.2 Invivyd Corporate Deck January 2026 © 2026 Invivyd, Inc. All trademarks used in this presentation are the property of their respective owners. 1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Statements in this presentation that are not statements of historical fact are forward-looking statements. Words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “seek,” “could,” “intend,” “target,” “aim,” “project,” “designed to,” “estimate,” “believe,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, though not all forward-looking statements contain these identifying words. Forward-looking statements include statements concerning, among other things, expectations regarding Invivyd’s efforts to develop potential best-in-class antibody therapies across multiple viral threats; expectations about the COVID landscape; beliefs about limitations of COVID vaccines and the expected advantages of monoclonal antibodies (mAbs); expectations regarding durability and stability of the company’s antibodies; plans related to the company’s research and development activities, and the timing and potential results thereof; the potential of VYD2311 as a mAb candidate; expectations regarding the company’s clinical trial designs and enrollment, regulatory pathway, product profile, target patient population, indication and administration paradigm for VYD2311; PEMGARDA® (pemivibart) as a mAb for pre-exposure prophylaxis (PrEP) of COVID-19 in certain immunocompromised persons; the company’s commercialization plans, strategies, goals and expectations; the potential of VBY329 as a novel, potential best-in-class respiratory syncytial virus (RSV) mAb candidate; estimates regarding the size of target patient populations and the potential market opportunity for the company’s product candidates, as well as its market position; the potential of Invivyd’s technology to address major needs beyond COVID; the potential of the company’s pipeline and discovery efforts, including for COVID, Long COVID, RSV and measles; the anticipated focus and goals of the SPEAR Study Group; the company’s business strategies and objectives, and ability to execute on them; the company’s future prospects; the company’s preliminary fourth quarter financial results; and other statements that are not historical fact. The company may not actually achieve the plans, intentions or expectations disclosed in the company’s forward-looking statements and you should not place undue reliance on the company’s forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause the company’s actual results to differ materially from the results described in or implied by the forward-looking statements, including, without limitation: uncertainties about the company’s expectations, projections and estimates regarding future costs and expenses, future revenue, capital requirements, and the availability of and the need for additional financing; whether the company’s cash and cash equivalents are sufficient to support its operating plan for as long as anticipated; uncertainties regarding market acceptance, payor coverage and reimbursement, or future revenue generated by any authorized or approved product; the timing, progress and results of the company’s discovery, preclinical and clinical development activities; clinical trial site activation or enrollment rates; unexpected safety or efficacy data observed during preclinical studies or clinical trials; the predictability of clinical success of the company’s product candidates based on neutralizing activity in nonclinical studies; the risk that results of nonclinical studies or clinical trials may not be predictive of future results, and interim data are subject to further analysis; how long the emergency use authorization (EUA) granted by the U.S. Food & Drug Administration (FDA) for PEMGARDA for COVID-19 PrEP in certain immunocompromised persons will remain in effect and whether such EUA is revised or revoked by the FDA; changes in the regulatory environment; the outcome of the company’s engagement with regulators; uncertainties related to the regulatory authorization or approval process, and available development and regulatory pathways; whether or not any preclinical candidate identified by the company is determined to be suitable for clinical development; the company’s ability to generate the data needed to support a potential Biologics License Application (BLA) submission for VYD2311; the ability to maintain a continued acceptable safety, tolerability and efficacy profile of any product candidate following regulatory authorization or approval; the success of the company’s in-house sales force, and company’s ability to maintain and expand sales, marketing and distribution capabilities to successfully commercialize any authorized or approved product; changes in expected or existing competition; the company’s reliance on third parties; potential variability in neutralizing activity of product candidates tested in different assays, such as pseudovirus assays and authentic assays; variability of results in models and methods used to predict activity against SARS-CoV-2 variants; whether the epitopes that pemivibart and VYD2311 target remain structurally intact and the company’s product candidates are able to demonstrate and sustain neutralizing activity against major SARS-CoV-2 variants, particularly in the face of viral evolution; the complexities of manufacturing mAb therapies, and availability of quantities of commercial launch product in the future, if authorized or approved; macroeconomic and political uncertainties; any change in the preliminary estimates of the company’s Q4 2025 results upon completion of the company’s financial closing controls and procedures, and finalization of the financial statements; the company’s ability to continue as a going concern; and whether the company has adequate funding to meet future operating expenses and capital expenditure requirements. Other factors that may cause the company’s actual results to differ materially from those expressed or implied in the forward-looking statements in this presentation are described under the heading “Risk Factors” in the company’s Annual Report on Form 10-K for the year ended December 31, 2024 and its Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, each filed with the Securities and Exchange Commission (SEC), and in the company’s other filings with the SEC, and in its future reports to be filed with the SEC and available at www.sec.gov. Forward-looking statements contained in this press release are made as of this date, and Invivyd undertakes no duty to update such information whether as a result of new information, future events or otherwise, except as required under applicable law. This presentation contains hyperlinks to information that is not deemed to be incorporated by reference in this presentation. All trademarks used in this presentation are the property of their respective owners. 2

01 Invivyd Approach 02 COVID 03 Long COVID agenda 04 RSV 05 Financial Highlights 3

We’re developing potential best- in-class antibody therapies across The need multiple viral threats, providing protection and defining what’s next in keeping people well. With is urgent. a broad pipeline and sharp execution, we’re moving quickly to turn breakthrough science into lasting impact and value. The market potential is significant. We’re taking action. M EA S LES CO VI D LONG COVID RS V 4

A Bespoke Platform For ID mAb Discovery Proprietary Analytics Best-in-Class mAbs Discovery Platform Mutable Targets 5

