UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ Preliminary Proxy Statement |

||

|

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||

|

☒ Definitive Proxy Statement |

||

|

☐ Definitive Additional Materials |

||

|

☐ Soliciting Material Pursuant to §240.14a-12 |

||

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2000 Pisgah Church Road

Greensboro, North Carolina 27455

(336) 510-7840

NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 21, 2025

To our Stockholders:

Notice is hereby given that the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Guerrilla RF, Inc. (the “Company”) will be held on May 21, 2025, at 9:00 a.m., Eastern Time.

The Annual Meeting will be held in a virtual meeting format only. Instructions on how to participate virtually will be provided on our website, www.guerrilla-rf.com, under the heading “Investor Relations – Events.” Stockholders who wish to participate in the Annual Meeting should contact Sam Funchess, Vice President of Corporate Development, at 336-579-5320 or sfunchess@guerrilla-rf.com before 5:00 p.m. Eastern Time on May 20, 2025. Upon verification of stock ownership as of the record date, participating stockholders will be provided with information that will enable them to join the Annual Meeting via Zoom. Stockholders are encouraged to vote their shares prior to the Annual Meeting, as directed on the proxy card, the Notice of Internet Availability of Proxy Materials or the information forwarded by your bank, broker or other holder of record.

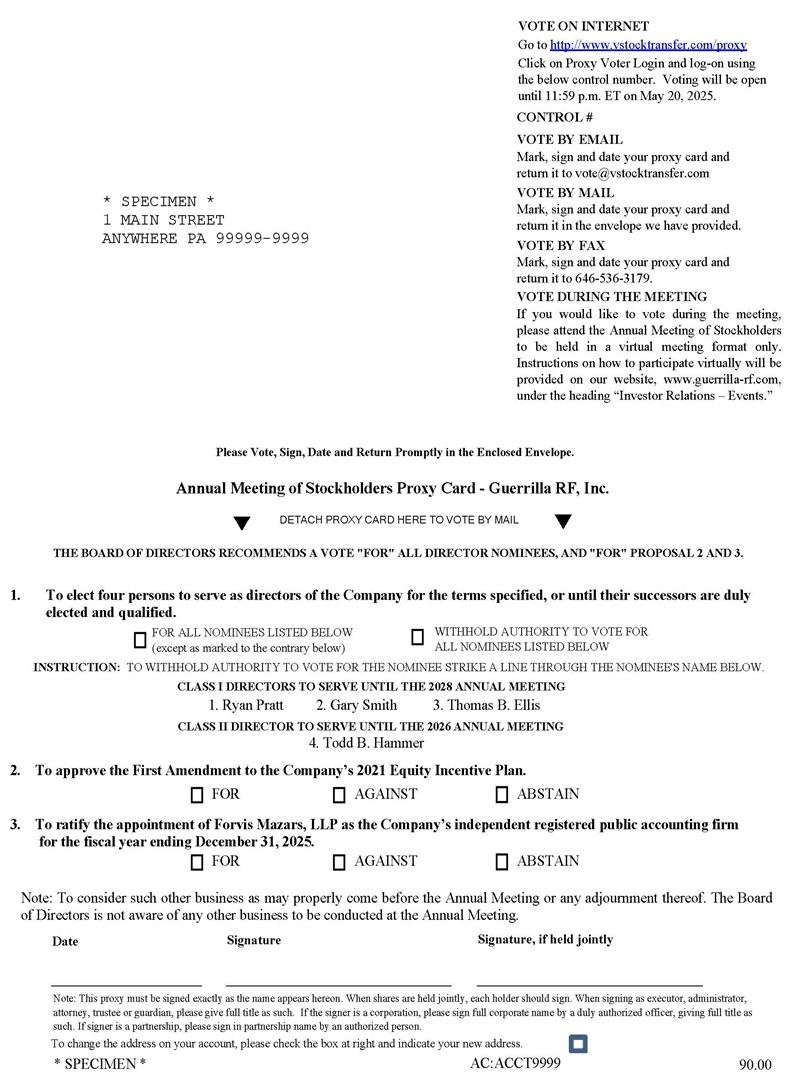

The purpose of the Annual Meeting is to consider and act upon the following proposals:

|

1. |

to elect four persons to serve as directors of the Company for the terms specified, or until their successors are duly elected and qualified; |

|

2. |

to approve the First Amendment to the Company’s 2021 Equity Incentive Plan; |

|

3. |

to ratify the appointment of Forvis Mazars, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025; and |

to consider such other business as may properly come before the Annual Meeting or any adjournment thereof. The Board of Directors is not aware of any other business to be conducted at the Annual Meeting.

Holders of record of shares of common stock and preferred stock at the close of business on March 24, 2025, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. In the event there are not sufficient shares present in person (including participation virtually/online) or by proxy to constitute a quorum or to approve or ratify any proposal at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

|

This 31st day of March 2025. |

|

|

|

|

Yours very truly, |

|

|

|

|

|

|

|

|

|

|

|

Ryan Pratt |

|

|

|

Chief Executive Officer and Chairman |

|

You may vote your shares of common and preferred stock at the Annual Meeting, over the Internet, by mail or in person. You are urged, regardless of the number of shares you hold, to register your proxy promptly by following the instructions on the accompanying proxy card, the Notice of Internet Availability of Proxy Materials or the information forwarded by your bank, broker or other holder of record. In the event that you attend the Annual Meeting in person, you may revoke your proxy and vote your shares in person.

PROXY STATEMENT

Annual Meeting of Stockholders

To Be Held on May 21, 2025

This Proxy Statement is being furnished to our stockholders on or about March 31, 2025, for solicitation of proxies by the Board of Directors (the “Board”) of your company, Guerrilla RF, Inc. Our principal executive offices are located at 2000 Pisgah Church Road, Greensboro, North Carolina 27455.

We were incorporated in the State of Delaware as Laffin Acquisition Corp. on November 9, 2020. On October 22, 2021, our wholly-owned subsidiary, Guerrilla RF Acquisition Co., a Delaware corporation, merged with and into Guerrilla RF, Inc., a privately held Delaware corporation (“Private Guerrilla RF”) formed on June 23, 2014 (the “Merger”). Following the Merger, Private Guerrilla RF was the surviving entity and became our wholly-owned subsidiary, and all of the outstanding stock of Private Guerrilla RF was converted into shares of our common stock. As a result of the Merger, the business of Private Guerrilla RF became our business. Also, on October 22, 2021, we changed our name to “Guerrilla RF, Inc.” and we changed the name of our subsidiary, Private Guerrilla RF, to “Guerrilla RF Operating Corporation.” In May 2023, Guerrilla RF Operating Corporation was merged with and into Guerrilla RF, Inc.

Our common stock is currently quoted on the OTCQX® marketplace under the symbol “GUER”.

As used in this Proxy Statement, terms such as “we,” “us,” “our,” and the “Company” refer to Guerrilla RF, Inc. and, for periods prior to October 22, 2021, Private Guerrilla RF; the terms “you” and “your” refer to the stockholders of the Company; the term “common stock” refers to the Company’s common stock, $0.0001 par value per share; the term “preferred stock” refers to the Company’s Series A convertible preferred stock, $0.0001 par value per share; and the term "voting stock” refers to the common stock and preferred stock.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (commonly referred to as the “JOBS Act”). As an emerging growth company, we are currently exempt from certain requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, holding a non-binding advisory vote on executive compensation.

We are also a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). For so long as we remain a smaller reporting company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are applicable to other public companies that are not smaller reporting companies.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 21, 2025

You may access the Notice of Annual Meeting, Proxy Statement, and the Annual Report on Form 10-K for the year ended December 31, 2024, on our website by going to www.guerrilla-rf.com, under the heading Investor Relations/Company/Stockholder Meeting.

