JPM Healthcare Conference January 2026 d

Disclaimer Cautionary Note Regarding Forward-Looking Statements: These presentation materials contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements describe future expectations, including, without limitation, estimates of and goals for future operating, financial and tax performance and results, as well as the expected execution and effect of our business strategies, including our growth strategies in new and existing centers, ongoing macroeconomic challenges, including an increased competitive labor market and inflation, our growth initiatives, including our M&A activity and de novo centers and our ability to integrate the same, and strategic collaborations. Forward-looking statements can often be identified by the use of terminology such as “expect,” “likely,” “outlook,” “forecast,” “would,” “could,” “should,” “project,” “intend,” “plan,” “opportunity,” “goal,” “target,” “aim,” “continue,” “believe,” “seek,” “estimate,” “anticipate,” “may,” “possible,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions, known or unknown, that could cause actual results to vary materially from those indicated or anticipated. Examples of forward-looking statements include, among others, statements we may make regarding our ability or expectations to increase the number of participants we serve, to grow enrollment and capacity within existing and new centers, to build additional de novo centers, to expand into new geographies, to execute on tuck-in acquisitions or joint ventures, quarterly or annual guidance, our financial outlook, including future revenues and future earnings, mid-term and long-term financial goals, expectation regarding legal proceedings or ongoing audits, reimbursement and regulatory developments, market developments, growth strategies, and the effects of any of the foregoing on our future results of operations or financial conditions. For a detailed discussion of the risks and uncertainties that could affect our actual results, please refer to the risk factors identified in our periodic reports filed with the SEC, including, but not limited to our most recent Annual Report on Form 10-K, and Quarterly Report on Form 10-Q, as may be supplemented or amended. We do not undertake, and expressly disclaim, any duty or obligation to update publicly any forward- looking statement after the date of this presentation, except as required by law. Non-GAAP Financial Measures: This presentation includes certain non-GAAP financial measures, including center-level contribution margin and all measures whose label includes the words “adjusted” or variations of such words and similar expressions, and we refer you to the Appendix to the presentation materials available on our investor relations website for reconciliations to the most directly comparable U.S. GAAP financial measures and related information. We believe the non-GAAP numbers included in these presentation materials are helpful to understand the company’s operating performance, but has limitations, and you should not consider non-GAAP numbers in isolation or as a substitute for analysis of the company’s financial measures determined in accordance with GAAP. These presentation materials, the Appendix hereto and the related management presentation are integrally related and are intended to be presented, considered and understood together. † We do not provide reconciliations for future projections of Adjusted EBITDA or Adjusted EBITDA Margin. The Company is unable to provide guidance for net income (loss) or a reconciliation of the Company’s Adjusted EBITDA guidance because it cannot provide a meaningful or accurate calculation or estimation of certain reconciling items without unreasonable effort. The Company’s inability to do so is due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including variations in effective tax rate, expenses to be incurred for acquisition activities and other one-time or exceptional items. 2

Company highlights We enable medically and socially complex frail seniors to live independently in the community and avoid nursing homes The only scaled multi-state PACE platform, with sophisticated operating and technology capabilities End-to-end accountability for the healthcare dollar, delivering meaningful savings to federal and state payors and value to investors 3 Demonstrated ability to drive consistent growth and profitability year after year, even amid industry-wide medical cost and regulatory pressures Accelerating growth aligned with powerful dual-eligible demographic tailwinds, as competing models struggle to bend the cost curve Our proven model of care is preferred by participants and their families InnovAge is a scaled, vertically integrated payor-provider platform delivering personalized, value-based care to high- acuity, dual-eligible seniors.

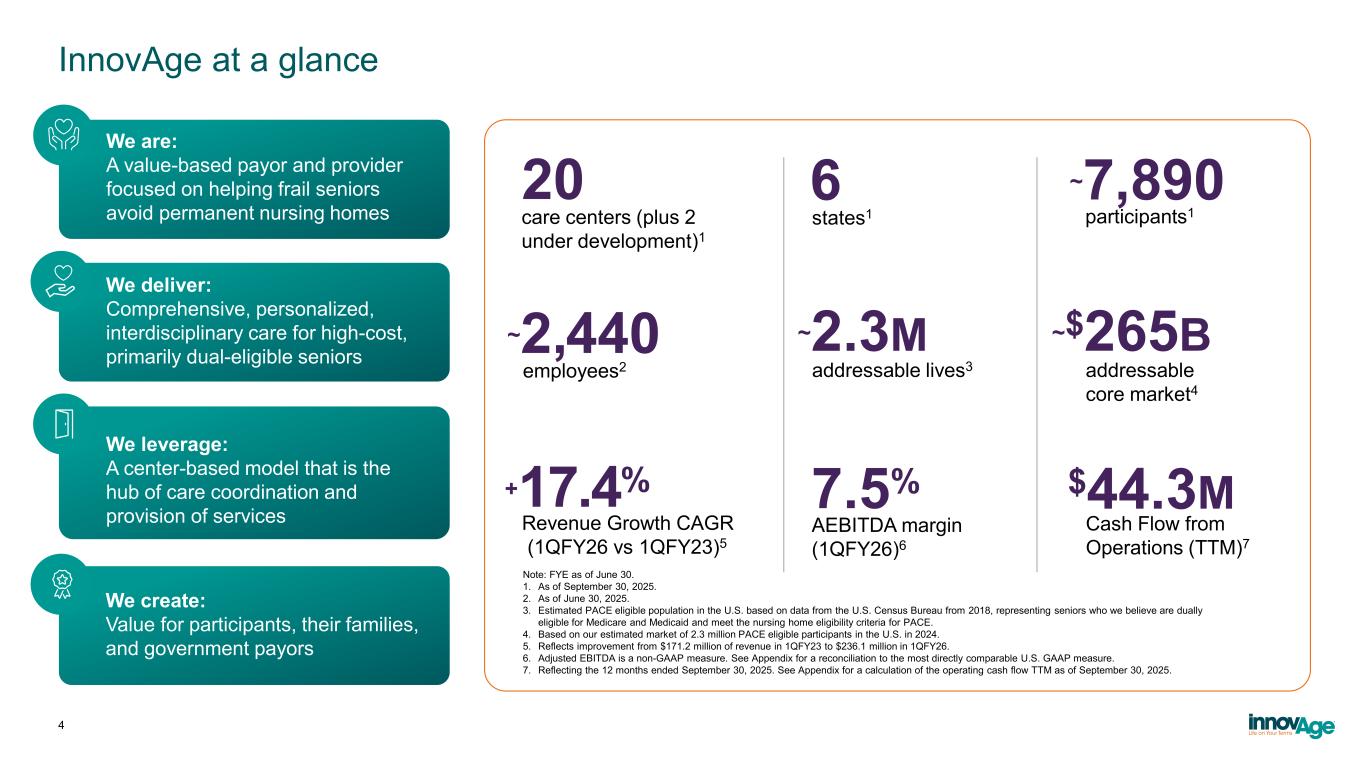

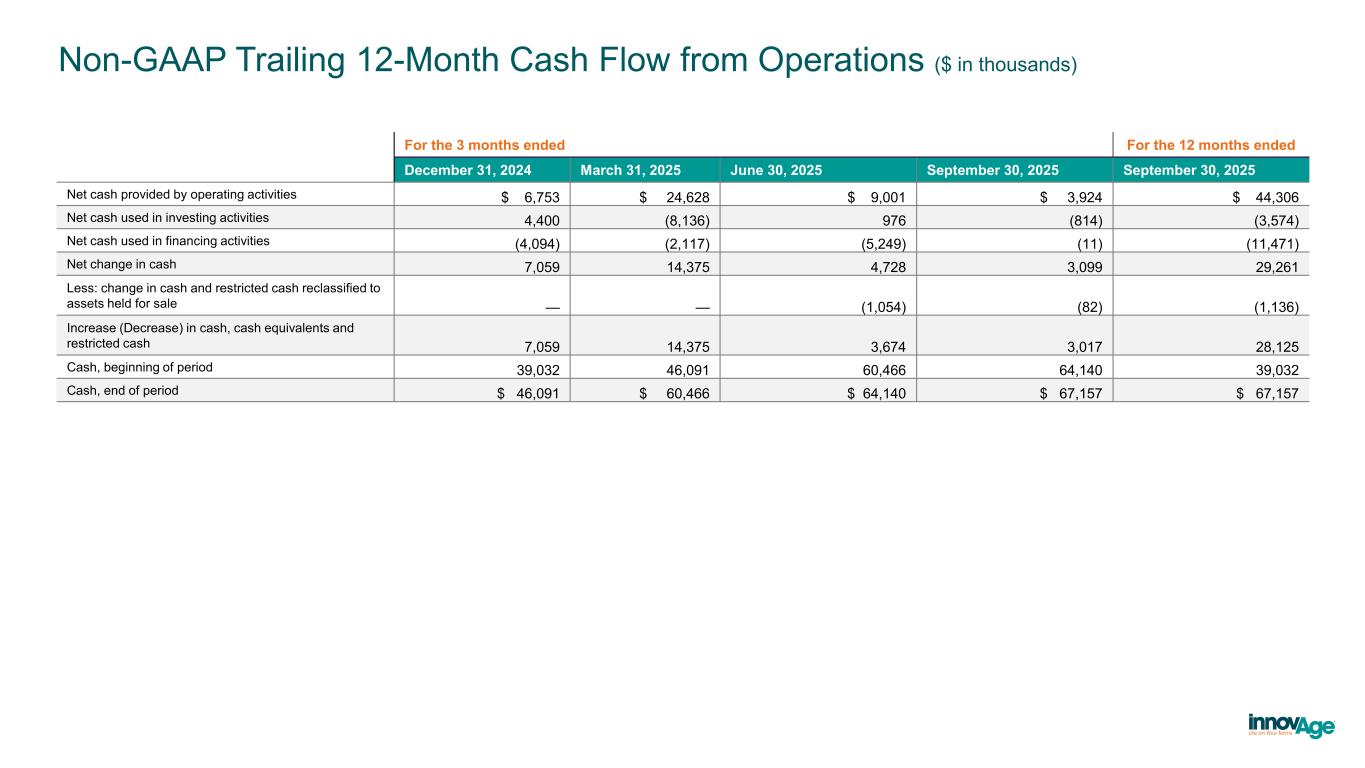

InnovAge at a glance We are: A value-based payor and provider focused on helping frail seniors avoid permanent nursing homes We deliver: Comprehensive, personalized, interdisciplinary care for high-cost, primarily dual-eligible seniors We leverage: A center-based model that is the hub of care coordination and provision of services We create: Value for participants, their families, and government payors 4 20 6 ~7,890 ~2,440 ~2.3M ~$265B care centers (plus 2 under development)1 participants1 addressable lives3 states1 employees2 addressable core market4 +17.4% 7.5% AEBITDA margin (1QFY26)6 Note: FYE as of June 30. 1. As of September 30, 2025. 2. As of June 30, 2025. 3. Estimated PACE eligible population in the U.S. based on data from the U.S. Census Bureau from 2018, representing seniors who we believe are dually eligible for Medicare and Medicaid and meet the nursing home eligibility criteria for PACE. 4. Based on our estimated market of 2.3 million PACE eligible participants in the U.S. in 2024. 5. Reflects improvement from $171.2 million of revenue in 1QFY23 to $236.1 million in 1QFY26. 6. Adjusted EBITDA is a non-GAAP measure. See Appendix for a reconciliation to the most directly comparable U.S. GAAP measure. 7. Reflecting the 12 months ended September 30, 2025. See Appendix for a calculation of the operating cash flow TTM as of September 30, 2025. Revenue Growth CAGR (1QFY26 vs 1QFY23)5 $44.3M Cash Flow from Operations (TTM)7

From stabilization to scale: building a platform for sustainable growth 5 Strengthen Foundation Optimize Platform • Built a scalable technology and operating backbone • Established payor-grade utilization and cost management capabilities • Implemented culture of compliance and accountability • Deepened regulatory and stakeholder relationships • Created a repeatable enrollment and growth playbook • Integrated critical clinical services to improve quality and cost controls • Drive responsible growth while expanding margins • Reimagine operations through a technology-first, integrated ecosystem • Advance clinical analytics to proactively manage risk and improve outcomes • Scale with fixed-cost discipline to unlock operating leverage • Expand selectively into complementary markets, products, and opportunities 2024+ Next 2 years:Last 2 years:

