Exhibit (c)(viii)

Project Breeze Financial Case Summary May 7, 2025 Evercore

Exhibit (c)(viii)

Project Breeze Financial Case Summary May 7, 2025 Evercore

These materials have been prepared by Evercore Group L.L.C. (“Evercore”) for the Special Committee of the Board of Directors of Tango to whom such materials are directly addressed and delivered and may not be used or relied upon for any purpose other than as specifically contemplated. These materials are based on information provided by or on behalf of the Company and/or other potential transaction participants, from public sources or otherwise reviewed by Evercore. Evercore assumes no responsibility for independent investigation or verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance prepared by or reviewed with the Management of the Company and/or other potential transaction participants or obtained from public sources, Evercore has assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such Management (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials were designed for use by specific persons familiar with the business and affairs of the Company. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. These materials have been developed by and are proprietary to Evercore and were prepared exclusively for the benefit and internal use of the Special Committee of the Board of Directors of the Company. These materials were compiled on a confidential basis for use by the Special Committee of the Board of Directors of the Company in evaluating the potential transaction described herein and not with a view to public disclosure or filing thereof under state or federal securities laws, and may not be reproduced, disseminated, quoted or referred to, in whole or in part, without the prior written consent of Evercore. These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by Evercore (or any affiliate) to provide or arrange any financing for any transaction or to purchase any security in connection therewith. Evercore assumes no obligation to update or otherwise revise these materials. These materials may not reflect information known to other professionals in other business areas of Evercore and its affiliates. Evercore and its affiliates do not provide legal, accounting or tax advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by Evercore or its affiliates to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. Each person should seek legal, accounting and tax advice based on his, her or its particular circumstances from independent advisors regarding the impact of the transactions or matters described herein. Project Breeze

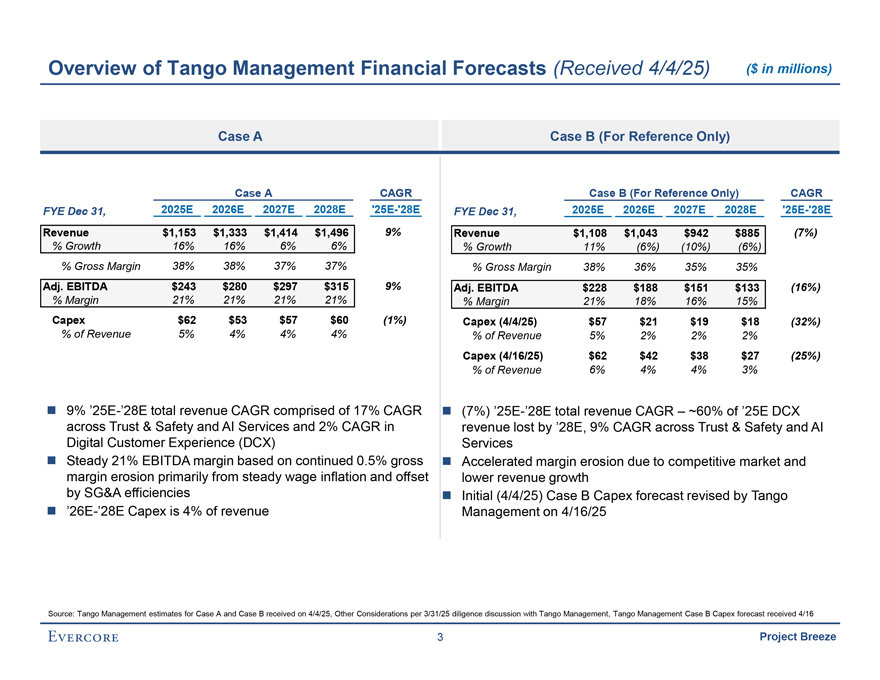

Overview of Tango Management Financial Forecasts (Received 4/4/25) ($ in millions) Case A Case B (For Reference Only) Case A CAGR Case B (For Reference Only) CAGR FYE Dec 31, 2025E 2026E 2027E 2028E ‘25E-‘28E FYE Dec 31, 2025E 2026E 2027E 2028E ‘25E-‘28E Revenue $1,153 $1,333 $1,414 $1,496 9% Revenue $1,108 $1,043 $942 $885 (7%) % Growth 16% 16% 6% 6% % Growth 11% (6%) (10%) (6%) % Gross Margin 38% 38% 37% 37% % Gross Margin 38% 36% 35% 35% Adj. EBITDA $243 $280 $297 $315 9% Adj. EBITDA $228 $188 $151 $133 (16%) % Margin 21% 21% 21% 21% % Margin 21% 18% 16% 15% Capex $62 $53 $57 $60 (1%) Capex (4/4/25) $57 $21 $19 $18 (32%) % of Revenue 5% 4% 4% 4% % of Revenue 5% 2% 2% 2% Capex (4/16/25) $62 $42 $38 $27 (25%) % of Revenue 6% 4% 4% 3% 9% ’25E-’28E total revenue CAGR comprised of 17% CAGR (7%) ’25E-’28E total revenue CAGR – ~60% of ’25E DCX across Trust & Safety and AI Services and 2% CAGR in revenue lost by ’28E, 9% CAGR across Trust & Safety and AI Digital Customer Experience (DCX) Services Steady 21% EBITDA margin based on continued 0.5% gross Accelerated margin erosion due to competitive market and margin erosion primarily from steady wage inflation and offset lower revenue growth by SG&A efficiencies Initial (4/4/25) Case B Capex forecast revised by Tango ’26E-’28E Capex is 4% of revenue Management on 4/16/25 Source: Tango Management estimates for Case A and Case B received on 4/4/25, Other Considerations per 3/31/25 diligence discussion with Tango Management, Tango Management Case B Capex forecast received 4/16 3 Project Breeze