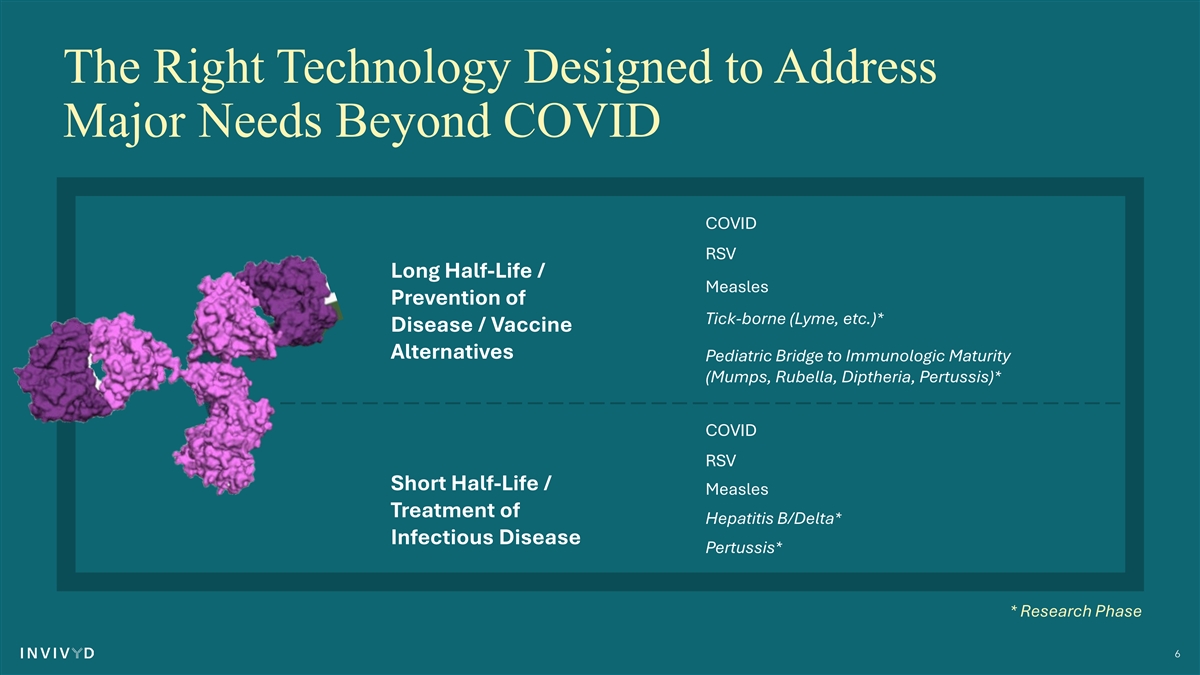

The Right Technology Designed to Address Major Needs Beyond COVID COVID RSV Long Half-Life / Measles Prevention of Tick-borne (Lyme, etc.)* Disease / Vaccine Alternatives Pediatric Bridge to Immunologic Maturity (Mumps, Rubella, Diptheria, Pertussis)* COVID RSV Short Half-Life / Measles Treatment of Hepatitis B/Delta* Infectious Disease Pertussis* * Research Phase 6

01 Invivyd Approach 02 COVID 03 Long COVID agenda 04 RSV 05 Financial Highlights 7

Perceived as Influenza RSV a “respiratory” Entry via sialic acid receptor Entry via CX3CR1 Largely bronchoepithelial cells Largely bronchoepithelial cells virus because of transmission, but actually a vascular, prothrombotic, SARS-CoV-2 immunomodulatory Entry via ACE2 Epithelial and endothelial cells novel virus 8

COVID’s systemic complications continue to unfold All trademarks and logos displayed are the property of their respective owners. Their use here is for identification purposes only and does not constitute endorsement or affiliation. 9

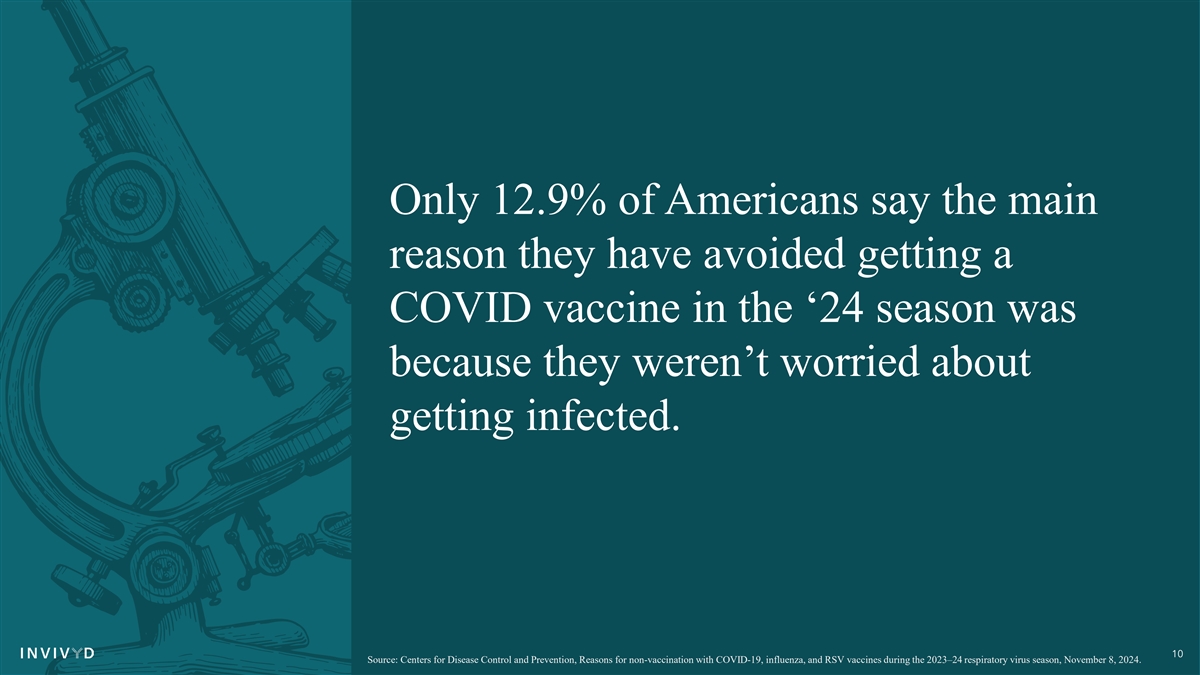

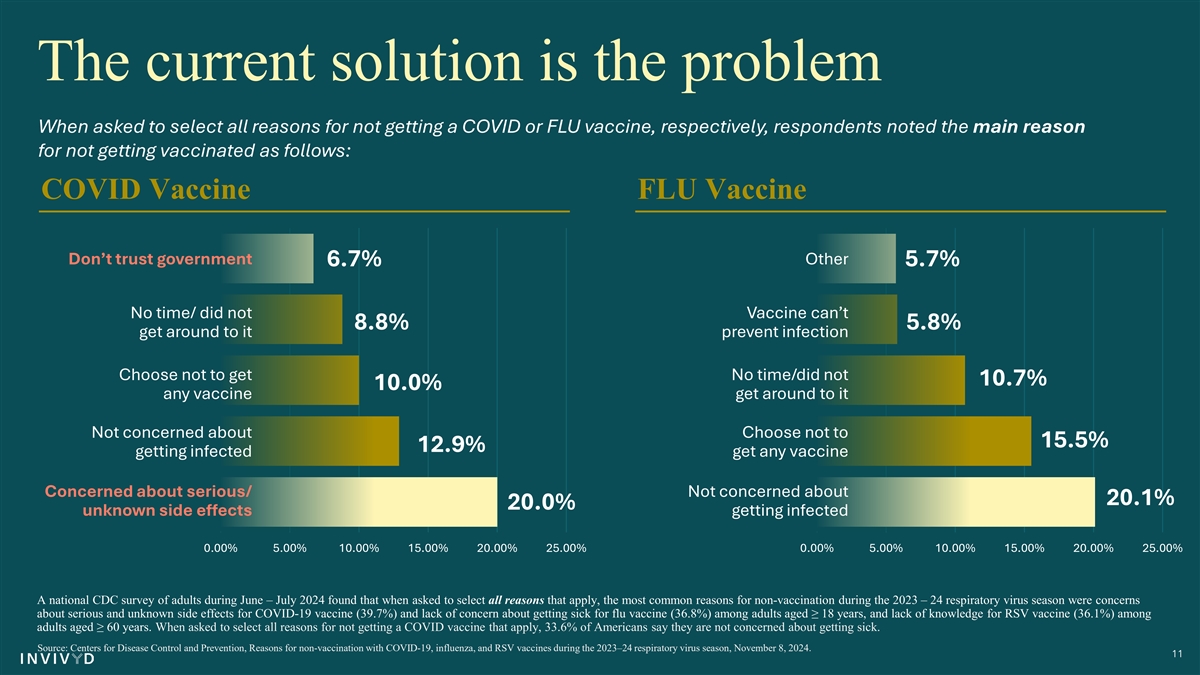

Only 12.9% of Americans say the main reason they have avoided getting a COVID vaccine in the ‘24 season was because they weren’t worried about getting infected. 10 Source: Centers for Disease Control and Prevention, Reasons for non-vaccination with COVID-19, influenza, and RSV vaccines during the 2023–24 respiratory virus season, November 8, 2024.

