.2 AI-POWERED, PORTABLE BRAIN MRI The Swoop® Portable MR Imaging System is Driving the Future of Brain Health Corporate Investor Deck – October 2025 The Hyperfine logo, Swoop, and Portable MR Imaging are registered trademarks of Hyperfine, Inc. The Swoop logo is a trademark of Hyperfine, Inc. PROPERTY OF HYPERFINE. ©2025. All rights reserved.

Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe from time to time in Company’s filings with the Securities and Exchange Commission (the harbor” provisions of the Private Securities Litigation Reform Act of 1995. Actual results of “SEC”), including those under “Risk Factors” therein. The Company cautions readers that the Hyperfine, Inc. (the “Company”) may differ from its expectations, estimates and projections foregoing list of factors is not exclusive and that readers should not place undue reliance and consequently, you should not rely on these forward-looking statements as predictions of upon any forward-looking statements, which speak only as of the date made. The Company future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” does not undertake or accept any obligation or undertaking to release publicly any updates “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” or revisions to any forward-looking statements to reflect any change in its expectations or and similar expressions (or the negative versions of such words or expressions) are intended any change in events, conditions or circumstances on which any such statement is based. to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s goals and commercial plans, including the Company’s This presentation includes preliminary financial estimates for the quarter ended September expansion plans; the benefits of the Company’s products and services, including the clinical 30, 2025, which reflect management’s current views and may change as a result of evidence supporting those benefits; the market demand and acceptance for the Company’s management’s final review of results and other factors, including significant business, products and services; the Company’s cash runway; the Company’s future performance, economic and competitive risks and uncertainties. Such preliminary financial information is including its financial performance; and the Company’s ability to implement its strategy. subject to the finalization and closing of the accounting books and records of the Company These forward-looking statements involve significant risks and uncertainties that could (which have yet to be performed). cause the actual results to differ materially from the expected results. Most of these factors are outside of the Company’s control and are difficult to predict. Factors that may cause In the course of preparing and finalizing these accounting books and records, and in such differences include, but are not limited to: the success, cost and timing of the preparing financial statements for the quarter ended September 30, 2025, the preliminary Company’s product development and commercialization activities, including the degree estimates for the quarter ended September 30, 2025 will be subject to change and the that the Swoop® system is accepted and used by healthcare professionals; the Company’s Company may identify items that will require it to make adjustments to the Company’s ability to grow and manage growth profitably and retain its key employees; changes in preliminary estimates described herein. Any such changes could be material. applicable laws or regulations; the ability of the Company to raise financing in the future; the ability of the Company to obtain and maintain regulatory clearance or approval for its For these or other reasons, the preliminary financial estimates for the quarter ended products, and any related restrictions and limitations of any cleared or approved product; September 30, 2025 may not ultimately be indicative of the Company’s results for such the ability of the Company to identify, in-license or acquire additional technology; the ability period and actual results may differ materially from those described above. No independent of the Company to maintain its existing or future license, manufacturing, supply and registered public accounting firm has audited, reviewed or compiled, examined or distribution agreements and to obtain adequate supply of its products; the ability of the performed any procedures with respect to these preliminary results, nor have they Company to compete with other companies currently marketing or engaged in the expressed any opinion or any other form of assurance on these preliminary results. development of products and services that the Company is currently marketing or developing; the size and growth potential of the markets for the Company’s products and These unaudited preliminary reserving estimates are presented for informational purposes services, and its ability to serve those markets, either alone or in partnership with others; the only and do not purport to represent the Company’s financial condition or results of pricing of the Company’s products and services and reimbursement for medical procedures operations for any future date or period. As a result, caution should be exercised in relying on conducted using the Company’s products and services; the Company’s ability to generate these estimates and no inferences should be drawn from these estimates regarding clinical evidence of the benefits of the Company’s products and services; the Company’s financial or operating data not provided. estimates regarding expenses, revenue, capital requirements and needs for additional financing; the Company’s financial performance; and other risks and uncertainties indicated 2 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

Who is Hyperfine? First FDA-cleared, AI-powered portable MR brain imaging system with strong proprietary technology, accessible across multiple sites of care from ICU, to offices and community settings, with compelling clinical and economic value proposition 1 $6B+ Market Opportunity . Early commercial stage with existing reimbursement, attractive revenue growth and gross margin profile, strong spending discipline, and increased operating leverage Growth strategy de-risked with recent launches of next-generation Swoop system and Optive AI software with highest performing image quality for ultra-low field MRI Platform technology expanding brain imaging globally to address large, unmet healthcare needs and improve brain health with opportunity to develop for additional anatomies 1) Inpatient and Outpatient Settings TAM. See Slide 5 for additional information on TAM. 3 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

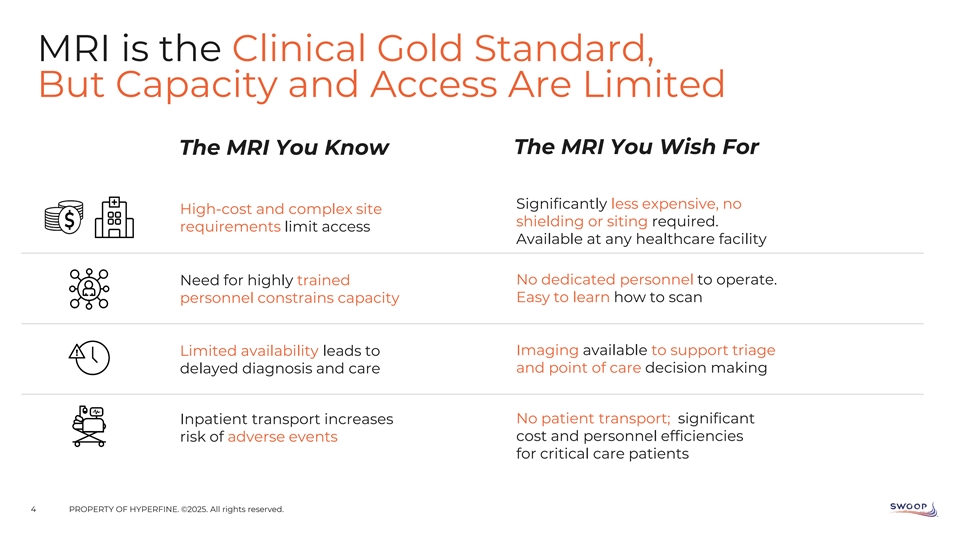

MRI is the Clinical Gold Standard, But Capacity and Access Are Limited The MRI You Know The MRI You Wish For Significantly less expensive, no High-cost and complex site shielding or siting required. requirements limit access Available at any healthcare facility Need for highly trained No dedicated personnel to operate. personnel constrains capacity Easy to learn how to scan Limited availability leads to Imaging available to support triage delayed diagnosis and care and point of care decision making Inpatient transport increases No patient transport; significant risk of adverse events cost and personnel efficiencies for critical care patients 4 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

