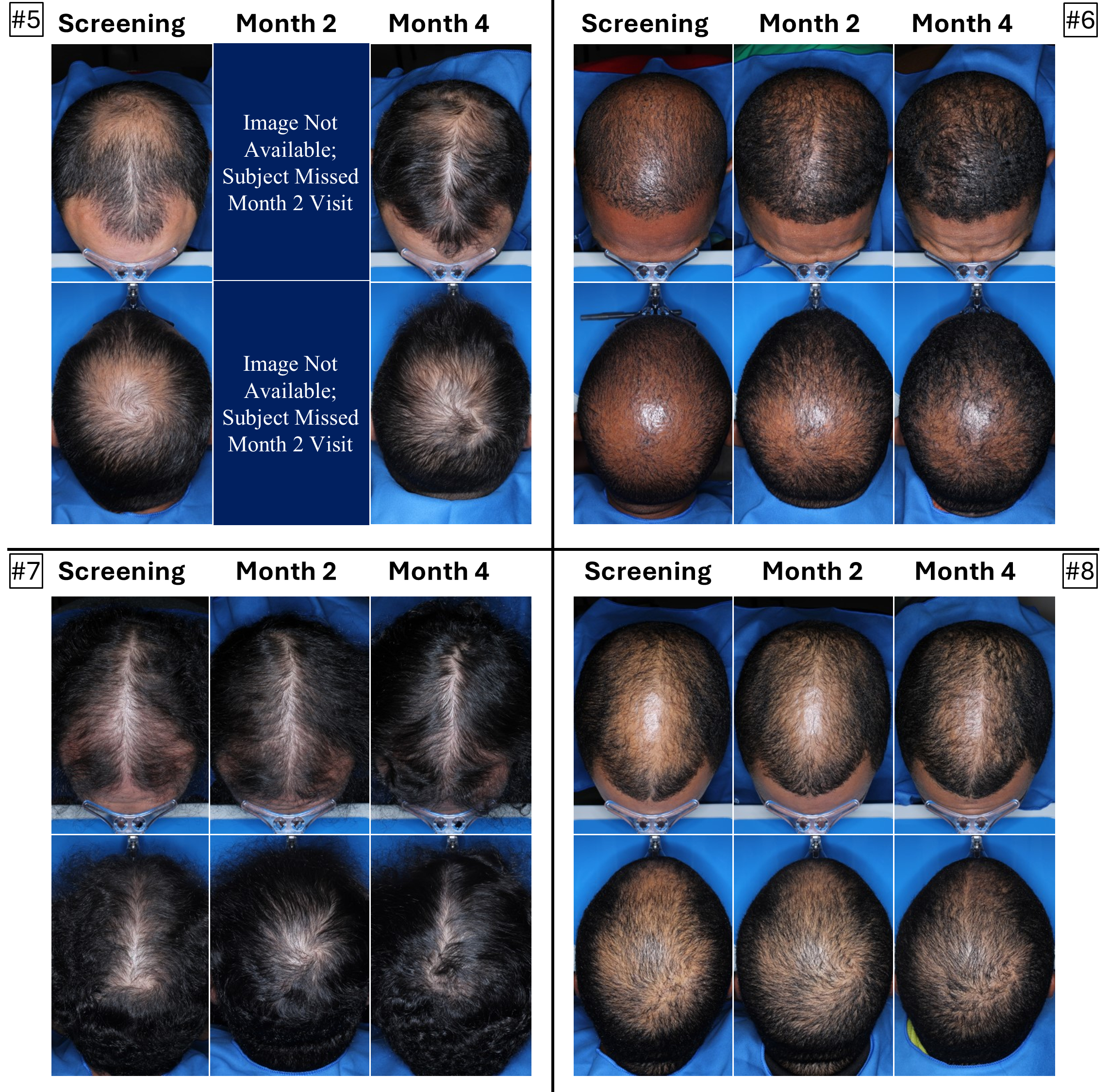

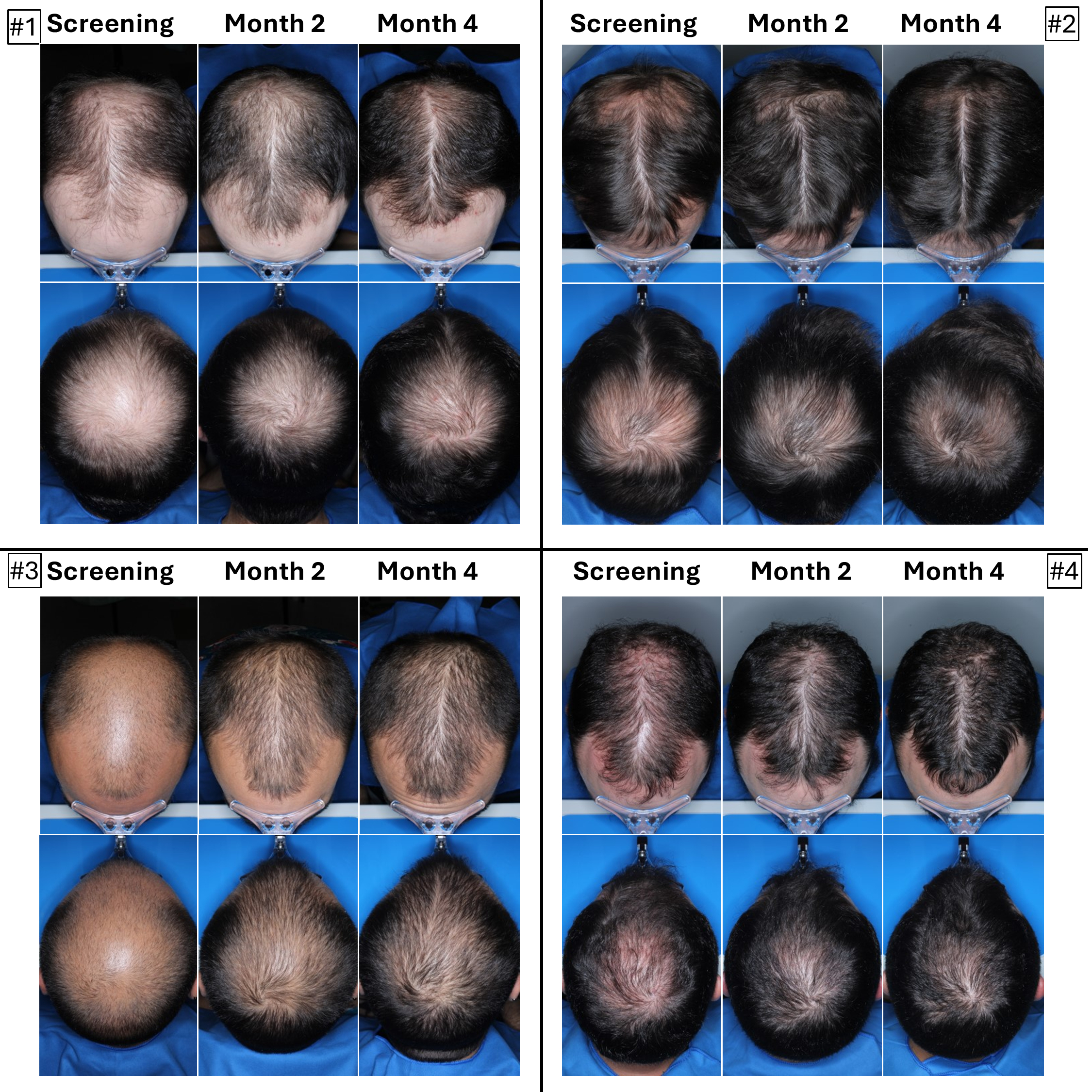

The below images are of the four patients, of 20 patients in the cohort as of August 2025, the time at which a blinded image analysis study was conducted. These patients were observed to have the highest average hair growth improvement scores as determined by expert graders using images from our Phase 2 clinical trial in male patients at month four. This blinded, retrospective image assessment study used image files containing before-and-after (in randomized order) scalp photographs from both the vertex and frontal view. These image files were reviewed independently by three U.S. board certified dermatologists who were blinded to treatment group and asked to identify the baseline image before assigning an IGA score for improvement using a 7-point Likert scale, a commonly used tool for assessing change in hair growth ranging from greatly decreased (-3) to greatly increased (+3) with intermediate categories of no change (0), slightly decreased/increased (-1/+1) and moderately decreased/increased (-2/+2). Images for patients from screening, month two and month four are presented in order (highest to lowest) of the average improvement scores at month four. Average IGA improvement scores shown represent average improvement scores as assessed by the blinded expert graders ranging from +2.7 (patient #4) to +3.0 (patient #1). See “—Our Solution for PHL: VDPHL01—Ongoing Studies—Study 207: Our Phase 2 Open Label Proof of Concept Trial” for the full set of images from the study (images are excluded for patients (n=1) with improvement scores less than or equal to the 5th percentile or greater than or equal to the 95th percentile in both image views at month four).