INFORMATION ABOUT THE ANNUAL MEETING

Your vote is very important. For this reason, our Board is requesting that you allow your shares of voting stock to be represented at the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) by the proxies named on the proxy card. Voting in advance by proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend. Returning a proxy does not affect your right to attend the Annual Meeting online or to vote your shares during the Annual Meeting.

|

When is the Annual Meeting? |

May 21, 2025, at 9:00 a.m., Eastern Standard Time |

|

|

Where will the Annual Meeting be held? |

This year, stockholder participation in the Annual Meeting will be virtual (online) only. Instructions on how to participate virtually will be provided on our website, www.guerrilla-rf.com, under the heading “Investor Relations – Events.” Please contact Sam Funchess, Vice President of Corporate Development, at 336-579-5320 or sfunchess@guerrilla-rf.com before 5:00 p.m. Eastern Time on May 20, 2025, if you wish to participate in the Annual Meeting. |

|

|

What items will be voted on at the Annual Meeting? |

1. |

ELECTION OF DIRECTORS. To elect four persons to serve as directors of the Company for the terms specified or until their successors are duly elected and qualified; |

| 2. | APPROVAL OF FIRST AMENDMENT TO THE COMPANY’S 2021 EQUITY INCENTIVE PLAN. To approve certain amendments to the Company’s 2021 Equity Incentive Plan (the “2021 Plan”) in order to cancel the “evergreen” provision and authorize an additional 1.5 million shares of common stock for issuance thereunder (the “First Amendment”); | |

| 3. | RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. To ratify the appointment of Forvis Mazars, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025; and | |

| to consider such other business as may properly come before the Annual Meeting or any adjournment thereof. The Board is not aware of any other business to be conducted at the Annual Meeting. | ||

|

Who can vote? |

Only holders of record of shares of voting stock at the close of business on March 24, 2025 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. On the Record Date, there were 10,326,940 shares of common stock outstanding and entitled to vote and approximately 683 beneficial owners and approximately 211 stockholders of record and 22,000 shares of preferred shares held by one stockholder of record. There is no other class of voting stock outstanding. |

|

|

How do I vote by proxy? |

You may vote your shares by submitting your proxy in accordance with the instructions on the proxy card or the information forwarded by your bank, broker or other holder of record.

The shares represented by a proxy card will be voted at the Annual Meeting if the proxy card is properly signed, dated, and received by VStock Transfer LLC (“VStock”), our transfer agent, prior to the time of the Annual Meeting. You may also vote your shares over the Internet. You should refer to the proxy card or the information forwarded by your bank, broker, or other holder of record to see what voting options are available to you. |

|

|

If you return your signed proxy card before the Annual Meeting, the proxies (our Board) will vote your shares as you direct.

The Internet voting facilities will close at 11:59 p.m., Eastern Standard Time, on May 20, 2025. If you vote over the Internet, you may incur costs, such as telephone and Internet access charges, for which you will be responsible. If you are interested in voting via the Internet, specific instructions are shown on the proxy card or the information forwarded by your bank, broker or other holder of record. The Internet voting procedures are designed to authenticate your identity and allow you to vote your shares, and confirm that your instructions have been properly recorded.

For the election of directors, you may vote “FOR” (i) all of the nominees, (ii) none of the nominees, or (iii) all of the nominees except those you designate. If a nominee becomes unavailable for election at any time at or before the Annual Meeting, the proxies may vote your shares for a substitute nominee. For each other item of business, you may vote “FOR” or “AGAINST” or you may “ABSTAIN” from voting.

If you submit your proxy but do not specify how you want to vote your shares, the proxies will vote them “FOR” the election of all of our nominees, “FOR” the First Amendment, and “FOR” the ratification of Forvis Mazars, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025. If any other matters are properly presented for consideration at the Annual Meeting, the proxies will have the discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. If your shares are held in an account with a brokerage firm, bank, or other nominee (i.e., held in “street name”), you will need to obtain a proxy instruction form from the broker, bank, or other nominee holding your shares and return the form as directed by your broker or other nominee.

We are not aware of any other matters to be brought before the Annual Meeting. If matters other than those discussed above are properly brought before the Annual Meeting, the proxies may vote your shares in accordance with their best judgment. |

||

|

How do I change or revoke my proxy? |

You may change or revoke your proxy at any time before it is voted at the Annual Meeting in any of four (4) ways: (i) by delivering a written notice of revocation to VStock; (ii) by delivering a properly signed proxy card to VStock with a more recent date than that of the proxy first given; (iii) by attending the Annual Meeting and voting in person; or (iv) by delivering a timely and valid later Internet or telephone vote. You should deliver your written notice or superseding proxy to VStock at the address noted on the proxy card. |

|

|

How many votes may I cast? |

You are entitled to one vote for each share of voting stock held of record on March 24, 2025, on each nominee for election and on each other matter presented for a vote at the Annual Meeting. You may not vote your shares cumulatively in the election of directors. |

|

|

How many votes are required to approve the proposals? |

Director nominees will be elected by a plurality of the votes cast by the holders of shares entitled to vote in the election of directors at the Annual Meeting. Abstentions from voting and broker non-votes, if any, are not treated as votes cast and, therefore, will have no effect on the proposal to elect directors.

The proposal to approve the First Amendment will be approved if the votes cast in favor exceed the votes cast in opposition. Abstentions from voting and broker non-votes, if any, are not treated as votes cast and, therefore, will have no effect on the proposal to approve the First Amendment.

The proposal to ratify the appointment of Forvis Mazars, LLP as the Company’s independent registered public accounting firm for 2025 will be approved if the votes cast in favor exceed the votes cast in opposition. Abstentions from voting and broker non-votes, if any, are not treated as votes cast and, therefore, will have no effect on the proposal to ratify Forvis Mazars, LLP as the Company’s independent registered public accounting firm for 2025.

Any other matters properly coming before the Annual Meeting will require such stockholder approval as is required by applicable law or our governing documents.

If you hold your shares in “street name” through a brokerage firm, bank, or other nominee, your broker, bank, or other nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker, bank, or other nominee specific instructions, your shares may not be voted on those matters. However, shares represented by such “broker non-votes” will be counted in determining whether there is a quorum at the Annual Meeting or any adjournment thereof.

A “broker non-vote” occurs when a broker or other nominee who holds shares for a beneficial owner does not vote on a particular matter because the broker or other nominee lacks discretionary authority on that matter and has not received voting instructions from the beneficial owner of the shares.

In the event there are insufficient votes present at the Annual Meeting for a quorum or to approve any proposal, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies. |

|

|

What constitutes a “quorum” for the Annual Meeting? |

A majority of our outstanding shares entitled to vote at the Annual Meeting, present in person (including participation virtually/online) or represented by proxy, constitutes the quorum necessary to conduct business at the Annual Meeting. If you have voted by proxy, your shares will be considered part of the quorum. Once a share is represented for any purpose at the Annual Meeting, it is deemed present for quorum purposes for the remainder of the Annual Meeting and any adjournment thereof. Abstentions and broker non-votes count as shares present at the Annual Meeting for purposes of determining a quorum. |

|

|

How are the votes counted? |

Mike John-Williams, our Chief Financial Officer, has been appointed by the Board as the Inspector of Elections for the Annual Meeting. With assistance from VStock, he will tabulate the votes received for each nominee for election as a director and all other items of business at the Annual Meeting. He will announce preliminary results at the Annual Meeting and subsequently certify to the Board the results of the election of directors and all other items of business voted on at the Annual Meeting. Final voting results will be reported in a Current Report on Form 8-K filed with the Securities and Exchange Commission. |

|

|

Who pays for the solicitation of proxies? |

We will pay the cost of preparing, printing, and mailing materials in connection with this solicitation of proxies. In addition to solicitation by mail, officers, directors (including those nominees for election as a director), and employees of the Company and Private Guerrilla RF may make solicitations personally, by telephone, or otherwise without additional compensation for doing so. We reserve the right to engage a proxy solicitation firm to assist in the solicitation of proxies for the Annual Meeting. We will, upon request, reimburse brokerage firms, banks, and others for their reasonable out-of-pocket expenses in forwarding proxy materials to beneficial owners of shares or otherwise in connection with this solicitation of proxies. |

|

|

When are proposals for the 2026 Annual Meeting of Stockholders due? |

It is presently anticipated that the 2026 Annual Meeting of Stockholders of the Company will be held in May 2026. For a stockholder proposal to be considered for inclusion in the proxy solicitation materials for the 2026 Annual Meeting, the Secretary of the Company must receive the written proposal at our principal executive offices at 2000 Pisgah Church Road, Greensboro, North Carolina 27455 no later than December 1, 2025. To be eligible for inclusion, a proposal must comply with our bylaws, Rule 14a-8, and all other applicable provisions of Regulation 14A under the Exchange Act.