The current solution is the problem When asked to select all reasons for not getting a COVID or FLU vaccine, respectively, respondents noted the main reason for not getting vaccinated as follows: COVID Vaccine FLU Vaccine Don’t trust government Other 6.7% 5.7% No time/ did not Vaccine can’t 8.8% 5.8% get around to it prevent infection Choose not to get No time/did not 10.7% 10.0% any vaccine get around to it Not concerned about Choose not to 15.5% 12.9% getting infected get any vaccine Concerned about serious/ Not concerned about 20.1% 20.0% unknown side effects getting infected 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% A national CDC survey of adults during June – July 2024 found that when asked to select all reasons that apply, the most common reasons for non-vaccination during the 2023 – 24 respiratory virus season were concerns about serious and unknown side effects for COVID-19 vaccine (39.7%) and lack of concern about getting sick for flu vaccine (36.8%) among adults aged ≥ 18 years, and lack of knowledge for RSV vaccine (36.1%) among adults aged ≥ 60 years. When asked to select all reasons for not getting a COVID vaccine that apply, 33.6% of Americans say they are not concerned about getting sick. Source: Centers for Disease Control and Prevention, Reasons for non-vaccination with COVID-19, influenza, and RSV vaccines during the 2023–24 respiratory virus season, November 8, 2024. 11

The Clinical Data Phase 3 RCTs: ~2 months of efficacy follow-up Current Disconnected The FDA Labels state of COVID “Once – OR – More than 2 months since last boost dose” mRNA vaccine prevention Observed Utilization Annual booster Sources: (1) Vaccines and Related Biological Products Advisory Committee Briefing Documents, December 10, 2020. (2) Prescribing Information – COMIRNATY® Aug 2025; Prescribing Information - SPIKEVAX® Aug 2025 (3) New England 12 Journal of Medicine, An Evidence-Based Approach to Covid-19 Vaccination, Vinay Prasad, M.D., M.P.H., and Martin A. Makary, M.D., M.P.H., May 20, 2025.

COVID In contrast to vaccines, demands monoclonal antibodies can be engineered for monoclonal consistent high activity antibodies 13 13

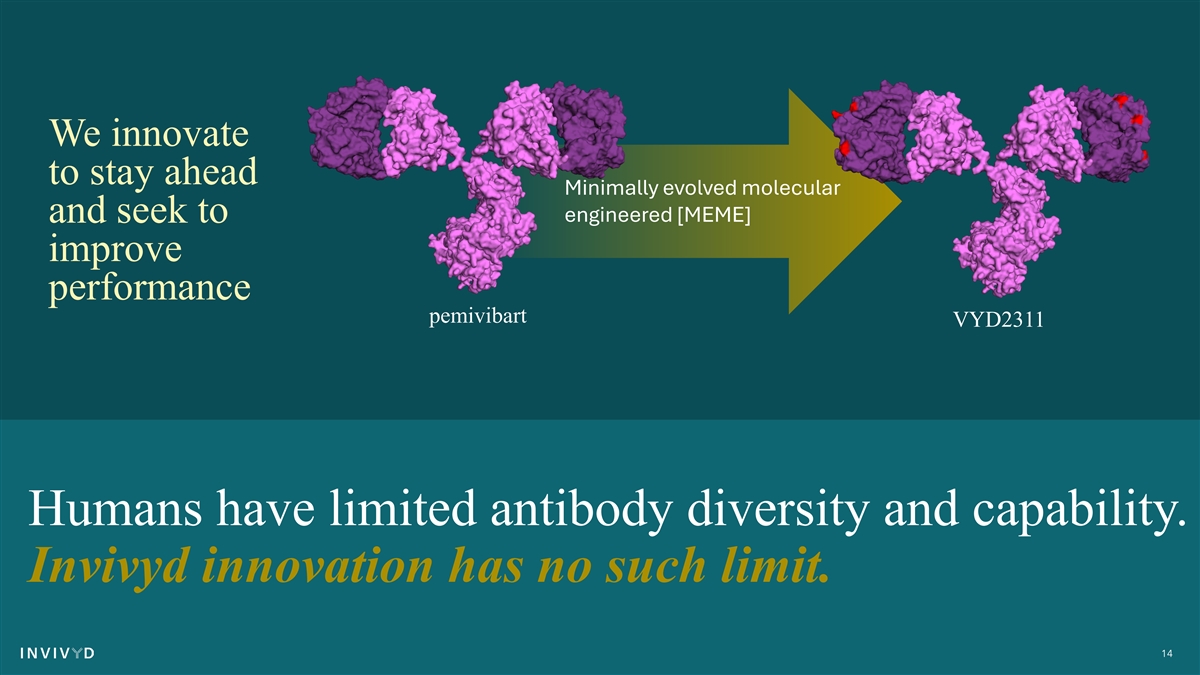

We innovate to stay ahead Minimally evolved molecular and seek to engineered [MEME] improve performance pemivibart VYD2311 Humans have limited antibody diversity and capability. Invivyd innovation has no such limit. 14

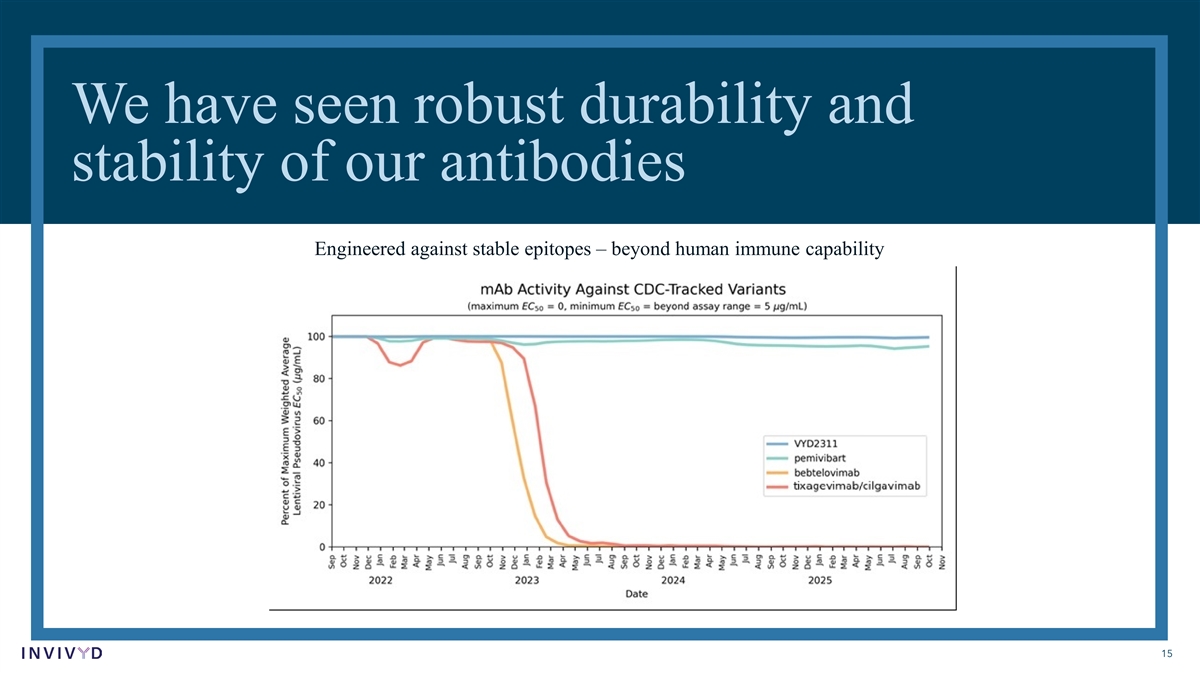

We have seen robust durability and stability of our antibodies Engineered against stable epitopes – beyond human immune capability 15

