1 1 Medicare Advantage Done Right .2

2 Legal Disclaimer Forward Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are subject to risks and uncertainties and are based on assumptions that may prove to be inaccurate, which could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. Important risks and uncertainties that could cause the Company’s actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: the Company's ability to attract new members and enter new markets, including the need for certain governmental approvals; its ability to maintain a high rating for its plans on the Five Star Quality Rating System; our ability to develop and maintain satisfactory relationships with care providers that service our members; risks associated with being a government contractor; changes in laws and regulations applicable to its business model; risks related to its indebtedness, including the potential for rising interest rates; changes in market or industry conditions and receptivity to its technology and services; results of litigation or a security incident; and the impact of shortages of qualified personnel and related increases in its labor costs. For a detailed discussion of the risk factors that could affect the Company's actual results, please refer to the risk factors identified in its Annual Report on Form 10-K for the year ended December 31, 2024, and the other periodic reports it files with the SEC. All information provided in this Current Report on Form 8-K is as of the date hereof, and the Company undertakes no duty to update or revise this information unless required by law. This presentation includes certain market and industry data and statistics, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms and our own estimates based on our management’s knowledge of, and experience in, the industry and market in which we compete. Third-party industry publications and forecasts have been obtained from sources we generally believe to be reliable. In addition, certain information contained in this presentation represents management estimates. While we believe our internal estimates to be reasonable, they have not been verified by any independent sources. Such data involve risks and uncertainties and are subject to change. This presentation contains certain “non-GAAP” financial measures within the meaning of Item 10 of Regulation S-K promulgated by the SEC. We believe that non-GAAP financial measures provide an additional way of viewing aspects of our operations that, when viewed with the GAAP results, provide a more complete understanding of our results of operations and the factors and trends affecting our business. These non-GAAP financial measures are also used by our management to evaluate financial results and to plan and forecast future periods. However, non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP. Non-GAAP financial measures used by us may differ from the non-GAAP measures used by other companies, including our competitors. To supplement our consolidated financial statements presented on a GAAP basis, we disclose the following non-GAAP measures: Medical Benefits Ratio, Adjusted EBITDA and Adjusted Gross Profit, as these are performance measures that our management uses to assess our operating performance. Because these measures facilitate internal comparisons of our historical operating performance on a more consistent basis, we use these measures for business planning purposes and in evaluating acquisition opportunities.

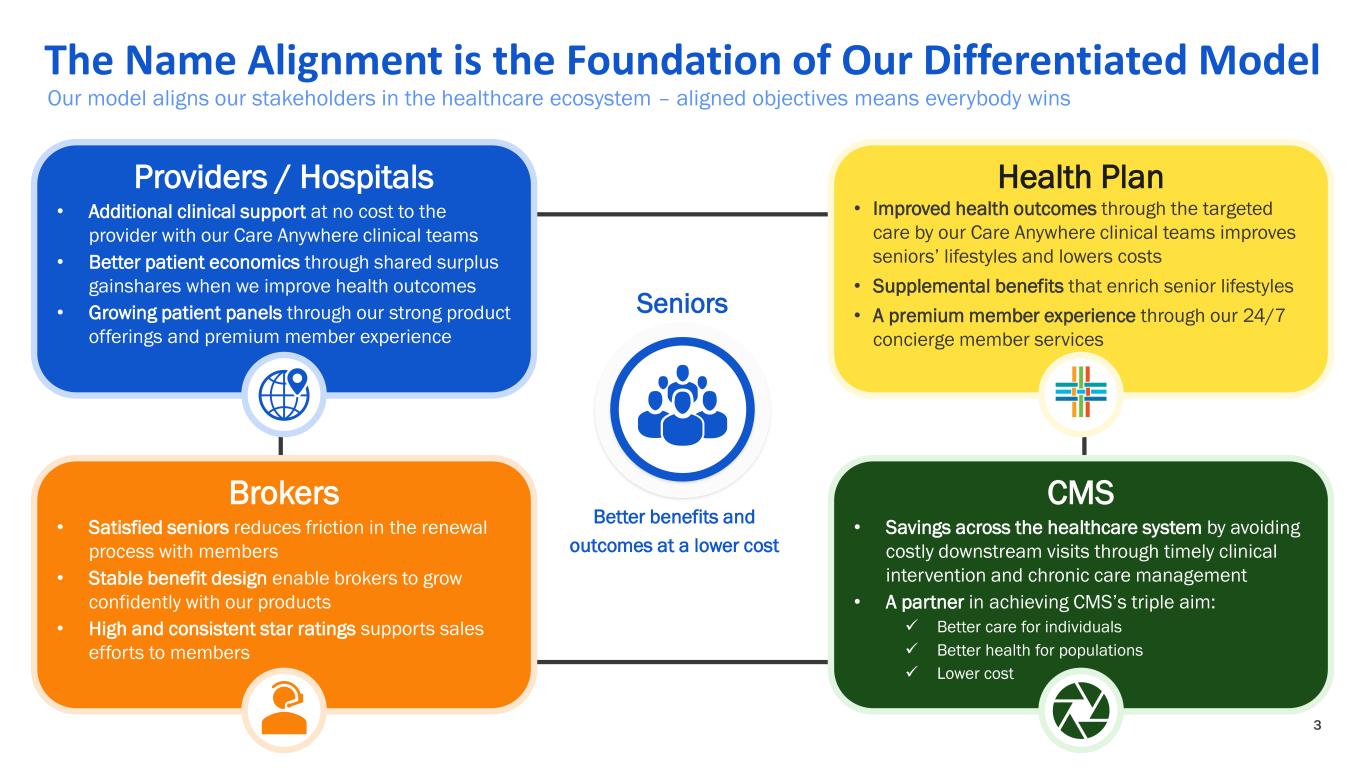

3 The Name Alignment is the Foundation of Our Differentiated Model Our model aligns our stakeholders in the healthcare ecosystem – aligned objectives means everybody wins Providers / Hospitals • Additional clinical support at no cost to the provider with our Care Anywhere clinical teams • Better patient economics through shared surplus gainshares when we improve health outcomes • Growing patient panels through our strong product offerings and premium member experience Brokers • Satisfied seniors reduces friction in the renewal process with members • Stable benefit design enable brokers to grow confidently with our products • High and consistent star ratings supports sales efforts to members Health Plan • Improved health outcomes through the targeted care by our Care Anywhere clinical teams improves seniors’ lifestyles and lowers costs • Supplemental benefits that enrich senior lifestyles • A premium member experience through our 24/7 concierge member services CMS • Savings across the healthcare system by avoiding costly downstream visits through timely clinical intervention and chronic care management • A partner in achieving CMS’s triple aim: ✓ Better care for individuals ✓ Better health for populations ✓ Lower cost Seniors Better benefits and outcomes at a lower cost

