© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 1 INVESTOR DAY OCTOBER 29TH 2025

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 2 Disclaimer Forward-Looking Statements This presentation includes forward-looking statements that reflect the Company’s current views with respect to, among other things, the Company’s operations and financial per formance. Forward-looking statements include information concern ing possible or assumed future results of operations, including future revenues and profitability, descriptions of our business plan and strategies and projected dates for project milestones, future project capacity, expected definitive agreement signings and the availab ility of future draws on our Asset Vault preferred financing and other capital resources including available tax credits. These statements often include words such as “anticipate,” “expect,” “suggest,” “plan,” “be lieve,” “intend,” “project,” “forecast,” “estimates ,” “targets,” “projections,” “should,” “could,” “would,” “may,” “might,” “will” and other similar expressions. We base these forward-looking statements or projections on our current expectations, plans, and assumptions, which we have made in light o f our experience in our industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropria te under the circumstances at the time. These forward-looking statements are based on our beliefs, assumptions, and expectations of future per formance, taking in to account the information currently available to us. These forward- looking statements are only predictions based upon our current expectations and projections about future events. These forward- looking statements involve significant risks and uncertainties that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level o f activity, performance or achievements expressed or implied by the forward-looking statements, including changes in our strategy, expansion plans, customer opportunities, future operations, fu ture financial position, estimated revenues and losses, expected monetization of tax credits, expected financings, projected costs , prospects and p lans; the uncertainly of our awards, bookings, backlog and developed pipeline equating to future revenue; the lack of assurance that non-bind ing letters of intent and other indication of interest can result in binding financings, orders or sales; the possibility of our products to be or alleged to be defective or experience other fa ilures; the implementation, market acceptance and success of our business model and growth strategy; our ability to develop and maintain our brand and reputation; developments and projections relating to our business, our competitors, and industry; the ability of our suppliers to deliver necessary components or raw materials for construction of our energy storage systems in a timely manner; the impact of health epidemics, on our business and the actions we may take in response thereto; our expectations regarding our ability to obtain and maintain intellectual property protection and not infr inge on the r ights of o thers; expectations regarding the time during which we will be an emerging growth company under the JOBS Act; our future capital requirements and sources and uses of cash; the international nature of our operations and the impact o f war or other hostilities on our business and global markets; our ab ility to obtain funding for our operations and future growth; our business, expansion plans and opportunities and other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on April 1, 2025, as such factors may be updated from time to time in its other filings with the SEC, accessib le on the SEC’s website at www.sec.gov. New r isks emerge from time to time, and it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those conta ined in any forward-looking statements we may make. Any forward-looking statement made by us in this press release speaks only as of the date of this press re lease and is expressly qualified in its entirety by the cautionary statements included in this press release. We undertake no obligation to publicly update or review any forward -looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws. You should not place undue reliance on our forward-looking statements. . Non-GAAP Financial Metrics This presentation includes financial measures not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), including Adjusted EBITDA and Adjusted Operating Expenses, which are supplemental financial information that are not required by, or presented in accordance with, GAAP. Our management uses non-GAAP financia l measures for business planning purposes and in measur ing our performance relative to that o f our competitors. Our management believes that presenting non-GAAP financia l measures provides meaningful information to investors in understanding our operating results and may enhance investors’ ability to analyze financial and business trends. In addition, our management believes that non-GAAP financia l measures allow investors to compare our results period to period more easily by exclud ing items that could have a disproportionately negative or positive impact on results in any particular period. However, this non-GAAP measures are not a substitu te for, or superior to , GAAP measures and should not be considered as an alternative to net income (loss) as a measure of financial per formance, or any other performance measure derived in accordance with GAAP. The presentation of non-GAAP financia l measures have limitations as an analytical too l and should not be considered in isolation, or as a substitute for our results as reported under GAAP. For example, because not all companies use identical ca lculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can d iffer significantly from company to company. P lease refer to this presentation for additional information regarding non-GAAP measures, including reconciliations of the non-GAAP financia l measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP. Market and Industry This presentation includes market and industry data and forecasts that we have der ived from independent consultant repor ts, publicly available information, various industry publications, other published industry sources and our internal data and estimates. Independent consultant repor ts, industry publications and other published industry sources generally indicate that the in formation contained therein was obta ined from sources believed to be re liable. The inclusion of market estimations, rankings and indust ry data in th is presentation is based upon such reports, publications and other sources, our in ternal data and estimates and our understanding of industry conditions. Although we believe that such information is reliable, we have not had th is information verified by any independent sources. You are cautioned not to give undue weight to such estimates. Trademarks Our registered or common law trademarks, tradenames and service marks appearing in this presentation are our proper ty. Solely for convenience, our trademarks, tradenames and service marks referred to in this presentation may appear without the ®, TM and SM symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, tradenames and service marks. This presentation conta ins additional trademarks, tradenames and service marks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, tradenames and service marks to imply re lationships with, or endorsement or sponsorsh ip of us by, these other companies. No Solicitation of Sale This presentation does not constitute an offer to sell or a so licitation of an offer to buy securities, and shall not constit ute an offer, solicitation or sale in any state or jur isdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

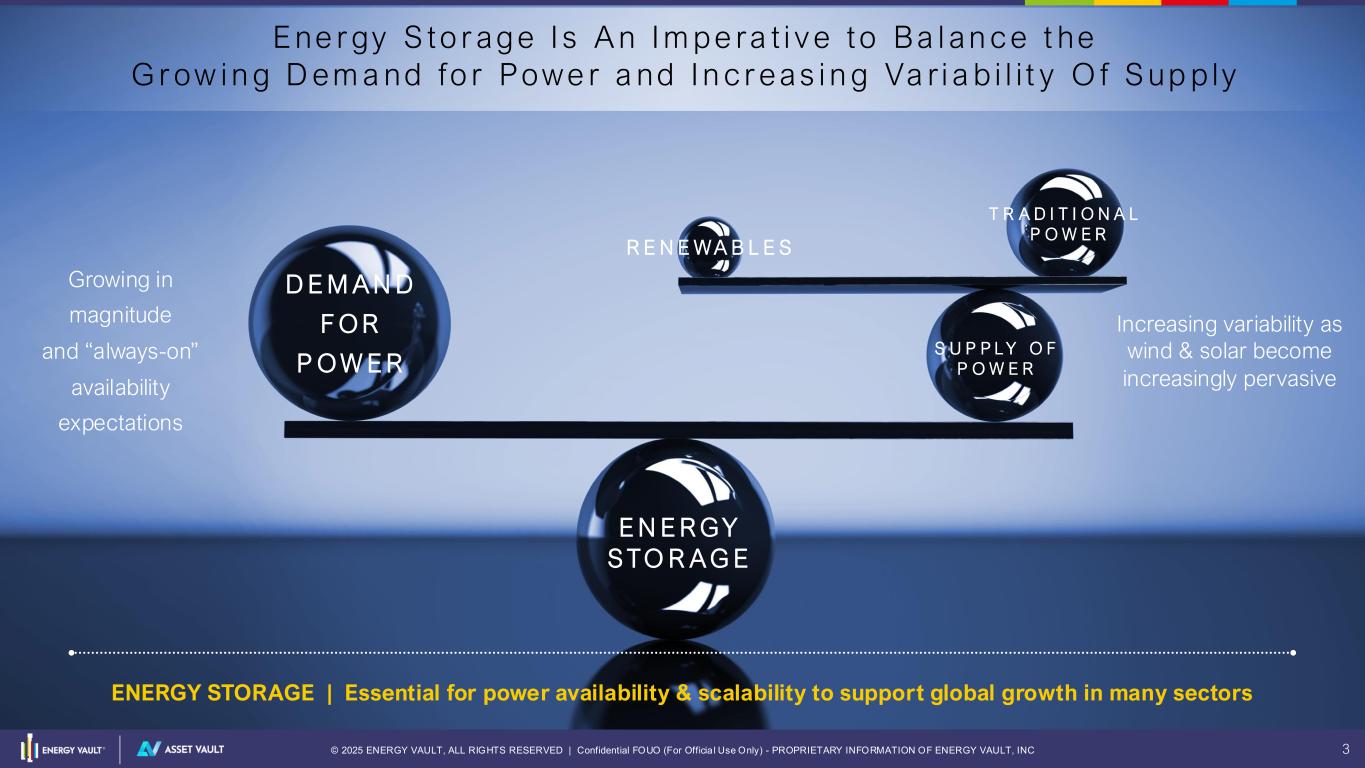

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 3 E ne r gy S to r ag e I s A n I m p e ra t i v e to Ba l an c e t he G r ow i n g D em a nd fo r Powe r a nd I n c r eas i n g Va r i a b i l i t y O f S up p ly ENERGY STORAGE | Essential for power availability & scalability to support global growth in many sectors E N E R GY S TO R A G E R E N E WA B L E S Increasing variability as wind & solar become increasingly pervasive D E M A N D F O R P O W E R T R A D I T I O N A L P O W E R S U P P L Y O F P O W E R Growing in magnitude and “always-on” availability expectations

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 4 Agenda S E C T I O N S P E A K E R Q & A I N T R O D U C I N G A S S E T V A U L T E N E R G Y V A U L T A S I N T E R G A T E D S T O R A G E I P P R o b e r t P i c o n i C h a i r m a n a n d C E O A S S E T V A U L T I N V E S T M E N T O V E R V I E W M a t t h e w B r e z i n a ( V i c e P r e s i d e n t & G M o f A s s e t V a u l t ) & C h r i s L e a r y ( O I C I n v e s t m e n t P a r t n e r & H e a d o f I n f r a E q u i t y ) F I N A N C I A L O U T L O O K M i c h a e l B e e r C F O C E O C L O S I N G R E M A R K S R o b e r t P i c o n i C h a i r m a n a n d C E O Q & A Q & A Q & A

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 5 INTRODUCING ASSET VAULT R O B E R T P I C O N I

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 6 Energy Vau l t as In teg rated Storage IPP wi th A sset Vau lt Executing our Plan: building and operating critical energy infrastructure • First 65MW online in California and Texas, closed project financings • In construction: 125 MW Stoney Creek in Australia, 150 MW Sosa Energy System in Texas • First 340 MW will deliver ~$40M EBITDA run rate in next 24 months (exiting 2027) Closed $300M Preferred Equity Fund to enable 1.5 GW and $1+ billion in CapEx • Fund #1 to deliver $100-150 million in recurring annual EBITDA • Self Integration expertise adds additional cash flows to Energy Vault (~15% of CapEx) Contract backlog at ~$1 billion – accelerating with AI infrastructure build-out • Long Term off-take agreements de-risk project cash flows, add predictable high margin revenue • Asset ownership tied to AI Infrastructure build-out represents massive multiplier on $EBITDA / MW NRGV as Storage IPP uniquely positioned to capture AI Infrastructure Build-out

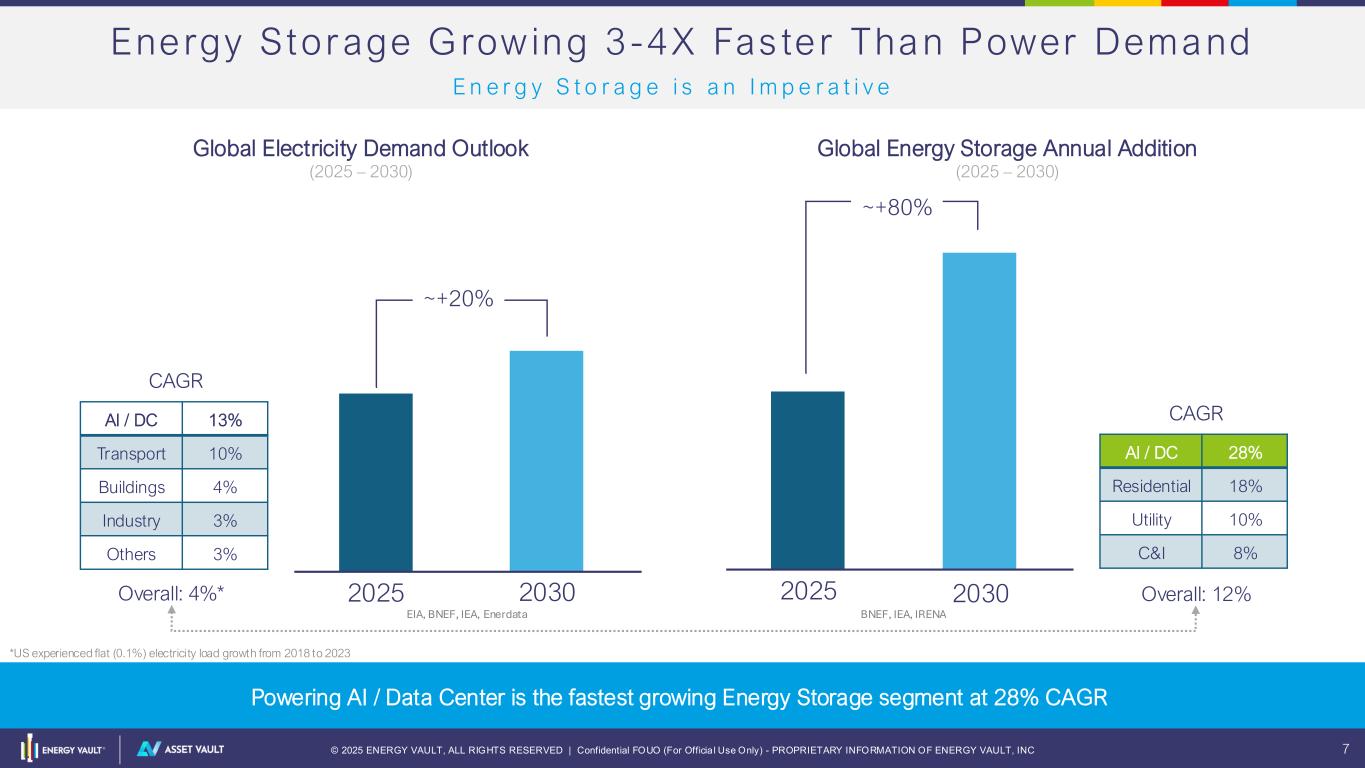

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 7 Energy Storage G row ing 3 -4X Fas te r Than Power Demand 2025 2030 Global Electricity Demand Outlook (2025 – 2030) ~+20% AI / DC 13% Transport 10% Buildings 4% Industry 3% Others 3% Overall: 4%* CAGR 2025 2030 Global Energy Storage Annual Addition (2025 – 2030) ~+80% AI / DC 28% Residential 18% Utility 10% C&I 8% Overall: 12% CAGR BNEF, IEA, IRENAEIA, BNEF, IEA, Enerdata Powering AI / Data Center is the fastest growing Energy Storage segment at 28% CAGR E n e r g y S t o r a g e i s a n I m p e r a t i v e *US experienced flat (0.1%) electricity load growth from 2018 to 2023

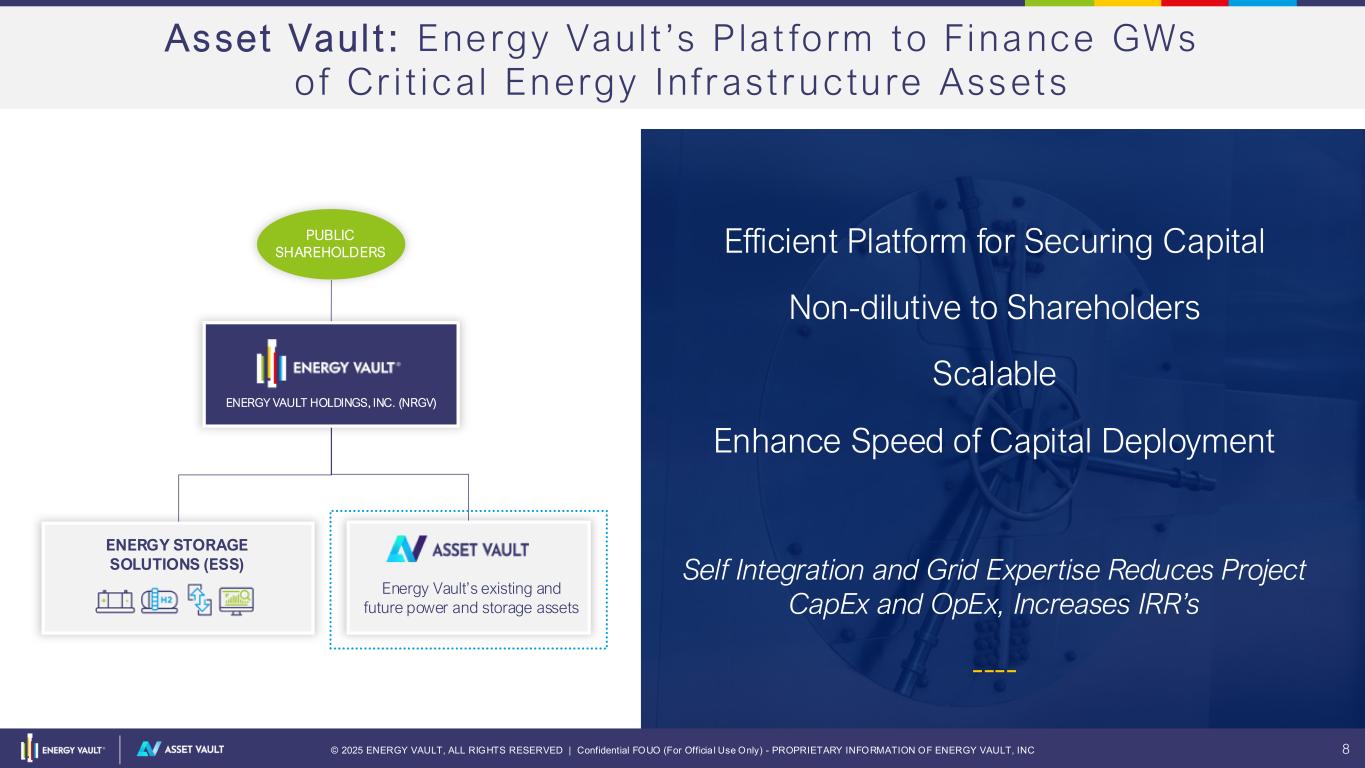

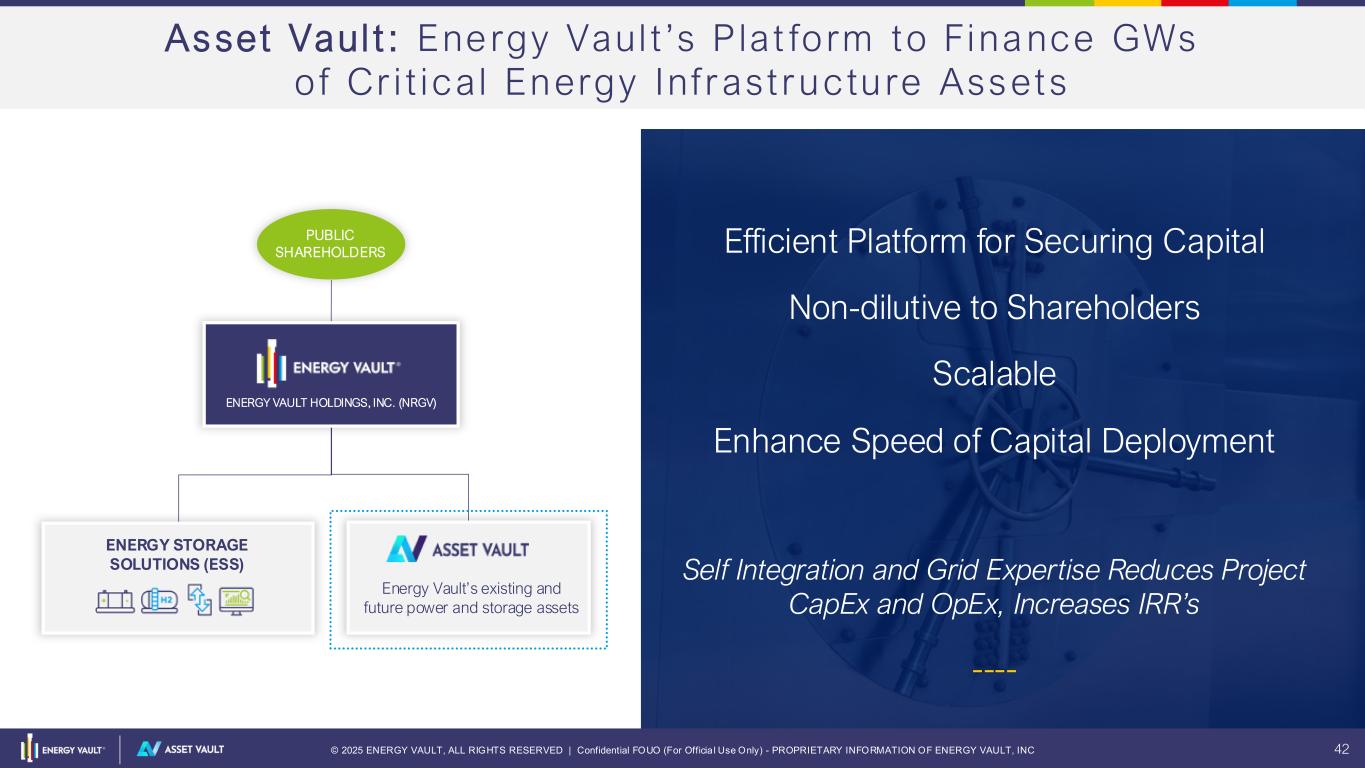

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 8 Asset Vaul t : Energy Vaul t ’s P lat fo rm to Finance GWs of Cr i t ica l Energy Inf rast ructu re Assets Efficient Platform for Securing Capital Non-dilutive to Shareholders Scalable Enhance Speed of Capital Deployment Self Integration and Grid Expertise Reduces Project CapEx and OpEx, Increases IRR’s ---- PUBLIC SHAREHOLDERS ENERGY VAULT HOLDINGS, INC. (NRGV) Energy Vault’s existing and future power and storage assets ENERGY STORAGE SOLUTIONS (ESS)