Any proposal not intended to be included in the proxy statement for the 2026 Annual Meeting, but intended to be presented from the floor at that Annual Meeting, must have been received by us at our principal executive offices listed above no earlier than January 15, 2026, and no later than February 14, 2026, and must otherwise comply with and include the information required under our bylaws. |

|

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board is divided into three classes of directors, designated Class I, Class II, and Class III, with staggered three-year terms. Ordinarily, one class of directors is elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective terms. Each director’s term will continue until the end of such director’s term and the election and qualification of his or her successor, or his or her earlier death, resignation, disqualification, or removal.

The Board currently consists of 10 directors, five of whom have terms expiring at the Annual Meeting. The Board has nominated the persons named below for election as directors to serve for the terms specified, or until their earlier death, resignation, disqualification or removal, or until their successors are elected and qualified. Each of the director nominees currently serves as a director of the Company. If all of the director nominees are elected, there will be nine directors serving on the Board following the Annual Meeting.

The persons named as proxies in the proxy card intend to vote “FOR” the four nominees listed below, unless authority to vote is withheld or any proxies are duly revoked. Each nominee has consented to serve as a director of the Company, if elected. If, at the time of the Annual Meeting, a nominee is unavailable for election or service, the discretionary authority provided in the proxy card will be exercised to vote for such other person for the office of director as may be nominated by the Board. Proxies cannot be voted for a greater number of nominees than the number named in this Proxy Statement. The present Board has no reason to believe that any of the nominees named will be unable to serve if elected to office.

Each of the nominees brings special skills and attributes to the Board through a variety of levels of education, business experience, director experience, industry experience, philanthropic interests, and community involvement. Additional information about each nominee and his or her special skills is provided below. The age of each director is as of March 31, 2025.

NOMINEES FOR ELECTION AS CLASS I DIRECTORS

TO SERVE UNTIL THE 2028 ANNUAL MEETING

Ryan Pratt (age 47) is the founder of the Company and has served as its Chief Executive Officer and a member of the Board since 2014. Prior to founding the Company, Mr. Pratt served as Director of Engineering at Skyworks, Greensboro Design Center from June 2008 to February 2013. Previously, Mr. Pratt served in various roles at RF Micro Devices, Inc. (“RFMD”), including as Senior Design Engineer from January 2004 to May 2006, and as Design Engineering Manager from May 2006 to June 2008. Mr. Pratt holds a Bachelor of Science degree in Electrical Engineering from North Carolina State University and has 11 patents. We believe that Mr. Pratt is qualified to serve on our Board because he is the founder and Chief Executive Officer of the Company and due to his extensive business and technical experience in the radio frequency (“RF”) semiconductor industry.

Gary Smith (age 66) has served as a member of the Board since August 2020. Since August 2018, Mr. Smith has served as President at AMB Investments LLC. Before joining AMB Investments LLC, Mr. Smith served as President and Chief Executive Officer of North State Aviation, LLC, an aviation MRO, from September 2016 through July 2018, and as Vice President and General Manager of the Elastomers Group at Wabtec Corporation from January 2014 to September 2016. Earlier in his career, Mr. Smith served as Executive Vice President and Chief Financial Officer at Longwood Industries from 2011 to 2013, Kinetic Systems Inc. from 2008 to 2011, International Textile Group, Inc. from 2004 to 2008, and Cone Mills Corporation from 1999 to 2004. Mr. Smith holds a Bachelor of Science degree in Accounting and Finance from the University of North Carolina at Greensboro and an MBA from the Bryan School of Business, University of North Carolina at Greensboro. We believe that Mr. Smith is qualified to serve on our Board due to his extensive experience in global operations and financial leadership.

Thomas B. Ellis (aged 55) has served as a member of the Board since August 5, 2024. Mr. Ellis is a co-managing partner of North Run Capital, LP, a public security investment firm (“North Run”). Prior to co-founding North Run in 2002, Mr. Ellis was a principal at Berkshire Partners, LLC, a private equity firm, and an analyst at MHR Fund Management, a hedge fund and distressed debt fund. Previously, Mr. Ellis was an associate in the investment banking division of Goldman, Sachs & Co. Mr. Ellis also serves on the board of directors of LENSAR, Inc. Mr. Ellis received a Bachelor of Arts degree from Princeton University and a Juris Doctor degree from Harvard Law School. We believe that Mr. Ellis is qualified to serve on our Board due to his substantial experience in business, finance, and leadership.

NOMINEE FOR ELECTION AS CLASS II DIRECTOR

TO SERVE UNTIL THE 2026 ANNUAL MEETING

Todd B. Hammer (aged 57) has served as a member of the Board since August 5, 2024. Mr. Hammer is a co-managing partner of North Run. Prior to co-founding North Run in 2002, Mr. Hammer was a principal at Greenbriar Equity Group, LLC, a private equity firm, a vice president at EnTrust Capital, LLC, a hedge fund and asset management firm, and an analyst at Baker Nye Greenblatt, LLC, an event-driven hedge fund. Previously, Mr. Hammer was an associate in the investment banking division of Goldman, Sachs & Co. Mr. Hammer also serves on the board of directors of LENSAR, Inc. Mr. Hammer received Bachelor of Arts and Bachelor of Science degrees from the University of Pennsylvania and a Juris Doctor degree from Harvard Law School. We believe that Mr. Hammer is qualified to serve on our Board due to his substantial experience in business, finance, and leadership.

THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE FOR ALL NOMINEES FOR ELECTION AS DIRECTORS

CONTINUING DIRECTORS

CLASS II DIRECTORS WITH TERM ENDING AS OF THE 2026 ANNUAL MEETING

David Bell (age 68) has served as a member of the Board since 2020. Mr. Bell has over 40 years of technology development experience. Mr. Bell co-founded Actev Motors, Inc. in December 2014, a company now focused on UVC ultraviolet light disinfection and indoor air quality monitoring. He has served as Actev Motor’s Chief Executive Officer since its founding. Prior to co-founding Actev Motors, Mr. Bell served as President and Chief Operating Officer, then President and Chief Executive Officer at Intersil Corporation from 2007 to 2012. From 1994 to 2007, Mr. Bell served in various roles at Linear Technology Corporation, including as President from 2003 to 2007. Mr. Bell holds a degree in Electrical Engineering from the Massachusetts Institute of Technology. We believe that Mr. Bell is qualified to serve on our Board due to his experience as an entrepreneur and substantial operational experience, business acumen, and expertise in technology development.

Susan Barkal (age 62) has served as a member of the Board since September 2022. Since 2021, she has served as the Senior Vice President of Quality, Supply Chain Executive, Chief Compliance Officer, and CFIUS Security Officer at Yageo Corporation, an electronic component manufacturing company. From 1999 until YAGEO’s acquisition of KEMET Corporation in 2020, Ms. Barkal served in various roles at KEMET, including as Senior Vice President of Quality and Chief Compliance Officer from 2009 to 2021. Ms. Barkal served as an Inside Board Director for the KEMET / TOKIN Electronics Joint Venture from 2014 to 2017. Ms. Barkal holds a Bachelor of Science degree in Chemical Engineering from Clarkson University and a Master of Science degree in Mechanical Engineering from California Polytechnic State University. We believe that Ms. Barkal is qualified to serve on our Board due to her extensive experience in the technology sector, particularly in global quality and compliance, portfolio management strategies, and new product development.

