Filed by the Registrant x | Filed by a Party other than the Registrant o | ||

Check the appropriate box: | |||

o | Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

x | Definitive Proxy Statement | ||

o | Definitive Additional Materials | ||

o | Soliciting Material under § 240.14a-12 | ||

Payment of Filing Fee (Check all boxes that apply) | |

x | No fee required. |

o | Fee paid previously with preliminary materials. |

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

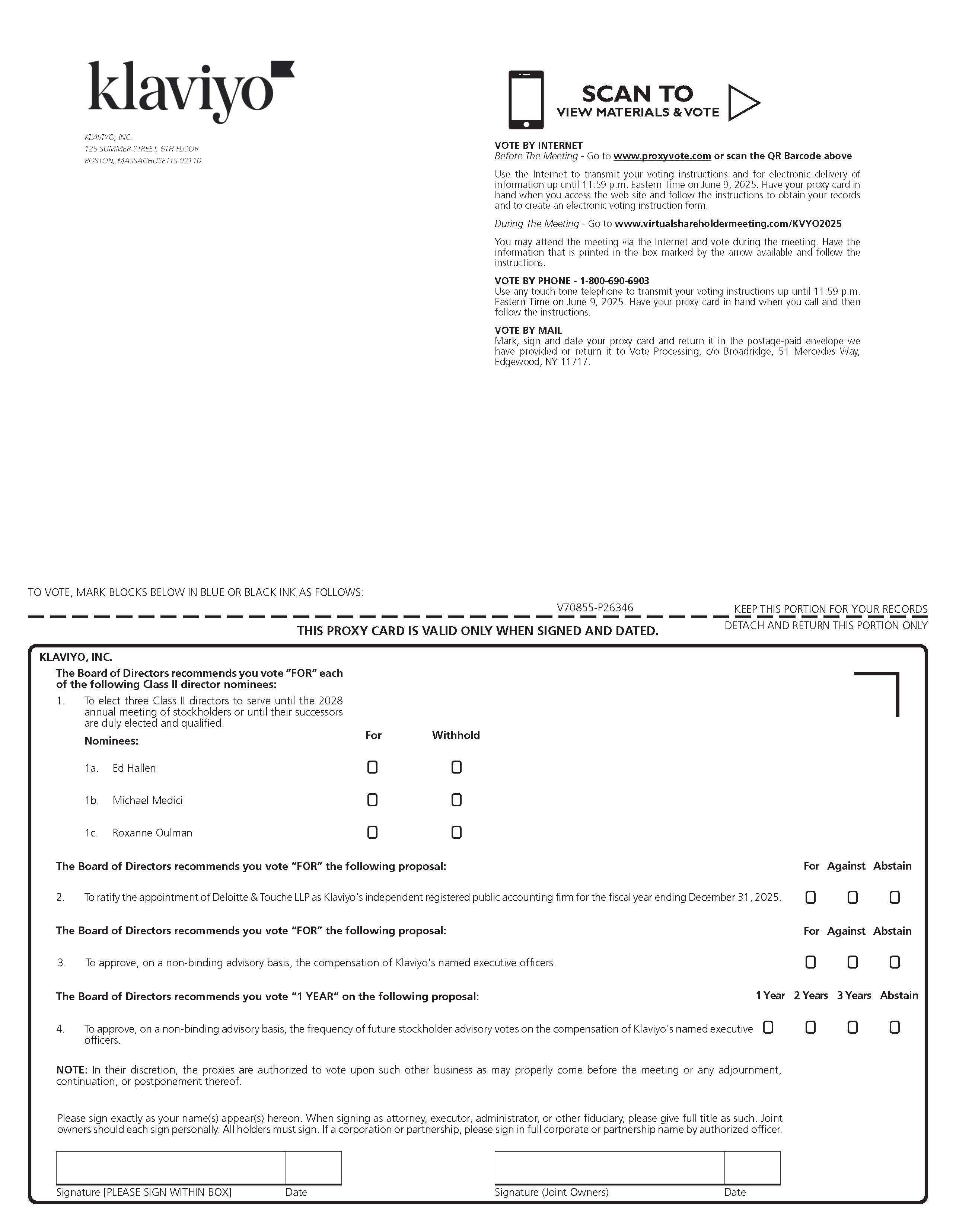

Proposal | Board’s Voting Recommendation | ||

(1) | To elect three nominees for Class II directors: Ed Hallen, Michael Medici, and Roxanne Oulman, each to hold office until our annual meeting of stockholders in 2028 and until their successor is duly elected and qualified, or until their earlier death, resignation, or removal. | “FOR” | |

(2) | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025. | “FOR” | |

(3) | To approve, on a non-binding advisory basis, the compensation of our named executive officers. | “FOR” | |

(4) | To approve, on a non-binding advisory basis, the frequency of future stockholder advisory votes on the compensation of our named executive officers. | “1 YEAR” | |

Page | |

FISCAL YEAR 2024 IN REVIEW | |

PROPOSAL THREE: NON-BINDING ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | |

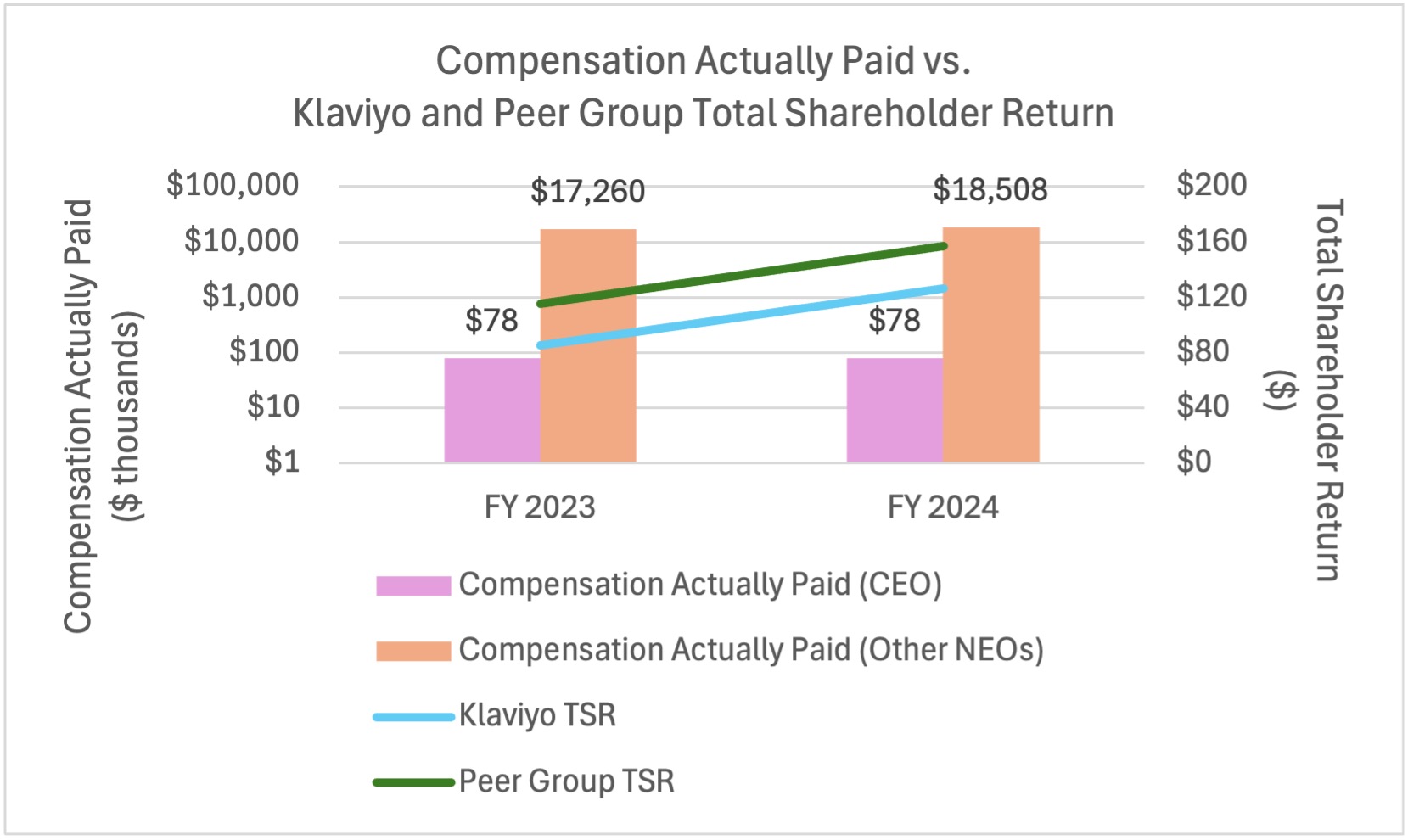

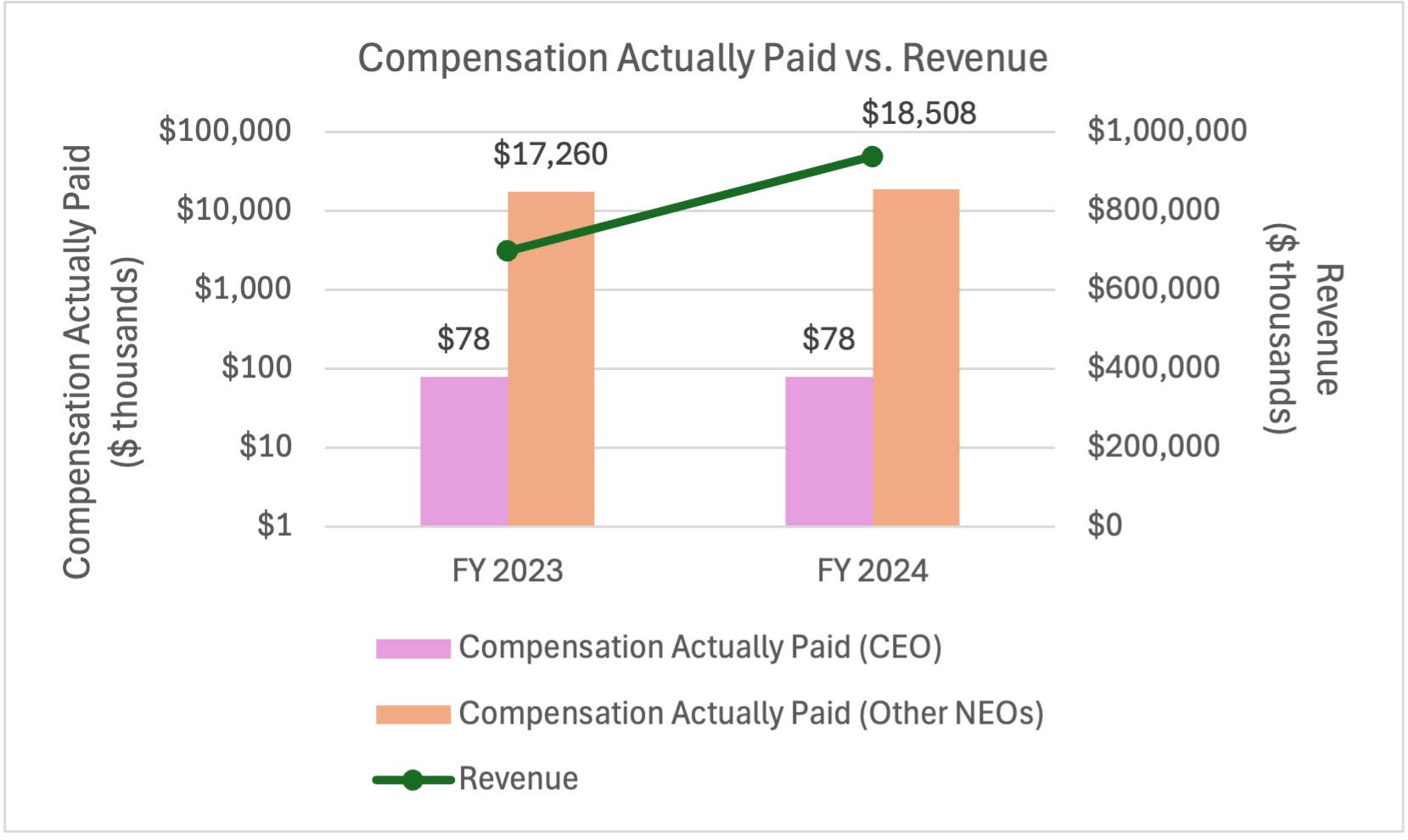

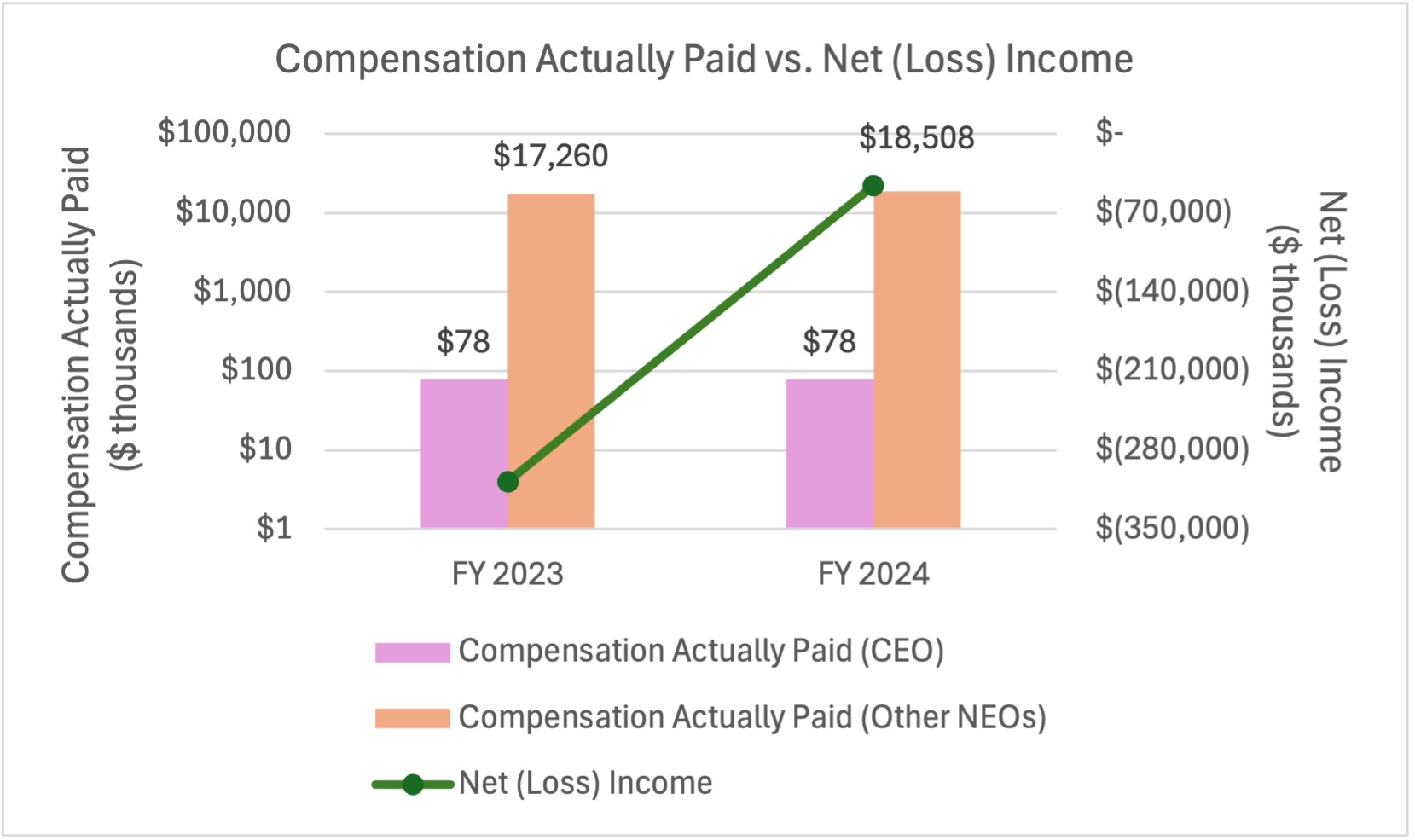

PAY VERSUS PERFORMANCE | |

CEO PAY RATIO | |

PROPOSAL FOUR: NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF FUTURE STOCKHOLDER ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICER | |

SELECT DEFINED TERMS | |

APPENDIX A |

Annual Retainer ($) | |

Board of Directors: | |

Member | 33,000 |

Additional retainer for lead independent director | 19,000 |

Audit Committee: | |

Member (other than chair) | 10,000 |

Chair | 20,000 |

Compensation Committee: | |

Member (other than chair) | 7,500 |

Chair | 15,000 |

Nominating and Corporate Governance Committee: | |

Member (other than chair) | 4,250 |

Chair | 8,500 |

Name | Fee Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Total ($) | |||

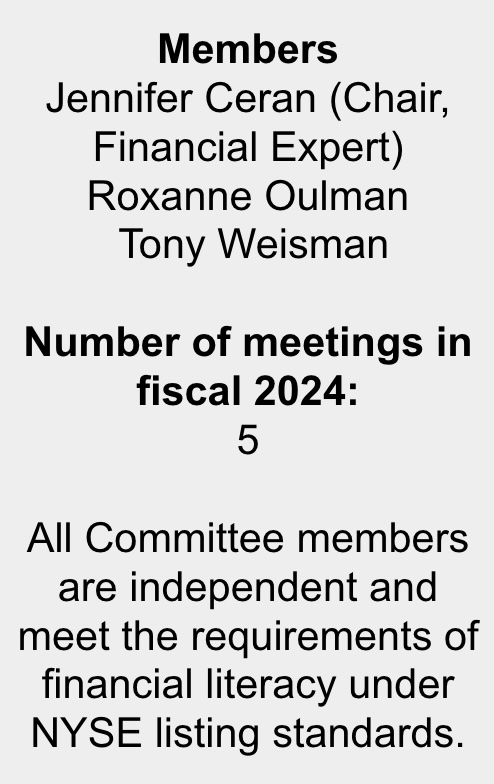

Jennifer Ceran | 57,250 | 192,652 | 249,902 | |||

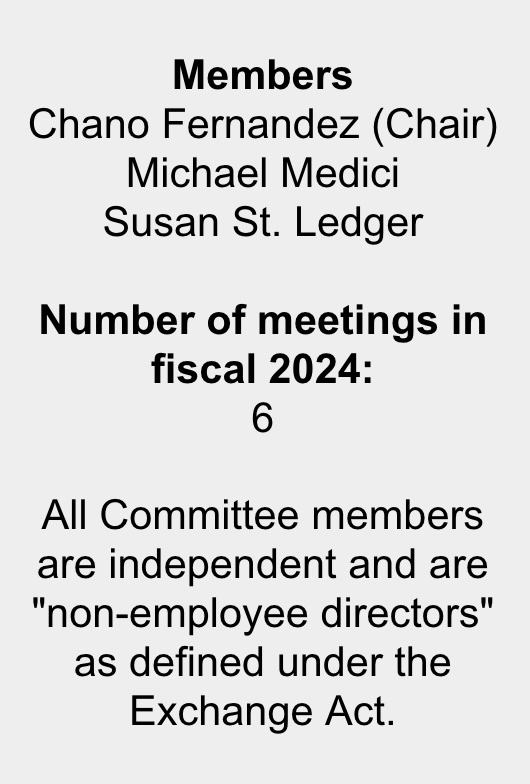

Chano Fernandez(3) | 46,833 | 192,652 | 239,485 | |||

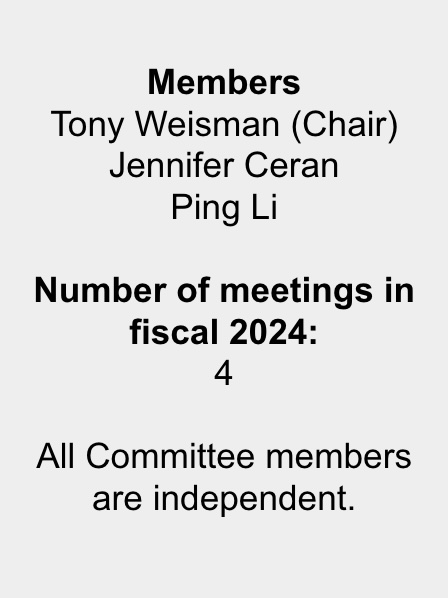

Ping Li(4) | — | — | — | |||

Michael Medici(4) | — | — | — | |||

Roxanne Oulman | 43,000 | 192,652 | 235,652 | |||

Susan St. Ledger | 40,500 | 192,652 | 233,152 | |||

Tony Weisman(5) | 64,648 | 192,652 | 257,300 |

Name | Number of Unvested Stock Awards Held as of December 31, 2024 | |

Jennifer Ceran | 8,532 | |

Chano Fernandez | 55,199 | |

Ping Li | — | |

Michael Medici | — | |

Roxanne Oulman | 55,199 | |

Susan St. Ledger | 55,199 | |

Tony Weisman | 8,532 |

Fiscal Year Ended December 31, | ||

2024 | 2023 | |

(in thousands) | ||

Audit Fees(1) | $2,669 | $3,840 |

Audit-Related Fees(2) | $— | $— |

Tax Fees(3) | $626 | $399 |

All Other Fees(4) | $6 | $6 |

Total Fees | $3,301 | $4,245 |

Name | Age | Position | ||

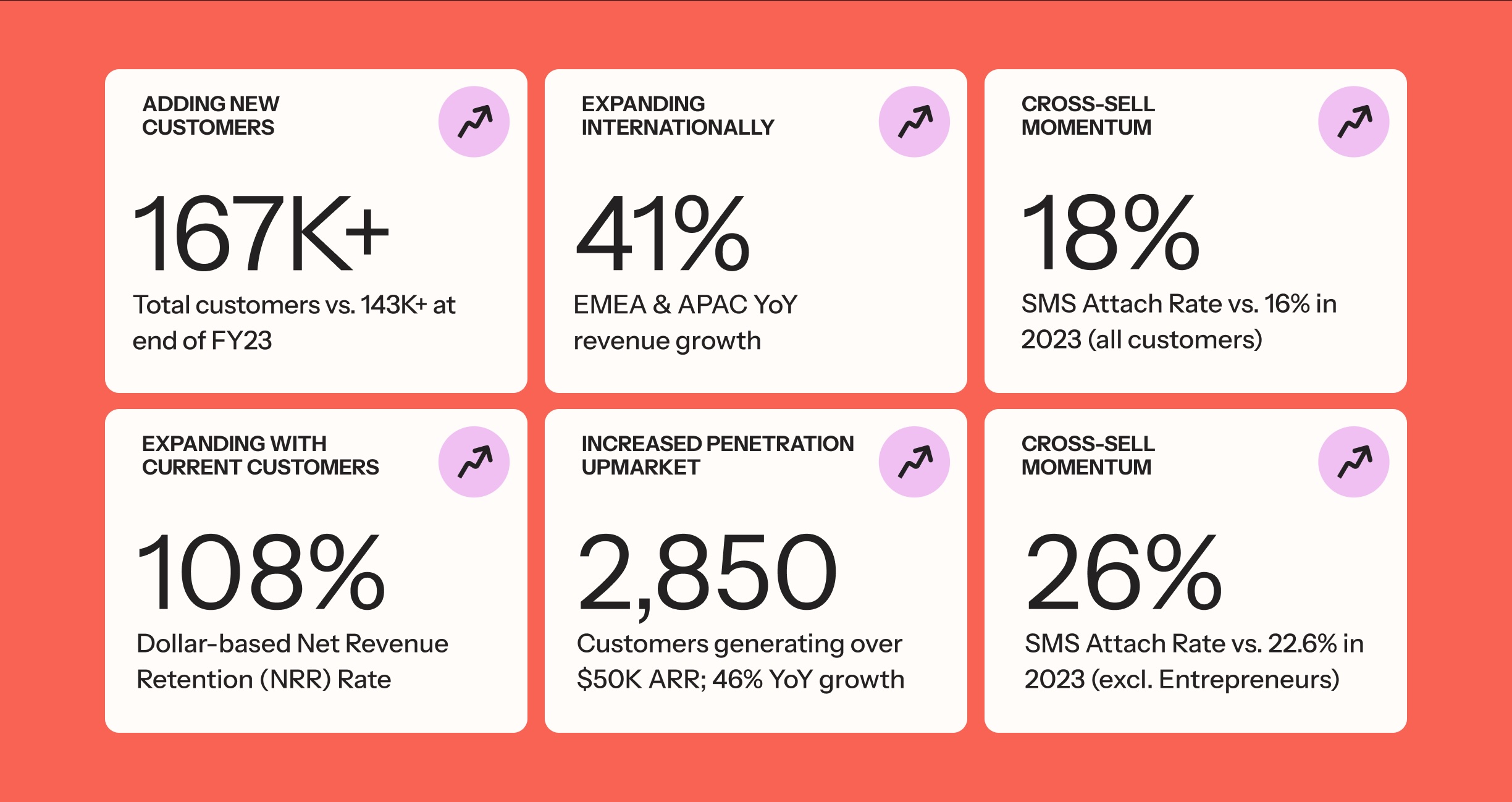

Andrew Bialecki | 39 | Chief Executive Officer, Co-Founder, and Chairperson | ||

Amanda Whalen | 50 | Chief Financial Officer | ||

Steve Rowland | 56 | President | ||

Landon Edmond | 54 | Chief Legal Officer and General Counsel | ||

Carmel Galvin | 56 | Chief People Officer |

Compensation Element | Fiscal Year 2024 Design and Rationale | |

Base Salary | •Our Compensation Committee maintained the annual base salary of our CEO at his fiscal year 2023 level. | |

Annual Performance-Based Cash Bonus | •Our CEO did not participate in our Senior Executive Cash Incentive Bonus Plan (the “Bonus Plan”). | |

Long-Term Equity Incentive | •Our CEO did not receive any RSU award. |

Compensation Element | Fiscal Year 2024 Design and Rationale | |

Base Salaries | •Our Compensation Committee maintained the annual base salaries of our Other NEOs at their fiscal year 2023 levels, with the exception of Ms. Galvin, who joined Klaviyo on April 15, 2024. | |