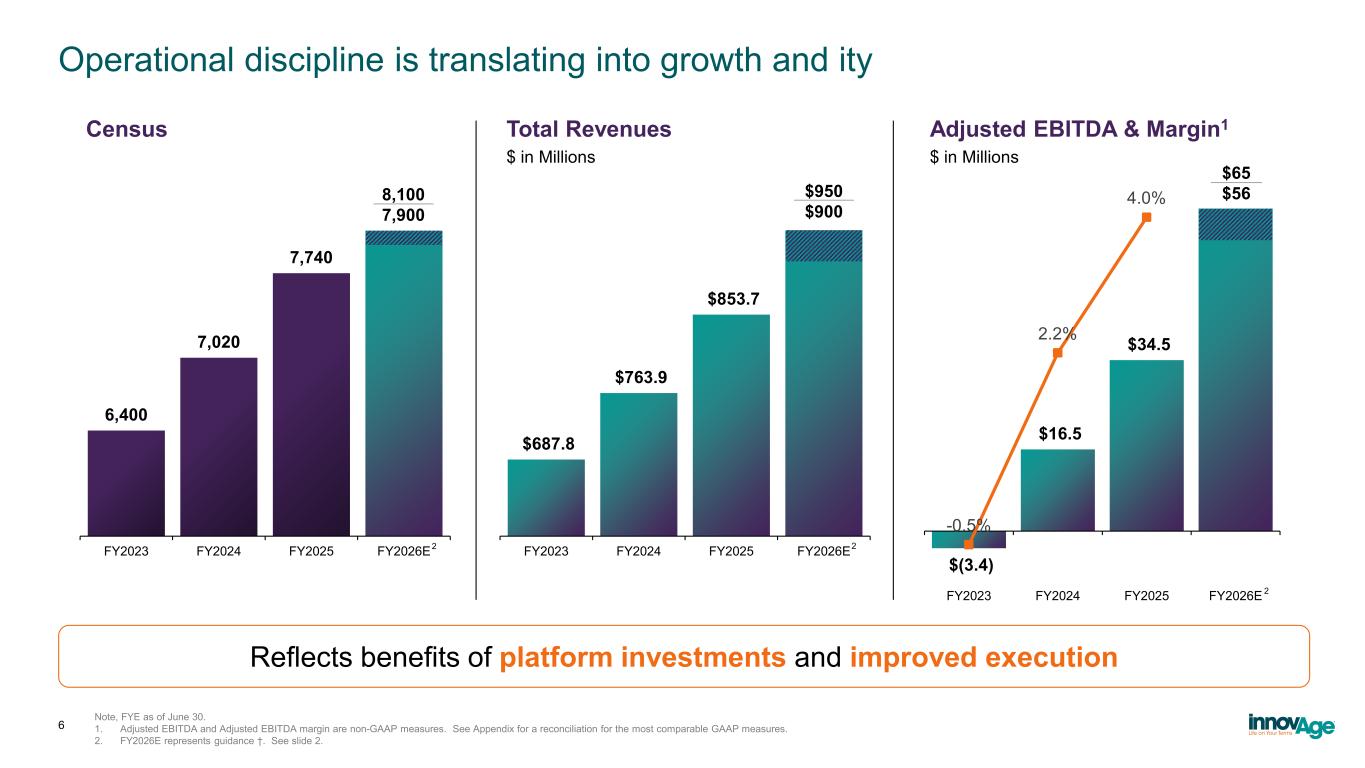

Operational discipline is translating into growth and ity Note, FYE as of June 30. 1. Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures. See Appendix for a reconciliation for the most comparable GAAP measures. 2. FY2026E represents guidance †. See slide 2. 6,400 7,020 7,740 FY2023 FY2024 FY2025 FY2026E $687.8 $763.9 $853.7 FY2023 FY2024 FY2025 FY2026E $ in Millions $(3.4) $16.5 $34.5 -0.5% 2.2% 4.0% -1.0% -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% $(10.0) $- $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 FY2023 FY2024 FY2025 FY2026E $ in Millions 8,100 7,900 $950 $900 $65 $56 2 2 2 Census Total Revenues Adjusted EBITDA & Margin1 6 Reflects benefits of platform investments and improved execution

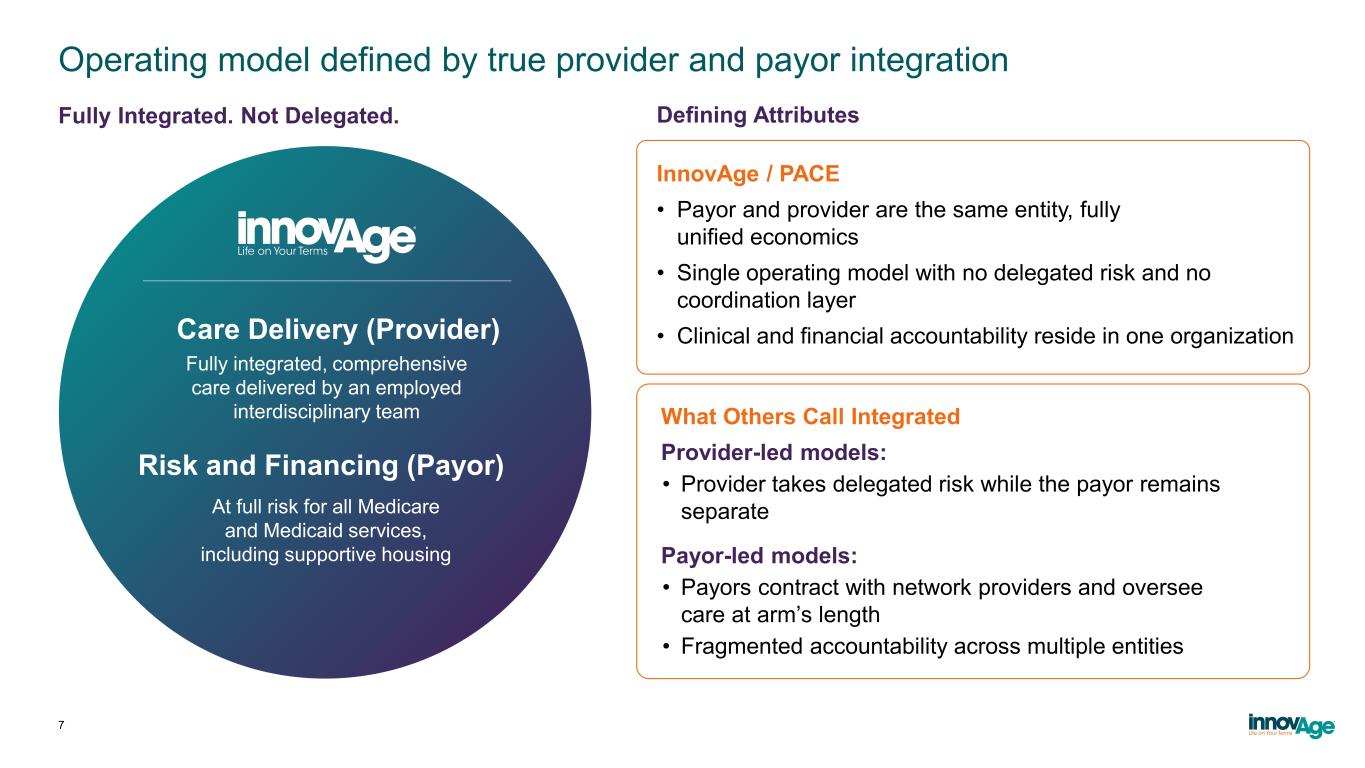

Operating model defined by true provider and payor integration 7 Defining Attributes InnovAge / PACE • Payor and provider are the same entity, fully unified economics • Single operating model with no delegated risk and no coordination layer • Clinical and financial accountability reside in one organization What Others Call Integrated Provider-led models: • Provider takes delegated risk while the payor remains separate Payor-led models: • Payors contract with network providers and oversee care at arm’s length • Fragmented accountability across multiple entities At full risk for all Medicare and Medicaid services, including supportive housing Risk and Financing (Payor) Care Delivery (Provider) Fully integrated, comprehensive care delivered by an employed interdisciplinary team Fully Integrated. Not Delegated.

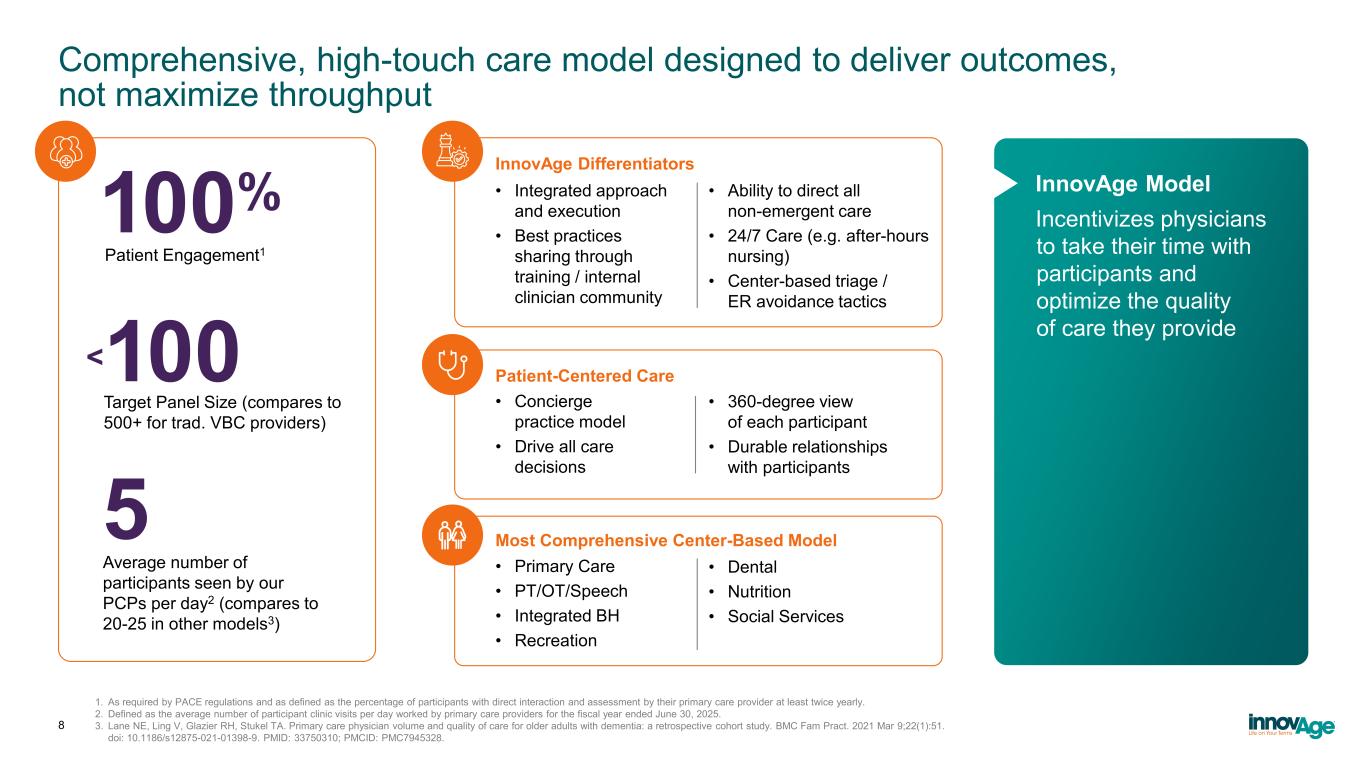

Comprehensive, high-touch care model designed to deliver outcomes, not maximize throughput 8 Target Panel Size (compares to 500+ for trad. VBC providers) InnovAge Differentiators • Integrated approach and execution • Best practices sharing through training / internal clinician community • Ability to direct all non-emergent care • 24/7 Care (e.g. after-hours nursing) • Center-based triage / ER avoidance tactics Patient-Centered Care • Concierge practice model • Drive all care decisions • 360-degree view of each participant • Durable relationships with participants Most Comprehensive Center-Based Model • Primary Care • PT/OT/Speech • Integrated BH • Recreation • Dental • Nutrition • Social Services <100 Incentivizes physicians to take their time with participants and optimize the quality of care they provide Average number of participants seen by our PCPs per day2 (compares to 20-25 in other models3) 5 100% Patient Engagement1 InnovAge Model 1. As required by PACE regulations and as defined as the percentage of participants with direct interaction and assessment by their primary care provider at least twice yearly. 2. Defined as the average number of participant clinic visits per day worked by primary care providers for the fiscal year ended June 30, 2025. 3. Lane NE, Ling V, Glazier RH, Stukel TA. Primary care physician volume and quality of care for older adults with dementia: a retrospective cohort study. BMC Fam Pract. 2021 Mar 9;22(1):51. doi: 10.1186/s12875-021-01398-9. PMID: 33750310; PMCID: PMC7945328.

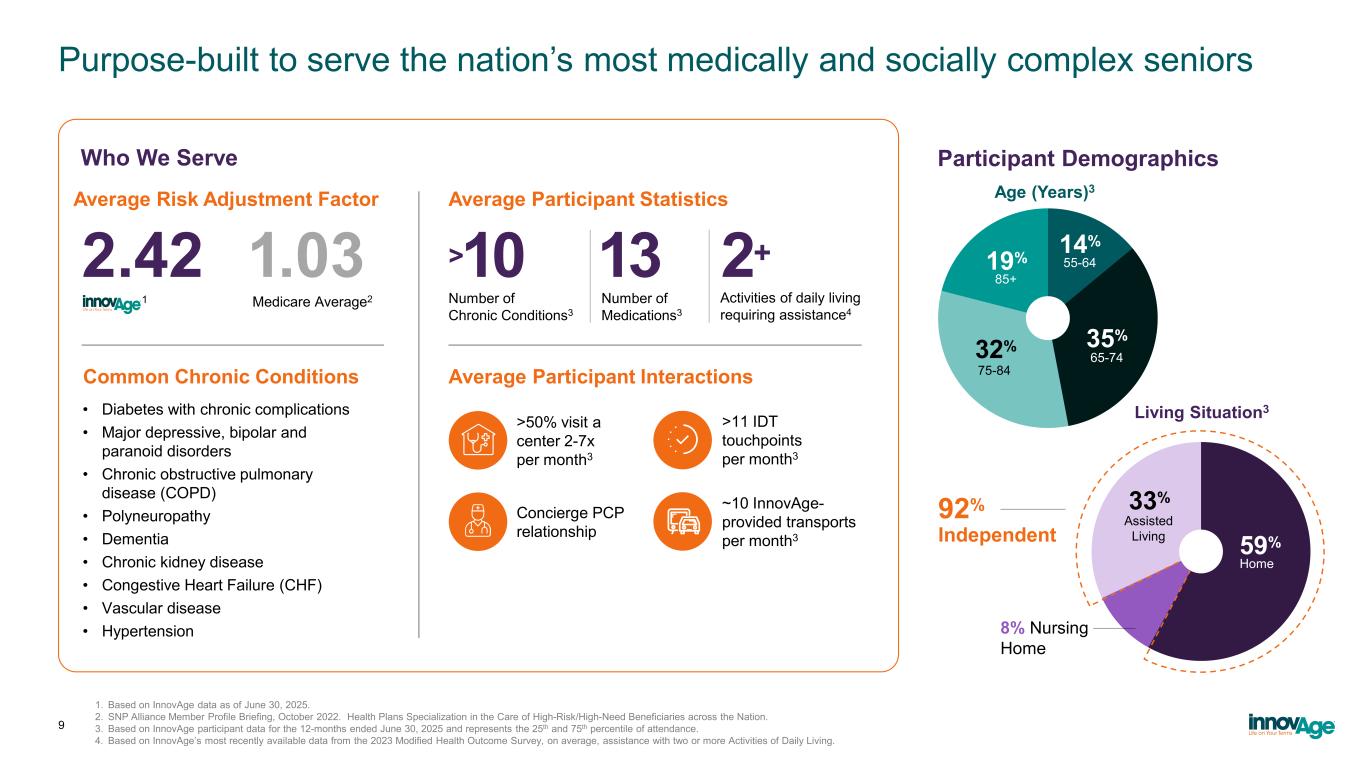

Purpose-built to serve the nation’s most medically and socially complex seniors 1. Based on InnovAge data as of June 30, 2025. 2. SNP Alliance Member Profile Briefing, October 2022. Health Plans Specialization in the Care of High-Risk/High-Need Beneficiaries across the Nation. 3. Based on InnovAge participant data for the 12-months ended June 30, 2025 and represents the 25th and 75th percentile of attendance. 4. Based on InnovAge’s most recently available data from the 2023 Modified Health Outcome Survey, on average, assistance with two or more Activities of Daily Living. 9 • Diabetes with chronic complications • Major depressive, bipolar and paranoid disorders • Chronic obstructive pulmonary disease (COPD) • Polyneuropathy • Dementia • Chronic kidney disease • Congestive Heart Failure (CHF) • Vascular disease • Hypertension Number of Medications3 Number of Chronic Conditions3 Activities of daily living requiring assistance4 >50% visit a center 2-7x per month3 Common Chronic Conditions Average Participant Interactions >11 IDT touchpoints per month3 Concierge PCP relationship ~10 InnovAge- provided transports per month3 1 Average Risk Adjustment Factor Average Participant Statistics 2.42 >10 13 2+ Who We Serve Medicare Average2 1.03 Home 65-74 35% 75-84 32% 85+ 19% 55-64 14% 59% 8% Nursing Home Assisted Living 33%92% Independent Participant Demographics Living Situation3 Age (Years)3

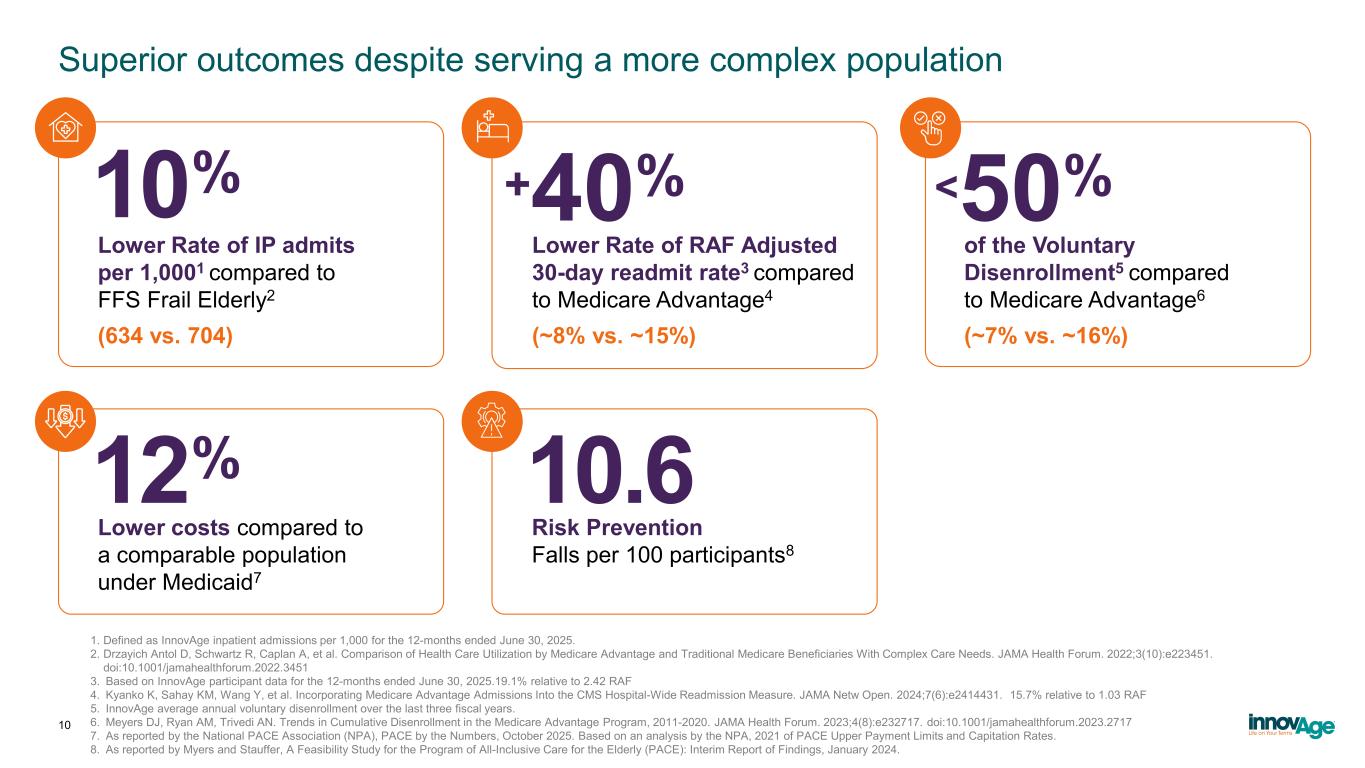

1. Defined as InnovAge inpatient admissions per 1,000 for the 12-months ended June 30, 2025. 2. Drzayich Antol D, Schwartz R, Caplan A, et al. Comparison of Health Care Utilization by Medicare Advantage and Traditional Medicare Beneficiaries With Complex Care Needs. JAMA Health Forum. 2022;3(10):e223451. doi:10.1001/jamahealthforum.2022.3451 3. Based on InnovAge participant data for the 12-months ended June 30, 2025.19.1% relative to 2.42 RAF 4. Kyanko K, Sahay KM, Wang Y, et al. Incorporating Medicare Advantage Admissions Into the CMS Hospital-Wide Readmission Measure. JAMA Netw Open. 2024;7(6):e2414431. 15.7% relative to 1.03 RAF 5. InnovAge average annual voluntary disenrollment over the last three fiscal years. 6. Meyers DJ, Ryan AM, Trivedi AN. Trends in Cumulative Disenrollment in the Medicare Advantage Program, 2011-2020. JAMA Health Forum. 2023;4(8):e232717. doi:10.1001/jamahealthforum.2023.2717 7. As reported by the National PACE Association (NPA), PACE by the Numbers, October 2025. Based on an analysis by the NPA, 2021 of PACE Upper Payment Limits and Capitation Rates. 8. As reported by Myers and Stauffer, A Feasibility Study for the Program of All-Inclusive Care for the Elderly (PACE): Interim Report of Findings, January 2024. 10 Superior outcomes despite serving a more complex population Lower Rate of IP admits per 1,0001 compared to FFS Frail Elderly2 (634 vs. 704) 10% +40% Lower Rate of RAF Adjusted 30-day readmit rate3 compared to Medicare Advantage4 (~8% vs. ~15%) <50% of the Voluntary Disenrollment5 compared to Medicare Advantage6 (~7% vs. ~16%) Lower costs compared to a comparable population under Medicaid7 12% 10.6 Risk Prevention Falls per 100 participants8

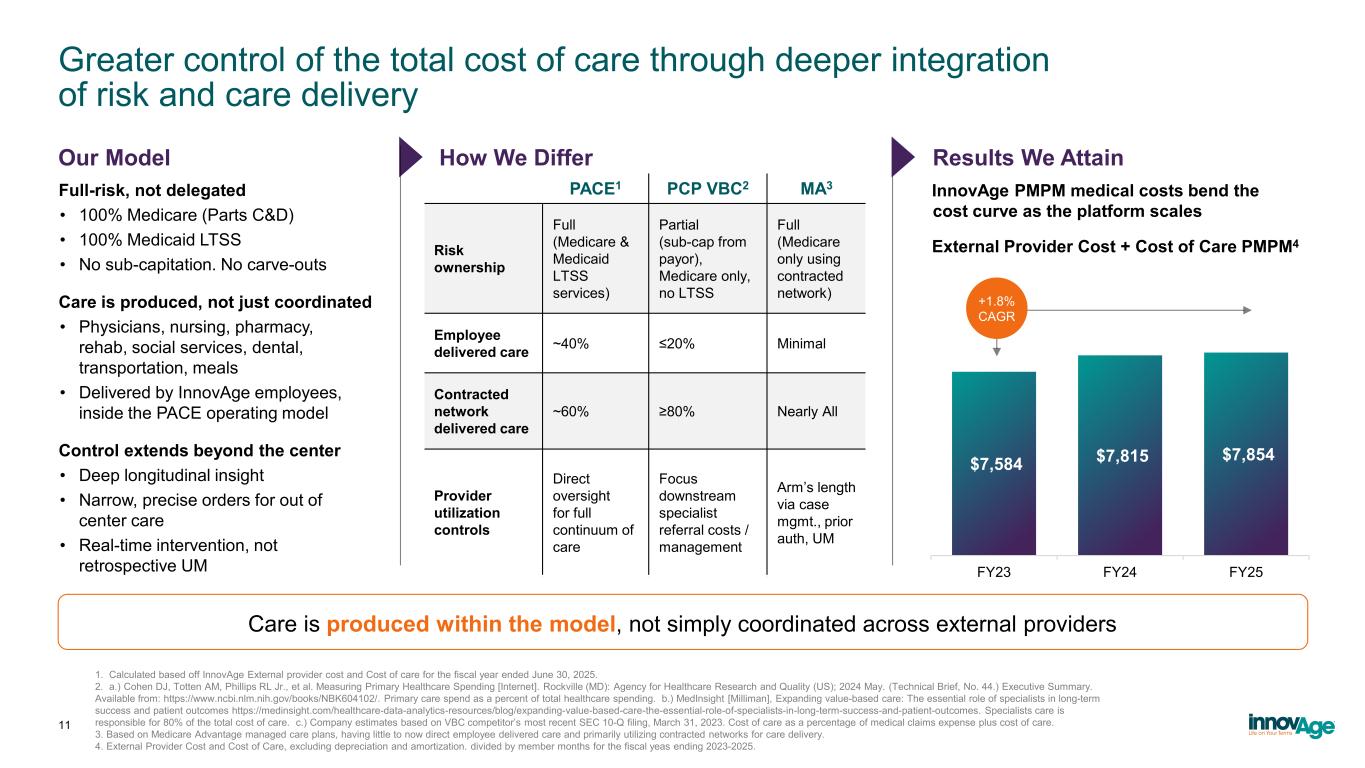

Greater control of the total cost of care through deeper integration of risk and care delivery $7,584 $7,815 $7,854 FY23 FY24 FY25 +1.8% CAGR Full-risk, not delegated • 100% Medicare (Parts C&D) • 100% Medicaid LTSS • No sub-capitation. No carve-outs Care is produced, not just coordinated • Physicians, nursing, pharmacy, rehab, social services, dental, transportation, meals • Delivered by InnovAge employees, inside the PACE operating model Control extends beyond the center • Deep longitudinal insight • Narrow, precise orders for out of center care • Real-time intervention, not retrospective UM InnovAge PMPM medical costs bend the cost curve as the platform scales 1. Calculated based off InnovAge External provider cost and Cost of care for the fiscal year ended June 30, 2025. 2. a.) Cohen DJ, Totten AM, Phillips RL Jr., et al. Measuring Primary Healthcare Spending [Internet]. Rockville (MD): Agency for Healthcare Research and Quality (US); 2024 May. (Technical Brief, No. 44.) Executive Summary. Available from: https://www.ncbi.nlm.nih.gov/books/NBK604102/. Primary care spend as a percent of total healthcare spending. b.) MedInsight [Milliman], Expanding value-based care: The essential role of specialists in long-term success and patient outcomes https://medinsight.com/healthcare-data-analytics-resources/blog/expanding-value-based-care-the-essential-role-of-specialists-in-long-term-success-and-patient-outcomes. Specialists care is responsible for 80% of the total cost of care. c.) Company estimates based on VBC competitor’s most recent SEC 10-Q filing, March 31, 2023. Cost of care as a percentage of medical claims expense plus cost of care. 3. Based on Medicare Advantage managed care plans, having little to now direct employee delivered care and primarily utilizing contracted networks for care delivery. 4. External Provider Cost and Cost of Care, excluding depreciation and amortization. divided by member months for the fiscal yeas ending 2023-2025. Care is produced within the model, not simply coordinated across external providers 11 Our Model How We Differ External Provider Cost + Cost of Care PMPM4 Results We Attain PACE1 PCP VBC2 MA3 Risk ownership Full (Medicare & Medicaid LTSS services) Partial (sub-cap from payor), Medicare only, no LTSS Full (Medicare only using contracted network) Employee delivered care ~40% ≤20% Minimal Contracted network delivered care ~60% ≥80% Nearly All Provider utilization controls Direct oversight for full continuum of care Focus downstream specialist referral costs / management Arm’s length via case mgmt., prior auth, UM

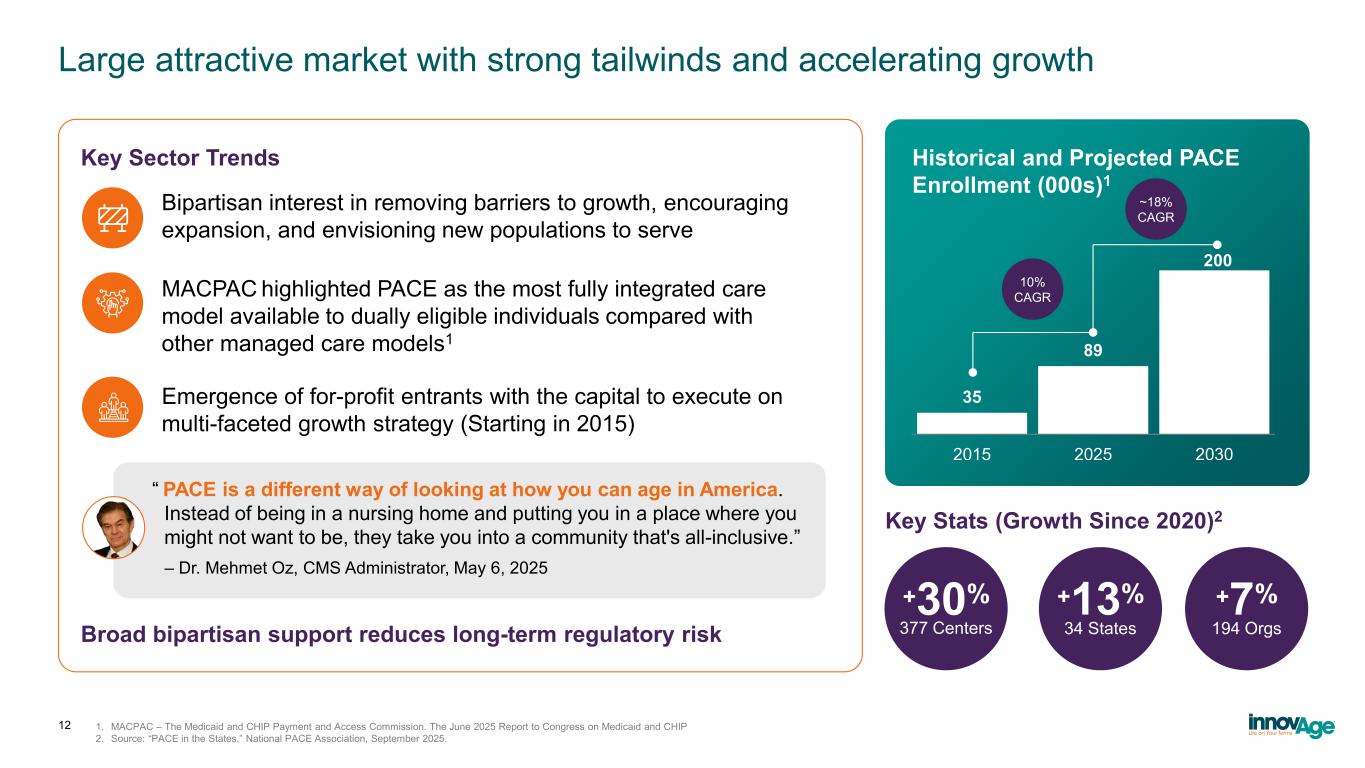

Large attractive market with strong tailwinds and accelerating growth 12 1. MACPAC – The Medicaid and CHIP Payment and Access Commission. The June 2025 Report to Congress on Medicaid and CHIP 2. Source: “PACE in the States,” National PACE Association, September 2025. Bipartisan interest in removing barriers to growth, encouraging expansion, and envisioning new populations to serve Key Sector Trends Historical and Projected PACE Enrollment (000s)1 35 89 2015 2025 2030 200 ~18% CAGR 10% CAGR “ PACE is a different way of looking at how you can age in America. Instead of being in a nursing home and putting you in a place where you might not want to be, they take you into a community that's all-inclusive.” – Dr. Mehmet Oz, CMS Administrator, May 6, 2025 +30% 377 Centers +13% 34 States +7% 194 OrgsBroad bipartisan support reduces long-term regulatory risk MACPAC highlighted PACE as the most fully integrated care model available to dually eligible individuals compared with other managed care models1 Emergence of for-profit entrants with the capital to execute on multi-faceted growth strategy (Starting in 2015) Key Stats (Growth Since 2020)2

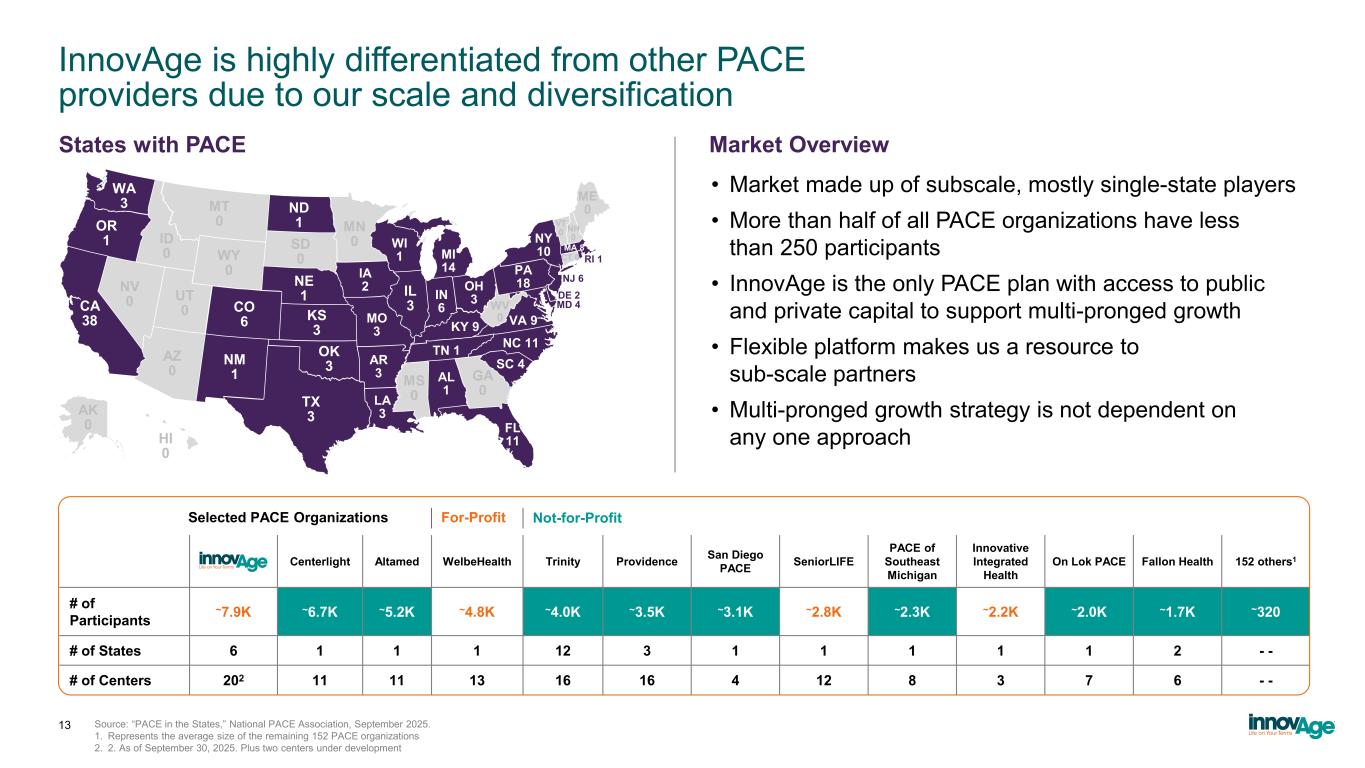

InnovAge is highly differentiated from other PACE providers due to our scale and diversification Source: “PACE in the States,” National PACE Association, September 2025. 1. Represents the average size of the remaining 152 PACE organizations 2. 2. As of September 30, 2025. Plus two centers under development Centerlight Altamed WelbeHealth Trinity Providence San Diego PACE SeniorLIFE PACE of Southeast Michigan Innovative Integrated Health On Lok PACE Fallon Health 152 others1 # of Participants ~7.9K ~6.7K ~5.2K ~4.8K ~4.0K ~3.5K ~3.1K ~2.8K ~2.3K ~2.2K ~2.0K ~1.7K ~320 # of States 6 1 1 1 12 3 1 1 1 1 1 2 - - # of Centers 202 11 11 13 16 16 4 12 8 3 7 6 - - For-ProfitSelected PACE Organizations Not-for-Profit 13 WA 3 OR 1 CA 38 ND 1 WY 0 NM 1 OK 3 TX 3 NE 1 CO 6 KS 3 IA 2 WI 1 MI 14 OH 3IN 6 PA 18 NY 10 LA 3 AR 3 TN 1 VA 9 NC 11 SC 4 FL 11 MD 4 DE 2 NJ 6 RI 1 AL 1 MA 8 KY 9 AZ 0 NV 0 UT 0 ID 0 MT 0 MN 0 IL 3 MO 3 SD 0 MS 0 GA 0 WV 0 ME 0 NH 0 VT 0 CT 0 AK 0 HI 0 • Market made up of subscale, mostly single-state players • More than half of all PACE organizations have less than 250 participants • InnovAge is the only PACE plan with access to public and private capital to support multi-pronged growth • Flexible platform makes us a resource to sub-scale partners • Multi-pronged growth strategy is not dependent on any one approach States with PACE Market Overview

Joint ventures accelerate impact in our communities 14 • Aligns mission in the community to serve frail, complex seniors • Co-branding unites local trust in health system with InnovAge’s PACE expertise, expanding care access, supporting aging in place, and improving outcomes • Creates more robust clinical network and integrated care delivery ecosystem within communities • Enhances referrals from partner’s providers • Strengthens partner’s role in keeping seniors at home and reducing hospitalizations Orlando Health’s success is not just a result of our outstanding teams, but also because of our community partnerships. We are excited to weave InnovAge, which has more than 30 years of success operating PACE programs, into the fabric of our mission. — Andy Gardiner, Senior Vice President of External Affairs and Community Relations, Orlando Health, May 29, 2024 “ Joint Venture Benefits Our partnership with InnovAge reflects our continued work to break down barriers and bring comprehensive, coordinated health care directly to those who need it most. Together, we are committed to ensuring that our seniors receive the respect, dignity and care they deserve. — John Couris, President & CEO, TGH, November 11, 2025 “

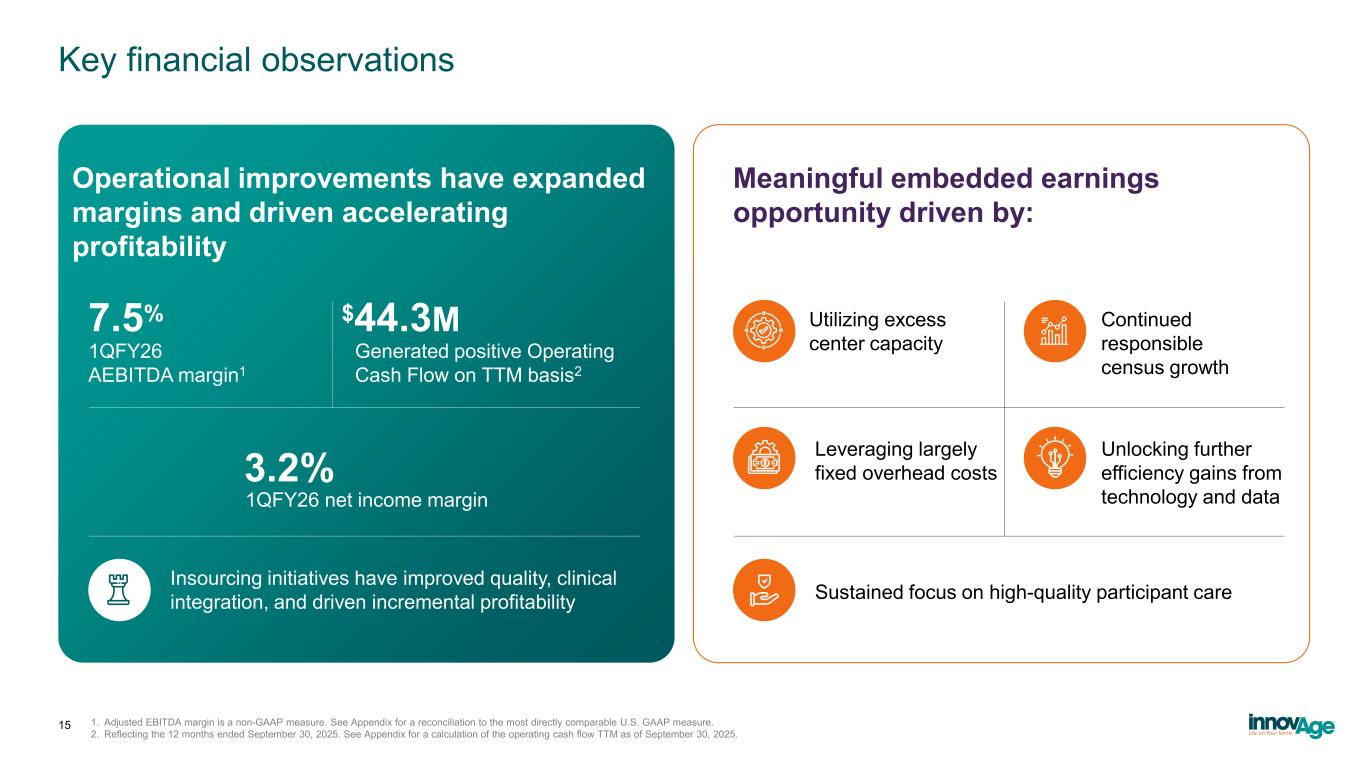

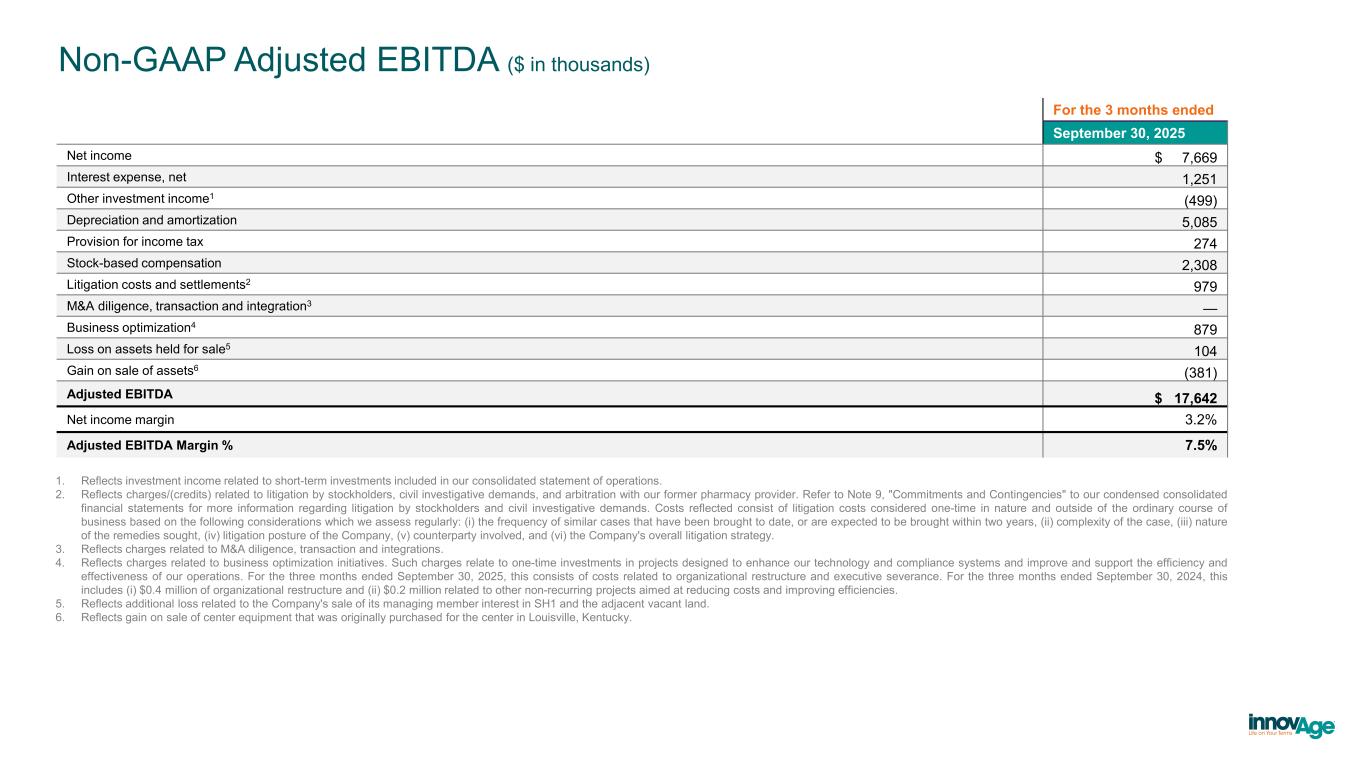

Key financial observations Operational improvements have expanded margins and driven accelerating profitability Meaningful embedded earnings opportunity driven by: Insourcing initiatives have improved quality, clinical integration, and driven incremental profitability 7.5% 1QFY26 AEBITDA margin1 $44.3M Generated positive Operating Cash Flow on TTM basis2 3.2% 1QFY26 net income margin Sustained focus on high-quality participant care Utilizing excess center capacity Continued responsible census growth Leveraging largely fixed overhead costs Unlocking further efficiency gains from technology and data 15 1. Adjusted EBITDA margin is a non-GAAP measure. See Appendix for a reconciliation to the most directly comparable U.S. GAAP measure. 2. Reflecting the 12 months ended September 30, 2025. See Appendix for a calculation of the operating cash flow TTM as of September 30, 2025.

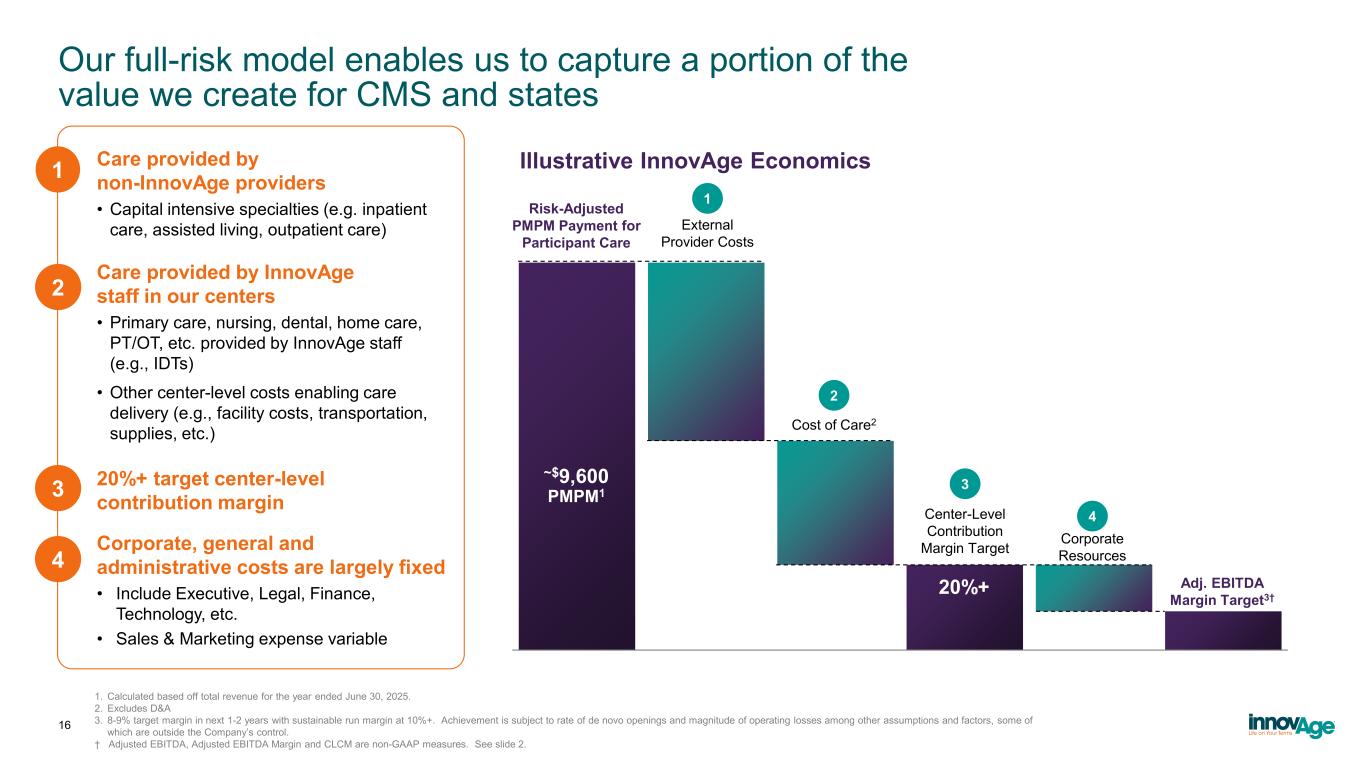

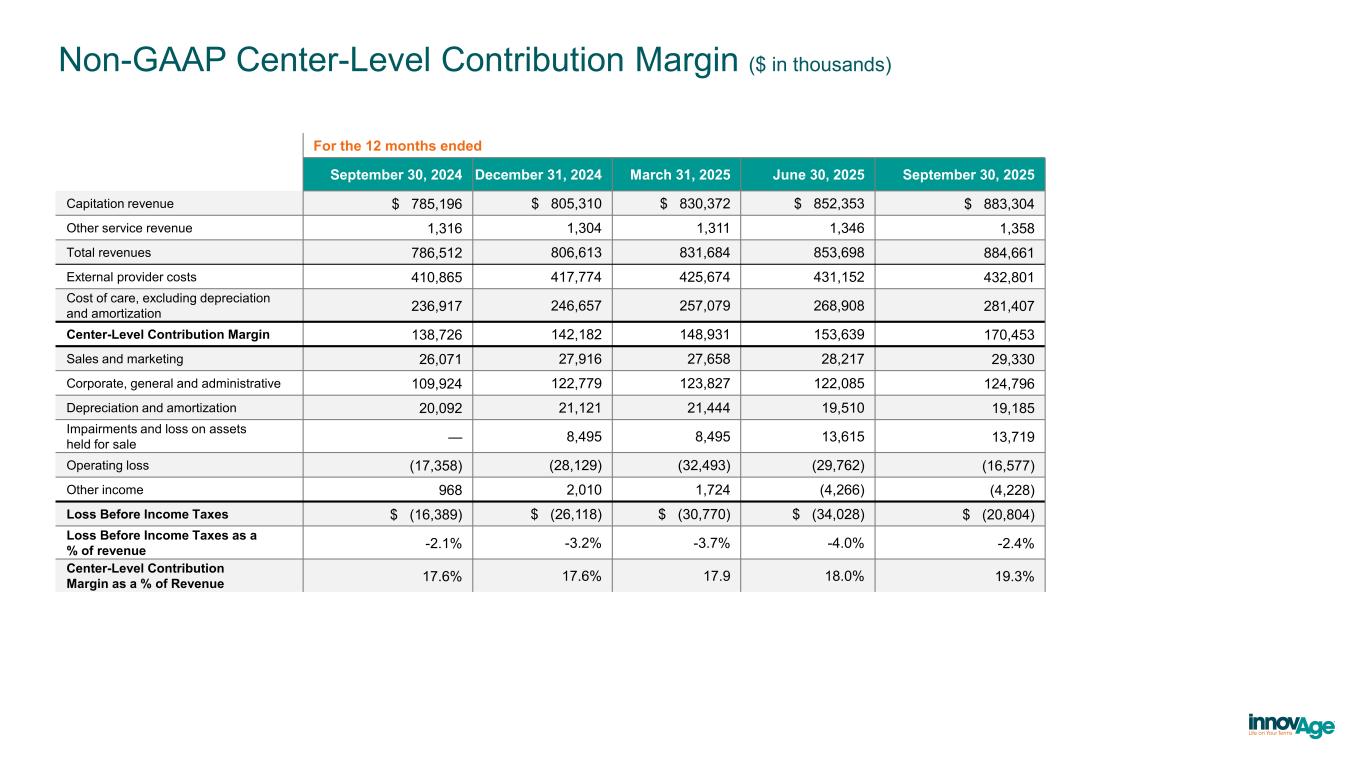

Our full-risk model enables us to capture a portion of the value we create for CMS and states 1. Calculated based off total revenue for the year ended June 30, 2025. 2. Excludes D&A 3. 8-9% target margin in next 1-2 years with sustainable run margin at 10%+. Achievement is subject to rate of de novo openings and magnitude of operating losses among other assumptions and factors, some of which are outside the Company’s control. † Adjusted EBITDA, Adjusted EBITDA Margin and CLCM are non-GAAP measures. See slide 2. 16 External Provider Costs Center-Level Contribution Margin Target Cost of Care2 Corporate Resources Adj. EBITDA Margin Target3† 1 2 3 ~$9,600 PMPM1 Risk-Adjusted PMPM Payment for Participant Care Care provided by non-InnovAge providers • Capital intensive specialties (e.g. inpatient care, assisted living, outpatient care) Care provided by InnovAge staff in our centers • Primary care, nursing, dental, home care, PT/OT, etc. provided by InnovAge staff (e.g., IDTs) • Other center-level costs enabling care delivery (e.g., facility costs, transportation, supplies, etc.) 20%+ target center-level contribution margin Corporate, general and administrative costs are largely fixed • Include Executive, Legal, Finance, Technology, etc. • Sales & Marketing expense variable 4 20%+ 1 2 3 4 Illustrative InnovAge Economics

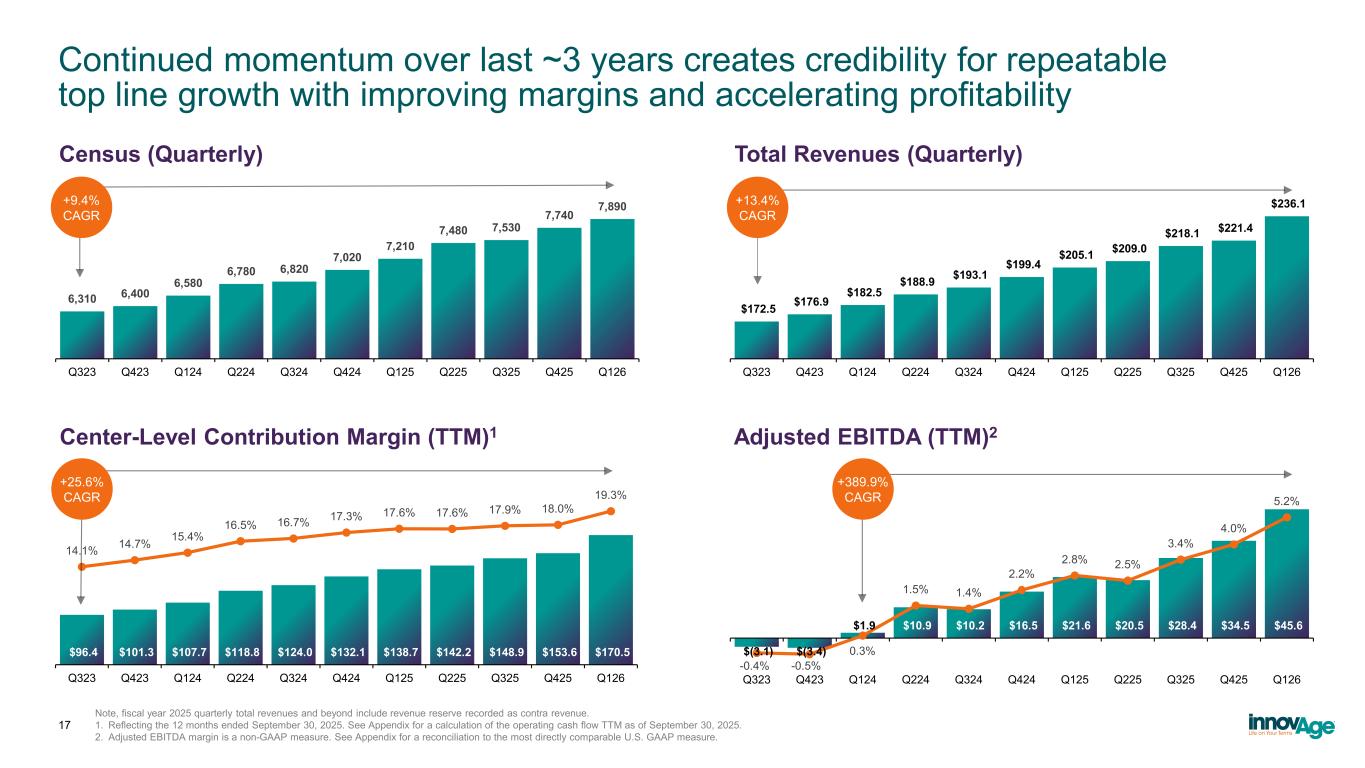

$(3.1) $(3.4) $1.9 $10.9 $10.2 $16.5 $21.6 $20.5 $28.4 $34.5 $45.6 -0.4% -0.5% 0.3% 1.5% 1.4% 2.2% 2.8% 2.5% 3.4% 4.0% 5.2% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% $(10.0) $- $10.0 $20.0 $30.0 $40.0 $50.0 Q323 Q423 Q124 Q224 Q324 Q424 Q125 Q225 Q325 Q425 Q126 $96.4 $101.3 $107.7 $118.8 $124.0 $132.1 $138.7 $142.2 $148.9 $153.6 $170.5 14.1% 14.7% 15.4% 16.5% 16.7% 17.3% 17.6% 17.6% 17.9% 18.0% 19.3% 5.0% 10.0% 15.0% 20.0% $50.0 100.0 150.0 200.0 Q323 Q423 Q124 Q224 Q324 Q424 Q125 Q225 Q325 Q425 Q126 6,310 6,400 6,580 6,780 6,820 7,020 7,210 7,480 7,530 7,740 7,890 Q323 Q423 Q124 Q224 Q324 Q424 Q125 Q225 Q325 Q425 Q126 $172.5 $176.9 $182.5 $188.9 $193.1 $199.4 $205.1 $209.0 $218.1 $221.4 $236.1 Q323 Q423 Q124 Q224 Q324 Q424 Q125 Q225 Q325 Q425 Q126 Continued momentum over last ~3 years creates credibility for repeatable top line growth with improving margins and accelerating profitability 17 Note, fiscal year 2025 quarterly total revenues and beyond include revenue reserve recorded as contra revenue. 1. Reflecting the 12 months ended September 30, 2025. See Appendix for a calculation of the operating cash flow TTM as of September 30, 2025. 2. Adjusted EBITDA margin is a non-GAAP measure. See Appendix for a reconciliation to the most directly comparable U.S. GAAP measure. +9.4% CAGR +13.4% CAGR +25.6% CAGR +389.9% CAGR Census (Quarterly) Total Revenues (Quarterly) Adjusted EBITDA (TTM)2Center-Level Contribution Margin (TTM)1

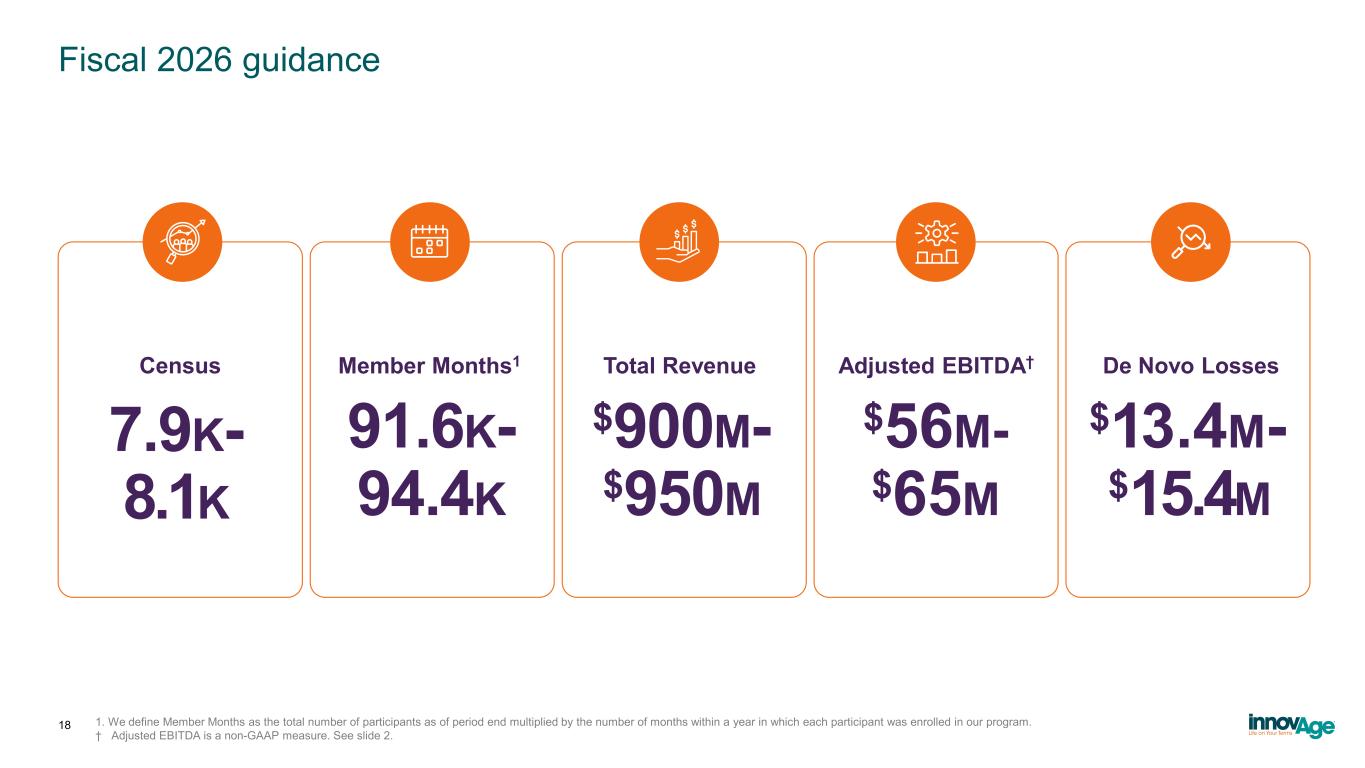

Fiscal 2026 guidance 18 1. We define Member Months as the total number of participants as of period end multiplied by the number of months within a year in which each participant was enrolled in our program. † Adjusted EBITDA is a non-GAAP measure. See slide 2. 7.9K- 8.1K 91.6K- 94.4K $900M- $950M $56M- $65M $13.4M- $15.4M Census Member Months1 Total Revenue Adjusted EBITDA† De Novo Losses

InnovAge: Key Takeaways 19 Purpose-built for the most complex seniors The PACE model is designed to care for medically and socially complex, nursing-home-eligible seniors where other value-based models struggle to operate economically A proven, scalable operating platform Multi-year investments in technology, operations, and clinical integration are translating into consistent growth, margin expansion, and positive cash flow Multiple paths to durable value creation InnovAge is positioned to drive value through responsible organic growth, operating leverage, selective partnerships, and disciplined expansion from a single scalable platform A structurally differentiated, full-risk payor–provider platform InnovAge combines full Medicare and Medicaid risk with deep, employed care delivery, enabling greater control over total cost of care than delegated or coordination-based models Large, underpenetrated market with strong policy support PACE serves a small fraction of eligible seniors today, with bipartisan regulatory tailwinds supporting expansion and long-term growth

Q&A 20

Appendix

Tampa General Grand Opening https://www.youtube.com/watch?v=ERDNDIy2RXI InnovAge Tour Video https://www.youtube.com/watch?v=RnGETw6igBg 22 Our mission in action

Non-GAAP Trailing 12-Month Cash Flow from Operations ($ in thousands) For the 3 months ended For the 12 months ended December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 September 30, 2025 Net cash provided by operating activities $ 6,753 $ 24,628 $ 9,001 $ 3,924 $ 44,306 Net cash used in investing activities 4,400 (8,136) 976 (814) (3,574) Net cash used in financing activities (4,094) (2,117) (5,249) (11) (11,471) Net change in cash 7,059 14,375 4,728 3,099 29,261 Less: change in cash and restricted cash reclassified to assets held for sale — — (1,054) (82) (1,136) Increase (Decrease) in cash, cash equivalents and restricted cash 7,059 14,375 3,674 3,017 28,125 Cash, beginning of period 39,032 46,091 60,466 64,140 39,032 Cash, end of period $ 46,091 $ 60,466 $ 64,140 $ 67,157 $ 67,157

Non-GAAP Adjusted EBITDA ($ in thousands) 1. Reflects investment income related to short-term investments included in our consolidated statement of operations. 2. Reflects charges/(credits) related to litigation by stockholders, civil investigative demands, and arbitration with our former pharmacy provider. Refer to Note 9, "Commitments and Contingencies" to our condensed consolidated financial statements for more information regarding litigation by stockholders and civil investigative demands. Costs reflected consist of litigation costs considered one-time in nature and outside of the ordinary course of business based on the following considerations which we assess regularly: (i) the frequency of similar cases that have been brought to date, or are expected to be brought within two years, (ii) complexity of the case, (iii) nature of the remedies sought, (iv) litigation posture of the Company, (v) counterparty involved, and (vi) the Company's overall litigation strategy. 3. Reflects charges related to M&A diligence, transaction and integrations. 4. Reflects charges related to business optimization initiatives. Such charges relate to one-time investments in projects designed to enhance our technology and compliance systems and improve and support the efficiency and effectiveness of our operations. For the three months ended September 30, 2025, this consists of costs related to organizational restructure and executive severance. For the three months ended September 30, 2024, this includes (i) $0.4 million of organizational restructure and (ii) $0.2 million related to other non-recurring projects aimed at reducing costs and improving efficiencies. 5. Reflects additional loss related to the Company's sale of its managing member interest in SH1 and the adjacent vacant land. 6. Reflects gain on sale of center equipment that was originally purchased for the center in Louisville, Kentucky. For the 3 months ended September 30, 2025 Net income $ 7,669 Interest expense, net 1,251 Other investment income1 (499) Depreciation and amortization 5,085 Provision for income tax 274 Stock-based compensation 2,308 Litigation costs and settlements2 979 M&A diligence, transaction and integration3 — Business optimization4 879 Loss on assets held for sale5 104 Gain on sale of assets6 (381) Adjusted EBITDA $ 17,642 Net income margin 3.2% Adjusted EBITDA Margin % 7.5%

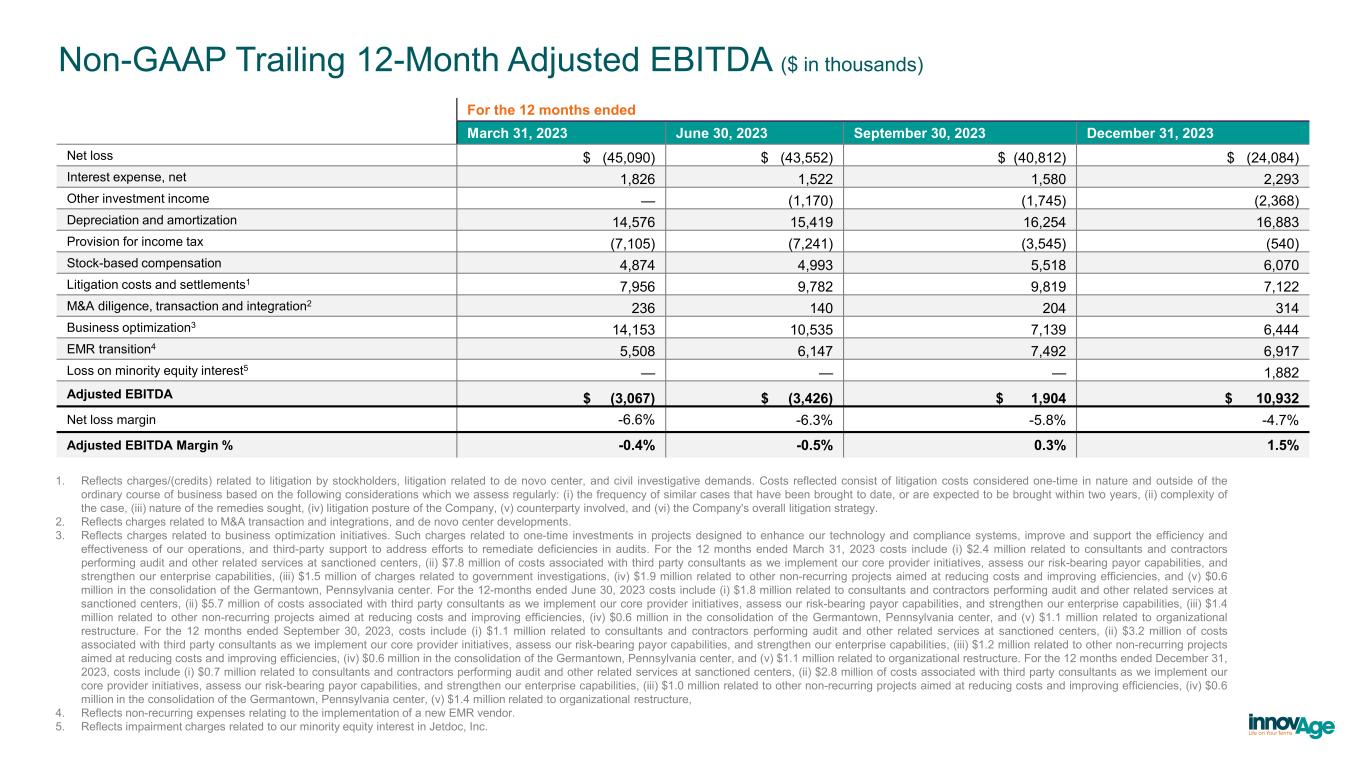

Non-GAAP Trailing 12-Month Adjusted EBITDA ($ in thousands) 1. Reflects charges/(credits) related to litigation by stockholders, litigation related to de novo center, and civil investigative demands. Costs reflected consist of litigation costs considered one-time in nature and outside of the ordinary course of business based on the following considerations which we assess regularly: (i) the frequency of similar cases that have been brought to date, or are expected to be brought within two years, (ii) complexity of the case, (iii) nature of the remedies sought, (iv) litigation posture of the Company, (v) counterparty involved, and (vi) the Company's overall litigation strategy. 2. Reflects charges related to M&A transaction and integrations, and de novo center developments. 3. Reflects charges related to business optimization initiatives. Such charges related to one-time investments in projects designed to enhance our technology and compliance systems, improve and support the efficiency and effectiveness of our operations, and third-party support to address efforts to remediate deficiencies in audits. For the 12 months ended March 31, 2023 costs include (i) $2.4 million related to consultants and contractors performing audit and other related services at sanctioned centers, (ii) $7.8 million of costs associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities, (iii) $1.5 million of charges related to government investigations, (iv) $1.9 million related to other non-recurring projects aimed at reducing costs and improving efficiencies, and (v) $0.6 million in the consolidation of the Germantown, Pennsylvania center. For the 12-months ended June 30, 2023 costs include (i) $1.8 million related to consultants and contractors performing audit and other related services at sanctioned centers, (ii) $5.7 million of costs associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities, (iii) $1.4 million related to other non-recurring projects aimed at reducing costs and improving efficiencies, (iv) $0.6 million in the consolidation of the Germantown, Pennsylvania center, and (v) $1.1 million related to organizational restructure. For the 12 months ended September 30, 2023, costs include (i) $1.1 million related to consultants and contractors performing audit and other related services at sanctioned centers, (ii) $3.2 million of costs associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities, (iii) $1.2 million related to other non-recurring projects aimed at reducing costs and improving efficiencies, (iv) $0.6 million in the consolidation of the Germantown, Pennsylvania center, and (v) $1.1 million related to organizational restructure. For the 12 months ended December 31, 2023, costs include (i) $0.7 million related to consultants and contractors performing audit and other related services at sanctioned centers, (ii) $2.8 million of costs associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities, (iii) $1.0 million related to other non-recurring projects aimed at reducing costs and improving efficiencies, (iv) $0.6 million in the consolidation of the Germantown, Pennsylvania center, (v) $1.4 million related to organizational restructure, 4. Reflects non-recurring expenses relating to the implementation of a new EMR vendor. 5. Reflects impairment charges related to our minority equity interest in Jetdoc, Inc. For the 12 months ended March 31, 2023 June 30, 2023 September 30, 2023 December 31, 2023 Net loss $ (45,090) $ (43,552) $ (40,812) $ (24,084) Interest expense, net 1,826 1,522 1,580 2,293 Other investment income — (1,170) (1,745) (2,368) Depreciation and amortization 14,576 15,419 16,254 16,883 Provision for income tax (7,105) (7,241) (3,545) (540) Stock-based compensation 4,874 4,993 5,518 6,070 Litigation costs and settlements1 7,956 9,782 9,819 7,122 M&A diligence, transaction and integration2 236 140 204 314 Business optimization3 14,153 10,535 7,139 6,444 EMR transition4 5,508 6,147 7,492 6,917 Loss on minority equity interest5 — — — 1,882 Adjusted EBITDA $ (3,067) $ (3,426) $ 1,904 $ 10,932 Net loss margin -6.6% -6.3% -5.8% -4.7% Adjusted EBITDA Margin % -0.4% -0.5% 0.3% 1.5%

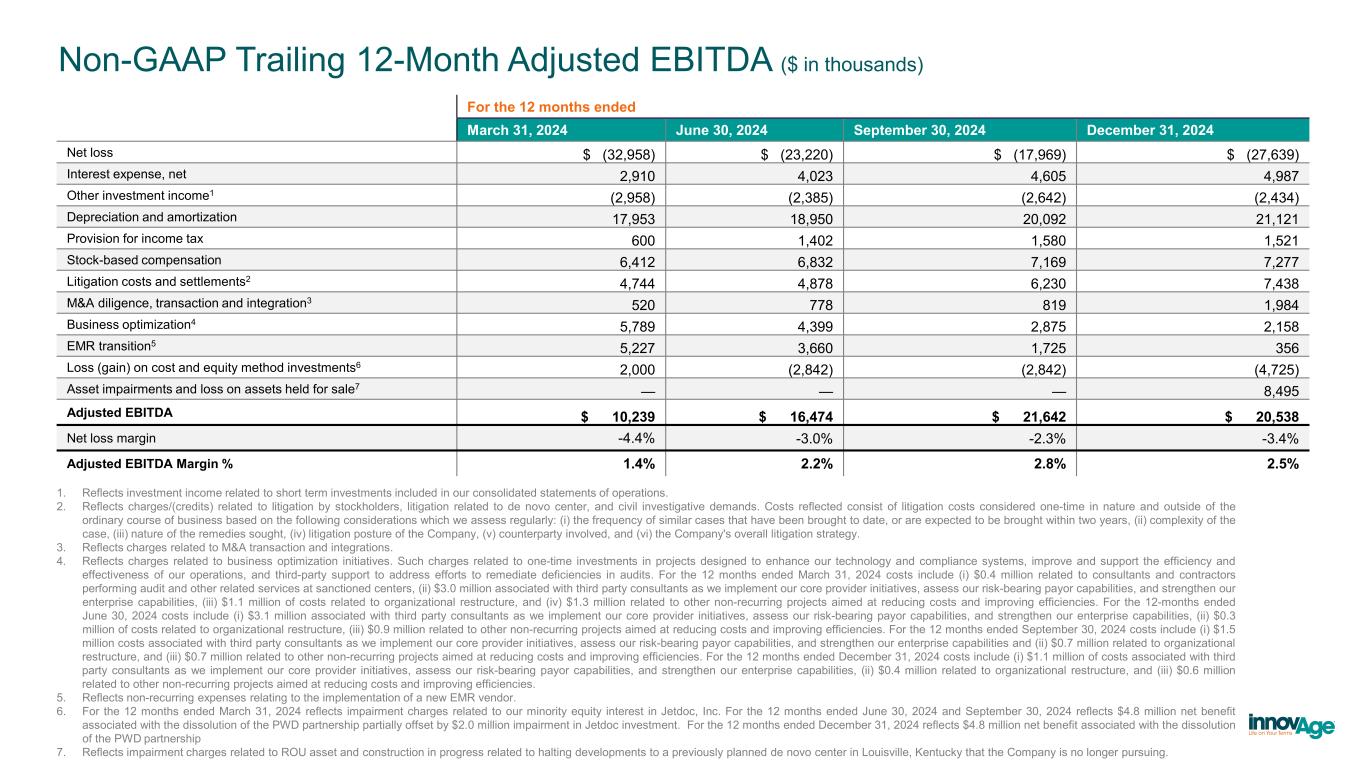

Non-GAAP Trailing 12-Month Adjusted EBITDA ($ in thousands) 1. Reflects investment income related to short term investments included in our consolidated statements of operations. 2. Reflects charges/(credits) related to litigation by stockholders, litigation related to de novo center, and civil investigative demands. Costs reflected consist of litigation costs considered one-time in nature and outside of the ordinary course of business based on the following considerations which we assess regularly: (i) the frequency of similar cases that have been brought to date, or are expected to be brought within two years, (ii) complexity of the case, (iii) nature of the remedies sought, (iv) litigation posture of the Company, (v) counterparty involved, and (vi) the Company's overall litigation strategy. 3. Reflects charges related to M&A transaction and integrations. 4. Reflects charges related to business optimization initiatives. Such charges related to one-time investments in projects designed to enhance our technology and compliance systems, improve and support the efficiency and effectiveness of our operations, and third-party support to address efforts to remediate deficiencies in audits. For the 12 months ended March 31, 2024 costs include (i) $0.4 million related to consultants and contractors performing audit and other related services at sanctioned centers, (ii) $3.0 million associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities, (iii) $1.1 million of costs related to organizational restructure, and (iv) $1.3 million related to other non-recurring projects aimed at reducing costs and improving efficiencies. For the 12-months ended June 30, 2024 costs include (i) $3.1 million associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities, (ii) $0.3 million of costs related to organizational restructure, (iii) $0.9 million related to other non-recurring projects aimed at reducing costs and improving efficiencies. For the 12 months ended September 30, 2024 costs include (i) $1.5 million costs associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities and (ii) $0.7 million related to organizational restructure, and (iii) $0.7 million related to other non-recurring projects aimed at reducing costs and improving efficiencies. For the 12 months ended December 31, 2024 costs include (i) $1.1 million of costs associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities, (ii) $0.4 million related to organizational restructure, and (iii) $0.6 million related to other non-recurring projects aimed at reducing costs and improving efficiencies. 5. Reflects non-recurring expenses relating to the implementation of a new EMR vendor. 6. For the 12 months ended March 31, 2024 reflects impairment charges related to our minority equity interest in Jetdoc, Inc. For the 12 months ended June 30, 2024 and September 30, 2024 reflects $4.8 million net benefit associated with the dissolution of the PWD partnership partially offset by $2.0 million impairment in Jetdoc investment. For the 12 months ended December 31, 2024 reflects $4.8 million net benefit associated with the dissolution of the PWD partnership 7. Reflects impairment charges related to ROU asset and construction in progress related to halting developments to a previously planned de novo center in Louisville, Kentucky that the Company is no longer pursuing. For the 12 months ended March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Net loss $ (32,958) $ (23,220) $ (17,969) $ (27,639) Interest expense, net 2,910 4,023 4,605 4,987 Other investment income1 (2,958) (2,385) (2,642) (2,434) Depreciation and amortization 17,953 18,950 20,092 21,121 Provision for income tax 600 1,402 1,580 1,521 Stock-based compensation 6,412 6,832 7,169 7,277 Litigation costs and settlements2 4,744 4,878 6,230 7,438 M&A diligence, transaction and integration3 520 778 819 1,984 Business optimization4 5,789 4,399 2,875 2,158 EMR transition5 5,227 3,660 1,725 356 Loss (gain) on cost and equity method investments6 2,000 (2,842) (2,842) (4,725) Asset impairments and loss on assets held for sale7 — — — 8,495 Adjusted EBITDA $ 10,239 $ 16,474 $ 21,642 $ 20,538 Net loss margin -4.4% -3.0% -2.3% -3.4% Adjusted EBITDA Margin % 1.4% 2.2% 2.8% 2.5%

