UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant | ☒ |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

agilon health, inc.

(Name of Registrant as Specified in its Charter)

N/A

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY MATERIALS

SUBJECT TO COMPLETION, DATED FEBRUARY 6, 2026

agilon health, inc.

440 Polaris Parkway, Suite 550

Westerville, Ohio 43082

February [ ], 2026

To Our Stockholders:

You are cordially invited to attend a special meeting of stockholders (the “Special Meeting”) of agilon health,

inc., a Delaware corporation (the “Company”), to be held on March 17, 2026, beginning at 1:30 PM Eastern time.

The Company has decided to hold the Special Meeting virtually via live audio webcast on the internet. We believe

hosting a virtual meeting enables greater stockholder attendance and participation from any location around the

world, improves meeting efficiency and our ability to communicate effectively with our stockholders, and reduces

the cost and environmental impact of the Special Meeting. You will be able to attend the Special Meeting, vote, and

submit your questions during the Special Meeting by visiting www.virtualshareholdermeeting.com/AGL2026SM.

You will not be able to attend the Special Meeting in person.

Details regarding the Special Meeting, the business to be conducted at the Special Meeting, and information

about the Company that you should consider when you vote your shares are described in the accompanying proxy

statement.

We hope you will be able to attend the Special Meeting. Whether you plan to attend the Special Meeting or not,

it is important that you cast your vote either in person or by proxy. You may vote over the internet as well as by

telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with

the instructions set forth in the proxy statement. We encourage you to vote by proxy so that your shares will be

represented and voted at the Special Meeting, whether or not you can attend.

Thank you for your continued support of the Company.

Sincerely,

Ron Williams

Executive Chairman

agilon health, inc.

440 Polaris Parkway, Suite 550

Westerville, Ohio 43082

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on March 17, 2026

Dear Stockholder:

You are cordially invited to attend a special meeting of stockholders (the “Special Meeting”) of agilon health,

inc., a Delaware corporation. The Special Meeting will be held on March 17, 2026, beginning at 1:30 PM Eastern

time via a live webcast at www.virtualshareholdermeeting.com/AGL2026SM. You will not be able to attend the

Special Meeting in person. The Special Meeting will be held for the following purposes:

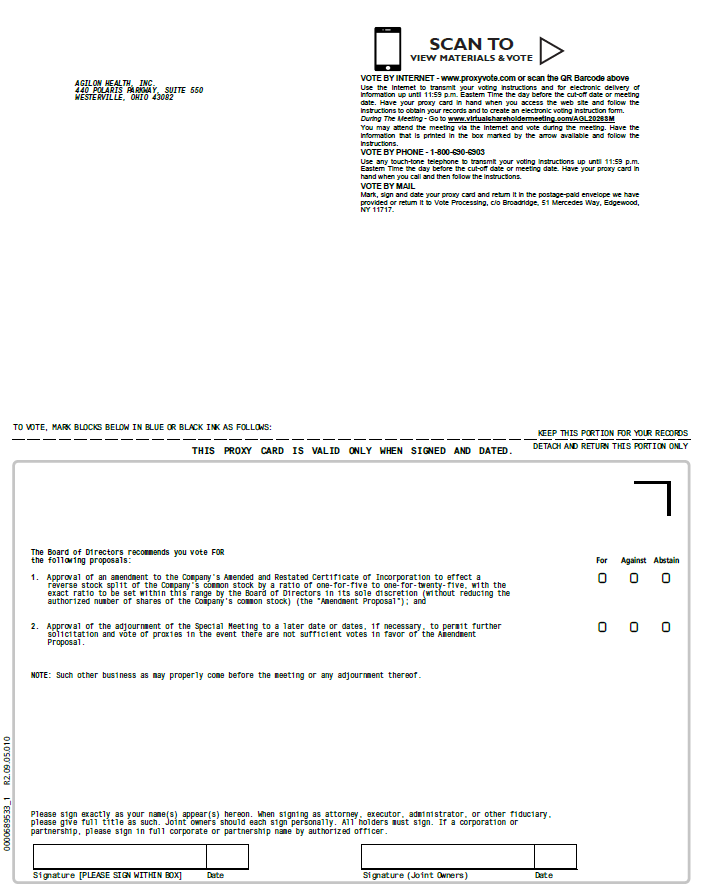

1.The approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to

effect a reverse stock split of the Company’s common stock by a ratio of one-for-five to one-for-twenty-

five (the “Reverse Stock Split”), with the exact ratio to be set within this range by the Company’s board of

directors (the “Board of Directors”) in its sole discretion (without reducing the authorized number of

shares of the Company’s common stock) (the “Amendment Proposal”); and

2.The approval of the adjournment of the Special Meeting to a later date or dates, if necessary, to permit

further solicitation and vote of proxies in the event there are not sufficient votes in favor of the

Amendment Proposal.

These items of business are more fully described in the proxy statement accompanying this notice.

The record date for the Special Meeting is February 17, 2026. Only stockholders of record at the close of

business on that date may vote at the Special Meeting or any adjournment or postponement thereof.

All stockholders are cordially invited to attend the Special Meeting. Whether you plan to attend the Special

Meeting or not, the Company urges you to vote and submit your proxy by the internet, telephone, or mail in

order to ensure the presence of a quorum.

It is important that your shares be represented and voted whether or not you plan to attend the Special Meeting

virtually. You may vote on the internet, by telephone, or by completing and mailing a proxy card or voting

instruction form. Submitting your proxy over the internet, by telephone, or by mail will ensure your shares are

represented at the Special Meeting. You may change or revoke your proxy at any time before it is voted at the

Special Meeting. Please read the enclosed information carefully before voting.

Your vote is important. Even if you plan to attend the Special Meeting, the Company urges you to submit your

proxy or voting instructions as soon as possible.

At the direction of the Board of Directors,

Denise Zamore

Chief Legal Officer and Corporate Secretary

February [___], 2026

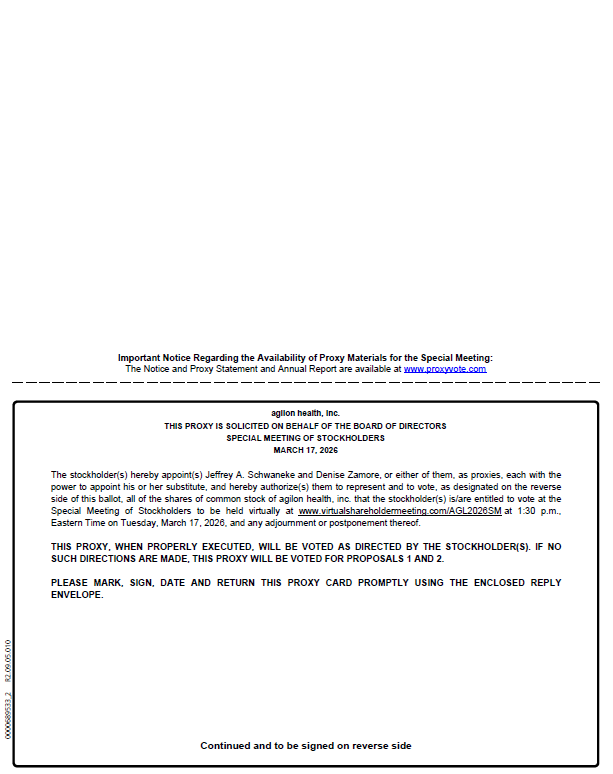

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON MARCH 17, 2026

This Proxy Statement, the Notice of Special Meeting of Stockholders and the Company’s form of proxy

card are available for viewing at www.proxyvote.com. To view these materials please have your 16-digit

control number available that appears on your proxy card.

