Mondee Holdings, Inc. 10800 Pecan Park Blvd. Suite 400 Austin, Texas 78750 VIA EDGAR December 21, 2023 U.S. Securities & Exchange Commission Division of Corporation Finance Office of Energy & Transportation 100 F Street, NE Washington, D.C. 20549-0405 Attention: Jenifer Gallagher, Staff Accountant Robert Babula, Staff Accountant Re: Mondee Holdings, Inc. Form 10-K for the Fiscal Year ended December 31, 2022 Filed April 11, 2023 File No. 001-39943

U.S. Securities and Exchange Commission December 21, 2023 Page 2 Dear Ms. Gallagher and Mr. Babula: Set forth below is the response of Mondee Holdings, Inc. (the “Company,” “we,” “our” or “us”) to the comments made by the staff (the “Staff”) of the Division of Corporation Finance of the U.S. Securities and Exchange Commission (the “Commission”) contained in the Staff’s Letter dated November 17, 2023 with respect to the Company’s Form 10-K for the Fiscal Year ended December 31, 2022 filed with the Commission on April 11, 2023 (the “Form 10-K”). The numbered paragraphs below correspond to the numbered comments in the Letter and the Staff’s comments are presented in bold italics. Form 10-K for the Fiscal Year ended December 31, 2022 Financial Statements Note 10 – Revenue Disaggregation of Revenue, page F-34 1. We understand from your response to prior comment six that you believe the requirements of FASB ASC 606-10-50-5 do not apply to the revenue streams that comprise your Travel Marketplace segment revenue, including those derived from sales of airline tickets and in connection with reservations made for hotel accommodations, rental cars, travel insurance and other travel products and services, in the form of service fees, margins and commissions, or incentive payments based on the amounts or volumes of bookings and transactions, because such arrangements involve a similar performance obligation. You also state “there is no significant level of disparity in the nature, amount, timing and uncertainty of revenues and cash flows associated with the travel marketplace revenue,” although provide no details to support either assessment or to demonstrate how your aggregation of these various sources of revenues serves to depict how the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors. FASB ASC 606-10-50-6 requires disclosure that enables users to understand the relationship between the disaggregated revenue information and the related segment disclosures, while FASB ASC 606-10-55-90 and 91 clarify that you should consider how information is presented outside of the financial statements when selecting appropriate categories, to include investor presentations and earnings releases, and provides examples of categories that may be applicable to your business, including the type of service, market or type of customer, type of contract, and sales channels.

U.S. Securities and Exchange Commission December 21, 2023 Page 3 On page 15 of your November 2023 Investor Presentation we see that you characterize your business as having “diversified revenue streams” and depict an evolving mix of revenue streams between markup, commissions, GDS/NDC, Fintech, Ancillaries, and Subscriptions, while grouping revenues based on the categories of consumer economics, supplier economics, and diversified, and indicating a long term target for air transactions of 50% compared to 80% now and 100% a few years ago. The remarks prepared for your recent earnings call include references to demand with differentiation between your “core business sectors” and “emerging sectors for new-era distributors, experts and influencers,” also noting the evolving mix of products in differentiating between your historic offerings that were limited to air transactions, stating that you “…have since added hotels, where Gross Bookings grew year-to-date 74% compared with the same period last year,” that hotels, packages, and other content “enjoy a higher Take Rate than air [and] continue to grow rapidly,” and that you “anticipate that cruises and activities will be a growth driver in late 2024.” In explaining the recent increase in the take rate within the earnings call remarks, you further clarify that it was “driven mostly by the uptake of higher-margin hotel content and the diversification of revenue streams, including fintech and ancillary services” and that you expect this important metric “to continue expanding into the double digits with the addition of cruises and a greater mix of non-air content.” We note disclosures on pages 32 and 33 of your annual report referencing the risk of adverse consequences if you are unable to maintain existing, and establish new, arrangements with travel suppliers, explaining that a significant portion of revenue is derived from commissions and incentive payments from travel suppliers, “especially airline suppliers, and GDS service providers,” clarifying that while you “generally maintain formal contractual relationships” with travel suppliers, you “maintain more informal arrangements with certain travel suppliers, such as airlines, GDS service providers, hotels and other travel product companies,” emphasizing the risk that these can be terminated with or without notice and may create uncertainty with respect to terms and pricing, and explaining that your largest airline clients are seeking to increase use of direct distribution channels by moving client traffic to their proprietary websites. Given these and other observations, including separately identifying and quantifying changes in commission revenues and incentive revenues when explaining variances in travel marketplace revenues in MD&A, unless you are able to demonstrate how differences in the various revenue streams based on the products, revenue types, and distribution channels are immaterial in understanding how the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors, further disaggregation should be provided to comply with FASB ASC 606-10-50.