This blinded, retrospective image assessment study used image files containing before-and-after (in randomized order) scalp photographs of each treatment from both the vertex and frontal view. These image files were reviewed independently by three U.S. board certified dermatologists who were blinded to treatment group and asked to identify the baseline image before assigning an IGA score for improvement using a 7-point Likert scale (–3 to +3), a commonly used tool for assessing hair growth, measuring whether scalp hair growth has “slightly,” “moderately,” or “greatly” increased or decreased or no change has occurred.

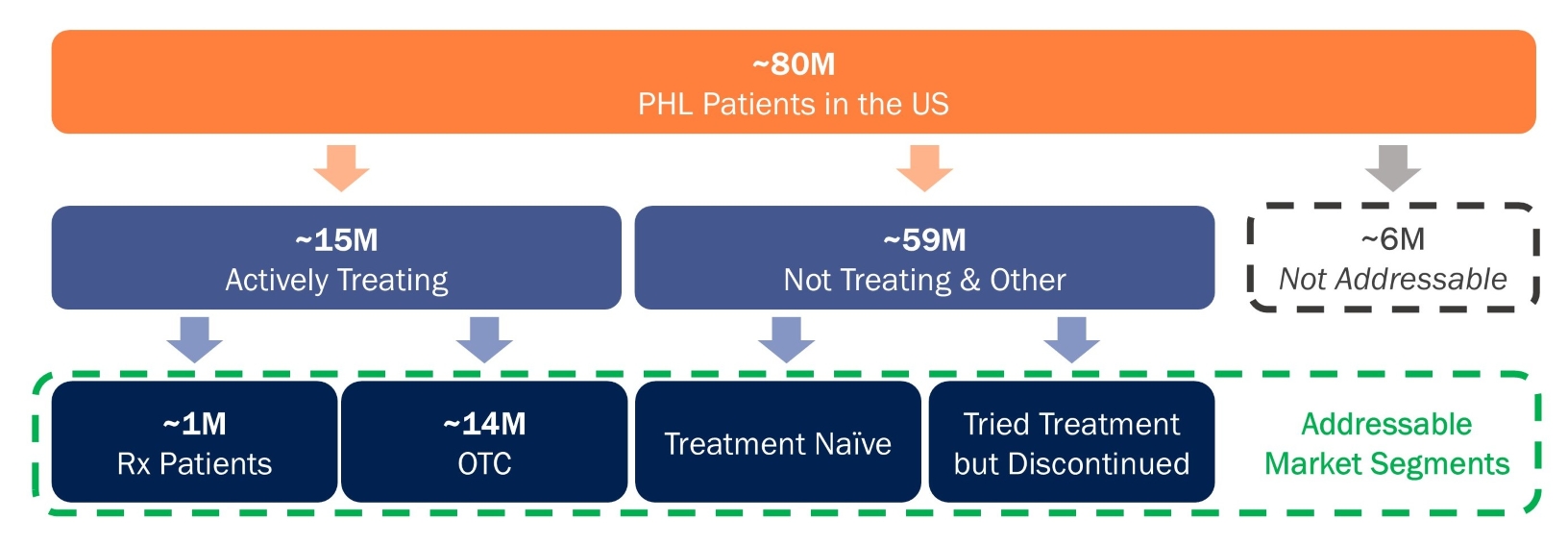

Our Phase 2 trial evaluating VDPHL01 in male patients and female patients with PHL is ongoing, and we have initiated three registration-directed trials evaluating VDPHL01, two in male patients with PHL and one in female patients with PHL. If approved, we believe VDPHL01’s commercial potential would be substantial, as we estimate that the current U.S. commercial opportunity for PHL treatments for men and women is valued at

approximately $9 billion annually, despite low patient engagement and high levels of dissatisfaction with current options reported. We believe that VDPHL01 could gain a meaningful share of this existing opportunity while also catalyzing substantial growth by offering a previously unavailable, transformative product profile to patients in an area of high unmet need. Our proprietary research indicates that 93% of patients would like to address their PHL yet only 9% are satisfied with their current treatment. Based on the initial product profile we have established for VDPHL01, we believe it could drive significant adoption in this large, motivated but underserved PHL patient population.