CLASS III DIRECTORS WITH TERM ENDING AS OF THE 2027 ANNUAL MEETING

James (Jed) E. Dunn, Jr. (age 64) has served as a member of the Board since 2016. Since 2013, Mr. Dunn has served as Managing Director at Newport LLC, a business advisory company assisting middle market companies focus on strategy and growth, where he co-founded the mergers and acquisition practice of the firm. Prior to Newport, Mr. Dunn served as the Chief Executive Officer at Piedmont Hematology-Oncology Associates, PLLC, from 2008 to 2012. From 1988 to 2007, Mr. Dunn was the Owner and Chief Executive Officer at Coleman Resources, a contract supplier of design, printing, fulfillment, and logistics services. Earlier in his career, Mr. Dunn served as a corporate lender at First Union Bank. Mr. Dunn currently serves as a director of Ax Nano, Inc., a provider of Environmental Remediation Solutions. He previously served on a number of boards, including the Board of Trustees for Washington and Lee University. Mr. Dunn holds a Bachelor of Arts degree in Economics from Washington and Lee University. We believe that Mr. Dunn is qualified to serve on our Board due to his experience as an entrepreneur and business advisor to middle market and start-up companies.

William J. Pratt (age 82) has served as a member of the Board since 2014. In 1991, Mr. Pratt co-founded RFMD, a global company providing wireless communication products, now named Qorvo, Inc. He retired in 2008 as RFMD’s Chief Technology Officer. Mr. Pratt served as chairman of the board of directors of RFMD from 1991 until 2002. Mr. Pratt earned a Bachelor of Science degree in Electrical Engineering from Villanova University and brings significant experience as a semiconductors and technology professional. We believe that Mr. Pratt is qualified to serve on our Board due to his more than 30 years of experience in the wireless communications industry and his deep understanding of the challenges and issues facing semiconductor companies gained from his experience as co-founder and Chief Technology Officer of RFMD.

Virginia Summerell (age 66) has served as a member of the Board since February 2023. From 1992 until 2021, Ms. Summerell served in various finance roles at Tanger Factory Outlet Centers, Inc., including as Senior Vice President of Finance and Treasurer from 2011 to 2021, contributing to the development of finance and treasury functions. Ms. Summerell helped the company navigate from a family-owned real estate development firm to a successful publicly traded Real Estate Investment Trust. Previously, she served in various roles in corporate, commercial and real estate banking at Bank of America and its predecessors. Ms. Summerell holds a Bachelor of Arts degree in Economics from Davidson College and an MBA from the Babcock School at Wake Forest University. We believe that Ms. Summerell is qualified to serve on our Board because of her substantial experience in finance, treasury and capital markets, in addition to broad experience in general management.

Director Independence

For independence purposes, we use the definition of independence applied by NASDAQ Stock Market LLC (“Nasdaq”), given the possibility of our potential uplisting to Nasdaq. Under the rules of Nasdaq, a listed company’s board of directors must be comprised of a majority of independent directors. A director will only qualify as an “independent director” if, in the opinion of the listed company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Board has determined that all members of the Board other than Ryan Pratt and William J. Pratt are independent directors, as defined under applicable Nasdaq rules. In making such independence determination, the Board reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and current and prior relationships as they may relate to us and our management, including the association of any of our non-employee directors with the holders of more than 5% of our common stock.

Family Relationships

There is one family relationship to note among the directors and executive officers. Ryan Pratt, our Chief Executive Officer, is the son of William J. Pratt, a director.

How Much Common Stock do our Directors and Named Executive Officers Beneficially Own?

The following table sets forth information as of the Record Date, concerning the beneficial ownership of shares of each director and each named executive officer who held office during 2024 and by each nominee for election, and by all directors named executive officers and nominees as a group. According to rules promulgated by the Securities and Exchange Commission (the “SEC”), a person is the “beneficial owner” of securities if the person has or shares the power to vote them or to direct their investment, or has the right to acquire ownership of such securities within 60 days through the exercise of an option, warrant, right of conversion of a security, or otherwise.

We have determined beneficial ownership in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Except as indicated by the footnotes below, we believe, based on information furnished to us, that the persons and entities named in the table below have sole voting and sole investment power with respect to all shares of common stock that they beneficially owned, subject to applicable community property laws.

The percentage of shares beneficially owned is computed on the basis of 10,326,940 shares of common stock and 22,000 shares of preferred stock (which are voting shares, and are initially convertible into 7,213,115 shares of common stock) outstanding as of the Record Date. Shares of common stock that a person has the right to acquire within 60 days of the Record Date are deemed outstanding for purposes of computing the percentage ownership of the person holding such rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person, except with respect to the percentage ownership of all directors and executive officers as a group. Unless otherwise indicated, the address of each beneficial owner in the table below is c/o Guerrilla RF, Inc., 2000 Pisgah Church Road, Greensboro, North Carolina 27455.

BENEFICIAL OWNERSHIP TABLE

|

Name |

Shares of |

Percentage of |

||||||

|

Directors, nominees, and named executive officers |

||||||||

|

Susan Barkal (1) |

20,579 | * | ||||||

|

David Bell (2) |

16,358 | * | ||||||

|

John Berg (3) |

76,087 | * | ||||||

|

Kellie Chong (4) |

35,283 | * | ||||||

|

James (Jed) E. Dunn (5) |

42,403 | * | ||||||

|

Thomas B. Ellis (6)(7) |

10,115,028 | 49.5 | % | |||||

|

Todd B. Hammer (6)(7) |

10,115,028 | 49.5 | % | |||||

|

Mark Mason (8) |

47,100 | * | ||||||

|

Ryan Pratt (9) |

1,019,365 | 9.9 | % | |||||

|

William J. Pratt (10) |

163,174 | 1.6 | % | |||||

|

Gary Smith (11) |

16,358 | * | ||||||

|

Virginia Summerell |

6,811 | * | ||||||

|

Greg Thompson (12) |

56,316 | * | ||||||

|

Directors, nominees, and named executive officers as a group (13 persons) (13) |

11,631,529 | 56.9 | % | |||||

Unless otherwise noted, all shares are owned directly of record by the named persons, their spouses and minor children, or by other entities controlled by the named persons.

|

* |

Represents beneficial ownership of less than one percent. |

|

(1) |

Consists of (i) 17,245 shares of common stock, and (ii) 3,334 shares of common stock issuable upon exercise of outstanding warrants. |

|

(2) |

Consists of (i) 12,662 shares of common stock, and (ii) options to purchase 3,696 shares of common stock that are exercisable within 60 days. |

|

(3) |

Consists of (i) 60,455 shares of common stock, (ii) options to purchase 13,965 shares of common stock that are exercisable within 60 days, and (iii) 1,667 shares of common stock issuable upon exercise of outstanding warrants. |

|

(4) |

Consists of (i) 19,033 shares of common stock, and (ii) options to purchase 16,250 shares of common stock that are exercisable within 60 days. |

|

(5) |

Consists of (i) 29,996 shares of common stock, (ii) options to purchase 11,573 shares of common stock that are exercisable within 60 days, and (iii) 834 shares of common stock issuable upon exercise of outstanding warrants. |

|

(6) |

Todd B. Hammer and Thomas B. Ellis are the principals and sole members of NR-PRL GP, which is the general partner of NR-PRL Partners, LP. Each of Mr. Hammer and Mr. Ellis, as the sole members of NR-PRL GP, may be deemed to beneficially own 10,098,361 shares of common stock beneficially owned by NR-PRL Partners, LP, comprising (i) 2,885,246 shares of common stock issuable upon exercise of warrants and (ii) 7,213,115 shares of common stock issuable upon conversion of the 22,000 shares of preferred stock, issued in the 2024 North Run Private Placement, defined below (collectively, the “North Run shares”). |

|

(7) |

Consists of (i) the North Run shares and (ii) 16,667 restricted stock units (“RSUs”) that vest within 60 days. |

|

(8) |

Consists of (i) 19,902 shares of common stock, (ii) options to purchase 26,364 shares of common stock that are exercisable within 60 days, and (iii) 834 shares of common stock issuable upon exercise of outstanding warrants. |

|

(9) |

Consists of (i) 980,364 shares of common stock, (ii) options to purchase 4,923 shares of common stock that are exercisable within 60 days, (iii) 33,822 shares of common stock issuable upon exercise of outstanding warrants, and (iv) 256 RSUs that vest within 60 days. |

|

(10) |

Consists of (i) 133,171 shares of common stock, (ii) options to purchase 8,864 shares of common stock that are exercisable within 60 days, and (iii) 21,139 shares of common stock issuable upon exercise of outstanding warrants. |

|

(11) |

Consists of (i) 12,662 shares of common stock, and (ii) options to purchase 3,696 shares of common stock that are exercisable within 60 days. |

|

(12) |

Consists of (i) 49,426 shares of common stock, and (ii) options to purchase 6,890 shares of common stock that are exercisable within 60 days. |

|

(13) |

Consists of (i) 1,341,769 shares of common stock, (ii) options to purchase 96,221 shares of common stock that are exercisable within 60 days, (iii) 61,630 shares of common stock issuable upon exercise of outstanding warrants, and (iv) 33,590 RSUs that vest within 60 days; (v) 2,885,246 shares of common stock issuable upon the exercise of warrants issued in the 2024 North Run Private Placement; and (vi) 7,213,115 shares of common stock issuable upon conversion of the 22,000 shares of preferred stock issued in the 2024 North Run Private Placement. |

