Exhibit (c)(vii)

Project Breeze Discussion Materials May 1, 2025 Evercore

Exhibit (c)(vii)

Project Breeze Discussion Materials May 1, 2025 Evercore

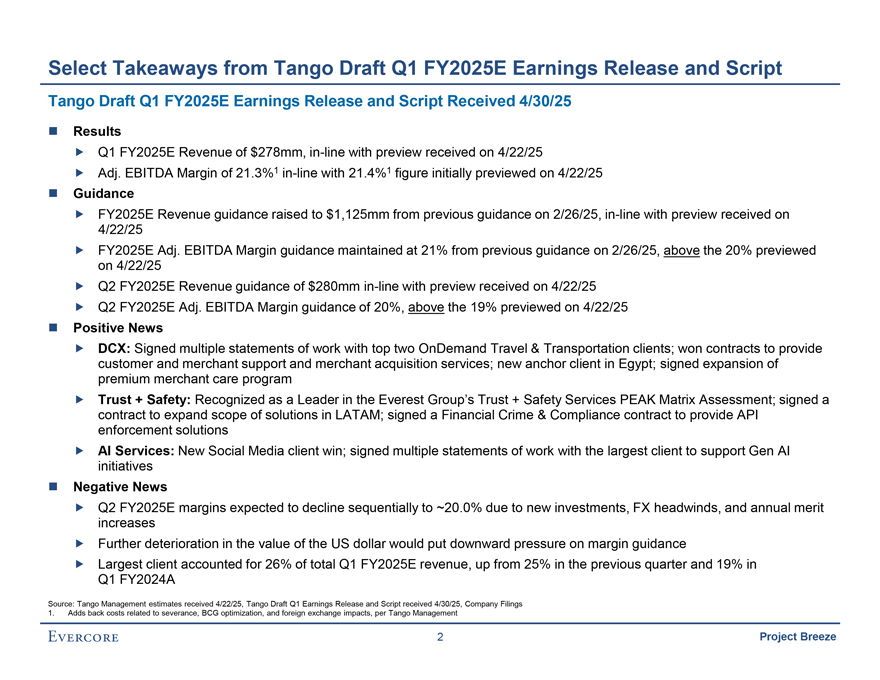

Select Takeaways from Tango Draft Q1 FY2025E Earnings Release and Script Tango Draft Q1 FY2025E Earnings Release and Script Received 4/30/25 n Results „ Q1 FY2025E Revenue of $278mm, in-line with preview received on 4/22/25 „ Adj. EBITDA Margin of 21.3%1 in-line with 21.4%1 figure initially previewed on 4/22/25 n Guidance „ FY2025E Revenue guidance raised to $1,125mm from previous guidance on 2/26/25, in-line with preview received on 4/22/25„ FY2025E Adj. EBITDA Margin guidance maintained at 21% from previous guidance on 2/26/25, above the 20% previewed on 4/22/25„ Q2 FY2025E Revenue guidance of $280mm in-line with preview received on 4/22/25„ Q2 FY2025E Adj. EBITDA Margin guidance of 20%, above the 19% previewed on 4/22/25 n Positive News „ DCX: Signed multiple statements of work with top two OnDemand Travel & Transportation clients; won contracts to provide customer and merchant support and merchant acquisition services; new anchor client in Egypt; signed expansion of premium merchant care program„ Trust + Safety: Recognized as a Leader in the Everest Group’s Trust + Safety Services PEAK Matrix Assessment; signed a contract to expand scope of solutions in LATAM; signed a Financial Crime & Compliance contract to provide API enforcement solutions„ AI Services: New Social Media client win; signed multiple statements of work with the largest client to support Gen AI initiatives n Negative News „ Q2 FY2025E margins expected to decline sequentially to ~20.0% due to new investments, FX headwinds, and annual merit increases„ Further deterioration in the value of the US dollar would put downward pressure on margin guidance „ Largest client accounted for 26% of total Q1 FY2025E revenue, up from 25% in the previous quarter and 19% in Q1 FY2024A Source: Tango Management estimates received 4/22/25, Tango Draft Q1 Earnings Release and Script received 4/30/25, Company Filings 1. Adds back costs related to severance, BCG optimization, and foreign exchange impacts, per Tango Management 2 Project Breeze