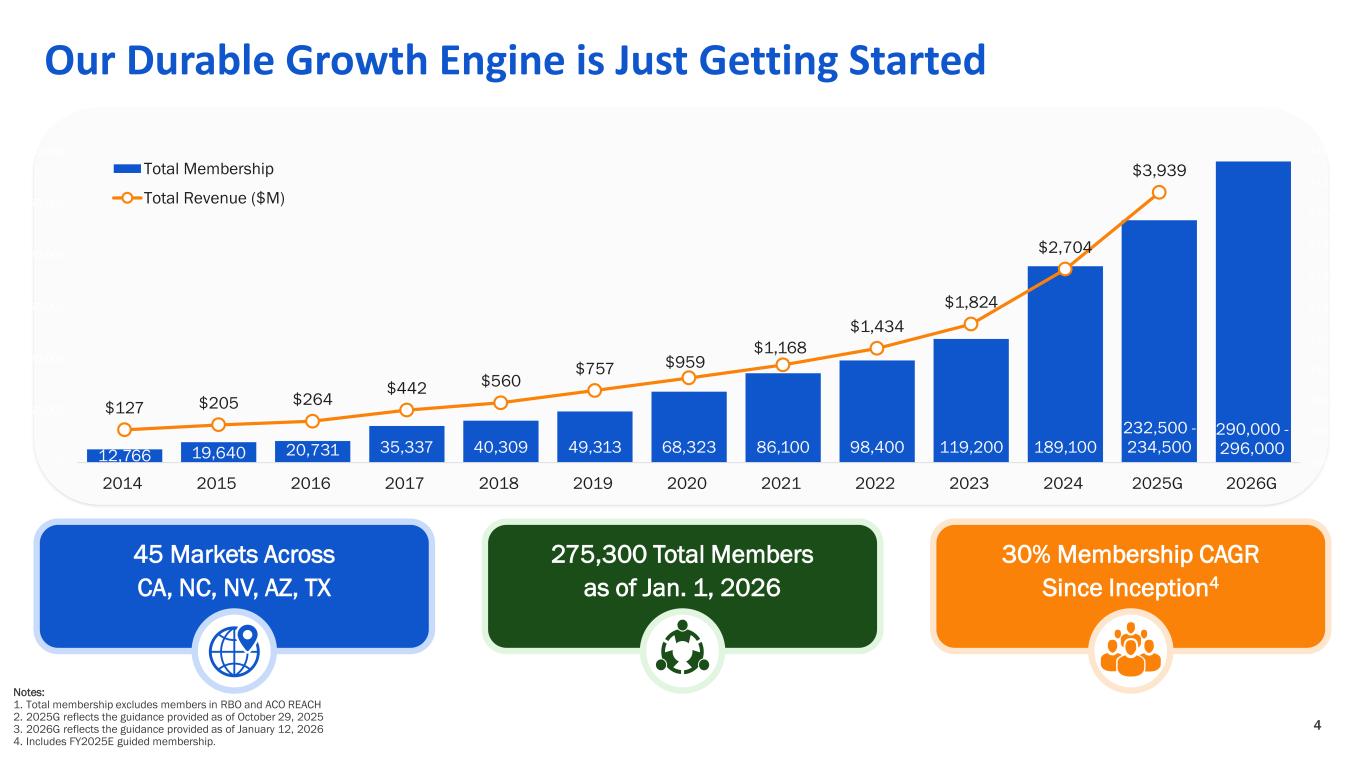

4 Our Durable Growth Engine is Just Getting Started Notes: 1. Total membership excludes members in RBO and ACO REACH 2. 2025G reflects the guidance provided as of October 29, 2025 3. 2026G reflects the guidance provided as of January 12, 2026 4. Includes FY2025E guided membership. 45 Markets Across CA, NC, NV, AZ, TX 275,300 Total Members as of Jan. 1, 2026 30% Membership CAGR Since Inception4 12,766 19,640 20,731 35,337 40,309 49,313 68,323 86,100 98,400 119,200 189,100 232,500 - 234,500 290,000 - 296,000 $127 $205 $264 $442 $560 $757 $959 $1,168 $1,434 $1,824 $2,704 $3,939 ($400) $100 $600 $1,100 $1,600 $2,100 $2,600 $3,100 $3,600 $4,100 $4,600 0 50,000 100,000 150,000 200,000 250,000 300,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025G 2026G Total Membership Total Revenue ($M)

5 Defying Expectations and Industry Trends +129% +1% (37%) (26%) (45%) (52%) (70%) (20%) 30% 80% 130% 180% 01/01/2024 04/01/2024 07/01/2024 10/01/2024 01/01/2025 04/01/2025 07/01/2025 10/01/2025 Trailing 24 Months Share Price Performance ALHC CVS UNH ELV HUM CNC MOH Notes: 1. As of 12/31/2025 ALHC

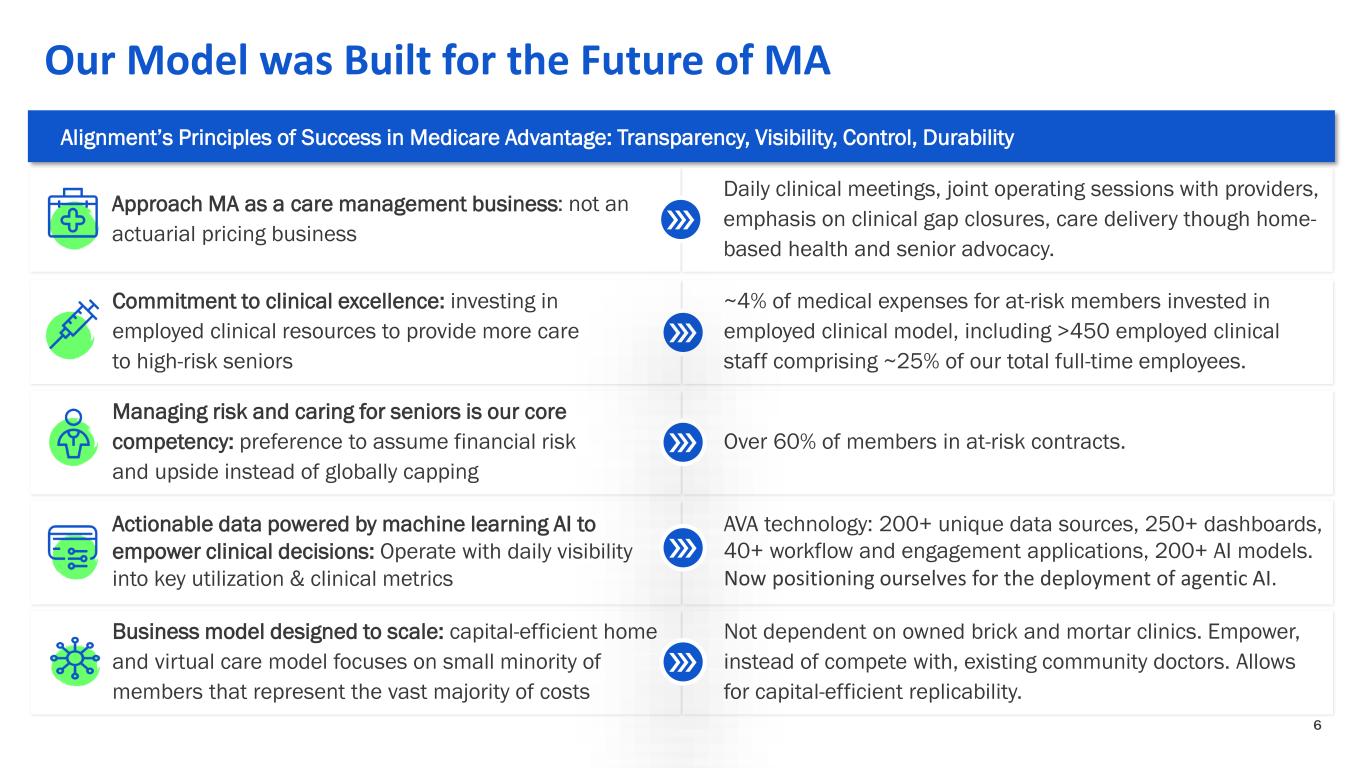

6 Our Model was Built for the Future of MA Commitment to clinical excellence: investing in employed clinical resources to provide more care to high-risk seniors Managing risk and caring for seniors is our core competency: preference to assume financial risk and upside instead of globally capping Actionable data powered by machine learning AI to empower clinical decisions: Operate with daily visibility into key utilization & clinical metrics Business model designed to scale: capital-efficient home and virtual care model focuses on small minority of members that represent the vast majority of costs Approach MA as a care management business: not an actuarial pricing business Alignment’s Principles of Success in Medicare Advantage: Transparency, Visibility, Control, Durability ~4% of medical expenses for at-risk members invested in employed clinical model, including >450 employed clinical staff comprising ~25% of our total full-time employees. Over 60% of members in at-risk contracts. AVA technology: 200+ unique data sources, 250+ dashboards, 40+ workflow and engagement applications, 200+ AI models. Now positioning ourselves for the deployment of agentic AI. Not dependent on owned brick and mortar clinics. Empower, instead of compete with, existing community doctors. Allows for capital-efficient replicability. Daily clinical meetings, joint operating sessions with providers, emphasis on clinical gap closures, care delivery though home- based health and senior advocacy.