Security Ownership of Certain Beneficial Owners

The Exchange Act requires that any person who acquires the beneficial ownership of more than 5% of our common stock notify the SEC and us. Set forth below is certain information, as of the Record Date, regarding all persons or “groups,” as defined in the Exchange Act, other than the directors and named executive officers, who held of record or who are known to us to own beneficially more than 5% of our shares.

|

Name |

Shares of |

Percentage of |

||||||

|

5% stockholders |

||||||||

|

Al Bodford (1) |

1,410,905 | 13.7 | % | |||||

|

Salem Investment Partners V, Limited Partnership (2) |

1,765,179 | 17.1 | % | |||||

|

NR-PRL Partners, LP (3) |

10,098,361 | 49.4 | % | |||||

|

Bleichroeder LP (4) |

800,000 | 7.5 | % | |||||

Unless otherwise noted, all shares are owned directly of record by the named persons, their spouses and minor children, or by other entities controlled by the named persons.

(1) Consists of (i) 1,370,905 shares of common stock and (ii) 40,000 shares of common stock issuable upon exercise of outstanding warrants. Mr. Bodford holds these shares in the name of his company, AMB Investments LLC. The address of Mr. Bodford and AMB Investments LLC is 1501 Highwoods Boulevard, Suite 302, Greensboro, NC 27410. Excludes 500,000 shares of common stock issued by the Company to Salem Investment Partners V, Limited Partnership (“Salem”), in which AMB Investments LLC has a pecuniary interest but no voting or dispositive power.

(2) Consists of (i) 1,455,378 shares of common stock and (ii) 309,801 shares of common stock issuable upon exercise of outstanding warrants. Of the 1,455,378 shares held by Salem, AMB Investments LLC and others have a pecuniary interest in 760,000 shares; however, Salem has sole voting and dispositive power. The address of Salem is 7900 Triad Center Drive, Suite 333, Greensboro, NC 27409.

(3) Consists of (i) 7,213,115 shares of common stock issuable upon conversion of 22,000 shares of preferred stock and (ii) 2,885,246 shares of common stock issuable upon exercise of outstanding warrants. The principal business office address for NR-PRL Partners, LP is 867 Boylston St., 5th Floor #1361, Boston, MA 02116.

(4) Based on the Schedule 13G/A filed by Bleichroeder LP with the SEC on March 21, 2025. The filing indicates that Bleichroeder LP has sole voting and dispositive power over 800,000 shares, consisting of (i) 400,000 shares of common stock and (ii) 400,000 shares of common stock issuable upon exercise of warrants.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires that our executive officers and directors, and persons who own more than 10% of our common stock, file ownership reports and ownership changes with the SEC. To our knowledge, based solely upon a review of the copies of the Section 16(a) reports furnished to us and written representations from officers and directors, we believe that during the fiscal year ended December 31, 2024, all Section 16(a) reports were filed on a timely basis.

Executive Officers of the Company

The following table sets forth certain information about our executive officers as of the Record Date:

|

Name |

Age |

Positions |

||

|

Executive Officers |

||||

|

Ryan Pratt |

47 |

Chief Executive Officer and Chairman |

||

|

Mark Mason |

50 |

Chief Operating Officer |

||

|

Kellie Chong |

61 |

Chief Business Officer |

||

|

Mike John-Williams |

43 |

Chief Financial Officer |

Ryan Pratt. Please see “Proposal 1 Election of Directors – Nominees for Election as Class I Directors to Serve until the 2028 Annual Meeting” above for Mr. Pratt’s biographical information.

Mark Mason has served as Chief Operating Officer of the Company since July 2019. From February 2011 until July 2019, he was Vice President of Operations at Triad Semiconductor. Prior to joining Triad Semiconductor, Mr. Mason spent 14 years at RFMD, most recently as the Manager of the Production Test Development Multi-Market Products Group. Mr. Mason holds a Bachelor of Science degree in Electrical Engineering from West Virginia University.

Kellie Chong joined the Company in January 2022 as a Chief Business Officer. She has over 35 years of industry experience, including over 29 years at RFMD. Ms. Chong started as an integrated Circuit (IC) designer in 1992, served as a Director of Corporate Engineering in 1996, transitioned to oversee Global Positioning System (GPS) product line in 2003 to a Director of Filter Technology in 2006, a Director of Infrastructure and Standard Products in 2009, and lastly as the Director of the Broadband Product line in 2013 before leaving to join the Company. Earlier in her career, Ms. Chong worked as a test engineer at ASEA Brown Boveri and a design engineer for high-speed Analog to Digital Converter at Addacon (Micro Networks). Ms. Chong holds a Bachelor of Science degree in Electrical Engineering from the North Carolina State University and an Executive Management Masters certificate from the University of North Carolina at Greensboro.

Mike John-Williams joined the Company in January 2025 as Chief Financial Officer. Prior to joining the Company, Mr. John-Williams served as Head of Finance and Strategy at Valmis Robotics, Inc., a startup company based in Bethesda, Maryland, where he led investment decisions, forecasting, and strategic planning to support growth opportunities. Previously he was Vice President and Chief Financial Officer of Pandora Jewelry’s North American Business Unit from 2021 to 2023, overseeing strategy, financial reporting, pricing, and M&A activities for the $1.4 billion revenue division. Prior to that, he served as CFO/Global Director of KitchenAid Small Appliances Business Unit (a Whirlpool Company) and Interim Head of S&OP, and as Head of Treasury Analytics, Global Treasury Analytics (Liquidity Management) at Whirlpool Corporation. Mr. John-Williams holds an MBA from the University of Michigan’s Ross School of Business and a Bachelor’s degree in Finance and Economics from Western Michigan University’s Haworth College of Business.

How Often Did Our Board Meet During 2024?

During our fiscal year ended December 31, 2024, the Board held 10 meetings. Each director attended at least 75% of the aggregate of (i) the total number of Board meetings held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of the Board on which such director served during the periods that he or she served. Our Corporate Governance Guidelines require that all directors are expected to attend the Annual Meeting.

How can you communicate with the Board?

We do not have formal procedures for stockholder communication with our Board. In general, our directors and officers are easily accessible by telephone, postal mail, or e-mail. Any matter intended for the Board or any individual director can be directed to Ryan Pratt, our Chief Executive Officer, at our principal executive offices located at 2000 Pisgah Church Road, Greensboro, North Carolina 27455. You also may direct correspondence to the Board or any of its members in care of the Company at the foregoing address. Your communication will be forwarded to the intended recipient unopened.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics (the “General Code”) which applies to all of our employees, officers, and directors, and the Executive Officer Code of Business Conduct and Ethics (the “Officer Code”), which applies to our Chief Executive Officer, Chief Financial Officer and our senior financial and accounting officers. The General Code outlines many standards, including those related to addressing compliance with laws, regulations, policies, and procedures; conflicts of interest; confidentiality; accuracy of financial statements and other records; and procedures for reporting violations of the General Code or any illegal or unethical business or workplace conduct. The Officer Code imposes additional standards on our Chief Executive Officer, Chief Financial Officer, and senior financial and accounting officers concerning our accounting and financial reporting. Generally, the Officer Code requires those individuals to bring to the attention of the Chief Executive Officer and, in certain circumstances, the Audit Committee, any material information which comes to their attention that (i) affects disclosures made by the Company in our public filings; (ii) demonstrates significant deficiencies in our internal controls; (iii) concerns fraud or a violation of the Officer Code or General Code by management or employees who have a significant role in financial reporting, disclosure, and internal controls; or (iv) involves a material violation of law, including securities laws. Under the Officer Code, the Board or its designee, determines the appropriate actions to be taken in the event the Officer Code or General Code is violated by our Chief Executive Officer, Chief Financial Officer, or our senior financial and accounting officers, which actions may include termination of employment. The General Code and the Officer Code outline appropriate behavior for all employees. The full text of the General Code and the Officer Code are available on our website by going to www.guerrilla-rf.com, under the heading Investor Relations. We intend to disclose any amendments to our General Code and the Officer Code, or waivers of their requirements, on our website.

