| Accelerated Access to the $3B+ U.S. Neurotoxin Therapeutic Market via Biosimilarity CORPORATE PRESENTATION SEPTEMBER 2025 NYSEAMERICAN: AEON © 2 0 2 5 A E O N B I O P H A R M A |

| This presentation includes forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements concerning possible or assumed future actions, business strategies, events or results of operations, illustrative timelines and targets for financing and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements may involve known and unknown risks, uncertainties and other important factors that may cause the actual results, performance or achievements of AEON Biopharma, Inc. (“AEON”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. The forward-looking statements in this presentation are only predictions. AEON has based these forward-looking statements largely on AEON’s current expectations and projections about future events and financial trends that AEON believes may affect its business, financial condition and results of operations. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by AEON and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (i) the outcome of any meetings with any regulatory authorities, including the FDA’s review of the Company's biosimilar meetings and document submissions, (ii) the outcome of any legal proceedings that may be instituted against AEON or others; (iii) AEON’s future capital requirements; (iv) AEON’s ability to raise financing in the future; (v) AEON’s ability to continue to meet continued stock exchange listing standards; (vi) the ability of AEON to implement its strategic initiatives, including the continued development of ABP-450 and potential submission of a Biologics License Application as a biosimilar for therapeutic uses of ABP-450; (vii) the ability of AEON to satisfy regulatory requirements; (viii) the ability of AEON to defend its intellectual property or avoid infringement of existing intellectual property; (ix) the possibility that AEON may be adversely affected by other economic, business, regulatory, and/or competitive factors; and (x) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in AEON’s Annual Report on Form 10-K for the year ended December 31, 2024 and any current or periodic reports filed with the Securities and Exchange Commission (the "SEC"), which are available on the SEC’s website at www.sec.gov. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond AEON’s control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in AEON’s forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Moreover, AEON operates in an evolving environment and a competitive industry. New risks and uncertainties may emerge from time to time, and it is not possible for management to predict all risks and uncertainties, nor can AEON assess the impact of all factors on AEON’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements AEON may make in this presentation. As a result of these factors, although AEON believes that the expectations reflected in its forward-looking statements are reasonable, AEON cannot assure you that the forward-looking statements in this presentation will prove to be accurate. Except as required by applicable law, AEON does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances, or otherwise. AEON qualifies all of its forward-looking statements by these cautionary statements. You should view this presentation completely and with the understanding that the actual future results, levels of activity, performance, events and circumstances of AEON may be materially different from what is expected. This presentation concerns anticipated products that are under clinical and analytical investigation, and which have not yet been approved for marketing by the FDA. These anticipated products are currently limited by Federal law to investigational use, and no representation is made as to their safety or effectiveness for the purposes for which they are being investigated. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and AEON’s own internal estimates and research. AEON has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, AEON’s own internal estimates and research have not been verified by any independent source. AEON Biopharma and the AEON Biopharma logo are trademarks of AEON Biopharma, Inc. All other trademarks used herein are the property of their respective owners. Forward-Looking Statements © 2 0 2 5 A E O N B I O P H A R M A 2 |

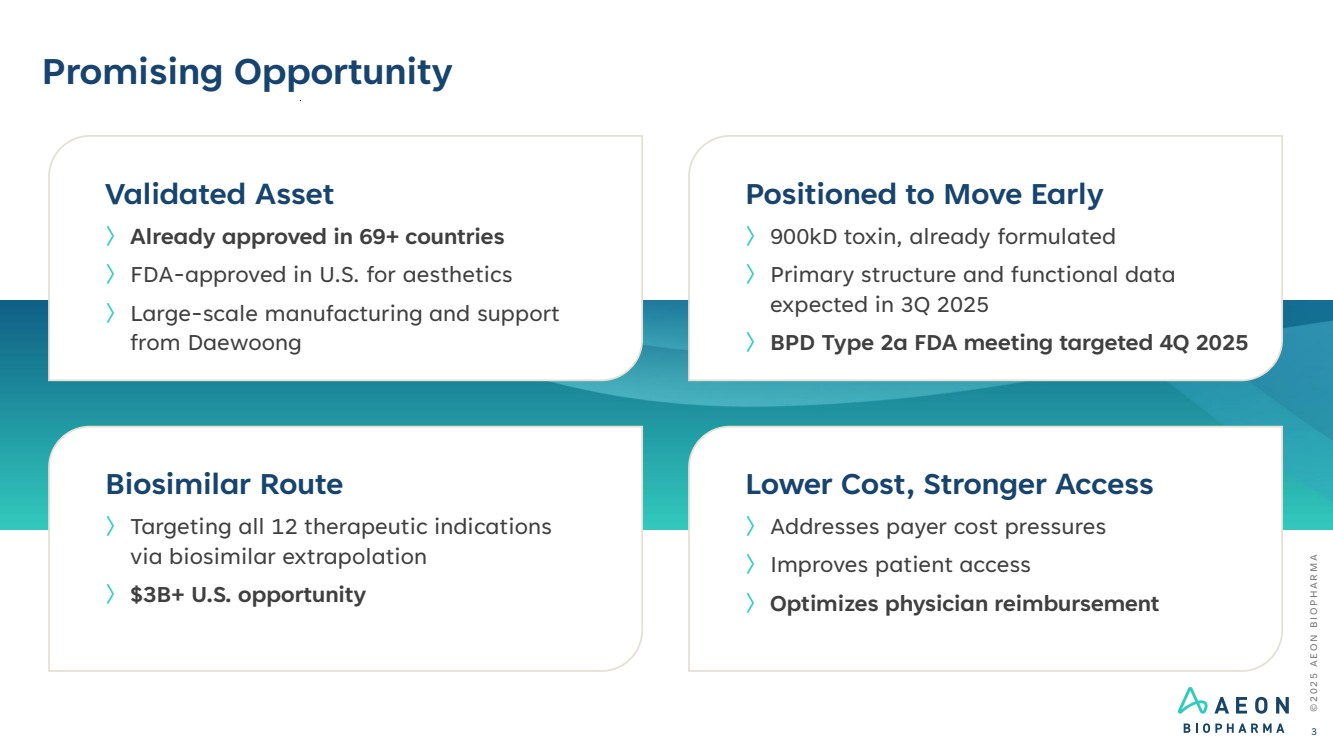

| Promising Opportunity Positioned to Move Early 〉900kD toxin, already formulated 〉Primary structure and functional data expected in 3Q 2025 〉BPD Type 2a FDA meeting targeted 4Q 2025 Lower Cost, Stronger Access 〉Addresses payer cost pressures 〉Improves patient access 〉Optimizes physician reimbursement Biosimilar Route 〉Targeting all 12 therapeutic indications via biosimilar extrapolation 〉$3B+ U.S. opportunity Validated Asset 〉Already approved in 69+ countries 〉FDA-approved in U.S. for aesthetics 〉Large-scale manufacturing and support from Daewoong © 2 0 2 5 A E O N B I O P H A R M A 3 |

| 〉 Proven leader in public company financial operations and reporting Jennifer Sy Chief Accounting Officer Proven Operators with Toxin and Biosimilar Experience Backed by Strong Legal and Financial Leadership 〉 25+ years life sciences leadership 〉 Led Daxxify® therapeutic launch at Revance; was engaged in biosimilar partnership with Viatris Rob Bancroft Chief Executive Officer 〉 20+ years in clinical development and regulatory strategy – responsible for multiple IND, NDA, and BLA submissions Chad Oh, MD Chief Medical Officer 〉 20+ years in biotech and life sciences capital markets 〉 Over $500M in capital raised through a variety of equity, debt, and hybrid structures Alex Wilson EVP, Chief Legal Officer & Secretary © 2 0 2 5 A E O N B I O P H A R M A 4 |