In anticipation of a potential NDA submission for VDPHL01 leveraging data from our registration-directed Phase 3 trials, we are developing a comprehensive multi-channel commercialization plan that will integrate patient identification, physician education, direct-to-consumer, or DTC, advertising, social media and telehealth engagement and customer care. This commercialization strategy will be designed to drive patient awareness of VDPHL01’s differentiated profile and demand for hair loss treatment. We believe that the success of analog therapies highlights both the unmet need and motivation among patients and reinforces the potential for VDPHL01 to create demand in a cash-pay market, convert over-the-counter, or OTC, patients to prescribed therapies and activate a population of untreated patients. We plan to focus commercial efforts at launch on establishing a dermatology-focused field force and conducting DTC advertising. We believe these commercial pillars will drive significant VDPHL01 adoption, if approved.

We maintain a broad library of patents and patent applications related to the key innovations of VDPHL01, including its method of utilizing an oral route of administration, ER formulation to stimulate hair growth as well as its optimized PK and PD qualities and profile. The earliest expiring patent term is 2043.

Our Pipeline

Our goal is to develop a focused portfolio of aesthetic dermatology product candidates targeting high-prevalence dermatologic conditions, with potential selective development of medical dermatology product candidates. We are advancing our lead product candidate, VDPHL01, in clinical trials as depicted below.

Our Team and Investors

Our team comprises a seasoned management team with deep connections in the dermatology physician and patient communities and expertise spanning dermatology, clinical development, regulatory affairs, operations, manufacturing and commercialization. The company is led by dermatologists who are well-regarded within the community, which we believe provides important credibility among physicians and insight into patient needs. Our corporate management team includes industry veterans with significant experience in both entrepreneurial

biotechnology and global pharmaceutical companies, and collectively, have authored more than 100 peer-reviewed publications. Our team has extensive late-stage clinical trial experience, having been involved in the successful development and approval of more than forty products. We are further supported by a board of directors comprised of thought-leading dermatologists, biotechnology industry leaders and corporate executives with collective decades of experience.

Since inception, we have raised $263.0 million from a broad syndicate of investors, including several leading investment advisers and life sciences funds, such as Longitude Capital, SR One, Surveyor Capital (a Citadel company), Suvretta Capital and Viking Global. Potential investors should not consider investments made by our existing investors when making a decision to purchase shares in this offering since our existing investors may have had different risk tolerances and paid less per share than the price at which the shares are being offered in this offering.

Our Competitive Strengths

We believe the following strengths will enable us to achieve our goal of becoming the leader in hair loss treatment:

nPotentially transformative late-stage lead product candidate, VDPHL01, innovating on validated science to address the millions of men and women suffering from PHL in the United States.

nClinical data to date supports a potentially differentiated profile for VDPHL01, with topline data from our initial registration-directed trial anticipated to read out in the first half of 2026.

nDermatology-rooted leadership with deep understanding of needs of PHL patients and physicians.

nComprehensive commercialization strategy to educate and engage physicians and patients.

nRobust intellectual property portfolio designed to protect the key innovations that drive VDPHL01’s therapeutic differentiation.

Our Strategy

Our goal is to develop a leading aesthetics- and dermatology-focused biopharmaceutical company that advances therapies to address significant unmet needs for large, underserved patient populations. In order to achieve this goal, we are currently advancing our lead candidate, VDPHL01, for the treatment of PHL. Our strategy involves the following key elements:

nEfficiently develop VDPHL01 through registration-directed trials to be the leading treatment of PHL for both men and women.

nBuild a sales and marketing organization focused on prescribers and dedicated to increasing patient awareness and activation.

nPosition for early and wide adoption through the cash-pay model.

nDeliver and commercialize VDPHL01, if approved, as the first FDA-approved oral treatment for female PHL.

nEvaluate strategic collaboration to maximize the value of our product candidates and deliver meaningful benefits to patients.

nIdentify additional solutions to pervasive unmet needs in dermatology.

Summary of Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks could materially and adversely impact our business, financial condition and results of operations, which could cause the trading price of our common stock to decline and could result in a loss of all or part of your investment. Additional risks, beyond those summarized below or discussed elsewhere in this prospectus, may apply to our business, activities or operations as currently

conducted or as we may conduct them in the future or in the markets in which we operate or may in the future operate. These risks include the following:

nWe are a clinical-stage biopharmaceutical company with a limited operating history and no products approved for commercial sale. We have incurred substantial losses since our inception, and we anticipate incurring substantial and increasing losses for the foreseeable future;

nEven if this offering is successful, we will require substantial additional financing to achieve our goals, and failure to obtain additional capital when needed, or on acceptable terms, would cause us to delay, limit, reduce or terminate our product development or commercialization efforts;

nWe currently anticipate that our success will depend on the approval and successful commercialization of VDPHL01, which is our lead product candidate. If we are unable to obtain regulatory approval for, and successfully commercialize, VDPHL01, or any of our other current or future product candidates, or experience significant delays in doing so, our business will be materially harmed;

nPreclinical and clinical development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future preclinical studies or clinical trial results. We may encounter substantial delays in preclinical and clinical trials, or may not be able to conduct or complete preclinical or clinical trials on the expected timelines, if at all. If our preclinical studies and clinical trials are not sufficient to support regulatory approval of any of our product candidates, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development of such product candidate;

nIf the FDA does not conclude that VDPHL01 satisfies the requirements for the Section 505(b)(2) regulatory approval pathway, or if the requirements for VDPHL01 under Section 505(b)(2) are not as we expect, the approval pathway for those product candidates will likely take significantly longer, cost significantly more and entail significantly greater complications and risks than anticipated, and in either case may not be successful;

nAny significant AEs or undesirable side effects caused by our product candidates may delay or prevent regulatory approval or market acceptance of our product candidates, or result in significant negative consequences following marketing approval, if any. Additionally, the clinical profile of VDPHL01 in female patients may differ from the clinical profile in male patients, and the outcomes observed to date in male patients may not be reflective or predictive of future outcomes for female patients;

nWe operate in highly competitive markets and face competition from large, well-established companies with significant resources as well as other entities, and, as a result, we may not be able to compete effectively;