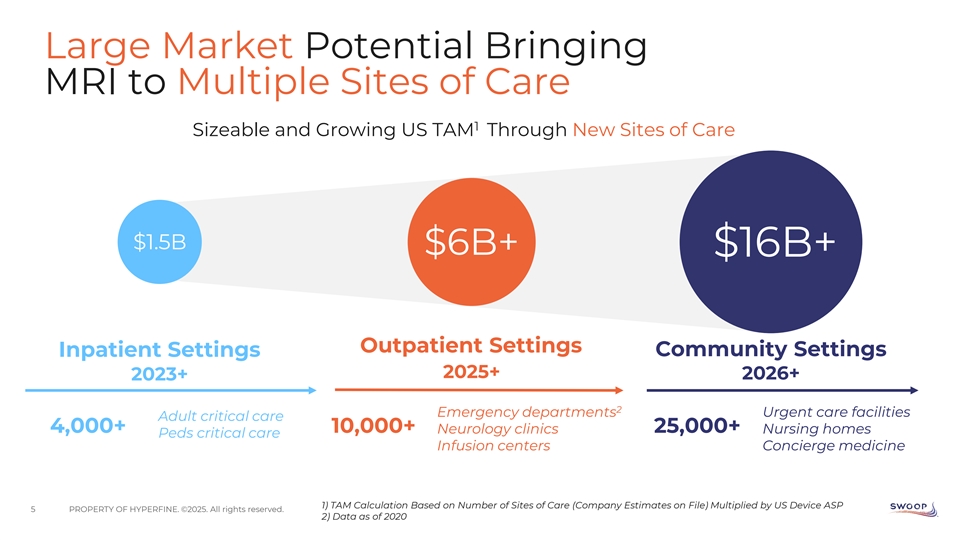

Large Market Potential Bringing MRI to Multiple Sites of Care 1 Sizeable and Growing US TAM Through New Sites of Care $1.5B $6B+ $16B+ Outpatient Settings Community Settings Inpatient Settings 2025+ 2026+ 2023+ 2 Emergency departments Urgent care facilities Adult critical care 4,000+ 10,000+ Neurology clinics 25,000+ Nursing homes Peds critical care Infusion centers Concierge medicine 1) TAM Calculation Based on Number of Sites of Care (Company Estimates on File) Multiplied by US Device ASP 5 PROPERTY OF HYPERFINE. ©2025. All rights reserved. 2) Data as of 2020

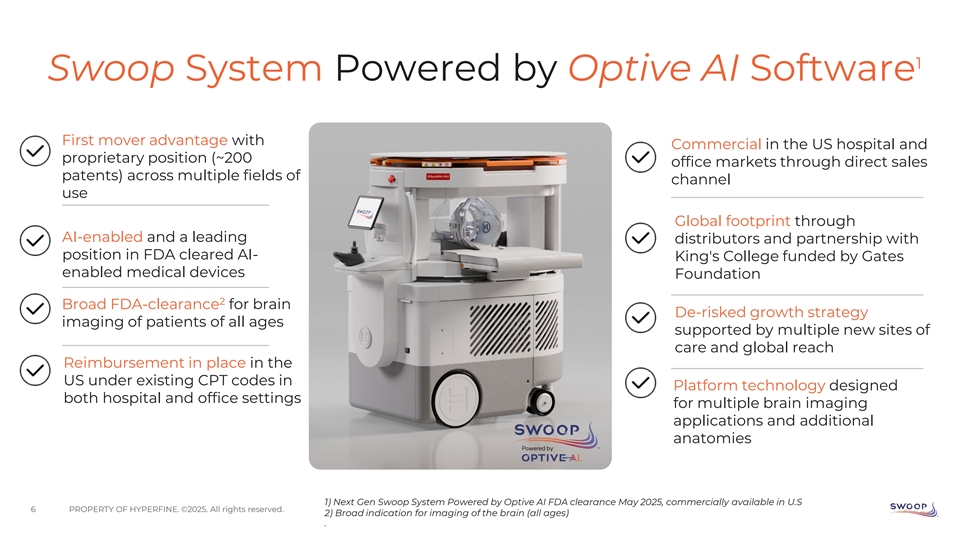

1 Swoop System Powered by Optive AI Software First mover advantage with Commercial in the US hospital and proprietary position (~200 office markets through direct sales patents) across multiple fields of channel use Global footprint through AI-enabled and a leading distributors and partnership with position in FDA cleared AI- King's College funded by Gates enabled medical devices Foundation 2 Broad FDA-clearance for brain De-risked growth strategy imaging of patients of all ages supported by multiple new sites of care and global reach Reimbursement in place in the US under existing CPT codes in Platform technology designed both hospital and office settings for multiple brain imaging applications and additional anatomies 1) Next Gen Swoop System Powered by Optive AI FDA clearance May 2025, commercially available in U.S 6 PROPERTY OF HYPERFINE. ©2025. All rights reserved. 2) Broad indication for imaging of the brain (all ages) .