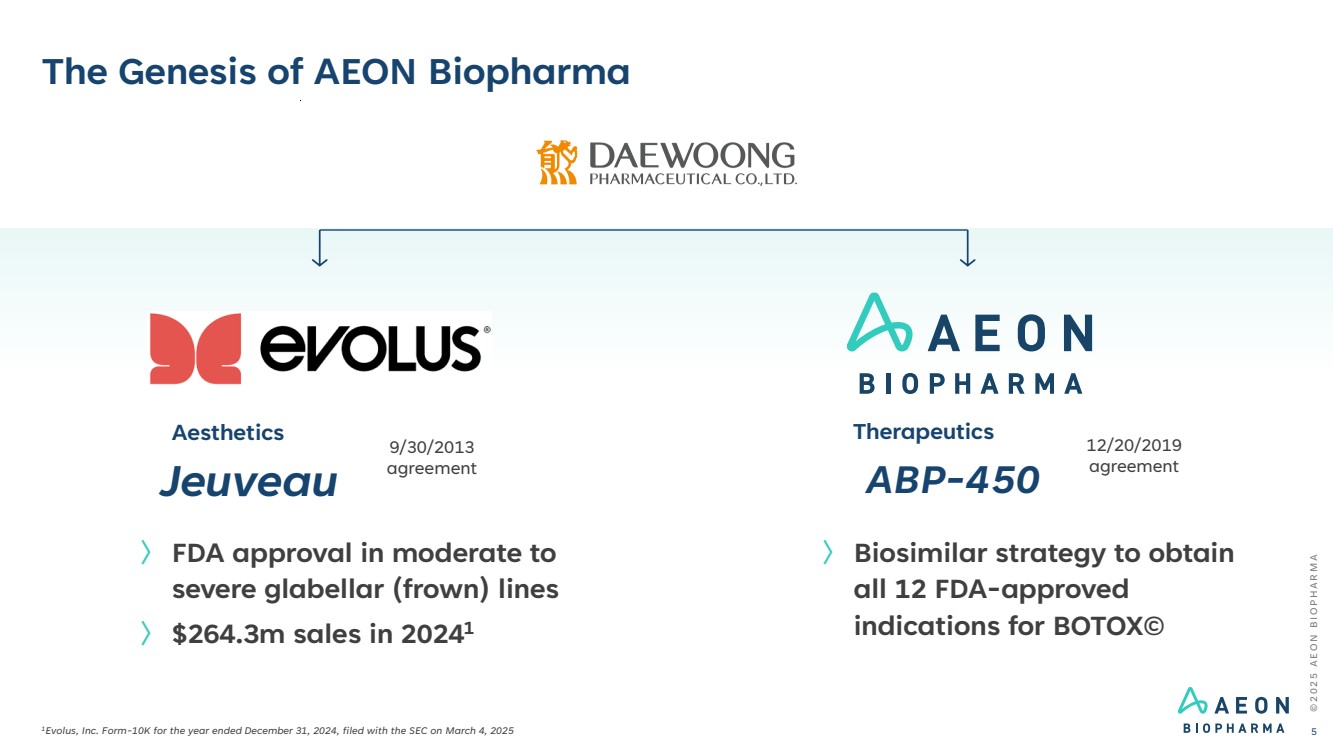

| The Genesis of AEON Biopharma 1Evolus, Inc. Form-10K for the year ended December 31, 2024, filed with the SEC on March 4, 2025 〉 FDA approval in moderate to severe glabellar (frown) lines 〉 $264.3m sales in 20241 9/30/2013 agreement Jeuveau 12/20/2019 agreement ABP-450 Aesthetics Therapeutics 〉 Biosimilar strategy to obtain all 12 FDA-approved indications for BOTOX© © 2 0 2 5 A E O N B I O P H A R M A 5 |

| Globally Validated Product and Platform Same Molecule, Same Product, Same Manufacturing Platform 2 15 8 34 12 Approved by regulators in North America, EU, APAC, LATAM, MENA 69+ regulatory approvals FDA approved (aesthetics and manufacturing for Evolus) Biosimilar approved (India, Mexico, Philippines) © 2 0 2 5 A E O N B I O P H A R M A 6 |

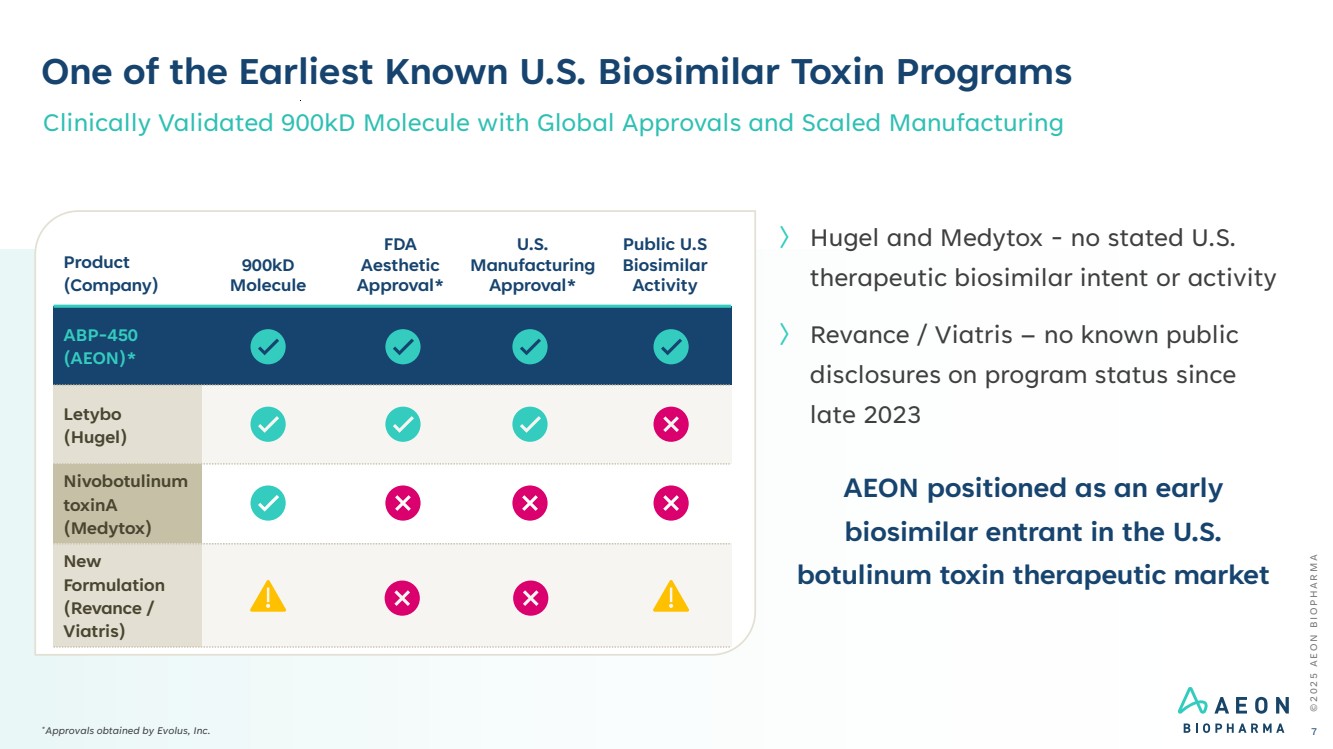

| One of the Earliest Known U.S. Biosimilar Toxin Programs Clinically Validated 900kD Molecule with Global Approvals and Scaled Manufacturing Product (Company) 900kD Molecule FDA Aesthetic Approval* U.S. Manufacturing Approval* Public U.S Biosimilar Activity ABP-450 (AEON)* Letybo (Hugel) Nivobotulinum toxinA (Medytox) New Formulation (Revance / Viatris) 〉 Hugel and Medytox - no stated U.S. therapeutic biosimilar intent or activity 〉 Revance / Viatris – no known public disclosures on program status since late 2023 AEON positioned as an early biosimilar entrant in the U.S. botulinum toxin therapeutic market © 2 0 2 5 A E O N B I O P H A R M A 7 *Approvals obtained by Evolus, Inc. |