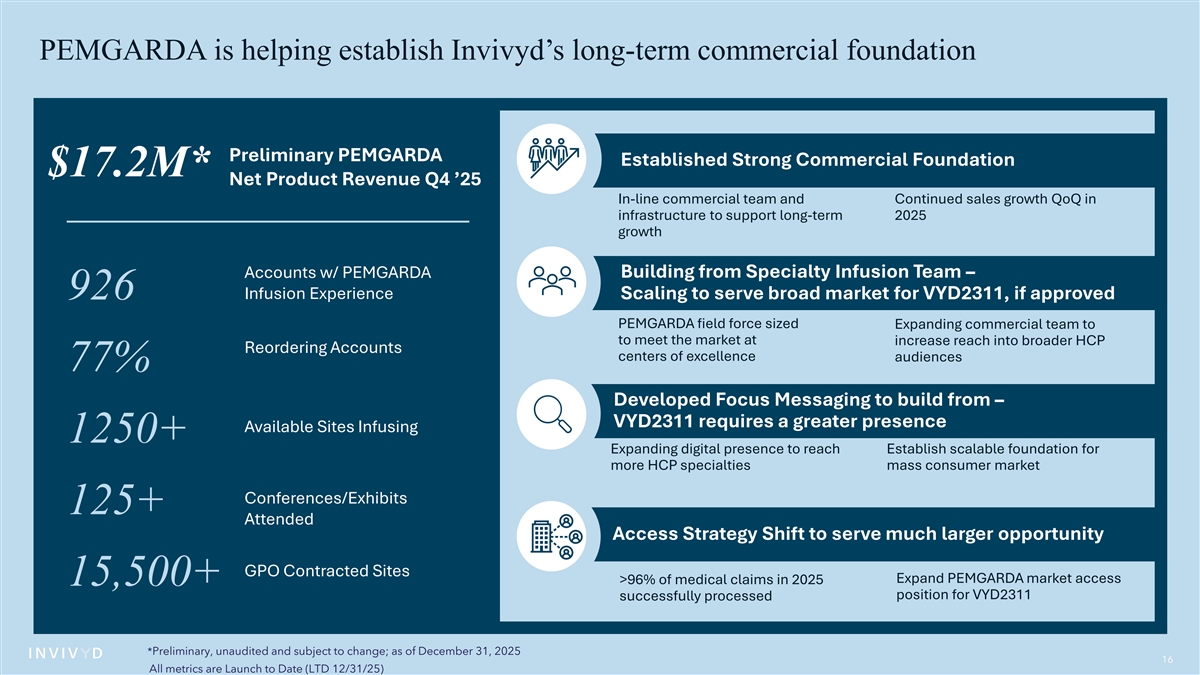

PEMGARDA is helping establish Invivyd’s long-term commercial foundation Preliminary PEMGARDA Established Strong Commercial Foundation $17.2M* Net Product Revenue Q4 ’25 In-line commercial team and Continued sales growth QoQ in infrastructure to support long-term 2025 growth Building from Specialty Infusion Team – Accounts w/ PEMGARDA Infusion Experience 926 Scaling to serve broad market for VYD2311, if approved PEMGARDA field force sized Expanding commercial team to to meet the market at increase reach into broader HCP Reordering Accounts centers of excellence audiences 77% Developed Focus Messaging to build from – VYD2311 requires a greater presence Available Sites Infusing 1250+ Expanding digital presence to reach Establish scalable foundation for more HCP specialties mass consumer market Conferences/Exhibits 125+ Attended Access Strategy Shift to serve much larger opportunity GPO Contracted Sites Expand PEMGARDA market access >96% of medical claims in 2025 15,500+ position for VYD2311 successfully processed *Preliminary, unaudited and subject to change; as of December 31, 2025 16 All metrics are Launch to Date (LTD 12/31/25)

Broad recognition from Societies and Guidelines for Antibodies in COVID SOCIETY / GUIDELINE PEMGARDA OR MAB TARGET AUDIENCE HIV.gov PEMGARDA Immunodeficiency IDSA Pemivibart Infectious disease NCCN – B-Cell Lymphomas Pemivibart Oncology NCCN – Infection Prevention Pemivibart Oncology Immune Deficiency Foundation (IDF) PEMGARDA Immunodeficiency MS Society PEMGARDA Rheumatology National Kidney Foundation PEMGARDA Solid organ transplant American Cancer Society PEMGARDA Oncology Invivyd poised to American College of Rheumatology mAbs Rheumatology American Lung Association Pemivibart Oncology deliver on National Council on Aging (NCOA) PEMGARDA Elderly BreastCancer.org PEMGARDA Oncology scalable form factor CLL Society PEMGARDA Oncology American Academy of Allergy, Asthma, PEMGARDA Immunology and Immunology (AAAAI) for broad access Vasculitis Foundation PEMGARDA Rheumatology 17