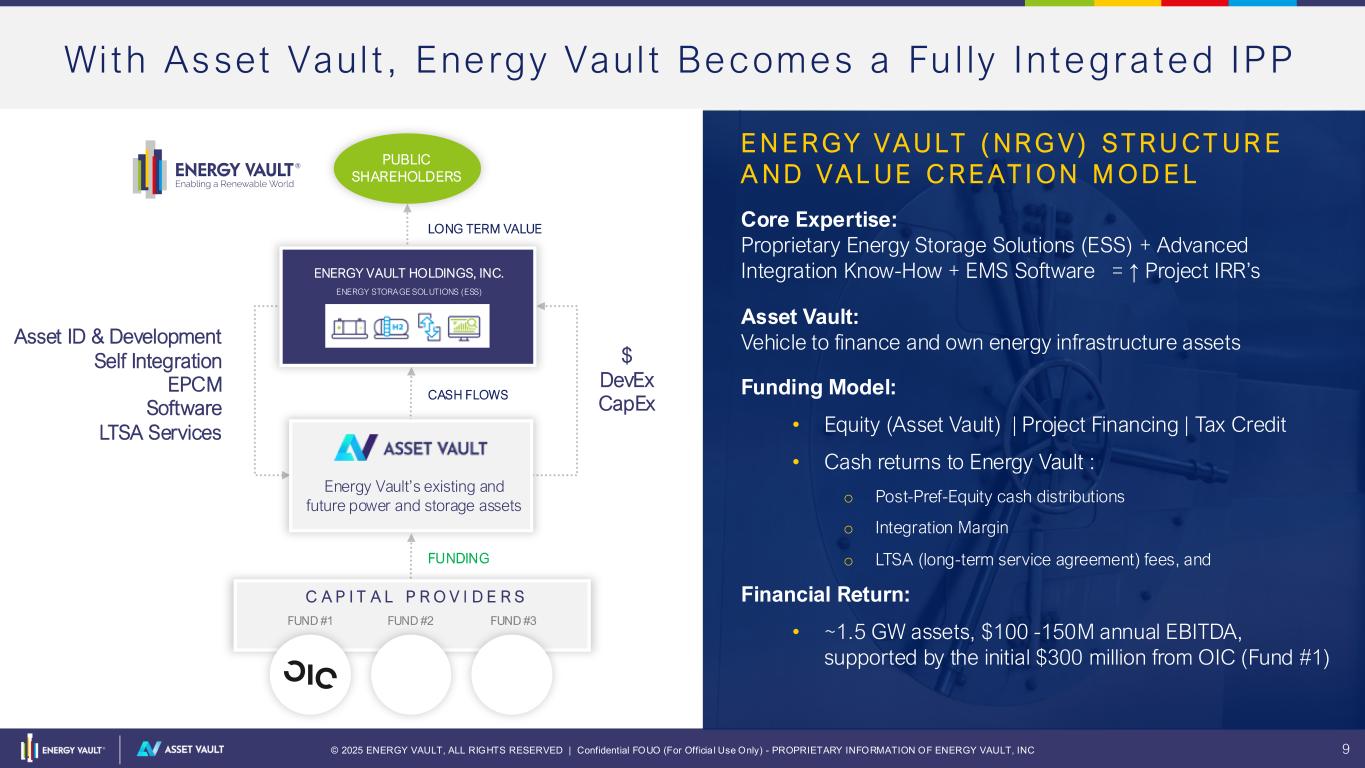

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 9 With Asset Vaul t , Ene rgy Vaul t Becomes a Fu l ly Integrated IPP Energy Vault’s existing and future power and storage assets ENERGY VAULT HOLDINGS, INC. CASH FLOWS PUBLIC SHAREHOLDERS LONG TERM VALUE Asset ID & Development Self Integration EPCM Software LTSA Services FUNDING E N E R GY V A U LT ( N R G V ) S T R U CT U R E A N D V A L U E C R E AT I O N M O D E L Core Expertise: Proprietary Energy Storage Solutions (ESS) + Advanced Integration Know-How + EMS Software = ↑ Project IRR’s Asset Vault: Vehicle to finance and own energy infrastructure assets Funding Model: • Equity (Asset Vault) | Project Financing | Tax Credit • Cash returns to Energy Vault : o Post-Pref-Equity cash distributions o Integration Margin o LTSA (long-term service agreement) fees, and Financial Return: • ~1.5 GW assets, $100 -150M annual EBITDA, supported by the initial $300 million from OIC (Fund #1) C A P I T A L P R O V I D E R S FUND #1 FUND #2 FUND #3 ENERGY STORAGE SOLUTIONS (ESS) $ DevEx CapEx

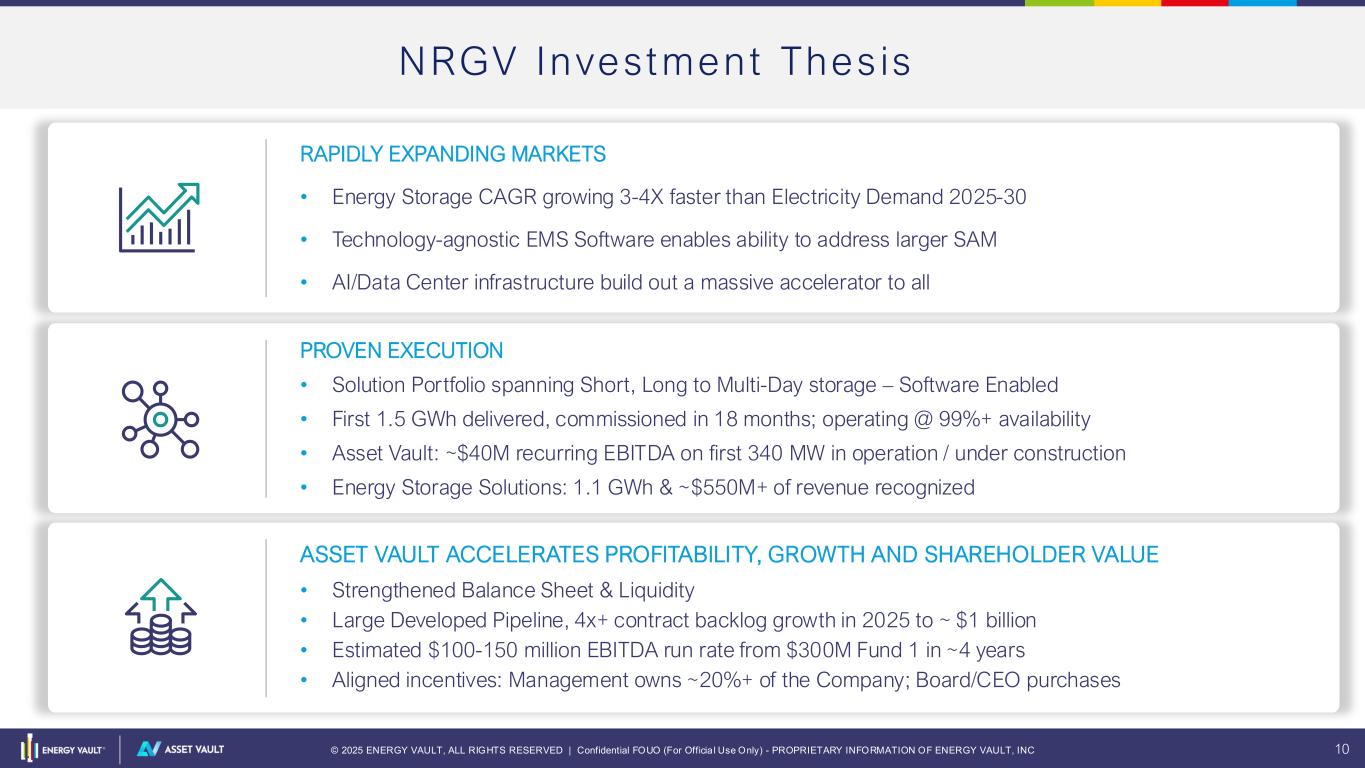

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 10 Screenshot 2025-10-08 at 11.26.43 AM Screenshot 2025-10-08 at 11.26.43 AM Screenshot 2025-10-08 at 11.26.43 AM NRGV Investment Thes is PROVEN EXECUTION • Solution Portfolio spanning Short, Long to Multi-Day storage – Software Enabled • First 1.5 GWh deliver d, commissioned in 1 months; operating @ 99%+ availability • Asset Vault: ~$40M recurring EBITDA on first 340 MW in operation / under construction • Energy Storage Solutions: 1.1 GWh & ~$550M+ of revenue recognized ASSET VAULT ACCELERATES PROFITABILITY, GROWTH AND SHAREHOLDER VALUE • Strengthened Balance Sheet & Liquidity • Large Developed Pipeli e, 4x+ contract backlog growth in 2025 to ~ $1 billion • Estimated $100-150 million EBITDA run rate from $300M Fund 1 in ~4 years • Aligned incentives: Management owns ~20%+ of the Company; Board/CEO purchases RAPIDLY EXPANDING MARKETS • Energy Storage CAGR growing 3-4X faster than Electricity Demand 2025-30 • Technology-agnostic EMS Software enables ability to address larger SAM • AI/Data Center infrastructure build out a massive accelerator to all

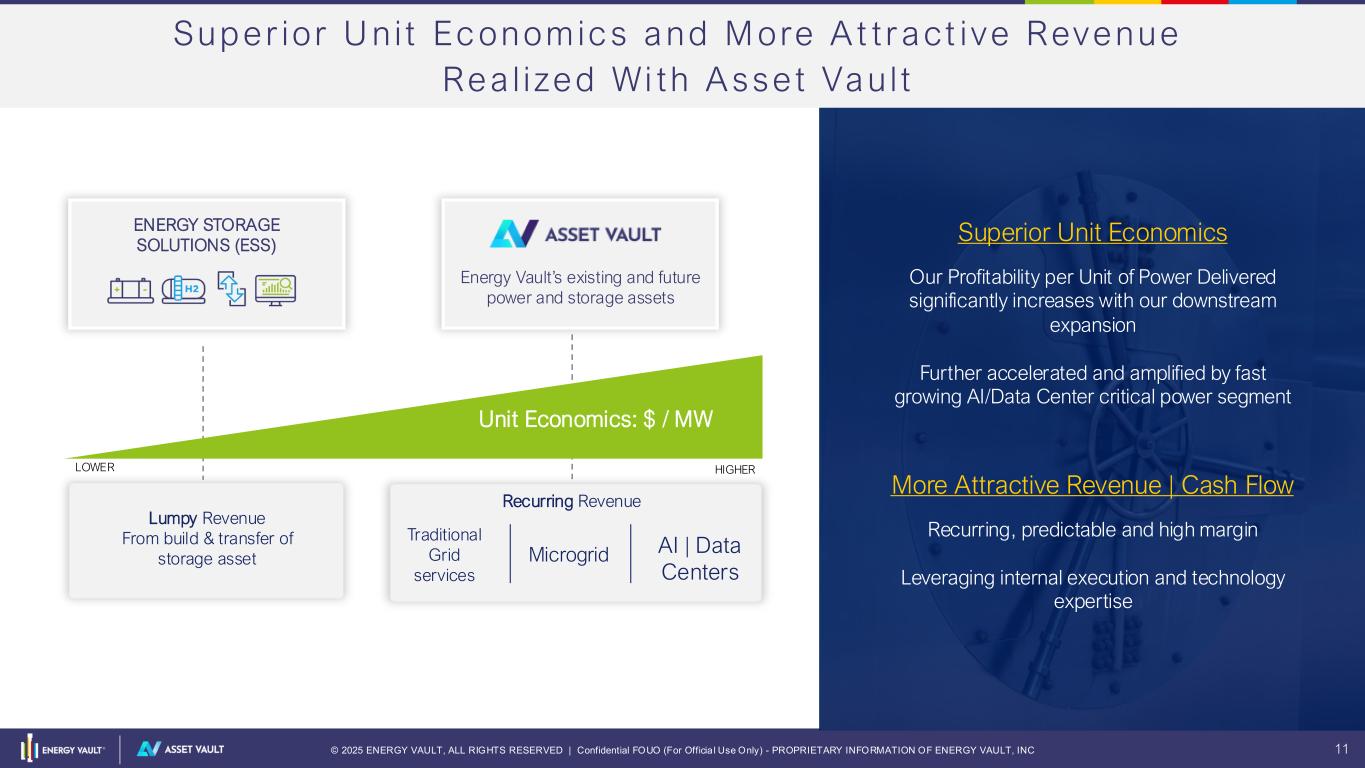

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 11 Sup er io r U n i t Ec onomic s and M ore A t t r act ive Revenue Rea l i zed Wi th A sse t Vau l t Lumpy Revenue From build & transfer of storage asset Superior Unit Economics Our Profitability per Unit of Power Delivered significantly increases with our downstream expansion Further accelerated and amplified by fast growing AI/Data Center critical power segment More Attractive Revenue | Cash Flow Recurring, predictable and high margin Leveraging internal execution and technology expertise Energy Vault’s existing and future power and storage assets ENERGY STORAGE SOLUTIONS (ESS) Unit Economics: $ / MW LOWER HIGHER Recurring Revenue Traditional Grid services AI | Data Centers Microgrid

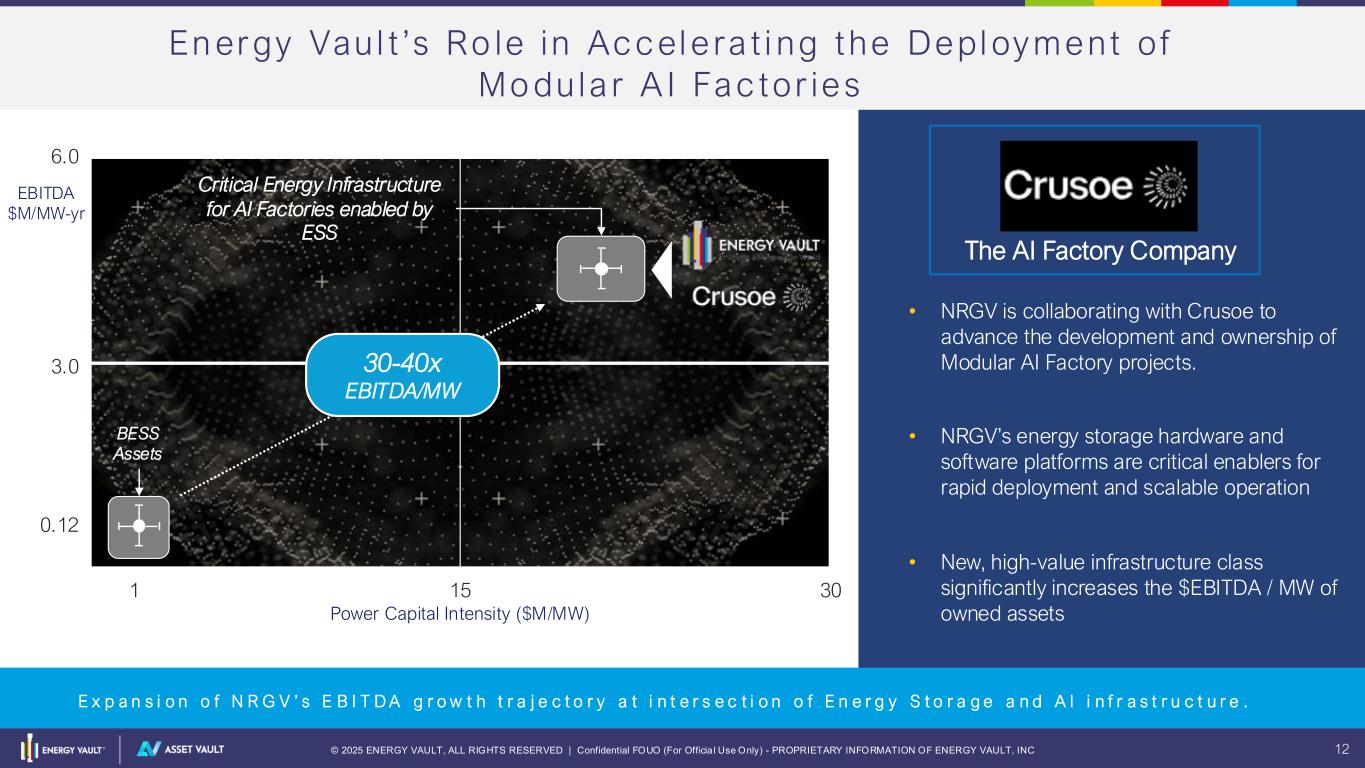

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 12 15 30 3.0 6.0 1 0.12 En er gy Vau l t ’s Ro le in Ac c el e ra t i ng the Depl oyment o f Mo du la r A I Fac tor ies Power Capital Intensity ($M/MW) EBITDA $M/MW-yr BESS Assets Critical Energy Infrastructure for AI Factories enabled by ESS 30-40x EBITDA/MW • NRGV is collaborating with Crusoe to advance the development and ownership of Modular AI Factory projects. • NRGV’s energy storage hardware and software platforms are critical enablers for rapid deployment and scalable operation • New, high-value infrastructure class significantly increases the $EBITDA / MW of owned assets The AI Factory Company E x p a n s i o n o f N R G V ’ s E B I T D A g r o w t h t r a j e c t o r y a t i n t e r s e c t i o n o f E n e r g y S t o r a g e a n d A I i n f r a s t r u c t u r e .