Additionally, you can find a copy of the Company’s Annual Report on Form 10-K on the website of the

Securities and Exchange Commission at www.sec.gov and on the Company’s website at

www.agilonhealth.com. You may also obtain a printed copy of the Company’s Annual Report on Form 10-K,

including the Company’s financial statements, free of charge, from the Company by (i) calling 800-579-1639;

(ii) sending an email to sendmaterial@proxyvote.com; or (iii) logging onto www.proxyvote.com using the

credentials provided on your Notice or proxy card.

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE PROXY STATEMENT………………………………………………..1

PROPOSAL NO. 1 (AMENDMENT PROPOSAL) ……………………………………………..…………..………4

PROPOSAL NO. 2 (ADJOURNMENT PROPOSAL) ………………………………………………..………………..9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT………………………10

ADDITIONAL INFORMATION………………………………………………………………………………………13

APPENDIX A CERTIFICATE OF AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF

INCORPORATION……………………………………..………………………………………………………………14

1

PRELIMINARY PROXY MATERIALS

SUBJECT TO COMPLETION, DATED FEBRUARY 6, 2026

agilon health, inc.

440 Polaris Parkway, Suite 550

Westerville, Ohio 43082

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 17, 2026

This proxy statement (the “Proxy Statement”) is furnished to stockholders of agilon health, inc., a Delaware

corporation (the “Company”), in connection with the solicitation of proxies by the Company’s board of directors (the

“Board of Directors”) for use at a special meeting of stockholders to be held on March 17, 2026, and at any adjournment

or postponement thereof (the “Special Meeting”). The Special Meeting will be held at 1:30 PM Eastern time via a live

audio webcast at www.virtualshareholdermeeting.com/AGL2026SM.

On or about February [ ], 2026, the Company will commence mailing of the proxy materials which are also

available at www.proxyvote.com. The proxy materials are being sent to stockholders who owned the Company’s

common stock at the close of business on February 17, 2026, the record date for the Special Meeting (the “Record

Date”). This Proxy Statement contains important information for you to consider when deciding how to vote on the

matters brought before the Special Meeting. Please read it carefully.

Why am I receiving these materials?

The Company sent you this Proxy Statement because the Board of Directors is soliciting your proxy to vote at the

Company’s Special Meeting. This Proxy Statement summarizes the information you need to vote at the Company’s

Special Meeting. You do not need to attend the Company’s Special Meeting to vote your shares.

What proposals will be voted on at the Special Meeting?

Stockholders will vote on two proposals at the Special Meeting:

1.The approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation, to effect

a reverse stock split of the Company’s common stock by a ratio of one-for-five to one-for-twenty-five (the

“Reverse Stock Split”), with the exact ratio to be set within this range by the Board of Directors in its sole

discretion (without reducing the authorized number of shares of the Company’s common stock) (the

“Amendment Proposal”).

2.The approval of the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further

solicitation and vote of proxies in the event there are not sufficient votes in favor of the Amendment Proposal

(the “Adjournment Proposal”).

The Board of Directors knows of no other matters that will be presented for consideration at the Special Meeting. If any

other matters are properly brought before the Special Meeting, it is the intention of the persons named in the

accompanying proxy to vote on those matters in accordance with their best judgment.

How do I attend the Special Meeting?

To be admitted to the Special Meeting, you will need to visit www.virtualshareholdermeeting.com/AGL2026SM

and enter the 16-digit control number found next to the label “Control Number” on your proxy card or voting instruction

form. If you are a beneficial stockholder, you should contact the bank, broker, or other institution where you hold your

account well in advance of the Special Meeting if you have questions about obtaining your control number/proxy to vote.

WHETHER OR NOT YOU PARTICIPATE IN THE SPECIAL MEETING, IT IS

IMPORTANT THAT YOU VOTE YOUR SHARES

May stockholders ask questions at the Special Meeting?

Yes. Representatives of the Company will answer stockholders’ questions of general interest (with the exception of

any questions that are irrelevant to the purpose of the Special Meeting or the Company’s business or that contain

inappropriate or derogatory references) following the meeting in accordance with the rules and regulations of the Special

Meeting. Questions can be asked by entering the question into the question-and-answer text box once in the virtual

2

meeting. A representative of the Company will read the question aloud prior to responding. If the Company receives

substantially similar questions, the Company will group such questions together and provide a single response to avoid

repetition. The questions and answers will be posted on the Company’s website on the same page as other investor

presentations for 30 days after the Special Meeting. In case of technical issues, stockholders may call the technical

support phone number(s) provided on the login page of the virtual stockholder meeting site.

How does the Board of Directors recommend that stockholders vote on the proposals?

The Board of Directors recommends that stockholders vote “FOR” the Amendment Proposal and “FOR” the

Adjournment Proposal.

Who is entitled to vote at the Special Meeting?

The record date for stockholders entitled to notice of, and to vote at, the Special Meeting is February 17, 2026. At

the close of business on that date, the Company had [ ] shares of common stock issued and outstanding and entitled to be

voted at the Special Meeting held by approximately [ ] stockholders of record. A quorum is required for the Company’s

stockholders to conduct business at the Special Meeting. The presence in person or by proxy of the holders of record of a

majority of the shares of common stock entitled to vote at the Special Meeting is necessary to constitute a quorum at the

Special Meeting. Each outstanding share of common stock is entitled to one vote. Dissenters’ rights are not applicable to any

of the matters being voted upon at the Special Meeting.

By granting a proxy, you authorize the persons named in the proxy to represent you and vote your shares at the Special

Meeting. Those persons will also be authorized to vote your shares to adjourn the Special Meeting from time to time and to

vote your shares at any adjournments or postponements of the Special Meeting.

Registered Stockholders. If your shares are registered directly in your name with the Company’s transfer agent,

Computershare Trust Company, N.A. (“Computershare”), you are considered the stockholder of record with respect to those

shares. As the stockholder of record, you have the right to grant your voting proxy directly to the Company’s representatives

listed on its proxy card or to vote in person at the Special Meeting.

Beneficial Stockholders. If your shares are held in a stock brokerage account or by a broker, bank, trustee or other

nominee, you are considered the beneficial owner of shares held in “street name” and your broker, bank, trustee or other

nominee is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to

direct your broker, bank, trustee or other nominee how to vote your shares using the methods prescribed by your broker,

bank, trustee or other nominee on the voting instruction card provided to you. Beneficial owners are also invited to attend the

Special Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Special Meeting

unless you follow your broker’s, bank’s, trustee’s or other nominee’s procedures for obtaining a legal proxy.

How do I vote?