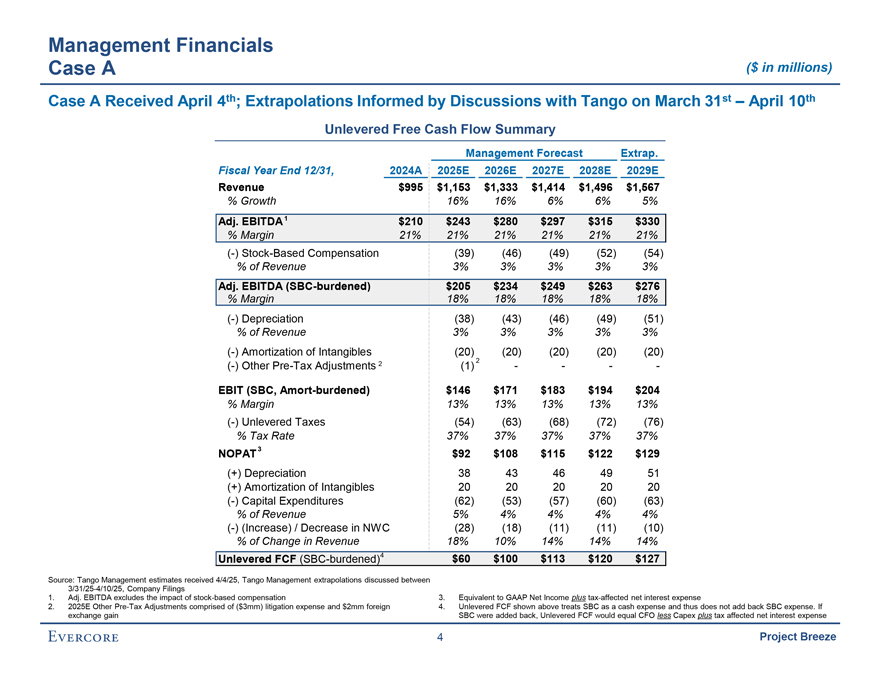

Management Financials Case A ($ in millions) Case A Received April 4th; Extrapolations Informed by Discussions with Tango on March 31st – April 10th Unlevered Free Cash Flow Summary Management Forecast Extrap. Fiscal Year End 12/31, 2024A 2025E 2026E 2027E 2028E 2029E Revenue $995 $1,153 $1,333 $1,414 $1,496 $1,567 % Growth 16% 16% 6% 6% 5% Adj. EBITDA1 $210 $243 $280 $297 $315 $330 % Margin 21% 21% 21% 21% 21% 21% (-) Stock-Based Compensation (39) (46) (49) (52) (54) % of Revenue 3% 3% 3% 3% 3% Adj. EBITDA (SBC-burdened) $205 $234 $249 $263 $276 % Margin 18% 18% 18% 18% 18% (-) Depreciation (38) (43) (46) (49) (51) % of Revenue 3% 3% 3% 3% 3% (-) Amortization of Intangibles (20) (20) (20) (20) (20) 2 (-) Other Pre-Tax Adjustments 2 (1) — — EBIT (SBC, Amort-burdened) $146 $171 $183 $194 $204 % Margin 13% 13% 13% 13% 13% (-) Unlevered Taxes (54) (63) (68) (72) (76) % Tax Rate 37% 37% 37% 37% 37% NOPAT3 $92 $108 $115 $122 $129 (+) Depreciation 38 43 46 49 51 (+) Amortization of Intangibles 20 20 20 20 20 (-) Capital Expenditures (62) (53) (57) (60) (63) % of Revenue 5% 4% 4% 4% 4% (-) (Increase) / Decrease in NWC (28) (18) (11) (11) (10) % of Change in Revenue 18% 10% 14% 14% 14% Unlevered FCF (SBC-burdened)4 $60 $100 $113 $120 $127 Source: Tango Management estimates received 4/4/25, Tango Management extrapolations discussed between 3/31/25-4/10/25, Company Filings 1. Adj. EBITDA excludes the impact of stock-based compensation 3. Equivalent to GAAP Net Income plus tax-affected net interest expense 2. 2025E Other Pre-Tax Adjustments comprised of ($3mm) litigation expense and $2mm foreign 4. Unlevered FCF shown above treats SBC as a cash expense and thus does not add back SBC expense. If exchange gain SBC were added back, Unlevered FCF would equal CFO less Capex plus tax affected net interest expense 4 Project Breeze