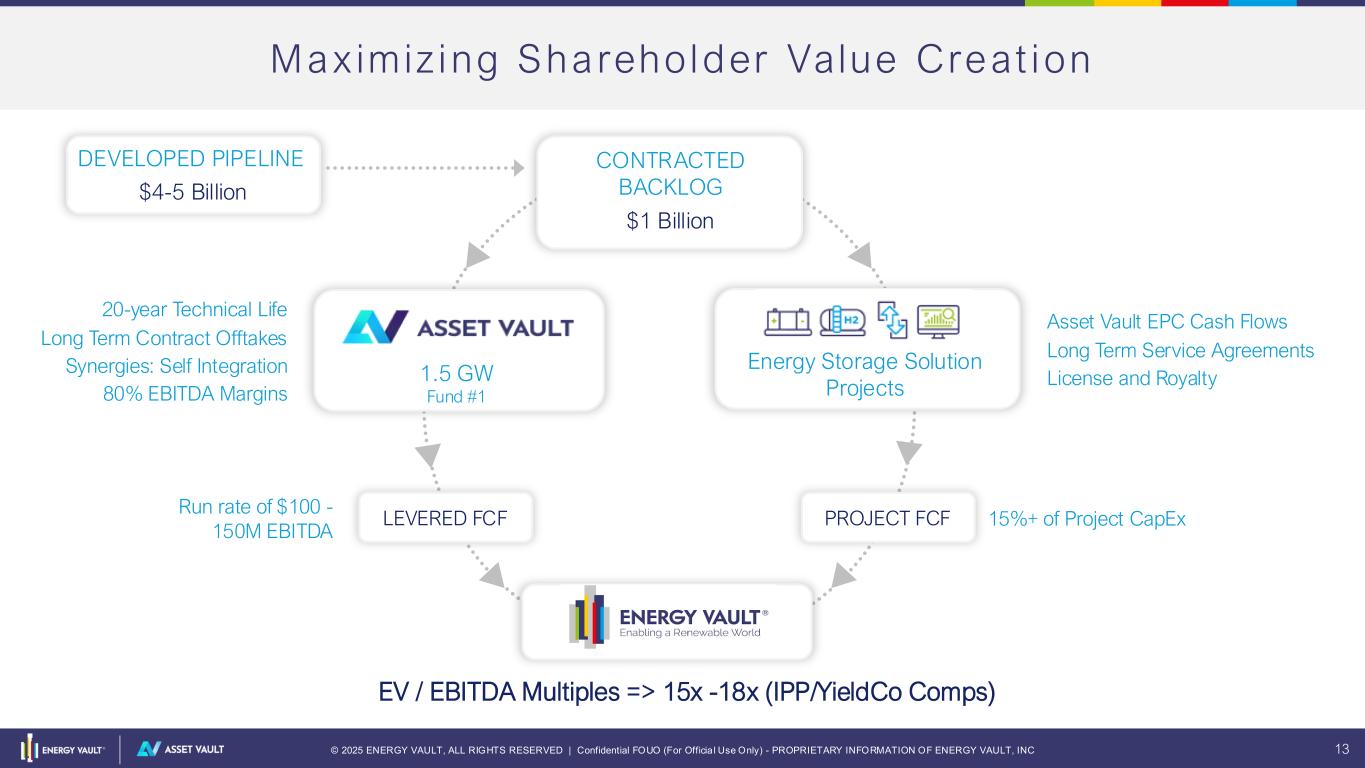

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 13 20-year Technical Life Long Term Contract Offtakes Synergies: Self Integration 80% EBITDA Margins DEVELOPED PIPELINE 1.5 GW Fund #1 LEVERED FCF PROJECT FCF EV / EBITDA Multiples => 15x -18x (IPP/YieldCo Comps) CONTRACTED BACKLOG $1 Billion $4-5 Billion Max imiz ing Shareho lder Value Creat ion Energy Storage Solution Projects Run rate of $100 - 150M EBITDA Asset Vault EPC Cash Flows Long Term Service Agreements License and Royalty 15%+ of Project CapEx

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 14 ASSET VAULT INVESTMENT OVERVIEW M AT T H E W B R E Z I N A & C H R I S L E A R Y

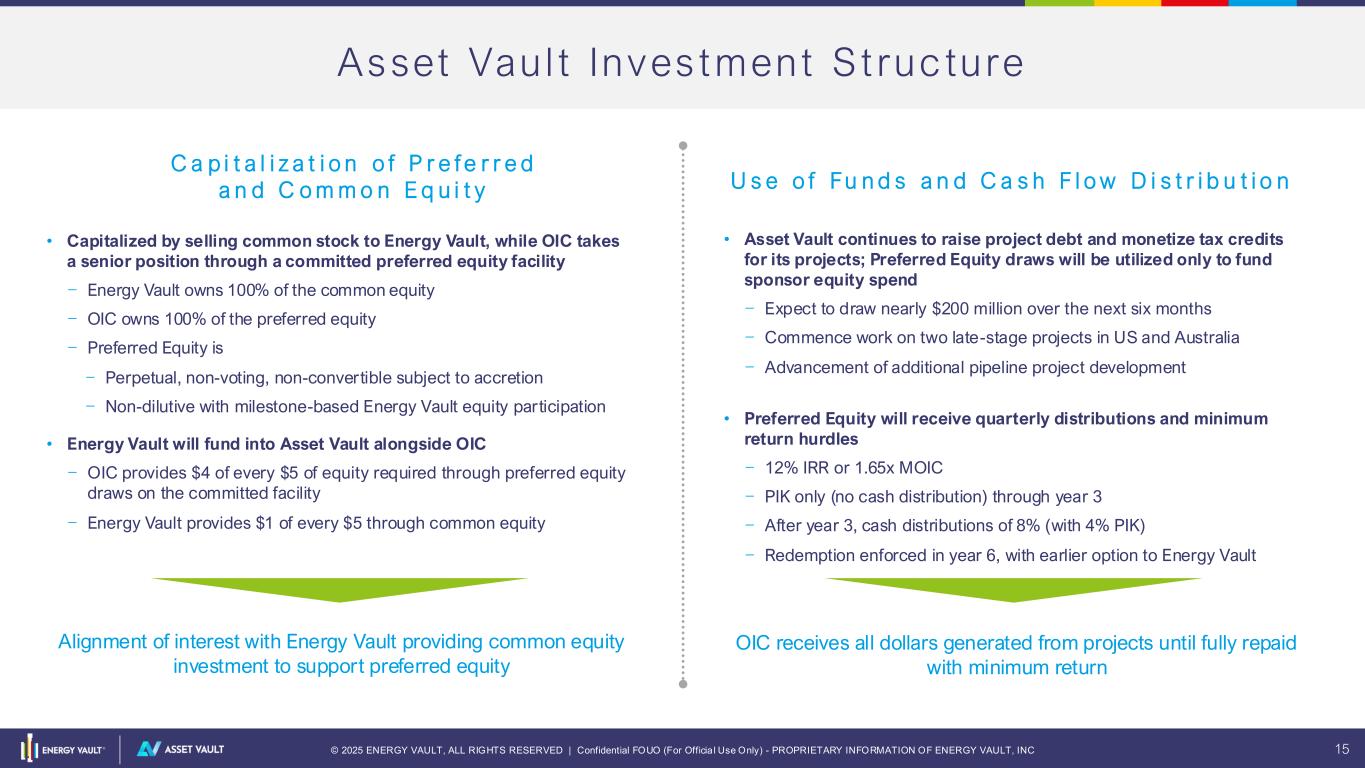

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 15 Asset Vau l t Inves tment S t ruc ture C a p i t a l i z a t i o n o f P r e f e r r e d a n d C o m m o n E q u i t y U s e o f Fu n d s a n d C a s h F l o w D i s t r i b u t i o n • Capitalized by selling common stock to Energy Vault, while OIC takes a senior position through a committed preferred equity facility – Energy Vault owns 100% of the common equity – OIC owns 100% of the preferred equity – Preferred Equity is – Perpetual, non-voting, non-convertible subject to accretion – Non-dilutive with milestone-based Energy Vault equity participation • Energy Vault will fund into Asset Vault alongside OIC – OIC provides $4 of every $5 of equity required through preferred equity draws on the committed facility – Energy Vault provides $1 of every $5 through common equity • Asset Vault continues to raise project debt and monetize tax credits for its projects; Preferred Equity draws will be utilized only to fund sponsor equity spend – Expect to draw nearly $200 million over the next six months – Commence work on two late-stage projects in US and Australia – Advancement of additional pipeline project development • Preferred Equity will receive quarterly distributions and minimum return hurdles – 12% IRR or 1.65x MOIC – PIK only (no cash distribution) through year 3 – After year 3, cash distributions of 8% (with 4% PIK) – Redemption enforced in year 6, with earlier option to Energy Vault Alignment of interest with Energy Vault providing common equity investment to support preferred equity OIC receives all dollars generated from projects until fully repaid with minimum return

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 16 Trans format ional Inves tment | S t ra tegic Par tnersh ip ”… Closing this transformational investment with OIC marks a pivotal moment in Energy Vault's evolution to a fully-integrated Independent Power Producer with proven execution capabilities … “ “… OIC's deep expertise in infrastructure investing and their confidence in the strength and financial attractiveness of our Asset Vault portfolio provides tremendous validation of our ability to deliver sustainable, profitable growth while addressing the critical energy storage needs of our rapidly evolving grid infrastructure and rapidly growing AI data center infrastructure …" “… Energy Vault has demonstrated exceptional execution capability in developing and operating energy storage projects, and we believe the Asset Vault platform positions the company to capture significant value in the rapidly expanding energy storage market …" ”… The combination of Energy Vault's integrated capabilities, strong project pipeline, and experienced management team creates a compelling investment opportunity in critical energy infrastructure as the demand for power continues to grow at unprecedented rates …" C H R I S L E A R Y I n v e s t m e n t P a r t n e r & H e a d o f I n f r a E q u i t y | O I C R O B E R T P I C O N I C E O | E n e r g y V a u l t

OIC Investment in Asset Vault OCTOBER 2025 CONFIDENTIAL & TRADE SECRET

18 OIC Executive Summary CONFIDENTIAL & TRADE SECRET An experienced infrastructure investment platform Investing in the innovative energy infrastructure space Utilizing structure to minimize dilution and avoid loss of control for equity owners ~$5Bn AUM(1) 45 Structured investments 14 Exits 1 2 3 10-year Track record Information on this page is as of 30-June-2025 unless otherwise noted. The views on this slide are the opinion of OIC, and such opinions may not prove to correct. There are no assurances that downside protect ion will achieve intended results, and investors may lose invested capital. (1) Total Assets Under Management. inclusive of commitments (including in respect of realized investments) in OIC Credit Opportunit ies Fund II, L.P. ("Fund II"), OIC Credit Opportunit ies Fund III , L.P. ("Fund III "), OIC Credit Opportunit ies Fund IV, L.P. ("Fund IV"), OIC Growth Fund I, L.P. ("Growth Fund I"), the Fund and other funds managed by OIC (collect ively, the “OIC Funds”), as well as related co-investment amounts, some of which are invested directly into transactions by investors but are subject to OIC’s overall deal oversight and control.

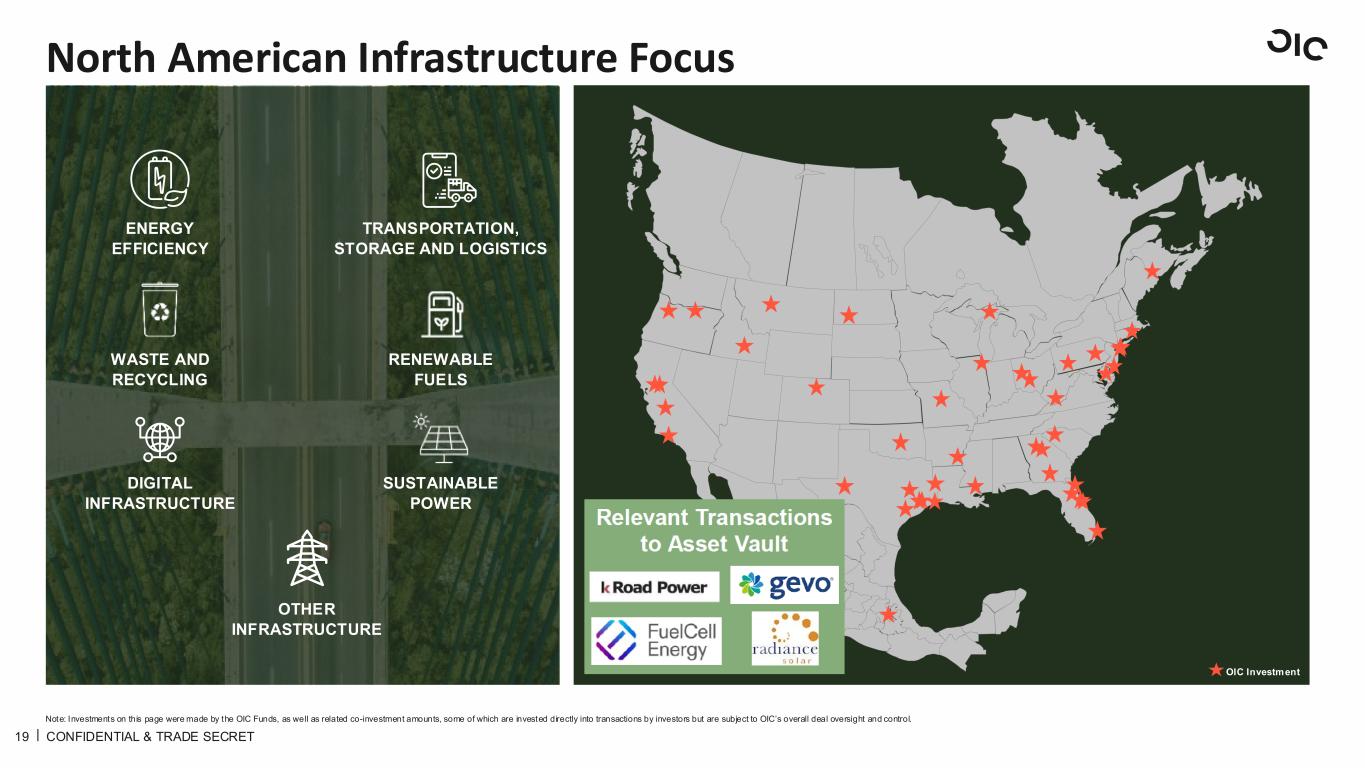

19 Note: Investments on this page were made by the OIC Funds, as well as related co-investment amounts, some of which are invested directly into transactions by investors but are subject to OIC’s overall deal oversight and control. North American Infrastructure Focus WASTE AND RECYCLING ENERGY EFFICIENCY DIGITAL INFRASTRUCTURE TRANSPORTATION, STORAGE AND LOGISTICS RENEWABLE FUELS OTHER INFRASTRUCTURE SUSTAINABLE POWER OIC Investment CONFIDENTIAL & TRADE SECRET

20 The views on this slide are the opinion of OIC. Innovative Partnership for Energy Storage OIC Investment Asset Vault ▪ New build, own, and operate subsidiary with two operational storage assets supported by long- term offtake agreements and project-level debt financing ▪ Quality execution capabilities driven by broader Energy Vault platform ▪ Attractive project pipeline in key power markets across the U.S. and abroad OIC believes the combination of Energy Vault’s integrated capabilities, strong project pipeline, and experienced management team creates a compelling investment opportunity in critical energy infrastructure as the demand for power continues to grow at unprecedented rat CONFIDENTIAL & TRADE SECRET

21 © 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 21 ASSET VAULT PROJECT PORTFOLIO M AT T H E W B R E Z I N A

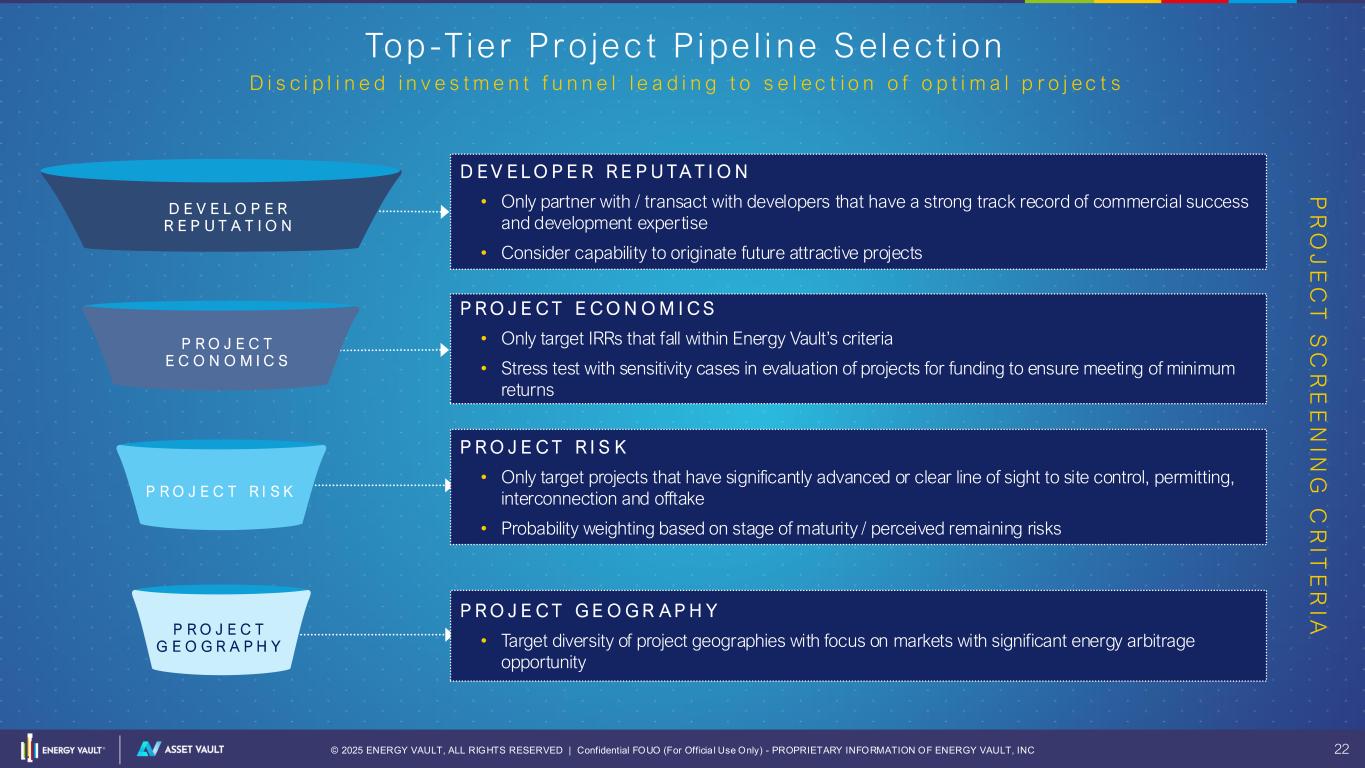

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 22 Top -Tie r Pro jec t P i pe l i ne S el ect ion D i s c i p l i n e d i n v e s t m e n t f u n n e l l e a d i n g t o s e l e c t i o n o f o p t i m a l p r o j e c t s D E V E L O P E R R E P U T A T I O N • Only partner with / transact with developers that have a strong track record of commercial success and development expertise • Consider capability to originate future attractive projects P R O J E C T E C O N O M I C S • Only target IRRs that fall within Energy Vault’s criteria • Stress test with sensitivity cases in evaluation of projects for funding to ensure meeting of minimum returns P R O J E C T R I S K • Only target projects that have significantly advanced or clear line of sight to site control, permitting, interconnection and offtake • Probability weighting based on stage of maturity / perceived remaining risks P R O J E C T G E O G R A P H Y • Target diversity of project geographies with focus on markets with significant energy arbitrage opportunity P R O J E C T S C R E E N IN G C R IT E R IA D E V E L O P E R R E P U T A T I O N P R O J E C T E C O N O M I C S P R O J E C T R I S K P R O J E C T G E O G R A P H Y

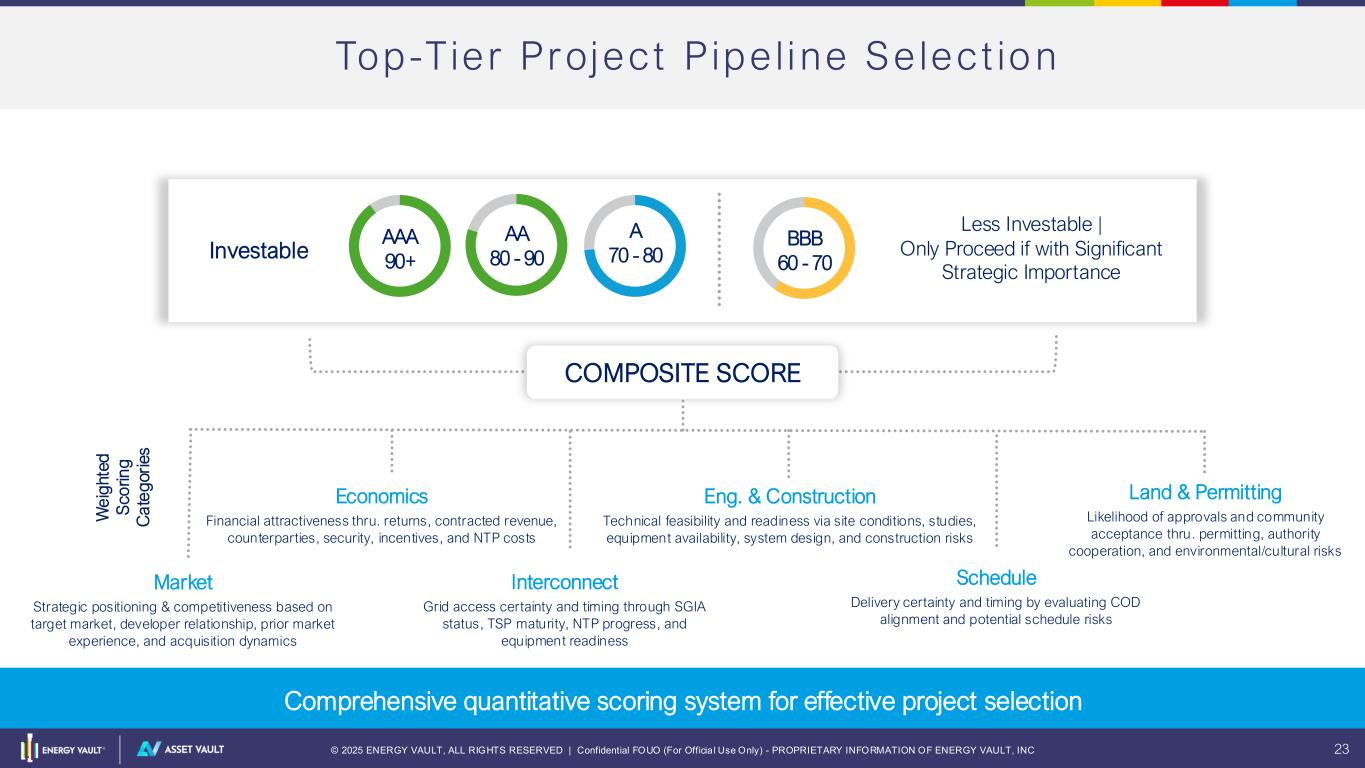

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 23 Top-Tie r Project Pipe l i ne Se lect io n Market Strategic positioning & competitiveness based on target market, developer relationship, prior market experience, and acquisition dynamics Economics Financial attractiveness thru. returns, contracted revenue, counterparties, security, incentives, and NTP costs Interconnect Grid access certainty and timing through SGIA status, TSP maturity, NTP progress, and equipment readiness Eng. & Construction Technical feasibility and readiness via site conditions, studies, equipment availability, system design, and construction risks Schedule Delivery certainty and timing by evaluating COD alignment and potential schedule risks Land & Permitting Likelihood of approvals and community acceptance thru. permitting, authority cooperation, and environmental/cultural risks AAA 90+ AA 80 - 90Investable A 70 - 80 BBB 60 - 70 Less Investable | Only Proceed if with Significant Strategic Importance W e ig h te d S c o ri n g C a te g o ri e s COMPOSITE SCORE Comprehensive quantitative scoring system for effective project selection