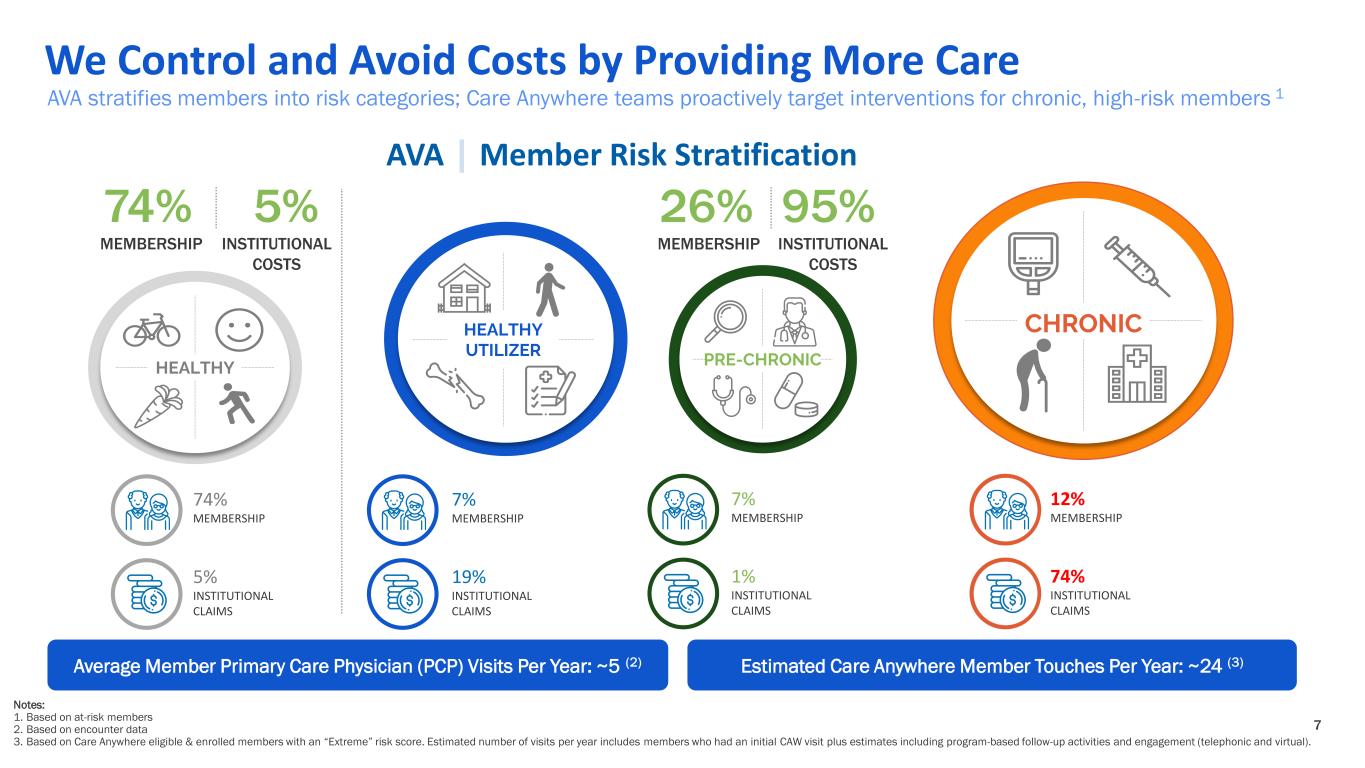

7 74% MEMBERSHIP 5% INSTITUTIONAL CLAIMS 7% MEMBERSHIP 19% INSTITUTIONAL CLAIMS 7% MEMBERSHIP 1% INSTITUTIONAL CLAIMS HEALTHY PRE-CHRONIC HEALTHY UTILIZER Notes: 1. Based on at-risk members 2. Based on encounter data 3. Based on Care Anywhere eligible & enrolled members with an “Extreme” risk score. Estimated number of visits per year includes members who had an initial CAW visit plus estimates including program-based follow-up activities and engagement (telephonic and virtual). 12% MEMBERSHIP 74% INSTITUTIONAL CLAIMS 74% MEMBERSHIP 5% INSTITUTIONAL COSTS 26% MEMBERSHIP 95% INSTITUTIONAL COSTS Average Member Primary Care Physician (PCP) Visits Per Year: ~5 (2) CHRONIC Estimated Care Anywhere Member Touches Per Year: ~24 (3) We Control and Avoid Costs by Providing More Care AVA | Member Risk Stratification AVA stratifies members into risk categories; Care Anywhere teams proactively target interventions for chronic, high-risk members 1