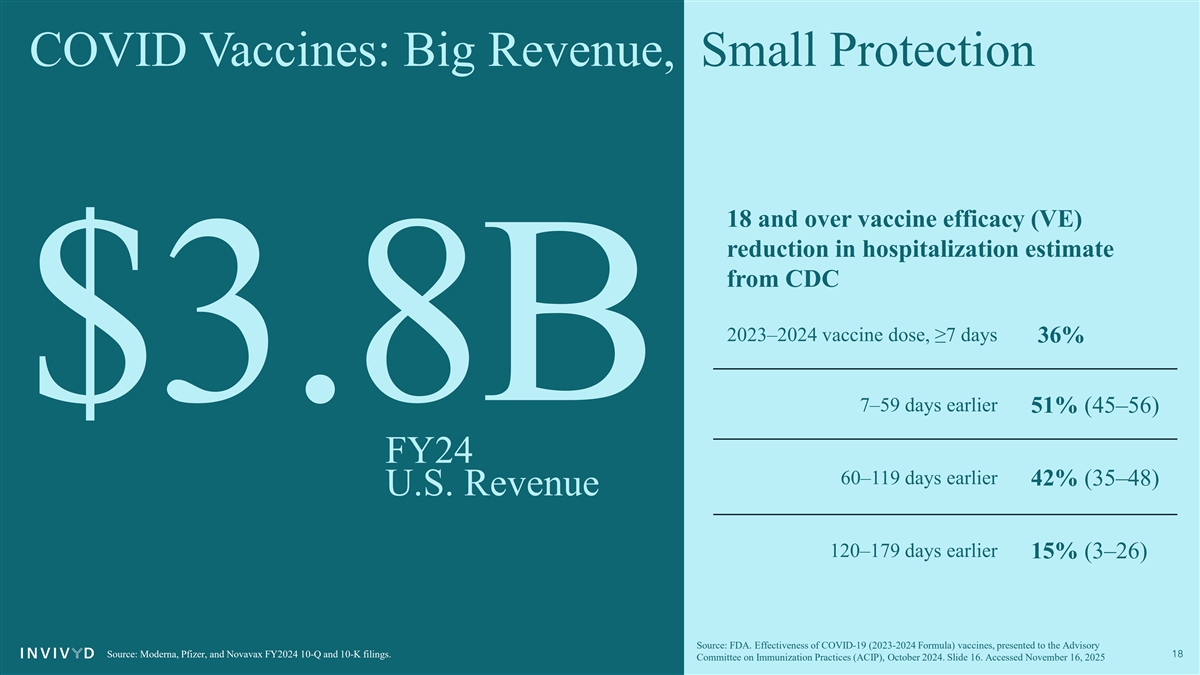

COVID Vaccines: Big Revenue, Small Protection 18 and over vaccine efficacy (VE) reduction in hospitalization estimate from CDC 2023–2024 vaccine dose, ≥7 days 36% $3.8B 7–59 days earlier 51% (45–56) FY24 60–119 days earlier 42% (35–48) U.S. Revenue 120–179 days earlier 15% (3–26) Source: FDA. Effectiveness of COVID-19 (2023-2024 Formula) vaccines, presented to the Advisory Source: Moderna, Pfizer, and Novavax FY2024 10-Q and 10-K filings. 18 Committee on Immunization Practices (ACIP), October 2024. Slide 16. Accessed November 16, 2025

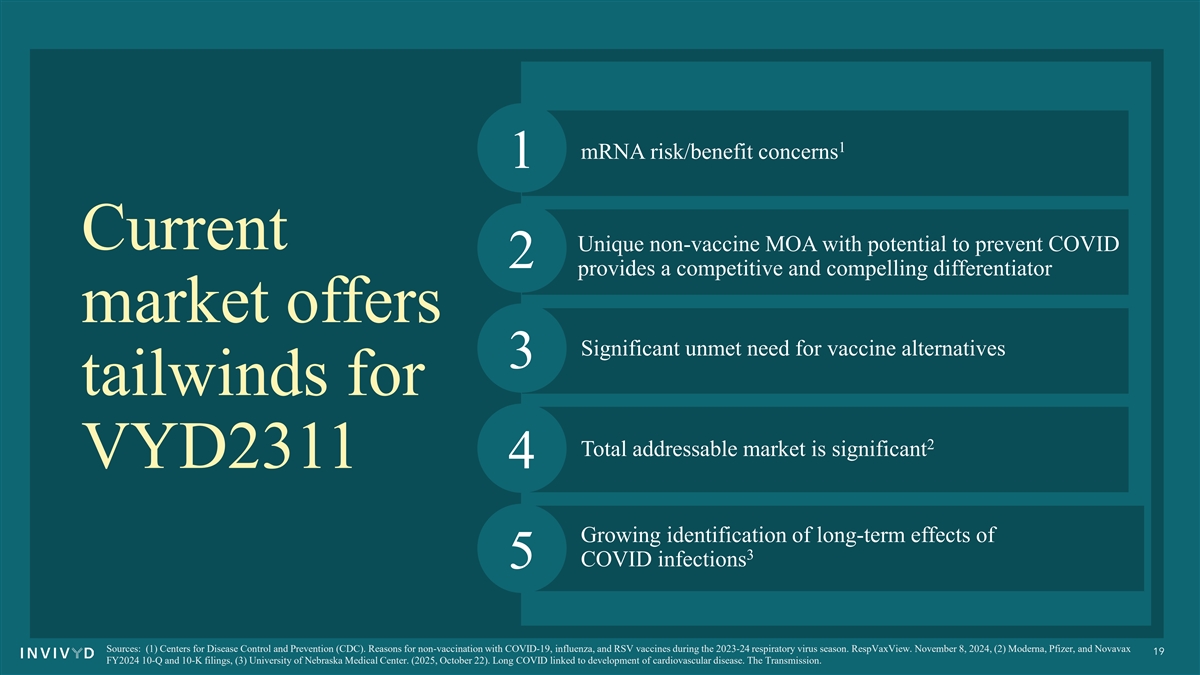

1 mRNA risk/benefit concerns 1 Current Unique non-vaccine MOA with potential to prevent COVID 2 provides a competitive and compelling differentiator market offers Significant unmet need for vaccine alternatives 3 tailwinds for 2 Total addressable market is significant VYD2311 4 Growing identification of long-term effects of 3 COVID infections 5 Sources: (1) Centers for Disease Control and Prevention (CDC). Reasons for non-vaccination with COVID-19, influenza, and RSV vaccines during the 2023-24 respiratory virus season. RespVaxView. November 8, 2024, (2) Moderna, Pfizer, and Novavax 19 FY2024 10-Q and 10-K filings, (3) University of Nebraska Medical Center. (2025, October 22). Long COVID linked to development of cardiovascular disease. The Transmission.

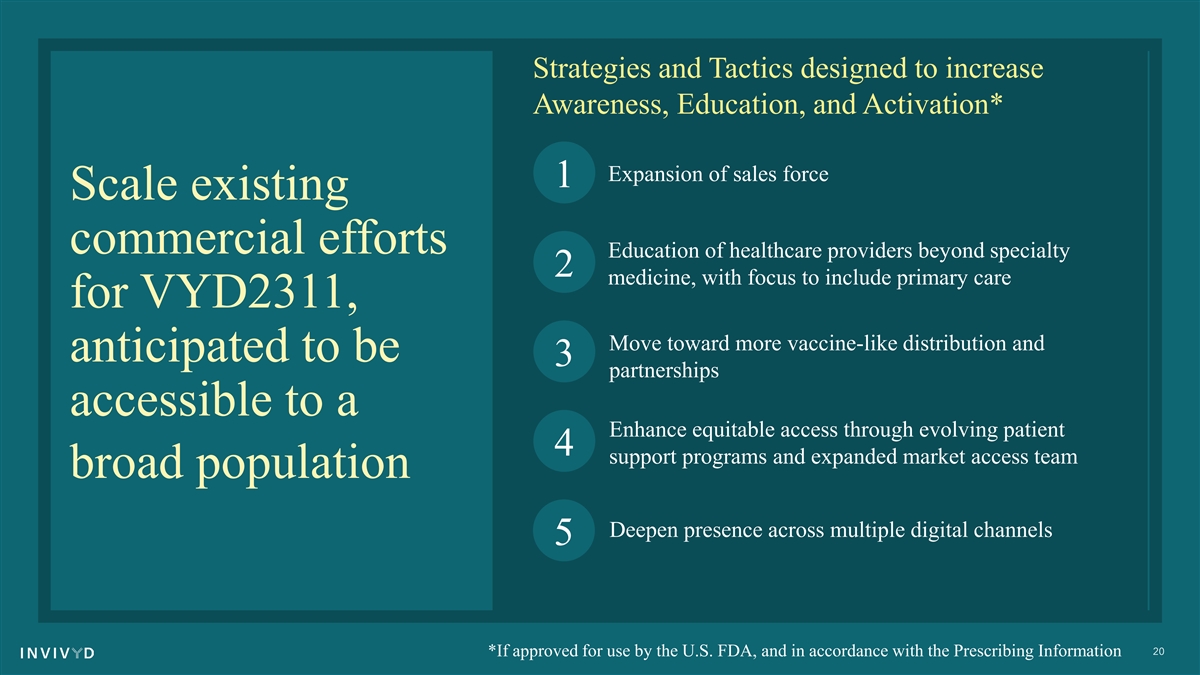

Strategies and Tactics designed to increase Awareness, Education, and Activation* Expansion of sales force 1 Scale existing commercial efforts Education of healthcare providers beyond specialty 2 medicine, with focus to include primary care for VYD2311, Move toward more vaccine-like distribution and anticipated to be 3 partnerships accessible to a Enhance equitable access through evolving patient 4 support programs and expanded market access team broad population Deepen presence across multiple digital channels 5 20 *If approved for use by the U.S. FDA, and in accordance with the Prescribing Information