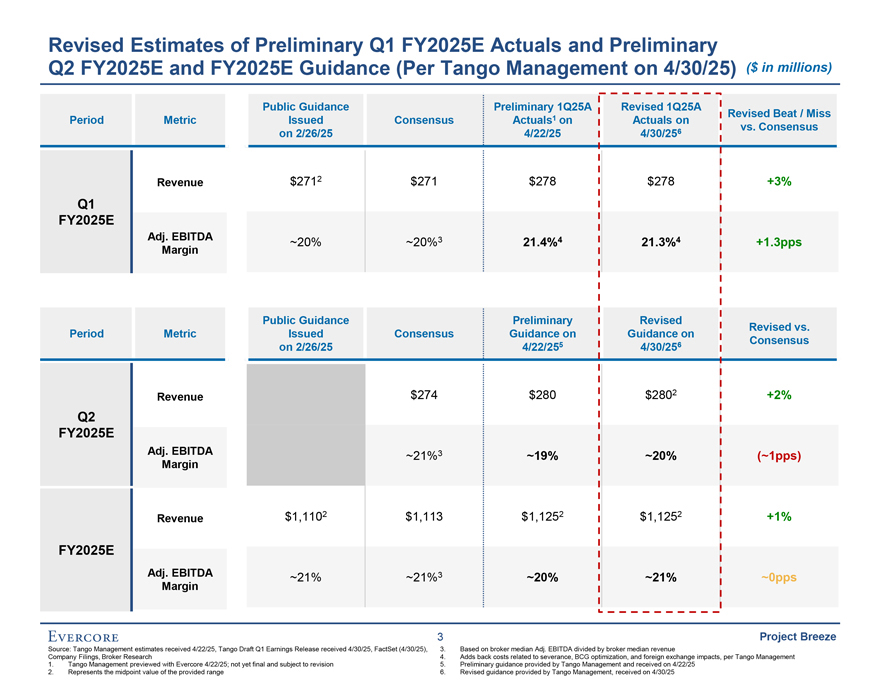

Revised Estimates of Preliminary Q1 FY2025E Actuals and Preliminary Q2 FY2025E and FY2025E Guidance (Per Tango Management on 4/30/25) ($ in millions) Public Guidance Preliminary 1Q25A Revised 1Q25A 1 Revised Beat / Miss Period Metric Issued Consensus Actuals on Actuals on 6 vs. Consensus on 2/26/25 4/22/25 4/3 $$/ 0/25 Revenue $2712 $271 $278 $278 +3% Q1 FY2025E FY Adj. EBITDA ~20% ~20%3 21.4%4 21.3%4 +1.3pps Margin Public Guidance Preliminary Revised Revised vs. Period Metric Issued Consensus Guid $$/ ance on Guidance on 5 6 Consensus on 2/26/25 4/22/25 4/30/25 Revenue $274 $280 $2802 +2% Q2 FY2025E Adj. EBITDA ~21%3 ~19% ~20% (~1pps) Margin Revenue $1,1102 $1,113 $1,1252 $1,1252 +1% FY2025E Adj. EBITDA ~21% ~21%3 ~20% ~21% ~0pps Margin 3 Project Breeze Source: Tango Management estimates received 4/22/25, Tango Draft Q1 Earnings Release received 4/30/25, FactSet (4/30/25), 3. Based on broker median Adj. EBITDA divided by broker median revenue Company Filings, Broker Research 4. Adds back costs related to severance, BCG optimization, and foreign exchange impacts, per Tango Management 1. Tango Management previewed with Evercore 4/22/25; not yet final and subject to revision 5. Preliminary guidance provided by Tango Management and received on 4/22/25 2. Represents the midpoint value of the provided range 6. Revised guidance provided by Tango Management, received on 4/30/25