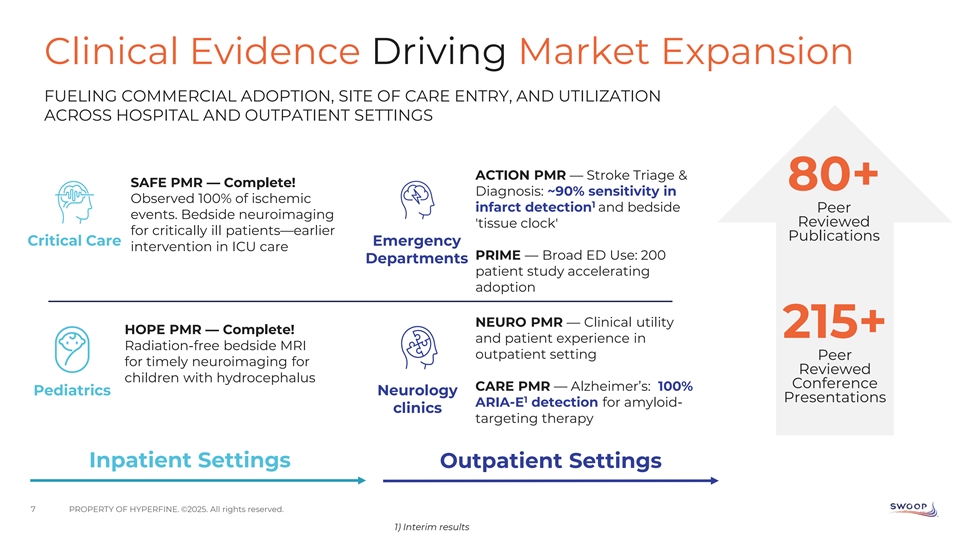

Clinical Evidence Driving Market Expansion FUELING COMMERCIAL ADOPTION, SITE OF CARE ENTRY, AND UTILIZATION ACROSS HOSPITAL AND OUTPATIENT SETTINGS ACTION PMR — Stroke Triage & SAFE PMR — Complete! 80+ Diagnosis: ~90% sensitivity in Observed 100% of ischemic 1 infarct detection and bedside Peer events. Bedside neuroimaging Reviewed 'tissue clock' for critically ill patients—earlier Publications Critical Care Emergency intervention in ICU care PRIME — Broad ED Use: 200 Departments patient study accelerating adoption NEURO PMR — Clinical utility HOPE PMR — Complete! 215+ and patient experience in Radiation-free bedside MRI outpatient setting Peer for timely neuroimaging for Reviewed children with hydrocephalus Conference CARE PMR — Alzheimer’s: 100% Pediatrics Neurology 1 Presentations ARIA-E detection for amyloid- clinics targeting therapy Inpatient Settings Outpatient Settings 7 PROPERTY OF HYPERFINE. ©2025. All rights reserved. 1) Interim results

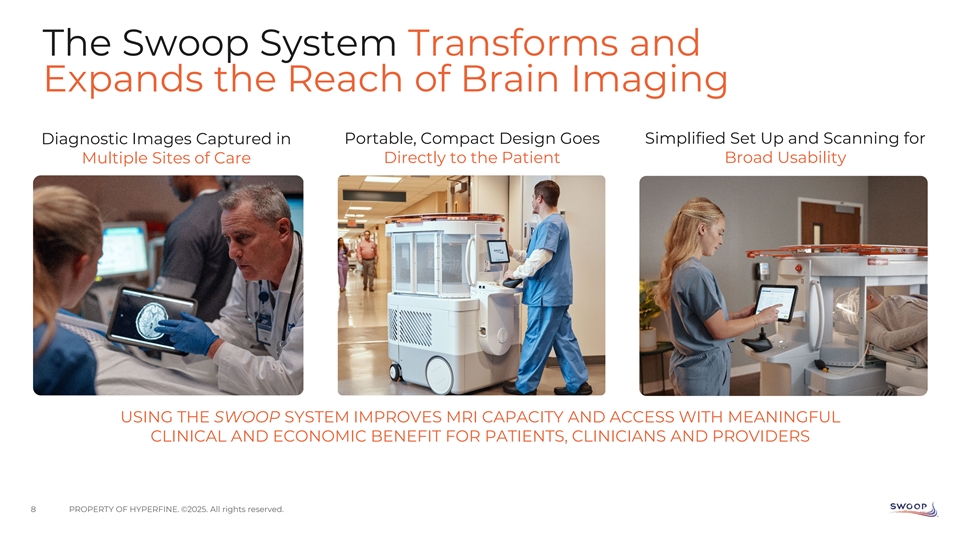

The Swoop System Transforms and Expands the Reach of Brain Imaging Diagnostic Images Captured in Portable, Compact Design Goes Simplified Set Up and Scanning for Directly to the Patient Broad Usability Multiple Sites of Care USING THE SWOOP SYSTEM IMPROVES MRI CAPACITY AND ACCESS WITH MEANINGFUL CLINICAL AND ECONOMIC BENEFIT FOR PATIENTS, CLINICIANS AND PROVIDERS 8 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

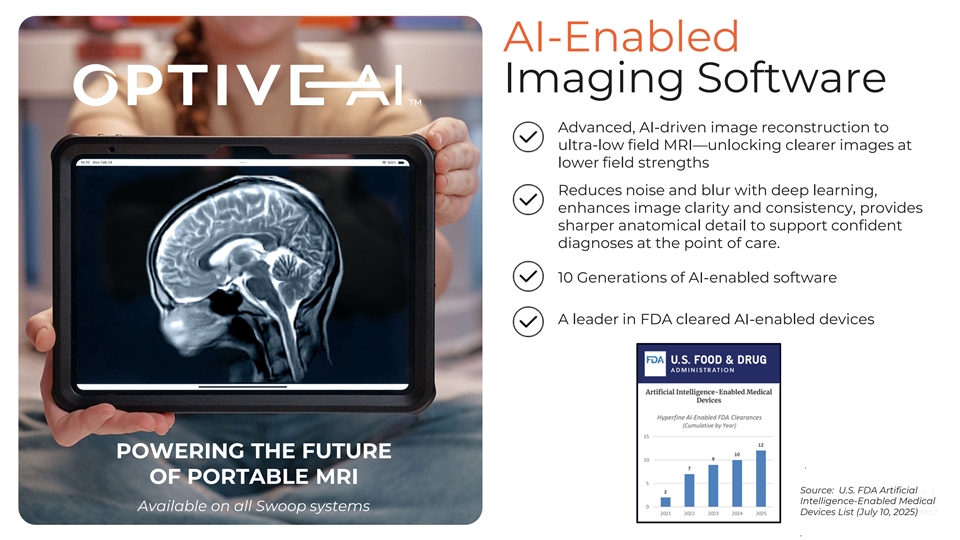

AI-Enabled Imaging Software Advanced, AI-driven image reconstruction to ultra-low field MRI—unlocking clearer images at lower field strengths Reduces noise and blur with deep learning, enhances image clarity and consistency, provides sharper anatomical detail to support confident diagnoses at the point of care. 10 Generations of AI-enabled software A leader in FDA cleared AI-enabled devices POWERING THE FUTURE . OF PORTABLE MRI Source: U.S. FDA Artificial Intelligence-Enabled Medical Available on all Swoop systems Devices List (July 10, 2025) .