Board Leadership Structure and Role in Risk Oversight

The ultimate authority to oversee the business of the Company rests with the Board. Our executive officers are appointed by, and serve at the discretion of, our Board. The Company’s officers have responsibility for the management of the Company’s operations.

Our founder, Ryan Pratt, serves as Chief Executive Officer and as Chairman of the Board. The Board believes that it is in the best interest of the Company for Mr. Pratt to hold both positions at the present time due to our early stage of development and his unique knowledge of our history and goals, which we believe complement both the officer and chairman positions.

The Board recently established the position of a lead independent director to support the Chairman of the Board and create appropriate “checks and balances” in corporate governance. The Board has appointed James (Jed) E. Dunn as the lead independent director. The duties of the lead independent director include: (i) providing an independent point of communications for principal stockholders of the Company to raise issues and concerns for consideration by the Board where contact with the Chairman, the Chief Executive Officer or other senior executive officers of the Company has failed to resolve such issues or concerns or where such contact is inappropriate; (ii) providing an independent point of communications among members of the Board with respect to issues or concerns that members of the Board believe have not been property considered by the Chairman or the Board as a whole; (iii) seeking the views of the Company’s non-executive directors to appraise the performance of the Chairman; (iv) convening and conducting executive sessions of the Board; (v) facilitating the Board’s selection of a successor Chairman in the event the Chairman resigns or otherwise ceases to serve as Chairman; and (vi) serving as a sounding board and adviser to the Chairman with respect to maintenance of good relationships among the members of the Board and the functioning of the Board.

Based upon the Company’s size and history, the Board considers that a combined Chairman/CEO role for Mr. Pratt and a lead independent director with a strong role and defined authorities is the optimum corporate governance structure for the Company.

One of the key functions of the Board is informed oversight of our risk management process. The Board administers its risk oversight function directly through the Board as a whole and through various standing committees of the Board that address risks inherent in their respective areas of oversight. Significant risk oversight matters considered by the committees are reported to and considered by the Board. Some significant risk oversight matters are reported directly to the Board, including matters not falling within the area of responsibility of any committee.

Directors keep themselves informed of the activities and condition of the Company and of the risk environment in which it operates by regularly attending Board and assigned board committee meetings, and by review of meeting materials, and auditors’ findings and recommendations. Directors stay current on general industry trends and any statutory and regulatory developments pertinent to us by periodic briefings by executive management, counsel, auditors, or other consultants.

The Board oversees the conduct of our business and administers the risk management function by:

|

● |

selecting, evaluating, and retaining competent executive management; |

|

● |

establishing, with executive management, our long- and short-term business objectives; |

|

● |

monitoring operations to ensure that they are controlled adequately and are in compliance with laws and policies; and |

|

● |

overseeing our business performance. |

The Board has established committees to effectively divide risk monitoring responsibilities and capabilities. The Committees include Audit, Compensation, and Corporate Governance and Nominating Committees. The Audit Committee, charged by the Board with the primary oversight responsibility for risk management, also oversees the integrity of financial reporting, compliance with laws and regulations, and the structure of internal control. The Compensation Committee provides oversight of executive compensation, administers and implements the Company’s incentive compensation and equity-based plans, and establishes our overall compensation philosophy. The Corporate Governance and Nominating Committee recommends persons to serve as members of our Board, establishes principles for the Company, and provides leadership on corporate governance matters.

In the day-to-day management of risk, management has established and implemented appropriate policies, procedures, risk assessment tools, and a defined organization and reporting structure. With respect to the organization and reporting structure, a hierarchy has been created which divides responsibility along functional lines of authority and further divides responsibilities efficiently and effectively into specific processes.

The Board believes that the foundation for risk management is well-established and understood throughout the Company at the Board level and throughout the organization.

Diversity of the Board

Although the Governance and Nominating Committee does not maintain a specific policy with respect to board diversity, the Board believes that the Board should be a diverse body. Diversity in experiences, perspectives, and backgrounds is just one of many factors considered by the Governance and Nominating Committee in considering director nominees.

Related Party Matters

The Audit Committee is charged with reviewing and approving all related party transactions of the Company and our directors, executive officers, and employees. All material facts of such transactions and the employee’s or the director’s interest are discussed by all disinterested directors, and a decision is made as to whether the transaction is fair to the Company. A majority vote of all disinterested directors is required to approve a related party transaction. The Board believes that all related party transactions with officers and directors are on terms comparable to those which would have been reached with unaffiliated parties at the time such transactions were made.

Board Committees

Our Board has three standing committees: the Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee, each of which, pursuant to its respective charter, has the composition and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by our Board. The following table provides the current committee membership for each of the Board committees.

|

Name |

Audit |

Compensation |

Corporate Governance and Nominating |

|||

|

Susan Barkal |

X |

|||||

|

David Bell |

X |

|||||

|

James (Jed) E. Dunn |

X |

X* |

||||

|

Thomas B. Ellis |

X* |

|||||

|

Todd B. Hammer |

X |

|||||

|

William J. Pratt |

||||||

|

Ryan Pratt |

||||||

|

Gary Smith |

X |

|||||

|

Virginia Summerell |

X* |

|||||

|

Greg Thompson |

X |

* indicates Chair of committee

Audit Committee. The Audit Committee held five meetings in 2024. Each member of the Audit Committee is financially literate. The Board has determined that each member of the Audit Committee is independent within the meaning of the Nasdaq director independence standards and applicable rules of the SEC for audit committee members. The Board has also determined that Ms. Summerell qualifies as an “audit committee financial expert” under the rules of the SEC. The Audit Committee’s principal functions are to assist our Board in its oversight of:

|

● |

overseeing the process by which the Board is informed regarding any significant legal and regulatory compliance risks facing the Company and coordinating with the Company’s legal counsel to ensure the Board receives regular legal and regulatory compliance updates from management; |

|

● |

selecting a firm to serve as our independent registered public accounting firm to audit the Company’s financial statements; |

|

● |

ensuring the independence of the independent registered public accounting firm; |

|

● |

discussing the scope, timing, and results of the audit with the independent registered public accounting firm, and reviewing, with management and that firm, our interim and year-end operating results; |

|

● |

reviewing the adequacy of the Company’s system of internal controls; |

|

● |

in consultation with management, periodically reviewing the adequacy of the Company’s disclosure controls and procedures; |

|

● |

reviewing related-party transactions that are material or otherwise implicate disclosure requirements; |

|

● |

providing the audit committee report for inclusion in our proxy statement for our annual meeting for stockholders; and |

|

● |

approving or pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm. |

A current copy of the Audit Committee charter is available on our website, www.guerrilla-rf.com, under the heading Investor Relations.

Audit Committee Report. The Audit Committee has reviewed and discussed the audited consolidated financial statements with management of the Company. The Audit Committee has discussed with Forvis Mazars, LLP, our independent registered public accounting firm, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the SEC. In addition, the Audit Committee has received the written disclosures and the letter from Forvis Mazars, LLP prescribed by applicable requirements of the PCAOB regarding Forvis Mazars, LLP’s communications with the Audit Committee concerning independence, and has discussed with Forvis Mazars, LLP its independence in providing audit services to us. Based upon these reviews and discussions, the Audit Committee has recommended to the Board that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 for filing with the SEC.