For beneficial stockholders with shares held in “street name”, a number of brokerage firms and banks are

participating in a program that offers an Internet voting option. Stockholders should refer to the voting instruction card

provided by their broker, bank, trustee or other nominee for instructions on the voting methods they offer. Registered

stockholders with shares registered directly in their names with Computershare will also be able to vote using the

Internet.

The Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give

their voting instructions and to confirm that stockholders’ instructions have been recorded properly. If you vote by

Internet, you do not need to send in a proxy card or vote instruction form. The deadline for Internet voting will be 11:59

p.m., Eastern Time, on March 16, 2026.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record

Date.

What are “broker non-votes”?

A broker non-vote occurs when a broker or nominee holding shares for a beneficial owner votes on one proposal,

but does not vote on another proposal because the broker or nominee does not have discretionary voting power and has

not received instructions from the beneficial owner. In this regard, brokers, banks, and other securities intermediaries

may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine,” but not

with respect to “non-routine” matters. The Amendment Proposal and Adjournment Proposal are considered “routine”

matters, meaning that if you do not return voting instructions to your broker before its deadline, your shares may be voted

by your broker in its discretion on the Amendment Proposal and Adjournment Proposal.

3

What if I return a proxy card but do not provide voting instructions?

If you provide specific voting instructions, your shares will be voted as you instruct. Unless contrary instructions are

specified, if you sign and return a proxy card but do not specify how your shares are to be voted, the shares of the

common stock represented thereby will be voted in accordance with the recommendations of the board of directors.

These recommendations are: “FOR” the Amendment Proposal and “FOR” the Adjournment Proposal, in accordance with

the recommendation of the Company’s Board of Directors. A stockholder’s submission of a signed proxy will not affect

his or her right to attend and to vote at the Special Meeting.

Who pays for the cost of proxy solicitation?

The Company has engaged Saratoga Proxy Consulting, LLC (“Saratoga”) to assist in the solicitation of proxies for the

Special Meeting. The Company expects to pay Saratoga (i) a fee of $12,500 for the engagement and will also reimburse

Saratoga for its reasonable out-of-pocket expenses and any additional costs associated with services requested by The

Company. In accordance with SEC and New York Stock Exchange (“NYSE”) rules, the Company will also reimburse

brokerage houses and other custodians, nominees and fiduciaries for their expenses of sending proxies and proxy materials as

intermediaries to the beneficial owners of the Company’s common stock.

Can I change or revoke my proxy?

Subject to any rules your broker, bank, trustee or other nominee may have, you may change your proxy instructions

at any time before your proxy is voted at the Special Meeting. If you are a holder of record and wish to revoke your

proxy instructions, you must either (1) subsequently submit a proxy via the Internet or by telephone, which will be

available until 11:59 p.m., Eastern Time, March 16, 2026; (2) sign, date and deliver a later-dated proxy card so that it is

received before the Special Meeting; (3) submit a written revocation so that it is received before 11:59 p.m., Eastern

Time, March 16, 2026; or (4) send a notice of revocation via the Internet at www.proxyvote.com before 11:59 p.m.,

Eastern Time, March 16, 2026. If you hold your shares in street name, you must follow the instructions of your broker,

bank or other intermediary to revoke your voting instructions.

How many votes are needed to approve each proposal?

Votes will be counted by the inspector of election appointed for the Special Meeting. The minimum vote needed to

approve each proposal and the effect of abstentions and broker non-votes is as follows:

•For Proposal 1, the Amendment Proposal, to be approved, the number of votes cast “FOR” the proposal must

exceed the number of votes cast “AGAINST” the proposal; abstentions and any broker non-votes with respect

to the Amendment Proposal will not be considered “votes cast” and will have no effect on the Amendment

Proposal. Brokerage firms will have discretionary authority to vote their customers’ unvoted shares held by the

firms in street name on the Amendment Proposal, and thus the Company does not anticipate receiving any

broker non-votes on this proposal.

•For Proposal 2, the Adjournment Proposal, to be approved, a majority of the shares of common stock present or

represented by proxy at the Special Meeting must vote in favor of the Adjournment Proposal. Abstentions with

respect to the Adjournment Proposal will have the same effect as a vote “AGAINST” the Adjournment

Proposal. Brokerage firms will have discretionary authority to vote their customers’ unvoted shares held by the

firms in street name on the Adjournment Proposal, and thus the Company does not anticipate receiving any

broker non-votes on this proposal.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if a majority of the shares

entitled to vote at the Special Meeting are present or represented by proxy. On the Record Date, there were [ ] shares

outstanding and entitled to vote. Thus, the holders of at least [ ] shares must be present or represented by proxy at the

Special Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your

behalf by your broker, bank, or other nominee) or if you vote online at the Special Meeting. Abstentions and broker non-

votes will be counted towards the quorum requirement. If there is no quorum, the chairperson of the Special Meeting or a

majority of the voting power of the shares of common stock present at the Special Meeting may adjourn the Special

Meeting to another date.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be

published in a current report on Form 8-K that the Company expects to file within four business days after the Special

Meeting. If final voting results are not available to the Company in time to file a Form 8-K within four business days

after the Special Meeting, the Company intends to file a Form 8-K to publish preliminary results and, within four

business days after the final results are known to the Company, file an additional Form 8-K to publish the final results.

4

PROPOSAL NO. 1

APPROVAL OF AN AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE

OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF THE COMPANY’S COMMON STOCK

Overview

The Amendment Proposal is a proposal to adopt an amendment to the Company’s Amended and Restated Certificate

of Incorporation to effect a reverse stock split at a ratio between one-for-five and one-for-twenty-five, inclusive (the

“Split Ratio Range”), in the form set forth in Exhibit A to this Proxy Statement. The Amendment Proposal, if approved,

would not immediately cause a reverse stock split, but rather would grant authorization to the Company’s Board of

Directors to effect the Reverse Stock Split with a split ratio within the Split Ratio Range, if and when determined by the

Board of Directors. The Board of Directors has deemed it advisable, approved, and recommended that the Company’s

stockholders adopt, and is hereby soliciting stockholder approval of, the proposed amendment to the Company’s

Amended and Restated Certificate of Incorporation to effect a reverse stock split at a ratio within the Split Ratio Range,

in the form set forth in Exhibit A to this Proxy Statement.

If the Company receives the required stockholder approval, the Board of Directors will have the sole authority to

elect whether or not to effect the Reverse Stock Split. Even with stockholder approval of the Amendment Proposal, the

Board of Directors will not be obligated to pursue the Reverse Stock Split. Rather, the Board of Directors will have the

flexibility to decide whether or not the Reverse Stock Split (and at what ratio within the Split Ratio Range) is in the best

interests of the Company and its stockholders.

If approved by the Company’s stockholders and, following such approval, the Board of Directors determines that

effecting the Reverse Stock Split is in the best interests of the Company and the Company’s stockholders, the Reverse

Stock Split would become effective upon filing the certificate of amendment to the Company’s Amended and Restated

Certificate of Incorporation as set forth in Exhibit A with the Secretary of State of the State of Delaware. As filed, the

certificate of amendment would state the number of outstanding shares to be combined into one share of the Company’s

common stock, at the ratio approved by the Board of Directors within the Split Ratio Range. The amendment would not

change the par value of the Company’s common stock and would not impact the total number of authorized shares of the

Company’s common stock or preferred stock. Therefore, upon effectiveness of the Reverse Stock Split, the number of

shares of the Company’s common stock that are authorized and unissued will increase relative to the number of issued

and outstanding shares of the Company’s common stock.