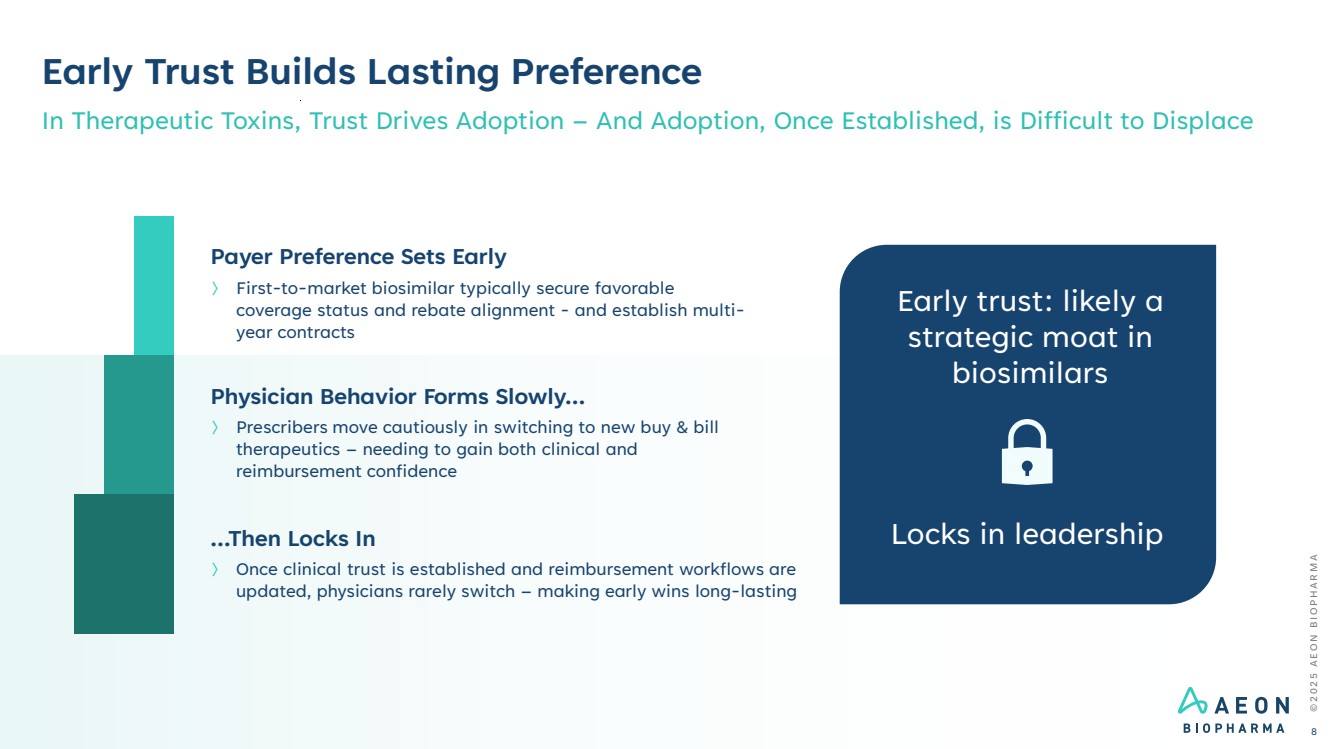

| Early Trust Builds Lasting Preference In Therapeutic Toxins, Trust Drives Adoption – And Adoption, Once Established, is Difficult to Displace Payer Preference Sets Early 〉 First-to-market biosimilar typically secure favorable coverage status and rebate alignment - and establish multi-year contracts Physician Behavior Forms Slowly… 〉 Prescribers move cautiously in switching to new buy & bill therapeutics – needing to gain both clinical and reimbursement confidence …Then Locks In 〉 Once clinical trust is established and reimbursement workflows are updated, physicians rarely switch – making early wins long-lasting Early trust: likely a strategic moat in biosimilars Locks in leadership © 2 0 2 5 A E O N B I O P H A R M A 8 |

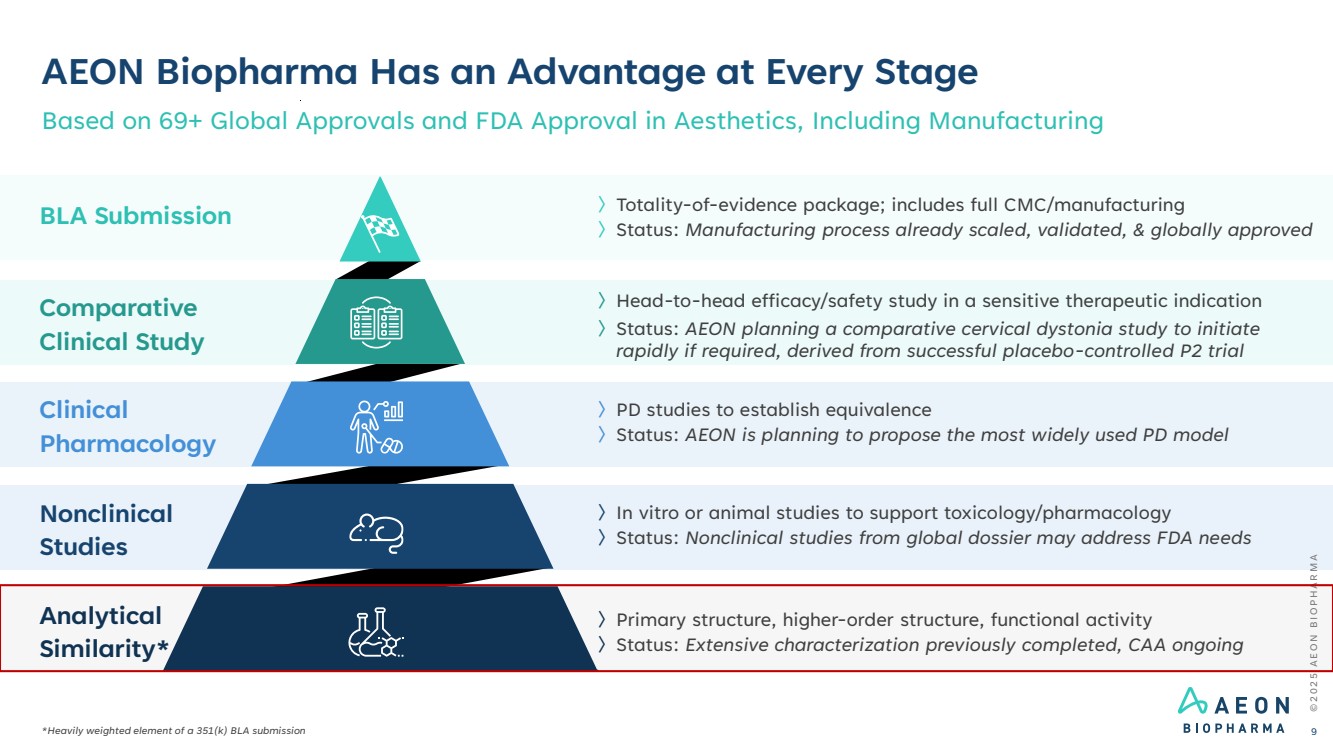

| AEON Biopharma Has an Advantage at Every Stage Based on 69+ Global Approvals and FDA Approval in Aesthetics, Including Manufacturing 〉PD studies to establish equivalence 〉Status: AEON is planning to propose the most widely used PD model 〉Head-to-head efficacy/safety study in a sensitive therapeutic indication 〉Status: AEON planning a comparative cervical dystonia study to initiate rapidly if required, derived from successful placebo-controlled P2 trial 〉In vitro or animal studies to support toxicology/pharmacology 〉Status: Nonclinical studies from global dossier may address FDA needs 〉Primary structure, higher-order structure, functional activity 〉Status: Extensive characterization previously completed, CAA ongoing 〉Totality-of-evidence package; includes full CMC/manufacturing 〉Status: Manufacturing process already scaled, validated, & globally approved © 2 0 2 5 A E O N B I O P H A R M A 9 Clinical Pharmacology Comparative Clinical Study Nonclinical Studies BLA Submission Analytical Similarity* *Heavily weighted element of a 351(k) BLA submission |

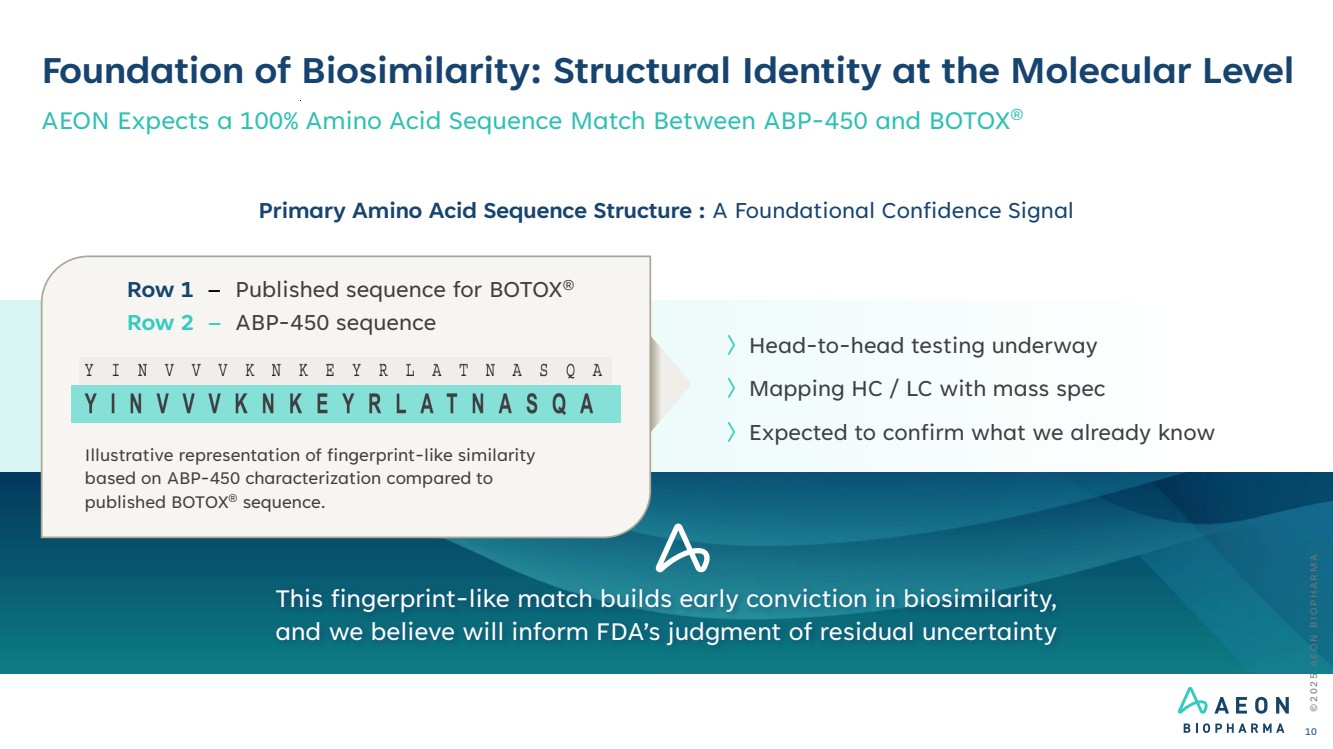

| 〉Head-to-head testing underway 〉Mapping HC / LC with mass spec 〉Expected to confirm what we already know Foundation of Biosimilarity: Structural Identity at the Molecular Level AEON Expects a 100% Amino Acid Sequence Match Between ABP-450 and BOTOX® Illustrative representation of fingerprint-like similarity based on ABP-450 characterization compared to published BOTOX® sequence. Row 2 – ABP-450 sequence Row 1 – Published sequence for BOTOX® Primary Amino Acid Sequence Structure : A Foundational Confidence Signal This fingerprint-like match builds early conviction in biosimilarity, and we believe will inform FDA’s judgment of residual uncertainty © 2 0 2 5 A E O N B I O P H A R M A 10 |

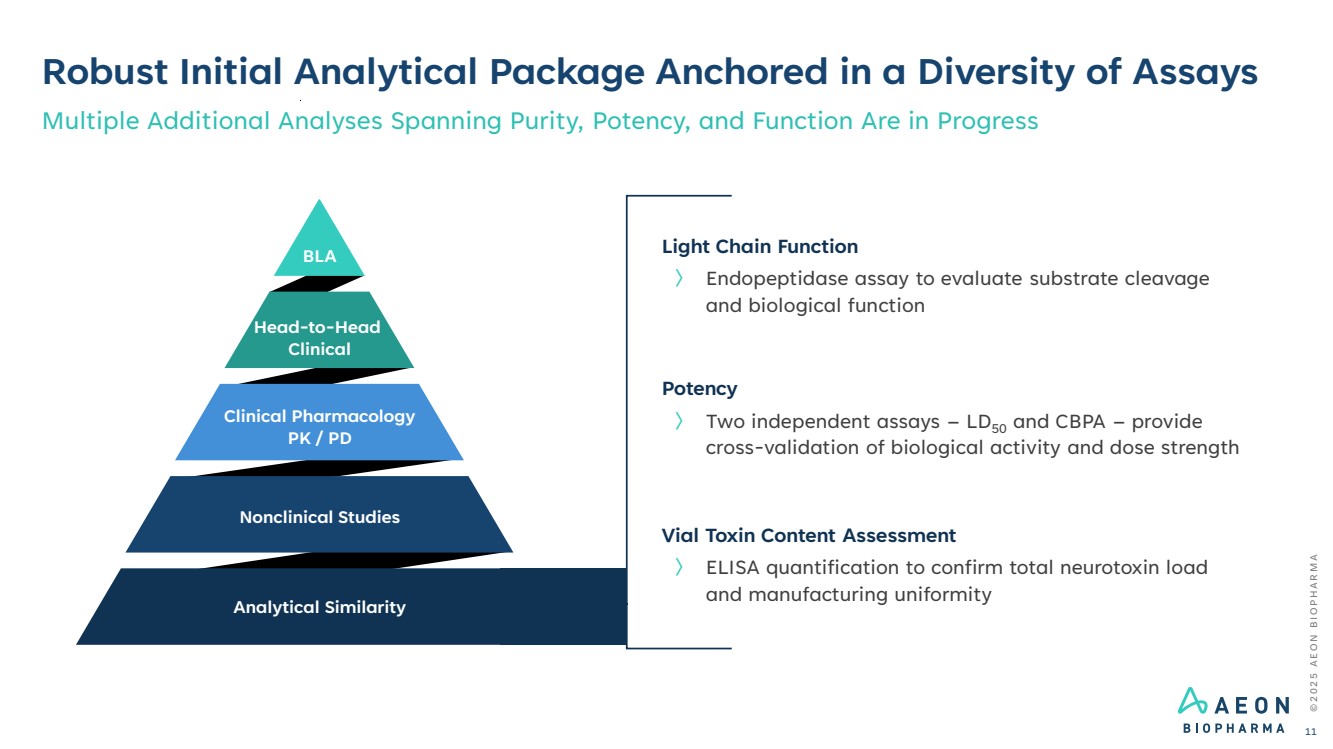

| Light Chain Function 〉 Endopeptidase assay to evaluate substrate cleavage and biological function Potency 〉 Two independent assays – LD50 and CBPA – provide cross-validation of biological activity and dose strength Vial Toxin Content Assessment 〉 ELISA quantification to confirm total neurotoxin load and manufacturing uniformity © 2 0 2 5 A E O N B I O P H A R M A Robust Initial Analytical Package Anchored in a Diversity of Assays Multiple Additional Analyses Spanning Purity, Potency, and Function Are in Progress 11 Nonclinical Studies Clinical Pharmacology PK / PD Head-to-Head Clinical BLA Analytical Similarity |

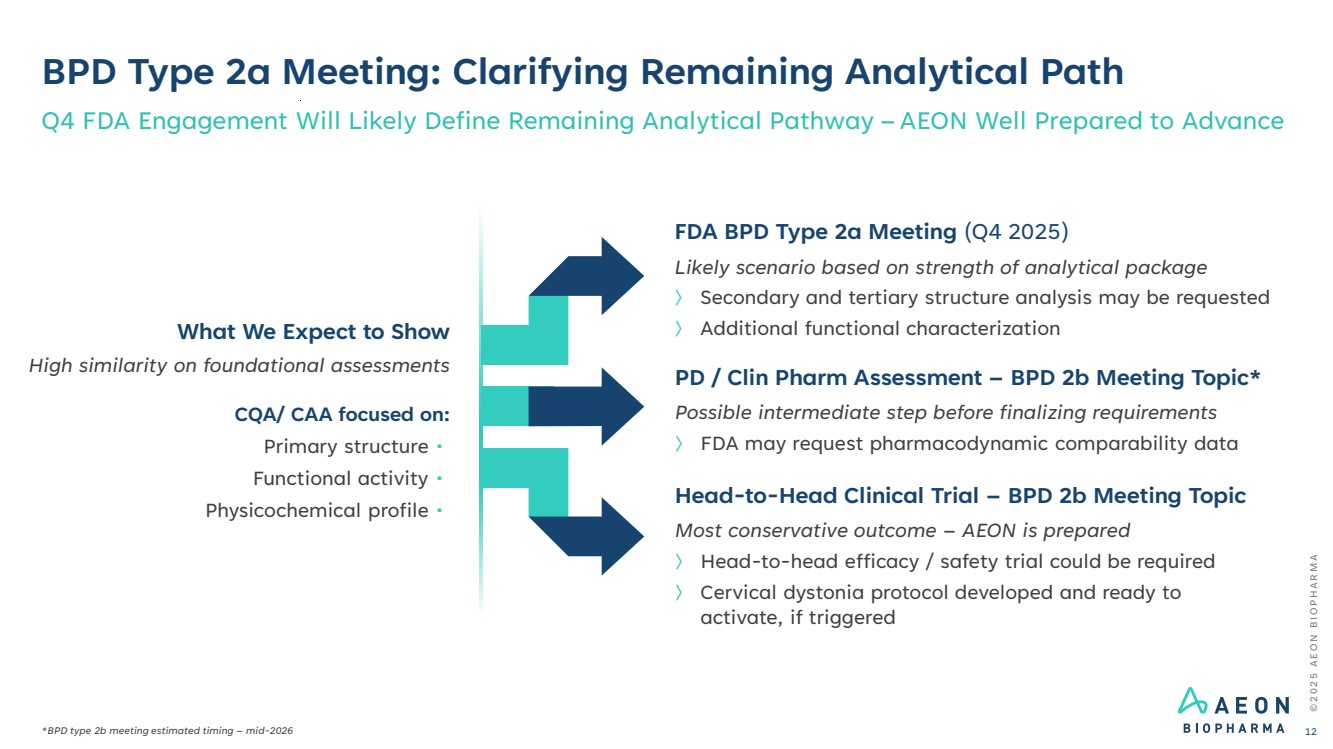

| BPD Type 2a Meeting: Clarifying Remaining Analytical Path Q4 FDA Engagement Will Likely Define Remaining Analytical Pathway –AEON Well Prepared to Advance FDA BPD Type 2a Meeting (Q4 2025) Likely scenario based on strength of analytical package 〉 Secondary and tertiary structure analysis may be requested 〉 Additional functional characterization Head-to-Head Clinical Trial – BPD 2b Meeting Topic Most conservative outcome – AEON is prepared 〉 Head-to-head efficacy / safety trial could be required 〉 Cervical dystonia protocol developed and ready to activate, if triggered PD / Clin Pharm Assessment – BPD 2b Meeting Topic* Possible intermediate step before finalizing requirements 〉 FDA may request pharmacodynamic comparability data What We Expect to Show High similarity on foundational assessments CQA/ CAA focused on: Primary structure • Functional activity • Physicochemical profile • © 2 0 2 5 A E O N B I O P H A R M A *BPD type 2b meeting estimated timing – mid-2026 12 |

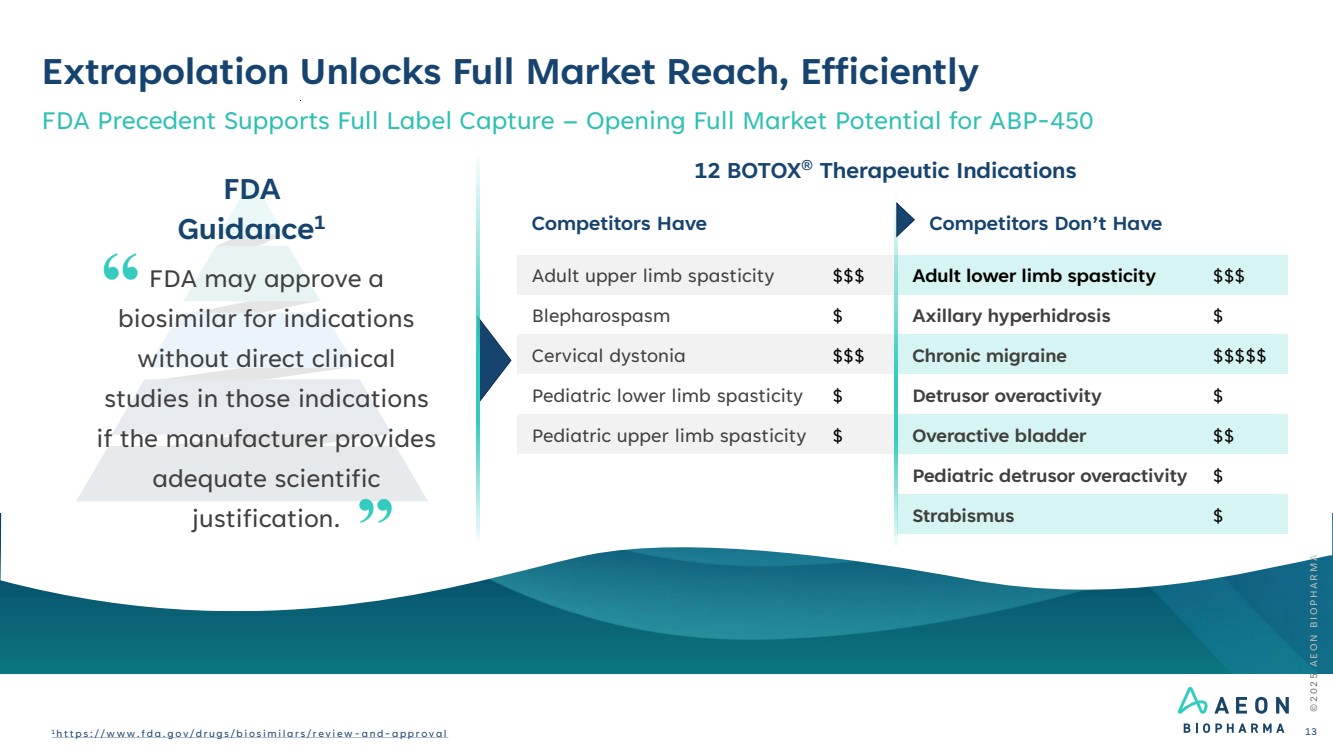

| Extrapolation Unlocks Full Market Reach, Efficiently FDA Precedent Supports Full Label Capture – Opening Full Market Potential for ABP-450 12 BOTOX® Therapeutic Indications FDA Guidance1 FDA may approve a biosimilar for indications without direct clinical studies in those indications if the manufacturer provides adequate scientific justification. Competitors Have Competitors Don’t Have … Adult upper limb spasticity $$$ Adult lower limb spasticity $$$ Blepharospasm $ Axillary hyperhidrosis $ Cervical dystonia $$$ Chronic migraine $$$$$ Pediatric lower limb spasticity $ Detrusor overactivity $ Pediatric upper limb spasticity $ Overactive bladder $$ Pediatric detrusor overactivity $ Strabismus $ © 2 0 2 5 A E O N B I O P H A R M A 1 h t t p s : / / w w w . f d a . g o v / d r u g s / b i o s i m i l a r s / r e v i e w - a n d - a p p r o v a l 13 |

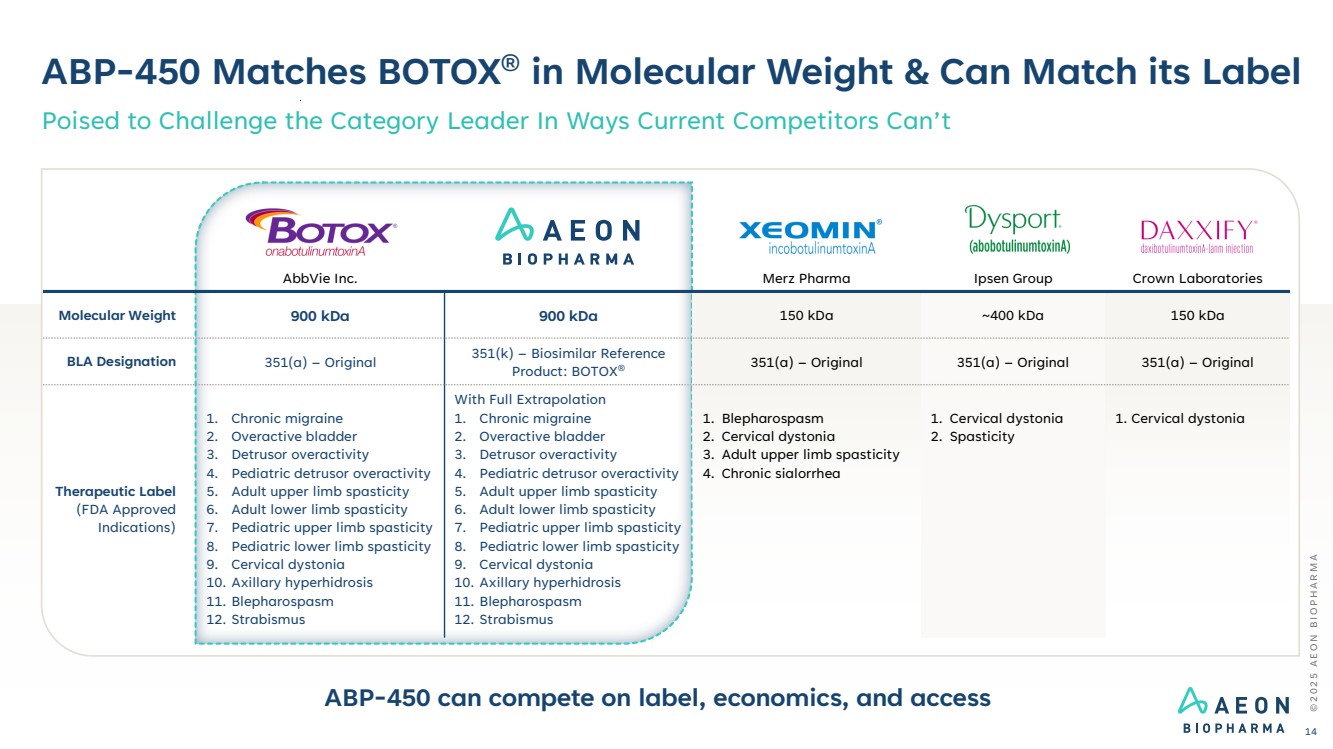

| AbbVie Inc. Merz Pharma Ipsen Group Crown Laboratories Molecular Weight 900 kDa 900 kDa 150 kDa ~400 kDa 150 kDa BLA Designation 351(a) – Original 351(k) – Biosimilar Reference Product: BOTOX® 351(a) – Original 351(a) – Original 351(a) – Original Therapeutic Label (FDA Approved Indications) 1. Chronic migraine 2. Overactive bladder 3. Detrusor overactivity 4. Pediatric detrusor overactivity 5. Adult upper limb spasticity 6. Adult lower limb spasticity 7. Pediatric upper limb spasticity 8. Pediatric lower limb spasticity 9. Cervical dystonia 10. Axillary hyperhidrosis 11. Blepharospasm 12. Strabismus With Full Extrapolation 1. Chronic migraine 2. Overactive bladder 3. Detrusor overactivity 4. Pediatric detrusor overactivity 5. Adult upper limb spasticity 6. Adult lower limb spasticity 7. Pediatric upper limb spasticity 8. Pediatric lower limb spasticity 9. Cervical dystonia 10. Axillary hyperhidrosis 11. Blepharospasm 12. Strabismus 1. Blepharospasm 2. Cervical dystonia 3. Adult upper limb spasticity 4. Chronic sialorrhea 1. Cervical dystonia 2. Spasticity 1. Cervical dystonia ABP-450 Matches BOTOX® in Molecular Weight & Can Match its Label Poised to Challenge the Category Leader In Ways Current Competitors Can’t ABP-450 can compete on label, economics, and access © 2 0 2 5 A E O N B I O P H A R M A 14 |