U.S. Securities and Exchange Commission December 21, 2023 Page 4 Please submit the revisions that you propose to address the concerns outlined above. In conjunction with your response, provide us with schedules showing the revenues derived for each of the products (e.g. airlines, hotels, auto rentals, cruises, insurance and other), and separately for each revenue type and category as referenced in the Investor Presentation noted above, and each distribution or marketing channel, covering each of the last three fiscal years and the subsequent interim period. The Company acknowledges the Staff’s comment on the Company’s disaggregated revenue disclosures and respectively submits the following revenue schedules for the last three fiscal years and the nine months ended September 30, 2023, disaggregated by segment, revenue stream, underlying travel product and by sales channel associated with the recorded Travel Marketplace segment revenues. For all periodic prospective filings beginning with our Form 10-K for the year ended December 31, 2023, and for the comparative periods presented, we will include an additional level of disaggregation by using the formatting of the Exhibits A, B and C proposed and footnote disclosures below. Please refer to the discussions below about how revenue disaggregation is reassessed in accordance with ASC 606-10-55-91. In the future, we will also reassess the revenue disaggregation and operational information related presentations in prospective investors presentations and earnings releases. With reference to ASC 606-10-55-90 (b) and (c), the CODM continues to review and monitor our operations by our reportable segments (Travel Marketplace and software-as-a-service (“SaaS”) segments). Specifically, with respect to our Travel Marketplace segment, the CODM continues to review the segment’s financial performance on an aggregated basis, as the nature of our overall revenues derived from Travel Marketplace segment essentially represents revenues from travel related activities. We reassessed revenues from the following categories in accordance with ASC 606-10-55-91: (a) Type of good or service (for example, major product lines) Within our Travel Marketplace segment, the Company, as an agent, facilitates traveler suppliers to sell underlying travel products and provides booking services to travelers through computerized network systems, such as global distribution systems (GDS). We generate travel transaction- related revenue from the above booking services. In addition, we generate commission revenues from banks and financial institutions based on the travel booking spend processed through fintech programs partnered with our platform. In our previous Investor Presentation materials, management used to discuss revenues categorized as Consumer Economics, Supplier Economics, Fintech, Ancillaries and Subscriptions without disclosing quantitative information. Such discussions were from various operational concepts, instead of viewing customer contracts through revenue recognition categories from an accounting perspective.