Under Section 242(c) of the Delaware General Corporation Law, the Board of Directors has reserved the right,

notwithstanding the Company’s stockholders’ approval of the proposed amendment to the Amended and Restated

Certificate of Incorporation at the Special Meeting, to abandon the proposed amendment at any time (without further

action by the Company’s stockholders) before the certificate of amendment is filed with the Secretary of State of the

State of Delaware. Further, the Board of Directors may consider a variety of factors in determining the appropriate range

within the Split Ratio Range for any such amendment, including overall trends in the stock market, recent changes, and

anticipated trends in the per-share market price of the Company’s common stock, business developments and the

Company’s actual and projected financial performance. The Board of Directors may decide to abandon the proposed

amendment of the Amended and Restated Certificate of Incorporation in its entirety, particularly if the closing bid price

of the Company’s common stock on the NYSE has significantly increased over a period of time.

The Board of Directors is seeking stockholder approval of the Amendment Proposal in order to have the authority to

effectuate the Reverse Stock Split as a potential means of increasing the per-share price of the Company’s common

stock. The Company believes that the low per-share market price of the Company’s common stock impairs its

marketability to, and acceptance by, institutional investors and other members of the investing public and creates a

negative impression of the Company. Theoretically, decreasing the number of shares of the Company’s common stock

outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be interested in

acquiring them, or the Company’s reputation in the financial community. In practice, however, many investors,

brokerage firms, and market makers consider low-priced stocks as unduly speculative in nature and, as a matter of policy,

avoid investment and trading in such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading

activity or otherwise provide coverage of lower-priced stocks. The presence of these factors may be adversely affecting,

and may continue to adversely affect, not only the price of the Company’s common stock but also its trading liquidity. In

addition, these factors may affect the Company’s ability to raise additional capital through the sale of the Company’s

common stock.

Risks Associated with the Reverse Stock Split

In evaluating whether to seek stockholder approval of the Amendment Proposal, the Board of Directors considered

negative factors associated with reverse stock splits. These factors included, but were not limited to, the negative

perception of reverse stock splits that investors, analysts, and other stock market participants may hold; the fact that the

stock prices of some companies that have effected reverse stock splits have subsequently declined, sometimes

5

significantly, following their reverse stock splits; the possible adverse effect on liquidity that a reduced number of

outstanding shares could cause; and the costs associated with implementing a reverse stock split.

There can be no assurance that the Reverse Stock Split will achieve any of the above desired result of increasing the

market price for the Company’s common stock. There also can be no assurance that the price per share of the Company’s

common stock immediately after the Reverse Stock Split will increase proportionately with the Reverse Stock Split, or

that any increase will be sustained for any period of time.

The Company cannot predict whether the Reverse Stock Split, if completed, will increase the market price for the

Company’s common stock. There can be no assurance that:

•the market price per share of the Company’s common stock after the Reverse Stock Split will rise in proportion

to the reduction in the number of shares outstanding before the Reverse Stock Split;

•the Reverse Stock Split will result in a per-share price that will attract brokers and investors who do not trade in

lower-priced stocks;

•the Reverse Stock Split will result in a per-share price that would increase the Company’s ability to attract and

retain employees and other service providers; or

•the Reverse Stock Split will promote greater liquidity for the Company’s stockholders with respect to their shares.

The market price of the Company’s common stock is based on the Company’s performance and other factors, some

of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of

the Company’s common stock declines, the percentage decline as an absolute number and as a percentage of the

Company’s overall market capitalization may be greater than would occur in the absence of a reverse stock split.

Effect on Number of Authorized, But Unissued Shares

The Reverse Stock Split would reduce the number of outstanding shares of the Company’s common stock without

reducing the number of shares of authorized common stock. Therefore, the number of shares of the Company’s common

stock that are authorized and unissued would increase relative to the number of issued and outstanding shares of the

Company’s common stock following the Reverse Stock Split. The Board of Directors may authorize the issuance of

authorized and unissued shares of the Company’s common stock without further stockholder action for a variety of

purposes, except as such stockholder approval may be required in particular cases by the Company’s Amended and

Restated Certificate of Incorporation, applicable law, or the rules of the NYSE or any stock exchange on which the

Company’s securities may then be listed. The issuance of additional shares would be dilutive to the Company’s existing

stockholders and an issuance, potential issuance, or the perception that issuances may occur may cause a decline in the

trading price of the Company’s common stock.

Other Anti-takeover Considerations; Not Intended to Be a “Going Private Transaction”

The issuance of authorized but unissued shares of common stock could also be used to deter a potential takeover of

the Company that may otherwise be beneficial to stockholders by diluting the shares held by a potential suitor or issuing

shares to a stockholder that will vote in accordance with the Board of Directors’ desires. A takeover may be beneficial to

independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for

their shares of stock compared to the then-existing market price. The Amendment Proposal is not intended to be an anti-

takeover device, and the Company does not have any plans or proposals to adopt provisions or enter into agreements that

may have material anti-takeover consequences. The Reverse Stock Split is not intended as, and would not have the effect

of, a “going private transaction” covered by Rule 13e-3 under the Securities Exchange Act of 1934 (the “Exchange Act”),

as amended. Following the Reverse Stock Split, the Company would continue to be subject to the periodic reporting

requirements of the Exchange Act.

Principal Effects of the Reverse Stock Split on the Market for the Company’s Common Stock

On the Record Date, the closing price for the Company’s common stock on the NYSE was $[ ] per share. By

decreasing the number of shares of the Company’s common stock outstanding without altering the aggregate economic

interest represented by the shares, the Company believes the market price would be increased.

Principal Effects of the Reverse Stock Split on the Company’s Common Stock; No Fractional Shares

If the Company’s stockholders approve the Amendment Proposal, and if the Board of Directors decides to effectuate

the Reverse Stock Split, the principal effect of the amendment would be to reduce the number of issued and outstanding

shares of the Company’s common stock, depending on the Split Ratio Range set forth in such amendment, from

approximately [ ] shares as of the Record Date to between approximately [ ] shares and [ ] shares, assuming

no shares of the Company’s common stock are issued before the effective date of the Reverse Stock Split. While the

Board of Directors has authorized the Company to complete the Reverse Stock Split within the Split Ratio Range, the

Company does not intend to effectuate a Reverse Stock Split to the extent that the Reverse Stock Split would result in the

Company going private or failing to meet any the NYSE continued listing requirements. If the Reverse Stock Split is

effectuated, each five to twenty-five shares of common stock issued and outstanding or held by the Company as treasury

6

stock immediately prior to the Record Date would be automatically reclassified, combined and converted into one (1)

share of Common Stock.