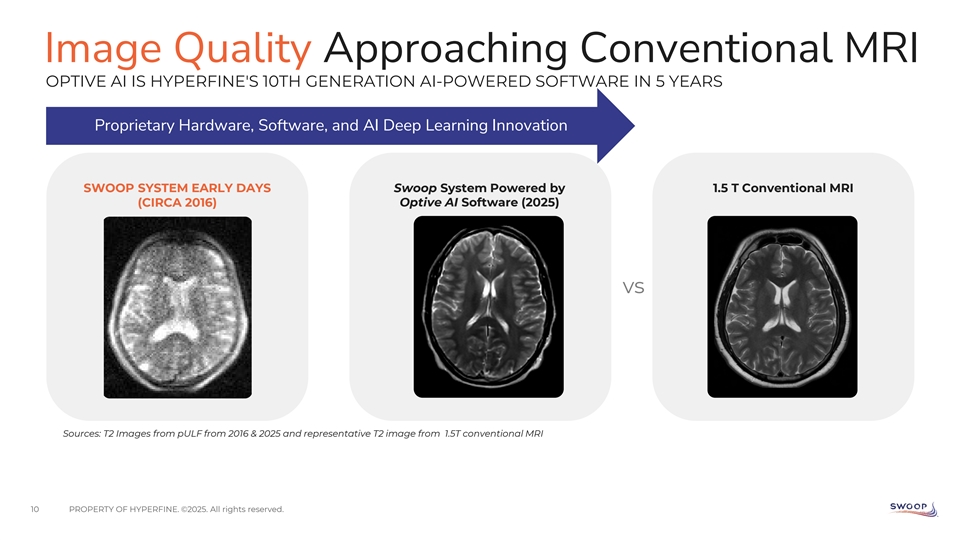

Image Quality Approaching Conventional MRI OPTIVE AI IS HYPERFINE'S 10TH GENERATION AI-POWERED SOFTWARE IN 5 YEARS Proprietary Hardware, Software, and AI Deep Learning Innovation SWOOP SYSTEM EARLY DAYS Swoop System Powered by 1.5 T Conventional MRI (CIRCA 2016) Optive AI Software (2025) vs Sources: T2 Images from pULF from 2016 & 2025 and representative T2 image from 1.5T conventional MRI 10 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

June 2, 2025 11 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

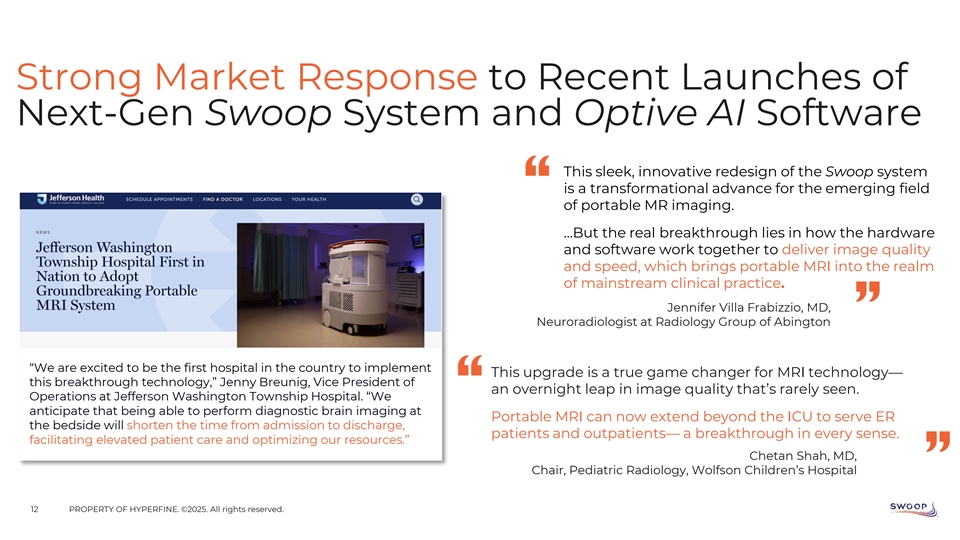

Strong Market Response to Recent Launches of Next-Gen Swoop System and Optive AI Software This sleek, innovative redesign of the Swoop system is a transformational advance for the emerging field of portable MR imaging. …But the real breakthrough lies in how the hardware and software work together to deliver image quality and speed, which brings portable MRI into the realm of mainstream clinical practice. Jennifer Villa Frabizzio, MD, Neuroradiologist at Radiology Group of Abington “We are excited to be the first hospital in the country to implement This upgrade is a true game changer for MRI technology— this breakthrough technology,” Jenny Breunig, Vice President of an overnight leap in image quality that’s rarely seen. Operations at Jefferson Washington Township Hospital. “We anticipate that being able to perform diagnostic brain imaging at Portable MRI can now extend beyond the ICU to serve ER the bedside will shorten the time from admission to discharge, patients and outpatients— a breakthrough in every sense. facilitating elevated patient care and optimizing our resources.” Chetan Shah, MD, Chair, Pediatric Radiology, Wolfson Children’s Hospital 12 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