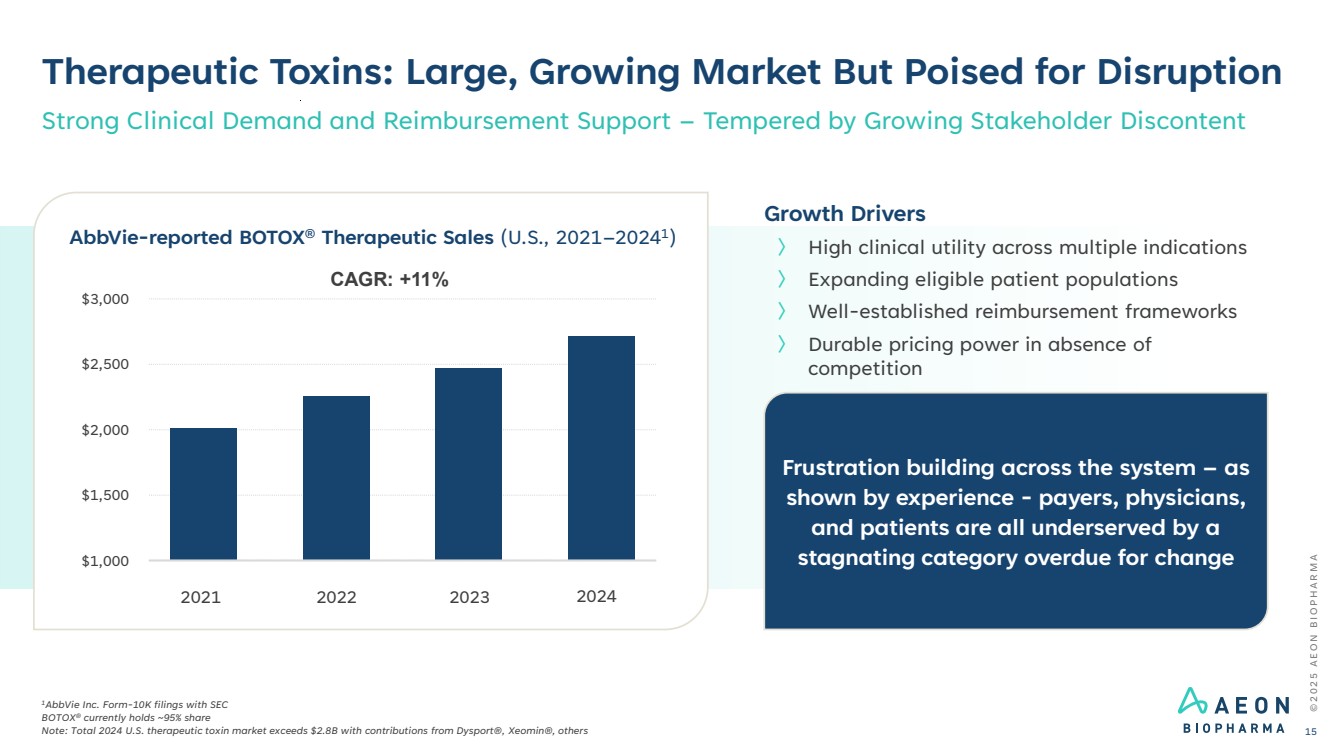

| Frustration building across the system – as shown by experience - payers, physicians, and patients are all underserved by a stagnating category overdue for change Therapeutic Toxins: Large, Growing Market But Poised for Disruption 1AbbVie Inc. Form-10K filings with SEC BOTOX® currently holds ~95% share Note: Total 2024 U.S. therapeutic toxin market exceeds $2.8B with contributions from Dysport®, Xeomin®, others Strong Clinical Demand and Reimbursement Support – Tempered by Growing Stakeholder Discontent $1,000 $1,500 $2,000 $2,500 $3,000 AbbVie-reported BOTOX® Therapeutic Sales (U.S., 2021–20241 ) CAGR: +11% Growth Drivers 〉 High clinical utility across multiple indications 〉 Expanding eligible patient populations 〉 Well-established reimbursement frameworks 〉 Durable pricing power in absence of competition 2021 2022 2023 2024 © 2 0 2 5 A E O N B I O P H A R M A 15 |

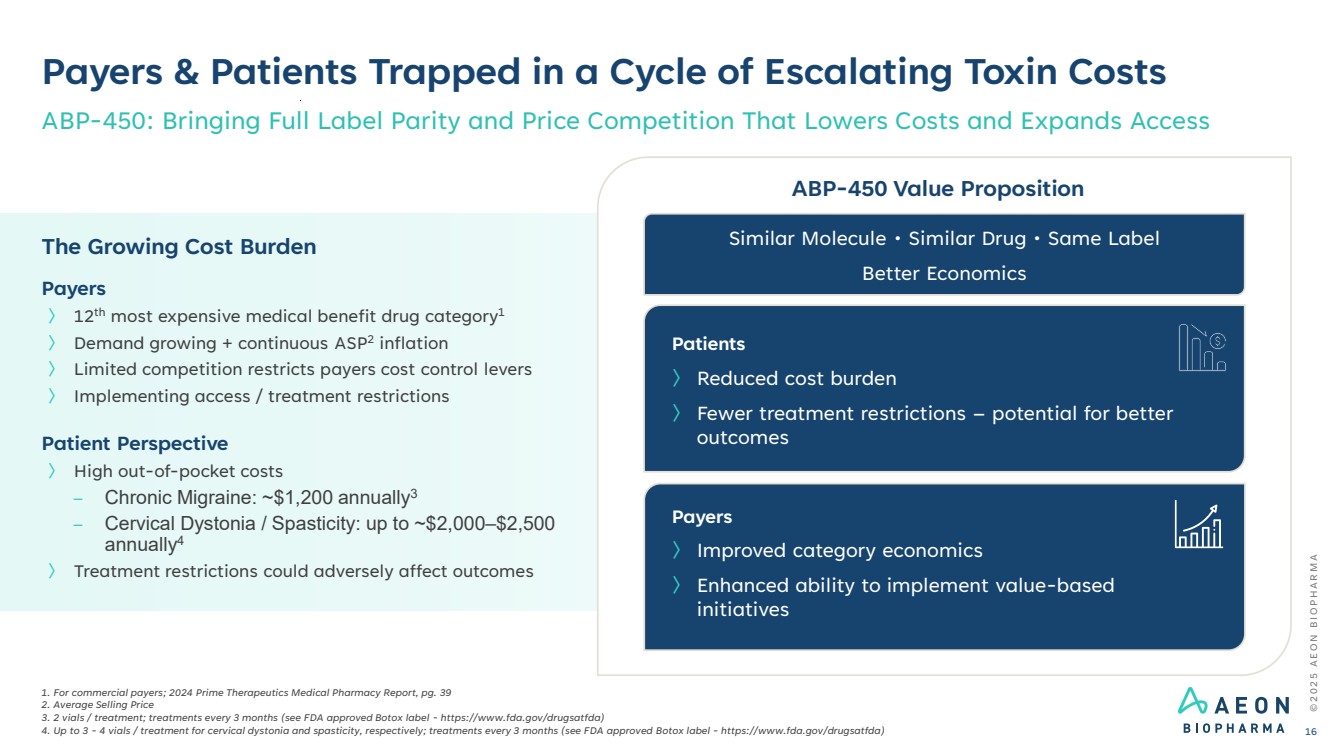

| Patient Perspective 〉 High out-of-pocket costs – Chronic Migraine: ~$1,200 annually3 – Cervical Dystonia / Spasticity: up to ~$2,000–$2,500 annually4 〉 Treatment restrictions could adversely affect outcomes Payers 〉 12th most expensive medical benefit drug category1 〉 Demand growing + continuous ASP2 inflation 〉 Limited competition restricts payers cost control levers 〉 Implementing access / treatment restrictions The Growing Cost Burden Payers & Patients Trapped in a Cycle of Escalating Toxin Costs ABP-450: Bringing Full Label Parity and Price Competition That Lowers Costs and Expands Access 1. For commercial payers; 2024 Prime Therapeutics Medical Pharmacy Report, pg. 39 2. Average Selling Price 3. 2 vials / treatment; treatments every 3 months (see FDA approved Botox label - https://www.fda.gov/drugsatfda) 4. Up to 3 - 4 vials / treatment for cervical dystonia and spasticity, respectively; treatments every 3 months (see FDA approved Botox label - https://www.fda.gov/drugsatfda) ABP-450 Value Proposition Patients 〉 Reduced cost burden 〉 Fewer treatment restrictions – potential for better outcomes Payers 〉 Improved category economics 〉 Enhanced ability to implement value-based initiatives Similar Molecule • Similar Drug • Same Label Better Economics © 2 0 2 5 A E O N B I O P H A R M A 16 |

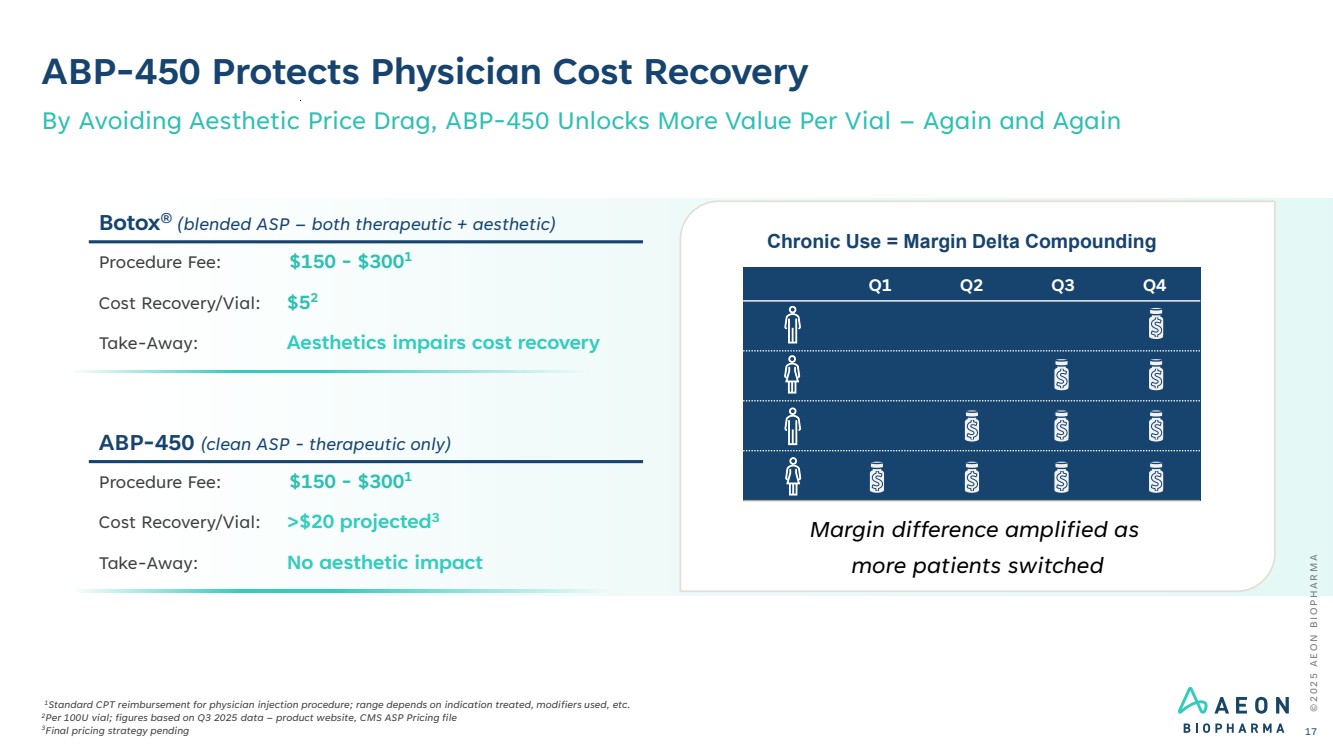

| ABP-450 Protects Physician Cost Recovery 1Standard CPT reimbursement for physician injection procedure; range depends on indication treated, modifiers used, etc. 2Per 100U vial; figures based on Q3 2025 data – product website, CMS ASP Pricing file 3Final pricing strategy pending By Avoiding Aesthetic Price Drag, ABP-450 Unlocks More Value Per Vial – Again and Again Botox® (blended ASP – both therapeutic + aesthetic) Procedure Fee: $150 - $3001 Cost Recovery/Vial: $52 Take-Away: Aesthetics impairs cost recovery ABP-450 (clean ASP - therapeutic only) Procedure Fee: $150 - $3001 Cost Recovery/Vial: >$20 projected3 Take-Away: No aesthetic impact Margin difference amplified as more patients switched Chronic Use = Margin Delta Compounding Q1 Q2 Q3 Q4 © 2 0 2 5 A E O N B I O P H A R M A 17 |

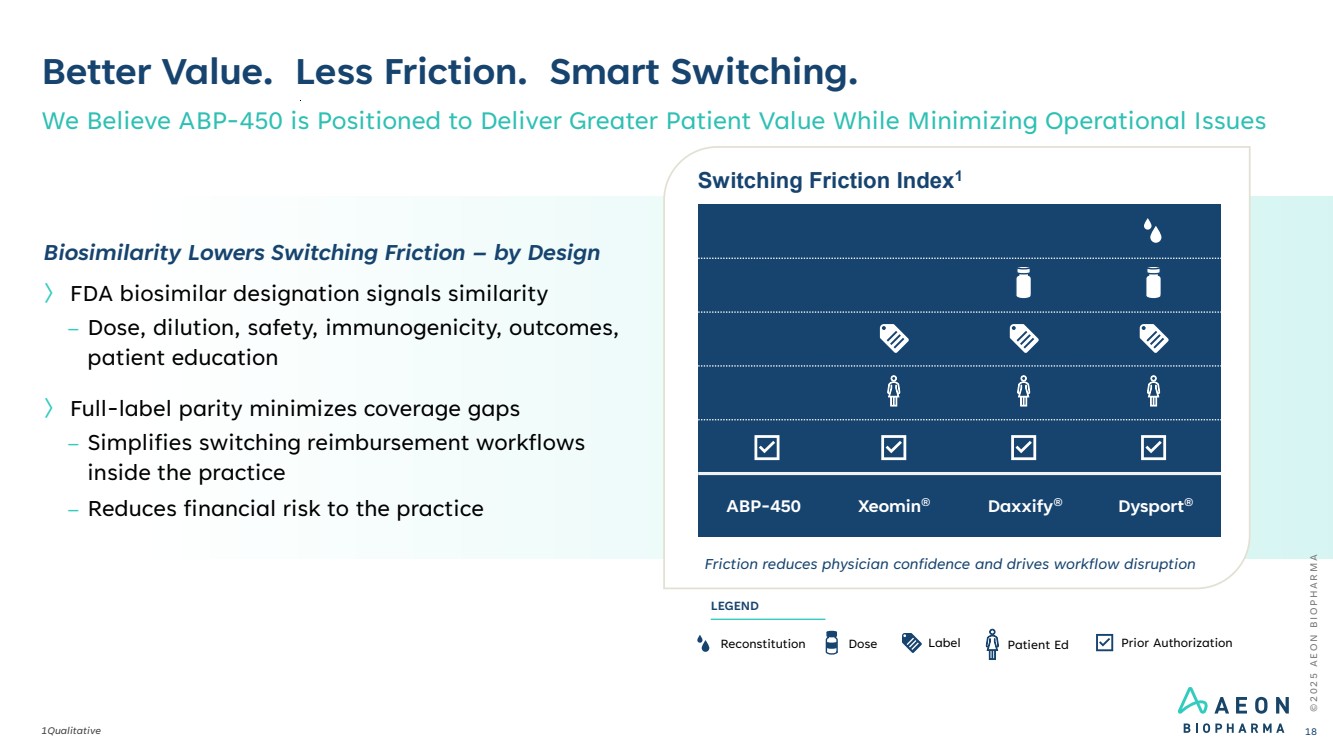

| © 2 0 2 5 A E O N B I O P H A R M A Better Value. Less Friction. Smart Switching. 1Qualitative We Believe ABP-450 is Positioned to Deliver Greater Patient Value While Minimizing Operational Issues 18 Switching Friction Index1 Friction reduces physician confidence and drives workflow disruption ABP-450 Xeomin® Daxxify® Dysport® Reconstitution Dose Label Prior Authorization LEGEND Patient Ed Biosimilarity Lowers Switching Friction – by Design 〉 FDA biosimilar designation signals similarity – Dose, dilution, safety, immunogenicity, outcomes, patient education 〉 Full-label parity minimizes coverage gaps – Simplifies switching reimbursement workflows inside the practice – Reduces financial risk to the practice |