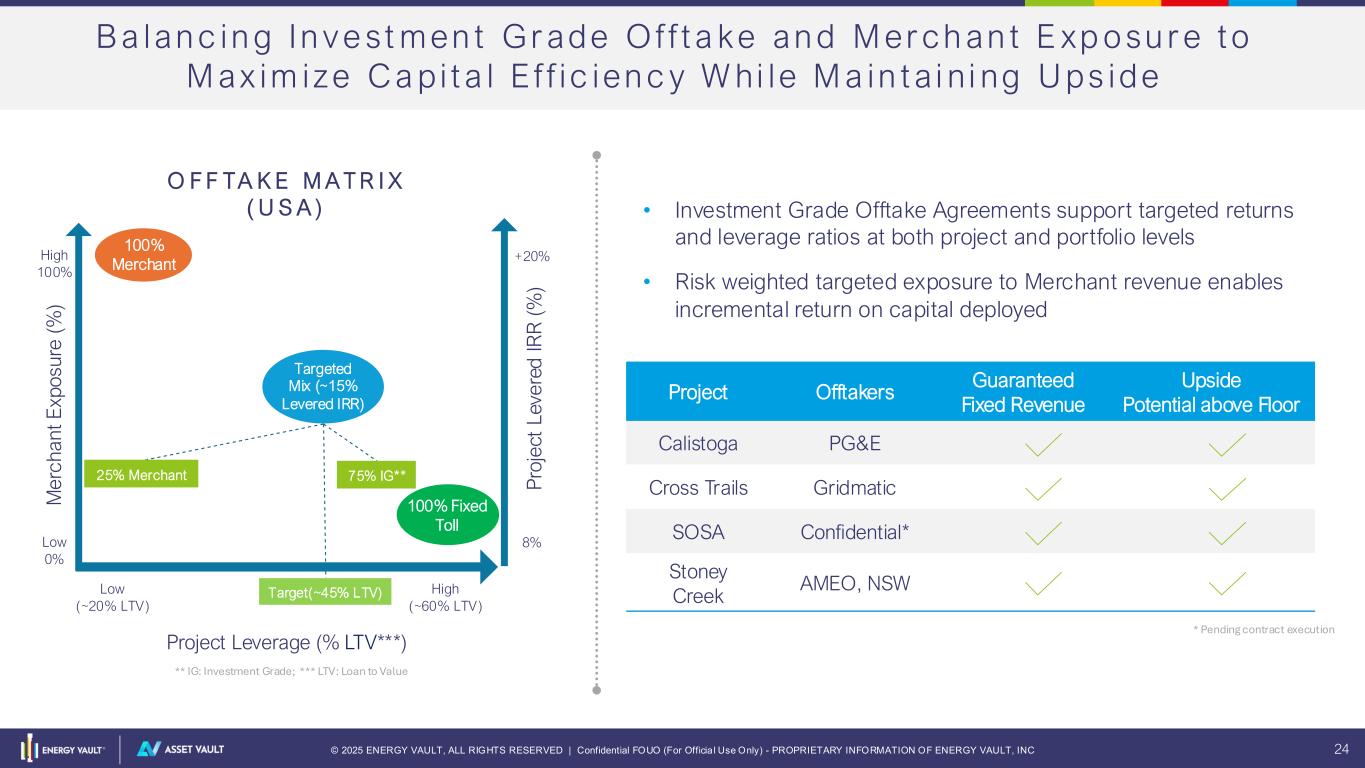

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 24 Project Offtakers Guaranteed Fixed Revenue Upside Potential above Floor Calistoga PG&E Cross Trails Gridmatic SOSA Confidential* Stoney Creek AMEO, NSW B a lan c in g In v e st men t Gr ade O f f t a ke an d M er ch an t E xp o su r e to M ax im ize Ca p i ta l E f f i c ien c y W hi le M a in ta i n i ng U ps ide Low (~20% LTV) Project Leverage (% LTV***) High (~60% LTV) Low 0% High 100% Targeted Mix (~15% Levered IRR) O F F TA K E M A T R I X ( U S A ) • Investment Grade Offtake Agreements support targeted returns and leverage ratios at both project and portfolio levels • Risk weighted targeted exposure to Merchant revenue enables incremental return on capital deployed * Pending contract execution 25% Merchant 75% IG** 100% Merchant 100% Fixed Toll +20% 8% Target(~45% LTV) ** IG: Investment Grade; *** LTV: Loan to Value

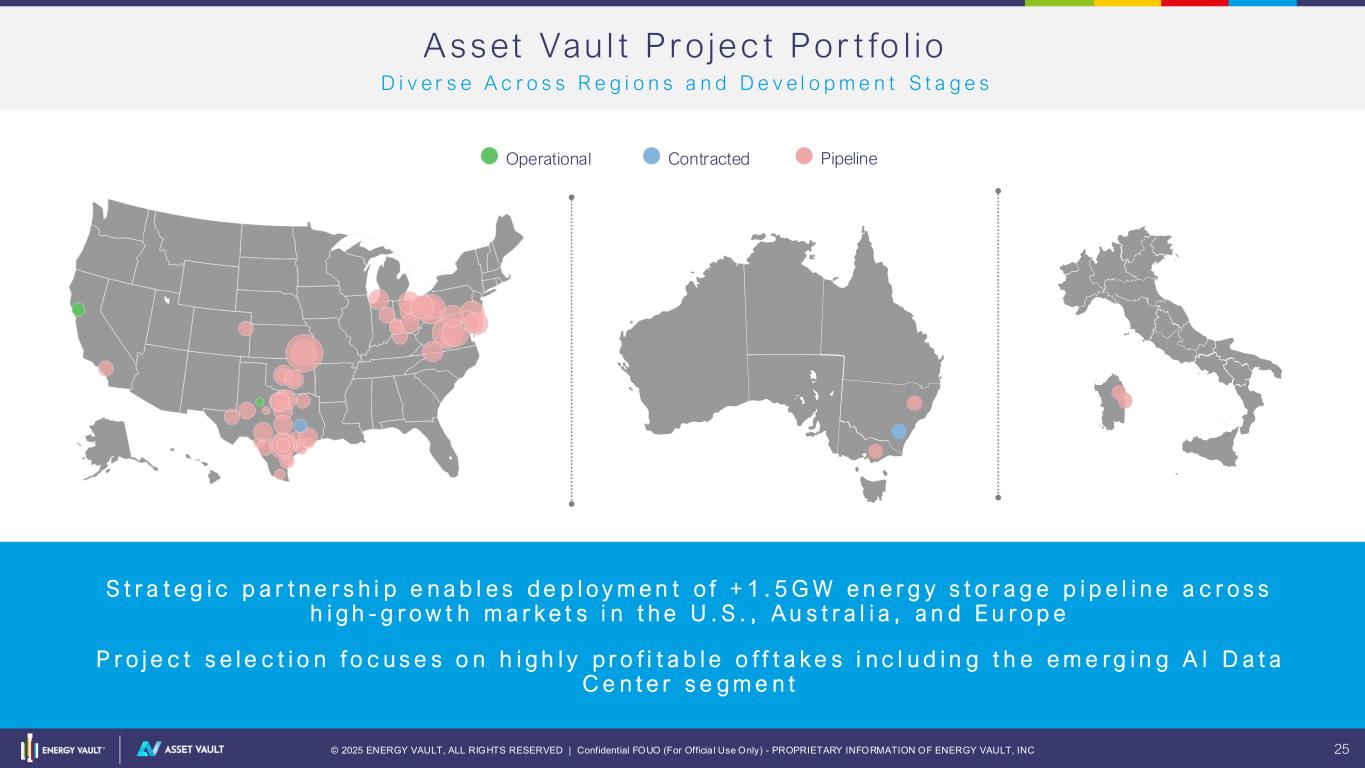

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 25 A sset Vau l t Pro jec t Por t fo l io D i v e r s e A c r o s s R e g i o n s a n d D e v e l o p m e n t S t a g e s Operational Contracted Pipeline S t r a t e g i c p a r t n e r s h i p e n a b l e s d e p l o y m e n t o f + 1 . 5 G W e n e r g y s t o r a g e p i p e l i n e a c r o s s h i g h - g r o w t h m a r k e t s i n t h e U . S . , A u s t r a l i a , a n d E u r o p e P r o j e c t s e l e c t i o n f o c u s e s o n h i g h l y p r o f i t a b l e o f f t a k e s i n c l u d i n g t h e e m e r g i n g A I D a t a C e n t e r s e g m e n t

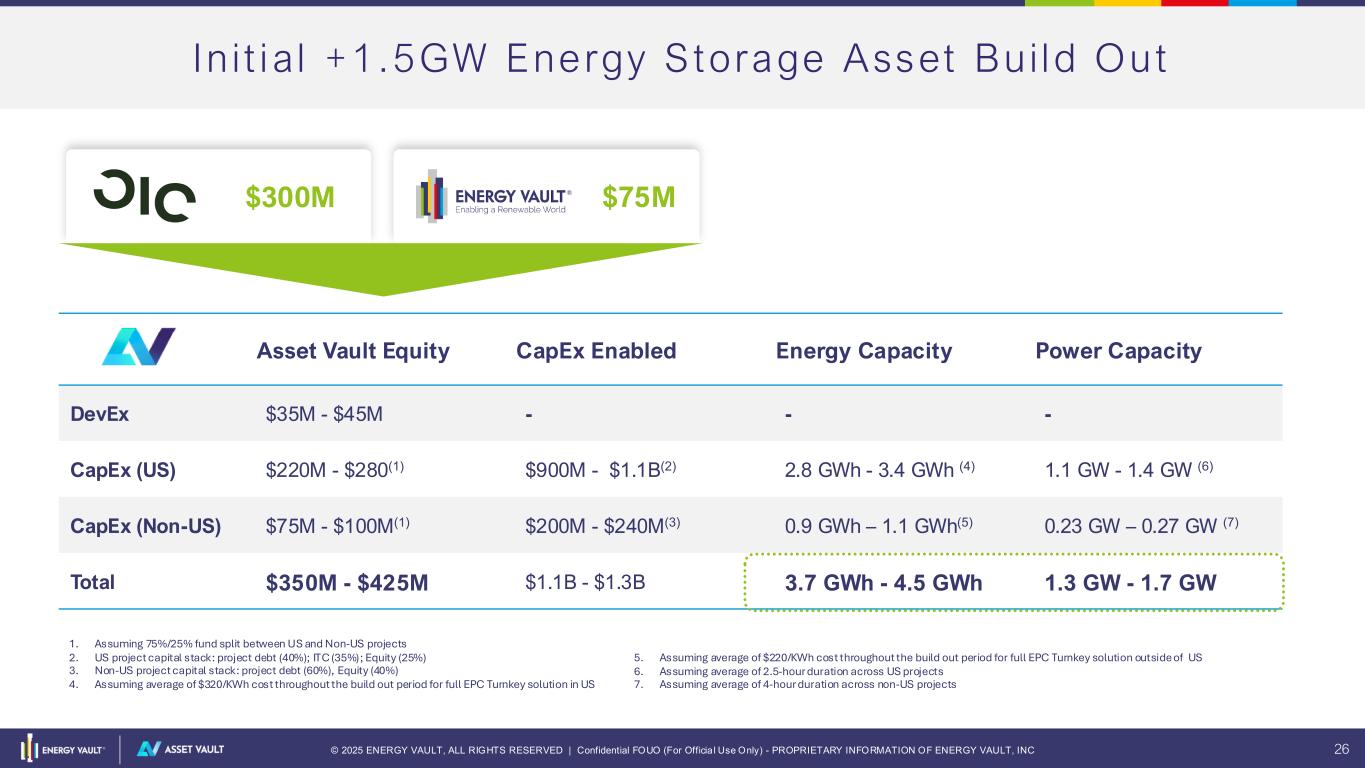

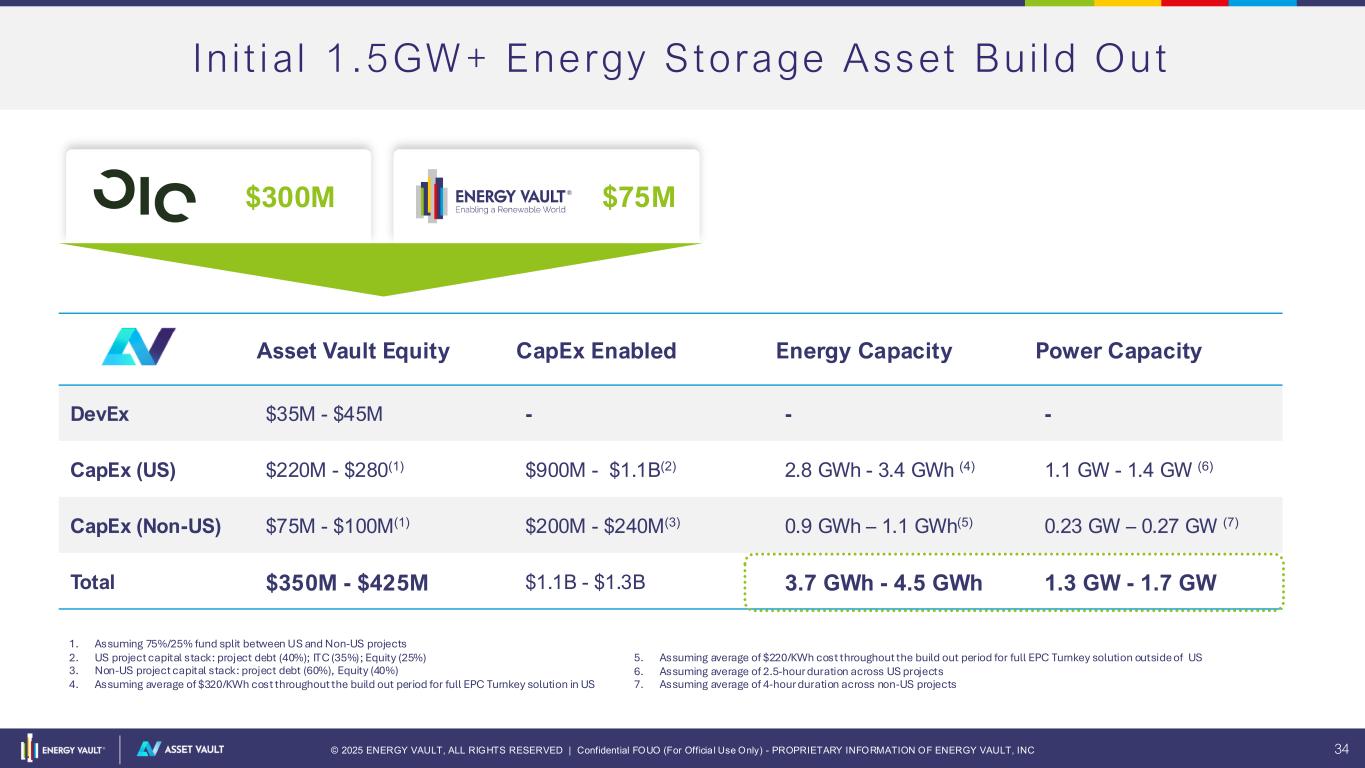

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 26 In i t i a l +1 .5GW Energy Storage Asset Bu i ld Out $300M $75M 1. Assuming 75%/25% fund split between US and Non-US projects 2. US project capital stack: project debt (40%); ITC (35%); Equity (25%) 3. Non-US project capital stack: project debt (60%), Equity (40%) 4. Assuming average of $320/KWh cost throughout the build out period for full EPC Turnkey solution in US 5. Assuming average of $220/KWh cost throughout the build out period for full EPC Turnkey solution outside of US 6. Assuming average of 2.5-hour duration across US projects 7. Assuming average of 4-hour duration across non-US projects Asset Vault Equity CapEx Enabled Energy Capacity Power Capacity DevEx $35M - $45M - - - CapEx (US) $220M - $280(1) $900M - $1.1B(2) 2.8 GWh - 3.4 GWh (4) 1.1 GW - 1.4 GW (6) CapEx (Non-US) $75M - $100M(1) $200M - $240M(3) 0.9 GWh – 1.1 GWh(5) 0.23 GW – 0.27 GW (7) Total $350M - $425M $1.1B - $1.3B 3.7 GWh - 4.5 GWh 1.3 GW - 1.7 GW

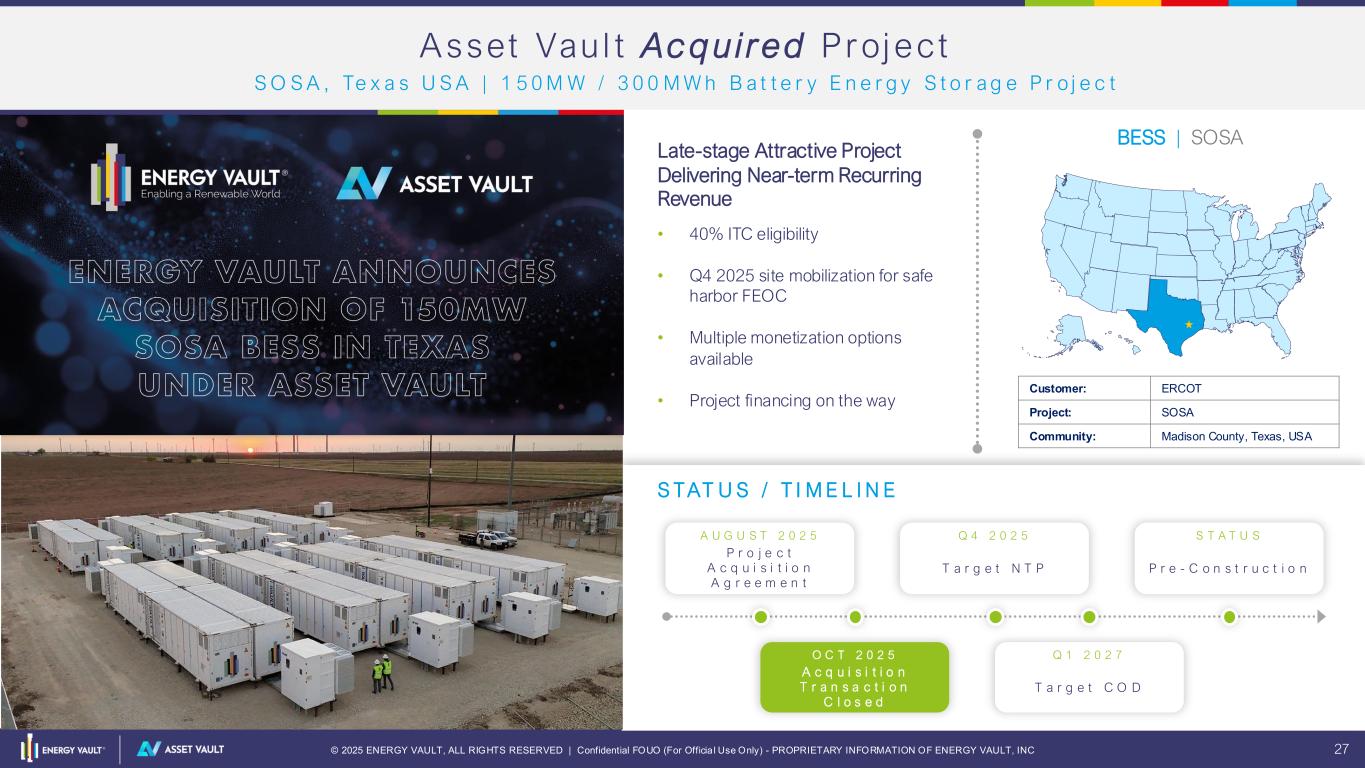

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 27 A sset Vau l t Ac q u i red Proj ect S O S A , Te x a s U S A | 1 5 0 M W / 3 0 0 M W h B a t t e r y E n e r g y S t o r a g e P r o j e c t Late-stage Attractive Project Delivering Near-term Recurring Revenue • 40% ITC eligibility • Q4 2025 site mobilization for safe harbor FEOC • Multiple monetization options available • Project financing on the way BESS | SOSA Customer: ERCOT Project: SOSA Community: Madison County, Texas, USA S TAT U S / T I M E L I N E A U G U S T 2 0 2 5 Q 4 2 0 2 5 S T A T U S Q 1 2 0 2 7O C T 2 0 2 5 P r o j e c t A c q u i s i t i o n A g r e e m e n t T a r g e t N T P P r e - C o n s t r u c t i o n T a r g e t C O D A c q u i s i t i o n T r a n s a c t i o n C l o s e d