VYD2311/REVOLUTION Clinical Program Pivotal Efficacy Study Vaccine Study Phase 1/2 Study ‘DECLARATION’ Phase 3, Randomized, double-blind, placebo- ‘LIBERTY’ Safety/Tolerability placebo-controlled efficacy controlled trial was conducted to evaluate comparison with COVID trial in prevention of safety, tolerability, pharmacokinetics, and mRNA vaccines (and co- symptomatic COVID immunogenicity in healthy participants administration) 21

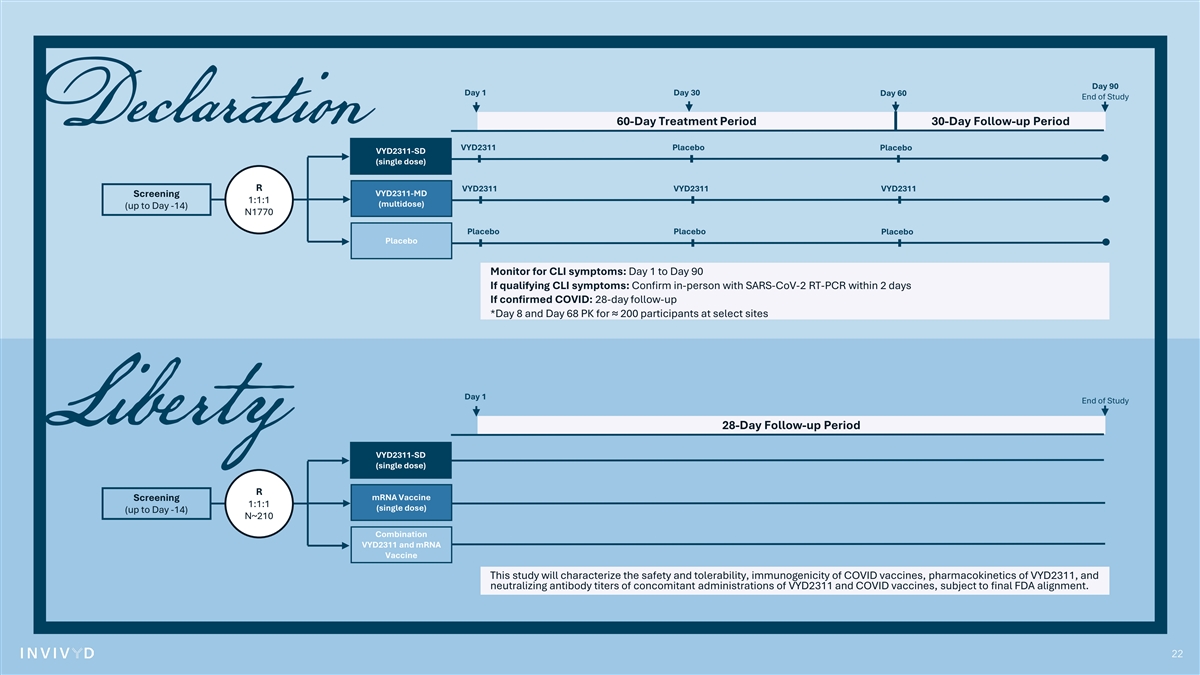

Day 90 Day 1 Day 30 Day 60 End of Study 60-Day Treatment Period 30-Day Follow-up Period VYD2311 Placebo Placebo VYD2311-SD (single dose) R VYD2311 VYD2311 VYD2311 VYD2311-MD Screening 1:1:1 (multidose) (up to Day -14) N1770 Placebo Placebo Placebo Placebo Monitor for CLI symptoms: Day 1 to Day 90 If qualifying CLI symptoms: Confirm in-person with SARS-CoV-2 RT-PCR within 2 days If confirmed COVID: 28-day follow-up *Day 8 and Day 68 PK for ≈ 200 participants at select sites Day 1 End of Study 28-Day Follow-up Period VYD2311-SD (single dose) R mRNA Vaccine Screening 1:1:1 (single dose) (up to Day -14) N~210 Combination VYD2311 and mRNA Vaccine This study will characterize the safety and tolerability, immunogenicity of COVID vaccines, pharmacokinetics of VYD2311, and neutralizing antibody titers of concomitant administrations of VYD2311 and COVID vaccines, subject to final FDA alignment. 22

Repeat dose Why study safety and titer VYD2311 in multi-doses? data Anticipate that, if approved, most people would choose to get VYD2311 once a year, with a safety profile that enables extra protection for those who want it.* 23 *Depending on Prescribing Information, if approved

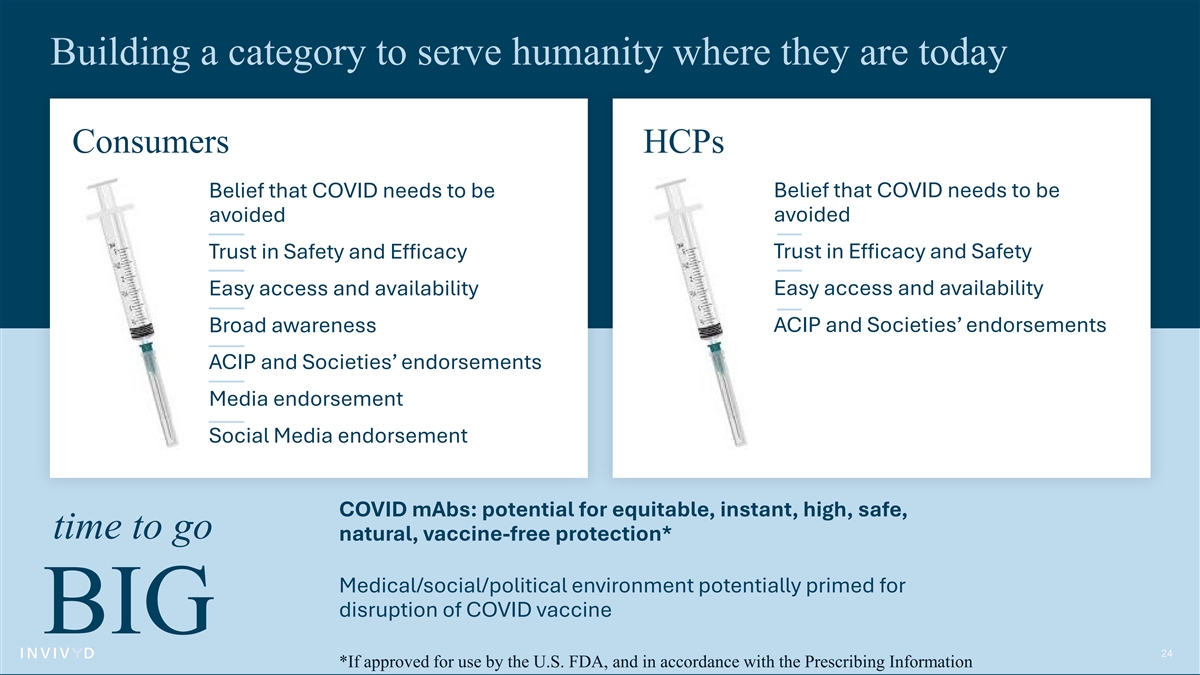

Building a category to serve humanity where they are today Consumers HCPs Belief that COVID needs to be Belief that COVID needs to be avoided avoided Trust in Safety and Efficacy Trust in Efficacy and Safety Easy access and availability Easy access and availability CP Broad awareness ACIP and Societies’ endorsements ACIP and Societies’ endorsements Media endorsement Social Media endorsement COVID mAbs: potential for equitable, instant, high, safe, time to go natural, vaccine-free protection* Medical/social/political environment potentially primed for disruption of COVID vaccine BIG 24 *If approved for use by the U.S. FDA, and in accordance with the Prescribing Information