As noted above, effecting the Reverse Stock Split will not change the total authorized number of shares of the

Company’s common stock. However, the reduction in the number of issued and outstanding shares would provide more

authorized shares available for future issuance. The Company has no specific commitment, arrangement, understanding,

or agreement regarding the issuance of common stock subsequent to this proposed increase in the number of authorized

shares at this time, and the Company has not allocated any specific portion of the proposed increase in the authorized

number of shares to any particular purpose. The Board of Directors does not intend to issue any common stock or

securities convertible into common stock except on terms that the Board of Directors deems to be in the best interests of

the Company and its stockholders.

The Company’s directors and executive officers also have no substantial interests, directly or indirectly, in the

Reverse Stock Split, except to the extent of their ownership in shares of the Company’s common stock and securities

exercisable and settleable for the Company’s common stock, which shares and securities would be subject to the same

proportionate adjustment in accordance with the terms of the Reverse Stock Split as all other outstanding shares of the

Company’s common stock and securities exercisable and settleable for the Company’s common stock.

The Reverse Stock Split would affect all of our stockholders uniformly and would not affect any stockholder’s

percentage ownership interests, except to the extent that the Reverse Stock Split results in such stockholder owning a

fractional share. No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who

otherwise would be entitled to receive fractional shares because they hold a number of pre-split shares not evenly

divisible by the number of pre-split shares for which each post-split share is to be exchanged will have all such fractional

shares aggregated per registered holder and will be entitled to a cash payment, without interest, in lieu of fractional shares

from our transfer agent in an amount equal to the proceeds (net of all commissions, transfer taxes and other out-of-pocket

transaction costs, including the expenses and compensation of the transfer agent incurred in connection with such sale of

shares) attributable to the sale of such fractional shares following the aggregation and sale by our transfer agent of all

fractional shares otherwise issuable. The proceeds would be subject to certain taxes as discussed below. In addition,

stockholders would not be entitled to receive interest for the period of time between the filing of the certificate of

amendment to the Amended and Restated Certificate of Incorporation and the date a stockholder receives payment for the

cashed-out fractional shares. The payment amount would be paid to the stockholder in the form of a check in accordance

with the procedures outlined below.

After the Reverse Stock Split, a stockholder would have no further interest in the Company with respect to such

stockholder’s cashed-out fractional shares. A person otherwise entitled to a fractional interest would not have any voting,

dividend, or other rights except to receive payment as described above. After the effective time of the Reverse Stock

Split, the Company’s common stock will have a new Committee on Uniform Securities Identification Procedures

(“CUSIP”) number, which is a number used to identify the Company’s equity securities, and stock certificates with the

older CUSIP numbers will need to be exchanged for stock certificates with the new CUSIP numbers by following the

procedures described below.

Principal Effects of the Reverse Stock Split on the Company’s Equity Incentive Plan, Employee Stock Purchase Plan,

Options, Stock Units and Other Convertible Securities

If the Company’s stockholders approve the Reverse Stock Split and the Board of Directors elects to effect the

Reverse Stock Split, the Company would make the following adjustments with respect to the Company’s outstanding

equity incentives: (i) adjust and proportionately decrease the number of shares of the Company’s common stock available

for issuance under the Company’s 2021 Omnibus Equity Incentive Plan and the Company’s Employee Stock Purchase

Plan, (ii) adjust and proportionately decrease the number of shares of common stock underlying outstanding options, and

outstanding time-based restricted stock units and outstanding performance-based restricted stock units and (iii) adjust and

proportionately increase the exercise price for all outstanding options.

Principal Effects of the Reverse Stock Split on Legal Ability to Pay Dividends

The Company has not declared or paid any dividends on the Company’s common stock, nor does the Company

have any plans to declare in the foreseeable future any distributions of cash or other property to holders of common

stock, and the Company is not in arrears on any dividends. Therefore, the Company does not believe that the Reverse

Stock Split would have any effect with respect to future distributions, if any, to holders of the Company’s common stock.

Accounting Matters

The Reverse Stock Split would not affect the par value of the Company’s common stock, which would remain

unchanged at $0.01 per share. As a result, on the effective date of the Reverse Stock Split, the stated capital on the

Company’s balance sheet attributable to the Company’s common stock would be reduced by the ratio approved by the

Board of Directors within the Split Ratio Range. In other words, stated capital would be reduced by the ratio approved by

the Board of Directors within the Split Ratio Range, and the additional paid-in capital account would be credited with the

amount by which the stated capital is reduced. The per-share net income or loss and net book value of the Company’s

common stock would be increased because there would be fewer shares of the Company’s common stock outstanding.

7

Beneficial Holders of the Company’s Common Stock (Stockholders Who Hold in “Street Name”)

Upon the Reverse Stock Split, the Company intends to treat shares held by stockholders in “street name,” through a

broker, in the same manner as registered stockholders whose shares are registered in their names. Brokers would be

instructed to effect the Reverse Stock Split for their beneficial holders holding the Company’s common stock in “street

name.” However, brokers may have different procedures than registered stockholders for processing the Reverse Stock

Split and making payment for fractional shares. Stockholders holding shares of the Company’s common stock with a

broker and having any questions in this regard should contact their broker.

Registered “Book-Entry” Holders of the Company’s Common Stock

If a stockholder holds registered shares in book-entry form with the transfer agent, no action needs to be taken to

receive post-Reverse Stock Split shares or cash payment in lieu of any fractional share interest, if applicable. If such a

stockholder is entitled to post-Reverse Stock Split shares, a transaction statement would automatically be sent to such

stockholder’s address of record indicating the number of shares of the Company’s common stock held following the

Reverse Stock Split.

If a stockholder is entitled to a payment in lieu of any fractional share interest, a check would be mailed to such

stockholder’s registered address as soon as practicable after the effective time of the Reverse Stock Split. By endorsing

and cashing the check, stockholders would warrant that they owned the shares of the Company’s common stock for

which they received a cash payment. The cash payment is subject to applicable federal and state income tax and state

abandoned property laws. No stockholders would be entitled to receive interest for the period of time between the

effective time of the Reverse Stock Split and the date payment is received.

No Dissenters’ Rights

Under the Delaware General Corporation Law, stockholders are not entitled to dissenters’ rights with respect to the

Reverse Stock Split.

Material Federal Income Tax Consequences of the Reverse Stock Split

The following discussion summarizes the material U.S. federal income tax consequences of the proposed Reverse

Stock Split to the Company and to U.S. Holders (as defined below). This discussion is based on the Internal Revenue

Code of 1986, as amended (the “Code”), U.S. Treasury Regulations promulgated thereunder, judicial decisions, and

published rulings and administrative pronouncements of the U.S. Internal Revenue Service (the “IRS”) in each case in

effect as of the date of this proxy statement. These authorities may change or be subject to differing interpretations. Any

such change or differing interpretation may be applied retroactively in a manner that could adversely affect a U.S.

Holder. The Company has not sought and will not seek any rulings from the IRS regarding the matters discussed below,

and there can be no assurance that the IRS or a court will not take a contrary position to that discussed below regarding

the tax consequences of the proposed Reverse Stock Split.