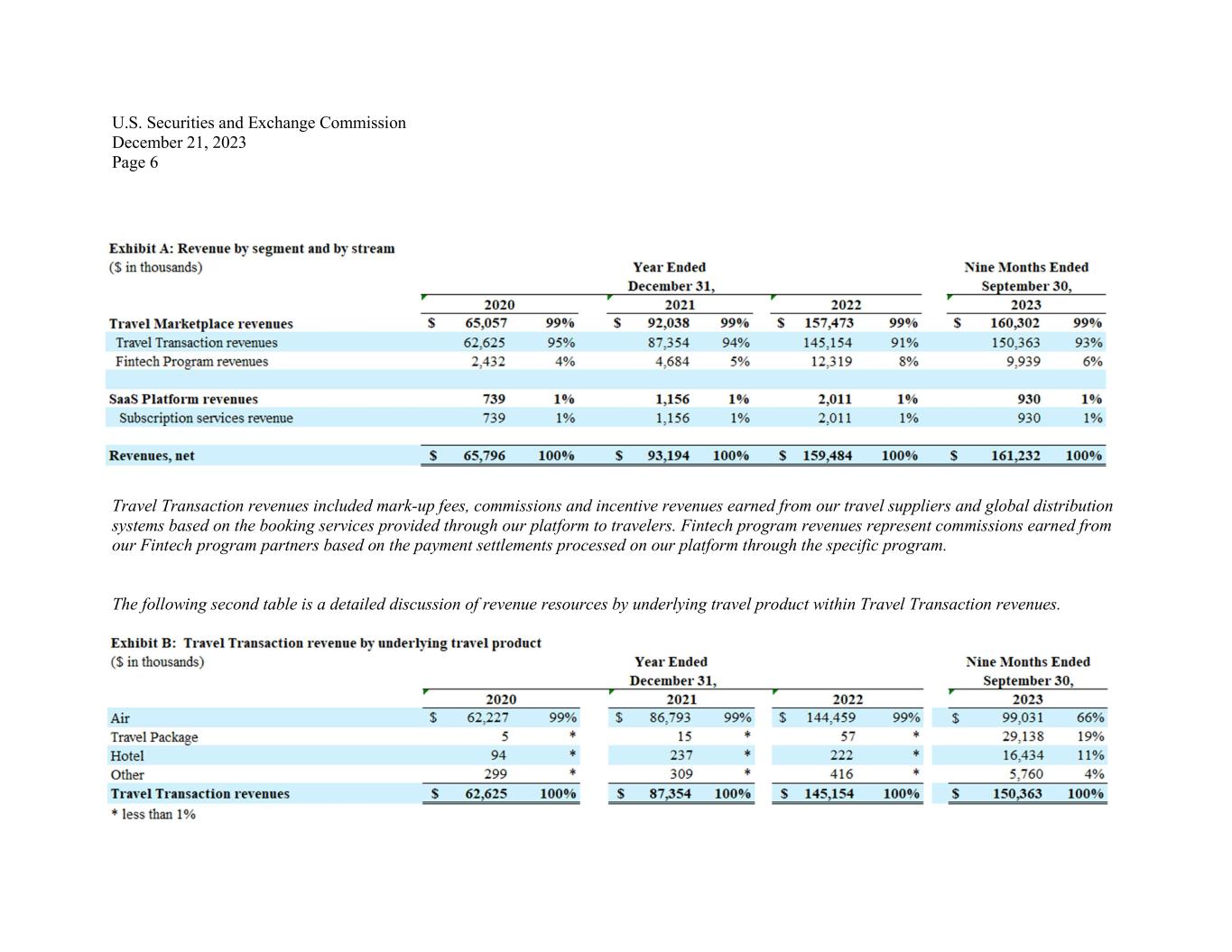

U.S. Securities and Exchange Commission December 21, 2023 Page 5 Generally, in the travel transaction booking process, both Consumer Economics and Supplier Economics are driven by the Company’s fulfillment of a single performance obligation, which is to facilitate booking arrangements between suppliers and travelers. Consumer Economics is driven by booking of travelers, and Supplier Economics is driven by travel suppliers’ incentives earned on the same booking. In operations, Consumer Economics and Supplier Economics are highly correlated as they are derived by the same booking: we earn (1) mark-up fees and certain commissions per booking at ticketing, (2) certain commissions per booking when the underlying trip is taken by traveler (For those commissions, the Company estimates the variable considerations at booking. However, the amount of revenue that can be earned is susceptible to reversal due to factors outside of the entity’s influence; refer to further discussions in sections (f) and (d) below), and (3) additional incentives when the booking volume performance goals during a period are achieved. Both Consumer Economics and Supplier Economics are priced on a booking basis - the rates could be flat fees or tiered fixed percentages and are subject to frequent modifications in a dynamic market. As such, the Company assesses its operations based on the total net revenue generated from the same booking, instead of separating the highly correlated components within the same transaction. Further, as an industry practice, certain commission and incentive rates are highly restricted among competitors and limited to supplier relationship management within a company. We believe presenting the details of Consumer Economics and Supplier economics would not be meaningful for the users of financial statements, and further disaggregation of revenues generated from mark-up fees, commissions and incentives would put us at a competitive disadvantage in disclosing where our peers have not, and management has not discussed the detailed amounts of travel transaction revenues with investors. Based on the analysis above, we propose to combine the Consumer Economics and Suppler Economics into Travel Transaction revenues in future presentations to investors and financial statements, and present Fintech Program revenues as a separate revenue stream within Travel Marketplace segment. Additionally, we propose to present Travel Transaction revenue stream based on the following underlying travel product given significant business expansions from fiscal year 2023: Air, Travel Package, Hotel, and Other. The following exhibits and footnote disclosures are the formatting we propose by using fiscal years ended December 31, 2020, 2021, 2022 and the nine-month period ended September 30, 2023 as examples to present disaggregated revenue by segment, revenue stream and underlying travel product under ASC 606-10-55-91(a) for future periodic filings beginning with the Form 10-K for fiscal year 2023 and its comparative period: Proposed footnote disclosures: Revenue by segment, stream, and underlying travel product The following first table presents revenue by segment and stream for the fiscal years ended December 31, 2020, 2021, 2022 and the nine-month period ended September 30, 2023:

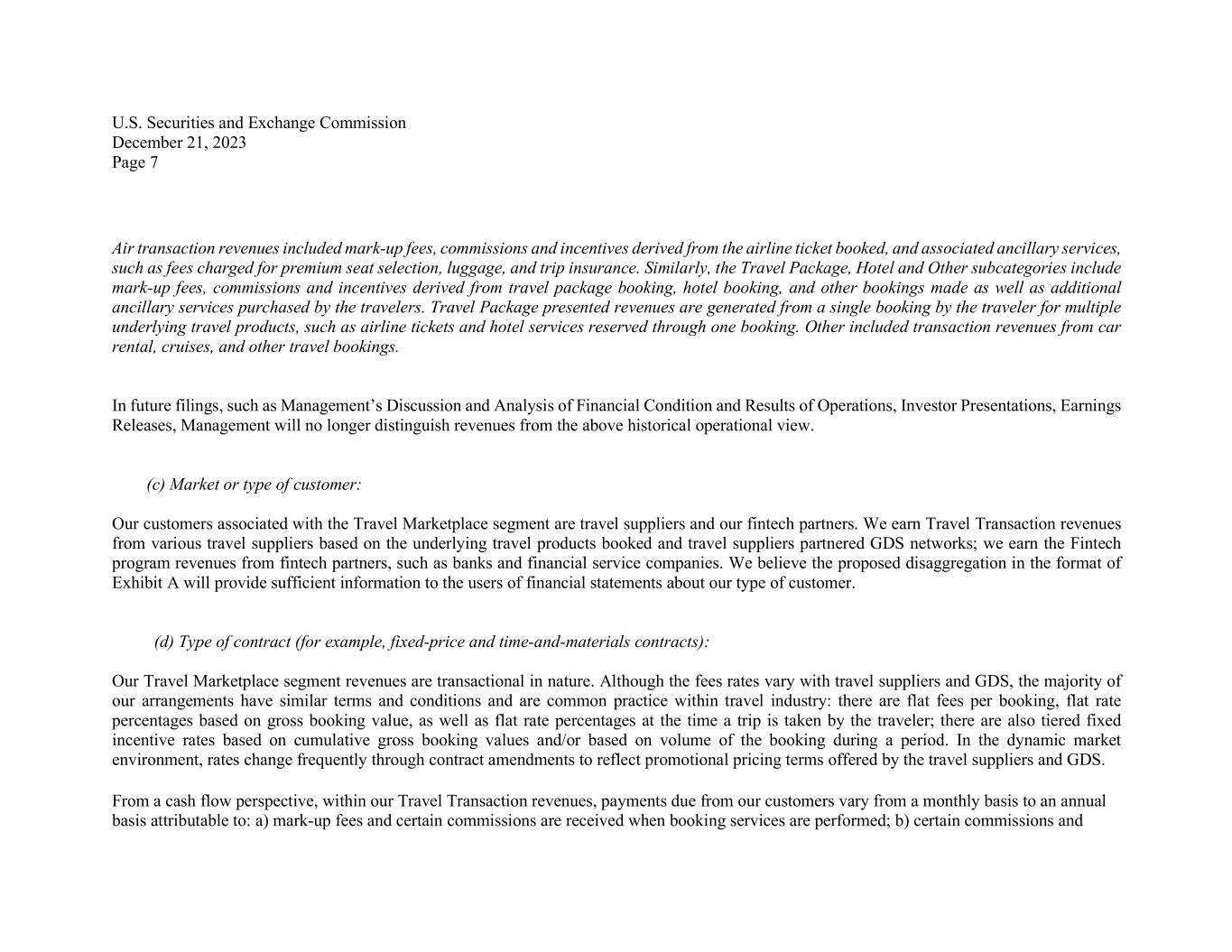

U.S. Securities and Exchange Commission December 21, 2023 Page 6 Travel Transaction revenues included mark-up fees, commissions and incentive revenues earned from our travel suppliers and global distribution systems based on the booking services provided through our platform to travelers. Fintech program revenues represent commissions earned from our Fintech program partners based on the payment settlements processed on our platform through the specific program. The following second table is a detailed discussion of revenue resources by underlying travel product within Travel Transaction revenues.