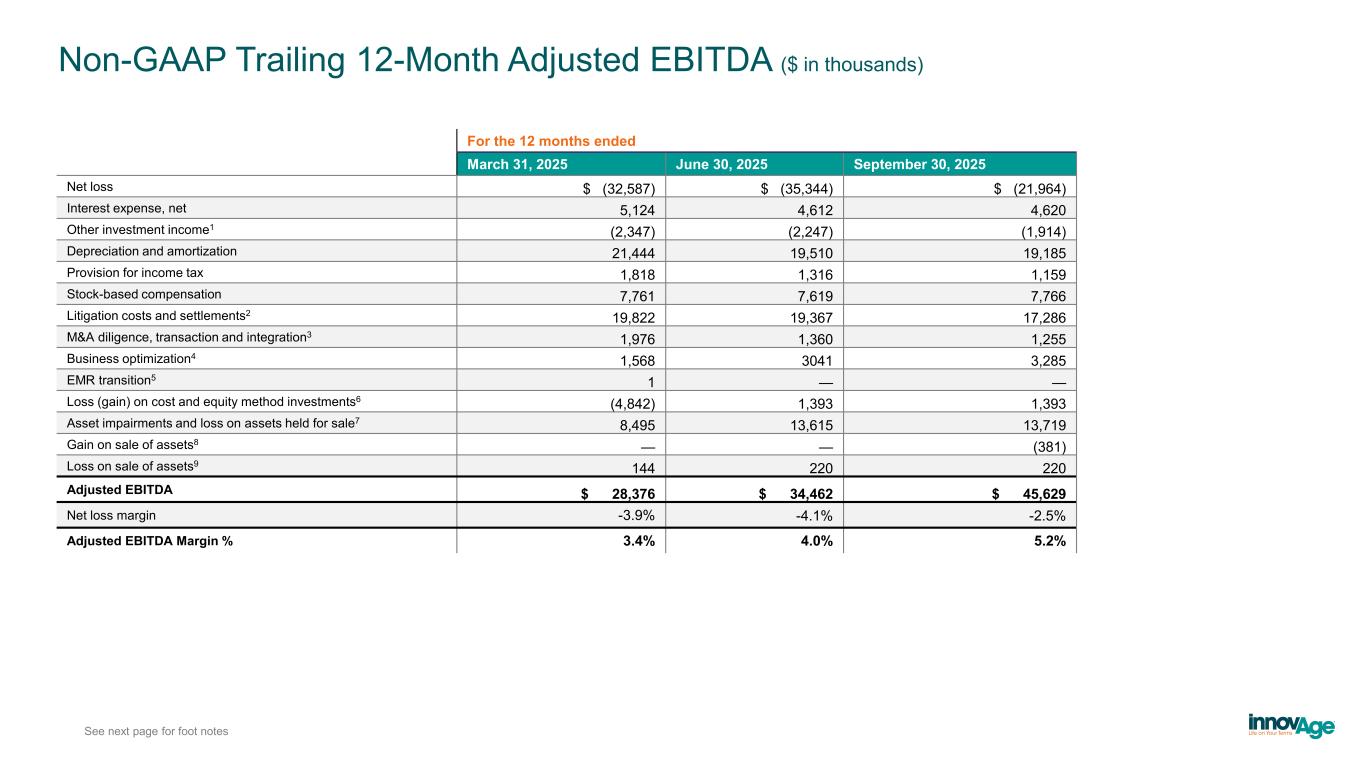

Non-GAAP Trailing 12-Month Adjusted EBITDA ($ in thousands) See next page for foot notes For the 12 months ended March 31, 2025 June 30, 2025 September 30, 2025 Net loss $ (32,587) $ (35,344) $ (21,964) Interest expense, net 5,124 4,612 4,620 Other investment income1 (2,347) (2,247) (1,914) Depreciation and amortization 21,444 19,510 19,185 Provision for income tax 1,818 1,316 1,159 Stock-based compensation 7,761 7,619 7,766 Litigation costs and settlements2 19,822 19,367 17,286 M&A diligence, transaction and integration3 1,976 1,360 1,255 Business optimization4 1,568 3041 3,285 EMR transition5 1 — — Loss (gain) on cost and equity method investments6 (4,842) 1,393 1,393 Asset impairments and loss on assets held for sale7 8,495 13,615 13,719 Gain on sale of assets8 — — (381) Loss on sale of assets9 144 220 220 Adjusted EBITDA $ 28,376 $ 34,462 $ 45,629 Net loss margin -3.9% -4.1% -2.5% Adjusted EBITDA Margin % 3.4% 4.0% 5.2%

Non-GAAP Trailing 12-Month Adjusted EBITDA ($ in thousands) 1. Reflects investment income related to short term investments included in our consolidated statements of operations. 2. Reflects charges/(credits) related to litigation by stockholders, civil investigative demands, and arbitration with our former pharmacy provider. Costs reflected consist of litigation costs considered one-time in nature and outside of the ordinary course of business based on the following considerations which we assess regularly: (i) the frequency of similar cases that have been brought to date, or are expected to be brought within two years, (ii) complexity of the case, (iii) nature of the remedies sought, (iv) litigation posture of the Company, (v) counterparty involved, and (vi) the Company's overall litigation strategy. For the year ended June 30, 2025 and September 30, 2025, includes $10.1 million accrued in connection with the potential settlement of the previously disclosed stockholder class action. 3. Reflects charges related to M&A transaction and integrations. 4. Reflects charges related to business optimization initiatives. Such charges relate to one-time investments in projects designed to enhance our technology and compliance systems and improve and support the efficiency and effectiveness of our operations. For the 12 months ended March 31, 2025 costs include (i) $0.6 million associated with third party consultants as we implement our core provider initiatives, assess our risk-bearing payor capabilities, and strengthen our enterprise capabilities, (ii) $0.4 million of costs related to organizational restructure, and (iii) $0.5 million related to other non-recurring projects aimed at reducing costs and improving efficiencies. For the 12-months ended June 30, 2025 costs include (i) $2.5 million of costs related to organizational restructure, (ii) $0.5 million related to other non-recurring projects aimed at reducing costs and improving efficiencies. For the 12 months ended September 30, 2025 costs include (i) $3.0 million related to organizational restructure, and (ii) $0.3 million related to other non-recurring projects aimed at reducing costs and improving efficiencies. 5. Reflects non-recurring expenses relating to the implementation of a new EMR vendor. 6. For the 12 months ended March 31, 2025 reflects $4.8 million net benefit associated with the dissolution of the Pinewood partnership. For the 12 months ended June 30, 2025 and September 30, 2025, reflects $2.6 million impairment loss for the investment in DispatchHealth Holdings Inc. partially offset by $1.3 million net benefit associated with the dissolution of the PWD partnership. 7. For the 12 months ended March 31, 2025 reflects impairment charges related to ROU asset and construction in progress related to halting developments to a previously planned de novo center in Louisville, Kentucky that the Company is no longer pursuing. For the 12 months ended June 30, 2025 reflects (i) impairment charges related to ROU asset and construction in progress related to halting developments to a previously planned de novo center in Louisville, Kentucky that the Company is no longer pursuing, (ii) loss on assets held for sale, and (iii) loss on settlement of lease liability in Louisville, Kentucky. For the 12 months ended September 30, 2025 reflects (i) impairment charges related to ROU asset and construction in progress related to halting developments to a previously planned de novo center in Louisville, Kentucky that the Company is no longer pursuing, (ii) loss on assets held for sale, and (iii) loss on settlement of lease liability in Louisville, Kentucky, and (iv) additional loss related to the Company's sale of its managing member interest in SH1 and the adjacent vacant land. 8. Reflects gain on sale of center equipment that was originally purchased for the center in Louisville, Kentucky. 9. Reflects loss on sale of center equipment that was originally purchased for the center in Louisville, Kentucky.

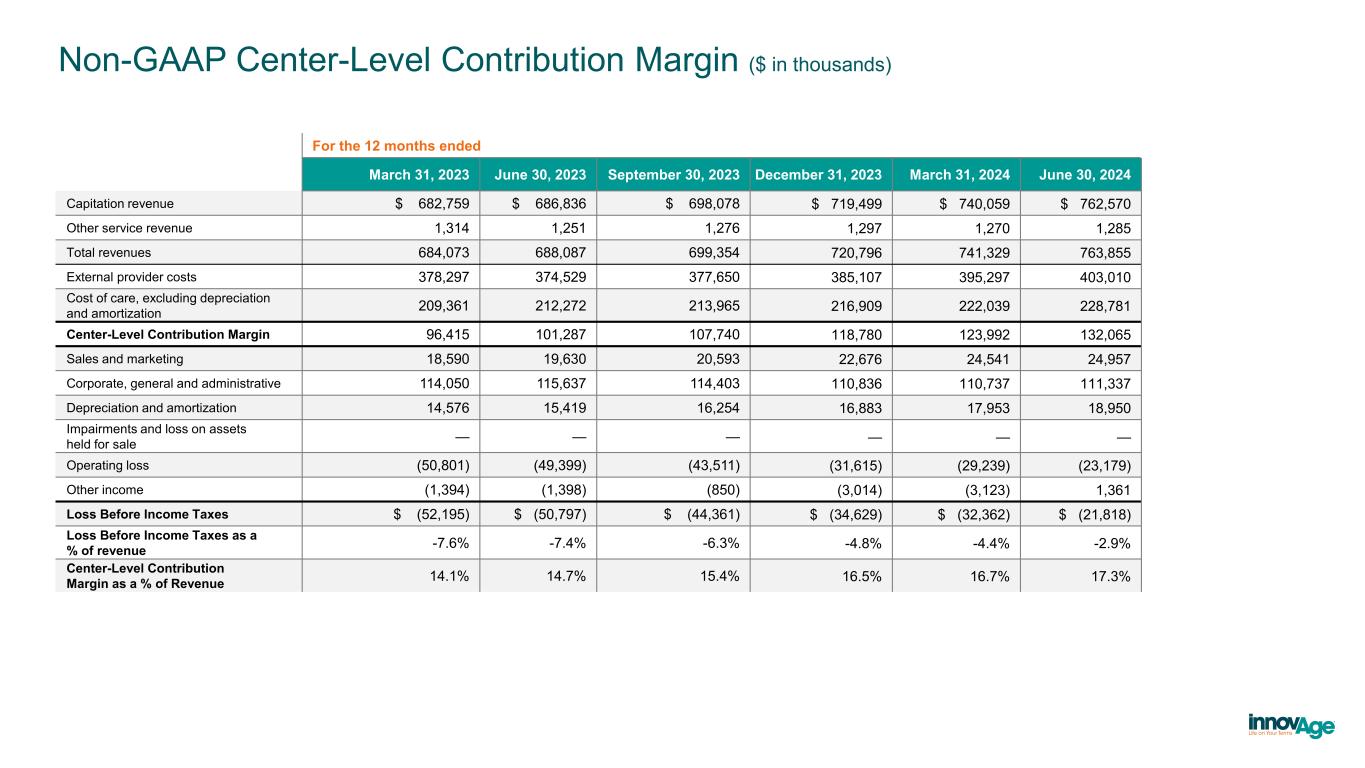

Non-GAAP Center-Level Contribution Margin ($ in thousands) For the 12 months ended March 31, 2023 June 30, 2023 September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 Capitation revenue $ 682,759 $ 686,836 $ 698,078 $ 719,499 $ 740,059 $ 762,570 Other service revenue 1,314 1,251 1,276 1,297 1,270 1,285 Total revenues 684,073 688,087 699,354 720,796 741,329 763,855 External provider costs 378,297 374,529 377,650 385,107 395,297 403,010 Cost of care, excluding depreciation and amortization 209,361 212,272 213,965 216,909 222,039 228,781 Center-Level Contribution Margin 96,415 101,287 107,740 118,780 123,992 132,065 Sales and marketing 18,590 19,630 20,593 22,676 24,541 24,957 Corporate, general and administrative 114,050 115,637 114,403 110,836 110,737 111,337 Depreciation and amortization 14,576 15,419 16,254 16,883 17,953 18,950 Impairments and loss on assets held for sale — — — — — — Operating loss (50,801) (49,399) (43,511) (31,615) (29,239) (23,179) Other income (1,394) (1,398) (850) (3,014) (3,123) 1,361 Loss Before Income Taxes $ (52,195) $ (50,797) $ (44,361) $ (34,629) $ (32,362) $ (21,818) Loss Before Income Taxes as a % of revenue -7.6% -7.4% -6.3% -4.8% -4.4% -2.9% Center-Level Contribution Margin as a % of Revenue 14.1% 14.7% 15.4% 16.5% 16.7% 17.3%

Non-GAAP Center-Level Contribution Margin ($ in thousands) For the 12 months ended September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 Capitation revenue $ 785,196 $ 805,310 $ 830,372 $ 852,353 $ 883,304 Other service revenue 1,316 1,304 1,311 1,346 1,358 Total revenues 786,512 806,613 831,684 853,698 884,661 External provider costs 410,865 417,774 425,674 431,152 432,801 Cost of care, excluding depreciation and amortization 236,917 246,657 257,079 268,908 281,407 Center-Level Contribution Margin 138,726 142,182 148,931 153,639 170,453 Sales and marketing 26,071 27,916 27,658 28,217 29,330 Corporate, general and administrative 109,924 122,779 123,827 122,085 124,796 Depreciation and amortization 20,092 21,121 21,444 19,510 19,185 Impairments and loss on assets held for sale — 8,495 8,495 13,615 13,719 Operating loss (17,358) (28,129) (32,493) (29,762) (16,577) Other income 968 2,010 1,724 (4,266) (4,228) Loss Before Income Taxes $ (16,389) $ (26,118) $ (30,770) $ (34,028) $ (20,804) Loss Before Income Taxes as a % of revenue -2.1% -3.2% -3.7% -4.0% -2.4% Center-Level Contribution Margin as a % of Revenue 17.6% 17.6% 17.9 18.0% 19.3%