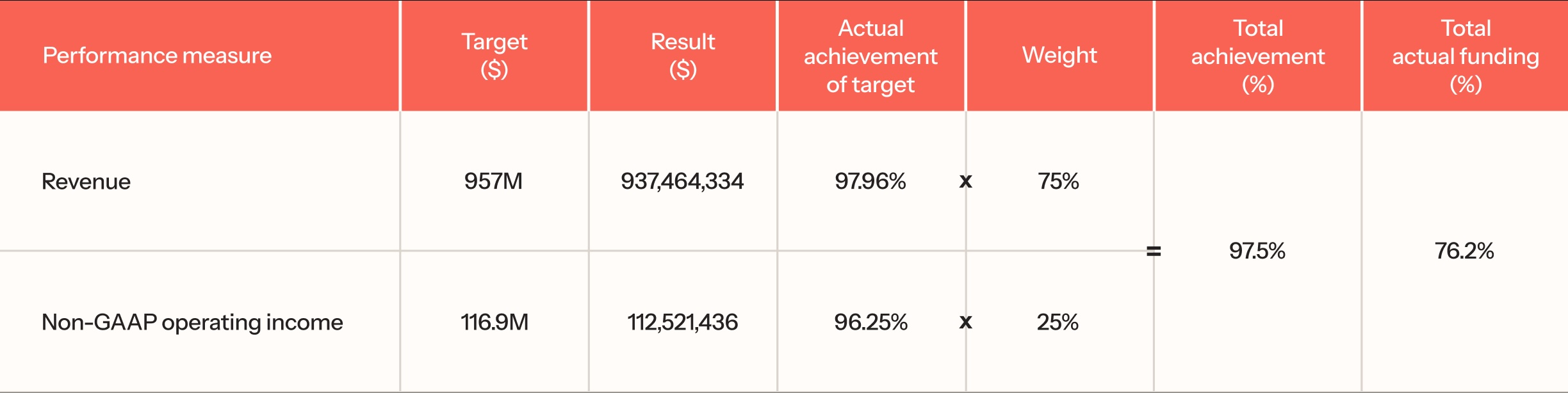

Annual Performance-Based Cash Bonus | •After achieving the performance objectives established under the Bonus Plan at 97.5%, our Compensation Committee exercised negative discretion, reducing the bonus payments for our Other NEOs to 76.2% of target, in order to more closely align with the achievement of goals established for our broader employee population. | |

Long-Term Equity Incentive | •Our Compensation Committee granted RSU awards to our Other NEOs with three-year vesting periods (other than Ms. Galvin). •Ms. Galvin was granted an RSU award with a four-year vesting period as a newly hired executive officer of Klaviyo in April 2024. |

What We Do | What We Don’t Do | |

•Our Compensation Committee consists solely of independent members of our Board. •Our Compensation Committee has retained an independent third-party compensation consultant for guidance in making compensation decisions. •Our Compensation Committee uses a representative peer group of comparable technology, internet, and software companies, as well as relevant compensation survey data, when setting executive compensation. •Our annual performance-based cash bonus is tied to achievement of specific, objective corporate performance metrics established each year and subject to threshold attainment and payout caps. •Our equity awards have multi-year vesting requirements to emphasize long-term incentives. •We maintain stock ownership guidelines for our executive officers and directors (6x base salary for CEO; 5x annual cash retainer for directors; 2x base salary for other executive officers). •We maintain a clawback policy that applies to both performance-based cash and equity compensation. •We conduct an annual advisory vote on named executive officer compensation. | •We generally do not allow hedging or pledging of Klaviyo stock. •Our Compensation Committee does not guarantee executive salary increases, bonuses, or equity awards. •We do not offer fixed term (vs. “at-will”) employment for our named executive officers. •We do not provide single-trigger vesting acceleration of the equity-based awards granted to our named executive officers upon a change in control. •We do not provide tax reimbursements or gross- ups on executive change-in-control payments. •We do not offer special executive welfare, health benefits, or retirement plans not available to our employees generally. •We do not provide any material perquisites to our named executive officers. |