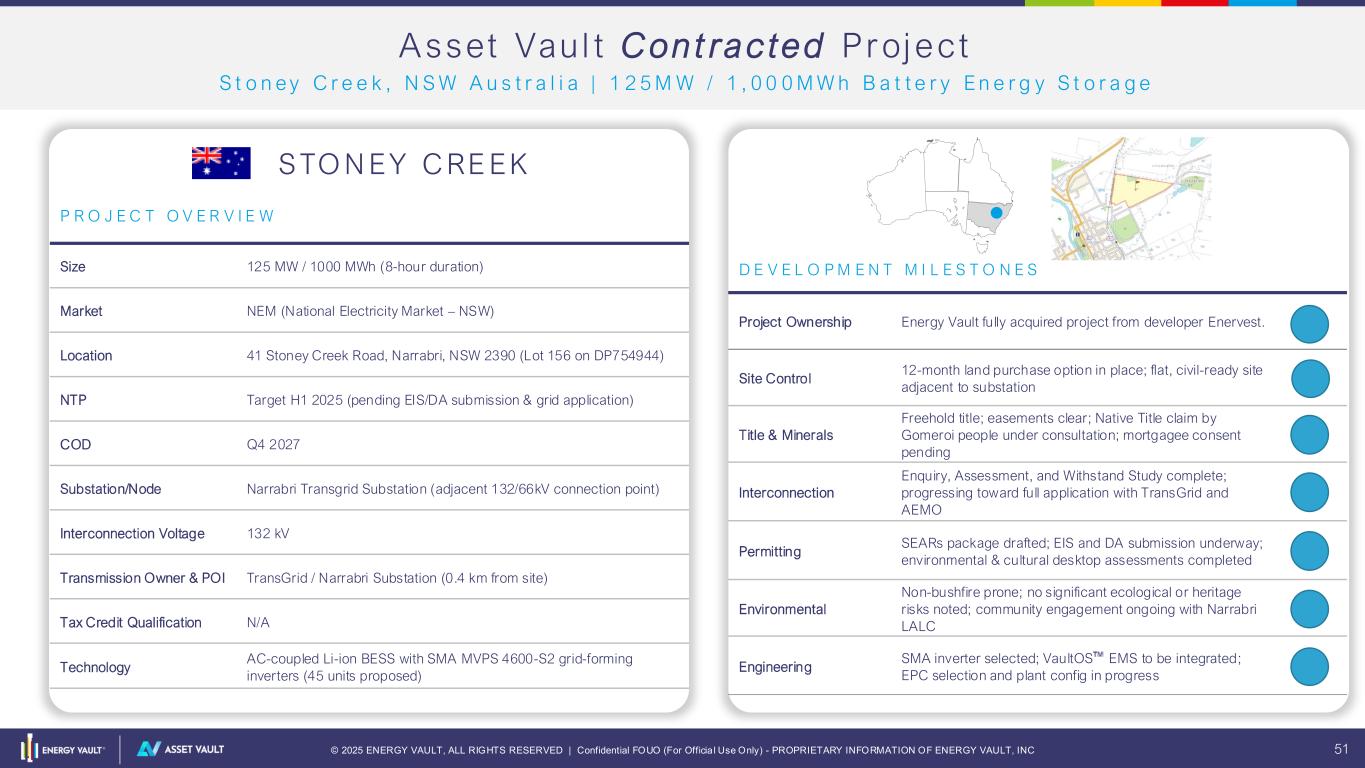

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 28 A sset Vau l t Cont racted Proj ect S t o n e y C r e e k , N S W A u s t r a l i a | 1 2 5 M W / 1 , 0 0 0 M W h B a t t e r y E n e r g y S t o r a g e Energy Vault’s First Fully Owned & Operated Battery Energy Storage System in Australia • Australia largest long-duration (8 hours) battery project • Highly bankable backed by 14-year Long-Term Energy Service Agreement (LTESA) with AMEO Services as the Consumer Trustee under the New South Wales Electricity Infrastructure Roadmap, ensuring stable capacity revenues • Provides critical grid stability and system resilience BESS | STONEY CREEK S TAT U S / T I M E L I N E M A R C H 2 0 2 5 Q 1 2 0 2 6 S T A T U S Q 4 2 0 2 7A U G U S T 2 0 2 5 P r o j e c t A c q u i s i t i o n A g r e e m e n t T a r g e t N T P P r e - C o n s t r u c t i o n T a r g e t C O D A c q u i s i t i o n T r a n s a c t i o n C l o s e d Customer: AEMO Project: Stoney Creek Community: New South Wales, Australia

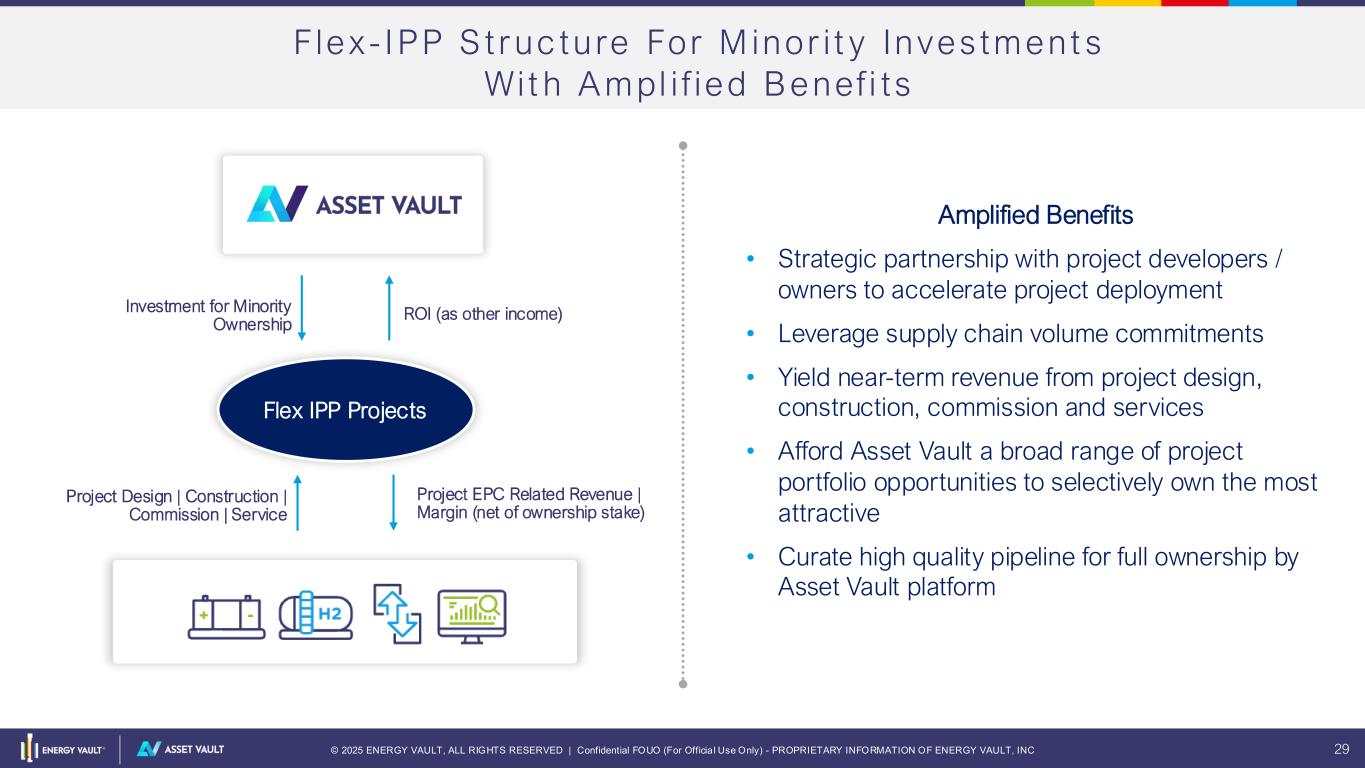

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 29 F lex - I PP S t ruc ture For M inor i t y Inves tment s Wit h A mpl i f ied B enef i ts Amplified Benefits • Strategic partnership with project developers / owners to accelerate project deployment • Leverage supply chain volume commitments • Yield near-term revenue from project design, construction, commission and services • Afford Asset Vault a broad range of project portfolio opportunities to selectively own the most attractive • Curate high quality pipeline for full ownership by Asset Vault platform Flex IPP Projects Investment for Minority Ownership ROI (as other income) Project Design | Construction | Commission | Service Project EPC Related Revenue | Margin (net of ownership stake) Screenshot 2025-10- 08 at 11.23 AM Screenshot 2025-10-08 at 11.26.43 AM

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 30 FINANCIAL OUTLOOK M I C H A E L B E E R

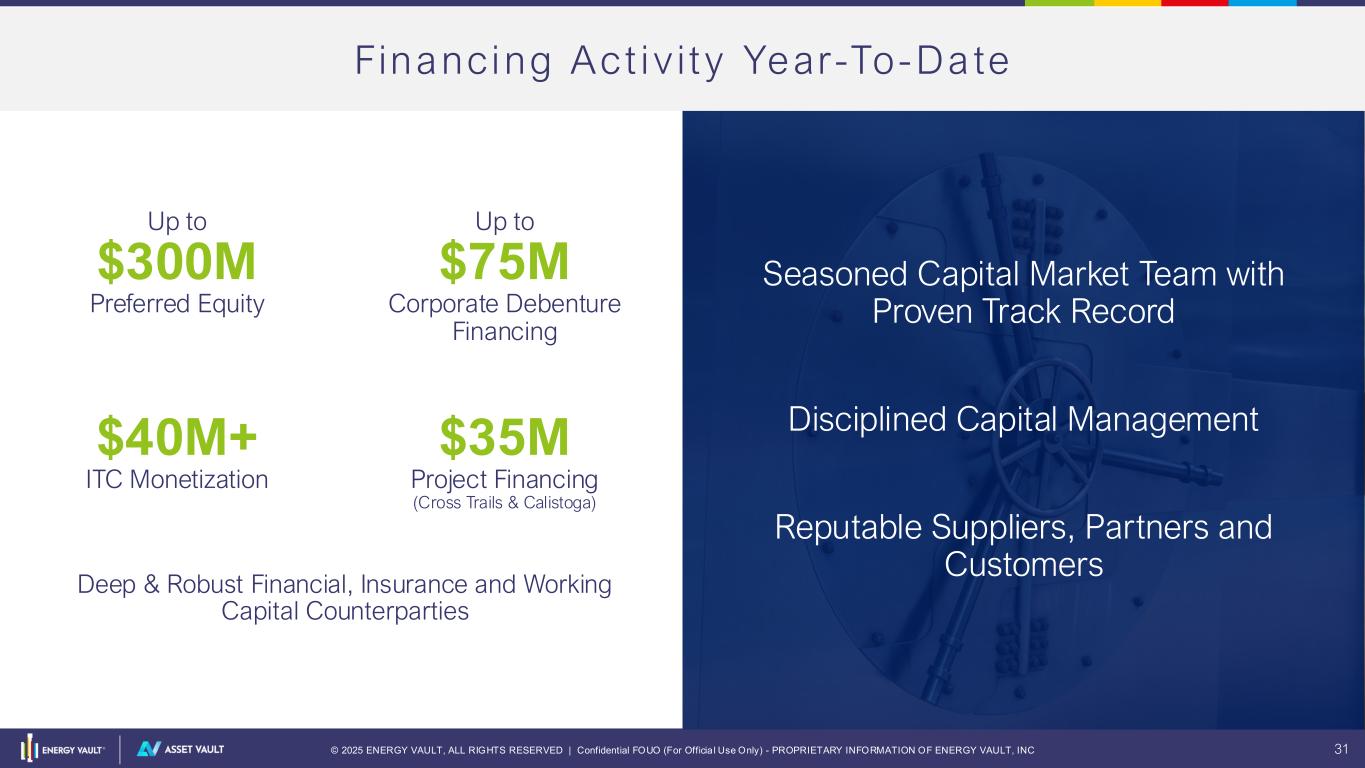

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 31 Financing Act i v i ty Year-To-Date Up to $75M Corporate Debenture Financing $40M+ ITC Monetization Up to $300M Preferred Equity $35M Project Financing (Cross Trails & Calistoga) Deep & Robust Financial, Insurance and Working Capital Counterparties Seasoned Capital Market Team with Proven Track Record Disciplined Capital Management Reputable Suppliers, Partners and Customers

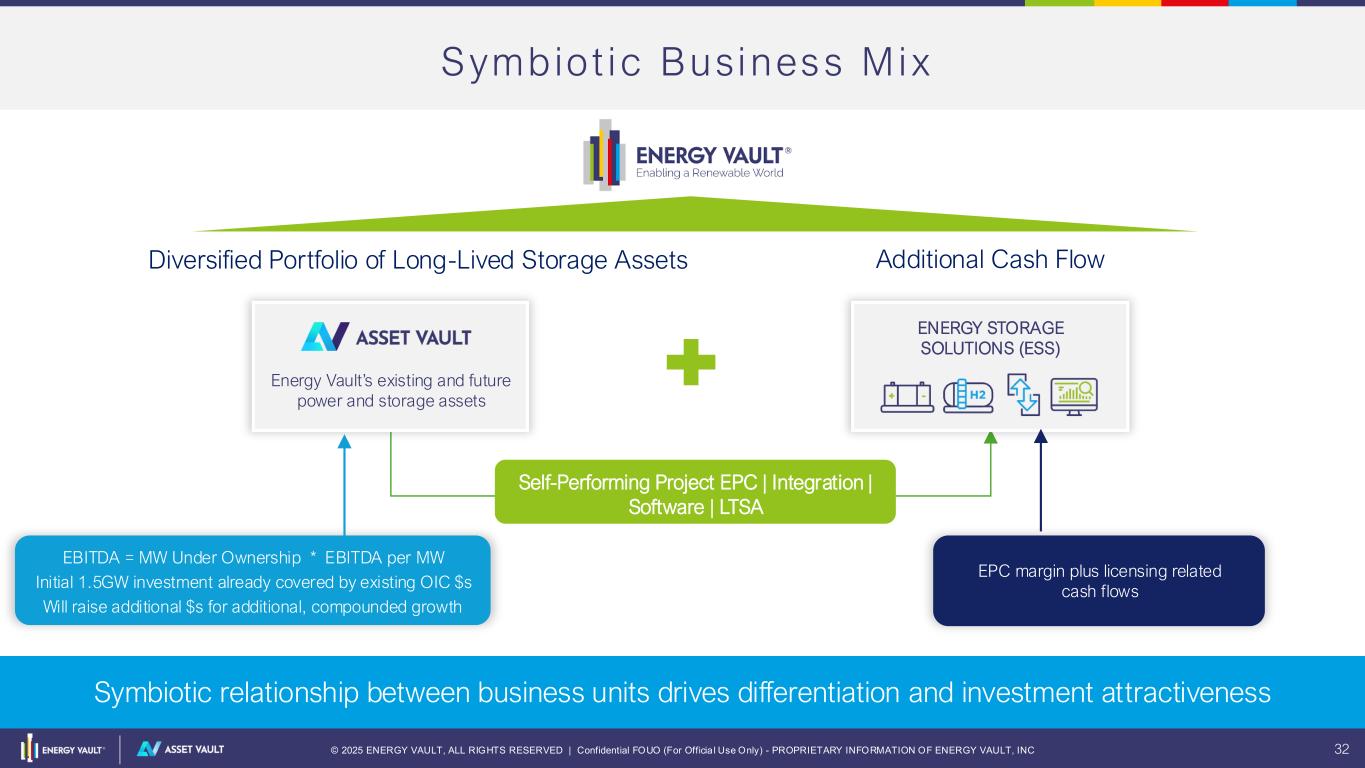

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 32 Symbiot i c Business Mix Symbiotic relationship between business units drives differentiation and investment attractiveness Diversified Portfolio of Long-Lived Storage Assets Additional Cash Flow Energy Vault’s existing and future power and storage assets ENERGY STORAGE SOLUTIONS (ESS) Self-Performing Project EPC | Integration | Software | LTSA EBITDA = MW Under Ownership * EBITDA per MW Initial 1.5GW investment already covered by existing OIC $s Will raise additional $s for additional, compounded growth EPC margin plus licensing related cash flows

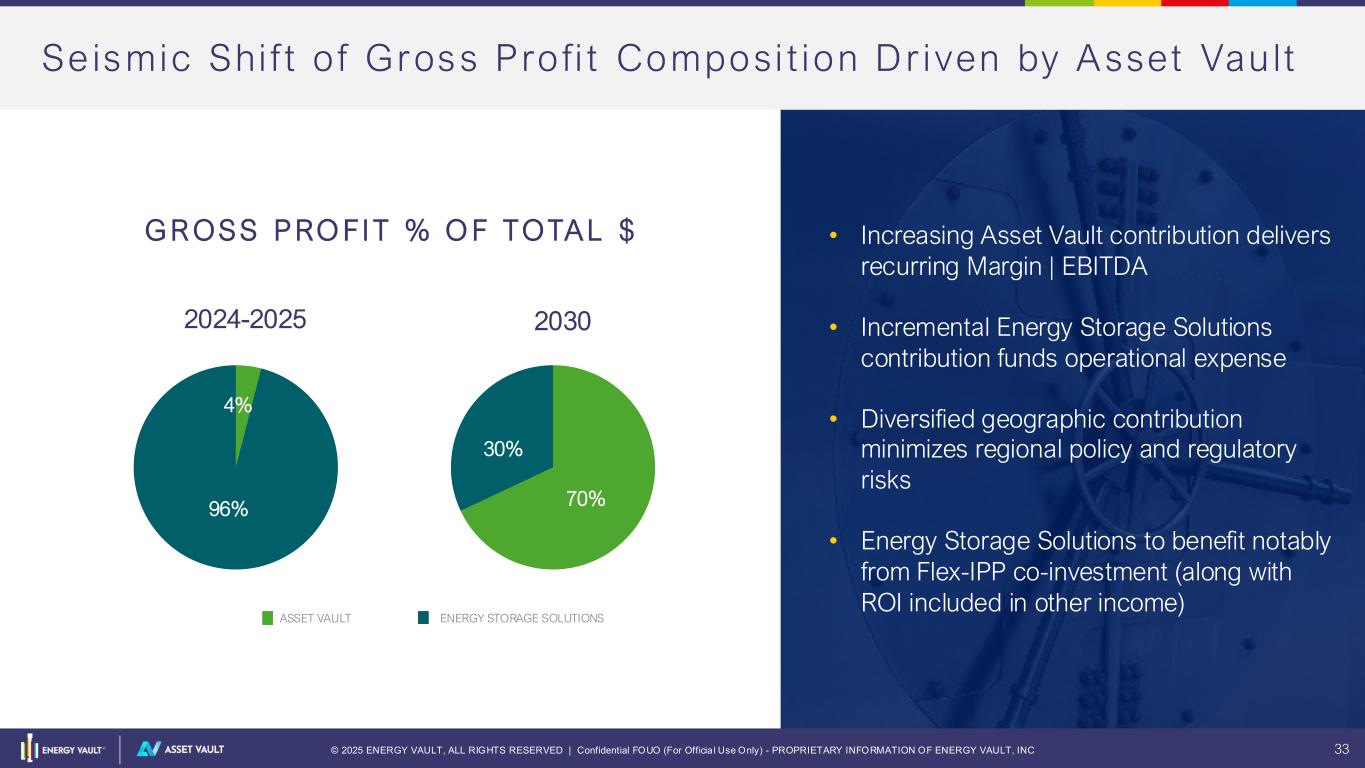

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 33 Se ismic Shi f t o f Gross Pro fi t Composi t ion Dr iven by Asset Vau lt 2024-2025 2030 35% 54% 46% 96% 4% G R OSS P RO FIT % O F TOTAL $ ASSET VAULT ENERGY STORAGE SOLUTIONS 70% 30% • Increasing Asset Vault contribution delivers recurring Margin | EBITDA • Incremental Energy Storage Solutions contribution funds operational expense • Diversified geographic contribution minimizes regional policy and regulatory risks • Energy Storage Solutions to benefit notably from Flex-IPP co-investment (along with ROI included in other income)