U.S. Securities and Exchange Commission December 21, 2023 Page 7 Air transaction revenues included mark-up fees, commissions and incentives derived from the airline ticket booked, and associated ancillary services, such as fees charged for premium seat selection, luggage, and trip insurance. Similarly, the Travel Package, Hotel and Other subcategories include mark-up fees, commissions and incentives derived from travel package booking, hotel booking, and other bookings made as well as additional ancillary services purchased by the travelers. Travel Package presented revenues are generated from a single booking by the traveler for multiple underlying travel products, such as airline tickets and hotel services reserved through one booking. Other included transaction revenues from car rental, cruises, and other travel bookings. In future filings, such as Management’s Discussion and Analysis of Financial Condition and Results of Operations, Investor Presentations, Earnings Releases, Management will no longer distinguish revenues from the above historical operational view. (c) Market or type of customer: Our customers associated with the Travel Marketplace segment are travel suppliers and our fintech partners. We earn Travel Transaction revenues from various travel suppliers based on the underlying travel products booked and travel suppliers partnered GDS networks; we earn the Fintech program revenues from fintech partners, such as banks and financial service companies. We believe the proposed disaggregation in the format of Exhibit A will provide sufficient information to the users of financial statements about our type of customer. (d) Type of contract (for example, fixed-price and time-and-materials contracts): Our Travel Marketplace segment revenues are transactional in nature. Although the fees rates vary with travel suppliers and GDS, the majority of our arrangements have similar terms and conditions and are common practice within travel industry: there are flat fees per booking, flat rate percentages based on gross booking value, as well as flat rate percentages at the time a trip is taken by the traveler; there are also tiered fixed incentive rates based on cumulative gross booking values and/or based on volume of the booking during a period. In the dynamic market environment, rates change frequently through contract amendments to reflect promotional pricing terms offered by the travel suppliers and GDS. From a cash flow perspective, within our Travel Transaction revenues, payments due from our customers vary from a monthly basis to an annual basis attributable to: a) mark-up fees and certain commissions are received when booking services are performed; b) certain commissions and

U.S. Securities and Exchange Commission December 21, 2023 Page 8 incentives earned per booking or based on cumulative booking performance are due monthly/quarterly/annually based on billing terms with travel suppliers/GDS. There are two multi-year contracts representing less than 5% of revenue recognized and cash flows incurred in fiscal years ended December 31, 2020, 2021, 2022 and the nine-month period ended September 30, 2023; refer to further discussions at section (e) below. Due to the overall short-term variations in billings and collections that are realized within a year, further details within travel transaction revenues would not be meaningful for the users of financial statements. Payments due from our Fintech program partners are on a monthly or a quarterly basis. In summary, we believe the revenue disaggregation in proposed Exhibit A format for prospective filings will provide sufficient information by type of contract. (f) Timing of transfer of goods or services (for example, revenue from goods or services transferred to customers at a point in time and revenue from goods or services transferred over time): Our Travel Marketplace segment revenues are recorded at a point in time. As we are an intermediary that facilitates booking arrangements between the travel suppliers and travelers, Travel Transaction revenues are recognized when the single performance obligation is fulfilled by the Company. At the point in time when a travel booking service is performed and the Company’s obligation has been fulfilled, the Company makes an estimate for variable consideration based on cumulative booking, which is calculated per applicable pricing tier. Additionally, when the same travel booking is processed, the Company makes an estimate for variable consideration for taking the trip, to the extent that there is a risk of significant reversal constraining the variable consideration, until the trip is taken, since the occurrence of the trip is influenced by outside factors, such as the actions of travelers and weather conditions. We recognize Fintech Program revenues at a point in time when the payment of the trip booked by traveler is settled through the Fintech program partnered with the Company. (g) Sales channels (for example, goods sold directly to consumers and goods sold through intermediaries): The underlying travel products sold by us on behalf of customers are through sub-agencies and travelers directly. Certain mark-up fees and commissions within the Travel Marketplace segment, derived from travelers’ direct bookings, may be subject to a different pricing term, as compared