Elements | Objectives | Key Features | ||

Base Salary (fixed cash) | •Provide a fixed level of cash to attract and retain highly qualified executives with market-aligned and peer-aligned compensation commensurate with job responsibilities. | •Generally reviewed annually and determined by our Compensation Committee based on a number of factors and by reference, in part, to market data obtained from our Compensation Committee’s independent compensation consultant. | ||

Annual Performance- Based Cash Bonus (at-risk cash) | •Motivate and reward achievement of our key business and financial objectives that underpin sustainable growth and shareholder value. •Align short-term incentives of management with our stockholders’ interests by linking pay to performance. •Attract highly qualified executives. | •Bonus opportunities are dependent upon achievement of specific, objective corporate performance metrics that are consistent with our long-term strategic plan. •Performance metrics and targets are reviewed annually by our Compensation Committee. | ||

Long-Term Equity Incentive (at-risk equity) | •Motivate and reward long-term company performance. •Align long-term incentives of management with our stockholders’ interests by linking pay to performance and stockholder value creation. •Attract highly qualified executives and encourage their continued employment over the long-term. | •Equity awards are generally reviewed annually and granted during the first half of the year. •Individual awards are determined based on a number of factors (including company and individual performance) and by reference, in part, to market data obtained from our Compensation Committee’s independent compensation consultant. |

Fiscal Year 2024 Peer Group | ||

Asana | Five9 | Shopify |

BILL Holdings | Freshworks | Smartsheet |

Braze | GitLab | Snowflake |

Cloudflare | Hubspot | Squarespace |

Confluent | MongoDB | Zoominfo Technologies |

CrowdStrike Holdings | Okta | Zscaler |

Datadog | Samsara | |

Named Executive Officer | Fiscal Year 2024 Base Salary ($) | Percentage Adjustment from Fiscal Year 2023 | ||

Andrew Bialecki | 75,000 | —% | ||

Amanda Whalen | 625,000 | —% | ||

Carmel Galvin | 530,000 | N/A(1) | ||

Steve Rowland | 600,000 | —% | ||

Landon Edmond | 520,000 | —% |

Named Executive Officer | Fiscal Year 2024 Target Bonus Opportunity (% of Base Salary) | Fiscal Year 2024 Target Bonus Opportunity ($) | Percentage Adjustment from Fiscal Year 2023(1) | |||

Andrew Bialecki(2) | N/A | N/A | N/A | |||

Amanda Whalen | 20% | 125,000 | N/A | |||

Carmel Galvin | 20% | 106,000 | N/A | |||

Steve Rowland | 67% | 400,000 | —% | |||

Landon Edmond | 20% | 104,000 | N/A |

Named Executive Officer | Fiscal Year 2024 Target Bonus Opportunity ($) | Fiscal Year 2024 Actual Bonus Paid ($) | ||

Andrew Bialecki | — | — | ||

Amanda Whalen | 125,000 | 95,250 | ||

Carmel Galvin(1) | 106,000 | 57,536 | ||

Steve Rowland | 400,000 | 304,800 | ||

Landon Edmond | 104,000 | 79,248 |

Named Executive Officer | Service-Based RSUs (#)(1)(2) | Total Fair Value at Grant Date ($)(3) | ||

Amanda Whalen | 279,888(4) | 6,566,172 | ||

Steve Rowland | 203,918(4) | 4,783,916 | ||

Landon Edmond | 107,956(4) | 2,532,648 |

Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | All Other Compensation ($)(3) | Total ($) | |||||||

Andrew Bialecki Chief Executive Officer | 2024 | 75,000 | — | — | — | 3,030 | 78,030 | |||||||

2023 | 75,000 | — | — | — | 3,031 | 78,031 | ||||||||

2022 | 78,670 | — | — | — | 3,147 | 81,817 | ||||||||

Amanda Whalen(4) Chief Financial Officer | 2024 | 625,000 | — | 6,566,172 | 95,250 | 13,799 | 7,300,221 | |||||||

2023 | 512,500 | — | 12,510,825 | — | 13,546 | 13,036,871 | ||||||||

2022 | 274,244 | — | 20,872,500 | — | 10,970 | 21,157,714 | ||||||||

Carmel Galvin(5) Chief People Officer | 2024 | 377,116 | 350,000(6) | 17,140,371 | 57,536 | 815 | 17,925,838 | |||||||

Steve Rowland(7) President | 2024 | 600,000 | — | 4,783,916 | 304,800 | 9,108 | 5,697,825 | |||||||

2023 | 300,000 | 100,000(8) | 20,516,540 | 198,298 | 4,125 | 21,118,963 | ||||||||

Landon Edmond(9) Chief Legal Officer | 2024 | 520,000 | — | 2,532,648 | 79,248 | 13,799 | 3,145,695 | |||||||

2023 | 460,000 | — | 12,592,985(10) | — | 13,385 | 13,066,370 | ||||||||

2022 | 416,171 | — | — | — | 1,512,805(11) | 1,928,976 |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | All Other Stock Awards | |||||||||||||

Name | Award Type | Grant Date | Threshold ($) | Target ($) | Maximum ($) | Number of Shares of Stock or Units (#) | Grant Date Fair Value of Stock Awards ($)(2) | |||||||

Andrew Bialecki | — | — | — | — | — | — | — | |||||||

Amanda Whalen | Annual Cash | — | 28,125 | 125,000 | 137,500 | — | — | |||||||

RSU Award | 4/15/2024 | — | — | — | 279,888(3) | 6,566,172 | ||||||||

Carmel Galvin | Annual Cash | — | 23,850 | 106,000 | 116,600 | — | — | |||||||

RSU Award | 5/15/2024 | — | — | — | 691,144(4) | 17,140,371 | ||||||||

Steve Rowland | Annual Cash | — | 90,000 | 400,000 | 440,000 | — | — | |||||||

RSU Award | 4/15/2024 | — | — | — | 203,918(3) | 4,783,916 | ||||||||

Landon Edmond | Annual Cash | — | 23,400 | 104,000 | 114,400 | — | — | |||||||

RSU Award | 4/15/2024 | — | — | — | 107,956(3) | 2,532,648 | ||||||||

Option Awards | Stock Awards | |||||||||||||

Name | Grant Date(1) | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares of Stock or Units That Have Not Vested (#) | Market Value of Shares of Stock or Units That Have Not Vested ($)(2) | |||||||

Andrew Bialecki | 09/01/2015(3) | 15,829,184 | — | 0.0125 | 08/31/2025 | — | — | |||||||

09/29/2015(4) | 5,600,000 | — | 0.0125 | 09/28/2025 | — | — | ||||||||

Amanda Whalen | 05/09/2022(5) | — | — | — | — | 206,250 | 8,505,750 | |||||||

03/31/2023(6) | — | — | — | — | 176,042 | 7,259,972 | ||||||||

09/19/2023(7) | — | — | — | — | 122,500 | 5,051,900 | ||||||||

04/15/2024(8) | — | — | — | — | 227,409 | 9,378,347 | ||||||||

Carmel Galvin | 05/15/2024(9) | 604,751 | 24,939,931 | |||||||||||

Steve Rowland | 08/01/2023(10) | — | — | — | — | 564,432 | 23,277,176 | |||||||

04/15/2024(8) | 165,684 | 6,832,808 | ||||||||||||

Landon Edmond | 03/31/2023(11) | — | — | — | — | 97,500 | 4,020,900 | |||||||

09/19/2023(12) | — | — | — | — | 131,250 | 5,412,750 | ||||||||

04/15/2024(8) | 87,715 | 3,617,367 | ||||||||||||

Stock Awards | ||||

Name | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($)(1) | ||

Andrew Bialecki | — | — | ||

Amanda Whalen | 305,646 | 9,283,666 | ||

Carmel Galvin | 86,393 | 3,037,578 | ||

Steve Rowland | 294,792 | 9,506,946 | ||

Landon Edmond | 196,775 | 5,981,527 | ||

Name | Type of Termination | Base Salary ($)(1) | Bonus ($)(2) | Accelerated Vesting of Equity Awards ($)(3) | Continuation of Insurance Coverage ($)(4) | Total ($) | ||||||

Andrew Bialecki | Termination without Cause or for Good Reason | — | — | — | — | — | ||||||

Termination without Cause or for Good Reason within the CIC Period(5) | — | — | — | — | — | |||||||

Amanda Whalen | Termination without Cause or for Good Reason | 625,000 | 125,000 | — | 20,156 | 770,156 | ||||||

Termination without Cause or for Good Reason within the CIC Period(5) | 625,000 | 125,000 | 30,195,969 | 20,156 | 30,966,125 | |||||||

Carmel Galvin | Termination without Cause or for Good Reason | 530,000 | 106,000 | 7,367 | 643,367 | |||||||

Termination without Cause or for Good Reason within the CIC Period(5) | 530,000 | 106,000 | 24,939,931 | 7,367 | 25,583,298 | |||||||

Steve Rowland | Termination without Cause or for Good Reason | 600,000 | 400,000 | — | 22,835 | 1,022,835 | ||||||

Termination without Cause or for Good Reason within the CIC Period(5) | 600,000 | 400,000 | 30,109,984 | 22,835 | 31,132,818 | |||||||

Landon Edmond | Termination without Cause or for Good Reason | 520,000 | 104,000 | — | 22,835 | 646,835 | ||||||

Termination without Cause or for Good Reason within the CIC Period(5) | 520,000 | 104,000 | 13,051,017 | 22,835 | 13,697,851 |

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (#) (a) | Weighted-average exercise price of outstanding options, warrants and rights ($) (b)(1) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (#) (c) | |||

Equity compensation plans approved by security holders(2) | 42,585,865(3) | 0.29 | 54,325,072(4)(5) | |||

Equity compensation plans not approved by the security holders | — | — | — | |||

Total | 42,585,865 | 0.29 | 54,325,072 |

Value of Initial Fixed $100 Investment Based on: | ||||||||||||||||

Fiscal Year | SCT Total for CEO ($) | Compensation Actually Paid to CEO ($)(1)(2) | SCT Average for Other NEOs ($)(3) | Average Compensation Actually Paid to Other NEOs ($)(2)(3)(4) | Klaviyo Total Shareholder Return ($) | Peer Group Total Shareholder Return ($)(5) | Net (Loss) Income ($ in thousands)(6) | Revenue ($ in thousands)(7) | ||||||||

2024 | ( | |||||||||||||||

2023 | ( | |||||||||||||||

Adjustments to Determine Compensation Actually Paid to CEO | Fiscal Year 2024 | Fiscal Year 2023 | ||

SCT total amount | $ | $ | ||

Less amounts reported in “Option Awards” and “Stock Awards” columns in SCT for the Covered Year | ||||

Plus fair value at Covered Year-end of outstanding and unvested equity awards granted during the Covered Year | ||||

Plus (or less) change in fair value as of the Covered Year-end from the prior year-end of outstanding and unvested equity awards granted in prior fiscal years | ||||

Plus fair value at vesting of equity awards granted during the Covered Year that vested during the Covered Year | ||||

Plus (or less) change in fair value as of vesting date from the prior year- end of equity awards granted in prior fiscal years that vested during the Covered Year | ||||

TOTAL ADJUSTMENTS: | ||||

TOTAL COMPENSATION ACTUALLY PAID: | $ | $ |

Adjustments to Determine Average Compensation Actually Paid to Other NEOs | Fiscal Year 2024 | Fiscal Year 2023 | ||

SCT total amount | $ | $ | ||

Less average amount reported in “Option Awards” and “Stock Awards” columns in SCT for the Covered Year | ( | ( | ||

Plus average fair value at Covered Year-end of outstanding and unvested equity awards granted during the Covered Year | ||||

Plus (or less) average change in fair value as of the Covered Year-end from the prior year-end of outstanding and unvested equity awards granted in prior fiscal years | ||||

Plus average fair value at vesting of equity awards granted during the Covered Year that vested during the Covered Year | ||||

Plus (or less) average change in fair value as of vesting date from the prior year-end of equity awards granted in prior fiscal years that vested during the Covered Year | ||||

TOTAL ADJUSTMENTS: | ||||

TOTAL AVERAGE COMPENSATION ACTUALLY PAID: | $ | $ |

Shares Beneficially Owned | Percent of Total Voting Power | |||||||||

Series A Common Stock | Series B Common Stock | |||||||||

Name of Beneficial Owner | Number of Shares (#) | Percentage | Number of Shares (#) | Percentage | ||||||