nWe currently have limited marketing, sales or distribution infrastructure. If we are unable to fully develop our sales, marketing and distribution capability on our own or through collaborations with marketing partners, we may not be successful in commercializing our product candidates;

nEven if we obtain regulatory approval for VDPHL01 or any other product candidates, such products may fail to achieve market acceptance which would adversely affect our efforts to commercialize any such product successfully;

nThe commercial opportunity for VDPHL01 and any of our other current or future product candidates we may develop may be smaller than we expect;

nOur strategy of focusing on the cash-pay healthcare market for VDPHL01 may limit our ability to increase sales or achieve profitability;

nIf we fail to effectively maintain, promote, and enhance our reputation and VDPHL01 brand recognition in a cost-effective manner, our business and competitive advantage may be harmed;

nWe are dependent on the services of our senior management and other key personnel, and if we are not able to retain these individuals or recruit additional management or key personnel, our business will suffer;

nWe will need to grow our organization, and we may experience difficulties in managing our growth and expanding our operations, which could adversely affect our business;

nOur commercial success depends on our ability to obtain and maintain sufficient intellectual property protection for VDPHL01 and our other current and any future product candidates and other proprietary technologies;

nIf the scope of any patent protection we obtain is not sufficiently broad, or if we lose any of our patent protection, our ability to prevent our competitors from commercializing similar or identical product candidates would be adversely affected;

nWe may not be able to protect our intellectual property rights throughout the world;

nThe regulatory approval process is highly uncertain, and we may be unable to obtain, or may be delayed in obtaining, U.S. regulatory approval and, as a result, unable to commercialize our product candidates or any future product candidates. Even if we believe our current, or planned clinical trials are successful, regulatory authorities may not agree that they provide adequate data on safety or efficacy;

nEven if we receive regulatory approval for any of our product candidates, we will be subject to ongoing regulatory obligations and continued regulatory review, which may result in significant additional expense. Additionally, our product candidates, if approved, could be subject to labeling and other restrictions and market withdrawal. We may also be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our product candidates;

nWe currently rely on third parties for the manufacture of drug or biological substances for our preclinical studies and clinical trials and expect to continue to do so for commercialization of any product candidates that we may develop that are approved for marketing. Our reliance on third parties may increase the risk that we will not have sufficient quantities of such drug substance, product candidates, or any products that we may develop and commercialize, or that such supply will not be available to us at an acceptable cost, which could delay, prevent, or impair our development or commercialization efforts;

nWe have relied and expect to continue to rely on third parties to conduct our preclinical studies and clinical trials. If those third parties do not perform as contractually required, fail to satisfy legal or regulatory requirements, miss deadlines or terminate the relationship, our development programs could be delayed, more costly or unsuccessful, and we may never be able to seek or obtain regulatory approval for or commercialize our product candidates;

nAn active and liquid trading market for our common stock may not develop, and you may not be able to resell your shares of common stock at or above the public offering price, if at all; and

nThe market price of our common stock may be volatile, which could result in substantial losses for investors purchasing shares in this offering.

The foregoing is only a summary of some of our risks. For a more detailed discussion of these and other risks you should consider before making an investment in our common stock, see “Risk Factors.” Our Corporate Information

We were originally incorporated on October 5, 2019, as VeraDermics, Incorporated, a Texas corporation. On September 15, 2021, we converted to a Delaware corporation. Our principal executive offices are located at 470 James St., New Haven, Connecticut 06513, and our telephone number is (228) 372-3376. Our corporate website address is www.veradermics.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies, including reduced disclosure about our executive compensation arrangements, exemption from the requirements to hold non-binding advisory votes on executive compensation and golden parachute payments and exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

We may take advantage of these exemptions until the last day of the fiscal year following the fifth anniversary of this offering or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company earlier if we have more than $1.235 billion in annual revenue, we have more than $700.0 million in market value of our stock held by non-affiliates (and we have been a public company for at least 12 months and have filed one Annual Report on Form 10-K) or we issue more than $1.0 billion of non-convertible debt securities over a three year period. For so long as we remain an emerging growth company, we are permitted, and intend, to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. We may choose to take advantage of some, but not all, of the available exemptions.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. In particular, in this prospectus, we have provided only two years of audited financial statements and have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected not to “opt out” of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we will adopt the new or revised standard at the time private companies adopt the new or revised standard and will do so until such time that we either (i) irrevocably elect to “opt out” of such extended transition period or (ii) no longer qualify as an emerging growth company. We may choose to early adopt any new or revised accounting standards whenever such early adoption is permitted for private companies. Therefore, the reported results of operations contained in our financial statements may not be directly comparable to those of other public companies.

We are also a “smaller reporting company,” meaning that the market value of our stock held by non-affiliates plus the proposed aggregate amount of gross proceeds to us as a result of this offering is less than $700.0 million and our annual revenue is less than $100.0 million during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our stock held by non-affiliates is less than $250.0 million or (ii) our annual revenue is less than $100.0 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700.0 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation. We may continue to be a smaller reporting company until the fiscal year following the determination that we no longer meet the requirements necessary to be considered a smaller reporting company.

THE OFFERING

| | | | | | | | |

| Common stock offered by us | | 13,350,000 shares. |

| | |

| Common stock to be outstanding after this offering | | 33,350,170 shares (35,352,670 shares if the underwriters exercise their option to purchase additional shares in full). |

| | |

| Underwriters’ option to purchase additional shares of common stock from us | | We have granted the underwriters an option to purchase up to an aggregate of 2,002,500 additional shares of common stock from us at the initial public offering price, less the estimated underwriting discounts and commissions, for a period of 30 days after the date of this prospectus. |

| | |

| Use of proceeds | | We estimate that our net proceeds from the sale of our common stock in this offering will be approximately $181.8 million, assuming an initial public offering price of $15.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering, together with our existing cash, cash equivalents and marketable securities, to advance VDPHL01 through NDA approval and initial commercialization in the United States, if approved. These funds will support physician education, brand awareness initiatives, marketing, pre-commercial and commercial launch activities, including building our commercialization infrastructure and manufacture of commercial supply, with any remaining proceeds for business development activities and other general corporate purposes. See “Use of Proceeds.” |