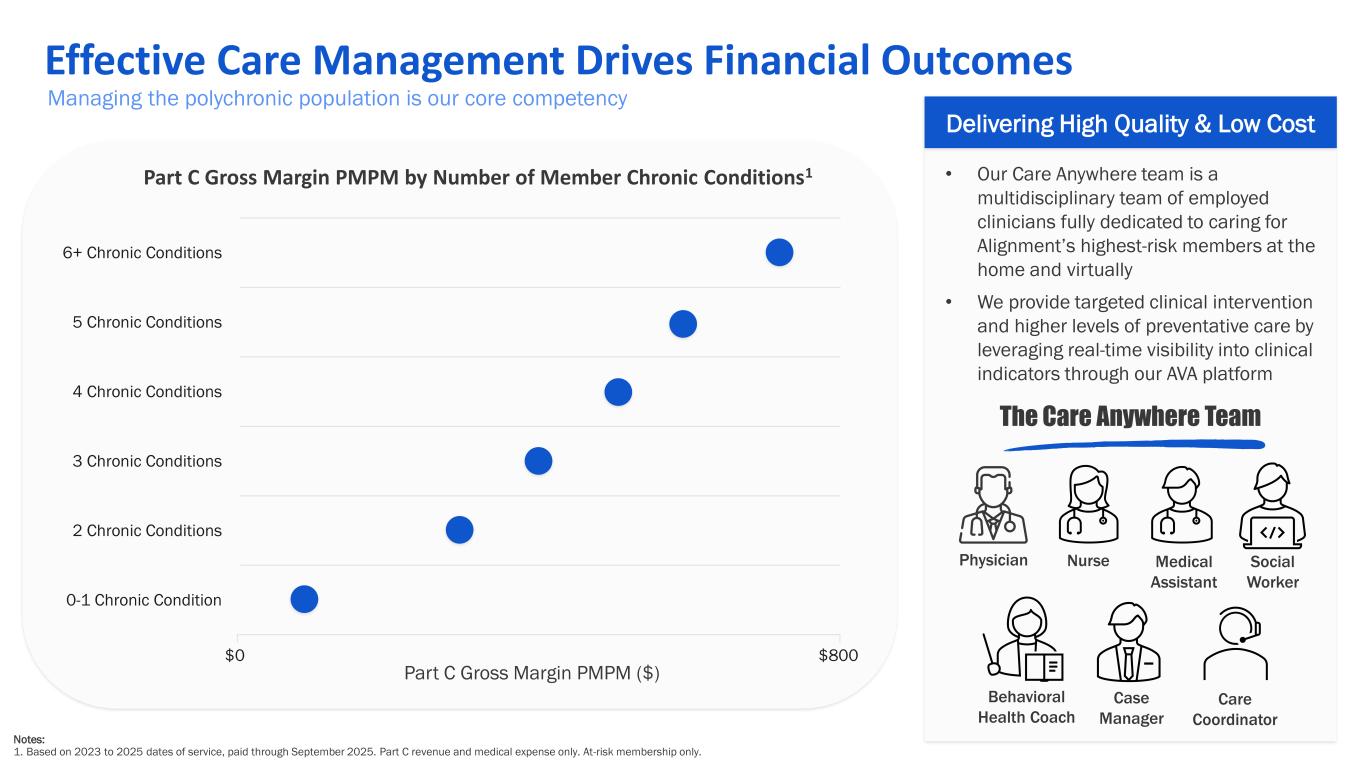

8 $0 $100 $200 $300 $400 $500 $600 $700 $800 0-1 Chronic Condition 2 Chronic Conditions 3 Chronic Conditions 4 Chronic Conditions 5 Chronic Conditions 6+ Chronic Conditions Effective Care Management Drives Financial Outcomes Notes: 1. Based on 2023 to 2025 dates of service, paid through September 2025. Part C revenue and medical expense only. At-risk membership only. Part C Gross Margin PMPM by Number of Member Chronic Conditions1 • Our Care Anywhere team is a multidisciplinary team of employed clinicians fully dedicated to caring for Alignment’s highest-risk members at the home and virtually • We provide targeted clinical intervention and higher levels of preventative care by leveraging real-time visibility into clinical indicators through our AVA platform Delivering High Quality & Low Cost Managing the polychronic population is our core competency The Care Anywhere Team Physician Nurse Case Manager Behavioral Health Coach Care Coordinator Medical Assistant Social Worker Part C Gross Margin PMPM ($)

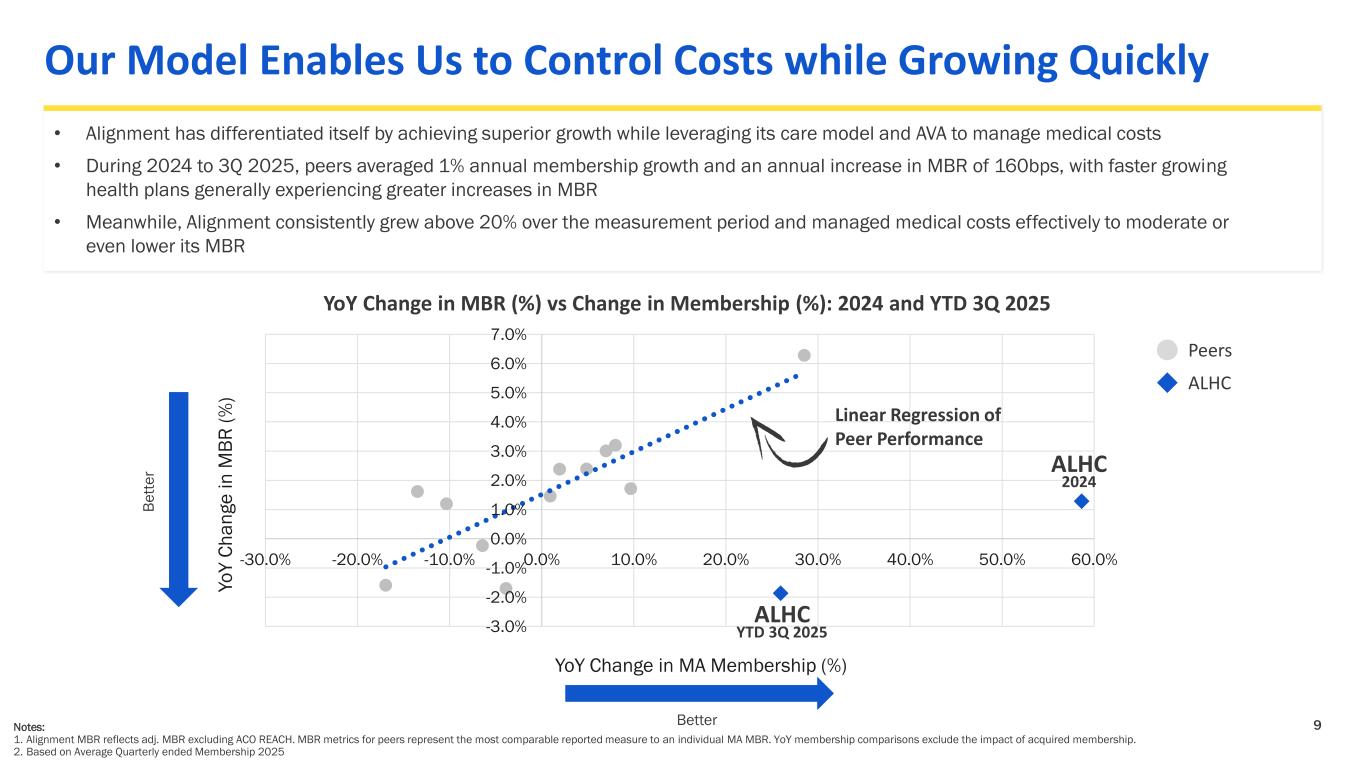

9 Our Model Enables Us to Control Costs while Growing Quickly Notes: 1. Alignment MBR reflects adj. MBR excluding ACO REACH. MBR metrics for peers represent the most comparable reported measure to an individual MA MBR. YoY membership comparisons exclude the impact of acquired membership. 2. Based on Average Quarterly ended Membership 2025 • Alignment has differentiated itself by achieving superior growth while leveraging its care model and AVA to manage medical costs • During 2024 to 3Q 2025, peers averaged 1% annual membership growth and an annual increase in MBR of 160bps, with faster growing health plans generally experiencing greater increases in MBR • Meanwhile, Alignment consistently grew above 20% over the measurement period and managed medical costs effectively to moderate or even lower its MBR -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% -30.0% -20.0% -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% Y o Y C h a n g e i n M B R ( % ) YoY Change in MA Membership (%) YoY Change in MBR (%) vs Change in Membership (%): 2024 and YTD 3Q 2025 B e tt e r Better ALHC 2024 ALHC YTD 3Q 2025 Linear Regression of Peer Performance Peers ALHC