For purposes of this discussion, a “U.S. Holder” is a beneficial owner of the Company’s common stock that, for

U.S. federal income tax purposes, is or is treated as (i) an individual who is a citizen or resident of the United States; (ii)

a corporation (or any other entity or arrangement treated as a corporation) created or organized under the laws of the

United States, any state thereof, or the District of Columbia; (iii) an estate, the income of which is subject to U.S. federal

income tax regardless of its source; or (iv) a trust if (1) its administration is subject to the primary supervision of a court

within the United States and all of its substantial decisions are subject to the control of one or more “United States

persons” (within the meaning of Section 7701(a)(30) of the Code ), or (2) it has a valid election in effect under applicable

U.S. Treasury regulations to be treated as a U.S. person.

This discussion is limited to U.S. Holders who hold the Company’s common stock as a “capital asset” within the

meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all U.S.

federal income tax consequences relevant to the particular circumstances of a U.S. Holder, including the impact of the

Medicare contribution tax on net investment income. In addition, it does not address consequences relevant to U.S.

Holders that are subject to special rules, including, without limitation, financial institutions, insurance companies, real

estate investment trusts, regulated investment companies, grantor trusts, private university endowments and other tax-

exempt organizations, dealers, or traders in securities, commodities, or currencies, stockholders who hold the Company’s

common stock as part of a position in a straddle or as part of a hedging, conversion, or integrated transaction for U.S.

federal income tax purposes, persons whose functional currency is not the U.S. dollar, persons who acquired their

common stock pursuant to the exercise of employee stock options or otherwise as compensation, or U.S. Holders who

actually or constructively own 10% or more of the Company’s voting stock.

If a partnership (or other entity treated as a partnership for U.S. federal income tax purposes) is the beneficial owner

of the Company’s common stock, the U.S. federal income tax treatment of a partner in the partnership will generally

depend on the status of the partner and the activities of the partnership. Accordingly, partnerships (and other entities

treated as partnerships for U.S. federal income tax purposes) holding the Company’s common stock and the partners in

such entities should consult their own tax advisors regarding the U.S. federal income tax consequences of the proposed

Reverse Stock Split to them.

8

In addition, the following discussion does not address the U.S. federal estate and gift tax, alternative minimum tax,

or state, local, and non-U.S. tax law consequences of the proposed Reverse Stock Split. Furthermore, the following

discussion does not address any tax consequences of transactions effectuated before, after, or at the same time as the

proposed Reverse Stock Split, whether or not they are in connection with the proposed Reverse Stock Split. This

discussion should not be considered as tax or investment advice, and the tax consequences of the proposed Reverse Stock

Split may not be the same for all stockholders.

Each stockholder should consult his, her or its own tax advisors concerning the particular U.S. federal tax

consequences of the proposed Reverse Stock Split, as well as the consequences arising under the laws of any other

taxing jurisdiction, including any state, local or foreign tax consequences.

Tax Consequences to the Company. The proposed Reverse Stock Split is intended to be treated as a

“recapitalization” pursuant to Section 368(a)(1)(E) of the Code. As a result, the Company should not recognize taxable

income, gain, or loss in connection with the proposed Reverse Stock Split.

Tax Consequences to U.S. Holders. A U.S. Holder generally should not recognize gain or loss upon the proposed

Reverse Stock Split for U.S. federal income tax purposes, except with respect to cash received in lieu of a fractional share

of the Company’s common stock, as discussed below. A U.S. Holder’s aggregate adjusted tax basis in the shares of the

Company’s common stock received pursuant to the proposed Reverse Stock Split should equal the aggregate adjusted tax

basis of the shares of the Company’s common stock exchanged therefor (reduced by the amount of such basis that is

allocated to any fractional share of the Company’s common stock). The U.S. Holder’s holding period in the shares of the

Company’s common stock received pursuant to the proposed Reverse Stock Split should include the holding period in

the shares of the Company’s common stock exchanged therefor. U.S. Treasury Regulations provide detailed rules for

allocating the tax basis and holding period of shares of common stock surrendered in a recapitalization to shares received

in the recapitalization, and special tax basis and holding period rules may apply to holders that acquired common stock at

different dates or at different prices. U.S. Holders of shares of the Company’s common stock acquired on different dates

and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of

such shares.

A U.S. Holder that, pursuant to the proposed Reverse Stock Split, receives cash in lieu of a fractional share of the

Company’s common stock should recognize capital gain or loss in an amount equal to the difference, if any, between the

amount of cash received and the portion of the U.S. Holder’s aggregate adjusted tax basis in the shares of the Company’s

common stock surrendered that is allocated to such fractional share. Such capital gain or loss will be short-term if the

pre-Reverse Stock Split shares were held for one year or less at the effective time of the Reverse Stock Split and long-

term if held for more than one year. There are limitations on the deductibility of capital losses under the Code. U.S.

Holders should consult their tax advisors regarding the tax treatment of their receipt of cash in lieu of a fractional share of

common stock pursuant to the Reverse Stock Split.

Any cash in lieu of fractional shares will be solely to spare the Company the expense and inconvenience of issuing

fractional shares and will not represent separately bargained for consideration paid to a U.S. Holder. As such, a U.S.

Holder of the Company’s common stock may be subject to information reporting and backup withholding on cash paid in

lieu of a fractional share in connection with the proposed Reverse Stock Split. A U.S. Holder of the Company’s common

stock will be subject to backup withholding if such U.S. Holder is not otherwise exempt and such U.S. Holder does not

provide its taxpayer identification number in the manner required or otherwise fails to comply with applicable backup

withholding tax rules. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding

rules may be refunded or allowed as a credit against a U.S. Holder’s federal income tax liability, if any, provided the

required information is timely furnished to the IRS. U.S. Holders of the Company’s common stock should consult their

own tax advisors regarding their qualification for an exemption from backup withholding and the procedures for

obtaining such an exemption.

The U.S. federal income tax discussion set forth above does not discuss all aspects of U.S. federal income taxation

that may be relevant to a particular stockholder in light of such stockholder’s circumstances and income tax situation.

Accordingly, the Company urges you to consult with your own tax advisor with respect to all of the potential U.S.

federal, state, local, and foreign tax consequences to you of the proposed Reverse Stock Split.

Vote Required

For the Amendment Proposal to be approved, the number of votes cast “FOR” the proposal must exceed the number

of votes cast “AGAINST” the proposal; abstentions and any broker non-votes with respect to the Amendment Proposal

will not be considered “votes cast” and will have no effect on the Amendment Proposal. Brokerage firms will have

discretionary authority to vote their customers’ unvoted shares held by the firms in street name on the Amendment

Proposal, and thus the Company does not anticipate receiving any broker non-votes on this proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” APPROVAL OF THE AMENDMENT PROPOSAL.

9

PROPOSAL NO. 2

APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING TO A LATER DATE OR DATES, IF

NECESSARY, TO PERMIT FURTHER SOLICITATION AND VOTE OF PROXIES IN THE EVENT THERE

ARE NOT SUFFICIENT VOTES IN FAVOR OF THE AMENDMENT PROPOSAL

Background of and Rationale for the Adjournment Proposal

If, at the Special Meeting, the number of shares of the Company’s common stock present or represented and voting

in favor of the Amendment Proposal is insufficient to approve such proposal, the Chairman of the Board of Directors, in

his reasonable discretion, may move to adjourn the Special Meeting in order to enable the Board of Directors to continue

to solicit additional proxies in favor of the Amendment Proposal.