Indication of interest | | The cornerstone investor has indicated an interest in purchasing up to $30.0 million in shares of common stock in this offering at the initial public offering price. The shares of common stock to be purchased by the cornerstone investor will not be subject to a lock-up agreement with the underwriters. Because this indication of interest is not a binding agreement or commitment to purchase, the cornerstone investor may determine to purchase more, less or no shares in this offering or the underwriters may determine to sell more, less or no shares to the cornerstone investor. The underwriters will receive the same underwriting discounts and commissions on any of our shares of common stock purchased by the cornerstone investor as they will from any other shares of common stock sold to the public in this offering. The number of shares of common stock available for sale to the public will be reduced to the extent that the cornerstone investor purchases shares of common stock in the offering. |

| | |

| Risk factors | | You should carefully read the “Risk Factors” section of this prospectus and the other information included in this prospectus for a discussion of factors that you should consider before deciding to invest in our common stock. |

| | |

| Proposed New York Stock Exchange symbol | | “MANE” |

The number of shares of our common stock to be outstanding immediately following the consummation of this offering is based on 19,999,437 shares outstanding as of September 30, 2025, after giving effect to (i) the automatic conversion of all outstanding shares of our convertible preferred stock as of September 30, 2025 into an aggregate of 7,461,130 shares of our common stock and (ii) the automatic conversion of all outstanding shares of Series C Convertible Preferred Stock, or Series C Preferred Stock, issued after September 30, 2025

into an aggregate of 11,789,280 shares of our common stock, in each case immediately prior to the consummation of this offering. These amounts exclude:

n739,331 shares of our common stock issuable upon the exercise of stock options outstanding as of September 30, 2025, with a weighted average exercise price of $12.19 per share;

n2,974,637 shares of our common stock issuable upon the exercise of stock options granted after September 30, 2025, with a weighted average exercise price of $12.77 per share;

n685,080 shares of our common stock reserved for issuance under the VeraDermics, Incorporated 2021 Equity Incentive Plan, as amended, or the 2021 Plan, as of December 31, 2025, which will cease to be available for issuance at the time the Veradermics, Incorporated 2026 Incentive Plan, or the 2026 Plan, becomes effective and will be added to, and become available for issuance under, the 2026 Plan;

na number of shares of our common stock equal to 10.8% of shares issued and outstanding as of immediately following the consummation of this offering (not to exceed 4,518,426 shares) reserved for issuance under the 2026 Plan, which will become effective in connection with this offering (which includes up to 1,768,254 shares of common stock underlying stock option awards to be granted to certain of our directors, executive officers and other employees under the 2026 Plan upon the pricing of this offering with an exercise price per share equal to the initial public offering price per share), as well as any automatic increases in the number of shares of common stock reserved for future issuance thereunder; and

n316,668 shares of our common stock reserved for issuance under the Veradermics, Incorporated 2026 Employee Stock Purchase Plan, or the ESPP, which will become effective in connection with this offering.

Except as otherwise noted, all information in this prospectus assumes or gives effect to:

na 1-for-10.067 reverse stock split of our common stock, which was effected on January 27, 2026;

n(i) the automatic conversion of all outstanding shares of our convertible preferred stock as of September 30, 2025 into an aggregate of 7,461,130 shares of our common stock and (ii) the automatic conversion of all outstanding shares of Series C Preferred Stock issued after September 30, 2025 into an aggregate of 11,789,280 shares of our common stock, in each case immediately prior to the consummation of this offering;

nno exercise by the underwriters of their option to purchase up to an additional 2,002,500 shares of our common stock from us;

nthe filing and effectiveness of our restated certificate of incorporation and the adoption of our amended and restated bylaws immediately prior to the consummation of this offering; and

nno vesting or exercise of the outstanding stock options described above.

SUMMARY FINANCIAL DATA

You should read the following summary financial data together with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this prospectus and our financial statements and the related notes included elsewhere in this prospectus. The statements of operations for the years ended December 31, 2024 and 2023 have been derived from our audited financial statements included elsewhere in this prospectus. The statements of operations and comprehensive loss data for the nine months ended September 30, 2025 and 2024 and our balance sheet data as of September 30, 2025 have been derived from our unaudited financial statements included elsewhere in this prospectus. In the opinion of management, the unaudited financial data reflect all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of such financial information in those statements. Our historical results are not necessarily indicative of the results that may be expected in the future. The summary financial date in this section are not intended to replace the financial statements and the related notes thereto included elsewhere in this prospectus and are qualified in their entirety by those financial statements and the related notes. | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, | | Nine Months ended September 30, |

| (in thousands, except share and per share amounts) | 2024 | | 2023 | | 2025 | | 2024 |

| Operating Expenses: | | | | | | | |

Research and development | $ | 23,283 | | | $ | 14,971 | | | $ | 43,873 | | | $ | 18,333 | |

General and administrative | 3,495 | | | 2,353 | | | 5,463 | | | 2,474 | |

Total operating expenses | 26,778 | | | 17,324 | | | 49,336 | | | 20,807 | |

Loss from operations | (26,778) | | | (17,324) | | | (49,336) | | | (20,807) | |

| Other income (expenses): | | | | | | | |

Interest income | 481 | | | 870 | | | 656 | | | 272 | |

Other income | 394 | | | — | | | 532 | | | — | |

Interest expense | (585) | | | (36) | | | — | | | (293) | |

Total other income (expense), net | 290 | | | 834 | | | 1,188 | | | (21) | |

Loss before income taxes | (26,488) | | | (16,490) | | | (48,148) | | | (20,828) | |

Income tax benefit | — | | | — | | | — | | | — | |

Net loss | $ | (26,488) | | | $ | (16,490) | | | $ | (48,148) | | | $ | (20,828) | |

Net loss attributable to common stock | $ | (27,303) | | | $ | (16,490) | | | $ | (55,166) | | | $ | (20,828) | |

Net loss per share of common stock, basic and diluted(1) | $ | (37.05) | | | $ | (22.38) | | | $ | (74.21) | | | $ | (28.26) | |

Weighted average common stock outstanding, basic and diluted(1) | 736,933 | | | 736,933 | | | 743,401 | | 736,933 |

Pro forma net loss per share of common stock, basic and diluted(2) | $ | (1.85) | | | $ | (1.21) | | | $ | (2.42) | | | $ | (1.51) | |

Pro forma weighted average common stock outstanding, basic and diluted(2) | 14,351,418 | | | 13,648,780 | | | 19,906,853 | | | 13,804,188 | |

| | | | | | | |

(1)See Note 7 to our unaudited condensed consolidated financial statements and Note 7 to our audited consolidated financial statements included elsewhere in this prospectus for details on the calculation of basic and diluted net loss per share attributable to holders of our common stock and the weighted-average number of shares of common stock used in the computation of the per share amounts.

(2)Pro forma basic and diluted net loss per share of common stock has been prepared to give effect to (i) the automatic conversion of all outstanding shares of our convertible preferred stock as of September 30, 2025 into an aggregate of 7,461,130 shares of our common stock and (ii) the automatic conversion of all outstanding shares of Series C Preferred Stock issued after September 30, 2025 into an aggregate of 11,789,280 shares of our common stock, in each case as if such conversion had occurred at the beginning

of the period presented or the issuance dates of the respective preferred stock, if later, and (iii) the filing and effectiveness of our restated certificate of incorporation, which will be effective immediately prior to the consummation of this offering.

| | | | | | | | | | | |

| As of December 31, |

| (in thousands) | 2024 | | 2023 |

Consolidated Balance Sheet Data: | | | |

| Cash and cash equivalents | $ | 53,084 | | | $ | 16,296 | |

Working capital | 50,817 | | | 14,510 | |

Total assets | 55,535 | | | 17,562 | |

Total liabilities | 4,718 | | | 3,838 | |

Redeemable convertible preferred stock | 99,297 | | | 35,966 | |

Accumulated deficit | (49,231) | | | (22,743) | |

Total stockholders' deficit | $ | (48,480) | | | $ | (22,242) | |

| | | |

| | | | | | | | | | | | | | | | | |

| As of September 30, 2025 |

| (in thousands) | Actual | | Pro Forma(1) | | Pro Forma as Adjusted(2) |

Consolidated Balance Sheet Data: | | | | | |

Cash, cash equivalents and marketable securities | $ | 15,139 | | | $ | 165,702 | | | $ | 347,535 | |

Working capital(3) | 13,019 | | | 163,582 | | | 345,415 | |

Total assets | 18,797 | | | 169,360 | | | 351,193 | |

Total liabilities | 5,710 | | | 5,710 | | | 5,710 | |

Redeemable convertible preferred stock | 109,102 | | | — | | | — | |

Accumulated deficit | (97,379) | | | (97,379) | | | (97,379) | |

Total stockholders’ deficit | (96,015) | | | 163,649 | | | 345,482 | |

| | | | | |

(1)The pro forma balance sheet data gives effect to (i) the automatic conversion of all outstanding shares of our convertible preferred stock as of September 30, 2025 into an aggregate of 7,461,130 shares of our common stock immediately prior to the consummation of this offering, (ii) the issuance and sale of 118,682,683 shares of Series C Preferred Stock, including the net proceeds from such sale, which occurred subsequent to September 30, 2025, and the automatic conversion of all outstanding shares of Series C Preferred Stock into an aggregate of 11,789,280 shares of our common stock immediately prior to the consummation of this offering, and (iii) the filing and effectiveness of our restated certificate of incorporation and amended and restated bylaws, which will be effective immediately prior to the consummation of this offering.

(2)The pro forma as adjusted balance sheet data give further effect to our issuance and sale of shares of our common stock in this offering at an assumed initial public offering price of $15.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

(3)We define working capital as current assets less current liabilities. See our unaudited condensed consolidated financial statements and the related notes included elsewhere in this prospectus for further details regarding our current assets and current liabilities.

The pro forma as adjusted information discussed above is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. A $1.00 increase (decrease) in the assumed initial public offering price of $15.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash, cash equivalents and marketable securities, working capital, total assets and total stockholders’ (deficit) equity by $12.4 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. An increase (decrease) of 1,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash, cash equivalents and marketable securities, working capital, total assets and total stockholders’ (deficit) equity by $14.0 million, assuming no change in the assumed initial public offering price per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding to invest in shares of our common stock, you should carefully consider the risks described below, together with the other information contained in this prospectus, including in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in our audited financial statements and the related notes. The events discussed below may occur and adversely impact our business, financial condition, results of operations and prospects, which may cause the trading price of our common stock to decline, resulting in you losing all or part of your investment. Risks Related to Our Financial Position and Need for Capital

We are a clinical-stage biopharmaceutical company with a limited operating history and no products approved for commercial sale. We have incurred substantial losses since our inception, and we anticipate incurring substantial and increasing losses for the foreseeable future.

We are a clinical-stage biopharmaceutical company with a limited operating history on which to base your investment decision. We were formed in 2019 and our operations to date have been limited to organizing, staffing, and financing our company, conducting research and development activities, conducting clinical trials for our product candidates and establishing our intellectual property portfolio. We have never obtained regulatory approval for, or commercialized, a pharmaceutical product. We currently generate no revenue from sales of any products, and we may never be able to develop or commercialize a marketable product. We have financed our operations with $263.0 million in gross proceeds from equity financings to date. Biopharmaceutical product development is a highly speculative undertaking, involving substantial upfront capital expenditure and significant risk. Any product candidate may fail to demonstrate adequate efficacy or an acceptable safety profile, gain regulatory approval or become commercially viable, despite substantial investment on development or commercialization.

We have incurred, and will continue to incur, significant expenses related to the clinical development of VDPHL01 and our other current and any future product candidates and ongoing operations. Our net losses for the nine months ended September 30, 2025 and 2024 were $48.1 million and $20.8 million, respectively. Our net losses for the years ended December 31, 2024 and 2023 were $26.5 million and $16.5 million, respectively. As of September 30, 2025, we had an accumulated deficit of $97.4 million. Substantially all of our operating losses have resulted from expenses incurred in connection with development of VDPHL01 and our other product candidates and from general and administrative costs associated with our operations. We expect to incur significant losses for the foreseeable future, and we expect these losses to increase as we advance VDPHL01 in our ongoing Phase 3 trials and, if results are positive, prepare for the commercialization of VDPHL01, if approved.

We anticipate that our expenses will increase substantially if, and as, we:

ncontinue development of VDPHL01 and our other current product candidates, including preclinical development and conducting clinical trials;

nseek marketing regulatory approvals for VDPHL01 and for any of our other current or any future product candidates that successfully complete clinical trials;

ntake steps toward supporting commercial activities, including establishing sales, marketing and distribution infrastructure;

nincrease marketing in connection with the potential commercialization of VDPHL01, if approved;

nadvance additional product candidates through preclinical development and clinical trials;

nidentify additional product candidates and acquire rights from third parties to those product candidates through licenses or acquisitions and conduct development activities, including preclinical studies and clinical trials;

nmake royalty, milestone or other payments under any current or future license or collaboration agreements;

nprocure the manufacturing of preclinical, clinical and commercial supply of our current or any future product candidates;

nestablish agreements with contract research organizations, or CROs, and contract manufacturing organizations, or CMOs;

nattract, hire and retain additional qualified clinical, scientific, operations and management personnel;

nseek to continue to develop, maintain and defend our intellectual property portfolio, including against third-party interference, infringement and other intellectual property claims, if any;

nadd and maintain operational, financial and information management systems;

nattempt to address any competing therapies and market developments;

nexperience delays in our preclinical studies, clinical trials or regulatory approval for our current or any future product candidates, including with respect to failed studies, inconclusive results, safety issues or other regulatory challenges; and

nincur additional costs associated with being a public company, including audit, legal, regulatory and tax-related services associated with maintaining compliance with an exchange listing and the Securities and Exchange Commission, or the SEC, requirements, director and officer insurance premiums and investor relations costs.

We may never succeed in these activities and, even if we do, may never generate any revenue or revenue that is significant enough to achieve profitability. Even if we succeed in commercializing VDPHL01 or one or more of our other product candidates, we will incur substantial expenditures to develop and market additional product candidates. We also may encounter unforeseen expenses, difficulties, complications, delays and other events that adversely affect our business. As a result, we will need substantial additional funding to support our continuing operations and pursue our growth strategy. Until we can generate significant revenue from product sales, if ever, we expect to finance our operations through a combination of public or private equity offerings and debt financings or other sources, such as potential collaboration agreements, strategic alliances and licensing arrangements. The size of our future net losses will depend, in part, on the rate that our expenses increase and our ability to generate revenue. Our prior losses and expected future losses have had and will continue to have an adverse effect on our stockholders’ equity and our working capital.

Even if we achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress the value of our company and could impair our ability to raise capital, expand our business, maintain our development efforts, obtain product approvals, diversify our offerings or continue our operations. A decline in the value of our company could also cause you to lose all or part of your investment.

Even if this offering is successful, we will require substantial additional financing to achieve our goals, and failure to obtain additional capital when needed, or on acceptable terms, would cause us to delay, limit, reduce or terminate our product development or commercialization efforts.

The development of biopharmaceutical product candidates, including conducting preclinical studies and clinical trials, is a time-consuming, capital-intensive and uncertain process. We expect our expenses to substantially increase in connection with our ongoing and future activities, specifically as we advance development of VDPHL01 in our ongoing Phase 3 trials and prepare for potential commercialization of VDPHL01, if approved. In addition, because the outcome of any clinical trial or preclinical study is uncertain, we cannot reliably estimate the actual amount of capital necessary to successfully complete the development and commercialization of our other product candidates, and if we obtain regulatory approval for our other current or any future product candidates we also expect to incur significant commercialization expenses of such products. Furthermore, following the completion of this offering, we expect to incur additional costs associated with operating as a public company including significant legal, accounting, investor relations, and other expenses that we did not incur as a private company.

Subsequent to December 31, 2024, we completed the second funding of our Series B Preferred Stock financing of $8.4 million in the first quarter of 2025, followed by a Series C Preferred Stock financing in the fourth quarter of 2025, from which we received gross proceeds of $151.0 million. As of September 30, 2025, we had $15.1 million in cash, cash equivalents and marketable securities, which did not include the proceeds from the Series C Preferred Stock financing. We expect the net proceeds from this offering, together with our existing cash, cash equivalents and marketable securities, will be sufficient to fund our operating expenses and capital expenditure requirements for more than twelve months from the date of this prospectus. We have based this estimate on assumptions that may prove to be wrong, and we could exhaust our capital resources sooner than we expect. We expect to attempt to raise additional cash in advance of exhausting our available capital resources.

We will not generate revenue from product sales unless and until we successfully complete clinical development and obtain regulatory approval for a product candidate, and we may never generate significant revenue or profits. If we obtain regulatory approval for VDPHL01 or any of our other current or any future product candidates, and do not enter into a third-party commercialization partnership, we expect to incur significant expenses related to developing our commercialization capability to support product sales, marketing, manufacturing and distribution activities. We also may require additional capital to pursue in-licenses or acquisitions of other product candidates. In addition, upon the completion of this offering, we expect to incur additional costs associated with operating as a public company, including significant legal, accounting, investor relations, and other expenses that we did not incur as a private company. As a result, we expect to incur substantial operating losses and negative operating cash flows for the foreseeable future.

Because of the numerous risks and uncertainties, length of time and scope of activities associated with research, development and commercialization of product candidates, we are unable to estimate the exact amount of our working capital requirements. Our future funding requirements, both near and long-term, will depend on, and could increase significantly as a result of, many factors, including, but not limited to:

nthe initiation, progress, timing, costs and results of our clinical trials through all phases of development, including our ongoing clinical trials for VDPHL01 and the development of our other current and any future product candidates;

nthe number and scope of preclinical and clinical programs we decide to pursue;

nthe identification, assessment, acquisition and/or development of additional research programs and additional product candidates;

nthe timing of and successful patient enrollment in, and the initiation and completion of, clinical trials;

nthe outcome, timing and costs of meeting regulatory requirements established by the FDA or any comparable foreign regulatory authority, including any additional clinical trials required by the FDA or any comparable foreign regulatory authority;

nthe willingness of the FDA or any comparable foreign regulatory authorities to accept our clinical trial designs, as well as data from our completed and planned preclinical studies and clinical trials, as the basis for review and approval of VDPHL01 and any other product candidates;

nthe progress, timing and costs of the development by us or third parties of companion diagnostics, if required, for VDPHL01 or any other product candidates, including design, manufacturing and regulatory approval;

nthe timing, receipt and terms of any marketing approvals from applicable regulatory authorities;

nour ability to establish new licensing or collaboration arrangements;

nthe performance of our future collaborators, if any;

ndevelopment and timely delivery of commercial-grade drug formulations that can be used in our planned clinical trials and for commercialization;

nthe cost of filing, prosecuting and enforcing our patent claims and other intellectual property rights;

nthe cost of defending potential intellectual property disputes, including patent infringement actions brought by third parties against us;

nthe costs associated with potential clinical trial liability or product liability claims, including the costs associated with obtaining insurance against such claims and with defending against such claims;

nthe effect of competing technological and market developments;

nour ability to hire additional personnel and consultants as our business grows, including additional executive officers and clinical development, regulatory, chemistry, manufacturing and controls, quality and commercial personnel;

nour ability to develop and commercialize products that are considered by physicians, patients and payors as medically and/or financially differentiated as compared to competitive products;

nour ability to establish arrangements with third-party manufacturers for the commercial supply of products that receive marketing approval, if any;

nthe cost of making royalty, milestone or other payments under any future in-license agreements;

nthe extent to which we in-license or acquire additional product candidates or technologies;

nthe cost of establishing sales, marketing and distribution capabilities for our product candidates, if approved;

nthe initiation, progress and timing of our commercialization of VDPHL01, if approved, or any other product candidates;

nour ability to achieve sufficient market acceptance, coverage and adequate reimbursement from third-party payors, if applicable, and adequate market share and revenue;

nmaintaining a continued acceptable safety profile of the product candidates following approval; and

nthe costs of operating as a public company.