Audit Committee

Virginia Summerell (Chair)

James (Jed) E. Dunn

Gary Smith

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee held two meetings in 2024. Our Corporate Governance and Nominating Committee’s principal functions include, among other things:

|

● |

recommending to our Board persons to serve as members of the Board and as members and chairpersons of the committees of our Board; |

|

● |

reviewing the size and composition of our Board and recommending to our Board any changes it deems advisable; |

|

● |

reviewing and recommending to our Board any changes to our corporate governance principles; |

|

● |

overseeing the process of evaluating the performance of our Board; and |

|

● |

advising our Board on corporate governance matters. |

Our Corporate Governance and Nominating Committee has a written charter and Corporate Governance Guidelines. The Governance Guidelines contain various provisions related to the functions of the Board, including (i) the composition and size of the Board; (ii) meeting attendance, meeting preparation requirements, and other responsibilities of directors; (iii) the composition of Board committees; (iv) the role of the Board with respect to management; (v) director orientation and continuing professional development; (vi) periodic evaluations of corporate guidelines; and (vii) annual self-evaluations with the Governance Committee to determine whether the Board and its committees are functioning effectively and in compliance with the Governance Guidelines.

The Board has determined that each member of our Corporate Governance and Nominating Committee is an independent director as determined in accordance with Nasdaq’s director independence guidelines.

A current copy of the Corporate Governance Guidelines and Corporate Governance and Nominating Committee charter is available on our website, www.guerrilla-rf.com, under the heading Investor Relations.

Compensation Committee. The Compensation Committee held five (5) meetings in 2024. The Compensation Committee is responsible for, among other things:

|

● |

reviewing and approving the compensation of our chief executive officer; |

|

● |

reviewing and recommending to our Board, the compensation of our directors; |

|

● |

reviewing our executive compensation programs; |

|

● |

administering and implementing the Company’s incentive compensation plans and equity-based plans; and |

|

● |

establishing our overall compensation philosophy. |

Each member of the Compensation Committee is a non-employee director as defined in Rule 16b-3 of the Exchange Act. The Board has also determined that each member of the Compensation Committee is also an independent director within the meanings of Nasdaq’s director independence standards and applicable SEC rules.

A current copy of the Compensation Committee charter is available on our website, www.guerrilla-rf.com, under the heading Investor Relations.

The Compensation Committee administers the Company’s 2014 Long Term Stock Incentive Plan (the “2014 Plan”), which was adopted in 2014 and most recently amended in 2021. No additional awards may be made under the 2014 Plan. The Compensation Committee also administers the Company’s 2021 Plan (together with the 2014 Plan, the “Stock Incentive Plans”), which was adopted in 2021 to replace the 2014 Plan. Subject to the terms and conditions of the Stock Incentive Plans, the Compensation Committee has the authority, among other things, to select the persons to whom awards may be granted, construe and interpret the Stock Incentive Plans as well as determine the terms of such awards and prescribe, amend, and rescind the rules and regulations relating to the Stock Incentive Plans or any award granted thereunder. The Stock Incentive Plans provide that the Compensation Committee may delegate its authority, including the authority to grant awards, to one or more officers to the extent permitted by applicable law, provided that awards granted to non-employee directors may only be determined by our Board.

Compensation Committee Interlocks and Insider Participation. None of the members of the Compensation Committee is currently, or has been at any time, one of our officers or employees. In addition, none of our executive officers has served as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our Board or Compensation Committee during 2024.

EXECUTIVE COMPENSATION

We became a public company in October 2021 and we are currently an “emerging growth company” and a “smaller reporting company.” As an “emerging growth company” and a “smaller reporting company,” we are not required to include a Compensation Discussion and Analysis section in our executive compensation disclosure and have elected to comply with the scaled disclosure requirements applicable to emerging growth companies and smaller reporting companies. The following tables and accompanying narrative set forth information about the compensation provided to our principal executive officer and the three most highly compensated executive officers (other than our principal executive officer) who were serving as executive officers as of December 31, 2024. These executive officers were Ryan Pratt, our Chief Executive Officer, Mark Mason, our Chief Operating Officer, John Berg, our former Chief Financial Officer, and Kellie Chong, our Chief Business Officer, whom we refer to in this section as our “named executive officers.”

Summary Compensation Table. The following table shows, for the fiscal years indicated, the cash compensation we paid, as well as certain other compensation paid or accrued for those years, to our named executive officers for services in all capacities.

|

Name and Principal Position |

Year |

Salary(1) |

Bonus |

Option |

Equity |

All Other |

Total |

||||||||||||||||||

|

Ryan Pratt, |

2024 |

$ | 315,000 | $ | 150,000 | — | $ | 150,000 | $ | 52,961 | $ | 667,961 | |||||||||||||

|

Chief Executive Officer |

2023 |

$ | 324,224 | $ | 150,000 | — | $ | 223,500 | $ | 53,677 | $ | 751,401 | |||||||||||||

|

Mark Mason, |

2024 |

$ | 315,000 | $ | 75,000 | — | $ | 75,000 | $ | 42,046 | $ | 507,046 | |||||||||||||

|

Chief Operating Officer |

2023 |

$ | 294,680 | $ | 75,000 | — | $ | 111,750 | $ | 48,600 | $ | 530,040 | |||||||||||||

|

John Berg, |

2024 |

$ | 288,558 | $ | 75,000 | — | $ | 75,000 | $ | 24,696 | $ | 463,254 | |||||||||||||

|

Chief Financial Officer |

2023 |

$ | 294,036 | $ | 75,000 | — | $ | 111,750 | $ | 35,417 | $ | 516,203 | |||||||||||||

|

Kellie Chong |

2024 |

$ | 315,000 | $ | 75,000 | — | $ | 75,000 | $ | 25,512 | $ | 490,512 | |||||||||||||

|

Chief Business Officer |

2023 |

$ | 296,354 | $ | 75,000 | — | $ | 111,750 | $ | 35,999 | $ | 519,103 | |||||||||||||

|

(1) |

For 2023, these amounts include deferred salary attributable to services performed in 2023, payment of which was voluntarily deferred until March 2024. |

|

(2) |

Amount represents the aggregate grant date fair value of RSUs awarded for services performed in the fiscal year indicated in accordance with FASB Accounting Standards Codification Topic 718. Such grant-date fair market value does not take into account any forfeitures related to service-based vesting conditions as the amount reported has a three-year service-based vesting condition. Note that the amounts reported in this column reflect the accounting cost for these RSUs and does not correspond to the actual economic value that may be received by our named executive officers from the RSUs. |

|

(3) |

The amounts reported in “All Other Compensation” are comprised of the items listed in the following table: |

|

Name and Principal Position |

Year |

Employer |

Premiums Paid |

Premiums Paid |

Premiums |

||||||||||||

|

Ryan Pratt, |

2024 |

$ | 21,996 | $ | 840 | $ | 6,369 | $ | 23,756 | ||||||||

|

Chief Executive Officer |

2023 |

$ | 11,041 | $ | 783 | $ | 2,254 | $ | 39,599 | ||||||||

|

Mark Mason, |

2024 |

$ | 17,181 | $ | 840 | $ | 607 | $ | 23,418 | ||||||||

|

Chief Operating Officer |

2023 |

$ | 11,052 | $ | 783 | $ | 1,908 | $ | 34,857 | ||||||||

|

John Berg, |

2024 |

$ | 14,828 | $ | 840 | $ | 607 | $ | 8,421 | ||||||||

|

Chief Financial Officer |

2023 |

$ | 11,590 | $ | 852 | $ | 5,722 | $ | 17,253 | ||||||||

|

Kellie Chong, |

2024 |

$ | 15,644 | $ | 840 | $ | 607 | $ | 8,421 | ||||||||

|

Chief Business Officer |

2023 |

$ | 13,080 | $ | 852 | $ | 5,043 | $ | 17,024 | ||||||||

Equity Compensation

From time to time, we grant equity awards to our named executive officers, which are generally subject to vesting based on each named executive officer’s continued service with us. As of December 31, 2024, all of our named executive officers held equity awards that were granted under the Stock Incentive Plans, as set forth in the table below titled “Outstanding Equity Awards at 2024 Fiscal Year-End.”