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 34 In i t i a l 1 .5GW+ Energy Storage Asset Bu i ld Out $300M $75M 1. Assuming 75%/25% fund split between US and Non-US projects 2. US project capital stack: project debt (40%); ITC (35%); Equity (25%) 3. Non-US project capital stack: project debt (60%), Equity (40%) 4. Assuming average of $320/KWh cost throughout the build out period for full EPC Turnkey solution in US 5. Assuming average of $220/KWh cost throughout the build out period for full EPC Turnkey solution outside of US 6. Assuming average of 2.5-hour duration across US projects 7. Assuming average of 4-hour duration across non-US projects Asset Vault Equity CapEx Enabled Energy Capacity Power Capacity DevEx $35M - $45M - - - CapEx (US) $220M - $280(1) $900M - $1.1B(2) 2.8 GWh - 3.4 GWh (4) 1.1 GW - 1.4 GW (6) CapEx (Non-US) $75M - $100M(1) $200M - $240M(3) 0.9 GWh – 1.1 GWh(5) 0.23 GW – 0.27 GW (7) Total $350M - $425M $1.1B - $1.3B 3.7 GWh - 4.5 GWh 1.3 GW - 1.7 GW

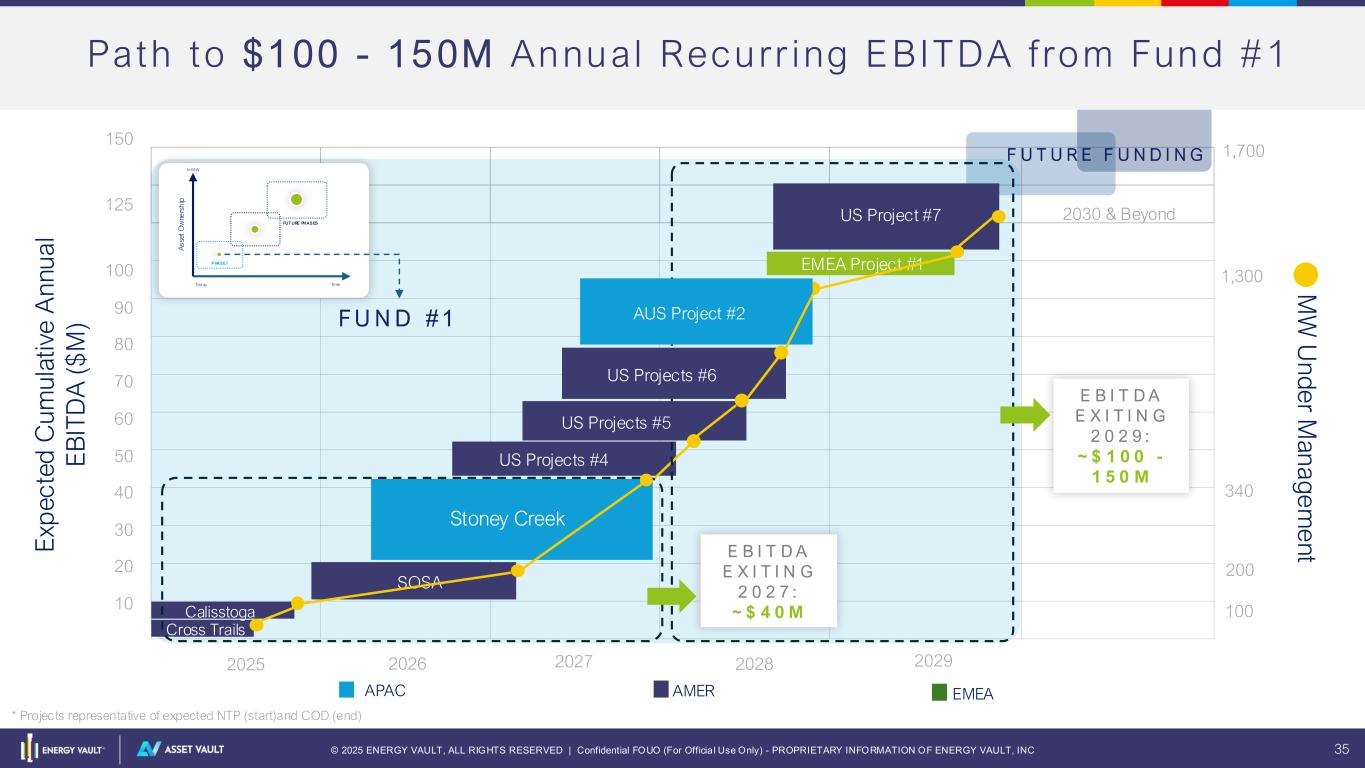

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 35 Path to $100 - 150M Annual Recurr ing E BITDA f rom Fund #1 E xp e c te d C u m u la ti ve A n n u a l E B IT D A ( $ M ) 20 40 60 80 100 100 200 340 1,300 10 20 30 40 50 60 70 80 90 100 150 2025 2026 2027 2028 2029 * Projects representative of expected NTP (start)and COD (end) APAC AMER EMEA Stoney Creek US Projects #4 SOSA Calisstoga Cross Trails EMEA Project #1 US Project #7 M W U n d e r M a n a g e m e n t 2030 & Beyond E B I T D A E X I T I N G 2 0 2 7 : ~ $ 4 0 M E B I T D A E X I T I N G 2 0 2 9 : ~ $ 1 0 0 - 1 5 0 M 1,700 US Projects #5 US Projects #6 AUS Project #2 F U T U R E F U N D I N G A s se t O w ne rs h ip In M W Tod ay PHASE I Time FUT URE PHASES F U N D # 1 125

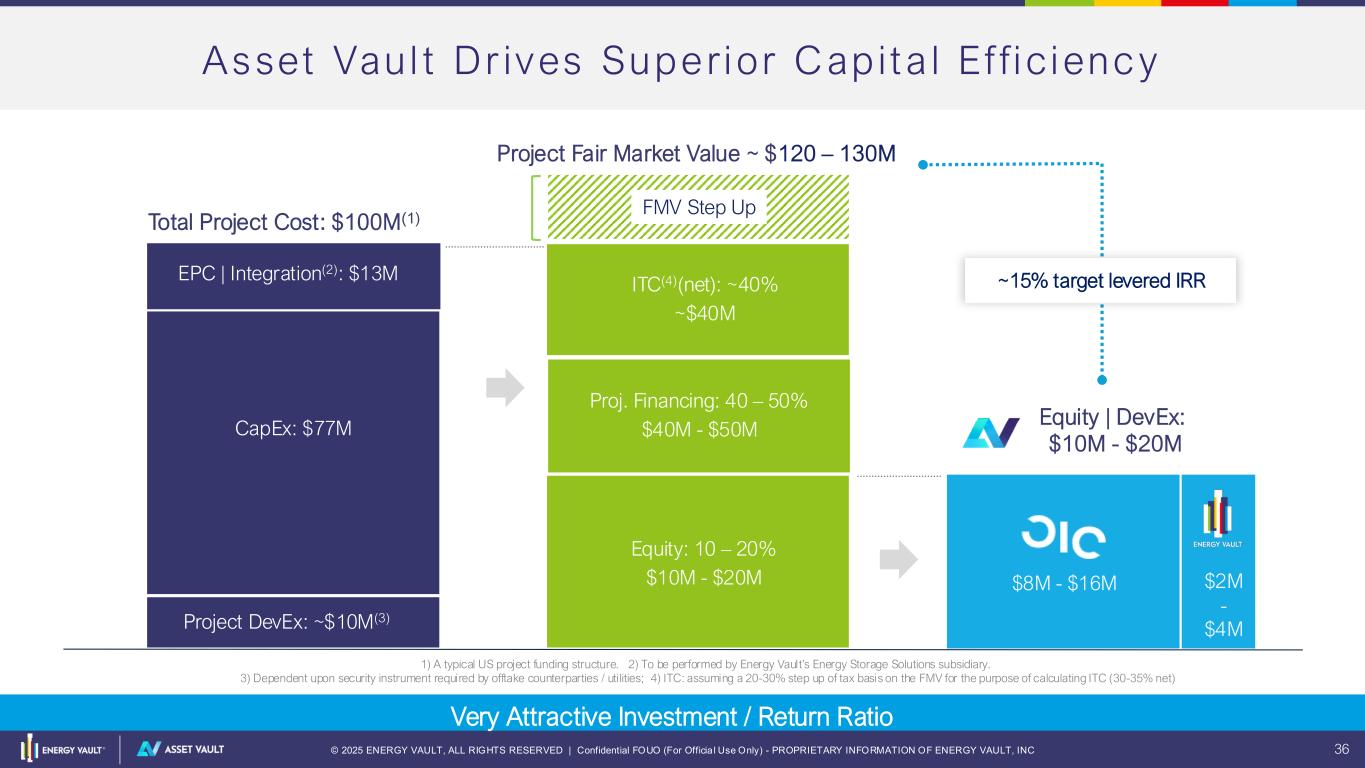

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 36 Asset Vau l t Dr ives Super ior Cap ita l Ef f i c i ency Project DevEx: ~$10M(3) CapEx: $77M EPC | Integration(2): $13M Equity: 10 – 20% $10M - $20M Proj. Financing: 40 – 50% $40M - $50M ITC(4)(net): ~40% ~$40M Equity | DevEx: $10M - $20M $8M - $16M Total Project Cost: $100M(1) Very Attractive Investment / Return Ratio $2M - $4M ~15% target levered IRR 1) A typical US project funding structure. 2) To be performed by Energy Vault’s Energy Storage Solutions subsidiary. 3) Dependent upon security instrument required by offtake counterparties / uti lities; 4) ITC: assuming a 20-30% step up of tax basis on the FMV for the purpose of calculating ITC (30-35% net) FMV Step Up Project Fair Market Value ~ $120 – 130M

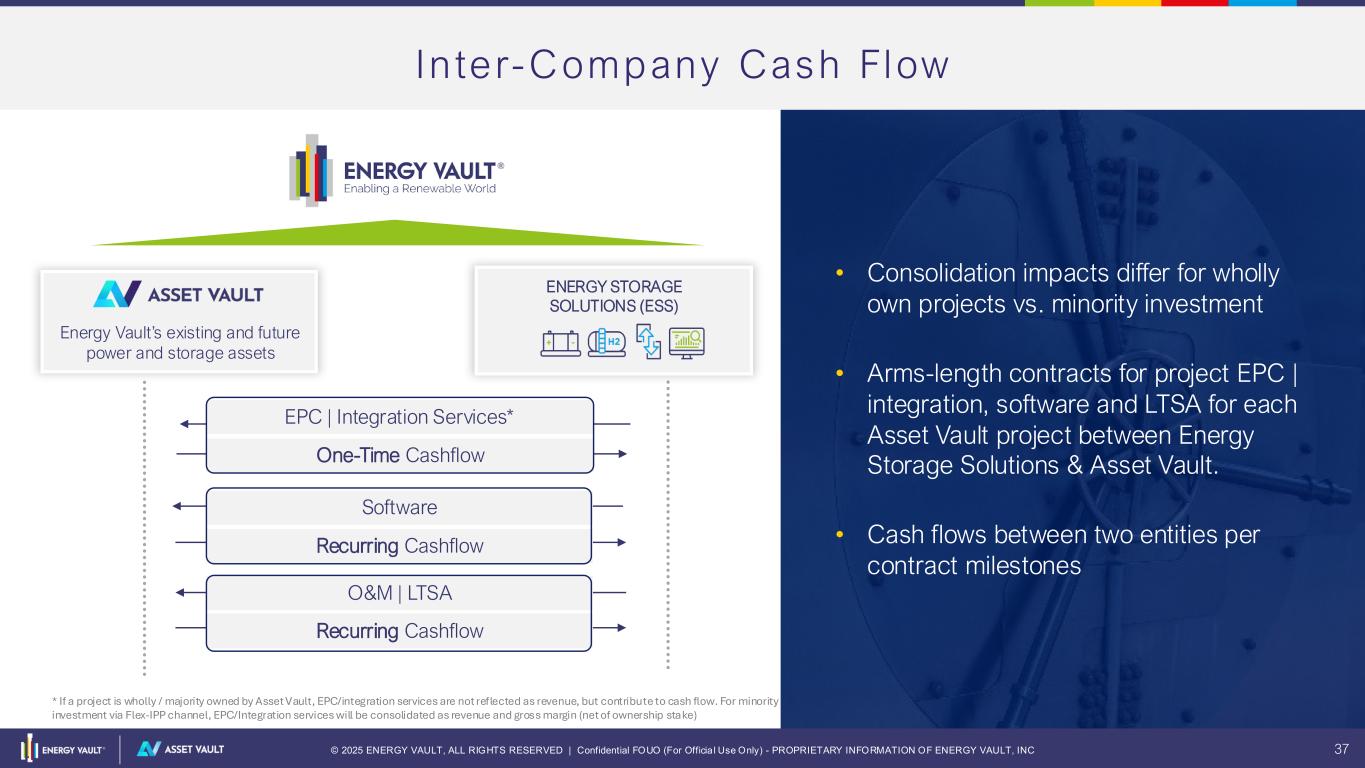

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 37 In te r-Company Cash Flow EPC | Integration Services* One-Time Cashflow O&M | LTSA Recurring Cashflow Software Recurring Cashflow • Consolidation impacts differ for wholly own projects vs. minority investment • Arms-length contracts for project EPC | integration, software and LTSA for each Asset Vault project between Energy Storage Solutions & Asset Vault. • Cash flows between two entities per contract milestones Energy Vault’s existing and future power and storage assets ENERGY STORAGE SOLUTIONS (ESS) * If a project is wholly / majority owned by Asset Vault, EPC/integration services are not reflected as revenue, but contribute to cash flow. For minority investment via Flex-IPP channel, EPC/Integration services will be consolidated as revenue and gross margin (net of ownership stake)

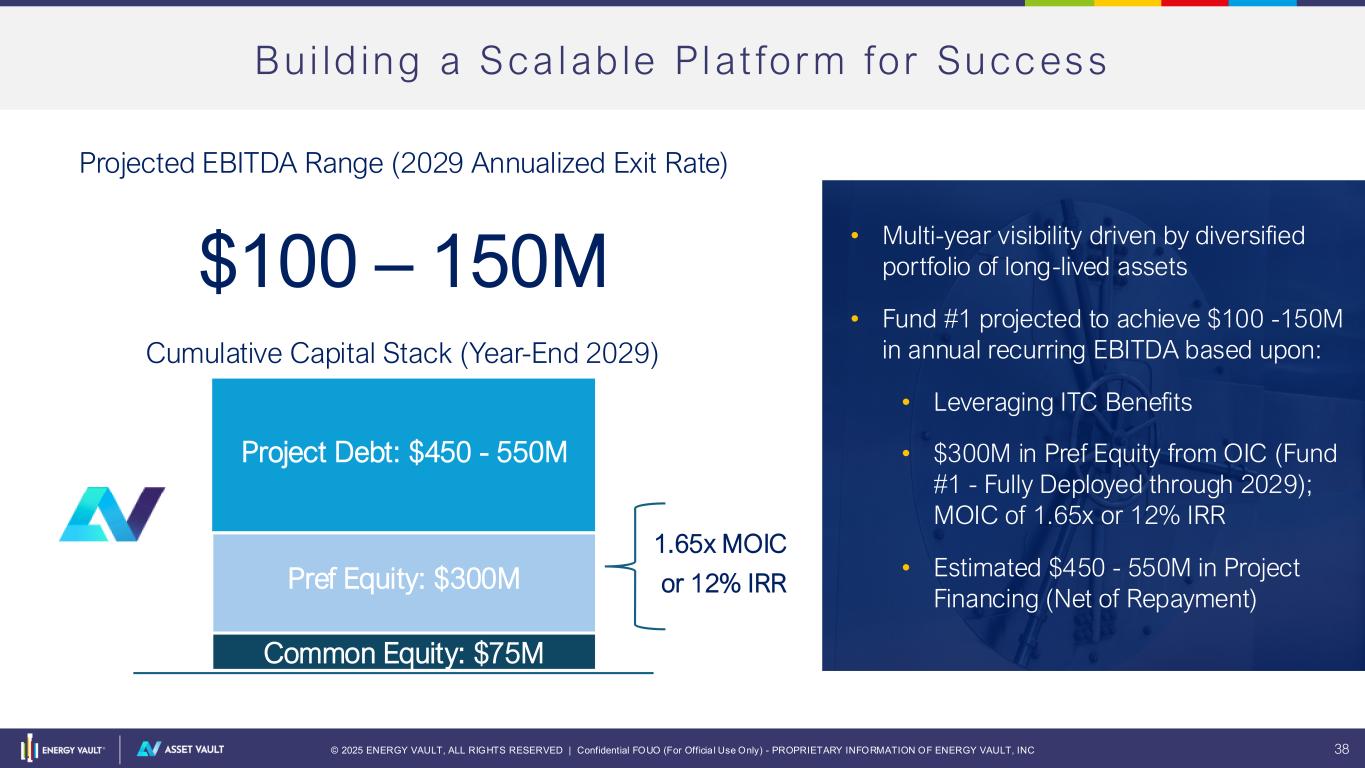

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 38 Bui ld ing a Sca lab le Plat form for Success Cumulative Capital Stack (Year-End 2029) • Multi-year visibility driven by diversified portfolio of long-lived assets • Fund #1 projected to achieve $100 -150M in annual recurring EBITDA based upon: • Leveraging ITC Benefits • $300M in Pref Equity from OIC (Fund #1 - Fully Deployed through 2029); MOIC of 1.65x or 12% IRR • Estimated $450 - 550M in Project Financing (Net of Repayment) Common Equity: $75M Project Debt: $450 - 550M Projected EBITDA Range (2029 Annualized Exit Rate) $100 – 150M Pref Equity: $300M 1.65x MOIC or 12% IRR

