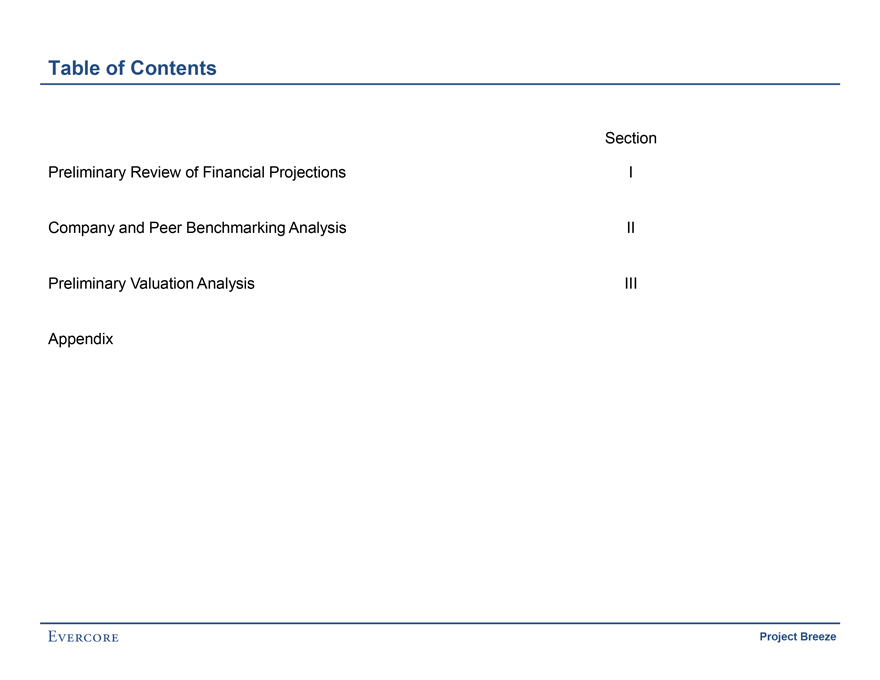

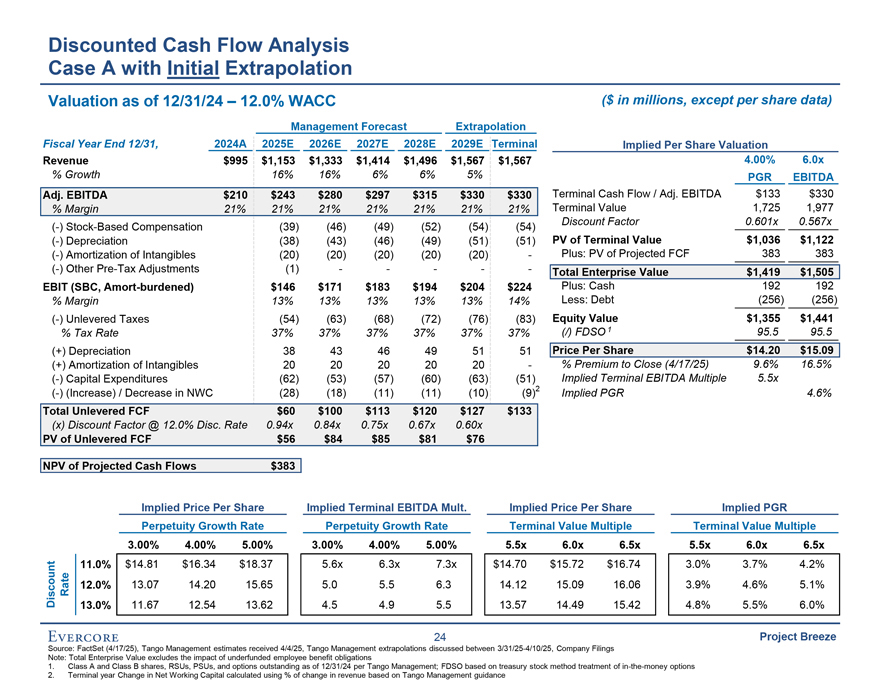

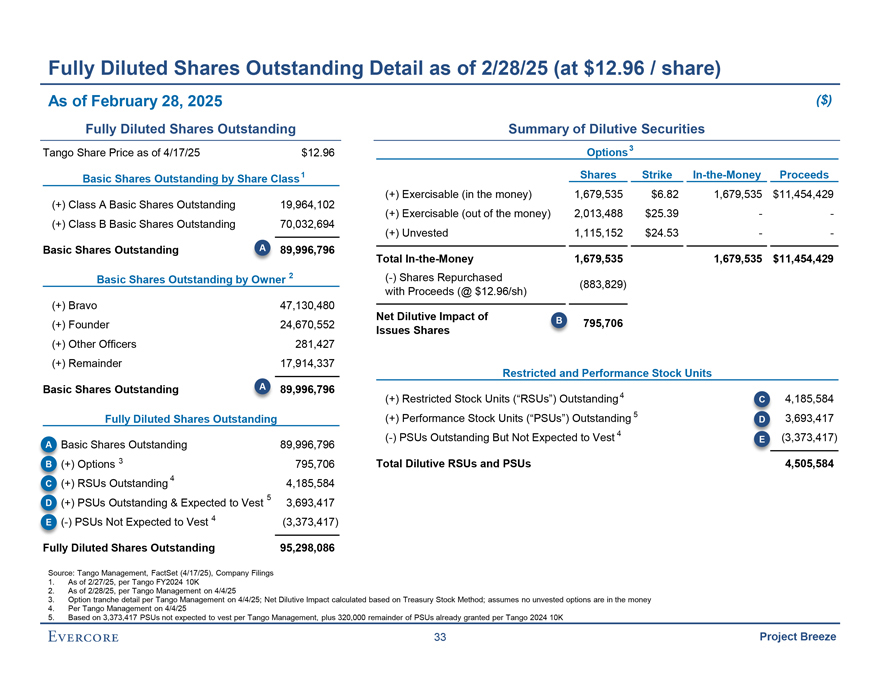

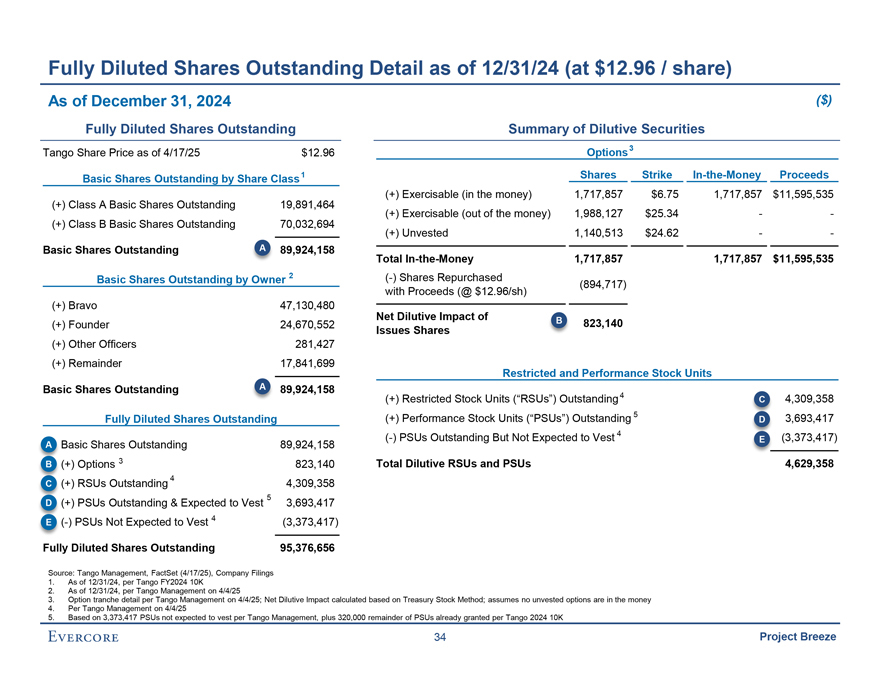

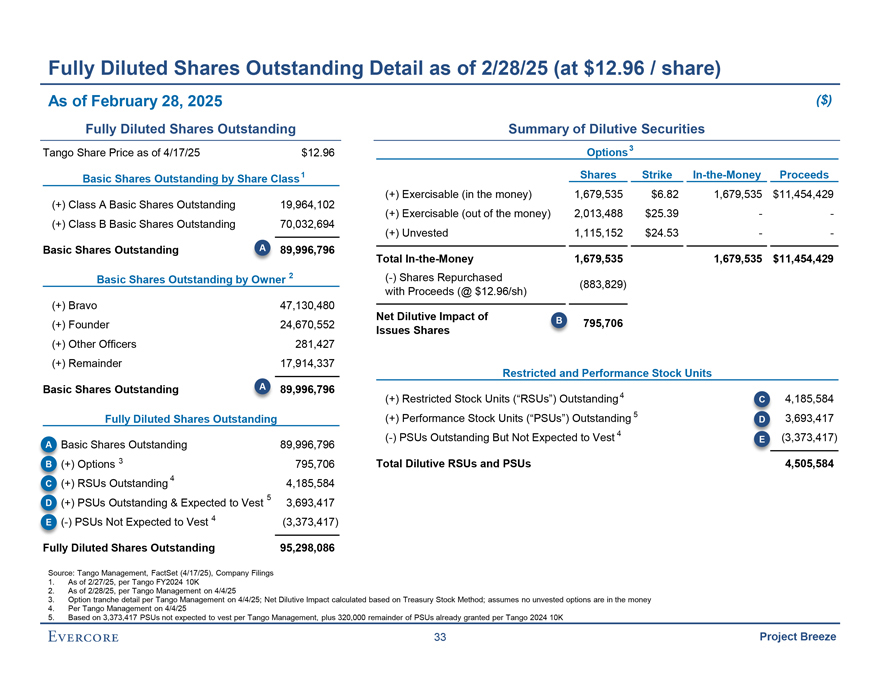

Fully Diluted Shares Outstanding Detail as of 2/28/25 (at $12.96 / share) As of February 28, 2025 ($)

Fully Diluted Shares Outstanding Summary of Dilutive Securities Tango Share Price as of 4/17/25 $12.96 Options3 Basic Shares Outstanding by Share Class1 Shares Strike

In-the-Money Proceeds (+) Exercisable (in the money) 1,679,535 $6.82 1,679,535 $11,454,429 (+) Class A Basic Shares Outstanding 19,964,102 (+) Exercisable (out of

the money) 2,013,488 $25.39 —(+) Class B Basic Shares Outstanding 70,032,694 (+) Unvested 1,115,152 $24.53 — Basic Shares Outstanding A 89,996,796 Total