01 Invivyd Approach 02 COVID 03 Long COVID agenda 04 RSV 05 Financial Highlights 25

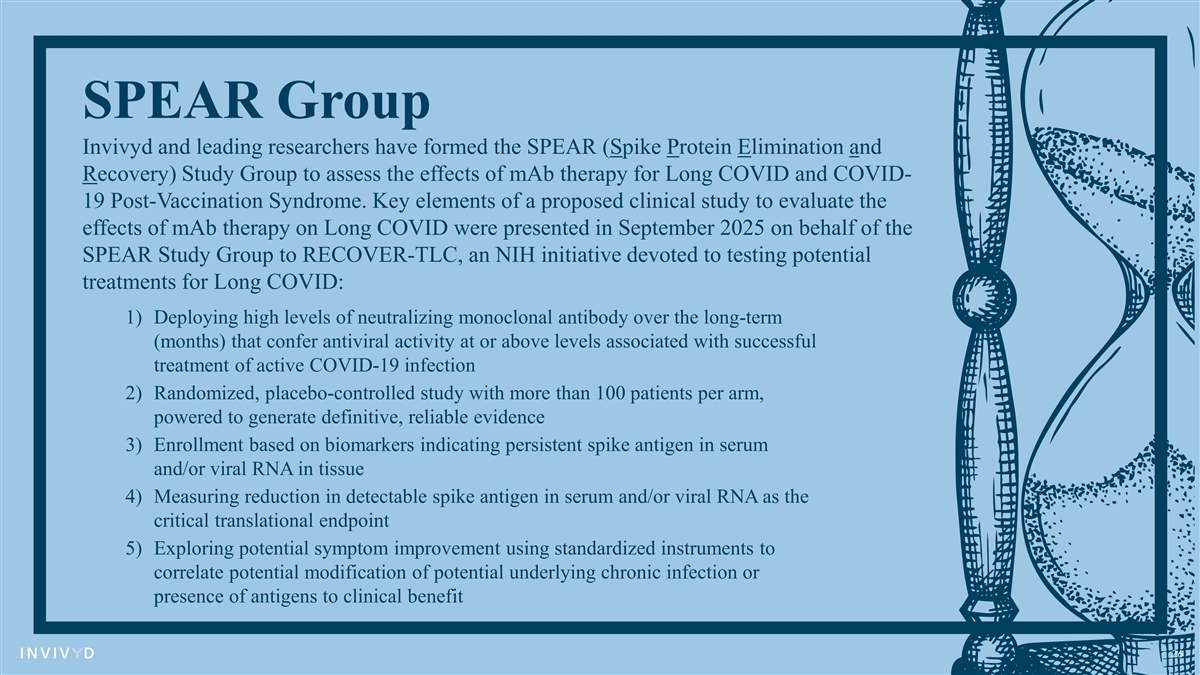

SPEAR Group Invivyd and leading researchers have formed the SPEAR (Spike Protein Elimination and Recovery) Study Group to assess the effects of mAb therapy for Long COVID and COVID- 19 Post-Vaccination Syndrome. Key elements of a proposed clinical study to evaluate the effects of mAb therapy on Long COVID were presented in September 2025 on behalf of the SPEAR Study Group to RECOVER-TLC, an NIH initiative devoted to testing potential treatments for Long COVID: 1) Deploying high levels of neutralizing monoclonal antibody over the long-term (months) that confer antiviral activity at or above levels associated with successful treatment of active COVID-19 infection 2) Randomized, placebo-controlled study with more than 100 patients per arm, powered to generate definitive, reliable evidence 3) Enrollment based on biomarkers indicating persistent spike antigen in serum and/or viral RNA in tissue 4) Measuring reduction in detectable spike antigen in serum and/or viral RNA as the critical translational endpoint 5) Exploring potential symptom improvement using standardized instruments to correlate potential modification of potential underlying chronic infection or presence of antigens to clinical benefit 26

01 Invivyd Approach 02 COVID 03 Long COVID agenda 04 RSV 05 Financial Highlights 27

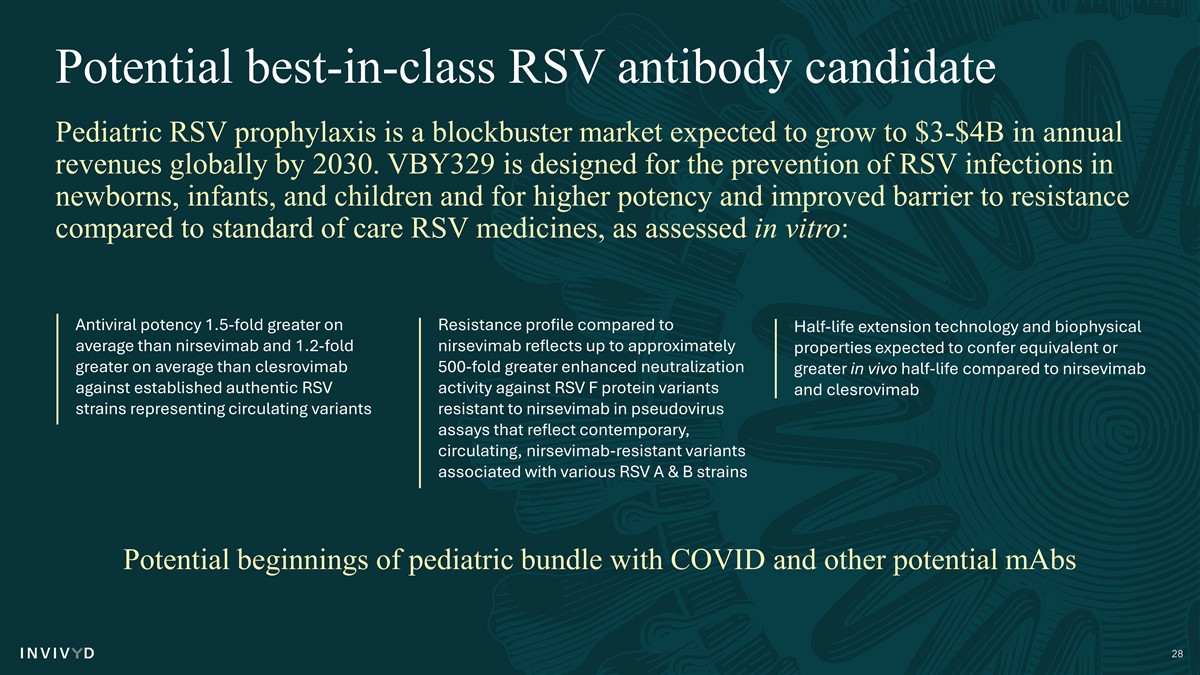

Potential best-in-class RSV antibody candidate Pediatric RSV prophylaxis is a blockbuster market expected to grow to $3-$4B in annual revenues globally by 2030. VBY329 is designed for the prevention of RSV infections in newborns, infants, and children and for higher potency and improved barrier to resistance compared to standard of care RSV medicines, as assessed in vitro: Antiviral potency 1.5-fold greater on Resistance profile compared to Half-life extension technology and biophysical average than nirsevimab and 1.2-fold nirsevimab reflects up to approximately properties expected to confer equivalent or greater on average than clesrovimab 500-fold greater enhanced neutralization greater in vivo half-life compared to nirsevimab against established authentic RSV activity against RSV F protein variants and clesrovimab strains representing circulating variants resistant to nirsevimab in pseudovirus assays that reflect contemporary, circulating, nirsevimab-resistant variants associated with various RSV A & B strains Potential beginnings of pediatric bundle with COVID and other potential mAbs 28