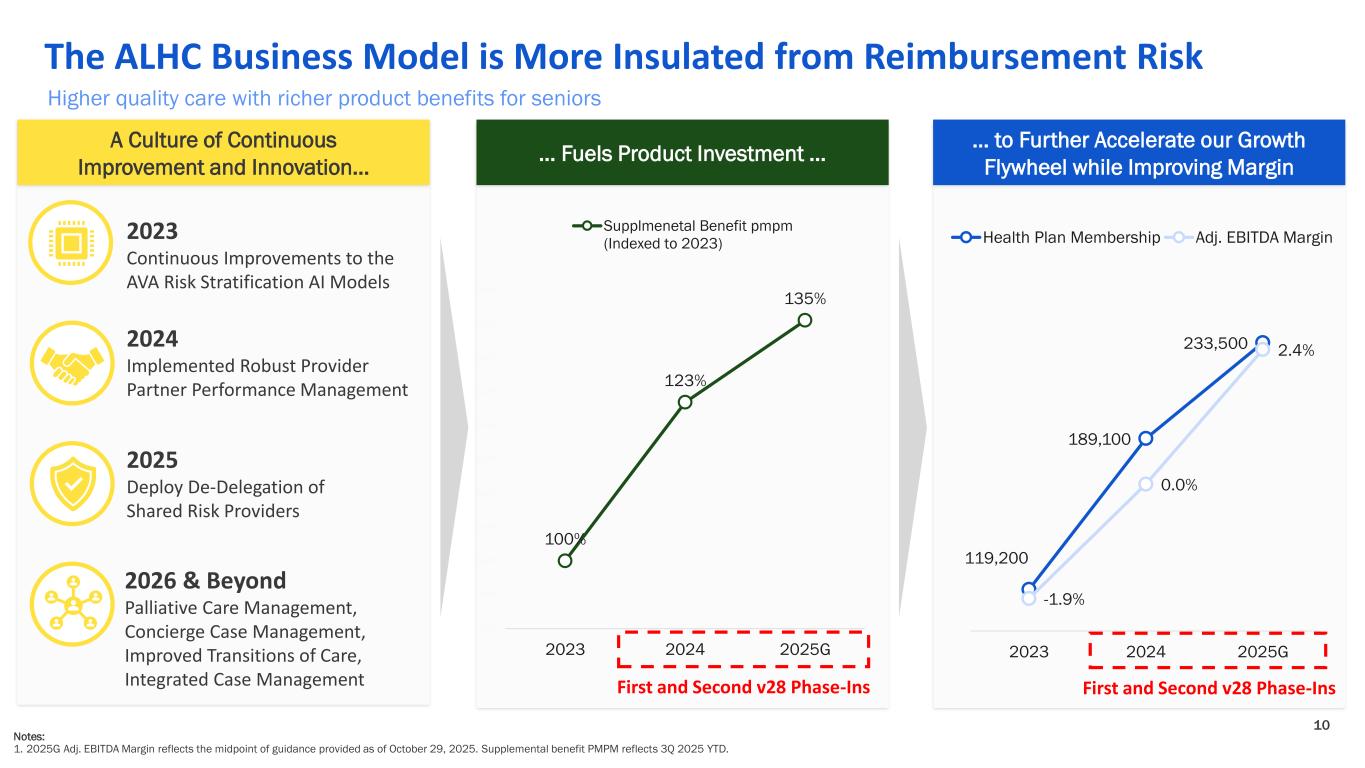

10 The ALHC Business Model is More Insulated from Reimbursement Risk … Fuels Product Investment … 100% 123% 135% 90% 95% 100% 105% 110% 115% 120% 125% 130% 135% 140% 2023 2024 2025G Supplmenetal Benefit pmpm (Indexed to 2023) 2023 Continuous Improvements to the AVA Risk Stratification AI Models 2024 Implemented Robust Provider Partner Performance Management 2025 Deploy De-Delegation of Shared Risk Providers 2026 & Beyond Palliative Care Management, Concierge Case Management, Improved Transitions of Care, Integrated Case Management A Culture of Continuous Improvement and Innovation… … to Further Accelerate our Growth Flywheel while Improving Margin Notes: 1. 2025G Adj. EBITDA Margin reflects the midpoint of guidance provided as of October 29, 2025. Supplemental benefit PMPM reflects 3Q 2025 YTD. First and Second v28 Phase-Ins 119,200 189,100 233,500 -1.9% 0.0% 2.4% -2.5% -1.5% -0.5% 0.5% 1.5% 2.5% 3.5% 100,000 120,000 140,000 160,000 180,000 200,000 220,000 240,000 260,000 2023 2024 2025G Health Plan Membership Adj. EBITDA Margin First and Second v28 Phase-Ins Higher quality care with richer product benefits for seniors

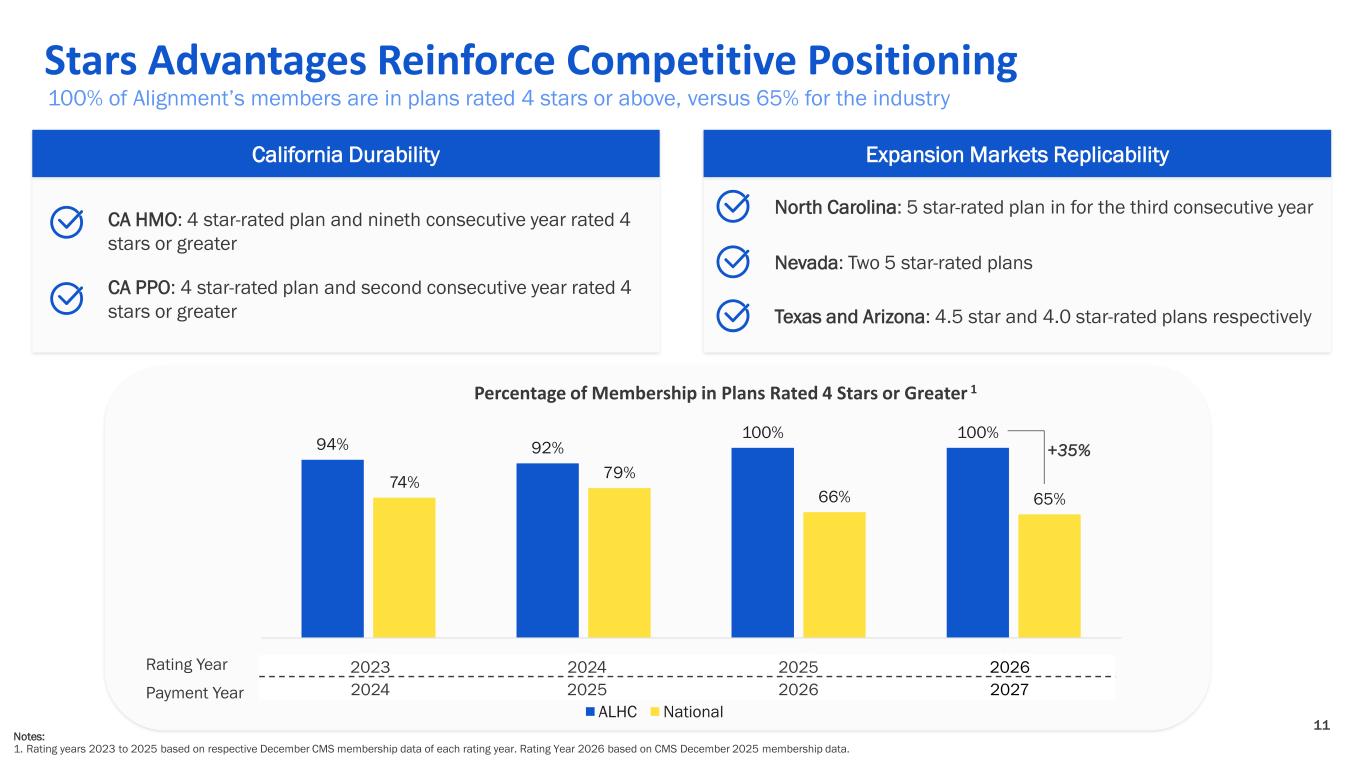

11 California Durability Expansion Markets Replicability 94% 92% 100% 100% 74% 79% 66% 65% 2023 2024 2025 2026 ALHC National Stars Advantages Reinforce Competitive Positioning 100% of Alignment’s members are in plans rated 4 stars or above, versus 65% for the industry Rating Year Payment Year 2023 2024 2025 2026 2024 2025 2026 2027 Percentage of Membership in Plans Rated 4 Stars or Greater 1 North Carolina: 5 star-rated plan in for the third consecutive year Nevada: Two 5 star-rated plans Texas and Arizona: 4.5 star and 4.0 star-rated plans respectively Notes: 1. Rating years 2023 to 2025 based on respective December CMS membership data of each rating year. Rating Year 2026 based on CMS December 2025 membership data. +35% CA HMO: 4 star-rated plan and nineth consecutive year rated 4 stars or greater CA PPO: 4 star-rated plan and second consecutive year rated 4 stars or greater