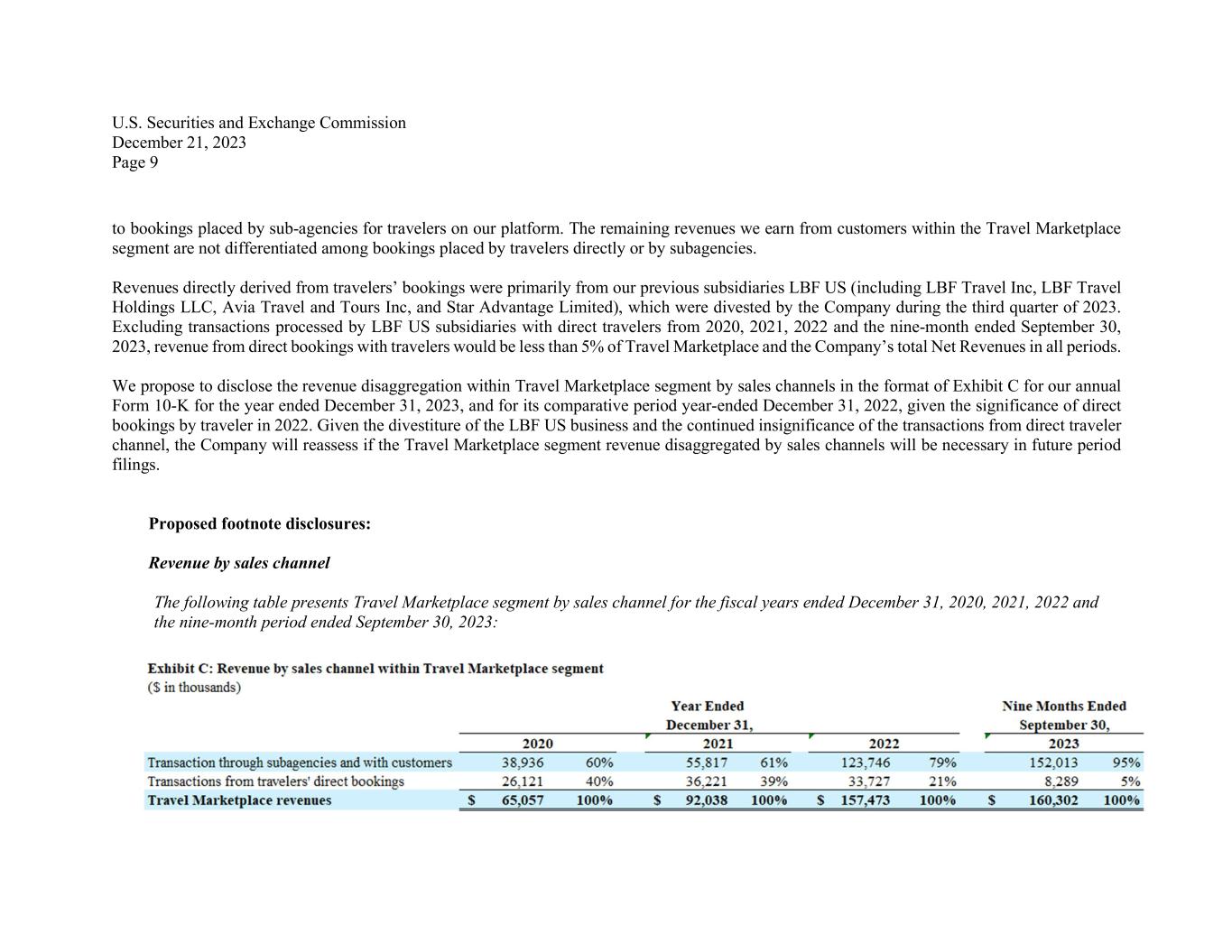

U.S. Securities and Exchange Commission December 21, 2023 Page 9 to bookings placed by sub-agencies for travelers on our platform. The remaining revenues we earn from customers within the Travel Marketplace segment are not differentiated among bookings placed by travelers directly or by subagencies. Revenues directly derived from travelers’ bookings were primarily from our previous subsidiaries LBF US (including LBF Travel Inc, LBF Travel Holdings LLC, Avia Travel and Tours Inc, and Star Advantage Limited), which were divested by the Company during the third quarter of 2023. Excluding transactions processed by LBF US subsidiaries with direct travelers from 2020, 2021, 2022 and the nine-month ended September 30, 2023, revenue from direct bookings with travelers would be less than 5% of Travel Marketplace and the Company’s total Net Revenues in all periods. We propose to disclose the revenue disaggregation within Travel Marketplace segment by sales channels in the format of Exhibit C for our annual Form 10-K for the year ended December 31, 2023, and for its comparative period year-ended December 31, 2022, given the significance of direct bookings by traveler in 2022. Given the divestiture of the LBF US business and the continued insignificance of the transactions from direct traveler channel, the Company will reassess if the Travel Marketplace segment revenue disaggregated by sales channels will be necessary in future period filings. Proposed footnote disclosures: Revenue by sales channel The following table presents Travel Marketplace segment by sales channel for the fiscal years ended December 31, 2020, 2021, 2022 and the nine-month period ended September 30, 2023:

U.S. Securities and Exchange Commission December 21, 2023 Page 10 We generate mark-up fees and certain commissions from booking reservations directly placed by travelers through our platform. The Transaction through subagencies and with customers category includes our revenues generated from mark-up fees and commissions via bookings placed by subagencies as well as other commissions, incentives and Fintech program revenues which are not differentiated by sales channels. As far as the other revenue categories, our analysis remains unchanged from our response letter dated October 31, 2023, and is summarized as follows: - ASC 606-10-55-91(b) Geographical region: we will continue to present revenues derived by Company’s subsidiary local i.e. United States, Brazil, and rest of the world. - ASC 606-10-55-91 (e) Contract duration: we have not identified other long-term contracts where resulting timing of revenue recognition and cash flow would be different from other agreements, except the two specific multi-year GDS contracts. Historically, there were two specific contracts executed with GDS providers, and the Company received incentive fees in cash in advance and recognized such cash receipts as incentive revenues over the remaining contract period. As discussed for ASC 606-10-55-91 (e) in our previous response letter, the cash flow impact and revenue recognition impact from the two specific contracts to fiscal years 2020 and 2021 are none, and less than 5% for the periods from 2022 and forward, respectively. Based on our evaluation, and in line with proposed disaggregation (included under Exhibits), we believe we will sufficiently meet the disclosure objective in ASC 606-10-50-5 to enable our users of financial statements to understand how our revenues impact the financial position and is in line with how management reviews our operational performance and manages our business. As our business continues to evolve, we will continue to evaluate this disaggregation and revise as necessary. Additionally, to address the Staff’s comment on our risk factor discussions about informal arrangements with certain travel suppliers in previous filings, we propose to modify the risk factor description as the following beginning with our Form 10-K for the year ended December 31, 2023: Previous statement: “Although we generally maintain formal contractual relationships with our travel suppliers we do currently, and may continue to, maintain more informal arrangements with certain travel suppliers, such as airlines, GDS service providers, hotels, and other travel product companies, which can be terminated with or without notice and may create uncertainty with respect to the agreed terms including pricing. If these arrangements are terminated unexpectedly, or there is disagreement regarding the terms of the agreement with such travel suppliers, our financial results or

U.S. Securities and Exchange Commission December 21, 2023 Page 11 operations could be negatively impacted. We cannot assure you that our agreements or arrangements with our travel suppliers or travel-related service providers will continue or that our travel suppliers or travel-related service providers will not reduce commissions, terminate their contracts, make their products or services unavailable to us, or default on or dispute their payment or other obligations with us, any of which could reduce our revenue and margins or may require us to initiate legal or arbitration proceedings to enforce contractual payment obligations, which may materially and adversely affect our business, financial condition and results of operations.” Proposed edits: We maintain formal contractual relationships with our travel suppliers. Under the master contractual framework with our travel suppliers, the contract duration may be terminated at convenience and pricing terms are frequently subject to modifications or amendments. Our pricing terms, especially the commission and incentive rates for specific incentive periods and specific travel segments of the underlying travel products processed through our travel platform may be modified over time by the travel suppliers and subject to renegotiation. Our Travel Transaction revenues, including mark-up fees, commissions and incentives earned could be negatively impacted if the renegotiated rates for us are less competitive. The contract durations with certain other travel product companies, such as local tour service providers, may be terminated unexpectedly, or there could be a negative impact to our financial results or operations if there is disagreement regarding the terms of the agreement with such travel supplier. We cannot assure you that our agreements or arrangements with our travel suppliers or travel-related service providers will continue or that our travel suppliers or travel-related service providers will not reduce commissions, terminate their contracts, make their products or services unavailable to us, or default on or dispute their payment or other obligations with us, any of which could reduce our revenue and margins or may require us to initiate legal or arbitration proceedings to enforce contractual payment obligations, which may materially and adversely affect our business, financial condition and results of operations. 2. We note your disclosure on pages F-14 and F-15 indicating that have incorrectly identified consumers that book travel reservations using your platform as customers and that your actual customers are the travel suppliers. As you have numerous references to customers where this distinction is not readily apparent, it appears that you will need to revise your disclosures throughout the filing to more accurately describe and portray your business relationships, to include differentiating between your customers and consumers that are the customers of your suppliers. Given the risk factor disclosure referenced in the preceding comment, we also believe that you should revise disclosures to clarify the extent to which revenues from suppliers are based on formal contractual arrangements or informal arrangements.