01 Invivyd Approach 02 COVID 03 Long COVID agenda 04 RSV 05 Financial Highlights 29

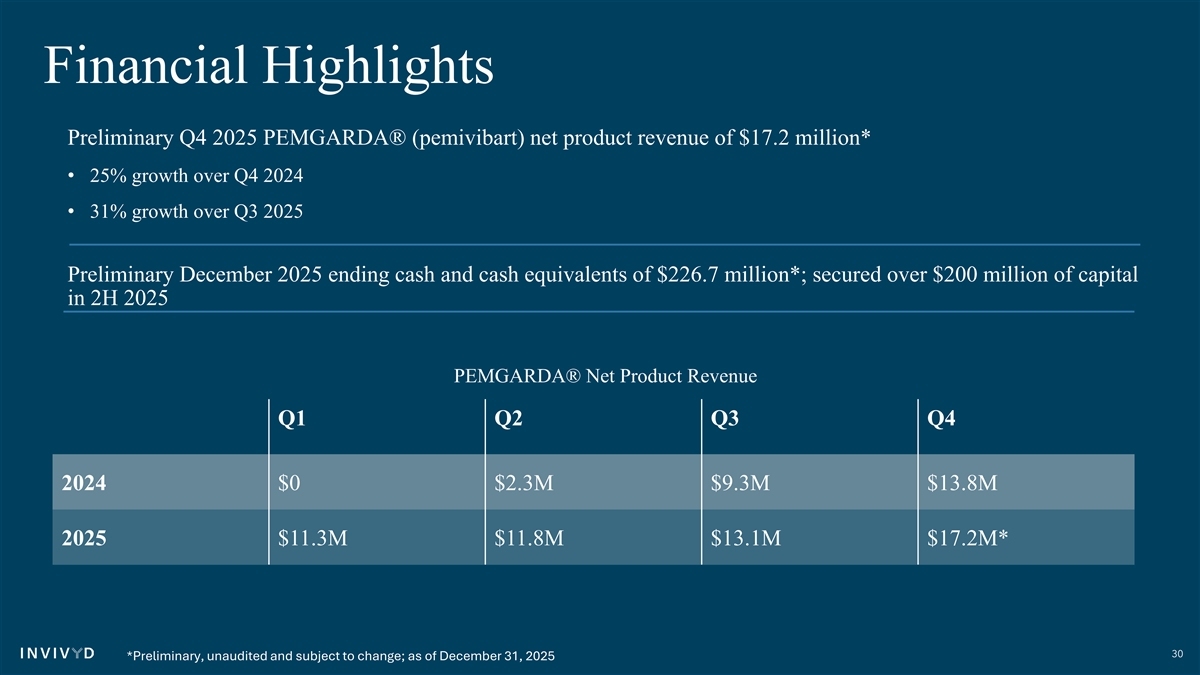

Financial Highlights Preliminary Q4 2025 PEMGARDA® (pemivibart) net product revenue of $17.2 million* • 25% growth over Q4 2024 • 31% growth over Q3 2025 Preliminary December 2025 ending cash and cash equivalents of $226.7 million*; secured over $200 million of capital in 2H 2025 PEMGARDA® Net Product Revenue Q1 Q2 Q3 Q4 2024 $0 $2.3M $9.3M $13.8M 2025 $11.3M $11.8M $13.1M $17.2M* 30 *Preliminary, unaudited and subject to change; as of December 31, 2025

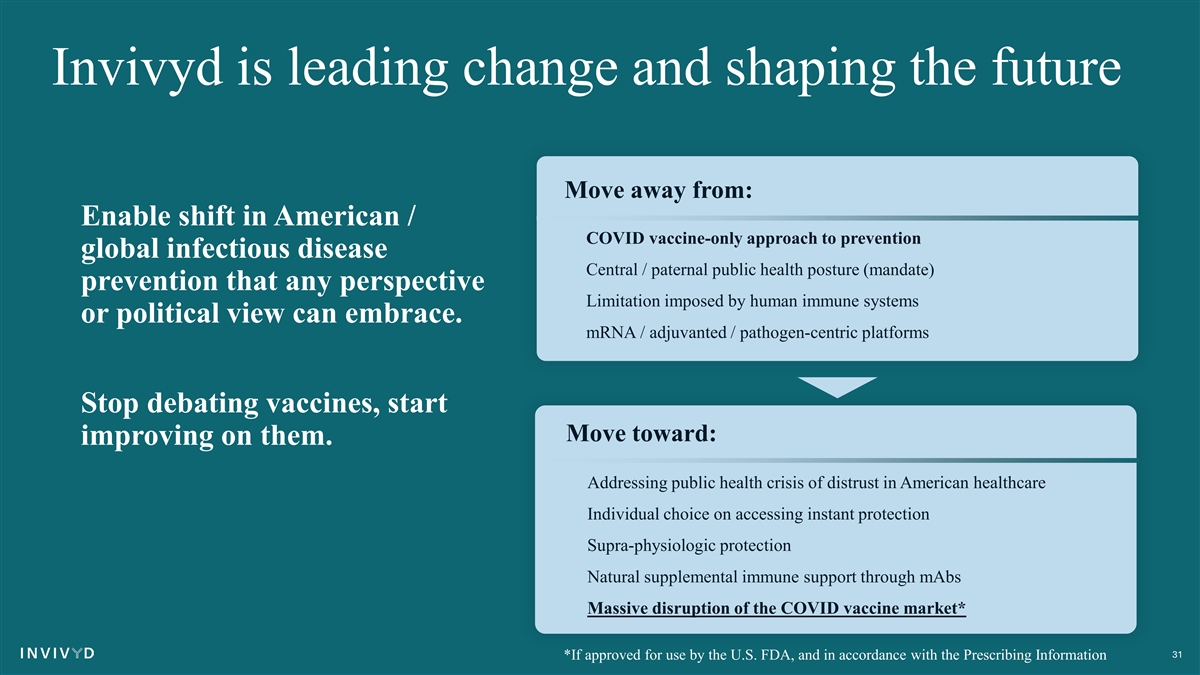

Invivyd is leading change and shaping the future Move away from: Enable shift in American / • COVID vaccine-only approach to prevention global infectious disease • Central / paternal public health posture (mandate) prevention that any perspective • Limitation imposed by human immune systems or political view can embrace. • mRNA / adjuvanted / pathogen-centric platforms Stop debating vaccines, start Move toward: improving on them. • Addressing public health crisis of distrust in American healthcare • Individual choice on accessing instant protection • Supra-physiologic protection • Natural supplemental immune support through mAbs • Massive disruption of the COVID vaccine market* 31 *If approved for use by the U.S. FDA, and in accordance with the Prescribing Information