Outstanding Equity Awards at 2024 Fiscal Year-End. The following table presents information regarding outstanding equity awards for each of our named executive officers as of December 31, 2024.

|

Equity Awards |

|||||||||||||||||||||||||||

|

Option Awards |

Stock Awards |

||||||||||||||||||||||||||

|

Number of Securities Underlying Unexercised Options |

|||||||||||||||||||||||||||

|

Name |

Grant |

Exercisable |

Unexercisable |

Option Exercise Price |

Option Expiration |

Number of RSUs that have not vested (#) |

Market value of RSUs that have not vested ($) |

||||||||||||||||||||

|

Ryan Pratt |

— | — | — | — | — | 61,767 | 85,238 | ||||||||||||||||||||

|

Mark Mason |

9/11/2019 |

24,590 | 0 | $ | 2.20 |

9/11/2029 |

27,666 | 38,179 | |||||||||||||||||||

|

10/30/2020 |

1,774 | 0 | $ | 3.19 |

10/30/2030 |

||||||||||||||||||||||

|

John Berg |

12/5/2016 |

6,149 | 0 | $ | 1.42 |

12/5/2026 |

27,623 | 38,120 | |||||||||||||||||||

|

9/25/2018 |

4,272 | 0 | $ | 1.93 |

9/25/2028 |

||||||||||||||||||||||

|

9/11/2019 |

2,066 | 0 | $ | 2.20 |

9/11/2029 |

— | — | ||||||||||||||||||||

|

10/30/2020 |

1,478 | 0 | $ | 3.19 |

10/30/2030 |

— | — | ||||||||||||||||||||

|

Kellie Chong |

2/21/2022 |

10,833 | 10,834 | $ | 12.00 |

2/21/2032 |

26,023 | 35,912 | |||||||||||||||||||

Employment Agreement

In 2020, we entered into an employment agreement with Ryan Pratt, our Chief Executive Officer and a member of our Board. The employment agreement superseded an earlier agreement and provides for an initial annual base salary of $240,000. The employment agreement does not have a fixed employment term and provides that Mr. Pratt is an at-will employee, meaning that either he or we may terminate the employment relationship at any time, with or without cause, and with or without notice. Under the terms of the employment agreement, Mr. Pratt is entitled to participate in all employee benefits to the extent generally available to our other similarly situated employees, including, without limitation, benefits such as medical, life insurance, 401(k) plan, and paid time off. The employment agreement also restricts him from competing against us, soliciting our customers or employees, or interfering with our relationships with our vendors, consultants, and independent contractors, in each case for a period of one year following a termination of employment. The employment agreement also includes invention assignment and confidentiality provisions.

Offer Letters

We have entered into offer letters with Messrs. Mason and Berg, and Ms. Chong. In addition, each of our named executive officers has executed our form of standard employee invention assignment and confidentiality agreement.

Mark Mason

In 2019, we entered into an offer letter with Mr. Mason, our Chief Operating Officer. This offer letter provided for an initial annual base salary of $201,600 and an award of 50,000 stock options. Mr. Mason is an at-will employee and does not have a fixed employment term. He is eligible to participate in our employee benefit plans, including medical, dental, vision, disability, and life insurance benefits.

John Berg

In 2016, we entered into an offer letter with Mr. Berg, our former Chief Financial Officer. Originally employed on a part-time basis, the offer letter provided for an initial annual base salary of $36,000 and an award of 50,000 stock options. Mr. Berg was an at-will employee and did not have a fixed employment term. He was eligible to participate in our employee benefit plans, including medical, dental, vision, disability, and life insurance benefits. Mr. Berg retired in January 2025.

Kellie Chong

In 2022, we entered into an offer letter with Ms. Chong, our Chief Business Officer. This offer letter provided for an initial annual base salary of $201,600 and an award of 50,000 stock options. Ms. Chong is an at-will employee and does not have a fixed employment term. She is eligible to participate in our employee benefit plans, including medical, dental, vision, disability, and life insurance benefits.

Clawback Policy and Amendments to Employment Agreements

In 2024, the Compensation Committee adopted, and the Board ratified, the Excess Incentive-Based Compensation Recovery Policy (the “Clawback Policy”) in compliance with the final clawback rules adopted by the SEC and the listing standards, as set forth in The Nasdaq Listing Rule 5608 (the “Final Clawback Rules”). The Clawback Policy provides for the mandatory recovery of erroneously awarded incentive-based compensation from current and former executive officers as defined in SEC Rule 10D-1 (“Covered Officers”) of the Company in the event that the Company is required to prepare an accounting restatement to correct a material error, in accordance with the Final Clawback Rules. The recovery of such compensation applies regardless of whether a Covered Officer engaged in misconduct or otherwise caused or contributed to the requirement of an accounting restatement. Under the Clawback Policy, the Company may recoup from the Covered Officers erroneously awarded compensation received within a lookback period of the three completed fiscal years preceding the date on which the Company is required to prepare an accounting restatement to correct a material error. In March 2025, the Company entered into agreements with each of our named executive officers for the purposes of implementing compliance with the Clawback Policy.

Potential Payments upon Termination or Change in Control

We have entered into an employment agreement with Mr. Pratt and offer letters with Messrs. Mason and Berg and Ms. Chong, which provide for the following benefits upon certain terminations as provided below:

Ryan Pratt

If Mr. Pratt is terminated by us without cause (as such term is defined in his employment agreement), he will be eligible to continue to receive his base salary for 12 months following termination, in exchange for executing a customary release of claims and his continued compliance with the restrictive covenants contained in his employment agreement.

Mark Mason

If Mr. Mason is terminated for any reason, he is not entitled to any severance.

John Berg

Mr. Berg retired in January 2025. He is not entitled to any severance.

Kellie Chong

If Ms. Chong is terminated for any reason, she is not entitled to any severance.

Stock Incentive Plans

The purpose of the Stock Incentive Plans is to attract and retain the best available personnel for positions of substantial responsibility, to provide additional incentive to employees, directors, and consultants, and to promote the success of our business.

2014 Plan

In connection with the Merger, we assumed Private Guerrilla RF’s 2014 Plan, and options issued and outstanding under the 2014 Plan were assumed and converted into options to purchase our common stock. Effective October 22, 2021, participation in the 2014 Plan was frozen, and no new awards will be made under the 2014 Plan. The 2014 Plan provides for the grant of incentive stock options and non-statutory stock options to purchase shares of our common stock, each at a stated exercise price. The 2014 Plan also allows for the grant of restricted stock awards, with terms as generally determined by the Compensation Committee (in accordance with the 2014 Plan) and to be set forth in an award agreement. We have not granted any shares of restricted stock under the 2014 Plan. As of December 31, 2024, options to purchase 267,050 shares remained outstanding under the 2014 Plan.

2021 Plan

The Company currently grants equity awards to our employees, directors, and consultants under the 2021 Plan, which was adopted in connection with the Merger. Under the 2021 Plan, the Company is permitted to award stock options and other types of equity incentive awards, such as restricted stock awards, stock appreciation rights (“SARs”), RSUs, performance awards, cash awards, and stock bonus awards. We initially reserved 37,166 shares of our common stock, plus any reserved shares not issued or subject to outstanding grants under the 2014 Plan on the effective date of the 2021 Plan, for issuance pursuant to awards granted under our 2021 Plan.

In addition, the number of shares reserved for issuance under our 2021 Plan increased automatically by 276,227 shares on January 1, 2022; 310,560 shares on January 1, 2023; and 394,660 shares on January 1, 2024, 512,024 shares on January 1, 2025, and will continue to automatically increase annually through January 1, 2031 by the number of shares equal to the lesser of 5% of the total number of outstanding shares of common stock as of the immediately preceding December 31, or such number as is determined by our Board. As of December 31, 2024, a total of 961,829 shares were reserved for issuance under the 2021 Plan, including 305,370 shares available for future awards.

As of December 31, 2024, options to purchase an aggregate of 348,467 shares remained outstanding under the two Stock Incentive Plans, with a weighted-average exercise price of $4.54 per share, and 575,042 RSUs were outstanding under the 2021 Plan.