5% Stockholders: | ||||||||||

Entities affiliated with Summit Partners(1) | — | * | 38,827,778 | 21.5% | 20.4% | |||||

Shopify Strategic Holdings 3 LLC(2) | — | * | 31,338,754 | 15.9% | 15.2% | |||||

Entities affiliated with Accomplice(3) | 53,664 | * | 11,087,390 | 6.1% | 5.8% | |||||

The Vanguard Group(4) | 7,075,227 | 7.5% | — | * | * | |||||

Named Executive Officers and Directors: | ||||||||||

Andrew Bialecki(5) | — | * | 98,865,414 | 48.8% | 46.7% | |||||

Steve Rowland(6) | 112,007 | * | 51,312 | * | * | |||||

Amanda Whalen(7) | 70,911 | * | 245,535 | * | * | |||||

Landon Edmond(8) | 112,080 | * | 22,500 | * | * | |||||

Carmel Galvin(9) | 107,477 | * | — | * | * | |||||

Ed Hallen(10) | — | * | 32,989,106 | 18.2% | 17.3% | |||||

Michael Medici | — | * | — | * | * | |||||

Ping Li(11) | 38,928 | * | 4,619,435 | 2.6% | 2.4% | |||||

Jennifer Ceran(12) | 8,532 | * | 120,333 | * | * | |||||

Tony Weisman(13) | 104,365 | * | — | * | * | |||||

Roxanne Oulman(14) | 8,532 | * | 46,666 | * | * | |||||

Susan St. Ledger(15) | 8,532 | * | 36,166 | * | * | |||||

Chano Fernandez(16) | 23,528 | * | 16,333 | * | * | |||||

All directors and executive officers as a group (13 persons)(17) | 594,892 | * | 137,012,800 | 67.6% | 64.6% |

Proposal | Board’s Voting Recommendation | ||

(1) | Election of Ed Hallen, Michael Medici, and Roxanne Oulman as Class II directors, each to hold office until our annual meeting of stockholders in 2028 and until their successor is duly elected and qualified, or until their earlier death, resignation, or removal. | “FOR” the election of each of Ed Hallen, Michael Medici, and Roxanne Oulman as a Class II director. | |

(2) | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025. | “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025. | |

(3) | Non-binding advisory vote on the compensation of our named executive officers. | “FOR” the approval, on a non-binding advisory basis, of the compensation of our named executive officers. | |

(4) | Non-binding advisory vote on the frequency of future stockholder advisory votes to approve, on a non-binding and advisory basis, the compensation paid to our named executive officers. | To hold future stockholder advisory votes on the compensation of our named executive officers every “1 YEAR.” | |

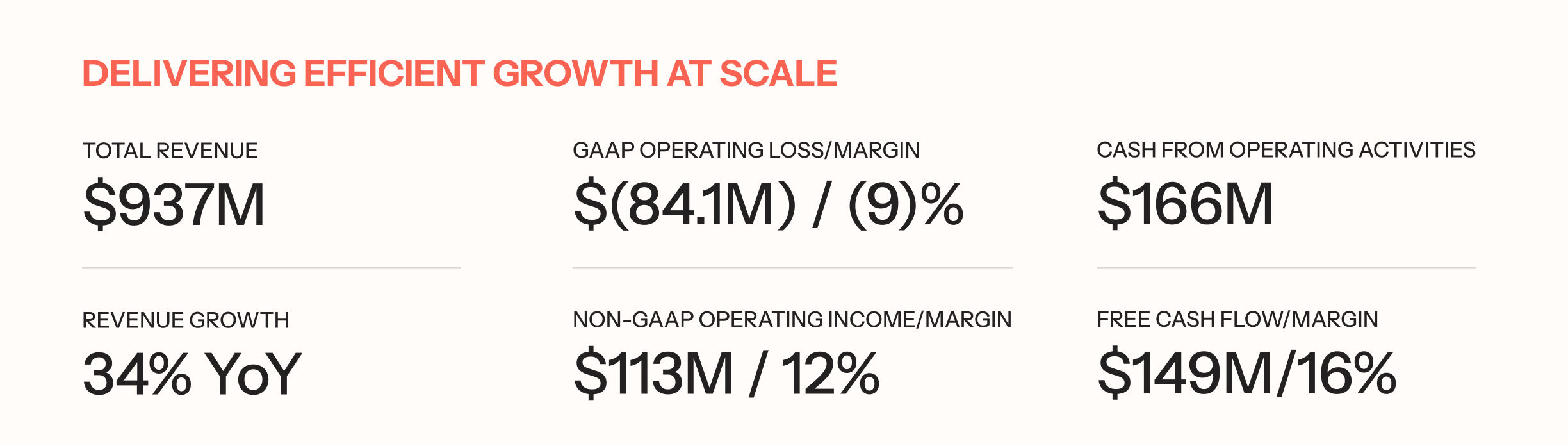

Klaviyo, Inc. | ||

Reconciliation of Operating Loss to Non-GAAP Operating Income | ||

(In Thousands) | ||

Year Ended December 31, | ||

2024 | 2023 | |

Operating loss | $(84,078) | $(330,622) |

Stock-based compensation | 135,212 | 340,799 |

Employer payroll tax on employee stock transactions | 8,491 | 7,660 |

Amortization of prepaid marketing | 52,897 | 52,897 |

Restructuring expense | — | 7,366 |

Non-GAAP operating income | $112,522 | $78,100 |

Operating margin | (9.0)% | (47.4)% |

Non-GAAP operating margin | 12.0% | 11.2% |

Reconciliation of Operating Cash Flow to Free Cash Flow | ||

(In Thousands) | ||

Year Ended December 31, | ||

2024 | 2023 | |

Cash provided by operating activities | $165,955 | $119,371 |

Acquisition of property and equipment | (5,921) | (3,653) |

Capitalization of software development costs | (11,305) | (5,705) |

Free cash flow | $148,729 | $110,013 |

Operating cash flow margin | 17.7% | 17.1% |

Free cash flow margin | 15.9% | 15.8% |