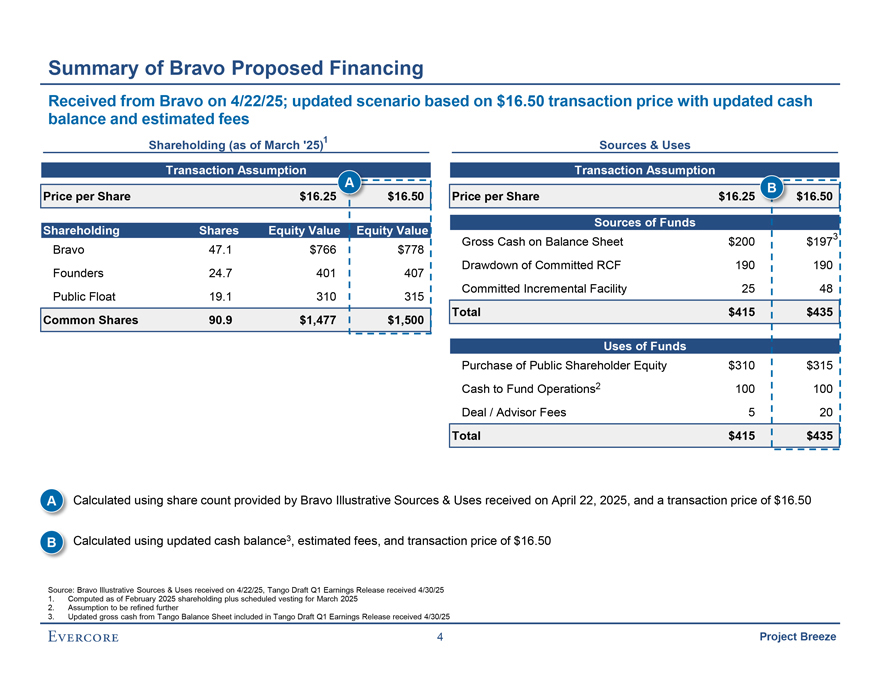

Summary of Bravo Proposed Financing Received from Bravo on 4/22/25; updated scenario based on $16.50 transaction price with updated cash balance and estimated fees Shareholding (as of March ‘25)1 Sources & Uses Transaction Assumption Transaction Assumption A B Price per Share $16.25 $16.50 Price per Share $16.25 $16.50 Sources of Funds Shareholding Shares Equity Value Equity Value Gross Cash on Balance Sheet $200 $1973 Bravo 47.1 $766 $778 Drawdown of Committed RCF 190 190 Founders 24.7 401 407 Committed Incremental Facility 25 48 Public Float 19.1 310 315 Total $415 $435 Common Shares 90.9 $1,477 $1,500 Uses of Funds Purchase of Public Shareholder Equity $310 $315 Cash to Fund Operations2 100 100 Deal / Advisor Fees 5 20 Total $415 $435 A Calculated using share count provided by Bravo Illustrative Sources & Uses received on April 22, 2025, and a transaction price of $16.50 B Calculated using updated cash balance3, estimated fees, and transaction price of $16.50 Source: Bravo Illustrative Sources & Uses received on 4/22/25, Tango Draft Q1 Earnings Release received 4/30/25 1. Computed as of February 2025 shareholding plus scheduled vesting for March 2025 2. Assumption to be refined further 3. Updated gross cash from Tango Balance Sheet included in Tango Draft Q1 Earnings Release received 4/30/25 4 Project Breeze