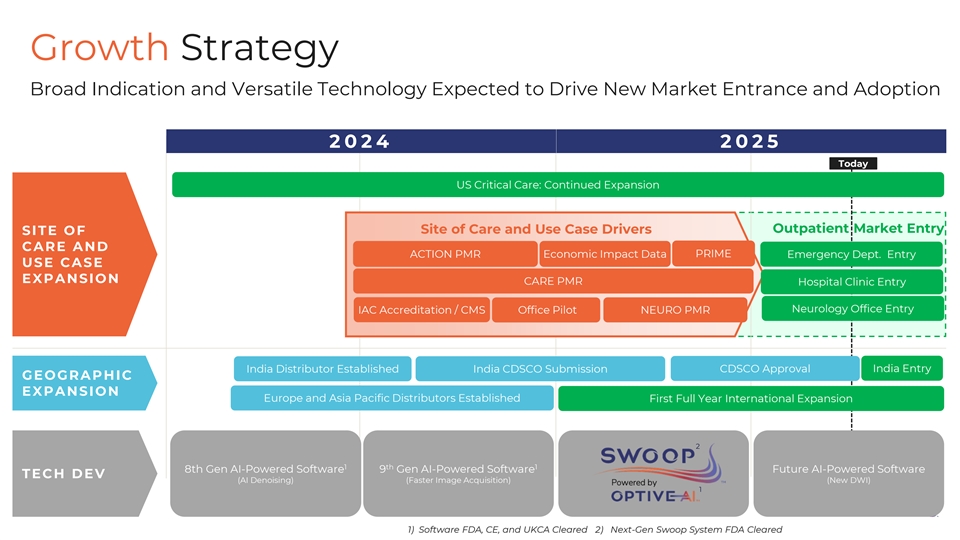

Growth Strategy Broad Indication and Versatile Technology Expected to Drive New Market Entrance and Adoption 20 24 20 25 Today US Critical Care: Continued Expansion Site of Care and Use Case Drivers Outpatient Market Entry SITE OF CARE AND PRIME ACTION PMR Economic Impact Data Emergency Dept. Entry USE CASE EXPANSION CARE PMR Hospital Clinic Entry Neurology Office Entry IAC Accreditation / CMS NEURO PMR Office Pilot CDSCO Approval India Entry India Distributor Established India CDSCO Submission GEOGRAPHIC EXPANSION Europe and Asia Pacific Distributors Established First Full Year International Expansion 2 1 th 1 8th Gen AI-Powered Software 9 Gen AI-Powered Software Future AI-Powered Software TECH DEV (AI Denoising) (Faster Image Acquisition) (New DWI) 1 13 1) Software FDA, CE, and UKCA Cleared 2) Next-Gen Swoop System FDA Cleared

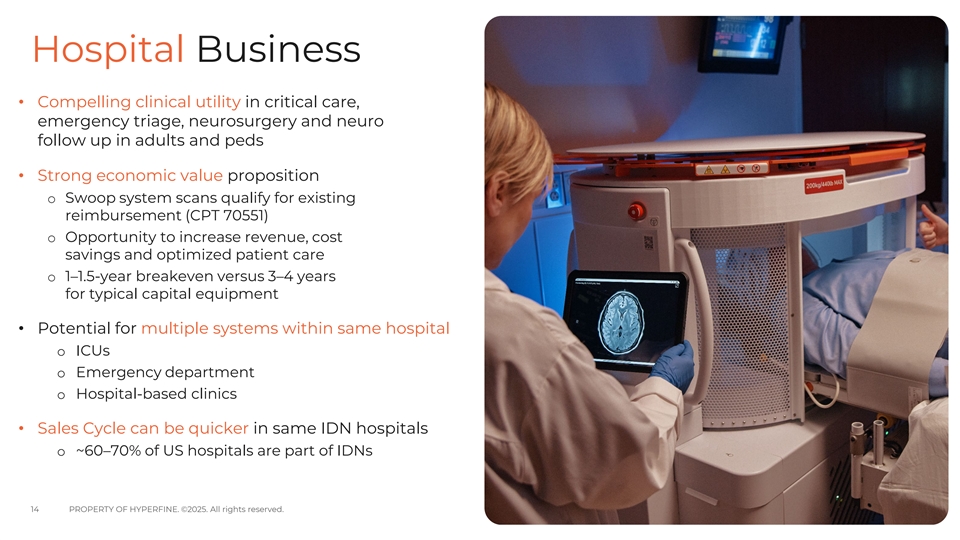

Hospital Business • Compelling clinical utility in critical care, emergency triage, neurosurgery and neuro follow up in adults and peds • Strong economic value proposition o Swoop system scans qualify for existing reimbursement (CPT 70551) o Opportunity to increase revenue, cost savings and optimized patient care o 1–1.5-year breakeven versus 3–4 years for typical capital equipment • Potential for multiple systems within same hospital o ICUs o Emergency department o Hospital-based clinics • Sales Cycle can be quicker in same IDN hospitals o ~60–70% of US hospitals are part of IDNs 14 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

Office Business • A typical neurologist orders 500–600 MRIs 1,2 annually for neurologic conditions such as headaches, dementia, tumor, MS, surgery follow-up • 90% of private neurology practices don’t have on- 3 site MR imaging • Affordable and appealing, plug-and-play Swoop system o No specialized siting required o No helium or electrical infrastructure required 4 o No MRI technologist required • Strong economic value proposition o Swoop system scans qualify for existing reimbursement (CPT 70551) o IAC Accreditation enables medical offices to qualify for CMS reimbursement o Opportunity to add incremental revenue stream & improve patient experience 1) https://practicalneurology.com/diseases-diagnoses/imaging-testing/viewpoints- why-neuroimaging-plays-a-critical-role-in-shaping-the-future-of-neurology/30403/ 2) Source: Mindfrog market research (data on file) • Office has shorter sales cycle and fewer decision- 3) The practice of neuroimaging within a neurology office setting, 2013 American makers than hospital business Academy of Neurology 15 PROPERTY OF HYPERFINE. ©2025. All rights reserved. 4) IAC Standards and Guidelines for MRI Accreditation. State regulations vary.

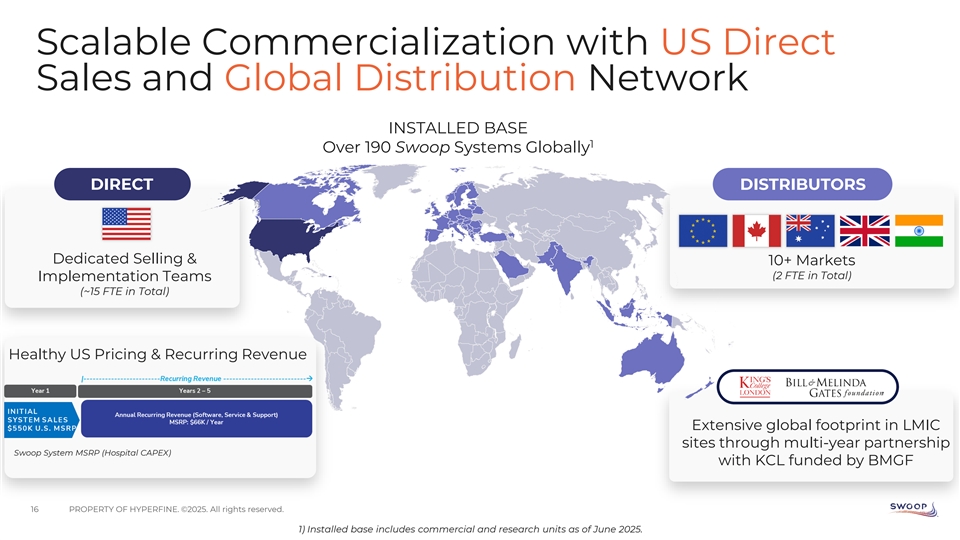

Scalable Commercialization with US Direct Sales and Global Distribution Network INSTALLED BASE 1 Over 190 Swoop Systems Globally DIRECT DISTRIBUTORS Dedicated Selling & 10+ Markets (2 FTE in Total) Implementation Teams (~15 FTE in Total) Healthy US Pricing & Recurring Revenue Extensive global footprint in LMIC sites through multi-year partnership Swoop System MSRP (Hospital CAPEX) with KCL funded by BMGF 16 PROPERTY OF HYPERFINE. ©2025. All rights reserved. 1) Installed base includes commercial and research units as of June 2025.