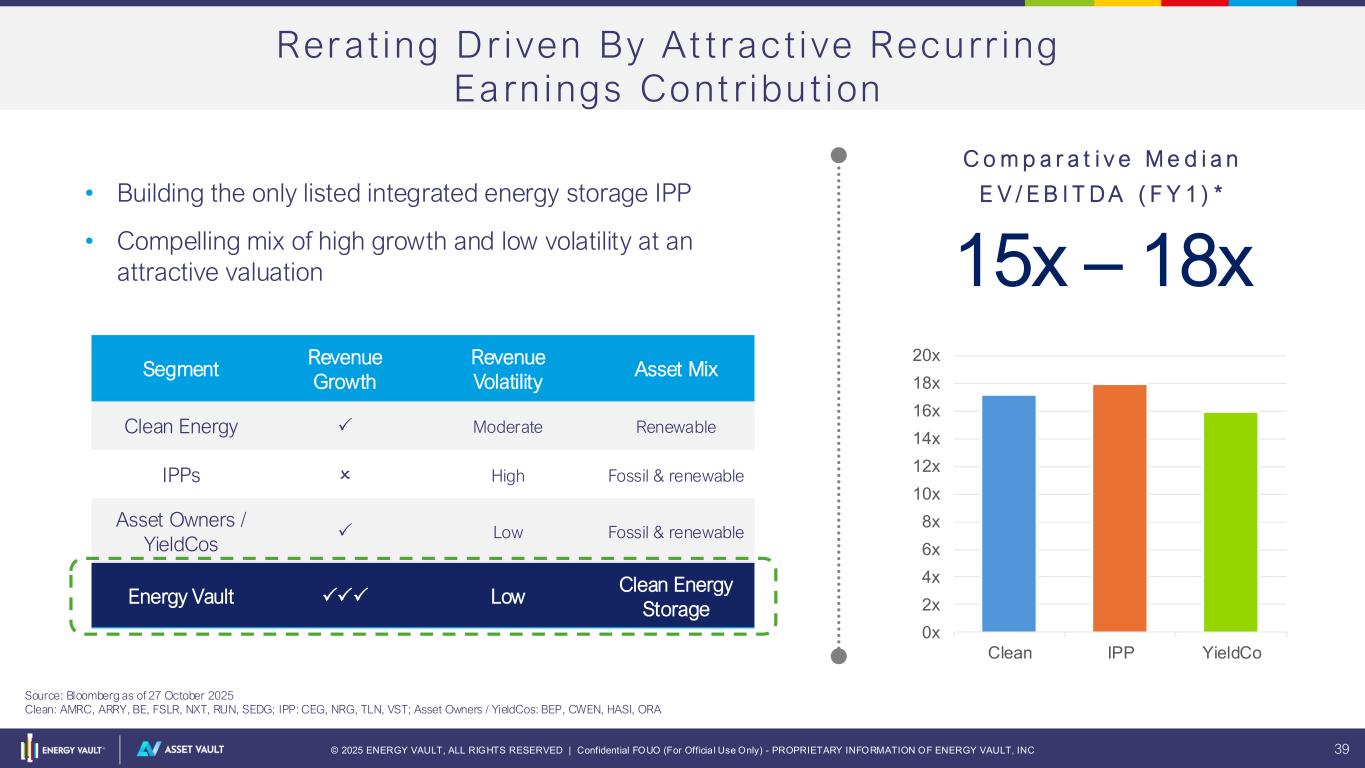

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 39 Rerat ing Dr iven By At t ract ive Recurr ing Earn ings Cont r ibu t ion Source: Bloomberg as of 27 October 2025 Clean: AMRC, ARRY, BE, FSLR, NXT, RUN, SEDG; IPP: CEG, NRG, TLN, VST; Asset Owners / YieldCos: BEP, CWEN, HASI, ORA 54% 0x 2x 4x 6x 8x 10x 12x 14x 16x 18x 20x Clean IPP YieldCo Segment Revenue Growth Revenue Volatility Asset Mix Clean Energy Moderate Renewable IPPs High Fossil & renewable Asset Owners / YieldCos Low Fossil & renewable Energy Vault Low Clean Energy Storage • Building the only listed integrated energy storage IPP • Compelling mix of high growth and low volatility at an attractive valuation C o m p a r a t i v e M e d i a n E V / E B I T D A ( F Y 1 ) * 15x – 18x

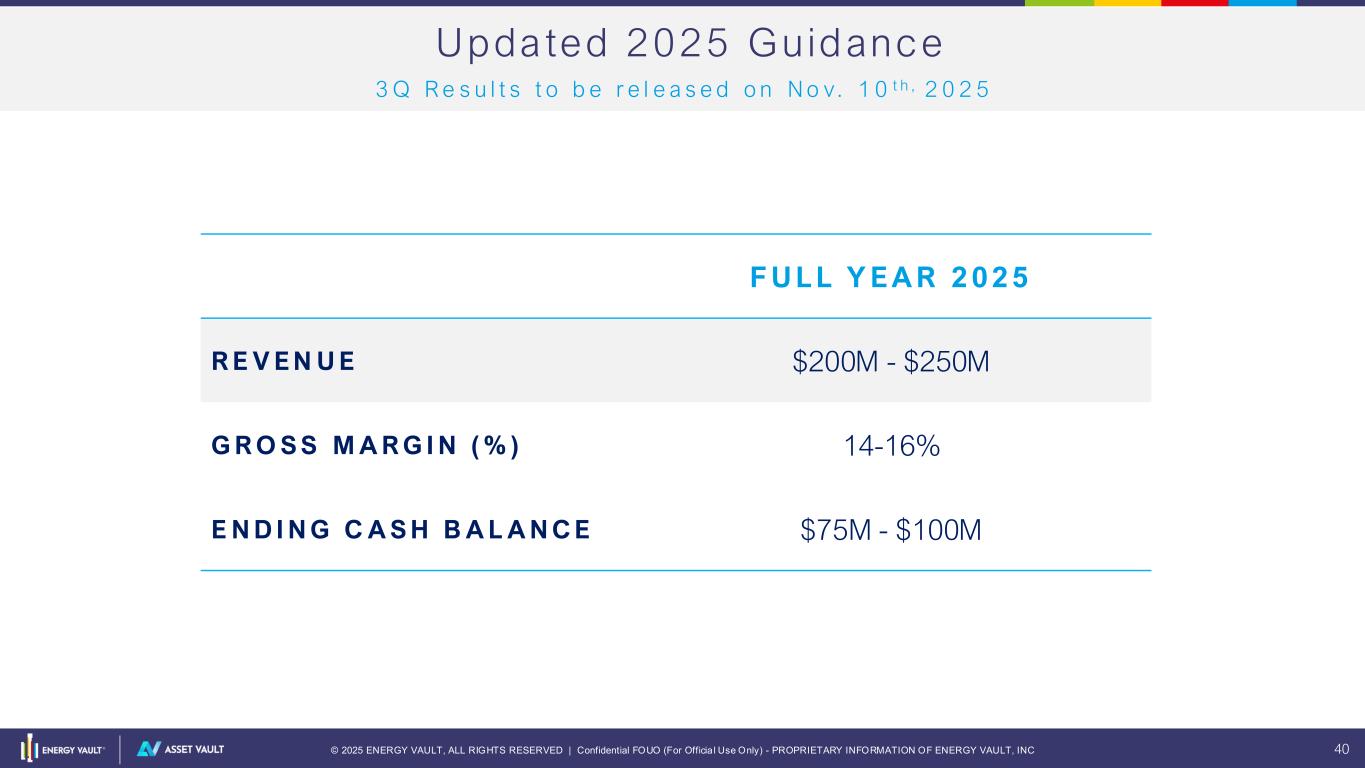

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 40 Updated 2025 Guidance F U L L Y E A R 2 0 2 5 R E V E N U E $200M - $250M G R O S S M A R G I N ( % ) 14-16% E N D I N G C A S H B A L A N C E $75M - $100M 3 Q R e s u l t s t o b e r e l e a s e d o n N o v. 1 0 t h , 2 0 2 5

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 41 CEO CLOSING REMARKS R O B E R T P I C O N I

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 42 Asset Vaul t : Energy Vaul t ’s P lat fo rm to Finance GWs of Cr i t ica l Energy Inf rast ructu re Assets Efficient Platform for Securing Capital Non-dilutive to Shareholders Scalable Enhance Speed of Capital Deployment Self Integration and Grid Expertise Reduces Project CapEx and OpEx, Increases IRR’s ---- PUBLIC SHAREHOLDERS ENERGY VAULT HOLDINGS, INC. (NRGV) Energy Vault’s existing and future power and storage assets ENERGY STORAGE SOLUTIONS (ESS)

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 43 THE ENE RGY VAU LT SOLUTION EX CELLE NCE CE NTE R RIBBON CUTTING Fr id ay, N ove m be r 21 , 20 25 • 0 9: 30 a m – 1 2 : 00 p m • S n y de r, TX The Energy Vault solution Excellence Center is Energy Vault’s first fully developed, owned and operated battery grid and gravity energy storage project delivering power and ancillary services to the ERCOT grid RSVP to sharon.reynolds@energyvault.com

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 44 THANK YOU

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 45 APPENDIX

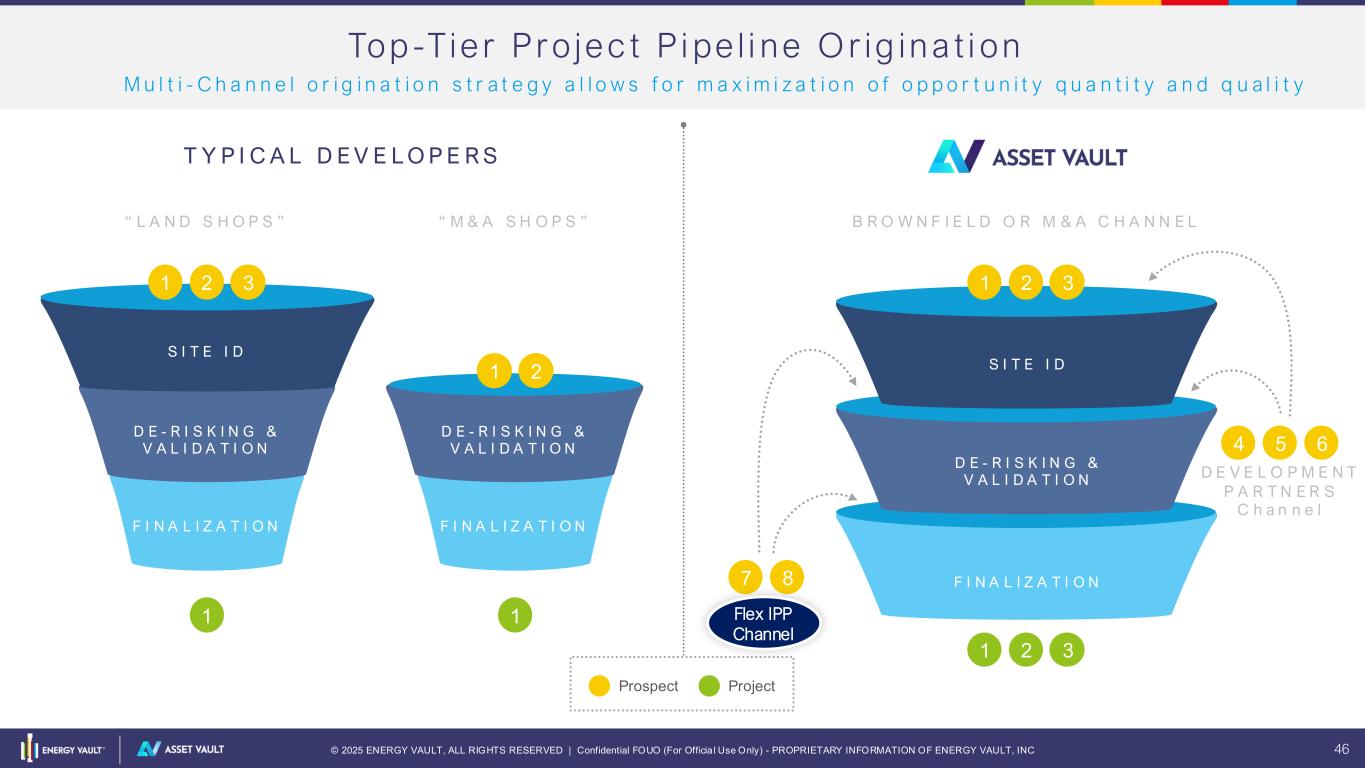

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 46 Top -Tie r Pr o jec t P i pe l i ne O r ig ina t i on M u l t i - C h a n n e l o r i g i n a t i o n s t r a t e g y a l l o w s f o r m a x i m i z a t i o n o f o p p o r t u n i t y q u a n t i t y a n d q u a l i t y Prospect Project T Y P I C A L D E V E L O P E R S D E - R I S K I N G & V A L I D A T I O N F I N A L I Z A T I O N D E - R I S K I N G & V A L I D A T I O N F I N A L I Z A T I O N S I T E I D D E - R I S K I N G & V A L I D A T I O N F I N A L I Z A T I O N S I T E I D “ L A N D S H O P S ” “ M & A S H O P S ” B R O W N F I E L D O R M & A C H A N N E L 1 2 3 1 2 1 1 1 2 3 1 2 3 4 5 6 7 8 D E V E L O P M E N T P A R T N E R S C h a n n e l Flex IPP Channel

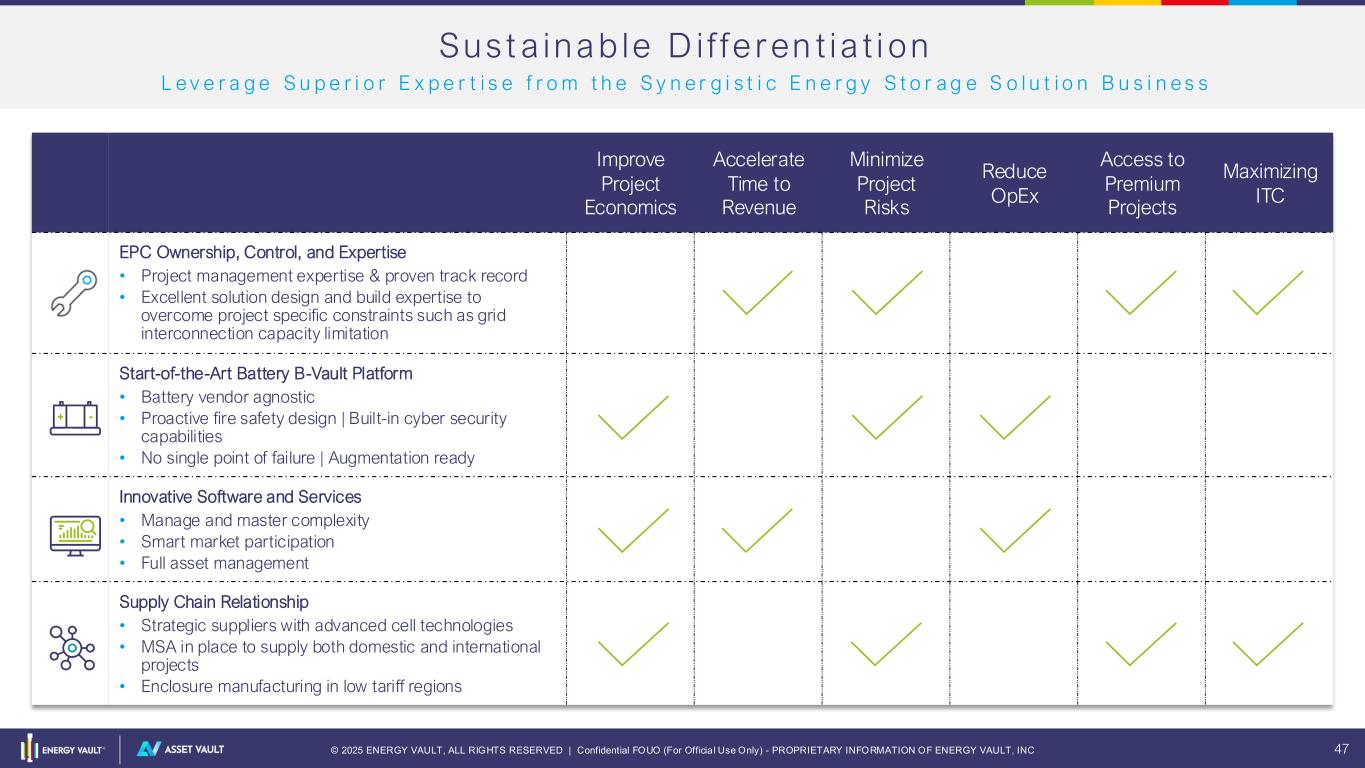

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 47 Sus t a inab le D i f fe ren t ia t i on L e v e r a g e S u p e r i o r E x p e r t i s e f r o m t h e S y n e r g i s t i c E n e r g y S t o r a g e S o l u t i o n B u s i n e s s Improve Project Economics Accelerate Time to Revenue Minimize Project Risks Reduce OpEx Access to Premium Projects Maximizing ITC EPC Ownership, Control, and Expertise • Project management expertise & proven track record • Excellent solution design and build expertise to overcome project specific constraints such as grid interconnection capacity limitation Start-of-the-Art Battery B-Vault Platform • Battery vendor agnostic • Proactive fire safety design | Built-in cyber security capabilities • No single point of failure | Augmentation ready Innovative Software and Services • Manage and master complexity • Smart market participation • Full asset management Supply Chain Relationship • Strategic suppliers with advanced cell technologies • MSA in place to supply both domestic and international projects • Enclosure manufacturing in low tariff regions

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 48 A sset Vau l t O p erat iona l Pr oj ect C r o s s Tr a i l s , Te x a s U S A | 5 7 M W / 1 1 4 M W h B a t t e r y E n e r g y S t o r a g e P r o j e c t Energy Vault’s 1st Fully Owned & Operated Energy Storage System • Utilize Energy Vault’s fully integrated solution stack of hardware (B- VAULT AC, software (VaultOS & Vault-Manager), and service offerings • Project delivered and in-operation within 6 months of site mobilization • First physically settled revenue floor contract signed for a Battery Storage System in ERCOT BESS | CROSS TRAILS S TAT U S / T I M E L I N E N O V 2 0 2 4 A P R I L 2 0 2 5 M A Y 2 0 2 5 S T A T U SM A Y 2 0 2 5N O V 2 0 2 4 I F C D r a w i n g M e c h a n i c a l C o m p l e t i o n R e v e n u e G e n e r a t i o n * I n O p e r a t i o n F u l l C o m m i s s i o n i n g S i t e M o b i l i z a t i o n Customer: ERCOT Project: Cross Trails Community: Snyder, Texas, USA * Excluding the force majeure event in Sep. & Oct. 2025. Asset to be back to Service by Oct. 2025

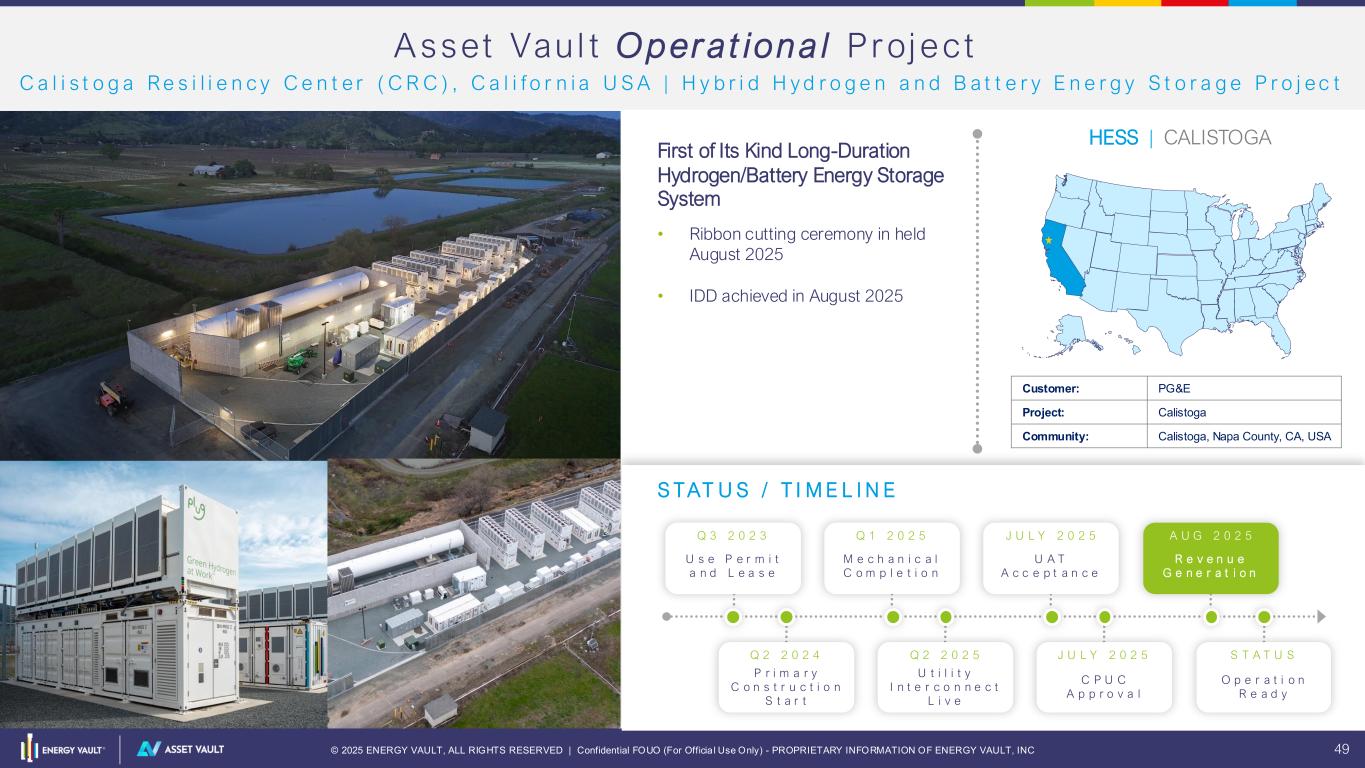

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 49 A sset Vau l t O p erat iona l Pr oj ect C a l i s t o g a R e s i l i e n c y C e n t e r ( C R C ) , C a l i f o r n i a U S A | H y b r i d H y d r o g e n a n d B a t t e r y E n e r g y S t o r a g e P r o j e c t First of Its Kind Long-Duration Hydrogen/Battery Energy Storage System • Ribbon cutting ceremony in held August 2025 • IDD achieved in August 2025 HESS | CALISTOGA S TAT U S / T I M E L I N E Q 3 2 0 2 3 S T A T U SQ 2 2 0 2 5Q 2 2 0 2 4 O p e r a t i o n R e a d y Q 1 2 0 2 5 J U L Y 2 0 2 5 A U G 2 0 2 5 J U L Y 2 0 2 5 C P U C A p p r o v a l U t i l i t y I n t e r c o n n e c t L i v e P r i m a r y C o n s t r u c t i o n S t a r t R e v e n u e G e n e r a t i o n U A T A c c e p t a n c e M e c h a n i c a l C o m p l e t i o n U s e P e r m i t a n d L e a s e Customer: PG&E Project: Calistoga Community: Calistoga, Napa County, CA, USA