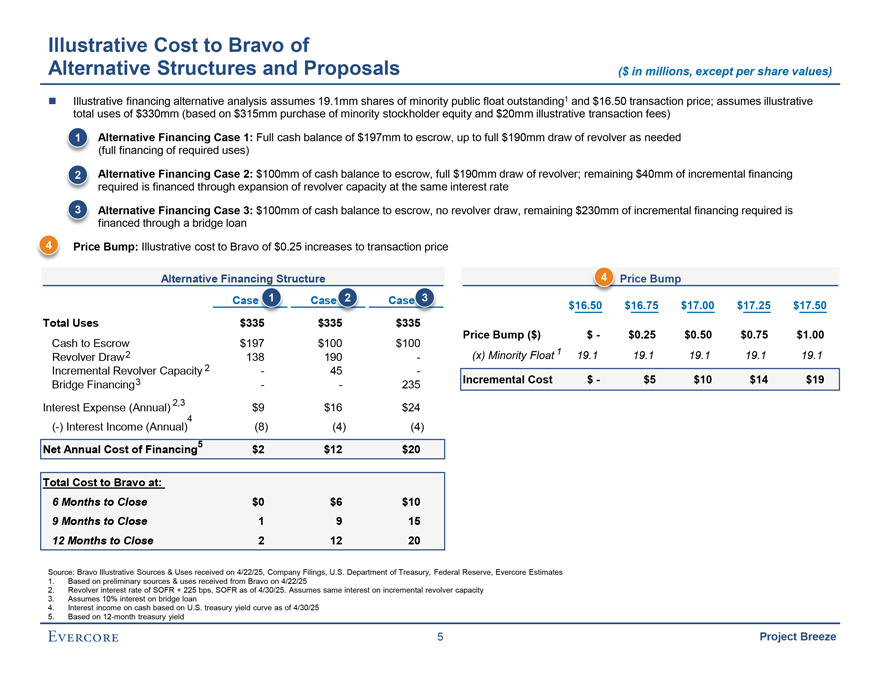

Illustrative Cost to Bravo of Alternative Structures and Proposals ($ in millions, except per share values) n Illustrative financing alternative analysis assumes 19.1mm shares of minority public float outstanding1 and $16.50 transaction price; assumes illustrative total uses of $330mm (based on $315mm purchase of minority stockholder equity and $20mm illustrative transaction fees) 1 Alternative Financing Case 1: Full cash balance of $197mm to escrow, up to full $190mm draw of revolver as needed (full financing of required uses) 2 Alternative Financing Case 2: $100mm of cash balance to escrow, full $190mm draw of revolver; remaining $40mm of incremental financing required is financed through expansion of revolver capacity at the same interest rate 3 Alternative Financing Case 3: $100mm of cash balance to escrow, no revolver draw, remaining $230mm of incremental financing required is financed through a bridge loan 4 Price Bump: Illustrative cost to Bravo of $0.25 increases to transaction price Alternative Financing Structure 4 Price Bump Case 1 Case 2 Case 3 $16.50 $16.75 $17.00 $17.25 $17.50 Total U $$/ ses $335 $335 $335 Price Bump ($) $—$0.25 $0.50 $0.75 $1.00 Cash to Escrow $197 $100 $100 Revolver Draw2 138 190—(x) Minority Float 1 19.1 19.1 19.1 19.1 19.1 Incremental Revolver Capacity 2—45—Bridge Financing3 — 235 Incremental Cost $—$5 $10 $14 $19 Interest Expense (Annual) 2,3 $9 $16 $24 4 (-) Interest Income (Annual) (8) (4) (4) Net Annual Cost of Financing5 $2 $12 $20 Total Cost to Bravo at: 6 Months to Close $0 $6 $10 9 Months to Close 1 9 15 12 Months to Close 2 12 20 Source: Bravo Illustrative Sources & Uses received on 4/22/25, Company Filings, U.S. Department of Treasury, Federal Reserve, Evercore Estimates 1. Based on preliminary sources & uses received from Bravo on 4/22/25 2. Revolver interest rate of SOFR + 225 bps, SOFR as of 4/30/25. Assumes same interest on incremental revolver capacity 3. Assumes 10% interest on bridge loan 4. Interest income on cash based on U.S. treasury yield curve as of 4/30/25 5. Based on 12-month treasury yield 5 Project Breeze