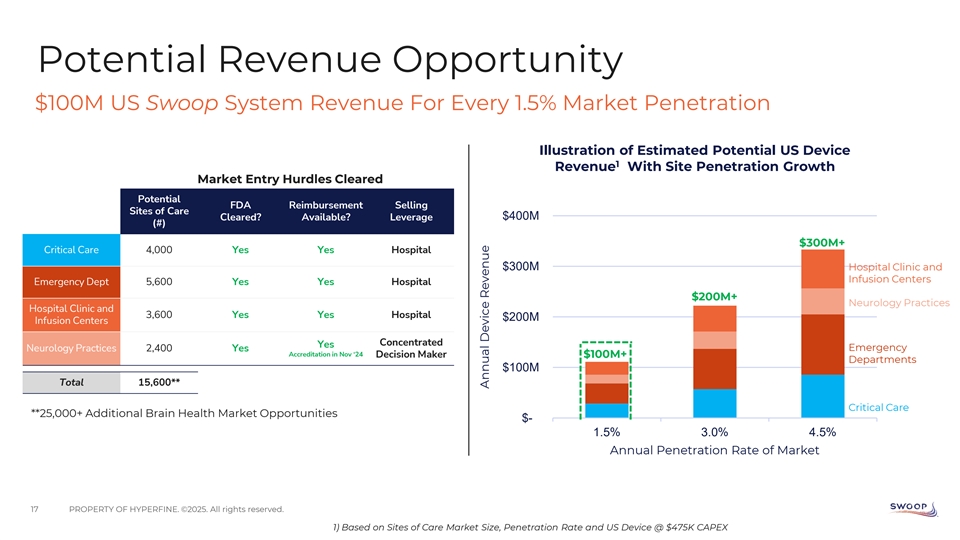

Potential Revenue Opportunity $100M US Swoop System Revenue For Every 1.5% Market Penetration Illustration of Estimated Potential US Device 1 Revenue With Site Penetration Growth Market Entry Hurdles Cleared Potential FDA Reimbursement Selling Sites of Care Cleared? Available? Leverage $400M (#) $300M+ Critical Care 4,000 Yes Yes Hospital $300M Hospital Clinic and Infusion Centers Emergency Dept 5,600 Yes Yes Hospital $200M+ Neurology Practices Hospital Clinic and 3,600 Yes Yes Hospital $200M Infusion Centers Concentrated Yes Emergency Neurology Practices 2,400 Yes Accreditation in Nov ‘24 Decision Maker $100M+ Departments $100M Total 15,600** Critical Care **25,000+ Additional Brain Health Market Opportunities $- 1.5% 3.0% 4.5% Annual Penetration Rate of Market 17 PROPERTY OF HYPERFINE. ©2025. All rights reserved. 1) Based on Sites of Care Market Size, Penetration Rate and US Device @ $475K CAPEX Annual Device Revenue

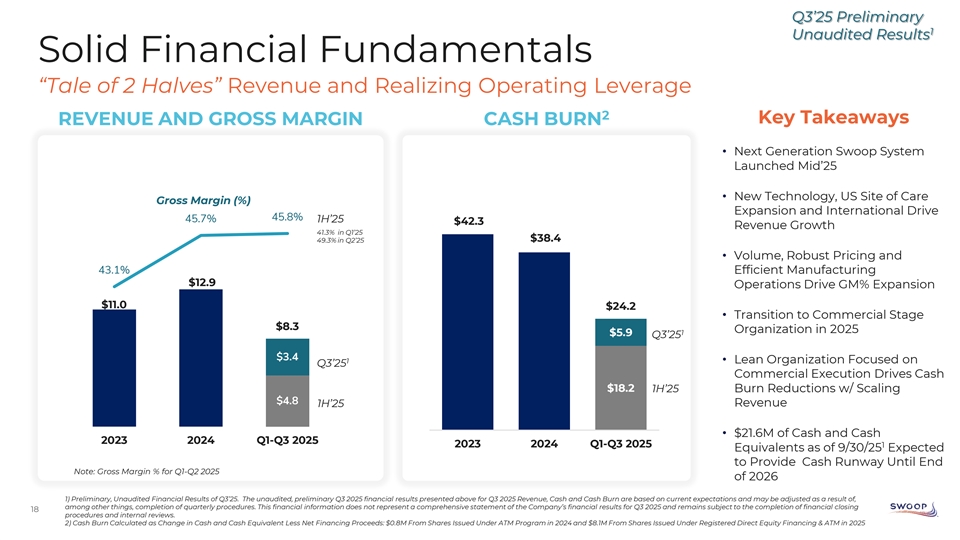

Q3’25 Preliminary 1 Unaudited Results Solid Financial Fundamentals “Tale of 2 Halves” Revenue and Realizing Operating Leverage 2 Key Takeaways REVENUE AND GROSS MARGIN CASH BURN • Next Generation Swoop System 25 Launched Mid’25 0.48 • New Technology, US Site of Care Gross Margin (%) Expansion and International Drive 20 45.8% 45.7% 1H’25 $42.3 Revenue Growth 0.46 41.3% in Q1’25 49.3% in Q2’25 $38.4 • Volume, Robust Pricing and 15 0.44 43.1% Efficient Manufacturing $12.9 Operations Drive GM% Expansion $11.0 0.42 $24.2 • Transition to Commercial Stage 10 $8.3 Organization in 2025 1 $5.9 Q3’25 0.4 $3.4 1 • Lean Organization Focused on Q3’25 5 Commercial Execution Drives Cash 0.38 $18.2 1H’25 Burn Reductions w/ Scaling $4.8 1H’25 Revenue 0 0.36 • $21.6M of Cash and Cash 2023 2024 Q1-Q3 2025 2023 2024 Q1-Q3 2025 1 Equivalents as of 9/30/25 Expected to Provide Cash Runway Until End Note: Gross Margin % for Q1-Q2 2025 of 2026 1) Preliminary, Unaudited Financial Results of Q3’25. The unaudited, preliminary Q3 2025 financial results presented above for Q3 2025 Revenue, Cash and Cash Burn are based on current expectations and may be adjusted as a result of, among other things, completion of quarterly procedures. This financial information does not represent a comprehensive statement of the Company’s financial results for Q3 2025 and remains subject to the completion of financial closing 18 PROPERTY OF HYPERFINE. ©2025. All rights reserved. procedures and internal reviews. 2) Cash Burn Calculated as Change in Cash and Cash Equivalent Less Net Financing Proceeds: $0.8M From Shares Issued Under ATM Program in 2024 and $8.1M From Shares Issued Under Registered Direct Equity Financing & ATM in 2025