In-the-Money 1,679,535 1,679,535 $11,454,429 Basic Shares Outstanding by Owner 2 (-) Shares Repurchased (883,829) with Proceeds (@ $12.96/sh) (+) Bravo 47,130,480 Net

Dilutive Impact of B (+) Founder 24,670,552 795,706 Issues Shares (+) Other Officers 281,427 (+) Remainder 17,914,337 Restricted and Performance Stock Units Basic Shares Outstanding A 89,996,796 4 (+) Restricted Stock Units (“RSUs”)

Outstanding C 4,185,584 (+) Performance Stock Units (“PSUs”) Outstanding 5 3,693,417 Fully Diluted Shares Outstanding D (-) PSUs Outstanding But Not Expected to Vest 4 (3,373,417) E A Basic Shares Outstanding 89,996,796 B (+) Options 3

795,706 Total Dilutive RSUs and PSUs 4,505,584 4 C (+) RSUs Outstanding 4,185,584 5 D (+) PSUs Outstanding & Expected to Vest 3,693,417 4 E (-) PSUs Not Expected to Vest (3,373,417) Fully Diluted Shares Outstanding 95,298,086 Source: Tango

Management, FactSet (4/17/25), Company Filings 1. As of 2/27/25, per Tango FY2024 10K 2. As of 2/28/25, per Tango Management on 4/4/25 3. Option tranche detail per Tango Management on 4/4/25; Net Dilutive Impact calculated based on Treasury Stock

Method; assumes no unvested options are in the money 4. Per Tango Management on 4/4/25 5. Based on 3,373,417 PSUs not expected to vest per Tango Management, plus 320,000 remainder of PSUs already granted per Tango 2024 10K 33 Project Breeze