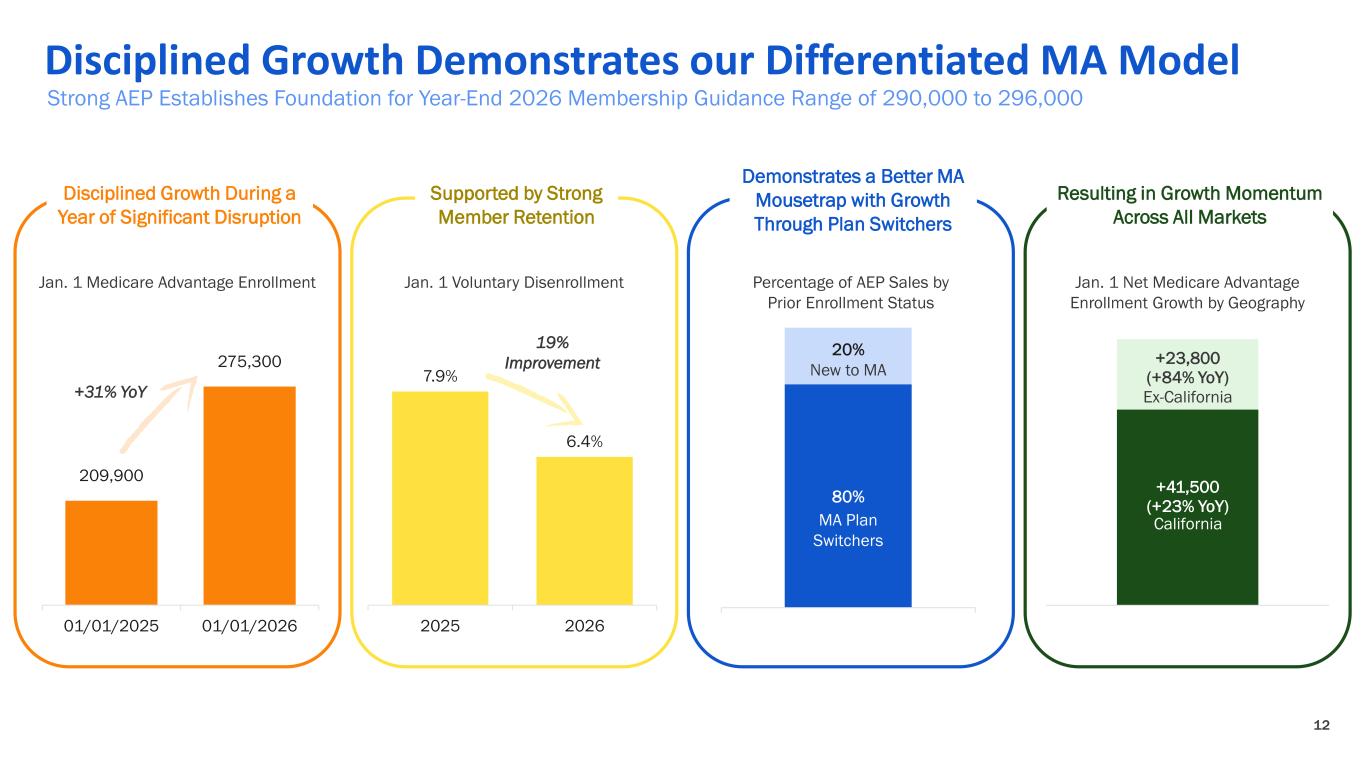

12 Disciplined Growth Demonstrates our Differentiated MA Model Strong AEP Establishes Foundation for Year-End 2026 Membership Guidance Range of 290,000 to 296,000 80% 20% 01/01/1900 New to MA MA Plan Switchers 209,900 275,300 01/01/2025 01/01/2026 Disciplined Growth During a Year of Significant Disruption Jan. 1 Medicare Advantage Enrollment Percentage of AEP Sales by Prior Enrollment Status +31% YoY Jan. 1 Net Medicare Advantage Enrollment Growth by Geography +41,500 (+23% YoY) +23,800 (+84% YoY) 1 California Ex-California Supported by Strong Member Retention Jan. 1 Voluntary Disenrollment Resulting in Growth Momentum Across All Markets Demonstrates a Better MA Mousetrap with Growth Through Plan Switchers 7.9% 6.4% 2025 2026 19% Improvement