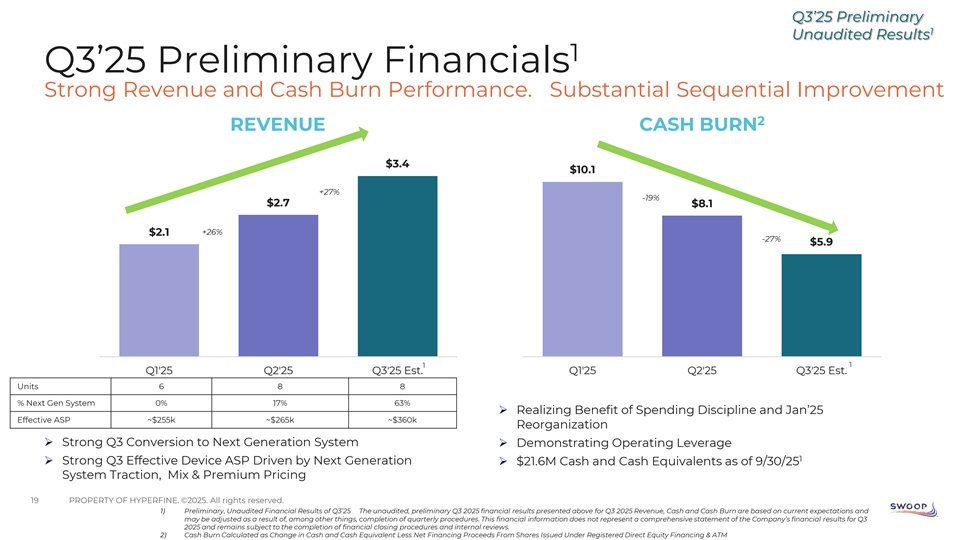

Q3’25 Preliminary 1 Unaudited Results 1 Q3’25 Preliminary Financials Strong Revenue and Cash Burn Performance. Substantial Sequential Improvement 2 REVENUE CASH BURN $3.4 $10.1 +27% -19% $2.7 $8.1 +26% $2.1 -27% $5.9 1 1 Q1'25 Q2'25 Q3'25 Est. Q1'25 Q2'25 Q3'25 Est. Units 6 8 8 % Next Gen System 0% 17%4.8 63% Ø Realizing Benefit of Spending Discipline and Jan’25 Effective ASP ~$255k ~$265k ~$360k Reorganization Ø Strong Q3 Conversion to Next Generation System Ø Demonstrating Operating Leverage 1 Ø Strong Q3 Effective Device ASP Driven by Next Generation Ø $21.6M Cash and Cash Equivalents as of 9/30/25 System Traction, Mix & Premium Pricing 19 PROPERTY OF HYPERFINE. ©2025. All rights reserved. 1) Preliminary, Unaudited Financial Results of Q3’25 The unaudited, preliminary Q3 2025 financial results presented above for Q3 2025 Revenue, Cash and Cash Burn are based on current expectations and may be adjusted as a result of, among other things, completion of quarterly procedures. This financial information does not represent a comprehensive statement of the Company’s financial results for Q3 2025 and remains subject to the completion of financial closing procedures and internal reviews. 2) Cash Burn Calculated as Change in Cash and Cash Equivalent Less Net Financing Proceeds From Shares Issued Under Registered Direct Equity Financing & ATM

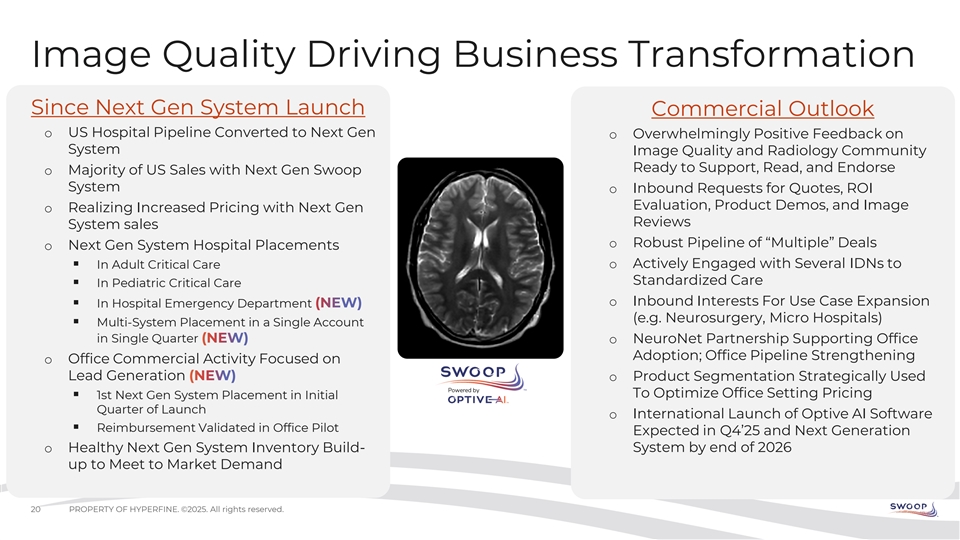

Image Quality Driving Business Transformation Since Next Gen System Launch Commercial Outlook o US Hospital Pipeline Converted to Next Gen o Overwhelmingly Positive Feedback on System Image Quality and Radiology Community Ready to Support, Read, and Endorse o Majority of US Sales with Next Gen Swoop System o Inbound Requests for Quotes, ROI Evaluation, Product Demos, and Image o Realizing Increased Pricing with Next Gen Reviews System sales o Robust Pipeline of “Multiple” Deals o Next Gen System Hospital Placements o Actively Engaged with Several IDNs to § In Adult Critical Care Standardized Care § In Pediatric Critical Care o Inbound Interests For Use Case Expansion § In Hospital Emergency Department (e.g. Neurosurgery, Micro Hospitals) § Multi-System Placement in a Single Account in Single Quarter o NeuroNet Partnership Supporting Office Adoption; Office Pipeline Strengthening o Office Commercial Activity Focused on Lead Generation o Product Segmentation Strategically Used To Optimize Office Setting Pricing § 1st Next Gen System Placement in Initial Quarter of Launch o International Launch of Optive AI Software § Reimbursement Validated in Office Pilot Expected in Q4’25 and Next Generation o Healthy Next Gen System Inventory Build- System by end of 2026 up to Meet to Market Demand 20 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