U.S. Securities and Exchange Commission December 21, 2023 Page 12 Please submit the revisions that you propose to clarify all references to customers and revenue contracts throughout the filing and explain to us how you propose to clarify these relationships in future reports, including earnings releases and investor communications. With respect to the request to clarify the extent to which revenue from suppliers are based on formal contractual arrangements or informal arrangements, we will update the specific risk factor in our future periodic filings as discussed in the Comment 1 above. All of our Travel Transaction revenues from travel suppliers/GDS is derived from formal contractual arrangements, which can be determined or finalized as a formal contractual arrangement after negotiation. As alluded to, on F-14 and F-15 of our Annual Report, we have disclosed “While we generally refer to a consumer that books travel reservation services on our technology solutions as our customer, for accounting purposes; our customers are the travel suppliers.” As has been further clarified in our prior response to the SEC comment letter for purposes of detailing revenue, for contractual purposes and for understanding our revenue recognition, our customers are the travel suppliers, fintech partners and SaaS platform users. Throughout the Annual Report, references to “suppliers” refer to travel suppliers and at least several references to “customers” refer to our SaaS platform users. Customers within the scope of revenue recognition does not extend to those consumers booking travel reservations through our platform and we have made every effort to identify instances there is a reference of the consumer booking reservations as our customer or it could be reasonably interpreted as such. We have noted instances of “customers” in our Annual Report and found certain instances where “customers” could reasonably be interpreted to mean “travelers, who are consumers that book travel reservations on our technology solutions” as per below (with the revision given after): On page 14: - Original: “feature-rich operating systems to provide service to millions of end customers” - Amended: “feature-rich operating systems to provide service to millions of travelers able to book reservations through our technology solutions” On page 18 - Original: “For example, our customers may select an ancillary, such as premium seat selection, trip insurance or fraud protection” - Amended: “For example, travelers booking through our travel platform solutions may select an ancillary, such as premium seat selection, trip insurance or fraud protection”

U.S. Securities and Exchange Commission December 21, 2023 Page 13 On page 21 - Original: “Brand marketing…increases awareness among potential customers, helping them to understand the benefits of using our technology solutions to book their travel experiences” - Amended: “Brand marketing…increases awareness among potential travelers, helping them to understand the benefits of using our technology solutions to book their travel experiences” On page 22 - Original: “In processing travel transactions and information about customers” - Amended: “In processing travel transactions and information about travelers booking travel reservations through our platform” On page 24 - Original: “sell additional products and services to our existing customers” - Amended: “sell additional products and services to travelers that book travel reservations on our technology solutions” On page 29 - Original: “Client complaints…could severely diminish client confidence in and use of our services. To maintain good client relations, we must ensure…differentiated client service. Effective client service requires…affiliates carry out their functions. Failure to properly manage…could compromise our ability to handle client complaints effectively. If we do not handle client complaints effectively…we may lose our customers’ confidence, which could reduce revenues and profitability” - Amended: “Traveler complaints…could severely diminish confidence in and use of our services. To maintain good relations, we must ensure…differentiated service. Effective service requires…affiliates carry out their functions. Failure to properly manage…could compromise our ability to handle traveler complaints effectively. If we do not handle traveler complaints effectively…we may lose traveler confidence, which could reduce revenues and profitability” On page 41 - Original: “chargebacks from customers with travel reservations with such travel service provider” - Amended: “chargebacks resulting from travelers booking travel reservations through us with such travel service provider” On page 68 - Original: “third party seller or service provider and the ultimate customer” - Amended: “third party seller or service provider and the traveler booking on our platform”

U.S. Securities and Exchange Commission December 21, 2023 Page 14 - Original: “increase in the number of customers using our platform” - Amended: “increase in the number of travelers booking on our platform” On F-15 - Original: “In the event of cancellation of airline tickets, revenue recognized…is reversed…at the time the cancellation is made by the customers” - Amended: “In the event of cancellation of airline tickets, revenue recognized…is reversed…at the time the cancellation is made by the traveler booking on our platform” We thank the Staff for its review of the foregoing. Should the Staff have additional questions or comments, please do not hesitate to reach out to Jesus Portillo at (650) 646-3336. Sincerely, /s/ Jesus Portillo_____________________________ Jesus Portillo Chief Financial Officer Mondee Holdings, Inc. cc: Meredith Waters, General Counsel