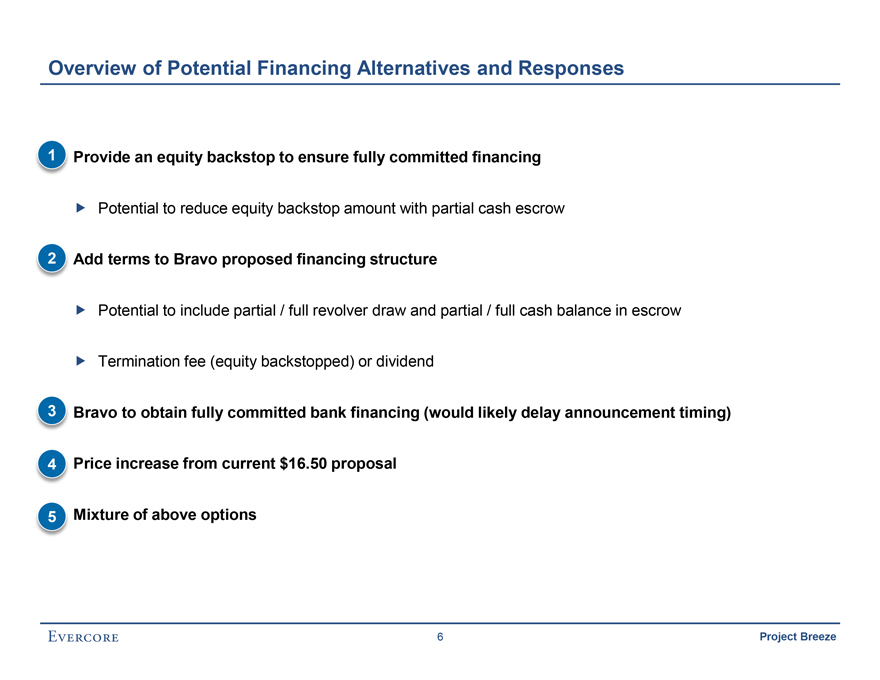

Overview of Potential Financing Alternatives and Responses 1 Provide an equity backstop to ensure fully committed financing „ Potential to reduce equity backstop amount with partial cash escrow 2 Add terms to Bravo proposed financing structure „ Potential to include partial / full revolver draw and partial / full cash balance in escrow „ Termination fee (equity backstopped) or dividend 3 Bravo to obtain fully committed bank financing (would likely delay announcement timing) 4 Price increase from current $16.50 proposal 5 Mixture of above options 6 Project Breeze

These materials have been prepared by Evercore Group L.L.C. (“Evercore”) for the Special Committee of the Board of Directors of Tango to whom such materials are directly addressed and delivered and may not be used or relied upon for any purpose other than as specifically contemplated. These materials are based on information provided by or on behalf of the Company and/or other potential transaction participants, from public sources or otherwise reviewed by Evercore. Evercore assumes no responsibility for independent investigation or verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance prepared by or reviewed with the Management of the Company and/or other potential transaction participants or obtained from public sources, Evercore has assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such Management (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials were designed for use by specific persons familiar with the business and affairs of the Company. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. These materials have been developed by and are proprietary to Evercore and were prepared exclusively for the benefit and internal use of the Special Committee of the Board of Directors of the Company. These materials were compiled on a confidential basis for use by the Special Committee of the Board of Directors of the Company in evaluating the potential transaction described herein and not with a view to public disclosure or filing thereof under state or federal securities laws, and may not be reproduced, disseminated, quoted or referred to, in whole or in part, without the prior written consent of Evercore. These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by Evercore (or any affiliate) to provide or arrange any financing for any transaction or to purchase any security in connection therewith. Evercore assumes no obligation to update or otherwise revise these materials. These materials may not reflect information known to other professionals in other business areas of Evercore and its affiliates. Evercore and its affiliates do not provide legal, accounting or tax advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by Evercore or its affiliates to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein. Projec Breeze