The Board of Directors believes that if the number of shares of the Company’s common stock cast at the Special

Meeting is insufficient to approve the Amendment Proposal, it is in the best interests of the Company’s stockholders to

enable the Board of Directors to continue to seek to obtain a sufficient number of additional votes to approve the

Amendment Proposal.

In the Adjournment Proposal, the Company is asking stockholders to authorize the holder of any proxy solicited by

the Board of Directors to vote in favor of adjourning or postponing the Special Meeting or any adjournment or

postponement thereof. If the Company’s stockholders approve this Adjournment Proposal, the Company could adjourn or

postpone the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time to solicit

additional proxies in favor of the Amendment Proposal.

Vote Required

For this Adjournment Proposal to be approved, a majority of the shares of common stock present or represented by

proxy at the Special Meeting must vote in favor of the Adjournment Proposal. Abstentions with respect to the

Adjournment Proposal will have the same effect as a vote against the Adjournment Proposal. Brokerage firms will have

discretionary authority to vote their customers’ unvoted shares held by the firms in street name on the Adjournment

Proposal, and thus the Company does not anticipate receiving any broker non-votes on this proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” APPROVAL OF THE ADJOURNMENT PROPOSAL.

*Less than one percent.

1 Beneficial ownership is as of December 31, 2023, and based on Amendment No. 2 to Schedule 13G filed, on February 8, 2024,

by CD&R Vector Holdings, L.P., CD&R Investment Associates IX, Ltd., and CD&R Associates IX, L.P., in which they reported

shared voting and shared dispositive power over 100,000,000 shares. The mailing address for each of these entities is c/o Clayton,

Dubilier & Rice, LLC, 375 Park Avenue, New York, New York 10152. The 100,000,000 shares are held directly by CD&R

Vector Holdings, L.P. and may be deemed to be beneficially owned by CD&R Investment Associates IX, Ltd., as the general

partner of CD&R Vector Holdings, L.P. CD&R Investment Associates IX, Ltd. expressly disclaims beneficial ownership of

shares directly held by CD&R Vector Holdings, L.P. Investment and voting decisions with respect to the shares held by CD&R

Vector Holdings, L.P. are made by an investment committee of limited partners of CD&R Associates IX, L.P., currently

consisting of more than ten individuals, each of whom is also an investment professional of Clayton, Dubilier & Rice, LLC (the

"Investment Committee"). All members of the Investment Committee expressly disclaim beneficial ownership of the shares

directly held by the CD&R Vector Holdings, L.P. CD&R Investment Associates IX, Ltd. is managed by two directors, Donald J.

Gogel and Nathan K. Sleeper, and may be deemed to share beneficial ownership of the shares of Common Stock directly held by

CD&R Vector Holdings, L.P. Such persons expressly disclaim such beneficial ownership.

2 Beneficial ownership is as of March 31, 2025, and based on Amendment No. 5 to Schedule 13G/A filed on May 5, 2025, by

Morgan Stanley and Morgan Stanley Investment Management Inc. in which they reported shared voting power over 48,709,489

shares and shared dispositive power over 50,200,249 shares. The mailing address for each of these entities is 1585 Broadway,

New York, NY 10036.

3 Beneficial ownership is as of September 30, 2025 and based on Amendment No. 1 to Schedule 13G/A filed on November 13,

2025 by North Peak Capital Management, LLC, North Peak Capital GP, LLC, North Peak Capital Partners, LP, North Peak

Capital Partners II, LP, North Peak Capital Alpha Fund, LP, North Peak Capital Ultra Fund, LP, Jeremy S. Kahan and Michael K.

Kahan in which they reported shared voting power 31,971,936 shares, sole dispositive power 7,440,021 and shared dispositive

power over 31,971,936 shares. Messrs. Kahan are the co-managers of, and each may be deemed to indirectly beneficially own

securities beneficially owned by, each of North Peak Management and North Peak GP. Such persons expressly disclaim such

beneficial ownership. The mailing address for North Peak Capital Management, LLC is 405 Lexington Avenue, Suite 5001, New

York, NY 10174.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to the Company regarding beneficial ownership of the

Company’s capital stock, as of February 3, 2026, for:

•each person or group of affiliated persons known by the Company to be the beneficial owner of more than five

percent of the Company’s capital stock;

•each of the Company’s named executive officers;

•each of the Company’s directors; and

•all of the Company’s executive officers and directors as a group.

The percentage of shares beneficially owned shown in the table is based on shares of common stock outstanding as

of February 3, 2026. Beneficial ownership is determined according to the rules of the Securities and Exchange

Commission (the “SEC”) and generally means that a person has beneficial ownership of a security if he, she or it

possesses sole or shared voting or investment power of that security, including stock options or warrants that are

exercisable within 60 days of February 3, 2026 or restricted stock units that will vest within 60 days of February 3, 2026.

The Company’s shares of common stock issuable pursuant to stock options, warrants or restricted stock units are deemed

outstanding for computing the percentage of the person holding such options and the percentage of any group of which

the person is a member but are not deemed outstanding for computing the percentage of any other person. Except as

indicated by the footnotes below, the Company believes, based on the information furnished to the Company, that the

persons named in the table below have sole voting and investment power with respect to all shares of common stock

shown that they beneficially own, subject to community property laws where applicable. The information does not

necessarily indicate beneficial ownership for any other purpose, including for purposes of Section 13(d) and 13(g) of the

Securities Act of 1933, as amended.

Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o agilon health, inc.,

440 Polaris Parkway, Suite 550, Westerville, Ohio 43082.

The percentage of beneficial ownership in the table below is based on 414,862,217 shares of the Company’s

common stock deemed to be outstanding as of February 3, 2026.

Name and Address of Beneficial Owner | Number of Shares Owned | Percent of Shares | |||||||

Greater than 5% stockholders: | |||||||||

CD&R Vector Holdings, L.P. 1 | 100,000,000 | 24.1 | |||||||

Morgan Stanley2 | 50,200,249 | 12.1 | |||||||

North Peak Capital Management, LLC3 | 39,411,957 | 9.5 | |||||||

4 Beneficial ownership is as of September 30, 2024 and based on the Schedule 13G filed on November 8, 2024 by BlackRock,

Inc., in which it reported sole voting power over 23,438,591 shares and sole dispositive power over 23,861,022 shares. The

mailing address of BlackRock, Inc. is 50 Hudson Yards, New York, New York 10001.

5 Includes 3,596,533 shares of common stock held by Mr. Williams.

6 Includes 66,144 shares of common stock and 12,834 shares that Ms. Battaglia has the right to acquire through the exercise of

stock options.

7 Includes 1,274,033 shares of common stock and 643,750 shares that Dr. Mansukani has the right to acquire through the exercise

of stock options.

8 Includes 58,819 shares of common stock and 7,328 shares Ms. McKenzie has the right to acquire through the exercise of stock

options.

9 Includes 73,166 shares of common stock and 7,959 shares that Ms. McLoughlin has the right to acquire through the exercise of

stock options.