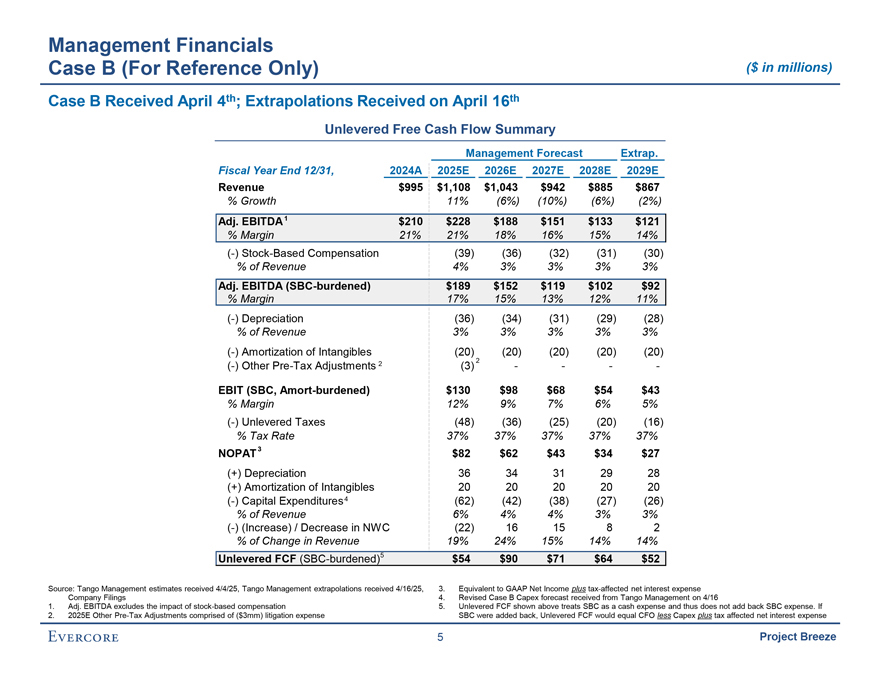

Management Financials Case B (For Reference Only) ($ in millions) Case B Received April 4th; Extrapolations Received on April 16th Unlevered Free Cash Flow Summary Management Forecast Extrap. Fiscal Year End 12/31, 2024A 2025E 2026E 2027E 2028E 2029E Revenue $995 $1,108 $1,043 $942 $885 $867 % Growth 11% (6%) (10%) (6%) (2%) Adj. EBITDA1 $210 $228 $188 $151 $133 $121 % Margin 21% 21% 18% 16% 15% 14% (-) Stock-Based Compensation (39) (36) (32) (31) (30) % of Revenue 4% 3% 3% 3% 3% Adj. EBITDA (SBC-burdened) $189 $152 $119 $102 $92 % Margin 17% 15% 13% 12% 11% (-) Depreciation (36) (34) (31) (29) (28) % of Revenue 3% 3% 3% 3% 3% (-) Amortization of Intangibles (20) (20) (20) (20) (20) 2 (-) Other Pre-Tax Adjustments 2 (3) — — EBIT (SBC, Amort-burdened) $130 $98 $68 $54 $43 % Margin 12% 9% 7% 6% 5% (-) Unlevered Taxes (48) (36) (25) (20) (16) % Tax Rate 37% 37% 37% 37% 37% NOPAT3 $82 $62 $43 $34 $27 (+) Depreciation 36 34 31 29 28 (+) Amortization of Intangibles 20 20 20 20 20 (-) Capital Expenditures4 (62) (42) (38) (27) (26) % of Revenue 6% 4% 4% 3% 3% (-) (Increase) / Decrease in NWC (22) 16 15 8 2 % of Change in Revenue 19% 24% 15% 14% 14% Unlevered FCF (SBC-burdened)5 $54 $90 $71 $64 $52 Source: Tango Management estimates received 4/4/25, Tango Management extrapolations received 4/16/25, 3. Equivalent to GAAP Net Income plus tax-affected net interest expense Company Filings 4. Revised Case B Capex forecast received from Tango Management on 4/16 1. Adj. EBITDA excludes the impact of stock-based compensation 5. Unlevered FCF shown above treats SBC as a cash expense and thus does not add back SBC expense. If 2. 2025E Other Pre-Tax Adjustments comprised of ($3mm) litigation expense SBC were added back, Unlevered FCF would equal CFO less Capex plus tax affected net interest expense 5 Project Breeze