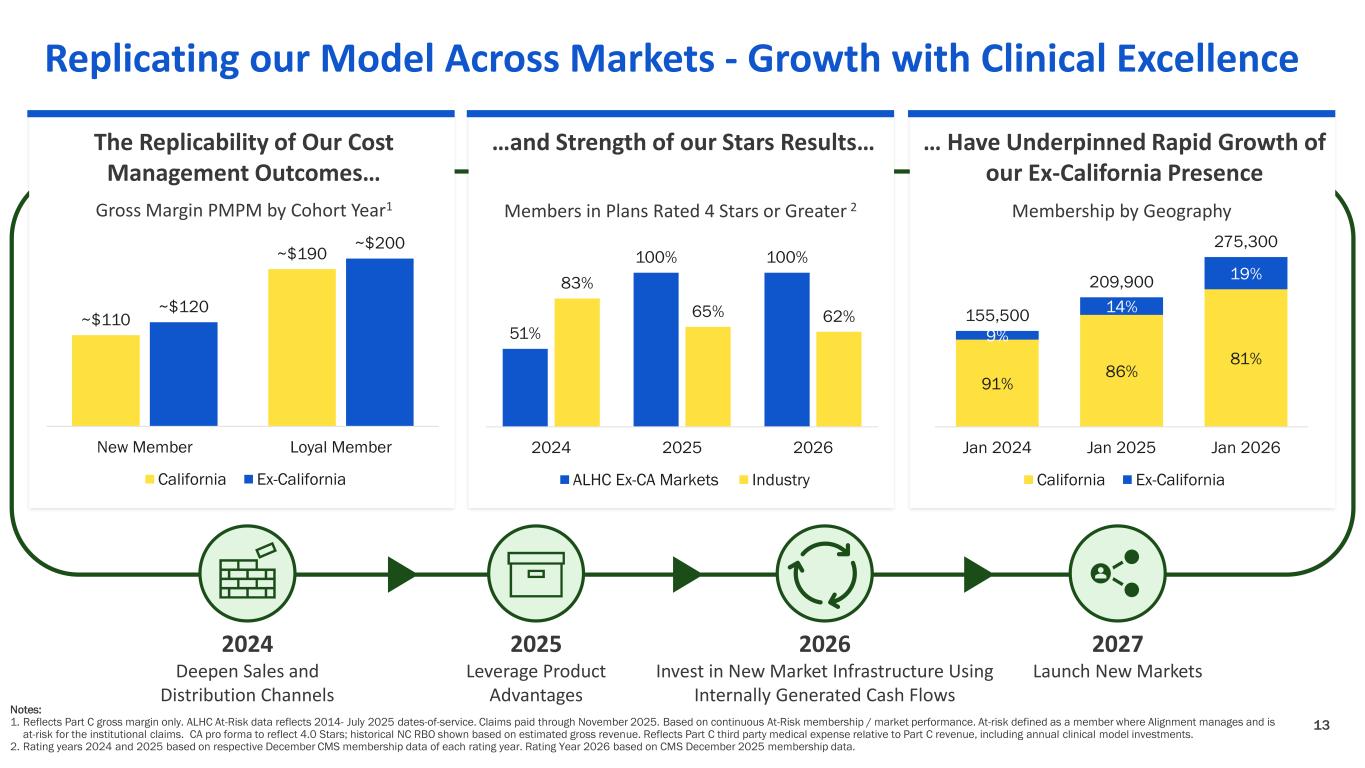

13 Replicating our Model Across Markets - Growth with Clinical Excellence 2024 Deepen Sales and Distribution Channels 2025 Leverage Product Advantages 2026 Invest in New Market Infrastructure Using Internally Generated Cash Flows 2027 Launch New Markets 51% 100% 100% 83% 65% 62% 2024 2025 2026 ALHC Ex-CA Markets Industry … Have Underpinned Rapid Growth of our Ex-California Presence 91% 86% 81% 9% 14% 19% 155,500 209,900 275,300 Jan 2024 Jan 2025 Jan 2026 California Ex-California The Replicability of Our Cost Management Outcomes… …and Strength of our Stars Results… Members in Plans Rated 4 Stars or Greater 2Gross Margin PMPM by Cohort Year1 Membership by Geography ~$110 ~$190 ~$120 ~$200 New Member Loyal Member California Ex-California Notes: 1. Reflects Part C gross margin only. ALHC At-Risk data reflects 2014- July 2025 dates-of-service. Claims paid through November 2025. Based on continuous At-Risk membership / market performance. At-risk defined as a member where Alignment manages and is at-risk for the institutional claims. CA pro forma to reflect 4.0 Stars; historical NC RBO shown based on estimated gross revenue. Reflects Part C third party medical expense relative to Part C revenue, including annual clinical model investments. 2. Rating years 2024 and 2025 based on respective December CMS membership data of each rating year. Rating Year 2026 based on CMS December 2025 membership data.

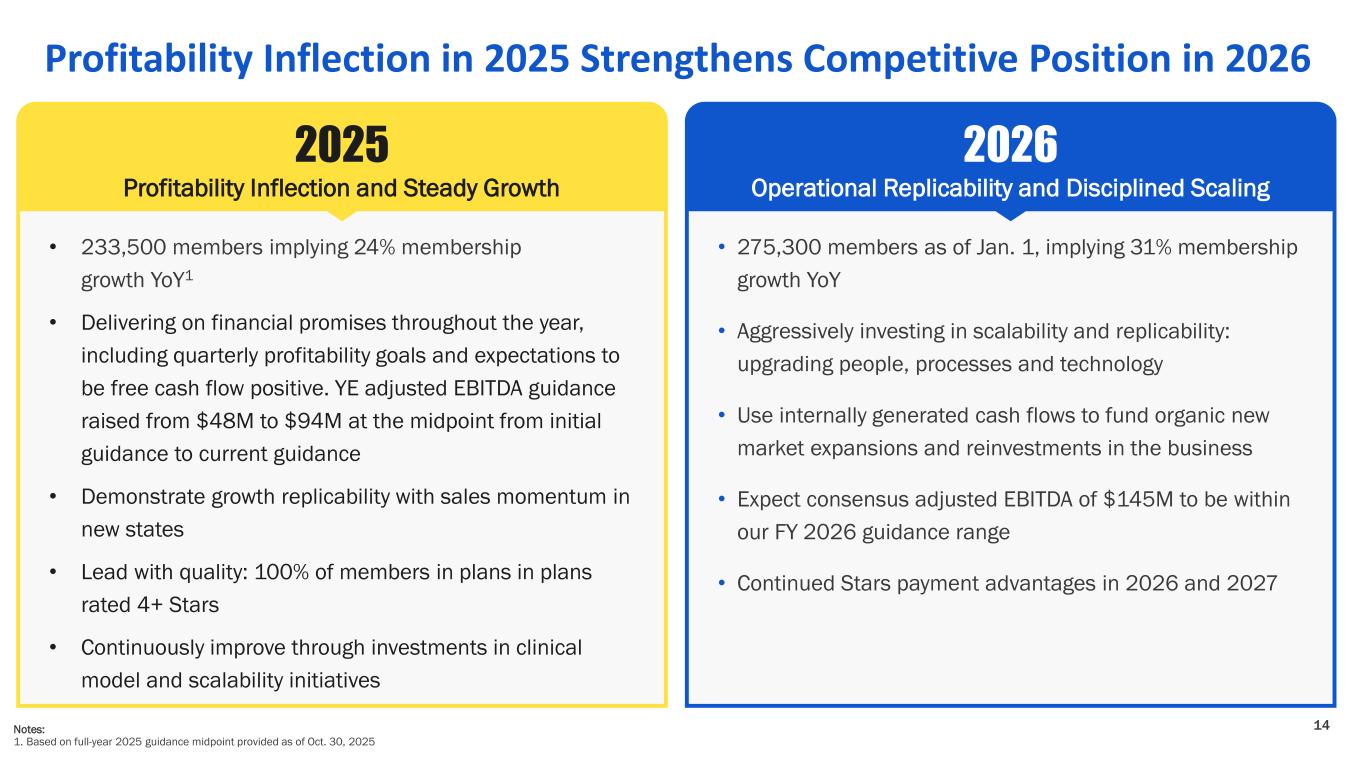

14 • 233,500 members implying 24% membership growth YoY1 • Delivering on financial promises throughout the year, including quarterly profitability goals and expectations to be free cash flow positive. YE adjusted EBITDA guidance raised from $48M to $94M at the midpoint from initial guidance to current guidance • Demonstrate growth replicability with sales momentum in new states • Lead with quality: 100% of members in plans in plans rated 4+ Stars • Continuously improve through investments in clinical model and scalability initiatives Profitability Inflection in 2025 Strengthens Competitive Position in 2026 Notes: 1. Based on full-year 2025 guidance midpoint provided as of Oct. 30, 2025 2025 Profitability Inflection and Steady Growth • 275,300 members as of Jan. 1, implying 31% membership growth YoY • Aggressively investing in scalability and replicability: upgrading people, processes and technology • Use internally generated cash flows to fund organic new market expansions and reinvestments in the business • Expect consensus adjusted EBITDA of $145M to be within our FY 2026 guidance range • Continued Stars payment advantages in 2026 and 2027 2026 Operational Replicability and Disciplined Scaling