We expect that our commercial revenue, if any, will initially be derived from sales of VDPHL01, which we do not expect to be commercially available in the near-term, if ever. Accordingly, we will need to rely on additional financing to achieve our business objectives until such time as we can generate sufficient commercial revenue. Adequate additional financing may not be available to us on acceptable terms, or at all, including as a result of financial and credit market deterioration or instability, including as a result of tariffs, fluctuations in inflation rates and concerns of a recession in the United States or other major markets, market-wide liquidity shortages, geopolitical events or otherwise. Weakness and volatility in the capital markets and the economy in general could also increase our costs of borrowing. If we are unable to raise sufficient additional capital, we would be forced to curtail our planned operations and the pursuit of our growth strategy.

Raising additional capital may cause dilution to our stockholders, including purchasers of common stock in this offering, imposing restrictions on our operations or require us to relinquish rights to our product candidates.

Until such time, if ever, that we generate substantial product revenue, we expect to finance our cash needs through equity offerings, debt financings or other capital sources, including potential collaborations, licenses and other arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a holder of our common stock. Any future debt or preferred equity financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, selling or licensing our assets, making capital expenditures, declaring dividends or encumbering our assets to secure future indebtedness. Such restrictions could adversely impact our ability to conduct our operations and execute our business plan.

If we raise additional funds through future collaborations, licenses and other arrangements, we likely would relinquish valuable rights to our potential future revenue streams or product candidates. We also may grant licenses on terms that may not be favorable to us or that reduce the value of our common stock. If we are unable to raise additional funds through equity or debt financings or other arrangements when needed, or on acceptable terms, we would be required to delay, limit, reduce or terminate our product development efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Further, we may not be able to access a portion of our existing cash due to market conditions. If banks and financial institutions with whom we hold accounts enter receivership or become insolvent in the future in response to financial conditions affecting the banking system and financial markets, our ability to access our existing cash may be threatened and could have a material adverse effect on our business and financial condition.

Risks Related to the Development of Our Product Candidates

We currently anticipate that our success will substantially depend on the approval and successful commercialization of VDPHL01, which is our lead product candidate. If we are unable to obtain regulatory approval for, and successfully commercialize, VDPHL01, or any of our other current or future product candidates, or experience significant delays in doing so, our business will be materially harmed.

We have never obtained regulatory approval for, or commercialized, a pharmaceutical product. With respect to VDPHL01 in PHL, we may pursue a marketing application to initially seek approval in male patients followed by an sNDA for female patients, or could alternatively pursue approval in both male and female patients simultaneously. The FDA may require us to conduct additional trials to support approval if it does not think our existing data are sufficient to support approval. We have invested a significant portion of our efforts and financial resources in the development of our most advanced product candidate, VDPHL01, for the treatment of PHL in male patients and female patients. Our business substantially depends on the successful development and commercialization of our product candidates, and in particular, VDPHL01, which may never occur. We currently generate no revenue from sales of any products, and we may never be able to develop or commercialize a marketable product. We do not expect to generate significant revenue, if any, unless and until we are able to obtain regulatory approval for, and successfully commercialize, VDPHL01, or for any of our other current or future product candidates. Successful commercialization of a product candidate requires achievement of many key milestones, including obtaining regulatory approval. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

We are not permitted to market or promote any of our product candidates, including VDPHL01, before we receive regulatory approval from the FDA or comparable foreign regulatory authorities, and we may never receive such regulatory approval for any of our product candidates. Even if VDPHL01 or any of our other current or future product candidates is approved, they may be subject to limitations on the indicated uses for which they may be marketed, distribution restrictions, or to other conditions of approval, may contain significant safety warnings, including boxed warnings, contraindications, and precautions, may not be approved with label statements necessary or desirable for successful commercialization, or may contain requirements for costly post-market testing and surveillance, or other requirements, including the submission of a risk evaluation and mitigation strategy, or REMS, to monitor the safety or efficacy of the products.

We have not previously submitted an NDA to the FDA, or similar drug approval filings to comparable foreign authorities, for any product candidate, and we cannot be certain that VDPHL01 or any other of our current or future product candidates will be successful in clinical trials or receive regulatory approval. Our product candidates are susceptible to the risks of failure inherent at any stage of product development, including the appearance of unexpected AEs or failure to achieve its primary endpoints in subsequent clinical trials. Further, our product candidates may not receive regulatory approval even if they are successful in clinical trials.

The future regulatory and commercial success of VDPHL01 and any of our other current or future product candidates is subject to a number of risks, including the following:

neffective Investigational New Drug, or IND, applications from the FDA that allow commencement of our planned or future clinical trials for our product candidates;

ntimely and successful completion of preclinical studies and clinical trials;

nsuccessful patient enrollment in clinical trials;

nsuccessful data from our preclinical studies and clinical trials that support an acceptable risk-benefit profile of VDPHL01 and any of our other current or future product candidates in the intended populations and indications;

nsatisfaction of applicable regulatory requirements;

npotential unforeseen safety issues or adverse side effects, either in clinical trials or following approval;

nreceipt and maintenance of marketing approvals from applicable regulatory authorities;

nremaining in compliance with post-marketing regulatory requirements;

nobtaining and maintaining patent and trade secret protection and regulatory exclusivity for VDPHL01 and any of our other current or future product candidates;

nmaking arrangements or maintaining existing arrangements with third-party manufacturers, or establishing manufacturing capabilities, for both clinical and commercial supplies of VDPHL01 and any of our other current or future product candidates;