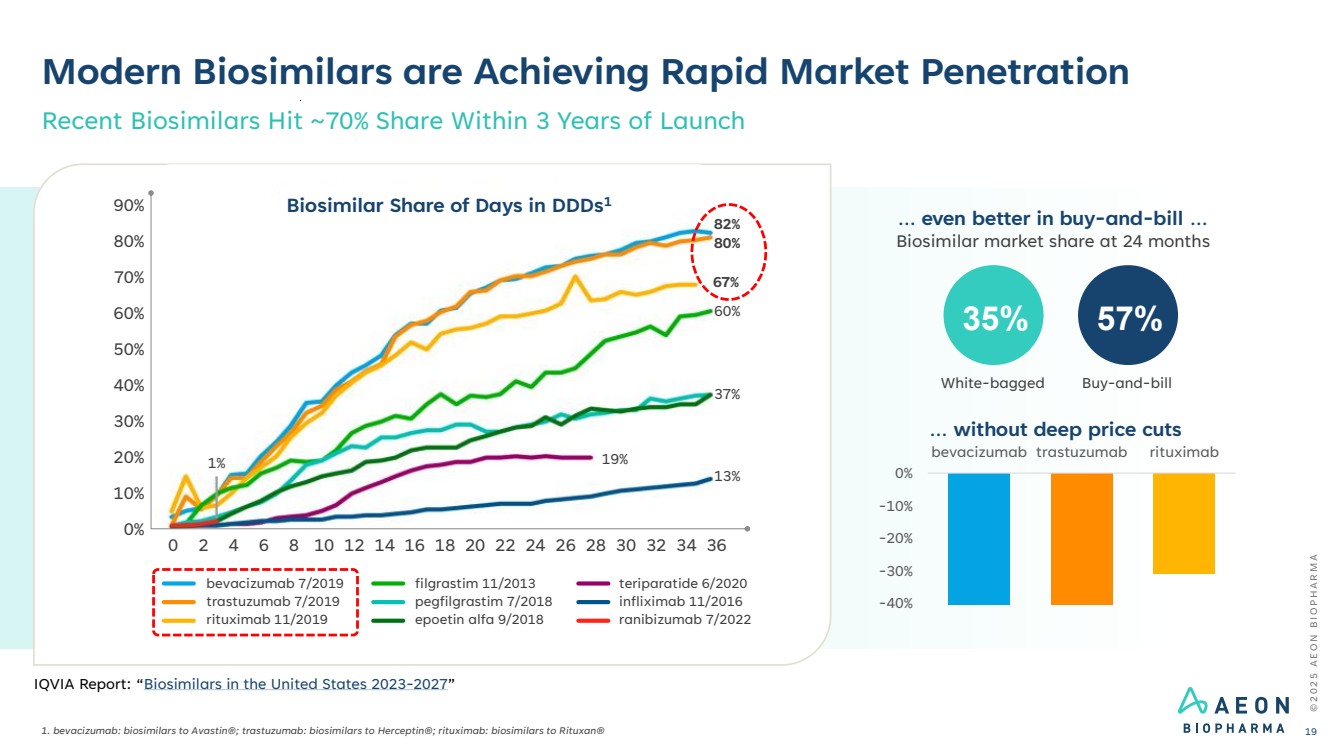

| Modern Biosimilars are Achieving Rapid Market Penetration 1. bevacizumab: biosimilars to Avastin®; trastuzumab: biosimilars to Herceptin®; rituximab: biosimilars to Rituxan® Recent Biosimilars Hit ~70% Share Within 3 Years of Launch bevacizumab 7/2019 trastuzumab 7/2019 rituximab 11/2019 filgrastim 11/2013 pegfilgrastim 7/2018 epoetin alfa 9/2018 teriparatide 6/2020 infliximab 11/2016 ranibizumab 7/2022 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 1% 19% 13% 37% 60% 67% 80% 82% Biosimilar Share of Days in DDDs1 Biosimilar market share at 24 months 35% 57% White-bagged Buy-and-bill … even better in buy-and-bill … -40% -30% -20% -10% 0% bevacizumab trastuzumab rituximab … without deep price cuts © 2 0 2 5 A E O N B I O P H A R M A 19 IQVIA Report: “Biosimilars in the United States 2023-2027” |

| Why ABP-450 Wins: Value that Connects Across Stakeholders Payers, Physicians, Patients Each Benefit From the Switch Payers: Cost control and - a strong rationale to prefer the biosimilar Physicians: A clinically familiar option – that works both economically and operationally Patients: Lower out-of-pocket costs – without sacrificing treatment effectiveness Similar Molecule Similar Drug Same Label Better Economics © 2 0 2 5 A E O N B I O P H A R M A 20 |

| Unique and Promising Opportunity Positioned to Move Early 〉900kD toxin, already formulated 〉Primary structure and functional data expected in 3Q 2025 〉BPD Type 2a FDA meeting targeted 4Q 2025 Lower Cost, Stronger Access 〉Addresses payer cost pressures 〉Improves patient access 〉Optimizes physician reimbursement Biosimilar Route 〉Targeting all 12 therapeutic indications via biosimilar extrapolation 〉$3B+ U.S. opportunity Validated Asset 〉Already approved in 69+ countries 〉FDA-approved in U.S. for aesthetics 〉Large-scale manufacturing and support from Daewoong © 2 0 2 5 A E O N B I O P H A R M A 21 |

| Thank you NYSEAMERICAN: AEON © 2 0 2 5 A E O N B I O P H A R M A |

| Appendix © 2 0 2 5 A E O N B I O P H A R M A 23 |

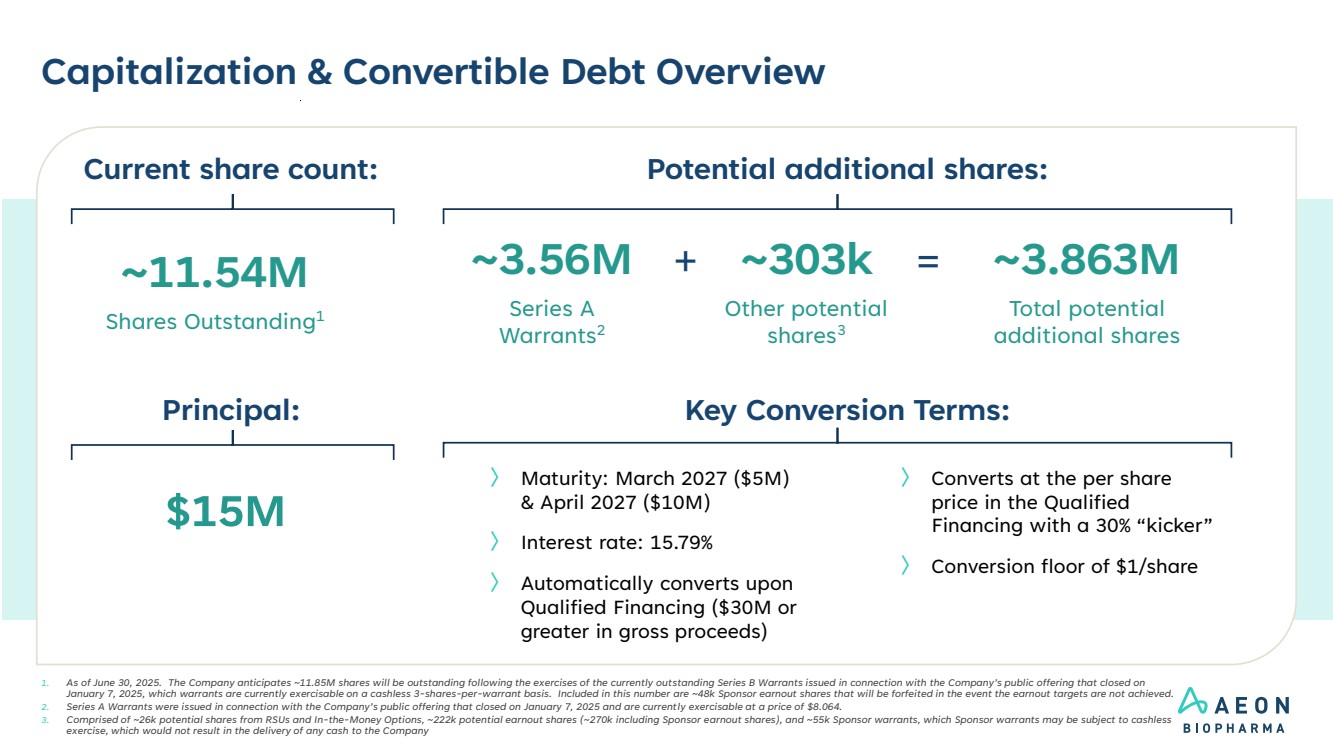

| Capitalization & Convertible Debt Overview 1. As of June 30, 2025. The Company anticipates ~11.85M shares will be outstanding following the exercises of the currently outstanding Series B Warrants issued in connection with the Company’s public offering that closed on January 7, 2025, which warrants are currently exercisable on a cashless 3-shares-per-warrant basis. Included in this number are ~48k Sponsor earnout shares that will be forfeited in the event the earnout targets are not achieved. 2. Series A Warrants were issued in connection with the Company’s public offering that closed on January 7, 2025 and are currently exercisable at a price of $8.064. 3. Comprised of ~26k potential shares from RSUs and In-the-Money Options, ~222k potential earnout shares (~270k including Sponsor earnout shares), and ~55k Sponsor warrants, which Sponsor warrants may be subject to cashless exercise, which would not result in the delivery of any cash to the Company Potential additional shares: ~11.54M Shares Outstanding1 ~303k Other potential shares3 ~3.863M Total potential additional shares = Current share count: ~3.56M Series A Warrants2 + Key Conversion Terms: $15M Principal: 〉 Maturity: March 2027 ($5M) & April 2027 ($10M) 〉 Interest rate: 15.79% 〉 Automatically converts upon Qualified Financing ($30M or greater in gross proceeds) 〉 Converts at the per share price in the Qualified Financing with a 30% “kicker” 〉 Conversion floor of $1/share |