10 Includes 287,133 shares of common stock and 420,000 shares that Dr. Wulf has the right to acquire through the exercise of

stock options.

11 Includes 22,300 shares of common stock held under the Schwaneke Family Joint Spousal Trust, 145,005 shares of common

stock, 69,448 shares Mr. Schwaneke has the right to acquire through the exercise of stock options, 224,359 options which will

vest and become exercisable on April 1, 2026 and 142,974 restricted stock units that will vest on April 1, 2026.

12 Includes 277,241 shares of common stock, 738,558 shares Mr. Shaker has the right to acquire through the exercise of stock

options, 224,359 options which will vest and become exercisable on April 1, 2026, 20,638 options which will vest and become

exercisable on April 14, 2026, 80,720 options which will vest and become exercisable on April 15, 2026, 142,974 restricted stock

units which will vest on April 1, 2026, 8,878 restricted stock units which will vest on April 14, 2026 and 49,047 restricted stock

units that will vest on April 15, 2026.

13 Includes 46,314 shares of common stock, 321,390 shares Mr. Venkatachaliah has the right to acquire through the exercise of

stock options, 64,102 options which will vest and become exercisable on April 1, 2026, 18,409 options which will vest and

become exercisable on April 14, 2026, 46,125 options which will vest and become exercisable on April 15, 2026, 40,850

restricted stock units which will vest on April 1, 2026, 8,200 restricted stock units which will vest on April 14, 2026 and 28,027

restricted stock units that will vest on April 15, 2026.

14 Includes 20,212 shares of common stock, 48,759 shares Ms. Zamore has the right to acquire through the exercise of stock

options, 128,205 options which will vest and become exercisable on April 1, 2026, 2,848 options which will vest and become

exercisable on April 14, 2026, 28,828 options which will vest and become exercisable on April 15, 2026, 81,699 restricted stock

units which will vest on April 1, 2026, 1,674 restricted stock units which will vest on April 14, 2026 and 17,517 restricted stock

units that will vest on April 15, 2026.

15 Includes 67,590 shares of common stock held under the Steven J. Sell and Margaret D. Williams Revocable Inter Vivos Trust

Agreement and shares of common stock. Excludes 556,200 shares held by the Sell Family Trust and the Sell Children's Trust,

each an irrevocable trust of which Mr. Sell is neither the trustee nor a beneficiary.

11

Name and Address of Beneficial Owner | Number of Shares Owned | Percent of Shares | |||||||

BlackRock, Inc. 4 | 23,861,022 | 5.8 | |||||||

Directors and Named Executive Officers: | |||||||||

Ron Williams5 | 3,596,533 | * | |||||||

Silvana Battaglia 6 | 78,978 | * | |||||||

Sharad Mansukani, M.D.7 | 1,917,783 | * | |||||||

Diana McKenzie8 | 66,147 | * | |||||||

Karen McLoughlin9 | 81,125 | * | |||||||

Ravi Sachdev | — | — | |||||||

William Wulf, M.D.10 | 707,133 | * | |||||||

Jeffrey Schwaneke11 | 604,086 | * | |||||||

Benjamin Shaker12 | 1,542,415 | * | |||||||

Girish Venkatachaliah13 | 573,417 | * | |||||||

Denise Zamore14 | 329,715 | * | |||||||

Steven J. Sell15 | 116,626 | * | |||||||

All current directors and executive officers as a group (11 persons) | 9,497,332 | 2.3 | |||||||

12

ADDITIONAL INFORMATION

Householding of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery

requirements for Proxy Materials with respect to two or more stockholders sharing the same address by delivering a

single set of Proxy Materials addressed to those stockholders. This process, which is commonly referred to as

“householding,” potentially means extra convenience for stockholders and cost savings for companies.

A single set of Proxy Materials will be delivered to multiple stockholders sharing an address unless contrary

instructions have been received from the affected stockholders. Once you have received notice from your broker that they

will be “householding” communications to your address, “householding” will continue until you are notified otherwise or

until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to

receive a separate copy of the Proxy Materials, please notify your broker or Tilray. Direct your written request to agilon

health, inc., Corporate Secretary, 440 Polaris Parkway, Suite 550, Westerville, Ohio 43082. Stockholders who currently

receive multiple copies of the Proxy Materials at their addresses and would like to request “householding” of their

communications should contact their brokers.

Other Matters

The Company knows of no other matters that will be presented for consideration at the Company’s Special Meeting.

If any other matters properly come before the Company’s Special Meeting upon which a vote properly may be taken,

shares represented by all proxies received by the Company on the proxy card will be voted with respect thereto as

permitted and in accordance with the judgment of the proxy holders.

Solicitation of Proxies

The Company will pay the costs of this solicitation. The Company’s directors, officers or other employees may

solicit proxies on behalf of the Board of Directors primarily by mail and via the Internet, but additional solicitations may

be made in person, by electronic delivery, telephone, facsimile or other medium. No additional compensation will be paid

to the Company’s directors, officers or other employees in connection with this solicitation. The Company may enlist the

assistance of brokerage houses, fiduciaries, custodians and other third parties in soliciting proxies. The Company will,

upon request, reimburse brokerage firms and other third parties for their reasonable expenses incurred for forwarding

solicitation material to beneficial holders of the Company’s common stock.

Where You Can Find More Information

A copy of the Company’s Annual Report on Form 10-K is available without charge upon written request to: 440

Polaris Parkway, Suite 550, Westerville, Ohio 43082.

13

APPENDIX A

CERTIFICATE OF AMENDMENT

TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

AGILON HEALTH, INC.

agilon health, inc., a corporation having a date of incorporation of April 21, 2017, and duly organized and existing under the

General Corporation Law of the State of Delaware (the "Corporation"), hereby certifies as follows:

1.Article FOURTH of the Certificate of Incorporation is hereby amended by adding the following paragraph immediately

after the first paragraph of Article FOURTH:

"As of the effective time of this Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the

Corporation filed with the Secretary of State of the State of Delaware (the “Reclassification Effective Time”), each [·] shares of

Common Stock issued and outstanding or held by the Corporation as treasury stock immediately prior to the Reclassification

Effective Time shall, automatically and without any action on the part of the Corporation or the respective holders thereof, be

reclassified, combined and converted into one (1) share of Common Stock (the "Reverse Stock Split"). No fractional shares shall

be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive a fractional share

of Common Stock shall have all such fractional shares aggregated per registered holder and shall be entitled to receive cash

(without interest) in lieu of fractional shares from the Corporation’s transfer agent in an amount equal to the proceeds (net of all

commissions, transfer taxes and other out-of-pocket transaction costs, including the expenses and compensation of the transfer

agent incurred in connection with such sale of shares) attributable to the sale of such fractional shares following the aggregation

and sale by the Corporation’s transfer agent of all fractional shares otherwise issuable. The Reverse Stock Split shall not affect

the total number of shares of Common Stock that the Corporation is authorized to issue, which shall remain as set forth in the first

paragraph of this Article FOURTH."

2.This Certificate of Amendment shall become effective upon filing with the Secretary of State of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its duly authorized officer

this ___ day of __________, 2026.

AGILON HEALTH, INC.

By: _________________________

Name:

Title: