Please wait

0001828161FalseDEF 14A00018281612024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

FTC Solar, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Exchange Act Rules 14a-6(i)(1) and 0-11.

April 30, 2025

Dear Fellow Stockholder:

You are cordially invited to attend the 2025 Annual Meeting of Stockholders of FTC Solar, Inc. to be held virtually via a live audio webcast accessible at www.proxydocs.com/FTCI on Wednesday, June 11, 2025, at 10:00 AM, Central Daylight time. The attached notice of meeting and proxy statement describe the formal business to be transacted at the meeting.

We are furnishing proxy materials to our stockholders over the Internet. You may read, print and download our 2024 Annual Report to Shareholders and our 2025 Proxy Statement at www.proxydocs.com/FTCI. On or about May 2, 2025, we will mail our stockholders a Notice of Internet Availability containing instructions on how to access these materials and how to vote their shares. The notice provides instructions on how you can request a paper copy of these materials by mail, by telephone or by email. If you requested your materials via email, the email contains voting instructions and links to the materials on the Internet.

You may vote your shares by regular mail, via phone or over the Internet, or during the Annual Meeting. The Annual Meeting is being held so that stockholders may consider the election of three Class I directors, the ratification of the appointment of BDO USA, P.C. ("BDO") as our independent registered public accounting firm for the year ending December 31, 2025, and to transact such other business as may properly come before the meeting.

The Board of Directors of FTC Solar, Inc. ("Board of Directors" or the "Board") has determined that the matters to be considered at the Annual Meeting are in the best interests of FTC Solar, Inc. and its stockholders. For the reasons set forth in the Proxy Statement, the Board of Directors unanimously recommends a vote “FOR” each matter to be considered.

On behalf of the Board of Directors and the officers and employees of FTC Solar, Inc., I would like to take this opportunity to thank our stockholders for their continued support of FTC Solar, Inc. We look forward to seeing you virtually at the meeting.

|

|

|

|

Sincerely, |

|

|

|

/s/ Yann Brandt |

|

Yann Brandt President and Chief Executive Officer |

FTC SOLAR, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the 2025 Annual Meeting of Stockholders ("Annual Meeting") of FTC Solar, Inc. (the “Company”, "we", "our", or "us") will be held virtually via a live audio webcast accessible at www.proxydocs.com/FTCI at 10:00 AM, Central Daylight time, on Wednesday, June 11, 2025 for the following purposes:

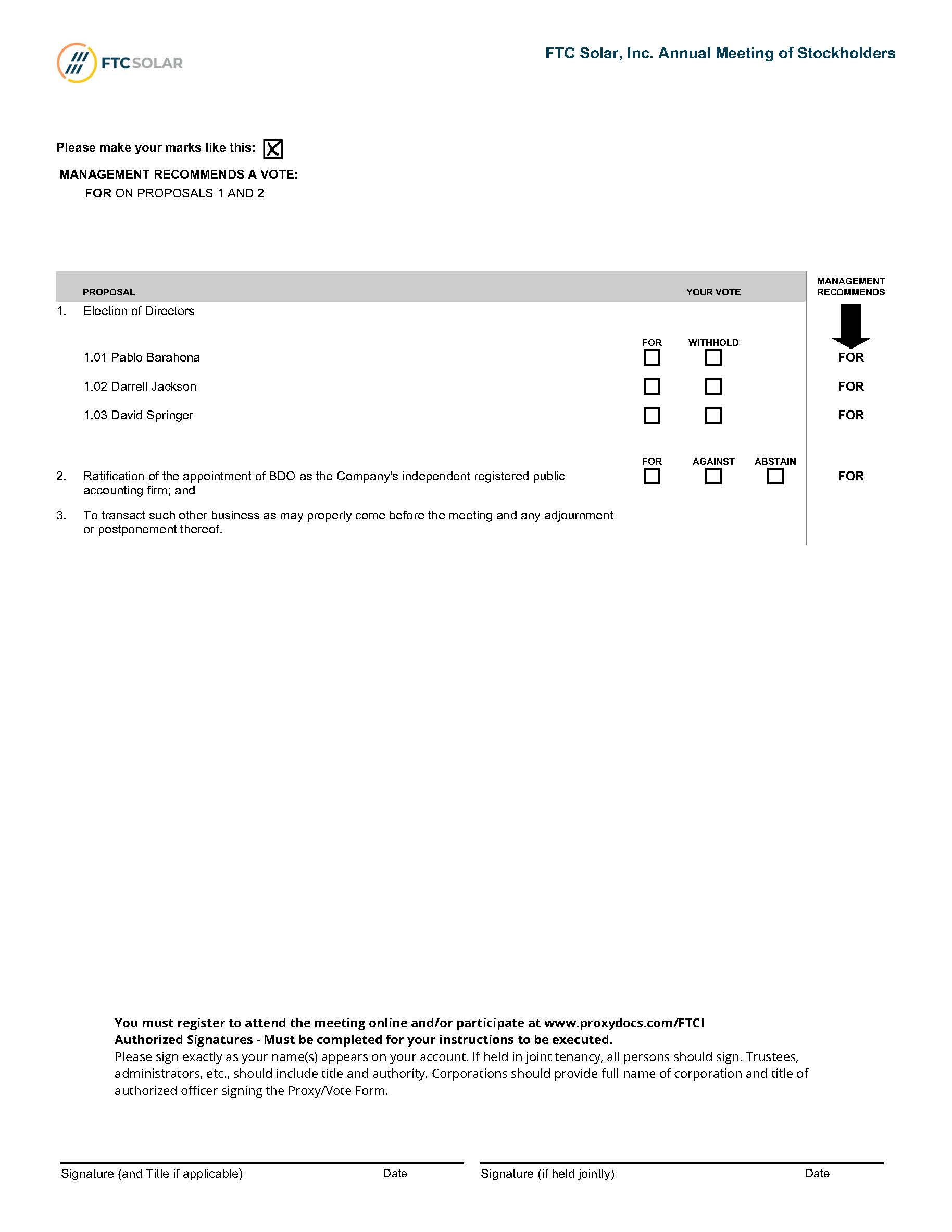

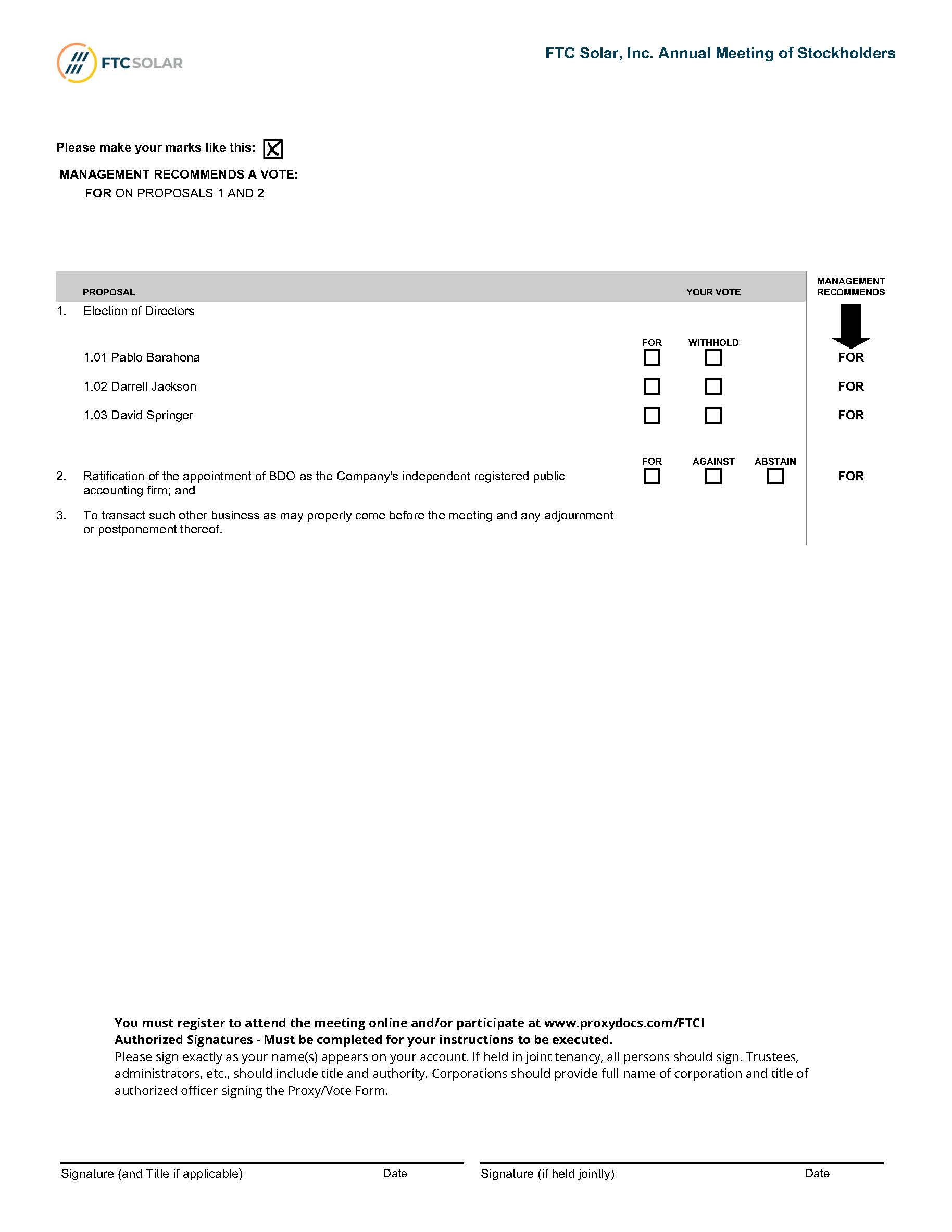

1.Election of three Class I directors for a three-year term expiring at the 2028 annual meeting of stockholders and until their respective successors are duly elected and qualified;

2.Ratification of the appointment of BDO as the Company's independent registered public accounting firm; and

3.To transact such other business as may properly come before the meeting and any adjournment or postponement thereof.

These proposals are more fully described in the Proxy Statement following this Notice.

The Board of Directors recommends that you vote (i) FOR the election of the three nominees to serve as Class I directors of the Company, and (ii) FOR the ratification of the appointment of BDO as our independent registered public accounting firm for the fiscal year ending December 31, 2025.

The Board of Directors has fixed the close of business on April 14, 2025 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Annual Meeting. A list of the stockholders of record as of the close of business on April 14, 2025, will be available for inspection by any of our stockholders for any purpose germane to the Annual Meeting online by registering at www.proxydocs.com/FTCI or, by appointment only, during normal business hours at our principal executive offices, 9020 N. Capital of Texas Hwy, Suite I-260, Austin, Texas, 78759, for a period of ten days prior to the Annual Meeting.

Stockholders are cordially invited to attend the Annual Meeting virtually. In order to attend the Annual Meeting, you must visit www.proxydocs.com/FTCI and register by entering the control number included on your Notice of Internet Availability, proxy card, or voting instruction form. After registering, you will receive further instructions via email, including a unique link to access the virtual Annual Meeting and to vote and submit questions during the Annual Meeting.

Regardless of whether you plan to attend the Annual Meeting virtually, please mark, date, sign and return the enclosed proxy, or vote via the Internet or telephone by visiting www.proxydocs.com/FTCI to ensure that your shares are represented at the Annual Meeting. Stockholders of record at the close of business on the record date, whose shares are registered directly in their name, and not in the name of a broker or other nominee, may vote their shares virtually at the Annual Meeting, even though they have sent in proxies.

|

|

|

|

By Order of the Board of Directors, |

|

|

|

/s/ Cathy Behnen |

|

Cathy Behnen Chief Financial Officer |

April 30, 2025

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 11, 2025:

The Company’s Proxy Statement and 2024 Annual Report to Shareholders are available at www.proxydocs.com/FTCI.

YOUR VOTE IS IMPORTANT

TABLE OF CONTENTS

Although we refer to our website in this proxy statement, the contents of our website are not included or incorporated by reference into this proxy statement. All references to our website in this proxy statement are intended to be inactive textual references only.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

Wednesday, June 11, 2025

ABOUT THE MEETING

What is the date, time and place of the Annual Meeting?

Our 2025 Annual Meeting will be held on Wednesday, June 11, 2025, beginning at 10:00 AM, Central Daylight time, virtually via a live audio webcast accessible at www.proxydocs.com/FTCI. In order to attend the Annual Meeting, you must visit www.proxydocs.com/FTCI and register by entering the control number included on your Notice of Internet Availability, proxy card, or voting instruction form. After registering, you will receive further instructions via email, including a unique link to access the virtual Annual Meeting and to vote and submit questions during the Annual Meeting.

During the 2025 Annual Meeting, we will answer pertinent questions submitted online by stockholders, as time permits. Note that we may group or summarize similar or related questions to provide answers as efficiently as possible. We may not, however, be able to provide live answers to every question submitted.

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the following matters: 1) election of three Class I directors; 2) ratification of the selection of BDO as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025; and 3) any other matters that properly come before the meeting.

Who is entitled to vote at the Annual Meeting?

Only our stockholders of record at the close of business on April 14, 2025, the record date for the Annual Meeting, are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to attend the Annual Meeting and vote all of the shares you held on that date at the Annual Meeting, or any postponement or adjournment thereof. As of the record date, there were 13,068,309 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

What are the voting rights of the holders of our common stock?

Holders of common stock are entitled to one vote per share on each matter that is submitted to stockholders for approval. The holders of our common stock do not have cumulative voting rights in the election of directors.

Pursuant to our amended and restated certificate of incorporation, the total number of authorized shares of preferred stock is 10,000,000 shares. We have no shares of preferred stock issued or outstanding as of the date of this proxy statement.

What constitutes a quorum?

The presence, in person, or represented by proxy, of the holders of common stock representing a majority of the combined voting power of the outstanding shares of stock on the record date will constitute a quorum at the Annual Meeting, permitting the Annual Meeting to conduct its business. As of the record date, there were 13,068,309 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

What vote is required to approve each item?

For purposes of electing directors at the Annual Meeting, each nominee shall be elected as a director by the plurality of votes cast. The affirmative vote of a majority of the shares of common stock present in person, or represented by proxy, and entitled to vote is required for the ratification of the selection of BDO and approval of any other matter that may be submitted to a vote of our stockholders.

The inspector of election for the Annual Meeting shall determine the number of shares of common stock represented at the meeting, the existence of a quorum and the validity and effect of proxies, and shall count and tabulate ballots and

votes and determine the results thereof. Abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting for purposes of determining a quorum. A “broker non-vote” will occur when a bank, broker or other nominee, as the holder of record for a beneficial owner (as described below), does not vote on a particular proposal because such nominee does not have discretionary power with respect to that proposal and has not received instructions from the beneficial owner. On Proposal 1, votes to "withhold" and broker non-votes will not be counted as votes cast and therefore will have no effect on the outcome of the election of directors. On Proposal 2, abstentions from voting will have the same effect as a vote “against” the proposal. Broker non-votes, if any, will not have any effect on determining the outcome of Proposal 2. As Proposal 2 is considered "routine" under Nasdaq rules, brokers generally have discretionary authority to vote uninstructed shares on the proposal, so broker non-votes are not expected on this proposal. If less than a majority of the combined voting power of the outstanding shares of common stock is represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting from time to time without further notice.

What are the Board's recommendations?

As more fully discussed under "Matters to Come Before the Annual Meeting", our Board of Directors recommends a vote FOR the election of the three nominees for director named in Proposal 1 and FOR the ratification of the selection of BDO in Proposal 2.

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received (and which have not been revoked in accordance with the procedures set forth below) will be voted (1) FOR the election of the three respective nominees for director named in this proxy statement; (2) FOR the ratification of the selection of BDO; and (3) in accordance with the recommendation of our Board of Directors, FOR or AGAINST all other matters as may properly come before the Annual Meeting. In the event a stockholder specifies a different choice by means of the enclosed proxy, such shares will be voted in accordance with the specification made.

How do I vote?

If you are a holder of record (that is, if your shares are registered in your own name with our transfer agent), you may vote using the enclosed proxy card, or via the Internet or telephone by visiting www.proxydocs/FTCI. Voting instructions are provided on the proxy card contained in the proxy materials, or on your Notice of Internet Availability.

If you are a beneficial owner (that is, if you hold your shares in "street name" through a bank, broker or other nominee as holder of record), you must vote in accordance with the voting instruction form provided by your bank, broker or other nominee. The availability of telephone or Internet voting will depend upon such nominee's voting process.

If you attend the Annual Meeting virtually, you can vote virtually during the meeting. If you are a street name holder and wish to vote at the meeting, you must first obtain a valid legal proxy from your bank, broker or other nominee authorizing you to vote and submit proof of your valid legal proxy via email to dsmsupport@mediantonline.com prior to the start of the Annual Meeting.

Can I change my vote after I return my proxy card or voting instructions?

Yes. Stockholders of record can revoke their proxy at any time prior to the exercise of that proxy, by voting in person at the Annual Meeting, or by filing a written revocation or duly executed proxy bearing a later date with our Secretary at our headquarters.

Beneficial owners who wish to change their votes should contact the organization that holds their shares.

Who pays for costs relating to the proxy materials and the Annual Meeting of Stockholders?

The costs of preparing, assembling and mailing this proxy statement, the Notice of Annual Meeting of Stockholders and the Annual Report to Shareholders and enclosed proxy card, along with the cost of posting the proxy materials on a website, are to be borne by us. In addition to the use of mail, our directors, officers and employees may solicit proxies personally and by telephone, facsimile and other electronic means. They will receive no compensation in addition to their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in so doing.

INFORMATION ABOUT FTC SOLAR, INC.

Overview

The Company was founded in 2017 and is incorporated in the state of Delaware. In April 2021, we completed an initial public offering ("IPO"), and our common stock currently trades on the Nasdaq Capital Market under the symbol “FTCI”.

We are a global provider of solar tracker systems, supported by proprietary software and value-added engineering services. Solar tracker systems move solar panels throughout the day to maintain an optimal orientation relative to the sun, thereby increasing the amount of solar energy produced at a solar installation. Our original two modules-in-portrait ("2P") solar tracker system is marketed under the Voyager brand name (“Voyager”) and our one module-in-portrait ("1P") solar tracker system is marketed under the Pioneer brand name ("Pioneer"). We also have a mounting solution to support the installation and use of U.S.-manufactured thin-film modules. Our primary software offerings include SUNPATH which helps customers optimize solar tracking for increased energy production and our SUNOPS real-time operations management platform. In addition, we have a team of renewable energy professionals available to assist our U.S. and worldwide clients in site layout, structural design, pile testing and other needs across the solar project development and construction cycle. Our products and services provide tracker solutions for large utility-scale solar and distributed generation projects around the world. Our customers are primarily engineering, procurement and construction companies ("EPCs") and we also contract with developers and owners. The Company is headquartered in Austin, Texas, and has international subsidiaries in Australia, China, India, South Africa and Spain.

We are an emerging growth company, as defined in the Jumpstart Our Business Startups (JOBS) Act.

Corporate Governance

Mission

Our mission is to drive energy independence through effective and efficient solar engineering and innovation. We accelerate the adoption of renewable energy by reducing the cost of construction, simplifying the installation process and improving the energy yield of solar projects, thus supporting the transition away from fossil fuels.

Core Values

We are committed to the following core values in the way we do business:

•Integrity - We do the right thing. We are humble and listen to new ideas. We respect our customers and our teammates.

•Accountability - We are all accountable and act with urgency. We are transparent and deliver on our commitments. We come together to solve problems.

•Innovation - We collaborate to create world-class solutions. We foster a learning culture. We turn great ideas into our future.

•Excellence - We are committed to high quality. We plan well and execute flawlessly. We are focused on results.

Environmental Policy

We are committed to protecting our environment for the benefit of current and future generations. In order to minimize the environmental impact of our operations, products and services, we shall:

•Prevent pollution, reduce waste and minimize consumption of resources.

•Encourage environmental protection among the customers and suppliers with which we do business.

•Provide training to all employees and encourage them to conduct business in an environmentally responsible manner.

•Comply with applicable environmental laws, regulations, and other requirements to which the company subscribes.

We are committed to continuously improve our environmental management performance and we design our products and operations to reduce environmental impacts and maximize environmental savings.

Climate Change

Climate change has primarily impacted our business operations by increasing demand for solar power generation and, as a result, for use of our products. While climate change has not resulted in any material negative impact to our operations to date, we recognize the risk of disruptions to our supply chain due to extreme weather events. This has led us to expand the diversity of our supplier base and to partner with more local suppliers to reduce shipping and transportation needs. We are also increasingly partnering with larger scale steel producers rather than smaller suppliers to facilitate scaling of our operations while remaining conscious of the environmental impacts of steel manufacturing as the regulatory landscape around these high-emitting industries evolves.

We also attempt to mitigate the climate-related risks from the use of our products by designing our equipment and systems to have a high-slope tolerance and wind mitigation capabilities, while at the same time reducing the required foundation/pile count needed. This allows our trackers to be installed in increasingly hostile environments with minimal disturbance to the surrounding land.

Social Governance

The personal health and safety of each of our employees is of utmost importance, and we work to continually improve our safety policies and procedures. Our employees do not directly perform solar installations, but we consider the safety of the on-site installers when designing our products and installation procedures.

We believe we have a diverse employee base in terms of gender, age, experience, background and ethnicity. Information on the gender, age and ethnicity of our Board of Directors and our employees may be found in Part I, Item 1 of our Annual Report to Shareholders for the year ended December 31, 2024 under the caption "Human capital resources".

We encourage you to read "Part I, Item 1. Business" in our 2024 Annual Report to Shareholders to gain a more comprehensive understanding of our mission, core values, environmental and governance policies, how we are impacted by climate change and additional demographic information regarding our executive leadership team and our employee base. In addition, our Board of Directors has adopted Corporate Governance Guidelines outlining the Board's roles and responsibilities, leadership structure, composition, compensation and other matters, which is available on our corporate website at https://investor.ftcsolar.com.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to all of our officers, directors and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, which is posted on our website, https://investor.ftcsolar.com. All employees are required to attend annual training on our code of business conduct and ethics. Our code of business conduct and ethics is a “code of ethics,” as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of the code on our website.

Cybersecurity

We recognize the importance of developing, implementing and maintaining robust cybersecurity measures to safeguard our information technology ("IT") systems and protect the confidentiality, integrity, and availability of our data.

We have integrated cybersecurity risk management into our overall risk management and internal control framework and have established policies and controls that we believe are appropriate in light of the risks of damage to our reputation and financial condition from unauthorized access to our key digital assets and systems.

We have established a Cybersecurity Governance Committee, which meets monthly or more frequently, if needed, to monitor:

•our current cybersecurity controls and our ability to address emerging threats;

•the status of our ongoing cybersecurity initiatives and strategy;

•incident reports from any cybersecurity events; and

•compliance with regulatory requirements and industry standards.

The Cybersecurity Governance Committee has the responsibility for determining if a cybersecurity incident is considered to have a material impact on the Company requiring public reporting in accordance with the rules and regulations of the U.S. Securities and Exchange Commission.

Under the guidance of the Cybersecurity Governance Company, we have adopted (i) a Security Incident Response Plan, (ii) a Cybersecurity Materiality Assessment Policy, and (iii) a Cybersecurity Register of Events.

Our IT management, in conjunction with our Director of Internal Audit, has responsibility for monitoring and testing the effectiveness of our cybersecurity controls and procedures on a recurring basis.

Our Board of Directors is aware of the critical nature of managing risks associated with cybersecurity threats and has established oversight mechanisms to ensure effective governance in managing these risks. The Audit Committee is central to the Board's oversight and has been directed to assume primary responsibility for such oversight by the Board. The Audit Committee is comprised of board members with diverse experience including risk management, technology and finance, which, in the judgment of the Board, equips them with the ability to oversee cybersecurity risks effectively. The Audit Committee actively participates in strategic decisions related to cybersecurity, offering guidance to our management and approval of major initiatives.

Insider Trading Policy

We have adopted an insider trading policy that applies to all of our officers, directors and employees, including our principal executive officer, principal financial officer and persons performing similar functions. Our insider trading policy prohibits our directors and employees, including executive officers, from hedging or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of Company securities, including collars, equity swaps, exchange funds and prepaid variable forward sale contracts. All employees are required to attend annual training on our insider trading policy. In 2021, our Board of Directors approved waivers under our insider trading policy allowing our directors to undertake margin loans and hedging transactions with respect to our common stock.

Clawback Policy

In compliance with the Dodd-Frank Act, rules of the U.S. Securities and Exchange Commission ("SEC"), and Nasdaq Stock Market listing requirements, we adopted a clawback policy, effective July 27, 2023, that applies to the executive officers of the Company. This policy requires the Company to recover certain incentive-based compensation (including equity and cash bonus payments) received by current or former executive officers on or after October 2, 2023 (as determined under the policy) in the event we are required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under the securities laws. The recoverable compensation is that compensation which was received during the three-year period preceding the date on which the accounting restatement was required. The clawback pertains to any excess income derived by a current or former executive officer based on materially inaccurate accounting statements.

Since the adoption of our clawback policy, we have had no restatement requiring recovery of erroneously awarded compensation pursuant to our policy and there was no balance of erroneously awarded compensation to be recovered as of December 31, 2024.

Board of Directors and Executive Officers

We are governed by a Board of Directors currently comprising nine members, including seven independent members. Our board has established an audit committee, compensation committee and nominating and governance committee, consisting solely of independent members, to advise the full board on various matters. The audit committee will also periodically meet separately with our independent auditors, without the presence of management, to discuss any matters of importance or concern to our auditors. Additionally, our Director of Internal Audit organizationally reports directly to the audit committee. Further information regarding our Board of Directors may be found below under the section "Information About Our Directors".

Our executive officers, which currently consist of our President and Chief Executive Officer, Chief Operating Officer and Chief Financial Officer, serve at the discretion of our Board of Directors and hold office until his or her successor is duly appointed or until his or her earlier resignation or removal. There are no family relationships among any of our directors or executive officers. Further information regarding our executive officers may be found under "Information About FTC Solar, Inc. Management" below.

Security Ownership of Certain Beneficial Owners and Management

The following table shows information regarding the beneficial ownership of our common stock for the following:

•Each stockholder known by us to beneficially own more than 5% of our common stock;

•Each of our 2024 Named Executive Officers;

•Each of our directors; and

•All current executive officers and directors as a group.

The amounts and percentages of our common stock beneficially owned are reported on the basis of SEC regulations governing the determination of beneficial ownership of securities. Under SEC rules, a person is deemed to be a “beneficial” owner of a security if that person has or shares voting power or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days of April 14, 2025. Securities that can be so acquired are not deemed to be outstanding for purposes of computing any other person’s percentage.

Our determination of the percentage of beneficial ownership is based on 13,068,309 shares of our common stock outstanding as of April 14, 2025 Unless otherwise indicated, the business address of each such beneficial owner is c/o 9020 N Capital of Texas Hwy, Suite I-260, Austin, Texas 78759.

Each of the stockholders listed has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable.

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock Beneficially Owned |

|

Name of Beneficial Owner |

|

Number |

|

|

Percentage |

|

5% Stockholders: |

|

|

|

|

|

|

ARC Family Trust(1) |

|

|

1,174,086 |

|

|

|

9.0 |

% |

South Lake One LLC(2) |

|

|

1,486,760 |

|

|

|

11.4 |

% |

Named Executive Officers and Directors: |

|

|

|

|

|

|

Yann Brandt(3) |

|

|

216,696 |

|

|

|

1.7 |

% |

Sasan Aminpour(4) |

|

|

93,088 |

|

|

*% |

|

Cathy Behnen(5) |

|

|

27,080 |

|

|

*% |

|

Patrick Cook(6) |

|

|

176,092 |

|

|

|

1.3 |

% |

Shaker Sadasivam(7) |

|

|

1,521,235 |

|

|

|

11.6 |

% |

Pablo Barahona(8) |

|

|

4,000 |

|

|

*% |

|

Ahmad Chatila(9) |

|

|

228,767 |

|

|

|

1.8 |

% |

Lisan Hung(10) |

|

|

37,163 |

|

|

*% |

|

Darrell Jackson |

|

|

— |

|

|

*% |

|

William Aldeen "Dean" Priddy, Jr.(11) |

|

|

46,750 |

|

|

*% |

|

David Springer(12) |

|

|

930,158 |

|

|

|

7.1 |

% |

Maximillian Sultan |

|

|

— |

|

|

*% |

|

All current Executive Officers and Directors as a group (12 individuals) |

|

|

3,281,029 |

|

|

|

24.9 |

% |

* Less than one percent (1%)

(1)The ARC Family Trust was established by Mr. Chatila for the benefit of certain members of his family. Based on Amendment No. 3 of Schedule 13G filed February 14, 2025, Mr. Shaker Sadasivam, the Chair of our Board of Directors, is the trustee of the ARC Family Trust and has shared voting and dispositive power with respect to the shares of common stock held by ARC Family Trust. As of April 14, 2025, Mr. Sadasivam had sole voting and dispositive power with respect to an additional 347,149 shares of common stock currently held and shares of common stock to be issued from the settlement of restricted stock units ("RSUs") that have vested as of April 14, 2025, or will vest within 60 days of April 14, 2025 (see footnote (3) below). The address of this stockholder is 20 Montchanin Road, Suite 100, Greenville, DE 19807.

(2)Based on Amendment No. 1 to Schedule 13G filed February 1, 2023 on behalf of South Lake One LLC ("South Lake One"), South Cone Investments Limited Partnership ("South Cone"), and South Lake Management LLC ("South Lake Management"). South Lake Management is controlled and managed by the Class A and Class B members of its Board of Managers whereby no member of the Board of Managers has direct or indirect control of South Lake Management, and no member of South Lake Management individually has the power to control South Lake Management or replace its Board of Managers. South Lake Management directly controls South Cone as its general partner with the power to manage South Cone. South Cone directly owns 100% of the issued and outstanding membership interest of South Lake One. South Lake One is managed by the Class A and Class B members of its Board of Managers whereby no member of the Board of Manager has direct or indirect control of South Lake One. South Cone, as the sole member of South Lake One, has the power to control South Lake One and replace its Board of Managers. South Lake One directly holds an aggregate of 14,867,592 shares of our common stock. South Cone and South Lake Management each indirectly holds an aggregate of 1,486,760 shares of our common stock. The principal business address for South Lake One, South Cone and South Lake Management is 5711 Pdte. Riesco, Office No. 1603, Las Condes, Santiago, Chile.

(3)Consists of (i) 191,697 shares of common stock held by Mr. Brandt, (ii) 8,333 shares of common stock to be issued from the settlement of RSUs that have vested, and (iii) 16,666 shares of common stock that will vest within 60 days of April 14, 2025 held by Mr. Brandt.

(4)Consists of (i) 79,794 shares of common stock held by Mr. Aminpour, (ii) 7,311 shares of common stock to be issued from the settlement of RSUs that have vested, and (iii) 5,983 shares of common stock to be issued from the settlement of RSUs that will vest within 60 days of April 14, 2025, held by Mr. Aminpour.

(5)Consists of (i) 25,146 shares of common stock held by Ms. Behnen, (ii) 645 shares of common stock to be issued from the settlement of RSUs that have vested, and (iii) 1,289 shares of common stock to be issued from the settlement of RSUs that will vest within 60 days of April 14, 2025, held by Ms. Behnen.

(6)Consists of (i) 24,025 shares of common stock held by Mr. Cook, (ii) options for 20,375 shares of common stock that have vested as of April 14, 2025, but have not yet been exercised, held by Mr. Cook, (iii) 878 shares of common stock to be issued from the settlement of RSUs that have vested, (iv) 1,757 shares of common stock to be issued from the settlement of RSUs that will vest within 60 days of April 14, 2025, held by Mr. Cook, (v) 110,197 shares of common stock held by the Etnyre 2021 Family Trust, of which Mr. Cook is trustee, (vi) 9,430 shares of common stock held by the Cook 2021 Family Trust, of which Mr. Cook is trustee, and (vii) 9,430 shares of common stock held by the Patrick Cook 2021 Trust, of which Mr. Cook is trustee.

(7)Consists of (i) 1,174,086 shares of common stock held by the ARC Family Trust, (ii) 32,992 shares of common stock held by Mr. Sadasivam, (iii) 301,710 shares of common stock held by ChristSivam, LLC, and (iv) 12,447 shares of common stock to be issued from the settlement of RSUs that will vest within 60 days of April 14, 2025 held by Mr. Sadasivam. Mr. Sadasivam is the trustee of the ARC Family Trust and has shared voting and dispositive power with respect to the shares of common stock held by ARC Family Trust. Mr. Sadasivam is also the Manager of ChristSivam, LLC and has sole voting and dispositive power with respect to the shares of common stock held by ChristSivam, LLC. See also above footnote (1) for further information about ARC Family Trust. Mr. Sadasivam has no pecuniary interest in any shares of common stock held by ARC Family Trust, and therefore, disclaims beneficial ownership of any such shares for purposes of Section 16 of the Exchange Act. The address of this stockholder is 1950 Pine Run Drive, Chesterfield, MO 63108.

(8)Consists of 4,000 shares of common stock held by Mr. Barahona.

(9)Consists of (i) 227,536 shares of common stock held by Mr. Chatila, and (ii) 1,231 shares of common stock to be issued from settlement of RSUs that have vested as of April 14, 2025, held by Mr. Chatila.

(10)Consists of (i) 24,716 shares of common stock held by Mr. Hung, and (ii) 12,447 shares of common stock to be issued from the settlement of RSUs that will vest within 60 days of April 14, 2025, held by Ms. Hung.

(11)Consists of (i) 36,364 shares of common stock held by Mr. Priddy, and (ii) 10,386 shares of common stock to be issued from the settlement of RSUs that will vest within 60 days of April 14, 2025 held by Mr. Priddy.

(12)Consists of (i) 771,132 shares of common stock held by Mr. Springer, (ii) 9,045 shares of common stock to be issued from the settlement of RSUs that will vest within 60 days of April 14, 2025, held by Mr. Springer, (iii) 49,136 shares of common stock held by the DS 2022 GRAT, (iv) 33,615 shares of common stock held by ZS 2021 Trust, (v) 33,615 shares of common stock held by NS 2021 Trust, and (vi) 33,615 shares of common stock held by AS 2021 Trust. As stated in Amendment No. 3 to Schedule 13G filed February 14, 2025, with respect to the DS 2022 GRAT, Mr. Springer is (a) the sole trustee, (b) has sole voting and dispositive power with respect to the shares of common stock held by the trust and (c) has sole power to acquire for himself any asset held in the trust, including the shares of common stock, by substituting other property of equivalent value. With respect to the ZS 2021 Trust, the NS 2021 Trust and the AS 2021 Trust, Mr. Springer has sole power to acquire for himself any asset held in the trust, including the shares of common stock, by substituting other property of equivalent value.

MATTERS TO COME BEFORE THE ANNUAL MEETING

PROPOSAL 1:

Election of Directors

Director Classes

Our amended and restated certificate of incorporation and amended and restated bylaws provide that our Board of Directors are divided into three classes, as nearly equal in number as possible, with the directors in each class serving for a three-year term, and one class being elected each year by our stockholders. Our current directors are divided among the three classes as follows:

•the Class I directors are Pablo Barahona, Darrell Jackson and David Springer, whose terms will expire at this Annual Meeting of Stockholders;

•the Class II directors are Shaker Sadasivam, Maximillian Sultan and Yann Brandt, whose terms will expire at the Annual Meeting of Stockholders to be held in 2026; and

•the Class III directors are Ahmad Chatila, Lisan Hung and William Aldeen "Dean" Priddy, Jr., whose terms will expire at the Annual Meeting of Stockholders to be held in 2027.

Tamara Mullings resigned from her position as an independent director of the Company, effective May 13, 2024. Mrs. Mullings resignation was not a result of any disagreement with the Company or any matter relating to the Company's operations, policies or practices.

Isidoro Quiroga Cortés resigned from his position as an independent director of the Company, effective August 11, 2024. Mr. Quiroga Cortés' resignation was not a result of any disagreement with the Company or any matter relating to the Company's operations, policies or practices.

The Board of Directors appointed Mr. Pablo Barahona as an independent director of the Company and a member of the Audit Committee of the Board, effective August 12, 2024. There was no arrangement or understanding between Mr. Barahona and the Company or any other person pursuant to which he was elected as a director. The Board believes that Mr. Barahona's knowledge of different economic sectors across global markets particularly in Latin America and Europe and significant experience in corporate governance and dealing with government agencies will be an important asset to the Board and the Company as we continue to expand our served markets and capitalize on the strength of our broadened product offerings across 1P and 2P tracker configurations.

The Board of Directors appointed Darrell Jackson as an independent director of the Company, effective April 28, 2025. There was no arrangement or understanding between Mr. Jackson and the Company or any other person pursuant to which he was elected as a director. The Board believes that Mr. Jackson's knowledge of U.S. capital markets and experience with complex financial transactions will be an important asset to the Board and the Company as we continue efforts to expand our business and improve our financial position.

The Board of Directors appointed Maximillian Sultan as an independent director of the Company, effective April 28, 2025. There was no arrangement or understanding between Mr. Sultan and the Company or any other person pursuant to which he was elected as a director. The Board believes that Mr. Sultan's experience in advising other companies on business strategy and operations management will be an important asset to the Board and the Company as we continue to adjust our cost structure while investing for future planned growth.

The terms of appointment for Mr. Barahona and Mr. Jackson, along with Mr. Springer's previously elected term, will expire at this Annual Meeting of Stockholders, unless elected by Company shareholders to a three-year term expiring at the Annual Meeting of Shareholders in 2028.

The other remaining director's terms will continue until the election and qualification of his or her successor, or his or her earlier death, disqualification, resignation or removal. Any increase or decrease in the number of directors will be distributed evenly among the three classes so that each class will consist of as near an equal number of directors as possible. This classification of our Board of Directors may have the effect of delaying or preventing a change in control of our Company. There are no family relationships among any of our directors or executive officers.

Nominees for Election as Directors at This Meeting

In accordance with the recommendation of our Nominating and Corporate Governance Committee, Pablo Barahona, Darrell Jackson and David Springer have each been nominated by the Board for election to a three-year term that will expire at the Annual Meeting of Stockholders in 2028. Additional information about the nominees is provided below under “Information about Our Directors.”

Vote Required

The three respective nominees shall be elected as directors by the plurality of votes cast. Unless authority to do so is withheld, it is the intention of the persons named in the proxy to vote such proxy FOR this proposal. Abstentions and broker non-votes will not be counted as votes “for,” or votes “withheld” for the election of directors.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF EACH NOMINEE UNDER PROPOSAL 1.

Information About Our Directors

Class I Director Nominees for Election

Below is biographical information of each of the Class I directors standing for election:

|

|

|

|

|

|

|

|

Name and Background |

|

Nominating and Corporate Governance Committee |

|

Compensation Committee |

|

Audit Committee |

Non-employee directors - |

|

|

|

|

|

|

Pablo Barahona was appointed as a member of our Board of Directors effective August 12 2024. Mr. Barahona served as President of Global Retail Markets West for Liberty Mutual from January 2016 through June 2024. Prior to that he served as President and CEO of Liberty Seguros Brazil from 2012 to 2014. Earlier in his career he served as President and CEO of Liberty Seguros Chile, General Manager of Asesorias e Inversiones Benjamin S.A. and CEO of Compania de Seguros PanAmerican. He served as Chairman of the Board for several Liberty Mutual subsidiaries between 2011 and 2019, including in Spain, Colombia, Ecuador, Brazil, Chile, and Portugal. Mr. Barahona earned a master's degree in economics from Duke University and a Bachelor of Arts degree from Universidad De Chile. |

|

|

|

|

|

Member |

|

|

|

|

|

|

|

Darrell Jackson was appointed as a member of our Board of Directors, effective April 28, 2025. Since March 2018, Mr. Jackson has been CEO of The Efficace Group, an executive coaching and consulting firm. Previously, Mr. Jackson was President and Chief Executive Officer of Seaway Bank and Trust Company from August 2014 to October 2015 and prior to that spent over 19 years at Northern Trust Company from January 1995 to July 2014 serving in various progressive corporate roles including as Executive Vice President and President, Wealth Management, as well as Senior Vice President, Group Executive, Private Client Services. Mr. Jackson currently serves on the Janus Henderson Investors Mutual Fund Board of Trustees, is an independent director for Amalgamated Financial Corporation and subsidiary Amalgamated Bank of New York and is on the Board of Directors of two privately held companies, Dome Construction, Inc. and William R. Gray and Company (DBA Gray-Bowen-Scott). Mr. Jackson earned a BA in Communications from St. Xavier University (formerly St. Xavier College) and holds an Executive MBA degree from the Kellogg Graduate School of Management at Northwestern University. |

|

|

|

|

|

|

|

|

|

|

|

|

|

David Springer is one of our co-founders and has served as a member of our Board of Directors since January 2017. Mr. Springer previously served as our Chief Executive Officer from January 2017 to May 2019 and as our Executive Vice President, Field Operations from May 2019 to April 2021. Mr. Springer is currently the Chief Operating Officer of Recurrent Energy. From 2013 to 2016, Mr. Springer was the Chief Operating Officer of Solar Materials at SunEdison. From 2011 to 2013, Mr. Springer was the Vice President of Manufacturing at MEMC Electronic Materials Inc. From 2005 to 2011, Mr. Springer held multiple leadership positions, including Vice President of Manufacturing Operations, at Freescale Semiconductor, Inc. Mr. Springer has also served as a Navy submarine officer. Mr. Springer has a Bachelor of Science degree in engineering from the United States Naval Academy. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Class II Directors

Below is biographical information of our Class II directors:

|

|

|

|

|

|

|

|

Name and Background |

|

Nominating and Corporate Governance Committee |

|

Compensation Committee |

|

Audit Committee |

Non-employee director - |

|

|

|

|

|

|

Shaker Sadasivam has served as Chair of the Board of Directors since January 19, 2023 and has been a member of our Board of Directors since January 2017. Mr. Sadasivam has served as the Chief Executive Officer of Auragent Bioscience, LLC since co-founding the company in 2018. From 2014 to 2016, Mr. Sadasivam served as President and Chief Executive Officer of SunEdison Semiconductor LLC. From 2009 to 2013, Mr. Sadasivam served as Executive Vice President and President of SunEdison. Mr. Sadasivam has served on the board of directors of Coherent Corp. (formerly II-VI Incorporated) since 2016. Mr. Sadasivam also serves on the board of directors of the private companies Sfara, Inc., Dclimate Inc. and Sea Pharma, LLC. Mr. Sadasivam holds a Bachelor of Science degree and a Master of Science degree in chemical engineering from the University of Madras and Indian Institute of Technology, a Master of Business Administration degree from Washington University and a Ph.D. degree in chemical engineering from Clarkson University. |

|

Member |

|

Chair |

|

Member |

|

|

|

|

|

|

|

Maximilian Sultan was appointed as a member of our Board of Directors, effective April 28, 2025. Mr. Sultan is currently a partner in Applied Value Group, a strategy and operations management consulting firm, having joined the firm in August 2013. He has led consulting engagements on issues including sourcing and Supply Chain, product design and innovation, and commercial excellence, and has worked with several renewable energy clients. Mr. Sultan has been a member of the Board of Directors of ES Solar, a private residential and commercial solar installer based in Utah since June 2023. He was also a Board member of Applied Value Technologies from December 2023 to December 2024 and of Division 5 LLC from November 2018 to May 2024. Mr. Sultan holds a Bachelor of Business Administration degree from the Goiueta Business School at Emery University. |

|

|

|

|

|

|

Employee director - |

|

|

|

|

|

|

Yann Brandt was appointed as our President and Chief Executive Officer and a member of the Board of Directors, effective August 19, 2024. Mr. Brandt served as Chief Commercial Officer of FlexGen Power Systems Inc. since November 2022, and he served as Chief Financial Officer from February 2021 until November 2022. He previously served as Chief Executive Officer of QuickMount PV from June 2018 until June 2020. Prior to QuickMount PV, Mr. Brandt was with Conergy, a leading downstream solar company, where he served as President of the Americas, as well as Global Head of Marketing and Public Relations. Mr. Brandt is a current board member for the Solar Energy Industries Association. Mr. Brandt earned a Bachelor of Science degree in mechanical engineering from The Johns Hopkins University. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Class III Directors

Below is biographical information of our Class III directors:

|

|

|

|

|

|

|

|

Name and Background |

|

Nominating and Corporate Governance Committee |

|

Compensation Committee |

|

Audit Committee |

Non-employee directors - |

|

|

|

|

|

|

Ahmad Chatila is one of our co-founders and has served as a member of our Board of Directors since January 2017. Mr. Chatila currently serves as the Managing Partner of Fenice Investment Group, a position he has held since 2017. Mr. Chatila is the co-founder and has served on the board of directors of Dimension Renewable Energy, since 2018. Mr. Chatila was also the transformation architect at Enphase Energy Inc. from 2017 to 2020. Mr. Chatila previously served as Chief Executive Officer and a member of the board of directors of SunEdison from 2009 to 2016, which filed for bankruptcy in 2016. Prior to joining SunEdison, Mr. Chatila served as Executive Vice President of the Memory and Imaging Division of Cypress from 2005 to 2009. Mr. Chatila also serves on the board of directors of the private companies Akra Inc., Ohmium, Inc. and SunEdison Infrastructure Limited. Mr. Chatila previously served as Chair of the board of directors of TerraForm Power, Inc. and TerraForm Global Inc. Mr. Chatila holds a Bachelor of Science degree in electrical engineering from Arizona State University, a Master of Science degree in electrical engineering from Cornell University and has completed the Stanford Executive Program at Stanford University. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lisan Hung has served as a member of our Board of Directors since April 2021. Ms. Hung previously was a member of the board of directors of Rodgers Silicon Valley Acquisition Corp. (now Enovix Corporation) from December 2020 through July 2021 where she was a member of the audit committee and compensation committee. Ms. Hung is currently the Senior Vice President, General Counsel and Corporate Secretary of Enphase Energy, Inc. From 2014 to 2019, Ms. Hung was the Vice President of Legal Affairs, General Counsel and Corporate Secretary of Crocus Technology, Inc. From 2009 to 2014, she was the Vice President of Legal Affairs, General Counsel and Corporate Secretary of Kovio, Inc. Prior to that, Ms. Hung joined Advanced Micro Devices, Inc. in 1999, where she held a number of progressive leadership roles in the legal department until her departure in 2009 when she was the Director of Law for the Technology Group. Ms. Hung began her legal career at private law firms based in Silicon Valley, California. Ms. Hung holds a J.D. from Santa Clara University School of Law and a Bachelor of Science in Political Economy of Natural Resources from the University of California at Berkeley. |

|

Chair |

|

Member |

|

|

|

|

|

|

|

|

|

Dean Priddy has served as a member of our Board of Directors since November 2020. Mr. Priddy began his career at Analog Devices where he held positions with increasing responsibility in finance and marketing from 1986 to 1991. In 1991, Mr. Priddy joined RF Micro Devices, Inc. ("RFMD"), a supplier of radio frequency integrated circuits for the various wireless markets, and served as Chief Financial Officer and Corporate Vice President of Administration and Secretary from July 1997 to December of 2014 when RFMD merged with TriQuint Semiconductor, Inc. forming Qorvo, Inc. ("Qorvo"). Mr. Priddy served as Chief Integration Officer of the merger and as Executive Vice President of Administration until his retirement from Qorvo in 2015. Mr. Priddy has served on the board of trustees of the University of North Carolina at Greensboro since 2015. He currently is a private investor and serves or has served as a business and financial advisor to multiple early-stage and emerging growth companies. Mr. Priddy holds a Bachelor of Science degree in business administration and a Master of Business Administration degree, each from the University of North Carolina at Greensboro. |

|

Member |

|

Member |

|

Chair |

|

|

|

|

|

|

|

Board Diversity Matrix

The matrix below summarizes certain key experience, qualifications, skills and attributes that our directors bring to the Board to enable effective oversight, as well as demographic information relating to each Board member as of April 30, 2025. The matrix is not intended to provide a complete list of each directors' strengths or contributions to the Board. Additional information regarding each director may be found above in his or her biography.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sadasivam |

|

Barahona |

|

Brandt |

|

Chatila |

|

Hung |

|

Jackson |

|

Priddy |

|

Springer |

|

Sultan |

Skills and Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive leadership |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

Global business |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

|

|

ü |

|

ü |

|

|

Public company experience |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

|

Solar industry experience |

|

ü |

|

|

|

ü |

|

ü |

|

ü |

|

ü |

|

|

|

ü |

|

ü |

Semiconductor and electronics industry experience |

|

ü |

|

|

|

|

|

ü |

|

ü |

|

|

|

ü |

|

ü |

|

|

Advanced degree |

|

ü |

|

ü |

|

|

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

|

Other board/trustee experience |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

|

ü |

Audit committee financial expert(1) |

|

ü |

|

ü |

|

|

|

|

|

|

|

ü |

|

ü |

|

|

|

|

Tenure on FTC Board since |

|

2017 |

|

2024 |

|

2024 |

|

2017 |

|

2021 |

|

2025 |

|

2020 |

|

2017 |

|

2025 |

Current FTC Board term expires |

|

2026 |

|

2025 |

|

2026 |

|

2027 |

|

2027 |

|

2025 |

|

2027 |

|

2025 |

|

2025 |

Demographics - Age |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age |

|

65 |

|

63 |

|

42 |

|

57 |

|

56 |

|

67 |

|

64 |

|

56 |

|

35 |

Demographics - Gender |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

ü |

|

ü |

|

ü |

|

ü |

|

|

|

ü |

|

ü |

|

ü |

|

|

Female |

|

|

|

|

|

|

|

|

|

ü |

|

|

|

|

|

|

|

|

Non-binary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Did not disclose gender |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ü |

Demographics - Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

African American or Black |

|

|

|

|

|

|

|

|

|

|

|

ü |

|

|

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asian |

|

ü |

|

|

|

|

|

|

|

ü |

|

|

|

|

|

|

|

|

Hispanic or Latinx |

|

|

|

ü |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

White |

|

|

|

|

|

ü |

|

ü(2) |

|

|

|

|

|

ü |

|

ü |

|

|

Two or More Races or Ethnicities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LGBTQ+ |

|

|

|

|

|

ü |

|

|

|

|

|

|

|

|

|

|

|

|

Did not disclose background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ü |

|

|

|

(1) |

As defined in Item 407(d)(5) of Regulation S-K. |

(2) |

Self-identifies a Middle Eastern/North African |

Board and Committee Meeting Attendance

All directors are expected to attend, in person or by teleconference or video conference, the Board meetings and meetings of the Board committees on which they serve. In accordance with our Corporate Governance Guidelines, each director is invited and encouraged to attend our Annual Meeting of Stockholders.

There was a total of five regularly scheduled and special meetings of the Board held during 2024. Also, during the same period, the Audit Committee held four meetings, the Compensation Committee held six meetings, and the Nominating and Corporate Governance Committee held three meetings. No current director serving during 2024 attended less than 75% of the aggregate of the Board meetings and meetings of the Board committees on which he or she served during the period they were on the Board, other than Pablo Barahona who attended one of two scheduled meetings following his appointment. Mr. Barahona was in attendance at the Board meeting on October 30, 2024, but not at the Audit Committee meeting on October 29, 2024. In addition, four members of the Board of Directors were in attendance during the Company's

virtual 2024 Annual Meeting of Stockholders and four members of the Board of Directors were in attendance during the Company's virtual Special Meeting of Stockholders held on November 8, 2024.

Director Independence

Our Board of Directors undertook a review of the independence of our directors and considered whether any director has a material relationship with us that could compromise that director’s ability to exercise independent judgment in carrying out that director’s responsibilities. Our Board of Directors has affirmatively determined that each of Pablo Barahona, Lisan Hung, Darrell Jackson, Dean Priddy, Shaker Sadasivam, David Springer and Maximillian Sultan is an “independent director” under the rules of Nasdaq. In making these determinations, our Board of Directors considered the current and prior relationships that each director has with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each director, and the transactions involving them described in the section titled “Certain Relationships and Related Person Transactions.”

Board Committees

Our Board of Directors has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The composition and responsibilities of each committee are described below. Our Board of Directors may also establish from time to time any other committees that it deems necessary or desirable. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors.

Audit Committee

Our Audit Committee consists of Dean Priddy, Pablo Barahona and Shaker Sadasivam, with Mr. Priddy serving as chair. Our Audit Committee is responsible for, among other things:

•selecting and hiring our independent auditors, and approving the audit and non-audit services to be performed by our independent auditors;

•assisting the Board of Directors in evaluating the qualifications, performance and independence of our independent auditors;

•assisting the Board of Directors in monitoring the quality and integrity of our financial statements and our accounting and financial reporting;

•assisting the Board of Directors in managing risks associated with cybersecurity threats, providing oversight of management's cybersecurity risk management efforts, participating in strategic decisions and providing approvals of major initiatives related to cybersecurity (see "Part I, Item 1C. Cybersecurity" in our 2024 Annual Report to Shareholders for further information on our risk management, strategy and governance relating to cybersecurity);

•assisting the Board of Directors in monitoring our compliance with legal and regulatory requirements;

•reviewing with management and our independent auditors the adequacy and effectiveness of our internal control over financial reporting processes;

•assisting the Board of Directors in giving directions to and actively monitoring the performance of our internal audit function, which reports directly to the Audit Committee with "dotted line" reporting to management;

•reviewing with management and our independent auditors our annual and quarterly financial statements;

•assisting the Board of Directors in reviewing the design and operation of our management information systems, including plans for system upgrades and enhancements;

•reviewing and overseeing all transactions between us and a related person for which review, or oversight is required by applicable law or that are required to be disclosed in our financial statements or SEC filings, and developing policies and procedures for the committee’s review, approval and/or ratification of such transactions;

•establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; and

•preparing the Audit Committee report included in our annual proxy statement pursuant to the rules and regulations of the SEC.