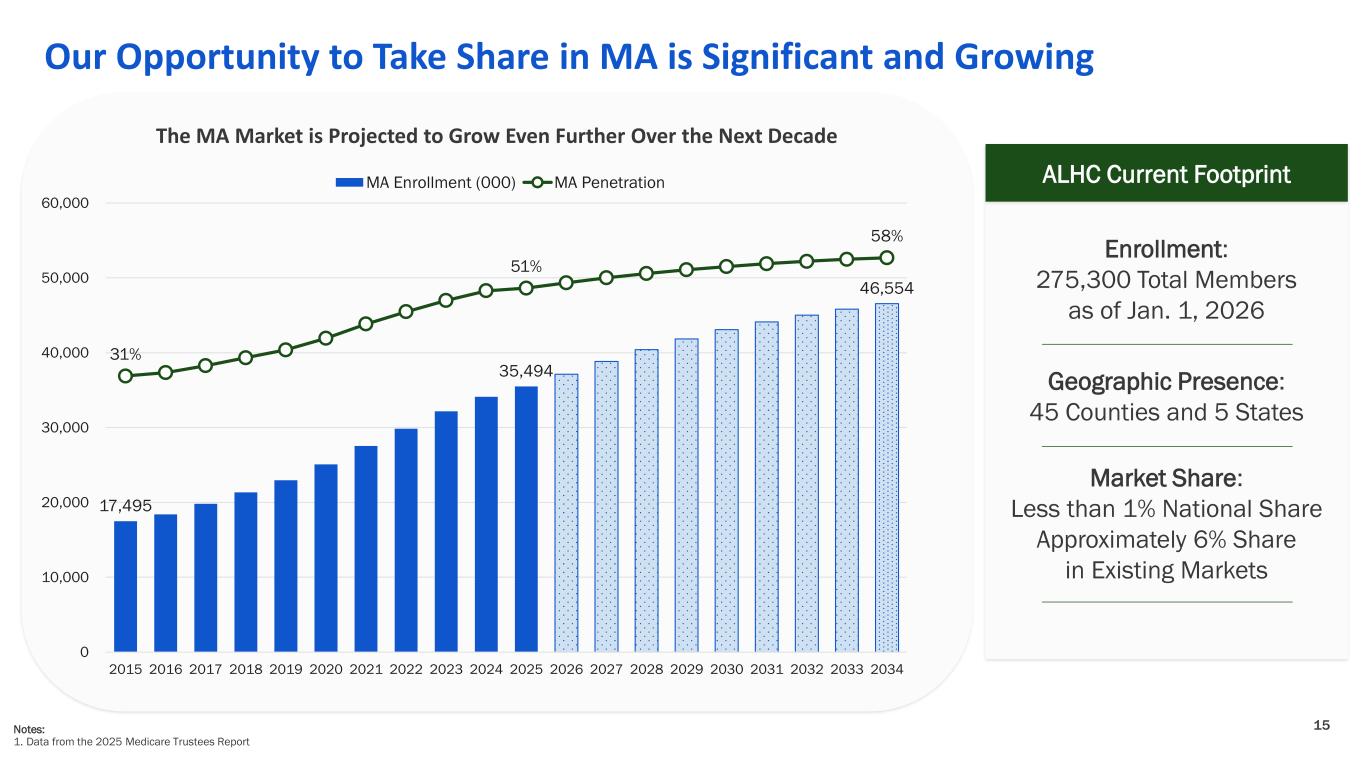

15 Our Opportunity to Take Share in MA is Significant and Growing 17,495 35,494 46,554 31% 51% 58% -30% -20% -10% 0% 10% 20% 30% 40% 50% 60% 70% 0 10,000 20,000 30,000 40,000 50,000 60,000 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 MA Enrollment (000) MA Penetration Notes: 1. Data from the 2025 Medicare Trustees Report The MA Market is Projected to Grow Even Further Over the Next Decade ALHC Current Footprint Enrollment: 275,300 Total Members as of Jan. 1, 2026 Geographic Presence: 45 Counties and 5 States Market Share: Less than 1% National Share Approximately 6% Share in Existing Markets

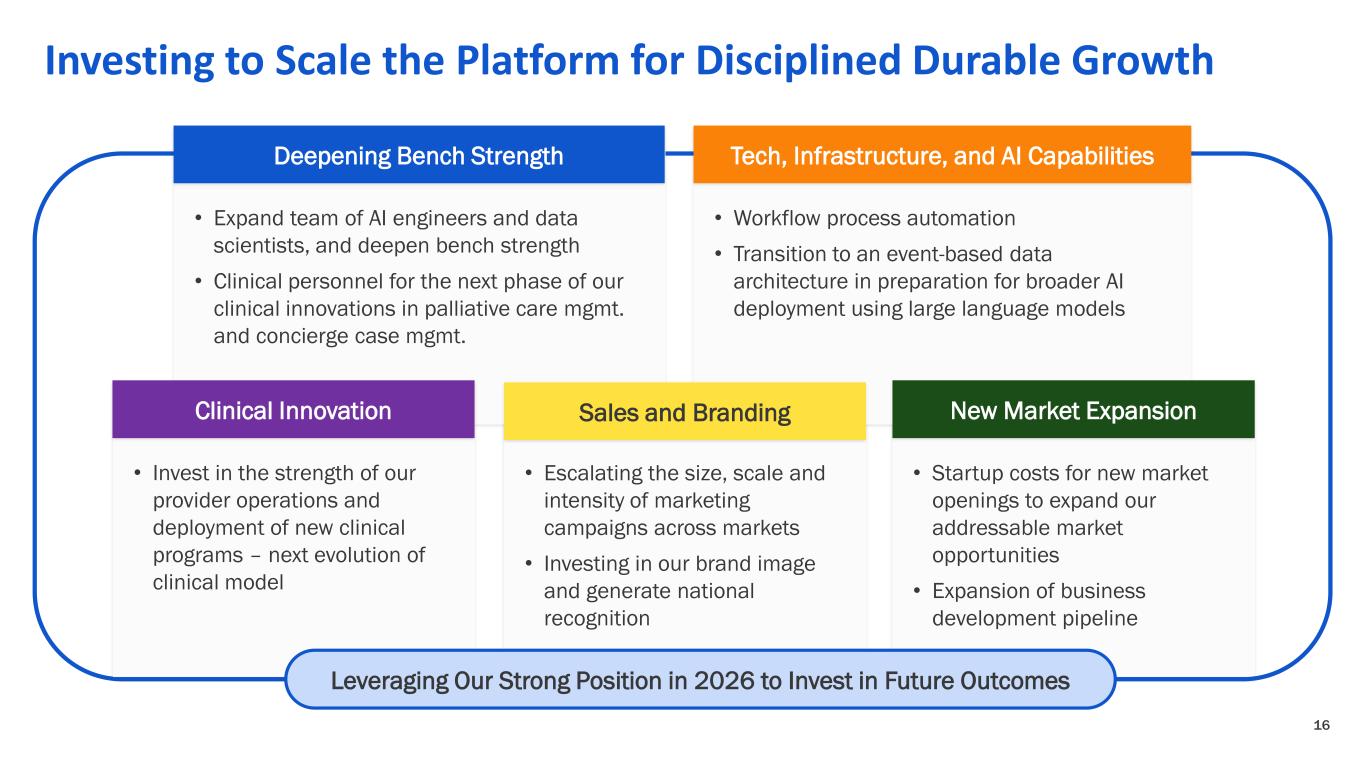

16 • Startup costs for new market openings to expand our addressable market opportunities • Expansion of business development pipeline • Escalating the size, scale and intensity of marketing campaigns across markets • Investing in our brand image and generate national recognition • Workflow process automation • Transition to an event-based data architecture in preparation for broader AI deployment using large language models Investing to Scale the Platform for Disciplined Durable Growth • Expand team of AI engineers and data scientists, and deepen bench strength • Clinical personnel for the next phase of our clinical innovations in palliative care mgmt. and concierge case mgmt. Deepening Bench Strength Tech, Infrastructure, and AI Capabilities Sales and Branding • Invest in the strength of our provider operations and deployment of new clinical programs – next evolution of clinical model Clinical Innovation New Market Expansion Leveraging Our Strong Position in 2026 to Invest in Future Outcomes