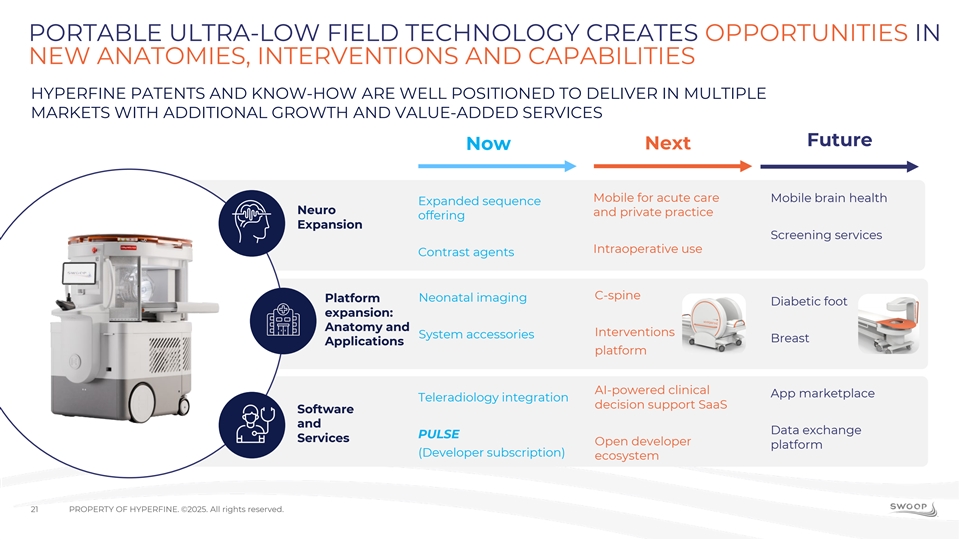

PORTABLE ULTRA-LOW FIELD TECHNOLOGY CREATES OPPORTUNITIES IN NEW ANATOMIES, INTERVENTIONS AND CAPABILITIES HYPERFINE PATENTS AND KNOW-HOW ARE WELL POSITIONED TO DELIVER IN MULTIPLE MARKETS WITH ADDITIONAL GROWTH AND VALUE-ADDED SERVICES Future Next Now Mobile for acute care Mobile brain health Expanded sequence Neuro and private practice offering Expansion Screening services Intraoperative use Contrast agents C-spine Neonatal imaging Platform Diabetic foot expansion: Anatomy and Interventions System accessories Breast Applications platform AI-powered clinical App marketplace Teleradiology integration decision support SaaS Software and Data exchange PULSE Services Open developer platform (Developer subscription) ecosystem 21 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

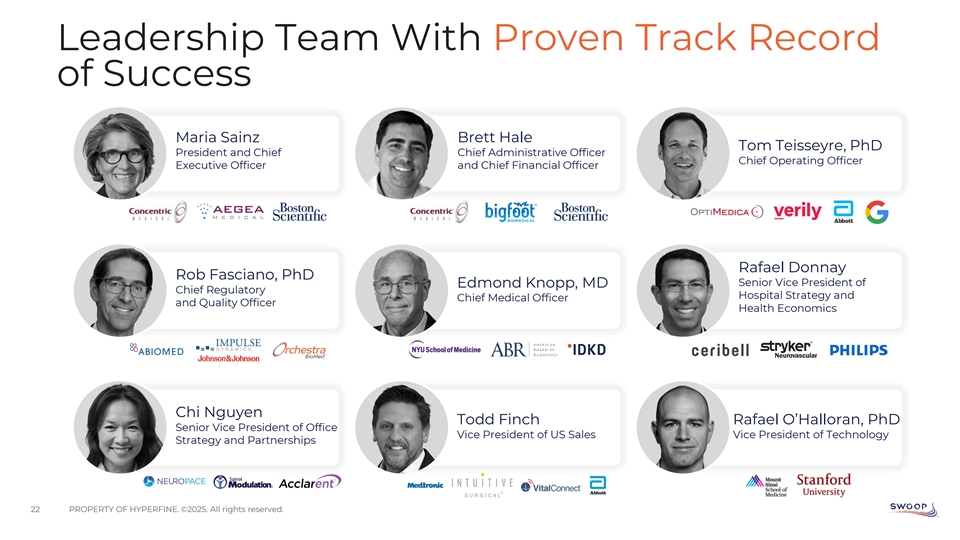

Leadership Team With Proven Track Record of Success Maria Sainz Brett Hale Tom Teisseyre, PhD President and Chief Chief Administrative Officer Chief Operating Officer Executive Officer and Chief Financial Officer Rafael Donnay Rob Fasciano, PhD Senior Vice President of Edmond Knopp, MD Chief Regulatory Hospital Strategy and Chief Medical Officer and Quality Officer Health Economics Chi Nguyen Todd Finch Rafael O’Halloran, PhD Senior Vice President of Office Vice President of US Sales Vice President of Technology Strategy and Partnerships 22 PROPERTY OF HYPERFINE. ©2025. All rights reserved.

Who is Hyperfine? First FDA-cleared, AI-powered portable MR brain imaging system with strong proprietary technology, accessible across multiple sites of care from ICU, to offices and community settings, with compelling clinical and economic value proposition 1 $6B+ Market Opportunity . Early commercial stage with existing reimbursement, attractive revenue growth and gross margin profile, strong spending discipline, and increased operating leverage Growth strategy de-risked with recent launches of next-generation Swoop system and Optive AI software with highest performing image quality for ultra-low field MRI Platform technology expanding brain imaging globally to address large, unmet healthcare needs and improve brain health with opportunity to develop for additional anatomies 1) Inpatient and Outpatient Settings TAM. See Slide 5 for additional information on TAM. 23 PROPERTY OF HYPERFINE. ©2025. All rights reserved.