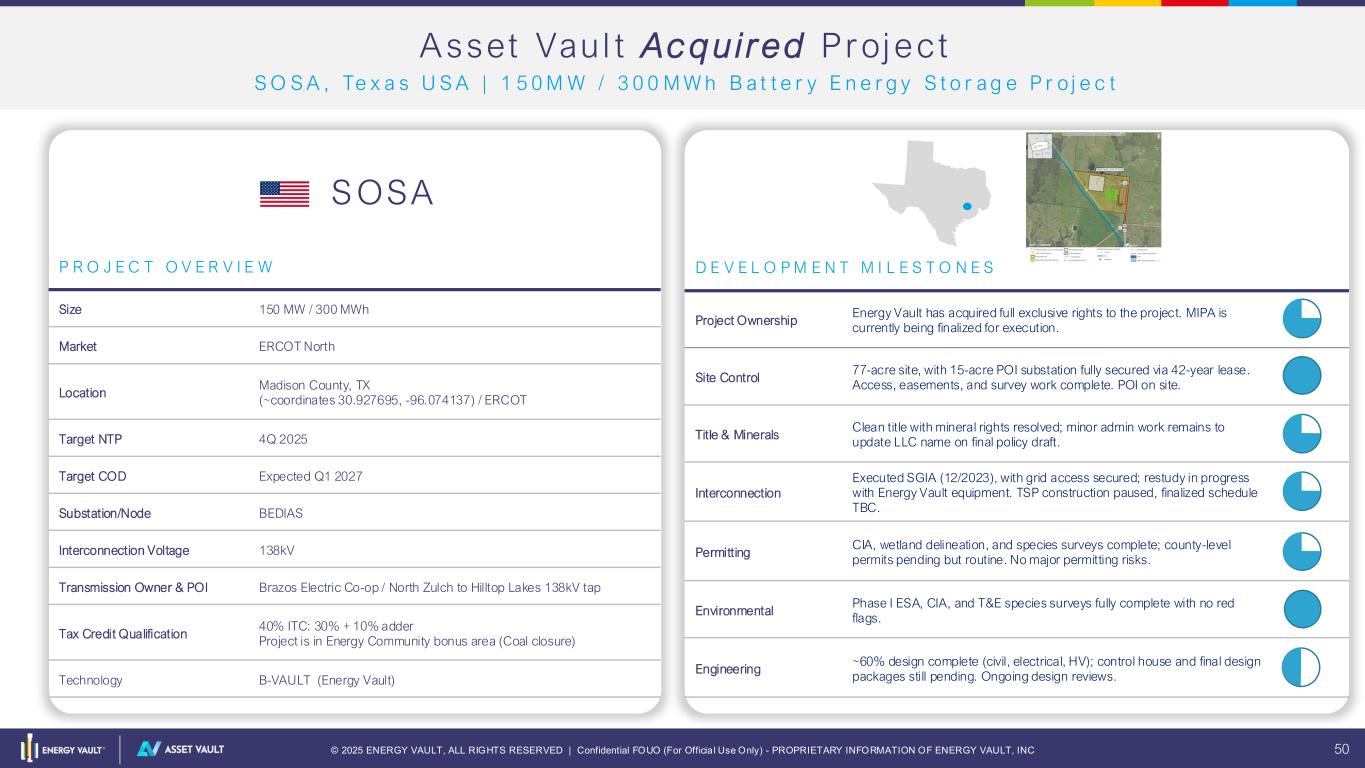

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 50 Screenshot 2025-10-08 at 11.26.43 AMScreenshot 2025-10-08 at 11.26.43 AM A sset Vau l t Ac q u i red Proj ect S O S A , Te x a s U S A | 1 5 0 M W / 3 0 0 M W h B a t t e r y E n e r g y S t o r a g e P r o j e c t P R O J E C T O V E R V I E W Size 150 MW / 300 MWh Market ERCOT North Location Madison County, TX (~coordinates 30.927695, -96.074137) / ERCOT Target NTP 4Q 2025 Target COD Expected Q1 2027 Substation/Node BEDIAS Interconnection Voltage 138kV Transmission Owner & POI Brazos Electric Co-op / North Zulch to Hilltop Lakes 138kV tap Tax Credit Qualification 40% ITC: 30% + 10% adder Project is in Energy Community bonus area (Coal closure) Technology B-VAULT (Energy Vault) D E V E L O P M E N T M I L E S T O N E S Project Ownership Energy Vault has acquired full exclusive rights to the project. MIPA is currently being finalized for execution. Site Control 77-acre site, with 15-acre POI substation fully secured via 42-year lease. Access, easements, and survey work complete. POI on site. Title & Minerals Clean title with mineral rights resolved; minor admin work remains to update LLC name on final policy draft. Interconnection Executed SGIA (12/2023), with grid access secured; restudy in progress with Energy Vault equipment. TSP construction paused, finalized schedule TBC. Permitting CIA, wetland delineation, and species surveys complete; county-level permits pending but routine. No major permitting risks. Environmental Phase I ESA, CIA, and T&E species surveys fully complete with no red flags. Engineering ~60% design complete (civil, electrical, HV); control house and final design packages still pending. Ongoing design reviews. S OSA

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 51 Screenshot 2025-10-08 at 11.26.43 AMScreenshot 2025-10-08 at 11.26.43 AM A sset Vau l t Cont racted Proj ect S t o n e y C r e e k , N S W A u s t r a l i a | 1 2 5 M W / 1 , 0 0 0 M W h B a t t e r y E n e r g y S t o r a g e STO N EY C RE EK P R O J E C T O V E R V I E W Size 125 MW / 1000 MWh (8-hour duration) Market NEM (National Electricity Market – NSW) Location 41 Stoney Creek Road, Narrabri, NSW 2390 (Lot 156 on DP754944) NTP Target H1 2025 (pending EIS/DA submission & grid application) COD Q4 2027 Substation/Node Narrabri Transgrid Substation (adjacent 132/66kV connection point) Interconnection Voltage 132 kV Transmission Owner & POI TransGrid / Narrabri Substation (0.4 km from site) Tax Credit Qualification N/A Technology AC-coupled Li-ion BESS with SMA MVPS 4600-S2 grid-forming inverters (45 units proposed) D E V E L O P M E N T M I L E S T O N E S Project Ownership Energy Vault fully acquired project from developer Enervest. 4 Site Control 12-month land purchase option in place; flat, civil-ready site adjacent to substation 4 Title & Minerals Freehold title; easements clear; Native Title claim by Gomeroi people under consultation; mortgagee consent pending 3 Interconnection Enquiry, Assessment, and Withstand Study complete; progressing toward full application with TransGrid and AEMO 3 Permitting SEARs package drafted; EIS and DA submission underway; environmental & cultural desktop assessments completed 3 Environmental Non-bushfire prone; no significant ecological or heritage risks noted; community engagement ongoing with Narrabri LALC 4 Engineering SMA inverter selected; VaultOS EMS to be integrated; EPC selection and plant config in progress 2

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 52 Geograph ical , Customer, Por t fo l io and Segment Expansion P O R T F O L I O A N D S E G M E N T E X P A N S I O N B - VA U LT Battery Storage US AUSTRALIA V I C T O R I A C K WSWITZERLAND ALBANIA INDIA Australia Expansion & Entry to European and Indian Market G - VA U LT Gravity Storage G E O G R A P H I C A L A N D C U S TO M E R E X P A N S I O N I P L I C E N S E Calistoga, CA Cross Trails, TX I N O P E R A T I O N C O N T R A C T E D SOSA, TX Stoney Creek, Aus. A C C E L E R A T E D E N T R Y I N T O O W N & O P E R A T E EVu Operational Solution Excellence Center, Snyder TX Emerging AI / Data Center Power Infra. Segment + = EVc IP and energy storage expertise Tall building and architectural expertise NewCo LLC

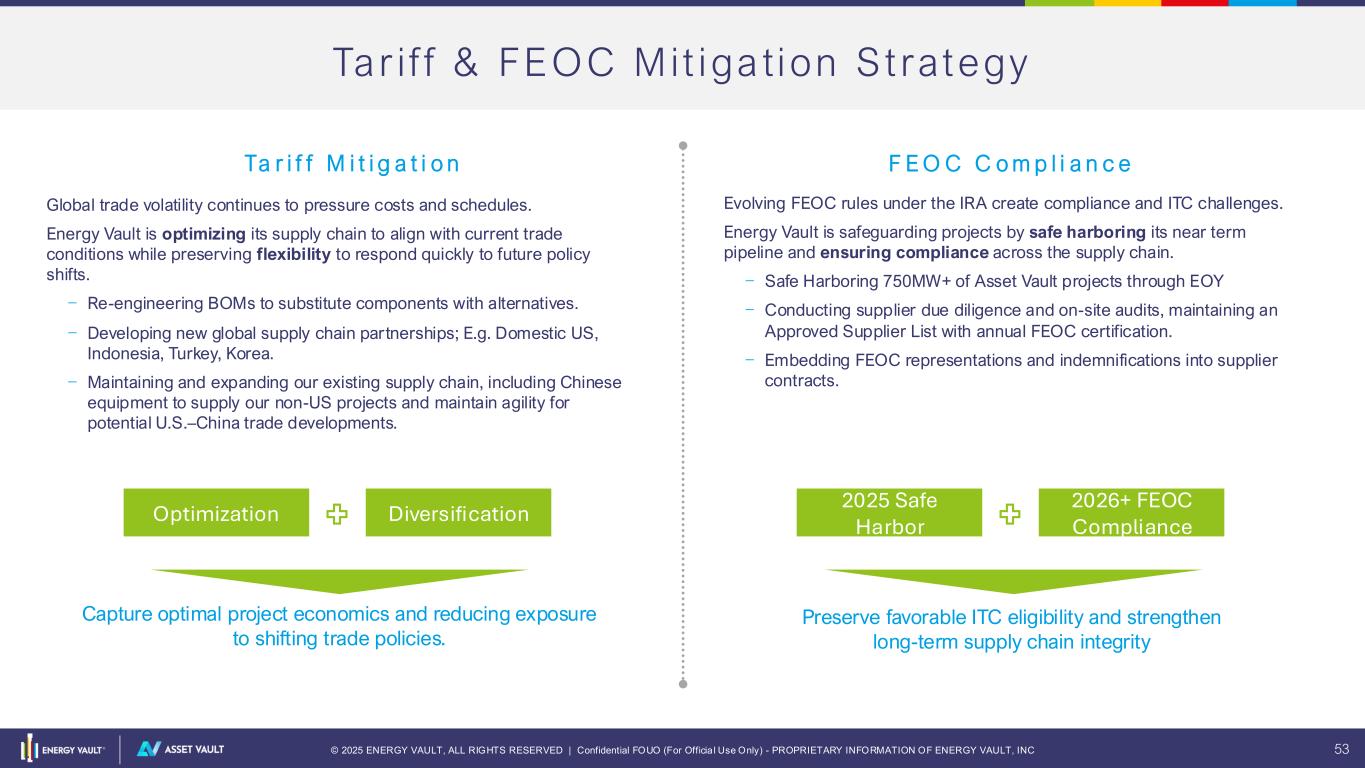

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 53 Tar i f f & FEOC Mit iga tion St rategy Ta r i f f M i t i g a t i o n F E O C C o m p l i a n c e Global trade volatility continues to pressure costs and schedules. Energy Vault is optimizing its supply chain to align with current trade conditions while preserving flexibility to respond quickly to future policy shifts. – Re-engineering BOMs to substitute components with alternatives. – Developing new global supply chain partnerships; E.g. Domestic US, Indonesia, Turkey, Korea. – Maintaining and expanding our existing supply chain, including Chinese equipment to supply our non-US projects and maintain agility for potential U.S.–China trade developments. Evolving FEOC rules under the IRA create compliance and ITC challenges. Energy Vault is safeguarding projects by safe harboring its near term pipeline and ensuring compliance across the supply chain. – Safe Harboring 750MW+ of Asset Vault projects through EOY – Conducting supplier due diligence and on-site audits, maintaining an Approved Supplier List with annual FEOC certification. – Embedding FEOC representations and indemnifications into supplier contracts. Capture optimal project economics and reducing exposure to shifting trade policies. Preserve favorable ITC eligibility and strengthen long-term supply chain integrity Optimization Diversification 2025 Safe Harbor 2026+ FEOC Compliance

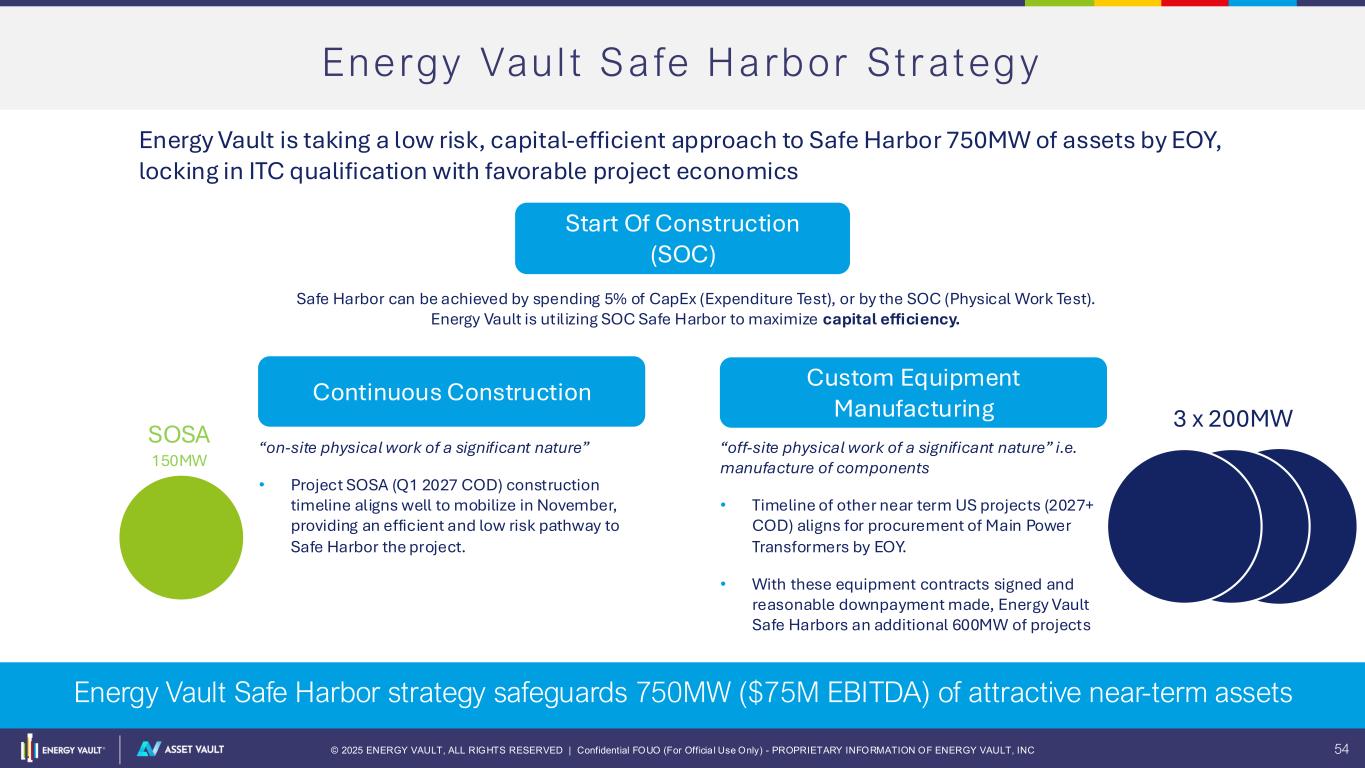

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 54 Energy Vau l t Sa fe Harbor St rategy Start Of Construction (SOC) Continuous Construction Custom Equipment Manufacturing Energy Vault is taking a low risk, capital-efficient approach to Safe Harbor 750MW of assets by EOY, locking in ITC qualification with favorable project economics “on-site physical work of a significant nature” • Project SOSA (Q1 2027 COD) construction timeline aligns well to mobilize in November, providing an efficient and low risk pathway to Safe Harbor the project. Safe Harbor can be achieved by spending 5% of CapEx (Expenditure Test), or by the SOC (Physical Work Test). Energy Vault is utilizing SOC Safe Harbor to maximize capital efficiency. 200MW200MW SOSA 150MW 3 x 200MW “off-site physical work of a significant nature” i.e. manufacture of components • Timeline of other near term US projects (2027+ COD) aligns for procurement of Main Power Transformers by EOY. • With these equipment contracts signed and reasonable downpayment made, Energy Vault Safe Harbors an additional 600MW of projects Energy Vault Safe Harbor strategy safeguards 750MW ($75M EBITDA) of attractive near-term assets

© 2025 ENERGY VAULT, ALL RIGHTS RESERVED | Confidential FOUO (For Officia l Use Only) - PROPRIETARY INFORMATION OF ENERGY VAULT, INC 55 Notice to recipients • This presentation has been prepared solely for, and is being delivered directly on a confidential basis to, certain recipients for the purpose of providing certain information about an investment partnership between Energy Vault and a private investment fund managed by OIC, L.P. (“OIC”). This presentation is confidential, proprietary and a trade secret, contains non-public information and is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. Any reproduction or distribution of this presentation, in whole or in part, or the disclosure of its contents, without the prior written consent of OIC, is prohibited and all recipients agree they will keep confidential all information contained herein and not already in the public domain and will use this presentation for the sole purpose of evaluating a possible investment in the Fund. Without limiting the foregoing, all recipients of this presentation are expressly advised that the securities of OIC and certain of its operating companies, investment vehicles and / or affiliates are not listed and posted for trading and that this presentation contains information not available to the public generally. All recipients are advised that United States securities laws restrict any person who has non-public information about a company from purchasing or selling securities of such company (and options, warrants and rights relating thereto) and from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities. Each recipient agrees to not purchase or sell such securities in violation of any such laws, including securities of OIC and certain of its operating companies, investment vehicles and/or affiliates, as applicable. This presentation is not an advertisement for any product managed by OIC. This is not an offer or solicitation to invest in the Fund or any fund managed by OIC. The information contained herein is provided for informational and discussion purposes only and is not, and may not be relied on in any manner as legal , tax or investment advice or as an offer to sell or a solicitation of an offer to buy any interest or securities of any issuer. Offers and sales of interests in any OIC-managed Fund will not be registered under the laws of any jurisdiction and will be made solely to persons that are both “qualified purchasers” (as defined under the U.S. Investment Company Act of 1940, as amended) and “accredited investors” (as defined in Regulation D under the U.S. Securities Act of 1933, as amended). The securities of the Fund will not be recommended, approved or disapproved by any U.S. federal or state securities commission or any other regulatory authority of any other jurisdiction.. • No person has been authorized in connection with this presentation to give any information or to make any representations other than as contained in this presentation and, if given or made, such information or representation must not be relied upon as having been authorized by OIC. Statements in this presentation are made as of the date hereof unless stated otherwise herein, and the delivery of this presentation at any time shall not under any circumstances create an implication that the information contained herein is correct as of any time subsequent to such date. OIC has no obligation and does not undertake to update, revise or correct any of the information contained herein after the date hereof. • The receipt and use of this presentation in certain jurisdictions may be restricted by applicable laws, rules or regulations. The information provided herein is intended only for and will be distributed only to persons resident in jurisdictions where such distribution or availability would not be contrary to applicable laws or regulations. The products mentioned in this presentation may not be eligible for sale in some states or countries. Recipients should inform themselves as to the legal requirements and tax consequences of an investment in the Fund within the countries of their citizenship, residence, domicile and place of business. By accepting delivery of this presentation, each recipient agrees to the foregoing. OIC is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission, any securities administrator under any state securities laws or any other governmental or self-regulatory authority. Neither the U.S. Securities and Exchange Commission nor the securities regulatory authority of any state or any other U.S. or non-U.S. jurisdiction has passed upon the accuracy or adequacy of this document, the information contained herein or the merits of an investment in the Fund. Any representation to the contrary is unlawful. More information about OIC can be found in its Form ADV which is available upon request. By accepting this presentation, each recipient on their own accord and on behalf of their respective business enterprises agrees to the foregoing.