Dean Priddy, Pablo Barahona and Shaker Sadasivam qualify as independent directors for purposes of serving on the Audit Committee under the corporate governance standards of Nasdaq and the independence requirements of Rule 10A-3 under the Exchange Act. Each member of our Audit Committee also meets the financial literacy requirements of Nasdaq listing standards. In addition, our Board of Directors has determined that each of Mr. Priddy and Mr. Sadasivam qualifies as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. Our Board of Directors has adopted a written charter for the Audit Committee, which is available on our corporate website at https://investor.ftcsolar.com.

Compensation Committee

Our Compensation Committee consists of Shaker Sadasivam, Lisan Hung and Dean Priddy, with Mr. Sadasivam serving as chair. The Compensation Committee is responsible for, among other things:

•reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating our Chief Executive Officer’s performance in light of those goals and objectives, and, either as a committee or together with the other independent directors (as directed by the Board of Directors), determining and approving our Chief Executive Officer’s compensation level based on such evaluation;

•reviewing and approving, or making recommendations to the Board of Directors with respect to, the compensation of our other executive officers, including annual base salary, bonus and equity-based incentives and other benefits;

•reviewing and recommending to the Board of Directors the compensation of our directors;

•appointing and overseeing any compensation consultants;

•reviewing and discussing with management our “Compensation Discussion and Analysis” disclosure, if and when required to be included in our annual proxy statement by the rules and regulations of the SEC ;

•preparing the Compensation Committee report, if and when required to be included in our annual proxy statement by the rules and regulations of the SEC; and

•reviewing and making recommendations with respect to our equity and equity-based compensation plans.

The Compensation Committee may form subcommittees for any purpose that the Compensation Committee deems appropriate and may delegate to such subcommittees such power and authority as the Compensation Committee deems appropriate.

Our Board of Directors has determined that each of Shaker Sadasivam, Lisan Hung and Dean Priddy, meet the definition of “independent director” for purposes of serving on the Compensation Committee under Nasdaq rules, including the heightened independence standards for members of a Compensation Committee, and are “non-employee directors” as defined in Rule 16b-3 of the Exchange Act. Our Board of Directors has adopted a written charter for the Compensation Committee, which is available on our corporate website at https://investor.ftcsolar.com.

Compensation Committee Consultant

The Compensation Committee has engaged an independent consultant, Aon Human Capital Solutions ("Aon'), a division of Aon plc, to assist the committee in its assessment of the appropriate levels and structure of compensation for executive management and the Board of Directors, as well as to assist in the design, strategy, governance and modeling of share usage from our equity incentive compensation programs through assessment of compensation programs in place at peer companies. Aon did not provide consulting services to us during 2024, other than with respect to executive and director compensation, including valuation of certain stock-based compensation awards with market conditions awarded to our Chief Executive Officer upon joining the Company in August 2024. The committee determined such services did not result in a conflict of interest.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Lisan Hung, Shaker Sadasivam and Dean Priddy, with Ms. Hung serving as chair. The Nominating and Corporate Governance Committee is responsible for, among other things:

•assisting our Board of Directors in identifying prospective director nominees and recommending nominees to the Board of Directors;

•overseeing the evaluation of the Board of Directors and management, including participation of the Board members in continuing education activities;

•reviewing developments in corporate governance practices and developing and recommending a set of corporate governance guidelines;

•reviewing our succession planning process for the Chief Executive Officer and other members of our executive leadership team;

•recommending members for each committee of our Board of Directors; and

•recommending to the Board for approval any changes to our policies related to environmental, social and governance matters.

Our Nominating and Corporate Governance Committee will also consider candidates recommended by stockholders. In considering candidates submitted by stockholders, the Nominating and Corporate Governance Committee will take into consideration the needs of the Board and the qualifications of the candidate, as well as the listing standards of the Nasdaq. The Nominating and Corporate Governance Committee may establish procedures, from time to time, regarding stockholder submission of recommendations for Board candidates.

Our Board of Directors has determined that each of Lisan Hung, Shaker Sadasivam and Dean Priddy meet the definition of "independent director" for purposes of serving on the Nominating and Corporate Governance Committee under Nasdaq rules. Our Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee, which is available on our corporate website at https://investor.ftcsolar.com.

Board Leadership Structure

Our current chair, Shaker Sadasivam, is an independent director and also serves as the lead director on the Board. Pursuant to our Corporate Governance Guidelines, when the chair of our Board of Directors is not an independent director, the independent directors on our Board will designate one of the independent directors to serve as the lead independent director. When the chair of our Board of Directors is an independent director, the duties of the lead director, which consist of coordinating the activities of the independent directors, coordinating the agenda for and presiding over sessions of the Board’s independent directors, and facilitating communications between the other members of the Board, will be part of the duties of the chair.

Background and Experience of Directors

Our Nominating and Corporate Governance Committee is responsible for reviewing with our Board of Directors, on an annual basis, the appropriate characteristics, skills and experience required for the Board of Directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the Nominating and Corporate Governance Committee, in recommending candidates for election, and the Board of Directors, in approving (and, in the case of vacancies, appointing) such candidates, will take into account many factors, including the following:

•significant accomplishment in his or her field;

•personal and professional integrity;

•experience in corporate management, such as serving as an officer or former officer of a publicly held company;

•experience in the industries in which we compete;

•experience as a board member or executive officer of another publicly held company;

•diversity of background, racial, ethnic and gender diversity, and expertise and experience in substantive matters pertaining to our business relative to other Board members; and

The Board's Role in Risk Oversight

Our Board has and exercises ultimate oversight responsibility with respect to the management of the strategic, operational, financial and legal risks facing the Company and its operations and financial condition. The Board is involved in setting our business and financial strategies and establishing what constitutes the appropriate level of risk for us. Various committees of the Board also have responsibility for risk management.

The Board delegated to its Audit Committee the responsibility to provide oversight of the Company’s management of risks associated with cybersecurity threats, its accounting functions, financial and compliance risks and internal controls. It has delegated to its Nominating and Corporate Governance Committee the responsibility to oversee the effectiveness of our governance documentation, policies and procedures and our compliance programs.

The Compensation Committee is responsible for assessing the nature and degree of risk that may be created by our compensation policies and practices to ensure the appropriateness of risk-taking and their consistency with our business strategies. To conduct the assessment, the Compensation Committee, with the assistance of Aon Consulting, Inc., its independent compensation consultant, reviews our compensation policies and practices and in particular, our incentive plans, eligible participants, performance measurements, parties responsible for certifying performance achievement, and sums that could be earned to ensure that our compensation policies and practices do not encourage or create risk-taking that could be reasonably likely to have a material adverse impact on us.

The Board's Role in Succession Planning

The Board is also responsible for planning for future succession to the position of Chief Executive Officer, as well as certain other senior management positions. To assist the Board, the Chief Executive Officer shall periodically provide the Board with an assessment of persons considered potential successors to certain senior management positions and annually provide the Board with an assessment of other senior managers and their potential to succeed to the Chief Executive Officer position.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee will have at any time been one of our executive officers or employees. None of our executive officers currently serves, or has served during the last completed fiscal year, as a member of the board of directors or compensation committee (or other committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our Board of Directors or Compensation Committee.

Communications with the Board of Directors

Any interested party desiring to communicate with our Board of Directors, or any individual director may send a letter addressed to our Board of Directors as a whole or to individual directors, c/o Chief Financial Officer, 9020 N Capital of Texas Hwy, Suite I-260, Austin, Texas, 78759. The Chief Financial Officer has been instructed by the Board to screen the communications and promptly forward those to the full Board or to the individual director specifically addressed therein.

Director Compensation

Our non-employee directors are entitled to the following compensation, as applicable. The following compensation for non-employee directors was approved by our Board of Directors at the time of the Company's IPO based on advice from Aon:

Cash Compensation

Each non-employee director will receive, in respect of his or her service on our Board of Directors, an annual cash retainer equal to $50,000, payable at the beginning of the year or on the date he or she begins service.

The non-employee chair of the Board is entitled to receive, in respect of his or her service as the non-employee chair of the Board, an additional annual cash retainer equal to $30,000, payable at the beginning of the year or upon the date he or she begins service as chair.